The People’s Republic of Santa Monica: Grandmas battles it out to rent place out via AirBnB and Westside prices for standard homes.

The airwaves are now once again blessed with the non-stop talk that accompanies a typical California housing fever. We are in the presence of a powerful headwind with low inventory and cheap money sloshing around the system. There was a story talking about the backlash being leveled on people renting out their Santa Monica homes via AirBnB. The story sounded like our typical Taco Tuesday baby boomer that hit the real estate lottery and is now cashing in on some nice rental cash flow. The issue? Other locals don’t enjoying paying for million dollar crap shacks and living as if they were next to a hotel. People want the Leave it to Beaver neighborhood with a Keeping up with the Kardashians price tag. As usual, people in California want it both ways. The story was interesting because it tried to paint the older person as cash strapped when in fact, they were sitting on an equity goldmine but alas, they would have to sell to unlock that equity. Instead, they would rather rent their Santa Monica pad, cash in some large rental checks, and use the proceeds to shop at Whole Foods and enjoy those delicious Taco Tuesdays. Welcome to the People’s Republic of Santa Monica.

Santa Monica Fun

Santa Monica is an odd mixture of NIMBYism and astronomical real estate prices that are largely reserved for the top-tier of income earners. Santa Monica is prime real estate although you don’t get much for your dollar in the area. The battle of temporary rental websites like AirBnB and VRBO are causing a lot of challenges for prime areas. Ironically, you don’t see people ranting and raving about AirBnB in East L.A. or Compton. But you will not have a hard time finding an opinion about renting out a place in Santa Monica.

Things tend to go full circle. Santa Monica led a charge of rent control back in 1979. Here is the brief rundown:

“(SMGOV) Santa Monica Rent Control was adopted by the voters in April 1979 in response to a shortage of housing units, low vacancy rates and rapidly rising rents.  The law was intended to alleviate the hardship of the housing shortage and to ensure that owners received no more than a fair return. The Regulations were adopted by the Rent Control Board to implement and enforce the Rent Control Law.â€

As you would expect, rental rates and housing prices are even crazier today. Let us look at what we can buy on the market today:

3010 Pearl St,Santa Monica, CA 90405

2 beds, 1 bath 1,165 square feet

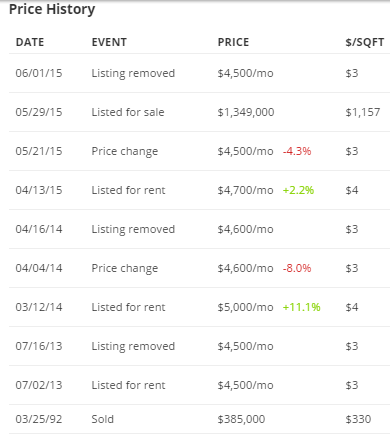

This is your typical Great Depression built “cottage†in Southern California. 2 bedrooms and 1 bath is tiny for a family. Let us look at the price history here:

I love this kind of listing with rental and price history. You can buy this place for $1,349,000. It looks like it was listed for rent back in March of 2014 for $5,000. No takers. It dropped to $4,600 and it looks like someone rented it for one year (potentially based on the history here). It was listed this April for $4,700 and then was dropped to $4,500 a month later.

$1,349,000 is a good chunk of change for this place. Yes, I realize this is Santa Monica and you could sell a kids tent for half a million here but who is your audience? This place last sold for $385,000 back in 1992. Someone is sitting on a million dollar ticket here.

Anyone able to afford this rent or monthly nut is doing well. I find it interesting that the rental history here is not as great as you would expect. People forget that not all renters will stay put indefinitely. As a landlord, you have to factor this into your analysis. Santa Monica is an interesting place. I find the AirBnB and VRBO frustration to be melodramatic. So you mean people are not happy having new neighbors every month in the People’s Republic of Santa Monica? Apparently when the price is right, people are willing to rent their house out to perfect strangers. I’m still surprised how people try to push the “buy and hold for 30 years†mentality as if this was the typical scenario. In California, it is a land grab by investors, flippers, foreign buyers, speculation, and property ladder climbers.  The “poor†grandma is anything but in the AirBnB and VRBO scenarios I heard on the radio. She can sell her pad and live like a queen anywhere in the country. Yet it would mean cashing in that lottery ticket. Of course it is her right to rent it out to anyone she would like. That is, until people get fed up and change the law (as they did in 1979 and look how great that worked).

What are your thoughts on being able to rent out your own place via AirBnB or VRBO in places like Santa Monica?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

93 Responses to “The People’s Republic of Santa Monica: Grandmas battles it out to rent place out via AirBnB and Westside prices for standard homes.”

What has happened with the rise of short term rental services is not surprising and the boost effect it has had on real estate prices is a natural outcome; it not, however, the primary reason why prices in SM has exploded. I know of quite a few people who have purchased in the tourist heavy neighorhoods such as SM/Venice to convert to AirBnB “home-tels”. I think as long as these people comply with the same set of rules (taxation, registration, safety) that hotels have to follow, they should be able to do what they want with their private property. However, if enough residents in the community decide this isn’t the direction they want their neighborhood to go, then they have the right to put in rules to stop this conversion. If you don’t like the law, change the law.

Coastal property is desirable. If grandma had the foresight (or luck) to buy ahead of the real estate boom, then grandma should damn well be able to rent out her property and frequent Whole Foods. Just stop with these envious judgmental ideas of what is “fair”. What is fair? rent control / subsidized low income housing that is akin to a mini-lottery for the poor?

This is very much related to Prop 13. Is it any coincidence that Prop 13 and Santa Monica’s rent control ordinance came about in the same time frame? Two prime coastal examples of unintended consequences that didn’t fix what they were purported to solve. Taxes are still high in CA as are rents in SM.

Did Grandma have the foresight of being born before others? Of course not, but is Grandma willing to pay a proportional share of taxes for the services rendered to the community which enables her benefit to cash-in on said community? Taking it a step further, should Grandma’s heirs pay a proportional share relative to their benefit?

I don’t think anybody minds Grandma participating in a free marketplace but why should others have to subsidize that benefit for her? That currently being the case, it’s anything but a free marketplace and the author rightly points out the inequity.

Adding insult to injury we have young people being directed to preserve their capital at the Wall Street casino while people ponder why there’s a trend in younger generations renting because they don’t have enough left over for a down payment on a house. Huge disconnects going on.

Forgot to mention student loans. Student loans and saving for retirement are the two biggest generational differences. Doctor HB is right on the money by continuously connecting this to housing. At a deeper level these issues are largely attributable to globalization. It’s unwise to believe that putting a stake in SoCal real estate is an assured method to shield oneself from the cost of these outcomes. The cost will find you one way or another, usually in the form of taxes.

Excellent points. Notice that the complaints regarding rent control never mention the proposition 13; they were passed in lock step to affix costs to out of control property speculation. And to your second point regarding student debt, at least in California, that is tied directly to prop 13.

“Fairness”, there is no such thing, Envy is poor argument and will only make you unhappy and miserable.

Still on that hobby horse?

The BIG change was the CALIFORNIA COASTAL COMMISSION.

My late Uncle was in real estate — COASTAL California real estate. In his entire career he NEVER saw price jumps like those triggered by the Coastal Commission’s political arrival.

In Laguna prices skyrocketed EIGHT TIMES in only four years.

The story on the SM cottage is that — like its neighbors — it’s frozen in (economic) time — almost like a swatch of Carmel, Mill Valley, Berkeley and other time-frozen enclaves.

Prop 13 is not even a factor for such oddities.

Those who benefit most from Prop 13 — don’t send kids off to school, don’t scarcely drive, … they don’t even hit up the local library.

The folks that CONSUME local government services — those raising kids — are seeing rocketing taxation — through the front door — through the back door — because Do Gooders are inviting in MASSIVE numbers of immigrant (welfare state) dependants.

What had been a mere trickle during prior generations is now an epic flood that is ENTIRELY destablizing the welfare state.

As Milton stated generations ago: ” a welfare state is impossible with open borders …”

(paraphrasing)

On the economics — the ENTIRE world wants to move to Los Angeles and retire on the dole. I know I would.

Ann Coulter has some tart stats in her latest broadside. I’d say the topper is that America has imported 25% of Mexico’s population — at the latest count.

This population wave has de-stabilized BOTH countries.

It’s hard for Americans to accept, but the Mexicans that flee their homeland are skewed UP towards the brightest. The truly stupid and unmotivated just sit down and plop back home in Mexico.

So Mexico’s polity is seriously depleted of hard striving young adults — the skew is shocking. You can go into rural areas and discover that ALL able bodied young adults have de-camped for an American chicken disassembly line.

STILL, the average IQ in Mexico is at the global mean: 85 ish. This means that the vast bulk of immigrant Mexicans have IQs BELOW that of native Americans — to top off cultural hurdles.

(There is NO language hurdle, as no Mexican ever has to learn a word of English to navigate the American economic world. Doing so will mean second tier wages — peonage second hand — soft slavery/ serfdom. The re-installation of antebellum economics in the American labor market is NOT something that Kennedy could bear to acknowledge.)

The result of this GLUT of young talent (IQ 80-105) (age 15-25 upon entry) is that AMERICAN blue collar wages have CRASHED.

This has had consequences in the real estate market as American blue collar labor can’t afford a SFH any more.

Neither can the immigrant Mexican.

And this is not restricted to Mexicans. America has immigrants pouring in from the former East Bloc — and from points south of Mexico — and India — and Red China.

Unlike prior immigration waves — this one eclipses ALL — and is composed of peoples who snub American culture… if they don’t actually HATE it.

Muslim culture is built ENTIRELY on a fulsome rejection of all American values… starting with the First Amendment. To Muslims those words are fighting words. Islam is ENTIRELY opposed to multi-culturalism; violently so. No culture has EVER not had trouble with Muslim immigration, going back more than a thousand years.

People are strange. They flee societies/ locations to get AWAY. Then, they proceed to re-enact the very cultural norms that caused them to flee in the first instance. They never question why they are re-walking the very path of their parents — which has always led to horrific outcomes.

&&&&

After a fashion we can see that in the Big Government Leftist movement.

On the one hand, the Left is against the government.

On the other hand, the Left is going to fix THAT problem by growing the central government — finally getting it ‘right’ this time — and in their own generation. (!)

Tilting at Prop 13: Cognitive Dissonance.

Virtually all of the travails we now suffer are from TOO MUCH GOVERNMENT doing too many things. Prop 13 is one of the few, pitiful restraints left on California government growth.

BTW, should it be repealed, the bump in taxes will be sausaged through Sacramento… as property taxes already are.

Simply even more centralization of government. PERFECT.

Markin SF…

You MUST mean Out of control Sacramento — in the late 70s under Jerry Brown, Governor.

The howling was NOT coming from real estate speculators.

They didn’t, CAN’T, benefit from Prop 13. They’re flipping.

The howling came from grandparents — the ANTI-speculation crowd.

This is a crowd that does not want to move for the rest of their days. It’s a notion that will make absolute perfect sense — when YOU reach retirement age.

Moving house is for the young.

It’s a nightmare when you’re old, enfeebled, and losing your memory.

THAT’S what Prop 13 was — and is — about.

Hobby horse? Really, blert? I’ll get off mine when you make some room in the stables which are crowded with all of yours.

For all of your moaning about “0-care” one would think you could spot an entitlement when you see one.

That’s what Prop 13 is, a transfer from one group to another, period, full stop.

It’s not a restraint on Sacramento. They simply went around it and adjusted taxes and fees in other areas to make up for the difference. Effectively those who pay property taxes are subsidized by others who are more proportionally subject to other taxes as a whole. Surely a revered blog commenter such as yourself, whom the very Bank of England supposedly plagiarizes would be able to understand how that works.

If the public wants to give a senior citizen discount on property taxes to Grandma to make things more “fair”, it would be better done in manner that directly subsidizes Grandma instead of this ridiculous farce we have in place now that includes non-Grandmas and her heirs.

Ignoring Prop 13’s role: Cognitive Dissonance.

&&&&

Agree that CCC has a hand in the matter, although it’s not the only hand.

####

Prop 13’s days are numbered. Life isn’t fair and not everyone is entitled to live somewhere nice because they can’t afford it — that’s the message oft repeated in this comment forum, does that apply equally to all age groups or does one get exempted from that rule for being early to the party by virtue of their birthdate?

@Blert

Something the Anti-Prop 13 crowd never addresses, mortgages and rents are based on what people qualify for and can afford. This fact means that while repealing Prop13 allows for increased tax rates, the properties then would be assessed much lower as the monthly nut must remain affordable and profit on rental properties would immediately be lowered. I don’t see anyway repealing Prop 13 does anything to solve CA’s Bubble/Bust RE cycle. Sure there are some loopholes that allow commercial properties to avoid reassessment, but that has little to do with the issue of serial bubbles in SFH prices.

As for your take on immigration as a lifetime resident of the SGV I can only lament the near total disappearance of American business and culture from the 710 to the 57 bordered by the 210 and 60.Show me an equivalent American ethnic enclave anywhere in the world. You can’t, and most definitely NEVER would in China. It’s the least amount of assimilation by immigrants in this country I imagine you’ll ever see…

Blert

Get a clue; it’s business that pushes for illegal immigration to cut labor costs. Period. You can’t offshore agriculture and hog farms (although the Chinese are buying these up) labor requirements so business needs the immigrants here. Residential real estate needs the immigrants so people can afford the upgrades their cheap labor affords. Once the local population accepts that their living standards have diminished dramatically and will never return to the good old days then maybe more of them will start working the very low wage menial jobs that the impoverished immigrants will take on. As for welfare, the amounts immigrants receive is a drop in the bucket compared to corporate welfare and an increasingly wasteful military, homeland security & prison budget. It’s obscene.

I’d like to point out prop13 is not just punishing the young by forcing them to shoulder the tax burdens of the old.

In a normal tax structure, rising taxes in high-value employment centers and good school districts gently push retirees to re-locate and free up room for new families to grow. This is no longer happening.

The result is retirees taking up living spaces which should be inhabited by working people, contributing to skyrocketing house prices AND to abhorrent traffic conditions as working people are forced to long commutes from the outskirts where, in an economically healthy urban environment, retirees would be located.

@NZ

I would imagine that the so-called “Anti-Prop 13 crowd” probably never addresses what you mentioned because it’s beside the point. So what if property prices move down and landlords’ profit margins are impacted? The issue is not that Prop 13 is some major contributor to boom/bust scenarios, rather it’s about bringing prices in line with actual costs.

@Blargh

The funny (or sad) thing is that the response to your supposition about retirees taking up space would be met with calls of “unfairness” by the very same folks who will likely be the first to lecture about life not being fair.

If it is a private property, the people should be free to rent to whomever they want, for any rent they want or sell it for whatever price they want. It is their private property. They paid for it and they pay property taxes on top of it. If people think the property taxes are to low, eliminate Prop 13. If they think the prop. taxes are too high, then lower them or eliminate them.

The more the government gets involved, the more it smells like communism where the government take the property to the state in the name of the People or they regulate the people or they tax the property till they willingly give it to the government.

Santa Monica acts and feels more and more like in communism.

@Flyover, it’s the Santa Monica hotels that oppose these airbnb rentals. Nightly hotel rates in Santa Monica range from $200 per night to $500 per night with $350 being in the midrange.

Nope, there is something called zoning. The Supreme Court ruled that local areas can enact zoning laws. If I paid good money to live in a residential area, I don’t want a hotel moving in next door any more than I want a slaughterhouse, auto body shop, or nightclub. Illegally operating a commercial use in a residential area is actually infringing on the neighbors’ private property rights.

“I think as long as these people comply with the same set of rules (taxation, registration, safety) that hotels have to follow, they should be able to do what they want with their private property.” BUT THEY AREN’T, not even close. And you forgot the most important rule, zoning.

Little talked about is that Santa Monica is 70% renters — and it’s not uncommon for tenants to hold onto rent-controlled leases, while surreptitiously subletting the units on AirBnB or elsewhere.

This defeats the whole purpose of rent control: to provide below-market rates to people who use the units as their primary residence. Instead, the tenant-of-record lives elsewhere, while the subtenants pay market rates — but to the tenant, not to the landlord.

Of course, it’s illegal. Rent-controlled tenants are supposed to live in their apartments — not become de facto landlords, extracting market rates from subtenants.

That juicy concept rarely plays out — because someone BLABS.

Based upon the experiences of San Fran, Berkeley, New York City…

The USUAL scam is to shift the occupation to YOUNGER members of the same family.

There have been cases — caught — in NYC — of children keeping their parents ‘alive’ (on paper) so as to lock down the rent backwards forty-years or more.

It can actually be tough to prove that someone has died — if the kids are clever enough.

When the landlord is an institution — who knows anything — for sure?

Fake parents are so common that they’ve entered Hollywood scripts: “Housesitter” (Steve Martin, Goldie Hawn)

Of course, there’s always the Chuck Rangel scam. As a sitting member of Congress, he was able to get away with murder: a slew of rent-controlled apartments.

As ever, his (institutional) landlord was never the wiser. It took outsiders to blow the whistle. (!)

There is craziness going on in SoCal Real Estate. I am from san diego and in many areas the home prices are more than their peak. Everyone is now saying, buy now or be priced out for ever.

Interest rate is wild card here and it is possible that interest rate may be perennially low like Japan.

Let’s see..

Sell now or be priced in forever

We wonder why Housing Starts and Permits have been so soft once you adjust to population

5 Charts that show the housing cycle in real terms

http://loganmohtashami.com/2015/05/19/housing-starts-permit-reality-in-this-economic-cycle/

Sub 300K detached SFR in greater Los Angeles:

https://www.redfin.com/CA/Los-Angeles/2426-S-Harcourt-Ave-90016/home/6897071

Don’t let this crack-house conveniently located in a ghetto near the freeway slip through your fingers. I predict there will be multiple offers and a bidding war.

Archie bunker’s generation had mortgage burning parties. No one has those anymore. Your house is an ATM. Like George W said, go shopping. Amerika land of consumers

Nothing to see here. Carry on……

I spent a bit of life living very close to the ocean in a “highly desirable” SoCal beach town and truly don’t understand the appeal. In my experience one must REALLY love people (and the 24/7 noise/trash they generate), parking issues, endless neighborhood construction projects, little/NO privacy, people urinating on your property in broad daylight, lots of dog poop, and some difficult, inconsiderate neighbors that can’t be avoided. Not to mention daily leafblowers and an ever increasing homeless/drifter population. No, it wasn’t Venice.

If you drive around Manhattan Beach west of Sepulveda it seems like the ahole driver ratio skews way high, what’s up with that? It’s as if they’re all so happy to be on prime land that they’re miserable. There’s ahole drivers everywhere but seriously in that area the passive aggressiveness on the road is really something of a higher order. At least Santa Monica outlawed the leaf blowers. If by desirable they mean sought after by aholes wanting to live on top of each other then they can have it because no amount of sand makes up for that.

Haha! The asshole driver ratio begins its exponential increase as soon as you get west of La Brea.

Go drive around Santa Monica North of Montana… It’s nothing like you describe. I personally live in the San Fernando Valley in a nice kid-friendly wide-sidewalk-ed neighborhood with cul-de-sac’s a plenty. The only downside is the extreme heat in July-Aug-Sept… The rest of the year the weather is pretty fantastic. And we have a big swimming pool and good central AC, so the dry summer heat hardly bothers us.

Schools are pretty damn good for LAUSD also… Granada Hills Charter High was just ranked #1 high school in CA… and 10th best in the entire United States. Beat out all the exclusive beach city schools!

Drinks, first of all I would like to commend you for the “highly desirable” quote. If you are young and/or single, living the beach lifestyle simply can’t be beat. If you have a family, then there are much better alternatives. The single 30 year old guy is much better suited for Hermosa Beach. The family is much better suited for Torrance or Irvine, they can have more space, peace and quiet and no drunks to deal with.

Say what you will, the beach will always have a powerful draw.

AirBnBs are usually in residential neighborhoods. Do zoning laws apply?

Of course Zoning Laws apply. The trick is to pursue the offense and not create a blanket prohibition. If it’s a noise or crowd problem – address that. I worry when regulators think the solution is to crush short term rentals and push home ownership that much further away.

It’s not just a noise or crowd problem, though “safety” is often cited as a reason to ban AirBnB.

Another reason is that the hotel lobby is strong in Santa Monica.

Hotels say it’s unfair that they must pay taxes, and be regulated, while “private hotels” run from people’s homes are exempt. It’s similar to the complaints of taxis vs. Uber.

Hotels pay a ton of taxes to Santa Monica, so the city has a vested interest in seeing that hotels keep generating customers and revenue.

Rent control kills the incentives to create new homes and apartments. The blizzard of regulations and boards to approve and permit new projects is deep and painful.

Why would anyone gamble on a project that might not be approved and is certain to carry unexpected permit and approval burdens that will reduce profitability and maybe even the possibility of completion?

You have to have regulators in your pocket or be a masochist to even contemplate a project these days.

At 1.35M and 4500/month it’s close to rental parity.

Obviously whomever bought it at 385k in 1992 is probably making a good chunk of change as a rental property now.

Would you have purchased it for $385k in 1992?

In 1992 average pay in LA was 35k and LA was in the midst of a recession.

Interest Rates in 3/92 would be about 9% so you’d be looking at around $2700 PITI compared to $1000 in rent.

It’s not close to rental parity because the buying equation will have maintenance and repair costs that the renting equation doesn’t, not to mention transaction fees upon sale should one want to lock-in any assumed gains. I’d also go out on a limb and claim that renting the place won’t require a minimum deposit anywhere near what even the lowest down loan would and that type of loan would also have MI added to the mix.

While no doubt the owner could make a decent profit on rent at this point, the real bitch with this place is going to be the taxes should the owner opt to sell. With a cost basis differential that large and depreciation recapture after all of these years, it’s gonna be a big check to the government. Even if they don’t sell, at $4,500/mo assuming free and clear, they make $54,000/yr less taxes, maintenance, repairs, improvements which ends up being who knows what but it’s not exactly going to make anyone rich by any definition.

Buying it for $385k in 1992 at 9% made more sense than buying it now for $1.35M at 4% due to the increased potential benefits in refinancing and re-ammortization.

When people talk about rental parity, do they include interest deduction? Do they consider effect of rent inflation and levered equity returns? Taxes or not, the earlier buyers like this this grandma can generate tremendous cash flow from their investment. Would agree with you that potential benefits of refinancing and re-amortization provided much greater upside for buyers in 1992 but most people today have to face the decision of whether to keep on renting / hoping for a downturn, or making a decision that interest rate won’t get out of control and that income/rent will return to normalcy without a housing slump in the process.

I appreciate websites like this that provide a counter opinion but let’s not forget people on this forum are a self selecting group (many appear to be those who moved away from LA, are hoping for a crash to get in, and/or envious of others).

The interest deduction is overrated because it’s dependent on each individual tax situation in regard to how beneficial it is. Most people also do not consider its benefit relative to the standard deduction. In a low rate environment the subsidy is lessoned due to less relative interest being paid to itemize against. That’s one reason it’s better to buy at a lower price with a higher rate versus today’s scenario because the effective subsidy is better. Then again, this subsidy is subject to change and therefore should not be relied on for any long term projections, like say 30 years.

Yes there is rent inflation but here’s the rub, homeowners don’t exist in a vacuum free of the effects of inflation. Maintenance, repairs, insurance and improvements are also subject to inflationary pressures.

Tremendous cash flow compared to what? Even after Grandma locks-in her equity by selling, and accounting for the huge tax bill she will pay, what’s left over in cash earning 3% annually is probably somewhere in the same neighborhood of what she’s left with each year in rental income. I’d much rather have cash flow coming from something passive as opposed to playing landlord. And for those that claim there aren’t any 3% passive earning opportunities out there with the same level of risk as real estate, they’re either unaware or are being disingenuous.

As for the self selecting group comment, here you are.

“And for those that claim there aren’t any 3% passive earning opportunities out there with the same level of risk as real estate, they’re either unaware or are being disingenuous.”

Would you mind enlightening us? My guess is you’re referring to municipal bonds or something? I’d love to earn 3% on my down payment fund while I wait for prices to deflate.

You can get annuities where you get your money back after 5 years (or a portion yearly over 5 years if you want) that are paying 5% right now.

@ Hotel California

“Yes there is rent inflation but here’s the rub, homeowners don’t exist in a vacuum free of the effects of inflation. Maintenance, repairs, insurance and improvements are also subject to inflationary pressures.”

– of course the maintenance costs are too. The question here is as long as real net rental yields are in the green/flat, what does that do to your equity, given that most mortgages are at long duration fixed rates?

“what’s left over in cash earning 3% annually is probably somewhere in the same neighborhood of what she’s left with each year in rental income. I’d much rather have cash flow coming from something passive as opposed to playing landlord. ”

– Yours and most people’s analysis assume people are just going to take their NW and pluck it all into a house and not use any debt. Obviously that rarely looks attractive unless we’re at the bottom of the cycle and you’re spinning off distressed yields. Yes, you can get 10% cap rates out there, just not in LA where the median price/rent is more in the range of 17 or so.

“And for those that claim there aren’t any 3% passive earning opportunities out there with the same level of risk as real estate, they’re either unaware or are being disingenuous.”

– I agree with you that 3% passive earning is not that rare of an opportunity. However, I would like to ask you where else can you get 5:1 type leverage at a suppressed financing rate? Even if you are earning 2-3% net real return on your purchase value, adjusted for leverage, that would be 10-15% return on your downpayment equity.

I am not saying real estate is not without any risks nor do I disagree that the healthy asymmetry in return potential vs risk available at the bottom of the market is no longer around. However, my general view is that real estate in prime areas of gateway cities such as LA will hold its value over the long run, it being a real asset with favorable constraints on the supply side facing a demand that will likely only increase over time due to population growth / urbanization / globalization. If one look at the major asset classes out there and remain cognizant about not taking too much leverage (ie your 3% downpayment types) to get into a bad cash flow situation in case there is a moderate pullback of 20-25% or so on rent or 35% in price, over the long run I prefer something tangible like real estate versus cash, bonds, and stocks. My background: I am a professional money manager.

As for the self selecting group comment, here you are.

@ Jerrelle: “…over the long run I prefer something tangible like real estate versus cash, bonds, and stocks. My background: I am a professional money manager.”

Different strokes for different folks. I have a rental currently, and it’s been extremely easy so far (2+ years). However, the more I think about it, the more I really just don’t want to deal with it, even as easy as it has been. At any moment, it could turn into a big headache. A management company would obviously detract quite a bit from your ROI if you only have a few rentals or less. At this point, I’m leaning toward selling the rental, waiting for a correction to occur in the securities market(s), and then investing the profit in the market.

Also, since you’re a professional money manager, where can I find this elusive risk-free/low-risk 3% ROI investment? LAer mentioned annuities (I appreciate the suggestion btw).

@Jarrell

The problem with the comparison of some earning opportunities to real estate is that real estate has to be completely disposed of in order to realize the gain short of playing the landlord game.

Your general view is basically claiming that buying in [prime areas of gateway cities such as LA] is a no lose proposition. The unwritten supposition being that if the proposition is no lose, everyone will pile into that trade, so buy now or be priced out forever. ***over the long run being your wildcard caveat while nobody knows what the “long run” really is.

By the way, professional money manager, BFD, but I guess some people need to pay others to think for them.

Yes, here I am indeed, but I’m not the one complaining about the others here, that would be you.

@Responder

There’s an old saying amongst those of us who’ve been lording the land for a long time. Your tenants will teach you everything you need to know. Luckily it sounds like you’ve had it good so far. Best of luck.

CurbedLA has a funny discussion about what the rent would be for the Three’s Company sitcom apartment in real Santa Monica today. 2 bed 1 bath no laundry.

The rent on the show was $300 back in the 70’s. That works out to about $1,100/month now, if you believe the BS that the BLS says about equivalent dollars.

I guess today they would have to shack up with Chico and the Man or Fred Sanford.

A 2 bed 1 bath in East LA or South Central for 3 young white kids? Now that is a sitcom.

Times have changed.

If Threes Company was on the air today, I’m guessing Chrissy would be portrayed as a hooker and/or porn star, Janet an angry militant lesbian, and Jack a chronically unemployed player w/multiple baby mamas who come over and fight each other in the living room daily. Hilarity ensues. Probably a top ten show, America can’t get enough.

My family are benefactors of Prop 13. My grandparents purchased a run down house on 16th Street, near San Vicente (North of Montana) in 1955 for $16K. My grandfather was a miner and his wife a hairstylist – and in the 1950’s they could buy a home North of Montana. In 1975 is appraised for about $70K. When my family moved in when Grandpa died, we built a granny flat for $25K. some decades later, Granny died, me and the 2 siblings moved out.

NOW, my mother lives in the granny flat, and the 3bed 1 bath front part of the house rents for $5,400 per month…. pays all my mothers expenses and then some. And her tax bill is $2,000 per year, and the house would sell for +/-$2.7M.

>> My family are benefactors of Prop 13. <<

I think you mean beneficiaries.

$2.7m in this market. Don’t come a crying when market goes down.

It definitely seems like AirBNB is driving the price higher for long-term rentals. The supply of long-term rentals are decreasing, whereas the supply of short-term (AirBNB) rentals are increasing. Not good for rental residence of those areas, but good for visitors/tourists of those areas.

Hotels are cheaper and you don’t have to clean up afterwards.

I’ve stayed at AirBnB’s when I travel to Seattle. They allow me to live atop Queen Anne Hill (no hotels on Queen Anne Hill).

Plus, I had my own washer/dryer. A nice amenity when one stays for a week or more. No dirty clothes piling up.

And I had a fridge and stove and microwave, so I could go grocery shopping, instead of spending more money at restaurants.

We pretty much always use Airbnb, now. I usually find two bedroom homes for the price of single room hotel rooms, and they tend to have more useful amenities. The only cleaning it usually entails is taking the trash out and maybe throwing a load of laundry in before we leave. These places still bring in cleaning people to do the actual cleaning. I just stayed on the ocean in Oregon last week for $175 a night, and it was a 2bed/2bath house.

So… can someone project what is going to happen with real state? The bubble can’t crash because the interest rates are so low, although the prices are much higher than before recession. Does it mean that LA/OC will become the land of the Wealthy? Most citizens are either middle class or at a poverty level…. is this sustainable?

@andrea, real estate only crashes in SoCal during recessions. No recession, no real estate crash. Even when there is a recession, it normally takes 4 to 7 years for prices to bottom out unless you get the Federal Reserve interfering and manipulating the markets.

Plus Federal banking law allows banks to keep foreclosures off of the markets for a period of up to 10 years.

And California has some of the most generous welfare benefits in the United States.

With all the above in mind, I do not expect to see a normal real estate market in SoCal until somewhere between 2018 to 2022.

During this era, the boom and bust cycles are occurring more often.

I am sure there would be a small correction soon but when would a crash happen, no one knows..

but whatever it is , it is not sustainable.

If you don’t like the law, change the law. Prop 13 goes. It was kind spirited but has been abused to the detriment of two generations full of ripped off angry renters. Millennials are going to have the numbers. Tick tock.

You assume — desperately hope? — that Millennials will be united against Prop 13.

But some Millennials (those who expect to inherit houses) will benefit. Others don’t want to own in any event. Still others prefer to leave California entirely. And others won’t ever pay attention to politics.

But keep hoping for an end to Prop 13. Maybe by the time you’re an old man, it will be so.

Your assumption is curious. It’s nothing I’m wishing for. Look at AWS, Milllennials’ obsession with fair play. Baby Boomers have never had to deal with a generation that’s bigger, more energetic, and acting united with conviction until now.

I think it’ll take disappointment after the next election to really kick things into gear. But when it does …

The chance of Prop 13 going away is slim and none. I could see it being overhauled where only a primary residence gets Prop 13 protection, but this wouldn’t cause a massive sell off from boomers.

And be careful what you wish for. Most rents would go up accordingly since long time owners would be hit with a huge tax bill. That bill will be passed right to renters.

There is no easy way out of the Prop 13 mess. I am very confident no changes will happen in a meaningful time period…as in the rest of our productive lifetimes.

“The chance of Prop 13 going away is slim and none.”

Just because you predict it, doesn’t mean your prediction comes true.

“And be careful what you wish for. Most rents would go up accordingly since long time owners would be hit with a huge tax bill. That bill will be passed right to renters.”

Wrong, rents are set at what the market with bear. What’s more likely is profit margin compression.

“I am very confident no changes will happen in a meaningful time period…as in the rest of our productive lifetimes.”

I am very confident that your confidence is based on nothing more than wishful thinking.

In my opinion i think the only way Prop 13 could get dismantled or changed is probably after another housing crash. At that point with prices reduced once again they may want to consider creating new rules otherwise these boom busts will likely keep going on and on more frequently.

Prop 13 is a HUGE factor that is keeping many employers down home in California.

There are MANY who will up stakes and displace to Arizona/ Nevada/ Texas — taking their jobs/ payrolls with them.

The key problem is – and always has been – Jerry Brown… a true tax and spend liberal.

Hence, the ‘temp’ increase in the state sales tax figures to be permanent.

Due to labor agreements already inked in Sacramento (& elsewhere) taxation can only go up — until the various communities IMPLODE Stockton style.

The budget buster for Sacramento is immigrants — legal and illegal.

They are CHOKING the prison system. It’s taboo to reveal the statistics. ENTIRE prisons are newly built and dedicated SOLELY to Mexican gang members — ALL facing 20 plus years in prison. (Deercreek, Ione, California) { Triggered by a Federal lawsuit after massive prison riots – – Folsom, California }

These massive outlays are not being picked up by Uncle Sugar.

At the same time, major defense contractors that USED to provide sugar all across the southland — have shut down. The impact on blue collar wages, engineers, and the associated supporting manufacturers has been vast.

They don’t live in Manhattan Beach any more!

Just how is “HUGE” and “MANY” defined in this regard? Is there any empirical evidence that can prove Prop 13 is keeping employers in CA? Apparently it wasn’t a HUGE enough of a factor to keep the Toyotas and Charles Schwabs of the world from moving out.

Look, I’m with you on the taxes out of control thing and the state taking on more than it can handle thing, but it’s a bit hypocritical to bemoan some special interests while approving of others.

Landlords can’t just soak renters for massive rental increases like that, no matter how hard you wish for it in Vested Interest World.

——————

Lord Blankfein

June 4, 2015 at 12:03 pm

The chance of Prop 13 going away is slim and none. I could see it being overhauled where only a primary residence gets Prop 13 protection, but this wouldn’t cause a massive sell off from boomers.

And be careful what you wish for. Most rents would go up accordingly since long time owners would be hit with a huge tax bill. That bill will be passed right to renters.

There is no easy way out of the Prop 13 mess. I am very confident no changes will happen in a meaningful time period…as in the rest of our productive lifetimes.

Those whom are benefiting the most from Prop 13 are clearly worried about losing their gift horse. Who could blame them, how great is it to have others subsidizing one’s lifestyle. Their membership relative to the overall population is increasingly becoming more of a minority.

But horses don’t live forever. Crowing on about generational warfare while putting up smoke and mirrors around the debate by pointing fingers in other directions won’t extend Mr Ed’s life. Tick tock indeed.

It’s not like California is going to repeal or lessen any other taxes in the event Prop 13 were repealed. So the benefit of repealing Prop 13 would likely be a depression of housing prices when all of the old timers are forced to sell. I think that would be temporary in nature though, as once all of those houses are sold, prices would adjust back to where they were assuming nothing there were no other economic changes.

So given the prospect that nothing will change over the long term (taxes will otherwise stay the same and house prices might not change much in the long term), I don’t know if repealing Prop 13 is in everyone’s best interest. Especially considering that many people will own a house at some point, even if they are not rich.

Agree that repealing it would push house prices down. That needs to happen. What occurs after that doesn’t change the fact that in the present moment, actual public expenditures are disproportionately informing home prices.

Also agree that taxes in CA are likely going higher no matter what. What makes sense is to address the causes instead of creating distortions by treating a symptom which is what Prop 13 has resulted in.

“Those whom are benefiting the most from Prop 13 are clearly worried about losing their gift horse. ”

Maybe if they live in coastal areas of California with high values, but for the rest on inland California, not so much. For example, my parents bought a 3 bedroom house in South Sacramento for $11,000 in 1960. The neighborhood was filled with middle class families. The area began to decline in the 1970’s and 1980’s as investors bought houses in the neighborhood and turned them into rentals. The neighborhood is run down with many Section 8 renters. The houses in that area now sell between $125K to $160K. My parents still live in their house. They pay property taxes of about $500 per year. The house next door sold in 2010 for $125K and their property taxes are $1,366 per year.

@SacramentoNative

Your parents pay less than half the amount of taxes than the new guy for the same public services and benefits. That’s not a gift horse?

Busted! Your parents are probably paying only one third of what today’s buyers are paying. No gift horse here? Blame it all on the wealthy coastal CA crowd.

I have been house hunting for a while now in So Cal San Gabriel Valley. Redfin.com and Zillow.com is what I use to help me find that elusive (and expensive) home. Since I’m signed up for the Redfin.com price change (both up and down) updates by email, recently there has been nothing but price drops coming thru the inbox. Some are just for looks (i.e. $2,590,000 to $2,490,00, as if that’s enough to convince people to shell out 2.5 million) while the rest are come in the range of 3% up to 8%.

Normally at this time of the year one would expect the sellers to keep the prices up for the hot cake season aka Summer. What I have seen, however, are hesitant buyers waiting for something. Have no idea what that is they are looking for but I have a feeling they sense (as I have) a shift into a buyer’s market.

With inventory supposedly still very low historically speaking, one would argue this is a pause before marching higher into new territory. But I am not sure if that’s the case this time. The valley between the last two peaks (1991 and 2007) was 16 years and that was a normal housing market cycle length (albeit the last two years before big crash was mainly driven by low interest rate and zero lending standards). But this time we are merely 8 years from the last peak, already we are seeing prices 10 to 20% higher than the previous peaks. This is what worries me the most. The hot air is coming out of this giant bubble but few people realize it. Perhaps the only way to reflate the bubble is the next round of QE. The longer the Fed postpones the rate hike, the more likely it becomes for QE4 and beyond!!!!!

The truly scary thing is that maybe the cycle still is 14-16 years and they haven’t even started lowering the standards yet. A stock market crash could easily cause the NINJAs to show up again. Then what?!? Perhaps no price is ever too high. LULZ.

I’m not against Prop 13. I think it’s beneficial. I also think that it should only be used for your primary residence. I’m a bit ignorant of the laws so correct me if I’m wrong. Anyhow, rentals should be taxed at current value IMO.

Yes, it is beneficial – to those benefitting from it at the expense of others on the basis of nothing more than “I was here first.”

how long before the credit bubble pops?

it almost popped in ’08.

So Sad. My wife and I bought a 3br 2 ba house on 21st in the 400 block in 1975 for 100k and sold for 300 k in 1979. That SM was beauftiful and probably stlll is, but the traffic by 2000 was unbearable. My wife and I divorced, I moved into an apt on 15th and Montana and lived for 20 years, 3 BR for 600$ mo. I must say that I took advantage of both Prop 13 and rent control.

I have remarried and now live in the Blue Ridge Mountains of Virginia on a small horse farm. I owe a debt to Santa Monica and the voters of California for Prop 13 and Rent Control. It allowed me to accumulate wealth and have the life of my dreams far away from the Glitz, Glitter and Congestion that characterizes Santa Monica and the entire West Side.

What worked? My wife and I lived our lives as best we could and made the decisions that seemed right at the time. All of our choices were made as the result of where we worked and where we wanted to school our children. Never did it cross our minds that we were building a financial future in any of these moves. My former wife and children are scattered across the country with no real desire to return to Santa Monica.

For a similar story read Megan McCardle’s “Real New Yorkers Can Say Goodbye to All That.”

The bottom line, there is no justification or rationale for insanity, just more insanity! Real estate in California and especially So. Cal. simply doesn’t have any explanation, which should be worrisome to all.

Doc:

this will completely re-define Taco Tuesdays!!!

http://www.chicagotribune.com/entertainment/dining/ct-food-taco-bell-in-wicker-park-will-be-first-to-serve-alcohol-20150603-story.html

Taco Bell great idea, just what Chicagoland needs on a cold windy afternoon, Alcohol to warm up your inside. Now can you imagine Denver with legal drugs and alcohol inside a Taco Bell, who needs Taco Tuesday, everyday is party time with or without Tacos?

We can see this as insanity but the market is able to pay these prices

The market along with govt support is able to sustain these prices..

“The market along with govt support is able to sustain these prices..”

I guess it depends how you define “sustain”. My guess is that these prices will not be sustained in the long term (though it’s anyone’s guess when the collapse will occur). Just like the last bubble wasn’t sustained, and the one before that and so on.

And yet… no matter how many burst bubbles, the prices are higher than ever before. And even though there may be more burst bubbles — in ten and twenty years they will be higher still.

@Eden

If something as historically momentous as ZIRP still can’t stop a real estate collapse or maintain buyer confidence, what other desperate measures will have to be enacted to keep prices artificially high?

When someone inherits a house that has been paying low taxes due to Prop.13 the house is reassessed and taxed at the current rate. The benefit to the person whom inherent comes from the stepped up value and the capital gains tax. When a propert’s title changes the tax rate changes. Prop. 13 does not extend to future generations where to you all come up with this nonsense?

Are you sure, Dan? I think Prop 13’s benefits do extend to the children, should they be the ones to inherit.

Yes. I am absolutely sure. Any time a property title changes to a new owner or if someone is added to the tile Prop. 13’is no longer in effect. The number of people who benefit from Prop.13 in a big way is small. What is the state average property turn over?I don”t know for sure but I think it is may be something like 7 years. Very few people have lived in their houses for 30 or 40 years.

“Prop. 13 does not extend to future generations where to you all come up with this nonsense?”

Sigh.

Proposition 58 (effective November 6, 1986) extended the protections of Proposition 13 by allowing parents to transfer property to their children, and vice versa, without requiring a reassessment for tax purposes.

Proposition 193 (effective March 27, 1996) expanded this tax relief to transfers from a grandparent to grandchild when the grandchild’s parent – who was the grandparent’s child – had already died.

Thank you. The nonsense here is that this neo-feudal bullshit puts the government in a position to require that the majority populace subsidize the lifestyle of a privileged group solely on the basis of capturing an earlier generation’s share of labor exchange. It’s beyond the question of what’s “fair” — it is a moral conflict.

Negative Dan. Proposition 58, effective November 6, 1986, is a constitutional amendment approved by the voters of California which excludes from reassessment transfers of real property between parents and children. Proposition 58 is codified by section 63.1 of the Revenue and Taxation Code.

I think it is completely unfair and will keep certain properties in “highly desirable” locations within one family for generations.

And people wonder why prices are so sticky in certain areas. Welcome to California!

Not only is it transferable to heirs, counties have swap agreements. An heir can sell an inherited property in one county and buy in another while maintaining the prop 13 from the original on the new purchase as long as it is equal or lesser value. Orange county and San Diego county have a swap agreement like this. Many others do as well. Noobs have no idea what they are up against. LULZ.

OK, I’m wrong but technically is is not Prop.13 that extends the benefits. I’m glad to hear it, my kids are going to get a hell of a deal. My wife is a 5th generation Californian, you newbie can suck eggs. Just kidding. You can transfer your taxes within the county you live in or transfer them tomsome other counties but the Counties that accept transfers are generally not Counties people want to retire to.

I’d be ok with keeping Prop 13, but overturning Prop 58. I think that’d be a fair compromise.

Gann-Jarvis playing shuffle board in heaven ” Well Howrad prop 13 was foolproof right, ” Paul just get this, we saved some folks taxes and we bankrupt CA like the pundits said, we tried but it didn’t work out, but we both made heaven?

For those actually expecting a NOMINAL price retreat in real estate values…

That’s NOT how the such follies end.

By TRADITION: it’s the value of the currency/ unit of account that falls entirely out of bed.

This causes the mortgage markets to IMPLODE. NO MORE MORTGAGES can be initiated.

EVERYTHING in the economy goes to ALL CASH.

When and where possible, natives flee their national currency. (A huge part of the global US dollar demand arises from this activity — outside the USA.)

The REAL ECONOMY simply tips over and dies.(A hyper-contraction beyond anything the natives imagined in their wildest nightmares.)

The situation has always been resolved by stiffing the retirees/ pensioneer class en masse… the ‘old money’ class is also normally swept away — commonly with plenty of bloodshed… (cf French revolution, the various Chinese revolutions, … )

In Confederate dollars, Tara never dropped in price. Indeed, it kept heading to the Moon.

But Confederate dollars became wallpaper. (And this was before wallpaper.)

In the MODERN case: it’s the welfare state that MUST implode.

EBT cards across the land will simply be flat-lined — riots or no — along with ALL welfare to immigrants.

They’ll get stiffed even quicker than seniors.

If America repeats prior political art: immigrants will be run out of town, out of state, and out of the country — by the millions.

It’s what FDR did eighty-years ago.

Other unpleasant budget decisions: a total end to farm aid — ESPECIALLY export programs to the dependent Third World. Such programs had no sponsorship eighty-years ago, either.

What they all have in common: no voter constituency strong enough to hold them up against the headwinds of reality.

Their prior political patrons will be hounded from office — if not worse. (cf French revolution )

When ANY big central government totally falls down on the Big Job: keeping the economy in gear — it loses the ‘mandate of heaven’ and ALL things suddenly become possible.

The “Overton Window” is blown wide open.

Such harsh times are BRUTAL for real estate values, … financed values across the economy.

Both incorporate time-value. In an economic free-fall, tomorrow’s value is given virtually no weight at all.

You’re almost back to “Barter Town” and living with the pigs.

As someone who lived through a hyperinflation I can attest to what Blert is saying. The pensioners suffered the worst. I had people accost me in the streets asking for a little money to buy bread. I was lucky to have a good job, so I did help. Eventually I did it proactively to spare them the humiliation.

The “Barter Town” part actually came earlier, with the liquidity crunch preceding the hyperinflation. Workers would get paid in the goods they manufactured, which they would then barter with.

To people here who are waiting to buy in a price crash: given that the financing evaporates, it seems the only way to succeed with this plan is to have the full amount in cash. How many are in position for that?

Leave a Reply