Real Homes of Genius Special Edition: Today we Salute you Southern California. 6 Counties and 6 Homes.

Dreams do come true. In the ongoing saga of Ed McMahon’s housing troubles on his Beverly Hills home, yesterday Ed’s realtor stepped up to plate asking for someone to come purchase the home before it would be foreclosed in the next two weeks. Well as it turns out none other than real estate mogul Donald Trump will be purchasing the home according to the L.A. Times. The agreed upon price is currently undisclosed but Ed has lowered the price on the home from $7.7 million to $4.6 million. Either way, we’ll find out soon enough what the agreed upon price is. The Donald does have a sweet spot for the 90210 zip code.

Today in a very special Real Homes of Genius we are going to look at the 6 counties that make up the Southern California market and give you a taste of what is happening on the ground. These homes will range from super prime homes to something akin to the $1 home that sold in Detroit:

*Source:Â Zillow

You’ll love the aerial satellite view from Zillow before the place was stripped naked like a Playboy photo shoot. This may in fact be the ultimate Real Home of Genius and you can only imagine the face of the agent receiving the whopping 6 cents in commission. Now on this home we can say that it was worth every penny. People forget that these homes may have unpaid taxes, major repairs needed, and also may be more of a burden than anything else. You can be the judge of that. Detroit has many homes that are practically being given away just to get someone to move in.

In Southern California some people are still in delusion land and think that the housing correction is only a minor bump in the road. A speed bump in the infinite pursuit of unlimited appreciation. This is the psychology that is still prevalent in the market. The market seems to be at a standoff between those that believe the bottom is not yet here and those that think now is the time to buy before prices skyrocket once again. I tend to believe California won’t see a bottom for another 3 years and prices will fall overall by at least another 20 to 30 percent.

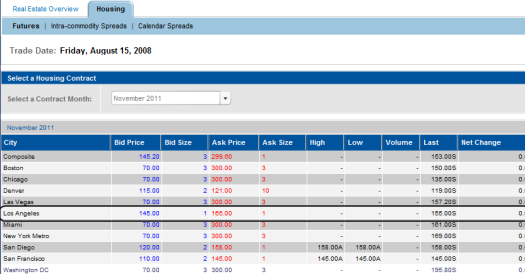

This isn’t some random theory. The Case-Shiller Index currently has the L.A./O.C. index at 198.59. The last sold future contract for November of 2011 sold for:

Someone is actually making the bet the Case-Shiller index will fall to 155. That translates into an additional fall of 21.9% for the entire region. These are bets that are made with real money. Clearly the line in the sand is being drawn. I think those making the bets for stability are vastly underestimating the explosive toxicity of the pay option ARM fiasco that will commence this forth quarter and will hit full stride in 2009.

So let us now salute the 6 counties that arguably are the most overpriced counties in our country. Today we salute you Southern California with our Real Homes of Genius Award.

County #1 – Los Angeles

Population:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 9,948,081

Area Spotlight:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Toluca Lake

Median Price zip code:Â Â Â Â Â Â Â Â Â Â $862,000

What more can you ask for than having NBC-4 weatherman Fritz Coleman as your honorary mayor? This small community of 16,978 people is between the city of Burbank and North Hollywood. The Santa Monica Mountains surround the area of Toluca Lake and provide one of the nicer areas of Los Angeles.

Toluca Lake even though it is considered prime, has not been immune to the housing bubble busting. The area’s median home price is now down 16.6% when it flirted with the $1 million mark. This 6 bedroom and 7 baths home provides a lake front view (hat tip L). You are going to love the view since it is going to cost you $6,650,000. Now before you go to your IndyMac FDIC taken over account to put down a earnest money deposit on this place, you may want to look at the pricing action:

Listing Price History

Date               Price

May 23, 2007 $8,795,000

Jul 10, 2007 Â Â Â $7,795,000

Oct 17, 2007 Â $7,100,000

Feb 16, 2008 Â $6,650,000

This place has been on the market for 450 days and has seen a reduction in price by a stunning $2.1 million in one year. Now that is a true discount. But is it? Let us look at the previous sales history on this place:

Date               Price

Jul 31, 1991 Â Â Â $1,200,000

Apr 09, 1999 Â $1,090,000

This place actually sold for a loss in 1999! Even given the current selling price, we are talking about a $5.5 million gain in 9 years. Now that is what we call high hopes.

County #2 – OrangeÂ

Population:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 3,002,048

Area Spotlight:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Newport Beach

Median Price zip code:Â Â Â Â Â Â Â Â Â Â $1.85 million

Just because Kobe Bryant lives in Newport Beach doesn’t mean all homes will sell for multi-millions. At least that reality is coming home now. It was thought during the days of housing bubble lore, that simply buying in Newport Beach meant you were going to be a millionaire with enough money for you to create your own rendition of Redline the movie.

This above home is amazing because who would of thought steel gates would be abound in a community with a $1.85 million median price. This 3 bedroom and 2 bath home is a nice starter home for any would be millionaire. This place is on the market and is a foreclosed home. A foreclosed home in Newport Beach? That is correct. The current list price for this home is $1.2 million. Not bad right? Well let us look at the previous sales history:

Sale History

12/21/2007: $949,900 *

06/27/2006: $1,477,000

The $949,900 price tag is simply the lender taking the place back. The more important price point is the $1.47 million. This home is already selling at a major loss since who only knows if there were second mortgages on this place that are now wiped out. Given the current market and lack of movement on this place, the current $1.2 million doesn’t seem to be wetting the appetite of many. At what price will this home sell? And when it sells, you can rest assured that median price is going to head lower.

County #3 – Riverside

Population:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2,026,803

Area Spotlight:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Riverside

Median Price zip code:Â Â Â Â Â Â Â Â Â Â $300,000

I love trash can real estate photography. You almost expect Oscar the Grouch to pop and say, “buy me, buy me, buy me!” Riverside is being hit hard by the housing crisis. This zip code is now down 36.6% on a year over year basis and once we go into the details of this Real Home of Genius, you will know why. This 5 bedroom 4 bath home has been on the market only for 3 days at least according to the MLS data. The current list price is $794,900. Is this a deal? Well let us now examine the previous sales history to find out:

Sale History

07/25/2008: $750,000 *

03/21/2007: $1,200,000

04/30/2002: $635,000

Again that $750,000 is simply the lender taking the place back. With the current sales price, it looks like the lender is simply trying to recoup part of the first mortgage. This place sold at its peak only last year for $1.2 million. If you do the math on the current discount, it works out to be approximately 33%. Lenders are paying attention to the current market price and are cutting prices to reflect this. A $400,000+ discount is not a bad deal. That is, if someone even has the money to buy this place in an area where the median priced home is $300,000! Do you see why this bottom is nowhere insight?

Until we start seeing housing glamour shots, we are nowhere near a bottom. I’ve seen places in the Midwest where lenders take the time and meticulously arrange homes to sell for $200,000! Here for a $794,900 home they can’t even move the garbage and recycle cans out of the way.

County #4 – San Bernardino

Population:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1,999,332

Area Spotlight:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Fontana

Median Price zip code:Â Â Â Â Â Â Â Â Â Â $321,000

Don’t you love model homes? I would get tons of brochures about these places during the boom. San Bernardino and Riverside counties make up the Inland Empire. These two areas have been absolutely slammed by the housing correction. Yet as you can see with L.A. and Orange counties we are simply a year away from catching up as well.

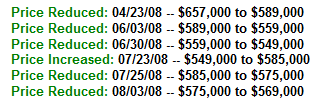

This above home is one reason why Southern California was the epicenter of the housing bubble. This 4 bedroom 4 baths home have been on the market for 115 days. Currently the list price is $569,000 which is high for an area with a median priced home goes for $321,000. This zip code has fallen 25.5% in the last year. The current list price may not be such a good deal:

The listing description tells us this is a short sale but the MLS data is stating that it is a foreclosure. I would venture after looking at the sales price that this is a foreclosure:

Sale History

03/14/2006: $875,000

A 34% discount in two years. This is why the Inland Empire is having so much pain. Also given the still high price of fuel, who is willing to commute 30 or 40 miles into OC or L.A. county for work?  The numbers simply do not work. The incomes in these areas do not remotely reflect the price of some homes.

County #5 – Ventura

Population:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 799,720

Area Spotlight:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Newbury Park

Median Price zip code:Â Â Â Â Â Â Â Â Â Â $699,000

This home should be called “when refinancing goes wrong.” This home is located in Ventura County in the city of Newbury Park. Newbury Park has seen a 15.7% yearly decline in their housing prices and this is one of the more prime areas of the county. This home above is a 4 bedroom 3 bath home with apparently dry grass. This is an REO and is currently on the market for $875,900. This home simply by looking at the sales history, we can tell that this was a refinance machine:

08/01/2008: $700,000 *

07/27/2006: $296,695*

11/07/2005: $163,000

Again, the August number is simply the bank taking the place back. But between November of 2005 some $500,000+ in who knows what of mortgages was attached to this place. Normally the banks take back the REOs should their be no matching bid at auction for the face value of the first mortgage. The 2006 price was probably a refinance and given the 2008 number, this place was a mortgage equity withdrawal machine. Don’t you wish you lived in California so you can max out your home, suck out all the equity, and let the bank take back the place? A salute to you Real Home of Genius in Newbury Park!

County #6 – San Diego

Population:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2,941,454

Area Spotlight:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Poway

Median Price zip code:Â Â Â Â Â Â Â Â Â Â $550,000

Our final stop takes us to Poway in San Diego County. San Diego was the first county to falter during the Southern California bust. It appreciated the quickest but also fell first. This 4 bedroom 2 baths home in Poway is another example of the hyper bubble here in the Southland. First let us look at the sales history action:

07/16/2008: $293,203 *

11/06/2006: $498,000

12/08/2000: $225,000

The bank is going to take a major hit on this one. The current list price is $320,000 and is sold “as-is” which you are going to see a lot of in the months to come. The peak price of $498,000 is absurd and even the current price of $320,000 is the lender simply trying to get out as soon as possible.

So there you have it. These 6 counties have a combined population of 20,830,000+ and still have prices that reflect very little of the incomes of those in the areas. California is years away from the bubble. Need more reasons than the above examples? Read 10 reasons why we are on the verge of flying off the diving board into the housing abyss.

Today we salute you Southern California with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Â

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

19 Responses to “Real Homes of Genius Special Edition: Today we Salute you Southern California. 6 Counties and 6 Homes.”

First, it looks like Riverside and Ventura counties have run out of green paint. How else could you explain brown grass. That home in Poway should be listed as having a low-maintenance, water-saving yard. You don’t have to mow dirt!

Second, the price on that home in Newbury Park in Nov 2005 doesn’t sound right. I don’t think anything other than an empty lot sold in So Cal for that amount in 2005.

Third, Toluca Lake is not that great, unless you like living next to the 101 & 170 freeways.

Back in the 1960’s homes in the SF Bay Area or Los Angeles had about a 20% premium over equivalent homes in Eastern cities. Thus a new 3 br 1 1/2 bath tract home in Santa Clara County would run about $30,000 in 1965 whereas a similiar house in Fairfax County would cost about $25,000.

Over the years that premium has grown until it is no longer a percentage but a multiple for a LA or Bay Area home. Some of this could be attributed to population growth but not all. California did double in population over the intervening years but so did, e.g. the Washington metro area. California does have a better climate than do eastern cities, or should I say did, because it is one thing to extol the climate of Santa Barbara or Marin and quite another to try and convince people that San Bernardino or Sacramento are blessed by nature as they more closely resemble Dallas than coastal California.

Therefore something other than ‘demand’ has been at work to turn those $30,000

tract homes in Palo Alto and Marin into million dollar properties when their Washington equivalents topped out at $400,000 or so. If the Bay Area has been afflicted with environmental, zoning and geographic limitations the same can’t be said of SoCal. Urban sprawl was invented in Los Angeles so its not simply a matter of no available land sparking the humongous appreciation in property values over other areas of the country.

Truly it has been a ‘real estate’ psychosis that afflicted Californians and it didn’t start in the 21st century. There was a boom in the 1970’s that sparked Prop.13

as a reaction to soaring real estate assesments. That boom ended when interest

rates soared into double digits but as soon as financing became possible again so did property inflation in California. What is worse, the California psychosis went national in this latest boom spreading to states that had never been prone to residential real estate speculation.

One wonders after this, if we get through this bust with our shirts, if the California

induced real estate fever of the first decade of the 21st century will become part of American folklore much as the 1849 Gold Rush has. People then probably did not think of themselves as being part of an historic episode. Merely trying to strike it rich same as real estate speculators of today were.

Our favorite CA congresswoman is back.

http://www.latimes.com/news/local/la-me-richardson15-2008aug15,0,912962.story

She can go ahead and DIAF as far as I’m concerned

I was wondering if anyone heard Alan Greedspan spilling his opinion that the solution is to relaxing restriction on immigration for skilled workers. His solution is bring enough people to increase demand for housing. He blames the economic woes on tighter restriction of immigrations. How long is this freakin guy going to live?

Great post! And since you mentioned real estate agents and glamour shots, can you please (please!) tell me why so many listings on the MLS have a shot of the bathroom with the toilet seat up?

Thanks for another good post Dr.

>

A good article on the New York Times website. Law school professor quoted as saying “That ‘unused home equity in your house? Put it to work for you.’ †“Doesn’t that sound financially sophisticated?†Not to Professor Warren. “Put it to work,†she said, is just a euphemism for borrowing.

>

Guess we are all suckers for advertizing… kids to adults. Been a die-hard capitalist my whole life. Guess I am wrong… we all have desires we can’t control. Yes, there are many “flippers” out there, but many were just homeowners trying their best to raise their families and fell for the slick sales pitch. Just like a line of cocaine… you know it isn’t right but it feels so good!

Now the spin is the bottom to the housing market. The economic cheer leaders on CNN and CNBC would sure like us to buy into it.

Dr. Greedscam has performed a necessary function by advocating more immigration to prop up housing prices. He has laid bare the true motive of our upper-class politicians in allowing this country to be inundated by immigrants when we are already in population and resource overshoot, and unemployment in soaring- our politicians want a swelling population to enrich the top 1% of the population by providing cheap labor and markets for overpriced goods, including houses, while our resource problems grow.

After hearing the good doctor, we cannot pretend that the Republithugs are on our side anymore than the Dummycrats.

Both parties pander to the worst elements in their respective constituencies while promoting policies that are very destructive to the population as a whole.If there is anything this country does NOT need, it is a larger population. We are now confronting not only depleting oil supplies, but mounting shortages of fresh water and arable land, and yet our masters advocate more immigration?

You know the line, if you don’t believe that this is how capitalism should work, then you are not a patriotic American. Hence CNN & CNBC’s spin keeps on rolling. This would even give Gordon Gekko nightmares

I see a problem with some this. At some point we could see housing/homes selling for less than they could ever be built. So when the supply starts to dry up and builders are encouraged to really start building again how are they going to justify much higher prices for the homes they build? Remember, the cost of materials is constantly going up and it will not be coming down—ever! China and India will see to that. Affordable housing a myth. For those that can’t afford a home what’s next? Government housing?

Great post Dr. HB. As a housing bubble schadenfreuder I have enjoyed your site for well over two years now.

If Americans were stupid enough to give Greenspan or any “economist” free reign to enact policy (more than we have), I *shudder* to think how bad off we’d be. Econ’s are no better than a village witch doctor, and the reverence with which CNBS and Bloomie treat Fed Reservists (Inc.) must mean they are very afraid of bad juju or bod mojo or voodoo or something if they ask difficult questions.

@oilwelldoctor-

I think you notice what I have, that it was not just advertising but entire television programs played a significant role in the runup of RE (and they still are). Both in England and here in the states the flipper shows are very popular, and the advice given in both places suspect, as it always assumed- you guessed it- RE prices would only go up. The mere fact that people cashed in their perceived equity to buy 1080p/720p so they could watch more of that crap is a modern O. Henry twist that I fully appreciate (“enjoy”).

Free advice: worth every $0.01

I think Greenspank would LOVE to have someone else blamed for his failure.

RLJ I forwarded link to Drudge Report.

There is no way the Ventura County, Newbury Park house has the correct price for 2005 & 2006. A small condo in that area goes for $500,000 during those years. Those figures are just not correct because there would have been a line for miles to purchase that house for that price and that area.

Realty Trac shows that Sacramento CA has a over 12 000 Foreclosed

Homes on the market.

Since I don’t have time to sift thru 12000 listings I couldn’t tell you how

many are just Notice of Default.

A quick check into the “cheap” sector showed that there are around

4000 homes for Sale that are in the 100K or less range.

There is really no telling what the criteria is anymore… you can pick

up a 500 sq. ft. cracker box for 80K that is listed in the same bracket

as a 3 bdrm. 2 bath, 1300 sq. ft. home for the same price. So.. that tells me

that the REO’s are flooding the market

Too bad I can’t stand the thought of living in Sacto…

Oh well… I will just wait until “my market” decides to give in and come

back to earthly levels.

Sacramento is only 30 miles away… I am sure the pressure will catch

on in our area soon. But right now they are still trying to make a buck

around here and the only reason why there is no mass migration to Sacto.

yet is that a 30 mile commute one-way can seriously kill the budget

around here. (Gas here is still anywhere between 4.09 to 3.99)

Homebuilders just might have to accept narrower profit margins than the 50% margins they became accustomed to in the boom years. They might have to accept the margins that were typical in the 40s, 50s, and 60s, if they want to remain in business in an era of rising materials costs and shrinking incomes.

We might see the end of the large production home builders and the re-emergence of local small builders, who will work for less. My guess is that the “factory” method of building homes, where thousands of homes were set down at once as though they were squeezed out of a giant cookie press, will not survive, and that houses will be built only in response to existing demand. There will be the natural push-pull between supply and demand, but you will not see entire new towns created by one developer in the space of a year, for this sort of thing was made possible only by public policy that wanted to create a demand for new homes and build new towns. Rather, we will see houses built individually, and for modest margins.

Laura your comment about home builders is spot on. I remember during the boom builders were changing the signs on their developments sometimes on a weekly basis. From the 280’s for a still being built townhouse became ‘from the low 300’s ‘ in a month or two. Also the waste was incredible. I don’t see that now in the few homes still under construction. Six foot lengths of 2X10 are not thrown in the dumpster, leftover brick is collected instead of just being bulldozed into a pile as waste and the signs are being changed in the reverse direction. As a note aside, the idea that gas prices will limit the development of exo suburbs. I’m no longer so sure. Reading about the Chevy Volt, due to hit the market in 2010, the cost of operating an electric car is very low. Problem is range. The Volt will only go 40 miles on a single charge but it only costs 2 cents per mile at 10 cents

per Kilowatt hour to operate! Imagine that. 40 miles on an 80 cent charge. Extend the range on these electric cars and commute costs will be negligible and time will once again be the only constraint on where one chooses to live.

Beginning of July 2008, BofA CEO Ken Lewis predicted another 20% drop in prices in California. He also said that BofA plans to help 250,000 Americans stay in their homes.

I watched House Financial Services Committee Chairman Barney Frank (and Rep. Maxine Waters and others) on CSPAN questioning MBIA, Wells Fargo, Bank of America, Hope Now, and I think a loan service company or two, if they had the authority to modify loan terms. It took forever before the guy from BofA said, yes, we have the authority to modify terms. First they would go for lowering the interest rate. When asked if they had the authority to reduce the principle, again, it took forever before they finally said that, yes, they had the authority to reduce the principle, but they would go for lowering interest rate first. If they are that resistant to just answering the question, I imagine it’s going to be very difficult for them to accept reducing principle as a viable solution.

Unless banks/investors are willing to reduce the principle to market value, I don’t see any incentive for a borrower to keep paying for a loan that is twice the market value of the home, and therefore hard to see how BofA can help 250,000 Americans stay in their homes.

We’ll see how it plays out as the option arms hit their negative amortization caps (happening now) and interest rates reset (peaking fall 2011). Congress can’t force the banks/investors to modify terms, they can only ask them to.

Either way, whether modifying loan terms to reduce principle to market value, or foreclosing on the property and reselling at market value, prices will continue to decline here in CA.

I’ve been too lazy to do the requisite calculations, but I’m idly wondering just what 200 million electric cars and trucks,driven as many or more miles as right now, will do to our already-stressed electrical grid.

In coming years, starting right now, we are going to have to move as much of our public intercity and long-distance transportation, including freight hauling, to electric as possible. Much more freight will have to move by rail for max efficiency and affordability, or we will find ourselves without the shipments of food and goods we currently rely on. Additionally, the passenger rails will have to start replacing air travel for shorter (under 700 miles) distances, for the airline industry is substantially over. We’re throwing $14 B a year in subsidies to airlines that will cave no matter what- they can’t hack these fuel prices.

Now, the grid is already stressed- we are talking no excess capacity whatsoever. The utility people call this “maximum efficiency”. The denizens of CA have some experience with that. Moreover, one denizen of the east coast pointed out that fuel oil is now so expensive that in the northeast, which is dependent upon fuel oil for heat, many folks are switching to heating their houses by electric space heaters and by leaving their electric ovens on all day- a horrid, inefficient way to heat a house but still cheaper than fuel oil.

I can only say that if we expect to be able to put anything like our current fleet of cars on the road by means of electrical power, we had better ramp up the nuclear power program plus every alternative we can think of. We have 3 nukes under construction, old fashioned light water reactors, and 33 in the planning stage. A really promising new nuclear technology, now being contemplated for Galena, Alaska, to test the prototype, has been developed-much safer,much more efficient, and vastly more “scalable”.

I personally don’t see us being able to run more than a fraction of the private autos now in service by electric, at least not for quite some time. Expect electric rates to escalate even more rapidly and for more brownouts to occur should we start rapidly adopting electric cars, as opposed to public transit and walkable communities.

Laura,

Charging electric cars is actually not as big a problem as you might think. Most of the charging would happen at night, when electrical demand is naturally lowest. Electric cars would have to become a pretty high percentage of the fleet before the existing excess off-peak capacity was insufficient.

Leave a Reply