Rent versus Buying: Should you Buy With Housing Prices Crashing? Culver City Case Example: Reasons to Wait Another Year.

With housing, there are only two positions in which someone can be. You own or you rent. That is it. The fascinating market dynamics are making people ask whether this is the bottom and should they jump into the market to buy. From the beginning, this question should not be approached as a gut reaction to take a nosedive into the market. I know the temptation is there especially with the marketing and familial pressure many face to become homeowners. Just because prices have fallen dramatically does not mean they will stop here. You should always do a market analysis on the area you are planning to purchase in. In today’s article we are going to look at a prime area in Los Angeles County, Culver City and run a market analysis and determine whether it is a good time to buy.

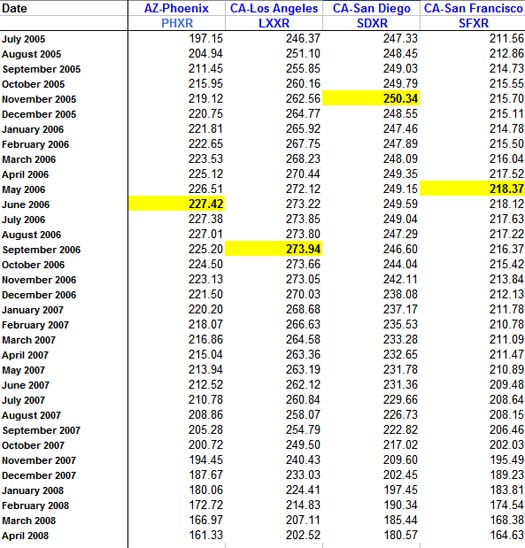

Yesterday, the closely followed Case-Shiller Index was released and showed that the housing market was still correcting. The media headlines were pretty standard highlighting the continued pressure downward in housing prices and also, the major drops in California, Florida, Arizona, and Nevada. Yet simply saying everyone is down does not really highlight the nature of housing prices. Let us take a quick look at the data for four cities just to demonstrate this:

I went ahead and highlighted the peaks for four metro areas:

Phoenix-AZ: Peak June 2006

Los Angeles-CA: Peak September 2006

San Diego-CA: Peak November 2005

San Francisco-CA: Peak May 2006

So as you easily see from the data, there is some divergence in when prices hit their apex. In fact, San Diego hit its peak almost one year prior to Los Angeles. Another key point in the data is to see how high prices got in relation to historical measures. Even though San Francisco has a higher median price than Los Angeles, the bubble in Los Angeles is still larger. In fact, if we are to assume the base 100 number in the Case-Shiller Index Los Angeles still has 50 percent more to decline and is still in the biggest bubble of the four sample areas.

Given the massive correction is now a good time to buy? After all, from the peaks mentioned above we are now off by:

Phoenix-AZ: -29%

Los Angeles-CA: -26%

San Diego-CA: -27.8%

San Francisco-CA: -24.6%

Those are sizeable numbers and would make people think, “is this a good time to buy given the quick correction?” It would seem many housing pundits have seized upon this psychological doubt and are trying to play on this desire. Yet buying something just because it has fallen drastically makes no sense. This is the same inane logic from people buying homes simply because they were going up. You can look at all the Real Homes of Genius in the state and figure out that people did buy anything at any price to have a piece of this epic housing bubble.

I wrote a rent versus buying article in October of 2007:

This is a piece of the article that still holds relevance today and we are going to modify it given the drastic change in such a short time:

“The credit markets were self correcting until the Fed decided to jump in and give the implication that they were the lender of last resort. Now the implication is that we will have a bailout and the market is rejoicing. Yet looking at the mortgage reset charts and mortgage equity withdrawals, it is clear we are only entering the first stage of a multiyear housing bear market bailout or no bailout. And when we look at Real Homes of Genius, we understand that fraud and outright speculation will come crashing down. You must ask yourself that a large proportion of our population was involved to some extent in producing products that provided no socio-economic benefit to our society. 2/28 loans? Option ARMS? Need we dig into more data of people making $9 hour being put into loans with the assumption they are making $157,000?

The only people benefiting from these loans were Wall Street and the lenders. No one else. Initially the claim was these people now have the pride of homeownership but what a crock that was. Lenders will continue to tighten since risk is now perceived in the market. This will make it more difficult for people to refinance, purchase discretionary items, and in general will put a pause on the consumer spending which greases the wheels of the American economy. We talked about debt being seen as the new form of money. But all this is changing. And Americans with a negative savings rate will have a hard time doing a paradigm shift in which lenders will require a down payment. Even a miniscule down payment like 5 percent will bring the market to a screeching halt. Everything is borrowed.

No one has a crystal ball into the future. Even Alan Greenspan didn’t see the subprime mess coming (or at least he would like us to believe that). Big Ben even in May of this year talked about the subprime market being contained in a “silo.” And of course we have the heads of housing lenders and builders making fools of themselves by making outlandish predictions that are now being verified in the arena of reality as false. Save up, run the numbers, and the time will come to buy. But right now, against the propaganda machine of the housing industry, this is not the time to buy a home.”

All that nearly a year later still holds true. You have to put yourself back into the time machine for fall of last year when people were still espousing the temporary nature of the drop! In fact, prices in many California areas were down but not in historical proportions like today.

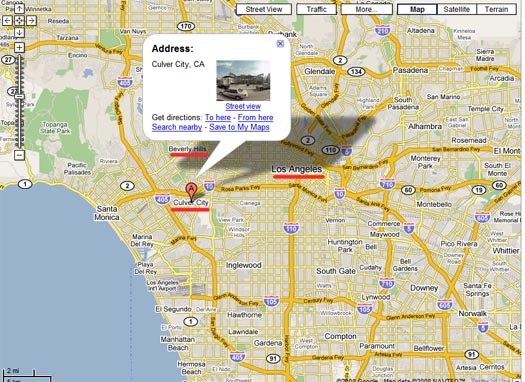

Today we are going to examine in detail a decision to buy in Culver City California. Culver City is a prime Los Angeles location. This is one of those areas that supposedly if the idea of prime areas being insulated would hold up, should not be falling. Culver City is located west from downtown Los Angeles and is just south of Beverly Hills:

For those not from Los Angeles County it is hard to believe how diverse the 88 cities are in this massively populated county. Even on this map, you can see that a little more south from Culver City is Inglewood and prices in that area are a world apart. So you can see the price progression as follows:

Inglewood

Culver City

So we are going to assume that you are in Los Angeles County and are making a reasonable amount of money and are ready to buy in today’s market. What would the reasons be for not buying even in a prime area?

Reason #1 Not to buy – Rent vs Buy Ratios Still Off

This should be a major consideration in buying. First, let us look at the median priced home in our sample zip code:

Culver City (90230) – $710,000 (down 7% from last year)

Median Price Per Square Foot: $598

Median sized home (1,187 feet from data above)

Already we know that this area is in fact holding up better than the county in general which is down 26%. But is that reason enough to buy a place here? For the last few years people bought not necessarily for the underlying ratios because of the implied appreciation. So for example, say we bought a place for $500,000 in Culver City a few years ago with zero down and sold the place at the current price of $710,000. That is a massive quick profit in a short time. Yet that appreciation is now gone. Now, we have to look at rent versus buying ratios to see what kind of difference really exists.

So let us see what 1,187 feet square foot homes would lease for in Culver City. The median rent for a 3 bedroom home in the 90230 is $2,950. Take a look at this place I quickly found on Craigslist for $1,500 a month:

Again, this one place is an anomaly but you can find deals anywhere. The more likely price range is $3,000 for a starter home.

So now that we have a better idea of the price, let us run the numbers between renting and owning:

Income tax rate: 28%

Price of home: $710,000

Down payment: $35,500 (5%)

Interest Rate: 6.5% 30 year fixed

Monthly rent payment: $3,000

PITI: $5,530

Initial tax savings: $1,200

Initial principal reduction: $661

Net house payment: $4,330

Each month, you are paying a true premium of $1,330 to own a place in Culver City. Even if we are to assume that 2 percent appreciation for the next few years (which of course we are looking at more realistically depreciation) your purchase will not break even for 13 years.

Keep in mind that $1,330 is being invested elsewhere. In fact, here is another faulty piece of logic that was spouted during the boom time. That PITI payment is what you have to pay each month. You have to have $5,530 handy assuming you have your insurance and taxes escrowed. Given that conservative ratios tell us that you should not spend more than one-third of your income on your actual housing payment, you would need an income of $200,000 or higher to make this purchase fall within those guidelines. The tax break comes after you do your taxes. That is the faulty assumption. When we look at the net house payment and how people squeezed into homes with 60, 70, or even 80 percent of income going to their PITI any slight movement is going to put them out of their homes.

This is exactly what is happening. To buy right now gives you only a razor thin buffer to protect yourself. The way this bubble is bursting, there will be a time when the net house payment will be equal to the monthly rent payment. In this example above, if rents stay at $3,000 the median income price for a home in the 90230 area code will hit $500,000. This seems reasonable given the market dynamics. So why would you overpay $200,000 right now?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

18 Responses to “Rent versus Buying: Should you Buy With Housing Prices Crashing? Culver City Case Example: Reasons to Wait Another Year.”

Very good article – concise, well explained and logical. This market is going to get much much worse as deflation (as opposed to inflation) will wreak havoc. We sold our house in August ’07 at the top of the market in London and don’t envisage buying in San Diego until 2011-2012. Case in point, there is a foreclosure near us in Carmel Valley, 92130 listed at 750k – 1,800 sq ft and on a busy road opposite a school. With the typical tiny garden. What was that great line from “Bridge over the River Kwai” – “Madness… madness…” The economy as it stands is broken and can only be fixed by addressing the larger problems at hand. The US needs to produce more, export more and import less. Stop relying so much on oil imports and pull out of Iraq as well as cut down it’s military presence throughout the world. This age of entitlement will be a dim and distant memory in the coming years as this perfect storm of excess, bubbles and manias decimates the world we know.

Extremely true.

Here’s another anecdotal, if it helps at all to figure out when to think about buying. Conservatively, houses should be valued at approximately 120x monthly rent (or 10x annual rent) to start being attractive as investments (vs other places to invest money) for investors (as opposed to speculators). A condo in my area (Mar Vista) was listed for 630k for 2 months, no takers. They rented it instead for ~2650/month. Using the investing value metric, that puts its total investment value at around 320k, roughly 50% of the price they listed it at (and that’s not including HOA dues, which would lower the value further). For a starter home renting at 3000/month, the maximum investment value would be 360k, approximately 50% of the 710k it would be listed at currently.

LA still has a looooong way to fall, imho.

Nick: My son’s school is in Culver City. None of the houses in that area are worth more than 360k if that, imho. If they retreat to those prices (which would be back to 99 I think) that would be reasonable. Still don’t know if I’d want to live in that neighborhood though. LA neighborhoods are all very different and one needs to know them well before deciding to live there.

Studies have shown investment properties to have a 45%-50% operating expense ratio (relative to rents). This number is nationwide and consistent throughout the country despite large price differences. Consequently to actually have a good, cashflowing, investment you need to get 2% of the sales price back each month in rent. The 1% number is actually something pushed more by the realtors whom obviously prefer the higher price 1% brings in. I have run the numbers on a large number of 1% properties and have yet to find one that cashflows, even by not figuring in hard to value expenses such as future maintenance, vacancies, collections, and damage by tenants. Theoretically you could make this break even at 1% if you pay all cash, although in reality that would still be a loss due to lost opportunity costs and no payment for your risk and headache. Down payments do not make a difference in this calculation either as the 7% saving on interest on that money is offset by the approximate 7% lost opportunity costs you could have gotten in safe investments elsewhere.

All of this brings up another point. You cannot accurately figure out the differences between buying and renting by just using the expenses and benefits listed in the blog entry. The base value of any property is going to be its value as an investment property, since by this value you will have an accurate account of its worth that will not be overvalued is you decide to use that property as an investment property or owner occupied home. So by the calculation of a shrewd potential landlord any property’s actual value would be something like monthly_rent / 0.02. Anything over this amount is the price a buyer is paying for the emotional value of owning his own home.

To be fair the expense load is a little different for an owner occupied unit. Namely vacancies, collections, slightly less insurance costs, slightly less maintenance costs as an owner is likely to be less harsh on the property and its fixtures than a tenant, and you can always forgo paying yourself to be your own landlord. Of course, this all depends on the hope that you will never need to switch to being a landlord for any reason. Not to mention that there is still the risk of owning such as property taxes, lawsuits, environmental problems (will follow anyone on the chain of title no matter who is responsible nor how long they were the owner), etc. This may add up to about 10%-20% of the potential monthly rent, maybe even less, depending on the location and the risk level associated with your possible potential tenants. This brings the number down to about monthly_rent / 0.0185. Of the 1% of month costs available for financing, principle pay down, and your profit you can figure about 7% is locked in for interest costs and 1% for principle pay down so you have the ability to forgo or reduce your headache payment of 4%. Of the potential profit you are thinking of reducing or forgoing you need to figure out how much you personally require to pay you for the risk of ownership and what other excess will be an incentive to go through all the associated costs of owning over renting. Lets say you will be happy with with 2% for this that leaves you only an extra 2% to further overpay for the property. So you are now at about monthly_rent / 0.0168. For me at least, not enough of a difference to justify purchasing at any amount other than the landlord sweet spot of purchasing at monthly_rent / 0.02.

This is quickly becoming the first blog that I check every day. I used to rent on the Westside of LA, and now living in Fullerton. And so this blog has become the running commentary for the events I have watched unfold over the past year. I can remember starting as a student at UCLA about 4 years ago, and even then, not being able to understand why anyone wanted or even could buy a house in LA.

My uncle is a former VP at B of A. I recently had a lengthy discussion with him about the current RE market conditions. He advised me that the timing of when to buy will be predicated on fed rate conditions, and that one should hold cash on the sidelines until the fed has to crank up interest rates for a prolonged period, in an effort to finally get inflation under control.

We’re in for a prolonged period of tightening, that hasn’t even started yet, and this will be the true nail in the coffin of the RE market, long after all of the option arms have reset. At that point there will be little speculative money available, and the patient person with good credit and a hefty down payment will be able purchase, hold, and refinance after a couple of years.

I agree. Renting is better. I have found this article that might be helpful. http://www.sunchaselv.com/buyingvsrenting

There is a calculation. Renting is better in the long run, I think.

I lived right on the border of L.A. and Culver City during the bubble and prices in that area (Westside L.A.) were truly, truly insane. I used to pick up the free real estate papers and laugh at them. Postage-stamp houses – like, seriously, 7-800 square feet – 5 miles from the beach, going for $800K. Rents, while IMO high compared to many other cities, were not even in the same league. Seriously, the only reason to pay these outrageous prices was if you planned to cash in on the vast equity that you would “earn” every year in a bubbly market. But no one spoke of a “bubble” back in 2004-2005…oh no.

Doc, what do you think about rents? Are they going up because foreclosed homeowners are now in the rental market again, reducing inventory? Or are they going down because so many previously owner-occupied houses are now for rent? From my perspective, here in San Diego, they seem to be holding steady.

One has to realize that there are couples out there that have a sizeable downpayment for a home purchase. They may have gotten an inheritance, their parents may have pitched in, or they are moving up from another neighborhood. Culver City schools are very good and most couples that purchase here will stay here for at least 10 years to 20 years until their kids graduate high school or college.

When you get a 30 year fixed mortgage rate, it stays fixed, same monthly mortgage, for 30 years! With rent, it will go up 4% to 5% annually.

Culver City median home prices will eventually drop but not as much as the rest of Los Angeles. There is a lot of old money and equity in the City.

SF under $200 per sqf? Doc, where you get your data from? SF is $370 including a lot of counties, the city of SF is probably $450. It is the most insanely priced city in the US.

With interest rates likely going up in the near future, that will either (1) crush the housing market even more or (2) cause fence sitters to take the dive and lock in a low interest rate. It’ll be very interesting to see what happens.

Matt,

Just because you put down cash, that does not mean that buying will be better than renting. Using cash has its own cost as well in lost opportunity costs. Your cash share of the payment will save you about 7% in interest on the amount that you would have otherwise financed. So your cash is basically earning 7% interest by using it as a down payment, assuming your mortgage rate is fixed at 7% and not counting any dubious appreciation on the value of the property. You can easily get the same 7% or more in relatively safe investments elsewhere without the same level of risk nor headache.

As for comparing it to renting unfavorably because rents go higher (in general) with inflation; that is not entirely correct. Sure your mortgage payment may have been fixed, but not your other related expenses. Landlord expenses usually run about 50% of the rent so you can figure that about 2.5% of that 5% increase will be related to the other related expenses that a homeowner will still generally have. And to top that off I have heard many reports that insurance and property taxes have been rising 10% a year for several years now. Also rents do and can go down. In those cases your fixed mortgage actually works against you. Meanwhile you are paying 7% interest every year plus paying down principal on a loan on an asset that may have gone down in value or up if you are lucky.

Finally keep in mind that just because a couple has a large lump of cash does not mean they will go out and spend it on a house; even if we are a spender society. Good financial planning will actually keep this money invested in diverse investments and relatively liquid to prevent it from being locked into something and spiraling down a financial black hole.

You began the article by saying that housing offers only two options: buy or rent. Wrong! You can live with your family, i.e. move back in with Mom & Dad. It’s happening more and more.

Matt: not many people are going to meet the demographic your talking about. A young couple in their 20’s say probably has parents still around and so they aren’t in the demographic to be getting an inheretence from their parents in most cases. Nor will they be moving up from elsewhere as anyone under 30 and many over have been priced out from day one with this bubble (unless they are moving elsewhere from some other part of the country possibly). Now lets say for the sake of argument that this young couple inheriteted $120,000 from their grandparents, and this is such an atypical assumption that it’s hardly worth running with, but lets run with it, and with some saving of their own made the 20% downpayment. Cool. But the downpayment isn’t enough with a property priced this high you still need a very high income flow, not just wealth from inheretence, but income, just to make the monthly nut. So they still need very high paying jobs, or in the case of your argument a trust fund I guess ….

And it’s true that Dr HB didn’t factor rents going up and mortgages staying the same, but he also didn’t factor the opportunity cost of using that money elsewhere. The young couple invests the 142k in the stock market instead say, then they have just gotten that much closer to retirement (they plan to retire out of state :)) or they investment in something kicking out money every month, if interest rates weren’t so low they could actually give them a significant amount of money, more than enough to easily cope with any rent increases.

Now if your couple is in their 40’s they may better fit your example. They may have money from moving on from another property, they may have money inhereted from their parents. If they had kids later in life they may even have fairly young kids. And they may have the income flow just because they are in peak earning years, the 20 somethings would need to be in super high earning professions to have the income flow.

I dont know about you dude but I would not put 142 thousand in the stock market.

John,

You state:

You can easily get the same 7% or more in relatively safe investments elsewhere without the same level of risk nor headache.

Where can I put my money and earn 7% interest? The only safest investment is putting your money in the bank earning 3% interest and then minus taxes. Did you see the stock market today?

You state:

And to top that off I have heard many reports that insurance and property taxes have been rising 10% a year for several years now

Property tax increases are limited to 2% a year increase. So for example, if your property tax bill is $3800 like mine is, then the increase at 2% goes to $3876 My property insurance has been relatively flat at $500 a year through State Farm.

You state:

Also rents do and can go down.

Rents have consistently risen in West LA average 5-7% a year since 1995.

I am paying $1200 a month fixed for a condo I bought for $300,000 in 2001 putting $60,000 down. Guess what, the interest in tax deductible so my true out of pocket cost is $900 a month. Comparable rents for my condo are now going for $2350 a month. Just in 7 years I am way ahead than renting and imagine in 10-20 years when rents are up to $3500 to $4000 a month for a condo while I am paying say $900 out of pocket.

Rents are like gas prices — they’re sticky on the down side. In eight years of renting I’ve never seen a lease renewal offer that didn’t come with a rent increase. I’m not saying rents never fall, but it seems to be highly uncommon.

Matt,

> Where can I put my money and earn 7% interest? The only safest investment

> is putting your money in the bank earning 3% interest and then minus taxes.

> Did you see the stock market today?

The stock market goes up and down, however it has averaged 10% per year. Safety comes with diversity and keeping yourself as well informed about your investments as possible. Just because stocks have not been fairing well in the past month does not always make them a horrible investment. And the nice thing about the stock market is that you can invest in many different kinds of things. Gold and oil have done very well in the past month.

As for the 7%. I was offered a very safe 7% annuity only a few years ago before rates got raised to their recent highest level. High quality bonds and t-bills were hovering around 6% only a year ago. The treasuries have obviously come down lately thanks to the free money the government is putting out, but the credit squeeze is still there so corporate bonds are still fairing quite well.

2% property tax

You are obviously in CA were your own property taxes are being artificially kept low by that proposition from many years ago. Unfortunately that has actually caused a distortion of the market as what should be your fair share of the property tax burden has instead been shifted onto more recent buyers of properties. Right now you happen to be the beneficiary. However if you ever need to move you will find yourself on the other side of the distortion, just like those people whom happen to have large down payments available that you suggest will go out and buy a house. Obviously if you never decide to move then you will win with this particular cost over the long run, assuming CA’s budget problems doesn’t force the state to remove the cap. As for the insurance I am happy for you that you have been able to keep the same rate, I lucked out on one of my investment properties this year with keeping the same rate as well. I would wonder if your coverage has actually gone down over time though. One of my properties’ insurances added a bunch of exemptions to their terrorist incident coverage in this past year. Also your coverage levels may no longer be adequate after all this time for your property. After all, after the bubble and the current bust I would expect that your property should still be worth about 500k and construction costs have also risen in that time. The 10% increases have been noted by various sources. These numbers are suppose to be nationwide so it would not surprise me if local variances exist. These numbers aren’t pulled from thin air, landlord have been complaining about them for years as various rent controls throughout the country aren’t allowing the landlords to keep their costs covered.

Rents have consistently risen in West LA average 5-7% a year since 1995.

> I am paying $1200 a month fixed for a condo I bought for $300,000 in 2001

> putting $60,000 down. Guess what, the interest in tax deductible so my true

> out of pocket cost is $900 a month. Comparable rents for my condo are now

> going for $2350 a month. Just in 7 years I am way ahead than renting and

> imagine in 10-20 years when rents are up to $3500 to $4000 a month for a

> condo while I am paying say $900 out of pocket.

Do you do realize you happen to buy just at the beginning of the bubble? The price you paid for your condo is probably pretty reasonable compared to even what someone could get today with the current 15% decline. Even then something seams very off about your numbers.

300,000 price

– 60,000 down payment

————————————

240,000 loan

That means that you should have started out paying about $1,200 in interest every month assuming a 6% loan. That amount of interest goes down over time but it should not have changed a huge amount in only 7 years assuming a 30 year mortgage, and the difference paid in principle pretty much does cancel itself out once you factor in the lost opportunity costs.

I suppose its possible that you are in a 50+% total tax bracket so you are getting a huge deduction. Although since you are bring up deductions, I should mention that as a landlord I get to deduct many more housing related expenses as they all qualify as business operating expenses, plus I get a free loan from the government through the depreciation deduction. Despite this I would love to see an expense rate as low as yours. I am going to assume your tax bracket is 30% as this is the average. Doesn’t change it much as either way it sound like you are forgetting to factor in a huge number of your housing related expenses. So lets see where you started.

$1439 monthly mortgage payment

$50 monthly insurance cost (unknown level)

$500 – property taxes, unknown??? I’ll assume you started at 2% of your value

$250 – condo common charges, unknown??? I’ll assume you started at 1% of your value

$30 – home insurance, to help keep big repair bills at bay. I’ve seen this run about $360/year for a condo.

$300 – lost opportunity costs on you $60,000$? – contribution for the deductible in the home insurance

$? – contribution for a maintenance fund, doesn’t matter if you actually budget for it, you will pay for it at some point.

$? – contribution to upgrades, new appliances, anything else.

$? – possible extra costs from being unable to move, extra gas, etc?

————————————————-

$2,569+ ———- total actual expenses, estimated

– $300 ———– tax credit at a 30% tax rate

—————————————–

$2,269+ ———— possible total actual expenses after tax deduction

Based upon your own numbers you said that the current rental value is $2,350 and it increased about 6% a year since 1995. So the rent a comparable condo in 2001 should have been about $1,562. Other related rental expenses? Maybe renter insurance, although that actually covers more than property and home insurance, but that is usually ridiculously cheap and optional. But I’ll be generous and set it at $38/month.

so your rental cost would have been $1,562 – $1,600.

Looks like a $669+ loss starting at the first month. At the end of the first year you would have had $8,028 that went to housing expenses instead of being invested somewhere else. Thats worth about $500/year in interest that you may have earned on that money. In the 7 years that passed that first year’s 8k loss has actually translated to a $12,071 loss in cash that you may have had today. Lets run the numbers. 2nd year $10/month increase in taxes and $15/month increase in common charges, we do not know what to figure in for the other unknown expenses. The comparable rent went up to 1,655. So its about a $69 increase in the numbers in your favor. 2nd year 600/month loss or $7,200/year or $10,213 in cash that you could have had today. 3rd year $1,754 rent, $520 taxes, $281 common charges; so $73 in your favor. $6324/year loss or $8,463 in cash you could have had today. You can continue running the numbers for your total count. Don’t forget that the cash you could have had today would be earning interest for you. To be fair I do not know what your common charges and taxes are, however keep in mind that I did not set any money aside for maintenance, upgrades, unexpected expenses that otherwise would have been covered in a rent. BTW, what happened to your closing costs? They are also part of your total purchase price; that should be about another $9,000 if not more.

After 7 years and having bought before the bubble you may very well be good. But the savings you are figuring in just may not be there. Even if I were to be generous and give you only a 25% real expense load (probably too low as deferred maintenance and the unexpected are real expenses), thats still an extra $600 on top of your $1,439 mortgage payment for a $300 current savings over renting. Your tax savings may add another $300, although that probably gets canceled out with the current lost opportunity costs on all the extra money you have paid so far. Also keep those fingers crossed that rising distressed properties in your area do not increase the number of places for rent, thus bringing down the comparable rents.

David,

Lease renewals usually don’t have the decreases, usually at best stay the same. For the same home its usually only the tenant going to the landlord to tell them that they could move for a better price that brings a rent reduction. This is more due to lack of information than anything else. Market rents are also set by comparable rents, just like owner occupied home prices. Landlords usually will not drop the price if the tenant is paying as they see the apartment worth that value, since the tenant is currently paying that amount. When renting anew, the landlord has to price correctly for the market. Also it is usually assumed that the rent will rise with inflation to cover the rises in costs. BTW, as for dropping rents, I read an article a week ago that here in Manhattan, NYC rents dropped 10% this year. Looks like we are to be hit as well.

I personally never thought there was a bad time to buy. Having said that if you bought 2 or 3 years ago you probably wouldn’t feel smart about that right now. The market I am in hasn’t taken the hit I see expressed here. I think prices could still go down for the next 6 months here but you need to plan on being in the property for more than a couple of years.

Leave a Reply