Record Low Housing Inventory and Inflation in Everything: Covid-19 Brings a Record Low in Housing Inventory but Will This Last?

One of the biggest surprises with Covid-19 is that the housing market has only gotten hotter. But it isn’t because the overall economy is great and people are getting amazing jobs in all sectors. What is happening is a massive trend in overall inflation as easy money is flooding the economy, we have large mortgage forbearance activity, record low interest rates, and a record low inventory in homes for sale. That is right, there is a record low number of homes available for sale on the market. In places like California we continue to see a record number of Millennials living at home with their parents. With people now spending more time at home, real estate is taking over a big part of our lives. With that being said, how will all of this play out once the economy starts opening up in a new normal environment?

Record Low Inventory

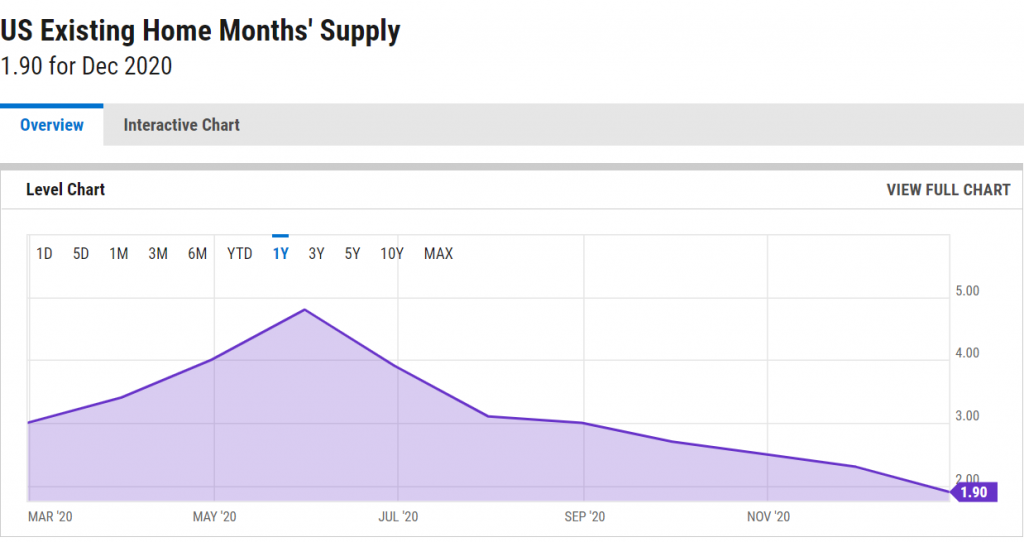

Supply and demand is a basic lesson taught in economic courses. So it should come as no surprise that with record low inventory, prices will go up. For the first time in a generation the amount of homes on the market for sale is at 1.9 months. Take a look at this chart:

The above chart is for the last year. What is interesting is that supply did increase in the first few months of Covid-19 but then has been steadily going down. This is not typical. Take a look at a longer-term chart:

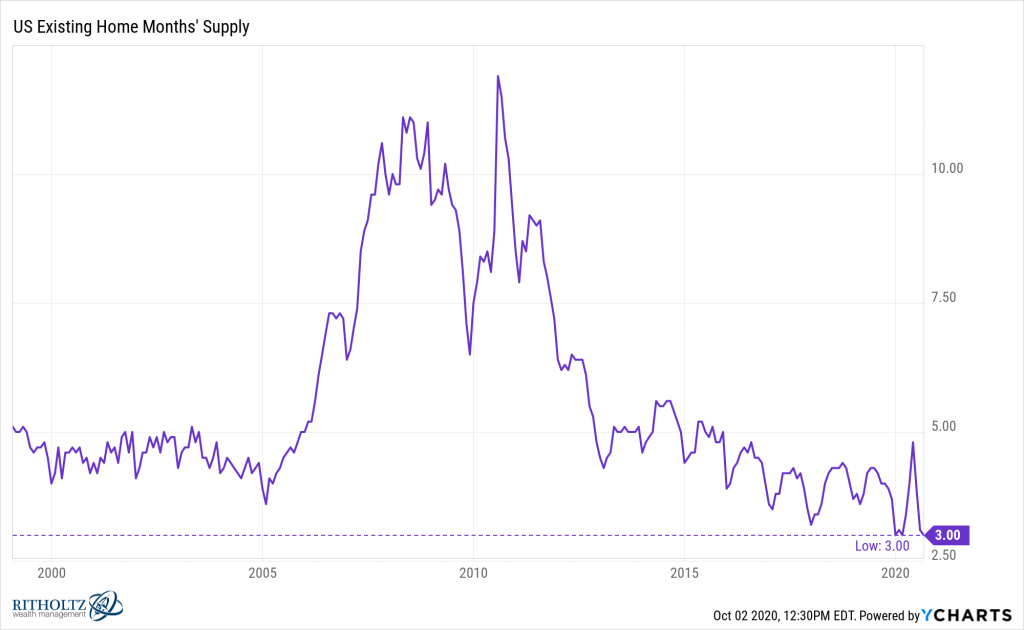

You can see that going back to 2000 a record low baseline was at 3 months of inventory. Today it is as 1.9 months which is unheard of. This has added a lot of pressure to purchase homes with the combination of record low interest rates. If you want to buy, there are slim pickings.

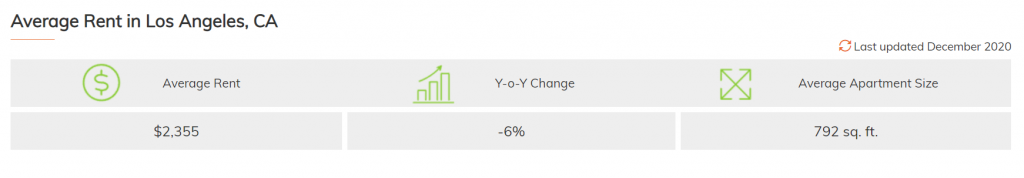

However because much of this is juiced by easy money, the rental market is a bit different:

Rental prices in expensive metro areas are not seeing increases but declines. You can see for L.A. rental rates for apartments are down year-over-year which makes sense given that we are in the midst of a global pandemic that has reshaped the way we view work and interacting with one another. Incomes are also not up in most households.

Everything is seeing massive gains: stocks, crypto-currencies, and real estate.

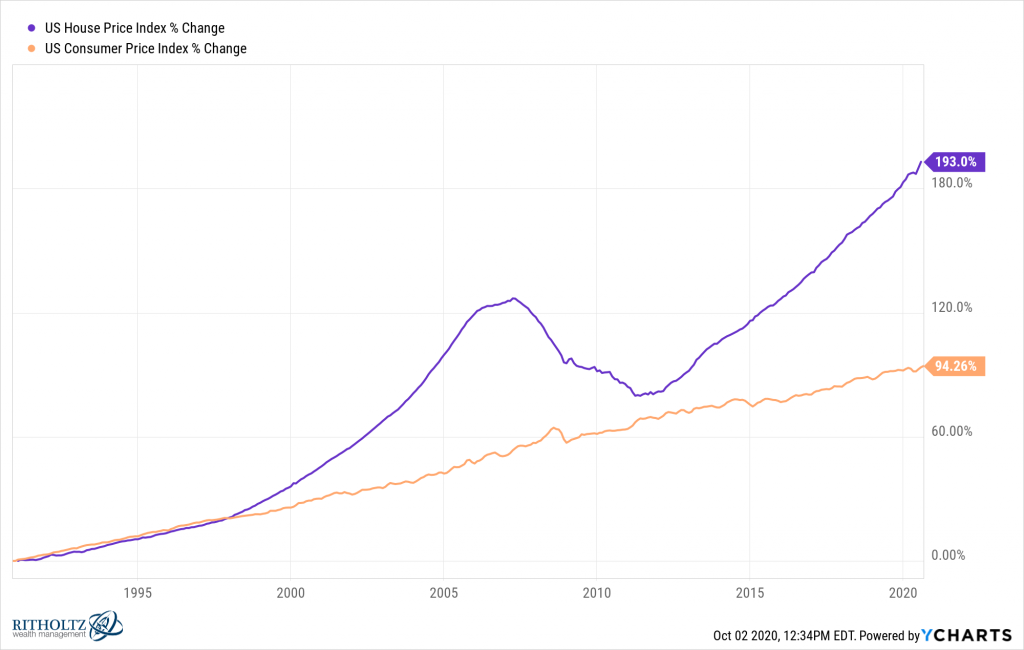

With more stimulus coming, we can expect this trend to continue but for how long? Real estate tends to track inflation in the long term and we are deviating from that path dramatically:

Real estate values are diverging even higher than they were in the previous housing bubble. Things tend to revert back to the mean but right now home prices are heading into uncharted territory. There are a few things that will hit the market shortly:

-Mortgage forbearance will end shortly for millions of households

-The economy will start opening up as more people get vaccinated

-With people working at home, how many will stay in high-cost locations? We’ve already seen the move of companies like Tesla and Oracle to Texas. Salesforce is saying you can work from anywhere.

So all of these variables are in play but for the short-term, expect all asset classes to see a move up as that is the current momentum trend. After that, expect some correction to happen.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

192 Responses to “Record Low Housing Inventory and Inflation in Everything: Covid-19 Brings a Record Low in Housing Inventory but Will This Last?”

We can’t help people that refuse to see we have an asset inflation never see before. Holding cash and waiting for a crash in asset prices is a pipe dream. Buy bitcoin, real estate and stocks or get left behind.

Even Tesla bought 1.5b usd of bitcoin. $1.5B!

The problem with buying investment assets is that prices, in some cases, already reflect increases in money supply that hasn’t yet occurred. Trying to pick the right assets and the right entry points is not a game the average person is likely to excel in. I think collectively we should just all stop working and demand UBI.

Funny, I got same advice in 1988. I would be fool to wait for crash. I knew inflation was coming and rates would skyrocket. I held on to my cash. When inflation hit interest rates peaked over 17 percent. Homes crashed 33 percent. If I bought in 1988 when prices over 300k, I would have had to get a 125k loan. I waited and, as you would say, my pipe dream came through . I got a home for 190k cash. Now hone 1 million.

How old are you? Atleast 60 I’m guessing. Waiting 30 years to live your life, isn’t really a good strategy.

Waitingforever: “Waiting 30 years to live your life, isn’t really a good strategy.”

As Old M used to say: You don’t need to buy property to live your life. You can live your life while renting.

I wanted to buy a home in 1988. Prices over 300k. I held onto my cash and waited for my “pipe dreamâ€. Was a bit worried because of low inventory. But I waited. and waited for crash. Like now, inflation was inevitably. Mortgage rates skyrocketed. Wow!!! Home dropped 30 to 40 percent. People walking away from their homes. I was able to buy a home for cash without get a loan. This will be no different .

Good for you! I bought a home for 300k that was worth almost 800k before the crash. Now its wor5h almost 900k.

A friend is on an apt search here in LA, and she has noticed many landlords have not dropped rental rates at all – what they are doing is offering the first month for free on a 1 year lease.

Now of course that’s a 8% decrease when avg over first year but keeps all the landlords happy to show their rental rates have not dropped on their books after the first month.

It also locks the tenant into the higher rent, which per rent control regulations is what the landlord can base future rent increases on. Why would the greedy landlord want to leave money on the table?

It also locks the tenant into the higher rent, which per rent control regulations is what the landlord can base future rent increases on. Why would the greedy landlord want to leave money on the table?

True…the landlords are loathe to reduce the rent…all seem to be using the ‘1st months free’ strategy. I guess it helps them for the future rental pricing, using 11 months base rent as a factor instead of 12.

Our rental agency that manages our out-of California house e-mailed us today about charging a modest increase in rent when the lease expires. They want to sweeten the deal by offering a smaller increase if the tenant signs another 1 year lease. The tenant under state law has the option now of going month to month. The house is far from the major urban centers, but does have cable internet from the telephone Co-op.

You should post Schiller’s house prices for inflation for the past one hundred years. It was between 80-120 for ninety years. Then it went to 200 in 2006. Ended up at 120 in 2011. Forty percent drop. Actual housing prices dropped 35%. Would have been 40% if Wall Street had not bought 250,000 houses.

The inflation house prices today are around 180. So we are 35% over valued again. The real question will be will the valuation stop at 120 when prices drop. Or go down to 90. Which would be a fifty percent drop over the next four years.

Good questions. Things are a little different this time.

2008, many people took out loans that could not make the payments when the adjustable rates went up. Many used no document loans. They would never be able to keep making payments once the houses stopped appreciating and they could not refinance. You read all kinds of stories of people with a $30k salary buying 600k homes or even multiple homes with no means of making payments.

This time, low interest rates have made most of the homes affordable (from a monthly payment) and their payments are fixed. Loans are strict so most people who get a home can afford the home. Even if they home drops if value some, they will not have the incentive to walk away as they most likely will neve see this low of an interest rate again. Lots of homes were bought with cash. More homes now are owned without a loan than in 2008.

Interest rates could rise and this could put pressure on home prices but in the past, rising interest rates did not cause a drop in home prices.

It is all about liquidity. As long as the money is flowing…housing does well.

I live in the midwest, up until 2 years ago you could still find 4 bedroom homes under $300k but they becoming more rare now.

If we start the MMT thing and pay people $2k a month, you will not be able to find any home under $300k. At a 3.5% interest rate a person can buy a $300k home for about $1500. If you were poor and suddenly get $1500 a month, why not buy a $300k home and still have $500 left over. In addition, what ever income you were paying for rent can be used for groceries.

I also think what you are seeing now is Wall Street buying up homes with this ultra cheap money. They got the SEC to allow them to bundle the loans into MBS and the GSEs will back these loans. Thus Wall Street has not risk so pay whatever price you need to buy up homes to keep getting bigger and bigger. If housing starts a correction, they will buy more.

A sucker and his money are easily parted, simple economics. Enjoy the weather, that’s ALL CA has going for it.

Finally, I agree entirely with Realist.

“Real estate tends to track inflation in the long term and we are deviating from that path dramatically”

The reason we are deviating is because the CPI is a bogus number. It was changed so many times to hide inflation and control entitlements that it is almost meaningless for the average person and the way s/he spends their after tax income.

I live in the real world and everything I buy went up through the roof. Yes, we have high inflation and it will continue to get higher. The FED can not increase the interest without crashing everything. Now they have a new tool to slow down things – lockdowns. They can not go negative on interest before eliminating the cash from circulation, or they cause a run on the banks. They try to buy time till they bring the whole world on one crypto approved by the BIS – the central bank of central banks. The existing cryptos are just trial runs for what is coming – they don’t like competition on their monopoly.

How do you know this?

Live and learn. Lots of reading and critical thinking to connect the dots.

so bitcoin and others are trial runs? I just heard a few billionaire backers for bitcoin but not sure of the truth to it.

Your right on the interest rates. They cannot allow rates to rise. It would put the government in a bind as they would have to pay more of the General Budget on interest payments.

Corporations are now addicted to cheap interest rates. Apple just sold some more bonds. They now have $115 billion in debt. Raising rates will hurt earnings and thus the stock market.

Japan has had Zero interest rates since 1996 or 25 years. The U.S. is only 10 years into ZIRP. We can do this game for another 15 years at least?

Spot on.

Many in the world are already using the USD as a digital currency. If digital currency is the future, why would governments choose to adopt some other crypto?

Yeah, these charts are just nuts. I guess it’s just basic Economics 101: low supply + high demand= higher prices. In 2007, we can see that there was a massive glut of properties on the market, but prices were sky high. Now, prices are sky-high again but with very few for sale.

Common economic wisdom would say that current prices are then “normal” or priced exactly as they should be(?) But then again, housing prices, just like in 2007, are completely disconnected from average incomes and keep rocketing higher. I guess there’s simply a few super-rich people (both foreign and domestic) who are buying these scarce properties for overinflated prices and that’s that? Every prediction of a housing crash the past 5 years just seems to fall flat and the market heads in completely opposite direction of where one would think it should go during a pandemic and unemployment crisis. It just seems unprecedented, illogical, and God knows where it’s all headed…

The tragedy is that housing is not a luxury good like a Jaguar or a Louis Vutton purse: working and middle-class people actually need a roof over their head to come home to at night after doing their basic, yet necessary job (i.e. teaching school children, picking up the garbage, working in a hospital etc etc) Where are all these folks supposed to live? We can’t all be Elon Musk, and even he’s moving to Austin!

“…God knows where it’s all headed”

Yes, and only Him. Bunch of guessers, we are. 🙂

Stay diversified and hang on tight for WHATEVER it is that happens next.

Homeowners should go Gamestop, and collude to keep listings to a trickle to drive up price.

Seattle rents are dropping and standard is now 2 months free on a 12 month lease.

please stop talking about the fake Covid-1984 virus that

doesn’t exist. it’s a SCAMDEMIC, not a pandemic. it’s just

the normal, regular, seasonal virus with the usual very low

death rate for the elderly/sickly. the PCR test doesn’t test

for any virus. the “vaccine” is a bioweapon. please stick

to real estate dr. housing bubble. you’ve got a great site!!!

I really like the graph showing housing compared to inflation. We discussed this last year in this blog.

Before 2000, housing was a place to live and prices tracked inflation very closely.

In my opinion, housing became a speculative investment after 2000 and deviated from the inflation curve. Housing won’t become truly affordable again until the curves match.

Notice in 2012, the housing curve dropped to nearly the inflation curve. At the inflation point, the majority of people could afford a home and home prices started to rise again.

I believe this means that the lower bound of the housing market won’t drop below the inflation curve since as it approaches the inflation curve, most people will jump in and buy a home stabilizing prices.

If you are looking at a lower bound that could be reached in a crash, this chart shows when you should buy. Housing prices will likely not drop below the inflation curve.

It’s only a theory, please discuss.

Great post. In my opinion, the 2012 recovery was fueled by the Fed lowering interest rates and starting QE. Without those things, I’d imagine we’d have dropped below the inflation average. With upcoming deflationary event, what will the Fed be able to do to reverse it? Not much at all…

Real estate is being treated like like Bitcoin now? Oh my.

I think your theory is reasonable based in the 30 years that chart shows. So, basically 50% drop max, if a crash happens at all. The correction could be slow and long though and history, as useful as it is, provides no sure indications of the future – especially in markets.

Predicting the future is hard without M’s crystal ball so we’ll just have to hear him out on this matter. M, what say you on this theory?

We are in the belief stage for housing. Meaning, this has legs. There is no euphoria in housing. Too many people talking about a bubble and crash means it wont happen. Housing is running too hot. No doubt. It needs to cool down. What will prevent a significant drop in housing is the the fact that people sit on a ton of equity and can refinance with historic low rates. Why would anyone want / have to sell?

Boomers dont sell due to prop13. they stay put. Unless is see an extremely high increase in inventory I wont move off the couch.

A few people in my neighboorhood are already saying how they can sell their house in a couple of years with a massive profit. Sure they can. But their plan is to leave CA.

how many retirees in my neighborhood came from other states and seek to live their last decade in a sunny place like CA? MANY.

I wouldnt sell my house. Even if you offer me 500k more. I want more properties and accumulate.

In regards to Bitcoin…..we have seen nothing yet (disbelief stage). This will be a massive, massive bull run in crypto. The likes we have never seen before and it will make 2017 look like a kids birthday party.

The last correction occurred from the peak in 2006 to the bottom in 2012. If another correction happens, it may take longer than 6 years to reach the trend line knowing it needs to fall much further to converge with it.

“Boomers dont sell due to prop13. they stay putâ€

Not anymore. The newly passed Prop. 19 allows boomers to move anywhere in Ca. And port their prop 13 protection with them if they buy a home. This will probably take a while before the effect is felt in the RE industry.

Living in Phoenix metro and reading local news accounts of why this time is different. That’s historically been an argument which fails. But, examining the points being made, more people are migrating to communities where it’s perceived life will be better. Lower taxes, better weather, better values, etc. Phoenix metro housing prices in coveted neighborhoods are now as expensive as So Cal. I’d love to see data on how many have bought second homes hoping to cash in on short term rental boom. In Arizona, SB1350 took local jurisdiction away and made short term rentals legal in all communities except where HOA and CC&Rs forbid. Lobbyists for home based rental platforms like Airbnb and VRBO have organized to foist this on us. Now, there’s pushback but the lobbyists are organized and have money. The same thing that happened to Arizona will happen to Florida as similar bill talk is in place. Without short term leasing, prices wouldn’t have increased as much and inventory of housing stock would be higher. It’s a bad thing for residents. Neighborhoods are hurt as in some areas like Sedona, close to half of the properties in non HOA neighborhoods are short term rental and superhosts are basically running hotels in the neighborhood. Houses are bought and renovated specifically to host out of town guests. Imagine what that does to the schools and community?

Many of the millennials don’t know how good the baby boomers had it. You mention this and the baby boomers will say that they did it and so can you. Lets see if that’s true.

The baby boomers I’m related to moved to California in the 1960s. My uncle got a job at Vons as a bag boy and worked up to being a meat cutter. His wife got jobs at fast food restaurants. They both bought a home, adopted two children, bought cars by paying cash, paid $10,000 down on one of their daughter’s wedding and saved lots of money.

Millennials today get a job at Vons and do the same thing as my uncle and can’t afford that same home, can’t afford to adopt children, can’t afford to buy good cars with cash, can’t get $10,000 cash to pay for a wedding because they don’t have equity on the home to borrow from and can’t save lots of money due to high inflation and a manipulated stock market that benefits baby boomers the most.

The baby boomers claims of they can do it and so can you are a lie.

My millennial daughter and her millennial husband did all of what your uncle did (but their kids aren’t adopted) and more. Their secret? Good paying government jobs. The government makes sure its people keep up with inflation much better than the private sector because they control taxes and money supply.

Your daughter and husband live in a $900,000 home near the beach in southern California and did it all on their own? That’s an exception and you know it because do a little research on how many millennials are living in $900,000 homes they own in southern California right now that they bought all on their own and you’ll see it’s a very low percentage of millennials overall. Good for her if true, but don’t try to get me to believe that baby boomers weren’t working at Vons and buying homes, supporting families, buying cars with cash, etc…an almost impossible feat today for people working at Vons in southern California.

k,

My point wasn’t that someone who is a millennial should have it as “easy” as your uncle, but that the pathway to an upper middle class lifestyle nowadays often runs through government employment. See SOAL’s excellent comment to my next post. The private sector is drifting in the direction of lousy pay and benefits coupled with unbelievable wealth for upper management. The $200K+ income that it takes to be upper middle class is happening in the government sector, and is increasingly tough to get in the private sector. Don’t be so bitter.

mark,

A 900,000 dollar house by the beach in SoCal? Really? Where can you find one at that price? I am seeing closer to double that.

Yup- and the Millennials bagging groceries today at Von’s probably have college degrees and 30K worth of debt for said worthless degrees. Paying rent, eating top ramen and… that’s about it. Essentially, they’re indentured servants with no chance to get ahead.

Millennial here

If crypto continues its path I will be a multi millionaire

I never worked at vons.

Baby Boomer parent to millennial child “Hey millennial child, You’re college material! Go to college or else you’ll be flipping burgers the rest of your life.”

Millennial child “Thanks Baby Boomer parent for showing me the way to success!”

Millennial child’s school counselors from age 13-18 “Go to college or you’ll be a loser working at Vons or flipping burgers!”

Millennial child to school counselors from age 13-18 “Thanks for telling me to go to college. I don’t want to be working at Vons or flipping burgers the rest of my life with the stupid people.”

Millennial adult “I graduated college with a STEM degree and can’t find a job. I had to get a job flipping burgers for the last 2 years because of the recession and now I’m working at Vons bagging groceries. They say I have room to move up to supervisor within the next 10 years to make a little more than minimum wage. I can’t afford a home and barely can afford my beater car.”

Baby Boomer adult “That’s what happens when you get a useless degree. You just aren’t trying hard enough. In my day…”

Millennial adult “but you said when I was a child…”

Baby Boomer adult “take responsibility for your life.”

Baby boomers ignored their responsibility teach their children to make good life choices and that makes them one of the most irresponsible generations ever. Thanks for selling America out to China, dipshits.

Kent,

I am a late boomer. Here is what I experienced.

1) I bought a house in 1987 with an 11% mortgage and paid 60% of my income to the mortgage. I was lucky to have someone to cosign on the loan or I never could have done it. I laugh at people on this blog who claim “22% is a waste of money”. With inflation, their rental payments when they retire will have a high probability of being 60% of their income. Poor forward thinking. Either suffer and buy a house in CA or move and buy a house elsewhere. That’s the way it has been since the 1980’s for all Boomers and Millennials.

2) The original first house I bought was 200K but is now worth 800K. If I would have kept that same house, my mortgage would now be paid off and my Prop 13 property taxes would have been 4K/year. I could retire on less than $400/month in living expenses. So I guess my good choices were not wildly investing in Dotcom or tulip bulbs way back then was a good choice and makes me one of those wealthy lucky boomers you mention. However, I believe it comes down to choices and planning. Where do you want to be in 30 years? Paying 20K/month in rent in S.CA or having a paid off house and benefiting from Pro 13 with a 800/month property tax bill?

If inflation does ramp up now, any Millennial who buys the same house now for 800K, will likely be be laughing at the next generation who will be complaining the same house is now 3M and the lucky Millennial will only be paying $800/month in property taxes while owning a fully paid off house.

The boomers you mention are the ones who ate ramen noodles in the 1980’s to own that 900K house. They believed Prop 13 would hold and benefited. They also believed mortgage rates would fall OR they bought because they believed mortgage rate might rise to make sure they would lock in their payment. They were conservative, long-thinking investors. You can’t blame them for their planning.

It’s all about choices you make now to how you will live 30 years from now.

1) Do you want to lock in your home payments for the rest of your life and take advantage of Prop 13? If so, buy what you can afford now for the long haul. Don’t even look at home values or visit this blog again for another 10 years. A home is a long-term investment and a vehicle for a stable retirement.

2) If you believe housing will crash again, it typically means everything will crash. Don’t be one of those Nomadland people who lost in housing, stocks, their job and became RV dwellers down by the river. Have some long-term thinking and keep cash to last 1-2 years if you do want to wait for a crash. I guarantee a crash will happen but I have too many coworkers who lost everything because as soon as they were underwater, they walked away too soon. Or a few co-workers who looked at the crashing home prices and decided to wait too long to buy and missed the boat in 2010.

3) If you never want a house, that is cool, but be prepared to pay 20K+ per month in rent when you retire or be prepared to downgrade to a trailer in Baker. Of all of the late boomers that I know that didn’t buy, half are in a trailer park in CA or in a nice home in flyover, the other half inherited their Silent Generation parent’s homes and are living the good life in the homes they grew up in while inheriting their parent’s 2K/year Prop 13 taxes. It does pay to have Silent Generation parents who planned ahead. It will pay off again to have Boomer, Gen-X, and Millennial parents who planned ahead.

We have seen it all before.

However boomers generated their wealth, it will be transferred to heirs. The issue looming is tax reform the could eliminate the stepped up basis. Probably won’t pass since those voting on it are wealthy boomers.

https://www.cnbc.com/2019/10/21/what-the-68-trillion-great-wealth-transfer-means-for-advisors.html

https://www.elderlawanswers.com/biden-administration-may-spell-changes-to-estate-tax-and-stepped-up-basis-rule-18125

Wrong! Most Baby Boomers are living on credit. I recall after the 2008 housing crash Baby Boomers owing hundreds of thousands of dollars they took out in reverse mortgages on their homes. Then things improved and Baby Boomers are getting one last reverse mortgage credit card to play with before they die. I doubt even half of them will have anything to give to anyone.

Kent, I somewhat agree with your generalization but there is still considerable wealth in the boomer generation. Probably even more than the $68T reported in the 2019 article I shared. Your own opinions and observations do not define a trend. Also consider accepting the current housing/financial climate as it may be the best you see in your lifetime. All generations struggled as young adults trying to make a life and improve their situation. Best of luck to you.

Kent, your uncle is not a Baby Boomer if he was old enough to be employed in the early ’60s. The baby boomers were born 1945- 1964.

Your uncle was a member of the Silent Generation. born 1925-1944. The people born in the middle to end of that generation truly had it good as adults, which a lot of people might think was just their reward for suffering through the depression and WW2 as children. These people reached adulthood at the peak of American economic might, when we were the most productive country in the world. Better, thanks to the baby bust of the depression, and the loss of so many men in WW2, they entered a job market desperate for labor, with extremely strong and confrontational unions, and cheap house prices everywhere.

By the time we “middle” boomers born in the 50s reached adulthood c. 1970, things were still very good, but starting to head south in many respects. The next decade brought recessions, oil shocks, rampant inflation, and the loss of millions of manufacturing jobs to oversea markets. This was about the time that California’s population was expanding rapidly, and Los Angeles, formerly a very reasonable place to live, was becoming as expensive as San Francisco, which had been nightmarishly expensive for a long time.

And by the late 80s and the 90s, the major defense contractors and other large, wealthy stable companies, who had always been places where you could count on keeping your stable job with a good salary and lavish benefits until you retire, decided to trim the fat, and Boomers found themselves out of jobs in their 40s , and dropping to a much lower rung on the ladder. Since that time, the sort of secure jobs that our parents had, had largely disappeared, unless you got a government job.

My uncle was a Baby Boomer born in the 1950s. I was born in 1981. I recall seeing how well the Baby Boomers had it and still have it compared to millennials. My father sold the house he built in 1996 for $250,000 and today it’s worth one million dollars. A four fold increase on the equity of a home is a pretty bad deal for millennials trying to get into one today. Not to mention they’re not going to get that home working the same job as my dad who built it or my uncle who was a butcher at Vons.

You’re right, Kent. Conditions have only worsened for successive generations since 1980.

We Boomers witnessed the slide downhill and many of us were financially destroyed by it on the way down, but most of us hoped that things would “normalize” and that our kids would have it better, not worse, not realizing how anomalous the exceptional ease and prosperity of the post-war period was, or how it was being eroded even then. With dismay have we watched as this country has slid steadily downhill since that time, losing its lead in manufacturing and technology, with a steady degradation in living standards, while people attempted to square the difference between their expectations and reality, by ever more debt creation and asset inflation. In 1960, we were a country of 200 million people with ample resources still in the ground, a healthy manufacturing base, and dominance in world markets. 50 years later, our population had swelled to 300 million, our resources had been squandered and turned into toxic waste, and we had let our manufacturing be offshored while giving away our lead in every major field of endeavor.

It was the baby boomers in general who led to the decline of American prosperity. Baby boomer Bill Clinton signed NAFTA and conspired with the baby boomers running corporations to move the manufacturing jobs to China. Sure you can give a few examples of baby boomers that had it rough, but that’s not the general result for them. The general result for them is when I walk outside and see them in their million dollar home they paid $100,000 for, driving their new BMW, living rich off the reverse mortgage until they need assisted living care and having one last party before their death.

The general outcome for millennials will be about half of them having a home. The other half will be in poverty. They’ll be driving beater cars if lucky, not having a reverse mortgage so they can have their golden years credit card party until the end and probably having to die under the care of a charity that was nice enough to give them a inflatable bed in a moldy old room next to the community showers.

Kent, I would respectfully dispute that Baby Boomers led the way in offshoring our jobs and manufacturing. I will allow that NAFTA was not a good deal, and I was furious at Clinton’s promotion of it, but it came far after the huge wave of offshoring and subsequent losses of millions of breadwinner jobs in the late 70s-early 90s.

The offshoring began long before that, in fact in the late 60s. I maintain that if the true purpose of the Korean and Vietnam wars was generally known, every single man in the country would have refused to go. But our leaders know that all they had to say was that we were fighting the Red Menace aka communism, to win the support of the population. They knew it was the bait that “hard hat” blue collar guys and conservatives would always take without question. The true purpose of those wars, of course, was to secure low wage havens. During the mid 60s, two men my mother worked for as a bookkeeper secretary, proposed to open a new metal-plating company, and invited my mom to invest and become an officer. But they could get no one to provide financing, whether loan or equity offering. The two men were told bluntly that their industry was over in the United States, and was rapidly moving to low-wage countries. This was in 1966.

Come the 70s, and the invasion of better-made Japanese and German automobiles into our markets, previously dominated by the increasingly complacent and senescent Big 3 automakers, who refused to recognize that the way they built and marketed cars no longer made it. Nobody any longer wanted badly-built 5,000 lb gas guzzlers built to last less than 100,000 miles. By the late 70s, auto plants and associated suppliers were closing and laying off hundreds of thousands of people, just as our steel industry that had previously dominated the world, was being routed by German and Japanese steelmakers. I remember shedding tears as I saw high rise buildings going up in ST Louis with KRUPP stamped on every i-beam. Hundreds and hundreds of thousands more breadwinner jobs lost forever. Never mind the dense networks of suppliers, jobbers, and other associated businesses, and the hundreds of different trades and skill sets necessary in manufacturing. By 1990, these networks had shriveled, and the Steel Belt was now the Rust Belt, with the formerly prosperous Midwestern cities in ruins. Reagan-era economists told us that it was great to see all the “dirty” smokestack industries replaced by the “service” industries, but anyone could see, even then, that low wage service jobs, and worse, increased financialization, could not replace the solid prosperity, and multiple opportunities for advancement, of manufacturing. But by 1985, as most Boomers were not much older than 30, it was too late.

So, if you want to blame a particular generation, you could even blame the so-called Greatest Generation, which was in the saddle in the 60s, and refused to adapt to changing times and needs while doing everything they could to induce our businesses to move their manufacturing to low-wage havens. Or the Silent Generation, that was in charge until 1990 or so, and clung to old Post WW2 ways of thinking that were well past their sell-date by that time. As someone remarked in the mid-60s, we had by that time become a senescent, backward looking society still clinging to past triumphs. In the 70s, we all together decided that debt and financial manipulation was a good substitute for the manufacturing, and the lead in tech and science, that we were beginning to lose.

Great commentary, Laura.

It started with Reagan in the 1980’s and became the middle for all subsequent Presidents.

Government should not inhibit Capitalism. The Unions died and so did most of the US.

If anyone wants manufacturing to return to the US, it must be either at the cost of low wages, or fewer higher wages and more automation. We cannot compete on costs with ALL of Asia, India, and maybe Eastern Europe.

From many manuscripts of Antiquity

Janet Yellen wants to regulate crypto currencies. Says they can be used by terrorists:

https://libertyconservativenews.com/janet-yellen-goes-full-boomer-by-suggesting-that-the-government-regulate-cryptocurrencies-that-are-used-in-terroristic-activity/

The billionaire class going into crypto (especially Bitcoin) hopefully will keep the government from banning it. But expect tight regulation of its use and steep taxes if you cash any in. This has been my #1 worry about crypto all along. I’m pretty much past the idea that all crypto is a Ponzi scheme. Some may use new cryptocurrencies as Ponzi schemes, but the more established ones are beyond that.

As people die from the vaccine the economy will only contract. Ending the bubble of everything.

Invest in funeral services.

Here is an article on the highest paid government employees:

https://www.thestreet.com/personal-finance/what-are-the-highest-paying-government-jobs-15028073

Looks like Nick Sabin is the highest paid government employe (University of Alabama is a public college).

The highest paid California state employee (2109) is Yu Meng whose total compensation including benefits is $1760489.96! Chief investment officer for public employees’ retirement system is what he is. The highest paid employee in LA City government is a John Dwyer who gets a total compensation of $642020.57 (2019) as a Chef Port Pilot, bringing big ships into the LA harbor. The highest paid employee in Orange County government is a psychiatrist, Nabi G Latif who has a total of $499369.47 (2019). Get a good government job, kids!

When I was a kid in the 1970s, our conservative parents, teachers, and friends mocked government jobs. Those jobs were for losers. If you wanted to get rich, you went into the private sector. Yeah, it was bad advice.

Most people only get those jobs because of nepotism. They don’t let your average joe off the street just walk into a high paying government job, especially in California.

The two people I know well who have or had 6 figure government jobs did not have anyone inside who helped them get the job. One started at a low level position and worked his way to supervisor and then into upper management. The other worked at building a resume with coursework and some volunteer work, and after being hired, completed his four year degree and was promoted through merit. If your Dad worked there it definitely does help you to get in. There are also ethnic quotas nowadays that help some people get ahead who might not have been able to do so in the past.

For what its worth

In the 90’s I worked for a hi tech company that made pressure sensors and one of my accounts was trying to design a pressure valve for gas station pumps. the project was headed by CARB. Calif Air Resources Board in Sacto.

In all honesty, the engineers and chemists working for CARB were top notch. All the engineers had their PE License which is a rigorous exam. I noticed their skills were same if not higher than private sector.

OF course they had ‘cush’ jobs, meaning working no more than 40hrs per week, 13 days vacation, benefits up the yin yang. On top of that they had to fit their engineering and scientific work into govt policy. ugh

Do you consider teaching a government job? I don’t think those jobs are that difficult to get?

You are cherry picking a few highly coveted jobs. No one just “walks off the street” and gets these jobs without experience and some cases decades of experience. The government is an employer who has to compete with the private sector for talent.

The article you linked points this out. The example used was federal judges making a couple hundred grand a year. Not a bad gig but any one of them could quit and make over a million a year working for top law firms. Not so much nepotism but politics. The pensions and job security is the only way to to keep people around. Former O.C. district attorney, Michael Capizzi, joined a local law firm. How valuable is someone like that to a private firm?

Yu Meng was making about $650K a year plus the rest was incentives (fund performance) and benefits. Sounds like a lot but consider this guy was the CIO and managed assets for China’s 3.2 trillion dollar forex exchange. CalPERS is a $400 billion dollar fund yielding 7%. Hedge fund mangers usually get 20% of the profits. This guy could easily make 10X what CA is paying him at any number of Wall St firms managing a much smaller portfolio.

Nabi G Latif is as MD (neurologist) with a psych degree as well with 26 years experience (quick google search). What do you think someone like that would make in OC in the private sector? My best friend is a surgeon (and not a brain surgeon), lives in the IE and makes $400k+ working at a university.

I worked for Uncle Sam and now contract for him in the private sector. I earn far more money than my counterparts. The #2 guy at my company is a retired general. That’s arguably one of the best jobs (and highest paid) in the military. I’d say he’s pretty valuable to my company considering we almost exclusively deal with the department of defense. You don’t get to that position without knowing some people.

The president gets $400K a year but I don’t think that’s how Obama bought a $15 million home in Martha’s Vineyard.

You are right that the top people I mentioned could get the good pay in the private sector. I used them because they attract more attention than the larger number of people drawing ~ $200K in salary and benefits. One thing they do get in government service that they don’t get in the private sector is job security. And for a lot of people, that is priceless. The middle range employees get much better benefits than the private sector now offers. And you don’t have a corporation closing down your work site and offering to move you to Illinois (which happened recently to someone I know). The Feds can move you between states (or even overseas e.g. the military), but state and local governments move people much less, and unless you work for the state of Illinois, they probably won’t move you there (unless you are a tax collector going after sales and income taxes owed to California, and they often hire those locally).

I’d rather recommend going into business for oneself. The problem with employment is that salaries have a ceiling. No employer will pay a [insert profession] more than X dollars, simply because no other employer does. It’s a different story when you’re the owner. You draw the extra for yourself. You don’t raise your employee’s salaries to infinite.

Yes, most new businesses fail but it sounds like getting one of these magical government jobs is at least as much of a stretch. Anyway, getting paid to do basically nothing all day sounds pretty boring. 😉

The wife and I are fortunate enough to have government jobs. She works for the California gov and I’m federal. We both plan on retiring next year and selling the house that we bought in 2013. I’d highly recommend a federal government job to those coming out of college or the military. I went to community college for 2 years out of high school before joining the Army. Best decision of my life! After the Army I went to the Bureau of Prisons and then to Customs a few years later. Now I am hitting year 29 with CBP and almost 35 years fed. With overtime and premium pay I am making $173K a year. It worked for me and I am grateful.

Check your facts. The days of generous pensions are over. Federal employees now get 1% per year of service. Given that it is nearly impossible to buy a house in places like DC/NoVA on a federal paycheck, what are you supposed to do when you retire after 30 years of service to a third of your takehome pay?

San Francisco Mayor London Breed cost taxpayers $452,421 – the highest paid mayor in the country. Breed enjoys a $342,974 salary and an additional $109,447 in benefit perks. Incredibly, there are another thirty-one staffers in her office with total comp exceeding $200,000 annually.

Not bad for a WOC who grew up in the projects and is mediocre in a failing city.

https://www.forbes.com/sites/adamandrzejewski/2020/09/01/why-san-francisco-is-in-trouble–19000-highly-compensated-city-employees-earned-150000-in-pay–perks/

I’m reading about all these Boomers who lived the easy life back in the

60 – 70’s. I have no idea where that shangri la was; however, in the So.

Cal So. Bay area it was a struggle even then to buy a home. We’re talking

on a single professional salary and a bit East of the beach areas. It was find

a small starter near the fwy, enlarge or renovate, hold on for a while and take

the next step up the RE ladder. And usually it took several steps up the ladder

to land in an area with good schools, cooler weather, etc.. On a normal salary

you weren’t putting your kids in private schools, or hopping in a new car every

3 years, and certainly not a luxury car. I remember a co-worker who bought a

house in Redondo and ate peanut butter and jelly sandwiches for a year. A bit

extreme, but not unheard of.

LOL at commentaries lamenting homeowners forking over 30-40% of their income

for housing. In the So. Bay, tell me when it wasn’t 50+ % when starting out. You

either had a bodacious income or sacrificed or rented. Looks like the options

haven’t changed.

Pretty amazing aint it.

my grandparents bought a home in Northern Santa Monica for $16K in 1955. When my grandfather died and my family moved in and built grandma a granny flat, the house appraised for $70K in 1975.

Then in the 90’s it became a hot neighborhood for the 1%rs who didnt want to live in Beverly Hills or Brentwood.

In 2000 it appraised for about $750K.

In 2020, its appraised at $3M

1975: $75K

2000: $750K

2020: $3M

2030: ???

I think it started getting harder in the late 70’s and 80’s during high inflation.

My parents moved from the Midwest in 1972 an paid 35K for a 3/2 SFH in S. CA.

They sold their 3/2 SFH in the Midwest for 35K. It is now worth 1.3M according to Zillow. They had a 6% loan back then. Their old house in the Midwest is now worth 180K according to Zillow. Prices started to deviate radically from the 1980s onward.

When I bought a house in the late 80’s, I paid 200K on a 30K starting engineering salary. That required a co-signer to get a loan at 11%. I remember senior engineers were making about 70K at the time so I figured over time, it would get easier. It was very hard and I couldn’t afford a new car.

Starting engineers in the same area now make 80K and the same house is 800K. The interest rates are now 2.5-3%. They don’t need a co-signer. In the same field, buying a house is still hard but doable.

Maybe in the Bay Area. In SoCal it’s twice as hard as 30 years ago even.

I repeat, any boomer who was living the good life in the 60s and 70s was doing it on his or her parents’ dime.

The oldest Baby Boomers were born in 1945, which means they were nowhere near the usual home buying age until 1970, at age 25 for those born in 1945, at the earliest. By the time the “middle boomers” born in the 50s were in jobs good enough to buy a house, in the late 70s, we were hit with oil shocks, double digit inflation, a mini-housing bubble that was only crushed when Paul Volcker wisely jacked up the interest rates into the teens to end the rampaging inflation, and most of all, the sudden and drastic contraction of our manufacturing economy, that had made our parents’ earlier generations so well and stably employed, and so prosperous.

I’ve been a periodic reader of this site for some years now.

My background: owned a condo for a few years in one of the beach cities leading up to Covid, managed to sell at a reasonable price going into lockdown (planned to upgrade to good school district with kid #2 planned… had thought about keeping 1st home as a rental but didn’t necessarily see LA real estate as a great long term investment at these cap rates and with incompetent politicians practically guiding jobs to low tax states). Had expected to see a more severe correction with the stock market implosion but once it was evident that the Fed’s stimulus was overwhelming, purchased a home last summer instead of waiting for a bigger bargain that was not going to come. So far it has turned out to be a good decision. The real estate market has been relentless and this is turning into a K shaped recovery.

The biggest reasons to be optimistic on prices holding up are low rates and demographics (still a lot of household formation versus tight inventory). I look at friends and family my age group and it’s clear that while CA real estate is sky high versus almost anywhere else in the country, home ownership is not unachievable as some get help from family and others are dual income families… holding a short house position by renting for the long term is not practical for most people.

That said, I don’t like CA real estate as a great long term investment. This economy is practically rigged for big corporations and the top of the wealth bracket; I say this as someone who works in the investment industry… the system needs some reworking as current trend is unsustainable. There is clear asset inflation going on across the board and the responsible / overly conservative ones are being punished as a result with loss of relative purchasing power.

I appreciate your thoughtful and helpful comment!

California’s population in 1965 was only about 19 million. A whole lot less competition for everything. There were good aerospace jobs. I was raised in Burbank where you could get a good job at Lockheed with no college degree, and buy a decent house in a safe neighborhood with good schools. My dad bought a house in1963 for $22K. A stretch for him at the time, but doable on one income that supported wife and kids. The competition for everything now is just too much for most people. Aerospace is gone. Quality of life is not nearly as good, either.

1965 is over a half century ago. Those were truly great days to live in CA. To everybody complaining about how tough it is here, either get a plan and stick to it or move to cheaper areas. It’s that simple.

I have some millenial coworkers who complain all the time that they’ll never be able to afford a home here. When I hear they are paying $2500 rent to live in a new “luxury” complex, drive a fancy European luxury car, have the latest electronic gadgets, “foodie” obsessions, etc…I really don’t feel too sorry for them. Get some roommates for a few years, drive a 10 year old Corolla, and save, save and save. Unless you have wealthy parents, this is exactly how you break into the market here. Nobody ever said it was going to be easy.

Lord Blankfein speaks the truth. My Corolla was 15 years old when it was totaled. I’m sure it could’ve gone on past 20, easily – and the gas was practically free.

I grew up in Westchester in the 60’s – 70’s and the amount of people, esp men working for the aerospace and aviation and all its subcontractors was amazing.

Even janitors for Hughes Aircraft could buy a home in Westchester at that time.

At least half my friends fathers worked in Aero.

Here is a memory job of employers

Hughes Aircraft, Hughes Helicopter, Hughes Research, Garret, TRW, Northrop, Douglas, Parker, AiResearch, Boeing, Raytheon, Grumman, Rockwell, Sierracin, along with countless no-name subsuppliers.

Aerospace. I grew up in the 80’s and 90’s with my Dad working blue collar in Aerospace, no college degree. He made more individually in the 90’s than the average household in SoCal does today. My parents bought a four-bedroom suburban home on 1/3 acre within a walk to the a charter school. So, it was a great upbringing for me.

That life is difficult for a family to attain now (seen clearly as I look at how my peers with their college degrees are living). Basically, I see two options: The first is to trade a hefty chunk of dignity for help from Mommy and Daddy, which is not on the table for most. The other is to find a path into the affluent class, which does not end up being reality for most.

And affluence in California ain’t like affluence in Texas or Florida. It’s just “average” in Socal by US standards of upper middle-class living. Quality of life is low otherwise and explains why so many have been fleeing CA for more reasonable pastures. Sad but true. I miss Pete Wilson and Ronald Reagan. The current leaders have blown it.

Black Knight mortgage data , shows 600,000 active forbearance expiring next month. Nearly 3.6 million on 90 day defaults occurred on 2020, 2.1 millions seriously delinquent

on their mortgage payments, possible stock market correction soon. Seems like inventories are coming up sooner or later

Don’t be too hopeful. IIUC , the CARES act allows expiring forbearance in 2021 to be extended no questions asked all the way through the end of the year.

Crypto is making me rich! Insane gains

Bitcoin plummets 17% since Friday: https://www.dailymail.co.uk/news/article-9286303/Bitcoin-slips-sharply-record-highs.html

Of course, M will say, “Bitcoin tanks? Great! Now I can buy more at a low price!”

Great discounts in crypto! Buy the dip! Always buy the dip in a bull market!

Bull markets can make you money, bear markets can make you rich. (Aka buy low sell high)

M, I didn’t think you were the type to keep dry powder on hand. What are you using to buy the dips?

During a bull market you buy the dips.

You are spot on. I am so heavily invested in crypto that I dont hold a lot of cash.

M: I am so heavily invested in crypto that I dont hold a lot of cash.

Which means that when crypto dips, you can’t “buy the dip” because you have no cash. All you can do is watch your crypto fall in value.

That’s correct. But buy the dip is true nonetheless. Maybe I cant keep buying the dip but you and others can. My crypto portfolio is already set 🙂 I am ready for “moon timeâ€.

Which kinda already happened on some of my coins but there is lots of upside for Bitcoin since smart money is not done buying.

I had to laugh. I remember the photos of the Real Homes Of Genius. I guess the market is so hot that nobody cares about appealing photos again.

Scroll through the photos on this home. You will never be lonely working from home again.

https://www.zillow.com/homedetails/3695-Primrose-Rd-South-Lake-Tahoe-CA-96150/195374618_zpid/?fbclid=IwAR1-5RDv8TkipF4Tx8OCpbUd9r71061WezYco7U0ozKmFnB5B0Dg1gjGMlg

lol, but you cant hump those. Nice to look at though.

Vacation rentals are highly priced…..friends of mine are trying to pitch in and buy one.

I love Tahoe….but I am not sure about this being a great investment at the moment….Maybe if Bitcoin hit 200k….i will have over 1M and can afford to risk some money for a vacation rental.

It should worry everyone that rents are moving the opposite of prices. A primary component of price is the ability to cash flow. Prices can be lunacy far longer than people can believe, but having ridiculous prices relative to rent is a precursor to a crash.

Low rent would seem to lower demand for buying somewhat, but supply is so low that it will hardly cause a crash. At worst for the next year or two there could be a plateau in prices after over heating. The crash will only come if a whole lot of people decide to sell at once and demand drops. But even a huge job loss recession in 2020 seemed to not be enough on it’s own to drop demand and cause a crash. This shows that in this case the soaring prices are a supply problem not demand, which the Dr has finally admitted.

@mind1 I wonder about forbearance because those people have been unable to sell which is suppressing inventory. I think those who cannot resume payments will want to sell high and escape with their bag of cash to a reduced-price rental.

I also wonder about the vaccines and COVID becoming less of a concern to sellers later this year. You know, that whole not wanting tons of possibly infectious people touring their home thing. The lessening of COVID could put more houses on the market too.

Why are prices ridiculous?

I bought my house (brand new) and today it showed its 75K up from the price i paid. Within 1 year. Thats reasonable. I want it to go up by several 100k. And i want lower interest rates. Its a great feeling to see your net worth go up while doing nothing! Thank you FED! Plus, Bitcoin is at 50k….i got a shit ton of BTC and other Altcoins…..if this rocket takes off I will retire in my late 30’s.

GET A GRIP ON YOURSELF, MAN!

😉

My house is up 300k in like 5 months. I lucked out as a major tech company is building an office close by. Announced last month.

My dad is an architect and we’re building a second story (pretty cheaply) and my Bay Area home will be worth 700k more after completion. I’m renting out the second story to pay my mortgage so I can buy another property.

I’m a millennial and just hit the housing lottery. I hope to get the value up over a million in the next five years.

Congrats nor cal girl! That’s awesome!

If I weren’t married, I’d consider you! 😉

That’s how it should be. Buying a house should make you rich (quick). I am dying to buy a rental in SoCal that someone will pay off for me while it appreciates 10-15% annually. We (millennials) deserve it.

Both the wife and I have government jobs. I work for the fed and she works for CA. I went to community college for a few years and felt like I was spinning my tires so enlisted in the Army. Best decision of my life. Great experience and it enabled me to get my first government job with the BOP right out of the army (VRA appointment). I transferred to CBP and am in my last year until retirement. With OT and premium pay, I am making 173K a year. I’m very grateful for the job I have and am happy that both the wife and I will have pensions. The cherry on the cake is the housing market. I bought our current house in the summer of 2013. We hope to sell it in September and one more gov move back to Canada and then retire in Indiana.

Something big is going on. On the first of this month, the 10 year Treasury Bill rate was 1.09. Today it was 1.54. Yesterday it was 1.38. All the rates for 2 yr and longer term are up big time since the beginning of the month. The Fed can set their bank rates, but Mr Market sets the Treasury auction rates. Look for higher mortgage rates soon.

It is a fascinating development. I would welcome higher mortgage rates.

Me too. I want to buy investment property. Higher rates help to cool the market off a bit and get me my first rental

You just said on Feb 24, “And i want lower interest rates.”

As a homeowner both (lower and higher interest rates) benefit you.

Lower interest rates: you refinance and lower your mortgage

Higher interest rates: you benefit if you want to accumulate more houses. It’s been hard to find a rental. One of my bucket list items is to own 5 rentals. I don’t even have one yet.

Regarding the 10 year Treasury rate; for a visual presentation, see this link and set the time frame to 1M:

https://ycharts.com/indicators/10_year_treasury_rate

Regarding the 10 year Treasury rate; for a visual presentation, see this link and set the time frame to 1M:

https://ycharts.com/indicators/10_year_treasury_rate

Hello. Long time lurker of this website. My family is selling some land in Washington state and we will end up with 4.5 million in 1031 money. Over the last 4 decades we have ended up with a great portfolio of residential and commercial property. We currently have two property management companies that manage some of our portfolio but they eat into our income. I am thinking we might just have to purchase more rentals in the Portland metro area and Clark county. Another thought is to purchases a property or two in one of the beach area communities of socal and have them as rentals or AIRBNB. Any thoughts or advice is appreciated.

This ain’t the place, IMO. I’d ask for advice on the Bogleheads forum. Shrewd investors they are. Here it’s more like guesses, gambling and a troll or two.

I am an older millennial in my late 30s living in a nice area of coastal California. I make around $150k and pay $3,500 in rent and there is no way in hell I could afford to buy house here. The real estate and rental market here for 85% of people sucks.

A tiny outdated crap shack is $1mil and up, rents are anywhere from $3,500-4,500 for a small ranch house, basic apartments and in-law rooms under people’s houses are now almost $3k a month. With the high cost of rents it is almost impossible to ever save for a downpayment and the income needed to purchase is waaaaay beyond what most people will ever make here. High earning dual income couples, techies and trust fund brats are all that can buy these stupidly priced homes. A crapshack here takes a downpayment of $200-300k and an income of $300k for 30 years. I’ve spoken to mortgage companies and have done all the math for mortgage,taxes and insurance not to mention the utilities, repairs and general cost of living here are all extremely high on top of it all. For example the out dated ranch house I rent for an outrageous $3,500 a month would cost me around $950k-$1mil to buy and it needs like $200k in updating/repairs. This would require me to have around a $200k downpayment, closing costs and lots of money to fix all the issues the house has that I tolerate as a renter because I have no other options unless I want to pay $4,000 a month to move. The mortgage, taxes and insurance on this house would be around $5k a month for 30 years plus $300-500 in utilities a month so just figure about $5,400 a month. How many first time home buyers do you know that have $200-300k cash and can afford a $5,400 a month payment for a basic crapshack?

Boomers are grandfathered in and bought way back when things were much more affordable which is fine and fair if they would just admit that they had it a bit easier. I don’t really know any boomers that don’t own a house no matter what their job is or whatever. Any boomers arguing this are full of crap. I can tell you using an inflation calculator most boomers payed around $150-350k in todays money(Example: $100k in 1980 is equal to $317,000 in 2021 dollars) for their houses and now those houses cost 3-4 times as much. The situation here gets worse every year, everything is overcrowded, overpriced and there is very little housing inventory most of the landlords have nazi like rules especially with pets,etc. Honestly, the weather is good but the ocean water is freezing and the sustainability for the middle class here is just fading by the minute.

Buy and hold crypto. You will be easily able to come up with the DP when you cash out at the right time. Cardano #3 crypto currency by market cap is trading above a $1. That was it previous all time high 1.38. I am betting this will at least hit $3 during this bull run.

Bitcoin will hit at least 100k this year.

I’m LOLing on all of your crypto pushing. Zero value in that crap. Worse than beanie babies or tulip bulbs. At least those were tangible items. You may be up now but when the bubble bursts you’ll have nothing. Cryptocurrency is the pet rock of the 21st century.

In the meantime, M is laughing all the way to the bank.

8X in one year? I don’t doubt it is a bubble. Sell now, M, and buy that dream rental property.

If you had 200K in BTC a year ago, you’d have 1.5M now. How many leveraged crapshacks can you buy with 1.5M? Time to diversify and pop that bubble.

That’s the other thing I noticed in 2001. You could cash out in Lucent at 12X gains in 2000, but if you put it in Cisco, you lost it all anyway by 2001.

Even if housing crashes 50%, you still got a place to live without rising rents and locked in Prop 13 taxes. Just don’t panic and don’t sell at a low. That works for houses but didn’t work for Lucent that never recovered. Huh, houses are more stable than tech paper futures.

This is the most succinct comment I have ever seen on this blog. You have absolutely laid bare the reality of home buying in SoCal in 2021.

I have no idea how people are saving down payments while paying CA rent. We earn several times the median household income in SoCal and have only been able to save a proper downpayment by moving to a low cost of living state. A few get help from Mom and Dad. Most others, I assume, are encouraged into a risky situation by their lender.

Our reality is finally that we can put down 50% but the payments and income tax are not so appealing. It would also be a downgrade from what we own free and clear now in Texas. We’ll wait until we can save even more cash or prices drop, whichever is first.

All the best to you, Mr. PricedOut. Enjoy the weather and family if they are there (family is the reason we’re planning to move back; otherwise, no thanks).

Hi Priced Out,

I am in my early forties and in similar situation as you. I am middle class with a good steady job and my household income is in middle $200K and I cannot afford to responsibly buy a house I would want to live in. Committing $5K a month for 30 years is a lot of risk and there is no significant upside potential really, the houses won’t appreciate like they did for boomers – the rates can only go up and the house prices will go down for sure and maybe even even before rates start rising. I still think we are in an asset bubble, just not sure it will pop soon anymore. Too much manipulation by the Fed and they really cornered themselves, there is no soft landing possible anymore, so they are stuck with this money printing Ponzi scheme for good now.

Unfortunately, our home ownership dreams have been canceled by the Fed for us for now. We will see what happens next.

I hear you! I’m in a very similar situation and it is frustrating. I think we have to just wait and see what happens once COVID lockdowns are over, forbearance is over, and interest rates creep up.

You may have your sights set to high to buy a 1M home for your first home. Most people play the housing ladder game in CA. You buy a condo or townhome first, or a cheaper SFR (has a commute or not the greatest area). You own for a while and roll this appreciation into your next property. Very few people can come up with a 200K down payment unless you have family help, you are the world’s greatest saver or you start on the socal RE ladder. Those are the hard, sobering facts of living and wanting to own RE in socal.

This is exactly what one of my friends is doing. Since 2015 he has moved his family 3 times and is now in the process of selling again. The first place they moved to I think they may have had one or two kids and now they have four! Anyway, it seems like this is how a lot of people are doing it. The key for most of those people “laddering” was to get in soon after 2009 or when the early surge of homebuilding began in 2014/2015. Hindsight is 20/20… we should have would have could have bought a SFH in 2010/2011 shortly after getting married but we were too naïve and picky. And now this has led to me seriously considering leaving the state–especially after having found out we were outbid on a home at $975k when we put in an offer of $915k over an asking price of just under $880. Expect to pay around $100k more for that excellent condition turnkey house you’re dreaming of… smh

This is exactly what one of my friends is doing. Since 2015 he has moved his family 3 times and is now in the process of selling again. The first place they moved to I think they may have had one or two kids and now they have four! Anyway, it seems like this is how a lot of people are doing it. The key for most of those people “laddering” was to get in soon after 2009 or when the early surge of homebuilding began in 2014/2015. Hindsight is 20/20… we should have would have could have bought a SFH in 2010/2011 shortly after getting married but we were too naïve and picky. And now this has led to me seriously considering leaving the state–especially after having found out we were outbid on a home at $975k when we put in an offer of $915k over an asking price of just under $880. Expect to pay around $100k more for that excellent condition turnkey house you’re dreaming of… smh

“The situation here gets worse every year, everything is overcrowded, overpriced and there is very little housing inventory most of the landlords have nazi like rules especially with pets,etc. Honestly, the weather is good but the ocean water is freezing and the sustainability for the middle class here is just fading by the minute.”

Because of COVID related issues, many employers now allow their employees to telework from home. If you have that option, then move to an area that is more affordable?

PricedOut,

I was a late Boomer and times were tougher back in the late 80’s.

Income: 30K/year – New grad

Mortgage: 160K

Mortgage interest: 11%

Yearly mortgage payments. 18,288

Ratio mortgage/income: 60% !! My parents co-signed and I ate a lot of Ramen

The same 3/2 house in Santa Barbara is now 800K, however. incomes have also gone up. In your case, 150K income but I agree that the Santa Barbara house is “Only” 800K.

Income: 150K

Mortgage: 650K

Mortgage Interest: 3.25%

Yearly Mortgage Payments: $33,420

Ratio mortgage/income: 22%

My point is that there are still 800K “cheap” houses out there and at 22% ratio, they were much more affordable than when I first purchased.

I had the advantage of a rapidly rising salary and dropping interest rates which I doubt Millennials will have so within a decade, I could buy a new car.

I think about buying that same house now that I had in the 1980’s in Santa Barbara for 800K.

1) It is only 3/2 so about the right size now that the kids have moved out. It would be a good retirement home and room for a home office and a guest bedroom.

2) Unlike when I first bought it, I could afford it now without a co-signer. Though I don’t know if I want a 3K/month payment at 3.25% even if it is at 22% of income.

Times are better now for some senior boomers who have more income, equity and savings than they were when they bought their first house. It may be the same hardship for someone buying an 800K house on an 80K starting salary. ie 40% mortgage/income

As Lord Blankfein said, do you need a 1M house now? Could you start with a “cheap” 800K house?

I could have bought a 100K condo in the late 1980s but SFH’s started at 200K so I recklessly stretched the limits. They never dropped below 200K but the appreciation in the 1990’s was only 3%/year. Everything took off after I sold it in the 2000’s.

My crystal ball fell off a shelf in 1994 Northridge quake in that house and broke. Who knows if inflation will drive the market up? If you hold for 10 years, you will likely be OK. At 3% appreciation, I held for 7 years and made a little money until more kids arrived.

The problem is you choose to live in an expensive coastal area while making above average pay. You should be living in a $2-2.5k house, not $3-3.5k. Move East. You probably have a car payment as well.

In California, you should be saving $25-50k per year with that salary. You’d have you down payment in 4-8 years, but you’ve probably been eating out, bought a car on payments, and generally haven’t been watching your money and here you are.

More on Treasury rates.

From Stansberry Research:

“The trend continued into February… Today, after spiking over the past few weeks, the 10-year Treasury rate trades around 1.4%. The “spread” between 10-year and two-year rates has widened to roughly 130 basis points – its largest number since December 2016.

As we also mentioned in January, this behavior is healthy… and logically, it makes sense. Most times, long-term rates are higher to compensate for the trouble of tying up your money for a longer period of time.”

In the remainder of the article, they talk about Jerome Powell’s Senate testimony, with its implications on the bond market. The gist of it is that Powell and the Fed are committed to low interest rates, and will buy bonds and put them on the Fed balance sheet.

“The Fed is basically saying… We shall let stocks Melt Up higher. We shall keep buying bonds and keep rates low. We shall keep intervening and running up the debt-to-gross-domestic-product bill for the next generation.”

My thoughts:

So the bond market will be a wholly owned subsidiary of the US Treasury Dept. And asset bubbles will keep happening. Whether home mortgage interest rates will remain this low is questionable without massive federal intervention. I see rising rates by Summer, but the rates will be low compared to inflation. There may come a time when the inflationary environment will force long term Treasury rates to rise regardless of the Fed’s positions.

Let’s… Keep This Party Going!

—

Drag it slam it

(Let’s keep this party going’ on)

Wear me out

Elevator rising fast

Crank it spank it

(Let’s keep this party going’ on)

Wear me out

(Let’s keep this party goin’ on and on and on and on)

Let it out ready to blast

Attain enlightenment

Gotta take it to the front

We’ve gotta be part of the universe

Keep this party going all night long

Things are getting dirty down in Washington

—

I’ll be they sing this song all day long at the Fed, those knuckleheads.

END THE FED!

Here is a 1 year ten year treasury rate chart with 50 day moving average:

https://www.marketwatch.com/investing/bond/TMUBMUSD10Y/charts?countrycode=BX

Sit and watch Mr Market vs Mr Fed for the next month.

Californicated: Watch out in the So. Cal. beach areas for a Airbnb rental. Some don’t allow them and those that do, might require a 30 day min. stay. That effectively negates getting a short term rental rate. Plus property mgt. for a vacation property will charge more than on a long term rental. And as far as long term rentals, you better see if the clowns in Sacramento are going to lift some restrictions or you might want to put down a large down pmt. in case your rental income doesn’t come thru as expected.

Priced Out: You have to decide whether the higher Cali. salary is worth it. Sounds like you’ve already made that decision. Probably just a matter now of assessing your other options. Can you move to a cheaper rental area and work remotely ?

PS- You left out the other big driver of coastal property demand — rich foreign buyers.

Here in Arizona something strange is happening. Prices are falling. Since I have several rental properties here and am watching the market, I have a theory. I will tell you what it is, and I’d be curious to hear your thoughts:

1. Change in messaging re. the covid19. Gov Ducey today allowed opening of all businesses 100%, including restaurants, gyms. This means less people feel like their home is all that matters. Hence, less demand. But curiously not more homes for sale – perhaps forbearance and the fact that everyone refinanced and can’t afford to move plays a role.

2. Exhaustion of panic among city dwellers (especially from California) who rushed to buy everything in sight in Arizona.

3. Higher interest rates (0.5% increase in the past few weeks).

There is very few homes on the market, but they are basically not moving or moving *very* slowly. Whereas a few months ago homes like that moved within a day or two, now they sit for 30-50 days. For real. Something very strange is happening in the market.

I don’t know if it’s a bad omen for housing prices, or just a temporary blip on the screen….

I left the San Fernando Valley with my wife and young family in 2016. We rented and purchased our home when we moved out of state. It was a tough decision to leave but cost of living and family on the east coast was the factor.

My wife recently received a call from a friend of hers who is a Physician out of San Francisco area. Her group is having a very difficult time staffing the OBGYN Medical practice with Doctors for $300,000 per year salary. Many doctors fleeing the area for Midwest and Texas. These people are receiving $300,000 matching offers in those states and can buy a gigantic home with land for $600,000, while a crap shack in Berkeley is $2 million.

We still love CA but just huge problems everywhere. Aside from the high tax and regulators environment they have huge car/licensing fees, traffic citations/parking tickets/street sweep are huge dollar offenses they enforce as a steady collection source. Crime and homelessness also has gotten much worse since we left. But with all that being said we will still stay on the lookout for the perfect second home/rental in California. Most likely somewhere in Orange County and prices will have to be 20-30% lower than they are now for an investment home to even make sense in my opinion. And with a low interest rate environment and Prop 13 still in place I’m not sure there will be much downward pressure on prices over next 3-5 years. Now if rates go back up to 4-5% and people in forebearance are eventually held responsible to pay then maybe there is some pressure downward. If Prop 13 is repealed then it’s a whole new ballgame .

JDM,

I agree with your assessment. You did the sensible thing to do given the circumstances. On the other hand, Kent is his worst enemy. I should say he doesn’t have flexibility in his thinking. He got to a wall in his life. Instead of going around it like you did, he keeps hitting his head in that wall hoping that it is going to get softer in time, especially with lots of complaining…like if that ever helped anyone!…I know lots of people like him.

When I came to US decades ago, I felt like having walls all around me!…I did not have any money, no help from parents, I did not know the language but I was willing to learn what works and what doesn’t; I had flexibility in my thinking and I was willing to do whatever it takes to change my circumstances. If that took me out of CA, so be it. I can move there anytime and buy in cash in a desirable neighborhood. But the question I always ask myself is this – is that the best course of action give all the alternatives? That question helped me a lot in life; it helped me to become a millionaire many times over. Yes, there are tens of millions of people richer than I. However, given the starting point and the circumstances and no help from parents, the wife having to stay home to raise four children, I am happy where I am.