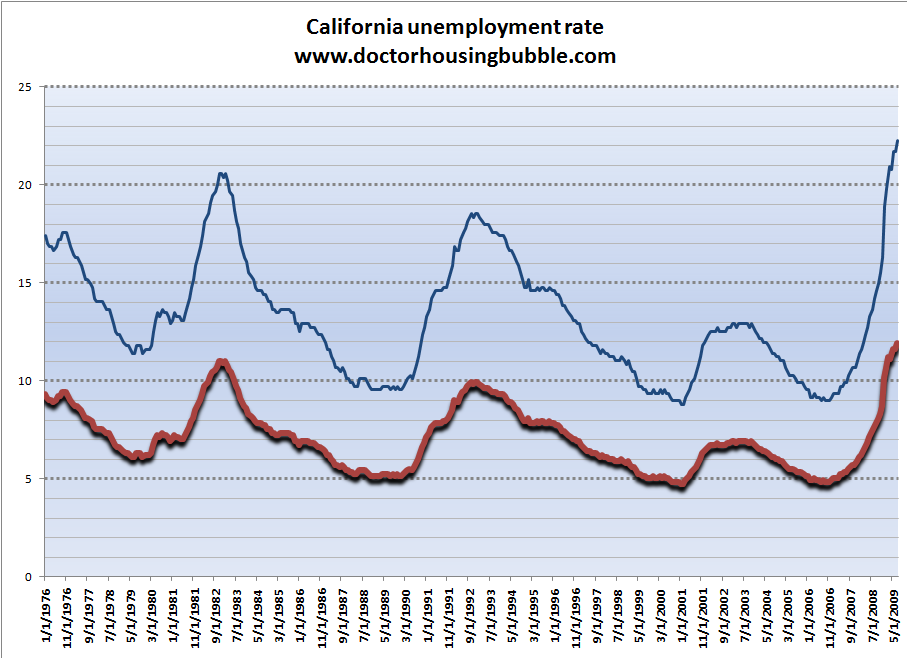

Real Homes of Genius: The South Bay of Los Angeles. Today we Salute Redondo Beach. 668 Square Feet 1 Bedroom Home for $539,000. California Unemployment now at 11.9 Percent Officially with U-6 at 22 Percent.

The South Bay of Los Angeles in its broadest definition includes all cities south of the 105 freeway and places west of Long Beach. It includes places like Manhattan Beach, Hermosa Beach, and today’s Real Home of Genius city Redondo Beach. Now I know today people are jumping up left and right like a kid juiced up on sugary drinks because existing home sales have increased. This headline is plastered all over the mainstream media. But did you also know that the median sales price fell 15.1 percent last year to the current median sale price of $178,400? Oh, and distressed sales accounted for 31 percent of all existing homes sold. What you should get from this is simple. Cheaper prices will drive sales even with conventional 30 year mortgages. It’s all about price.

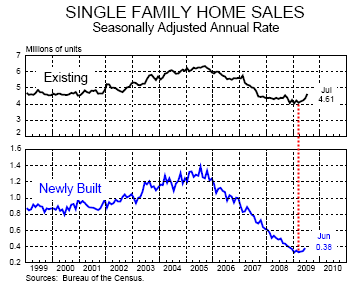

Nationwide it is likely we have bottomed in terms of sales. But as we have discussed many times there will be two bottoms and one of those may have been reached:

The other bottom comes in the form of price and that still has a way to go. The shadow inventory will keep pressure on housing prices especially in shady regions like California. There seems to be a growing divide in terms of how things are now going to play out. Some are arguing that the Alt-A and option ARM products are a tiny event and those waiting for a second flood of foreclosures will be surprised. Their argument is banks will simply keep these homes off their books and will slowly trickle inventory into the market like some form of intravenous medicine drip. They may be right but so much shadow inventory is building that at a certain point, something will have to give. The only thing we can do at this point is look at the data and try to come up with an estimate of where we are heading.

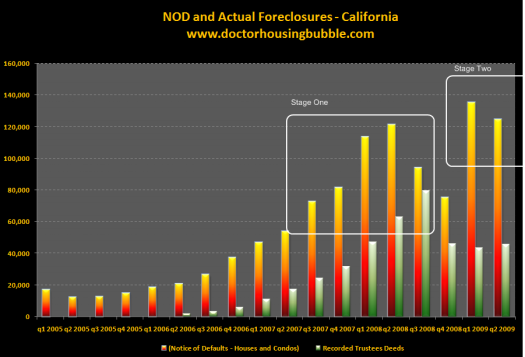

My take on why something will have to give is this. In Southern California we concluded that there were 40,000 REO properties in the dark shadows. These are homes with no mortgage payment coming in. As we all know, many of these notes are chopped up like hamburger and are beholden to various contractual agreements with investors. Do you think investors are happy receiving no income stream? My take is many of these banks are playing financial brinkmanship and are trying to hold their breath long enough to dump this stuff off to the government (aka public) and the public private investment program (PPIP) is one of those vehicles to perform this transaction. In fact, that is why I have heard numerous stories of people not getting a notice of default from 6 to 12 months! We already know that foreclosures are at record highs and rising:

The assumption that banks can hold this stuff indefinitely is wrong for a variety of reasons including banks have extremely low capital. This will drain them further. But they can’t sell because they will collapse since the market is moving with cheaper prices (i.e., see Friday’s existing home sales). If we allow this to go on we have learned absolutely nothing from Japan and will repeat a lost decade here in the U.S. And the proof is already occurring! If we leave it up to the banks to determine policy, they would hold this stuff off forever while coming back to the government cheese each and every year until this is all worked out. As you can see on a nationwide basis, if you set the price right people will buy. Yet banks have no incentive to sell because they will implode as they should. Even now, as the FDIC reaches a breaking point with its reserve insurance fees are going higher across the board and good banks are now subsidizing weak and irresponsible banks. This story I’m sure is sounding very familiar to most of you.

At a certain point, there will need to be transparency in this market. Just because it happens doesn’t mean they will flood the market with these properties but the public will be flooded with data. Some think that the argument means that one day, a banking CEO is going to say, “hey, today is a nice sunny day. I’m going to put 6,000 REOs on the MLS before I go eat some tacos.” It doesn’t work that way. But you can’t have no cash flow from properties and hold them off indefinitely. That is how banks imploded in the first place! The cash flow ran out. People stopped paying.

Now assume the government assumes all the Alt-A and option ARM products on to their books. Then what? All you did was shifted the risk. You still have over valued assets and the only thing that happened is you passed the hot potato to the public. At a certain point there will need to be price discovery. You can only have price discovery by putting these homes on the market. Otherwise you follow Japan down the path of a lost decade because you will have these zombie banks and loans just eating tax brains forever. Yes, I know we aren’t like Japan because we don’t save, we aren’t homogenous, and every other pretext. But we are like them in this regard if this is the path we follow. Is there a different result if a Japanese and American man jump off the Grand Canyon?

Let us now focus on our overpriced home. Today we salute you Redondo Beach with our Real Home of Genius Award.

Redondo Beach – 668 Square Feet 1 Bedroom Home for $539,000? Is this 2006?

The South Bay is one of those regions where people think nothing can happen to housing prices. They assume every city is somehow Manhattan Beach or Rancho Palos Verdes. They are not. Redondo Beach is one of those areas. Depending on which zip code of the two you focus on, Redondo Beach is either doing well or contracting:

90277:Â Â Median Price ($989,000) Up 16.4% year over year

90278:Â Â Median Price ($686,00)Â Down 7.7% year over year

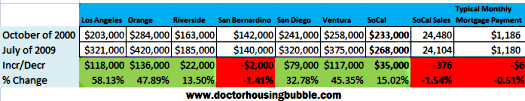

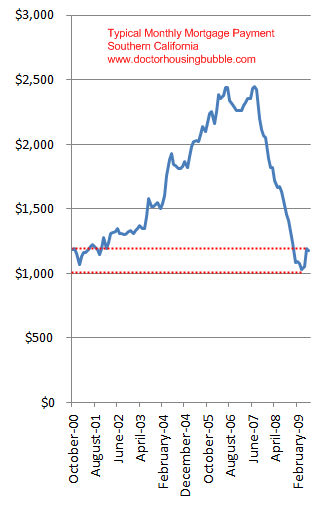

Our home today is in the 90277 zip code. If you are wondering what a million dollar neighborhood looks like in an inflated market, this is a perfect example. But before I dig deeper into the data on this home, I want to focus on the monthly nut phenomenon. This also helps to explain why people were so willing to take on Alt-A and option ARM loans even though the principal was simply a ridiculous amount. What people are missing is that the monthly Southern California buyer is now taking on a monthly mortgage amount that is now resembling the average amount from a decade ago! Did you get? The average monthly nut now looks like the monthly nut from 2000. Let us look at two sample months and what you will see is a clear indication of where we are heading:

This chart probably tells you everything you need to know. Riverside and San Bernardino Counties, the Inland Empire, are now at prices that date back one decade. If you are buying in these areas, you probably will find good deals. However, if you look at the other counties they are still largely overpriced. Los Angeles is up 58% from a decade ago, OC is up 47%, and the other counties of San Diego and Ventura are overpriced as well. Yet if we look at the total sales for the region, we are virtually at the same point as in October of 2000. And the irony is the typical monthly payment is now even with that from 10 years ago. So something has to give here. Either prices in the higher priced regions decline to meet the monthly nut or the monthly payment will have to jump. And just take a look at what Southern Californians were taking out on a monthly average during the bubble:

At the height of the insanity, Southern Californians were taking out an average $2,500 mortgage payment. No taxes, insurance, or maintenance either. Just your principal and interest (assuming you paid interest which many didn’t on option ARMs). Now that we are actually checking for income and using debt-to-income ratios people can’t afford gigantic mortgages. Remember during this decade incomes have been stagnant. And now, if you didn’t notice on Friday California released the unemployment rate and in another stunner, the unemployment rate jumped up to another record of 11.9 percent putting the U-6 rate over 22 percent:

Hard to buy a home without an income. But this home in Redondo Beach brings back memories of those 500 square foot shacks going for $500,000. This home has a housing bubble history like you wouldn’t believe. Let us look at what a 668 square foot home can do during a bubble:

Sales History

3/31/2000:Â Â Â Â Â Â Â Â Â $273,000

7/20/2006:Â Â Â Â Â Â Â Â Â $680,000

12/23/2008:Â Â Â Â Â Â Â $431,000

And the current list price is get this…$539,000! Bwahahahahaha! Someone is trying to flip in California even with an unemployment rate of approximately 12 percent and housing imploding! Real Home of Genius quality indeed. I love this part in the ad:

“Sunny property surrounded by million dollar homes. Perfect second home, first home or private home. Walk to the beach, shopping and restaurants. It is darling, very special and can grow.”

Surrounded by “million” dollar homes? Let us take a look:

Zillow doesn’t seem to think so and their pricing algorithm has been generous in California. That $1.3 million home is 4 bedrooms and 3 baths on 2,614 square feet by the way, in Redondo Beach. You are at least six blocks away from the beach. Let us look at some of the pricing action here:

Price Reduced: 06/11/09 — $569,900 to $550,000

Price Reduced: 07/29/09 — $550,000 to $539,000

Now think about this. $539,000 for a 1 bedroom 668 square foot home that was originally built in 1920! Before the Great Depression! One thing is for sure, your monthly nut is going to be much more than the current average of $1,180 for Southern California.

Today we salute you Redondo Beach with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

22 Responses to “Real Homes of Genius: The South Bay of Los Angeles. Today we Salute Redondo Beach. 668 Square Feet 1 Bedroom Home for $539,000. California Unemployment now at 11.9 Percent Officially with U-6 at 22 Percent.”

REO is renting out a whole bunch of foreclosed houses up here around Sacramento and advertising them on Craiglist.

“In Southern California we concluded that there were 40,000 REO properties in the dark shadows. These are homes with no mortgage payment coming in. ”

A number of these REOs have become rentbacks with former owners now renting them from the banks with a monthly payment they can handle – so there is some cashflow coming in, and the homes are not going into disrepair. These REOs wont be added to the inventory ranks for a long long time.

The rental market is already weak in many parts of the state so this will be interesting to follow. This is something where I would love to see how banks are accounting for these properties. I doubt that many have taken the actual write-down. In fact, this is like renting a $600,000 home for $2,000 even though the market value would fetch $400,000.

Dr. B – I hate to say it but its the best thing for us, the taxpayers, is to allow the banks to continue their shenanigans.

Remember when we commited 700 Billion to them in TARP money? The only way to ensure we get it back is to ensure they remain solvent – meaning they dont recognize the loss til on the REO the market stable.

So far it is working – see what is happening with Bear Stearns & AIG:

http://finance.yahoo.com/news/Fed-loss-on-Bear-Stearns-AIG-rb-545887451.html?x=0&sec=topStories&pos=6&asset=&ccode=

LIkewise, did you know we got all our money back from Goldman Sachs? In fact if you include the interest and premium, we made quite a mint off that deal. If the govt allows the other banks to do this (those that we gave tarp money to) we should get alot of it paid back.

So unfortunately, it behooves us as taxpayers not to see the tsunami. We became “pot comitted” once we plunked down that 700B. I for one would like to see most of it back, as opposed to having them dump all the REO on the market and we get 50cents on the dollar (right now we are averaging 124 cents on the dollar).

As a renter, I hate this. I want to see cheap prices – bigtime. But as a taxpayer, I understand it.

@GeekGirl

Spot on — It seems unbelievable, but I think Sherlock Homes said “Once you eliminate the impossible, whatever remains, no matter how improbable, must be the truth.â€

There is obviously a massive “if you can’t beat them join them” mentality out there.

Nobody goes to jail, nobody indicted. FBI told to stop looking at housing fraud and look for the fictitious character Obama Sin Laughlin. How far does the fraud go? Eve buying snake oil to get rid of cellulite and excess tummy fat, I think.

Tool shed with a bathroom for half a million. Makes sense to me…as long as it has a stainless steel toaster oven and a trendy paint job, as seen on TV.

The Japanese lost decade is really almost 20 years old, so it should be renamed “the lost score.” The US might be following in its footstep. We are importing their cars and electronics; why not import their financial situation too?

I like how the home address starts with “911” – somehow fitting since they’re charging nearly that amount per square foot (and someone once paid over $1,000!) and it also makes me want to shout “Get the Sheriff!”. I’m starting to think every Dr. HB post should begin with, “Repeat after me: House Price Bottom = Sane Debt-To-Income Ratios”.

If the banks won’t go over 38% DTI anymore, what kind of family could live in this house at $540K? Only one earning at least $135K a year – in other words – a firmly middle-class one. Is this oversold shed honestly even close to the best they could do from the proceeds of their hard work? Are two thirds of the population that make under this amount supposed to live with even less?

Absurdity reigns.

Genie, we haven’t gotten our money back from Goldman Sachs. What about the $13 billion they got through AIG? Paid out 100%? No, we got screwed big time.

If I buy this place for $500K, raze it, then build a mc mansion for another $500K, Ican sell it to a laker or dodger for $1.4M…Thats a 40% profit / $400K income in a year or so..not bad…now if i could only find that $1M I had laying around….so bay aint cheap….

This rather long-winded fellow’s video provides graphic evidence of homes being held off the market:

– Last Warning, If You Buy A House – You Are Going To Get Killed! –

a bit for those into econ and statistics:

inventory levels whether shadow or actual, don’t affect the market price at the margin. high inventory levels are the RESULT of asking prices being higher then people are able to pay, not the CAUSE of price declines. low inventory level occur when bidders are able to afford the asking prices, whether though having a job and actually being able to make the payments, or whether its from getting a crazy loan they can’t pay back. if there is only one house on the market or if there are millions, if it is priced out of reach, it will not sell until priced at what the buyer at the margin can afford to pay. price declines are realized when a house is marked to market by being sold. the more of these that are realized, the further down aggregate statistics, such as median and average sales prices fall.

I’m amazed at the prices sellers are asking and people are still paying for homes in the Redondo Beach area. The price overall in the south bay area has drop to about the 2003 and 2004 price level but some sellers are just way out of touch. Check out this property in Redondo Beach $982 per sq ft. Amazing…

http://www.ziprealty.com/buy_a_home/logged_in/search/home_detail.jsp?source=CARETS&cKey=b2n5xxjf&listing_num=V09091048&mls=mls_so_cal

Great article… love the real homes of genius… There are a lot of those in San Diego as well especially coastal.

I appreciate Dr. HB’s reasons for the bank’s REO bluff being called. Here’s another reason that could be a powerful force. Unoccupied homes quickly start to decay and attract blight. Mold, termites, rats, etc. are just the beginning (especially if the former owner trashed the place before their untimely departure). Vandalism, squatters and a rash of crime in the neighborhood will surely get everyone’s attention. Code enforcement, the cops and the HOA get involved. Before you know it, there’s no more “shadow” in the shadow inventory. The owners, i.e. banks, will start to accrue penalties in addition to their other carry costs. Banks are not structured to deal with asset ownership, much less the headaches that await them.

Those who believe the banks can play the shell game indefinitely are wrong. You cannot sustain the unsustainable (ask Bernie Madoff).

Be brave Comrades!

Shadow inventory will flood the market if the banks feel any uptick in the market. Either that, or we are in for a slew of zombie houses along with our zombie banks.

Lot values just cratered 47% on a property in Pacific Palisades over the last 2 years. The fun is just beginning to start…..

http://www.westsideremeltdown.blogspot.com

There’s a lot of psychological warfare occurring right now to convince people to buy. As a renter in the South Bay I can confirm that this specific region is filled with more hard-core Bubble Deniers than other parts of town, i.e. people who think prices are justified. And that’s fine. People are entitled to their own opinions and the market hasn’t changed yet, so the proof has yet to occur.

I think the South Bay correction largely depends on how many 2004-2007 South Bay house buyers used liar loans and toxic financing to fund their purchase. People stretched their finances very hard to live here. It’s only logical that many of them knew going in that they only had five years before they needed to sell. I’m pretty sure that not all the recent buyers were doctor/lawyer super couples. Additionally, I wonder how many longer-term residents abused mortgage equity withdrawals and soon won’t be able to meet the terms of their loans.

Indeed, there seems to be more buyers than sellers for the moment and that’s creating some spirited anecdotal evidence that prices are justified and the seasonal bump could represent something more significant. But the sales volume is very low compared to previous years and buyer/seller momentum seems poised to shift directions again.

The pivotal question will be if banks can manage the anticipated foreclosure inventory and keep prices near current levels. I’d like to have an answer to that question before I buy. The banks don’t exactly have a good track record of getting things right the first time. Bottom line, I refuse to solidify the perceived gains that current sellers are claiming. I hope others feel the same way, too, because the buyers who are in the market right now are most likely making a mistake. Impatience has its price.

Genie is completely misguided. The money that went into the bailouts will never be paid back – $180 billion for AIG, hundreds of billions for Fannie and Freddie, the car companies, and the banks. mey was right – $13 billion went straight through AIG to paying GS for bad swaps and they used that money to pay back their TARP loan – some deal there.

Now all the banks are trying to mod their crappy mortgage paper onto the goverment’s tab. That’s why Fannie and Freddie are now taking mortgage modifications with a loan-to-value ratio up to 125%. Shovel all the debt onto the taxpayer and let the bankers keep their bonuses.

Great interactive map of unemployment in California at: http://www.sacbee.com/1232/rich_media/1698037.html

I realize this is slightly off topic but I have a theory that the bubble blowers want to maintain the bubble at least past the holiday season so that we don’t get a commercial real estate melt down on top of the alt-A meltdown. Maybe the second leg down can be delayed from the fall into early 2010. If you find a link to an article that might shed light on this, please share. Cheers!

@Blutown

” Mold, termites, rats, etc…” Were you talking about literal vermin or Wall Street?

@blutown

It is amazing that seemingly intelligent people are convinced this whole thing can be shoveled under the rug and there are no repercussions. It’s like the Blair Witch movie where they keep walking across the exact same log to cross the same creek and can’t figure it out that we’ve already been here before. The most important thing is that we can pass on a country to our children where they have a chance to raise their own children…and it’s not going to happen if we stay the course. But perhaps this course of slowly drowning the middle class is preferable to sudden collapse, which is what seems likely to happen when there are too many zombies at the door. Eventually Vincent Price can’t keep them at bay any more. Everyone needs to see Idiocracy, the black-balled movie that in a humorous way explains a lot of what is going on and how the wealthy are turning us into ignorant subjects by our own choice. Unreal…but real.

Maybe in that massive RHG we can all retire to the home theater room and watch Idiocracy and Planet of the Alt-Apes on my new 1080p big-screen LCD flat panel with 240 Hz refresh. I just love my new stainless-steel popcorn maker. Somebody make another pitcher of kool-aid and open another bag of Goldman Snacks. Better get comfortable. This is going to be a long movie.

We have seen alotof lenders postpone forclosure in an attempt to delay posting them on the books. Like it or not, lenders have investors and now the Feds to answer too. So they attempt to negotiate with borrowers through loss mitigation and modifications in a two fold attempt to “stay” forclosure proceeding.

Leave a Reply