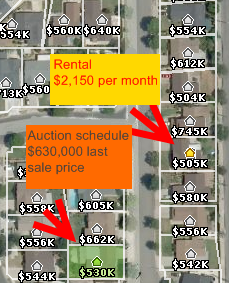

Your Neighbor is being foreclosed on but you don’t know it. 3 Identical Homes on the Same Street Telling us a Very Different Story Each. Real Homes of Genius – A $630,000 Foreclosure in Cerritos has a Neighboring Home Renting for $2,150. Or You Can Buy a Similar Home Today for $549,000.

People love to overpay for homes in California. It seems to be a rite of passage. Even if it meant that someone needed to go into a property with the leverage only available through an Alt-A or option ARM toxic loan. People don’t get that some cities still have a tremendous amount of shadow inventory and that prices will come down unless the economy improves and improves significantly. Yet I understand that statistics don’t drill down into the personal reality of what is happening on the ground. So today, I will show you that all in one block (3 nearly identical homes in size and room) we have shadow inventory, an overpriced home, and a rental reflecting the realities of what homes are really worth.

Today we salute you Cerritos with our Real Home of Genius Award.

The Home for Sale in Cerritos

Cerritos currently has a median home sale price of $610,000. This is simply absurd given that the average household income is $89,000. This is the prime example of a shadow inventory city. Each shadow inventory city has a unique attribute that people think is unique to the area. Pasadena has the idea of the Rose Bowl and the allure of it being close to L.A. and Cerritos has the draw of quality schools. But that in itself does not sustain an area if incomes don’t match up to housing values.

The above home is 1,106 square feet with 3 bedrooms and 1 bath. It has been listed on the MLS for 9 days. The current list price is $549,000 so if you look at the city median price, this seems to be in line with that figure. But again, this is simply another area that is in a deep bubble and will correct in the next year or two. Why?

Because only a few houses down, we have a home that is scheduled for auction and a rental that shows a very different market:

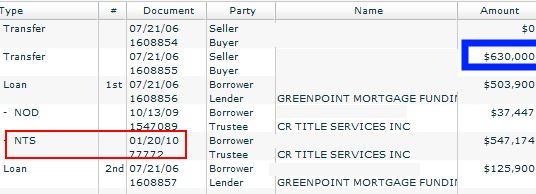

Let us first look at the home that is part of the shadow inventory. The data on the home scheduled for auction is nearly identical with the home that is for sale. It is a 3 bedroom and 1 bath home. It is listed at 1,100 square feet so this area seems to be a suburban box neighborhood where many homes are built nearly the same way. The home for sale was built in 1969 and this foreclosed home was built in 1970. Let us look at what occurred on this property:

This home was bought during the peak of insanity for $630,000 in 2006. This was a 100 percent financing deal. They took out a first mortgage of $503,900 and a second of $125,900. Greenpoint Mortgage by the way was a toxic mortgage superstar. So now after three years the home is scheduled for auction. When the notice of default was filed in October of last year the borrower was already behind by $37,447. The auction was only scheduled a couple of weeks ago. This home is nowhere to be found on the public view. Keep in mind a few houses down the other home above is being sold for $549,000.

You can see the problem already growing. This home if it were to be added to the inventory would add pressure to the price of the other home. Clearly the current borrowers have stopped making their payments. So who really knows where this is at but this is a clear case of shadow inventory.

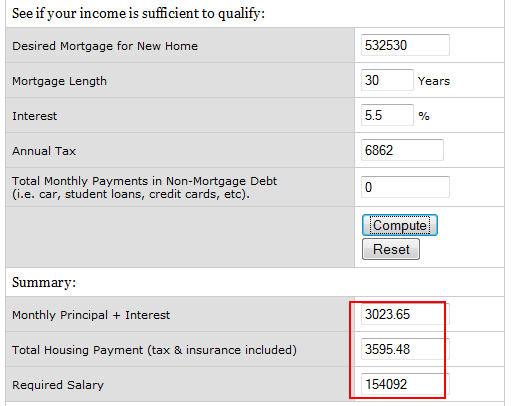

But let us run the numbers on that $549,000 home if we go with 3.5% down and a wonderful FHA insured loan:

First, you will need a household income of $154,000 (nearly twice the average for the city) to qualify for the loan. Next, your monthly housing payment (PITI) is going to come out to be $3,600. But did you notice that the above rental is going for $2,150? You are paying 40 67 percent more per month to own the home ($1,450 more per month). This is insanity. It will always be more expensive to own, that is correct. But nothing like this. In other words, this area is in a gigantic bubble. Keep in mind your total housing payment is coming out of your net income. All your wonderful tax subsidies and breaks come at the end of the year when you file your taxes. The rental rate is more reflective of the actual local market because it is subsidy free and what a local area renter is able and willing to pay out of their net income.

Let us now look at the rental:

The rental is identical in size to the other two homes. A 3 bedrooms and 1.75 bath home listed at 1,100 square feet. This is an excellent example of what is going on because we have virtually three identical homes all in the same block but telling us very different stories. You would have to be out of your mind to pay the current price. You would be buying at a peak low in mortgage rates in an area that can clearly only support a rental income of $2,150. Think about that. No investor in their right mind would pay this amount. And rates will go up. Just look what happened to the markets today once people realize a country can’t pay their debt (hello California!). If you bought this home as an investor, you would be negative cash flowing by over $1,000 per month depending on your down payment. That would be a dumb move right off the bat and keep in mind, for investment properties the interest rate is much higher and you have to go in with at least 20 percent down. This is why I believe we are far from a bottom in many markets that are filled with shadow inventory. And let us run those numbers.

Cerritos in our last month of data had 21 homes sell. The MLS has 49 homes listed. Not bad right? After all, that is about 2 months of inventory. But let us run the shadow inventory numbers:

Notice of defaults:Â Â Â Â Â Â Â Â Â 83

Auction Scheduled:Â Â Â Â Â Â Â 143

Bank owned:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 16

242 homes in the shadow inventory versus 49 homes on the MLS. In other words, you would be speculating into a bubble area right now if you decided to buy.

Today we salute you Cerritos with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

62 Responses to “Your Neighbor is being foreclosed on but you don’t know it. 3 Identical Homes on the Same Street Telling us a Very Different Story Each. Real Homes of Genius – A $630,000 Foreclosure in Cerritos has a Neighboring Home Renting for $2,150. Or You Can Buy a Similar Home Today for $549,000.”

Hi, Dr,

Nice job.

I have a couple of stupid question here.

First, in you post, you believe 40% more to own a home comparing to rent is way to much. In your mind, what’s the right ratio? 30%, 20% or 0%?

Second, you are calculating monthly payment based on FHA loan, how about based on 20% down conventional loan? I understand, currently FHA is taking 20-30% of market, but still 20%-down is the main stream loan form and it will make the difference between rent and own much less.

Third, I still have problem when you are using average income of a town to calculate house affordability. In my humble opinion, using “home owner average income” to calculate is a better way. As you know, in a town, we can there should be 20 to 50% renter with lower income compare to home owner. The renter don’t have home affordable issue. If we are calculating potential first time home buyer, we should count their income; while if we want to calculate how many home will be foreclosed, I don’t think we should count them, only the income of home owner should be count. What do you think?

thanks

Norman

If we use the 154k income for the 532k loan and adjust for the median 89k income, the typical house should sell for 532(89/154) / (1-.035) = 318k

The monthly pmt would be ~3600*89/154 = 2080, in the ball park of the rental. If we use the rental as guide here then (532)*(2150/3600) / (1-.035) = 329k for this 40 year old 3/1.

It would be interesting to see what they get at auction. I hope there’s a barber in the house, because somebody is getting a haircut.

Great article, Doc!

I wonder how long the rental has been on the market? Months?

Landlords did not receive a bailout. They will have no choice but to lower rent to attract renters or end up foreclosing on the property. Just driving around So. Cal. I see so many rental signs. I believe rents will continue to go down and then it will be extremely obvious that house prices are so out of whack with reality.

Dear Dr House, any relation to Dr House on TV? Actually, I think you’re more brilliant.

I don’t have anything specific to write about. I just want to thank you for such an insightful blog. A friend wanted to buy a house for investment purposes and I sent him a few of your posts.

So thank you, the real Dr House, for your writings. I’ve learned a lot. But I’ve got to tell you, I’m scared for what the future may bring.

Wouldnt it be useful to have an accurate map of NOD’s and non-payment status properties in a given zip code? Or at least the outstanding loans. This way one could estimate the likelyhood of future strong downward pressure.

It is not a moral obligation to pay on an underwater home. It is a financial agreement. Like any other business transaction, if the deal goes bad you exit the deal under the terms of the contract. That’s it. Any bank would do the same thing. If you keep paying on a house that is so far underwater that you will never recoup your loses, you are a fool. Try to negotiate, then walk if you can’t make a reasonable deal.

Our entire economy is a paper economy that is caving in while we wait for overpriced homes to fall 10 or 15% more. Folks, don’t go into debt in this depression. Study how people survived the last one and protect yourself. This will not be better in another 6 months–it may take a decade before we stop sliding. Even then, we will never resume the Gay 90’s in our lifetimes. Get over it. It was phony. You think a generation raised on Ritalin and Red Bull is going to turn US into an economic juggernaught? Hope springs eternal, but if you got hope in one hand…

Can’t argue with the Doctor’s post, however, just want to add that the majority of buyers in Cerritos are Asian, and most loans are conventional with HUGE downpayments. I have several buyers that I represent in that area, and they are in the 35 to 45 age group, with young children (schools are the draw as the Doctor mentioned), and they’re all putting a minimum of 30% down.

Thanks for the great blog.

Can you confirm the rule of thumb I read on several sites on the internet that the average house price in a country/state cannot be more than 3.5 times the average household income in that same country/state.

“Cannot be more” applies of course to an ideal world, but for Cerritos this would mean 3.5 x 89,000 = 311,500. Presently the average house price is 610,000 which would mean there is room for a 50% drop.

Nice article, but I wanted to point out one thing. You don’t really have to wait until the end of the year to wait for the tax refunds. If you are an employee, you can modify your W-4 to reduce withholdings which means you can pocket more money with every paycheck. If you are self-employed, you can reduce your estimated quarterly payments by reporting anticipated mortgage interest/propery tax payments.

Here in Chicago it’s the same thing Doc. I went on a for sale by owner website and this guy is asking 400K for a bungalow. While the foreclosed properties that are similar to his are selling for 140K to 200K. Also, rents are very low compared to buying a home. But that doesn’t stop some people from buying. I guess if you want to overpay for a house and pay a disproportionate part of your income so you can be an “owner” then feel free.

I enjoy your blog. You make some valid points. With all due respect, looking at today’s post makes me wonder if what you have written in the past is off the mark.

Let’s say you purchased 17118 Antonio Ave in Cerritos for $540,000. You put 20% down not 3.5%. Your conventional $432,000 30 year fixed mortgage at 5% with 1.5 points will cost you $2319/mo. Add taxes, $563 and insurance $125 and the monthly nut is $3007. Income needed to qualify would be $3007/33% X 12= $109,000 per year. Most lenders will easily allow 33/38 DTI ratios.

Although comparing an area’s average household income to the median sales price is not an accurate indicator of value because not every household is turning over every home simultaneously, the $109,000 is not that far north of the $89,000 average. Only the average income of the people looking to buy in an area is relevant to the price of homes in an area. The average income of someone who has lived in their home for 20 years in an area is not relevant especially because only a small percentage of the homes in a given area will change hands in a given year.

First year’s interest and taxes are about $2350 per month. If your blended Fed & State tax bracket is about 33%, that means you save $776/month which is the equivalent of renting for $2231/month with no tax savings. You can most certainly get the benefit of the tax break right away by filing a revised tax form claiming higher exemptions with your employer who will then withhold less tax each month.

In any event, I do agree with your assumptions regarding the toxic shadow inventory looming in the background however your loan qualifying guidelines are off the mark.

Once again I want to say that I really appreciate your blog and all the excellent work you put into it. Thanks!

I have to wonder of the 143 homes scheduled for auction, how many will sell? I doubt very few will sell.

And I wonder if the bank will buy the home at auction? In other words, will the home become bank owned, a REO, or will the bank will simply hold the home?

If the home becomes bank owned, it goes through foreclosure, which taints the local market pricing; so I think the bank will simply hold the home — reschedule for auction.

I also have to wonder just how many of the homes scheduled for auction, that the banks are letting the people stay there — simply live there, hoping that the residents will pay something, and take reasonable care of the place and not vandalize the home before they leave; many banks now pay residents a $500 exit allowance for leaving the home in good order and turning over the keys.

And I have to wonder and ask just how long it will be before the nice area of Cerritos becomes blighted with abandoned and vacated homes.

As long as the SEC and AICPA allow FASB 167 and 168 enable banks to write their mortgages at manager’s estimate and not to market, in other words at mark-to-fantasy, rather mark-to-market, then shadow inventory will continue to exist, and the banks will stay flush with Treasury Bonds that they received under the Federal Reserve’s TARP facility, giving them liquidity. The banks will soon begin to have financial troubles, as US Treasuries, traded by ETF TLT, start to loose value, as interest rates rise, and as pressure mounts on banks to pay property taxes on their REOs and homes in process of auction.

As property taxes go unpaid, just think of the budgeting nightmare this will cause cities! Many will unexpectedly be forced into bankruptcy because the home taxes they are planning on, will not be coming in.

You mention: “Greenpoint Mortgage by the way was a toxic mortgage superstar”. I have to agree. They provided a second mortgage for 100% mortgage financing on the home for auction; I believe they did so as a business plan to collect exorbitant interest on an Alt-A loans.

No, it will not always be more expensive to own. For a similar property, rental prices should be more expensive than a mortgage, as the landlord must cover his mortgage cost, and make a return on his investment.

True, rental properties tend to be lower quality properties to begin, thus the perception that renting is cheaper than buying, but for the same/similar properties, renting it should always be more expensive than buying it.

This is a great example for appraisers. What is the ‘value’ of a property when comparables vary to such a degree? Is ‘value’ subjective and evolving? Is the concept of an OBJECTIVE value no longer valid? This is a great example for the valuation profession to contemplate. Don

I figured throwing away money in rent is much less than throwing away in interest,insurance,taxes and maintenance. What surprises me is that there are so many pre bubble home owners in below Cerritos standard neighbourhoods who wants to rent their current home(as it is tough to sell or they are still in that state of mind that renting is better than selling) and move up buy that Cerritos home. I guess one good financial decision and one bad one makes it even.

Posters are making this to complicated. Who cares what the actual monthly carrying costs are to buy? All that matters is the rent for a comparable. At $2150/month rent you would be nuts to pay more than about $275,000 for that house. It is irrelevant that the carrying costs may be lower than this article states to buy….the buyer could get laid off or transferred or become sick. The chances of them staying in that house for 30 years to make it pay off instead of renting are beyond slim. This is a no brainer, the rental is by far the better and safer deal.

I can’t believe we are a couple of years into the crash and yet there are still people pushing the idea that now is a great time to buy.

Hi All

I am renting in Cerritos for last 14 months. People are willing to pay 400-500 per sq feet since this is very desirable location. Houses are selling close to asking price becuase there are very few homes for sale. Majority of the Asian people put 20% (or more) down.Prices must fall in other Cities first before they fall in Cerritos.

I disagree with the above posters who claim that “only the average income of the people looking to buy in an area is relevant to the price of homes in an area. ” The classic ratio that investors look at is for the area, not for only for the potential homebuyers in an area. What if there was only one homebuyer for the whole area? Then who cares if that one homebuyer makes $1,000,000/year. It is the average income for the area that will determine how many homebuyers there are based on affordability in an area. Or are we still to believe that there are all of these foreign investors out there who are secretly buying up California real-estate? And please, let’s not forget about un-employment. LA City Council getting to lay off 1000 people. State with a huge budget deficit…probably not getting ready to start hiring a lot of people any time soon. This is what really effects rents and home prices in an area.

I think the point here is simple the numbers dont jive still when trying to figure out fair housing values , even after the 3yr housing decline and the future is bleak. I see it all the time with people who own stocks they become emotionally attached and disregard the obvious facts. Becoming emotionally attached to YOUR house is very easy obviously . Prices will not rise because supply is huge , demand even if it increases cannot drive pricing and incomes will not rise in the near future. So at best one could hope they hold . Why would you give a bank 110K CASH for a place you can rent for 2K a month? Someone please answer that ? Thats why I would not use the conventional 20% down payment . The truth is housing is simply not a good longterm investment because you can only buy and hold . So unless you buy near bottoms you cant and wont profit. We all need a place to live though but at what cost ? In my opinion its probably worth about a 20% premium to own vs rent .

Some very solid commentary in here but thebottomline to me is the house is simply overpriced and prob worth somewhere in the 300-350K range….

When using the price calculations dont see why people use more then 3xhousehold income. Its certainly been less historically and when its closer to 2x income then you have your buy signal IMO….. Look at median income in 1999 vs 2009 (with or w/o inflation factored) then look at housing increases in this period….

Also banks are not writing loans only the government is technically …

Had this article saved …..http://homeguide123.com/articles/Wha…ef=patrick.net

Comment by Jon King

February 5th, 2010 at 9:27 am

Posters are making this to complicated. Who cares what the actual monthly carrying costs are to buy? All that matters is the rent for a comparable. At $2150/month rent you would be nuts to pay more than about $275,000 for that house. It is irrelevant that the carrying costs may be lower than this article states to buy….the buyer could get laid off or transferred or become sick. The chances of them staying in that house for 30 years to make it pay off instead of renting

Good point Jon King. And the price of renting should theoretically be MORE, not LESS than buying. When you factor in the costs that a landlord incurs with maintenance, advertising, vacancy rate, transaction fees, cost of having your money tied up in an illiquid asset, relative returns on other types of investment that you could have your money in, etc…For each comparable house the investor will have to charge more than what his monthly nut is in order to make a PROFIT and get a return that makes all the work involved woth his/her while. In return, the renter will pay more than the monthly nut for the luxury of being able to invest their money in other areas rather than pay a big downpayment and fees, the luxury of calling the landlord when the roof is leaking, the luxury of being able to move after the lease is up if you lose your job, hate the school district, hate the neighbors, decide you need another bedroom, want to be close to work, or have to move out of state because your company decided to move out of California.

The advantage of paying to own instead of rent are will probably begin to lose their lustre as the economy continues to stagnate…advantages such as flipping your home for waaay more than you paid, being able to drop 40k on a kitchen cabinet upgrade, being able to impress your parents and your ex-boyfriend from high-school that you own a house, being able to OWN and POSSESS something REALLY COOL…Don’t get me wrong, I think these are all real and compelling reasons to own for a lot of people. I just don’t think these advantages are realistically priced at the moment.

Dont criticize the variables chosen by Dr HB. Adjust/choose your own, then re-calculate, and provide your answer. It comes down to how risk averse you are or aren’t. (or how clueless and stupid, which we obviously have no shortage of on this planet)

Strange that people use the argument that a big down payment would effect the affordability calculation – e.g. if I plunk down a $200,000 down payment, I should disregard the cost of capital for the $200K? That kind of calculation can only spring from a realtors pen….

There is such a map, for CA at least. It’s called Foreclosure Radar, and it’s about 50 bucks a month. Well worth the money if you are considering a housing transaction.

You can also see “foreclosure” properties on the Google maps if you choose the real estate option.

Doc:

Good stuff. I reallty do wonder if an owner should pay more than a renter… it really should be that the renter should be paying a premium for their obvious flexibility in the arrengement and the liquid/transient nature of the renter.

That said, to me, you have to cap a house at 10%… or basically annual rent must be 10% of the value of the home to give a reasonable assurance of a return for the investor/owner and some risk coverage (say if the unit is not occupied 20% of the time) (lowering the cap rate to a bottom tolerance of 8%).

This values these homes at something around $260K.

And with an annual HH of $89K for Cerritos then the pre-bubble/pre-Barney Frank rule of thumb of 2.5 times annual salary for a house price is close enough to make this make sense.

Well done Locked_in. I’m surprised at how some of the people here completely gloss over even the opportunity cost of $200k cash not to mention how much a bank would charge you to borrow that sum.

joshv

That has always been my take too.

When I was young your credit history and your ability to come up with a down payment gave you the ability to buy a house. Why did everyone want to buy? Because it was always equal to or cheaper than renting.

If it was always more expensive to buy than rent, what is the point? People would strive to buy because not only were the payments cheaper than rent, you built equity,.

The last 30 years of home prices rising faster than incomes has warped our thinking.

A retiree who owns their home free and clear living on a small pension and Social Security drags down the median income in a city, but then again, they don’t need a high income to be solvent. This is also the case with renters whose income is also factored into the median dragging it down when compared to those on the make for a home. The income levels of certain residents are arguably irrelevant in establishing affordability in a particular city. I know my grandparents lived in a nice area where they retired on a railroad pension. Their house was fairly modest, but it was also free and clear and he had the nicest lawn on the street but I’m sure he also pulled down the city’s median income figure.

.

Here’s an idea that would allow you to tell at a glance how strong the residents of a city are in terms of equity. A barometer that tells you whether the homeowners are weak or strong but not based upon their annual income figures.

.

What if you were able to look at a map and see a dot overlaid for each home? The color of the dot would indicate the debt load on the house. For example, if a home has 50% or less debt, the dot would be bright green, with variations in shades of yellow up to the point where the home is 100% or higher in debt, which would be indicated with bright red.

.

The variations of color in between are like traffic signal colors. Green means the owners are holding strong high equity positions. Red means the owner’s are highly leveraged. Yellow… mmeeeh.

.

I would expect the Riverside area would be red as a monkey’s butt, whereas areas such as San Marino and well, maybe to an extent, Cerritos, would be as green as a Goldman Sachs loot chamber. With but a glance, a green area would show extreme stability whereas a red area would rationally suggest a purchase here could result in a crimson bloodletting… yours of course, as you would be bobbing in a sea of weak handed “owners” easily knocked into foreclosure like a cascade of dominos. You couldn’t tell just by driving by that the Jones’s were jonesin for a higher card limit.

.

The interesting thing about this idea is that you would find that a lower-priced area with high equity green, would enjoy a better quality of life than a more expensive area where everyone lives strapped to the gills in debt. The homes in the high equity/low priced area would have nice lawns; not because the owner charged the premium lawn service to his credit card but because the owner had the time and peace of mind to take gardening classes and tend to the lawn him or herself.

.

Do you think such a map might cause like-minded people to congregate in a particular area? In other words, conservative “live below their means” types huddling together in their own private Idaho of destressed living. copacetic dude. Or do you think the existence of the map would have no effect on home selection?

.

Just a thought.

.

As always, a tip of the cap to the Doctor whose posts are always relished by yours truly like the first bite of pizza while watching the tip-off to a Laker game. Yum.

.

Thanks Doc.

Guess my dissent wasn’t approved.

Comment by Locked_in

February 5th, 2010 at 12:39 pm

Strange that people use the argument that a big down payment would effect the affordability calculation – e.g. if I plunk down a $200,000 down payment, I should disregard the cost of capital for the $200K? That kind of calculation can only spring from a realtors pen….

LOLOL! Exactly! And how many people have 20% of 600k lying around?…in a town where the average hh income is $89k? (There was a realtor on here the other day that was aghast that an alternative for FHA gov’t subsidy would be someone save the 15k they would need for a downpayment over a couple of years!!!) There may be a few who have $120k + closing costs lying in their sock drawer, but it wasn’t this few that fueled the last bubble. That’s for sure! And if they are smart enough to have that kind of money set aside, they are most likely smart enough to know/determine the relative cost/value of real-estate as an investment vs other investment opportunities.

Seems many of you posters are a bit jealous of those that have $200,000+ “stashed” in their sock drawers for a downpayment on a home. Whether you think it’s a good time to buy or not is irrelevant. There are many people who do, and are doing so. They aren’t planning on flipping, they plan on living there and raising their families, and enjoying their neighbors. My block consists of homeowners that have been in their houses for 20+ years. They have ridden every wave of home values you can imagine and not once have they thought of selling. And luckily, they haven’t had the need to. If you can afford it, and it makes sense to you, go for it. The only one who should care if it’s a “good time to buy” is the one paying the monthly nut.

I think too many of you are waiting for a wave of foreclosures to wash ashore with 1970s price tags hanging from the door knobs. If you are, it’s gonna be a long wait. In the meantime, I suggest you stop hanging out at those medical marijuana shops. That’s far more damaging than buying a home in this market.

And yes, this would come from a Realtor’s pen.

To complete the analysis you need to consider the economics of an all cash buyer/investor. Assuming a sale price of $549K, $2,150/monthj rent, $6,000 taxes/year, and $1,000 each for insurance and maint gives a yield of 3.25%.

Not great, and I wouldn’t buy a place in Cerritos no matter what the price (ok, I’d pay $100 for it). But what are the alternatives? Getting 1% in a MM fund, buying overvalued common stocks, or getting 30 year Treasuries yielding 4.5%, but with the chance of significant loss of principle if interest rates rise?

Then once you figure out the nominal yield, you need to convert it to an equivalent after tax yield by taking into account the depreciation deduction you get on your tax return for rental properties.

Houses trade like any other commodity. The markets are skewed by businesses and government, but especially financials and ‘investors’, actually gamblers. Investors no longer anticipate providing capital to ventures for long-term profit growth. It’s all complex formulas of program trading that are designed to pilfer the middle-class retirement funds. Obviously if jobs are net-lost and the UE rate goes down, it’s a bogus formula, just as Doc and others have insisted for many years. You think you want to see housing prices fall another 30% so you can get in ahead of the next bubble, but the carnage that will take place when that happens (not if) will be catastrophic. Be careful what you ask for because you aren’t going to like the ramifications.

According to the bears, these homes in Cerritos should be selling for about 300K. I’m not holding my breath.

Renting SHOULD be more expensive than buying! DUH! Historically, renting has always cost more. Common sense tells you that there is no incentive to buy if renting is so much cheaper. Yeah, some of the comments here are dripping off a realtor’s pen for sure.

Our government is acting in a criminal manner by artificially propping up home prices, punishing both savers and first time home buyers.

Dr., keep up the good work.

Good post Doctor. I am quite familiar with Cerritos and have a few friends who own there. What was said above is correct…mostly Asian buyers, people buy for the school district and there are large downpayments being used. Cerritos is very similar to what is going on in Irvine. Prices are very sticky.

Another topic of debate is where are these big downpayments coming from? Some people slave away for many years and save, others are from bubble equity sales of prior homes. As much as I hate the housing bubble, I doubt we will ever see these featured houses sell for 400K or less. To own a house in Cerritos or Irvine…you are paying a premium. This premium is also debatable…10%, 20%, 30%?

I know it doesn’t make sense to buy investment properties at the current price, but some cultures (Asians) view hard assets such as real estate as must haves. So if an invester has a big downpayment (150K+), they might view the featured property as a potential good future investment. The thought might be that this could be a potential first home for one of their children. Who knows what will happen, but all this shadow inventory will eventually have to be dealt with.

I still remember the CA housing recession of 1990 to 1996. After about 3 years of prices not rising and many falling, everyone started to become bearish on homes. That’s human behavior. Another year or two of flat to falling prices and people will decide it’s not an investment to be in any longer.

Then is when the fun begins.

SoCalRealtor, can you please make a strong cogent argument against an impending housing crash? Go ahead, give us your best shot (I have heard it all; growing population, immigration, the recession is over, etc…). This is a wonderful forum for reasonably intelligent people can interact, exchange ideas and have a healthy/productive discourse. Oh, one more thing, there is no need to insult people who disagree with your premise by saying “stay away from the marijuana shops”. Focus on making a cogent argument instead of illogical attacks. I will be patiently waiting for your response SoCalRealtor.

I have asian friends, close asian friends….they are not stupid. They are thrifty and wise. They are not likely to overpay just for the hell of it. Simply because they have money does not mean that they allow themselves to be taken advantage of. Quite the contrary, they look for bargains like everybody else.

But nice try realtors!

When prices come back to reality, you won’t hear a damn thing about “Asians” with regards to the housing market.

The “Asians will own it all” crap was around in the early 90’s also….but shhhhhhh…don’t say anything about it or else you will be labeled a racist.

Renting should not be more expensive then buying. If you buy, after 30 years on a standard loan, you actually own the home and don’t have to make anymore payments. At tha point your only costs are taxes and upkeep and those costs are just a fraction of what you could then rent the place out for. After around 5-8 years if you bought at a time of sane prices, you start to build up equity in the house.

But I will be the first to state that the monthly mortgage payment for a house you buy shouldn’t be tremendously more expensive then monthly rent for a similar house. So in the scenario presented in this article, renting is the better buy.

When rental prices on a monthly basis => mortgage prices on a monthly basis, you are usually getting a bargain on buying a home for that specific area.

About 85% of the country now has sane home prices, especially when you factor in interest rates, but in areas that are still in a bubble, I would advise renting unless you can get a great deal on a foreclosed home/short sale.

Shadow inventory are not homes being sold at an auction as one knows the actual number, but reo’s that are held by the bank and at some point will be offered up for sale. One can only guess when these units will be released by the bank, causing concern among potential purchasers that a large number released at one time, will further depress market value.

I live in northern San Diego county and I believe house prices are still too high. too high by 20%.

@Nimesh:

My argument against a housing crash?

Two words: Government Intervention.

The new push will be for principal write-downs and short sales @ market value. New legislation will force the banks to grease the skids for short sales and no more giving homeowners the run-around if they want a loan mod. Banks will approve or deny requests for loan mods more quickly than in the past. If approved, you’re fortunate. For those that are denied, they will be “encouraged” to do a short sale–less damaging than a foreclosure to your credit and under Fannie Mae guidelines, a former borrower will be able to purchase within 2-3 years vs. 5-7 years with a foreclosure.

Short sales done at “market value” will stem the tide of properties banks are taking back. Wachovia is already doing it. They’ve ditched the red tape and the thousands of hoops stuggling homeowners have to jump through. It’s working. Expect more banks to follow their lead to deal with this crisis. Short sales and principal reductions will likely be the primary ways banks deal with homeowners who have been in default mode for years and have not received a notice of default.

Make no mistake, the government will continue to prop up the housing market regardless of how unfair many people think it is. They have no choice.

http://www.reuters.com/article/idUSN0318956120100203

The “large down payment” reasoning still makes no sense. It is a luxury, an option limited to very few. Overpaid is overpaid. Eventually, you run out of buyers.

The idea that an average house should cost 600-700-800 K$ is just plain nuts. Applied to transportation, it would be like paying for a 1972 Ford Pinto the price of a Rolls-Royce.

@ Socal Realtor

Thanks for writing in. We’re just trying to find the truth so we don’t make a big mistake like so many have in the recent past. We don’t think there’s a problem with folks who have a 200k down payment and buy a house–it’s the pervasive concept that anyone can buy a house with little or no skin in the game that artificially props up the prices. Also, the govenment buying paper to artificially skew interest rates. Also, that realtors are allowed to fix prices for their services. In many industries this is illegal and people can be fined (AMD, for instance) or go to jail for price-fixing. What gives? Please read some of the past articles here and tell us why you believe the good doctor is wrong.

They tried to prop up prices on just about everything during the depression as well. Eventually they had to stop and prices fell to what was actually affordable. Wait my young padawan.

@Socal Realtor,

How do principle reductions work exactly? If you own a home that is not underwater, but you need a 50% principle reduction to continue to pay the mortgage, do you get it? What about your neighbor who lives in an identical house but can meet his mortgage payments without needing a principle reduction? Does he not get one? If the answer is “yes'” this is nothing less than communism.

Just wait until all the old people close to retirement see that housing is going to crumble again….that should add a bunch of over-priced homes to the market as well. Time is running out and the demographics of America will also dictate price on the market, I hear the clock ticking, and I’m sure THOUSANDS of people also watch that clock hoping housing goes up so they can CASH OUT and retire out of California.

@ SoCal Realtor Don’t drag medical marijuana into this, there’s already enough negative feelings going around and your fascist judgment based on the “this is your brain on drugs” zealous banana republicanism will only feed it. Reagan cranked up the war on drugs so the CIA could fly in cocaine to sell and finance the Contra War. That and arms sales to Iran. Yea, don’t smoke marijuana, just stick your head in your posterior, and vote for the facists who defraud americans of their civil rights, support crony capitalism/banksters and invade countries based on lies.

See, you shouldn’t bring that sh1t judgmental attitude in here Socal.

I wonder if you posted in the past where your business is because I would very much like to avoid it and tell others to avoid it based on my opinion….and you can bet it will be like your opinion. Facist, judgmental, and untrue. So tired of the “old” mindset like yours. Can’t wait until that mentality is gone…almost like realtards are today.

This generation can’t do any more damage than the Baby Boomers have already done. The “me” generation; “Greed is Good”; etc., etc.

They inherited a safe and prosperous nation, descended on it like a swarm of locusts, sucked it dry, and will leave it a smoldering carcass to their children.

Rents are already dropping whether you are in California or Texas:

http://www.calculatedriskblog.com/2010/01/rents-fall-to-3-12-year-low-in-orange.html

The average rent for a unit in a large Orange County apartment complex fell to $1,473 a month in the fourth quarter of 2009, the fifth straight quarter to see monthly rents drop.

Apartment tracker RealFacts reports today that numerous empty apartments forced local landlords to cut rent $105 a month on average — 6.7% — vs. the fourth quarter of 2008. And it’s the lowest average rent in 3 1/2 years.

“They’ve come down quite a bit,†observed Hugo Gonsalez, manager for Nextrent.com, a Santa Ana rental listing service. “You see eight empty units (in an apartment complex) where you used to see one.â€

SoCalRealtor here is my reply. You said two words; “government intervention”.

Real estate prices doubled from 2000 to 2006. And this was the largest unprecedented asset bubble ever. In some locations, prices tripled in value. Plus I am not even counting people who took all of their equity and cashed it out.

The government simply doesn’t have enough money to bail out everyone who is underwater. So far, the government has paid lip service and come up with one gimmick after another to “keep hope alive” for underwater home debtors.

With Social Security broke, a banking system that is insolvent, state and local governments in debt and may even default, an aging workforce that can not retire and young people who can not find employment, we have a lot of problems. Yet, time and again, instead of doing what is necessary; living below our means, we want to have it all. A McMansion, two cars, pensions, a huge flat screen tv, etc….

Rent vs buy calculator:

http://www.nytimes.com/2007/04/10/business/2007_BUYRENT_GRAPHIC.html?_r=1

Large (20-30%) down payments have no bearing on the affordability of a home. You may lower your monthly payment, but you have parted with a substantial amount of principal money that could be earning a return elsewhere. Housing purchases make sense in an appreciating environment, but in an uncertain environment like ours don’t go for it, and don’t get brainwashed by the conventional wisdom (of people who got us into this mess in the first place) that says now is a good time to buy. By what reasonable measure? The fundamentals of the economy in California (and the US) are still terrible, and housing prices still have room to fall. Think it can’t go down further? Did you expect prices to be as low as they currently are in 2010? They can fall further and folks, they will. You don’t need to own to live in the neighborhood of your choice, you can still rent there. If you can afford to own there you can afford to rent there.

The financial/realtor establishment knows that psychology and emotion underlies a recovery: if you make people believe that things are stabilizing/getting better, and now is a great time to buy, then people will act. Nothing wrong with positive action unless it’s based on false hope. Folks, everyone is spreading false hope today. This is not pessimism, this is reality. The fundamentals simply do not bear what the establishment wants you to believe. Protect yourself in this great recession, no one else is looking out for you.

I don’t know. I just bought my first home in Orlando. It was a REO and is 3014 sq feet for $125K and only 3 years old. You can’t possibly BUILD this house for less than $180K and it’s in good shape. It only needs some new carpet. Considering all, I think I did really well and no matter how people cry that the market is still crashing, I still think I am super lucky to own my dream home for a fraction of the cost of materials.

@Nimesh

You hit the nail on the head with that particular observation, as John Cleese might have once said. I’m just a stupid engineer. I can’t find the formula for all this to work out in the long run. I wish one of the pundits could show me the algorithm.

Even is “stable” value areas like houston, tx there is still distress selling, especially in the large homes. There are many 4000-6000 sq ft homes in major distress.

Where I like the 8000 sq ft mansions on golf courses that cost around $1M all go up for sale in major market corrections… 2000 and 2008. I think the people in those upper markets here are buying big but have no reserves so when they lose that $250K a year job they cannot afford their $1M house anymore.

That is what it seems.

Beware of Foreclosure Radar. Your $50/month will not net you very much. Most posts on the site are over a week AFTER the notices are posted at the county. Many auctions posted to their site are 2 or 3 days away, leaving you, the investor, little time to properly investigate a property’s condition (physical condition, liens on title, property tax status, etc…). You’d do better to get online at the county sites and research this yourself, check the free postings on the trustee websites, review newspaper classifieds (online too), or subscribe to a local abstract report that will get you the data on the next-day with no 2-week lag like Foreclosure Radar can have.

Lots of intersting comments. We call it the housing “market” but it’s really just people buying and selling individual things. The old idea of “comparables” goes out the window when a bubble sets in. Realestate people yell about comparables becuse they are using 1960 conventions in an inapropriate way. Objective value continues to be 2000 value plus inflation. Inflation has been very low for a long time since we hit the deflation trap door. so say 3%. You take the value the house sold for in 2000 or before and you compound 3% from there and you get objective value as if the bubble never happened. If you pay more than that you have overpaid and will loose the amout you overpaid. If we took away comoditization of mortgages housing bubbles wouldn’t happen. It’s that simple.

There are so many variables to take into consideration, the areas that are seeing the income equals rents or a slight cash flow are threatened by more gov intervention called section 8! There is stil plenty of investor monies and with the low interest rates and shaky stock market this is where many are turning to make a dime. Its all about keeping the assets propped up, while the buck dwindles. stagnation?

Leave a Reply