Orange County inventory up 14 percent year-over-year and the art of house flipping. Taking a look at an affordable area in Orange County.

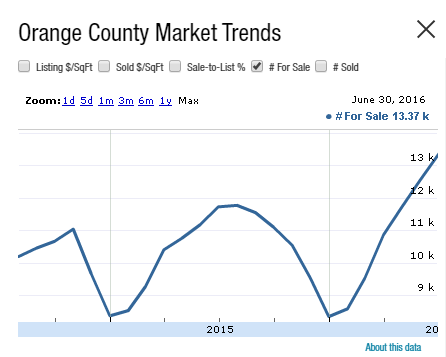

The honor of the most expensive county in Southern California goes to Orange County. There has been a nice steady increase of inventory in Orange County over the last year. You have places like Irvine that are building new homes at a quick pace (although a large number of these homes are being bought by foreign buyers and investors). There is now a healthier amount of inventory on the market. Inventory for the county is up 14 percent over the last year. Summer tends to be the time when inventory peaks so we’ll see if we level out at this point or begin trending lower. One thing that continues to go on is aggressive flips. These flips are happening in lower priced areas where older homes are typical. Today we’ll take a look at a Garden Grove property.

Flipping in the OC

If you are unable to afford a $700,000 to $1 million new home in more expensive parts of the county, you might want to try looking at Garden Grove. Of course “value†is a relative term here. Yet people are largely in these categories:

-1. Broke Millennials – a large number since 2.3 million adults live at home with their parents in California

-2. Foreign buyers – a healthy number of foreign buyers are buying in California (largely from China)

-3. Investors – this number has dwindled since current prices are simply not attractive to investors

-4. House humping couples – largely dual income families looking to buy before popping out kids

-5. Renters – 50% of SoCal renters are cash strapped (spending close to half of their income on rent)

-6. Flippers – those lovable HGTV people trying to add value and trying to make a tiny buck as well

Today we’ll focus on that last category. First, inventory is trending higher in Orange County:

This does mean there are more options this summer than in a few of the past years. Here is one flip in Garden Grove:

4 beds, 2 baths listed at 1,301 square feet

12142 Morrie Ln,

Garden Grove, CA 92840

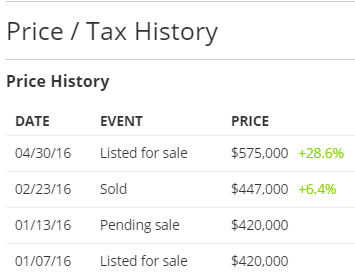

Some nice work was done here. Your typical HGTV inspired work. The place is listed at $575,000. Let us look at price history:

So a little history here. The place was listed for sale at $420,000 back in January. It looks like there was some competition here as it ended up being sold for $447,000 only a week later.

Obviously some work has been done on this place recently. Here is street picture from March of 2015:

The place was listed back in late April for $575,000. That is an increase of $128,000. Do you think that much work has been done on this place? Seems like a big jump in price only in a matter of three months for some HGTV work (between the sale date in January and the listing date in April). The place is still on the market.

Flipping isn’t an easy job. But in this market, it wouldn’t surprise me if it sells close to the current list price.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

91 Responses to “Orange County inventory up 14 percent year-over-year and the art of house flipping. Taking a look at an affordable area in Orange County.”

Inventory is up in the IE as well. It’s climbing in Corona for sure. It will be interesting to see how this affects prices come the fall season. There is a lot more housing available than there has been in several years.

All those areas, IE, Garbage Grove, Anaheil, etc are land-locked in as far as, it just takes too long to get to the beach so you never go there unless you do it as a vacation in a hotel down in SD or something. All of those places get really hot in the summer, are flat as a pancake, some parts have surprisingly high crime rates (generally gang-gang so less of a problem if you’re not in “the game” but property crime is a thing) etc.

Gangs active in Garden Grove:

Family Mobsters (FMS)

Garden Grove Boys (GG)

Korean Crazy Dogs (KCD)

Vietnamese Thug Family (VTF)

In April, A 15-year-old gang member on probation shot a man in a possible gang-related attack in Garden Grove. The 42-year-old victim was in a car stopped in westbound traffic in the 9400 block of Westminster Avenue in front Bolsa Grande High School.

http://www.ocregister.com/articles/police-713656-shot-garden.html

Siesmic – Leave it to the OC Fishwrapper to not put in any details about the victim; seems quite an age gap there and there’s nothing about race or what the argument was supposedly about. Could be an older member of a family deeply connected with a rival gang, or some good ol’ boy commenting on the marginal driving habits seen in Garden Grove, no telling.

You remember the old Tom’s Cycle Accessories store on Harbor? It was owned by an old friend (RIP) and he said the Viets were literally deadly serious about their billiards playing, and it was smart to stay away from their pool halls.

Where I am now, up in San Jose, there’s a little bar down the street. I went in one night to check it out, have a burger maybe, and it was full of Viet folks with that hokey music they love playing loud, and the atmosphere was not friendly. Not too much later, a guy was shot/killed in there – probably it is or was an off-the-books gambling establishment. I don’t worry too much about my safety here though, because of all the various “games” going on, I’m not in ’em.

I grew up in Garden Grove in the 90’s and can tell you it was much worse back then as far as gang activity is concerned. Overall, the city has improved.

I have a FB friend who grew up in San Jose. Her father was a federal judge. I posted something on Fb recently and she commented that her parents paid $16k for their house in San Jose, I want to say in the 60s. When her and family members sold it, it sold for over 1 Million. She said she “felt bad” for the people buying it, because they paid so much. Silly lady lol. No one forced them to pay that. Isn’t SJ pretty populated by Vietnamese? The lady that used to do my nails was a “boatperson” from Vietnam, and her father and brother live in SJ. Vietnamese gangs are cutthroat. Thankfully it seems thy’re in your area, skip my area and then are in Sacramento area. Here we just have Norteno/Sureno, and for the most part, they tag things up and kill each other. Recently they did kill a young girl who was in the wrong place at the wrong time with the wrong people. She wasn’t the target, but sadly she’s still gone.

Housing To Tank Hard in 2016!

No, You are speaking bull crap again Jim.

No chance there is a tank in 2016. 2017, ok i am on board.

I can see a tank in 2017 or 2018. Right now is feeling like the long slow gradual decline of 2006, with the tank happening in mid-2007, but “on paper” it really happened in 2008.

Don’t kow, it seems logical it will reset, but most of Cal defies logic whey it comes to real estate?

I would love to hear from someone knowledgeable about what you think the actual costs were on improvements, you know materials, loan costs, paying the workers to do the work and so on.

I realize it would be a broad guest, but I’d like to see what people think the net profit on a house like this would be. Thanks

It’s not just the materials, but the cost of labor, too. I don’t know if they used skilled or unskilled labor. There is a major difference in quality and cost.

There is also the friction cost when they buy and when they sell: escrow fees, title insurance, excise tax, RE commissions and that assumes a cash deal. Without the commission which is negotiable, the other cost can be 2% or more. These costs add a lot to the cost of remodel. If the flippers borrowed, add on top of that the loan fees and interest.

Flipping is a hard job and I don’t envy those risk takers. The risk is very high and the compensation is not the same as what you see on paper. After you subtract the soft cost (permits) and the friction cost, there is not too much left.

Not true. Just by browsing a few listings you can tell most flips..

Use unskilled cheap labor

Use cheap stock HD or Lowes materials

Obviously only pay commission on selling and even that is usually negotiated down (or an inside sale)

If there wasn’t profit in flipping you wouldn’t see so many flips. Duh.

Oh, and flippers pulling permits is more the exception than the rule.

Really think this flipper pulled permits for kitchen cabinets and electric? Hardly.

As far as cost, for a small 1300 sq ft house like this, new floor, cabs, quartz counters, bathroom tile, fixtures .. could easily come under 15k for a flipper who knows how to shop smart. Add labor, most likely unskilled for this type of flip, and total upgrade costs could range from as little as 20-30k.

Loan fees? I didn’t bother to look up if it was a cash sale, but even if so, fees wouldn’t be more than a few % of the loan value. Most flippers are partnered up w realtors, loan and escrow officers so they’re not paying the same fees as Average Joe Bloe anyhow.

Plenty of profit margin.

(Unless you’re a “builder” used to “builder-size” profits I guess.)

SoCal Rulez,

That was exactly my point – depends what type of materials and labor they use, depends if they pull a permit or not, depends on wether they use cash or loans and it depends to what extent they remodel.

My answer to the question was basically that there are too many variables at play to determine the profit. I forgot the most important variable – how much they paid initially.

Obviously it must be a profit or nobody would take the risk. Lots of things could go wrong and many inexperienced flippers lose money. If the profit would be really high or if the risk would be small, I guess every Joe on the street would have a guarantee path to success. As you very well know that is not the case. I flipped properties in 2005/2006 and in 2010/2011. Now, I wouldn’t touch anything; the risk is too high for the profit.

A true investor is not thinking only about the rate of return, but first and foremost about the return of the capital invested (capital preservation). In today’s market only the adrenaline junkies flip homes; those and those who don’t know what they get into. I have enough experience to know when to play and when to stay away, and I’m not an adrenaline junkie. Disclaimer: I do have my own capital so I don’t have to borrow.

Chinese top foreign buyers of US real estate for fourth year:

http://www.marketwatch.com/story/chinese-top-foreign-buyers-of-us-real-estate-for-fourth-year-2016-07-06

60% chance of recession:

http://blogs.wsj.com/moneybeat/2016/07/05/yield-curve-shows-60-chance-of-recession-deutsche-bank-says/

Garden Grove is a tough location. And, realtors say the low interest rates are triggering bidding wars on stuff under 1M. Crazy stuff. Possible that prices will surge from here.

what would trigger a price surge now? The market in S. Cali has been slowing drastically for months now. Even with lower and lower interest rates, buyer demand is diminishing. This is not to say people do not want to buy, they either refuse to buy at these prices or they cant afford to buy. Prices has no where to go but down from here. If and when rates do go up, that price decline will even more severe.

Just because things are different now….for the 100th time.

Inventory is starting to stick in the South Bay.

Slowing? Really? Someday, it will slow down. But we have more upside left before the slowdown.

http://mynewsla.com/business/2016/06/21/home-sellers-rejoice-buyers-brood-la-county-prices-soar-8/

There is no question that prices have been rising for the past few years. However that is exactly the problem.

Prices have been inflated for a few reasons, one of which is low supplies and another which is low rates. High demand is NOT a reason prices have been inflated. Demand is pitiful relative to demographics. Thus when you have inflated home prices due to restricted supply and low rates in a low demand environment, you have really everything to lose and nothing to gain from buying during these times. Rates are so low, chances are they will rise. Supply is also very low and we are already seeing inventory climbing. What will demand do? Unless we see a surge in demand, we will not see prices surge as you suggest. Rather we see demand soft still with no reason for it to surge. People are more and more in debt, wages are climbing minimally, the economy is still very uncertain and sluggish.

I do not have a crystal ball, but I see MUCH more reason for prices to dip than for it to surge as you suggest.

The article at that link focuses on price. Price and volume don’t always move at the same rate, especially with real estate.

jt is a troll, he’s using all the classic triggers just like last time.

you’ll see

Garden Grove has always considered a tough location even when it was mainly white back in the 1970’s. There were a few white biker gangs and Latino gangs even in the 1970’s. GG is split between Latinos and Asians which is good. Its less trouble than Anaheim or Santa Ana.

Go Jim go!! I can’t wait to see it happen, in the mean time though historically we should start to see at least a slight cool down in fall. This is an election year after all. Depending on who wins will also have an impact as well. Should be interesting.

I’d bet it won’t matter who wins.

It doesn’t matter who wins this election – a fascist (Trump) or a hitlerist (Hitlery) – pick your poison and you still end up dead.

If you’re going to apply labels, it’s better to apply them property.

Donald Trump is not a fascist. Not sure what a “hitlerist” is.

http://www.vox.com/policy-and-politics/2015/12/10/9886152/donald-trump-fascism

If anything Hillary (whom I’m voting for) is the Fascist, given the actual description of Fascism, AKA corporatism, which is the sort of uniting of corporate goals with social control.

Trump is more of a character like Huey Long “The Kingfish” from the 1930s. In this way I see him as more of a “hitlerite” in that, Hitler would have happily hitched his wagon to a pure Socialist party, a Fascist party, anything, as long as he got to be his meglomaniac self. An opportunist.

What bugs me about Trump is that he’s almost certain to do none of the things he talks about, and many of the things he decides to do for his own perceived benefit, on the spur of the moment.

you can’t wait to see millions of people lose their hard earned money so you can have a shot at buying property in ca? you must be fun at parties

Why would that be the case when private home ownership is at multi-decades low and the beneficiaries of recent price gains have been financial firms and private investors. Besides, it’s not the taxpayers’ job to subsidize private gains.

I’m an absolute blast at parties. As for losing earned income, I really don’t think the ridiculous price increases have anything to do with earned income. I’m a native Socal resident and have watched our real estate prices go up and down for decades, it’s all about the timing. When prices do drop, which they will, owners just need to hold on because they will make it back and beyond over time. I’m just waiting for the next drop to help my kids get into homes of their own so they will not have to move my grand babies out of state.

“owners just need to hold on because they will make it back and beyond over time”

we are coming up against a demographic cliff (as are most western nations) that is the game changer. The next 30 years are going to look nothing like the last 30 years, there just isn’t enough people to make that happen. And most of the next generation, the “asset buyers”, don’t make enough to buy said assets that the boomers are going to need to sell…..but sell to who? You even make the case that you have to ‘help’ your kids buy, that is not a recipe for long term price appreciation.

if we take the price that my aunts house in Huntington beach would sell for today vs what she paid for it, if that trend continues, that house will be $15,000,0000 in 2030. That’s not going to happen.

What do you all suppose would be the True fair market value of this Santa Monica house — listed at $1,850,000 — in an undistorted market?

https://www.redfin.com/CA/Santa-Monica/1720-Washington-Ave-90403/home/6769641

It’s a nice house, nicely remodeled. But it’s 127 years old — built in 1889. At least some of it is. I assume much of it has been rebuilt over the years.

No backyard, just a small patio. No front lawn. No garage that I can see, just a driveway which is used as a patio. Condo or apt dwellers looking down into the patio.

Did you see that size of the lot? tiny. How can anyone say what the true market value is? wont we have to wait till close of escrow to find out?

OK, how about if it sells for $1.7M would that be true market? yes.

5 years from now $2M? $1M?

It appears to have a one car detached garage along with a large parking lot directly behind it which I assume belongs to one of the many nearby apartment buildings. In fact this house is surrounded by apartment buildings. Who’s gonna pay 1.8 million to be surrounded by apartment buildings just feet away? This appears to be the only SFH on what appears to be a very densely populated neighborhood.

Garden Grove is also “affectionately” know as Garbage Grove. If one is near retirement age and sells their house in southern California, there are a lot of large beautiful homes in Oregon, Idaho, etc. going for 200,000-300,000! And you don’t have the horror of “Third World-ness” and the truly horror of horrors: Driving in Southern Califonia! I have a 2.3 million dollar house in Pacific Palisades that has been in my family for three generations and it is paid for. I will be 68 soon and will retire from a government job. I am getting the h#ll out of Southern California before the civil war starts between La Raza and the our fellow Americans.

Spoken like a true government employee…and I am one of your ilk (at least for another week or two). Pull the cord and jump out of the mess that we created in Kalifornia

It’s interesting. The sudden upswing in the civil unrest (race war) doesn’t exactly forebode a bullish horizon for urban living. But it would be sort of just desserts for the millennial SJW crowd whom have been mostly responsible for this decade’s urban renaissance. Safety is as important as shelter. Perhaps shit is about to get real.

Charles Manson was not able to bring on a race war but these SJW idiots may just be able to pull it off.

I don’t know why they want this – have they lived where their tribe is but one of many, where another tribe is the one in power, and where they’re doomed to work the shittiest jobs, or no jobs at all, because of being born into their tribe?

If things get real I doubt they’re going to fight for the very tribes that want to wipe ’em out.

Rich white celebrities have been promoting Muslim immigration into Europe. Lots of re-tweets of articles about sympathetic refugees, noble refugees, the young Muslim girl who dreams of becoming a doctor, etc. Tweets on how to contribute to groups funding refugees. Angry tweets about Trump and Brexit. And these celebrities’ solution to any increase in violence is to ban all guns.

The Game of Thrones cast welcomes refugees into Europe: https://www.youtube.com/watch?v=dCe0Nz7Ie90

Rich white celebrities and CEOs are astonishingly hypocritical. They live in safe, mostly white bubbles, with lots of security, armed bodyguards, panic rooms. They welcome in poor, violent, often anti-white racist refugees, who are often dumped on poorer whites. The celebrities pat themselves on the back for their progressive values, which are paid for by their poorer fellow countrymen.

Son – and they think they can do these things with no backlash, with no efforts toward self-preservation by the non-rich. Their own parents – unless they’ve been rich for generations – would be voting for Trump or whoever they think will repel the foreign horde.

My biggest problem with Trump is that there’s very little chance he’ll do what he says he will. I feel he’s just saying what sounds good, to get elected, then will go right on ahead and do whatever he thinks will benefit him personally, and he’s not very smart. Same as with another Fuehrer decades ago – do you think the rank-and-file Germans would have voted for him if they’d known it would have meant going into WWII, and fighting WWII the way their Fuehrer dictated? You know, they could have won the thing if they’d just gone East, and fought the USSR with the West’s, and the US’s, blessing. The rest of the world would have been comparatively easy to conquer, most of it with no bloodshed but merely through elections. France rolled right over, and England was going to also if it weren’t for an upstart named Churchill. And Churchill only had a leg to stand on because Germany didn’t go straight East.

No, if Trump gets elected it will be because the rank-and-file still have some fight in them but Trump will likely find some stupid war to get into, and a big one because he doesn’t do anything small.

Who owns the tv/movie studios and who are the producers, screenwriters, casting agents, etc? The matzo mafia gives the actors their marching orders or they’re out of work, simple as that. They take the money and retweet the lies from the safety of their gilded cages.

If you’re sitting on all that equity why in the world are you waiting until you’re 68 to get out? Why haven’t you already sold and left?

Jeff: Answer; a coalescence of circumstances.

BTW, I It is not a state or local position I am retiring from. I never voted for the kind of policies promoted by the likes of Gov. Moonbeam! I have never hired an illegal alien or one of their Anchor litter. I am also concerned about the Islamo-Fascist invasion of our country. Just look at what Merkel in Germany has done to Europe. Sweden has virtually been destroyed from within!

The guy I work for still works his ass off at age 67 because he got suckered into the high tech scam. Yes, I’ve told him how much better off he’d be if he’d just gone to work for the Post Office like his dad did. He agrees.

Hell I’d have gone to work for the Post Office myself, but in my universe, white people don’t get to work there. And the oligarchs are puzzled at where the anger just below the surface comes from.

Not OC but just curious what the commenters think of this:

https://www.redfin.com/CA/Torrance/22306-Ellinwood-Dr-90505/home/7717053

Great area for a long term investment. I would negotiate the price lower because of the unusual structure. But, that one would work.

Not worth half the price if people weren’t out of their minds right now. If I were a research chemist, I would name the drugs I invent “Calitarded”, “OC-URFKD”, “LAderp”, etc.

Needs a lot of work.

Nearly $900k (after closing costs) seems overpriced for a large, but somewhat crappy, house in Torrance. But then, so many houses seem overpriced to me. And yet, many of them get sold.

Hideous, Miss American. Looks like someone attached a goiter to it.

How close is it to the refineries in Torrance?

On the morning of February 18, 2015, the ExxonMobil oil refinery in Torrance exploded, causing chemical ash to rain on the surrounding community for hours.

http://www.desmogblog.com/2016/05/31/why-there-could-be-more-blasts-2015-exxonmobil-torrance-oil-refinery-explosion-putting-millions-risk

Way too high priced for a basically crappy house that could use additional cosmetic renovations.

Wretched flip. Every cliche but the use of subway tiles. Cold, hard and characterless. IKEA grade cabinets. Every bit as bad as any tract home of the 60s 70s 0r 80s.

Kitchen looks like it could come out of office building in the city. WTF is this ?

$575,000 for a questionable flip ? Depressing what cynical “investors” will throw at the masses. Just throw some shiny counters and cheap flash at and it will sell.

And it will play to the house horny masses who will gladly string themselves up to a bank’s 30 year claim on their future labor.

I don’t know which is more sickening. A cheap and nasty flip or the delusional sucker who’ll buy it.

The on!y thing worse is your Government calling this a policy success actually…. and indeed it does at every level. “Everyone is canon fodder now so let’s blow The Hugest Bubble Ever-er Say Never-er and then call the Winners the Master Blasters.”

What’s really funny is the US Senate now going after AirBnb as “dangerous.” There was a huge party at an abandoned Marylin Mansion on Long Gisland replete with champagne swimming pools, loud live music and trashing the place which “even more shocking than Syria!!!”

Right on time. I have suspected for a long time this is how they would exit. Good luck everybody!

Blackstone Tenants Get a Shot at Buying Their Rental Houses

http://www.bloomberg.com/news/articles/2016-07-05/blackstone-s-tenants-get-a-chance-at-buying-their-rental-houses

Yep, insiders have been telegraphing their intentions to cash in for over a year. I’m surprised that they’re not waiting for wealthy Chinese investors to swoop in with their suitcases full of cash. Oh wait, even foreign buyers are scaling back due to domestic economic troubles.

Yep Phoenix has topped out and is starting to turn. I looked at new homes there last month and the builders are giving away crazy incentives – closing costs, $15k upgrades, swimming pool thrown in, etc.

The hedge funds selling to tenants is not a good thing. 1/ Tenants are buying at the top of the market. 2/ They are using ever increasing creative ways to fund the purchase.

Expect these to go into foreclosure in 2 or 3 years.

Same old same old – sell to the next greater fool.

Great link! They are starting to leave, I love how the article skews it to sound like its such a positive thing. Man… the news is so out of touch.

Great article. The rats are fleeing the sinking ship. Jim may be right after all. This is likely the top of Bubble 2.0.

California will always be nice, as long as you’re within a 5 mile band by the ocean. This area will always be detached from the real world in the same way that the French Riviera is detached from urban decay in France.

That being said, these prices are just laughable. Especially the inland values.

That 5 mile band seems to apply everywhere from San Luis Obispo (could be all the way North also, I dont know) to the Mexican border with the exceptions of pockets of barrio in Oxnard (Ventura County) and Gardena (LA County).

So, what’s up with Oxnard? Is Gentrification in its future, or will it always be “Gangland by the Sea”?

California will always be nice, as long as you’re within a 5 mile band by the ocean?

Maybe, maybe not.

For example, hundreds of migrants set up a camp near actor and immigration activist George Clooney’s exclusive Italian villa on Lake Como.

http://www.dailymail.co.uk/news/article-3692844/The-posturing-actor-s-Italian-idyll-awash-migrants-neighbouring-nations-slam-shut-borders-tensions-rising-favour-unlimited-migration-Mr-Clooney.html

This price is about what 1500-1600 sq ft houses sold in our North OC suburban neighborhood 2 years ago. Our area isn’t in the hills but you can see them from here, and the streets don’t flood when it rains due to a nice slope. We’ve got a few new young families on the block, as well as a loud partying Mexican immigrant contractor who picked his house up at a bargain about 15 years ago. (He’s not a real bad guy to live near for the most part. He just has a lot of relatives over every so often and they like loud music.) The three other hispanic families on the block are quiet as mice. We may have another house for sale on the block soon (just a guess…he hasn’t told me yet that he’s moving out). I’ll be interested in seeing what it goes for. Hopefully not to a flipper.

They’d better hurry.

After last week, it seems as rioting could occur relatively soon in a number of major US cities. That will only make the desirable areas with good police forces have a big price jump since everyone will be willing to pay the price to be safe.

Furthermore, the riots will show America how many illegal immigrants are willing to riot. This is bad for Obama and Clinton policies.

I heard back to back ads on the the radio today for two different house flipping seminars. The first one said you’d make $10k a month. Then then next one less than 30 seconds later said you’d make $20k a month.

Seems like anyone who signed up for the first one is a sucker! /sarc

These “seminars” were all the rage towards the end of the last bubble, too. The flippers run out of houses to buy at the right price, so turn to holding “seminars” – at $40,000 a head, to teach the amateur latecomers get-rich-quick suckers how to “make $20,000 a month!”.

Same old thing… just 9 years later.

The real question is if anyone thinks the real estate crash is coming sans interest rate hikes? I still can’t see the driver for this implosion other than prices climbing to a breaking point and then flattening. In other words, without the cost of money going up (rates) the bubble will expand and then flatten to meet demand essentially walking on the head of a pin until some sort of economic headwind that blasts it all. Other than wacky prices alone, nobody is certain what will cause inventory to spike and then market to reverse itself.

Everybody’s wrong. Always. 2 weeks ago Brexit was going to sink our economy and cause the bubble to burst. People were saying it on this blog. I talking to you Jim Taylor.

As of today the stock markets up over 18,200. Bounced back in 4 days from Brexit! Everybody’s wrong. Always!

Stock market at all time highs. Interest rates at all time lows. No tanking in sight!

Hilarious. Gas pedal mashed to the floor, speedometer at all time highs, fuel level at all time lows, obviously this thing is geared for success!

Fed are printing money and buy all those stocks it is manipulation fed are so greedy

“than prices climbing to a breaking point and then flattening”

other than the fact that they have never done that in socal the breaking point is “which one of your kids, on their income alone, can afford to buy the house you live in”?

the boomers have to sell their assets (eventually) to a smaller demographic that earns less income…..show me the math on how that works.

There has always been only a tiny sliver of first time buyers who could afford the house their parents live in.

Yes, there will be a shrinking market for boomers to sell into, I get that. But your first claim is irrelevant.

I should also add: boomers never retrench. They’ll hang on to that phantom equity all the way to the bottom.

What do I expect from my generation whose greed and materialism far surpassed our parents, with none it’s financial prudence?

An inheritance as the keystone of one’s retirement plan is pure folly.

First, location, location, location, is everything in real estate! The rest of the assumptions people are making to justify house prices or their purchases on the west coast, are in my opinion ‘feel good’ rationale, or realtor hype, and have little basis. The laws of supply and demand always ebb and flow, and usually the ‘tell’ is missed by 99% of those hoping to capitalize! While certainly not everyone who has bought a home wants to sell, the mindset of real estate has changed from a place to live, to an investment … how much will my home be worth in 5 years, 10 years? Anyone who is looking to capitalize on the rampant appreciation and doesn’t have that sacred location, location, location, is playing Russian Roulette!

Jed,

My recommendation is for you to ignore the stock market. A light bulb burns brightest before the filament burns out. Its not different this time.

Don’t expect the Fed to see the bubble as inflationary either. Although home prices go up a lot, the weights they assign to Housing is a pathetic 15.9%. Yet mortgage lenders often factor in 30% of gross in their lending limit. It’s like they adjusted their math to put proverbial blinders. They’re full of excuses too on why not to raise rates. Keeping rates low just helps Big Corp get bigger and the middle class get poorer.

http://nexthousingbubble.com/macroeconomics/fed/2016/06/28/why-housing-bubbles-do-not-directly-appear-on-fed-inflation-reports.html

The house listed is close to Disney Land so you would get your daily dose of loud fireworks at 9:00 pm, very annoying. My house is 5 mile south of here (in Garden Grove bordering Fountain Valley) and I can still hear it. That is not the good part of Garden Grove being close to Anaheim. That house at current market value is $520,000 top for the location and square-foot. Maybe the flipper can break even if they reduce the price by 10%. I don’t know maybe they put about $35,000 worth of repair and looking to score something around $60,000 in profit net the fees. This market is not stalling but it’s going nowhere fast so it will sit some more and my guess is they will cut the price by $30,000 to draw in some suckers [buyers].

I am a CA real estate investor, but wife and I decided to peruse the state of Idaho this week and look at real estate. A wonderful state with some truly amazing people, but I must say prices are super rich here as well. Comparable to where I live and invest in California. Boise has been so overbuilt with high density housing and snarled traffic all over the place. I feel sorry for the natives. Especially for their having to deal with the hoards of Californians who have turned downtown into a hipster fest and jacked up their real estate prices. Even Idaho is getting Californicated. Wow.

Government sponsored insider scum taking that freshly printed money and spreading it and their demonic ideology everywhere they go like locusts. All governments are doing this now, which can only result in war.

Wow, Boise was different about 10 years ago, I remember an article complaining about conservative Orange County people moving there but if you want ID it has more to offer unless you are retired.

Brb,

The FED knows all about the bubble in housing because they create them intentionally. Keeping rates low indeed does help fuel the bubble, their goal. They are not interested in raising rates, that is just a side show.

Got gold…..the house of cards will fall with the new admin, no matter the party…

so let it be written, so let it be said

45 days on the market according to Redfin. Properties like these are starting to sit longer and longer both in the OC and in Nor Cal. The messed up thing is as a bay area resident, I look at the $575K price tag on this house and think how cheap it is.

At some point the market will start the shift from sellers to buyers. I believe we are just at the beginning of that transition.

Good Lord. That house in Garden Grove is the same # of beds and baths and 6 sq ft bigger than my house in Northern California, that I paid $179k for in 2009. My house was a flip, BUT, the person that does the flips owns a Heating and A/C company, his wife is a realtor, and he’s a millionaire from flipping homes. He’s not in and out in a week, throwing things together that are going to fall apart weeks later. His name is known out here, and people want his houses. I was paying $1500 rent for a 3 bedroom house from 05-07, wondering how others were buying homes $400k+. A few years passed and those people I wondered about had their homes foreclosed, including the one I was renting, so I had to move to an apt. When the bubble was bursting, I saw my only chance to own a home here. Last month, my exact floorplan 2 streets over sold for $330k. Doesn’t have solar panels, newer roof, landscaping, 7 yo old furnace and a/c like mine either. I wouldn’t pay $330k for my house. My mortgage with taxes and insurance is $860. I’ve had to replace the plumbing due to a leak because a co used bad pipes in the Bay Area years ago, lost the lawsuit and filed BK. I’ve added simple things like solar screens, carpeted the garage and painted it, just bought a new hot water heater, changed the flowers in the front. The apt I lived in before moving into this house in 09 rented for $825 when I moved in 09. Now it’s $1500. I literally CAN’T afford to RENT. That’s ludicrous.My friend lives in an “affordable housing” apartment, and her rent is $1100. If you want to see my crap shack, google 802 Spoonbill ln,94585. Note the pics were taken in 2009 though, so the flowers and bushes have grown a lot. I do need a new driveway, but other than that, I feel I got a pretty good deal on my Crap Shack 🙂 I’m 40 miles from San Francisco. There’s a bridge you cross way before SF, and the motto is “Once you cross that bridge you can’t afford to live out there. It’s 1000 times worse the closer you get to Berkeley, Oakland, SF, and San Jose.

Leave a Reply