Real Homes of Genius: Today we Salute you Santa Monica. When the Westside Comes Crumbling Down.

Today we are going to highlight the story of a home in Santa Monica that chronicles 15 years of Los Angeles County housing history. A home that has experienced two housing bubbles and is still feisty and hungry for another one. For a city with 91,124 people, you would think given the media coverage that a larger number of the 10,000,000 residents of the county would live in this area. Clearly, they do not. Very few cities exemplify the California housing mania quite like Santa Monica. It had the perfect brew to intoxicate a number of would be real estate moguls and L.A. status fighters. The trajectory of housing prices in Santa Monica seemed to defy the laws of physics and dared gravity in the face to pull it downward.

Before I detail the home to you, I have gotten a few e-mails regarding my article posted on August 6 detailing the 10 reasons how the California housing market will be in the doldrums until May of 2011. Most of the questions concern the massive government intervention and how it will influence the current housing market in California. Let me quickly sum up the 10 reasons and how all 10 still apply today:

(1)Â REO and foreclosures still growing

(2) Â Pay Option ARMs hitting peak recast periodsÂ

(3)Â Living rent-free while the foreclosure process works its way through

(4)Â FYI – California is in a major recession already

(5)Â Federal Reserve and U.S. Treasury throwing money in the wrong places

(6)Â Income to price ratios still out of whack

(7)Â L.A. County has a renting majority

(8)Â Demographics point toward more demand for affordable housing

(9)Â Feedback loop from being too dependent on real estate for our economy

(10) Consumer Psychology and why buy today when tomorrow will be cheaper?

All these 10 reasons still apply. I have gotten a few e-mails highlighting how notice of defaults and foreclosures have slowed down in the last month. Much of this trend is due to the recent signing of SB 1137 which requires lenders to contact homeowners multiple times and then waiting 30 days before filing foreclosure notices. Here is part of the text:

“Until January 1, 2013, and as applied to residential mortgage loans made from January 1, 2003, to December 31, 2007, inclusive, that are for owner-occupied residences, this bill would, among other things, require a mortgagee, trustee, beneficiary, or authorized agent to wait 30 days after contact is made with the borrower, or 30 days after satisfying due diligence requirements to contact the borrower, as specified, before filing a notice of default.”

So how does this really help someone with a large oversized mortgage? It really doesn’t. It looks good for one or two months of statistics but simply delays the inevitable. In addition, the bill requires legal owners of the foreclosed properties to maintain the home or face a $1,000 per day fine. Many times if it is a REO, the bank takes the property back. Do you really think banks have the money to become a major property management company? Of course not. That is why they are going to the bank of Uncle Sam on a daily basis to tap credit lines. Amazing how those responsible for the bubble still have access to credit. Although the bill is good intentioned it does very little to address the fundamental core issues of what is going on. That housing prices are still too high for the current population.

Real Homes of Genius – Santa Monica Edition

This home takes us to the Republic of Santa Monica, as many comrades in the Southland affectionately know it. Santa Monica was the source of many housing porn rehab shows and almost provided a self-indulgent congratulation celebration on the virtues of using pastel colors on your wall and infusing jet streams into your bathtub to wash away the hard work of defrauding people into unsupportable mortgage products. Those really leave a dirty stench. The art of fixing up homes seemed to actually have a workable and successful pattern. “If I add a stainless steel mega industrial strength refrigerator and recessed lighting, we can add $50,000” the housing “experts” would tell us. Of course this was all part of the delusional housing bubble world and many convinced each other that yes, the Kool-Aid was delicious and refreshing. Please, take a sip from the newly installed fridge.

This 3 bedroom and 2 bath home was built in 1954. It is 1,319 square feet and has been on the market for 1 day. We are told that there is an attached garage if any comrades have a hard time actually looking at the picture. And once again, if you look closely at the picture we will see the patented garbage can 2.0 photo technology at work:

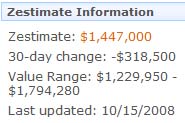

This wouldn’t be so shocking until you realize this place has a Zestimate of $1,447,000:

Now really, does this place look like a $1.4 million dollar home? Seriously. But when I put on my 2006 customized housing bubble goggles I am quickly able to see the absolute potential here. What was I thinking! A touch of new paint, a little bit of landscaping, and next thing you know we have a $2 million home. This is housing economics 2.0 right?

This home sold many times over 15 years. Starting in 1993 we will chronicle some headline stories in the L.A. Times and also place the sale price of the home as well. Ready for this fantastic journey? Let us begin.

Sale in 1993:Â Â Â Â Â Â Â Â Â Â Â Â Â Â 05/27/1993: $290,000 Â Â Â Â

Bottom Line: Housing Market May Be Mending Real Estate: Despite a three-year slump, experts say prices are stabilizing, especially for homes under $500,000.

PATRICIA WARD BIEDERMAN; Los Angeles Times (pre-1997 Fulltext); Aug 22, 1993; pg. 1

A sad Westside story: Home prices have declined up to 50% since late 1980s

Myers, David W; Los Angeles Times; May 28, 1993; D; pg. 1

Indeed it was a sad Westside story. This poor home only sold for $290,000 after the Southern California housing bubble of the late 1980s popped. It has now been a few years since peak prices and people are thinking that a bottom is in sight. Keep in mind that in our current bubble, the Los Angeles housing market didn’t peak until the middle of 2007. That is, we are only 1 year from the peak. But have no fear, after people got burned they got hungry for another bubble and this is when things really got interesting.

Sale in 2001:Â Â Â Â Â Â Â Â Â Â Â Â Â Â 09/18/2001: $417,500Â Â Â Â Â Â Â Â Â Â Â +$127,500

After 8 years, this home finds itself being sold at the beginning of the epic California housing bubble. Little did this seller know that this home was going to be on an amazing journey into Dante’s version of the housing inferno. You’ll love some of the headline articles during this time:

The Nouveau Austerity; The post-Sept. 11 mantra may as well be: If we quit shopping, they win, right? Those with money are still spending, just quietly.

SHAWN HUBLER and MIMI AVINS; Los Angeles Times; Dec 16, 2001; E.1;

THE NATION; Enron Was Warned of Violations, Auditor Says

RICHARD SIMON;THOMAS S. MULLIGAN; Los Angeles Times; Dec 13, 2001; A.1;

You would think given what was going on during this time that people would be more careful with their finances. Yet this notion that we had a patriotic duty to spend beyond our means or “they” will win took hold. Alan Greenspan lowered rates to ridiculous levels and took us from the tech bubble to the housing bubble without skipping a beat.

Sale 2002:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 09/16/2002: $476,000Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â +$58,500

One year later this home sold for a$58,500 profit. Not bad given that the median household income of those in L.A. is approximately $50,000. At this rate, why work when you can live off the appreciation of your home?

Realty companies thinking globally

Mary Umberger; Los Angeles Times; Dec 1, 2002; K.11;

Bwahahaha! Oh I bet realty companies were thinking globally. Now a few years later we are in a global mess. 2001 and 2002 saw the seeds of the bubble take hold and this is when the snowball really started gathering speed and size.

Sale 2004:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 10/28/2004: $696,000Â Â Â Â Â Â Â Â Â Â Â Â +$220,000

Wow. Now, our 2-year appreciation gain is nearly the price of the home in 1993. We have now made $110,000 a year from simply living in our home. Isn’t life grand? Even if life isn’t grand we just made a few. Now we are making twice the median household income of households in the county. No bubble here right? What were some people saying?

No Sign of a Housing Bubble, Study Says

Los Angeles Times; Jun 23, 2004; C.6;

Builders Keep Putting Up Housing — but Not Enough

Annette Haddad; Los Angeles Times; Aug 3, 2004; C.1;

Home buyers ante up; In Las Vegas, the big gains aren’t just in the casinos, they’re in the housing market.

Allison B. Cohen; Los Angeles Times; May 30, 2004; K.1;

The middle-class housing squeeze; The high cost of homes is pricing many residents out of the California market. Some are staying in rentals, and others are leaving the state.

Allison B. Cohen; Los Angeles Times; Mar 7, 2004; K.1;

At this point people are drawing lines in the sand. You either drink the Kool-Aid and believe housing prices are justified or start realizing we are in a bubble. Take a look at the four headlines above during the year. One argues there is no housing bubble. Good job on that call. One of the articles compares housing to a Las Vegas Casino. The L.A. Times is a mainstream paper and we still get revisionist pundits trying to say that no one saw this coming today. This was 2004. Just because a bonehead pundit had the lack of foresight does not mean others did not see what was coming down the pipeline.

The next sale is when we hit hyperspace and go into weird cult world and prices simply go completely unhinged from any semblance of reality:

Sale 2006:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 11/22/2006: $1,100,000 Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â +$404,000

2-more years and we are now making $202,000 a year by simply sitting in our home and watching the grass grow. At this rate if we follow this pattern, we will sell the home in 2008 for $1,700,000 for a nice $600,000 profit. I like this math. We’ll keep selling the same home over and over and each time the price will get hyper inflated. At this point, we are in another galaxy of logic and rules. The cult herd mentality is now in full speed and you have a school of new believers that actually think these prices justify some new form of back of the napkin economics. This is where we get a mix of reality based articles and those who finally fly off the real estate religion cliff:

The Nation; Housing Speculators Relocate to Hotter Spots; Some who scored with L.A.-area property take their profits to Las Vegas and Arizona. Their flight may soften the local market’s landing.

Annette Haddad; Los Angeles Times; Mar 18, 2006; A.1;

The State; Inland Empire: Where the L.A. Dream Landed; The region, once a blue-collar bedroom community, is creating its own good jobs. Now its upscale amenities and housing rival the coast’s.

Roger Vincent; Los Angeles Times; Apr 16, 2006; A.1;

Housing Costs Too Much? Then Work More, Mayor Says; Conservative Jim Naugle joins developers to fight an affordable-housing law in Fort Lauderdale. He suggests a 40-hour workweek is too little.

Brittany Wallman; Los Angeles Times; May 21, 2006; A.23;

Housing Prices to Drop, Report Says; Projecting a median price decline of 3.6% in 2007, a firm offers one of the starkest forecasts yet of the weakening sector.

Los Angeles Times; Oct 4, 2006; C.3

COLUMN ONE; A loan that’ll get ugly fast; Option mortgages allow payments so low that borrowers go deeper into debt. Their popularity could pose risks for the housing market.

David Streitfeld; Los Angeles Times; Dec 11, 2006; A.1;

The first article talks about delusional folks who mistook luck for skill. These are the folks that made big dough in L.A. and thought they could replicate these same behaviors in Vegas and Arizona. You can take a wild guess as to how these folks are now doing. How appropriate that it was Las Vegas too. Another article talks about the Inland Empire as the “dream” of L.A. which of course is nothing more than an utter nightmare now where prices are down 50 to 60 percent with vacant homes on nearly every block.

You have to love the “starkest” forecast of a 3.6% drop in housing prices. Bwahaha! If that were only the case. By this time I was already blogging away about the massive excess in California and the nation. Housing prices in California are now down 41+% on a statewide basis. And we also get someone calling out Option mortgages which of course are going to kick the California housing market in the groin in 2009 through 2011.

This is the history of an epic housing bubble. An era has now come to an end. This Santa Monica home that sold at the peak for $1,100,000. What is the current price? How about $709,000 with only 1 day on the market. Do you think lenders are quickly getting the idea? This is as prime as you get in terms of L.A. We are now going to see practically every area in the Southland take a hit from this bubble bursting. The fact that credit markets are still in a defensive position will not help the market for many years. Even in the Republic of Santa Monica, comrades still find that rare foreclosure.

Today we salute you Santa Monica with our Real Home of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

20 Responses to “Real Homes of Genius: Today we Salute you Santa Monica. When the Westside Comes Crumbling Down.”

I think that house looks horrendous. For the same money you could buy a chateau in the middle of France or a 3000 square foot villa in Bali.

If the median income in LA is $50k, the median house price will have to fall to about $150k. That house sure looks “median” to me. In any case, whatever the fall in price, it will be stunning, likely more than $700k drop from last price.

And still, the Bubbleheads speak of housing stabilizing. Of course, when you spout inanities on CNBC for five million a year, you don’t give a rat’s ass about house prices. You simply want to make sure your stock portfolio gets bailed out by broke taxpayers.

America is a sad, sad thing right now. I personally think every single American should be waterboarded and then forced to live in a slum in the Third World for six months. Maybe, just maybe, then something could be saved.

The banks are FINALLY tipping their hand as they have no choice now. This property is a trendsetter and I’m sure is sending shockwaves through the RE community in SM. Some fool will buy it and still lose money. However, it does change the game in SM.

Panic now starts to set in on The Westside

http://www.westsideremeltdown.blogspot.com

This paragraph:

–

“This home takes us to the Republic of Santa Monica, as many comrades in the Southland affectionately know it. Santa Monica was the source of many housing porn rehab shows and almost provided a self-indulgent congratulation celebration on the virtues of using pastel colors on your wall and infusing jet streams into your bathtub to wash away the hard work of defrauding people into unsupportable mortgage products. Those really leave a dirty stench. ”

–

is hilarious, pointed, and poignant. It’s what I’ve been saying for months, and I just wanted to say thanks for the great morning laugh. But you forgot the part about ripping out good, 30+ year old hardwood cabinets and replacing them with particleboard garbage from ikea that are pretty much guaranteed to disintegrate at the same rate as the viability of the loan on the place. Seeing crap like that and the smiles and profit surrounding such asinine decisions just made my blood boil.

Nice post, Doc — what’s the address on that house, I’m missing the link.

I’d like to post on it, but need a link to the listing.

Pete

disregard previous, i found the house on dewey street.

excellent post, i’ll link to it today on LA Land

pete

As a Santa Monica renter who’s remained on the sidelines with my wife and 2 little kids, *THANK YOU* for calling BS on all the terrified underwater Jetta-driving $90K/yr fools who are trembling as they realize that their $1.2M home is really worth $700K now, and falling.

Everybody say it with me:

UNTIL HOME PRICES FALL IN LINE WITH INCOME, THEY WILL CONTINUE TO FALL.

The only thing I’ll say (to the guy predicting $150K in Santa Monica) is that a) $50K is the average household income in L.A., including Compton, etc…. in Santa Monica it’s higher (I *think* I remember seeing $90K?) and b) that 3x income multiplier has always been higher in very desirable areas like Santa Monica, Malibu, etc… But even then, you’re sitting at maybe $500K, not $1.2M.

Thanks also for the info on $1K/day fines (is that really correct?), that’s damn steep and good motivation to keep the lawn (excuse me, the little concrete slab) mowed.

Any buyer today isn’t a knife-catcher. Try a chain saw catcher. Like the Black Knight in “The Holy Grail”, any seller in the area will have to say “that’s not a price cut. It’s merely a flesh wound” as their values hemorrage daily.

Here’s another SM gem. Take a look at the listing history, ouch! Any knife catchers out there? Hello? Hello?

http://www.redfin.com/CA/SANTA-MONICA/819-PIER-Ave-90405/home/6776295

Cramer finally got real last night on Donny Deutsch show.

It was weird to hear him recommend that grown men and women siblings, move back in together, in the same house, to save money.

Cramer, bringing families back together.

When asked what advice parents should give their kids about the new world order, he said that he told his kid to ‘travel the world’ (ha, assuming one has the money) and see what true poverty looks like.

Then come back and be happy with a little bit of money – cause that’s the future from here on in. Forget about getting rich, take a job that helps society, do service for the nation.. It’s a new world, he said, and get used to being poor. Make the best of it.

Doc,

I wonder if folks are finally getting picture. There is nothing the government can do–this was caused by irrational human thought patterns and until intelligent thought returns and correct choices are made, there is no hope. I was on the phone with our 401k guy the other day right before the second 700+ drop, and he’s still ranting the some rhetoric, “Great time to buy!” “Staocks are a bargain!”. People still don’t get it. They think once we get past this little speed bump, it will be back to the races.

It took a while for people to figure out the depression was not going to pass quickly without getting back to sustainable institutions. The free market has some positve feedback components, but it is not an algorithm to correct every possible ill to the human condition. Not everyone will do the right thing if left to their own devices. In fact, it has been demonstrated that MOST people will not do the right thing without the feedback of swift consequences. In fact, it seems obvious that the only lesson bankers learned from the 80’s-90’sbank bailout was that if you do it right, you can rip off amazing amounts of money and get away scott-free. In fact, you might even become a presidential candidate al la Keating Koolaid Klan…

Thanks for the honest foresight. You saved a lot of folks that had ears to listen.

What?!?!? Room to build 3 Condos?!?! They are truly insane. As a up an coming young first time buyer (fingers crossed) I have seen this madness from afar and noticed developer after developer knock down a modest size house with a decent yard and squeeze in 4 BIG homes with almost no yard!! I don’t know about most of you but I want my kinds to run on a lawn with trees, not a concrete ring that surrounds the house with barely enough room for the trash cans. As a Long time renter in Glendora I’ve seen homes in my neighborhood go from $120,000 in 1996 to $679,000.00 in 2006!!! They are now down to $399,000.00 but that is still way to high. There is even one house one block away from me that has been on the housing market for 18 MONTHS!!! This is because the bank is still holding out hope that they may still sell it for $499,999.00 (whats with the nine hundred ninety-nine part?)Here’s hoping for lower prices!!

Ok, I still don’t get the desirability of Santa Monica. A similar house in SW Florida can be had for ninety percent off at $70,900. Ok, Cape Coral is not everyone’s cup of tea, but is S&M really ten times nicer? Don’t they also have homeless, drugs, gangs, and high taxes in S&M?

The upscale zip code of S&M is 90402 and had median income of $118,553 on zipskinny. (Of note, zip 90401, also in S&M, had a lowly median income of $36,461, so not all of S&M is prime. It is not at all clear that this Real Home of Genius is in a prime area.) Even if the prime areas of S&M are worth 4X income at market cycle bottoms due to some sort of enduring sex appeal, you still get only $475k as a reasonable median house price.

This house needs to be marked down at least another $200k. At least.

PS: Who believes that the median family incomes in 90402 will not drop during the ‘great recession’?

Here’s another SM gem. Take a look at the listing history, ouch! Any knife catchers out there? Hello? Hello?

http://www.redfin.com/CA/SANTA-MONICA/819-PIER-Ave-90405/home/6776295

What?!?!? Room to build 3 Condos?!?! They are truly insane. As a up an coming young first time buyer (fingers crossed) I have seen this madness from afar and noticed developer after developer knock down a modest size house with a decent yard and squeeze in 4 BIG homes with almost no yard!! I don’t know about most of you but I want my kinds to run on a lawn with trees, not a concrete ring that surrounds the house with barely enough room for the trash cans. As a Long time renter in Glendora I’ve seen homes in my neighborhood go from $120,000 in 1996 to $679,000.00 in 2006!!! They are now down to $399,000.00 but that is still way to high. There is even one house one block away from me that has been on the housing market for 18 MONTHS!!! This is because the bank is still holding out hope that they may still sell it for $499,999.00 (whats with the nine hundred ninety-nine part?)Here’s hoping for lower prices!!

Comment by David

October 17th, 2008 at 1:30 pm

Here’s another SM gem. Take a look at the listing history, ouch! Any knife catchers out there? Hello? Hello?

http://www.redfin.com/CA/SANTA-MONICA/819-PIER-Ave-90405/home/6776295

This old abandoned shack is in Zip 90405: Median Household Income: $50,540

Yes, some of S&M is not much different from Compton in income.

“There is a vintage cottage on the property which could be torn down to or fully remodeled.”

This cottage is worth 100x rent, maximum. How much would it cost to remodel the shack before it could be rented out? And isn’t S&M rent controlled?

digi001, That’s a great point about really seeing poverty. I was in Jamaica at a beautiful hotel with a waterfall in the atrium, but on the other side of the hill there were endless shacks with ‘tins’, a piece of currugated metal that was the roof. That same night the most awesome, frightening storm I’ve ever been through hit, and once I figured the masonary villa we were in wasn’t going to collapse, a feeling of dread came over me about how in the world the folks on the hill fared…a lot of people are ill prepared for the storm that is coming. Maybe if they get shelter under their granite counter-top they’ll get through it…this is not good.

Since this tread is mostly about sharing data, here’s some to ponder:

~

“There are 129 million housing units in the United States, comprising owner-occupied, rented, and vacant units. Of these, 18.5 million are empty. This vacancy rate is 2.5 percentage points higher than it has been at any point in the half century the data have been tracked, translating into at least 3 million too many empty housing units in the country. This number, moreover, is rising. This is the most intractable part of the real estate bubble, for we cannot find a true bottom to home prices until this inventory of empty units starts to clear, and we cannot find a bottom to the mortgage finance market until home prices bottom out.” -It’s Only Going to Get Worse, Everything you always wanted to know about the housing crash, but were afraid to ask.

by Lawrence B. Lindsey

The Weekly Standard

06/09/2008, Volume 013, Issue 37

~

Obviously, we have an epic supply/demand imbalance. One metric worth watching is homeownership rate. It peaked at a historical high of 69.2% in 2004 and averaged about 64% since 1960 according to data from Wikipedia. Just to get back to the trend line, we have to loose about 6.45 Million homeowners. That’s a lot of deadbeat loans! And we are likely to overshoot it given the economic precipice we are at. Any elaboration by Comrade Dr. Housing Bubble would be appreciated. Understanding when supply and demand will come into some historical norms will be key to finding a bottom.

~

Despite this, there is no lack of voodoo government rescue planning to put a “floor” under housing prices. Here’s a gem from the NYT:

http://www.nytimes.com/2008/10/18/business/18nocera.html?em

Realtors have caused a lot of the problems…

http://www.youtube.com/watch?v=Hv9hSLtEwOM

Read the comments on the video too – very interesting.

Los Angeles is a nightmare. The extreme example of what slavery to the automobile will lead to. My value of this house: you would have to pay me $100K a year to live there.

Time for a Real Homes of Genius story about overpriced places in West Hollywood: http://www.ziprealty.com/buy_a_home/logged_in/search/home_detail.jsp?property_type=CONDO&source=CLAW&cKey=66wc68n3&page=2&listing_num=08_278133&mls=mls_so_cal

The price of the condos at 917 N Sierra Bonita have been dropped from $963,088 to $499,999 in just 167 days!

Hello Doc,

I appreciate your site and its humor. Seriously, you make some great points here, but unfortunately, this particular Dewey listing is not even remotely an example of LA’s finest, either in Santa Moncia or Los Angeles, either in terms of house style condition/style or location. As you pointed out, the home is an absolute joke, in every sense. The house sits on the edge of Santa Monica as you travel toward venice/LA and sites on an awful lot, with essentially no yard and at the intersection of busy winding roads and, more importantly, at the end of the Santa Monica Airport runway. This house is really almost as bad as it gets and I would agree with you, it’s a joke, though a sad one. Even sadder is the fact that this home sold for 675K and likely should have sold for considerably less. Bottom line, I agree with much of your commentary, but this home really ins’t a fine example to use in demonstrating your point of values in Santa Monica, given so many others would have better and more objectively proven many of your points. Thank you for allowing me to comment.

Leave a Reply