Real Homes of Genius: When a $127,000 Down Payment Evaporates in Santa Monica. Living the good life for 3 Years Courtesy of Easy Debt in the Westside.

Some people when thinking of shadow inventory have images of poor rundown homes in suspect neighborhoods. Yet the reality of shadow inventory sometimes include some of the most priciest and beautiful real estate in the world. Take for example the Wells Fargo executive who was using an exclusive Malibu foreclosure for private parties. The initial owners in Malibu invested some of their money with Bernard Madoff only to have their home taken over by Wells Fargo. Talk about trading one positive partner for another.

In recent days many articles have come out talking about shadow inventory and have silenced the tiny crowd that somehow believed that it was somehow a myth. It was fun for them to believe but that argument is now over. In fact, the shadow inventory amount is larger than one would have imagined:

“Sept. 23 (Bloomberg) — The crash in U.S. home prices will probably resume because about 7 million properties that are likely to be seized by lenders have yet to hit the market, Amherst Securities Group LP analysts said.

The “huge shadow inventory,†reflecting mortgages already being foreclosed upon or now delinquent and likely to be, compares with 1.27 million in 2005, the analysts led by Laurie Goodman wrote today in a report. Assuming no other homes are on the market, it would take 1.35 years to sell the properties based on the current pace of existing-home sales, they said.â€

If that isn’t enough to satisfy the doubting Thomas in you, take the word from Bank of America:

“(WSJ) we are going to see a spike from now to the end of the year in foreclosures as we take people out of the running” for a loan modification or other alternatives, says a Bank of America Corp. spokeswoman. Foreclosure sales had dropped to “abnormally low” levels in response to government efforts to stem foreclosures, she adds.â€

In other words, gear up for round two of the housing bubble burst courtesy of the shadow inventory. 7 million homes may seem like a gigantic number. The reason the number will be huge is because we are now seeing problems in housing due to more historical reasons like unemployment. Obviously a loan modification is pointless if someone doesn’t even have a job. When you have banks openly acknowledging that more inventory will be hitting the market it is time to prepare and get your facts straight on Alt-A and option ARM products.

Today we have a very special Real Home of Genius. It was once rare to see foreclosures reaching into the million dollar range but today’s home is a perfect example of the California gold rush mentality and living off of borrowed time. Today we salute you Santa Monica with our Real Home of Genius Award.

Santa Monica Million Dollar Foreclosure

Now for those living in Los Angeles or in Southern California, we realize that a large portion of the population lives under the “fake it until you make it†mantra of economics. The housing bubble fed into this mentality perfectly. Easy credit allowed people to buy homes and cars beyond their means. Being that many people are still guided by high school insecurities, they had to keep up with the Joneses and buy the latest car and home otherwise they would face the wrath of being called a loser. Here in Los Angeles the Westside brings out the best in many.

Today’s home in Santa Monica is a good example of this lifestyle. In fact, let us take a look at the place:

This home is a 2 bedroom and 1 bath home. Initially built in 1936 this place has 1,515 square feet. The current list price is $784,900. Let us look at some sales history here:

03/25/2005: Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $800,000

02/01/2006: Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $1,075,000

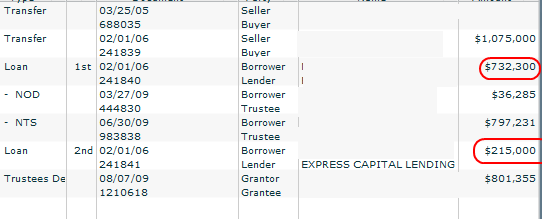

First, the 2005 sale was overpriced but the 2006 sale just put it over the top. Given that this home is now bank owned, we realize that something went astray. Let us look at some of the loan history:

Do the quick math:

$732,300 + $215,000 = $947,300

Buying a million dollar home with 10 percent down as you can tell is not a good plan if you are buying in an epic bubble. In fact, whoever bought this home has now seen some $127,700 in an actual down payment money evaporate into thin air. That is why all you folks itching to buy should think twice about jumping in before the second leg down hits in 2010. Even a modest 10 percent decline in the mid to upper tier markets can wipe out $100,000 to $200,000 of your down payment. And don’t bet on another bubble to rescue you.

If you want to see problems just look at the notice of default line above. Notice of defaults are normally filed after 3 missed payments. So let us do the numbers:

$36,285 / (3 months) = $12,095 monthly nut

Does this home look like a $12,095 per month home? You can rent a nicer place in Beverly Hills for that amount. Clearly whoever bought this home was unable to carry that amount and lost the home in August.

This home is viewable to the public and not part of the shadow inventory. On the MLS I’m seeing 4 foreclosures listed for Santa Monica including this home. But guess what is in the shadows?

Pre-foreclosure:Â Â Â Â Â Â Â Â Â Â Â 104

Bank owned:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 25

And there are some bigger fish in the shadows that I’ll bring to you in the near future. The public is only seeing 4 houses in the foreclosure column while the distress number is much larger. Now who really knows what this home will fetch once it sells. I doubt it will get the million in this market and so does the current bank owner.

Today we salute you Santa Monica with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

23 Responses to “Real Homes of Genius: When a $127,000 Down Payment Evaporates in Santa Monica. Living the good life for 3 Years Courtesy of Easy Debt in the Westside.”

Another great post DHB; thanks.

Found this little gem on Patrick.net.

http://www.mybudget360.com/35-million-americans-on-food-stamps-12-percent-of-us-population-on-food-stamps-highest-since-records-kept-in-1969/

35 million Americans now on food stamps (1 in 8). One million joined the ranks in one month.

Housing is not all that is unwinding.

I know of a few people that haven’t made a mortgage payment in over a year yet there is still no NOD filed per foreclosure.com. The banks know the bubble bloggers follow those stats. That’s why I follow the tax liens!

DHB,

Two points, both offered in the spirit of somone who fundamentally agrees with your hypothesis (i.e. SoCal housing will further deflate in the coming months):

1) The debate over shadow inventory will not end until such inventory starts emerging from the shadows and becoming real inventory that is for sale, either at auction or via the MLS; and

2) I think your assumption about NOD after 3 months is wrong, both in general and in this case. I think the real NOD average lag time has grown to 4 or even 5 months, but in this case, the $12k per month figure suggests that you’re off, because that would require extreme loan terms for a principal balance of about $950k. Maybe if this is a pay option ARM, but otherwise I think you need to be dividing the NOD default amount by a different number of months.

That’s no magic data bullet either, though. I know of homeowners with tax liens who are not in foreclosure and homeowners with NOD and NTS but current on their tax bill (nobody strategically or “ruthlessly” defaults on the tax bill).

What I have seen is folks that live in the corporate packaged developments or usually distressed areas like Palmdale or Corona are not being sent NOD’s. The banks find its makes sense to just let the default owners stay in the house rather than let it rot. In desirable areas, I have seen a different story. The defaulters are usually kicked out in a few months, depending on the situation, the house is tidied up and put on the market.

“I know of homeowners….with NOD and NTS but current on their tax bill”

Sean, I don’t know if what you are saying is very common. Any unpaid taxes on a home become the responsibility of the bank following a foreclosure. It wouldn’t make any sense to pay the taxes if the owner cannot make the house payment. On top of that, it takes approximately 2-3 years of unpaid property taxes before the governement will foreclose as opposed to the 3-12 months before a bank takes action. I’m not saying that you are wrong, it just makes such little sense to pay the taxes and not the mortgage that I doubt it is very common.

The other problem with checking the tax records to see if a homeowner is behind is that in some cases the lender will pay the taxes (even if taxes are not paid via an escrow account) and then add the taxes to the outstanding due on the mortgage. There is no way to determine who is actually writing the check for the taxes if you are looking at a property tax website, only whether or not they have been paid.

With the variety of strategies utilized by the lenders to recoup money from the borrower and avoid tax problems, it is very difficult to ascertain what is really going on in a lot of cases. So I guess you are right, no magic data bullet to look at.

Great Westside example of what’s in store. This Santa Monica house is one from the corner of Ocean Park Blvd. and 11th Street. 2 very busy streets complete with a suicide driveway on Ocean Park Blvd. It shows you how absurd real estate in Santa Monica was/is, when a house like this sells for over $1,000,000.

Santa Monica and the entire Westside wil get hit hard when the next foreclosure wave arrives (Dec./Jan). The question is:

How many garbage loans from 2003, 2004, and 2005 will be recasting into regular payments instead of teasers? And, how many will just walk away.

http://www.westsideremeltdown.blogspot.com

People living in the house for a year without paying. It now takes 9 months from NOD to being listed. This will go on for years.

Old post-WW2 suburbs of Midwestern cities are stuffed with crappy little houses that look just like the house featured here. In most places, you’d be lucky to get $180K for a house like this, and that’s if it’s in good condition and shows really well, which this place does not.

“many people are still guided by high school insecurities, they had to keep up with the Joneses and buy the latest car and home otherwise they would face the wrath of being called a loser.”

That is comedic genius / truth / phsychology of what drives this entire mess.

“People living in the house for a year without paying.” How come renters can’t get this same deal? The government should bail out everybody. Just print more money. You know the song, “Let’s forget about domani.” Well, let’s forget about the money, and let’s forget about tomorrow.

One area often missed in the story of the housing collapse is the plight of the lowly Homeowners Association. If people have stopped paying their mortgage, it stands to reason that they are not paying their HOA dues either. If the banks haven’t taken over the property, they aren’t paying the dues either. I know for a fact that my association has $80,000 in uncollected dues (thankfully I am a renter). Add all that to the homeowners out there who are paying their mortgage but are not paying their HOA dues and you have another whole layer of “government” that is functionally bankrupt.

Before long, vandalism and neglect will start to take over the common property/amenities. This will put additional downward pressure on home prices. Remember that many developers installed these “amenities” to create a premium on home sales. Nothing says “dumpy” like weeds, peeling paint and broken walls. In the case of condo associations, deferred building maintenance will lead to some very big bills down the road. I guess the HOAs will want a bailout at some point as well.

Be brave Comrades!

Amen brother!

Regarding “…guided by high school insecurities…” I married a lady like that. And at the upswing and peek of the housing boom I felt left behind while her H.S. friends and brothers were buying there “golden nest eggs”. Little did they know I actually did my Homework and concluded that it was all B.S.

My wife was totally against me, evan though I showed her the numbers. I finally got the last laugh when the housing market started deflating. No one was talking about housing anymore. So who’s the loser now KIDS?

And yes we are still holding out, sitting on the fence enjoying the bloodbath!

For anyone interested. Last payment made 12/01/08(Delinquent 1/1/09). NOD filed 9/18/09. I have a buddy that got an NTS recently and right before they were about to sell the house they gave him a HAMP mod at 2% for 30 years. I don’t anticipate that will happen in my case as my LTV ratio is around 225%.

Deflation is out of the question. I will print however much I have to to sustain housing prices. If you worked hard and saved your money during the boom instead of being a debt-ridden consumer, I will hereby take it from you. Don’t bet against me – my printing press is a lot bigger than yours!

http://www.chrismartenson.com/blog/federal-reserve-buys-more-100-mortgages-issued-2009/28343

Thought you all might enjoy some RHG that are not in CA.

>>

Laura Louzader – The listings below ARE IN the MIDWEST!

>>

While these are waterfront properties in northern Michigan, the ones below (except 1) are all on small inner lakes – not Lake Michigan. The lakes are pleasant enough but are landlocked and located 5 hours from Chicago, 5 hours from Detroit and 8 hours from Cleveland. The only airport would fit in the 1/4 of one concourse of O’hare or LAX. Less than 1.5% of the permanent population in the area have incomes over $200000 as compared to the national where 6% have incomes in excess of $200,000. Median household income in the surrounding 5-county area has dropped to $39,000 –45,000.

>>

http://www.realtor.com/realestateandhomes-detail/5265-W-Northwood-Dr_Glen-Arbor_MI_49636_1087934735

>>

Great shag carpeting and a pure 1960s kitchen. $1,050,000. On market at least 3+ years.

>>

http://www.realtor.com/realestateandhomes-detail/4433-Glen-Eden-Dr_Glen-Arbor_MI_49636_1111933250

>>

Maybe materials to finish it are included. $1,250,000

>>

http://www.realtor.com/realestateandhomes-detail/606-W-Lake-Michigan-Rd_Maple-City_MI_49664_1102593295

>>

Now this is on Lake Michigan. Hey they have reduced the price $400,000 and only want $2061 per sq ft for the house at $1,600,000. (Note: (1) You can NOT build something else because of restrictions about building in the dunes. You have to live with the size of the house that is there and (2) the beach looks deserted but that is deceptive. The house is smack in the middle of the US National Park, one of the most popular beaches is a few hundred feet away and in Michigan, people have to the right to walk across ‘private beaches’ on Lake Michigan so long as they stay between the water and the beach grasses. This is definitely high traffic central with tourists and there is NO privacy.)

>>

http://www.realtor.com/realestateandhomes-detail/8229-W-Day-Forest-Rd_Glen-Arbor_MI_49630_1111045207

>>

They must have filmed the Brady Bunch in this house – it sure hasn’t had anything done to it since the ‘60s! That blue-brown shag carpeting is too-die-for. LOL! $2,900,000

>>

http://www.realtor.com/realestateandhomes-detail/8229-W-Day-Forest-Rd_Glen-Arbor_MI_49630_1111045207

>>

Now this one has two houses and the property can be bought with both or buy just one ($3,100,000) or the other ($6,900,000). This is the price for the whole thing – $9,600,000. Check out the great indoor-outdoor/office carpeting and the lineoleum in the low white house. In the local MLS listing, the realtor-fool describes both houses as “fixer-uppers.†WOW! $9,600,000 for a handyman special. At least there is no garbage can photos.

>>

Now would you want those places? Or would you want one of these in Hyannis MA area on Cape Code about 1 – 2 hours from Boston?

>>

http://www.realtor.com/realestateandhomes-detail/50-Driftwood-Ln_Yarmouth-Port_MA_02664_1106970222

>>

$1,075,000

http://www.realtor.com/realestateandhomes-detail/181-Breakwater-Shores-Dr_Hyannis_MA_02601_1112505565

>>

$1,499,000

>>

http://www.realtor.com/realestateandhomes-detail/181-Breakwater-Shores-Dr_Hyannis_MA_02601_1112505565

>>

$2,795,000

>>

http://www.realtor.com/realestateandhomes-detail/38-Magnolia-Ave_West-Hyannisport_MA_02672_1110855325

>>

$4,500,000

>>

http://www.realtor.com/realestateandhomes-detail/79-Island-Ave_Hyannis-Port_MA_02672_1107161939

>>

$9,950,000

>>

>>

RHG are NOT confined to LA. The same realtors and delusions are alive and well up here on the eastern shores of Lake Michigan. They refuse to face the fact that the former-potential buyers for these RHG can’t even sell their primary homes on the Gold Coast of Chicago even when they have cut the price 40% to a mere $3,300,000.

To see Laurie Goodman’s entire report from Amherst, go here:

http://multifamilyinvestor.com/exclusive-how-did-she-come-up-with-seven-million/

been under const for decades????????????? just bulldoze the sumabitch and give the land to the boy scouts. aint enough room there to swing a cat anyway. eclectic my ass! more like, “gee! what do i feel like doing today, ah, lets go get stoned”.

2mil nine? brady bunch house? looks like a mobile home inside——– must be a new whack-out drug being pimped in that area for the appraisers and realestate to toot.

Personally, I love small houses. I’d just like to see small house prices for them and this isn’t it.

I know this and other Westside locals. I’d love to be a knife catcher but I’m being bid out of being just plain stupid by stupider people. I’d like to know how people are paying for these properties. 1 million for a piece of sh^t. I guess I have to leave the Westside.

if the buyer stays in the home rent free for 12 months before eviction,

he will have saved 12 * $12,000 = $144,000 in rental expense compared

to the cost of renting a similar home.

That is $144,000 in tax free money. More than he lost in equity.

All Is Illusion – yeah and $400 bucks a day? WT?

I spent a total of $19,000 cash in Cumberland, MD for three houses – debt free. $12K cash around here is like paying in full for 1-2 homes, in ONE PAYMENT… Like 3,000 square feet. – For YOUR Westside, I could buy about 41 homes in Cumberland, MD and about three pristine homes in the historic district.

If all the popular people and jobs moved here, then what would you do? – I see jobs and movie stars all the time – right here on the internet… A fool and his money quickly parts

Leave a Reply