Real Homes of Genius: Today we Salute you Huntington Park. Sold 3 Times in 4 Years.

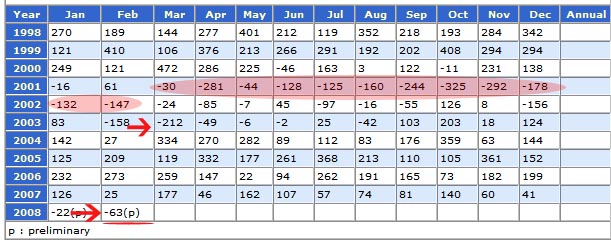

Some have commented that much of what is being said on housing blogs is self indulgence and a form of righteousness. I can’t speak for other blogs but I care to disagree. Most of these comments have an underpinning that bloggers need to come to the table with a solution to a decade long bubble as if the housing bubble was a historical fact, something that has already occurred. I hate to tell many of you but there are still people jumping into the housing market TODAY. This isn’t some case study from the 1800s but a real-time event. The media has been pumping the housing market up and even as it is correcting, they are trying to season the market with the sentiment that we are quickly approaching bottom. Those in the perma-bull camp are still reluctant to come to the table and openly admit that we are indeed in a recession. That is hard enough for them to say. Forget about them admitting that this recession is the product of years of reckless spending and massive consumer speculation tied to the housing market. You want a solution? You want a debate? Let the market correct. The market was fueled by easy credit and lack of oversight and now it is being propped up by proposed bailouts and every other imaginable piece of absurd legislation. Take a look at the below chart showing job growth:

*Source: BLS

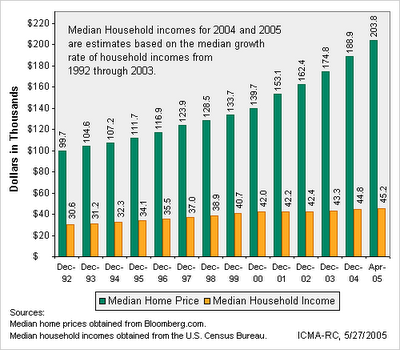

Take a look at the chart very carefully. Considering that the recession of 2001 was considered to be a mild one, we had 12 straight months of solid job losses. Given that we have seen only 2 months of job declines and the consensus is the market is much worse than in the earlier part of decade, how can anyone start mentioning a bottom? That is why it is crucially important to remind people, many who are new to the “debate” (although I’m not sure there is any debate about there being a housing bubble) that housing in many large metro areas is still massively overpriced. The most important thing is to protect current prospective buyers from making the same mistake. It is also vital to put the entire housing market in context to the current jawboning of many pundits. Take a look at the following chart showing median income vs median home prices from 1992 to 2005:

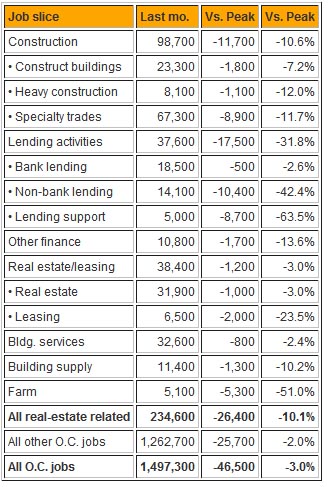

What you’ll notice nationwide is that the median home price went up 100+ percent while median income went up 47 percent. If there is a bubble nationwide you can only imagine how disconnected prices got here in California where the median prices reached $551,000 in January of 2007. The price has now adjusted swiftly to $430,000 but how much further do we have to go before we really reach a bottom? The new item now being thrown into the debate is the actual employment health of the economy. So much of California’s economy was built around real estate; agents, brokers, construction, banks, and others that were extremely high paying jobs. What industry is going to absorb these displaced workers? Take a look at this chart from the Lanser on Real Estate Blog:

*Source: Lanser on Real Estate

This chart is for February of 2008 and I’m not sure we can paint a clearer picture of what is occurring. Now another factor that we have to contend with in regards to housing prices correcting is a looming recession. How long will it go? At the very least if we use the mild recession of 2001 as an example we can expect to see 12 months of negative payroll growth and at times, steep declines in employment. States such as California with such a high emphasis on housing will pay a much steeper price.

Real Homes of Genius – Third Times a Charm

Today’s home takes us to Huntington Park. This 732 square foot home with 2 bedrooms and 1 bath sold at the peak of the bubble for $311,000 in 2005. It then sold in February of 2007 for $308,305. Take a look at the sales history:

Sale History

02/21/2007: $308,305

07/06/2005: $311,000

10/07/2003: $160,000

Why is this important? Each time a sale is recorded, an agent gets a cut, a title company gets fees, an appraiser gets paid, a broker/lender gets a cut, and the seller gets a check out of escrow. As you can see, each transaction pays many people. So a home that sold 3 times in 4 years is paying a lot of people. What happens now that sales are dwindling? A market flooded with homes and many not being paid. Take a look at these important statistics:

Statewide

Existing Home Sales January 2007: 446,820

Existing Homes Sales January 2008: 313,580

A -29.8% decline.

Median Time on Market Jan. 2007: 68.7

Median Time on Market Jan 2008: 71.6

*In days.

Unsold Inventory Index (months) Jan 2007: 7.6

Unsold Inventory Index (months) Jan 2008: 16.8

A 121.1% increase.

What this tells us is that housing is in no shape or form bottoming out here in California. As a rule of thumb, having about 6 months on the unsold inventory index is pretty normal. 16.8 months of inventory is not a good sign and also seeing the median price drop by $120,000+ in one-year isn’t exactly good either.

This current home is now being sold for $261,900 and was built in 1924. Given that it is relatively new on the market, we can expect it to sit for at least a few more months. It is bank owned and many are now chopping and dropping prices rather quickly trying to move inventory off their books. The housing market has crashed here in California but how low will it really go? Until we see how our employment sector holds up, it is really difficult to predict.

Today we Salute you Huntington Park with our Real Home of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

13 Responses to “Real Homes of Genius: Today we Salute you Huntington Park. Sold 3 Times in 4 Years.”

Thank you DHB for another enlightening post. I was watching Larry King Live last night here in Qatar (BTW, gasoline here is $.80/gallon). This woman, one of CNN’s economists (sorry I can’t remember her name) was stating how bad things were in America, but at the end of her speal, she was pitching housing! What a good time it is to get into the market! She had written a book on how to make money in real estate and was obviously in denial about the poor investment real estate is; especially now! One only hopes people see thru her and don’t take their savings and throw it away.

Here’s a sampling from Sonoma County for ’08. The number of distressed properties is GROWING. Bottom, or near bottom? I think not.

NODs:

Jan 451

Feb 513

Mar 121 (through Mar 7)

REOs:

Jan 164

Feb 238

Mar 48 (through Mar 7)

Unemployment is much worse than the government’s juiced numbers. There aren’t enough jobs now, wait until even more people leave their real estate related job in the future and need a job. You’re going to see a lot more stories about thousands competing for hundreds of entry level jobs. The company I work for is already starting to chip away at our compensation because they know there are hundreds in line willing to take our spot. I’m just a punk kid; I don’t know how my older co-workers get by.

I wont think about buying a new pad until DHB shows me the numbers and the facts with graphs and pie charts that the roller coaster is hitting the bottom.

My 2 realtor neighbors keep telling me to jump into the market (since things are bottomed out & about to turn around). The louder they plead the more silly it seems. What’s that line? Oh yeah — “Methinks thou doth protest too much”.

Neighbor works for McKinsey. Their analysis is that the housing market will be in serious pain through at least 2011, and sometime in 2010 homes in SoCal will be at 50% of their 2005/6 peaks. My God, can you imagine buying a $1.4M crackerbox and have it lose three quarters of a million dollars while you’re sitting there watching the money slip through your fingers?

I guess all the assholes driving around in their Jettas and Audi A4s with popped collars and Gucci sunglasses should have stuck to their $2K/mo rents instead of buying million dollar properties that they couldn’t afford.

I see from your chart that median home prices were a multiple of 3.25 median income in 1992. To reach that same equilibrium point today would require the median price house to drop a further 25%. I recognize interest rates also factor in here and I don’t know what they were in 1992 relative to today but the data should be available so, assuming we are returning to traditional standards of real estate finance, and credit markets seem to be demanding it, then it should be possible to estimate when a ‘bottom’ or price stability has been reached. I gather that is what Goldman Sachs and others have done when they opined housing prices have a further 20-30% to fall. Of course, we don’t know the damage that a further 20-30% fall in housing values will entail. We could shoot right through a theoretical equilibrium point on the way down just as we blew past it on the way up. Boom and Bust! A severe recession caused by a collapse in real estate prices makes it possible if not probable prices could fall past that equilibrium point for a time.

As always… brilliant, illustrative and completely suported. Well done. I live in the O.C. and sold my house in the I.E. prior to the bubble. Dumb luck, as i just wanted to live closer to my friends at the beach and made a decision to rent. THANK GOD. However, i always knew that it had to stop somehow. Me and my girlfriend kept asking ourselves how anybody could afford a home by then (2005) when i was making $100K/yr and would not even feel comfortable with more than a $300K loan. Anybody who was not here in California (w/ maybe the exception of bubble state Florida) can not even imagine the rabid nature of the housing speculation. People really believed that housing never went down. Idiots were taking home equity loans out and buying new cars and taking vacations. THAT WAS THE NORM! You are right about one thing, housing supported a lot of incomes. I knew so many people in the mortgage, contruction and real estate businesses that were living fat… and did not save their money, and instead bought bigger houses and fancier cars. It is going to be an ABSOLUTE BLOODBATH by the time this is all said and done. All those big incomes were supporting all the Starbucks and California Pizza Kitchens. Another sector that will be hurt will be those in the financial sector…. and i know plenty of friends in that sector as well. Laslty, the final nail in the coffin for housing will be a change in the public’s perception towards housing and debt. It will be looked to less as an investment and more people will feel the freedom that i feel right now by renting, and putting my money into more lucrative investments or capital preservation mediums. Looks like there will be hard times ahead for sure. People who are underwater with their mortgages should walk away now and start preserving what money they can save.

As part of the federal bailout (that means you and me paying, by the way), they should mandate that all homes must be sold at least once every two years. Additionally, other than homes of historic interest, all homes over fifteen years old must be demolished. This would all be great for the economy. RE agents would be guaranteed work, as would appraisers, et al. Home builders would boom. And prices would rocket as old, boring homes are demolished to make way for new, exciting homes. Tax revenues would skyrocket. GDP would explode. We could buy back all those shares we sold to the grubby Arabs and Chinese. Good lord, I think this plan would cure cancer and make deserts bloom.

The analysis here so far covers the order takers and investors at the bottom and leaves out the Federal Reserve bankers and the Federal Government shills to buy, buy, buy real estate…become part of the ownership society and invest through your pensions and 401k’s in RE derivatives allowed through banking deregulation. The bubble and credit system is being blown up by these rotten debt derivatives apparently now worthless but priced and held in the trillion$…by the huge banks.

I don’t live in California, but just looking at that house, its not even worth the $160,000 that it went for in 2003. I would pay $50,000 at most for it, and that would just be for the cost of the land, sense the house is worthless. I mean come on; 732SF. I’ve lived in bigger and much nicer apartments in far better neighborhoods for far less than the carrying cost of that albatross.

I guess it must be the fine school district for the reason of the house being worth so much…snicker, snicker.

Check this RHG out on homes.com:

9126 Buhman Ave

Downey, CA 90240

Real Estate Agent States:

“Bank owned fixer in best downey location. Sold for $760k in 2007!”

Currently selling at: $315,000.

This house declined 60% in one year. BWWAHAHAHAHAHAHHA.

Too funny Compa.

That is far from a ‘disirable’ (their spelling) area….but at 1200 sq ft, I am surprised this hasn’t been snapped up.

What a deal, eh?

Well the reasons are you need 20% down to buy, excellent credit and some assets. People with these three characteristics know what the heck is going on and are more than happy to wait on the fences.

Leave a Reply