Real Homes of Genius: $1 Million Discount for a 948 Square Foot Long Beach Condo!

If you think you’ve seen it all be prepared to see the most manic pricing action in the history of this housing bubble courtesy of a condo in Long Beach California. That’s right, the home of Snoop Dogg and the beautiful Queen Mary. The ability to access past sales history readily makes for some fascinating forensics on the incredible financial stupidity of this bubble. If this happened say 20 years ago, it would take some savvy journalist a lot of time to head down to the county clerk’s office, work with local realtors for MLS access, and finally be able to put all the pieces together to show the insanity of the housing orgy. Now all you need is an internet connection, some common sense, and the insanity of the housing market comes together like a thousand piece jigsaw puzzle.

For those of you thinking we are at a bottom, there are futures traders that would like to disagree. In fact, the futures markets are pricing in a 28.3% further drop for Los Angeles by November of 2010. The housing futures contracts are also pricing in 24.8% of that drop in the next year! You may want to take a look at some of the other housing futures over at housing derivatives that compiles a list periodically. Here’s a little rundown of the April 2008 published future prices:

November 2010

Las Vegas: -28.9%

Miami: -21.9%

New York: -15.2%

San Francisco: -25.6%

Chicago: -12.0%

Bottom line? More pain ahead at least from people that are putting their money where their mouth is. Think housing will go up? Go ahead and put some money down.

Let us now move on to one of our most absurd Real Homes of Genius on record (hat tip MC). Today we salute you Long Beach with our Real Homes of Genius Award.

From $1,325,000 to $200,000 in 3 Years?!

Today we are looking at a 948 square foot condo in Long Beach California. In housing bubbles, condos usually run up the quickest first but also correct the fastest as well. This place makes no exception to that rule. Yet the pricing action on this place makes you wonder if you aren’t living in some Twilight Zone. Instead of Ed McMahon stopping by your home with a $1 million check we get a reverse housing clearing house award; in this world you get a knock on your door and you have the potential of losing $1 million simply for turning the knob.

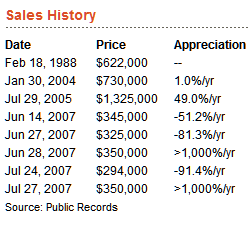

This place is located on Ransom Street which runs deep with Shakespearean irony. Let us look at some of the sales history on this place courtesy of the excellent website, Redfin:

Oh sweet mother of Earth! This place is now half off of a price that was reached 20 years ago! Could it be that we’ve found a condo that went through the late 80s bubble but also the current mega housing bubble? This place sold for $622,000 in February of 1988 and then sold for a peak of $1,325,000 in July of 2005! It also sold for a ridiculous price of $730,000 in January of 2004. The real action is all the entries that occurred in 2007. There is something going on here and I’ll leave it up your imagination as to what exactly is playing out.

Let us now take a look at the pricing action on this place:

Bwahaha! Hey, if this place sold for $622,000 in 1988, sold for $1,325,000 in 2005 anything is possible so why not ask for 10 zillion dollars? I think the $3,500,000 was an input error but at this point nothing would surprise me. This place is now listed at $200,000; that is a $1,125,000 discount in three years! Bwahaha! Hold on a second and let me catch my breath…Bwahahaha! What the hell is going on here? Why would you even want to rob a bank were you are probably only going to get $50,000 and be put behind bars when you can be a shady broker, lender, appraiser (seriously who the heck appraised this place?), or agent and you have yourself a method of getting criminal amounts of money without facing prison time. I’m still waiting to see massive amounts of people being put behind bars because I equate this with flat out stealing money.

I love how these ads tell us that you have “great freeway access” when everyone in Southern California by default has great freeway access. You’ll be stuck on the freeway once you do get on and idling away that precious $4 a gallon fuel but yes, you do have great freeway access. We are also told that this place has “low maintenances living” whatever that means.

Digg this article, Reddit, Stumble it, and get these insane examples out to the larger public. Frankly, the best way to show how idiotic any bailout would be is to highlight financial irresponsibility through actual real world examples. I think most folks with common sense can see how pathetic any help would be to lenders that clearly manipulated the system and now need to eat their own imprudence. The lenders can go pound sand for all I care and their CEOs think the same way about borrowers. How is bailing out a place like this good for our economy?

Today we salute you Long Beach with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

20 Responses to “Real Homes of Genius: $1 Million Discount for a 948 Square Foot Long Beach Condo!”

Hahahahahahahahaha!

This place changed hands 5 times in 6 weeks! How is that even possible??? I can see schmucks flipping it to each other on some website; even if noone made any real money in those deals in 2007 at 4% those sales generated $66,560 in commissions for someone.

Unbelievable.

Doc. Where ever you got the info from, must have been a typo. Maybe it was for the whole building. Probably the whole street. Its over by Joe Jost (Scooner of Pabst and a special please) there’s no way.

Some may decry title company fees, but this property is exactly the poster-child of why lenders require it and buyers would be stupid not to obtain it even if they paid cash for the place. During the fat years when title transfer was clean, title fees may have seemed excessive. Now that there are funky liens of a variety of natures popping up – including, NOD’s, NOTS, mechanic’s liens, judgements, mortgage liens, questionable grant and quitclaim deeds – a title officer actually has to earn his or her money and determine who of the previous title insurer gets to pay for this little bit o’fraud.

DHB – what are the rents on this place? At $300k it might cash flow?

I think the data for that building might be inaccurate. It looks like it was previously an apartment building, which sold for $622k, $730k, and then $1325k in 2005. After that it was converted to condos, which sold for various prices, but all of their sales showed up in this one record (presumably because the unit numbers were excluded). The current listing (and all of its pricing changes) is for just one of the condos, but it’s showing all of the prior sales for the whole building.

Wow the price on that condo went up faster than the price of oil this month!

Back to an earlier topic, the GSE’s, I see that FNM’s own analysis of its own mortgages reveals that home prices have fallen in 43 of the 50 states. The declines are not as precipitous as those from Data Quick or Case Schiller but then they are based on conforming loans sold to FNM so they don’t include the more extreme examples of financing. What are we to make of FNM’s decision to allow downpayments of as little as 3% given their own data reveals declining home prices in 43 states, not zip codes? Yes, Atherton and Malibu homes maybe holding up but FNM doesn’ t ‘do’ Atherton or Malibu. Since the GSE’s now account for 84% of all mortgage securities what happens to real esate financing if, or should be, when, these outfits meet the same fate as Bear Stearns? We are talking trillions here, beyond even the capacity of the Federal Reserve to rescue.

Is it near the blue line? It better be, because thats how you will be traveling to work with $4 plus gas at the pump. Forget about freeway access. Get use to walking to Albertson’s, better yet buy a segway for neighborhood traveling.

Please tell me how a condo loses $1,000,000 of value in a single year? bwhahahahaha, pardon me, bwhahahaha!

The numbers sound right to me. I saw plenty of ads for condos in the million dollar range in parts of long beach during the bubble days. Ransom street is west of the traffic circle and that whole area is gentrified overpriced condos. Its overpriced since that kind of money should get you closer to the ocean but its in the ballpark for what real estate was going for over there at the time.

the data must be wrong.

its not possible

why would the place change hands 5 times in 2007 in month time ???

I find it ironic that we have people saying “Oh, better check it out, make sure it’s real.”

Had we had the same mentality when prices rose like this we all would have been much better off. I have no reason to doubt these numbers. Fraud was SO widespread during this latest bubble that I am amazed only by the fact that we do not see more of these.

Think to yourself: if you did it, who would know? Establish a false alias, be a realtwhore and sell it back and forth between yourself 8 times. When I was a trader I knew a guy who made free 100MM bets on the way the short-term Treasuries would trade, made bank doing it for 18 months and only got caught when Greenspan finally raised rates. Dude, it happens.

And even if all that sounds like BS ask yourself this; why would anyone spend the time to get this property listed at 200K if they weren’t willing to sell there?

Occam’s Razor in action if you ask me.

I think David hit the nail on the head.

622K, 730K and 1.3M were sales as a multiplex.

The lower amounts are individual unit sales.

David is absolutely right. There were a slew of these 8 and 9 unit buildings which were purchased in the $600-$900k price range and then converted to condos. The initial sales prices were in the $289-$329k range in early 2007 depending on amenities and location. By summer when the 100% financing availability was impacted, the prices started decreasing and now the market is pretty much frozen with many developers renting the unit

There is so much fraud on this property, it is oozing out of the foundation and spilling into the gutter.

This is a serious loss that is the first of many…

Public records show it was an 8-unit apartment building that converted to condos on 4/9/07. The multiple sales have an appearance of being recorded on the original old parcel (which the broker is using in the MLS listing) before the individual airspace condo map became available. The $200,000 list price is for a short sale on one of the units.

Hey Doc, would you please clarify: “In fact, the futures markets are pricing in a 28.3% further drop for Los Angeles by November of 2010.” When I see these percentages, I don’t know what they really mean…28.3% less than what? The current price? The price at the peak? My guess is that generally the peak price is meant, but in this case that sure sounds like a total drop of close to half by 2010 given where we are now.

“Real Homes of Genius: $1 Million Discount for a 948 Square Foot Long Beach Condo!”

I would be willing to bet those sales prices, prior to 2005, are based on the entire building. I believe the entire building was purchased in 2005 as an apartment building and they converted it to condos. That would make the most sense to me. Even at the peak, nice 1+1 condos in Long Beach, on the beach, with a straight on ocean view never went over the $1,000,000 mark. This one is like a mile or so inland, with no view. This place had to be a condo conversion. If it is not, I want to sell that 2005 buyer the Vincent-Thomas Bridge! What do you think Dr. Housing Bubble?

All we need now is some sign spinners and the buyers will come running!

Here is the listing again – http://www.redfin.com/CA/Long-Beach/3305-E-Ransom-St-90804/unit-D/home/7604374

Jes, the futures declines are “to spot,” i.e., the current price at the moment the report was generated.

In other contexts, we do indeed talk about drop from peak, but not here.

Long Beach?

My dear Ex Brother In-law did buy there.

A tiny 2 Bdrm. 2 bath house, corner lot, 4 blocks away from the beach….

for a whooping 925K around 2005. I think it was a bungalow built in the 1960’s?

The townhouse I rent for $1100 is bigger than his 925K house…

I told him then that he is nuts… but unfortunately he got caught

up in the mania…

I don’t understand Southern California even back in 2005 you could

have bought a Mansion and enough acreage to have

your own wildlife preserve in Northern Ca. with this price tag.

Congratulations… he is now looking into “buying” a house in Mexico.

Reena

Maybe the 2005 owners trashed the place.

Love the comment on Great Freeway Access: “I love how these ads tell us that you have “great freeway access†when everyone in Southern California by default has great freeway access. You’ll be stuck on the freeway once you do get on and idling away that precious $4 a gallon fuel but yes, you do have great freeway access.”

It’s true…absolutely true. Each day, I drive the 105, 405, and the 90 freeways. When I am lucky, I get to add the 110, 10, 101 and the 5 freeways. Now driving the 91 and 605 freeways is really pushing it but yes, sometimes I get to drive all 9 freeways in one day because of our GREAT FREEWAY ACCESS. I’m with you. Give me a break:)

Leave a Reply