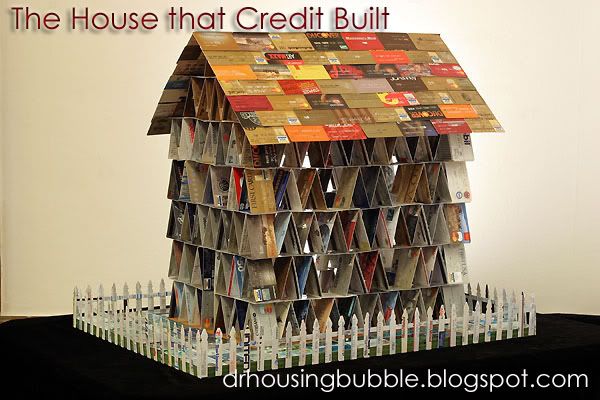

Ponzi Financing – The House that Credit Built.

Do you know the story of Charles Ponzi? Ponzi was an Italian immigrant and figured out how to use an early form of arbitrage to create money. In a nutshell Ponzi made money by exchanging foreign postal stamps that were fixed and leveraged into favorable currencies. Since Europe was ravaged at the time, many currencies were devalued yet the rate of the stamps was never changed. This was all legal. However, Ponzi decided that he would seek out investors and offered them a 50 percent return on their investment in 45 days. You could double your money in 90 days! What did this do? Well after a few successful investments he started to build momentum. Take a look below:

Feb 1920: $5,000

March 1920: $30,000

May 1920: $420,000

July 1920: $1,000,000+

This was the start of the Securities and Exchange Company (sound familiar?). The ironic thing was that Ponzi was losing money daily. The thing that kept him going? Debt. Basically he was paying out his investors with money that was coming in. In fact, so many people bought into the hype that widows were mortgaging their homes to get a piece of the action. When someone from Barron’s decided to examine Ponzi more closely, they realized that the company was completely unsustainable. They realized that 160 million postal coupons would need to be in circulation when only 27,000 were estimated to be in use. By August 13 Ponzi was under arrest. Even at this time, so many people had blind faith in Ponzi that they cried and held anger toward the officers who arrested him. They bought into the dream Ponzi was selling even though economically it had no basis in fundamentals.

“Hello, my name is Charles Ponzi and I approve of the Housing Bubble.â€

Looking back nearly 100 years one can easily say “why in the world did people fall for the Ponzi scheme?!†Why look back that far when we can look at our modern day heroes, the flippers and speculators. Again how does this compare? For one thing, many flippers that purchased properties in the last few years did not care that the property would produce a negative cash-flow because they figured a greater fool would purchase the property. Heck, they were fixated on 50 percent gains! Think of it this way, buy a property with $10,000 down, spend $5,000 fixing it up and sell it for a profit of $15,000. So you get your $15,000 back plus $15,000, a net gain of 100 percent. In addition, many flippers held onto property for only a few months thus increasing their yearly gains. So this is all anecdotal right? If you want a real life case study I point you toward Casey, a 24 year old flipper with 2.2 million dollars in debt: www.iamfacingforeclosure.com

And again if you look at recent foreclosure data for the month of October, 50 percent of mortgages that are entering foreclosure originated in 2005 or after and have a median age of 14 months. This is not a homeowner that bought in 2000 and is worried; that is unless he used his home as an ATM machine and did cash-out refinancing. The well is quickly running dry. Washington Mutual reported that 30+ lates noticeably increased in the last few months and their mortgage portfolio has decreased. In addition, they are laying off 9,300 workers. Are these signs of a booming market? Or what about Kara Homes that is now in Chapter 11 bankruptcy? http://www.bloomberg.com/apps/news?pid=20601087&sid=ajY74Kg6RI7o&refer=home

These are only two examples of a financer (WM) and a seller (Kara Homes) that are two sides of the same coin. One cannot do exceptionally well without the other. Now that the Ponzi scheme is starting to unravel and lending is tightening, we will see more caution by buyers and more drastic measures by sellers. Now we will get those that say “are you kidding! I can still get a 125 percent interest only with no money down.†Is this really prudent? Look at the below data by the Mortgage Broker Association:

“As of September 2005, Adjustable rate Mortgages (ARMs) accounted for roughly 70% of the prime mortgage products originated and securitized and 80% of the subprime sector.*â€

* 2006 Global Structured Finance Outlook: Economic and Sector-by-Sector Analysis, FITICH RATINGS CREDIT POLICY (New York, N.Y), Jan. 17, 2006 at 12.

Think this is isolated? Look at some data for the Bay Area:

“The following chart shows the percentage of Bay Area loans that were interest only or Option ARMs (know as negative amortization).â€**

Year Interest Only Option Arm

2005 42.6% 29.1%

2004 43.7% 9.6%

2003 20.3% 0.8%

2002 12.0% 1.7%

2001 2.9% 1.6%

**Kathleen Pender, Mortgage options explode, SAN FRANCISCO CHRONICLE, April 13, 2006

Like a Ponzi scheme, it is good until it isn’t. Think of it as musical chairs. When chairs are plenty, everyone is having fun. Yet as the music winds down, we know that eventually only one person will be able to sit.

Filed in: mortgage-fraud housing-humor mainstream-media housing-data

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

5 Responses to “Ponzi Financing – The House that Credit Built.”

LMAO!

“The following chart shows the percentage of Bay Area loans that were interest only or Option ARMs (know as negative amortization).â€**

Year Interest Only Option Arm

2005 42.6% 29.1%

====================

Hold on here! Those are new loans, right? Of course, but, that’s not what it says…..

Buffet: “Overall, I’m an enormous bull on the country.”

Now, how can he be bullish and have the whole economy blow-up over a so called housing bubble? LOL

Year Interest Only Option Arm

2005 42.6% 29.1%

I’m willing to bet the percentage numbers will be much higher for 2006.

…

Hold on here! Those are new loans, right?

Were you expecting old loans instead?

“Buffett: Real estate slowdown ahead

The Oracle of Omaha expects the housing market to see “significant downward adjustments,” and warns on mortgage financing. “

[Link]

Now, how can he be bullish and have the whole economy blow-up over a so called housing bubble?

You tell me..

actually markets adjust by offering 40 50 and 60 year amortizations with possible 1 year deferments in the life of the loan like a construction loan however construction loans can be 18 months deferred like FHA DUS and as time is being extended and offered to customers equity appreciation over time realizes higher market values in long run with the higher cost of living to complement higher values with possible structured lower rates based on good credit just have a strong long term financial plan and you will succeed. The housing so called bubble is created by inexperienced homeowners who in turn cause short sales and higher insurance premiums for us in the later no one really gets hurt since the same moron in 2 years or less can reapply and get financing again even with bad credit. Financing once understood and used wisely can create extreme opportunity or wealth

Leave a Reply