Option ARMs and Recast Shock Syndrome: Toxic Financial Products are Imploding on Schedule. Examining the Impact on California.

California’s credit rating is now the lowest in the country as the state’s rating was just downgraded. On top of that great news, the option ARM spigot is now open. We’ve been warning about the financial destruction that option ARMs would cause once they started recasting in full fury. Well now we do not have to speculate. These loans are imploding like their subprime siblings. The curious notion that option ARMs were “prime” products rested on the fact that these loans were made to folks with higher FICO scores. This is simply absurd. I knew people making $30,000 a year with 700+ scores. Does that warrant a person like this buying a $500,000 home? I keep remembering an article that I highlighted on May 3rd, 2007 where someone making $14,000 a year was able to qualify for a $720,000 loan. The real estate agent told the buyers that they would be able to refinance the loan with more affordable terms. Listen, you can offer them a 0 percent 50 year mortgage and the math still wouldn’t work.

Yet this is the mentality that permeated with the subprime and option ARM snake oil salesman contingent. There was always a belief that you would be able to refinance or sell off your modified plywood granite countertop holder to some other schmuck for more money. Agents and lenders believed this and even if they didn’t, that commission check was a strong enough reinforcement for many to blur the ethical and fiduciary lines. Either way, one good thing is that delusional psychology is taking it on the chin and that is now gone probably for a few decades (until people forget and want to start another bubble). Before we examine where we are with option ARMs, let us first see how we got here through a series of pictures:  Â

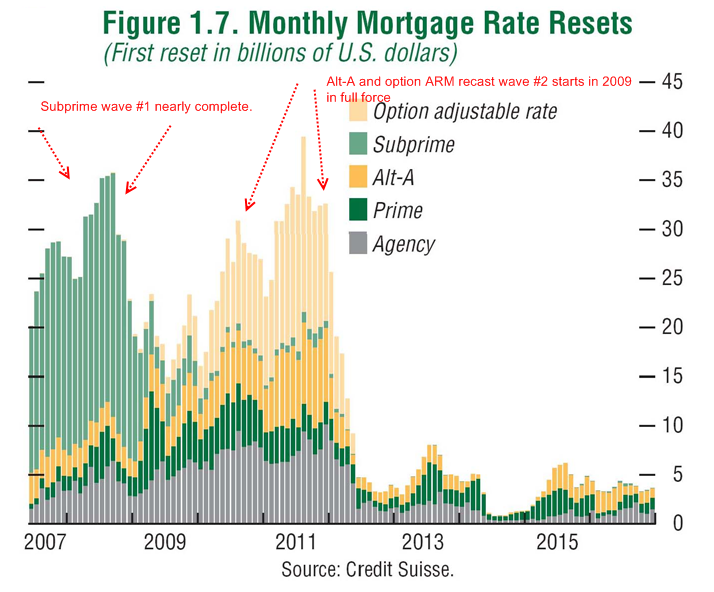

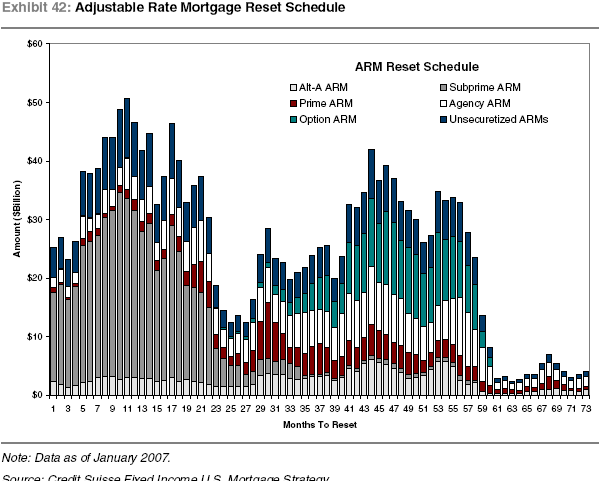

Now I’m sure many of you have seen these charts multiple times in the past but it is important to study them carefully in the context of where we are at today. We are dealing with the actual mess instead of looking at charts dumbfounded and wondering what the impact is going to be when payments skyrocket. Well first, many payments are now jumping significantly which is not exactly a good recipe for success in our current beaten down economy:

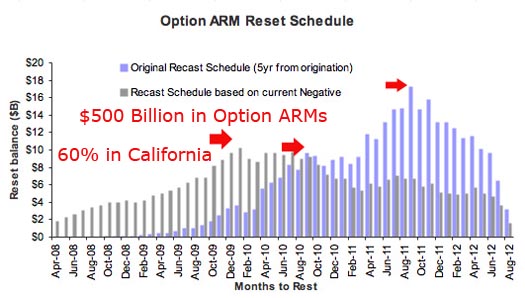

We’ve only started the first round and it is game over. In total approximately $750 billion of option ARMs were originated from 2004 to 2007. What is even more troubling is that 55% of borrowers with option ARMs owe more than their actual home is worth. And this data is conservative since it comes from the banking sector which didn’t even see the recession coming even while they were standing knee deep in it.

Now here is where the data becomes more recent. As of December of 2008, a stunning 28% of option ARMs were delinquent or in some stage of foreclosure. We haven’t even seen the major recasts and already over 1 in 4 of these loans is imploding. Can you say subprime redux?

In recent reports I have been seeing that people are saying this won’t be as bad as subprime since just over half of subprime loans were delinquent or in foreclosure in December. To those people I say, come back in December of 2009 and it will be a very different ball game. 50 percent is optimistic for the option ARM game.

According to a report from Bloomberg, $200 billion of the original $750 billion in option ARMs are outstanding. They also list the following:

2009:Â $30 billion will recast

2010:Â $67 billion will recast

Further data points to an even more troubling picture. The average option ARM monthly payment is going to go up by 63 percent or $1,052! While the employment situation sours and people are losing jobs or getting hours cut back, many are going to see their monthly payment skyrocket. With these loans we have a silent bomb just waiting to go off. What I can tell you is that you are going to need to get ready for a lot of people moonwalking away from their mortgages. What do I mean by moonwalking? This is a very important point and warrants a psychological analysis. People tend to forget that subprime loans already started out at higher interest rates to begin with. So many of these people actually had a chance to refinance if they wanted to. Many didn’t because they couldn’t even afford their payment – that is why they were subprime to begin with! Most simply defaulted since they were already a poor risk to begin with. The subprime game is basically done and was only the tip of the toxic mortgage iceberg.

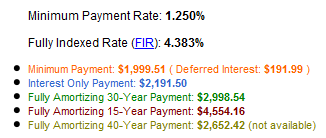

Yet with option ARMs and the legendary “prime” FICO borrower, you might have a situation play out like this. We’ll focus on California since the vast majority of that $200 billion is here.

(a) You have a couple making $100,000 buy a home in California for $600,000 with an option ARM in 2005. Let us run the numbers:

Not bad. We have a $600,000 home for only $1,995 a month. Now, we aren’t factoring taxes and insurance which will probably add another $625 a month. So let us see how our budget looks:

Monthly Net Pay:Â $6,010

PITI:Â Â $2,620

Okay, so we’re okay with the current payment. But let us now fast forward to today:

(b) The same couple is now making $70,000 because of cut backs and the employment situation in the state. The home is now worth $350,000 and the payment has jumped up since it is 2009. What does the crystal ball show us?

Monthly Net Pay:Â Â Â Â Â $4,499

PITI:Â Â $3,876 (with average 63% jump on PI)

Game over.

It is simple as that. So these people are flying under the radar right now. And this is assuming that the income is still coming in. So technically these people are still current on their teaser rate because in many cases this is probably cheaper than renting. But once the rate recasts, all of a sudden you get recast shock syndrome (RSS). At that point, you moonwalk away and that is why we are already seeing a default rate of 28%. We will see 70% plus of the current loans implode (that is, if the government doesn’t jump in with some other cockamamie idea). And instead of running some complex macro economic analysis, just look at the above numbers. Anyone can see that this was going to happen and those that are “shocked” to see 28% defaults already are simply smoking delusional crack laced with happy go-lucky real estate PCP.

So this is where we now stand. California and Florida have the majority of these option ARMs and they will have to deal with the brunt of these loans. The irony is these loans are good until they go RSS and then it is missed payment after missed payment. Get those ruby slippers ready because there is going to be some serious moonwalking from option ARMs in 2009.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

24 Responses to “Option ARMs and Recast Shock Syndrome: Toxic Financial Products are Imploding on Schedule. Examining the Impact on California.”

isnt the less worse cure for banks to make a write off of the principal of say 30%-50%, depending on the income of the borrowers (ie 3x, 3.5x, 4x ???) BUT the loan becomes NON-RECOURSE AND the bank takes EQUITY in the home (if the home prices go up from that renegotiated price)

letting everyone walk away means economic and social disorder… you will have plenty of homeless people, while on the other hand plenty of empty house for sale, it just doesnt make any sense. and the banks should not be home owners, that is not their job.

they didnt make their job, because in the first place they should have lent money taking into consideration the income of the people, not only the (bubble-inflated) market price of the home. free market mechanism under some circumstances set stupid prices (inflated or deflated) which does not reflect intrinsic value or cash flow value of an asset, but increased or decreased risk aversion (same as anticipatory price appreciation or price depreciation)

this is well known, but arrogant free market supporters will blame only the government and the FED while this has only to do with free market mechanisms. You could certainly blame the govt and the FED for not having prevented this bubble, and even for making it worse, but dont lose sight that in the first place lenders made those loans because they wanted to make money, and borrowers as well. They got an incredible deal, with the non-recourse system, having a free option on the market upside.

We read about distressed homeowners etc… but they put themselves in that mess in the first place. but now is not the time to blame anyone but to fix America (and the world) before its too late

the good doctor lays it out… and thick… sent the first graph to my girl- ‘see honey, this is why i’ve been telling you we won’t buy until 2012…’. glad for me here in sunny and way overpriced LA, but shudder to think what this means for the larger national economy and the state. in LA this picture is also getting worsened by a pretty significant change underway and a lot of high dollar layoffs in the film and tv biz- i expect an even more dramatic collapse in real estate prices in the prime areas of LA where those execs and others live… in those places the entertainment biz folks are a not small chunk of the economic pie… i bought an apartment in brooklyn for 110k in ’98 from someone who had paid 65k…. it originally sold when remade into a condo for 157k in ’87…. no one should think that we aren’t in for something similar here in LA… this is an even worse bubble.

FGR, I believe you mean changing the loan from non-recourse to recourse? I loosely agree that some kind of write down may be in order. 20% of buyers in my CA county are under. Two more years of resets and that number will be 40%. I predict unemployment will double just the same. This is going to get to those who bought even before 2000. And this is just the housing variable. The greater economic implications are mind boggling.

@FGR

The cram-downs are coming, but that doesn’t solve the problem. As doc mercilessly and tirelessly has pointed out, the scope of this is so vast the damage is coming so suddenly that it’s like a dingy in Cat-5–everybody gets wet. Another consideration is the unintended consequences of the cram-downs: I made my payments, why not readjust my mortgage too? Bond holders: we got a deal. Future: Why should I buy this mortgage paper if I can have the terms rewritten? The worst part is that subprime occurred when banks still had huge war chests and vast resources. This comes when the banks are reeling and trying to stay afloat. There is no solution to this, but mitigating the damage is the best we can hope for. Maybe Big Ben can use the Citi-coptor to drop a couple trillion.

In the past we had stag-flation. We need a word for simultaneous deflation and inflation. Din-flation?

What the charts dont show are the option arm, alt-A, ect that walk before the loan resets. How many will walk early? How many already have?

JO says-

“How many will walk early? How many already have?”

3 more business days until my auction/foreclosure. Hope Obamalakalaka and crew don’t change the rules before Monday! Moonwalkin’ it, yo. No shame, no regrets, no remorse, no down payment, no skin in ‘da game, no intended speculation on my part. Cali, baby. Non-recourse – non-pay. See ya!

Tick Tock, Tick Tock, Tick Tock. That’s the sound of the Real Estate Timebomb getting ready to detonate on the Westside. There isn’t time left to sugarcoat the truth anymore. No amount of arrogance, ignorance or denial will obscure the facts. We can’t sugarcoat it any longer. Just look at human history and behavior. It is your own fault now, if you don’t.

Do yourself a favor and read:

Irrational Exuberance, by Shiller

or

Contagion, by Talbott

These will give you a good idea of what’s happening right now.

http://www.westsideremeltdown.blogspot.com

http://www.santamonicameltdownthe90402.blogspot.com

If you think loans with no money down are bad wait till this stimuls package goes through. First time homebuyers will be able to get a FHA loan with 3.5% down and a tax credit of 15%… thats -11.5% down. Aparently the best way to deal with a deflating bubble is to pump more air into it and watch it deflate again.

My loan for 80/20 for 780k is not due to recast until 2011. I decided to walk away early last yr 2008, non-recourse loans. I’ve been reading Dr housing and Irvinehousingblog and listened to Mr Mortgage and everything they say makes sense. I am now renting a better house and saving almost 3k a month compared to what I was renting from the bank. It just makes me wonder how many people out there are moonwalking like me.

The Gov. will talk about cram-downs but it won’t happen. If they destroy the contract rule of law then what little we have left holding our system together will collapse.

There will be anger, riots and everyone will demand a cram down. Everyone will look at their neighbor with suspicion …did he get a cram-down? How do I get one? People will stay home from work and instead camp outside laywer’s offices waiting for their turn to sign-up for the mother of all class action law suits. The country will shut down in the bubble areas. Who would waste time at a $60k a year job when expending all your effort/time obtaining your piece of the cram down lottery will save you $200k, $300k or $500k?

Who will judge us? Who will decide who gets the biggest mass-gift in US history and who does not?

Yo Mark, you know you’r the reason we are in this mess. I find it funny in a sad way that people are bragging about being deadbeats. Because that is what you are. Don’t buy something that you don’t intend to pay for. Excusses about how the housing market collapsed and that is why you moonwalked, are just that excusses. I am a big believer in Karma so I guess you will get it in the end. Also hope you save enough money to pay cash for your next house because you wont be getting a loan anytime soon.

$15K won’t do anything in a market like L.A. You also need to make under $150K (married couple) to even get a penny of this.

It changes nothing in Southern California!!

I have clients calling everyday to go over their options–the best option for them, from a business perspective, is to stay for free for the year while they save money and the foreclosure process plods along, and then move out and rent a nicer newer unit for substantially less money…

I have been reading Dr. Housing Bubble, Irvine Housing Blog and others for quite some time now. The insight from the authors as well as the reader’s comments have been extremely valuable. I have never been one to comment, but now is the time to seek some sage advice.

I was laid off from a 10 year banking related career last week (M&A transactional services related work). I’m neither surprised nor shocked as it was round three in the last four months.

I am a fairly young guy (early 30’s, unmarried), who had most of his savings in the stock market – now wiped to the tune of -60% or more.

I have done my best to remain fiscally prudent over the years. No real debt besides a car almost paid off and a small amount of credit card debt. I never was enticed into the real estate bubble. Way back in 2003 when I first could afford to buy a place, I believed housing in Southern California was insanely overpriced. Little did I know how the insanity was just beginning.

I lived for the past 7 years in primarily in wealthy beach communities, preferring humble rentals with roommates as a trade off for access to the “beach lifestyle”. Sure I probably spent too much on dining out, partying and traveling but never put myself in debt for it. I just ended up not saving as much as I could. In retrospect it is perhaps a good thing as the saved money would likely have just been additional red ink in my monthly brokerage statements.

I never understood how much wealth could be floating around in these areas, the luxury cars, the multi-million dollar homes, the endless supply of expensive, overpriced restaurants. This obviously wasn’t just limited to beach areas, and I now understand how artificial it all was.

So my 401k is decimated and my savings to one day possibly fund a start-up or use as a down payment will likely be gone by the time all is said and done. I was able to pull some stocks out at profit or a reasonable loss over the last six to 12 months and have enough cash to live off of for 6-9 months, so I’ll be Ok.

It pisses my off that I have been caught up in a tidal wave caused by the uncontrolled greed of others. But I recognize I am fully in control of my situation and have the skills, education and experience to make the best of it.

So my question to you all is what’s a guy to do now?

Laid off from a decimated industry, that still has a ways to go – I don’t have high hopes for finding employment there (nor do I think I want to).

Big things are happening.

There must be a multitude of ways to make something out of this downward spiral. Some way to make an honest profit while maintaining your integrity.

We all know what direction we are heading, but I don’t hear people discuss how to take advantage of it.

This is a generational event – chaotic and traumatic. I don’t plan on being eaten alive by it.

In chaos lies opportunity – I just need your help identifying it.

I vote for jubilee instead of all this end of the world stuff.

Alan, I’d agree with you if trillions of taxpayer dollars weren’t funneling into the lender’s coffers. No bank should be required by law to cram down a note. But banks may need to be compelled if they decide to take bailout money (though all have, so arguing against mods is moot). If banks feel their mortgage portfolios are viable, then there is no need for them to modify mortgages, let alone receive bailout fund in the first place.

LA-Architect

I agree. My husband and I make more than $150k (so like many we do not qualify for the tax credit) and we have been waiting to buy in LA for 8 years. Oh and my husband is also an architect…

Don’t confuse recast with reset. From what I’ve learned, this will be much more accelerated than the 1-2 year old graphs shown because all loans recast once they are 110% or 120% LTV. Loans only neg-am for so long. With 40% to 50% price drops in California, it’s clear that the 28% you are seeing now is what should happen according to charts 2 years from now. Unless they are modified into debt slavery loans, then recast to foreclosure should come much faster.

To Miami Beach RE Atty: Nothing personal, but compounding the problem in Miami is that people don’t buy houses . They buy “units”: hi-rise condos so that they can live like rates in a cage with a view of the other rats in their cages and the tacky people down below driving their Hummers to the Dollar Store. Condos are doubly ruined, since the associations implode when the few remaining owners can’t pay the water bills. And financing will become increasingly difficult for rat cages – I mean condos. So it’s a negative feedback loop.

O.k…. THAT IS SOOO UNFAIR!!!!!

Why are the rest of us paying rent then???

I think lightdemand has a great observation – we are way ahead of schedule for these loans to implode. Isn’t this a good thing? Hasn’t everyone been saying we need to rip off the band aid and get it over with? That the more the government meddles in this the longer it lasts? Well, so far the government has been ineffective and slow to create a program that may actually encourage people to catch the falling knives. The Subprime wave is almost over (except for the implosions from the “modified” loans) and the Opt-A wave is in hyperdrive. Americans are now hip to the fact that it is NOT a great idea to buy right now even with incentives. We may get through most of this before any government programs gain momentum.

When we moved to California from Arizona in 2004 we were in complete sticker shock. I asked the RE agent how anyone could afford a home here and he said with “creative financing” and when the time came for our payments to increase, all we had to do is put the home up for sale or refinance. He also said he had a report from a university’s real estate department and real estate is going nothing but up and it would be a sound investment. Ha! My husband and I opted to rent but then began to see all the sale prices of the homes around us increasing to double their value — we realized we had moved here just when the bubble was really gaining legs AND the prices of homes were crazy to begin with. I’m sure you hear stories like this all the time… but I’m really mad as hell that they were so many irresponsible people out there!

It’s sad, I used to work in the loan industry in Las Vegas. Naturally option arms were very popular in our neck of the woods. The customers loved them for the Minimum Payment and loan officers loved them for the 3 points in the back. When used responsibly, especially with interest rates as low as the are, the Option ARM can be better than a standard loan, however most people lack the discipline and keep checking the minimum payment box until the re-cast monster rears its ugly head.

This site does a fairly good job of breaking down the option arm as well:

http://www.bankapedia.com/mortgage-encyclopedia/faqs/534-how-does-an-option-arm-work-

unfortunately like your article it won’t get read by the people who need to read it.

Hi great article thanks for sharing. What section of California Housing Law say that the buying agent on foreclosed home doesnt pay past due bills ?

Leave a Reply