Real Homes of Genius: End of $1 Million Home in Pasadena and the Extinction of Mortgage Equity Withdrawals.

Now what do you think the world is saying about this so called stimulus package announced last week? I think many are starting to realize that all the jawboning going around is simply that, a lot of air with no substance. They sense that below it all, something deeper is happening. Take a look at the S&P chart:

We have broken major support levels so you can expect two things. Either the market rallies back up or it drops even further until it finds a bottom. Now with further banks and lenders getting ready to announce at the end of the month, I would expect even further declines across markets. Over in the

If anything, many are still in denial and still want to help the perpetrators with bailouts instead of getting the Justice Department ready for subpoenas and indictments. I call this what it is, a major white collar crime on the markets of the global economy. If you are to rob a bank, the most you will get away with is potentially $50,000. You will get caught and face multiple years in prison. However, you can fabricate a few loans in a couple of months, put people into financial danger foregoing all fiduciary responsibility and not only get away with $50,000, you’d also be free to do it again over and over. This is not free market capitalism but criminal activity. Until politicians can admit this openly expect more band aids while the market trends lower and lower. Why is it in the hands of politicians? We are now moving toward fiscal stimulus which of course the administration will never admit is needed since they believe the dogma that tax cuts for the uber rich are the mantle to all financial security. Good luck getting them to admit any wrong doing ever.

Real Home of Genius

A million dollars used to be a lot of money. Now it is enough for a few Whoppers at Burger King and a side order of fries. The dollar has taken major hits over the decade. Even in light of Southern California prices going down, as we examined the double-digit declines of each County in SoCal, there are still folks thinking that they can sell starter homes at peak bubble prices. If anyone has any doubt that

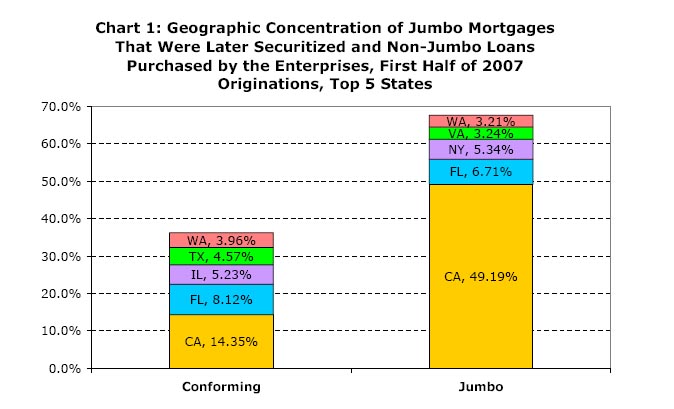

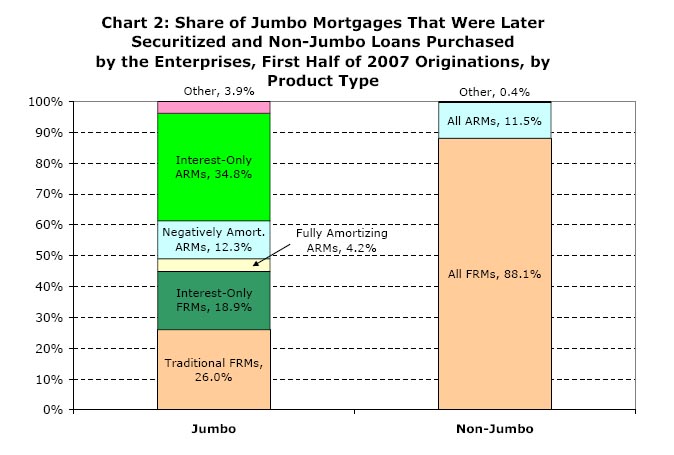

Are you thinking what I’m thinking? That’s great because I’ve always wondered how they got so many nice colors into this pretty looking chart. Oh, and take a look at the insane amount of jumbo loans in

Basically when folks go into jumbo territory they are going into wonderland mortgage product territory. And these are the one’s purchased by enterprises so you can imagine how the secondary market looks with who knows what in the portfolio of many lenders and banks. I think you get the idea. Raising caps is not going to do anything except set the ground for another bubble but to be honest, folks are maxed out and credit is tight so unless you can get a traditional 30 year jumbo, you can kiss Pay Option ARMS and Interest Only loans good bye.

It always helps to see the bubble unfold with Real Homes of Genius. Today’s example highlights so many things that went wrong with the bubble. Mortgage equity withdrawals, flippers, and absurd prices. Today’s home takes us to the beautiful city of

06/11/2007: $1,100,000

06/08/2007: $110,000

08/02/2006: $870,000

09/24/2003: $595,000

12/15/1999: $317,500

Can you tell where the bubble started? Hint it starts with a 19 and ends with a 99. You may notice the 2007 $110,000 but that is simply a second mortgage equity withdrawal for who in the world knows. We can safely assume that this money was spent elsewhere fueling the

Welcome to 2008. We are entering a new era. Our $14 billion dollar short fall in

Today we salute you

*Update: Fed cuts rates by .75 basis points in emergency move ahead of next week’s regularly scheduled meeting. Biggest action since 1984.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

12 Responses to “Real Homes of Genius: End of $1 Million Home in Pasadena and the Extinction of Mortgage Equity Withdrawals.”

Your ‘REAL HOMES OF GENIUS’ series shows that it was the United States not China that experienced the true economic miracle of the 21st Century. While China powered its way forward with 10% growth rates they had to produce things, degrade their environment with industrial toxins, maim and poison their workers and what did they get for all this work and Dickensian squalor? They became the world’s largest holder of US dollars.

Over a trillion of them accumulated by keeping the shelves of Walmart well stocked and now those dollars are depreciating. Hahaha.Hell we even sold their sovereign wealth funds some of Bear Stearns.

On the other hand American GDP grew at a far slower rate. Rising from $9.500 trillion in 2000 to $13,500 in 2007. But since when did actual economic growth matter when you can simply inflate the value of US household

real estate over the same period by $8.5 Trillion and not have to do anything more than hold some open houses and fill out some paper work to realize this modern bonanza. Perhaps someday Orange County will have a NFL football team and as a team needs a name might Orange County want to commemorate its role in unlocking this hidden wealth and name the club the OC 06’ers or maybe the Anaheim Flippers.

I a future home buyer that stayed out the housing market. I graduated in 2005, and all I can say is that I’m glad I stayed out of all the real estate agent cheerleading mania.

I just wanted to point out something interesting I discussed with a co-worker of my over the weekend. Apparently its not enough that bush is going to be dropping Benjamin’s out of helicopters, my co-working knows plenty of people that are ready to walk away from their houses regardless of free money.

What I found surprising is that these people are just waiting for their tax returns to arrive. Since we all know its a tax deduction to own a home. Instead of these people paying off some debt with their tax refunds, they will IMMEDIATELY stop paying their mortgages and living mortgage free until they are thrown out. The benefit of course being that they will have some cash in their pockets. Given that most of these refunds will be distributed in February, and it takes about ~4-5 months for the foreclosure process, I’m expecting ‘good’ times for housing in the months June and July. Stack this up with the fact that a large chunk of these mortgages will be reseting in March, and you can see how ‘great’ housing is going to be in the near future.

Well that price isn’t bad if you don’t mind if you

don’t mind leaving your house on the market for

about 20 years. Most people that weren’t flippers

and made a 200,000+ profit probably moved out

of state and spent those 200k+ there creating

wealth in their new state.

Wealth was moved out of state and

and now Tax Payers have to pay the piper.

What I fail to understand is that all media outlets are panicking

throwing out numbers and statistics as being the

worst in 20 years because 2 years ago they were cheering

for numbers which were the best in 20 years.

Call it what it is “A CORRECTION”

and not use those harsh words like crash, and slump.

CompasJD: since the real estate problem is affecting most of the country, and most of the money was seemingly spent on crap or new homes, what wealth creation are you referring to? I have not seen any news about how North Dakota is offering to finance the federal deficit with its new tax revenues or how Iowa’s state fund is buying Temasek.

Media outlets are simply reversing course after having gone too far in one direction. You are free to call it a correction if you like ,but that won’t change reality. Reality is that the US consumer is massively in debt, far beyond reasonable levels. House prices were built on a foundation of this debt. House prices went a few multiples beyond affordability. As these things go up, they can do fairly fast, but not as fast as when they go down. When the realization sets in that it’s a bubble, things get bad fast because the bubble is built on illusions, lies, and hope, not economic fundamentals. If the recession were causing the “correction” we might expect a slow decline.

The reality is that the housing CRASH (destruction, Armaggedon, catastrophe…wheee!) is causing the recession. The bottom will come when prices adjust to even where broke Americans and their bankrupt lending institutions will accept that they can afford to buy. This might mean something as low as two time median income. So, look for median home prices to hit 100 to 125k.

It’s a CRASH. It’s a COLLAPSE. Why? Because it was a the Mother of all Bubbles and bubbles pop.

Wow.. What a cool idea… Get the interest deduction and ‘cash out’ literally.. I never would have thought of that…

That house would go for about $120K in my city (moved here because the bubble never made it here).

That house needs to drop down 90% before this is over… Imagine how many people will buy it for 800K, then 400K, then 200K…. I foresee lots of people losing fingers as the knife falls year after year…

KA BOOM!

Aw gee Doc, you read the links I posted to the OFHEO reports on the one thread the other day.

I read that report a over a week ago – OFHEO released it on Friday and I pulled it up on Monday.

Now where I am, we are inundated with mega expensive second homes. Trust me – the 800 sq ft concrete block house on .83 acres on the shore on a inner lake in far northern Michigan for $1,750,000 can definitely hold its own with any of the Real Homes of Genius. Always wondered how in the world people were coming in and spending $500,000 on vacation condos, $800,000 on summer homes and $1,300,000 on beach houses – and these are just some that have gone into foreclosure but the interest rates on the loans did not like the subprimes that were resetting to 8,9, 10 or more %.

When I read the report, it was obvious how they were buying these places. I picked up the phone and called my local bank Vice-president (we gossip about this stuff all the time and his bank never got into weird loans); told him about the report, and hit ‘send’ on the email with it – as he kept saying holy s – – -t, those 2nd homes are going to crash and burn!

I heard they also throw in lifetime tickets to the Rosebowl. So that is worth at least $100 a sq/ft.

Hey, maybe with today’s cut some of these hyperinflated McMansions will get offers.(sarcasm off)

FED Hits Panic Button. Jumbo Loan Rates at Historic Lows.

http://thegreatloanblog.blogspot.com/

Dr. HB

Can you elaborate on your statement?

“The Fed just blinked and is saying “hey, no problem here everyone!†while they just slashed rates by .75 basis points. With talk of a even bigger stimulus package, we already know what road we are heading down and none of this is unexpected. “

The Fed just blinked and is saying “hey, no problem here everyone!” while they just slashed rates by .75 basis points. With talk of a even bigger stimulus package, we already know what road we are heading down and none of this is unexpected.

Hold on to your hats folks, it is going to get bumpy.

Ok well I am not a dweeble. I will say however that I am 25 years old with absolutely no debt to my name and refuse to put debt to my name. It makes life rough not being able to do alot of things that people do like “Satellite TV” yes my credit rating is so non existent I cannot get that 🙂 But for all that what do I get? No harrasing phone calls. Nothing! I cant have my stuff taken from me that I have worked to get. I own my car I buy reasonable cars.

Only sad thing is I rent right now, However if the housing market takes a downturn and becomes affordable I will buy outright otherwise I wont own. There is no need to put myself in debt. At least this is how I feel. Banks and the Fiat Money System get their power from debt. I feel debt is extortion and morally wrong.

Ahh the spice of life.. Being not able to keep up with the jones’es is so awesome as I know better LOL!!

This is a good example but try these. Two recently sold house on 2424 and 2383 E. Mountain street went for $585K. A smaller house on the same block was sold for $527K in 2004. Granted the 2004 house had better curve appeal but it was significantly smaller. Another house sold on address 2336 sold for $925 about a year ago. This house was well maintain and also had very good curve appeal. I knew the previous owner. However, a vacant house on 2336 Loma Vista St is now listing for $799K but 1 1/2 years ago, it was listed for over $1.1 million. Some genious bought it for $930K in 7/2006 and wanted to immediately gain nearly $200K in profit. It didn’t sell and now s listing for $131K less than purchase price.

I don’t know if my previous post went thru but I wanted to add the following.

However, a vacant house on 2336 Loma Vista St is now listing for $799K but 1 1/2 years ago, it was listed for over $1.1 million. Some genious bought it for $930K in 7/2006 and wanted to immediately gain nearly $200K in profit. It didn’t sell and now is listing for $131K less than purchase price.

Leave a Reply