Real Homes of Genius: The Height of Insanity. Pico Rivera Home Taking Prices Back to 1995.

At this point seeing housing prices drop isn’t a shock. What should be a shock and revelation to everyone is the extent of the damage the bubble has caused in certain areas. This trauma can only be measured now that we are seeing foreclosures spring up and we are realizing what peak prices were paid for tiny homes that really did not deserve to be any where near the top price. No one will really uncover every single case of fraud during this epic boom. This kind of fraud is a crime of opportunity and criminals donned a suit and ripped off thousands of people only to do it once again. Now we are starting to hear stories about these same people changing shop and now becoming “foreclosure specialist” and taking more money of an already distraught populace. The FBI should go after these people and raid their bank accounts.

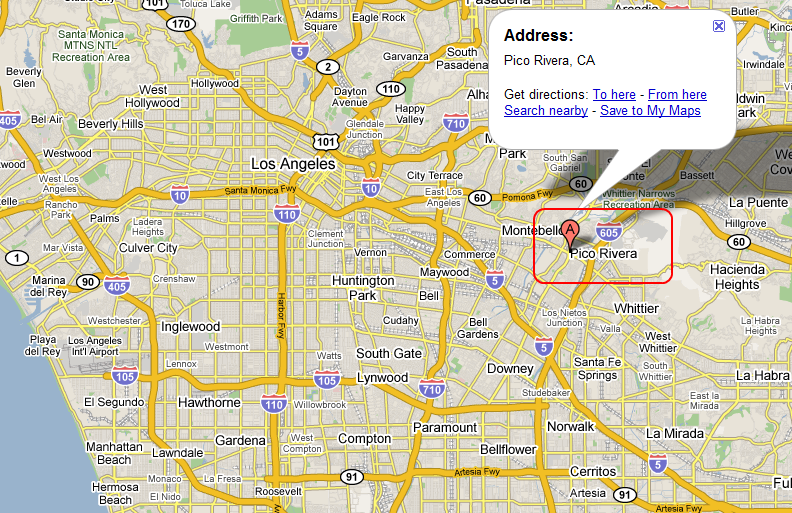

The Los Angeles housing market has been ripped to shreds with this housing debacle. There is simply no other way to describe the carnage. When you see prices falling 38% from their peak in one year you know something is changing drastically. No one has been left immune from this including once nighttime sidekick Ed McMahon and his Beverly Hills mansion.  Today we are going to look at a home in a lower-income area in Los Angeles County. Today we salute you Pico Rivera with our Real Home of Genius Award.

Real Home of Genius – Peak Price

Pico Rivera is located southeast from the downtown of Los Angeles. Pico Rivera is your common working class L.A. city with 64,336 people calling the city home. The city was named after PÃo Pico who was the last Californio governor of California. In 1982 Northrop Grumman purchased a former Ford plant. Years later in 1988 it was revealed that much of the work on the B-2 Spirit bomber was completed on the site. This location now has a WalMart and Lowes. How times have changed.

The current median price for a home in the city is $315,000 which is down 28.4% from a year ago. Even at these levels, it is still too high. The median household income for a family in the city is $41,564 according to the 2000 Census. Given that wages have remained stagnant for the region, I would imagine that not much has changed since then. After all, you go from replacing a Ford plant, to a Northrop Grumman plant, to a WalMart. This is a microcosm of what is occurring in places in Michigan except here in L.A. The only difference here is there a large enough population to keep the consumption going. That is until this bubble burst.

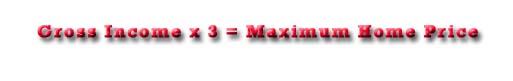

As I discussed in a previous article, the most someone should spend on a home is 3 times their gross income on a mortgage. Here is the simple equation again:

Now given this equation, if we are to take the median income family we would get the following:

$41,564 x 3 = $124,692 Pico Rivera median home price in sane world

So the current median price of $315,000 is still absurd and demonstrates a willingness of people to still over pay even in the current climate. Take a look at this home in the city that exemplifies this insanity:

This stunning 744 square foot home has 2 bedrooms and 1 bath. It was built in 1938 although the peak price would make you think it was last sold in 2038. The home has been on the market for 113 days with no action. Time to reduce the price a bit:

Price Reduced: 09/03/08 — $189,900 to $174,900

Nice movement. Let us take a picture of the backyard before we decide on whether this is a good deal:

The ad tells us “lot all dirt” which we can clearly see for ourselves. We are also told in the ad that this place has “high ceilings.” Oh yeah. You have to be high to believe that. At least they tell us in the ad that this is a major fixer. Take a look at the inside:

Again, are these photographs going to inspire us to buy? Before you start feeling sorry take a look at the sales history on this place:

06/13/2008: $169,400 *

12/12/2006: $425,000

02/03/1995: $105,000

The June line item is simply the lender taking this place back. Take a look at the peak price. $425,000 for a 744 square foot home in Pico Rivera! This 744 square foot home! Which lender made that absurd loan? Paulson should flat out reject the entire institution on the basis of this one bonehead decision. Really, an area with a median income slightly over $41,000 is seeing a 744 square foot home sell for $425,000. This wasn’t even two years ago. This home is the epitome of a Real Home of Genius.

You may be thinking that the price now makes sense. It doesn’t. Keep in mind that Northrop Grumman when it was working on the project employed an estimated 13,000 people. These were high paying jobs. Do you think someone working at WalMart or Lowes can afford a $174,900 home? Would they even want to buy this place?

As an investor, why would you even buy this place? Keep in mind a similar rental to this place would go for $950 a month even after the stunning 59% price discount or a loss of $250,100 in less than two years. The numbers at first glance seem appetizing. That is after you run the real figures:

Monthly Rent:Â Â Â Â Â Â Â Â Â Â Â Â $950

Principal and Interest:Â Â Â Â Â Â Â $978 (7.5% with 20% down investment property)

Taxes and Insurance:Â $182

Misc Expenses:Â Â Â Â Â Â Â Â Â Â $95

Monthly net loss:Â Â Â Â Â Â -$305Â FAIL

Downpayment:Â Â Â Â Â Â Â Â Â Â $34,980

Mortgage Amount:Â Â Â Â $139,920

This home fails on every front. Today we salute you Pico Rivera with our Real Homes of Genius Award. Â

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Â

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

10 Responses to “Real Homes of Genius: The Height of Insanity. Pico Rivera Home Taking Prices Back to 1995.”

Dear Dr Housing Bubble,

Its heartening to see that you are impressing upon readers the importance of housing not being any more than three times the household income. This will only happen when Californians decide land use regulations must change to allow more affordable supply.

With this example you provide – it is really a teardown – and is only worth its land value, whatever that might be. The land value cold be calculated by allowing for the construction of a reasonable standard new house – and assessing what the replacement house / land package should be worth. The land would be the residual amount.

So this teardown is still grossly overpriced.

Hugh Pavletich

Co author – Annual Demographia International Housing Affordability Survey

Christchurch

New Zealand

Well, at least there aren’t trash cans in the pictures this time.

Dr.,

You are dead on by pointing out the shift from Ford->Grumman->Walmart. We’ve moved from producing goods to simply selling crap to each other. High paying jobs replaced with retail clerks. My business suffered through the devastating loss of these positions back in the day. Seems to have finally caught up with the country as a whole as we’ve outsourced/off shored our production on a massive scale and moved to a consumer society.

Doc, one of the best RHOGs you’ve given us. It seems you’re pretty busy these days, but just wanted you to know that I look forward to your posts.

Now after the election, hopefully once the pageantry dies down we can focus on actual policy decisions once we know what the political landscape looks like. I really would like to see some concrete plans finally discussed in the media, instead of the BS that has nothing to do with the real problems in this country.

As punishment to the bank CEO and loan officer that agreed to finance this house for $425,000, they should be forced to live there under house arrest for a time no less than 1 year, and no modifications are to be made to the house during their stint at the residence.

I guess the taxpayer will be paying 400K for homes like this one.There is no way in hell the prices for homes like this RHG will appreciate back up to 400K for at least another quarter century when inflation is running rampad. The only way to recover losses on this one is by discovering oil under it.

Hey doc, great article as usual. But as you addressed in the comments of a previous post, the 3x salary rule applies to mortgage value. At this point, getting 0% down is highly unlikely. Even a 10% down could be tough for the kinds of work that would pulling the area wages (manual labor, office drones, etc., with little in the way of advanced skills to maintain a recession-safe position). So if we assume a $40,000 and a 20% down payment, that’s closer to $160,000. But that’s also making the presumptive leap that median wages are fit to buy houses. Pico has a lot of slummy areas pulling those median wages down. It may very well be that poorer areas with a lot of renters (like in the towns surrounding the 22 freeway in OC) might have housing straddling a higher wage percentile than the 50% line. Or so I would expect.

.

Well, I suppose those prices might be pulled down farther as people making high enough wages to go somewhere nicer exercise that option. (although that may take a while given the unlikelihood that buyers from the last decade can get out with a substantial loss)

Nice to have you back, Doc.

What’s really disturbing to me is McCain’s oft-blurted “idea” to have “the government buy up all these bad mortgages.” I guess this is a new way of buying votes — have taxpayers buy your fradulently-obtained overpriced house for you!

If this house were still occupied, that would mean that its occupants would apparently get to keep it while the taxpayers make a balloon payment on their behalf of $300K.

What’s next? Introducing a new character on the campaign trail: “Joe the Shady Appraiser?”

I agree this one’s a dog, but when figuring the attractiveness from an investor’s POV, you have to figure net cash flow, and that means you have to work in the depreciation. Writing down 170.000 over 17 years gives an additional $800+ a month to shelter income.

Keep it real.

Nice to hear from you Doc. Seems all but those on this post can’t understand why they can’t have something for nothing.

>

Teaser rate loans that reset only after considerable appreciation allowing a kick back on the third for a nice trip to the Bahamas or a flat screen TV. Job base is gone too.

>

Either presidental candidate making promises they know they can’t keep. Ron Paul is one of the few that speaks openly about our problems and he is considered a nut case.

But then again, why not? See what the bonus money will be for the bankers we bailed out?

Leave a Reply