The politics of housing: Why are many blue cities unaffordable to the middle class?

There tends to be this notion that politics and housing are fully separate realms. Never do the two meet. Yet there is a large connection between politics and housing. Even during the bailouts the propaganda was that too big to fail banks needed to remain to provide loans for middle class families. The underlying assumption was about keeping affordability alive. Instead housing once again has become unaffordable for many and prices are out of reach for many middle class Americans living in large cities. As it turns out, it appears that cities that tend to vote liberal actually have some of the worst housing affordability. San Francisco is the worst offender. Ironically the politics are largely one of strong protections but what unfolds is massive constraints on land usage and NIMBY policies that constrain inventory. Even things like Proposition 13 simply inflate prices for the locked in low tax rate while the big pitch here was to keep grandma from being booted out in the street and eating Kibbles ‘n Bits. They forgot to mention grandma was actually holding onto a lottery ticket. Now grandma lives in a million dollar shack in San Francisco but still shops at the dollar store. Places like the South, including Texas have conservative policies and some of the most affordable real estate in the United States. It would appear that liberal cities are no place for the middle class but of course there is more to it.

Unaffordable markets driven by politics?   Â

The Atlantic made this interesting observation in a recent post:

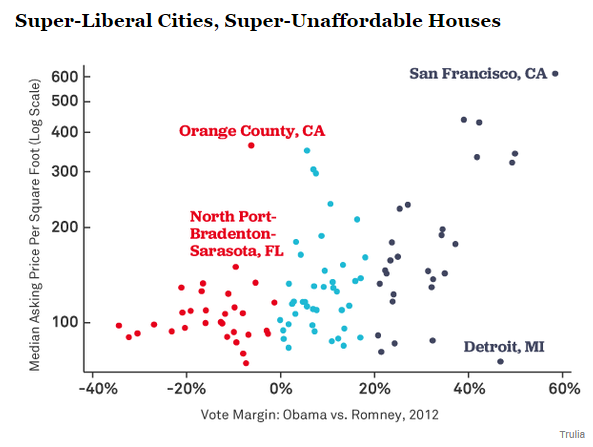

“(The Atlantic) But there’s a second reason why San Francisco’s problem is emblematic of a national story. Liberal cities seem to have the worst affordability crises, according to Trulia chief economist Jed Kolko.

In a recent article, Kolko divided the largest cities into 32 “red” metros where Romney got more votes than Obama in 2012 (e.g. Houston), 40 “light-blue†markets where Obama won by fewer than 20 points (e.g. Austin), and 28 “dark-blue†metros where Obama won by more than 20 points (e.g. L.A., SF, NYC). Although all three housing groups faced similar declines in the recession and similar bounce-backs in the recovery, affordability remains a bigger problem in the bluest cities.â€

Here are the numbers:

Now this doesn’t apply everywhere of course. Orange County tends to vote more conservatively and is the most expensive county in Southern California. However the data above does show a clear pattern. Areas that tend to vote “blue†tend to have affordability issues when it comes to housing.

Both political parties are in a deep capture to big money. Even in this recent election we are basically taking off the same stinky shirt and reversing it. Thinking otherwise is simply being naïve. The chatter on the boob tube is always about emotionally divisive topics. Rarely do we hear about the Fed, middle class income, or inflation. It is simply ignored so it is no surprise that people are all the willing to dive into deep debt to purchase a home.

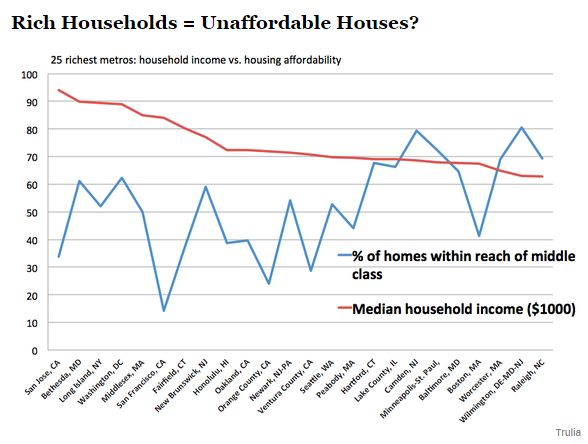

Here is another look at the data based on local area incomes:

There are other factors at play here as well beyond politics. Some areas may be more conducive to investor funding because of established networks or higher income households simply prefer to live near higher paying jobs. Many tech workers need to be around the Bay Area. That makes sense for the Bay Area but as we noted, the LA/OC area is the most unaffordable housing market based on what people actually earn.

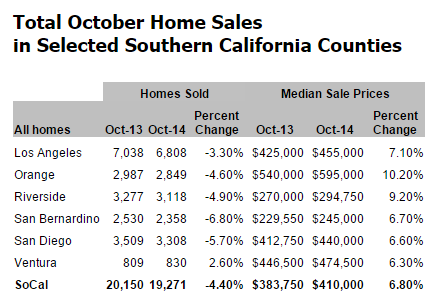

SoCal sales continue to be weak and price gains are stalling out:

The only affordable counties for the middle class in SoCal are in the Inland Empire. How much can you read into this? I tend to believe this has more to do with policies and land constraints. California has favored real estate via Prop 13 low tax rates. You also put in restrictions on building higher density properties and it is no surprise we get the current market. Then again, you have New York with very high density and look at housing values. No simple answer here. Texas with high property taxes but low to nonexistent taxes in other areas has lax building restrictions and look at what housing values are there. Someone e-mailed me a few years ago that both the husband and wife worked at CVS and as a waitress and found the same jobs in Texas and bought a 4 bedroom house in a good city. In California good luck finding a rental in a safe area with that income. Yet that is what most people are doing. Los Angeles is a renting majority county.

Of course if values are driven by politics, things can change on a whim versus allowing market forces to unfold. Nothing can change more quickly than a politicians view and we are seeing many more people become renters especially in high priced areas.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

66 Responses to “The politics of housing: Why are many blue cities unaffordable to the middle class?”

There is hidden order in chaos. Need a few supercomputers to process all the variables in this market. It does not seem healthy; policies that protect for one group, and block opportunity for younger entrants. I should add that those jumping deep into debt should have the sense to question very high prices. Markets are ferocious places, and I put my own renting/saving family first, before those who chose to outbid me.

Some negatives of intervention/stimulus/forbearance (Especially page 2) and why stimulus isn’t really working – except for boosting values of so many assets.

http://www.marketwatch.com/story/the-fed-and-other-central-banks-arent-doing-enough-2014-11-10

http://seekingalpha.com/article/2631035-john-hussman-losing-velocity-qe-and-the-massive-speculative-carry-trade

_____

Doc: >In California good luck finding a rental in a safe area with that income. Yet that is what most people are doing. Los Angeles is a renting majority county.<

_____

Yes Doc; thought your entry on 10 Jan 2014 was very interesting.

_____

10 Jan, 2014

[..]A large majority of Californians moved into their properties from 2000 to the present, roughly 69 percent. That is a sizeable number. Even if we look at 2010 to the present, we find that 30 percent of current households moved into their current shelter. For California, 54 percent of households own and 46 percent rent.

http://www.doctorhousingbubble.com/california-baby-boomers-golden-real-estate-handcuffs-generational-wealth-taxes/

Brain of England: this might interest you.

Escaping liquidity traps: Lessons from the UK’s 1930s escape

Nicholas Crafts 12 May 2013

http://www.voxeu.org/article/escaping-liquidity-traps-lessons-uk-s-1930s-escape

He points out that monetary easing in the UK in the 1930′s, WORKED because it had somewhere productive to GO:

“…….Obviously, for the cheap-money policy to work it needed to stimulate demand – a transmission mechanism into the real economy was needed. One specific aspect of this is worth exploring, namely, the impact that cheap money had on house-building. The number of houses built by the private sector rose from 133,000 in 1931/2 to 293,000 in 1934/5 and 279,000 in 1935/6 – many of these dwellings being the famous 1930s semi-detached houses which proliferated around London and more generally across southern England. The construction of these houses directly contributed an additional £55 million to economic activity by 1934 and multiplier effects from increased employment probably raised the total impact to £80 million or about a third of the increase in GDP between 1932 and 1934. House building reacted to the reduction in interest rates and also to the recognition by developers that construction costs had bottomed out; both of these stimuli resulted from the cheap-money policy (Howson 1975).

Why was house-building so responsive in the 1930s? Two factors stand out. First, the supply of mortgage finance grew rapidly and became more affordable in an economy in which there had been no financial crisis that curtailed lending.

Building society mortgage debt rose from £316 million with 720,000 borrowers in 1930 to £636 million with 1,392,000 borrowers in 1937 when about 18% of non-agricultural working-class households were buying or owned their own homes. In these years, deposits fell in some cases to 5% and repayment terms were extended from around 20 to 25 or even 30 years reducing weekly outgoings by 15% (Scott 2008).Second, houses were affordable to an increasing number of potential buyers.

85% of new houses sold for less than £750 (£45,000 in today’s money). Terraced houses in the London area could be bought for £395 in the mid-1930s when average earnings were about £165 per year. Houses were cheap because the supply of land for housing was very elastic which in turn meant that there was no incentive for developers to sit on large land banks. Underpinning the availability of land for house-building was an almost complete absence of land-use planning restrictions which applied to only about 75,000 acres in 1932 – the draconian provisions of the 1947 Town and Country Planning Act were still to come……â€

Get that: an absence of restrictions on urban fringe growth means that monetary easing “gets stuff built” instead of “asset price inflation”. I believe we can see that in the two different USA’s – while CA has already commenced the next house price bubble, in elastic-housing-supply States everyone is getting on with actually putting the cheap money to some productive use.

It is also interesting that those 1930’s building-boom houses in the UK are today some of the most sought-after in the entire market. The strangled supply situation since 1947 has tended to steadily erode all “value” in housing – it gets smaller and cheaper as the site costs swallow more and more of the housing consumer’s budget.

Interesting read Phil; thank you. It is true that old 1910 – 1930s-1940 UK housing stock is much more appealing to buyers than so many newbuild properties. Too many UK newbuilds are charmless small ultra-expensive bland slaveboxes.

Stimulus; I understood how stimulus worked in the 1930s- but suggest it can only have much more modest effects today. Building new roads is not going to create many new surburbs as is did in the 30s, businesses in those suburbs, sell a whole load of new cars. Any stimulus project, you want each $1 put in, to longterm bring in $3 or $4 of revenue. I can’t think of many stimulus projects left to do. Houses by themselves; not so much a positive stimulus measure, unless it brings about emergence of other businesses/revenue.

Now we have too many vested-interests who hold the assets, sitting on them, wanting buyers to pay a lot more than it’s worth, and they can hold on to elevated price assets, because of such low interest rates. Very few transactions in market for real price/value discovery.

I am also not sure just how ‘cheap’ this money is that you suggest is being put to productive use – vs – the prices of ‘gets stuff built’ new build real estate in some areas. There is plenty of cheap housing around if you go to areas where economy is depressed… can you see long term prospects for these areas to support current prices? Falling oil prices might help stimulate suburb demand again.

A majority of Americans make less than $20 per hour

Published: Nov 14, 2014

http://www.marketwatch.com/story/a-majority-of-americans-make-less-than-20-per-hour-2014-11-14

_____

Market wide though, including Government debt, rising debt levels create economic feedback that eventually forces a deflationary reaction. Put simply – debt cannot indefinitely compound faster than income.

Excellent points, Brain of England, I agree. I would just comment re “There is plenty of cheap housing around if you go to areas where the economy is depressed”.

But the cheapest, depressed areas in a country like the UK, with universal growth containment – is Liverpool a good example? – are STILL more expensive than pro-growth US cities like Houston. And in the US, a “depressed” area as bad as Liverpool tends to have houses being given away!

You probably will agree that more money being sucked out of the real economy in housing costs, tends to reduce multiplier effects as they relate to everything actually getting “produced”. I actually argue that the old “aggregate demand” argument that gets Keynesians and non-Keynesians so wound up, relates to the actual “stuff” of goods and services produced, and that zero-sum transfers do not merely result in inequitable sharings of this “stuff”, but a lower actual production of it to BE shared around. I think this is where those macro debates should be going, but are not. To the Keynesian, a dollar spent IS an “increase in aggregate demand” and this IS “the economy”. Nonsense. But the Say’s law people are no better when it comes to incorporating the effects of zero-sum transfers into their model.

The “Blue” party has the middle class fooled into thinking that they “care” about them. As long as inventory stays low, home prices will increase. Wait till they loosen the credit restrictions, then we’ll see even higher prices and more competition.

“As long as inventory stays low, home prices will increase. Wait till they loosen the credit restrictions, then we’ll see even higher prices and more competition.”

That ship sailed with the election of a GOP congress. Housing was/is going down no matter what. Easing mortgage guidelines could have staved it off for a short while, but that dream is dead. The GOP loves fiscal conservatism, when Team Blue is in the White House 🙂 QE is dead. There are no new mortgages to be bought even if it wasn’t. Lending guidelines will not loosen because the banks know the party is over. The GOP is going to do everything they can to ensure the bust happens before 2016. It is all over but for the crying of specuvestors and knife catchers.

If the market is so solid, so fundamentally sound why are mortgage rates being artificially depressed by 2-3% ??? The paper/computer-digit wealth that is driving the global markets is in a more precarious position than ever. We use the drug addict analogy because it is so accurate. It takes larger and larger “hits” of intervention just to maintain the system. Not growth, but just preventing collapse. The FED is going to keep equities up if possible, of that I am sure. But housing MUST be sacrificed if only to restore spending power to consumers. They are tapped out and no wage inflation is coming. Letting residential RE revert to the mean is the ONLY way the FED can put dollars in the hands of consumers. Lower Joe6Pack’s fixed costs and he can help Walmart and McDs bottom lines. All this time I was comparing 2014 to 2006/2007 I should have been looking at 1990/1991.

I am taking the only action I can retaliate with, and hope other younger-professionals who want better value in low-mid-high prime are doing similar.

On an individual level it is nothing, but when repeated by millions it matter = I am cutting back on spending, and doing more saving, to reduce overall aggregate demand. – commodities etc falling in value, can quickly spread pain to market participants in the financial sector levered to higher prices, which may eventually bring about a reaction that can not be stopped.

In fact the 2nd year running payday for Gross of $200m, and huge sums for others in his firm, could be deflationary in itself; unless he’s acting like Brewster’s Millions on a spending spree in the economy.

_____

Rising Real Interest Rates

By Vince Foster May 28, 2013

[..]What seems to be lost in the monetary debate is that this persistent drop in inflation defies the primary purpose of quantitative easing, which is designed to lower real interest rates. In fact, with nominal yields rising in the face of falling inflation and thus raising real interest rates, the US economy is now closer to a deflationary death spiral than at any time during the Fed’s unprecedented policy designed to prevent just such an outcome.

The consumer balked at attempts to stimulate aggregate demand via inflationary policy of negative real interest rates, and ever since, has been raising real interest rates by reducing inflation through lower aggregate demand. This is perhaps the most unappreciated yet significant market development since the financial crisis.

Rising real interest rates is Bernanke’s worst nightmare. Everything he has worked for in academia and implemented in monetary practice is imploding before his very eyes. Contrary to his assertion in 2002, aggregate demand in the real economy has in fact met the limit of monetary policy, rendering QE’s impact ineffective and obsolete.

http://www.minyanville.com/business-news/the-economy/articles/Bernanke2527s-Worst-Nightmare-Rising-Real-Interest/5/28/2013/id/50031?page=1

I disagree Nihilist. The GOP is the party of the wealthy. The wealthy own real estate. The GOP is not going to shoot itself in the foot by pulling the rug out from under the housing market and losing wealth. The new GOP senate will push for higher interest rates and try to reinstate fiscal responsibility policies, but that does not mean they are going to throw the current housing market into a tailspin. If anything it seems that confidence in the economy has risen under the GOP win just look at the stock market.

Hunan: You say “The GOP is the party of the wealthy. The wealthy own real estate.”

The difference between the libbewwal housing market and the GOP one is this. In the libbewwal housing market, “the wealthy” own grossly overpriced luxury houses, NOBODY owns a house that represents fair value, and “property investment” is mostly crazed-by-greed speculators chasing quick capital gains. In the GOP ones, “the wealthy” own luxury houses that cost a fraction of what the same ones do in the libbewwal markets, plus they might own a lot of investment property all of which is priced at fair value, there are minimal capital gains anticipations, and income from them is modest and honest rental income. The rental tenants are NOT people who have been denied the option of actually buying their own fair-price home, as in the libbewwal markets. One of the ironies of this is that the rate of home ownership among minorities is 2 to 3 times higher in the South and rural heartland than in coastal libbewwal States, and segregation is also lowest in the South.

Libbewwals do not have the intelligence to work out causes and effects in the real world – conservatives who vote for conservative Republican representatives, do tend to understand these things much better. You can throw tantrums all you like about those dreadful bible-bashin, gun-totin’ redneck hicks in “places no-one wants to live”, but this would be the spite of the self-deluded idiot for the success of people he likes to perceive as stupid.

I use the term “libbewwal” because I cannot bear to use the term “Liberal”, for people that have hijacked it and have no right to it, they are poisoners of the true liberal tradition all the way from William Gladstone to Tony Abbott. They are the modern-day entrenchers of privilege and creators of serfdom.

RE: Phil

The last GOP housing market I remember was Housing Bubble 1.0 and Bush was national housing cheerleader championing Ninja loans for all. Liberals and Democrats are two different things as are Conservatives and Republicans. The Team Red/Blue false dichotomy is beyond trite and your embrace of it means none of your comments merit serious analysis. The GOP and their Democratic buddies will serve their Wall Street masters and their own interests at the expense of their constituents as always.

“The GOP is not going to shoot itself in the foot by pulling the rug out from under the housing market and losing wealth. The new GOP senate will push for higher interest rates and try to reinstate fiscal responsibility policies, but that does not mean they are going to throw the current housing market into a tailspin.”

You contradict yourself in the space of two sentences. What do you think fiscal responsibility and higher interest rates will do??? Yeah, tailspin. Not to mention commercial Rental is doomed without an increase in consumer spending. As I said before the only option outside of helicopter drops is to lower consumer’s fixed costs. Residential RE tanking will accomplish this. Like the guy below your making projections based on Team Red/Blue propaganda as opposed to facts.

@NihilistZerO

I will take a different take.

There is no fundamental difference between Republicans and Democrats in the Senate or House of Representatives.

The Republicans and Democrats in Congress set their votes based on the political affiliation of whomever is occupying the White House.

NihilistZero: you don’t get it. It is what happens in individual housing markets that matters, not what happens with monetary and fiscal policy. It is inelastic supply of housing at the local level, that makes a whole host of otherwise-beneficial policies, toxic.

Low interest rates either get more houses built and lower the cost of home ownership; or they force house prices up leaving no-one any further ahead but the crony capitalist land-rentier class. The latter is what happens in libbewwal city housing markets. Libbewwals are stupid. Case closed.

The crony capitalist land rentiers also score big from the following policy settings that are perfectly all right in non-distorted urban land markets. Upzoning and building “up”; the absence of a capital gains tax; the ability to write off rental operating losses against other income; immigration and population growth; non-recourse mortgage laws; rent controls; subsidies to first home buyers; the securitization of mortgages; and a whole lot more. The libbewwal vainly applies these policy settings to urban land markets they have screwed up with “smart growth”, and creates BUBBLE CITY; then they have the effrontery to accuse Republicans of causing the problem! The fact that Republican cities have policy settings that when combined, are beneficial, not toxic, is evidence of their intellectual superiority.

I see a future like ‘Idiocracy’ where bloods and crips are replaced by democrat/republican ‘party affiliates’, shooting each other in the street on sight in a never ending cycle of violence. That is as soon as things get bad enough, or they have went too far on the whole divide and conquer strategy. That or the internet goes dark and people can’t attack each other from the privacy of their homes so they take to the streets. Either way, the pendulum can only swing so far in either direction without alienating masses of people, which is why they are circumventing posse comitatus and equipping local law enforcement with left over military gear from Iraq and Afghanistan.

SF is expensive not so much due to politics but rather is a landlocked, 49 sq. mile haven for hot Asian money and VC funded tech bubbles sopping up every precious sq. ft of space for both office and housing for their bloated legions of employees. Rent control has become a relatively minor factor in recent years. This current bubble will inevitably burst, but SF will never be cheap due to supply/demand dynamics

SF is also one of the most physically beautiful places in the country and has perfect weather. People would flock there even if there weren’t lucrative tech jobs available. I would be happier in a studio in SF than in the nicest house in Camden, NJ. If SF were to magically become red over night, Mitt Romney would move there in an instant and start renovating a $10,000,000 fixer upper.

Perfect weather? Surely you jest! The only place in the country where you need a coat handy all but about 10 days a year.

SF…Been there many of times, I never think of that city of perfect anything let alone weather?

SF has perfect weather if you’re morbidly obese and allergic to the sun. For those of us who don’t break a sweat when we blink, San Diego and especially Hawaii are where its at.

S.F. has not always been expensive, I’m a native and lived there until the late 90’s…prior to the ’80’s it was affordable to buy or rent for middle income people and large parts of town were blue collar, renting was still affordable until the dot com boom.

So far as the weather goes it is completely different on the east and west sides of town…lots of fog out in the avenues, lots of sun in the Mission, Potrero Hill, etc…I lived on both sides and know whereof I speak.

It always counts, though, where are the competitors for location choice and what are the prices there? SF’s prices have always tended to be at a small premium over those of other CA cities. When LA was affordable, SF was only slightly less so. Now that nowhere in CA is really affordable, SF is extremely unaffordable.

Post-crash, there are some locations in CA that are kind of affordable, but it certainly is not TX. I think Sacramento could help the situation a lot by allowing TX-style development rules to prevail inland. It is important to distinguish between TX style development rules, and Spain-style ones where you can end up with an oversupply along with your price bubble – but the urban development supply chain in Spain was 7 – 10 years long. It is a 6-week-long supply chain that is the TX secret. In fact there are plenty of other States at least as good – Kansas and Indiana, for example.

The problems in Phoenix and Vegas did not help our analytical ability; in a cruel twist of fate these cities with pro-growth policies, have de-facto growth boundaries in the form of National Parks, Defence Dept land, and other government land that is not for sale.

By the way, it is not necessary for the boundaries to be tight – the “supply” of land inside a boundary is NOT the total quantity – it is the PROPORTION of it with land owners intending to sell it anyway without developers chasing them and pleading with them to do so. This is why you cannot have an affordable, stable housing market without “splatter” growth. the splatter simply represents the sites that developers managed to obtain at normal rural prices as they “came on the market anyway”.

“Texas have conservative policies and some of the most affordable real estate in the United States.” And don’t forget that we make a powerful chili and have grass fed, free range, happy cow beef(at least before the jackhammer hits) for the real men. The folks in The City look down upon the Philistines in the south(they mean SoCal). The differences is that in the bay area they are very environmentally conscious and years ago, before most of you were born, they passed environmental laws that reduced housing, whereas in SoCal(e.g. San Fernando valley, aka Babbitt land), it was LIKE TEXAS, build, build. SoCal, is no bay area, and the bay area, is not like The City.

Excellent point, Tex

I only just realised from a New Geography article, that Texas always was growing fast, even back when LA was. CA has slowed down while TX has not.

http://www.newgeography.com/content/004767-measuring-current-metropolitan-area-growth-1900

Of course the difference has to be CA’s restrictions on development. It is interesting to find academic work on housing supply elasticities by metro – when a figure of “1” is the break-point where supply allows housing to be affordable, many US cities score around “2”, but CA’s cities are below “1”.

The UK scores literally zero – a legacy of decades of growth containment planning commenced in 1947. There is an absolutely undeniable correlation between the introduction of growth containment policies, and unaffordability of housing – in the UK, California, Canada, Australia, New Zealand, Sweden, France, everywhere I look. There has been a global mania in growth containment in more recent decades, you have to be dead from the neck upwards not to know this.

Appreciate the link. It adds to what I’ve had a gut feeling on for some time – which is that potentially highly productive people are increasingly not incentivized to stay or even come to California. That does not portend well for those of us whom are not wealthy and wish to stay. For the dwindling middle class that does remain, all the property tax caps in the world aren’t going to sweeten the idea of a neglected surrounding public infrastructure due to a bifurcated populace of tax sheltered wealthy and net negative producing poor.

Available data clearly demonstrates that the pendulum of migration has already begun to swing back eastward and mostly to the south. I’ve no desire to live in places such as Texas but some of us are not doing the rest any favors by being so haughty as to put a nose up at the option and overestimate the value of traditional California attributes such as climate and culture as they apply to the productive masses.

It’s very frustrating because the writing is on the wall that competing locales and regions are ripe for renaissance while we likely continue to sit by resting on cliches that everyone we’d desire to have living next door is always going to want to be here. It seems that many get caught up on “I got mine” while the bitter irony is that they may well be the very people getting screwed in the end.

I don’t know about anyone else but the idea of wealthy foreign expat neighbors with little ability to relate to or have regard for my situation sounds like another side of an undesirable coin that includes the option of poor neighbors.

Interesting Phil re global growth containment policies – I know in the UK nimbyism is strong… fewer houses built = more house price inflation on existing stock. Too many older homeowners are in love with how rich they feel from years/decades of house price inflation. Always expecting there should be someone to come along and pay more for similar housing in their road/street. They don’t like it when that proves not to be the case, and instead try and loosen credit.

Your article link also interesting. I just wonder where the money is going to come from vs servicing existing debt, for new mega-cities and ‘densification’. Although there is always the possibility US market participants becomes dominant in taking positions in assets around the world at distressed prices, leading to quite some rebalancing of US financial positions over the longer term.

Skeptic, and Brain of England – thank you for the kind and constructive comments. I get a lot of discouragement, and it is nice when people “get it” like you guys do.

Two common consequences that you will probably note, from these policies, is that the most successful areas end up comprised more and more of extremes of super wealthy cosmopolitans who can afford the obscene prices of the best housing, and ghettoes of recent immigrants from the third world who are prepared to endure the overcrowding necessary to “buy in” – while native-born people would rather remain unemployed and on welfare in a depressed area. With a “social” house provided, they are probably better off. At least in the UK, where there is no Texas to move to.

Re money to pay for intensification – of course you can do more actual building “up” when the sites cost you less. Most of the building “up” of Manhattan would have taken place simultaneously with NY urban area sprawling for dozens of miles, which actually always keeps site costs much lower everywhere in the city. This is why Houston and Dallas are where the most intensification is going on now. You actually reduce the rate of intensification when you force up the cost of sites.

From the McKinsey Institute’s latest Global Report on Affordable Housing: in London, 45 percent of land with permission to be developed remains idle. The UK’s waiting list for social housing has 1.8 million people on it; a pitiful 98,000 new units were constructed in 2012; and 400,000 sites with development permission remain undeveloped!

The reason for this is that in these “created scarcity†urban land markets, site owners are thinking like speculators, not like “producersâ€. Why should they even bother to develop their site to maximum potential, or sell it, when its value already embodies the “rights of development†and that value is going up? (And when the crash comes and the value is down, no-one is interested in doing development).

Increasing population density in an affluent society is the major factor in increasing price of land, and thus of housing. You can do the math – get the data from the US census, lag population by 2 decades, run lagged correlations.

Zoning is a reaction to increasing population density.

In any case, California had zoning long before affordability became an issue.

Yes, but there is a difference between “having zoning”, and having zoning that actually represents a barrier that growth has run up against. William Fischel’s books discuss this. CA hit a crucial tipping point back in the 1970’s where there were enough fast-growing cities running up against adjacent municipalities zoned for rural only, to start causing price inflation. In successive cycles, remaining areas that still had not hit constraints, were swamped with growth diverted from elsewhere – and in their turn, ran out of space zoned for urban development.

The magic ingredient that avoids this in TX, is that no rural area can block the creation by a developer, of a new “Municipal Utility District” (MUD) on land that he has legally purchased.

HOUSING TO TANK HARD IN 2014!!

Nice!

Housing To Tank Hard in 2014!

Housing To Tank Hard 2014!!!

TANK! TANK! TANK!

Calling housing prices as struggles between Blue vs. Red is a crock of **it.

What drives high prices in coastal CA, NYC, DC, parts of FL, and now along stretches in middle of the country (Dakotas to Texas, the reddest of states) is flood of newcomers and immigrants moving in, for whatever reasons (jobs, weather, schools, lifestyle, opportunities, etc.). Rents (of mobile homes) in any areas with shale oil is as pricey as any in CA (and these are white, Red, and conservative). So don’t drag politics into a simple economic issue.

If oil is found Detroit then it would be revitalized in no time.

Right – supply and demand.

You can more or less prove the connection using US Census data on population increase by state, and housing prices (since 1940), via lagged correlation.

I think it comes down to the smarter you are the more you want to live where other smart people live hence housing demand is high in those areas. Plenty houses in Honey Boo Boo land but you have to subject yourself to the collective intelligence of the red states.

Christie S, if you want to live among all those “smart” blue people why not move to Detroit? Or to Camden, NJ? Or to any of the deep-blue inner cities that today look like war zones?

Drop the “We blues are so much smarter” attitude. Some Democrats out there make Honey Boo Boo look like Einstein

LA had affordable houses at the very time it was growing fastest (in the 1950’s and 60’s) and has had a problem with affordability even as its growth has dropped to a fraction of what it was. Meanwhile, the Red State growth cities can add 20% population per decade while the house price median multiple remains around 3.

There is no inherent reason that “demand” needs to make housing more expensive, any more than “demand” makes cars or TV’s or computers more expensive. All things that nobody had once, and everybody has now – because “suppliers” were free to act not merely to meet the demand, but even to create it, only under genuinely competitive conditions.

The city of Liverpool in the UK has managed to lose 40% of its population in 3 decades while its house price median multiple remains stuck at between 5 and 7 – in spite of the fact that its average house size is something like 70% smaller than what US cities have. The cause? Its tight Green Belt policy. Rationing the land available in the urban economy results in urban land becoming a speculative commodity like gold and bullion, with prices bearing no relationship to actual demand for actual USE. Yes, even as there is a crisis of access to housing on the part of the bottom couple of quintiles in society.

There are other issues that are referred to by some as “the most serious moral crisis of our time” – but this one really IS but is never actually identified as such.

This has more to do with LA becoming a world class city on par with NY in the last 15 years. That said there is an incredible price disconnect in non-prime LA. The Wset Side and Santa Monica is the home of the elite just like Manhattan and such, I get that. There is still no reason that outlying areas in the SFV and SGV should be so out of whack to incomes. Specuvestors and the FED are responsible for this and no one else. I’m really intrigued by the parallels to the 90’s that are developing. WE had a tanked RE market and a rising stock market based on pixie dust. We had a GOP congress and a Clinton in the White House. We’re likely to have this again as the GOP is to stupid to nominate Rand Paul and the rest of their field is a joke on the national stage. This will means a fiscally tight congress (the GOP hates bubbles when their guy isn’t Pres) and a president who vetoes the most looney legislation. Time will tell but I’d take anything even close to the 90’s as opposed to what we have now.

Yes, but New York has been a global city for decades, and its statistical area managed to have house prices relative to incomes, similarly affordable to most of the USA – and floor rents in Manhattan were a fraction of those in London or Hong Kong or Paris or Vancouver. In fact floor rents in Manhattan still are only a fraction of those cities, and meanwhile floor rents in cities like Sydney, Melbourne, Auckland, Stockholm and Barcelona have also surpassed Manhattan!

Every city in the UK – even those of 300,000 population – has floor rents higher than Manhattan (Cheshire and Hilber 2012).

The simple reason is that even a “global city”, if it is allowed to sprawl for dozens of miles into the hinterland, will have its urban land rent curve lowered and flattened thereby.

But ANY city to which you apply a rigid boundary to growth, will suffer its urban land market becoming speculation-driven and completely disconnected from actual economic and social requirements and use. See my comment on Liverpool UK – a shrinking city with land prices per square foot hundreds of times higher than Houston.

Liberals tend to prefer large cities. Conservatives tend to prefer small towns.

Large cities end up having greater density and have a lower supply of land and real estate.

Houston and Dallas are not small cities, and also they have the fastest intensification going on in any US cities right now.

The kind of fringe growth constraints favoured by libbewwals, ironically distort urban land markets in such a way that intensification is slowed down. From the McKinsey Institute’s latest Global Report on Affordable Housing: in London, 45 percent of land with permission to be developed remains idle. The UK’s waiting list for social housing has 1.8 million people on it; a pitiful 98,000 new units were constructed in 2012; and 400,000 sites with development permission remain undeveloped!

The reason for this is that in these “created scarcity†urban land markets, site owners are thinking like speculators, not like “producersâ€. Why should they even bother to develop their site to maximum potential, or sell it, when its value already embodies the “rights of development†and that value is going up? (And when the crash comes and the value is down, no-one is interested in doing development).

The more intense cores of cities WITH intense cores, always relates to “pre automobile” development phases. You cannot replicate this intensity by imposing an urban growth boundary, in fact by doing so you guarantee that you will forego intensification that a city like Houston is experiencing.

Even in the case of cities with “pre automobile” dense cores, those cores densities have shrunk as the city has spread out – Manhattan is around 60% less dense now than it was 100 years ago. Refer Shlomo Angel et al, “Making Room for a Planet of Cities”.

Of course a totalitarian country like China can do what it likes in terms of urban development and form. I am talking about countries where you still have private property rights and “free” markets and just try and impose boundaries and cargo-cult Plans on top of that.

Phil…MB has a point well taken , as a investor in both commercial and residential, overall conservatives prefer not to live in large cities if they had a choice.

Robert, my own experience leads me to agree that conservatives prefer not to live in “urbanist” type city cores, while liberals do. This will indeed end up creating a correlation with city size, if only because larger cities generally do evolve in such a way that there are more dense urban areas in them.

But I think there are outliers, and that the way cities are evolving under changing conditions of technology and regulation, is tending to break the old correlations. Particularly, there are more and more smaller cities positioning themselves as “liberal” cities by way of planning and regulations. In Oregon it is not just Portland, but a small city like Salem as well. Capitals, even if small, tend to trend (left) “liberal”.

There will always be conservatives in the suburbs of large cities, outnumbered by the (left) “liberals” in the core. And what I am picking is that the modern, automobility-era city could remain conservative even as it grows and grows at low density. A certain amount of sorting of populations occurs.

Of course when there is not the options and the inter-municipality competing differences that the USA has – consider the UK, for example, there are no low density areas at all, the density is “relative” only. Many “conservatives” simply lack the freedom of choice of affordable low density living, and are stuck with forced trade-offs of living space. So it gets more and more difficult to guarantee correlations.

As a general rule, singles prefer to live in cities. When they marry and want kids, they move to a suburb. “Kids need a yard to play in.”

Simultaneously, people get more conservative after they marry and have kids.

Unmarried or divorced women vote Democratic more heavily than do married women.

Son of L. “Unmarried or divorced women vote Democratic more heavily than do married women”

They replace the husband with the big government.

Would you rather be poor in paradise or comfortable in hell?

***

Personally, I’d rather rent in San Diego than own a house in Kansas. I’ll be leaving the SF Bay Area next year, lived here my whole life and it’s overrated.

Here is something that has to be one of the best one-liners ever, on the subject of urbanism:

Mr. Olson, 42, said his family had not shed tears over leaving New York (for Oklahoma City). “There’s a little less to do, yeah,†he said. “But now we can afford to do it.â€

http://www.nytimes.com/2014/08/04/business/affordable-housing-drives-middle-class-to-cities-inland.html?_r=0

Great conversation on this post. I used to think San Diego was the only place I could ever live. Now I live in Appalachia in a sweet house with a view that I have the deed for. I also have access to the largest U.S. Dept. of Energy public research facility in the country (does CA have a spallation neutron source?) as well as a statewide entrepreneur incubator system that no other state has, and frankly, the Great Smoky Mountains rival anything CA has and I’ve hiked all over CA. While it may not be hot all year, I also don’t burn every time I step outside. The whole CA thing wore off after a couple months and now you couldn’t pay me to go back.

Laugh all you want at red states and how stupid they are, the joke is on you. 🙂

IPFreely; great comment contribution to a great discussion thread. I will probably quote that frequently in future as well, I love it!

I’ll bet that the buyers’ education level, rather than the buyers’ politics, has far more to do with residential real estate prices in almost every area in the country. The higher the buyers’ education level, the higher the prices of housing in the area, whether it be between cities or between areas within the cities.

Yet Silicon Valley was a cheap, lightly-regulated exurb when it got started.

And it is the cheap, lightly-regulated areas that are attracting the educated today, and especially the entrepreneur and the people with initiative and the seekers of opportunity. Of course the migrations include a lot of people who are not highly educated, as well – but you shouldn’t miss the whole picture.

Of course “exclusionary” policies – which libbewwal policies on urban matters are – will FORCE the less skilled out to less exclusionary locations. But if you look at a country like the UK where ALL their cities have growth containment, city-centre-first, transit-oriented policies, the less skilled have nowhere to go where they are not condemned to crowding and deprivation. Is this a better approach? I think one syndrome libbewwals suffer from, is a kind of Marie Antoinette syndrome regarding the effect of their policies on the poor. “The poor people are suffering from lack of space and from low quality of their housing? Then let them live in transit-oriented CBD condos like we do” – D’OH.

hay, rents are going up, that is all that I care about. I go laughing all the way to the bank. Carlos, he is my rent collector. I ask no questions and he tells me no lies. Of course, I am no fool, I live on the westside with my people, not in the valley, where the rentals are.

What came first coastal blue states becoming expensive places to live or big urban areas attracting the welfare state and becoming blue. Politics has very little to do with it

This analysis is wrong. Even in Harris County (Houston), and Dallas County, Texas, Obama won more votes than Romney in 2012. Same goes for Wake County, NC (Raleigh), which is in a red state. Even the most red state, Alabama, has its largest city and county, Jefferson, going for Obama in 2012.

It’s really a question of suburbs and rural areas in conservative states going to the red party, and cities going for the blue party.

Suburbs and rural areas have more land and cost less to build, cities have less land and costs more to build. It’s that simple. It’s not about party allegiance or policies.

Thank you for the spot-on remarks.

You are correct, but there are two lots of correlations at work here.

Yes, the city does have more expensive land than the suburbs, all other things being equal.

But in the Red States, both the city and the suburbs are a LOT cheaper than both the city and the suburbs in the Blue States.

This is one point I am constantly trying to make: policies that make the suburbs more expensive, also make the city more expensive too. The same trade-offs continue to exist regarding location decisions, only the prices of all options are higher. And ironically, the price inflation of the more central locations of the urban area tends to run ahead of the trade-off in housing size, meaning that the city condo or apartment becomes more unaffordable to far more people than the suburban McMansion does. Until the bust comes – leading some analysts to claim that “there has been a revolutionary shift in demand towards city living”, when in fact all that has happened is that the prices have fallen back to a norm where more people could choose the city living. Including people with (left) “liberal” values!

What difference does it make if politics has anything to do with affordability? The only thing that matters is that prices cannot continue to appreciate if affordability continues to decline! The rubber band can only stretch so far before it breaks … if I were a betting person, I’d say prices will decline before wages rise … the only real question is how precipitous that decline will be? Just look at an earlier article on this site showing the the roller coaster real estate prices since 1985 …

Yes, but the red-state areas tend to not have this bubble and bust, massive equity losses, malinvestment in housing types that speculators chase, developments in the wrong place, and so on. Besides the affordability, the economic stability and security will be a cause of long term outlier success and attraction to people and businesses. There is of course a risk that migrating libbewwals will bring their political values with them, turn the State blue, and turn the urban property market exclusionary and volatile….

Phil, seems like you have a political agenda. The rest of us are here to make sense of real estate trends.

“Yes, but the red-state areas tend to not have this bubble and bust, massive equity losses, malinvestment in housing types that speculators chase, developments in the wrong place, and so on.”

I have three words for you: Arizona, Nevada, and Florida. All are pretty much red states (AZ, definitely, and Nevada, other than Reid, is pretty much a red state, with a red governor, senator, control of the state senate). Phoenix and Las Vegas had some of the worst boom and busts, so there goes your theory. South Florida wasn’t much better, and Repubs have control of their state senate, legislature, and governor.

“But in the Red States, both the city and the suburbs are a LOT cheaper than both the city and the suburbs in the Blue States.”

Detroit, Buffalo, and Youngstown would like to differ with you…

I don’t have a horse in this race as I’m on a similar page with NZero in that I think both team red and team blue are generally bought and paid for by the entrenched status quo.

That said, the political policy connection to housing is undeniably important to discern for anyone interested in understanding how and why we’ve arrived to this point.

Phil Hayward may very well have a political agenda, however, that alone does not invalidate his observations or claims.

From what I can gather, states such as Nevada, Arizona, and Florida have a fair amount of exception factor from more traditional “red” states such as Kansas or Mississippi in that we’ve observed an increasing amount of “blue” state and foriegn immigration to those particular red states relative to the others. Surely this is a correlative input into the boom bust scenarios witnessed in those states. Phil Hayward qualified his statement with the word “tend” which indicates that he indeed believes there are exceptions. Just anecdotally I personally know enough left of center minded people from California who have speculated or continue to speculate in the Vegas and Phoenix RE markets to make one’s head spin.

As someone living in a coastal blue state, I’m more concerned with what future implications this may have for my community in Los Angeles as I increasingly see well educated, productive neighbors and co-workers leaving the area for these “redder” pastures. The weather and diversity of eating establishments don’t seem to be keeping them from leaving.

Excellent observations!

Few things in life are black or white. Most of the time, for a useful observation you have to distinguish between different shades of grey (different locales and market segments).

The more accurate observation of the bigger picture you have, the more useful it is going to be for personal decisions.

Also, for personal decisions is very important to dissociate wishful thinking from reality. Our emotions can be our greatest enemy because they distort our logic.

I actually said in an earlier comment:

“…The problems in Phoenix and Vegas did not help our analytical ability; in a cruel twist of fate these cities with pro-growth policies, have de-facto growth boundaries in the form of National Parks, Defence Dept land, and other government land that is not for sale…”

Florida is the only place in the world to repeal “Smart Growth” mandates – at the State level – having learned their lesson.

Skeptic, thanks for the kind comments. It is people like me who actually “make sense of real estate trends” and libbewwals who are driven by political dogma. For the record, I admire places like Japan, Hong Kong and the Netherlands making “smart growth” actually work – because they have to (due to actual lack of land) – by using compulsory acquisition and direct government operation in RE markets. And no-one calls them raving Marxists for doing that. Libbewwals who apply “smart growth” to systems where there are still private property rights, merely create “regulatory givings” and don’t actually achieve any benefit as alleged by their policies. Guess why there is so much crony capitalist property tycoons money in smart growth advocacy? This would stop overnight if “saving the planet” was understood to require compulsory acquisitions and suspension of property rights!

Of course there will be outlier exception cities like Detroit and Kabul and Mogadishu. It is not fair to use cities like these as arguments to claim that someone else’s observations of how markets work, are invalid.

Obvious blog point is obvious.

Shelter is a universal and highly inelastic human need.

Artificially constraining organic growth of cities will obviously destroy affordability, thereby dragging down economic growth, increasing inequality of wealth, and generally “making the poor poorer”.

It establishes a new class of speculator “middle men” who take a massive skim of what would otherwise be actual GDP growth.

The only problem now is we have a critical mass of people who have a vested interest in perpetuating the system. Only when enough people are at the mercy of slum-lord renters will there be enough pressure to shove the strange bedfellows of militant environmentalism and entrenched land barons out of the way.

Yep, you said it your way, and you qualify as a wide-awake person.

I am reminded of anti-smoking advertisements that say “Don’t Start”.

That is my advice to all those few dozen cities in the USA that have not yet enacted growth containment policies. “Don’t start”.

And those cities with containments that are not intentional, but that are distorting their economies in the direction of a rentier’s paradise, at the expense of productivity and inclusion, need to find solutions that address the obstacles to their growth.

Vegas and Phoenix, for example, need to somehow get from the State or Federal government (as the case may be) the right to annex land that is currently National Park or Defence land or other government holdings withheld from the land market. Or perhaps Nevada and Arizona need to devise a serious program of growth diversion onto land beyond the accidental growth boundaries of their significant cities.

Janet Yellen 6th on Forbes most powerful people list.

http://www.truthdig.com/eartotheground/item/vladimir_putin_is_the_most_powerful_person_in_the_world_according_to_forbes

How does land area correlate with the median home price? Liberal cities tend to be places that are land-constrained by natural boundaries (e.g., San Francisco and New York), while conservative cities tend to have large areas of open land (e.g., Phoenix and Dallas). Just speculating that this might be an underlying variable that helps explain the trend.

Leave a Reply