Real Estate inventory is piling up: Housing market unaffordable to most Californians so what happens next?

Price cuts. Cookies at open houses. Listings lasting longer than a few weeks on the MLS. The housing slow down is now officially here. Delusions usually end up on a direct path with reality. Housing is always a lagging indicator of underlying economic activity. People will fight to the bitter end to save their homes. Unlike the stock market, prices do not adjust overnight. However, in places like California the weak performance in the stock market last year is going to hit the bottom line for state tax revenues. It is also giving pause to VC money that was chasing absurd companies with nonsensical P/E ratios in search for the next billion-dollar unicorn. But little by little inventory is starting to pile up. People are opting to rent versus buy or in California, or as over 2 million adult “children†have opted to do, move in with their baby boomer parents. So what does the rise in inventory signal for 2019?

As the market shifts

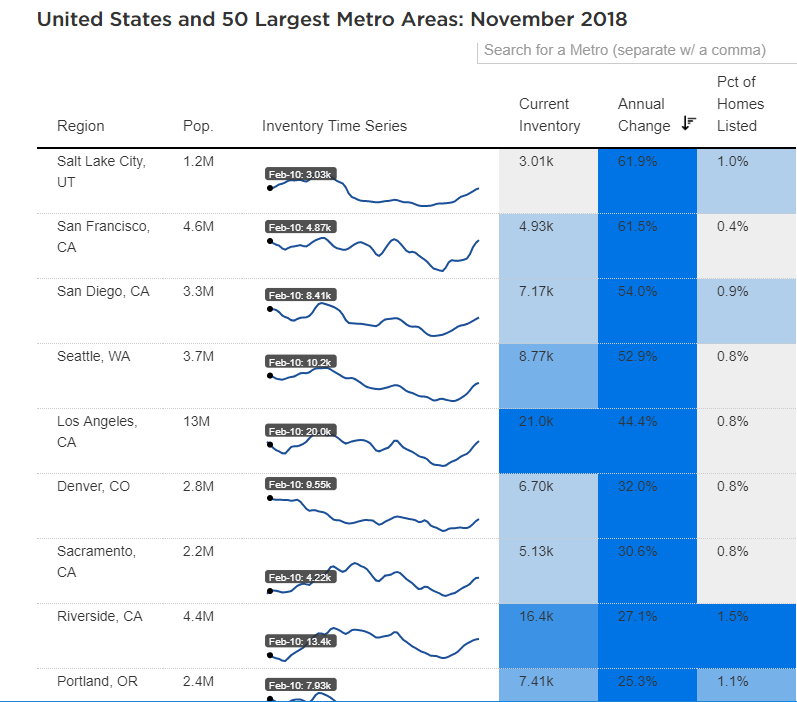

Inventory is up in a dramatic way in California. Take a look at this chart and the year-over-year changes:

San Francisco inventory is up 61.5 percent year-over-year.

San Diego inventory is up 54 percent year-over-year.

Los Angeles inventory is up 44.4 percent year-over-year.

Sacramento inventory is up 30.6 percent year-over-year.

Riverside inventory is up 27.1 percent year-over-year.

I sorted the above based on annual percentage change for inventory. Of course, it is no surprise that most of the regions are in California. This is the land of the Jimmy Buffet Taco Tuesday baby boomer crowd. People that talk about how easy it was to buy a house on one income while working a blue-collar job rail against Millennials for not saving enough. Blue collar work unfortunately does not buy a house in most of California. And many of these people now have Millennial kids that are now back at home and they wonder why they can’t venture out and buy a home. This is at the core of the affordability crisis.

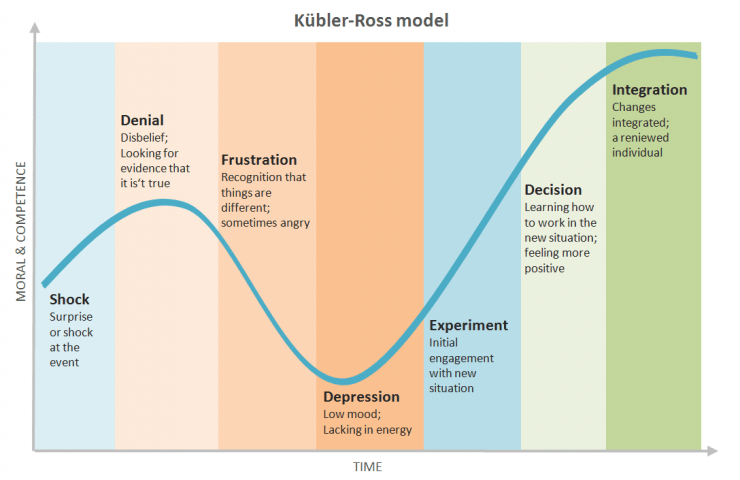

Housing inventory is now significantly up. But we are in the denial stage ebbing into the frustration stage for sellers:

This pattern played out in the last housing bubble bust as well. I need to remind people that while yes, NINJA loans made the crisis worse, the vast majority of foreclosures came at the hands of vanilla 30-year fixed rate mortgages. In other words, if you can’t pay your bills it doesn’t matter if you have an option ARM or a 30-year fixed rate mortgage.

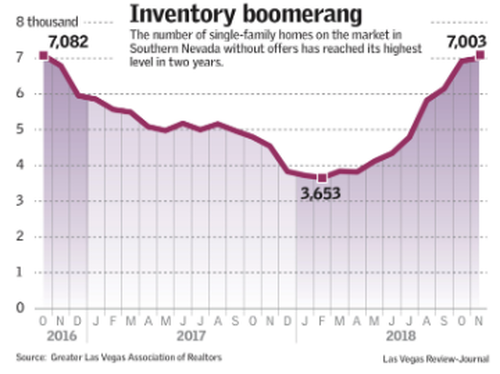

Las Vegas is like a canary in the coal mine for California. Take a look at what is happening there:

Many places are getting no offers at all. If a home is priced to sell, you will get offers. But right now, people are still in deep denial and feel as if high prices are justified simply because things have been moving up for nearly a decade. Las Vegas is already feeling the hit as in many other places.

So what this means for the housing market is that buyers will have more options. Those that want or need to sell will have to adjust pricing or face the home not selling. The days of prices going up unhinged from underlying economic forces like wage growth are coming to an end if the stock market continues to have lackluster performance.

While people knew this day was coming, it is viewed through denial colored glasses. Â

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

305 Responses to “Real Estate inventory is piling up: Housing market unaffordable to most Californians so what happens next?”

Burglar poses as realtor, attends Open Houses to case the joint and disable the alarm: https://deadline.com/2019/01/lapd-arrests-suspect-in-series-of-celebrity-home-burglaries-1202527916/

This burglar/realtor targeted celebrity homes in the Hollywood Hills.

Well, we have extremely low sales. We also have way too many realtards. If they can’t make money by selling they have to get creative. Just like lenders have to get creative by designing bad loans in order to get unqualified people into buying. This is normal for the last phase of the bubble cycle. Realtards get paid for lying to you. I would argue that disabling the alarm And taking a few things from your house isn’t better or worse of what they do on a day to day basis anyways.

Badly designed loans PRECEEDED the last housing crash by 5 years. Those good ol “no-docs” loans let anyone lie about their income. It’s difficult to be more cleverly stupid than that! But thank Congress for those loans. Especially Dem Barney Frank (House), and Christopher Dodd (Senate). They helped design those anti-American products. I know it was in 2003 because as a realtor then (and still today) I cold hardly believe what a mortgage broker friend was telling me when she described N0-Doc loans. It was so laughable and appalling that I went to a lender and purchased a cheap investment home based on No-Docs. The Only documentation I had to show was my driver’s license when my signature was notarized at closing. The problem this time is that the FED has held interest rates down to jack up the housing market. Now that the real estate market is sick again the FED wants to raise rates. Higher rates will destroy the housing market. Meanwhile look at all of the across the board debts. Individual, local, state, federal, corporate….. and we haven’t had a recession in 10 years!!! Government and the FED. Invest in ammo.

“Higher rates will destroy the housing market.“

Higher rates is the best thing since sliced bread. Let’s you buy a house at a cheaper price. Cheaper price is what matters. Nothing else matters.

Not to worry – the state is buying homes maybe to give them to the illegal people who come here. State housing!

Think everyone should have to give half their Social Security to a new immnigrant.

Housing to TANK HARD!!!!! soon, maybe 🙂

Already happening. Just follow some data for hot market on the west coast. I post sales, inventory and prices on a monthly basis for Seattle, San Diego, Oc county. In a few days I will have the December data.

Im starting to think “Jim” was a realtor troll making fun of all you housing bears! LOL. Now that the housing market is tanking for real, where is he or her????

Housing to tank hard soon!!!

Haha! We knew you’d get it right one of these years.

Jim!

Is this really you? We missed you all of these years.

in process Jim. Thanks for keeping the faith.

Nope. Inventory levels are still low. While they are up a lot in percentage terms, still, there is a shortage decent homes for sale. If you have two homes for sale before inventory jumps 100%, then you have 4 homes for sale. Big deal. Wake me up when something changes.

Many RE experts have warned the last few years of the upcoming crash. I prepared and saved lots of money. Now that the market is crashing I am ready to invest when a great deal comes up. Many who believed the lies from RE cheerleaders bought high and are stuck now. They can’t sell at a profit and their cash is tied to overpriced real estate. Good thing I followed the data and waited.

Prices are sticky on the way down. Be patient.

THIS: “They can’t sell at a profit and their cash is tied to overpriced real estate.”

Newly-minted homeowners who went all in the last 1-2 years are going to be feeling a lot of pain this year. Once folks start realizing that they’re paying 50% or more of their paycheck every month on a mortgage, taxes and insurance while their home value is not going up because they bought at the peak of the market- things could end up very ugly indeed.

I’ve been following RE news these past many years- my wife and I have saved up a considerable down payment- but housing values have wildly surpassed the absurd in terms of their relation to median incomes (we live in the Bay Area). Better to wait and see where prices and the stock market go this year and buy a place when things have settled down- hopefully in favor of affordability for the average person.

Yes, there is still a shortage of housing and prices are not dropping yet. The current real estate market appears to be similar to that of early 2006 so prices will likely remain strong thru Spring. A great buying opportunity is probably about 3-6 years away, but prices will likely be down 10-15% by this time next year.

We are at 2016 level of low inventory… you know when how prices went up:

https://2.bp.blogspot.com/-DrA52yPVLSI/XBphn6ISJFI/AAAAAAAAw1w/2-IaqYW8UckZuW8zWDEqGTe7BBTUDFKcgCLcBGAs/s1600/EHSInvRedNov2018.PNG

Talk to me when we get to me when we get to 12 months supply of inventory, we are so far away from that it’s not even funny.

It’s beautiful to see these high inventory numbers. Our RE cheerleaders told us we won’t see an increase in inventory! They also told us we will not see an increase in rates, they also told us we need to buy now or be priced out forever. They also told us that this is the year when millennials will Go out and buy in droves. None of that BS has come close to being true. The exact opposite is happening. Inventory is rising rapidly and prices are falling left and right. Most Experts are saying the same thing now: buy now and be screwed forever (financially).

I expect to buy at a 50-70% discount within the next two years.

Millennial,

It’s easy to just ignore all facts and believe what ever you want. You are a master at that with 100 post almost identical on every Dr Housing Bubble article.

You are going to be the first 40 year old real estate “expert” who has never owned real estate.

It’s hilarious to me that you even view living with your parents… or god forbid you in-laws??? LoL as an acceptable solution.

Seriously dude, WTF?

Tank in sight! It seems you are not happy for me? I was right about the market and that the low inventory lie was just that: a lie. Now, you can read it everywhere, If you like it or not.

Your posts are very much in line with this stage of the bubble: denial. I hope you keep on reading and posting as this crash unfolds. We run out of perma bulls and real estate cheerleaders very quickly! Buying high and early in your life doesn’t make you an expert. 7 Mio bought and foreclosed last time. Do you call them experts? Literally everybody can buy high. The smart ones wait and buy half off. It won’t matter if I am 31 or 35. and while you wait and save for the crash, why not live with your parents or in-laws to save even more? I would do that in a heartbeat. But my rent is so cheap I can save a lot each paycheck just by renting a little 2b/2b close to work. 🙂

%50 drop? no way is that happening, local and big government cant afford to let house prices drop. Nor can Too Big To Fail banks.

Housing inventory has been low for almost seven years now. Low as in low relative to historic norms. A house receiving multiple offers the first day it goes on the market is not normal. The market has been such a seller’s market, many views have been distorted. Do not confuse normal inventory with a tanking market. As was consisely stated by the Dr., housing markets don’t go down over night, it generally takes years to find a bottom. Millie may be able to wait another 5 years, most others don’t have that luxury.

Yep, waiting 5 or ten years for the bottom is a nothing burger. You save several hundert thousand dollars. Why wouldn’t you have the luxury of waiting? What could possibly a reason that forces you into buying high? I asked the question many times and nobody ever answered?!

I take it you haven’t seen it with your friends and peers, but social pressure and spousal/family are the biggest reasons not to wait from what I’ve seen. Next would be a desire for the freedom of ownership. Third would be for financial/investing reasons.

Totally! And herd mentality. Thats why I go against that. Let all your friends buy high….you buy during the crash you win. With dramatic financial results for the rest of your life. It’s just math to me not an emotion. A house is just a box….you either rent it from the bank or from a private landlord. When renting from the bank you better make sure you buy at the right time.

“A house is just a box.”

Uttered by someone who has never owned a home before. When you have a family one of these days, you’ll realize a home is much more than a box. Renting a cheap apartment in a sketchy part of town or moving in with mommy and daddy will not be part of the equation. Keep doing what you are doing Millie, but always remember you are in the minority.

Quite the opposite is true blankfein. We are a renters nation. Most people get that it’s much better to rent that house instead of buying it for a hyper inflated price. I am not the minority-at all. As most of us know there is no rental parity during this severe bubble. It’s much better financially to rent instead of buying during these times. Nobody here is saying a house doesn’t bring value to you. We are saying you pay much less during the bubble for that value by renting. This all changes when we see the crash. Than you just rent from the bank (“buyingâ€) because your monthly cost will be the same or less compared to renting from a private landlord. If you don’t believe there is no rental parity provide me with your zip code and I do the math for you.

Millie, quit trying to obscure the argument. I never once mentioned rental parity and you are correct we aren’t close to rental parity in any of the areas you would want to live in CA. Unlike yourself, most people can’t save even if their lives depended on it. Any opportunity is a buying opportunity. Combine this with spousal pressure, family pressure, instant gratification, supply and demand, policies that favor homeowners…and you get people buying even if the numbers don’t add up.

I’m with you preparing for any decline. If I could pick up a sweet beach close rental for a 25% off coupon, I would be one happy camper.

Its a lot like a bottle rocket. What goes up must come back down. Especially when its based on artificial stimulation that the fed has been providing for years. As that leaves so will this market. The Democrats will tank the stock market in hopes of getting rid of Trump in 2020. As that unfolds the recession will be in full swing and the housing market will tank.

One hope so, kind like Jimmy Carter in a period of high inflation and the recession hits the wrong time for the Dems for a changed. Maybe, the Republicans will comeback in 2024 with senator Scott of Florida. According to the US Census Ca, only grew 2 million in 8 years while Texas and Florida around 3 million. California days as the top dog is over when population growth has shifted to other states which also includes, Arizona, Oregon, Washington, Colorado and even small populated Idaho which in the past 8 years gain more people than New York. New York another high real estate market particularity in New York City.

You are correct. We could all be dead in 5 years and would have never been able to enjoy that dream home because we waited too long. The best strategy might be to buy in 2 years and say that whatever prices are then is low enough. Life is too short to wait 5 or more years.

At current prices that dream home is a shoe box. Not sure how they have convinced people that buying an old beat up shoe box is something to aspire.

No job loss recession, no tanking.

Bingo. A crash is an undervalue of an asset and is usually triggered by something. The bubble isn’t housing. The bubble is employment. Unemployment is too low along with inventory which means that the market was prime for an increase. Right now inventory is creeping up and that’s enough to take us back to 2017 levels but once massive unemployment hits, then the crash will happen. First vacancy rates in rental will shoot up, then prices will come down in the rental market which then means that housing will follow starting in major metropolitan areas then propagating to the suburbs. We’ll go back to 2013 levels AT BEST. Housing would ultimately have to be at 10-15% below equivalent rental before it bottoms out. There won’t be a spectacular bust like 2009 because those conditions that brought about that crash we’re unique to that era. There’s also no massive housing starts during this cycle so there won’t be an oversupply like before. I’ve been pretty spot on with my predictions so far so take it to the bank and cash it.

Would you call a 19% drop in home values a crash?

The stock market dropped 19% last year and the Bulls are calling it a correction.

If potential homebuyers have lost 19% of their downpayment last year and payment money from capital gains and dividends, I would suspect a similar drop in home values since home prices generally lag the stock market.

There is also the psychological fear that when you lose 19% of your net worth, you are not likely to spend on a house.

We know incomes from workers are not tracking the house price increases over the last decade. The stock market under Obama went up 250%. Now they are down 19%.

I think we don’t need a Black Swan event like in 2007/2008 to see a 15%-20% drop in house prices. If we do see a pseudo Black Swan (increased tariffs, prolonged government shutdown, fed raising rates again, etc), we may see a drop more than 20%.

I’ve been following this blog for a very long time and have never commented on any post. I love reading the banter and Millennial makes it all worth coming back. (Thank you Millennial!! Love your content!) I, too, am a Millennial. Married, high-income, dual earners. In a perfect position to buy a home (high down payment, great credit, young family). We sold a house within the last couple years and are currently renting our parents property in the community we wish to live. We will continue to rent and save until we feel a home price is actually worth what the seller wants for it. We refuse to buy in this inflated market. We’ll rent forever if we have to, but we are not stupid enough to buy high and weather the storm. To all you oldies, we millennials saw the housing crisis just as we were becoming adults. We saw a lot of destruction and have since watched carefully. Home prices are unsustainable given incomes, new tax laws, and interest rates. Also, while there aren’t NINJA loans, there are a lot of low down payment loans have been created in the last few years. Specifically, here in CA, so many people are leaving, that the rise in inventory is a bigger deal than you think. Companies leaving CA, new governor coming in. High, stupid taxes. No more foreign buyers. Prop 90 expiring. Stock market has been declining, recession talk everywhere. It’s finally starting to unravel. While I don’t wish ill on anybody, the housing market is distorted and needs to correct. California is beautiful, I was born and raised here. I want to stay. But there is absolutely no way that I’m spending my hard earned money on a complete fixer upper while somebody pockets hundreds of thousands of dollars selling me their crap shack. Looking forward to more banter on this thread, make me proud, Millie!

Sounds like you and Millie have all the time in the world to wait for a housing price decline. However, the vast majority are not nearly as fortunate as yourself with you rental situation. I’m sure the parents are giving you a sweet deal on the rent, will never increase it and would never “evict” you like other renters have faced on this blog. I would recommend staying put as long as possible or even buying the property from them (sweet deal guaranteed).

Blankfein, you still don’t get it. There is no rule that says Your life improves when you buy an overpriced house. It could be quite the opposite. As we know Decent homes are overpriced by 40, 50%. If you buy a house that you cant afford you suffer from financial stress and might have to cut back in other areas. So why not rent that nice house and save lots of money? As long as prices are overinflated it’s much better for your health and well being to rent cheap or live rent free (parents, friends, in-laws) instead of wasting your hard earned money to make someone else rich. There is not a single reason that would force you into buying high. No matter how hard you try.

I am a Millenial and I was not old enough to be looking to buy a house in 2008 but I was old enough to see the devastation it caused and be little traumatized by it. I think one of the points this blog is highlighting is that a lot of Millenials do not care about buying a home and I think that is really accurate. We were old enough to remember people being stuck and I know that is not a place I ever want to be, it sounds like a cage. I am happy renting in So Cal and I don’t have a sweet deal. My parents moved to Texas after the crash so I am not leaning on anyone to assist me.

Lord Blank, My best friend had your attitude, three kids, house-maker wife, single income family but he had a above average income being a programmer. Family needs was the major quote he layed out for buying his home. After losing his job, hit a rough patch, now he’s questioning his house ownership attitude. House ownership is not a liquid position.

Excellent post, im herefor a while and don’t post much. Milli’s posts are enjoyable, articulate and spot on. Wife and I talk about moving to CA all the time, she works for a company in Irvine, we live in South. Prices are stupid high, seen this movie before, worked in the mortgage industry for 16 years, saw that last bubble a year before the shtf, none of our friends would listen, they laughed and bought bigger homes, new cars, condos at the beach, traveled over seas. And then, BOOM, shtf, and they lost it ALL. Now they don’t want to talk about it, I LOVE TALKING ABOUT, we lived below our means, fixed up our starter home, banked a ton of cash, our lives are great because we didnt move and buy into the CA dream. So, we still would love to move to CA, untill we look at housing prices, homeless, trash, taxes, toxic water, shit on the sidewalks, fires, droughts, illegals, Libtards, Dumbacrats, Government spending, and more taxes, fuck that. We visit, enjoy, then get the fuck out of that shit hole. It’s happening again, but this time its different. Got a little off track, bottom line, excellent blog, housing will correct 10-30% depending on what market, live below your means, then buy what you can afford. Nobody is getting out unscrathed, just dont be a sheeple and follow the herd off the cliff.

I was following your post with interest and appreciation until you used devisive rhetoric. You are most likely right with your assessment of the market, but I question your critical thinking skills when you parrot propaganda. Those who know what is really going on would never use the words “libtard, etc…â€, especially when that class is among the most educated in the country, just as I’d never use rhetoric to insult “family values†middle-Americans who are truly hurting financially, due in some part to neo-liberal policy. It shows that you fall hook line and sinker for propaganda designed to destroy our country. I’ve seen far too much of that in these comments. Most have no idea what is really behind this latest bubble or where it comes from, but the enemy is not a “side.†That’s a hint. Learn.

JmaesJim,

You are correct that it is not about republican vs. democrat in the old sense of the words. It is about globalists (totalitarians) vs. nationalists (constitutionalists). There are plenty of globalists on the GOP (See Romney, Bush, etc) and in most of the Democratic party. The globalists have full support of the FED owned by the largest banks in US.

Those who desire globalism (NWO) envision slavery on a global scale where democracy is just a fancy word with no meaning in real life (look at what happened in Europe lately). Globalism serves the interests of the mega corporations who use governments to live above free market forces. It also serves the interests of those who control the IMF and the Bank of International Settlements (the central bank of the central banks). Many decades ago I lived in a microcosm of what these globalists envision. It is hell on earth for 99% of the people.

Those who desire nationalism want respect for national borders, truly free markets, a limited government and the Constitution. Without these, we end up like those who lived under bolsheviks (they did the same in USSR, eradicating national borders, the democracy was a sham, no free markets and super strong central government). Compare that to Switzerland, where everything is 180 degrees apposite than what the bolsheviks did – most of the power is at the local level (canton), they strongly defend their borders and strongly oppose EU with their open border policies. The Swiss (and I should also add Israel) are nationalists. They are a federation where the french can not tell the Germans how to live their lives and the Italians or germans don’t tell the french what they shall do in their cantons. That is true freedom.

I meant WhoKnows, not JmaesJim – I addressed the wrong person.

Team Millenial: Prop 60/90 isn’t expiring. I believe El Dorado County is the only one opting out. Here is the BOE’s list of counties participating.

https://www.boe.ca.gov/proptaxes/prop60-90_55over.htm

Team Millenial: Prop 60/90 isn’t expiring. I believe El Dorado County is the only one opting out. Here is the BOE’s list of counties participating.

boe.ca.gov/proptaxes/prop60-90_55over.htm

I’m GenX, currently home owner in Europe and on that same team I guess.

You did what I am planning to do, just some years earlier: rent for a while. Of course markets around the world don’t go up and down completely in sync. Not fully sure if Amsterdam peaked yet. One wants to sell in the month that the market peaks, but it’s only possible to make an estimate – it’s easy to get it wrong by a year or so…. Still there is a correlation between markets the world, and following the sentiment around the globe makes total sense. I love this blog!

Inventory going up, time to sell going up… Markets elsewhere starting to go down… Denier fanaticism… All signs.

An other advantage of renting for a while might be that you don’t have two large dependent deals going on at the same time.

I am Gen-X. Parents were Early Boomers. We are flyover-state people. A lot of Early Boomers built McMansions in golf course neighborhoods in the 1990s (once their kids were out of the house–what sense does that make?). We watched them pour big bucks as well as blood, sweat, and tears into those places, only to find by the early 21st century they couldn’t sell them if they needed/wanted to. Many of us watched that entire scene burn to the ground, and are happy to live without custom-built homes or ridiculous accoutrements such as 3-story-high entryways. We see Millennials like you learning lessons from the 2008 crash as we learned from the 1990s McMansion building boom, and it is heartening. Congratulations on your pragmatic attitude. You will do well.

Yup- I’m a “young” GenXer or “late” Millennial depending on whose definition you choose, but lived most of my life in the Bay Area. This is now the THIRD TIME in 18 years I’ve seen housing prices explode to unaffordable levels, tank, everyone gets laid off, and then things reset for another ridiculous boom just 1-2 years later. 2000, then 2008, now 2019…? It seems that people’s historical memory lasts no longer than Snapchat. We cannot keep repeating these destructive economic cycles and expect that things will turn out differently.

The human damage to working and middle class people who simply just aspire to a simple, stable life is truly a tragedy. Honestly, I do hope this time around the comedown is slow and not as sharp a bust as the boom we’ve just seen, but if just recent history is any guide…

Don Pelion, Buying a house has nothing to do with the ancient reasons to ownership anymore. Nowadays, it’s like the stock market. Pure speculation. The music stops every time after a ridiculous run up. Everytime you hear “this time is different†just to watch it crash again. There are no soft landings because it’s a money game. Buy at the right time and sell to the greater fool for a big profit. Entire neighborhoods are being flipped. Don’t complain about it. as long as people think you can make quick money with housing nothing will change. Just learn how to play the game and participate. I can’t even imagine how it must feel if you recently bought and watch your neighbors house sell for 150k-250k less than what yours was. And, this is just the beginning. There will be a ton of pain for some people who got suckered in recently. The good thing is, we are a very forgiving society. Just default on your mortgage and walk away. Try again during the next cycle.

Why do you even thinking about buying or not buying a primary residence when your parents have spare properties rent to you? If I were you, I’ll just wait for inheritance. Simple and easy.

This old millenial agrees with Team Millenial. I saw my father lose his job in 2005, followed by by parents divorcing and selling my childhood home in 2006, then my mother also lost her job a few years later. My father is basically a functioning opiod addict now and my mother passed away a couple years ago. I’ve definitely soured on the American Dream after seeing my parents left with nothing.

I have the means to buy but don’t plan on it until it’s time for babies. The area I rent is a lot fun but the schools are crap and the parks are filled with drugs and homeless. This is not the California I grew up in.

I would probably feel different if I thought the homes were worth it but I also have to factor in the cost of private school in this neighborhood.

There’s also a need to remain mobile. My boyfriend’s job site is about to have large scale automation followed by mass layoffs and we may have to move (they are trying to get it done before the $15 minimum wage kicks in). Governor Patrick Bateman and his wealth redistribution ideas scare the crap out of me and I want to be able to bail if he comes for more of my paycheck.

I grew up in CA when it was the GOLDEN state, leader in everything in the 70’s and 80’s. then it went to hell the last 20 years under democrat rule. Just like every other democrat stronghold, cannot name one that is not on its way to failure, or completely failed already. I left more than a decade ago and have taken my millions worth company and dozens of jobs away with it.

The future does not appear bright in CA. there are so many more cost effective places to live, the future population growth is negative (other than people who need handouts and free stuff and could NEVER afford to buy real estate), and the crap and homeless pile up in the middle of your ROTTING cities. You spend 20% of your work getting to and fro your workplaces, you spend 20% of your income for taxes to award free stuff to law breakers and you get more of what you buy!

I visit my remaining sibling there, around the cities it sucks, never a time without slow traffic, never a time without illegals begging for work or handouts. Then I see that the rich white people don’t want section 8 housing near their neighborhoods. Wonder Why? Soon they will all be your neighbors in their section 8 free handout shacks. See your property prices fall to that of watts.

I also grew up in CA in the 1970’s and 1980’s when Jerry MoonBeam Brown was governor.

It was a very nice place to live.

It seems to me CA went downhill when those conservatives became governor and planning went out the window.

Bob: It seems to me CA went downhill when those conservatives became governor and planning went out the window.

So millions of poor illegals soaking up public funds, and crowding into classrooms and freeways, and billions in debt due to public employee benefits, and lax treatment of criminals — all resulting from Democratic policies — would not be so bad if Republicans had better “planned” for these Democratic effects.

Its funny to visit this board and see all the home buyer wannabies. Covetousness and Envy is so evident in all the posts. Anyone with eyes to see know clearly that most of CA is an S-hole, a waste of 50% of your time and money, lost sanity is the norm.

Yes, Millennials and their blue collar parents are losers. For many older professional folks, the retired ones, selling the home can result in large Federal and state income taxes. Federal rate is capt gain 15%, and California, has no capt gain, the rate is 9.3% to 11%. After income taxes and real estate sells costs, the net amount is substantially reduced. This is why many old retired rich folks do not move.

Prof Watson,

$500K in gains is completely tax free both federal and CA.

Sorry you are just wrong.

Not everybody is married like you. In SoCal, due to divorce or death, most are single and it is only $250k. You must be thinking of Texas. By the way, the income tax rates in CA are much higher for single people at the same level of income of those in marriage bondage. But that is another subject.

Why would anyone complain about paying taxes on a property gain that you may be tax free up to $250k single or $500k couple? So what are you complaining about or are you just trolling?

https://www.nolo.com/legal-encyclopedia/the-250000500000-home-sale-tax-exclusion.html

I’ve been following this blog for a very long time and have never commented on any post. I love reading the banter and Millennial makes it all worth coming back. (Thank you Millennial!! Love your content!) I, too, am a Millennial. Married, high-income, dual earners. In a perfect position to buy a home (big down payment, great credit, young family). We sold a house within the last couple years and are currently renting our parents property in the community we wish to live. We will continue to rent and save until we feel a home price is actually worth what the seller wants for it. We refuse to buy in this inflated market. We’ll rent forever if we have to, but we are not stupid enough to buy high and weather the storm. To all you oldies, we millennials saw the housing crisis just as we were becoming adults. We saw a lot of destruction and have since watched carefully. Home prices are unsustainable given incomes, new tax laws, and interest rates. Also, while there aren’t NINJA loans, there are a lot of low down payment loans have been created in the last few years. Specifically, here in CA, so many people are leaving, that the rise in inventory is a bigger deal than you think. Companies leaving CA, new governor coming in. High, stupid taxes. No more foreign buyers. Prop 90 expiring. Stock market has been declining, recession talk everywhere. It’s finally starting to unravel. While I don’t wish ill on anybody, the housing market is distorted and needs to correct. California is beautiful, I was born and raised here. I want to stay. But there is absolutely no way that I’m spending my hard earned money on a complete fixer upper while somebody pockets hundreds of thousands of dollars selling me their crap shack. Looking forward to more banter on this thread, make me proud, Millie!

An ex-Californian who wonders if the ‘canary in the coal mine’ isn’t Las Vegas, but China! Is Apple just the tip of the iceberg? Will the wealthy Chinese now flee even faster to the U.S., namely California bringing more money, or will their economic slowdown become a slowdown for California? And finally, the nice little spot I found is now itself becoming overrun with the hoard fleeing California. This wouldn’t be a problem if everyone leaving left their political baggage behind and simply tried to adjust to a new way, small town values, but I can tell that isn’t happening … so it’s only a matter of time before the infestation spreads far and wide …

Interesting question here.

Red China is definitely showing cracks in their economy, whether it’s decades of shadow banking excess or BS numbers or the trader war w/ US, I wonder what the result would be on US (specifically west coast) real estate will be.

Are the chinese cash buyers that have gobbled up inventory over the past few years in order to hide their money from the Chinese govt going to be forced to liquidate in order to fund their struggling businesses?

Are these business owners now struggling after being flush with cash? Do they fear further tariffs and an economic crash and causing them to lose their cash cows which requires them to liquidate their US RE holdings?

Or

Will these same business owners go the opposite direction and figure China is past the point of no return for the forseeable future and further liquidate their businesses and Chinese holdings in order to transaction fully to “safe” US RE holdings?

Which way will the Chinese money flow??? That’s a big part of this US RE equation.

Dan, don’t overthink this like your “upcoming pot boomâ€. In the 80’s Californians (and others) thought the Japanese will buy up all the real estate. It was a marketing trick to sucker in people into buying high. If you make the public believe that there is an abundance of cash buyers you can easier justify overpriced property values. Nowadays nobody talks about Japanese cash buyers anymore, correct? So how come people where so wrong back then? Well, just look at what happens now. Lenders and realtards wanted to you to believe that there is a high amount of cash buyers from China for the same reasons. Sucker you into buying high. Now that Chinese cash buyers are disappearing experts (like me) prove to be right again: just like the Japanese, the Chinese will lose their shirt. Herd mentality….they thought buying RE in California, Vancouver or New Zealand will be a great investment. Now those overheated markets are crashing hard. As I mentioned many times before. There is not a single good reason to buy overpriced real estate. Once you are smart enough to understand when real estate is overpriced and when it isn’t you can easily make the decision to rent. Once the market crashes you buy.

This is from the 80’s and history repeats again.

https://www.google.com/amp/s/amp.businessinsider.com/japans-eighties-america-buying-spree-2013-1

Dan, nobody knows the answers to your questions and if they say they do, they lie. Everything depends on which way the top leaders go. In a centralized form of government like China, only the top leaders know what they want to do and even that can change overnight based on the dynamic between them – there is no loyalty among the thieves. Each one is an opportunist who wants to grab as much power for himself. Sometimes they make temporary coalitions to overthrow the top leader; sometimes they succeed and sometime they lose. There are too many “moving” pieces to this puzzle to know the final outcome beforehand.

You are right in your assessment that China today is big and strong enough to affect RE prices in CA, unlike the past. How is that going to play, nobody knows.

To Team Millennial , you spoke of the ending of California Prop 90 . I was under the impression that the original Prop 90 was not changed, only the expansion of the different counties willing to participate in the transfer of the tax base. That small fraction of eligible voters who did exercise their voting rights chose to vote against the new proposal. I, for one , would like to transfer my tax base to a quieter part of California, and let the young people move into the active and energetic part of the state. But until then , I will stay with my low-taxed property and take extended vacations when the weather gets bad, and transfer my residence to my heirs at the stepped up basis, and then they will sell at the new tax base with little gain to show for tax reporting.

I forgot to mention one thing: While the real estate inventory has only increased a little during the current slow down, the time it takes to sell a home has increased rapidly. In other words, demand is dropping so fast that even a moderate increase in inventory is enough to overwhelm buying interest.

To Millenial and the Team: Same here. I’m a bit older and considered borderline millennial.:D My hubby and I are both high income earners but not stupid enough to jump ship and buy a $ 2M crap shack to live the CA dream!!!

To the realtards and oldies out there who’s been misleading folks: Have you really thought we’re stupid to buy at ANY price???? Nope, we’ll wait and enjoy the show. Worse, we’ll leave CA, move to a cheaper place, buy cash, and early retire/ freelance with the cash we saved? How about that dream for one?

Mortgage rates are falling fast. Average 30 yr fixed is 4.5% with deals available at 4.25%. Great great news for the spring housing sales season. Great news.

Ah ahah jt comes again with this “spring season will be epic?†Just like 2018 when we hit a wall. Demand is in the toilet. Lower mortgage rates won’t save the market. Buyers sentiment shows there is no sucker left to buy high. The game is already over.

Milli, last spring we saw multiple offers with record high prices. What are you talking about?

I am glad you are asking finally. Since Spring inventory in OC, SF, Las Vegas, Seattle, San Diego and many other places is rapidly rising. In many former hot market the shift was so dramatic that we are now talking about a buyers market. 2 overpriced houses are now competing with one buyer. Buyers sentiment has dramatically changed. Buyers no longer fear rising prices, they fear catching a falling knife (lower prices in the future).

No. You are much better off buying a less expensive house at a higher interest rate than a more expensive house at a lower rate.

Yes, we all know that. It hasn’t been possible for decades. Interest rates went from 18% to 3% in the past 40 years. Buy only when YOU can afford it and plan on owning for the long term.

As the Lord said,

Plan on owning for the long term and take advantage of any rate drops with a refi.

However, rates are not likely to drop in the near future. Housing prices are dependent on income (both job income and stock market gains), wealth (stock market, gold, bitcoin, and savings), and interest rates.

If the overbloated stock market recovers its 19% loss from last year, then I don’t see any drop in housing prices even if the interest rates go higher.

If inflation and wages go up (like in the 1970s), then housing prices will go higher. In the 1970’s wage growth and inflation was at least 15%. Housing prices tracked these even though interest rates were also rising. If this is the case, I would say buy now and in 10 years your house payments will seem like nothing. (My lucky parents who had a 6% mortgage on their 45K house when I bought my first 200K house with a 10% adjustable loan (13% fixed).

Since my crystal ball broke, please take Lord Blankfein’s advice and buy what you can afford in a location you can stay for the long term.

Bob, you completely disregard cycles and buyers sentiment? How come prices are falling left and right and the moment? Are you not watching the market closely? Why is inventory going up rapidly? Why has demand dropped? We have heard this can only happen during a job-loss recession. BS! It’s happening now during a strong economy!

Bubbles feed on themselves. People think in linear terms, what goes up will keep going up. But the same happens On the downside. People expect lower prices now and wait. Again, they think it will continue to go that way. Sellers who must sell have no choice but to reduce prices. Now your comps are screwed and you can’t ask for what it sold for 6-12 month ago. Several homes start to compete for one buyer and down you go.

The advice of buying when you can afford it screws you in a massive way. It’s outdated and you only hear it from people who bought a long time ago or are profiting from bubbles (realtors, lenders, flippers and those who want to cash out and pocket a nice profit from the next sucker)

Btw. I have seen a significant change in what realtors say now. It’s seems they changed their mind accros the board. You don’t hear them Say anymore that prices will go up. Instead they all say, the market is turning, shifting, softening. Just like the house description “cuteâ€, “adorable†means that the house is tiny….current descriptions for the market are saying: this market is done. Pain is here. Price cuts are the new normal.

Millennial, Don Pelon had an accurate observation above.

House prices have always risen and fallen.

My parents bought their 45K house (possibly overpaid) in 1974 and then the neighbor sold the same house for 35K a year later. Yikes! A 20% fall!

When the house finally sold in 2016, for 900K, nobody remembers that incident.

Inflation is your friend if you own a house for the long term. It is your enemy when waiting.

I made the mistake of being jealous of my parents for their 45K house when I bought a smaller house in the same town for 200K in 1987. That house is now 900K. I should have kept it to rent. It was much too small for a growing family so I would not have stayed.

Your goal of buying a house at a low is admirable. If your family can survive in a small rental, keep the faith. It may be a while but history shows that within 10-20 years, you will likely get your 50% deal. 50% off what is the question.

If it were me in your situation when I was your age, I’d buy the right house for the next 10 years for my situation (you want 2 kids = 4 bedrooms) when housing prices drop 15%. They may drop 40% 10 years later or even 1 year later but you are there to stay so don’t look. In another 10 years when the kids all move out, you will have a gain (and owe the IRS something) no matter what the market does.

I had some money in my mattress that was waiting for a 50% stock market crash (which may still happen). When the Christmas Eve happened, and the market had dropped 19% for 2018. I put some of that money back in the market for the long term. I have no doubt that it will go up and then down, but in the long term, it was still buying low.

Buying when you can afford and wait forever is a strategy that might have worked in the 70’s. In the 70’s they did not have everything bubbles, historic low interest rates and QE.

For the last 30 years its heavy boom and bust cycles. Buy low or be screwed forever (or until you foreclose) Old people have a mindset from 40-50 years ago. Thats long gone.

Nowadays its all about buying low and selling to an idiot for 200-300k profit. Wait for the crash (happens every ten years), rinse and repeat.

Near the end of last month’s topic, I posted the OC Register columnist Lazerson’s results for his 2018 predictions, where he batted about 0.500. I mentioned his bearish 2019 predictions.

Well, here they are:

1) 30 yr fixed will average 3.75 %. My early millennial daughter raised her eyebrows one that one. She will keep an eye on the rates and may refi if interest rates get down that low soon.

2) Nationally, 2019 Refi activity will be more than double 2018 (well with rates like that, why not?)

3) The Fed will not raise short term interest rates (he whiffed on that one last year).

4) FHA Mortg. payment delinquencies will increase by 10% (His canary in a mine.)

5) FHA Commish. Montgomery will reduce max debt to income loan approval ratio from current 56% to 48 %. ( principal, interest, taxes, insurance, HOA, credit report payments, alimony/child support sum divided by monthly gross income).

6) The US will experience an inverted yield curve between the 2yr Treasury and the 10 yr constant maturities.

7) The GDP will see an average growth rate of 1% for 2019.

8) SoCal home Sales volume [LA, OC, SB, Riverside & SD counties] will decrease by 8% for 2019 compared w/ 2018.

9) SoCal Median home price will decrease 3% (same turf and time no doubt).

10) Fannie Mae & Freddie Mac will remain in conservatorship for the 11th year.

He will no doubt publish his batting average at the end of the year like he did just last week.

#5

Haven’t heard anything about FHA changing guides, but, it’s possible. If they do indeed change that guideline that will certainly have a big impact on the bottom of the market. FHA usually for first time buyers who have very little saved as the move up buyers roll their equity into the new step up buy and can go conventional.

Interesting to see what happens with this.

Here is what I see:

Rates are at 6-9 month LOWS. Yep we’ve been on a huge winning streak the past few weeks (my refi biz is up).

Inventory is UP with properties sitting longer and price reductions happening.

Sellers are starting to adjust their expectations and realize they are not going to get the standard 3-4 offers within a few days unless the property is turnkey and in a hot location. So, buyers are underbidding, not a huge amount but I am seeing between 1%-5% of the ask. Some offers are getting accepted some are getting rejected; it all depends.

Buyers are more picky in general. Again, if it’s a hot area then they don’t care, but, it is not like it was 6+ months ago when buyers w/o perfect credit and a huge down w/ over ask offer had no chance. It’s much more balanced now and sellers do not have the leverage they once did.

All cash buyers have slowed down too, whether it’s China or whether it’s flippers that are realizing the market is turning and margins are squeezed and they need to lower volume to chase higher margins and be more picky.

Not much has changed in the lending sphere, although I did hear that a couple credit unions are now offering HELOC’s to 100% ltv; which I do not like.

Definitely seeing at least a plateau, but, wages are rising and unemployment at record lows. So I think there is a mixed bag right now and a lot of variables so it’s best to ignore the fanatics on either side who fail to consider any viewpoint other than their own. You know the ones that argue that water isn’t wet type of people.

We all appreciate your input, Dan. Thank You!

You are embedded in the middle of it so can see what is happening in the mortgage market.

…home price will decrease 3%?

Impossible. I have it on good authority that prices will decrease by 70%.

70-3 = 67.

If they drop less than 33.5% in 2019, he wins and your “authority” loses.

Job growth in December was 312,000. That is a big number. News flash. There is no way the housing market will crash with 312.000 jobs being created in a single month. You guys thinking somehow the housing market will crash while 312,000 jobs per month are being created had better put the crack pipe down. A lot of buyers have stepped back because the negative housing stories being pumped out by those that want to damage the housing market for political or personal reasons. Soon, they will step right back in when they realize they made a mistake.

These are low income jobs, nothing more nothing less.

Seasonal hiring of course cannot be the reason for the high number of jobs, right?

Seasonal hiring of course cannot be the reason for the high number of jobs, right?

Does anyone know how these job reports numbers are generated, especially when the government is supposed to be shut down for the last two weeks. I can’t imagine that the Department of Labor would be classified as essential.

You are SoCalJim who posts on Wolfstreet. Am I right?

Most of you might already know, but JT doesn’t just deny that house prices are currently overvalued, he flat out denies that there was a housing bubble from 2004-2007 as well. He believes that since house prices have since recovered and gone on to new highs, that this proves there was no prior bubble. He believes also that there was no true housing crash in 2008 (you read that right) but it was a financial crash that just temporarily pulled down housing, and the “doom and gloom media” did the rest. He’s got his cause and effect all effed up. Not much we can do. Seriously, if one cannot learn from 2008, one cannot learn, period.

jt – why do you follow a housing bubble blog? You obviously think that real estate always and only goes up, and any time is a great time to buy. Do you just have low self-esteem, looking for some weird rejection from people who don’t agree with you?

You and your ilk don’t even bother to read the articles. Everything in this particular entry goes against what you’re saying, you understand that, right?

“Job growth in December was 312,000”

Part-time temp jobs paying less than miminum wage, exist solely for Christmas season.

All of them have already vanished as Chrismas season is over. Anyone who is using December employment numbers to anything, is basically lying.

If similar year-to-year increase happens in July, then I’m listening.

Hi where can I get this type of data for Florida. Interested in zip codes 33486 and 33432. I think the story here is very different from California.

Elliman has reports for a number of areas, including Boca Raton:

https://www.elliman.com/reports-and-guides/reports/florida/3q-2018-boca-raton-sales/17-1028

Does anyone know how these job reports numbers are generated, especially when the government is supposed to be shut down for the last two weeks. I can’t imagine that the Department of Labor would be classified as essential.

Housing bubble is not just popping at the west coast. It’s happening globally. Pretty amazing to be able to witness another epic crash!

https://www.zerohedge.com/news/2019-01-05/global-housing-markets-hong-kong-sydney-join-global-rout

Sorry to say that housing is not going to crash like 2007-2008. McMansions yes, but not workforce, affordable housing. Construction has not kept up and is not on track to outpace supply. The US will be short 4.6 million housing units by 2030.

https://www.naahq.org/news-publications/units/june-2017/article/united-states-needs-46-million-new-apartments-2030

Don’t waste your time here! Go out and buy! It’s a great time to buy! And if you don’t buy now you might be priced out forever!

Take the realtor BS out of here.

You are as bad as Zero Hedge or Millennial.

Can only see things from one side.

Real Estate is more about location than house size. “McMansion” is a pejorative for large houses on less than stellar lots. (My Definition.)

Maybe you prefer Wikipedia:

“In suburban communities, McMansion is a pejorative term for a large “mass-produced” dwelling, constructed with low-quality materials and craftsmanship, using a mishmash of architectural symbols to invoke connotations of wealth or taste, executed via poorly thought-out exterior and interior design.”

If you’re talking about big new houses in Rancho Cucamonga or Corona, I’d say probably yes. A similar house in Anaheim Hills or South OC, not so much. Anything by the Beach or on LA’s West Side, hardly at all.

Sure kid, whatever you say.

Never trust a boy in a tie dispensing financial advice.

” not workforce, affordable housing.”

I can believe that if I ever see even one workforce affordable house which doesn’t need full rebuild before it’s livable. Near my job of course, not just anywhere.

Boy, last weeks big big employment number, which reported many high paying slots, really shut up the housing crash nuts. What a shocker. Should be a good spring market, but only if the job market stays strong. Recessions do come out of nowhere, but so far, I don’t see one.

The economy is considered as strong, yet the housing market is turning quickly. A lot more inventory and asking prices are falling left and right. Apparently you don’t need a job loss recession in order for housing to correct. Now, add a job loss recession to the weak housing market and you have your 50-70% crash so many of us predict. Good times ahead (lower RE prices).

Re: Employment

1929: Unemployment rate —> 3.2%

1933: Unemployment rate —> 25%

So Peter schiff said in order to save markets fed will start dropping rates and this is going to lead to inflationary recession, so will home prices go up or down?

Gary, both, the inflation and interest rate influence house prices; however, the dominant drivers are interest rates, how easily people can qualify for a loan and the job market. The inflation per se is like a forth factor in terms of influence on house prices. If people would buy with cash, inflation would be the dominant factor. I explained many times before why that is so.

One point though – the FED can not keep high inflation and low interest for too long; the bond market would rebel and you have a financial crash. Sometimes they get a little bit behind the curve and they roil all financial markets. You can not punish the bond holders without major consequences; the bond market is three times the size of the stock market. Between the two, the FED will always save the bond market.

I hope that answer your question somehow. It is hard to give black and white answers in finance because you always look at 2 variables, all other things staying the same. The reality is that you have hundreds of variables always influencing one another. That makes the system very complex. Add to that the players emotions (which can not be quantified) and you see why the decision makers drop the ball so many times. Then, they get criticized by many who are looking only at few variables and who are right from their point of view. Also, when the dam breaks, the decision makers always try to save the stockholders (not the stake holders) of the privately held “FED”.

Just look at the 1970s for your answer. Home prices went up with 13% mortgage rates.

@NTiS – that’s a silly argument. It’s never that simple. There were numerous factors involved back then that don’t apply today. Different times entirely, different economies, etc.

LAS VEGAS housing update – market is getting very ugly very fast

https://www.calculatedriskblog.com/2019/01/las-vegas-real-estate-in-december-sales.html?utm_source=feedburner&utm_medium=twitter&utm_campaign=Feed:+CalculatedRisk+(Calculated+Risk)&utm_content=FaceBook&m=1

82% increase in inventory and sales numbers are crashing (like in other former hot markets as well).

Las Vegas and Phoenix were the canaries in the coal mine for the west coast in 2007. History repeating itself again.

When the last bubble burst LV went up something like 5 fold or more in about a year, year and a half. Still, 82% is no joke.

In my hood I see places being listed for joke prices. Then I look at history – invariably bought in the last couple years and looking to get out with a little profit. Sorry pal, but you just screwed yourself – time to mail those keys before the sheriff kicks in the door and throws you out on your azz!

Las Vegas Inventory is at 2016 levels…. it’s still a giant nothing burger, but certainly something to monitor.

Hilarious! Yep NoTankInSight, maybe time to adjust your position (and user name) slightly? How about to TankInSight? Or,maybe you desire to be the last person on this blog to acknowledge what’s happening? For those of us who have been through the rodeo before it’s a nothingburger to see that this will end in tears (for those who bought recently). Keep denying the bust notankinsight! Whatever let’s you sleep at night!

Millennial,

You love straw man arguments.

Your premise is for a 50-70% “epic tank”.

My premise is for a housing correction that looks a lot like the 1990s sometime between now and into the next recession. In nominal terms I don’t expect the drop to be that large in premium areas of California and elsewhere. However in real terms it will be large. I think you will see a 15-25% drop in nonimal terms extended over a 5 to 8 year period.

In nominal terms 20% over 8 years isn’t much… but when you add in real inflation of say 4% per year… in real terms that could be as much as 50%.

The hard part is predicting what curve balls can occur. Last time in 2004 it was negative amortization no documentation loans that shot the market up another 30-40%.

This time it could be something unpredictable like mortgage rates dropping to record lows with looser lending standards subsidized further by the government. Or run away inflation and devaluation of the US dollar. I am not saying either of these scenarios will happen but I have seen something unpredictable happen too many times before.

“This time it could be something unpredictable like mortgage rates dropping to record lows with looser lending standards subsidized further by the government. Or run away inflation and devaluation of the US dollar. I am not saying either of these scenarios will happen but I have seen something unpredictable happen too many times before.”

Or we have an alien invasion or maybe a zombie outbreak? Or what about Dan’s (OC Lender) prediction of an Californian POT boom that will translate into skyrocketing real estate.

The “INFLATION IS COMING” and “LOW INTEREST RATES FOREVER” crap has been screamed at us by RE cheerleaders since many years. We haven’t seen it-at all. At least you are not telling us anymore that there is no inventory and that there are millions of Chinese Millionaires. Looks like you finally (after a few year) got it. Inventory is rising sharply and asking prices are going down left and right. Foreign cash buyers have disappeared and flippers are getting burned.

Most of us – especially if you look at the data – know that the market is going down quickly. A 50-70% crash seems like a sure bet to me (and many experts).

OC County Inventory update – by Steven Thomas

Active inventory:

“The inventory more than doubled from January to mid-October, rising by 114%. With a late peak, the inventory dropped by only 20% by the end of 2018. In the past two weeks, the inventory has shed 9%, 566 homes, and now totals 5,829, the

highest level for an end to a year since 2011, seven years ago. That will translate to an elevated supply of homes to start 2019. The overall temperature of the housing market has everything to do with supply and demand. More homes will pave the way for a slower housing market.”

Demand: With rising interest rates, demand was muted all year.

Within the past two weeks, demand dropped by 205 pending sales, or 14%, and now sits at 1,303 pending sales, the lowest reading since January 2008. Last year at this time, demand was at 1,605, or 27% more than today.

Luxury End: Luxury homes dramatically slowed in the second half of 2018.

demand started to drop during the Spring Market. That translated into a slower third quarter with 1% fewer closings year over year. The brakes were pumped a bit more over the summer with even less demand, which resulted in 12% fewer year over year sales in the fourth quarter.

With more supply and muted demand, the market felt a lot more sluggish in the

second half of the year. There simply were not enough buyers actively looking to buy. On the other hand, there were plenty of sellers competing with each other, the higher the price, the slower the market.

Expected Market Time: As the market shifted from a supply problem to a demand problem, the market shifted from a

Seller’s Market to a Balanced market, and finally to a slight Buyer’s Market.

The expected market time for all of Orange County grew from 127 days two-weeks ago to 134 days today. The start to 2019 is going to be the slowest in eight years, and it will initially be a slight Buyer’s Market.

The 2019 Forecast: A sluggish year.

The bottom line, 2019 will continue shifting away from sellers and line up more in favor of buyers. It will finally be the buyer’s turn during the second half of the year. Sellers will not get away with overpricing Sellers will have to pack their patience in 2019. Gone are the days of multiple offers and instant gratification.

This is how Canada’s housing correction begins

Canadians are finally getting a taste of what a world with rising interest rates will look like, and one thing is painfully clear: we’re not ready for what happens next

Jan 3, 2019

“Pain. I predict pain.â€

“https://www.macleans.ca/economy/realestateeconomy/this-is-how-canadas-housing-correction-begins/”

This is how Canada’s housing correction begins

Canadians are finally getting a taste of what a world with rising interest rates will look like, and one thing is painfully clear: we’re not ready for what happens next

Jan 3, 2019

“Pain. I predict pain.â€

‘https://www.macleans.ca/economy/realestateeconomy/this-is-how-canadas-housing-correction-begins/’

This is how Canada’s housing correction begins

Canadians are finally getting a taste of what a world with rising interest rates will look like, and one thing is painfully clear: we’re not ready for what happens next

Jan 3, 2019

“Pain. I predict pain.â€

Just mind blowing how the Seattle bubble market is tanking hard:

Check this out! Make sure you sit down….

https://wolfstreet.com/2019/01/08/housing-bubble-trouble-in-the-seattle-bellevue-metro/

The great thing nowadays is that this information is available to everybody-for free!!

With a few mouse clicks the avg joe can find out the state of the market and understand its crashing hard. A few mouse clicks can save you hundreds of thousands of dollars….how? Well, who wants to buy overpriced real estate that is about to crash by 50%?

That’s right, not a single person, no matter how dumb and rich he or she is.

Seattle tanking HARD?

Give me a break, here is the reality with Seattle inventory:

https://seattlebubble.com/blog/wp-content/uploads/2019/01/KingCoSFHInventory_2018-12.png

60% increase of inventory in one year is a lot. And that can be seen from the graphs.

That basically means very small percentage of houses put to sale are sold, at any price.

Respectively that means either prices drop significantly or the inventory continues to grow, eventually leading to crash.

Obviously either must happen.

Good interview in regards to the popping of the bubble with housing bubble blog founder

https://youtu.be/ait7sKU_L1c

Hello Folks

Say ‘hola’ to the latest Real Homes of Genius.

You too can own in prestigious mid-cities. a 2bd 1 ba for only $950K

be sure to add bars to the windows and a rottweiler in the frontyard.

https://www.trulia.com/p/ca/los-angeles/2104-hauser-blvd-los-angeles-ca-90016–2077216652

Don’t you love when your email inbox blows up with price reductions and new listings?inventory is skyrocketing and prices will continue to fall sharply. 2018 should be fun for those who waited. I feel sorry for those who bought recently or worse: for those who need to sell (flippers). Just joking, I don’t feel bad for flippers at all.

Ha! I meant 2019 🙂

I just noticed some very large drops in the asking prices of 2 homes: one located in Riverside Co. and one located in Northern San Diego Co. The Riverside home’s asking price has dropped 20% in the last 3 months while the SD Co. home’s asking price has dropped 25% in 10 months. Both homes are currently for sale but should sell soon at their current asking prices.

My point is that prices can fall much faster and greater than people think. All it takes is one person who really needs to sell to drop his price and the comparable home price paradigm is destroyed.

My second point is that there are always some people who need to sell, but no one really ever needs to buy. Buying is always an option that can be delayed indifferently. Millennial is living proof of that.

Gary, spot on. Your best post since a considerably long time.

Gary, I hate to burst your bubble but some home sellers significantly overprice their house. It sits and reality sets in and seller reduces said asking price by a large percent. Do not confuse this with the entire area tanking in price by that large percent. The selling price should always be based on sold comps.

Just like Millie, I hope we see a 50% percent tank in the beach cities so I can scoop up a cheap rental. I highly doubt that since desirable beach areas didn’t decline anywhere close to that a decade ago. But one can only hope and dream…

Holy smokes, some houses I am watching were sitting for 4-5 month. They tried everything. Renting it out, auction, open house after open house. Now 100k-150k price reduction! We will get so many fantastic buying opportunities in the next year it’s not even funny!

I think it’s going to take more than a year, my friend. Give it at least two to three years to see a true bottom.

But yes, I’m seeing the same. Tons of price reductions. My personal favorites are the listings that pop up as “new” for the 2nd, 3rd, 4th time. Comedy!

At least it was cheaper than renting lol

Our real estate cheerleaders used to tell us: “everybody makes 200k except 18year old fry cooks†In other words, we won’t run out of high wage earners to buy that 1mio crapshack. Well, it seems they were off by a bit:

Shocker!

https://www.zerohedge.com/news/2019-01-09/nearly-half-us-workers-earn-less-30000

Here is a good entry home for a first time buyer. You will need to move quick on this one.

https://www.redfin.com/CA/Manhattan-Beach/1300-18th-St-90266/home/6703965

I am now starting to think you might be a satirist.” Entry level” at 1.25 million.

Early 30’s professional with nearly a million in savings here. No way in hell would I pay $1.25M for this dump.

Early 30s professional with nearly a million in savings here. No way in hell would I pay $1.25M for this dump.

Good on ya. There are quite a few of us actually. I’m late 30’s with over a mill too, all from real estate investments. Started in RE when I was 23. Did you get your cash from RE or another industry? Just curious. Good job man!

I bet on average the folks that consume data on this blog are pretty well-papered or if not they are on their way to being well-papered. Some people on this blog ‘get it.’

After this coming crash I will turn my $1M into several Mil. Did it last cycle and gonna do it again.

That property is land value only. You are paying for that beautiful piece of MB dirt. If the price is right, a developer will buy it, bulldoze and build a McMansion. Asking price for McMansion will be 2.5M. Welcome to CA RE!

Seattle housing bubble update for December

Massive surge in inventory – 143% increase YoY!

https://seattlebubble.com/blog/2019/01/07/nwmls-home-price-gains-vanish-as-sales-continue-to-slip/

Got the following spam email from a realtor:

Now may be the time to make your move.

The real estate market is once again shifting and homes are selling quickly – very quickly. Many people have been waiting for just the right moment to make a move; your time may be now.

* Demand is high.

* The number of days a home is on the market is down.

* Multiple buyers are bidding on the same property.

* Home values are increasing.

* Mortgage rates are still low.

Contact me to learn what is happening in your local market and how you can take advantage.

“your time may be now.

* Demand is high.

* The number of days a home is on the market is down.

* Multiple buyers are bidding on the same property.

* Home values are increasing.

* Mortgage rates are still low.”

SOL, that realtor is kind of simple minded or he looks like it. He has everything backwards. The conditions he is describing are good for selling not buying. For buying, it should be “blood in the streets”. You buy when all want to sell and sell when all want to buy. I feel sorry for people who buy when all buy and sell when all sell; that is a sure way to the poor house. All my life I made money by being a true contrarian and have nerves of steel. The brain has to control the emotions and that doesn’t happen easy. I am talking from experience. It is a real struggle between logic and emotions especially on the buying side. Many times I felt like the sky is falling, my emotions told me not to buy but my brain told me to do it; eventually I listened to my brain (“the heart is deceitful above all things”). In conclusion, don’t follow your heart in business; RE investing it is for the most part a business decision.

Hey Bubble Dummies/JT, new home sales are down 40% in Northern CA and 49% in Southern California.

Were you able to process that?

Here, let’s look at that stat again and this time read it aloud to yourself slowly and then reflect on the statistic itself for 10 seconds…

“NEW HOME SALES ARE NOW DOWN 40% IN NORTHERN CA AND 49% IN SOUTHERN CA.”

Let me know if you need the CNBC link to verify the authenticity of this data. I will gladly reply with the link.

A 3 bedroom 2 bath home built in 1959 located in North Hills in the SF Valley is listed for $675K. It’s a dump that has been on the market since Sept. 2018. North Hills has become a haven for illegals and homeless in the sanctuary sh*thole city of Lost Angeles.

https://www.zillow.com/homedetails/9249-Aqueduct-Ave-North-Hills-CA-91343/20142321_zpid/

Hey, jt, a couple of months ago you said there were no beach houses available for under 2 million.

Here’s a very nice Santa Monica house: https://www.redfin.com/CA/Santa-Monica/3214-Pearl-St-90405/home/6765473

Listed last August for $2.2 million.

Listing was already down to $1,795,000 when you made your post.

It finally sold at $1,597,000.

There is not been a statement by JT that turned out to be true yet. It’s usually the exact opposite.

Millennial, forget buying a home. You need to hire a therapist.

JT

Sounds a bit to me that you don’t agree? Has there bin a statement made by you that has ever made sense or turned out to be true?

“There is no inventory†– false

“This 2018 spring Season will be epic†– false

“This will be be the year when millennials go out and buy in droves†– false

“Don’t fight the fed. Interest rates will not go up†false

“I considered making an offer†– triple false. You say this every other month to pretend buying makes sense.

You are the worst RE cheerleader/troll I have seen so far.

That is a crappy area of Santa Monica, and Pearl Street is busy as heck.. I said there were no decent beach close homes in decent areas. That part of Santa Monica has gang issues … that is why it is so cheap. If you go to the better part of Santa Monica, which is north of Montana, it is hard to find anything under 3M. But, I do see one killer deal in Santa Monica … this home could be listed way under to generate a bidding war … but, if you could get this one anywhere near ask, it would be a huge win. Street is busy, but I would be all over this one … I almost put a bid on it myself, but I decided not to cause I want a better street. Still, what a deal.

https://www.redfin.com/CA/Santa-Monica/2223-California-Ave-90403/home/6769375

@jt…this California Ave house is on a small lot. With the new zoning ‘anti-mansionization’ they passed last year in SM, this may be a bad deal for a developer unless he can make a profit by building up to the allowable size of 50% of the lot size. 2500 square feet is hardly worth it for a new build in SM. But I agree it is priced to sell quickly at multiple offers…probably to an owner/user.

Jt, that part of Santa Monica — Sunset Park — doesn’t really have a gang problem. Santa Monica’s small gang problem is in the Pico District, centered around Woodlawn Cemetery. And the problem is diminishing with gentrification.

But there are plenty of other beach houses available for under $2 million. That was your criterion. Not whether it was in an area with a gang problem.

This Santa Monica Canyon (i.e., Pacific Palisades) house is only a few blocks from the beach. It originally listed at just under $2 million. Now it’s just under $1.5 million: https://www.redfin.com/CA/Santa-Monica/333-E-Rustic-Rd-90402/home/6840444

Redfin currently lists 13 other houses in Santa Monica proper, ranging from $1.049,000 to $1,815,000.

Sure, none North of Montana, but in EVERY other SM neighborhood — Sunset Park, Wilmont, Mid-City, Pico, Ocean Park.

And yes, some of those houses are very small, and at lease two have no garages.

But you said you were seeking investment properties. Rentals. So it’s not like you have to live there.

You said SoCal beach houses are a sure thing, investment wise, provided you could get one at under $2 million. Well, there’s plenty to choose from.

Apart from those SM houses, you’ll find more all along the coastal beach cities.

Son of Landlord, that rustic road is a trash property. It has a major cliff right next to it … and it is at the bottom. Just trash that is not worth buying.

Venice Beach looking guuuuud: https://www.zerohedge.com/news/2019-01-14/its-worse-it-has-ever-been-venice-beach-residents-rebel-homeless-crisis-intensifies

Them desirable beach areas where you get your tires slashed 6 times a year, taxed up the wazoo, and spend half your life in traffic – where do I sign up?

Google is expanding in West L.A. – https://therealdeal.com/la/2019/01/08/google-will-lease-all-of-massive-westside-pavilion-amid-redevelopment/

If this doesn’t increase real estate prices, it will at least put a brake on any HARD TANK in the area.

We are at 2006 in the market, act accordingly this time….. 2020 will not be pretty, 2019 I think is going to be a wash….just like 2007

recent headline

SP 500 off to best start since 2006……..cycles are just a reset, they are to be respected and they don’t come in days, it will take a couple years for the lows in housing to show….

2022 might be best bet…

Yes, we are in the equivalent of the 2006 real estate market. However, we are not at the beginning of the year 2006 but rather near the end of 2006. My best guess is that Jan. 2019 is the equivalent of July 2006 (so the current cycle is about 6 months ahead of the 2006-2012 cycle).

This is a little confusing, but the real estate bottom will likely not occur about Sept. 2022 and will last until about 2025. This is going to be a slow, painful decline. However, despite the fact that the sharp price decline is years away, I still believe home prices will be about 5-7% lower by the end of the year.

Two interesting articles in the Sunday OC Register: