Real Homes of Genius: Revisiting a Past Downey California Home. $305,000 Discount in 2 Years. $1.7 Trillion in California Equity Gone in One Year.

People have sent a few e-mails wanting to know the eventual history and life story of past Real Homes of Genius. Given the current housing market in Southern California many of these homes were taken back by lenders and have been sold for significantly lower prices. The home that we’ll examine today takes us to Downey California and was featured in January of 2008; it was being sold at a $270,000 discount from the peak price at the time.This home sold for $905,000 in August of 2006 and sold for $600,000 in June of 2008. Such has been the nature of the current housing crisis and in California and why housing issues will continue to persist throughout the foreseeable future.

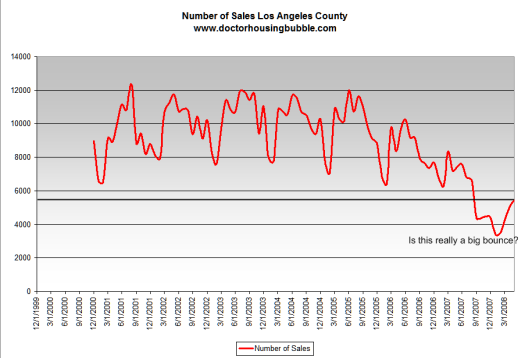

Before we examine the home in detail, let us go over a few key things that are happening in the current housing market. Foreclosures are still running at historical highs. Even though we saw a minor jump in sales for the July data for Southern California this information simply reflects the seasonal sales history of the spring and summer selling months. This chart which shows sales for Los Angeles County shows an up and down curve highlighting the peak spring and summer seasons and the troughs which hit in the fall and winter:

This minor jump has caused some to question whether we are approaching some form of lull in the current housing market. The general stock market rallied this week on the poetic and inspiring words from Fed Chief Ben Bernanke:

Since when has the Fed taken any action against inflation? The reasons prices may be coming down in the future is because of wealth destruction which is more characteristic of deflation. This is the same logic that is used about the housing market.  Here is a sample list of how to address problems according to the Federal Reserve:

(1) – Deny any problems

(2) – Deny any problems further

(3) – Deny the problem even though problem is causing problems

(4) – Mention that you knew problem existed all this time and that problem is now being solved

(5) – What problem?

That is essentially how things have been operating at the Federal Reserve. Want some evidence? Take a look at some quotes from Ben Bernanke:

“House prices are unlikely to continue rising at current rates,” said Bernanke, who served on the Fed board from 2002 until June. However, he added, “a moderate cooling in the housing market, should one occur, would not be inconsistent with the economy continuing to grow at or near its potential next year.” October 2005 Source: Washington Post

“Given the fundamental factors in place that should support the demand for housing, we believe the effect of the troubles in the subprime sector on the broader housing market will likely be limited,“ Bernanke said in May of 2007 Source: Forbes

“Although we have seen improved functioning in some markets, the financial storm that reached gale force” last August “has not subsided,” Bernanke said August of 2008 Source:Â CBS MarketWatch

We went from not seeing housing prices falling, to thinking subprime mortgage issues would be contained, to “gale force” credit problems all within three years. Now that is what I call forecasting ability. California is seeing a stunning amount of equity destruction in the current housing market and most of it has occurred in the last year. How much equity has been destroyed in California?

The median peak home price for California during the height of the bubble was $597,640 reached in April of 2007. That is, half the homes sold went for below this and half above this. Let us first run some quick numbers:

Total Housing Units in California:Â Â Â Â Â 13,174,378

Homeownership Rate California:Â Â Â Â Â Â 56.9%

This is simply a quick back of the napkin exercise here. So if we want to know how many homes are owned in California we can figure this out:

13,174,378 x 56.9% = 7,496,221

We can then do a quick multiplication out of this with the median price:

7,496,221 x $597,640 = $4,480,041,518,440 (peak California real estate value)

This of course isn’t exact. The housing unit count is only for homes that are “owned” and doesn’t take into accounts apartments or other rental/lease housing. Keep in mind that certain estimates put the peak residential nationwide housing value at $24 trillion and given that California makes up 12.1 percent of the population and makes up 10.4 percent on all housing units this number gives us a ball park figure. The last estimate I saw showing relative housing wealth in the United States via the flow of funds information from the Federal Reserve puts this number at approximately $20 trillion.  So $4 trillion in “housing equity” has evaporated.

Now that prices have fallen and the median price for California is $368,250 let us run the numbers again:

7,496,221 x $368,250 = $2,760,483,383,250Â Â (current California real estate value)

If you’re wondering why people are feeling poorer in California it can be that approximately $1.7 trillion of housing wealth has gone up in smoke. Given that nationwide prices values have taken a hit by $4 trillion you can see how big of an impact California has on the overall housing market.

Keep in mind many people are not planning to sell. The numbers above are completely rough estimates but simply highlight a quick point that housing in California has taken a large hit and overall wealth destruction is high because of the magnitude of the destruction.

Now how does this wealth destruction look like in the real world? Let us take a trip down Real Homes of Genius memory lane.

$305,000 Discount in 2 Years

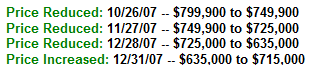

We featured the above 3 bedroom 2 bath home in Downey back in January of this year. At the time the home had been on the market for over 300+ days and no action had happened even with the major reductions:

Now before you go out and think that this was a great deal, let us look at the sales history:

Sale History

06/30/2008: $600,000

01/30/2008: $735,000 *

08/08/2006: $905,000

At the time I was suspicious about the price being jumped up so quickly given the lack of interest but what appears to have happened is that the home was taken back by the lender. This was a few weeks after our initial report in early January. Now knowing what we know and the quickly disintegrating market, the lender might have taken the place back simply to unload at a later date.

This home is 2,197 square feet and let us look at the current per square foot median price for this zip code:

Per square foot median price:Â $310

Median home sale price:Â Â Â Â Â Â Â Â $444,000 (down 26.3% from a year ago)

You might do a quick calculation per square feet and find that this is a “good deal”:

$310 x 2,197 = $681,070

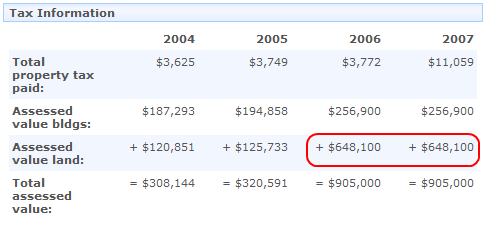

A great deal at $600,000 if we go strictly by the math. Yet this may not be the case in an area where the median home price is $444,000. You need to remember one simple rule in buying homes. It is better to buy a small home in a very expensive neighborhood then having an expensive mansion in a lower priced area. This holds true for California since most of what you are paying for is the land and not the physical home. Think this isn’t the case? Look at the assessed value of the land versus the actual home for 2006 and 2007:

It is amazing that this home with an assessed land value of $125,733 in 2005 suddenly saw a jump to $648,100 in one year! That is, the land magically went up in value by $522,367 in one year. Welcome to California folks. So now that prices are correcting it is the land value that is getting hammered. After all, concrete, wood, windows, and all the other pieces that psychically build a home have either gone up in price or have stayed the same.

I’ll leave it up to you to judge whether that $600,000 price is a good deal. Â Today we salute you Downey with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

10 Responses to “Real Homes of Genius: Revisiting a Past Downey California Home. $305,000 Discount in 2 Years. $1.7 Trillion in California Equity Gone in One Year.”

What do you make of these guys?

‘Housing Bubble’ is Really a Land Bubble

.

The tax data on this home is astonishing! Here was the data that should have set off alarms to every banker, Federal Reserve Chairman and GSE bond investor. Values simply do not explode like that absent some fundamental change in land use. Oil is discovered, zoning is changed, Sutter finds a gold nugget in the backyard. These are plausible reasons for such dramatic rises in land values. An innovation in financing property is not. For example, let’s say I was a farmer and Anthony Mozillo comes to me and says ‘Scott, got some good

news for you, with our new farm mortgage product we can qualify you to buy half of Kern County.Being an old rustic I say ‘what in the hell does that have to do with the price of corn on the Chicago Commodity Exchange and besides I’d need more seed, fertilizer and tractors to farm it.’ Mozillo gives me a disgusted look and says ‘You stupid hick, don’t you see, no one cares about your crummy farm

operation, its the monthly payment that counts. You don’t even have to plow your goddamned land because its going to be worth more simply because more people can afford to be farmers now and you can sell them acreage.”

Apolgies if this is double post, but I think it’s an important point to make and despite attempting to submit a similar comment a few minutes ago, it doesn’t seem to have gone through.

The jump in assessed tax value is easily explained by Prop 13 rules. The tax assessed value of a home can only be increased by 1% per year from the time of purchase. Discounting anomalies like the housing bubble, we could reasonably expect in the long term that housing prices will follow wages which follow inflation. Thus, the assessed tax value of the house will will increase at a rate far less than the presumable sale price of the house. Compounded over several years, the difference could be rather large. Assuming 4% inflation over 10 years, a $200000 house will end up with an assessed tax value of around $220000 while its price would end up around $300000. Granted, the jump is far less drastic that what could be seen in a bubble, let alone the mother-of-all-bubbles we’re bursting out of now, but the point is that there will always be a disparity between tax assessed home values and housing prices in California. It’s in the law.

Grew up in the Antelope Valley and remember the last housing bubble pretty well because my friends and I used to entertain ourselves by vandalizing unoccupied houses. Never got caught (I was in 6th and 7th grade) but maturity and conscience eventually got the better of me.

But I digress – The point of this post is adverse possession.

When my wife and I were first married, we saw this modest house in the AV. We liked it ok, but weren’t willing to spend the 220-240K asking price back in 05. Well, I drove by one day and noticed one of the nicer units was REO and had been winterized since Nov 07. Today, a number of similar houses in the neighborhood have asking prices that range from 89K (almost right) to 135K (not even close). The RE agent posted in the window said the listing had been taken away from her months ago and that she had no idea who was representing it now. Was also told that people are making offers on REOs but banks take so long to respond that buyers eventually withdraw. Based on this and the condition of the yard (tall dead weeds in a long dead lawn), it seems fair to conclude that this house has been practically abandoned. And with all of these banks going down and mortgages with multiple backers, seems like decent places could fall through the cracks for a while.

Per personal observations, emotion about RE is not yet as bad as it was back in the late 80s/early 90s, despite the fact that we’ve taken a 40% hit since last year, and building has not stopped. I’m thinking this could help me too.

According to California Law, I understand that I would have to occupy said property openly without the permission of owner of record, improve it, pay its taxes, and deny its use to others for a continuous period of five years in order to become the legal owner.

Can anyone tell me how to find out who holds the title on a particular property and how to go about paying taxes on a property I don’t own? Does anyone know what kind of legal risks I could face?

Basically, I hate seeing decent houses decay while my wife and I have been living in small dumpy dwellings waiting for a smart and affordable buy. I also don’t like that my savings are being eroded as Uncle Sam bails out lenders that sit on houses people want to buy (for a fair market price). In fact, as a patriotic American, I feel it might be my duty to repossess this house from those who own the securities used to buy this house in the first place (Chinese/Arabs/other foreigners).

Would love any advice or direction on where to go for advice.

Thanks

@Adverse

I tend to doubt any attorney is going to give you the time of day on this one. Seems like you have a decent grasp of the 5 year rule. You’d likely be risking trespassing laws. And 5 years is a looooong time to be paying taxes on something that isn’t yours. If your erstwhile followers – that is, delinquent 6th graders – get involved in the unoccupied dwellings near you, that wouldn’t bode so well for the neighborhood returning either, don’t you think? And so then why would you pay prop taxes on that, especially since they will be based on last sales price in the $300k’s rather than the ostensible $100k valuation, unless you dispute – and then how do you show the county you have standing to challenge?

You’d be a squatter, pure and simple. Not that it doesn’t fall in line with our forebears from the 19th century, mind you. But it’s all rationalization at that point – patriotism, etc. Good luck, and let us know how that works out.

@Doc,

Lost “Equity”? Um, I’m not sure I agree with that term. Fakequity maybe. Can I trademark that?

Dear Dr Housing Bubble,

Thank you for having a go at the “fake equity evaporation” of residential real estate in California,

I note you used medians instead of average prices and put to one side the rental housing stock, which constitutes near half of the residential stick. It is my view that this should be included as well.

Lets have a rough – very rough – guess at this. With 13 million residential units in California and an AVERAGE price of $600,000 (incl apartments / condos) – this would suggest that there was well in excess of $7.8 trillion of residential stock in California at the peak (likely nearer $9 trillion) which has slumped about 37% or in excess of $2.8 trillion so far since the peak.

Nationally too – the 120 million of all residential stock neads to be multiplied out at the AVERAGE price at the peak – then what the average price is now – to assess the “fake value evapoation” to date.

Anything below three times annual household income should be treated as “real value” – above that “fake value”.

My gues is that there is in excess of $8 trillion of “fake value” to work out of the system in coming years in the United States. Counties such as the United Kingdom, Ireland, Australia and New Zealand have a much greater “fake value problem” – in rough terms near double their GDPs. The United States in contrast has the equivilent of somewhat less than one times its GDP of “fake value”.

I trust you and your readers make more refined attempts at assessing the “fake value” in the California and United States markets.

Hugh Pavletich

Christchurch

New Zealand

I think there is a minor ($1.3 Trillion) error in the amount of equity that has depreciated into thin air. ALL of the 13m houses have depreciated, NOT just the houses occupied by their owners. Using the same calculations, $3 Trillion has evaporated. It has affected landlords and owner/occupiers alike. A landlord can no longer get a HELOC for that European holiday/new Picasso/new yacht etc.

(I haven’t misunderstood something, have I ???)

Dr. HB,

County assessor’s records do not accurately represent land value. Since Prop 13, the allocation of land and building value has become irrelevant. Therefore, assessors make no attempt to properly allocate values. Even the IRS recognizes this and ignores CA property tax bills when allocating land v. depreciable structures.

While it is difficult for me to consider CA land values from TX, even the value of the buildings looks out of line. Considering the square footage of the house and even giving it credit for being a very nice model, I could have purchased a similar house near Dallas for around $150,000 at market peak, land included.

The land isn’t the important thing, it is the LOCATION of the land that is hyper-important. Many things come into view here: the view, of course, is a huge factor. What you see is what you buy, a beautiful view is priceless. Next, schools: good school districts are far more valuable than bad ones. Land associated with bad schools is nearly worthless EXCEPT in retirement communities.

Transport: too close to airports=low property values compared to others which don’t have planes in the vicinity. Nearby highway ramps are good but not too close due to air pollution and noise. The list is very long. Next to a lake: good. On a shore: excellent, etc.

Leave a Reply