Rental Armageddon continues: Federal Reserve shows housing to be a big push in household net worth yet we are hitting a generational low of actual homeownership.

The Federal Reserve recently released household net worth figures and what was found in the report continues to follow the theme regarding a shrinking middle class. Wealth jumped nicely at the upper-end of the income spectrum but overall, the cubicle hamster isn’t doing all that well. The recent improvement in home values has helped but this largely has helped investors since in the last decade we have gained 10,000,000 renting households while losing 1,000,000 homeowners. The figures are interesting and are already creeping up in the pontificating that comes with any political season. At the core, a healthy housing market is one where owner-occupied buyers dominate the bulk of home sales. That is simply not the case. This is how you have well paid tech workers in San Francisco cramming into a 2-bedroom apartment like a clown car simply to get by. One thing that is certain from the overall trend is that larger investors are pulling back from the market dramatically.

Investors dominate the market

One interesting highlight that is occurring is that smaller time investors, those that purchase 10 or fewer properties per year are getting into the game while the bigger players back out. The television ads and radio shows are now screaming (for a few years now) how awesome it is to get into the flip/sell/buy real estate game.

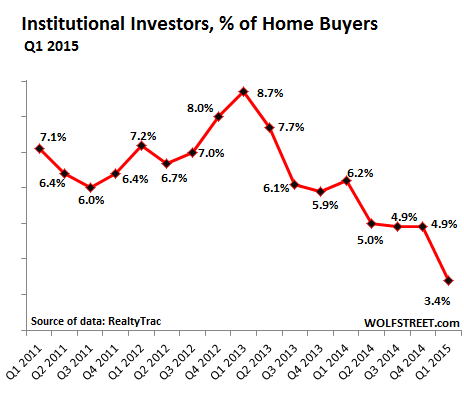

First, it might be useful to see how the big money is pulling back:

The big money is pulling back significantly. Yet investors are still a big part of the market:

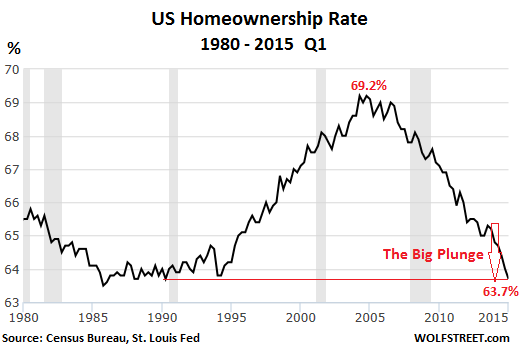

“(Wolf Street) The homeownership rate in 2014, not seasonally adjusted, plunged by 1.2 percentage points to 64%, the largest annual drop in the history of the data series going back to 1965. And in the first quarter of 2015, it dropped to 63.7%, according to the Commerce Department, the lowest since Q2 of 1990, unwinding 25 years of the American Dream.

The highest ownership rates were in the Midwest at 68.6%. The lowest were in the West at 58.5%, which includes California where homes have become immensely expensive, and the American Dream a phrase tarnished with cynicism.â€

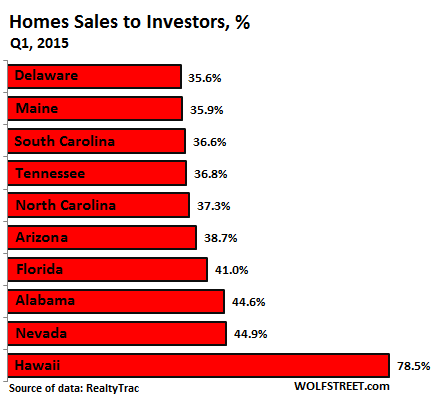

So for now, if you want to play in the California real estate game, you have to pay. But overall, prices on real estate are up pretty much across the country. It is shocking to see how big of an impact investors are having across various states:

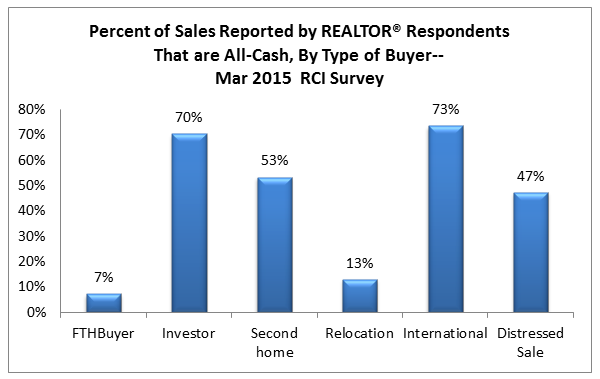

Hawaii of course is usually a second home trophy location. You don’t get more landlocked than an island. And for cash buyers, the foreign money is a big player:

A big portion as reported by the NAR is investor buying from an international background. Many are using the property as a second home. I’ve received a large number of e-mails talking about people seeing “ghost†properties where someone bought the place, but no one is living in the house. At times, some people will go a year without seeing someone set foot in the property.

Of course the Fed report points out that real estate was the largest net worth driver over the last few years (too bad we are reaching generational lows in homeownership):

The homeownership rate is back to where it was 25 years ago. And as we have mentioned, you would think builders would be adding more new homes but for what? They realize that many Millennials are not in the market for more expensive properties and many are living at home with their parents. What builders are building is multi-unit properties to meet the changing demographics out there. Rental Armageddon continues and in places like California, the homeownership rate continues to become a tougher proposition.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

89 Responses to “Rental Armageddon continues: Federal Reserve shows housing to be a big push in household net worth yet we are hitting a generational low of actual homeownership.”

What’s the point of making 6 figures if you have no time to enjoy life and chill a little. You must really love being a worker bee and earning all that money.

@ben: Since 6 figures is an extremely broad income range, I’m not sure if you meant $100k, $500k or $900k. However, a family making $100k in many areas of So Cal is barely scraping by. You might not starve, but you also wont save much for retirement or have the quality of life you would elsewhere in the country with that same income. Making 6 figures is pretty much a necessity in So Cal, whether you have time to enjoy life or not.

“Making 6 figures is pretty much a necessity in So Cal, whether you have time to enjoy life or not”

No. A huge swath of the population living in SoCal make far less than six figures. The low income/no income crowd heavily supplemented by .gov bennies, 10+ people crowded into houses/apartments to pay the rent/mortgage, platinum handcuff seniors who bought RE decades ago who are house rich/income poor (unless they cash in their RE lottery ticket), adult kids living with Mom/Dad…the idea that SoCal is a majority of six figure earners is a myth. Sorry.

I’ll second what drinks said. Six figure incomes are NOT the norm for socal, that is unless you talk about the desirable coastal areas. Hasn’t it been brought up time and again that the median income for LA is 50 or 60K..that ain’t no six figures the last time I checked.

If you are trying to support a family on a 100K income and living the “keeping up with the Jones” lifestyle…life will be rather difficult if no impossible in many parts of socal.

@WeDontMakeThoseDrinksNoMore: I didn’t state that most people in So Cal made 6 figures. I effectively stated that, for a family, making 6 figures is pretty much a necessity in So Cal if you want any semblance of quality of life.

@Lord Blankfein, median household income in the city of Los Angeles is $49K per year. Median household income for the county of Los Angeles is about $54K per year. Median household income for Los Angeles County / Orange County combined is about $59K per year.

Factoring in housing costs, Los Angeles has a poverty rate of about 28%, Orange County is close behind at 24%, the highest and sixth highest in the U.S.

So yes, very few people in SoCal make 6 figures. I believe the 6 figure earners are maybe less than 20% of the SoCal population.

Yep, I am making six figures in the SF Bay Area and living the Top Ramen lifestyle.

The US homeownership rate chart is not as bad as it looks. For 2015, the rate has fallen to 63.7%, the same as 1990. But

1990 US Population 249 mil

2015 US Population 315 mil

at the same 63.7% rate it means 41 mil more people own homes today than in 1990.

Along that line of thinking, there are X amount more people that do not own homes.

Touché !!

Exactly what I was thinking Gerardo. RSpringbok has a future in spinning fables at the NAR.

Along that line of thinking, there are X amount more people that do not own homes.

Gee, Geraldo, why didn’t you solve for X? Let’s see, what is X… (315 – 249)*(1 – .637) = 23.96 mil. Call it 24 million. So let’s check the facts: 41 more million people became homeowners while 24 million did not. Last time I checked 41 mil is a bigger number than 24 mil.

Granted, the trend is for the 24 mil number to grow and the 41 mil number to shrink, at which time non-demand for homes will begin to exceed demand. We aren’t there yet, but the chart makes it look like we are.

We’re Gonna be rich! said RSpringbok has a future in spinning fables at the NAR.

Good investors look at facts in an unbiased way. What, just because I find a data point that doesn’t fit your preconceived narrative means I’m a NAR shill? Far from it pal.

Juuuuust give it up… That was a game/set/match for Geraldo. 🙂

= Housing To Tank Hard

keep saying it Jim…eventually it will come true. Lol

Haha!

After reading the last post, we are getting close, I can read capitulation…2017 mark to market returns, 2016 the equity market will crash more than 25%…

95% of traders lose all their money, the housing market is now like the stock market. Investors will sell but why when the fed is paying them to hold on to the home for 5 years.

I believe most posters here are not looking deeper into what is holding pricing up….due diligence is required. I own a home and believe anyone buying at these prices will pay the piper in 5 years…The change is coming but most people have no patience, as an underwriter for one of the first and biggest subprime whored out lenders, I can honestly say I see the writing on the wall, the fear of losing out, the fear of renting, the game of ego…good luck…

I can’t wait to sell and get out of this state…soon to be a giant sucking sound without water…

don’t be delusional, housing is a investment now, it goes up and down… Peak is near you can feel it in the comment section

Doc: Hawaii of course is usually a second home trophy location. You don’t get more landlocked than an island. And for cash buyers, the foreign money is a big player:

_____

Buy Julia Roberts’ Hanalei Bay Estate in Kauai, Hawaii for $30 Million

Bloomberg-29 Apr 2015

…has listed her Hanalei, HI estate with more than 200 feet of beachfront for $29.85 million, Pacific Business News reports. The estate, which the actress bought for $13.4 million in 2011..

http://www.bloomberg.com/news/articles/2015-04-29/buy-julia-roberts-hanalei-bay-estate-in-kauai-hawaii-for-30-million

I can wait forever, even if it means never buying. I will gladly rent a room out and watch my net worth grow while taking vacations around the world in the meantime. To greedy homeowners, keep your overpriced house and enjoy paying those high property taxes.

Gerardo, you are in the minority. Most people can’t wait forever and simply rent out a room. Trying doing this with a family or tell this to a nagging wife. Homeownership will always be held in high regard in this society. I am confident that won’t change in our lifetime. I am basing my home owning/buying decisions on that.

No Gerrardo, you are actually in the MAJORITY in SoCal. Family formation is down. Staying mobile is paramount. Most people ARE waiting, see the infinitesimal volume of organic sales. I thought last year would be akin to 2007 but I was clearly off by a year at least. However I just saw a home in North Upland close for 100K less than a similar home closed for in early 2014. The correction has just begun. Patience and wisdom everyone…

Gerardo, good luck waiting while I’m almost 1/2 way through my mortgage (bought in 2011, did a 15 yr w extra principal payments, only idiots do 30). Which scenario would you rather be in, owning home outright or renting? Well, while you miss all opportunities to own, I keep my “overpriced” home, paid off, and greedily charge you my overpriced rent as you fund my vacations. Do I think it’s a good time to buy right now? No, but the hardcore perma bears cant see an opportunity if it hits them in the face because of their apocalyptic beliefs.

@Jason

Did you know in advance the government and Fed would embark on such unprecedented actions to artificially prop up asset prices (to this day)? If not, then you should consider yourself lucky and thank the taxpayers instead of patting yourself on the back.

Meanwhile, a generation of potential buyers is being shut out, leaving the RE industry — and the economy — relatively stagnant.

Excellent assessment, cd. I agree.

CD – I just wanted to say THANK YOU for giving your 2 cents. Its great to get insights from someone in your field of work, in the industry in question. For what its worth I actually share your view!

Stryyker31, really? The guy claims to be in underwriting and you believe that 95% traders will lose all their money? So, 95% traders all bought in the past several years, and will all liquidate once market falls below their purchase price? And housing will plummet based on the drought?? If you look hard enough, there is something devastating happening all the time. If this was 5 years ago, CD would be arguing that the radiation leaking into the pacific from Japan would take down California housing. Or the Arab spring, or the EU default, or the debt ceiling, or the Boston bombing, or the.. . Want the answer? It’s very simple. Low interest rates. As long as interest rates are this low, wealth will be speculated in housing, period. Fed will not raise rates because will cause global default. This can linger for decades and won’t end well, but I assure you won’t be due to the drought.

Jason, I bought paper at the start of the last boom and left right before the bust, I have since decided to never push debt again. I guess you don’t read slowly, I have a house, People whom bought in 2011 did fine…I’m not lamenting them.

95% of people whom try to trade stocks do go bust. You have a little too much hopium for my style, I’m a realist so we differ. The world is not ending and California real estate will have problems ingrained in the drought if it continues. As a lifelong Cali resident this bubble blowing and popping hasn’t changed. Buying now makes no sense. Right now the fed will have to push inflation for price gains to go anywhere now.

That will be your clue, if inflation numbers start trending up without some fed fakery in numbers than pricing might stay here…if not, it will be hard pressed to stay at this level.

If things were so good, FASB 157-158 would be renewed, the banks wouldn’t be getting .25% on reserves and PE wouldn’t be paid per home by the fed to hold and rent it out…

You sound young and cocky…I too own and have lots of equity…but things change and stuff happens.. life is too busy to worry about renting or owning… People have lucked out that the fed helped the market but its time to move on and see if the market can hold up without outside help….

roll the dice

@cd

Great comments. Those who act haughty with their investments conveniently ignore the men behind the curtains who are with endlessly manipulating the economy. The goal is the same now as it was in the mid 2000’s: inflating asset prices to create an artificial wealthy effect. The Fed would have instituted ZIRP far earlier or summarily declared negative rates in perpetuity if their policies were the elixir for the economy.

cd, I agree that the stock market is long overdue for a big correction. We haven’t had one in over half a decade which is definitely disconcerting. Mark to market accounting rules can be changed at a snap of a finger. I would not bet any money the financial world returns to normal in 2017.

You didn’t mention anything about rents. They are sky high and will likely keep going up. If the cost of owning is similar to renting, any dip in home prices will bring in droves of new buyers. These circumstances did not exist in 2008 due to the huge inequality between buying and renting.

This housing rally caught me off guard also. We need a BIG job loss recession or massive interest rate hike for housing to really tank. I do not see any of those in the near term. Expecting a massive tank in prices is wishful thinking, I could see 10 to 20% and that is it. With likely higher rates, your payment will be the same as today.

Just my 2 cents.

20% with overthrow to 33% is not entirely impossible. Inflation will be the key, if it somehow picks up than prices will stay elevated. The market and hot money associated with it will leave but whom knows when. Stay with the trend until it ends.

This experiment has never been tried before. So I guess no matter the position we get to watch it play out…..I was on top of the push down before maybe I will be lucky again…but you never know.

Your correct in that the Fed will do anything to keep this up, Currency wars though never really end well and it’s just starting to heat up….

All we can ask for is good health for our family and friends, that is what I wish for…

housing, I’m not concerned where it goes…I’m more concerned about water and natural forces elevating their game right now….

Mortgage rates may have recently reacted to some wider bond-market / stock-market wobbles… so much paper chasing yield on ridiculous investments like 40 year 4% bonds from South American countries and supposed ‘stalwart’ corporates raising cash in the here and now. (Those bonds then have trade-able values… which can rise and fall)

http://wolfstreet.com/2015/05/06/smart-money-prepares-to-profit-from-bond-market-swoon/

_____

May 6 2015

Mortgage rates are having a rough couple of weeks. Yesterday saw rates approach the previous 2015 highs set on March 6th. Today’s rates moved slightly higher still, setting a new 2015 high. The average lender is now quoting conventional 30yr fixed rates of 4.0% on top tier scenarios, though 3.875% is still available in some cases.

in full http://www.mortgagenewsdaily.com/consumer_rates/469946.aspx

The Fall of Homeownership In America

The Rise Of The Rental Recovery

3 Charts here to show even a more adjusting to population story of housing.

Math, Facts and Data matter

http://loganmohtashami.com/2015/04/28/the-fall-of-homeownership-in-america/

“well paid tech worker in SFO living poor.” They choose this lifestyle. If they want to live better, they can come to Austin. People choose their lifestyle and where they live. I, for one, would not want to live in SFO, even though, I can afford to live anywhere, but I choose not to live in such a depressing place as SFO. In the end, we all make our decisions.

Yes, mortgages are going up. Prices will go down, because people can only afford to pay so much. Oh, I forget, it is the Red Chinese money(that we send to them) that is driving up the prices on the left coast.

http://dfw.cbslocal.com/2015/05/04/texas-legislature-oks-rules-prohibiting-city-fracking-bans/ : if this law passes will the standard of living continual to raise in your state.maybe that fracking water won’t flow across property lines?

I agree with you on that. People chose where to live. Nobody is forcing them to live where they live. It is a big free country.

Like you, I can live prety much anywhere, but I chose Eastern Washington. Not so much rain like western WA and not so crowded and expensive (read massive taxation on all fronts) as SoCal. TX is nice for people who like humid heat. Eastern WA is nice for people who like dry heat.

Coeur d’Alene, ID is a half hour drive from Spokane. Kootenai County is a nice place to go to in the summer, to get away from the hot and humid heat of the south. The county, as you know, has a lot of southern minded folks. Reminds me of some places in the south. A lot of southern California folks moved there. The folks in the county really like their guns.

Big Tex,

CDA is a very nice place. I have property there. I like it except winter for about 5 months.

Big Tex, how do you deal with the freezing (I mean freeezing, many SoCals don’t know what that is) weather and the tornadoes? Just curious.

Boy, what are you talking about? The average Jan. low in Kerrville is 37. I have been in the California Sierras and in a normal winter, they have snow. Even the mountains surrounding Los Angeles turn white sometimes. Same goes for San Diego mountains. California gets plenty of snow in a normal year, but since California went abnormal, the heavens have closed up. But Malibu is nice, the Country Mart is a good hangout.

As a former New Yorker, I know what freezing is, and I don’t mind it. Anything over 20 degrees (and under 60) is comfortable for me. My ideal range is 20 to 59 degrees.

Under 20 is too cold. I recall a walking in 9 degrees one January in New York. Yeah, that was uncomfortable. My face was freezing. But 20 is fine.

Above 60 is sweltering.

But I realize most people prefer warmer climes.

Put a cork in it Big Tex, and don’t hit your head on that gun rack. No one cares about you or Texas. Read the sentence just under, “Dr. Housing Bubble”.

Enjoy it while it lasts. Migrant tech workers will drive up real estate prices. Eventually most of the industry will move on leaving Austin with a mangled economy and displaced Austin natives nowhere to be found when it’s time to rebuild the community.

The only salvation this time around is that all-cash has made up a significant part of home buying. When the correction comes, and it will, mortgaged houses will again lead to foreclosures, otherwise all those owned outright properties will only suffer paper loses! Of course even those with paper losses will get hurt if they have to sell, the ‘buy high, sell low’ debacle. However, that will create new opportunity for those who can pick up those now relatively cheap properties and the cycle will start all over again!

The all cash buyers are Other People’s Money purchases as well. It’s ALL leverage! Those cash sales of the last few years will be subject to the correction as well. Don’t calculate your Cap Rates while the market is on FED Monetary Meth.

All dollars are created through debt.

Just because someone buys cash it doesn’t mean he doesn’t have any debt. He may borrow on another property or get a HELOC in order to make a cash offer (more attractive). Then he goes and get a loan on the property just purchased. Just because a property is bought with cash it doesn’t mean that it will stay like that – that is a myth.

Some oligarchs from other countries may be looking to diversify their portfolio of stolen money and buy with cash – that is an isolated occurence.

“However, that will create new opportunity for those who can pick up those now relatively cheap properties and the cycle will start all over again!”

The government and Fed enacted historically unprecedented intervention in response to the last 2 recessions. They provided the cheap money to fuel investor RE buying binge. If prices collapse again despite all the extraordinary economic manipulation, what will the government and Fed be able to do to stop it?

Doc: At the core, a healthy housing market is one where owner-occupied buyers dominate the bulk of home sales. That is simply not the case. This is how you have well paid tech workers in San Francisco cramming into a 2-bedroom apartment like a clown car simply to get by.

Doc.. powerful stuff… have we really reached that stage? I know investors are piling into other parts of the West with the view they can cram in compliant young professionals into the houses they are buying (at very high prices).

Something has to give.. doesn’t it? Although some studies are suggesting the Chinese real estate move into the West is only just getting started. Sadly there does not appear to be much by way of younger saver-renter frustration at the situation… vs the ‘haves’ and the ‘have ever mores’ against this background of reflated markets, and $TNs in global QE.

CD, I would not be so sure about many of your assertions.

1) For RE prices to tank, there needs to be a big regional job loss. That will not happen just because the stock market resets at some point. So what event will lead to the millions of jobs lost in CA?

2) The buyers this time around did large down payments rather than 0 down lair loans. They can sit out a 5 year down turn in prices (if that happens) continue to collect their rents or live there and down the road, sell for a profit unless the countries economy collapses (doubtful and I hope not).

3) The water issue, I am hopeful this too will even out with a few more years and a return to the moisture levels we had prior to the last few years. At that point the good news will be millions of households will have ripped out their landscaping for very low water required alternatives. Smarted policies and infrastructure changes to use more of what we waste today. If Israel can thrive in a desert, CA will eventually find a way too.

It’s called reverse desalination and low water farming. The VAST VAST majority of water goes to farming in this state. The farmers here are incredibly wasteful. Yet it is the rest of us whom suffer because of their waste. That, and the delta smelt…

Ah, the delta smelt…a Federal District Court Judge ruled in 2007 that increased amounts of water had to be re-allocated towards protecting the Delta smelt – a three-inch fish on the Endangered Species List.

In California, it takes about 1.1 gallons of water to grow an almond; 1.28 gallons to flush a toilet; and 34 gallons to produce an ounce of marijuana. But how many gallons are needed to save a three-inch delta smelt, the cause célèbre of environmentalists and bête noire of parched farmers?

To protect smelt from water pumps, government regulators have flushed 1.4 TRILLION gallons of water into the San Francisco Bay since 2008. That would have been enough to sustain 6.4 million Californians for six years.

http://www.wsj.com/articles/forget-the-missing-rainfall-california-wheres-the-delta-smelt-1430085510

Desalinization takes a immense amount of energy that is prohibitively expensive in California partly because of the alternative energy requirements (wind, solar, etc.) and desalinization produces a brine that is so salty that it cannot be discharged back into the ocean.

http://blogs.kqed.org/science/audio/why-isnt-desalination-the-answer-to-all-californias-water-problems/

Israel “thrives in the desert” partially due to its military bullying.

It’s true that Israel has built desalination plants. But also…

* Israel steals Arab groundwater from the West Bank. In all proposed “sovereignty” deals with the PLO, Israel insisted on retaining its “rights” to West Bank groundwater.

* Even in Israel proper, Israeli Arabs have a harder time in getting permits to dig new wells than do Jews. This forces Arabs to dig wells without permits, which soon enough are bulldozed by the military or police.

* Israel has pressured Lebanon and Syria not to take much water from the Jordan River, despite their growing populations, because Israel wants to ensure that it gets all the water it wants for its growing (Jewish) population.

Lots of blogs, radio shows, newspaper articles are full of glowing talking points about Israel’s “miracle” in the desert, and its remarkable desalination efforts. It seems like an organized campaign. Much less talk about Israel’s decades-long theft of Arab water (i.e., using its superior might to take more than its pro rata fair share).

See: http://www.imemc.org/article/46460

and http://desip.igc.org/TheftOfWater.html

Or Google “Israeli theft of Arab water”

There is much less talk Israel’s “decades-long theft of Arab water” because it’s not true and only a burka wearing libtard would cite anti-Israel and anti-semitic links in a lame attempt to make it true.

Google Hamas and PLO to find out how the adherents of the so called religion of peace want to destroy anyone who doesn’t share their hateful dogma.

Hear that, son of a landlord? If there is something you don’t like about Israel, you must surely be a terrorist! Especially if you add relevant links.

NonPC, you should change your handle to VeryPC. The vast majority of both Democratic and Republican politicians offer unqualified praise and support for Israel.

And Hamas, the PLO, and what you sarcastically call “the religion of peace” have nothing to do with the Israeli government’s water policies. Just a clumsy attempt on your part to change the subject.

Don’t you know, anything said against Israel makes you an anti-semite. And yes to both parties tripping over themselves to proclaim their love to Israel, you know because the 2% of the US population the Jews make up somehow control both parties, and in the house and the senate. Even Sarah Palin while still governor of Alaska had an Alaskan, American, and Israeli flag on her desk.

To the young who are undecided consider:

When the King of Ur raised taxes, Abraham left for the Promised Land. His father stayed.

My widowed aunt retired and moved to Florida from up north. Within a short time she moved back. She said something like “I moved away from friends I’ve had for 35 years and I want to see my daughter and grandchildren on a regular basis.†She surrounded herself with people she loved until her death.

Proposition 13 was passed so people could stay in their homes. Unfortunately for many, they had to pay to add bars on the windows and steel screen doors.

The author of “Mexifornia†recently spoke. He gave the history and talked about the current status of his home town. His description can be extrapolated to Southern California. When asked about the future, his answer was more of the same……chaos. The link: https://vimeo.com/122160603

If your young and don’t believe you will be in the top 1% income bracket, consider another state. It won’t be the high density housing but the barbarism that will depress you.

I enjoy reading everyone’s comments. I am renting in socal (inland empire) and waiting for some kind of dip so I can afford to buy a nice home and not a fixer upper. Hard to know when the time is right. Unfortunately I was not ready to buy between 2009-2011.

You have a better chance with nicer homes since fixer uppers will be littered with investors out bidding you.

I am hoping to move into a nice home with a conventional loan if possible. I am amazed at the current prices this past year. Wife and I looked at a home in April of last year for 260k. small starter home. It is now back on the market 13 months later for 355k. wow!

Matthew Rognlie in an excellent paper critiquing Thomas Piketty’s “Capital in the 21st Century”, said that Piketty’s thesis should be called “Housing in the 21st Century”. ALL the increase in inequality in Piketty’s data relates to housing – actually, it relates to urban land that houses are sitting on, the structures haven’t inflated in value.

I argue that this trend in every nation that experiences it, dates from when that nation starts to restrict the conversion of non-urban land to urban use, which is a major interference in what would otherwise be free market processes that allocate land to best uses according to price signals. Worse, a rationed supply of urban land invariably leads to urban land prices that have been described, very appropriately, as “monopolistically derived”, or derived under conditions of “monopolistic competition”.

Cheshire et al at the London School of economics started analysing, in the late 1980’s, what was the divergence in urban land prices in UK cities since the 1947 Town and Country Planning Act, compared to US cities that would otherwise have been comparable. They found the difference in urban land prices in 1984 were a FACTOR ranging from 100 to 320! Repeats of their study have found the factor at the upper end of the range to have been steadily rising – it is now over 900 in London.

This phenomenon has hit Canada, Australia, New Zealand, France, and numerous other nations precisely at the point at which urban planners in those nations major cities get a fetish for “saving the planet”. The situation in the USA is not so clear-cut because there are still several dozen cities that are allowed to sprawl freely and still have extremely cheap, stable urban land prices; and many of the cities with inflating and volatile land prices do not have an explicit “urban growth boundary” policy, leading to academic confusion over the role of regulatory distortions, in the land price inflation and volatility.

However, there are numerous accidental restrictions on “conversion of non-urban land to urban uses” that have the same effect; the most common one in the USA is “rural” zoning in all municipalities surrounding the fringe of a growing city, which might as well be an explicit Green Belt exactly like those that have caused the price inflation in UK cities.

In some cases the accidental “boundary” is partly comprised of geographic obstacles and in some cases it is National Park land or other government owned land that is not for sale – even Defence Dept land.

An example of a more in-depth analysis of mine, of the appalling mainstream theoretical confusion on this point, is this:

http://www.voxeu.org/comment/105244#comment-105244

You will find it worth your trouble to peel into the history of English boot/ shoe making.

It’s very surprising.

1) The ENTIRE English shoe/ boot production at the beginnings of mass production was confined to one town — a village, really — with all of the key players being kin.

It was this tight group that came up with what is now the standard way of crafting lasts, insoles, heels, — everything. This was the crowd that standardized what a given size was. At all times prior, shoes were strictly for the wealthy/ nobles… and those had terrible fits — most of the time.

But shoe making / leather craft STINKS to high heaven.

So the lairds that owned all of the perimeter lands around the magic village collectively refused to sell any more land/ rent any more land to their Non-Green ‘neighbors.’

The result was that that industry was compelled to build straight up… and at great expense.

The nearest available land to the magic village was miles and miles away. On the economics, it was impossible to make the move. Every shop was a boutique, family, affair.

[This village was the prequel to the Silicon Valley incubation hot-house. No-one in Santa Clara County can flee and boot-up elsewhere, either. ]

Needless to say, any village land held in fee simple exploded in value and price… just like Silicon Valley has at this time.

This bizarre devotion to Green Living ended when the critical player died — and their sons scrapped the non-rental covenant. (The money was simply too good — and they were getting pressure from London inre boots for the British Army.

Lastly, it was this village that was — get this — the source of the boots for the French Army. Nappy never recovered from his decision to stop importing English boots. (His “Continental System”)

Mercantile France has never lost their lust for Napoleonic economic logic — even though it froze up in the depths of Russia. (1812)

The above history squib encapsulates your entire thesis — and in a much simpler world.

[ BTW, the boot makers did all they could to stop the exit of their technology – – especially their ‘lasts.’

One is reminded of the original guilded cage — just north of Venice — where the glass blowers were (literally) trapped for generations. It’s another case worthy of your study. Yes, land values on that ‘prison rock’ also exploded upward…it was Alcatraz built out like Beverly Hills.]

http://europeforvisitors.com/venice/articles/murano_the_glass_island.htm

“Glassmakers weren’t allowed to leave the Republic.”

The above is a lie. They weren’t (normally) allowed to even leave the island — for their entire lives. It’s not a big place. Their only alternative was to boat on down to Venice, itself. Yes, they were heavily guarded.

Outside Italian powers were offering staggering bounties to any blower willing to blow the secrets of their craft. Many a spy was caught and executed — by the Venetians — over the years.

Similar games were played by the Chinese inre silk and paper. They kept both processes secret for centuries. (!)]

As for the English boot makers — the leakers made it to America — and rock bottom rents and dirt cheap materials. But, that’s another story.

Lastly, it was this village that was — get this — the source of the boots for the French Army. Nappy never recovered from his decision to stop importing English boots. (His “Continental Systemâ€)

Hmm… Nappy didn’t want our boots no more? I know Nappy dismissed the English with this famous statement. “L’Angleterre est une nation de boutiquiers.”

Wiki: This phrase can be translated from French to English as: “England is a nation of shopkeepers.” Although the description was often seen as a disparaging one, Napoleon claimed that it was not intended to be so, but was merely a statement of the obvious fact that British power, unlike that of its main continental rivals, derived from commerce and not from the extent of its lands nor its population.

The phrase, however, did not originate with Napoleon. It first appears in The Wealth of Nations (1776) by Adam Smith, who wrote: “To found a great empire for the sole purpose of raising up a people of customers may at first sight appear a project fit only for a nation of shopkeepers. It is, however, a project altogether unfit for a nation of shopkeepers; but extremely fit for a nation whose government is influenced by shopkeepers.” —Adam Smith, The Wealth of Nations.

Boris Johnson in 2012: “As Napoleon almost said, Britain is a nation of small and medium-sized enterprises.” —> sadly it seems to me small enterprise is retarded and disincentivsed by asset-value protection policies. I’m tired of all the carrot and stick effort, vs continual price rises and prevented corrections and being told to be grateful for QE as high asset prices and lower borrowing costs (for younger people), meaning the protected meaning the protected can buy my products if I take on big loan for new enterprise. Worn out with it.

Roglie is either wrong or deceptive. The value of stock (22.5 trillion) considerably exceeds that of home equity (11.2 trillion), has generally been growing faster, and is almost exclusively owned by the very wealthy. Also, the main driver of inequality to date has been the extraordinary compensation granted to those fortunate enough to have their friends on the corporate boards set their salaries. Picketty’s r/g theories are a significant risk for the future but that’s not been the main driver of inequality so far.

During such eras there is always a huge under-the-radar move to bisect single family residences into duplexes and more.

By ‘under-the-radar’ we mean without any troublesome paperwork/ taxes/ inspections from city hall…. and no statistics to be recorded either.

This was the multi-decade process that transitioned Harlem from upper-middle class urbanity into the 20th Century Harlem that we all know. BTW, Harlem is now a bastion for Latinos — with Black Americans departing in scale.

Kipling made endless references to the insanities of Whites in the tropics. “Mad dogs and Englishmen braving the noon-day sun…”

The flip side is that all of the tropical races, Polynesians and Blacks and South Asians, can’t long abide cold weather. Once the wallet permits, they set up home where they feel comfortable.

[ One of the ‘Alaskan reality’ TV shows had a southern boy attempt the climate. He didn’t last three weeks. And he wasn’t even in the wrong season and the harshest climate. (!) Yes, he was White, too. ]

Most of humanity is brown(ish) … and most of humanity is not lusting for northern weather. (Hence the vast numbers of Canadians that fly to Cuba every winter and American retirees fleeing to Arizona, likewise.

So it can be no surprise that, given the means, Black Americans are fleeing the brutal northern cities with every passing decade.

The striking thing about Detroit — and get a load of its real estate market — is the Black flight from that city! Unlike Whites, who shifted a few blocks out of Detroit to live in the ‘burbs… Blacks are moving back to Georgia.

This macro trend is evident in every US Census since 1970.

These macro shifts in residency have staggering impacts on real estate pricing. They foretell median incomes looking out two and more generations ahead.

Vancouver, BC — circa 1985-2000 — is a portent of what must flow in San Francisco. In 1980 THE most expensive neighborhood in Vancouver was atop one commanding height — sort of a residential Nob Hill.

Last I looked, that hill has been entirely purchased by immigrant Chinese — first from Hong Kong and then from Red China. All prior Canadian architecture was flattened, scrapped out, with each purchase. It, the nob, looks like little Beijing at this time.

The epic liquidity created by Beijing has to flow — and it’s lapping up in San Francisco — and some beaches in LA.

As Tokyo showed (1989-1990) once the tsunami reverses the resulting hangover is also epic.

The hyper-boom in Red China has actually reached the end of the road — and the boys at the top don’t quite know how to adjust course. They never do. The ‘system’ is off the map.

This ‘off-the-map’ situation is evident in Washington DC and Yellen and Company.

We have reached an economic nexus that humanity has never crossed through before.

At all times prior one could invest/ flee to some unconnected location on the planet to get away from this or that total economic insanity.

We now live in a totally linked world. It’s also a very brittle place.

The best analogy might be that of a U-2 pilot. For those unaware, no plane is more difficult to fly. Its flight dynamics are tight: at altitude the craft is bounded by stall or Mach 1. Incredibly, both speeds are extremely close.

Red China is (economically) shuddering at the Mach barrier. The stick no longer responds.

America is (economically) shuddering at the stall barrier. The PTB are goosing the engine for all she’s worth to forestall stall.

In both societies, the elites are wildly over-compensated / benefiting — and have corrupted the political control system/ economic feed-back loop.

Macro corruption.

The resolution of such debacles is normally a torment to real estate owners and mortgage holders. The cash stops flowing.

Yet, the whole ‘system’ relies upon cash flow — its blood supply.

&&&&7

Which gets us back to 0-care: the PTB in the US have yet to even get a glimmer.

I have yet to see a single pundit comprehending that 0-care totally throttles the creation of new (conventional) money.

The brighter lights within the Fedsury and the Bank of England realize that they absolutely have to hyper-inflate the currency (inject plasma) to stave off arterial collapse in the global economic body.

The PRIMARY reason for the strong US dollar is consequential to the tightness created by 0-care.

Due to emotionalism / politics / immaturity I expect this statute to survive until REAL damage is done.

At which time its connection to the economic damage will be blamed on the innocent.

&&&&&&&&

In most markets, it’s too late to acquire properties for rental.

One ought to look into shorting Canadian, Australian and New Zealand real estate markets. This usually takes the form of shorting the players that live off of the real estate game in said markets: banks, contractors, suppliers, … the usual suspects.

Just watch out, you won’t be alone. Every savvy player sees the carcass.

Blert, again a good thoughtful comment. There are people disagreeing because they can’t connect the points. However, sooner or later they will realize that you were right.

Blert’s insightful comments are a treasure on this site.

Such a treasure that Uncle Mark across the pond will no doubt publish blert’s plagiarized comments in a forthcoming white paper.

Blert is pounding the table yet again for cataclysmic ruination of American real estate market vis-a-vis “0-care”, yet offers as financial advice to short Canadian, Australian and New Zealand real estate markets….but not American?

1) The American short play is already ‘crowded.’

2) The extreme insanities in Canada and Australia are miles above and beyond American metrics.

Most Canadians don’t even think they are in a bubble.

!!!

That’s something that only happens to stupid Americans.

Blert, thank you for posting. Can you please expand on why you believe the primary reason for the strength of the US dollar is consequential to 0care?

What you call the conventional money is only a part of all the US dollars in existence. While it is a major – and likely deflating – part, it is not completely isolated from the QE-created dollars. Do the currency markets care where their USD come from?

If the QE dollar creation outpaces the conventional market-deflating dollars shouldn’t that lead to the USD weakening? Just trying to understand the mechanism at work here.

Modern money is created within the commercial banking system when (good) loans are made.

First mortgages are BY FAR the dominant source of loan volume and persistence.

The average weighted maturity of a 360 month mortgage is about 150 months… (a stat that shifts wildly back and forth based upon swings in interest rates, BTW.)

0-care THROTTLES the creation of mortgages consequent to a FIRST TIME home purchase.

The players who would be first time home buyers are EXACTLY those who are most taxed by the cost shifting of 0-care.

1) They are entirely outside the 0-care subsidy zone… No 0-care windfall for this crowd.

2) They are young, family-forming, early marrieds — HEALTHY — yet with huge non-health related outlays consequent to their first home purchase.

3) When you tote up the ‘damages’ / affordability budget I becomes obvious that the income threshold for that first time home purchase has leapt straight north. In most major markets… states with fulsome income taxes, themselves… the requisite income bump is $ 50,000 to $ 90,000 per family. (!!!)

4) Such a quantum leap in requisite income — at this time — is ‘squirrelly’ as one has to juggle local taxes, 0-care rates, and local real estate. Consequently 0-care political-emotional partisans will be entirely successful in disputing any specific calculation one might ever pull together. Yet, the actual figure, soft as it is, is still going to be a box-car sized jump.

5) The consequent shrinkage in the market — those able to stump the money — hugely explains why the housing industry is not building SFH. Indeed, the SFH housing stock is actually going backwards — a reality that the politicians and their BLS statisticians obfuscate.

All of the above has ALREADY kicked into gear:

The money supply has largely stopped growing over the last six months.

As time advances, this non-growth will turn into steady deflation: old mortgages — to stay good — are paid down. With each principal reduction, the circulating money supply shrinks.

This effect totally overwhelms other debt creation mechanisms. Real estate mortgages are that dominant.

A scarcity of US dollars — is instantly felt — if not understood — by the global money circulation system.

At which point, momentum in the various currency pairs begins to take hold.

I give you the Euro vs the US dollar.

BTW, when Greece is kicked out of the Euro Zone fixed exchange rate regime — the losing parties are its creditors: Germany, France, Holland, Austria, et. al.

And, of course, there is no such thing as THE Euro. By treaty none of the European powers cross-guaranteed each others fiat currency. The whole entire edifice is a fake.

Our financial press obscures this black-letter-ink reality.

And, of course, Europe has been down this very mercantilist ‘break-up’ before — usually by devolving into war or depression.

W…

“If the QE dollar creation outpaces the conventional market-deflating dollars shouldn’t that lead to the USD weakening?

Just trying to understand the mechanism at work here.”

&&&&

Hardly, you’re trying to argue against what has already happened in the market.

Which is a strong indication that you’re just to smart for it.

%%%

OE, per se, does not create money.

Debt creation — by the central government — is the fount of Plan B/ alternate money/ hyperinflation of the currency.

Whereas normal money is sprinkled across the entire economy by mortgage loan expansion — government deficit spending creates money as a spigot stream — with only the one, single, creditor.

In the most recent period, US Treasury tax collections have been rocketing ahead… actually closing the Federal deficit. No small amount of that increase — AT THE MARGIN — think FLOW — is via 0-care taxation.

Never forget: 0-care is a TAX BILL. Even the USSC finally figured that out — once they actually read it — as against reading what the Left Stream Media scribbled.

It’s larded with taxes up and down the line — none of them large enough to be worthy of notification to the proles. Of course! Collectively, these “excise taxes on health insurance” take quite a bite — and vector the monies to the US Treasury.

When you launch QE in the face of a collapsing Federal deficit, you end up with the crazed bond market toted up by ZeroHedge virtually every day: negative bond yields.

The Federal Reserve Bank has been, and still is, driving financial assets out of T-bonds/ notes/ bills into anything else. This is called either “cashing everyone out” or “monetizing the national debt.”

While not perceived by the proles, the national debt is actually being ‘cancelled’ — second hand — by having an organ of the US Government swapping debt instruments for current deposits on account.

That this has been going on for years, now, is largely denied because the boys selling into the QE engine have been — overwhelmingly — the domestic branches of foreign banks.

Their windfall profits (nominal) have been repatriated back to the Euro Zone – by the billion — to top off the corrupted balance sheets of European finance — low and high.

The end of this road/ period is — naturally — triggering the exodus of Athens from ‘the Club of Berlin.’

The tit-for-tat in this fiat swap has been that Berlin rolls forward any bullion claims on America.

&&&

BTW, I’m getting sick and tired of idiots posting up about foreign gold being on deposit — EVER — within Fort Knox vaults.

That never, ever, ever, ever, happened.

Fort Knox only ever held the minority of US bullion going back half-a-century.

The planetary vault is in lower Manhattan — underneath the US Federal Reserve New York City branch. THAT’S where all alien central bank gold is held.

The big draw-downs from Fort Knox stopped in the 1960s — when the hammer went down against France. That was the last period that featured massive transfers — with the bullion always being reprocessed, to boot.

No way was France going to have American bullion stamps on their national bullion reserve. (The bars sent to Paris.) It’s another thing entirely for bullion shuttled to and fro underneath Manhattan.

Lastly, all Fort Knox gold — not all of which is bullion — is no longer ‘good delivery.’ The old standard of good delivery bullion was 99.5% — which was produced by a flame process that burned off not-gold.

Today, good delivery bullion has to be 99.95% — or better — as far as central banks are concerned. This involves an electro-chemical refining process. It costs but peanuts, as the impurities are themselves platinum group metals — usually more costly than gold — and the electric juice required is a joke.

This ultra-refining is a bottleneck at this time, as Red China has been hoovering up the entire floating/ trading supply of gold. This means ultra-refining thousands of tons of gold every year — keeping every dang refiner rolling in back-orders.

Most are physically expanding their plants — as this trend figures to persist.

&&&&

Glad to be of help — to the general readership.

Blert – thank you. I’m pretty sure it took me longer to read your post than it took you to write. But I believe I now understand most of it. The bond part was a bonus.

Hopefully other readers will take their time to read and benefit from your post as well.

Good post Blert. It’s just that with every suggestion China going to tighten, I see more evidence they’re out there spending hard. 110 Million Chinese tourists expected to visit the West this year. Radio show I just listened to telling how China investing billions in $50 Billion in Brazil infrastructure (deal just signed apparently). It doesn’t appear as if there’s any real China money slowdown, even though many a outsider news agency points to such data.

The INTERNAL growth of Red Chinese liquidity is being ‘tapered off’ — while the holes in the Red Chinese capital controls regime are entirely breaking down.

The result is that clear cut indications of deflation within Red China are popping up — even as the flood of funny liquidity is leaking like puss into the wider world.

The very insanity of their real estate bids is a ‘tell’ that you’re looking straight at crooked money — at least crooked by Red Chinese capital controls standards.

Since Americans have never lived under a capital controls regime, they are naifs in this matter.

Even the term “capital controls” goes in one ear and out the other.

&&&

The REAL solution to all of these problems can’t be apprehended / nor countenanced by the PTB: real wage increases for the proles — ESPECIALLY in Red China.

Which is run in every practical sense, as a slave/ serf/ peonage state.

The Red Chinese can’t afford to buy what they, themselves, are producing.

There’s something really, really, wrong with that picture.

It gets virtually no commentary in Barrons, WSJ, or the Financial Times of London.

Whereas, it’s the single biggest driver of the global insanity.

Financial Times has a list of cities where investors should buy real estate 1.nyc,2.san francisco and 3.houston.i read articles that houston now has the most millionaires and growing and houston will get even more expensive due to population growth.some middle-class people are being priced out.

A blast from the past…

2002: Bush’s Speech to the White House Conference on Increasing Minority Homeownership

“We are here in Washington, D.C. to address problems. So I’ve set this goal for the country. We want 5.5 million more homeowners by 2010 — million more minority homeowners by 2010. (Applause.) Five-and-a-half million families by 2010 will own a home. That is our goal. It is a realistic goal. But it’s going to mean we’re going to have to work hard to achieve the goal, all of us. And by all of us, I mean not only the federal government, but the private sector, as well.”

“I appreciate so very much the home owners who are with us today, the Arias family, newly arrived from Peru. They live in Baltimore. Thanks to the Association of Real Estate Brokers, the help of some good folks in Baltimore, they figured out how to purchase their own home. Imagine to be coming to our country without a home, with a simple dream. And now they’re on stage here at this conference being one of the new home owners in the greatest land on the face of the Earth. I appreciate the Arias family coming.”

http://www.unz.com/isteve/2002-bushs-speech-to-white-house/

Another blast from the past:

Former Democrat Congressman Barney Frank blamed the financial crisis on the failure adequately to regulate the banks. However, for most of his career, Barney Frank was the principal advocate in Congress for using the government’s authority to force lower underwriting standards in the business of housing finance. His most successful effort was to impose what were called “affordable housing” requirements on Fannie Mae and Freddie Mac which required Fannie and Freddie to meet government quotas when they bought loans from banks and other mortgage originators. HUD was given authority to administer these quotas, and between 1992 and 2007, the quotas were raised from 30% to 50% under Clinton in 2000 and to 55% under Bush in 2007.

By 2000, Fannie was offering no-downpayment loans. By 2002, Fannie and Freddie had bought well over $1 trillion of subprime and other low quality loans. Fannie and Freddie were by far the largest part of this effort, but the FHA, Federal Home Loan Banks, Veterans Administration and other agencies–all under congressional and HUD pressure–followed suit. This continued through the 1990s and 2000s until the housing bubble–created by all this government-backed spending–collapsed in 2007.

http://www.theatlantic.com/business/archive/2011/12/hey-barney-frank-the-government-did-cause-the-housing-crisis/249903/

“In an interview on Larry Kudlow’s show in August 2010, he (Frank) said “I hope by next year we’ll have abolished Fannie and Freddie … it was a great mistake to push lower-income people into housing they couldn’t afford and couldn’t really handle once they had it.”

If only Bush were as gracious in admitting his myriad of disastrous decisions.

http://www.theatlantic.com/business/archive/2011/12/hey-barney-frank-the-government-did-cause-the-housing-crisis/249903/

Democrat Barney Frank begrudgingly admitted in 2007 that his errors contributed to the housing collapse, but by then it was too little too late.

Democrat Barney Frank never had good judgement. In 1987, Barney Frank had a male prostitute living in his house paying him $20,000 a month to be he live-in boy toy. The male prostitute was selling drugs and sex out of Congressman Barney Frank’s home and Congressman Barney Frank knew about what was going on. Congressman Barney Frank not only lied and tried to cover this up, he also threatened to “out” fellow closeted gay Democrat congressmen and women who dare question or speak of his bad behavior and lawlessness.

https://www.youtube.com/watch?v=gHbcbETKef0

SoCal at its current valuation of real estate is completely out of reach of middle class.

Either housing would tank in couple of years or Socal would have just two classes: Elite Class and Servant class

I personally feel, housing is being propped up by Fed and the bubble would burst without Fed support. No one know how long this low interest rate would be here.

The current bubble (really an echo bubble from the last one) is a combination of the last 2 — tech and real estate. Internet companies that make no money receive sky high valuations from investors desperate for the next big thing. RE prices once again are close to peak years regardless of the nature of the money behind the run up.

The Fed is once again punishing conservative investments and rewarding risky behavior.

I think there is somewhat of a convergence of two trends. First, I do believe there is a natural gentrification that has finally arrived to the L.A. area, which was in a bit of a slump for many years. Second, I believe this natural gentrification of hipsters moving West and South from New York and Portland (sprinkled with some techies from San Francisco), the Federal Reserve (yet again) has very much embellished and influenced into this real estate bonanza in a very ugly way that is so ugly it’s oogily.

Ultimately, while I do see a crash that may resend prices back to their 2010-2011 levels, but the LA area will never crash to the 2008-2009 levels. I see LA’s gentrification in the same league as most major cities in the world as globalization continues its ascent. It will be more akin to Paris, London, New York and San Francisco, where the inner portion or the core of the city will be expensive, and filled with the haves in this new feudal economy, and the have nots will be pushed into the peripheries and suburbs therein who will drive in to the core to work, and head back. Already you see this very much in the 210, 10, 60 and 91 freeways.

By “L.A. area”, I hope you don’t mean the entire LA/OC region. I can understand a few enclave cities, but certainly not county-wide phenomenon. “Gentrification” and comparisons to international cities were the rationalizations for the LA/OC price run ups prior to the bubble. What suddenly made L.A. a center of historical, cultural, and economic interest in 6 short years? It’s no coincidence that price reflation occurred after the Fed instituted easy money policies.

Personally, another the crash of the current echo bubble will be a symptom of a problem bigger than the last one. Cheap money coupled with very little productivity gains for several means that investor speculation is at an all time high. In this case, I wouldn’t be so comfortable in declaring which cities or enclaves or communities would be immune from a major economic downturn.

@Mr.Wonderful, “gentrification” is a myth. Adjusted for inflation, median household income in Los Angeles County was about $62K in 1989, today it is about $54K.

What separates 1989 from 2014 is debt and savings (or lack thereof). The LA area was more dilapidated in 1989 than 2014 but budgets were balanced and people saved for the future. That isn’t the case in 2014. Many of the mid-tier cities in SoCal are borderline insolvent. Riverside County, Stockton, Vallejo are where these mid-tier cities are headed when the next recession hits.

The house flippers are back…

http://www.bloomberg.com/news/articles/2015-05-08/hard-money-comes-easy-as-wall-street-funds-home-flippers

Banks don’t like to loan at under 4% for 30 years hence many won’t qualify if they do. When rates go to 5% and above then standards again loosen and they avoided a housing slowdown. You see folks it is a given on the future of anything, they are way head of the news of the day.

When rates climb to 5% and above, wages will all of a sudden climb, they can’t give you a 30 year mortgage at 3.75% and pay you a higher wage then it would make sense and they are not in the business of helping you buy anything and get a comfortable wage. The economy always have to be on the brink in capitalism. Trillions of dollars sitting remember that, when it gets released they ( the banks and Feds) have to have another plan in place. Bank interest will see many flee to 5 year CD’s this hurts the markets, so watch for a major correction, San Jose and Manhattan are going to hurt big time, the rich in these locations already know it, that is why the are selling overinflated properties to overseas buyers and getting them appraised. Even a cash transaction you can ask for a appraisal to make sure it is worth it, at the high end it is a ponzi scheme same as 2005-2006, only the 1 to 2% of foreigners some Americans get hurt, nobody cares.

Many homes are delisted everyday in America, they didn’t sell, NAR gives no stats on that, it makes it look like low inventory of course it is low many left the market. Sells of homes booming in some location’s (?) check the property record of closed homes most lost their shirt, this is not good and healthy.

If the Fed skates by not because they know what they are doing but the cycle of the times, the trending like I always post about is coming around. I see the elephant in the room, banks and fed see the same thing, they just do a illusion, a David Copperfield, it is their believe me.

Hoard cash if you have some, bank rates and the magic of compounding will happen, only buy a distress house check tax and public records, never buy into this neighborhood will soar because all the homes sold high(?) really, tell the agents how many took a bath and watch them runaway from it.

When your wages climb don’t fear 5 to 6% mortgages this real is a norm for loaning 30 years or even 15, fed zero rate never to return in your life time. Many homes will be sold for smaller profits and yes a normalcy will return. The crazy SF-SAN JOSE, NY stuff is reality shows no correlation to the masses, think inside your box when the opportunity hits, enjoy the very rich whose proprieties will take a huge hit who cares, they had their fun at the majorities expense the last ten years.

wages will not rise for the 90-95% because there will always be someone willing to work for less.

less than 65% labor participation rate, outsourcing, illegal aliens, automation, etc.

Admittedly rents were not always so high in San Francisco but homeownership was always pretty low. Here is the data from the 1940 US Census for SF.

Occupied dwelling units 206,011 92.7%

Owner occupied 64,398 31.3%

Tenant occupied 141,613 68.7%

Leave a Reply