Owning with no equity is just renting with no mobility. 11 million mortgage holders underwater backed by $2.9 trillion in mortgage debt. In California, close to 20 percent of mortgage holders underwater by 25 percent or more.

I think the concept of owning a home is undergoing a radical paradigm shift. Owning conveys a sense that you actually have tangible equity in a property. This has always been the connotation of ownership in our society. In the past it did mean something because of decent down payment requirements that built in an equity buffer when people bought. Even when I attend conferences and events when someone tells me that they purchased a home in the last few years, most of the group automatically assumes that the person somehow has an automatic buffer of equity in the home. Unless you live under a rock, we all know that over the past decade most of the popular loans required very little to nothing down. This is a radical shift to the home buying structure. Yet psychology is a very powerful thing when it comes to home buying and the mythology of the American Dream which is inextricably linked up to owning a home (for better or worse). Yet is it factual to call it ownership if you have no equity? What about millions that now face having a mortgage that is underwater? Today I’m going to examine new housing data provided by the Census and look at the current status of underwater mortgage holders.

Owning with no equity is renting with no mobility

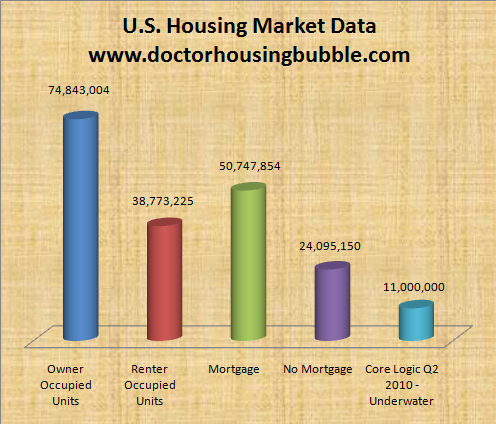

First we should take a look at the entire housing situation in America:

Source:Â Census, CoreLogic

The number of mortgage holders in the U.S. fell on a year over year basis. This isn’t good news because we also see the number of those with no mortgage and owning a home falling (this number fell by 195,000). The number of homes with a mortgage fell by 867,000. What happened? What occurred is the massive number of foreclosures. A large number of the questionable mortgages are falling into distress and people are still losing their homes. The trend is still moving along like a bullet train. It does take years for the mentality of people to change their entrenched views on a strongly held belief. After all, how can you claim to be a homeowner and actually have no equity in your property? The recent numbers are startling for many reasons.

If we combine underwater homeowners with renters, we will find that in the U.S. we have virtually the same number of homeowners with equity as we do with renters combined with negative equity mortgage holders. This is a giant shift in thinking here since the generally accepted idea is that in the U.S. we are a large home owning nation when in fact, we are largely a debt owning nation. If we look at the actual nominal value of mortgage debt, the amount of mortgage debt underwater is $2.9 trillion:

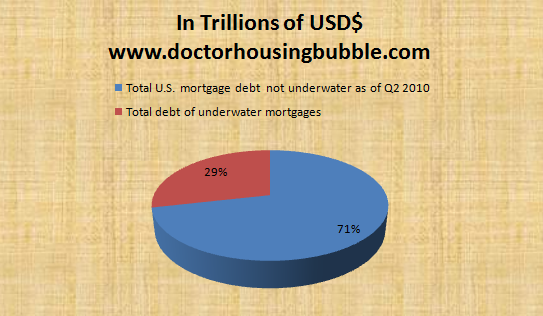

Source:Â Federal Reserve

29 percent of all mortgage debt ($2.9 trillion) is underwater. This is incredible given that the number of underwater mortgages amounts to 22 percent of all mortgages which tells us that there are some big loans skewing the figure here. In fact, we can see this when the numbers are broken down further:

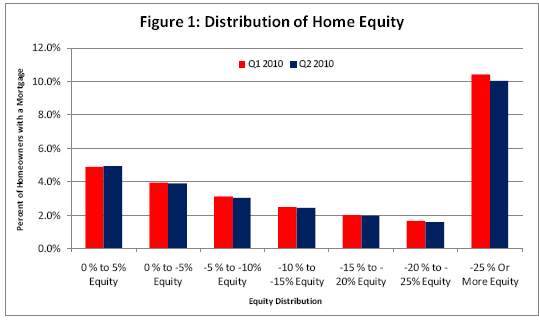

Source:Â CoreLogic

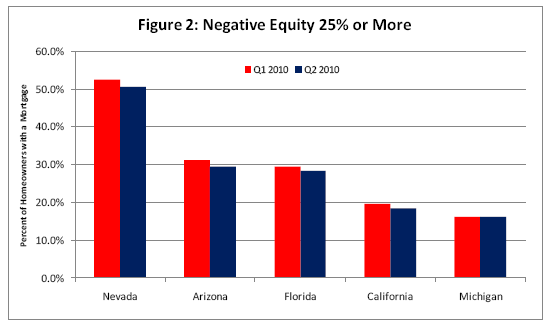

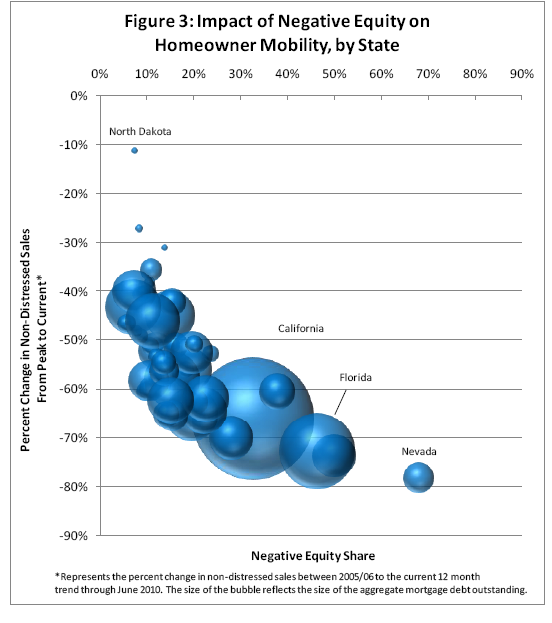

Of the 11 million mortgages underwater, 10 percent (1.1 million) are underwater by 25 percent or more! These loans are setup for foreclosures. No market is going to recover 25 percent in the near future. So what will happen to these 1.1 million active underwater mortgages? As you can see from the chart above, you also have many in the -5, -10, and -20 percent equity ranges as well. In other words, these people basically rent their home with no mobility. If they want to move, they would actually have to bring money to the table. And given the massive number of toxic mortgages in the market, the worst of the worst underwater mortgages are in states that Wall Street lovingly dubs “sand states†or Nevada, Arizona, California, and Florida:

The above chart should give you a good understanding of why some states will have much tougher housing markets moving forward. It is incredible that 50 percent of all underwater mortgages in Nevada are underwater by at least 25 percent. In California that number is closer to 25 percent. But run the numbers:

California housing data

California underwater mortgages:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1,724,774

California underwater mortgages -25% equity or more: Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 344,954

We can almost guarantee that those 344,000 mortgages will default in the next year or two. The 1.7 million mortgages are also in this risky pool. So in many respects this large group here has it worse off than a renter. What if a new job opportunity came up in a different location? Or out of state? Their mobility is completely constrained. Being underwater by 25 percent or more in California will likely mean they are underwater by tens of thousands (or even hundreds of thousands) of dollars. Since many bought with no or low money down mortgages, it is likely that they do not have the funds to make this deal happen even if they wanted to.

The sand states also have the biggest problems moving forward:

Nevada is so bad it is literally by itself far to the right. But California by sheer size has the largest nominal amount of these mortgages. In California just by statistics you can say that every one out of three people that tell you they are a homeowner is likely underwater. And every one out of five of those people is underwater by at least 25 percent. We look at certain examples even in more select cities and we realize that this is happening all over the place. And what if home prices fall as we expect in the next year? Then more people will find that they are now in the position of renting their home from the bank and not having any equity. Isn’t that renting in a nutshell? Plus, what metrics are they using to claim homes being underwater? They are being too generous in many areas that still are largely in bubbles.

And keep in mind in many of these higher priced areas renting is much cheaper than buying even with multi-decade low interest rates. You also have to ask why do we as a nation so heavily subsidize home buying. For many Americans, the tax breaks from owning a home are minimal because of already built in standard dedications (plus the fact that they live in more moderately priced areas – the median home price in the U.S. is roughly $179,000). Yet someone in California who purchases gets an overwhelmingly high subsidy to buy (forget about the extremely wealthy that have giant advantages in terms of writing off interest and other deductions).

I am happy to say that many more people are becoming more comfortable with the notion of renting and will only buy if it makes sense. You will always have people especially here in California that will view a broke homeowner in a better status than a wealthy renter. Just like I’m sure many of you know folks who lease BMWs and live in tiny apartments. That you can’t change. But you also can’t change the fact that owning with no equity is basically renting with no freedom to move without forking money over to the bank. Hard to think of something more American than freedom.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

72 Responses to “Owning with no equity is just renting with no mobility. 11 million mortgage holders underwater backed by $2.9 trillion in mortgage debt. In California, close to 20 percent of mortgage holders underwater by 25 percent or more.”

Maybe I’m missing something but aren’t there 64 million homeowners with equity and 50 million renters and negative equity households. Almost the same but not virtually the same. I’m optimistically surprised that 1/3 of all homeowners have no mortgage. Granted, 15% of all homeowners currently underwater is a big number, but not terrifying. I’m more likely to bet on inflation 5 to 10 years down the road, thus allowing home prices to ultimately go up. That is what the gold traders are telling us right now. If we have a long period of deflation then we are all screwed. The 30’s and WW2 showed us that.

JH…where is this inflation going to come from? If they are going to send everyone a check in the mail for $100k, then OK, but with un-employment is as high as it is and the economy not exactly taking off at the moment, I don’t see how printing more money is going to do much of anything. The banks will continue to store it in their vaults and buy treasuries with it. They won’t be lending it out like they used to. Wages are/have been stagnant for years…so where are people going to find the money to drive up home prices?

Good post!

The goal is to increase employment because it will solve 99% of the problem. To increase employment, the government needs to decrease business taxes below most of the foreign country. If the government stop spending (giving handout), people will go look for job (legally or illegally). They will find it some way some how. The next step is to depreciate the dollar so that export will improve. That’s how you bring in company and help them to thrive.

Great, great article, Dr. HB. This ought to slap the taste out of the mouth of various smug, delusional home “owners” (more like anchor-weighed-down debtors) and hopefully smack a little bit of reality into them. BTW I think in your second to last paragraph you meant to say “standard deductions” instead of “standard dedications”…

State and local govts. have a deficit this year of around $170 Billion. Obama has tossed them $60 Billion, in order to forestall an election massacre.

State and local govts. are therefore not making the hard choices, and it will be worse next year. When the red ink hits the pavement, a lot of teachers and other government workers will be out on the streets, looking for work.

With the unemployment numbers today, looks like those public pink slips have started going out. 159,000 government/public sector jobs gone…just a drop in the bucket on what’s to come, and in all honesty, it’s well past time the incredibly bloated public sector started trimming its enormous abundance of fat and dead weight.

Where do you think the excess is? I know our schools here in LA have cut teachers and I would not call the staffing bloated. There are lots of prison guards, but then there are lots of prisoners, so we’d have to release them before we could cut prison guards. I’d love to see numbers that give an idea of where excess $$ are going.

If you are 25% underwater you don’t own the home…the home owns you, unless there’s some way you can walkaway with no consequences for your credit or future borrowing ability.

Also, I wonder how prospective employers look at a “walk-a-way” borrower when they are making hiring decisions. A lot of employers now run credit checks on prospective employees.

Leveraging RE has been a money maker including its use as an ATM machine during the big bubble periods but as Bill Gross of Pimco’s recent letter makes clear those days are over and if the recent FED outbursts about the current sour state of the new normal economy are correct its over for a very long time.

There is no place to hide, there are no deals, those that continue to hunt and peck for left over scraps need to pay attention as the FED which normally is about making everybody feel good about the economy has gone out of its way of late to say things are going to get worse, so buckle up!

Doc, I think it’s time to investigate how a foreclosure moratorium/freeze fits into this picture. Rep. Alan Grayson (D- Florida) is calling for a nationwide moratorium.

“I write to encourage the FSOC to appoint an emergency task force on foreclosure fraud as a potential systemic risk. I am also writing to ask the members of the FSOC to use their regulatory authority to impose a foreclosure moratorium on all mortgages originated and securitized between 2005-2008, until this task force is able to understand and mitigate the systemic risk posed by the foreclosure fraud crisis.”

They are using MORE FRAUD TO COVER UP THE FRAUD.

http://www.dailykos.com/story/2010/10/7/908604/-Alan-Grayson-Calls-Geithner-Bernanke-for-a-National-Foreclosure-Freeze

this is kind of a strawman….to rent a 1 bedroom apt in san francisco takes first last and a deposit equal to a months rent for a 12 month lease…thats like $7500 upfront…..and you cant break leases now like you could when the rent was $135 a mth. today, 6mths of lease payments can be $15,000…no way a landlord is going to just let you break a lease and leave….i guess a home owner is stuck for 30 years and a renter is stuck for 12mths.

SF isn’t rent controlled? In LA you sign a lease for 12 months initially and then it becomes month to month in rent controlled areas. Which makes for a much better deal.

Dr. Bubble is debunking the homeowner myth, not knocking down a strawman. San Fran blah blah blah, but here in the sand state of Florida you can rent with no lease at all, which means about ten days to evict for non-payment. $7500 cash down to rent an apartment is la la land for 99% of the US. Hell, there’s neighborhoods around here where all you’ve got to do is look for an unmowed lawn, kick the door down, and call the power company.

People were sold a bill of goods by a bunch of smarmy libertarian neo cons raving about an “ownership society”, based on bullshit, and reinforced by corrupt rating agencies without whom this entire Hindenburg could not have been financed. We’re about to find out just how valuable the cognoscenti consider a decent fico. I’m thinking acceptable scores will be revised downward.

Bob, when I signed a lease for my new apartment last year there wasn’t any big upfront cost. They wanted a $500 deposit for cleaning carpets, etc. That was it. Regarding breaking a lease…people would probably only do that if they lost their jobs. If there is no money coming in, you can’t write a rent check. I’m sure many landlords will gladly let people off the hook knowing they won’t get paid. You simply can’t take what’s no there.

Owning free and clear can be a ball and chain also.

I lived in Columbia, MO until 2005 when I sold my house and moved back to Los Angeles.

A neighbor down the street had their house on the market at that time also.

That house is still for sale.

When I look at RE there, there are countless empty homes for sale in established neighborhoods from the low end to the high end. They will sit forever until they rot. They don’t rent out easily either from what I’m seeing. I can only assume that the original owners owned them until they died and now the heirs are trying to get rid of them.

Believe it or not, it’s cheaper to rent than it is to buy there. $75K-$90k condos rent for $500 a month. It’s not much different with SFR’s. $175k homes can be rented for under $1000.

http://columbiamo.craigslist.org/apa/1974821827.html

And for those that think that there wasn’t a bubble in the midwest because homes are *only* $150k don’t realize that those same homes were selling for $50k back in the mid 90s.

Its not much different for the other midwest cities. Believe me…I’ve done my fair share of “zillowing”.

IMHO, 90% of what’s out there isn’t worth owning unless you can purchase it at a GRM of 50 because once you own it…it’ll own you.

Forever.

Jeez, what happens when we lost another 30%-40% in some area.

Please let’s take care not to apply knee-jerk thinking here. I.e., house buying used to be the cat’s ass, now it’s bad; renting used to be bad, now it’s the cat’s ass. That’s just another kind of flipping.

I’m not big on that whole Twentieth Century Car Culture drumbeat of incessant, drop-of-the-hat mobility being “freedom.” American rootlessness–in our homes, our jobs, and our families–seems to be emerging as a source of social fabric fraying, and mental and emotional meltdown. It has surely been structurally imposed on us by corporations (which live forever as fictional persons, and therefore outlive us all), and then we’ve been mind-engineered/advertising lobbied (including by the NAR) to accept it as a good thing.

Roots in a community can free up money, attention, energy, and other resources through long-standing social networks. Knowing and trusting neighbors–including which ones came through for others the last time the power was out for a week, etc.–is a kind of social capital. I’m willing to bet that a lot of the trouble people got themselves into with stupid mortgage tricks, derived from them applying the idea that staying anywhere for more than twothree years was bad. (“Buy new every two!”–used to be just for cars.)

Owning *with* equity doesn’t translate into “mobility” automatically either. At the peak of the bubble, on three separate occasions, strangers came to our door (one dropped a letter in our mail box) offering us twice what we’d paid for the house and land just five years previously. Their offers translated into our modest mortgage amounting to only 20% LTV/80% equity. Now we’re back to about 66% equity with the downturn. Whatever; there’s no way we could rent a place like this at twice our monthly nut, and we’re where we wanted to be. So we feel OK with it. And we wouldn’t be here except for accidents of timing and good luck.

Still, where would we go had we chose to cash out then, or chose it now? We chose this house based on a palette of practical things, like not needing a car to earn a living, being able to be productive in in/on the land, and the walk to work and back being a good part of the weekly exercise regimens. We’ve put effort into the land that would be impossible to duplicate, same with the building of barter and cooperative labor networks.

Doc, I’d say we need to question the entire cultural underpinnings of home ownership post-Reagan. From roots and responsibility we have devolved into “equity,” flipping, “moving up,” cashing out, gambling, scamming, and all other forms of monetarization of our private lives.

While I agree that prices still have to come down, it’s also the case that wages for working people need to be strengthened and the job base needs to be more robust. Otherwise this slow crash does nothing but impoverish the prudent, and reward the gamblers either with easy gains or walking away from their poor choices that then get billed to the prudent.

In other words, DHB, the “radical paradigm shift” of home ownership occurred somewhere around 1981, when debt became a way of life for everybody. Leave it to the geniuses in Delaware to turn mortgages–once the most conservative of debt instruments–into credit cards.

Rose I generally like your posts and if you had a blog, I’d definitely read it.

However, I think you’re underestimating how much the government intervenes in the establishment of roots in a community and the formation of social capital. I could get into the ways in which it does on this blog but I’d get the standard hysterics from the usual suspects.

When you’re upset, you need to point your finger somewhere. After the dust settles, you come back to your sense with a lesson learned, and hopefully you make at least one better decision from then on.

I agree that there’s now an ‘anti’ bandwagon on home ownership, but that really depends on context. If anyone gets into ownership as an investment vessel, what can you say except that owning a home is bad? If, like you, owning a home is for more intrinsic values, then owning a home is still a great thing. It’s just not the best time to own if you do not own enough wealth.

I think the paradigm shift you speak of has broader applications than just homes. We’re a consumer economy, and in the past decade, we’ve been fed a lot of garbage values that revolve around self gratification and the corporation of ‘me.’ We want bigger houses, we want wealth, we want to be beautiful or to own beauty. Ultimately, it’s a quest for self-validation by extrinsic means. Same old story I guess, but the significance lies in a new, more accessible way of doing it: easy credit

Compass Rose: I am TOTALLY on board with your sentinments against Big Biz induced rootlessness, and the disintegration of REAL neighborly-hoods and healthy social fabric in the USA. I count myself lucky to have been part of such a neighborhood, if only until age 8.

That said, Dr.HB is doing an ENORMOUS public service by focussing SOLELY on the economic nuts and bolts (and implicit CRIMINALITY) of this BigGov-BigFI-BigRE/NAR vs. The People housing debacle, and I think it is wrong for you to hijack his mission, and urge him to expand the scope of his blog to encompass your points.

OTOH, *you* would do well to start such a blog, and I would definitely count myself amongst your avid readers, and even contributors/link providers! ;’)

Agreed. I’d like to add that being underwater on their mortgages isn’t the only reason these people cannot move. In addition, their credit is, most likely, completely shot. They may also be unemployed. Try getting a lease with a bad FICO and/or no job or only a part-time/low-wage job; most landlords are stricter than BANKS when it comes to FICO scores and employment. (The Biblical passage about it being easier for a camel to pass through the eye of a needle comes to mind.)

To Number 6: The large complexes are moving to a “Rent Check” score because over 25% of Americans currently have a FICO score below 620 which limited the renter pool. I recently rented a new apartment in Irvine and the Irvine company no longer checks FICO because they really don’t care if you have lousy credit. They only want to know if you have ever been EVICTED. Welcome to the new reality… even high-quality landlords (like the Irvine Company) cannot rely on FICO scores anymore. The system of evaluating risk via quant formulas and numerical algorithms is falling apart.

Interesting, Chris. I had wondered when that was going to happen. With so many people’s credit being shot, not just because of bad mortgages but unemployment/underemployment, I figured that, eventually, landlords would *have* to relax their standards just to keep their units filled. If you won’t rent to anyone who doesn’t have an 800 FICO and 10 years at the same job, chances are you’ll go broke because your units will be perpetually empty.

Frankly, I’ve never understood landlords’ obsession with FICO scores. If I were a landlord, my only concern would be whether a tenant had been evicted, whether they’d trashed the place or otherwise caused problems for their previous landlords, and whether they had enough money to pay the rent. It would not be my concern if they didn’t pay their credit cards, so long as they paid me (any sane person with awful credit is going to pay for their housing first, above and beyond credit cards).

However, I imagine not having a job is still an insurmountable burden to being approved for a lease, and one I can understand. If a prospective tenant has no job, there’s no way they can pay the rent.

I absolutely agree with the idea of this post. The other day a friend of mine (we’re in our mid 20’s) was bragging about how so and so owned a home. I said that’s too bad, because the value is sure to go down (they bought earlier this year). On top of that, they put very little down. The economy AND housing trends is against them at the moment. I’m just hoping they keep their jobs long enough for this market to turn around. I definitely wouldn’t take that risk and would rather save my money and buy on an uptrend.

You should buy now if you have money because it’s cheap— buy it within a large metropolitan…. somewhere where you or your renter doesn’t have to drive 2 to 3 hours to work.

d_artish, you are incorrect. House prices are inverse to interest rates. As interest rates go up, everyone qualifies for smaller mortgages based on their income. That means people cannot afford to spend as much on a house as they did with a lower interest rate. Therefore, when interest rates are at record lows (ie right now) house prices are inflated. There is little room now for mortgage interest rates to fall further, they are about as low as they can go – on the other hand, there is ample room for them to go up.

compass rose–just want to let you know I read here as much for your comments and insights as I do for DHB’s. Excellent post today. Thanks.

So when are you better off owning? Or if you’d like to own, what is the best strategy?

I am considering buying the house that I rent and would like to figure out the best strategy to do so, but I am beginning to wonder if it is even worth it.

Right now, if (big if) we were to do it, the best way to go about it seems to revolve around sitting on the house as a renter for a few more years, and then making an offer with a large down payment (maybe 40/60) that was made possible by the dirt cheap rent.

Then again…maybe we’re just better off with the dirt cheap rent.

According to another study, we’ve also apparently reached the point where a bachelor’s degree is no longer worth it, financially speaking. In other words, the costs you incur in loans and lack of productivity during those years is, on average, greater than the wage increase you get for holding a bachelor’s degree.

So you’re apparently better off going to work right out of high school and renting your home than you are going to college and buying. When you think about what this says, socially speaking, it’s pretty scary stuff.

We officially live in culture that values education, bettering yourself, and having control over the very place you live less than being another cog in the wheel and giving that control to someone else. We now value dependence over independence, which seems a little anti-American to me.

I never thought we’d see the day, but apparently we’re there.

I’m tired of hearing how people who put zero or very little down caused this crisis. I bought in 2006 with 800,00 down on a 1,200,000 and my current situation is not any different than someone who put little or zero down. It’s a loss no matter what you put down. I feel that I got burned because I put so much down. I could not possibly walk away from my loan like so many underwater homeowners. I have sold my home for a huge loss because I do not feel that real estate will come back in the next 5 years that I planned to live in this home till my daughter graduates from High School. My money is better served out of this horrible housing market. I’m moving back into a rental property that I own. I agree that there is nothing to be gained by owning a home nowadays. I understand what foreclosures does to local neighborhood home prices, it is the fallout of bad lending practices. People got loans that should have been turned down. The banks were in charge of lending not the people. We would not be in this mess if banks did not change their lending practices. I see walking away from a loan as a defiant option that I would do if I could in protest to the banking industry. It all comes down to lending practices and guidelines, not what someone put down on a home. I agree more down is better. People put zero or little down because they got the approval from the banks. The banks are responsible the entire mortgage crisis along with Bush’s policies towards banking/lending and oversight. I am tired of websites blaming the people while the banking industry is to blame. It’s easy to lay blame on the people who took out loans with little down or no down. Putting little down did not make people default on their mortgages. People defaulted on their mortgages when home values took a nose dive. Banking opened the flood gates on lending which created a demand and drove prices artificially high. The banking industry successfully ran the biggest Ponzi scheme in the history of banking- the last people to take out the loans got stuck with worthless mortgages including me. We bailed out the criminals! Stop blaming the people and research the changes in lending, incentives, Wall Street, government policies over the last 10 years.

Was the 800k that you put down proceeds from the sale of another house or was it savings?

If it was the proceeds from a bubble sale can you really say you “lost” anything?

No unfortunately the 800,000 was from savings. My beef with banking/lending is that ten-twenty years ago loans would never be approved for zero or little down, incomes and credit history would be scrutinized.

The next big wave of uncertainty will come from the stock market as more baby boomers will move their investments into safer vehicles and institutional investors will not be happy with little or no growth in the American market and big investment dollars will go over seas. This will leave the American market/ 401 k in a flat earning pattern for the next 20 years. Home prices will come down more in the California market because the jobs we have lost has been the higher earning jobs from mortgage and finance industry that won’t come back. Any jobs created will be lower paying jobs that will not support the current housing market. The money you have now to invest you can no longer count on for home appreciation or 401k growth. It will be more important than ever to save, save, save.

You put $800 G’s down on a $1200 G house? Are you nuts? Why didn’t you buy an $800G house outright? 2/3 Less property tax, probably less upkeep, no interest payments, less insurance costs, easier to sell, and still ‘better’ than 99% of the rest of the market us working stiffs live in. I only dream of the day I can own outricht….$62000 to go!

I agree with you I over bought. I did not finish college but I did get my Phd in stupidity with this bad decision. I always give myself a buffer financially but this loss was beyond what I ever imagined. My back round is in apt. housing. I learned a lot and it was a great education. It’s not what you earn, it’s what you save. I have have seen how people live, I have see what people really make, I have seen what they really save. I was one of those renters- it’s great for the wallet. If you are single and don’t need to stay in the same school district for your kids, renting can be the way to go. Renting can be good if you are flexible and don’t mind being at the whim of a landlord who wants to sell, wants to move back in, wants to significantly increase the rent, ect. You will be mobile but not exactly experiencing the stability people crave at a certain age. Moving is not fun after awhile even if it means more money in your pocket. It’s not always easy to find the perfect rental that will let you live there long term. Moving is stressful-you have to change your address on every account you have, your furniture needs to be moved yet again. Your furniture does not fit or look good in your new space. If you have kids they really don’t like moving around. It is disruptive for them to change schools and neighborhood friends.

Excellent post Christie!

The banks (thieves) gave out loans that are meant to fail; thus, it’s only right for borrowers to default. Big businesses can default property, and people should take a lesson from them. It’s the law of business.

Equity in a home is just a number on a page. You have to live somewhere. If you sell when the market is down, you will also be buying when the market is down. A rising tide lifts all boats.

The depression led congress to limit speculation in stocks by making it illegal to extend credit secured by stocks more than half the stocks value (margin rules). Back in the day, a borrower had to put 20% down to buy a house, with the effect that real estate borrowing was limited to 80% of real estate value. Then came zero down financing, which is a formula for speculation. Why should we be surprised that people borrowed the money if it was available?

But people should bear the consequences of their own behavior. Loan forgiveness for people who are underwater is a prescription for moral hazard, and totally unfair to people who were prudent and did not borrow beyond their means.

Barney Frank and “everyone deserves a mortgage” is as much resopnsible for this bubble as anyone.

PP

I know several families that are underwater on their homes. For them it basically means they can never move. If they want another job they can only look in their area. Plus they all bought at the peak and are now dealing with broken water mains, water heaters, etc. And since they feel trapped in their houses they’re even doing renovations because they feel like they have to “make the most of it.” So new kitchens and bathrooms add to their debt. Oh, and they all lease new cars. Like the Doc describes it’s a mentality that I think is tearing these families apart, both financially and emotionally. When these people finally capitulate in however many years, they’ll be facing a whole new reality that will be difficult to accept. We rent month-to-month and put away about 25% of our net income into savings. We don’t feel rich, but we can’t imagine how it feels to be underwater and drowning in debt.

Pwned, If your friend is one of them, tell them to default it. Don’t feel ashamed because it’s just the law of business.

Believe me I’ve tried, but the point is these folks are addicted to debt. They can’t stop buying toys and think defaulting is for losers (which of course they are not). It’s going to take years for them to change their thinking. Until then they’re resigned to the fact that they’re staying put for the foreseeable future.

Bob: Not all places require first and last month rent, and a long lease requirement. I’ve been renting the same home on a month to month basis in a nice area of CA for 5 years. To start renting, my landlord, required the first months rent and a $500 security deposit. It is only a 1500 sq ft house built in the 1920’s, without the large ammentities a huge apartment complex, but then again, I get a back yard, garage and freedom to pack up anytime I want. I think the trick is to deal with private owners or small property managers that might be willing to forget about a long 1 year lease. You can always negotiate a 12 month lease into only a 6 month lease. OR, many places will have you lease a place for 1 year, if you state up front, I’ll lease for a year, then I would like to go month to month or quarterly, etc.

“…I think the trick is to deal with private owners or small property managers ….”

The problem with this is that many of those people are the ones floating in debt. If you do this currently you are at real risk of living in a house/apt that gets foreclosed upon.

There are plenty of big fish floating in debt. Recall the Stuyvesant Town default? One of the largest apartment complexes in the world, purchased for a record price during the height of the market, and now one of the largest defaults in history?

http://www.bloomberg.com/news/2010-10-06/stuyvesant-town-senior-lenders-said-to-be-in-talks-to-buy-ackman-s-debt.html

Yep….I got screwed pretty good by renting from a women who had moved from CA to CO because she said she “wanted to be closer to her grandkids”….well she was in her 70’s and had taken out HELOC after HELOC then a giant second in June 2006….after 8 months into a 1-yr lease, the realtors stopped by and put a sign out front. She hadn’t been paying the mortgage with our rent (totally “legal” to do apparently)….anyways, after the 1-yr was up we moved out….this was in April, the house short-sold in July…..and guess what….she was bankrupt and never paid me my deposit back…gone….I lost $1200….never to be seen again.

I took her small claims court….the judge said I was correct and should get in the deposit back…but she had her bankruptcy paperwork and proved that she living off of social security only…..judge told me that won’t be able to get the money…and tossed the case.

Good times.

California has something the other states don’t enjoy – A-S-I-A-N-S.

Homes in areas predominantly Asian will NEVER fall, because there are still people coming from Korea, China, Taiwan, Vietnam, and whatnot brining money from across th pond.

That’s why premium areas and some CA locations still hold on.

To the best of my knowledge, Dr Housing Bubble never discussed Koreatown, Westminster (a predominantly Vietnamese area), or Monterey Park/San Gabriel Valley (where lots and lots of Chinese live).

They are the bastions; will never fall.

FLOL Koreatown? Koreatown is overbuilt and most of it is a SHITHOLE that actually has dropped significantly in value. I assure you, there are more and more K-Town short sales and foreclosures/REOs daily, and prices in 90005, 90020, 90004 and whatever other zip codes are east of those further into Koreatown, have dropped 25-40% or more at this point.

Westminster? Ugh that entire area smells like shit thanks to the major OC sewage treatment plant being there, and no one but Vietnamese and Latinos would ever consider living there, same as its neighbor Garbage Grove. Monterey Park and the rest of the San Gabriel Valley has indeed held up well thanks to the Chinese money rolling in from the mainland now (instead of entirely from Hong Kong and Taiwan), but it too has stalled and dropped a good 10-25% from peak even in prime San Marino, Arcadia, Duarte etc.

I’m Vietnamese , and while it’s true there are many Asians in those and other So Cal areas, it’s not true that they alone will be able to sustain abnormally high prices. Once the China property bubble pops (which is currently showing huge cracks), it’s game over. You’re correct about one thing though, some of the most expensive homes I’ve seen sell in those areas, were bought by foreigners. The problem is that in most cases there was always some shennanigan. Whether it was trying to qualify with a valid income that didn’t exist, or getting a down payment from a non-existent bank overseas, or getting a family member (doctor or lawyer type) to co-sign, it was always the same story that things just didn’t add up. In fact, the main reason foreigners have always been more willing to buy an overpriced property is that they really have no skin in the game. They can walk away at a moments notice, especially if they don’t have citizenship. I see it all the time with the H1 visas that flood the tech and medical fields. As soon as a couple starts pulling down $$, they max out 40% to 50% of their income to purchase a property. Unfortunately though, you may be right, as long as the government keeps giving/backing subprime loans up to $729K, the game may never stop.

You fail to understand the nature of markets. They’ll fall too as homes in contact with their boundaries fall.

…asians are notorious for overpaying for status, w/o fail…isn’t that what you mean? Or, are you talking about SUPER asians, those immune to the problems felt by the rest of society? I’ve heard about these asians…but unfortunately for us non-asians, will have to continue to deal with realty.

Oh, side note-Westminster is a terrible example. Any viets w/ money move away and only visit the area to shop @ a market or eat some pho…the city is quickly becoming a latino hub…just like Koreatown…damn, your whole post is wrong. Why didn’t you say Irvine?

“You are what you own – not what you owe.” Everyone in the second and third world understands this why is it so hard for you in the USA to understand this simple concept?

Perfectly said.

Okay, I’m going to play devil’s advocate here, since we recently bought a condo. Could we rent somewhere else for dirt cheap? Sure. But I wouldn’t want to raise kids in those areas, or frankly even walk down the street by myself at night there. I don’t know about other people, but we’ve found that if you want to rent in a good area, you’ll have to fork over a pretty penny every month. There’s no such thing as “dirt cheap rent” in a decent area. (Unless you’re talking about a city out in the desert; I, for one, do not enjoy spending 4 hours on the road each day.) If we’re going to be spending $1500-$2000 on housing no matter what, we might as well spend it on something where we can build equity.

Could we rent instead of buy in a nice area? Sure, but we would only save about $250 a month versus owning. After renting for several years, we don’t mind paying a premium knowing that we are in control of our own living space. If we get kicked out, it will be because of our own doing, not because a roommate secretly spent the rent money, or because the landlord wants to move back in. No more landlord inspections either. I’d pay $200 extra just for that.

Do we mind the lack of mobility? Not really. We planned to put down roots here, so non-mobility is sort of the point. Plus, we picked this spot because of its proximity to LA and Hollywood, where my fiance works. Moving to Bakersfield or Iowa isn’t in our plans anyway.

Lol ehehe…. don’t get too upset, because nobody is talking about you. Your situation falls into the same category, but you are an exception. There are many like you, including myself.

I`m renting an apartment (in Poland) – we have here less mature rent-market than you have in USA but I think that it is only a matter of deal with homeowner (rentier?) that he don`t check few times a month that you didn`t break anything. For me renting and saving money is the only way too buy my own home. I`m only 26 so maybe I`m in another situation than you.

@CC ….Other points of your posting not withstanding, you may not see realized growth in your equity for 8-10 years or more.

CC, I don’t think they’d want you in Iowa, anyway. You don’t sound all that smart…and there aren’t any over-priced condos out there either 🙁

…because buying a condo to raise kids is Super smart! I’m sure that and the $250 loss/mo. won’t matter when you can tell he kids you’re not renters *gasp*…mind telling us where this beautiful, family-friendly condo town is?

The dollar is falling fast so we can export. With a cheap dollar, our imports will be more expensive, hence higher prices. The Fed is considering how to cause inflation now because that is the only way to save the banks and to get some relief from our big debts.

Right, because we use paper money, inflation is the way out. In this present, it’s the only way.

what is going to happen now that all foreclosures are halted (BofA)

my guess is that sellers will think they can jack up supply since all the foreclosures will stop coming in for now (more inventory from sellers, tho less from foreclosures)

but won’t buyers be thinking, i’m waiting for all the shadow inventory and sit on the sidelines?

also, i am expecting the gov’t to legalize the foreclosure problem away. Maybe after the elections?

Stop paying and fight the foreclosure you could get a free house. Pretty tempting to your average small time con artist. And the press is portraying you as the victim against those slimy banks.

There is no doubt that mobility plays a big part in today’s dysfunctional economy.

They say it has been one of our great economic strengths in past downturns, with the hordes of the great unwashed able to relocate to a different area that is not so economically disadvantaged.

Trust me – I know. I live in Atlanta and saw a nice, livable city turn into some thugged out, transient, mega mall in the span of 20 years.

That said however, I learned an important lesson from my folks.

Own two things outright – A house and a car.

Then you always have a safe place to lay your head (and your children’s heads) at night and a way to move around in this society.

And no blood sucking bank will come with a wrecker in the middle of the night, or post a notice on you door the day after the second Tuesday of the month.

So for me, as a “true” “owner”, there isn’t much more satisfying than that feeling.

Everything else is secondary.

The way I look at it, I can usually or always scrape up enough dimes to pay the taxes and the utilities. Should I decide to relocate, yeah, I’d take a pretty large hit to the net worth right now. But then again, maybe I would just close the blinds, winterize the house, and just move if I had to.

I probably wouldn’t even think of selling, since all of the transactions in my neighborhood for the last 3 years have been BANK SALES.

Not a single “arms length transaction among the 32 transactions in the last 3 years.

Some house have actually sold for less than they did NEW in 1987!

But you can thank the banks and the Frddies for that nonsense.

Some of the ways I accomplished owning both of the things that I consider important, were taking A 15 year mortgage, paying a 20% downpayment as to avoid PMI and escrowing T&I, NEVER taking out a HELOC, have only one credit card for essential travel related neccesities, and paying cash for my $7500 2007 late model car at auction (yes it was a repo;- their loss – my gain).

A friend went from Interest-only to trying to catch a government bailout for homwowners and is now essentially financially ruined for life. Just because all the evil was exposed doesn’t mean the criminals stopped their behavior. I can’t imagine a scenario of how we get through this as a nation when we have become so many cannibals and our only connections are through the Internet. What a mess.

Look at it this way: you didn’t lose the $1,200 deposit, your rent was $100 higher per month than you originally agreed to.

11 million underwater, 1 million underwater over 25 percent of mortgage, over 2 million in foreclosure, and over 2 million seriously delinquent.

There are 3 times as many homes in or headed for foreclosure that are between 0 and 25 percent underwater than the 1 million underwater 25 percent.

The banks cant squeeze blood from turnips but they can delay.

Looks like BoA wont be selling all those foreclosures they’d been talking about earlier this year. At least not in the near term.

From this post and many others I have read, I am convinced that the housing market is unequivocally headed over a cliff. It is like a car speeding at 100 mph headed strait for a big cliff of the Grand Canyon.

Housing prices are going DOWN, DOWN, DOWN and it very well may get UGLY.

However unlike a car which can put on its brakes to avoid a collision, the housing market has no safety mechanism. In this aspect it is more like water fallling over Niagara Falls. The government is doing all it can to prop up housing prices, but it is like trying to prevent oceans of water from falling over Niagara Falls. Impossible!

You are too negative. I can write a book on how to invalidate your post, but most people have already wrote it in response to the article.

The housing market will get better when the Chinese (mainland) stop poring money into Canada and find a way into the States.

Some areas in the California are improving.

…you “could write a book.” I doubt that. Please tell us where it is getting better, okay? And don’t forget to factor in the low interest rates when talking slightly higher price. You weren’t planning on doing that, were you?

Compass Rose fan, here, too! Thanks for taking the time to share your wisdom and insight.

In Poland we have housing bubble too. Maybe one year ago I`ve watched some videoblog on one of the economics portal in Poland. The editor said the same thing: “Why you want to buy a apartment and rent it from a bank, when renting on free market is cheaper than take a credit?” For the first two or three years of 30-40 years credit – you will be owner of 2 or 3 square meters of 50square meters apartment (name is misleading 🙂 ). This is insane – but people were and still are crazy – they had cheap credit (in CHF) and they didn`t think about consquences of their choice – “buy fast because it will be only more expensive”.

In Poland the subsidiary program is called “Rodzin na Swoim” which means “Family on their own” – but today we called it “Banks on their own”. But the program will be runned to 2013.

It`s not normal that average income of Polish (brutto) is only 0.5 of average apartaments square meter.

“People were sold a bill of goods by a bunch of smarmy libertarian neo cons raving about an “ownership societyâ€, based on bullshit, and reinforced by corrupt rating agencies without whom this entire Hindenburg could not have been financed.”

Don’t know why you’re raving about libertarians or neo-cons when none of then had anything to do with this, and Bush’s attempts to rein in the GSA were A) at least made and B) stopped with primarily Democrat opposition.

We’ve been a long time renters and have been the one’s looked down upon for doing so. We have been building up our passive income by buying rental properties (that in today’s market have no shortage of renters) with the goal of eventually having that passive income cover our rental expense. I’ve had serious arguments with home owners that believe home ownership is the best investment one can make. I obviously disagree…why not buy an investment property, have someone pay down the mortgage and the left over cash flow goes toward your own cost of living? Return of investment and return on investment.

When you see the sheeple jumping into an investment in droves…go the other way. It happened in the stock market bubble…people with no investment knowledge were suddenly traders making money day trading…everybody got in on it. The only ones that made money on that were the investment houses offering the IPO’s…a lot of people, lost a lot of money when that bubble burst. Same as the housing market…people buying houses with little or no down buying homes and/or using their home as an ATM…refinancing year over year. Again, the banks made off large by pooling these loans and selling them off…thereby encouraging less stringent underwriting and putting more sheeple into homes as an investment…prices always go up right? And as much as banks play a role…ultimately it’s the people who are responsible for their own choices…no-one had a gun to their head forcing them into high leverage loans. As I heard somewhere before…when the barista at Starbucks is giving you investment advice, it’s time to sell.

The advice given above is highly applicable.

The article reveals some burning questions and issues that should be discussed and explained, found something much like this page a couple

days ago – https://davidsmcdonough.com/7-mistakes-that-can-get-you-expelled-from-university/. Furthermore, it’s essential to comprehend

within the very detail. In the post, an individual can easily find something basic, remarkably for him/her,

something that can be extremely useful. So I am delighted with the data I’ve just obtained.

Thanks a lot!

Leave a Reply