3 stories of the current housing market: The true long-term cost of owning a home, Orange County housing inventory, and Pasadena real estate.

It is very true that most people are only focused on the monthly payment. Most in California inflate their lifestyle up to their paychecks. That is why you have many older people now looking into the long path of retirement with little in savings. They expected to live like millionaires but realize that their housing equity doesn’t send them a check each month. It is also hard to live like royalty when the adult kids are back home in their rooms. I’ve heard it said incorrectly a few times so I thought I would go into the total cost of owning a home more clearly. Someone said “if I pay $700,000 for a home that is all I will ever pay whereas in rent it is never ending.â€Â First, there are never ending costs associated with a home including taxes, insurance, and maintenance. Second, there is a little thing called “interest†and this is so vital, that it makes banks the rulers of the world. Let us first dive into the cost of owning a home first.

Cost of buying a crap shack

Let us say you drank the Kool-Aid and you are ready to buy a home. It is the summer time and the humidity is bringing out the housing lust. You must buy. You can’t wait to walk into the bank and sign that 30-year contract. You’ve been searching the market and thankfully, although prices are still high there is a growing amount of inventory. You will pay a premium but you are likely to have options this summer.

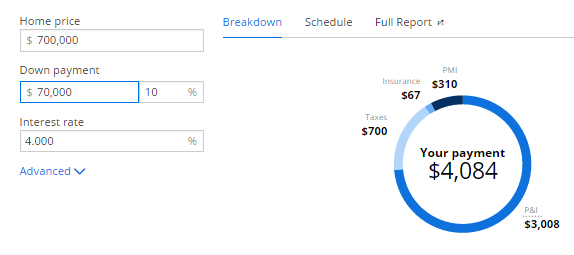

You have your eye on a lovely $700,000 stucco box crap shack. You can see yourself turning old and frail in the place and you are ready to have that mortgage burning party in 2045. What are you going to pay for the place? Let us assume you plunk down 10 percent:

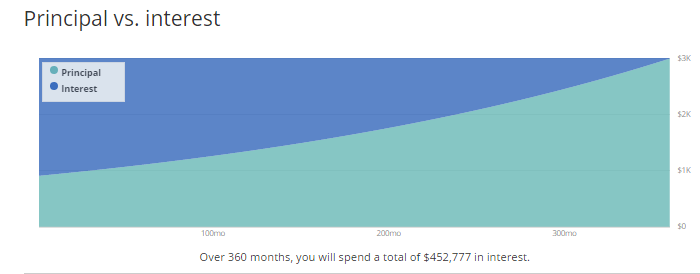

With a 10 percent down payment your monthly nut is $4,084. Taxes and insurance will be part of your monthly outlays for life. People somehow miss the interest portion of the price. So in the end you pay:

$70,000 down payment

$630,000 principal

$452,777 in interest

Total interest and principal (with down payment):Â Â Â Â Â Â Â Â Â Â $1,152,777

You will fork over $1,152,777 in principal, interest, and your down payment for that $700,000 crap shack assuming a low 4 percent mortgage. What about taxes and insurance? Taxes for now will be about $700 per month and insurance about $67 per month. Assume no increase in taxes or insurance and over 30 years you are paying out $276,120. So in total you are paying for that $700,000 crap shack $1,428,897 over 30 years. And I reiterate, this is on an ultra low interest rate of 4 percent.

Now this might make sense for you but rarely do I see these numbers broken down in this way. The most typical format is the monthly nut breakdown. I think this simple view misses out on the long-term outflows and as many Taco Tuesday boomers hit retirement, many realize their retirement accounts are not going to allow for them to live high on the hog. They could live high on the hog if they sold their home but many are zip code addicted. Better to eat Purina Dog Chow than cash in the stucco box lottery.

If you were to save $1,000 a month and toss it into a total market fund after 30 years you would likely have $1,200,000. This is of course is assuming you start with zero and earn a 7 percent rate of return. Investing isn’t all or nothing. There is no magic one way or another. Many younger professionals also realize the benefits of renting for mobility sake. Some see leverage as a plus in housing. How about the 1,000,000+ Californians that only a few years ago lost their homes in foreclosure because of the drawbacks of leverage?

Let us now move on to Orange County housing inventory.

Orange County Inventory

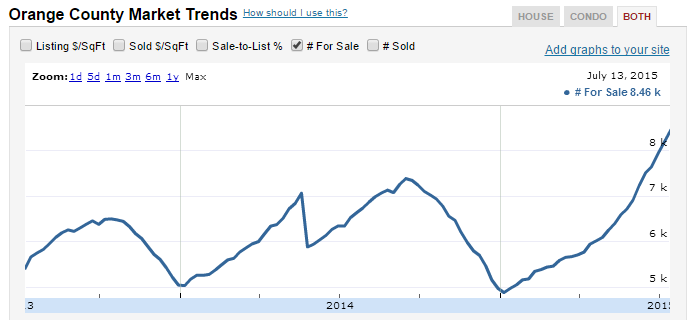

For the first time in many years we are seeing a big growth in inventory, especially in Orange County:

Inventory in the OC is up 55 percent from 2 summers ago. This is a big jump. Prices are still high but the days of writing tear stained letters to get the attention of sellers is gone. In fact, inventory is rising because some homes are sitting longer on the market. This isn’t just the case in the OC. Let us look at Pasadena.

Pasadena Real Estate

I know for many readers Pasadena is a targeted market. Let us look at two homes:

3060 E Del Mar Blvd

Pasadena, CA 91107

2 beds, 2 baths 912 square feet

This is a smaller place and is definitely a starter home. Â Let us look at the price:

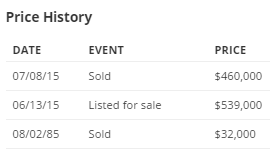

Someone wanted $539,000 for this place last month but got $460,000 instead. So now this buyer is trying to sell the place for guess what amount? $539,000 within a couple of weeks of buying this place. Sure seems logical to me. Let us look at the next place.

1785 La Loma Rd

Pasadena, CA 91105

2 beds, 2 baths 1,283 square feet

This is a nice starter home. Let us look at the ad:

“Home buyers seeking a sprawling backyard with a green lush lawn will need to look further. Eco-conscious home buyers seeking the perfect combination of taste, science, low maintenance, conservation, energy efficiency, and location have met their perfect match!â€

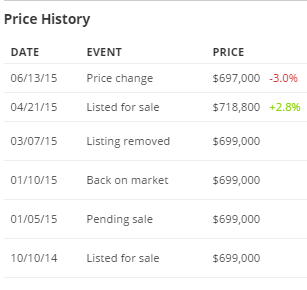

Science? Conservation? This ad might as well read “give me your money hipster†and be done with it. Let us look at the price history:

They tired selling this place last October for $699,000 and it went pending in January 2015. Came back on the market and was removed in March of this year. It was listed for $718,800 back in April. No takers. Now it is listed for $697,000. See how motivated they are to sell? They are chopping off $2,000 for you!

Welcome to the wonderful world of California real estate.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

113 Responses to “3 stories of the current housing market: The true long-term cost of owning a home, Orange County housing inventory, and Pasadena real estate.”

It’s just a matter of waiting for the psychology to change. Inventory is up, and a rate rise is coming. There could always be a global or domestic financial crisis, but those are unpredictable. What we do know is, rates are going up for the first time in 9 years, and inventory is going up. We’re already at very low single digit YOY gains…and if those turn negative, with increasing rates, and sellers chopping their asking price to get while the getting is good…then things can turn quickly.

If there IS a financial problem, like the stock market returning to reality…then things could turn south very quickly. However you slice it…what’s the urgency? Why buy now? We’re almost bubble 1.0 peaks in nice areas…the market can barely eek out the door am that we’re at now. What are we going to miss out on exactly, except for a downturn?

We are certainly not at a bottom of an economic housing cycle. The real good deals are probably gone. I still believe money liquidity is the key for housing. If banks do not provide liquidity (via new loans) or cannot provide it then housing prices will stagnate or fall. But if they keep liquidity high….prices will stabilize or rise.

On the other hand if people look at charts it appear we may have already started a secular bull market. They usually last 15 to 20 years? What could be the driver? Consumers have deleveraged. Their debt to income is around the lowest it has been in 15 years. In 2007 it was very high. That means U.S. consumers could start to take on debt after deleveraging for 6 years.

Sovereign fiat money printing? The U.S. just printed $4 Trillion dollars over 5 years. Japan is in the middle of a huge QE fiat printing cycle. Europe just started their Trillion dollar a year QE program. I would not be surprised if China, S. Korea, and other Asian countries start QE programs too. The current solution to any financial issue is to print money and other countries have seen how it lowered unemployment in the U.S. as well as gave the stock market and housing a boost. Over the next 5 years it is possible another 5 to 15 Trillion dollars could be added to the global money supply. That would probably lead to inflating prices for hard assets. This may drive more foreign ownership looking to park newly printed money into the safe U.S. assets.

I am just putting out food for thought. It does not mean I am right. 🙂

Over the next 5 years it is possible another 5 to 15 Trillion dollars could be added to the global money supply. That would probably lead to inflating prices for hard assets. This may drive more foreign ownership looking to park newly printed money into the safe U.S. assets.

How is this strategy working for China’s stock and housing markets right now? Bubbles burst and mal-investment is corrected. Every time. The only way to stave off deflation is if the printed money goes into consumers hands, but since that isn’t happening anywhere, it’s just a circle jerk of monetary malfeasance that only delays the inevitable. If the authoritarian PR of China can’t control a market downturn there is little hope for the rest of the money masters. Select enclaves of RE may prove safe havens (Manhattan, SF, Prime LA) for sometime but everywhere else, eventually, it’s all about the cap rate. Reality is coming sooner than later. The tank may not happen as fast or as deep as my buddy Jim Taylor may hope, but it has already begun.

NihilistZerO. I agree with you. Central Banks can print but unless they actually give it to consumers they have a hard time of controlling where it goes. I just think globally there is going to be other countries that will attempt QE which could put a floor under U.S. housing and maybe boost it.

China real estate is expensive compared to the U.S. They think U.S. real estate is cheap. As does people living in S. Korea, Singapore, Taiwan, etc.

China probably has a bubble because of easy liquidity…..just like the U.S. subprime fiasco. So this excess/mal-investment has to burn off just as you said I have read so many stories of people in China owning several properties as a way to get rich just like what happened in the mid 2000s in the U.S. as there were 5 million excess homes built above the need of current population growth. The strategy of getting rich buying real estate in China appears to have played out (no new buyers and too expensive) and is no longer a get rich strategy in China. Well where is real estate cheap, you can use leverage (via a small down payment), and what country does not have any restriction on foreign ownership. The U.S. Housing is more expense (in USD) in the major cities of Australia, New Zealand, UK, and Canada when compared to the U.S.

I guess what I am saying is new QE programs could cause a flux of money that could find its way into U.S. real estates. That is because globally the U.S. real estate bubble burst and is on the way up again. The countries I listed above have not seen their bubbles pop. Take a look at the following charts. China has not implemented a QE program yet but they are exploring the idea.

http://i.huffpost.com/gen/1193690/thumbs/o-PAUL-KRUGMAN-CANADA-HOUSING-570.jpg?5

https://sp.yimg.com/ib/th?id=JN.SUBgQTyQVo4yHNs8o8g3cw&pid=15.1&P=0

http://www.otterwoodcapital.com/wp-content/uploads/2014/04/april29.png

I have a friend who moved from Australia to LA this year because LA housing is less expensive.

@ru82

You’re only further reinforcing my point if you think about it. It’s P/E in stocks and Cap Rates in RE. It’s ALWAYS the P/E or Cap Rate in the long run. What sense does it make to leave cash because you fear devaluation and move into an “asset” that will face deflationary devaluation? This is why the corrections come. Every time. Once you run out of greater fools you face true price discovery. Price discovery can be held at bay for some time, but the longer Central Banks manipulate the market, the more severe the correction. This is why the FED is finally raising. They’ve determined that any longer and the shit storm is exponentially worse. Now just like every other time, I doubt their timing is going to be perfect. But they accomplished their goal by inflating Housing Bubble 2.0 and moving inventory to private equity. That was always its sole purpose. Now all those lovely second homes, investment properties, etc are going to be priced in an market that has gone bear with a complete absence of specuvestors. Their is not enough foreign capital to push markets higher or keep them levitated once mortgage rates rise. Even those looking for a safe haven will gladly buy at lower prices just as they were from 2009-2012. The invisible hand is undefeated in economic history. We are about to learn that lesson, again.

Something people need to remember is, how much money can also be made in a down market, whether it be stocks, housing, bonds, commodities or whatever. If big money sees an opportunity and everyone is betting one way, that is when the market turns. Most investors prefer to be in the middle of the herd to protect any gains and follow the leaders. It’s a game that governments play along with and has been going on for years. Unfortunately, foreign money is now parking cash in high priced real estate such as Southern California and has turned it into a high stakes casino.

Investments are all about perception. Once that perception changes, investments normally decline much faster than they increase. I guess you have to ask yourself “do you feel lucky?” and how much more upside is there, compared to the downside.

If possible, normal folks might want to look elsewhere beside Southern California to buy a home to live in.

http://www.taxcomxvilla.weebly.com

Investing in the stock market has a hit a new age. There is more reliance on computer algorithms than yesteryears. There are also more speculators and hedge funds than ever. What all this adds to is a potential for large swings (higher peaks and larger crashes) in the future.

I don’t know much about California but in DC metro areas, “normal” people have not seen prices increasing. If rich people buying 800k 2 bedroom townhouses see their property values collapse…well they’re rich and can afford it. For those of us that are no rich, there is no bubble and is barely a recovery. Prices declined year over year in the affordable suburbs (places where 75-150k household income can buy a house).

http://www.longandfoster.com/Market-Minute/VA/Prince-William-County.htm

Localized housing bubbles created by and for the 1% is not my concern.

Great entry Doc. This is what I keep banging on about; math.

So in total you are paying for that $700,000 crap shack $1,428,897 over 30 years. And I reiterate, this is on an ultra low interest rate of 4 percent.

And if the market turns, prices soften, and buyers fall away, unless you can sell for a loss, you’re handcuffed towards working off that $452,777 ‘dead money’ in interest payments for years to come.

With math, $600,000 borrowed at 4% is much much worse than those who complain they had to pay 10%+ on $150,000 mortgages in the late 90s.

-They fell foul of compound interest which Einstein described as: ‘The eighth wonder of the world… he who understands it earns it, he who doesn’t pays it’

-‘Interest on debt grows without rain’ – Yiddish proverb

In a low inflation world then, money illusion is that a mortgage is cheap when its initial payment is low. Without higher earnings growth, repaying the total debt will consume a far greater share of career earnings.

…unless you can sell for a loss, you’re handcuffed towards working off that $452,777 ‘dead money’ in interest payments for years to come.

C’mon GB. This is California. The greatest of the non-recourse states. It is called:

F O R C L O S U R E

And it will be dragged out and made the bane of the lender. Just as the previous period specuvestor and home debtor implosion provided us the last buyers market so shall this.

Re non-discourse foreclosure clearing the market…

The lenders took it in the shorts last time around but this time its the taxpayers (Gubberment-backed) or US Dollar holders (FED QE to the moon) that will take it. And they won’t offer green-ink lube to us before the act.

A few issues with these calculations

1) This is not a conforming loan, so I don’t think u can get a mortgage with 10% down. 20% is more like it. This will also cause PMI to go away. One has no business to buy a home without 20% down.

2) You are forgetting about the tax advantages of owning a home. So you should subtract 40% of your interest and tax payments

3) What do you compare this to? What does a rental of a comparable home costs?

All good points Mik.

1. Nobody has any business buying a house with less than 20% down. If this rule would have remained intact, this would have prevented the giant bubble and millions of foreclosures.

2. Property tax and mortgage interest deduction needs to be taken into account, I’m sure we’ll hear about AMT from the bears. The truly wealthy aren’t buying 700K crapshacks. These are working stiffs making ends meet.

3. And what is this housing payment compared to? In buying, your housing costs are essentially fixed for the next 30 years. Renters certainly can not claim the same. What will your rent payment be in 2035?

If you can save and invest 1K per month for 30 years, you’ll have 1.2M assuming 7% returns. No arguing with that math. Then again, this 700K crapshack will be paid off in 30 years and be worth much more than 1.2M based purely on inflation. As I have said umpteen times, buying a primary residence in a decent area that you plan on owning for the long term is a no brainer.

Then again, this 700K crapshack will be paid off in 30 years and be worth much more than 1.2M based purely on inflation. As I have said umpteen times, buying a primary residence in a decent area that you plan on owning for the long term is a no brainer.

Based purely on inflation? What sort of inflation Lord Blankfine.

Wage inflation that boosts house prices (together with foreign money etc). Inflation in everything else (food, energy, medical) just takes away from the money people have to spend on housing. Got that !? It could be worth far less in a couple of years in a house price crash. Not this rainbow-unicorn dream you have of forever rising house prices.

Buy today for this ‘long term investment’ = The classic definition of a long term ‘investment’ = A trade that went wrong.

That must be some crystal ball you have to know how real asset value as it relates to inflation will be 30 years into the future.

“no brainer” + “plan on owning for the long term”

That is the crux of the problem, right there. Just sign and don’t think – but make a 30 year “plan.” That’s why we’re here. It is a brainer, people are better served with critical thinking.

But hey, just apply a label such as “bear” to any skepticism so as to avoid having people use their brains.

This is a good counterpoint. Some additional things to consider:

– We have to assume that you don’t sell in the middle of your 30 year mortgage because then you’ve just paid far more interest than principal and the effective interest rate is very high

– Can we assume that taxes, home value and maintenance costs will track (rise) inflation and on the other side rents will track inflation?

– Assuming one keeps the home for 30 years then the other tricky assumption is that investing can earn a 7% return but everything else will only track inflation.

I think when you include everything in the equation, the two options come out really close and the overriding factors should be

– which activity will you be more comfortable with? investing or buying and owning a house?

– how much do you value owning a home and living in one place for a long time?

Galaxy and Hotel, you two seem like pretty smart fellows from reading your posts. Do you honestly think that in 30 years from now (that’s the year 2045), that same crapshack in LA will be selling for 700K or less? If you really do, you are in the ultra fringe minority. The only way this entire system works is through inflation. To think inflation won’t be a factor going forward is just as silly as saying “home prices will go up forever.” There are financial doomsday blogs where your message will be better received, I highly doubt the majority of bloggers agree with your housing inflation (or lack there of) projections.

On a nominal basis, the probability is that it will be higher – in real terms, not sure. In terms of end-user value (considering the cost of inputs such as congestion and opportunity), also not sure.

Perhaps some things are getting lost in translation but I agree with you that inflation is the game plan, although I also expect readjustments that can’t yet be accounted for. History demonstrates that imbalances shift over time, so either SoCal will see inflation shift from assets to income or the productivity drain will ramp up its flow to other competing locales.

It’s not a doomsday scenario, it’s human agency seeking balance.

“Then again, this 700K crapshack will be paid off in 30 years and be worth much more than 1.2M based purely on inflation. ”

That is what people forget is the inflation mandate by Central Banks will cause all assets to rise. 700k at 2% inflation will be 1.27 million in 30 years. 3% inflation will be $1.7 million. What is interesting is that $150k 4 bed home in flyover land will be only be 271k at 2% interest over 30 years and $360k at 3%.

It will be interesting to see how things playout. Will flyover land actually appreciate more so it can catch up with property in places like California? My parents bought a 4 bedroom home 30 years ago for $108k in Kansas City and know it is worth $150k. Total maintenance cost are probably more that double what the house has appreciated over this time frame. This price appreciation comes to an average of 1% a year which is low compared to California. The average house price in LA in 1984 was $120k and now it is $500k which is a 5% YOY average.

According to the CPI index 120k in 1984 would be $281k in 2014 as avg. inflation has been 2.876% YOY.

So a tale of 2 houses. One has appreciated 50% less than the average inflation rate while the other has been 2x as fast. The question is can an will this continue.

Lord B., you are wrong given the current circumstances. In a global economy salaries for middle and upper middle class can not increase. In the best scenario the nominal salary stays the same. With so many trade agreements being in the pipeline to be signed, how can you increase the wages for the middle class?

Since you are right that all energy, food, medical and education costs (everything the average person buys) are going up fast (above the published CPI), that means you have less and less available for saving for the downpayment. Since less and less people have money left for housing the number of mortgages is dropping. The Doc and Logan already showed that number of mortgage applications plumeted. Blert already explained the same thing with Obamacare and people said that he is rambling. I would say he had a VERY good insight for stating that what happened in the past is not going to happen in the future. Commercial mortgages are the main mechanism for increasing the money supply in the economy and that mechanism is broken. Every single dolar in the economy is created through debt. If US economy can not increase the money supply, it can not service the interest and the system implodes.

The FED can create trillions; however those trillions sitting in the bank without circulating on main street are not doing any good. Therefore, both Blert and Nihilist are correct in their assesment. During our lifetime people were able to borrow and that created for most people, including you, a certain mindset. That paradigm is no longer valid. Obamacare just exacerbated a fenomena which started in 2003. The new trade agreements to be signed soon will just amplify this desastruous fenomenum.

I agree with your anaylsis ONLY for locations where the 0.01% are buying. The banking cabal is the ONLY group benefiting from all this. I doubt any of the bloggers here are in the 0.01%. Most of the bloggers here are going to be affected the way Blert and Nihilist and I are saying.

@Lord Blankfein wrote: “… Do you honestly think that in 30 years from now (that’s the year 2045), that same crapshack in LA will be selling for 700K or less…”

45 years ago, the city of Detroit had the highest per capita income and the highest household income in the United States. 25 years ago (1990), inflation adjusted median household income in Los Angeles County was about $63K, today it is about $54K. Los Angeles County has one of the highest poverty rates in the United States, Orange County is worse.

The long term trend lines are not positive for SoCal. Short-term, the prime and mid-tier areas will do fine. However, these areas are no more than 25% of SoCal. Long term the prognosis is not good for SoCal but short-term I expect the real estate in prime and mid-tier areas to track the stock market. The commodities market is the real predictor of where the global economy is headed. And the commodity market is in a recession.

Don’t forget what the Realtors say, you are making an investment and you will be rich someday(appeals to a person’s greed). Raw dollar values will go up when the currency is devalued. Remember Germany in the 20’s before Adolf came to power? First you destroy the currency then the people will be ready for a “savior” .

I am a renter. I lived in a house for 4.5 years in Toluca Lake. I recently moved to another house 1 mile away in Burbank. I now pay less money for a nicer house. The difference is that I no longer live in 91602. On my old block a house sold for 1.5MM. It is an 1100 sq.ft. house . It was originally listed at about $800 a sq.ft. It didn’t sell. A month later — it magically grew to 2200 sq.ft without additional construction. Marvels of RE. The person who bought the railroad design house marveled at the quality of the flip. Here’s how this worked: Amanda Pays flips for the stars. The stars pull in many millions a year. They don’t care like I care with my hard earned 20%. Their properties will continue to go up. People who can afford what I can afford should be scared. Stars don’t want what I can afford and there are fewer and fewer people who can afford what I can afford. Paradox. So, I rent, I put my money into my business, I have mobility. The people next door to me right now paid 528K in 2013 for their house. Zillow say it’s worth over 700K. Seems great, right? Who is going to pay over 700K to live in an 1100 sq.ft. house on an alley in Burbank? If the house was 91602 — no problem.

@Flyover, middle class can’t afford 700K crap shacks and never will. What do you consider “upper middle class?” I would consider upper middle class a household income of 150K per year, people like this can squeeze into said crap shacks.

@Eblo, the old 54K median income argument gets old. These people aren’t buying 700K crap shacks. They are doubling and tripling up and living paycheck to paycheck. You are free to have your opinion about socal ending up like Detroit. I wouldn’t take that bet!

There are no real issues with any of it.

“1) This is not a conforming loan, so I don’t think u can get a mortgage with 10% down. 20% is more like it. This will also cause PMI to go away. One has no business to buy a home without 20% down.”

Agreed, but that’s not what happening in SoCal today. It’s either all cash specuvesting or lowest-down leverage for owner-occupiers. Such informs the price level and is the current marketplace of competition.

“2) You are forgetting about the tax advantages of owning a home. So you should subtract 40% of your interest and tax payments”

The tax subsidy is dependent on each individual tax situation and it’s often way overrated. The actual benefit is the difference between the standard deduction and what (MI + Property tax itemizations) achieve above the threshold – but that important detail is normally goes unmentioned. For most people it’s certainly not 40% and with low rates the potential benefit is less. In low cost areas I bet most people are better off with the standard deduction, and in high cost areas the subsidy phases out for high earners.

All of these people in the past few years that have refi’d re-ammorting out to 30 years are lessoning the potential annual benefit even more so.

There’s also no guarantee as to how long the subsidy will remain in its current form, if at all. Most people don’t recall that 30 years ago the subsidies for personal interest went poof in the night.

Of course, a non-leveraged purchase only leaves the property tax deduction, an even smaller potential benefit.

“3) What do you compare this to? What does a rental of a comparable home costs?”

Even assuming so-called rental “parity” – the argument is often made that renting is throwing away money or enriching the landlord. The point Doc makes is that leveraging a home purchase is the same thing, just substitute ‘bank’ for where you see the word ‘landlord.’

Considering point #1, the only skin in the game for the renter is the deposit, a mere fraction of what 20% of $700K would be, and still less than 3.5% – with an explicit guarantee of getting the money back.

What I don’t think Doc mentioned is that most of the payments in the first several years are mostly paying down interest.

An unwise man might speak of a “new normal” which can cut both ways. Opportunities are increasingly upping the value of mobility, further lessoning the likelihood of someone staying in a home for more than several years. For those that sell at five or seven years, there’s not much principal (savings) if any at all after netting out expenses and transaction costs. The same unwise man would then tell you that everyone wants to live here, so no worries. The problem with that is we are then in speculation territory, as making bets on what other people will make bets on is not a fundamental input.

The recent surge in inventory is the people finally unstuck on paper after all of these past few years attempting to unload. What a lame situation to be stuck in. It’s now a scramble for the exits.

But hey, they can do whatever they want with the property. Oh wait, no they can’t because building codes and municipal process (along with fees). The intangibles of “owning.”

Great, intelligent replies as always, Hotel California.

Good post Hotel California.

Maybe my observations are “anecdotal”, or maybe I am too self-centered, that I think my situation will apply to many of those who buy these properties.

Me (and most of my friends who buy 700k-2mm properties) are either 2 income professionals or small-mid size business owners. So based on this sample of population

1) We do all put 20-30% down to optimize interest rate as well as not to pay PMI. None of us “inherited” money, or have our parents pay for us. I am not sure what’s the statistics of all cash payment for these types of homes, but when we were on the market only about 10-15% of offers were all-cash

2) Yes, not everyone gets a tax write off. However, everyone that I know does. As we use our active income to qualify for a mortgage, and it definitely helps. In California (and now we live in Oregon) 40% marginal rate is actually on a low-end for my estimate.

Can this deduction go away at some point? Sure. But we all have to plan based on existing tax code.

3) In reality to value buy vs. rent you should do a full analysis, and make some assumptions. You are leveraging 4-5:1 on your equity, in anticipation that your home value over a long term will go up at a rate of inflation (this is based on historical trend).

This is not hard math, and everyone should do it for themselves, using their own assumptions. To ME it makes sense to own, maybe to you it does not.

“Considering point #1, the only skin in the game for the renter is the deposit, a mere fraction of what 20% of $700K would be, and still less than 3.5% – with an explicit guarantee of getting the money back.”

Exactly – and if you take that 20% (and only that) and invest it at 7%, then it becomes $1mln after 30 years, and it’s yours to spend, too. Whereas with RE you are locked into an investment, and you have to incur the maintenance costs and you can only hope that you can sell it one day and unlock the growth.

I don’t think you understand how little the tax deductibility of mortgage interest matters. Most homeowners do not take the writeoff because the standard deduction gives them more. 40% is way off the mark.

Most home purchasers are not buying 700K crapshacks. To buy a 700K crap shack, you need to make over 100K. So the property tax and mortgage interest deduction is substantial. We are talking 700K socal crapshacks here, not flyover country 100K crapshacks. Don’t cloud the argument.

Then again, this 700K crapshack will be paid off in 30 years and be worth much more than 1.2M based purely on inflation. As I have said umpteen times, buying a primary residence in a decent area that you plan on owning for the long term is a no brainer.

That means there’s no bad time to buy. “Hey buy oil at $100+ or Gold at $1800… don’t worry because of the magic of inflation means they’ll be worth x5 times more in 2040!!” Next up for deflationary forces and lower monetary velocity; a nice big Stock + prime Real Estate Crash. 2040.. to have $700K on that shack… we could be living in the skies by 2040 via tech revolution, or local on the ground conditions could have changed.

40% is indeed way off the mark. You would subtract (marginal tax rate x interest amount). For mid- to higher earners, this would be 25-33%, not 40%.

Galaxy, your argument is pointless. You mention oil and gold which are HIGHLY SPECULATIVE investments, why don’t you throw internet stocks in there while your at it. Shelter (housing) is a basic human need we can not live without, additionally there are immense political and financial forces tied to housing.

Keep on dreaming that housing is not tied inflation. Why don’t you go ask your landlord if you can sign a 30 year lease at today’s rate since there will be no inflation going forward. See what kind of response you’ll get.

Lord Blankfein I wouldn’t take that rental deal if it were offered to me – not when I expect to buy a home in the future at much lower price than today, and many a landlord to be foreclosed on.

Political pressures work both ways. And you might want to look at the positions of the banks. Housing was a basic need in many other house price crashes; it didn’t stop values from falling. Housing is highly speculative at these price levels, in all the low to middle – to high prime areas; and hipster areas. We take our positions; I’m in cash awaiting big house price correction, while others see only ever higher values. That’s a market.

The fact that borrowers pay interest on a loan + property taxes can’t come as a surprise to many. Circumstances vary but rent for an average 3bdrm ranch house in our area has gone from 3+k to 5+k (and u can easily spend more) in the last 5 yrs. Income has not increased to that degree. Housing stock is limited and with kids you can’t just move to a new town every few yrs w/out forcing them to change schools and friends. We got tired of that scenario and bought a house – granted we put down more than 20%. Our payments are fixed w/property taxes at the low end of the above range – we can live here with predictability for the next 10 – 15 yrs until schools are no longer an issue.

Getting an average 7% return on an index fund? Maybe but I wouldn’t count on it – especially if you become disheartened, sell during a downturn and lock in a loss. that’s human nature.

My point is – owning a home isn’t necessarily a bad thing.

@BayAreaResident

I wouldn’t count on getting 7% appreciation returns either if you can’t do the same with real estate. Remember, an ever growing segment of RE is intertwined with the stock market: MBS, investment funds, Freddie and Fannie, etc. The same ZIRP that is levitating stock prices is also responsible for inflated real estate prices.

Actually, the stock market grows faster than time-average house costs – mainly because house cost grows at inflation rate, but a stock grows at inflation rate + gdp. 7% may still be too optimistic in the current market, but it still outpaces home price growth.

Meant: I wouldn’t count on getting 7% in RE appreciation either if you can’t do the same with an index fund.

Staying longer in the O.C. for sure.

My parents have had their home in Nellie Gail Ranch up for a few months now.

A lot of buyers have been non English speaking Chinese and Russians. Already one price reduction to 1,945,000

Now the next door neighbors, both a new homes just built during the housing bubble years … First weekend one got 2.5 million cash sold, the other went for 2,650,000 and they got a 2,450,000 offer they rejected.

Strong buyer traffic this last weekend.

However, the housing inflation story in CA is taking control. We do have wealthy people in CA, but take out all cash buyers and those making 3X Median income 190K and the buyer demand curve slips badly

All this is happening at the lowest rate curve we have seen post WWII when 10’s where this low during 1941-1945 time frame.

Looking for 10’s to go back to test 3.04%

That means 4.375% – 4.625% in rates

First rate inflation test will come when 10’s are 2.66% -3.04% just like the taper spike back in 2013.

The 10 year action is exactly what I thought it would be back in Dec of 2014 when I said we will test 1.60% and then head back to 3% but not break of that level . Today we are 2.38%

Key level 2.53% then 2.66% and then back to 3%

http://loganmohtashami.com/2015/06/09/10-year-yield-having-a-2nd-taper-moment/

@Nathan118

Yup,pretty much agree that it does feel like the top in the market. Plus I have a HUGE itch to buy that second home in the mountains and my timing has always sucked in the short term, so now is likely not the time to buy for short term owner ship.

A few points the Doc skipped in the above post: Tax savings due to interest write off (we still allow that, right?) On the $9k+ a month income needed to qualify for that $4k payment, you will have a substantial tax savings. My accountant use to suggest using a 30 year mortgage for the tax write off rather than a 15 year mortgage like I preferred. He suggested putting the monthly payment difference into a mutual fund so that you had a maximized tax write off and hopefully enough accumulated savings over 15 years to pay off the 30 year loan at the end of 15 years. Worked for me. YRMV

Jim,

You assumed a high income. However, the high incomes face the AMT, therefore, not much savings on taxes. With a low income you can not buy anything in SoCal.

In new developments in SoCal, you have to add in the ever-increasing monthly home owners’ association fees, and the bond payments for the installed utilities – these will add at least 50% to the mortgage payment every month, on homes the vast majority of people living there can’t possibly afford to purchase. When the Chinese stop buying, or worse – start trying to sell, things will get interesting.

” these will add at least 50% to the mortgage payment every month”

Um…50%? Not likely. 5.0%? Maybe.

I know associations (non-condo) that haven’t had dues increases in decades. Bonds? Nope. Tons of pre-melloroos property out there. Even condo association dues increases won’t add 50% to your mortgage payment. In fact, just about nothing will increase your mortgage payment 50%.

Perhaps you meant monthly payment. Again, that’s not going up 50% unless you have no loan or a tiny loan.

What you are talking about are called MeloRoose. And, yes, most of the homes in SoCal have them and the Doc forgot about them. They are higher that the prop. tax and insurance combined. In some cases they can be higher that interest payments. The Doc also forgot about the HOA dues which most of the time can be really high. The MeloRoose and the HOA dues combined can be higher than PITI and the Doc forgot about both. Maybe he did not want to scare the buyers too much:-)))

Any stats on “most of” California?

There is wrong and then there is some nonsense posted by Flyover. You claim the majority of homes in CA are subject to Mello Roos tax. Do you have any data to back this up? Buyers in NEW communities can be subject to this tax to help pay for supporting infrastructure, these are bond measures and will go away at some point in time. We hear it everyday on this blog that socal is littered with prewar and 1950s and 1960s crapshacks. There ain’t no Mello Roos tax at these properties!

Many areas of Irvine, and some areas of Tustin and Orange (where I’ve looked at condos within the past few years), have Mello-Roos taxes. The one I can remember best is a development in Irvine off of Sand Canyon north of the 5 Freeway (sorry, can’t remember the name of the development).

If I recall correctly, Mello-Roos and property tax combined were about 1.8 percent, or about 0.7 percent more than what you would pay in a non-Mello-Roos area of O.C. So a $600K purchase price would mean that might expect to pay about $10,800 per year ($900/mo) taxes in a Mello-Roos area versus about $6,600 per year ($550/mo) taxes in a non-Mello-Roos area.

It’s not too egregious, but I’d prefer to live in a nice non-Mello-Roos area (like Newport Beach) and apply that $350/mo difference toward a mortgage. $350/mo might equate to roughly $70K more in purchasing power at current interest rates.

In addition to property taxes and Mello-Roos, there are also parcel taxes:

https://en.wikipedia.org/wiki/Parcel_tax

http://www.caltax.org/ParcelTaxPolicyBrief.pdf

Santa Monica has imposed several parcel taxes over the years. Voters are so liberal here, they pass most parcel taxes, as well as sales tax increases.

I’m not a genius in math, nor do I have access to reams of data and statistics, but what I see…is that in the 80’s the fed’s interest rates where double digits, now they are zero. In the 80’s we had very high inflation and high wage pressure, now it’s 2 per cent or less. So, house prices have inflated to match the income to house payment ratios at the fed’s zero per cent interest rates. The fed’s inflation target is 2 per cent, so wages for the most part won’t need to increase more than 2 per cent any more. The fed is in control of this market. If people make more money, the fed increases interest rates, house prices stabilize. No high demand for labor anymore, because of lack of manufacturing and production here, not to mention immigration, so no wage pressure. Interest rates currently at zero, can’t lower the cost of money, house prices stabilize. Therefore house prices have no where to go. Besides, the government is going to end up with it all anyway, why not just say the hell with it and have fun!! That’s what I see my tenants doing!!! HAHA I learned one thing in high school…’we are a product of our environment’.

atraightfromLA:

Inflation in the USA is running anywhere from 9% to 14% for the last 4 years, depending on which metropolitan area you live in, or near. This is according to

the chapwoodindex.com, which unlike the federal govt’s CPI, actually records year over year price changes in tangible things, not make believe fantasy stuff like “owner’s equivalent rent” (see an excellent article on this subject by Dr. Bubble a page or 2 back on the blog btw). So, inflation in L.A. was actually 12.1% in 2014, not the 2% you’ve think it was

Also, you say the fed is in “control”, I beg to differ, they’re trapped and the dollar just keeps getting stronger and stronger (multi-year highs vs Canadian dollar and Mexican peso right now) and there ain’t nuthin the fed can do about it.

For the strenght of the dollar, the FED can do QE. When QE long and big enough, the dollar looses value.

I agree that the inflation is way higher than published CPI.

Flyover said, “For the strenght of the dollar, the FED can do QE. When QE long and big enough, the dollar looses value.”

No, they can’t do QE again, inflation is insane right now, if we look at the chapwoodindex.com for L.A. the last 4 years, for example, you have price

increases of 50% in that time. That’s 25 years of “good inflation” (fed 2% target) in 4 years!

QE causes inflation, lots of it, thus, there is nothing the fed can do about the dollar increasing across the board. They can’t go negative rates, the dollar is the reserve currency and inflation is running away now with no QE (that we know of anyway, these rallies lately are curious).

In military terms, you could say that the fed is surrounded and the only thing left for them to do is to try to negotiate terms of surrender. However, these fed financial terrorists need to realize that no conditions or terms will be offered. There will be no quarter.

I agree with your rates of inflation and I agree that the FED is cornered in terms of the dollar strenght.

I was just speaking from the theoretical/technical, not practical point of view.

This sort of stuff is all over the internet. Just Google downsizing of packages, or whatever: http://www.weeklyuniverse.com/2011/downsizedfood.html

http://www.mouseprint.org/category/downsizing-2/

https://www.bostonglobe.com/lifestyle/food-dining/2014/02/11/the-incredible-shrinking-package/Ti6VwQCCcg0whLdr8bHnyJ/story.html

I disagree with the premise that “the Fed is cornered and they have run out of options”. A common analogy is a chess board and the Fed is about to lose but it’s only a matter of time, they are cornered. Now that is in an ideal world where all of the market participants (that includes the Federal Reserve and their banking friends) play by the rules. What happens when the Fed and the banks are about to lose, but they just create more and more chess squares out of thin air (I am not talking about printing money) so they have more room to play with? In other words, they just change the rules. If a deflationary spiral becomes worse enough, the federal government can place a moratorium on housing sales, declare a stock market holiday, a bond market holiday, etc. There is a difference between what we want to happen and what we get. In my heart I wished it would be true that finally the prudent would profit and the foolish would suffer losses. That is how free markets are supposed to work. But that will not happen; there is a difference between what we want and what we get.

“There are never ending costs associated with a home.” Absolutely. Friends just bought a home for $430k in a pretty rough (urban/hipster) area of Denver (lots of crime, even though the area is very slowly gentrifying, but not quickly enough IMO to justify a $430k, 1100 square foot home off a busy intersection in a historically crime/gang-infested neighborhood.)

Anyway, they had to arm wrestle 8 other buyers just to get the place, and waived all inspection/contingencies in order to entice the seller to accept their offer. Well, come 6 weeks after moving in, the sewer line is completely screwed up and it’s going to cost them several thousand dollars to fix it.

But at least they’re not “throwing their money away on rent.” *sarc*

what does Taco Tuesday allude to?

$1 taco nights found around LA at various restaurants.

I love this blog, but the “Taco Tuesday” thing still makes no sense to me. Does it mean the “Taco Tuesday” crowd is cheap, or poor, or frugal-but-smart?

Usually refers to older people that are in homes they couldn’t afford if they bought today, and financially are so unprepared for retirement that they have to seek out Taco Tuesday deals to afford going out. Otherwise, as the Doc has pointed out, they must indulge in some Fancy Feast.

Doctor Richard Kimble, wanting his $1 dollar change…

https://www.youtube.com/watch?v=u27j0KNqMYY&t=20m55s

Pretty Lady: This (dollar) important to you?

Richard Kimble: Well it has to do with Gresham’s Law of Economics; when good money is scarce it’s always in demand.

The math doesn’t add up in favor of rent in bay-area norcal.

Rents are easily 400-1000 a month over PITI on a house unless you’re in the very best neighborhoods.

Does anyone have a feel for RE in San Diego on the coastal areas, say around Del Mar (Heights) in the $0.8-1.0M range. Relocating there for a job, and not sure whether to buy or not. Hate to buy at the peak.

Timmie,

I moved to SD in 08 when things were collapsing and have yet to see coastal North County real estate take a significant dip. I’m a bear for most of so cal housing but it seems like demand and dollars will always be there for the I-5 corridor between 52 and 78. Except for the ends of SD County, people just cannot pay enough to live near the beach.

Many preaching to not buy, but those are the ones afraid to sell their own homes.

Ooooor, people renting and don’t think it’s a good time to jump in.

You left out tax advantages- this is significant in California, at least for first time home buyers.

What tax advantages are you referring to for first time home buyers? I am not aware of any in California.

question for the peanut gallery,

I refi’d my condo here in FL in 2012 and got a 4% interest rate. I bought at the very top of bubble 1.0 but I bought what I could afford.

With the lower interest rate, I am making steady payments to equity every month, for two reasons.

1. Every dollar pre paid against equity is ‘earning’ 4% which for now is a decent return compared to most other safe investments.

2. I want to be out of debt and own free and clear well before retirement, (Taxes, maintenance, and insurance would then be less than $700.00 per month) and a low monthly nut in retirement seems a good thing.

What are the disadvantages to pre paying the equity every month?

You need to check with an accountant regarding the mortgage interest deduction.

Financial planners also recommend nowadays that you should never pay off your mortgage. You save 4%, in your case, but if you had put that money in the market over the past 3 years you would have had a threefold increase in your money (before deducting taxes). It’s relatively easy to find bond funds, annuities or index funds that return 5-7%. Reason they say not to pay off is that at 4% it’s easy to find investments that beat that interest expense. At 10%, you’re better off paying the mortgage. What you really don’t want is all your money tied up in real estate.

Consider the following scenario. You are retired, your home is paid off but you have regular expenses like everybody else and are on a fixed income. Any emergency, repair, car problem will stress your finances. Better to have that cash working for you in the market instead of tied up in a loan. If you decide to do a HELOC, then you’re further stressing your fixed income. Have the money working for you in an investment and use the returns to pay off the loan. When the loan is paid off, you still have that nest egg in the markets paying for your retirement in addition to any Social Sec, IRA, 401K you might have. If that that point investments are gaining more than a HELOC interest rate, you could do that and pay HELOC out of investment gains in addition.

Please point me to the bond funds making 5-7%. In general I agree with your point that if your other investments yield a return greater than your after tax interest payment then there is little point in paying off your mortgage.

However, as folks get older and closer to retirement a more conservative asset allocation plan is warranted – including some of the aforementioned bonds/bond funds. These days intermediate term high quality bonds may yield about 3-4% before tax. If you have a substantial allocation in such investments it may very well be worth your while to pay down your mortgage instead.

As I am in my 50’s and near retirement my asset mix is now about 55/45 stocks/bonds and in this context paying off my mortgage was worth it for me last year. In the first 10-15 years I had the mortgage, though, my asset mix was much more aggressive (about 90% stock – typically yielding 8-10%) and I didn’t make any mortgage prepayments for the reasons you describe.

And if you had that money in the market when the crash came in 2008? 3 years is not enough time in a rigged market to do anything.

Thanks for explaining the theory, I’ve heard this before. Looks good on paper, but I’d hate to be investing in the market, have it crash [and it will] and still be making a mortgage payment [ in addition to maintenance, property taxes, HOA fees ] when I’m 75.

Only the most rosy projections, the .1% and computer models can make this work. For the ordinary slob, this is sheer speculation.

Financial advisers benefit themselves and Wall Street. With the huge # of derivatives on the books of Chase and Citibank it needs greater fools to stay in the bubble market to sustain this charade. And once it blows, you’re going to be far safer being out of debt rather than over extended.

It’s one way to do it, as is taking out a low rate 84 month car loan for a new car and investing your own money at a higher rate.

Now who is best served taking on debt to buy a depreciating consumable and then investing the “difference” one might have paid in the market? The banks.

Especially when that asset is headed for the junkyard from the day it rolls off the line. Why take on the debt in the first place if you want to invest in the market.

Debt is not money. Wall Street cheerleaders want you in debt and control over your money so they can speculate with it. When those derivative books blow at the TBTF banks, guess who loses ?

Currently re-adjusting my so-called “portfolio” to have less exposure to the market and Wall Street “financial instruments” and more in fixed income to protect the principle, from which I will pay for “emergencies”when they happen.

I’m off the debt hamster wheel: no debt of any kind, mortgage, credit or automotive. And given all the so called “financial experts” pumping the “everything is awesome” propaganda while using manipulated government #s [aka not the Chapwood Index , # of people no longer in the workforce ] tells me they’re not advisers, but shills.

Meaning no disrespect, but trying to play the game like the big boys will just end in disaster for the retail investor.

And given the rise in subprime auto loans, credit card debt, payday and title loan popularity tells me that the financial acumen of the populace is questionable. Debt is going to destroy their lives.

If you’re sophisticated enough as an investor, LAer, go ahead. But that sort of “arbitrage” brought down a whole lot of people in 2008.

Personally, that’s not a game I want to play.

If you want to own your property sooner, consider biweekly mortgage payments or making one extra monthly payment per year to retire your loan a few years earlier.

http://www.interest.com/refinance/news/3-free-ways-to-pay-your-mortgage-faster/

Hello Doc. Following on to your earlier posts on SF, here is an article on the SF Housing Market. Suffice it to say that lifelong middle class folks can no longer afford to live in the city they grew up in…

http://www.zerohedge.com/news/2015-07-20/san-francisco-%E2%80%9Chousing-crisis%E2%80%9D-gets-ugly

Under new guidelines that the Obama regime rolled out earlier this month to racially balance the nation by zip code, the middle class might be able to live in SF –depending on their race and ethnicity. The Affirmatively Furthering Fair Housing database will map every US neighborhood by four racial groups — white, Asian, black or African-American, and Hispanic/Latino — and publish “geospatial data†pinpointing racial imbalances. The agency proposes using nonwhite populations of 50% or higher as the threshold for classifying segregated areas.

Federally funded cities deemed overly segregated will be pressured to change their zoning laws to allow construction of more subsidized housing in affluent areas in the suburbs, and relocate inner-city minorities to those predominantly white areas. HUD’s maps, which use dots to show the racial distribution or density in residential areas, will be used to select affordable-housing sites.

HUD plans to drill down to an even more granular level, detailing the proximity of black residents to transportation sites, good schools, parks and even supermarkets. If the agency’s social engineers rule the distance between blacks and these suburban “amenities†is too far, municipalities must find ways to close the gap or forfeit federal grant money and face possible lawsuits for housing discrimination.

http://nypost.com/2015/07/18/obama-has-been-collecting-personal-data-for-a-secret-race-database/

I hope they start implementing that program in the Hamptons, Aspen and Vail, Medina (where Bill Gates lives) and other areas where the politicians proposing those laws live.

By that rationale, affluent Asian cities might qualify as racially segregated, whereas affluent White cities would not.

So rich Whites must import poor Blacks. Rich Asians get to keep out poor Blacks.

Good, I hope the white liberals get what they deserve. They can experience the very policies they vote for and can experience it right in front of their door steps.

FWIW: Economic Fact and Fallacies.

Interesting video. There can be affordable housing if they would allow tear downs and high rise condos to be built in big cities.

https://youtu.be/V6ZPg6kOBkc?t=367

This fixes the link as it did not start at the beginning.

https://www.youtube.com/watch?v=V6ZPg6kOBkc&feature=youtu.be&t=367

well, you’d think so wouldn’t you – hasn’t proven to be true where I live, mind.

Unrealistic. If you are a homeowner, you have utilities to pay for, most want their cable and internet, and if you think taxes and utilities aren’t going to go up, well you are fooling yourself. Look at California’s unfunded liabilities … supposedly no money for roads, water mains, underfunded pensions, and on and on! Your government, your utility companies, will raise your taxes and rates.

I can’t believe what I’m reading. Is anyone paying attention to the imminent DESERT that is just now reaching a conclusion? No water. Presently the water trucks are grabbing water from where-ever. They sell to the highest bidder to refill those plastic/metal water tanks that are sprouting up like mushrooms. Anyone catch the story about Actor Tom Selleck? He has been riding the roads with his water truck draining the juice from municipal hydrants. Even AFTER the municipality cited him for “alleged” water theft… he kept on doing it. I guess he needs to keep his pool filled. He couldn’t water his lawn too well with all the water ranger snitches taking photos and posting them. That is a crime too out in Califori-desertland.

A simple question… how long will the value of a property without water last? The flood of people leaving is just beginning. Those figure you are tossing around will drop to ZERO in a flash, just like a mirage. Own or reant? How about live, or die?

I too am worried about drought, but doomsday scenarios rarely come to pass.

Periods of drought don’t last forever. Rain comes and goes, then comes back again. We can always build with more dams and desalination plants. And California has the political muscle to steal more water from up north if need be.

El Nino is coming….

If enough money is thrown at a solution a solution will be created. If we can build and oil pipeline from Alaska to the Gulf of Mexico we can certainly build a water pipeline from the Great Lakes (30% of all the fresh water in the world) to California. 🙂

@ru82 I know you are saying that as a joke, but that scenario is interesting. I think most residents of the Great Lake States would rather die than have anyone take their water. Most are economically depressed since the downturn of manufacturing and are hemorrhaging residents. The only thing they have is water. They have the attitude, of if the rest of the country is desperate for water, move to one of our states and bring your jobs with you.

Southern California has beautiful beaches and beautiful people. More importantly, it has the Pacific Ocean. Relax. There will be more than enough water for gardens and swimming pools. Just hang in for a while. We have the technology to resolve the problem of water scarcity.

Dont forget the remodel costs if it is a real crap shack,$60-100k and at least one more remodel over the next 30 years, exterior painting every 5-7 years, interior paint 10 years and thats if you go easy on the home, plumbing, flooring, heating and cooling system replacements, water heaters, a new replacement roof at some point because they dont last forever 25 years max, all of these are high dollar ticket items, the gardener bill for 30 years, trash, water…….sometimes I can see why people rent instead.

Mike, a lot of “remodels” are done just to feed the ego of the buyer, not out of necessity. I don’t think that’s a valid projection of expenses, with all due respect.

Just because one wants an “open floor plan” and the trendiest floorings and counters doesn’t make it a wise financial decision.

Fads come and go and one need not fork out significant money just to keep up with the mob.

RU82,

The fallacy in your explanation is explaining what happened in the past and extrapolating into the future. Already the present is very diferent from the past and the future will be even more diferent in more ways than one. In order to avoid repeating, please read my explanation to Lord B.

I once agreed with the idea of not paying off a 30-year mortgage, but now I feel differently. I still think carrying the mortgage is the “smarter” thing to do, but I just can’t bring myself to do it. Sure, right at this moment, I could find investments that paid 5-6% compared to my mortgage’s 3.66%. But the uncertainty of this economic environment worries me. Even if the possibility of an epic, Great Depression collapse is tiny, with two small kids I can’t just ignore it. We’re solidly middle class right now, with two good white collar incomes, but one of those incomes is in danger of going away in a few years, and what happens if the other does, too, and I can’t find another job? We have 6 months salary saved and then some, but at our age (mid-40’s) finding work isn’t easy. Our PITI+HOA is currently $1,350 for 2,000sf in a great neighborhood and school district, but if the place was paid off (which we have the means to do in the next 4-5 years), total monthly housing expenses would be $450, which we could handle with only one of us working a full time minimum wage job. With the full $1,350 payment, we would be out of luck in that scenario. Maintenance won’t be much of an issue for 10-15 years, as all big ticket items are new and preventative stuff (new water valves, drainage, sealant, and the like) are looked after religiously. I prefer peace of mind to a *chance* of a bigger nest egg in retirement – and I can always throw the extra money at other investments in 5 years, assuming the country hasn’t fallen apart.

30 years ago, I asked my landlord if he felt it was better to carry a mortgage, than to pay the place off if it was possible. He was a middle-aged Jewish gentleman, old school, and his heartfelt reply was to always pay it off if you can. Don’t carry any debt you don’t have to.

He died suddenly short after, and so did not live to see what 3 decades of reckless financialization and debt creation can do to deform every single market, but I feel very sure that he would be agog with shock and horror at the deformations wrought on all of our markets by interest rate repression and ballooning and unrepayable debt.

I don’t care if mortgages are 1% and some bonds are paying 10%, this is the worst climate possible to overpay for an asset and carry a huge loan for it, while investing in the hyper-risky bonds that are the only things that pay anything like 5%. Would you like to take on a 30 year mortgage in a housing market that has inflated as rapidly as it has in some metros in the past few years, and invest your cash in City of Chicago GO’s yielding nearly 8%? I didn’t think so.

I can’t think of a better time to stay out of debt and out of high-yield, high-risk investments, than right now.

Exactly. Not sure why some agents are very desperate in trying to get my to buy now because rates are “low”.

I’d rather buy a how I can actually afford with cash. Instead of overpaying by 300k to carry a 30 year mortgage. Making a $650K home, costing me over 1 million after 30 years. That makes zero sense to me.

Thank you.

Andrew, what some agents are desperate for is a commission. Those people work for straight commission with no guaranteed salary or benefits. They can’t care if it’s the “right time” for you to buy.

John…The old adage of every paid off is sometimes just that old adage? I have two homes completely paid and a lot of money out of the bank in these two places. If I break even on the sale of our second home I will consider myself lucky to get back a large chunk and maybe get 3% interest in the bank in 2106.

On the other hand I could face a rather large loss and just say oh well housing doesn’t guarantee you a profit anymore. Yes it is great having no mortgages but I also could give a lot back in loss just like making payments. Really if you look at it what is the difference, lose up front with payments or lose back end with equity gone, somebody figure this all out and none of us are going to escape, we are heading for a big problem.

Plus, John, your 3.66% rate will remain the same and those 5% investments go up and down. Remember the disclaimer: “Past performance does not….. etc etc etc.”

Trust this market ?

Trust your instincts, John D. The “smart” people are the ones who invented junk bonds, derivatives, CDS, Mortgage Backed Securities, the S&L crisis and Enron accounting practices.

You’re the one keeping a roof over your family’s head. Debt is not your friend no matter how much the “smart” people claim it is.

My good Doctor, your premise is 100% correct. The data you provide is correct and logical. What you don’t understand my good Doctor is that you are dealing with the psychopaths. The banking/finance cartels and the government is flooded with debt. They hold all of the cards and they have proven that time and time again, the only way out of this mess is to keep reinflating old bubbles and to inflate new bubbles. The Fed, the governments of the world, businesses, etc. are all awashed with debt and the only feasible alternative is more and more inflation. If it doesn’t work, then the solution will be to change the rules and rule by fiat. Who will stop them? To think that the rules of economics still matter is wishful thinking.

The average Household income in Orange County is 75K.

The average property is 600k.

Using Chase mortgage calculator. The avg family can only afford a $300k house.

Which is no wonder investors are buying, and people are renting.

Maybe the next bubble won’t happen at all since most of the buyers are investors who are renting out their units. So they are unlikely to face foreclosures.

Correct Andrew…until they find ways to make a better return.

We have to remember that the big investment firms borrowed a ton of money to acquire their RE portfolios. In the event of downturn, they will face the threat of liquidation rather than that of foreclosure.

Andrew, using average incomes and average home prices is a bad indicator here in California. This would work in a perfect economic world, but CA RE is anything but that. A large segment of the OC population will never be able to afford a home. OC has a population over 3M and according to Redfin there are only 8300 properties for sale (June 2015 data point). Laws of supply and demand, globalization, draconian anti growth measures, etc all come into play. When you factor in people who will never be able to afford a home, people who already own…that leaves a small segment of today’s potential buyers. Rest assured that the household income of potential buyers is much greater than 75K. People on this blog have a hard time grasping this concept, but it’s really not that hard when you dissecting the numbers.

I believe most buyers are investors. And a lot of people in OC are renters.

My families is a good example of that. All of my aunts and uncles own several properties. Including my parents and sister.

My aunt who lives in Santa Ana (a horrible place to live according to people posting on City-Data) purchased a huge lot 3 years ago. For cheap. She built a custom home costing over a million dollars.

They just moved in as the home was finally finished. She owns a small business and has several rentals in her portfolio.

And people may mistake her for “investors from China”. lol

Actually, La had lower income and higher poverty than Orange County. Conventional poverty LA county 17.6 and Orange County 13 percent. Supplemental rate LA 27 percent and Orange County 24 percent. So, why do you say Orange County is worst. La has always had the worst poverty of the greater La area. There are millionaires and billionaires in La but it has a lot less people that make 6 figures like Orange or San Diego even Anaheim has lower poverty than LA

And these millionaires / billionaires are buying up properties left and right. And the people on Section 8 are rending up in LA and OC.

You see proprieties in OC with like 5 cars on the lot. No parking on the streets. Which shows that several people are renting together. Or kids moving back in at home.

I just checked the US Census city of Los Angeles 22 percent poverty and Anaheim 16 percent even adjusting for cost of living Los Angeles does worst since rent is higher in Los Angeles city than Anaheim since Anaheim is one of the cheaper rented cities in Orange County. Before you open your mouth research that La not OC has the worst poverty in So Ca next to Imperial County.

I ‘m a trend guy, and without question I continue to see slowly but surely listings stating to show pre-foreclosure or short sale. This is like stage one cancer you have a better shot at treatment in this stage. Housing has started the stage one faze folks, it better be recognize and treated early or we all know what is down the road, 2007-2008 will look like child’s play, a complete disaster with no remission this time around?

Pretty good assessment in Bloomberg saying that L.A. is one of 20 major cities American’s are fleeing. They go on to say that a place like L.A. is growing due to immigrants who are taking low wage jobs and are fine with living 8 – 10 to a dwelling, and immigrants with high-tech skills who can afford the high cost of living.

Things are un raveling in San Diego in a bad way

The largest employer with rich employees is laying off thousands of people..

http://www.cnbc.com/2015/07/22/qualcomm-q3-earnings-2015.html

How would it impact real estate ?

The $1.2 million in your total market fund is in 2045 dollars, which will be worth about half of what a 2015 dollar is, assuming ~3+% inflation. Still, ~$600k+ isn’t bad.

Lets say you have ~$100k for a down payment. Houses rent for ~$2700, and sell for ~$650k. If you rent, you invest your $100k plus $1k/month in a total market fund that returns a real ~3.5%, which would net you ~$900k in the future.

If you buy using a 30-year plus points from a credit union (~3.5%), the mortgage will be ~$2460. Including insurance/taxes, that’s ~$3k/month. Lets also assume you drop the extra ~$700 you have on the house payment. Your mortgage will be paid off in 2035, and if you dump the amount you were paying on your mortgage into the market, assuming the same returns, you would have ~$520k by 2045. Your net worth would be ~$520k (market)+~$650k (paid off house), so ~$1,170k. Factor in maintenance, and those buying is neck and neck with renting.

With that said, the rise in interest rates and next recession will sooner take a chunk out of home prices, so it’s likely that you house wouldn’t be worth $650k in the future. At the same time, there’s no guarantee you’ll earn a nominal 3.5% in the market. You probably will, but there have been two decade periods where nominal earnings were only ~1.5%, and it’s possible to see that in a three decade period.

Taxes and tax breaks further complicate things, but buying and renting are pretty close, with buying possibly ahead by a bit, but only if you stay someplace for a few decades. In the long run, the CAR’s housing affordability index is in the high 30s, so the market will continue to be sluggish. If rates rise and/or we slip into a recession, home prices will have to give (likely) or wages will have to increase (doubt it).

Actually went to Zillow to take a look at the Loma Rd. House. I know that area. More or less crime free, something rare L.A. Very nice little house in a older nicer area of Pasadena, secluded, heavily wooded and all that: http://www.zillow.com/homedetails/1785-La-Loma-Rd-Pasadena-CA-91105/20856867_zpid/ The whole Eco-Friendly Hipster thing is probably too harsh in this instance, although it certainly sounds that way at first reading. Just a nice house on a hillside with an inner courtyard that is tastefully decorated – not a staging in this instance – well built and evidently well maintained.

As for them jacking up the price, I suspect that there’s a lot of reverse psychology at play here. They can claim that the house *has* gone up in value since the last offer fell apart, and that they’re only trending the market. In other words: “Hurry hurry buy now because it’s only to go up in value, and we might even be willing to consider a $699K offer again, but only if you *buy now*!” I’ve seen this same ploy on other properties in some nicer areas, esp. in Palos Verdes. How effective it is remains to be seen.

Anyway, worth a look, esp. in view of most of the truly overvalued crap for the same price I’m seeing listed elsewhere.

Just a thought.

VicB3

Somewhere between owning and renting is the owner of a mobile home living in a rented section of property. There are advantages and disadvantages. Since the price is so much lower, you can buy for the price of a down payment on a house. When you leave you can recoup the cost of the mobile. It is a nice compromise and a way to save toward the purchase of a home or business. I arranged a contract with the seller for a reasonable amount for five years and paid it off in three. Before signing, I had the contract read by a Real Estate Broker in the family.

Leave a Reply