Real Homes of Genius Special Country Edition: Examining the 7 Hardest Hit Metropolitan Areas. 7 Home Foreclosures That Make you say Hmmm. IndyMac Bank and Reaching the Untouchable Shady Borrower.

As October came to a spectacular end, the housing market is still in severe distress. You would think that all the massive government intervention would at least do something in regards to stabilizing prices but unfortunately for Uncle Sam, prices are determined by local area incomes and fundamental factors. The massive economic intervention which has taken the form of billions in capital injections to banks has yet to see massive purchases of toxic mortgages. You may be asking yourself like the diligent citizen that you are, what are some local area factors in determining household prices:

(a)Â Household incomes

(b)Â Neighborhood safety

(c)Â Schools

(d) Â Employment outlook

When you look at the above 4 items, you quickly realize that the government intervention does nothing to address any of these. First, pumping money into banks will not increase the household income of families. Next, neighborhood safety or quality of life issues will have minimum impacts based on this massive bailout. Many schools derive their income from local property taxes so a declining market hurts their budgets. And finally, the market intervention does nothing to the overall employment outlook unless you are one of the few banks that can go to the U.S. Treasury and get a government sponsored corporate welfare check.

Banks are hoarding the money because in order for them to make loans, they need a qualified populace. The government can scream all they want but responsible lenders, the few that are out there don’t want to give money with no standards and return to the genesis of this economic crisis. One of the new measures is massive loan modifications. But in the world of unintended consequences, many borrowers don’t want their loans modified! Why? It is hard to determine how many people bought homes with the idea they were going to flip the property for a nice sum of cash. They may have no intention of staying in the place. IndyMac Bank, now under the auspices of the FDIC is trying a massive loan modification program. There’s only one significant catch. People aren’t responding! Bwahahaha!

“(L.A. Times) But of the 35,000 seriously delinquent IndyMac customers who were sent letters about the possibility of such modifications, more than half have yet to be heard from, officials said this week.”

And this isn’t for lack of incentives either:

(a)Â Reducing the borrower’s interest rate to 3%.

(b)Â Extending the loan terms to 40 years.

(c)Â Waive a portion of the interest on the mortgage.

Where do I sign up? I’d like to put some my investment properties under these terms. Unfortunately, I pay on time and have not been late so I guess that excludes me. If you own your home and pay on time, wouldn’t you like similar terms to the above? Those numbers look like a beautiful coastal sunset yet some people have their eyes closed. Yet the government is saying sorry, you are prudent and responsible and unlike aspiring flippers or Wall Street gamblers you did not take unwarranted risks therefore you get to sit back and watch your money be squandered.

Therein lies the rub. The government is operating under the impression that people will “do the right thing” and fight to stay in their homes. However, many of these people flat out lied on their loan applications with the help of mortgage lenders, both complicit to varying degrees, and entered into the deal together. Even back on June 1st of 2007 I reported that there was a survey that found that 50% of stated income loans had incomes with 50% or more of their household income inflated. This had nothing to do with some government mandate forcing poor people to buy homes. This in fact was greed on many levels. Therefore, you have a massive amount of no documentation loans that from day one started on false pretenses and included both poor and rich alike. If the loan started out on a massive lie, who is to say what the intention of these folks is? Maybe the borrower was a suburban couple who watched too much HGTV and thought they could flip a home. Heck, each week we saw a new group of aspiring flippers on shows like Flip this House and most of the time they were middle to upper class folks. If they got in way over their heads, why would they want to stay in that home even on generous terms?

You also have to think like a shady person. Lying on a mortgage application is flat out fraud. Now, IndyMac Bank which is under the FDIC, a government backed institution is trying to get a hold of you shady borrower. You know you lied and committed fraud and now you’re getting a government letter? Hmmm, guess how a few of the borrowers are going to respond? They’d rather let the home foreclose and be gone. The government’s premise is that fraud isn’t as rampant as I think it is. After all, much of the fraud can only be seen after the fact. That is why it is fraud! There isn’t a housing fraud data bureau. Yet anyone with an ounce of common sense could see what was going on. Especially in places like California where IndyMac made a large amount of loans fraud was the case and not the exception.

In this article, we are going to look at 7 of the hardest hit areas in the country and also give you 7 home examples that put this housing bubble into a nationwide perspective. Some readers think that only California and Florida had delusional and greedy people. Too bad greed is a global human vice. Today we salute you America with our Real Homes of Genius Award.

A Real Country of Genius

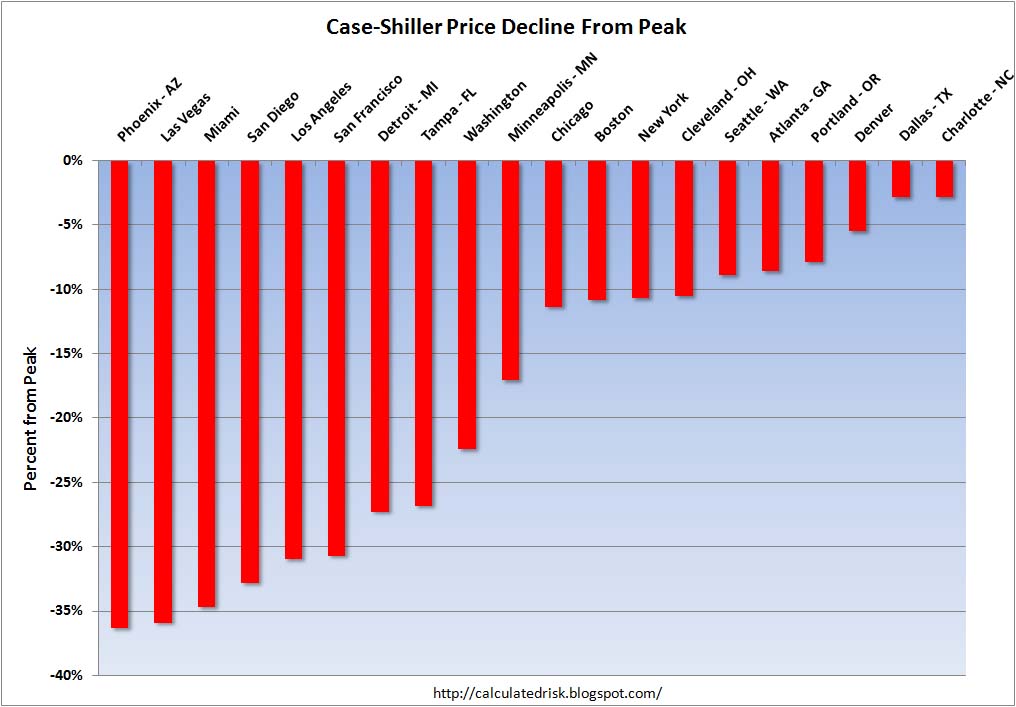

First, we will be going by the Case-Shiller metro areas. This monthly report is one of the most widely used housing health indicators since it tracks same home sales over a period of time. Unlike most reports that look at monthly sales and then the current monthly price, this report tracks the same home over time. Some have been critiquing the median prices as an overall indicator of market health but even looking at other measures, the housing market is very unhealthy and in need of help. Let us look at an excellent graph put together by Calculated Risk:

*Source:Â Calculated Risk

From this list, we will be looking at the following areas:

(1)Â Phoenix Arizona

(2)Â Las Vegas

(3) Â Miami

(4)Â San Diego

(5)Â Los Angeles

(6)Â San Francisco

(7)Â Detroit

It is stunning to see that the top 5 declining areas have seen prices decline from their peak by over 30% and in 2 cases, by over 35%. All 7 areas above have seen prices decline by 25%.

Let us now look at each individual area and give you an example of what kind of insanity took place during the height of the housing bubble.

Area #1 – Phoenix, Arizona

Decline from peak:Â Â Â Â Â -36.3%

Peak reached on:Â Â Â Â Â Â Â Â June 2006

Peak sale price on home:Â Â Â Â Â Â Â Â June 2005 for $340,000

Current list price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $189,900

Phoenix Arizona is the epitome of the housing bubble. Builder after builder erected enormous McMansions thinking this housing bubble would last forever. In few other states can you find this many oversized McMansions that are selling now at fire sale prices. The Inland Empire in Southern California is a touch of Arizona for those who never ventured out of the state.

The above home was built in 2004, has 4 bedrooms and 2 baths, sits on 2,190 square feet and as you can see from the picture is a good sized home. This home is currently foreclosed and selling 44% below the peak price. Only one small and tiny problem. The employment situation in Phoenix is poor. This of course is dragging the housing market down while many McMansions sit empty. Prices are coming down hard and until the fundamental factors improve, this will continue to be the case.

Area #2 – Las Vegas, Nevada

Decline from peak:Â Â Â Â Â -35.8%

Peak reached on:Â Â Â Â Â Â Â Â August 2006

Peak sale price on home:Â Â Â Â Â Â Â Â October 2006 for $315,000

Current list price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $172,900

Las Vegas, the neighbor of Arizona always has a flavor for the get rich quick dream. Why keep gambling inside of air conditioned casinos when you can easily gamble on McMansions galore? Many people left the penny slots to go flipping in sin city.

The above home has 4 bedrooms, 2 baths, and sits on 1,890 square feet. Built in 2004 (see a pattern here) this is a nice place. But again, the major caveat is employment!  The local household income is $67,000 so the peak price of $315,000 never ever made any sense. It put the home to income ratio at 4.7. The current income to home price ratio is now at 2.5 which makes a bit more sense. As I discussed previously, the simple equation in determining a suitable price for a home that you can afford is:

I’d like to point out that the equation above should reflect the actual mortgage balance. That is, do not get a home loan that is more than 3 times your income. So if that is the case, is the home above a deal? Doubtful. You need to remember that we are now working in reality and we have to go with things beyond the price. The economy in Las Vegas isn’t exactly booming. Energy costs are still high and you have to factor that in since AC will cost you a good sum for over half the year. What we are now coming to realize is that buying a home requires a patient and thoughtful process. This in fact is the biggest purchase most people will ever make.

Area #3 – Miami, Florida

Decline from peak:Â Â Â Â Â -34.6%

Peak reached on:Â Â Â Â Â Â Â Â December 2006

Peak sale price:Â Â Â Â Â Â Â Â Â Â Â March 2006 for $165,000

Current list price:Â Â Â Â Â Â Â $29,900

This my friends, is the biggest single percent price decline I have seen on any home. The price decline from the peak is a stunning 81.8%! Where the Phoenix and Las Vegas homes were nice McMansions in the middle of the desert, here we have a true Real Home of Genius in Miami. If you think someone made one delusional move in paying that peak price just look at the sales history:

03/25/2006: $165,000

12/29/2003: $113,000

11/07/2003: $74,000

This home is a 3 bedroom and 1 bath home. It is 1,174 square feet and features the new patented Garbage Can 2.0 photography:

The household income of the area is slightly over $30,000 so the current price may or may not be a bargain depending if safety and good schools are a concern for you. As an investor, who knows how the vacancy rates are in this area. 3 times this home sold at inflated prices and there was no justification for those $100,000+ sales.

Florida and California had shacks selling for absurd prices as well. Aren’t you happy that your tax dollars are going to bailout lenders that actually gave out money on these places? The next 3 areas are all in the sunny state of California.

Area #4 – San Diego, Calfiornia

Decline from peak:Â Â Â Â Â -32.7%

Peak reached on:Â Â Â Â Â Â Â Â November 2005

Peak sale price:Â Â Â Â Â Â Â Â Â Â Â April 2007 for $430,000

Current list price:Â Â Â Â Â Â Â $199,900

When this housing market reaches a bottom in the long future (California won’t see a bottom until May of 2011 and I’ll give you 10 reasons) the nominal amount of money lost will come disproportionately high from one state, California. People bought up homes in the inner city, outer city, the valley, mountains, and anywhere with a California address. It was complete and utter insanity reminiscent of the 1920s Florida housing bubble that included trustworthy characters like Charles Ponzi who sold “prime Florida property.” Where have we heard that language before?

This home is located in Chula Vista, a city in San Diego County. San Diego was one of the first counties to reach a price peak. It was the canary in the coalmine. This home above is down an eye popping and gut busting 53% in slightly over a year but this isn’t uncommon given that the entire region is down nearly 40% from the peak reached last year.

This home has 4 bedrooms and 2 baths and is 1,508 square feet. Built in 1953, it is actually newer since some homes in California were built during the Great Depression. It has been on the MLS for 96 days even after having the price reduced to this level. Why? Well the average household income in the area makes $60,000 so the recent price reduction on 10/20 may cause some eyes to look here since it puts it near that 3 times income ratio. Yet this house needs work:

You’ll have to factor in whether you want to spend the time to get this place ready to go. And that is another minor item. During the boom, it wasn’t uncommon for banks to also give you additional funds for you to fix a place up. If the bank didn’t help just take a cash advance on your credit card. Now, let us say a home will require an additional $20,000 in work you will need that plus a 10 to 15 percent down payment. Even with these slight standards, the market is drying up. People are broke. That is why they needed easy credit in the first place!

Area #5 – Los Angeles, California

Decline from peak:Â Â Â Â Â -30.9%

Peak reached on:Â Â Â Â Â Â Â Â September 2006

Peak sale price:Â Â Â Â Â Â Â Â Â Â Â December 2005 for $305,500

Current list price:Â Â Â Â Â Â Â $85,000

I’ve been hearing some absurd pundits blaming lower income folks for causing this economic calamity. What a shock that they don’t blame lenders who were “professionals” and had a fiduciary responsibility for making boneheaded loans. Last time I checked, lower income families weren’t investing in credit default swaps or jumping into high yield bonds. This is a red herring and a distraction.

In fact, who cares if lenders made bad loans in these areas right? I wouldn’t care if say, IndyMac Bank, wanted to make loans to people with no ability to ever repay them. I do care when the government (aka you) gets involved to bail them out. That is then a major issue. That is why I am adamant that many lenders should still fail or be forced to write down mortgages to current appraised values if they want government help. If it forces some institutions to collapse, so be it. They never belonged here anyways. Some are also wanting to blame Fannie Mae and Freddie Mac for this entire mess. They miss one tiny fact however. They weren’t the biggest players in the toxic market! As of November 2007, Fannie Mae had $57.9 billion in subprime loans. Not a small number at all. As of 2006, $600 billion in subprime loans were originated. These were originated by many aggressive mortgage outfits like New Century Financial, Countrywide, and Ameriquest trying to satisfy the appetite of Wall Street firms looking for mortgage backed securities and a method of allowing side bets in derivatives based on the housing market. Plus, you have an even larger Alt-A market that catered to middle/upper class candidates who frankly, decided to speculate in the market. The credit default swap market is over $50 trillion in value. There are over $10 trillion in residential mortgages in the United States. Let us blame the approximately $1 trillion subprime market (much of which has already foreclosed) for all the ills of our economy.

This above home is truly a Real Home of Genius. Whichever lender made this loan should be banned from the government TARP program. This home is 756 square feet with 2 bedrooms and 1 bath. From the peak sale price this home is now down 72.1%. This home is located in Compton and I put together a montage of the current foreclosed homes on the market:

(click for a clearer picture)

California was truly a wonderland for this decade.

Area #6 – San Francisco, California

Decline from peak:Â Â Â Â Â -30.6%

Peak reached on:Â Â Â Â Â Â Â Â May 2006

Peak sale price:Â Â Â Â Â Â Â Â Â Â Â April 2004 for $400,000

Current list price:Â Â Â Â Â Â Â $214,900

It is hard to imagine an area that had a bigger housing bubble than Southern California but leave it to our neighbors in Northern California to beat us out. Our next home takes us to East Palo Alto. For those of you from the area, you will know that unlike Palo Alto, the east side doesn’t carry a heavy premium.

This 760 square foot home with 2 beds and 1 bath sold at the peak price of $400,000. The current list price is at $214,900. As you can see it isn’t hard to find homes in California that are 50% or more off from their peak sale price.

Only time will tell if we are approaching a bottom but from my assessment and looking at fundamental market conditions, we have a few years before hitting a trough. Doubt it? Take a long and hard look at these homes once more.

Area #7 – Detroit, Michigan

Decline from peak:Â Â Â Â Â -27.2%

Peak reached on:Â Â Â Â Â Â Â Â December 2005

Peak sale price:Â Â Â Â Â Â Â Â Â Â Â March 2007 for $65,000

Current list price:Â Â Â Â Â Â Â $100

Okay, it only took me a few hours to find a larger percent decline than our Miami home. This above “home” is now off 99.8% off its peak value! It is practically being given away. Detroit is actually facing a fundamental collapse in their economy. This has more to do not with bubble prices but simply a purely economic driven price decline. If you need any more convincing this is a good deal:

I’m not exactly counting 4 bedrooms here. What are you going to do with this? It is going to cost you a ton of cash to knock the place down. You have taxes as well. What about the rental market (if there is one) here? I’d like to see some of the HGTV folks be sent here on a boot camp 2 month mission to see what they can do with this place. I doubt granite counter tops would do the thing here.

This is a global problem. You have now seen 7 major areas and homes that sold for absurd prices. Sometimes it helps to put a face to the actual problem. Hopefully this will solidify how bad an idea it is for this bailout to pay face value for any mortgages. Transparency is going to be so vital that money isn’t squandered into the abyss. If this were a crime case (which it may become) these examples would probably convince the jury to sentence many lenders to a lethal injection of no-capital.

Today we salute you America with our Real Home of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

21 Responses to “Real Homes of Genius Special Country Edition: Examining the 7 Hardest Hit Metropolitan Areas. 7 Home Foreclosures That Make you say Hmmm. IndyMac Bank and Reaching the Untouchable Shady Borrower.”

Another outstanding article. Thank God for bloggers,I read the MSM to get the lies not to get the news. When people say that the bottom of the housing market has arrived I give them this link.

Dr., you continue to succinctly & beautifully summarize with laser-like precision the fundamental issues of this crisis:

– housing prices must come in line with neighbor incomes, period

– many people lied (committed fraud) on their loan applications

– the responsible, paying homeowners are getting the back of the hand

– ultimately, the government cannot and should not try to “keep people in their homes” and/or prop up housing prices

I never thought I’d see a revolt (or revolution?) in my day, but one may be coming…. the responsible middle class can only take a pounding so much before it fights back with the furor of a cornered wild animal staring its predator in the face. Go for broke & fight back like hell, or lie back and embrace certain death.

Middle class, I’m talking to you. Don’t let the $14K/yr strawberry pickers stay in their $720K homes while you drive your 12 year old car around and shop for your kids at the thrift store to make sure you don’t miss a mortgage payment.

This article appeared in the White Plains Times, a local weekly in NY.

The Real Story on Real Estate

Hit to Local Market “Minimal,” Realtors Say

By: Pat Casey

Published: October 30, 2008

If you want to get a good sense of the state of the local economy, there are many places to look. One is the residential real estate market. The news media are full of disaster stories of areas out west and across the “Sun Belt” where the housing market has suffered tremendously during recent weeks. Houses are in foreclosure, which forces prices down; the only good news is that the inventory is at least moving. This scene, however, is not the headline news for most of the Northeast, Westchester County, or White Plains. Residential real estate here has its own story.

In a recent discussion with Peter Gorbutt, president of the White Plains-based Gorbutt Group Real Estate, we found out that “our local market took a minimal hit compared to what other areas around the nation are experiencing.”

“Our strength in this market comes from our prime location and we will always have a demand for housing here,” Gorbutt continued. “White Plains has a well-balanced economy, great quality of life, great transportation, easy commute to Manhattan, excellent schools, and a vibrant city.”

We heard the same thing on Monday evening during the White Plains Downtown Residents Association meeting at Vintage on Main Street, when Ann Bernstein, a top-producing agent for the White Plains office of Houlihan-Lawrence, told the group that the Wall Street downturn has not significantly affected the White Plains residential real estate market thus far.

Bernstein attributes White Plains’ residential housing strength to the diverse population in the city that both buys and sells housing at various levels. Based on data she had collected, Bernstein said the median price for a single-family house in White Plains had only dropped slightly from 2007 to 2008. If you look at the various real estate ads in this newspaper and others, recent listing prices do seem to bear that out.

When it comes to condo sales, Bernstein claims there has been a 9.6 percent increase in the median sale price. “That is an overall number,” she said, which includes sales of luxury condos in the Ritz-Carlton, Westchester and Trump Tower, so the number is exaggerated. Also in attendance at the WPDRA meeting was Susan Fitzpatrick, the new property manager for the Ritz-Carlton, Westchester who spoke briefly about how those luxury condo sales are going. “What we have heard from the developer [Louis Cappelli] is that Tower I is almost fully occupied; Tower II opened on Sept. 24 and is nearly 50 percent occupied.” Fitzpatrick further stated that Tower II would include retail and office space—housing Cappelli Enterprises in the near future—and that construction on the upper floors of Tower II is still in progress.

Co-op sale prices in White Plains from 2007 to 2008 have remained relatively steady. Where there is a growth trend is in the rental housing market. “Much of our market slowdown comes from the tightening in mortgage lending criteria,” said Gorbutt. “Lenders are now requiring buyers to have good established credit histories and larger down payments,”—about 20 percent, according to Dean Curtis of DC Funding LLC, a boutique mortgage company based in Bronxville, who added that some lenders will not close on a mortgage if the down payment is coming from a property sale until that property has sold. “This is sending many [potential buyers] back to the rental market, which is causing a higher demand for rental units, and rental prices are increasing. The White Plains rental market is doing fabulously at the moment. Many developers and real estate investors have changed direction in projects to take advantage of the demand for rentals in our area,” Gorbutt continued.

No one can say for certain where economic markets will be three months down the road. A snapshot of today shows White Plains residential real estate prices remaining stable.

According to Bernstein, “history shows real estate is the best investment you can make,” and she stands by that claim going forward in White Plains. Gorbutt agrees. “Soon-to-be empty nesters in White Plains still have a very valuable asset. If they have been a long-time homeowner, the increase in value alone in the past seven years has been incredible. It all comes down to pricing the property right and making your home show- ready.”

It can be tough to seperate fact from realtor speak. White Plains, unlike other places sited in this article is not dependent on real estate or tourisim to keep the ecconemy flowing. There is an enormus corporate structure extending from Manhattan. Will there be an impact? Yes, but it won’t be as distructive as Las Vegas, Miami, Detroit, Phoenix or throughout California. That doesn’t mean that this area wont feal any pane, oh yeah, we will feal it with the loss of finantial jobs & related fields not payng New York State taxes.

As a footnote I personally know people sited in this article.

DHB, thanks for pushing back against the ridiculous notion that poor people caused the mess. I think that many people are now realizing that the right-wingers have jumped the shark with their ludicrous assertions like “the stock market crash is because Obama is leading in the polls” and “poor minority borrowers caused the housing crash.” Still there is bound to be some in their core audience who believe it and there needs to be someone pushing truth. I mean seriously, who could fall for the idea that our major economic problem is that poor people have been pushing around and taking advantage of multi-billion, and even multi-trillion, financial institutions? Still, if the assertions go unchallenged some will be fooled. After all, look how many people believed that “real estate always goes up,” or that $10,000 counter-tops in a 700 square foot shack is the key to wealth creation.

Wow, that Detroit $100 “fixer” really slays me! I wonder which bathroom is the tree — the 1 or the 1/2? I presume the MLS refers to the upstairs bedroom(s) as “open and breezy with skylight!”

~

As for the taxpayer’s forced bailout of the fat-cat criminals, want to know how much of it is being paid as “fees” to those responsible for administering it? Well, sorry, you can’t know. You see, it’s a secret. The documents have been heavily “redacted” with such details blacked out:

http://www.propublica.org/article/why-are-docs-from-the-bailout-being-redacted-1022/

~

Why aren’t these people swinging from lamp posts?

I agree with the 3 times your income equation to come up with an acceptable mortgage loan, but you missed one thing; there are many immigrant communities living in the SF and LA area who have multi-generational families living under the same roof, all contributing to pay for the mortgage.

For example, in one neighborhood, we have 8 people living in a 4 bedroom house. The parents, 2 adult children, the spouses, plus 2 grand children. 5 people are working full time to help pay for the mortgage, with the grand mother staying at home to watch the grand kids. If you factor in all the family members incomes and multiply it by 3, then yes, they can afford to pay the 400k plus mortgage for that house. This is for a house, that in essence should only be worth $200 k if you use the 3 times the local income for one person(or two working people) equation. This is one reason why I don’t think the housing prices will bottom out to as low as 3 times the “local” income. They will come close to a low, but not that low.

Another reason why I don’t see the housing prices bottoming out to the “low” of 3 times the “local” income is that there is a sizable number of baby boomers out there that are now coming in to wealth, ala inheritances from their parents. The mortgage equation is not applicable to them as they can use their inheritance to pay cash for a house. And there will be enough of them out there.

Dr. HB-

Thank you! I personally think 2011 is the absolute “best case” and most optimistic scenario for a housing bottom. Don’t forget the demographic shifts with baby boomers looking to sell en mass, the shift in psychology to “houses should be rented not bought because they’re a lousy investment,” and the elephant in the room that we all need to pray never manifests itself: the potential for long-term interest rates to SKYROCKET if the government stays on its foolish “spend like drunken sailors even though we’re broke” course.

Dr HB, how about a Real Home of Genius collage on Santa Monica as delusion and denial is still very thick there. Especially in 90402. Fundamentals are still out of whack and it has just begun to correct. My guess is, the bigger they are the harder they fall.

September 2008 (Dataquick)

90402

(-35%) Median Price (Y.O.Y)

http://www.westsideremeltdown.blogspot.com

I think Furgal is delusional if he thinks the average multigenerational household has five working adults and those adutls earn anywhere near $120k combined. Why not pretend everyone in Socal has three jobs each paying $400k so the minimum house price should be $3.6 million? Or maybe the grandmother, who certainly plays bingo and the lottery, wins at least three million dollars a year in prize money? Whee! The minimum house price should be $10 million!! Why stop there?

frugal bicycler–

Your point is inapplicable inasmuch as the determination of median income is a collective, rather than individual, measure of the Census Bureau. So, if the median household income of a particular municipality is $50,000, the fact that one person living at 123 Anywhere Street is making $50,000, or that 100 people living at 125 Anywhere Street are each making $500 isn’t relevant; the statistic is based on the median of the household. Accordingly, the median home price should be $150,000; exception to this by any rationale is exactly why we are in this mess.

Comrades,

~

I had the opportunity to hear Paul Volker speak last week at a real estate conference in Miami Beach and if you’ll allow me to provide a bit of sidebar from your Genius-speak, here are a few interesting tidbits:

* Until recently, Volker was reluctant to admit we were in a recession. Now he is convinced that we are in a world-wide recession. Duh. Remember, economist are usually looking at rearward data so NEVER rely on them for forecasts.

* He believes this will be a long recession but the depth is uncertain. He never gave his reasoning to back up this conclusion (his resume also includes being a lifelong politician. What, you didn’t know that members of the Fed were politicians???)

*My favorite line was that in the last decade or so, we’ve graduated too many financial engineers and too few civil engineers. This has resulted in both crumbling financial and infrastructure systems. True that.

~

However, the absolute best quote from the conference was from an attendee who said “embrace the suckiness”.

Hey Dr. HB,

I’m always amazed at how many comments there are nowadays. I’ve been reading your blog and others (Ben, Patrick, many others) since mid-2005. It’s been a long ride to get where coworkers no longer cheerlead the housing market. Anyways, I still tune in to your blog, in fact it’s at the top of my list. Keep up the good work,

Bubba

Dr. Housing Bubble, Thanks so much for your great work! Please see, and in bold print or something on your home page, invite your readers to go to https://watchingmarcitz.wordpress.com to see the call to e-mail, immediately, Treasury officials. Please see my comment to Marcitz’ sample e-mail homepage in which I (i) argue why it is worth the time and why it can influence any ultimate plan; and (ii) I provide my thoughts on others who should be sent the same e-mail, and I provide all the contact info I have found so far. Thanks!

By the way, any thoughts on the Greater Boston market? We are still at 5 times median income (down from 7). But, even though rental prices are very high, (Many young or middle-income people pay as much as 50% of gross income for housing!) Greater Boston’s price to rent ratio is still significantly above the national norm and the historic Boston norm. But, no one I have read or heard on this forecasts anything more than an ultimate 15% drop from Boston’s 2007 (sic) peak. I am shocked by this, as housing prices are still, related to stagnant or dropping incomes, impossible for non-wealthy first-time buyers. Boston has lost over 10% of young workers for this reason, and this “brain drain” is forecasted to hit as high as 30% over the next few years. I don’t want to wait that long for Greater Boston’s housing bubble to REALLY burst. Any (quick; please don’t trouble yourself to write one of your usual epic works, unless, of course, you have interest in Greater Boston) thoughts would be helpful to me.

At any rate, thanks again for your great site and work!

Check this article I found in the NY Times, it will make your head spin.

Was There a Loan It Didn’t Like?

By GRETCHEN MORGENSON

AS a senior mortgage underwriter, Keysha Cooper was proud of her ability to spot fraud and other problems in a loan application. A decade of vetting mortgage documents had taught her plenty, she says.

But as a senior mortgage underwriter at Washington Mutual during the late, great mortgage boom, Ms. Cooper says she found herself in a vise. Brokers squeezed her from one side, her superiors from the other, she says, and both pressured her to approve loans, no matter what.

“At WaMu it wasn’t about the quality of the loans; it was about the numbers,†Ms. Cooper says. “They didn’t care if we were giving loans to people that didn’t qualify. Instead, it was how many loans did you guys close and fund?â€

Ms. Cooper, 35, was laid off a year ago and is still unemployed. She came forward to discuss her experiences at the bank in order to help shareholders recover money from WaMu executives.

Ms. Cooper is one of 89 employees whose stories fill a voluminous complaint filed against officers of the company by the Ontario Teachers’ Pension Plan board, a big shareholder. Topping the list of defendants is Kerry K. Killinger, the WaMu chief executive who was ousted in mid-September.

WaMu was seized by federal regulators in late September, the biggest bank failure in the nation’s history. It was sold to JPMorgan Chase for $1.9 billion.

The shareholder complaint depicts WaMu’s mortgage lending operation as a boiler room where volume was paramount and questionable loans were pushed through because they were more profitable to the company.

When underwriters refused to approve dubious loans, they were punished, she says.

MS. COOPER started at WaMu in 2003 and lasted three and a half years. At first, she was allowed to do her job, she says. In February 2007, though, the pressure became intense. WaMu executives told employees they were not making enough loans and had to get their numbers up, she says.

“They started giving loan officers free trips if they closed so many loans, fly them to Hawaii for a month,†Ms. Cooper recalls. “One of my account reps went to Jamaica for a month because he closed $3.5 million in loans that month.â€

Although Ms. Cooper couldn’t see it, the wheels were already coming off the subprime bus.

“If a loan came from a top loan officer, they didn’t care what the situation was, you had to make that loan work,†she says. “You were like a bad person if you declined a loan.â€

One loan file was filled with so many discrepancies that she felt certain it involved mortgage fraud. She turned the loan down, she says, only to be scolded by her supervisor.

“She told me, ‘This broker has closed over $1 million with us and there is no reason you cannot make this loan work,’ †Ms. Cooper says. “I explained to her the loan was not good at all, but she said I had to sign it.â€

The argument did not end there, however. Ms. Cooper says her immediate boss complained to the team manager about the loan rejection and asked that Ms. Cooper be “written up,†with a formal letter of complaint placed in her personnel file.

Ms. Cooper said the team manager told her to “restructure†the loan to make it work. “I said, how can you restructure fraud? This is a fraudulent loan,†she recalls.

Ms. Cooper says that her bosses placed her on probation for 30 days for refusing to approve the loan and that her team manager signed off on the loan.

Four months later, the loan was in default, she says. The borrower had not made a single payment. “They tried to hang it on me,†Ms. Cooper said, “but I said, ‘No, I put in the system that I am not approving this loan.’ â€

Brokers often tried to bribe Ms. Cooper to approve loans, she says. One offered to pay $900 to send her son to football summer boot camp if she would approve a loan that had been declined by a host of other lenders. “I told him no and not to disrespect me like that again,†Ms. Cooper says.

Hidden fees meant brokers could easily make between $20,000 and $40,000 on a $500,000 loan, Ms. Cooper says.

“WaMu was allowing brokers to get 6 to 8 percent off one loan,†she says. “If I had a loan where the borrower was already tight and then I saw the broker is getting $10,000 or $20,000, I would cut their fees back. They would get so upset with me.â€

Ms. Cooper says that loans she turned down were often approved by her superiors. One in particular came back to haunt WaMu.

Vetting a loan one day, Ms. Cooper says she became suspicious when a photograph of the house being bought showed one street address while documents deeper in the file showed a different address. She contacted the appraiser, and recalls that he said that he must have erred and that he would send her the correct documents.

“So then he sent me an appraisal with a picture of the same house but this time with the right number on it,†Ms. Cooper recalls. “I looked the address up in our system and could not find it. I called the appraiser and said, ‘Please investigate.’ â€

The appraiser came back, reporting that a visit to the California property had found everything in order and in agreement with the original appraisal. “I was so for sure that it was fraud I wanted to get on an airplane,†Ms. Cooper says.

The $800,000 loan was approved, but not by Ms. Cooper. Six months later, it defaulted, she says. “When they went to foreclose on the house, they found it was an empty lot,†she recalls. “I remember clear as day this manager comes over to me and asks, ‘Do you remember this loan?’ I knew just what she was talking about.â€

Rejecting loan after loan, however, gave her battle fatigue. “The more you fight, the more you get in trouble,†she says. She was written up three or four times at WaMu.

After WaMu’s mortgage lending unit laid her off, she applied for work in its retail banking division. She was turned down, she suspects, because of the critical letters in her personnel file.

Ms. Cooper’s biggest regret, she says, is that she did not reject more loans. “I swear 60 percent of the loans I approved I was made to,†she says. “If I could get everyone’s name, I would write them apology letters.â€

CHAD JOHNSON, a partner at Bernstein, Litowitz Berger & Grossmann, is lead counsel for shareholders in the suit. He said: “Killinger pocketed tens of millions of dollars from WaMu, while investors were left with worthless stock.†With WaMu gone, he added, “it is all the more important that Killinger and his co-defendants are held accountable.â€

The lawyer representing WaMu and Mr. Killinger did not return a phone call seeking comment.

Ms. Cooper hopes to return to the mortgage business soon. “I loved underwriting because it’s about being able to put a person in their dream home,†she says. “But messing these borrowers around was wrong.â€

I’d buy that for a dollar!”

Great work again.

The question before us: So if 2011 is the mythical “bottom” of the market – then what? I believe we’ll scrape along the bottom for a great period of time. That said, if we hit bottom in 2011 is everyone going to jump in the water? Perhaps, but it will not make difference one for appreciation which is the point of home ownership for most.

Your article was factual and very well written for what you wrote.

With all due respect, you have presented one side of the foreclosure

crisis with a solid argument for those banks and borrowers that

only had profit as a motive for owning the property.

I do not agree that the house flipper were in any kind of majority as far as foreclosures.

I would go further and state that the sub prime loan was not in any kind of majority as far as the cause for foreclosure. I would categorically state that the banks, the lenders were the main cause for the housing meltdown and foreclosure crisis. I support that statement

for the simple reason that Banks operate autonomously with absolute impunity and answer to no one. They are not regulated, supervised nor subject to any enforcement of the few ambiguous mortgage lending rules by inept federal regulators. You prove this point by researching the US Code under Title 12 -Banking.

The borrowers were victims who trusted and relied on their banker for a mortgage loan. These victims trusted their mortgage banker who financially took advantage of them based on the lie that the federal government regulated these banks. Understand the Congress passes only legislation that protects banks and other entities within the financial system but not the people that use the banks. Mortgage regulations are a myth.

Note that the Bankers, lenders if you will absolutely control the mortgage process.

They are the ones that require documentation, they create the paper work, the covenants, the appraisal, the dollars amounts to be lent and under what conditions and what terms.

On a federal level there are few mortgage regulations, prudent banking and lending activities that support that sound banking practice is the only criteria that the federal government sets. It therefore is the banks interpretation of those criteria that makes their rules for lending their money. If people lied as to there income or other facts if indeed the banks did require that documentation, then those borrowers committed fraud as is the same fraud if you lie on your financial statement to procure a bank loan. But the Bank is the authority, the Bank has the expertise, the Bank has the knowledge and the responsibility for verification of the facts. The Banks and they alone control that mortgage. The Borrower has positively and absolutely no control over that process.

The question becomes what did a given bank require of that borrower for that mortgage loan? Under what conditions did the loan default? What did the borrower have to say? The banks have been talking since 2004 about that scumbag borrower. It is hard to fight a lie, but it is impossible to hide the truth.

The truth comes out a little more each day. And each day the Congress and the Financial community sweat to keep the truth hidden.

My bank AM Trust Bank in Cleveland Ohio did not follow the rules, changed the purpose of my mortgage loan which barred me from refinancing my original mortgage under federal regulation CFR564, produced a flawed appraisal and the Bank appraiser was cited by the State of Ohio for violation of State law There were other violations of federal consumer regulations. Accordingly my home of 7 years was sold at foreclosure because the Congress never passed any Federal Consumer Banking Regulations that give the borrower the right to contest or object their foreclosure within the same regulatory system that the bank lends their mortgage money.

That too is why you saw states like CA, IL and FL who have no authority over federal thrifts basically sue Countrywide Bank for those borrowers who had no rights under federal law. Certainly when tell your story, it is necessary to inform people that banks operate their mortgage lending with impunity without any fear of the borrower because the borrower has no rights.

Yes I did fight my foreclosure and I ran out of money. This bank threatened to file a frivolous lawsuit against me for fighting my foreclosure.

In 49 years never missed a payment, sent 2 kids each through 11 years of college and have driving my same car for 12 years.

What you should understand is that there are 4 million foreclosures completed, 2 million more projected for 2009, 5 million facing foreclosures and 7.5 million home owners underwater. These people have no rights. They have no voice. They do not want a handout. What they do want they can not have-justice. Why haven’t these victims spoken up? Why did they not hire an attorney to fight their foreclosure? These foreclosure victims carry stigmatism of being bad people. What about all the banks and Wall Street and the Brokers that bought the world economy to their knees? As veteran I am offended by people that think I as a mortgage loan borrower caused this housing meltdown.

It is people like you that write these articles that spread the rumors and the misinformation.

Again with all due respect you need educate yourself and understand that this is not a problem about flipping houses. This is a problem of the Congress of this country serving the wealthy and the powerful. This is problem of the banks and their aberrant lending behavior that was out of control for greed. This problem sir is bigger than a housing bubble. This is a problem that is like a cancer that has been growing in our financial system that is financially devastating millions and millions of people.

I believe that the housing market will be different in the future to some degree. But if those who caused this world wide financial holocaust are not held responsible and accountable then history will repeat itself over and over and over again.

For those foreclosure victims that truly lost their homes my thoughts and prayers are with them. I cannot speak for them because I am one of them.

For those of you who are truly ignorant of the federal banking system, the federal regulatory system, the wealthy and powerful Congress that only legislate to protect the wealthy and the powerful then I truly feel sorry for you. You have to pay off the 2 trillion dollars that were gifts to the wealthy and the powerful from your elected Congressional representatives.

You see I don’t have to pay; they took everything I had when they sold my house under the Lynch Mob act. That is where the Bank forecloses your mortgage and hangs the borrower.

The Bankers killed the Golden Goose and Congress buried the body.

Hi Doc… been a while since I commented. I’d offer congratulations on your foresight and well-reasoned commentary, but we know, to have been right means that, unfortunately, the entire house of (dis)cards has come a-tumbling down, and we’re all squashed by the rubble.

Echoing previous commenters reply to frugal biker- DHB and others have ably discredited the postulate that immigrants and heirs will keep the bubble afloat. As Kevin Depew over at Minyanville has noted, “math is not a rumor”, whereas hard evidence of the mythical immi-beast and its cousin the heir-ball is as hard to come by as a yeti photograph. Grampa Richguy got slaughtered in the Dow(n)draft, and Shmitty points out the demographic error of FB’s argument. FB… what else does that stand for? Oh, right, foolish buyer…

And while I certainly appreciate Sean’s and Michael Littlebigs’s comments – can’t you just post the link, and give your take, or in MLB’s case, get your own blog, rather than posting the whole darn article or your rant? This is DHB’s blog, after all, and he gets to give his viewpoint. If you disagree, fine – but keep it short, to the point, and point back to your own post on your own blog if you don’t like his take.

Besides, the good doctor doesn’t absolve the bankers from blame. Read up on previous posts and you’ll find that he points to everyone. Read Matt Padilla’s “Chain of Blame” and you’ll find that there are lots of parties deserving of the finger. Of blame.

And be offended to your heart’s content if don’t like the finger pointed at borrowers as being blameless. But don’t be surprised when people disagree with you. Your diatribe lacks evidence to support your contention, and without it, is unpersuasive. DHB provides data to support his views, so if you choose to attack him please line up your evidence or be dismissed as a crackpot. Or write your own blog. You may or may not be correct in your views, but without data, why should anyone bother to listen?

Of course they aren’t refinancing. People who want something for nothing are partly motivated by their estimation of potential gain, and partly by whether they think they can get away with it. Now that the gain has vanished, they turn to the second part–and we watch in dismay as the banks/system *invite* them to get away with it.

~

But all along, the banks’ hunger for fees, and the financiers’ hunger for more debt to turn into derivatives, was what led to them marketing home ownership as the road to wealth. Can’t really blame people for believing it, especially when all around them, people were getting rich (it seemed) flipping houses.

~

That doesn’t happen for many people through working, saving, scrimping; 40-50 years of hard work, and pennypinching, and modest digs, and deferring whimsy…gets ya WHAT again? Supposing of course that you even manage to HAVE work for 40-50 years.

~

I’ve been re-reading William Greider’s 1987 _Secrets of the Temple_, his history of the Federal Reserve, which makes many points from the ’70s and ’80s that are identical to today’s problems. Including that people in the ’70s started buying things they knew they’d never be able to afford, because a) they could get the debt/credit and b) they could have it today whereas c) there was no telling what the future would bring since d) real wages froze, even as the numbers inflated.

~

The example Greider uses is people of very modest incomes buying $400 and $500 jewelry; 30 years later you just add three more zeroes, and make it for houses. Who was it who described real estate shopping earlier this decade as “the ultimate in catalogue shopping”?

~

Doc, if you rotate that Case-Shiller bar chart about 135 degrees CCW, you have something that looks oddly like a stacked series of Enron logos (the Slanty E).

~

The Miami house is clearly trying to evoke the Bounteous Spirit of Xmas with its fabulous red-and-green theme. Maybe Santa Claus will pop out of the garbage can if you crank the handle! (And pop a cap in yer ass.)

~

rose

~

PS–Exit, factually speaking, I have lots of yeti photographs! Really! It’s a cottage industry here in the PNW. ;D

I guess they don’t have internet in W. Hollywood yet:

http://latimesblogs.latimes.com/laland/2008/11/httpwwwlatimesc.html

L@@K at THOSE condo prices!!!

Exit,

Sorry if my postings were a bit longer then usual. The articles I posted were ment to compare & contrast DRHB’s points of view & not to be a rant. Both of these pieces needed to be pasted in there entirety because of there importence to what DRHB has been saying. Especially in light of WM’s questionable practices.

I don’t see the problem with the long posts as long as the blogmaster doesn’t mind… maybe if someone objects to long posts so much they should start THEIR own blog and forbid them THERE…

Leave a Reply