Winter in summer: Orange County home sales post worst first quarter of sales since the Great Recession.

In the housing market, home sales are a leading indicator as to where prices will head. The priciest county in Southern California is Orange County and it has now faced the worst start of a year since the Great Recession ended. Sales are low. Extremely low. We have more people in the county since that time but this is a question of affordability. And it is no surprise that we’ve already seen the median price of a home in Orange County dip year-over-year for the first time since the housing bubble burst. Yet the economy is great right? Things are looking fantastic, right? We have multiple bubbles going on right now with student loans, auto debt, and with housing. While the NINJA loans are gone we are now seeing the housing ATM picking up and people pulling every single penny to overextend themselves into properties on “secure†30-year fixed rate mortgages. Now what happens when the inevitable next recession hits? Just take a look at home sales in Orange County.

A poor start to the year

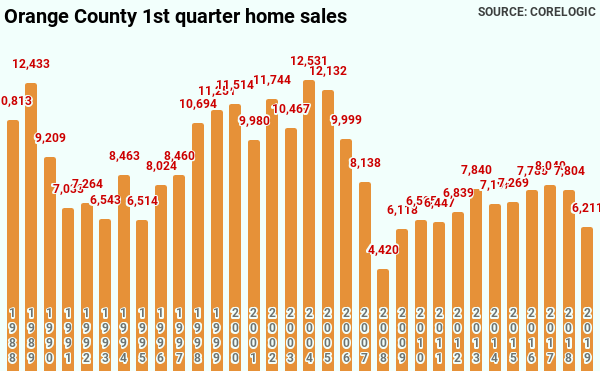

The Orange County housing market is off to a very slow start. In the last couple of years, we have seen people scrimping by to get in and of course the housing appreciation train has gone into a ridiculous clip. When a home in California is appreciating at the rate of the annual median household income of a U.S. family that is simply nuts and unsustainable. In other words, you can buy a crap shack in California and just by default it will “appreciate†by more than the gross household income of a U.S. family that is actually working in the economy. Of course people get delusional and forget about the past. Take a look at this telling chart:

Source: OC Register

“Yes, only other two years — mid-crash 2008 and 2009 — have been worse in at least 32 years.

So it should come as no surprise that Orange County’s median sales price for all residences was down 2.1% in a year to $710,000. Prices rose in only 36 of 83 Orange County ZIP codes.â€

As a leading indicator, this home sales report is telling especially since the stock market is blistering hot and frothy and all the talk of being tough on China doesn’t really help Orange County since many investors from China purchase in the area.

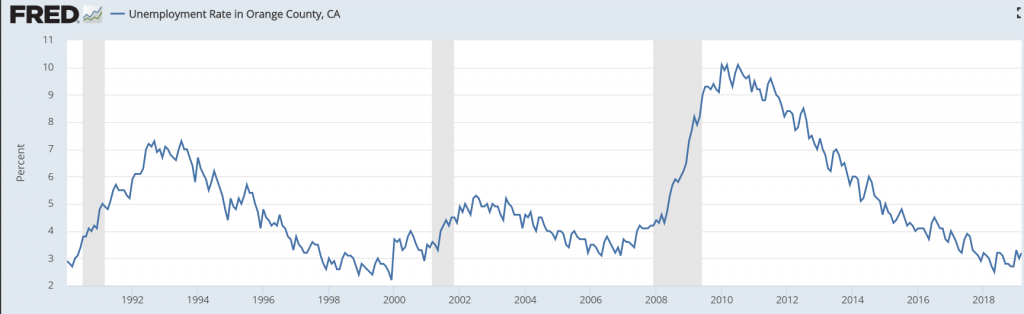

This correction is bound to happen and Californians are one of the most cash strapped buyers in the nation. In Orange County with a median home costing $710,000 a nice chunk of net income is going to pay for that mortgage and all other associated expenses (e.g., taxes, insurance, maintenance, etc.). Then factor in costs like daycare when people grow their families and you realize people are one paycheck away from missing payments even with a healthy household income. The more troubling thing about the decline in home sales is that by all accounts, things look great in Orange County:

Looks like the last time we were in this range was in 2007 and 2008. And here is the thing, in Orange County many people are tied to the real estate industry for work: commercial builders, new home building is very high right now, leasing, financing, equity being tapped out of homes, people feeling wealthy buying expensive goods, and you get this entire eco-system that depends on housing going up. But as the narrative now changes, what do you say when year-over-year prices are going down and sales are near Great Recession levels. Buy now or be priced out forever? And these are the good times.

[stock chart]

The stock market is up 326 percent since it bottomed in 2009. That is a nice run. Yet somehow, housing can’t continue to go up even with all of this good news because it is inflated overall. Why? Because we are in a low interest rate trap. We are now addicted to this low rate environment. But we’ve maxed it out short of no-doc no-income verification loans entering the market or incomes shooting up dramatically. Housing sales are pointing to a market that now looks frothy.      Â

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

225 Responses to “Winter in summer: Orange County home sales post worst first quarter of sales since the Great Recession.”

Homes are still selling in the Inland Empire but taking 2x as long as last year. Area’s I am looking at have not surpassed 2006 prices and its gone down a little bit this year. I think prices are going to be pretty flat until they do something with interest rates (up or down) and then we have the election in 1.5 years.

If you own in the IE it’s time to cash out. Prices in the IE will not be as high as today for a very long time. Highly overpriced. Sell before it’s too late!

Over the last 40 years I bought four houses in southern california for my family to live in. I bought none of them based on whether the market was going to be at the top or whether the market was at the bottom. It did not matter where the market was I bought the houses based on what I needed at the time. First house i bought just to have a house, second house better neighborhood, third house stupid reason i wont mention, and last house in Chino Hills to be closer to work. It worked for me.

That’s great Miguel. Pls keep doing that. We can’t have bubbles without people buying high. Imagine everyone would save in good times and buy on discounts?! Boom and bust cycles wouldn’t happen and I wouldn’t be able to profit when it crashes again.

My god i have lived a very happy and productive life until now as i just found out from the smartest kid in the world that i’ve been very stupid and i should of been trying to make more money than i did by timing the market. Forget family happiness just think of the big bucks.

Miguel, sry I wasn’t clear. I am not trying to talk you out of what you are doing. You are coming to a housing bubble blog just to tell us how happy you are by buying high. By all means, keep doing what you are doing! I am encouraging you. You are buying high and you are happy. Nobody will ever say anything against that. I am happy not buying, seeing my cash balance increase and my bitcoins exploding. I am waiting for a nice crash to deploy my funds. We are both happy doing very opposite things. I am not here to convince anybody to do what I am Doing. I am here to learn and share my strategy because I am always interested to hear what the critics say. So far I haven’t heard a single reason why it would be a good idea for me to buy high. Remember, my rent is dirt cheap compared to buying. So why rush into it and not wait for a nice discount (50/70%)?

Buying overpriced real estate makes your family happy? Interesting. Sell now while you can.

Just cause the market is high doesn’t mean I should sell my house. If I sold my house for a profit I would have to buy another home or rent. I will not rent as you are making someone else rich(er) when you do. I suspect you have no children and can just pack up and leave when you want.

You can time the market or try to but you still have to live somewhere. If I sold now I might have to wait 3 years or longer for the market to come back down. Also, it is not a fact that the market will come down. I suspect that we are going to have stagnation or period but I think we have a new normal as far as housing prices.

Everyone swears the market is going to crash worse than 2008, but that will only happen if millions start losing their jobs and have to walk away from their homes.

Milli: So far I haven’t heard a single reason why it would be a good idea for me to buy high.

Thank you, Captain Obvious.

Everyone knows to buy low and sell high. You’re not smarter than anyone else for saying that.

What nobody knows is when the market for stocks or RE has peaked, or reached a nadir, or if it will continue to rise, or begin to fall, or what.

Jordan, “Just cause the market is high doesn’t mean I should sell my house.â€

Thank goodness. If everybody would wait for lower prices I would be able to by 50% off.

Yes, correct. Times will change. Unemployment will not remain at 3% forever.

Son of landlord,

I think you haven’t paying attention. Most real estate cheerleaders love to buy high. Miguel for instance told us how happy he is to by high, low, whatever. Mr landlord bought amazon at 2000 and that December was a buying opportunity. New age seems to think now is a great time to buy and the joker jt thinks the RE market is cheap. So yeah, I am smarter by saying wait and buy when it crashes. A lot smarter.

Oh i should of added that i traded up each time. First house bought in Bell Gardens for $15,000 and i have no idea if the market was up or down. But then it gets good cause every time after the first house i would make big profit when i sold: doubled that house, second house more than doubled, third house tripled original cost now last house tripled original cost up to about $900,000. So to me it did not matter cause i sold high and bought high and living the good life. Not going to move even if current house drops to original cost. No need to cash out when life is good dont change it. No one knows what will happen to the housing market but if anything is like the past prices should be dropping on houses in Southern California soon.

“ if anything is like the past prices should be dropping on houses in Southern California soon.â€

Miguel, very true. Prices will fall like a rock and always revert back to fundamentals after an artificial run up. It’s the normal boom and bust cycle in California. If you buy during the bust, discounts of 50-70% are common.

I got an OC realtor email this week titled “the market is picking upâ€. And that “As of May 1, the median sale price for Orange County homes was $724,000. Up $24,000 (+4.0%) from last month, and down $10,000 (-1.4%) from the same time last year.â€

Yep, realtors are allowed to lie and make up shit. It’s allowed because we need the last suckers to buy before it crashes.

Dunno about SoCal but it’s full steam ahead in the Bay Area. Friend just had a bidding war on the home he was selling. 750sq ft listed 1.3 million sold for 1.6

This marks the era of The Great Stagnation. Just remember that I coined the term!

But on a serious note, don’t expect massive price drops. If we’re lucky we’ll get 3% drops a year for the next 5 years coupled with some inflation instead of that 50% off sale some people on this blog seem to think is imminent.

@New Age, CA has always been a boom/bust economy. High highs and low lows. What makes you think this time is different?

“This time is different” – didn’t I hear this before somewhere????!!!!….

New age has no idea what he is talking about. He is trolling this blog. Everybody with a brain knows we are crashing hard in California. It’s the same cycle every ten years. Boom and bust. People who follow the market and/or live in California have mentioned it countless times.

You are far too young to say CA is and always has been boom and bust. First of all.. there’s been a total of 2.5 booms and busts in the last 30 years. The first one as due to the savings and loans crisis… the 2nd was the dot.com crash.. that’s the 1/2 crash. And the third the worst, was 2008… which was a scenario that can’t be duplicated again based on new banking rules. We’ll have a sell off sure… but it will be much milder than the 2008 crash… which was a perfect storm of sorts.

I couldn’t agree more with you sillymilly. In the past 30 years the market crashed 3 times. Every generation gets a few buying opportunities in their lifetime. Millennials haven’t had the chance yet but nothing goes up forever. We’ll get a nice crash and will buy low eventually. Good times ahead! We are close to the big one (50-70% price drops).

Silly Millie,

I am old, very old, and I’ve seen it all before.

You are correct. The housing market crashed 3 times before the BIG ONE.

In the 70’s, 80’s and 90’s the crash was about 10%. For the BIG ONE, Our Millennial was correct and it was 50%-70% similar to the last BIG ONE 100 years before in the late 1920’s.

I’m a betting man. My bet is the BIG CRASH will happen every 100 years (when Our Millennial is 130 years old. Thanks to Our Millennial and myself working in health tech. This may happen.)

My advice is take advantage of the typical crashes of 10%-20%. Buy and hold your house for 10 years and you will not lose everything and foreclose. No Matter When You Buy.

When Milllennials turn 80 (and I’ll be 150), they will be secure with a paid off mortgage and a $700/month insurance and Property tax bill (Thanks to Prop 13)). Meanwhile, with inflation, rent will be $15K per month. Sad…. As some say. They will be posting on Dr Housing Bubble who will be approaching 200 years old at that time on how unfair it is for the Millennial Generation.

My thoughts.

If Trump continues what he is doing and driving up the deficit, we will see massive inflation. Trump is thinking 2 years down the road and driving up US debt Biggly to get re-elected during what he quotes is the “Best US economy EVER” Trump is correct, if you keep pouring fuel on a raging Obama economy, it will still grow. However, it will elventually go out. Trump wants to be elected and he doesn’t care about the long-term economy.

FYI, that is why I am voting for Bernie in the next election. I care about America and not just my immediate net worth. I guarantee, Trump will be a citizen of a tax sheltered state like the Caymans when this happens. MAGA with Bernie!

Here’s why there will be a very long but sustained sell-off that will, in fact, lead to at least 50% reduction in prices over time in inflation-adjusted dollars:

1) This whole mania began in 1998, coinciding with Baby Boomers beginning to receive inheritances and entering the highest earning years of their lives. This massive generation is starting to hit their 80s. At some point, they NEED to sell their giant McMansion and downsize. Just like they bought all at once, they will sell all at once: and that time is starting now.

2) Housing is a leading economic indicator of economic slowdown. The Baby Boomer Sell-Off is starting at the same time as the next recession is becoming a larger and larger gleam in the eye. The Trump Recession may not be deep like TGR, but it will likely be long.

3) No way do Millennials and Zoomers have the money to buy 3,000 – 4,000 sft house at massively inflated prices; nor do they want to. Tech jobs can only go so far and can only ruin so many neighborhoods. The rest of us have to live with real salaries in the real world — and with our meager retirement savings and massively high health insurance costs growing ever bigger (sky high premiums, co-pays, and deductibles.)

4) At some point, people will see how literally insane it is for 40% or more of their gross economic output or more to be transferred directly into the hands of real estate bankers. There is a revolution coming in public policy around California housing with the sole (and noble) purpose of driving housing costs down in relation to incomes.

5) This bubble is bursting without the weird unsupportable mortgages. Think about that. The last bubble was obvious because their was so much fraud in the market. This time, not as much fraud, just a massive list of actual, real world fundamentals pushing on the cost of housing.

The Perfect Storm is brewing. This ridiculous bubble that began in 1998 — where housing prices jumped and jumped and jumped out of all proportion to any previous California boom ‘n’ bust cycle — this Tulip Mania of the late 20th Century — is finally coming to an end. The unwinding will take 15 years at least. (Think Japan, 1980s.)

Thus spake Betty Rubble. Listen up, Fred, Barney, & Wilma! You too, Pebbles and Bam Bam!

We’ve heard this baby-boomer sell off before. 10,000 people per day have been retiring for about a decade and was supposed to cause the dead-cat bounce after the crash of 08. Well, it didnt at all. Why – boomers let their children and grandchildren move in, and rented out their houses on AirBnB and rented out rooms to cover their costs in their senior years.

On the other hand, god help anyone who is buying a home over the next 3 years, because around 2022, there will probably start a long slow grueling unwind.

Boomers, what can’t they be blamed for? Boomers of the 2010s are like Bush of the 2000s. Everything bad in the world is their fault.

LOL

Great post! Individually there are some very nice boomers. My parents are boomers, I love them. Collectively though they are the worst generation in the history of this country. The first generation to not leave the next generation better off than they were. Selfish b*stards.

Josh: Collectively though they are the worst generation in the history of this country. The first generation to not leave the next generation better off than they were. Selfish b*stards.

Generations are not omnipotent. They can’t determine world trends. What control had most Boomers over globalization, and the resulting race to the bottom in wages?

Also, perhaps the most destructive political act post-WW2 was the 1965 immigration reform bill, which opened the floodgates of Third World immigration into the U.S.

Boomers ranged in age from 1 to 20 when that bill passed. They had nothing to do with it.

Son,

Don’t confuse them with facts or logic it makes their little millennial brains hurt. Loser milenials still living at home with mom or dad need someone to blame for their pathetic lives. So they spun the wheel and landed on “boomers” as the cause of their misery.

@sonofalandlord The Boomers may have been kids when the traitors foisted their demographic revolution on them in 1965. But as adults they acquiesced in it, benefited from the economic growth it fostered, and built the cultural, legal, and political infrastructure to defend it. The result is a massive destruction of social capital which many celebrate, believing that new social capital is replacing it. It’s not. Boomers may not have started the fire, but they absolutely poured gasoline on it and bathed in it’s warmth.

New Age,

What leads you to believe that California RE will not to what it’s done every single time? This is the 4th bubble I’ve witnessed and every single time the pop has reduced prices by 50% or more. Please explain in detail why this won’t happen again, use pictures and graphs if you have to. TIA

according to zillow the house I sold in 2005 for $460K bottomed in 2011 at $195K, that’s a +50% drop

@interesting

So your logic is that because it has happened in the past, it must happen in the future? Seems a little strange. Perhaps you’re saying that because we had a massive decline in 2009, we must get the same massive decline in the future? I’m not sure I follow. At any rate, to get a 50% reduction in asset values, we need a financial crisis. The recession of 2009 was exceptional. We hadn’t had a crisis like that since the great depression. Are you reasoning that we’re going to have another crisis of the same magnitude within the near future? What will be the impetus? Is it possible that we may have a smaller correction? Is it possible that we will go longer without seeing a recession? Is it possible that we’ll just stagnate? I think all of these scenarios are possible, but what seems a little outlandish to me is to say that because we had a massive decline in prices at some point in time, it must happen the same way again.

Let me re-iterate what I said to clarify a bit more. You won’t see massive price drops hit all at once like we’re used. What you’ll see is gradual declines over a certain time period (I’m estimating 5-10 years) of about 3% nominal per year. This is because most of this market is has been fueled by widely printed hard money rather than credit like the last book/bust. What this means is that it’s a pretty sustainable market on the sellers side, there aren’t many factors that will cause them to miss their low interest payments. The buyers side however simply doesn’t have enough money to buy at these levels so what you’ll see is a game between the two where the sellers inch lower and lower over a few years to entice buyers into buying. Of course inflation will also erode home value away at a rate of another 2% a year and what you get is a 30% price drop in value inflation adjusted by year 5 and UP TO a 60% drop by year ten if the trend continues (which I highly doubt it will). Before you go attacking me about why I said 60% drop when I normally make conservative estimates, if we’re going to entertain the highly unlikely idea of a 50%+ drop then this is how I believe it will happen. It won’t be overnight like the one, it’ll be a long drawn out process that we barely feel because we’re used to seeing value in nominal terms not inflation adjusted. Inflation is going to be a HUGE player in the next decade as the consequences of freely printed money will eventually catch up to us. In other words, that $500K house you’re looking at will probably sell for $400K in 2025 and not many people will realize that’s equivalent to about $350K present value or a 30% discount because it takes a while for people to calibrate their price guage. It’s not one of those “this time it’s different”situations. It’s the same thing just a different means of devaluation that we’re not used to.

Appreciate you thinking about price increases in inflation-adjusted terms. Most people look at prices and assume that $1 in 2006 is worth $1 today. They can’t help but scream “bubble!!!” when they look at the Case-Shiller Index and point to the fact that the index is above it’s 2006 peak, all the while ignoring the fact that on an inflation adjusted basis, the index is below its peak.

Inflation will be the biggest factor in the housing market in the next few years. You cannot ignore it and if you do, you will pay the price in opportunity cost. What most people including millennial fail to understand is that what seems like a sour deal on the outside is actually a steal once you analyze the price with inflation in mind. I just closed on a flipper in Riverside for $400K, about 5000 SF on a acre lot with mostly usable land on top of a hill, three stories a HUGE overhanging deck with 360 degree views of lush forest and city lights. It needs about $70K of work to get it up to it’s maximum potential but it could easily sell in this market for $750K to $800K. My parents 4000 SF cookie cutter house in a standard neighborhood in Riverside peaked at $750K in 2006…that’s almost $1M today. THAT is outrageous. The house I’m sitting on now is a bargain by comparison but let’s assume the bubble deflates which I admit is looking like the case. It’s not overnight so there’s no rush to frantically unload it. On it’s worst day I can put it on the market for $600K and sell it in seconds. Boo flippin hoo. You can’t tell me that there’s no money to be made even in this market. That’s why I ignore doomsdayers and keep racking up my money.

New age, your last post was very telling and is typical for recent buyers. Recent buyers often go on the internet and seek confirmation that buying at the peak of the market was a good purchase and the right choice.

We all have to own our decisions but it can help if someone on the internet tells you good job, I guess. Best of luck to you and thanks for sharing. You did great. Keep buying.

I don’t need confirmation from anyone on the internet about my investment decisions. The point I am trying to make is that there is money to be made in this real estate market despite a deflation in assets in the near future. An epic rise brings on an epic fall but a slow and steady rise deflates slowly and steadily as well. I will keep buying deals and steals not just any property and I’ll keep making money while you sit on the sidelines rotting your money away in the bank for 0.5% interest.

You are a flipper in the worst market for flipping. Terribly overpriced. You probably never got a career going and now you have so much time and frustration on your hand that you need to tell us on a housing bubble blog how your house flipping business is making money. Sure! Keep buying! It’s a great time to buy!

It’s ok to feel bad about missing so many wonderful opportunities over the years since you’ve been crying wolf since 2013. It’s not OK to take out your frustration on people you wish you could be like. That doesn’t do anything for you, it doesn’t turn back time, the only way to move is forward but your crippling fear is holding you back. Maybe you should see a therapist.

Does this look like I am unhappy? 🙂

Let’s see:

Six figure tech job

No debt

800+ credit score

Made a killing in crypto (5,000% in 2017 on litecoin) and stocks and sits on large cash balance

Can buy a nice house now but waits for a nice correction to pick up a Dream house on the cheap cheap

Currently rents 15 min from the beach 2b/2b for under 1400!!

Continues to make fun of RE cheerleaders who try so hard to lure in the last sucker

Dude, i can’t lose by winning. You on the other hand….

New age:

Says “Buy now†because he just bought a flip.

Buys at the peak of the market and seeks confirmation on a housing bubble blog to feel better about himself.

It all makes sense now. New Age bought a flip at market peak, got nervous and Googled “housing bubble” and found his way here. Now he’s trying desperately to convince HIMSELF that he didn’t just commit financial suicide by attacking people on a housing bubble blog website. Classic.

Anyway, you better get to work and sell that thing quick. The crash is underway and the only way your prediction of a 10 year selloff and 50% drop comes true is if EVERYTHING in the economy stays the same. The chances of that are slim to none.

https://seekingalpha.com/article/4266026-housing-collapse-2_0-continues-predicted-everything-else

@Josh I’m been on this blog for quite some time. If I was panicking, believe me I wouldn’t be on a blog lying to myself I’d actually be mitigating my losses actively. I’m just here to provide some experience and insight.

Anywho, since you’re all probably wondering, the house is almost complete! Should be done next weekend just in time for selling season. Total investment: $525K with a few off market offers of $650K but I want at least $750K for it so I’m in no rush to sell. Not bad for three months of work! Now what were you guys saying again? I didn’t quite catch that…

New age is so full of shit. All the flippers I know personally don’t just hang out on a housing bubble blog to “share their experienceâ€. First you pretended you are just here to tell us this time is different and that the market isn’t overpriced. Now you that we know you are actually a peak buyer and wannabe flipper you have lost all credibility. Who buys high and tells everyone in 500 posts that it was a good purchase?! Your panic screams through your posts.

Another Tax proposal for LA homeowners:

“Measure EE would authorize the district to levy an annual parcel tax—a kind of property tax based on units of property rather than assessed value—for 12 years at the rate of $0.16 per square foot of building improvements to fund educational improvements, instruction, and programs. ”

These vultures.

Taxes for most homeowners are wayyyy to low. The rich and the old don’t pray their fair share in property taxes thanks to the scam prop13. We desperately need to eliminate this scam.

I think the Government should charge everyone .75 percent of market value. 4% yearly cap and every five years reappraisal. No prop 13 exemptions. Also, Homeowner exemption should be 10% of the market value up to $1,000,000.

I think that should be fair. A Lot people are keeping their houses just because of the low property taxes. Bring the property taxes up ( to a fair level ) and you will see more turnover and more inventory which in theory should bring down prices. Just my thought.

How would you determine a property owners fair share?

@free real estate

I tell you what’s not a fair share: if an owner of a multi million dollar house pays less in property taxes than a millennial who just bought an overpriced little condo. That’s happening in California right now! End the prop13 scam and the real estate bubble ends tomorrow.,

Milli, you are going to hate yourself when you finally buy a home… and then end up paying the difference in mortgage on increased taxes for life. Atleast with low taxes… when you pay off the note… you aren’t eternally sucked dry.

That’s $480 a year on a MCMANSION of 3,000 sft — a huge house in LA. A third that on a typical condo. Those house owners probably pay $40000 a year to send their brats to private schools and don’t bat an eye. This is a reasonable expenditure. (It will pass, BIG TIME.)

3k sq ft is a McMansion? LOL.

More taxes! More Taxes! & More Taxes! Let’s tax them all until everyone is equally poor.

This board has really taken a liberal turn for the worst.

One day god willing you may all be property owners, and trust me you will NOT be calling for higher taxes.

Yeah, that’s typical. If you ask to end the prop13 scam that benefits only the old and rich and screws the young than you must be a liberal. I have zero interest in politics. I could care less who is president. But I do care about buying low (not high). Ending the prop13 scam will certainly help. Also, if the rich and boomers finally pay their fair share in property taxes the state will overflow on tax revenue. We can easily reduce the tax rate for all and still come out ahead. A person who ownes a multi million dollar home shouldn’t get away paying less than a millennial buying a condo. That’s wrong on so many levels. To balance it out millennials shouldn’t have to pay property taxes for a decade and the rest should back pay what they owe. I realize that won’t happen but that would be the right thing to do.

I wasn’t quite old enough to vote for Prop 13 back in the day but I was against it for the following reasons.

1) It rolled back property taxes from 3% to 1%. Insane! I tell you! That affected quality of education immediately.

2) It was touted as saving the seniors on Social Security from losing their homes but it applied to all ages including the 21 year old new homeowner who had a lifetime of 15% wage raises ahead of them. You laugh at 15% but that is what inflation was until the mid-1980s. I agree with saving the seniors on fixed wages but damn the late boomers (like myself) who were almost the same age as Millennials are now.

3) It locked the property tax increase to a non-inflation number. 2%??? When has inflation EVER been at 2%?

If it really was intended to save the seniors on fixed income, it should have applied to only everyone over 60.

It was the original Tea Party Republican Jarvis/Gann tax bill. Who would argue against a 70% tax bill decrease? Even if it meant throwing the schools under the bus. Flyover thinks Reagan was governor then. However it was Jerry Brown the First. Democrats are not what they seem in CA.

IMO, asking price are just too damn high. Sellers are acting like it’s still a seller’s market and anything goes. Affordability is out the window at this point for many middle-class families in CA. As a real estate investor I find the ROI too low at these prices. I am not going to tie up my money in a property and hope to net 3-4% or less while risking a major repair and/or overall market correction. Prices will have to come down to meet affordability if the market is to move forward otherwise it will stagnate. In the meantime we could see real meaningful inflation if the trade war with China escalates and/or persists. In a normal economy that would mean higher interest rates and possibly lower housing prices. But this current economy seems anything but normal when all indicators show a booming economy and the president is calling for lower interest rates.

According to mr landlord we are in a full on housing bull market. Here is more evidence

https://wolfstreet.com/2019/05/10/house-flipper-zillow-lost-109k-35-per-flip-net-loss-triples-shares-soar/

Sounds like an epic spring selling season, doesn’t it?

“orange-county-home-sales-lowest-since-great-recessionâ€

Damn! Sounds like an epic spring selling season doesn’t it JT & new age? thoughts mr landlord?

Very Red hot this spring selling season?

I thought this is the year when millennials go out and buy in droves? Where are the bidding wars? Where are the buses touring the neighborhoods occupied with Asian millionaires Ready to buy? Where are the lines in front of open houses?

Must be the weather! Or is it seasonal ;)?

I think I saw socaljim selling hotdogs on the street in Santa Ana. REIC business must be slow this year LOL

https://www.zerohedge.com/news/2019-05-11/bitcoin-soars-near-7000-crypto-comeback-continues

Wait what????? Smart people on this blog told us bitcoin is dead? The recent parabolic surge Must be a dead cat bounce! This time it really goes to zero! Any day now!!!

Seen It All Before, But To Dumb To See It Coming Again, Cuz Its Different This Time. CA will continue to drop,it’s anybodys guess on how much per year. It’s a 3rd world schitthole, and declining faster daily with the retards electing bigger retards. Enjoy the crime, taxes, illegals,drugs, piles of schitt, syringes, sanctuary schittholes, declining home values, fires, droughts, water rashing, fukashima radio active waiste water infecting everything up and down the coast, business’s leaving, flash floods, traffic, chem trails, ect. On a good note, it’s sunny.

JamesJim,

Happy Mother’s Day! Don’t worry, be happy

You and I actually agree. Well, except for your overall unhappiness.

We have seen this all before. 4 times in the 1970’s and 1980s when prices dropped 10% and life went on. And 1 time in the 2000’s where prices dropped 50% and people still haven’t recovered.

What will it be now?

The Fed has been raising mortgage rates to slow the housing appreciation to the 2% inflation rate. Is it working? Someday inflation will catch up and rental parity will be renewed. The only thing preventing this from happening is Trump and his village idiot Trumplings.

If Trump wants to help his base before the election, he will crash housing and rent prices back to an inflation based normal by raising rates. If he is neutral, housing will drop 10% and stay flat until inflation catches up. . If he is driven by his ego, and inflates the Biggly Bubble by lowering rates, Bernie will win the next election since Trumplings will be become homeless with their pittance for wages and Bernie’s promise will drop housing and rent by government decree.

We’ve seen it all before except this time it could be a controlled landing instead of a Republican driven horrific 50% crash. Ala The Bush Disaster. It is up to the Fed and Trump.

You really are an idiot if you’ve seen it all before and that’s your opinion of what’s coming. Like they say about opinions? I’m sure your one of those West Coast Dumbacrats that thought Hitlery Clinton was gonna win, then you hide in your safe space and create Ed for weeks when big bad Donny spanked ur assamd became your new master. Good luck with the burnman, or drunk creepy sleepy joe, either way your gonna wanna move into moms basement for the next 6yrs. Trump2020 is as sure as Dumbacrat voting for and idiot career politician who puts illegals over citizens.

President Trump has no legal authority or ability to raise or lower interest rates. The Federal Reserve has the ability to target an interest rate range through the purchase of securities and paying banks a specific level of interest.

The President no matter who is in office does not have the legal authority to set home or rent prices.

Stoned!

Thanks for your opinion.

Are you really the Village idiot JamesJim cowardly hiding under a false name?

You write like him.

It’s pretty universal, you are an Idiot and Seen It All Before and Can’t Figure out ur Asshole for your Piehole.

Thanks for confirming my suspicions that you are Stoned.

Woody,

You might be a little naive.

Despite legality, if the President, the Banks, and Wall Street talk, the Fed listens.

Even if the models and logic behind the decision don’t make sense. Everyone wants to keep their high paying job. Few in the group above have morals to turn down a mid-six figure job.

Life is great in SoCal, so long as you live in a secure compound with a massive wall all around it.

You are not safe, not even in your compound, even if you have guns. Recently the feds entered into a compound in Beverly Hills and confiscated 1000 guns (against the law of the land – the Constitution). The Constitution does not say how many guns you can have. It just says the government “shall NOT infringe”.

In CA the law is only for the slaves. The governor and his appointed judges rule the state like dictators regardless of the state laws, the Constitution or voted approved laws. CA looks like a banana republic where one dictator is replaced by another. With so many from S. America voting there (legal and ILLEGALS) that is no surprise that the state looks like a third world country and led the same way. At least Bob is happy to have 100% Democrat control.

Nothing to see here. The 20% stock market drop in Dec/Jan caused some to hold off purchasing very expensive homes. But, that is old news. Because, the stock market has recovered, and homes are moving.

The stocks market is doing GREAT now! To the moon and beyond!!!!! I’m gonna buy me 10 houses!!!! BUY NOW OR BE PRICED OUT FOREVER!!!!

The stock market is back up from the Dec low by about 20%.

If you had $1M in stocks on Dec 24th and rode the market back up, you now have 200K more.

Most rational people are afraid of the stock market and housing market volatility.

If I was looking for a home and saw a local drop of 5% in home prices like today, I would be tempted to take that “free” 200K that I won and diversify into a down payment on my forever home.

This is why I think the housing market won’t crash hard until the stock market crashes hard.

When or if that will that happen? I don’t know. My crystal ball broke in the Northridge quake.

I do know wages have been lagging house prices for a long time and the Chinese are no longer buying as-is cash homes. The housing prices have peaked and home prices are balanced at the peak like a pile of spinning plates on a stick. It remains to be seen whether the Fed can keep the plates spinning until wages and inflation catch up.

If they can, house prices will remain mostly flat. If a severe recession hits, the plates could all come crashing down and I will refi my 3.5% 30 year loan to a 0.5% 15 year loan for my forever home as the Fed scrambles to save us.

The stock market is back up from the Dec low by about 20%.

If you had $1M in stocks on Dec 24th and rode the market back up, you now have 200K more.

Most rational people are afraid of the stock market and housing market volatility.

If I was looking for a home and saw a local drop of 5% in home prices like today, I would be tempted to take that “free” 200K that I won and diversify into a down payment on my forever home.

This is why I think the housing market won’t crash hard until the stock market crashes hard.

When or if that will that happen? I don’t know. My crystal ball broke in the Northridge quake.

I do know wages have been lagging house prices for a long time and the Chinese are no longer buying as-is cash homes. The housing prices have peaked and home prices are balanced at the peak like a pile of spinning plates on a stick. It remains to be seen whether the Fed can keep the plates spinning until wages and inflation catch up.

If they can, house prices will remain mostly flat. If a severe recession hits, the plates could all come crashing down and I will refi my 3.5% 30 year loan to a 0.5% 15 year loan for my forever home as the Fed scrambles to save us.

If despite all odds, we never see a recession again, and the economy keeps booming forever, I will have a paid off house when I retire and ride it out with my 3.5% loan. I might as well if my CDs are paying 5%.

Seen It All Before Bob: Where do you get a 5% CD?

I said “if”.

They will be 5% if tariffs drive up inflation. They will if they remain long enough.

OC Register writer Lansner’s column today is about Millennials (23 to 37) living with parents. No.1 in the US among metro areas is the IE at 35.4% (22% nationwide). LA OC is 3rd at 32%. But San Diego is 17th at 23.8% yet it is #3 in rental costs. Other towns with a lot of out-of-town Millennials (Denver, Portland & Seattle) also have low numbers for Millennials living at home. And Orlando is #7 on the list despite being affordable. My guess is young folks follow their retiring parents there.

Very interesting numbers. Not sure what’s going on with SD but maybe it’s low ranking because there are a lot of military and those people tend to get housing subsidies. SD rent has become super unaffordable but it wasn’t nearly as bad 4 years ago, so a lot of young renters are staying put in their current living arrangements as the prices go up. My work is having trouble hiring interns and new college grads because the cost of living has gotten so bad in San Diego. We even had an intern commute from — you guessed it — IE where he lived with his parents.

Hi, I love this blog and the thoughts and observations it publishes. I tend to agree with most if not all of it. But perhaps of interest would be to expand on some of the other contributing factors to our economic stall. I can’t help but think of a Forbes article I had read regarding corporate employers who, despite experiencing a labor shortage, are still able to suppress household wages because advanced technology is helping big business to communicate more effectively with each other in order to keep wages low to increase profit margins. I see this as part of the reason why the US income disparity is growing and why residents are not able to keep pace with housing price inflation. Just my two cents. Love the blog man.

Richard

I think we sometimes forget that there is more to CA than LA, SD, and SF. And believe it or not some of these places are doing quite well despite all the doom & gloom rhetoric here.

https://www.cnbc.com/2019/05/10/california-cities-where-business-is-booming-and-salaries-are-rising.html

These cities mentioned in the article have heavily overpriced real estate. During an extreme bubble it’s not a good idea to buy a house (unless you hate your money and want it gone). Or if you love to be house poor. (House poor means you bought sky high, made realtors, lenders and seller rich. Now you have a house and no more money to eat).

It’s usually a better idea to wait for the bust and buy 50% off. Or 2 for 1.

Check out these townhouses in El Segundo: https://www.redfin.com/CA/El-Segundo/510-E-Imperial-Ave-90245/unit-18/home/166469065

* Includes an AMAZING VIEW of LAX — right across the street! Sip a latte in your living room as you watch awesome jets flying in and out all day long.

* Only $1,155,000 (view included).

They forgot to include in the description “CALLING ALL AVIATION ENTHUSIASTS.”

“Sip a latte in your living room as you watch awesome jets flying in and out all day long.”

I stayed at the Hilton LAX a few times. Some of the rooms have a direct view right onto the runway and it’s pretty cool to watch the planes take off and land. Something very soothing about it.

Of course I wouldn’t want to live there. Even if the home were soundproofed, the pollution levels that close to the airport have to be off the charts.

Seems everyone here forgot the last BUST! It doesn’t matter if home prices drop you won’t be able to buy one anyway.

Just like last time, the government will find a way to keep people in their homes, let them pay nothing for a few years, reduce the cost, and bail them out.

There won’t be a fire sale and cheap deals to be had, NEVER!

I wish there was, I’d buy a few, but so would every other investor.

So if you are waiting for the next bust to buy and think you will get a deal, think again! You would be better off buying at this prices with a highly leveraged loan and when things get rough, get the free government money!

The worst crash in our lifetime this is what happened and for the most part it’s called a success. So it will happen again.

The only way it won’t happen, is if the dollar collapses and everything goes to crap. At which point you better own gold as doomsday Peter Schiff always touts.

Good Lucky All! But living your life waiting for this to happen just cost you 10-15 of the best years of your life! If you really want a home pay up for the prices in LA or buy in a part of the country you can afford what you want.

Its a brave new world.

In the next crash, dont be surprised if through Artificial Intelligence, companies like Zillow and Trulia and RedFin are the ones scooping up all the good deals and flipping homes.

https://la.curbed.com/2019/5/9/18563453/zillow-offers-ibuyer-house-flipping

Why do we need realtors? Just replace them with an App lol

How does the AI manage to get the server rack to stand at the courthouse step with a cashiers check?

Zillow’s flipping business is doing great

https://wolfstreet.com/2019/05/10/house-flipper-zillow-lost-109k-35-per-flip-net-loss-triples-shares-soar/

Now that the stock market is selling off we need to quickly say our goodbye’s to mr landlord!! As a good-weather poster he doesn’t show up when things don’t go up.

Thanks for hanging out during the stock recovery. We’ll see you next time around!

But Wait!

The stock market is bouncing back today 200+ points.

Mr Landlord’s heart attack is over and he is now able to post again.

And the typical stockholder how has another 100K to put towards a down payment to drive housing prices even higher!

We won’t see a real house price bust until the stock market truly busts.

I should have bet it all when the stock market was down 30% in December. I would have had more than enough to buy 3 overpriced rental properties now. 30% ROI in 4 months. Crazy Awesome… Or just crazy…..

Bobby,

I’ve been around financial markets long enough to know one or two days does not a trend make. Only novices and imbeciles in the MSM panic when the DJIA drops 2%. I don’t pay much attention when it’s up 2% or down 2%. What I pay attention to is long term trends. Stocks and real estate are long term great buys right now.

But if you feel better earning 0.1% in a savings account, be my guest.

Mr Landlord,

I’ve worked on systems and control systems long enough to know that anything that is oscillating 30% is unstable. Imagine your airplane rising to 1000 feet and then plummeting to 700 feet in a short time. Would you say the airplane is operating normally or would you fear the plane is likely to auger in at any moment?

That’s the way I view the stock market now.

Bitcoin is even more unstable.

The housing market tracks the stock market with a lag. When the stock market crashes 70%, the housing market will do the same 3 months later.

“Bitcoin is even more unstable.“

Hehe, I think I found the guy who missed the boat and is not participating at a once I a lifetime investing opportunity. Can’t blame him.

Yes. Q4 and Q1 were kinda crappy. Not all of Q1, just Jan and Feb. March was better. And with sub 4% interest rates, Q2 will be outstanding. What you are reporting on, good Doctor, is sales data that are up to 4 months old, with contracts having been signed for those homes 5-6 months ago. Remember, a house closing in January went under contract in November. So yeah late fall and winter was a downtime for real estate. An excellent buying opportunity. That is now ancient history.

This is what’s happening right now…..

“First, the purchase index from the Mortgage Bankers Association, which measures applications for mortgages to buy homes, increased 5% during the first week of May compared with the previous week, and was 5% higher than the same week one year ago.”

“Sales of new homes, which are recorded when a contract is signed, rose 4.5% in March, according to the Commerce Department. Pending home sales, reflecting existing homes with newly signed contracts, rose 3.8% in March, according to the National Association of Realtors.”

ttps://tinyurl.com/y4rqwwtj

My guess is you’ll be gone as soon as the correction hits full force. You’re just a fair weather commenter.

I’ve been here for 2-3 years dude.

It’s not been 3 years 😉 also you took a looong Break during the last stock market sell off. You got your reputation as a good weather poster who runs as soon as headwinds occur.

All I know is I am seeing some indicators that are showing some kind of slowdown going on.

Around the Sacramento region up north, there are price reductions every day on just about every other property.

And in some other parts of the country, there are $0 houses picking up on the daily Zillow emails showing all are foreclosures being sold at auction.

This is all recent within the last 3 to 5 months maybe since it started and more recently, the last 1 to 2 months, it is daily, these kinds of emails come in – price reductions and foreclosure auction sales.

Where is a good place (weather wise) to live for those that want to get out of California but have never really traveled to other parts of the country? I do not like snow. I can handle less then 10″ a year I would guess. my sister lives in salt lake city and that is hell weather imo

There is nowhere in the U.S. that I am aware of that has the weather of California. Florida (and vicinity) is hot and very humid, northeast is too cold, Midwest is too extreme (too cold in winter, too hot in summer), northwest is way too gloomy and rainy and a bit cold.

This is far from crash, of course, but at least the prices started moving in the direction of the fundamentals. Zillow forecasts prices to drop 1% in 1 year in the zip codes I am interested in. And this is based on the assumption that the economy remains strong, which is a big IF.

I have talked to a good number of people who were shocked with their tax refunds and not in a good way. That’s another factor that will be pushing demand down going forward. All we need is a nice stock market crash back to reality and the real estate will follow.

Those pesky fundamentals, such as average incomes, are like gravity. You cannot escape it, no matter how many times you say: “it’s different this time!”

You nailed it SD Accountant:

“ have talked to a good number of people who were shocked with their tax refunds and not in a good way. That’s another factor that will be pushing demand down going forward. All we need is a nice stock market crash back to reality and the real estate will follow.

Those pesky fundamentals, such as average incomes, are like gravity. You cannot escape it, no matter how many times you say: “it’s different this time!â€â€

San Diego Accountant,

You always have excellent points.

The stock market crashed in late 2019 so we are seeing the delayed effect in RE now.

People had 30% less to spend on a down payment in Dec than they do now. ie their $1M in stocks was down 300K. $300K is a huge down payment difference.

Now the stock market is up 30% from the beginning of the year. What effect will that have on RE in the next few months?

IMHO, people cannot be buying RE on income. The RE prices are too high for median wages. It has to be their stock portfolios driving RE prices. If my stock portfolio gains $300K-$500K, I would be looking to diversify into RE (likely rental properties). That is driving up prices.

As far as taxes, anecdotally, my total state and property taxes were $12K (that is a property tax bill of 5K) . My interest at the time of my loan was almost nothing. Sum total, I could not achieve the new 24K standard deduction.

If you had a 200K income and a 750K house, your state and property taxes would be

higher. About 28K. You could only deduct 10K of that. so you would pay taxes on 18K. (about 4K)

The tax brackets are lower so your 200K income, so you paid about 4K less in taxes this year.

I agree with Mr Landlord that the taxes are are a wash for this particular situation.

However, psychologically, it is true that buying a house for a tax deduction is less as of incentive to buy a personal house now. However, there are huge incentives and deductions to buy a rental property now. They have not changed. IMHO, that is still driving up prices with boated bubbly stock market equity.

Typo. The stock market crashed in late 2018.

Thanks for your comment, Seen it all before, Bob!

I agree with you: I can’t see how average house in CA can be purchased on average income responsibly.

My point on taxes was as follows: prior to the new tax law, the itemized deduction for interest and property taxes (and all other stuff you could itemize) IN EXCESS OF STANDARD DEDUCTION created a significant additional tax incentive to own the place where you live as opposed to renting it. Now with a cap on itemized deductions and a much higher standard deduction, this incentive is gone for a lot of people. So this will turn more people into renters and will reduce demand for housing going forward.

My point on real estate prices always coming back to parity with average incomes in the area is as follows: in finance 101 in college they teach you that the fundamental value of anything is a present value of future cash flows. So the fundamental value of a house is a present value of future rents one can receive. The rents are directly tied to incomes and so are the real estate prices. Yes, stock market bubbles, foreign investors, zero interest rates and many other things can shift demand and supply to the point where prices are way above or way below where they need to be based on parity with incomes. But long-term prices will always reflect income levels. So right now we are in a bubble because of zero interest rates and foreign investors and speculators parking money. However, this is temporary and that’s I have to believe the prices will be coming down. Have no idea when. Maynard Keynes: “The market can remain irrational longer than you can remain solvent.”

San Diego Accountant.

You and I agree that it is not responsible to buy a personal home today with the bloated prices and much less tax incentive to buy. Today, I would rent. Just like Our Millennial.

I’d like to hear your free advice on buying rental properties. I really should pay for the advice since several of my co-workers did pay for it and are buying local rental properties for their future retirement. They have seen $1M+ in stock market equity gains since 2008 and want to diversify. They are the investors you mentioned above and they are part of the pool that are still driving up housing prices.

I own a very small rental and with the current tax rules, (ie depreciation, appliance replacement, painting, etc), almost everything is deductible compared to a personal house. I deduct all of my property taxes (no limit), interest, etc. I view it as maintaining the property for free with a positive cash flow. Thanks mainly to the depreciation deduction.

As an accountant, would you advise people to take their stock equity and roll it into rental houses? Again, doing this, drives up housing prices even more with a tremendous tax break since almost everything is deductible and depreciation is a huge part of the deductions.

This and foreign investment will keep houses flat or rising. Housing price increases do not need any personal home tax incentive.

“… The priciest county in Southern California is Orange County and it has now faced the worst start of a year since the Great Recession ended. Sales are low. Extremely low.”

Not so along California’s South Coast (Santa Barbara, Goleta, Montecito, Carpinteria). The number of sales YTD 2019 is up from the same period a year ago. And the median SFH/PUD selling price (which bottomed at less than $800,000 in 2011-12) is now at around $1,300,000 (YTD through April). That’s more than a 60% increase over a 7-year period. It’s different here. Or is it?

Barb

Administratrix, Santa Barbara Bubble

Dear Administratix Barb.

I like your title.

I grew up in Santa Barbara and read your blog. It is informative. Thank you!

Santa Barbara is like Healdsburg. Meaning the median wages there do not justify the house prices. Wealthy LA people are buying overpriced second homes for the Santa Barbara zip code. Yay for my Mom who bought in the 70’s when people there could actually afford homes with a median job wage. Today, is a different story. My Mom’s neighbor sold their 60’s tract home to a foreign Chinese investor who was sending his daughter to UCSB for $1.5M! They bought in the 70’s for $60K. Some say RE is not a good investment. Location, Location, Location.

We bought a 60’s tract home house in 1986 for 200K and people called us CRAZY!

We sold in 1992 for 260K. I considered that breaking even. It went up to $600K in 2006. I could have bought the same house back in 2009 for $350K. True story, my loss. Now it is worth $800K!

Housing in Santa Barbara has always been at a premium due to second home owners but a recession causes wild swings in house prices.

Many Lottery winners in Santa Barbara! Well, until the next bust.

The question is: How long will this party go on?

I went to hear Bruce Norris speak tonight in Culver City. Famous RE investor since the 80’s in SoCal. He had a room with about 100 investors to hear his predictions for CA real estate.

He said that we seem to be in a strange new phase of the market. Homebuilding is low, unemployment is at 60 year low, affordability index is still over 20%, interest rates are low, financing is still tight yet home prices are waning.

[He gave an interesting example of the migration OUT of Socal. Uhaul is charging $1400 to rent a truck from Irvine to Phoenix but the same truck rented in Phoenix back to Irvine is renting for $150. ]

He also said he does not predict any dramatic drops in prices for good homes whereas flawed homes will linger on the market now or require price drops. (Flawed inventory meaning homes on busy streets or bad floorplans, old homes, rough neighborhoods, etc).

He is telling his investors that if they plan to sell their rentals and move their money elsewhere to do it this year, because 2020 will probably be more pullback in the market but nothing catastrophic. He added that landlords probably wont lose money over the next 5 years but wont see the rising prices like they have for the past 5 years and we could be in for a long great stagnation.

He gave an interesting example of the migration OUT of Socal. Uhaul is charging $1400 to rent a truck from Irvine to Phoenix but the same truck rented in Phoenix back to Irvine is renting for $150. ]

This is an interesting comment.

In my opinion, the people leaving SoCal are lower wages and they see opportunity in AZ, TX. They will use U-Haul to move themselves. They cannot afford a SoCal home or rent.

The people moving into SoCal are getting extremely high wage job offers. Either their company is moving them or they are paying someone to moves them which bypasses the need for U-Haul.

The people moving to California are young singles with few possessions and dont need a Uhaul — just pack your car up and take a road trip. The people leaving probably have families and possessions and would need a truck. Most of my friends left once they got married. There are high paying jobs elsewhere in the country too.

If UHAUL were overcharging me that much.. i’d go rent it in PHOENIX…drive it to LOS ANGELES load up my stuff and drive it back to phoenix. To do otherwise would be stupid.

I had an employer move me once. It was a flat fee paid that you could do whatever you wanted with. The amount was based on distance, number of family members and maybe a couple of other variables. Anyway I was single and moving coast to coast so they gave me $6500. I owned practically nothing other than a couch, a bed, some dishes and TV. I sold it all for a few hundred dollars. Sold my car as well. I flew to the new gig and bought everything new, and still had some money left over. And bought a new car.Driving cross country is 3-4 days and shipping is $1500. If it’s some classic car or whatever, do it. If it’s a run of the mill Camry, sell it and buy new at the new location and use the $1500 for something else.

And every time I’ve moved since I’ve done a version of that. When you calculate the cost (both monetary and time packing/unpacking) of moving “stuff” from point A to point B, a lot of times it’s better to just throw it out/sell it at point a and buy new and better stuff at point B. Stuffing a 26′ UHaul truck with junk to haul it 1000 miles is kinda dumb when you think about it. Or hiring a moving company to stuff their truck with your junk…not much smarter.

He knows his stuff

We haven’t heard that “this is the year when millennials go out and buy in droves†In a while now?

@Real estate cheerleaders: what changed?

https://www.zerohedge.com/news/2019-05-14/62-millennials-are-living-paycheck-paycheck-says-study

Chasin’ it down

https://www.zillow.com/homes/1430-Kentucky-Greens-Way-Newcastle,-CA,-95658_rb/17667483_zpid/

Jeanie, what is your point. This is a beautiful home. on a large lot, in a fantastic location. I think it is worth at least $950,000. I think Zillow’s est. of 937,000 is low. Zillow’s employee’s also can’t count since the home clearly has a 4 car garage–not a 3 car one.

I don’t know the area that well, but $1M for exurban Sacramento seems way too much for that house. The house needs a lot of updating. And the market is reflecting this as it has sat on the market for almost 2 years 10+ price drops along the way.

I never get people who do this. Selling a house is a PIA and stressful. Why go through this for 2 years?. The price drops are laughable. $5K or $10K on a $1.1M house. WOW!! LOL. Drop the price $100K then you might see some movement.

Good ole Gar – the point is the repeated change in listing price, check it out! Is it worth 1.5? I thought prices only went up. And it’s 3 car.

Gary, lol

What high paying jobs are in Newcastle?

Have you looked at the price history? They are trying to sell since 2017….yes 2 0 1 7

Heartache for the perma bears. Housing starts up 5.7%. bbbbut muh 75% crash!!!! LOL.

“U.S. homebuilding increased more than expected in April and activity in the prior month was stronger than initially thought, suggesting declining mortgage rates were starting to provide some support to the struggling housing market.”

https://www.cnbc.com/2019/05/16/housing-starts-ap-2019.html

Increased Housing starts (the beginning of construction of a new house). Builders always build into a recession. Builders come late into the cycle since margins look better.

Landlord, As a perma bull you want to see increasing sales and increasing prices and declining inventory. The opposite is happening. Prices are going down(look on Zillow or Redfin) – price declines across the board. Sales are down and inventory is up. What are you cheering about?

Mr. Landlord,

Please explain how increased supply of housing in an already cooling market is somehow bad for us – perma bears – hoping for a housing correction to the point where housing looks attractive as a long term investment.

Demand is down, supply is up – the prices go down. The new construction will lead the popping of the bubble, because new construction prices are not as sticky on the way down.

SD,

Are you serious? Every time housing starts drop the PBs(perma bears) high five each other saying see see see the crash is coming. And now when housing starts increase, you’re also saying this is sign of a crash. You guys are if nothing else entertaining, I’ll give you that.

Housing developers won’t start building if they don’t think anyone will buy. The fact they are building means they are confident sales will be there. Hence, no crash, hence no fantasy 75% off fire sale.

Does that explain it?

The link you posted is dead. I am going to assume because it was false; housing starts in April 2018 1,267k vs housing starts April 2019 1,235k (2.6% decline).

https://fred.stlouisfed.org/series/HOUST

I found Millie on YouTube

https://www.youtube.com/watch?time_continue=80&v=-t6HDWZIz5A

so true… sad.

Huh? What’s so true?

Are you promoting “toxic masculinity? The CA liberal democrats are not going to be happy 😃

I hope it is not Our Millennial.

The guy in the video is obviously crazy and need psychological help. I mean, look at his eyes. Scary! I hope they take all of his arsenal of semi-automatic weapons away so he doesn’t kill me and my family.

The guy is actually arguing that people are trying to close down shooting ranges. Who has ever argued to close down shooting ranges? Nobody. They are necessary to allow gun owners to safely own weapons.

Yet Republicans are arguing something like lunatics that isn’t even a real issue?

He is just like Trump!

Wow, I hope Our Millennial isn’t a scary dude like this guy. We’ll see this dude on the news shortly after he psychotically blows away 100 children in a mall and claims the Democrats made him do it.

Haven’t made YouTube videos yet. I am just an avg guy who made a killing with bitcoin & litecoin waiting for the RE crash. Once we see 50-70% off in housing I will buy a dream house- probably in all cash until then I get to make fun of the RE shills who desperately want avg people like me to buy high.

Seen it All Before, But To Dumb To See It Coming Again, Yup Pretty Dumb

Auto-Loan Delinquencies Spike To Q3 2009 Level, Despite Strongest Labor Market In Years

https://www.zerohedge.com/news/2019-05-17/auto-loan-delinquencies-spike-q3-2009-level-despite-strongest-labor-market-years

Yes James Jim,

I agree with you again

If I have to agree with you again, you truly are a Village Idiot. You are calling yourself an idiot when you post. Just learn to read, and then read my posts and you will agree.

Trump is increasing the wealth disparity and things are starting to crash all around him.

Next time, vote for Bernie.

This condo, just sold in multiple over asking offers.

https://www.zillow.com/homedetails/2025-4th-St-UNIT-207A-Santa-Monica-CA-90405/20484377_zpid/

properly priced properties still flying off the shelf.

In your dreams QE abyss.

The condo sold 2 month after it was listed and it sold 5k over asking. This is like day and night compared to the frenzy where houses sold within days after listing and tens of thousands of dollars over asking.

Also you are cherry picking. Either you don’t know the market or are really bad in observing it or you are a RE cheerleader trying to deceive people.

If you would monitor the current market you would know that there are price drops across the board. I get bombarded daily with emails by Zillow and Redfin showing price drops.

The federal limit on state and local tax deductions to $10,000/year is having a dramatic effect on Orange County sales where many are second home sales. This impacts most high tax states like New York where home sale prices in the Hamptons are down over 7%.

Marka, Spot on!

Marka it has only just begun. Banks look for solid W2 income to write loans. New tax law is brutal for solid W2 income earners = less W2 income earners looking to enter into home ownership and less homeowners looking to upgrade. (Why would I upgrade to a home that is going to cost 10k more per year in property tax that I can’t write off. Or why would I want to buy a 2nd home and throw away 10k+ per year in property tax/insurance. Essentially Less overall action all the way around the market. A bull market will continue to help push things along but eventually if it stalls and employment falls a bit then cracks will show. Prop 13 will also help buoy the market as well. If it weren’t for Prop 13 there would be big problems already.

even a broken clock is right twice a day. I have asked a few real estate investors that I know about what they think. They both came back and said you can never know when the market will go up or down but they both believe we are going to stagnate for more than 2 years. If fed raise rates to fast (just dropped again and houses are selling but not historic highs) we can see a change, and in 2020 with the election, we can see a change.

I have to ask as many are waiting for a 50-70% off sale and I told the investor this and he laighed as all the good deals in 2009-2012 went to all cash buyers. He actaully ran out of cash and got hard money loans to buy more. He has hundreds of rentals. So the people waiting for a crash I can assume they have all cash or something of value to get additional hard money loan?

It doesn’t mean anything when you say I talked to an investor. We all are investors. Some make a killing with bitcoin, some buy houses at the peak. Talking to an investor has no meaning. If you really talked to someone and he said what you stated he has no idea what he is even taking about. I can easily prove this.

Look back at the three crashes in the last 30 years and talk to your circle of friends and family. Are you telling me none of them bought between 2009-2012? BS.

I know many. The avg joe bought during his time. Why wouldn’t they? They only knew not buying were the 7mio who foreclosed because they bought high….

A crash is the time to buy. That’s why you save now when idiots tell you to buy sky high and then you invest when the market is down. Anybody who tells you otherwise lies to you. Don’t be a dummy.

It’s obvious that during the next crash you can buy 50-70% off peak prices. Just like every time the market dumps.

Saying an investor in real estate has no meaning! (I mean really) The guy has almost 300 single family homes that he rents out. Don’t you think it would be good to pick his brain a little bit? Most of your comments are educational and often funny, but for someone that owns ZERO real estate to comment on when the market will crash is pretty ridiculous. We are all waiting for an adjustment or correction but when none of us know.

Jordan, it’s way to easy to debate you.

Your words: “ all the good deals in 2009-2012 went to all cash buyers. â€

That is total BS and everyone with a half brain and Internet access can prove the opposite. Again, you are telling me none of your friends and family have bought during that time? You never met anyone? I know many that bought 50% off from the 2005 peak. I must be very popular or you only have friends like mr landlord and new age who love to buy high?

Than you said “for someone who owns zero real estateâ€

As if it were written somewhere that you must own real estate in order to understand where we are in the cycle. You may have heard before that it takes the avg American less days to buy a house than to buy a car? They get pre approved, a realtor and buy the most expensive house they can afford. 7 Mio foreclosed – not because it’s someone else’s fault but because they bought something they could really afford – and sky high. Yes, I am very sure we will see a meaningful correction within the two years – just by looking at the current market, the data and the change in buyers sentiment.

Jordan,

That is absolutely true. If/when there is a crash, there are thousands upon thousands of investors waiting to pick up the bargains. By the time Millie shows up with his 20% down and mortgage approval letter, there will already have been 5 all cash offers on the property from investors.

And it doesn’t matter how much prices drop, perma bears like Millie will always think there is more to go. We had a bit of a correction in Q4 and Q1. Prices dropped 5-10%. An excellent buying opportunity. Did Millie jump in? No of course not. Because when prices fall 10%, he waits for 20%. When prices fall 20%, he waist for 30%. And so. Unless home prices go to $0, perma bears will never buy.

I almost fell off my chair, had to laugh so hard at mr landlords post. Q4 was a buying opportunity? Rofl, if he calls this a buying opportunity we don’t have to be surprised he bought amazon at 2000.

And why does he keep saying I am a perma bear? A perma bear is always bearish. I am a real estate bull long term. Just short to mid term I am bearish. We had boom and bust cycles since 30 years in California! But with these extemists like landlord, if you remind them that recessions and downturns are part of economic cycles they freak out and think you are a doomsdayer. Which tells you they never went to a college and took any business classes or economics courses.

If a correction 50% to 70% happens Millie will never buy a home because he’ll be going up against all cash offers and will have to overbid 10% to 20% over asking to get his offer accepted. You think Milly will be willing to “overpay” just to beat out an investor? Magic * ball says “very doubtful”.

Even a 20% drop in prices with rents staying put will bring out the investors in force. Only hope for Milly is an all out collapse but the collateral damage from that would be hard to dodge. In a perfectly aligned universe (in Milly’s delusional visions) the economy would collapse, houses would drop 70% in value, all investors will go broke and he’ll be the only one that won’t get laid off. Good luck Milly. Better to stay asleep and enjoy your dreams, it’s the safest environment for you.

It’s a common lie by the real estate cheerleaders. (“Only investors buy during a crashâ€)

A few bullet points to get you up to speed.

During a crash normal people buy. Happened the last 100 years

RE cheerleaders always pretend this time is different

During a crash, many flippers and investors go bankrupt

During a crash, people with no debt and money can easily buy

During a crash many who bought high have to foreclose or want to foreclosure because their neighbor is buying at 50-70% discount

50-70% discounts are normal during a crash

A crash is not “the end of the world†scenario. It’s normal for California and some other overheated markets. What goes up must come down at some point. The massive run up in assets was fueled by cash buyers from Asia, house flippers and low interest rates.

Cash buyers from Asia? Nobody talks about them anymore. Hey have disappeared. Too bad.

Prices will revert down to fundamentals (50-70%)

Let me know if that clarified a few things for you. Happy to assist further.

https://www.bloomberg.com/news/features/2019-02-14/zillow-wants-to-flip-your-house

Zillow and Redfin “flipping houses” on one hand is a good thing because it will enhance the liquidity of real estate.

It’s a market clearing device. On the other hand it could be negative because they may be incentive to fudge their valuation tool for their assets. If that happens other sites will pop up to take their place in valuation tools, so we may be covered there.

Contrary to some of the articles you’ll see on the internet from Wolf Street and Zero Hedge types…., this is a positive contribution to Zillow. As it’s a startup they are allocating cost and investment from their overall company based on revenue. Their overall company is losing money still so there is that….. like any of the tech startups Millennial wishes he worked for and had personal ownership in.

Oh and there is absolutely still not tank in sight.

I will let you know when the recession is here. Study the 1990s for a model on what the next recession is likely to look like. Until then… party on.

tank in sight

Hilarious post.

https://wolfstreet.com/2019/05/10/house-flipper-zillow-lost-109k-35-per-flip-net-loss-triples-shares-soar/

Yeah, great business model….flipping houses with a 100k loss per flip. You should def “party on†and keep flipping in this market.

I am 100% certain someone like you who promotes buying at the top has actually never made any money in real estate.

You were one of the shills screaming the loudest that there is not enough inventory. That was only a year ago. Every RE news article is showing sharp increases YoY in inventory. You never provide ANY data just empty sales pitches. All your calls have been so wrong that you now serve as an indicator for what’s not to happen. If you say party on, it means the crash is around the corner.

@NoTankInSight, you said “I will let you know when the recession is here. Study the 1990s for a modelâ€.

What makes you think you can predict the future? If I were you, I would have made billions already…. having the gift of knowing the future.

“On the other hand it could be negative because they may be incentive to fudge their valuation tool for their assets”

I’ve been thinking this is what Zillow is up to. Either the Zillow algorithm sucks or they’re intentionally misleading people using their site. The difference between zillow and redfin valuations is pretty glaring. Zillow is consistently under estimating the valuations of all home I see for sale so much that I’ve stopped looking at their site. Redfin seems like a more accurate valuation estimate and this valuation is more closely aligned with asking and sale prices.

Yup, I’m An Idiot, Ive Seen It All Before, And I’m To Dumb To See It Coming Again.

Builders Bet Too Heavily On The Upscale Market

A report from the Orange County Register in California. “Southern California builders, stuck with the largest supply of unsold homes in seven years, have slashed construction to the slowest pace since 2016. First-quarter data from MetroStudy shows 3,750 new homes went unsold in the four counties covered by the Southern California News Group — an increase of 688 units in a year or 22% and up 37% vs. the five-year average. It was builders’ largest inventory of unsold units since 2012’s first quarter.â€