Rental Market Softens While Home Prices Soar: Taking Staying at Home to the End of the World.

What do you get when you mix in a global pandemic, low housing inventory, a Fed that is juicing the markets, a mortgage payment moratorium, and baby boomers addicted to Facebook? You get a market that is being pushed up by house humping boomers while many younger Americans are struggling to get by in rentals or are living at home with mom and dad in quarantine. In this article we will look at two divergent stories – one includes home prices surging on record low inventory while another shows a softening rental market. Let us explore the numbers.

Home Prices Rise in a Pandemic

You would think that a once in a lifetime global pandemic would soften the rise of home prices but the opposite has happened. Why is that? Here is a brief summary as to why home prices are up this year:

-The Federal Reserve is flooding the market with cheap money and interest rates are incredibly low

-Housing inventory which was low before the pandemic is now pathetically low (don’t want the rona creeping into your place during a realtor showing)

-Boomers are addicted to buying homes even as they enter older age

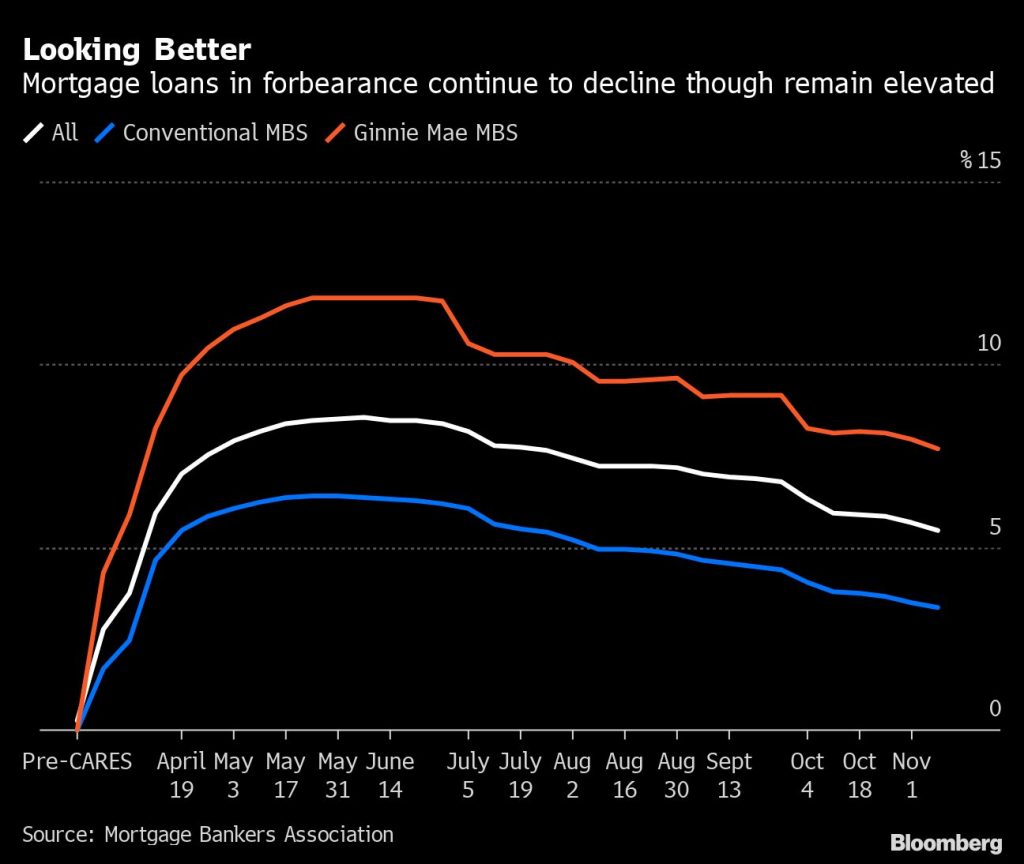

-You have a startling number of mortgages still in forbearance (that clock is going to end soon)

-The shift to working from home and staying at home has shifted the focus to residential real estate

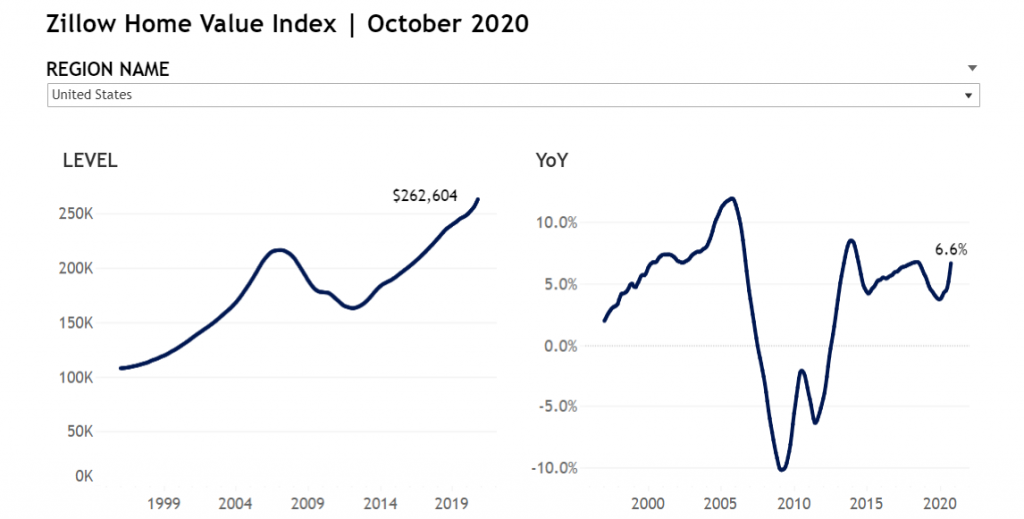

All of this has combined doing this to home prices:

Yet much of this is running on fumes and it is hard to tell how it will continue to go without the excessiveness that is happening in this market. There has been fraud in the PPP market largely going to big business that didn’t need the help to begin with. Smaller businesses have had a tough time getting funds here.

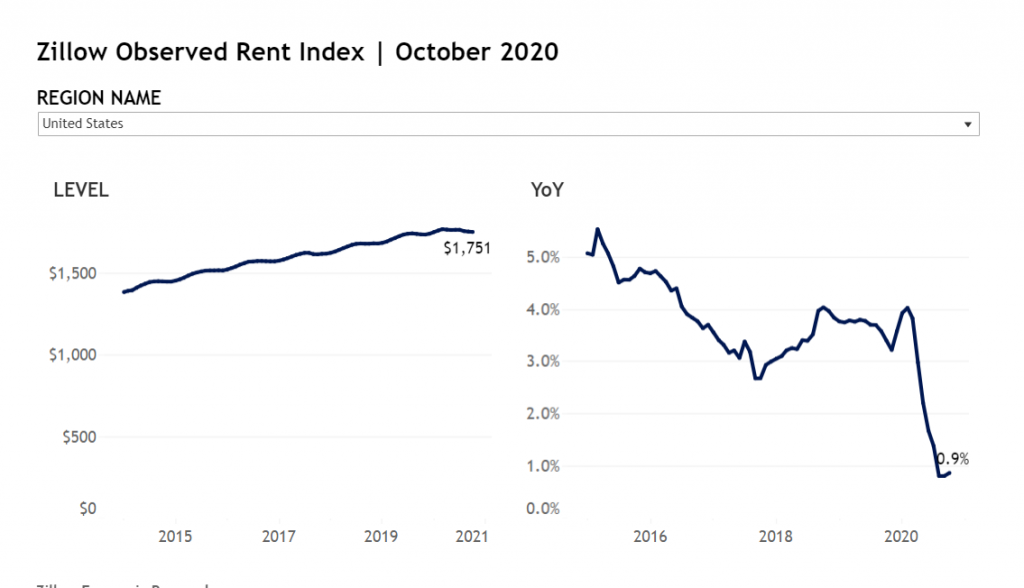

Home prices are not up because the economy is good but it is running on artificial juice. Just take a look at the rental market that is a better indicator of the economy since people have to pay for rent from actual income that is coming in:

14 million Americans have no confidence or little confidence they can pay the rent next month. And the lack of attention to public wellbeing, thoughtful debate, and cronyism is essentially going to let 12 million people fall off unemployment support so you can expect this to align with the eviction moratorium coming to an end. Of course there will be massive spin and distortion but this reminds me of 2005 and 2006 during the bubble when “irrational exuberance†caused prices to soar with no underlying justification beyond sheer momentum of easy money and people were making profits on real estate by flat out pure unbridled speculation. Make no mistake, having interest rates this low is artificial and is juicing markets up.

So this is why the rental market is softening:

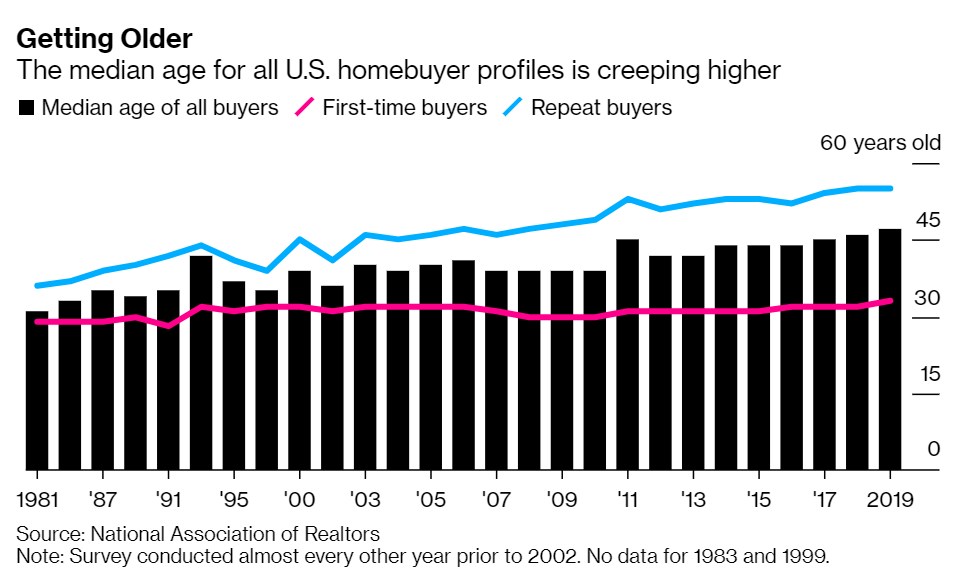

While there is a demand to buy, the reality is most can only live with mom and dad or rent. A lot of the buying and selling right now is basically baby boomers reshuffling homes amongst each other. Just look at the typical age of a repeat buyer here:

The median age of a repeat buyer is getting closer to 60! While a vaccine looks like it will start taking care of the pandemic in 2021, the graft in our financial system is so extreme that unfortunately a reckoning is going to be hitting parts of the economy.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

163 Responses to “Rental Market Softens While Home Prices Soar: Taking Staying at Home to the End of the World.”

I’ve got friends that are going all-in making offers on rental properties. Everything looks just like it did in 2007-2008. Everyone running for buy, buy, buy with no real justification for doing so other than “this is what they’re saying.”

I’ve resigned myself to shake my head and let go. If you are looking to capture cheap properties for future profit, you need to ACTUALLY LET THE MARKET CRASH FIRST!!!!

People buying now are buying at or very near the top of the curve in a sector that is showing signs of extreme disease. If it were healthy, I’m fairly confident the Fed would be buying $1.5 billion in mortgage bonds every single day.

NO HOUSING BUST READ WHY

Opinion: Fannie and Freddie are helping American homeowners during the COVID recession — so why reprivatize now?

https://www.marketwatch.com/story/fannie-and-freddie-are-helping-american-homeowners-during-the-covid-recession-so-why-reprivatize-now-11607436106?siteid=yhoof2

Whenever there is a real estate crash that is deep, there is also a crash in mortgage origination(s). So far, it doesn’t look to be like 2008-2010.

The situation today is almost like what happens at the end of a war, with massive spending and big shifts in where and how people are engaged in work. Like the end of WW II or Vietnam. What we saw then was stagflation, and that may well be what we’re seeing now.

Real Estate does very well in stagflation. Even better in the era of fiat currency (what happened in the 70s). The new vaccines for Covid-19 should allow the economy to be jump started, and whether Biden or Trump is at the helm, the US Government will turn on the faucet. I don’t see a debt deflation happening in Real Estate at this time as the weaker households that lost everything in 2008-2009 never got back in for the most part. Two industries are leading the economy; health care and tech related to cloud/blockchain. There are also the non-real estate inflation hedges, precious metals and blockchain cryptocurrencies. If either of those is in a bubble, it’s crypto (sorry M).

You have seen nothing yet. Bitcoin at 20k at a bubble?! Nope, try when bitcoin hits 300k a coin.

The blockchain technology that enabled cryptocurrencies could also be used by governments to eliminate cash and institute total government control over transactions. Fedcoin competing with Bitcoin and Ethereum.

Ethereum is now offered in closed-end funds. Bitcoin trust shares can be found now in etfs. They are now more used as a store of value than as currency. But it is as a currency that they really have their best use; for transnational payment outside government control. Gold has to be smuggled, but with a wide open internet, Bitcoin can fly here and there unnoticed. That is, unnoticed now. If I wanted to move large sums to an offshore bank, crypto would be less subject to scrutiny. But that isn’t necessarily true in the PRC Chinese style world that could come sneaking up on us, particularly with a Biden presidency and someone worse who could follow him. Evil governments could and would crush Bitcoin and steal gold. But the gold would still exist and continue to have value. i personally think it has a use, but I know people who think like Roubini:“Crypto is the mother or father of all scams and bubblesâ€.

Bitcoin has been called dead for many years now by its haters.

The reality is, PayPal/square/microstrategies and hedge funds are making big investments in Bitcoin and crypto. Citibank issued a price target of 318k per bitcoin. The bull market has just started and is driven by institutional investors.

I made a chart for Bitcoin vs GLD (gold) and PALL (palladium) ETFs since the start of 2018:

https://bigcharts.marketwatch.com/advchart/frames/frames.asp?show=&insttype=Future&symb=BITCOIN+FUTURES+CME&time=100&startdate=1%2F1%2F2018&enddate=11%2F24%2F2020&freq=1&compidx=aaaaa%3A0&comptemptext=GLD%2CPALL&comp=GLD%2CPALL&ma=0&maval=9&uf=0&lf=1&lf2=0&lf3=0&type=64&style=320&size=4&x=33&y=13&timeFrameToggle=false&compareToToggle=false&indicatorsToggle=false&chartStyleToggle=false&state=13

Note the volatility of both palladium (an industrial precious metal commodity) and Bitcoin (a speculative inflation hedge) compared to gold since the start of 2018. You aren’t going to get big upward movement of gold against the Dollar unless there is a big spike in inflation. That is because millennia of evidence shows that gold is a stable currency for the long haul. I know if you started back when only geeks knew about crypto, you’d have made a pile. But now, crypto is a speculative hedge against currency devaluation with no long term track record and a hoard of new investors who might spook easily..

I’d buy a little bit of crypto, but that would set off someone I have spent most of my life with, so instead I bought shares in a blockchain stock ETF. I’m happy with that and will buy the dips.

Nice chart!

Gold is a 9trillion market. Bitcoin a 400billion market.

Since institutional investors, hedge funds and nasdaq listed companies are pouring money into bitcoin you will see unbelievable growth in Bitcoins price. Retail hasn’t even entered the market yet. It’s all driven by big players.

Here is bitcoin futures vs a blockchain stock ETF from Bigcharts:

https://bigcharts.marketwatch.com/advchart/frames/frames.asp?show=&insttype=Future&symb=BITCOIN+FUTURES+CME&time=100&startdate=1%2F1%2F2018&enddate=11%2F25%2F2020&freq=1&compidx=aaaaa%3A0&comptemptext=BLOK&comp=BLOK&ma=0&maval=9&uf=0&lf=1&lf2=0&lf3=0&type=64&style=320&size=4&x=52&y=14&timeFrameToggle=false&compareToToggle=false&indicatorsToggle=false&chartStyleToggle=false&state=13

Since the start of 2018, this ETF investing in the technology has beaten Bitcoin itself. Plus it has a dividend yield of over 1%. There are several other blockchain ETFs available. I see a good future for both as long as we remain a free society. Cryptocurrencies are a force for good if they are allowed to exist and develop. Blockchain can be used for either good or evil.

People still humping bitcoin? LMAO. 7 transactions per second, good luck getting out when you need to!

Paying 4K/mo for a 2bd in lockdownville? If stupid burned, this would be the sun. Did I mention the taxes?

Have fun paying up fools, life is for LIVING.

Jonny,

You obviously have not the slightest idea what’s happening with Bitcoin at the moment…. this next bill run will blow your mind (and let’s me retire early).

I’m not a crypto guy although I do own some, I’m just nearly as aggressive on it as other assets but I just wanna point out the fact that BC is up 70% since the discussion started. I think M knows what he’s talking about, numbers don’t lie and the potential is there. It’s not just something that’s made of thin air (that’s just how you perceive it).

My boomer parents are now buying a home while simultaneously offloading two other homes.

Rents are actually getting higher in some parts. Here in Long Beach CA I am seeing 1BR’s for $2.1k and 2BR’s for $4k in an upper-middle class neighborhood. I don’t know who the heck is renting them – I did see a boomer signing the lease on a 1BR for $2k. Most people I know have a job but they live paycheck to paycheck.

Exactly! Does anyone know who is paying these high rents? How many people do you know that make $8,000.00 to $15,000.00 a month?

Can you elaborate on exactly what you think will happen when all of this ends? Will government action mitigate it or is it inevitable?

CA Housing CRASH 2021, enjoy that weather :))))

Thanks, we had 72 today.

I was worried the crash had been cancelled. Glad to hear it’s just postponed to 2021! We are almost there then! Really want to buy that rental soon, preferably at a good 5% discount.

Why pay for a rapidly depreciating asset when the Big Fat Bastard will pay your mortgage for you? Don’t be stupid.

Thank you Big Fat Bastard for paying my mortgage!

Stagflation seems a lot less likely to me than massive inflation after a vaccine is released. People have been hoarding cash right now, yes. But once the pandemic is over, everyone’s wallet is gonna open wide, and with how much the government has been giving out free money, and likely will continue to, the dollar is gonna weaken.

Having a large loan at a low interest rate might be a good position for a lot of people.

Cryptos are a great inflation hedge/investment

Rents are falling in the areas where BLM and Antifa marched. They are also falling in areas that are high density. They are rising very fast in the suburbs, especially where single family homes are. Same story with the prices. You have to buy in nice suburbs or don’t buy at all/

JT is correct.

Some interesting statistics here:

https://www.calculatedriskblog.com

Dow 30k

Let’s go America!!! Vaccines are on the way! Ready to 🚀 🚀 🚀

USA USA USA 🇺🇸 🇺🇸ðŸ¾ðŸ¥‚🗽🥇

The RE is extremely strong

https://www.cnbc.com/2020/11/24/home-prices-see-biggest-spike-in-6-years-in-september.html?fbclid=IwAR0ocny0qfW-1mcVOoboELy77KhURu5VqhpT17d6IovRK3SRoHa2nCTttZ0

Biggest spike in 6 years. 🚀 ðŸ 🔥

Housing Bubble 2.0 has already popped, but pay no attention and get outside and enjoy that weather, after all it’s costing you 40% of you income, lmao

A report from the Orange County Register. “Skipped mortgage payments across California are jumping to levels not seen since the mortgage mess surrounding the Great Recession. Let’s start with a few numbers from mortgage tracker CoreLogic and its measure of ‘seriously delinquent’ home loans in August — those with 90 days or more of late payments. Statewide, 3.8% of home loans were in deep trouble compared with 0.6% a year earlier. Yes, that’s a six-fold-plus jump.â€

“It’s largely the same story in this sample of key markets. Riverside and San Bernardino counties: 4.6% ‘seriously’ tardy vs. 1% a year earlier. Los Angeles-Orange County: 4.2% vs. 0.6% a year earlier. San Francisco metro: 2.8% vs. 0.3% a year earlier. San Jose metro: 2.2% vs. 0.2% a year earlier. This isn’t just California craziness. The nation’s rate was 4.3% — up from 1.3% in August 2019 and the highest rate of ‘serious’ trouble since February 2014.â€

CA is gonna take a beating, some deservedly so.

Delinquency only matters if it translates to foreclosures. If delinquent owners can liquidate at a net zero position, they just go back to renting and a new buyer with presumably stronger finances replaces them. I’ve seen plenty of houses appreciate 10 percent in the last year, plenty of equity for owners to get out of a bad loan if things go south. Banks won’t make the same mistake of foreclosing en-mass like 08-11 because that depressed values for half a decade. Don’t forget that it takes 18 months to actually get someone out of a house after a foreclosure process if started. Buyers can always redeem when times get better, especially when credit is so cheap. Everything else notwithstanding, Papa Biden will bail out the RE market if things get too bad.

Happy Thanksgiving everybody! I know it’s going to be a weird year for holidays, but 2020 is almost over and we almost have a vaccine (or two or three).

Happy Thanksgiving 🦃ðŸðŸ½ everyone!

I’ve been waiting for this bubble to pop forever. Let’s get this show on the road.

And so it begins- A dark covid winter is descending on the working-poor of America as millions of adults face eviction or foreclosure in the next few months. Bloomberg, citing a survey that was conducted on Nov. 9 by the U.S. Census Bureau, shows 5.8 million adults face eviction or foreclosure come Jan. 1. That accounts for 32.5% of the 17.8 million adults currently behind rent or mortgage payments.

But if you live in CA, no worries, just look how beautiful the weather is, lmao

This all happened in 2008 and our new President and VP fixed it. We’ve seen it all before.

Now our old VP who is our new President will have to fix it all again.

I’m beginning to see a pattern here.

The only pattern I am seeing is that each time a globalist is in power they destroy everything and each time we have a nationalist, they try to fix things. Bush and Obama were two globalists and Trump a nationalist. Till the virus was introduced, the economy was the best ever, with the lowest unemployment and the lowest unemployment for minorities in a century. The stock market was skyrocketing. The only reason is still holding is the hope that the democrats will take the senate and juice the assets with another 10 trillions.

Globalists did not like to be marginalized. Now, the globalists introduced this virus and a draconian response to make sure they grab the power again to achieve their dream to enslave the whole humanity.

That is the only pattern I am seeing.

The biggest pattern I see is that when a Republican leaves office, the economy is in ruin.

Initially Hoover, and then Bush and now Trump.

We’ve seen it all before.

The biggest pattern I see is that when a Republican leaves office, the economy is in ruin.

Clinton ended his reign with the dotcom bubble burst.

Carter ended his with the economic “malaise” that Reagan fixed.

If FDR, Truman, and LBJ ended their terms with a good economy, it was largely because of war spending — WW 2, Korea, and Vietnam.

Without the war spending, FDR would never have lifted the U.S. out of depression. The economy in 1937 was a bad as in 1932.

You are stuck in the old democrat/republican paradigm. What we have today is a new paradigm – globalists (i.e. Clinton, Bush, Romney, Obama, Biden, etc) vs. nationalist.

The globalists fight to undermine the sovereignty of US, eliminate the dollar as reserve currency, have de facto open borders, make everyone equally poor and you still enjoy the slavery they prepare for you. You are stuck in the past in an old paradigm. You are so entrenched in the old ideology that you don’t see what is going to hit you before you know it. You are going to lose everything to higher taxes and wealth taxes (confiscation or nationalization). Don’t ever believe the lies you hear from politicians that you are not going to be affected. They said the same thing in 1913 wen they created the IRS.

Under the new plan, the middle class will disappear. The Czar Biden is planning for the Ministry of climate change is Kerry, yes that billionaire with 6 houses, 2 yachts and private jet!…the irony!…. Biden cabinet will be full of these specimen who will destroy the wealth of the middle class and who will be above the laws they will create; …and you cheer for them!…

You are right, Son of a Landlord. Clinton and Carter Presidencies did not end positively.

The cure in all cases FDR, Obama, Reagan has been deficit spending. Reagan deficit spent and cut taxes, Obama deficit spent to provide bank and auto bailouts and infrastructure improvements, and FDR deficit spent on WW II.

Clinton balanced the budget when the economy was good.

Obama deficit spent after the economy tanked.

Trump deficit spent when the economy was good.

Biden will have to continue to deficit spend until we are out of the Covid crisis.

When we are past this crisis, there will be another Roaring 20’s and a fiscally responsible President will balance the budget again. I hope.

I don’t think Nationalism can help us without causing massive inflation. People are too used to cheap imports. Even much of our Defense spending is spent on electronics fab’ed overseas. Everything would be much more expensive if it were manufactured here. Globalism would be hard to eliminate but I agree it should be fair.

Flyover,

IMHO, Globalists are true Capitalists. They want to open all borders to manufacture and produce goods without government intervention. That will provide the most opportunity for business and the lowest prices for consumers.

Socialists and Communist governments want to regulate and control business for a nationalist goal. They believe in government regulation and control over private business to prevent them from finding the cheapest optimal solution globally. That is bad for a capitalist business and for the consumer.

So far, Trump has imposed tariffs on overseas goods and regulated where private business can manufacture goods. This isn’t capitalism.

Given that, from my prior posts, I do believe in government intervention over private business to maintain fairness. However, I am not a Nationalist.

Fun times dead ahead, skid row coming to your town soon – https://www.youtube.com/watch?v=UnR-agGYCJg

OC Register Economy/Real Estate section discussed the Covid economy of California. The difference between the way monthly and quarterly job losses are calculated meant that the monthly numbers were probably overstated according to Register columnist Lansner. California total wages paid dropped 0.4% for the fiscal year that ended last June compared to 1.6% nationally. Average weekly earnings for the employed are up in the coastal metro areas and down in the Central Valley compared to a year ago. So what we have is the better off wage earners doing just fine and the lower rungs getting hosed. So we see some rent decreases for apartments and jumps in single family home prices (partly fueled by low low interest rates).

The pain of low wage earners doesn’t have anything to do with how much people with good jobs are willing to pay to get a place in a good neighborhood. In fact, it could drive more people to (as Rev Ike used to say) “get out of the Ghet-to and into the Get-mo”.

The Great Reset-Own nothing and be happy

LMAO, that sunshine tax sure is expensive, better get outside and enjoy it- The Mendocino Voice in California. “Ed Keller was sure there had been a mistake when he opened a letter from his home insurance company and read that his policy had been cancelled, and that purchasing a new policy would cost four times what he had paid in the past. Bewildered, he picked up the phone and called his provider, Mark Davis Insurance, to clear things up, only to hear from a company representative that it was not an error at all. Keller’s insurance premium had been hiked up by around 400%, from around $1,000 to just over $4,000 per year.â€

“His story is by no means unique. Across California, almost one million homeowners have received notices of non renewal since 2015. Short of serious intervention, insurance experts, consumer advocates, and state agencies only expect this to continue.â€

“It was just two years ago that Keller moved to the Golden Rule Mobile Village, a mobile home park for seniors that lies in a valley off US Route 101, about half-way between Willits and Ukiah. He put an offer on the home the first day he saw it and, using a mortgage, purchased it for $100,000. That was about a year after the Redwood Fire burned within a quarter mile of the Village.â€

“Keller felt a bit of sticker shock when he saw the amount he would be paying for home insurance then, around $1,000, but brushed it aside. Of course, that pales in comparison to what his insurance company raised it to this spring, around $4,000, which Keller said is more than what some of his friends with houses worth close to half a million dollars pay for their home insurance.â€

“As hotter, faster, larger, and more frequent wildfires make California a more dangerous place to live and own property in, homeowners, government agencies, and the insurance industry are all trying to figure out who should be responsible for the vastly increased risk of extremely destructive wildfires. No one wants to end up holding the bag.â€

“‘At some level, insurers are overreacting,’ said Amy Bach, the executive director of a nonprofit that advises consumers on how to navigate the insurance market ‘Their reaction is out of proportion. But, to a certain degree, people can’t just point the finger at somebody else and say, ‘well I’m a victim of climate change and somebody has to do something about it.’ People who have made that choice to live in a heavily forested area, in some way have to bear the consequence of that decision…You’re gonna get more and more people asking the question,’ ‘Should I stay here?’â€

No worries, your property value is gonna triple in the next 2yrs, or not. lol

Same thing with the flood-prone southeast coast of Florida. I would pay at least $4,000 to insure a condo there comparable to my Chicago condo, for which I pay $550 a year to insure.

That expense alone is enough to scare me off coastal, warm-climate cities, even if I weren’t extremely intolerant of heat- no way can I live in a place where temps reach 115F in the summer.

Housing market stili in boom mode.

Demand for housing was strong in early 2020, before the COVID-19 crisis hit. Mandated shut-down measures and the fear of what COVID would do to our economy temporarily immobilized the housing market, evinced by nine weeks of declines in the weekly purchase applications data on a year-over-year basis. Then it was as if the Housing Demographic God exerted her chronokinetic powers to snap demand back to pre-COVID levels of growth. The frozen market thawed and resumed its steady pace of growth, even making up for lost time.

Instead of a housing crash, as many others predicted would be the lasting consequence of shut-down policies and massive job losses across the nation, the opposite happened as the 2020 U.S. housing market has been the most out-performing economic sector in the world.

https://www.housingwire.com/articles/the-downside-of-the-hot-2020-housing-market-rapid-home-price-growth/

I think think the bubble is starting to burst. I live in the Bay Area and work for a medium sized glass subcontractor. I have previously worked for 2 extremely large glass contractors that do business in the Bay Area, LA/OC/SD, and Las Vegas. Primary scope is mid to high rise buildings. My company is doing well but we are starting to run through our backlog and projects are harder to win. I have heard from an ex co worker one of the companies I worker for has lost $300 million dollars of work. Projects are now being put on hold. They just laid off 300 employees last month and supposedly are preparing to layoff a few more hundred. Real Estate is hot now but I see it softening up by Spring. The way our economy works now is an extreme domino effect, so this could be a ominous sign. Will the fed keep the bubble from popping? or really how long?

Interesting. Rent and condo prices in SF have been dropping for some time already. Are single family homes next to tumble? Then SoCal. Rent is already down 10% in LA. No more forbearance signups after December 31 and Newsom is trying hard to destroy small business again. Come mid-2021, most on forbearance will need to resume payments. The jobs situation in CA is terrible, but a vaccine is coming….

So, will people take it? This is America, right. We tend to be skeptical of things like rushed-through mRNA vaccines, a type of vaccine that has never before succeeded. “There is a race to get the public vaccinated, so we are willing to take more risks” – Tal Brosh. Personally, I’ll wait and watch both the vaccine and the housing market before deciding what to do.

https://www.jpost.com/health-science/could-an-mrna-vaccine-be-dangerous-in-the-long-term-649253

Yup, when the Fresh Prince of Bellaire sees a coming CA Housing Collapse, Philly is looking pretty good. The San Jose Spotlight in California. “San Jose has issued far fewer residential building permits this year — and it could signal a severe economic downturn. ‘It looks like a slowdown is coming,’ said Will Smith, business agent for the IBEW 332 electricians union. ‘We’re potentially heading into a recession.’â€

“Smith’s observation is backed up by the latest numbers released by San Jose’s Housing Catalyst team, part of the city’s Economic Development department. According to the city, San Jose has issued 994 building permits for new residential units so far this year, less than half of last year’s. Rich Truempler, a senior vice president at CORE Companies, said the main obstacle to residential building this year is the fact that rents have fallen while the cost of construction remains high. ‘We have not realized any savings in costs,’ Truempler said. ‘That makes projects very tough to finance right now.’â€

“Smith said IBEW 332, which represents about 3,700 local electricians, regularly monitors upcoming projects to estimate the likely workload and determine how many new apprentices to hire for the following year. He said all of the union’s larger projects are ending next year, and there are no large projects starting after those are completed. ‘Unless things change,’ Smith said, ‘it looks as though 2021 is going to be the start of the downturn.’â€

From KPIX in California. “As COVID cases climb and the exodus from the Bay Area continues, rents are falling with some of the biggest declines in the South Bay. The continued drop since April is due to the departure of remote working techies, creating opportunity for steep discounts near Silicon Valley tech giants. Keller Williams real estate broker Myron Von Raesfeld showed KPIX 5 a newly renovated unit at 1400 White Drive in Santa Clara, just off El Camino Real that became vacant during the pandemic.â€

“‘We used to – a place like this we would when it first goes on the market place, we’d have 15, 20 calls in the first day or two,’ said Von Raesfeld. If it were available in the same condition last year at this time, it would have rented for about $2,150 within 2 weeks of hitting the market. It’s been sitting empty for 4 months. The rent now – $1,900 and the first month is free.â€

“A new report by Zumper found that in the Bay Area, Mountain View saw the largest decline in rent since this time last year at 23.8%. In San Francisco and Menlo Park rents dropped 22.6% while in Santa Clara they have dropped 20.7%. ‘I do hear my friends who want to actually move out from here, and buy or rent a bigger place,’ said Baljeet Kundo of San Jose.â€

The Los Angeles Times in California. “Snowboarder Shaun White has racked up a record 15 X Games gold medals over the course of his career, but his recent Malibu home sale is slightly less historic. The 34-year-old just sold the coastal estate for $8 million — nearly $5 million less than he was originally asking, and $2.75 million shy of the price he paid for the property in 2016.â€

Enjoy that weather, there is a shit storm off the coast.

Of course upper end Malibu homes are waning in prices, this means the ultra rich are no longer buying their 3rd of 4th homes. Who cares.

I used to worry about a ‘crash’ when I bought my home in 2012 when I was told I was ‘catching a falling knife’. haha.

I bought in 2012 in LA, I have a 1800 sqft home on 7000 sqft of land, my mortgage is $1650 and taxes $500 per month.

I will never have a better financial situation in terms of mortg and taxes than I do now.

Do I care that there is going to be a housing crash, of course, I do that I have empathy for peoples hardships, but isnt there a crash about every 10 years???????

Congrats, 2012 was the best time during this millennium to buy in CA. I have a relation that bought for $200s in 2021, sold for $500s then bought in the $600s. It has appreciated to around $900. It’s a 2 bed, 1 bath. The fact is that $200s and $900 are both fantasy in LA. Reality lies somewhere in the middle and this kind of unnatural environment never lasts forever. The nutty pendulum swings hard in CA.

Naturally by 2021, I meant 2012. 😉

Congratulations! 2012 was a great time to buy if you didn’t have any fear from the 2008 crash.

The good news is that your mortgage is likely lower with a much lower rate and Prop 13 locks in your taxes to a known rate increase for the rest of your life. Insurance and upkeep may go up but typically with inflation.

Even if housing crashes temporarily, you know your fixed costs and can ride it out.

If housing continues to go up, it will be a good inheritance or a hefty bank account if you want to sell.

Loved this blog for years. Actually bought street side house in the Goldenwest estate area of HB (half down) but like an idiot sold it a year later. Guys OC is a different animal. Youve got middle easterns, south asians, east asians all with savings ready at moments notice when a house popus up.

One word on Housing, UNSUSTAINABILITY and leading the way is CA 🙂

From The Eastsider in California. “Here are some examples, followed by a breakdown by neighborhood, of recent price cuts on homes, condos, apartments and other Eastside properties. Echo Park 2-bedroom: $20,000 slice on remodeled 1898 home with air conditioning, security alarm, hot tub, and separate entrance to guest room with separate bathroom. Now asking $849,500.â€

“Highland Park duplex: $30,000 reduction on 4-bedroom home in Historic Preservation Zone converted into 2 apartments with backyard. Now asking $898,000. Atwater Village Traditional: $114,000 chop on fully upgraded 4-bedroom home with 4-bathrooms, expansive floor plan offering natural lighting. Now asking $1,085,000.â€

The Los Angeles Times in California. “Two years and six price cuts later, Grammy-nominated singer Michael Feinstein has finally sold his Los Feliz home. The dramatic Tudor Revival-style spot just traded hands for $7.33 million — a big drop from his original ambitious price tag of $26 million. Feinstein put the property on the market in 2018 a few months after moving east. Feinstein bought the place for about $2.5 million in 1998, records show.â€

The Ukiah Daily Journal in California. “We are seeing more of a return to a seasonal market in Wine Country with sales falling on a month over month basis. They still remain relatively high to a year ago. Inventory is starting to more closely mirror inventory from a year ago. I was introduced to a new statistic for watching the direction and strength of real estate markets. I call it the ‘Price Reduction Ratio.’ Across the country, one might expect that 30 to 35 percent of the homes put into the MLS to sell will have a price reduction before they eventually sell.â€

“For October 2020, of all closed homes in Sonoma County, 25 percent had price reductions before selling. In Napa, the ratio was 27 percent and in Mendocino County it was 22 percent.â€

While you are out enjoying that beautiful weather and looking up at the sun saying “BOY AINT CA SWELL” you just stepped into a big pile of shit, with a needle sticking into the side of your foot, the clock is now ticking on your health.

For those homes in LA area – Highland Park, Echo Park, Atwater… not surprising.

As a life long LA resident, I can say those areas seemed way overheated due to yuppy demand replacing lowriderville. Next was Boyle Heights.

These are the yuppies who work in Downtown LA, probably mostly IT people and TV, Film, who wanted to make those neighborhoods the next hip places.

It can all crash down as far as I’m concerned.

These are the yuppies who work in Downtown LA, probably mostly IT people and TV, Film ….

DTLA has never had a reputation for attracting TV & film people. The Westside, the Valley, Hollywood, even Pasadena, have greater reputations for attracting TV & film people.

DTLA’s reputation has been for attracting people involved in law, finance, government, and international business.

Son of LandLord –

Yes, you are right, my point was there are lots of people living in Highland Park, Echo Park and Atwater who are working in the TV and Film, which is a close drive to their work locations in Hollywood and Burbank as well as close to all the work (finance, law, govt) in Downtown LA.

Doesn’t matter if price is reduced from ask. What matters is ROI. E.g., While I asked for $3 million for my crapshack that I purchsed in 2010 for $500,000, I actually sold it for $2.25 million. Versus, while I asked for $3 million for my crapshack that I purchased for $2.5 million in 2019, I actually sold it for $2.25 million.

I think the real question is: Did you do better than renting the same house? If the cost of renting would have been greater than mortgage interest+taxes+insurance+upkeep+improvements+/-gain/loss then you did OK.

You have to live somewhere.

The fact that you have to post so many times on the same article screams how much you desperately want to be right after years of being dead wrong and your debilitating fear of investing in the RE market.

I’m breaking ground on a 6 home development by mid-February. Should be done by July in time for the crazy hot housing market this upcoming year will bring. Should we circle back around that time? I bet you that I will be well in the money (probably more than I anticipate tbh) and you will be wrong (again). Just give up man. You’ve had a horrible year, don’t make 2021 horrible for you as well.

Whats the location of this 6 home development. I may be interested. Thanks.

That 6 home “development” is as real as M’s “house.”

Nice NewAge! I know you have mentioned this before a while ago and I am glad your plans are materializing!! All the best and keep us posted how it goes!

Now, Josh. Give New Age some time to reply. Someone looking to develop and sell 6 units should be eager to share details to anyone asking.

@Josh

You got me man, you finally got me. All those years of calling me out on my BS and today, I decided I can’t keep living this lie anymore. You win bro. I am nothing more than a troll that blurts out absolutely ridiculous things on this blog. Nothing I ever said is true.

Like the time back in February 2018, just under 3 years ago when I said:

“Sure a rise in interest rates will negatively affect prices but it will stagnate them AT BEST until wages catch up which is right around the corner. You know what else is right around the corner? Automation! While this means that it would banish a great deal of people to rental land, it would introduce a great deal of new players to homebuying, namely the working professionals with jobs that can’t be automated. Those guys will be getting a hefty payday for their skills which means they will easily be able to buy into these prices. And last, an internet revolution is also right around the corner. If I could transfer hundreds of gigabytes of data a second why do I need to be physically present at my job? Can’t I move out of expensive silicon valley and work remotely from affordable Indiana? In the near future, you sure can!”

Like I don’t even know what the heck I am talking about man. I actually never made a single dime on RE. As a matter of fact I’m writing to you right now on my Obamaphone on a Starbucks WiFi connection. I am such a loser desperate for acceptance because all I know in life is rejection. Hope you forgive me buddy.

@Butch

I’ll post details when Realist lives up to his name 😉 I sure have lived up to mine! It’s a NEW AGE people! You’re either in with the NEW or out like the OLD!

So no details on your development? Just an over the top emotional reaction? Like I said…

I mean I thought I would demonstrate how scary accurate my predictions are and how important to conduct in-depth analysis and think much more broadly to make educated decisions without revealing my identity but I guess you didn’t like that 🙁

So I’ll just straight up tell you that I’m not going to reveal my identity on the internet. I thought this was obvious. Lot to lose buddy. My Obamaphone and my blankie that keeps me warm when I sleep under the overpass is all I got.

I will say a little bit more, maybe you can learn a thing or two about personal development too. The development belongs to a college buddy of mine that has been in the works since early 2019ish when the market looked “grim” due to rising interest rates at the time. I was actually scrolling thru the posts Doc made around that time and I know for a fact I was a mega bull early 2019 but I believe you were a MEGA bubbler as if the sky was falling (credit to you, you’re not as insane as REALIST) but how’s that due diligence workin out for ya man? Crazy RE crash we’re goin thru this year, those poor RE investors my heart goes out to them 🙁 Anywho, I’m loaning some money for the build interest free and to your delight, I’m not making a single dime. In exchange, he’s teaching me everything. Unrestricted access his books, his accountants, suppliers, labor force, discount equipment rentals, manufacturers, project managers, brokers, plans, specifications, the whole 9 yards and 9 more. I’m pretty much consolidating his 15+ years experience into one because knowledge is power. It took him at least 10 years to get his costs down to $75/SF + land. I wanna skip that part because the party is about to start soon.

Great news, just passed my professional civil engineering exam so I can legally design structures in CA now, up to 3 stories. Want my license number too? It’s S4206969, call me when you’re ready to build at 323-420-6969, I’ll get you thru plan check fairly quick.

Anyways, hope 2021 is a great year for everyone. Have a happy and prosperous new year.

LMAO, Yah, it’s sure is different in Crapifornia – rom Socket Site in California. “Measuring nearly 2,700 square feet, the three-bedroom unit #32B near the top of the Lumina tower at 201 Folsom Street was priced by the sale office at $5.385 million in mid-2017 and ended up selling for $5.25 million in August of 2018. The ‘premier’ unit returned to the market this past May priced at $5.595 million. Reduced to $5.395 million in July, dropped to $4.7999 million in September and then further reduced to $4.4999 million in October, the resale of 201 Folsom Street #32B now closed escrow with a contract price of $4.2 million or roughly $1,565 per square foot.â€

“The unit’s HOA dues, which include valet parking in the building’s garage, are currently running $1,461 per month. And while $1,565 per square foot certainly isn’t ‘cheap,’ it was 20 percent cheaper on an apples-to-apples basis than in August of 2018 (while the index for Bay Area condo values is only down 2.7 percent over the same period of time and ‘median sale prices’ are up).â€

Sun is out, so are the homeless who is craping on your driveway 🙂

Bob,

You can not have capitalism without free markets. Globalists are not capitalists. They don’t want free markets – they want rigged markets, rigged in their favor. Like all the fascists, they use the power of government to REGULATE the competition out of business so they can act as monopolies. Globalism leads to concentration of power and money in the hands of few people which leads to totalitarianism.

I agree that Trump is not a true capitalist; stopping landlords to collect rent on their private property and trashing contract law is not a feature of capitalism, but socialism/fascism. I wrote to White House in this regard, but that is all I can do. That being said, in regard to free markets, Trump is evil lite. The alternative is Kamala Harris which is evil on steroids.

So, as bad as Trump is, the alternative is a million times worse.

In regard to foreign markets, yes, trade should be free. However, we don’t live in an ideal world. Therefore, we need fair trade agreements to level the playing field.

Bob,

I am trying to reply, but I am censored. I tried to post something five times, with no success.

Bob,

You can not have capitalism without free markets. Globalists are not capitalists. They don’t want free markets – they want rigged markets, rigged in their favor. Like all the fascists, they use the power of government to REGULATE the competition out of business so they can act as monopolies. Globalism leads to concentration of power and money in the hands of few people which leads to totalitarianism.

I agree that Trump is not a true capitalist; stopping landlords to collect rent on their private property and trashing contract law is not a feature of capitalism, but socialism/fascism. I wrote to White House in this regard, but that is all I can do. That being said, in regard to free markets, Trump is evil lite. The alternative is Kamala Harris which is evil on steroids.

So, as bad as Trump is, the alternative is a million times worse.

In regard to foreign markets, yes, trade should be free. However, we don’t live in an ideal world. Therefore, we need fair trade agreements.

I posted a relatively non-controversial post on Crypto a week ago and it never showed up. I doubt it was censored. Probably a browser glitch, or a problem with a server somewhere while you were posting. Some websites won’t work well with some browsers (e.g. Safari).

Or maybe it is censored because people are tired of political rhetoric that elicits trolling banter.

I’m sure breibart has their own forum somewhere. Stay on topic.

Mass mutual insurance company invested 100m in Bitcoin.

Hedge funds, banks, billionaires, square, PayPal, microstrategies are pouring Millions into Bitcoin. That should tell you something.

M: Hedge funds, banks, billionaires, square, PayPal, microstrategies are pouring Millions into Bitcoin. That should tell you something.

Like what?

Certainly not that Bitcoin has inherent value. Financial insiders often prop up worthless “investments” as part of a pump & dump strategy. Remember derivatives?

Really funny comment.

What’s the intrinsic value of a piece of paper that says 100 dollars? You won’t know, so I tell you. It’s a few cents to manufacture it. The only reason why it has value is because it’s backed by the US government which can print as much as it wants. Money is a believe system.

Bitcoin is deflationary. It has a finite supply and is decentralized. Smart money is getting in now. People like you will remain on the sidelines and watch it explode in price.

M: What’s the intrinsic value of a piece of paper that says 100 dollars? You won’t know, so I tell you.

Actually, I do know. Many people do.

M: The only reason why it has value is because it’s backed by the US government …

Yeah, that’s a common observation in conservative and libertarian publications. It’s not esoteric knowledge.

And being backed by the current world empire is no small thing.

Confederate dollars aren’t worth much today (though they are bought and sold among collectors). And U.S. dollars might not be worth much after the fall of the U.S. Empire. But the Empire seems like it’ll stick around for another generation or so, so the dollar has real value.

Crypto is backed by nothing except belief. It’s not something you can use. And it’s not backed by imperial military might.

M, I’m curious how a digital currency can be guaranteed of a finite supply. How is it not so easy to create more. Help me understand. Thanks.

SOL, now we are talking about value and intrinsic value. I agree Bitcoin has no intrinsic value. Most things don’t. If you take a tech stock for instance you may calculate an intrinsic value. A dividend stock has intrinsic value as well. However, the market price of those assets are often multiple times above the calculated intrinsic value. I don’t know any investor in stocks that buys based on intrinsic value. It’s based on TA, news, Macro economics etc.

Bitcoin offers something that gold, the dollar and real estate can’t offer. The value of bitcoin comes from its traits. It’s a belief system after all and if you play the game right you will be able to make a sh*** ton of money.

Smart money knows this and is pouring in like never before. I would say 8 out of 10 people here have no idea. They will get in when bitcoin is all over the news due to all time highs and hype.

Now again (and I will have to post this many, many more times):

It’s scarce, decentralized, easy to transact, digital, seen as gold 2.0, a store of value.

Bitcoin is essentially code/programmable money. Its part of its design that by 2041 all 21M Bitcoins will be mined.

Calculate the number of blocks per four year cycle:

6 blocks per hour

* 24 hours per day

* 365 days per year

* 4 years per cycle

= 210,240

~= 210,000

Sum all the block reward sizes (every 4 year there is a halving event>>block rewards are cut in half)

50 + 25 + 12.5 + 6.25 + 3.125 + … = 100

Multiply the two:

210,000 * 100 = 21 million.

Since Bitcoin is decentralized, nobody is really in charge other than the community consensus. its open source and you can edit the code but users/bitcoin community need to have consensus in order to make a change to the code (peer reviewed). In its 10+ years no major change has been made (like increasing the supply).

Not financial advice….buy Bitcoin….you will thank me later.

There is mass adoption by institutions and I see a 100K+ Bitcoin price by next year.

Is crypto scarce? I browsed one site, and it seems there are a couple of dozen crypto currencies out there, with people always starting up new ones. How scarce is that?

I realize Bitcoin has the advantage of being first out of the gate, but since it has no real value, how long can that advantage last before people stop believing.

Cryptocurrencies: growing in number but falling in value

Though there are now more than 2,000 different cryptocurrencies in circulation, the total value of all coins has crashed.

https://graphics.reuters.com/CRYPTO-CURRENCIES-CONFLICTS/0100818S2BW/index.html

Everyone headed to the hills with pic axes looking for gold.

Butch,

I haven’t seen many smart comments from you. Sadly, this is another weird one. “Running for the hills�!?! You must have missed that bitcoin just blasted through its previous old time high??

https://www.cnbc.com/amp/2020/12/17/bitcoin-btc-price-hits-new-all-time-high-above-23000.html

Sol,

Bitcoin has value to hedge funds, square, PayPal, billionaires, banks, life insurance companies. If you don’t see the value in bitcoin so be it. Watch us get wealthy.

M, Sorry your intellect is shallow at best. Explaining the “gold” analogy would be useless.

Institutional investors are picking up SMALL amounts of BTC as a means to diversify. Nothing else.

https://cointelegraph.com/news/why-institutions-suddenly-give-a-damn-about-bitcoin

Regarding In total 81,154 BTC, or 0.5% of all BTC in circulation is held in the treasuries of publicly traded companies.

This bitcoin/crypto bull run is driven by institutional investments. You have once again proven you have no idea what’s happening. Follow the price. It’s 27k as of dec 27 per bitcoin. Let’s see where we are at in 6 month.

Hi Flyover,

I’m always interested in your response and for a friendly debate.

I’ve noticed that that the first time I post, I get an error. i then browse back to my post and wait until all of the updates occur – 10 seconds. and then try again. I then get a duplicate comment message but it works

I use Firefox.

Yeah, that happens to me too. I always get an error message, yet my posts usually go through. I also use Firefox.

I always do that. However, some posts take 5 days to post.

This is not the post I told Flyover about, but it is something new I found:

https://www.buybitcoinworldwide.com/bitcoin-price-in-gold/

If you click on the start date, you can reset it to 2018-01-01 which is the important date to start looking at bitcoin. That start date will show you the real volatility of Bitcoin. Using the dollar includes the decline of the dollar. See below:

https://bigcharts.marketwatch.com/advchart/frames/frames.asp?show=&insttype=Future&symb=BITCOIN+FUTURES+CME&time=100&startdate=1%2F1%2F2018&enddate=12%2F11%2F2020&freq=1&compidx=aaaaa%3A0&comptemptext=&comp=none&ma=0&maval=9&uf=0&lf=1&lf2=0&lf3=0&type=64&style=320&size=4&x=58&y=16&timeFrameToggle=false&compareToToggle=false&indicatorsToggle=false&chartStyleToggle=false&state=9

Either way, Bitcoin has a lot of volatility, just like a lot of stocks. As a reminder, here is GLD (gold ETF) for the same period:

https://bigcharts.marketwatch.com/advchart/frames/frames.asp?show=&insttype=&symb=GLD&x=45&y=17&time=100&startdate=1%2F1%2F2018&enddate=12%2F11%2F2020&freq=1&compidx=aaaaa%3A0&comptemptext=&comp=none&ma=0&maval=9&uf=0&lf=1&lf2=0&lf3=0&type=64&style=320&size=4&timeFrameToggle=false&compareToToggle=false&indicatorsToggle=false&chartStyleToggle=false&state=9

Big Lump of Coal for the CA Real Estate Market, 2021 will not be pretty. A weekend topic starting with KPIX in California. “Rent collection has dropped from 80.4% nationally at this time last year to 75.4% at the start of December. Meanwhile tenants are fleeing urban centers left and right. ‘I’ve even seen properties where they’ve dropped the rent 50% and they still can’t fill up the units,’ said Sid Lakireddy a small landlord and the President of the California Rental Housing association said. ‘San Francisco has a very big problem now.’â€

From KRON 4 in California. “We’re seeing major changes in the last month for San Francisco rentals in what were very popular areas. There are hundreds of listings less than $2,000 for a studio and in the once-coveted neighborhoods, like North Beach, Marina, and Lower Pacific Heights, they’re seeing listings below low as $1,500 literally slashed by half since this time last year. The eastern side seeing the biggest annual drop and just for more perspective on how wild this is, this time last year, we did a report on what was called PodShares that was a bunk bed in the Tenderloin for $1,200.â€

From SF Bay in California. “‘For Rent.’ Vanessa Khaleel sees that sign more and more from her office in Hayes Valley. And that’s not something the deputy director of the San Francisco Apartment Association wants to see. Khaleel said: ‘Our owners are seeing vacancies at about 20 percent higher and then they’re seeing their market rents come down anywhere from 20 to 25 percent so those two things are creating a financial hit to the property owners.’â€

“Thomas Bannon, CEO of the California Apartment Association, supported the moratorium but thinks it’s time for the moratorium to be lifted. said: ‘You’ve got to figure out a way that the landlord can either be made whole or pretty close to it. If not, they will probably sell their single family rental units and walk away.’â€

From Socket Site in California. “Despite the fact that the average asking rent for an apartment in San Francisco has dropped 24 percent since the end of February and the average asking rent for a one-bedroom is back under $2,700 a month for the first time since 2012, listing activity for available units continues to tick up. In fact, there are now over three (3) times as many apartments listed for rent in San Francisco than there were at the same time last year with vacancy rates on the rise.â€

From Travel Weekly. “As California looks to combat rising Covid-19 cases with strict stay-at-home mandates, hoteliers across the state are bracing for a bleak holiday season. ‘We already have a number of our hotels that are at risk of having distressed loans,’ said Pete Hillan, a spokesman for the California Hotel & Lodging Association, citing a recent American Hotel & Lodging Association member survey that showed that 59% of hotel owners are in danger of foreclosure by their commercial real estate debt lenders.â€

Remember Kids, You Can’t Have Any Pudding if You Don’t Eat Your Meat

How do mid-income people get approved for 800k+++ loans without barely enough money for downpayment? I’ve been saving $$$ for years to use for a down payment (and have close to 10-15% for down payment) for these local so cal/la area prices, but haven’t been able to get approved for a loan.

No bankruptcy’s. No high debt. I just don’t have any verifiable income sources.

I have been renting the same house (4 bed, 2bath) for 12years now and want to stop just throwing 4K/month away for the rest of my life.

I guess I don’t understand why I have had such a hard time (with little clarification as to why?) getting approved for a home loan.

I have a proven track record of 12+years of on-time payments, more than enough $$$ saved for most down payments, and plan to rent out a couple rooms (if I could get a loan approval).

The way I see it is that I’m ACTUALLY less of a risk for a loan but have been denied because of lack of “income verificationâ€.

Yet many other individuals that get approval pose a much greater risk of not being able to pay back the loan compared to me due to many factors including: not much $$$ for down payment, past bankruptcy, children, multiple outstanding loans, etc.

I couldn’t find any form or section, when applying for a loan to include “future rents†to use toward the approval. I’ve read a lot about using future rent as 75% (or more) of income for income verification.

Could anybody explain how I too can get approved for a home loan in la area with the info and plan I provided?

I agree, Jiggles, How many people can qualify for an 800K house? I can’t.

The last time we purchased a home, here is what was asked:

1) Credit Score. – Over 740 or it got tough to get a loan.

2) W2”s from work income. – The total loan payments had to be less than 30% of income and employment had to be stable.

3) Past 3 years income taxes. – I suppose to show stability of income and that I paid taxes.

4) Appraisal showing the house was really worth what I was paying for it.

5) Proof of downpayment. A single bank account showing this. They told me that the higher the downpayment, the easier it was to get a loan at a better rate. 20% minimum. If you could get 30%, then it was easier.

The lender never asked about 401Ks, bitcoin, gold buried in the backyard, or investment accounts, but they did scrutinize EVERY withdrawal and addition to the single bank account I provided. I thought that was strange. ie why did you withdraw $1,000 on November 10th. Where did the 3K deposit come from on November 15th? Next time I will set up a bank account without much activity just for the downpayment.

Given that, my loan was not 800K so maybe I had it easy.

I feel your pain.

I have friends who are self employed ‘dba’s’ and even though they have good income and stable for over a decade, they cant get a loan.

As for me, I am sort of self employed. I am shareholder in a company but I also made myself a W2 employee. The fact that I am a W2 employee, the banks approved by loan (even though my W2 income is significantly lower than my friends self employed ‘non verifiable’ income).

Good luck

Yeah it’s looking more likely I’ll have to just keep at it (saving $$$) for a few more years and just attempt to cash buy some property later (given there isn’t some bs disqualification even when buying outright).

I’ve been self employed my entire adult life, so I’m not going to magically become a w2 employee with the same income overnight.

I’ve read about the amount of applicants fudging their incomes on home loan applications is wayyy up! So even w2 workers are having a tough time qualifying with the current prices.

I don’t see home values dropping significantly in the next couple years. But I DO see the value of my investments going up exponentially against the (slower) rise in home prices.

My experience with loan officers and RE agents is that at least 80% (maybe 90%) are total losers who are either dumb or lazy or a combination of the two. That still leaves plenty of excellent loan officers; you just have to find them. Just because you found a loser, don’t give up. Go to others.

I used one loan officer for over 25 years. It doesn’t matter what bank he was working for, I went to him. Why? He is highly intelligent, hard working and consistently produces excellent results. I also have very good RE agents in different states that I always use. They form an excellent team. A good RE agent and a good loan officer are like good employees – they make you successful. They always look for long term success, to provide excellent service so you can refer them.

New Age, I think land development is a good investment right now. I completed a subdivision of 9 lots few weeks ago and already sold 4. It took over 2 years to push it through all engineering and city red tape, but it was worthed. Last time I did land development was over 30 years ago. It was much easier back them.

I don’t like to do land development because it takes so long. However, I think that many investors think like me, and for that reason, there is not much competition. That allows good profits.

Sorry Flyover I just noticed this! I agree man! It’s not nearly as risky as some people on this blog think it is. I think the broad market is pretty strong and still has way more room to grow. Look at my post below under the title “Dr. Housing Bull.†I used the best most accurate numbers I could to show that there’s so much life left in the RE market. If you’re you’re extremely risk intolerant then maybe a multi family build would be a great investment. A little pricier but at least you’ll have multiple units to rent out and generate income if you can’t get top dollar for it as a wholesale. Just make sure your loan amount is less than the conservative market rent estimates. With ReFi’s it’s more than just doable, it’s profitable. But I think SFH is the way to go at the moment. The profit margin is a good amount higher and the land is cheaper and they’re not as scrutinized by local planning jurisdictions because they’re not high density. A complete build could cost as little as 400K for a 3000 SF main house with an ADU. Those are HOT right now because buyers could rent out the mini house and subsidize their mortgage. Add another 200K for land and you’re looking at 600K in, easily 850K out. The monthly on that to the buyer would be $3800 with 20% down but people have that kinda money and if they rent out that ADU for 1200 they only pay 2600 a month for an estate that costs at least 3500-3800 to rent. The buyer is far below rental parity, sitting on an asset with high resale value and if they decide to move out, they still pay 3800 but receive 4700 for it. Literally everyone wins. THAT’S why people pay that much for these kinds of homes. And a dual income working professional household can EASILY afford that. Your profit is 250K for a three month build. Have three going at one time, twice a year during the summer months and enjoy the winter in the tropics.

Of course we have to look at the risks; can’t be unrealistic and ignore the potential downsides. Interest rates are the only unknown and that’s also the biggest factor. If they shoot up to 5.5% vs the current 2.67 that I modeled my example with, now you’re looking at an almost $5000 monthly which means the price comes down to $650K to get back in line with the 3800 monthly. YOU STILL PROFIT. It’s peanuts but not a loss. And interest rates don’t shoot up that high that quickly. You’ll have plenty of time to reassess and restructure. The risk/reward is such a no brainer. It simply makes perfect sense, there’s a reason why I’m all in.

“Non-verifiable” income must be code for you’re a tax cheat.

Claim your income and pay taxes on it. If you can provide a couple years of tax returns and business bank statements (separate from personal) to back up your claims you’ll qualify. Debt-to-income ratios must be observed as well.

You don’t claim taxes and now you’re pissed? Sorry Charlie… You have to pay your share if you want to participate in the system.

If you don’t want to participate in the system that enjoys low down payments, low interest rates, etc., you can either pay cash for a home or swim with the (loan) sharks i.e. hard money lenders. 35% down and they don’t care if you earn a penny since they have enough equity to foreclose on you in the event of the default.

Lenders learned from the last mortgage melt down that “stated” income loans performed FAR worse than a regular W2 verified borrower. From an underwriting standpoint, other than your credit score they have no idea if/how you pay your bills. You think they are just going to take your word for it?

You may have been renting the same place for the last 12 years but how are you paying your rent without verifiable income? For all I know, your mother/father/brother/wife is paying the bill and your name is just on the lease. You sound like a “straw buyer” whether or not that is the case.

Too much risk. Hard pass…

SoCalGuy,

If you listen to both the liberal and Conservative talk radio on AM or Sirius XM, there are so many ads on who to call to help with paying unpaid or back taxes. They must be making money on these ads. They won’t help you for free and the people who are using them must have some reason to get back on the grid on on the table.

If you were giving a loan to someone who had a discrepancy between their stated income and their tax returns, it would be a huge red flag.

The IRS could easily take everything for back taxes and you would be last on the list to get paid.

It might be best to come out from under the table and back on the grid to get a low interest rate on a loan. Or just pay with laundered cash. I didn’t say that and I know nothing about that other than watching Breaking Bad.

I’m not a “tax cheat†or a con-artist (im not like many w2 workers who lie on resumes, inflate their income on verification forms, and bite off more than they can chew because they know Uncle Sam, or mom or dad or granny are gonna just bail them out if they get caught living dumb)

Maybe I’ll just claim some arbitrary income, pay tax on that and go that route. Then am I suddenly a tax paying citizen participating (honestly in your opinion) in YOUR system YOU live within. Lol! Read: modern monetary policy. Learn a thing or 2.

What do you mean “how do I pay my rent without verifiable incomeâ€? Wtf? I pay it with… wait for it… income!

I was mainly asking if anybody knew any info about how to use “future rents†for verification and if anybody might have some experience with that.

My ability to pay off a home loan is not an issue. My ability to get approved for a home loan is. Does that make any sense to you?

@ Seen it all before, Bob

You actually get it.

@ Jiggles

“I guess I don’t understand why I have had such a hard time (with little clarification as to why?) getting approved for a home loan.”

I’d tried to explain it to you (and Bob understood completely) but you went on some kind of rant about irresponsible people getting loans. Being irresponsible isn’t illegal. Not paying taxes or declaring all your income is…

“Unverifiable” (or any other word you put into quotes, wink wink) is just another word for you dodge taxes. I suppose you believe illegal aliens aren’t don’t any wrong either. They are just “undocumented”. Otherwise, you are either a sole prop or have a corp and file taxes every year. That’s completely legit and documentable. You can even file as a S-corp and pay yourself a wage (W2) each year.

You admit to being self employed your entire adult life. How do you generate this money? You are either entirely off the grid and operate with prepaid debit cards, money orders and cash (money from illegal sources) or you deposit SOME money into an account while you (or your accountant) inflates your expenses to minimize your taxes. If it’s the first one, watch the last couple seasons of Breaking Bad and pay attention to the car wash business.

So you pay your rent with “income” you say? The IRS would see that differently. I hope whatever “income” you do document (hopefully some of it) you paid taxes on and sufficient to cover your lifestyle. If you go out and buy a million dollar home for cash and “document” $30K/yr, I’d be prepared for an audit. Now you are a prime target for the feds to slap a lien on an asset (your home).

The IRS will then impute income (we think you made at least $250K/yr for the last decade and with taxes and penalties you owe us $500K, prove us wrong). ‘Hey honey, what was that number for those tax help people on TV?

You cannot use “rental income” for your owner occupied residence (renting out rooms) to qualify for a loan. The only exception is if you were buying units (duplex, triplex, fourplex). You can then use 75% of expected rents (based on rental survey by appraiser actual leases in place).

Testaru. Best known

What to watch for in December from Ken.

sounds scary

1) will there be a govt shutdown amidst a vaxxine rollout amidst other govt disfunction v

2) end of unemployment benefits last week of year? new benefits?

3) eviction moratorium comes to an end. he claims we need rental assistance.

https://www.youtube.com/watch?v=v5uu3wr7QPQ&inf_contact_key=b2f287401d649173cf2b232f77d740ac680f8914173f9191b1c0223e68310bb1

The real central discussion of this board is economics and the value of assets. This is why topics like crypto and other investments are apropos. Real estate can be primarily something you buy or rent to give you a place to hang your hat. Or (for most people who buy RE) it is a big part of your personal savings. So, do you rent and save your money in anticipation of another deflationary crash, or do you buy now because inflation is looming. And if you save, do you save in cash accounts, bonds, stocks, crypto or precious metals? Right now, the people who said “buy!” back in the first 5-6 years after the start of the crash are looking pretty smart, and the “housing to tank hard soon” crowd are looking like the big losers.

100%. All these bull trap calls have been wrong. This has been a mega V shape recovery.

I am glad I bought a big house and stocks in Q1. I am still not finding a rental unit. I don’t know what the future brings. This was the year when bears came out in droves telling everyone this is the big one. The crash is coming and millennial bought the top. The exact opposite happened. I hope some learned a lesson: Don’t go with the crowds, do what makes sense to you and your finances. Don’t try to be a market timer.

“do you rent and save your money in anticipation of another deflationary crash, or do you buy now because inflation is looming”

There are more than two crowds. Don’t forget property owners with varied assets waiting for an opportune moment. $1M for an old 2 bed, 1 bath draped in power lines… “I feel good, I feel great, I feel wonderful.”

Stay diversified,

Turtle

Joe R,

Agreed! But without my Crystal Ball that smashed after falling off the shelf during the Northridge quake, or 4th cousin Mike’s info on what the Fed will do next, I don’t know what to do.

It is now a crapshoot. The odds are with the true mystics and insiders at the Fed.

If you know of any true mystics or insiders, let us know.

IMHO, invest in 60% S&P index funds, 20% bonds, and 20% cash until the Covid crisis ends. Make sure you have enough cash to keep the mortgaged house for a year. Don’t walk away no matter what happens to housing prices. This worked in 2008.

It ain’t over until the Fat Lady sings or dies of Covid.

Home prices in Kalifornia not in such bad shape after all

Middle-income housing across America — particularly in big coastal cities — is growing scarcer than ever, as the wealthy bid up properties that might once have been considered “affordable.”

Why it matters: The pandemic’s effects on the housing market may turn out to be permanent — and could widen the gap between rich and poor. Renters and buyers alike face rising prices that outstrip income growth and favor people with cash savings.

Driving the news: The median price of a single family home in California crossed the $700,000 mark this summer — a record — setting a new standard for what the American Dream might cost.

Housing experts say it’s a trend that’s accelerated over the last five months and tied directly to the pandemic: Low interest rates — which the Fed seems inclined to keep, thanks to coronavirus — are lulling people into the market at a time when everyone’s craving more space to live and work.

https://www.axios.com/us-home-prices-march-upward-50a76ad7-4a89-400b-8908-a2c5aeddf61d.html?utm_source=newsletter&utm_medium=email&utm_campaign=newsletter_axiosam&stream=top&fbclid=IwAR1pSoGWhcGq3-28CV14fHj_aeUw-fo07SLN8AUWIvwCLUWTn6FaLlHzxUg

@ Dr Housing Bubble Doc,

pls consider doing an article about the impact from Cryptos to Real Estate. Smart crypto investors will be able to purchase several houses in cash. There is a crap ton of money to be made and housing affordability will be a thing from the past for Bitcoin holders.

https://fortune.com/2020/12/16/bitcoin-price-20000-usd-all-time-high/

M, Write the article yourself. Here’s some data for you.

https://graphics.reuters.com/CRYPTO-CURRENCIES-CONFLICTS/0100818S2BW/index.html

That is some world class data. It ends in November of 2018 which is exactly when time stood still and nothing, and I mean absolutely nothing, has changed since then.

Bravo 👠what a brilliant checkmate. Is your real estate data as useful as this? It seems like a lot of the naysayers on this blog get their data from the same sources you do.

NA, I guess I’m on your radar now for asking about your 6 unit development. I would hope everyone does their own due diligence and not rely solely on my input. I suspect current data is even more concerning. Let me know what you find.

And, can you show me how to use cute emojis? Would add so much credibility to my posts.

Thanks.

Dearest Butch,

No I don’t hold grudges, I just read comments and save everyone time on the due diligence.

Since you don’t enjoy my emojis, I guess I’ll share some useful information with you. As sarcastic as I may be on this blog, I do love to help people by sharing some well evaluated analysis. This blog helped me thru the years, thought maybe I’d make it a two way street. As always, do your due diligence.

Alright, lets get into the numbers:

Peak Year Pre-Great Recession: 2006

Average home price: $459K (Riverside County)

Average interest rate in 2006: 6.4%

Property tax: 1.28%

Insurance: ~1000/year

HOA: none

Monthly Payment: $2870

Inflation adjusted payment, 2020: $3705 (that’s INSANE)

2020 Analysis:

Average Home price: $442,000, same tax rate, same insurance rate, etc

*Pause* You’re looking at the average home price and probably thinking OMG were almost at peak bubble!” That’s what the Lords want you to think so they can snatch all this RE at (still reasonable) prices). NO!!!!! WE ARE NOT!!! KEEP SCROLLING DOWN!!!

Average Interest rate 2.67

Average Monthly Payment: $2000

% Peak Bubble: 2000/3700 = 55%

I believe that we will never see a housing collapse like the Great Recession, so in fairness, I don’t believe we will see the conditions that got us there to begin with. Conservatively, if the housing market gets to the point that we get 80% there, put your seatbelts on.

Here’s a very valuable hint: most dollar values that you pull from sources are almost always nominal not inflation adjusted. If you always take things at face value, you’ve already busted your analysis. A good analyst must put the pieces of the puzzle right side up, not upside down if you want your crystal ball to work properly. Of course different markets have different unique factors (Ex: Silicon Valley/NYC is struggling while Lake Tahoe/Big Bear is booming during this pandemic). Find them out, apply them. There are also factors unique to the times we live in (employment trends, higher-than-normal-inflation, tech influence on wages, volatile interest rate fluctuations, dual income norm). Find them out, apply them. Of course some factors are anyone’s guess but there are clues to point you in the right direction. Ex: booming gold/crypto/stock prices foreshadow higher than normal future inflation, buy signal. Interest rates trending down, buy signal. Automation, buy signal. Trending dual income households, buy signal. Inflated markets no longer relying on tech nerds to physically be at work, sell signal. Low inventory, buy signal. So looking at all these people buying houses like hot cakes, you’re probably thinking “Man these guys are idiots!” But are they really?

If you wanna know why I was super aggressive in RE in early 2019 when interest rates shot up, this is why. Go look at the comments, I’m done proving anything to anyone. I saw steals and deals while (most) everyone else was drinking that fizzy, bubbly bear kool-aid. Had you bought then, you would be at 46% (with a refi) on the New Age Bubble-o-Meter (TM). I tweak my analysis every so often and this is really just the base analysis (can’t share all of my secret sauce).

-Dr. Housing Bull formerly known as New Age

I agree that people should stay diversified and not try to time the market. Nobody knows the future.

I think that everyone should have an emergency fund. Beyond that holding cash is a losing proposition. Money are not wealth; they are just a medium of exchange. Everyone should invest in whatever they feel comfortable with. My preference was always Real Estate and for that reason I don’t hold too much stocks and bonds. I agree with gold in theory, but practically, the government sooner or later will confiscate. I don’t trust cryptos, but that is me; I am not against those who feel comfortable with them.

I don’t like high risk and massive leverage. However, buying RE with 25% down, with 1/4 of the income for 15 years, I think that is safe enough. There is no 100% safe investment.

That has been my investment philosophy all my life and I did excellent. I missed lots of opportunities, but I never lost. I went like a turtle but I still ended up a multimillionaire, safe, almost no debt and with not too much headache.

I don’t agree with any debt, unless it is for investment which produces good cash flow. I was and still am a big fan of real estate, residential and commercial. It doesn’t mean that I would buy any real estate anywhere. I am very picky and patient. In my life I learned that there are always far more excellent deals than I have money to buy. I believe that is true for all if they scan multiple states.

“Stay diversified,

Turtle”

Good advice, sort of. But there is diversification and diversification. You can be so diversified that the one asset that takes off is only as small part of what you have. And then there is asset class diversification, and diversification within the class. And assets can be diversified by location. RE in some places isn’t worth owning, but other locations have shot up like a rocket. And location diversification can be applied to currencies, stocks and tangibles. (You could own gold in your safe, or gold stored in a foreign country.)

Maybe “put your money into things you understand” would be the best advice. That is what has me worried. I have a lot of dollar denominated retirement savings, but I’m not sure I really understand what is happening to the US Dollar.