A theory on the bounce and slog housing market – Will rising home prices resurrect those negative equity home owners?

Another thesis regarding the housing market’s future path is that of a bounce and slog market. The theory focuses on the negative equity home owners and also the low inventory on the current market. This view point actually holds some solid ground. As of last count, there are over 11 million negative equity home owners in the US. This data is usually put out quarterly but with the stronger home price movement this summer, many will move out of the negative equity position. The theory proposes that many are not selling today simply because they cannot without bringing cash to the table. Out of the 11 million underwater home owners, how many would like to sell but simply do not because they would actually lose money on their sale? This is an interesting perspective on the underwater segment of the market. Yet the outcome is probably not as clean cut as one would expect.

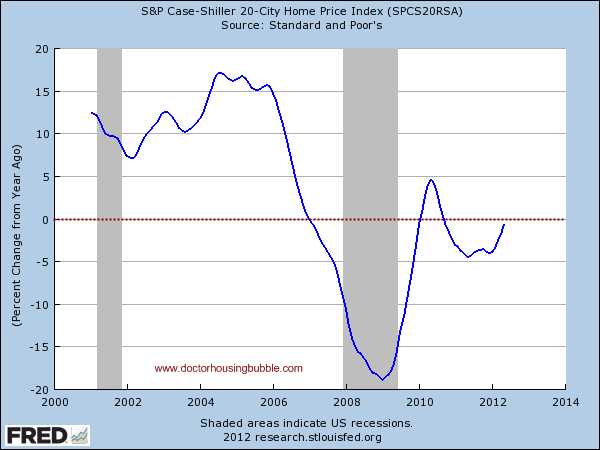

Case Shiller will turn positive shortly

2012 has been a solid year for housing thanks to low inventory and very low interest rates:

Coupled with the above items, you also have very low down payment mortgages like FHA insured loans that have boosted the entry level market buyer by allowing maximum leverage with little money in the game. This has assisted on one front but there are still many in a negative equity positions that are paying their mortgage dutifully. To the initial theory of the bounce and slog, the idea goes that many will want to sell and are seeing that prices are going up. So they hold off inventory until they reach a tipping point where it finally does make sense to sell. In normal markets, people move for more common reasons like starting a family, up-sizing, divorce, or down-sizing. The distressed portion of the market was typically a small segment. For the last few years it has dominated.

As more of these home owners enter positive equity territory many are likely to sell based on more historical reasons versus the current leakage of shadow inventory. But think of what happens then. A larger portion of inventory will enter the market and likely put pressure on prices. After all, we know that 11 million of these homes are sitting in this exact position. It is an interesting theory and seems to be a very likely outcome on a nationwide scale especially if household incomes do not go up (and there is little evidence to show this is happening).

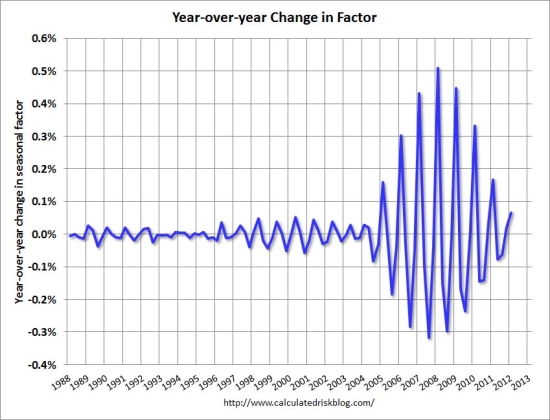

You also have seasonal impacts of home prices. Spring and summer are usually the best times for sellers and fall and winter usually see prices stall based on volume of sales:

Since the Case Shiller data lags the current market by a few months, you are likely to have positive news coming out for the spring and summer while the fall and winter data will not show up for a few months. It is really an interesting phenomenon because the market forces have been blunted to a large degree but you now have this pent up inventory of distressed home owners but also many more who are simply underwater. Someone that is say 5 to 10 percent underwater and has no issue paying their mortgage really isn’t a distressed home owner.

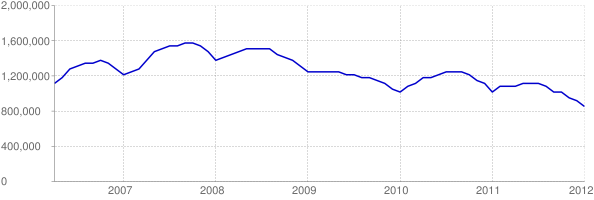

Visible inventory seemed to peak in 2008 but has moved steadily lower since that point:

With demand being increased via:

-Lower interest rates

-Banks controlling distressed inventory

-Low down payment mortgage products

Home prices have stabilized and are actually increasing nationwide. The one aspect I am cautious here about is that household income remains weak and prices have increased simply by various mechanisms of leverage. The housing bubble was created by leverage products that decoupled from household incomes. We are nowhere close to liar or NINJA loans but is a 3.5 percent down payment product something that should remain if default rates are soaring? Anyone that buys a home with an FHA insured loan (the vast majority go with the lowest down payment possible) will be in a negative equity position for a couple of years given selling costs associated with a home sale.

The premise is interesting and I think this is likely a path for housing for the next few years. A sort of bouncing along on the bottom as distressed inventory is funneled out but also, many underwater home owners come online to sell and thus pushes inventory up putting a cap on how high home prices can go up. Supply and demand on the MLS but behind the scenes, we have a potential pool of inventory that has never existed in the US housing market.

The religion of the Fed

On a side note, some seem to think that the Fed is nearly omnipotent in what they can do. Do not forget that it was the Fed with little oversight of the banking system and Alan Greenspan slamming rates lower that provided a very fertile ground for the housing market to expand. Also, let us use Ben Bernake’s words from 2007:

“(Fed Reserve, 2007) All that said, given the fundamental factors in place that should support the demand for housing, we believe the effect of the troubles in the subprime sector on the broader housing market will likely be limited, and we do not expect significant spillovers from the subprime market to the rest of the economy or to the financial system. The vast majority of mortgages, including even subprime mortgages, continue to perform well. Past gains in house prices have left most homeowners with significant amounts of home equity, and growth in jobs and incomes should help keep the financial obligations of most households manageable.â€

Does that sound like a central bank that can predict deep into the future? Only a few months later the economy started to implode. The danger with the very generous monetary policy of the moment is that people are now conditioned to insanely low rates and low down payment loans. Black Swans are common because people act irrationally and we do not have full transparency in current markets. The vast majority even openly admit that banks are sitting on millions of properties yet the only way to get a true measure of their price is to have them on the market! In the short-term a bounce and slog market seems to be the name of the game.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

43 Responses to “A theory on the bounce and slog housing market – Will rising home prices resurrect those negative equity home owners?”

People will buy homes to have lots of children and for their mama and papa to live in.

The thing that bugs me the most as someone sitting on the sidelines for the past 7 years is that politicians seems to think (out loud in public anyway) that a rise in housing prices back to near bubble levels would be such a great thing. Really? let’s do everything in our power to get housing prices back up there? that’s the cure all?

I’ve been tossing this idea around in my head for a while, so hear me out.

What if they passed a law that stated, as of a certain date, nobody can get financing on a home for more than the growth rate in the CPI+1% since the home was last sold? If someone wants to pay more than that, then they need to come up with cash to make up that difference. On the down side, if prices fall, they fall and there’s no financing restriction on the lower price (relative to CPI, which usually goes up). People don’t get caught up in this game of viewing a house as an internet stock circa 1999. Yet, there is room for appreciation loosely tied to inflation and if demand does increase prices beyond this benchmark, then buyers become more vested due to having to come up with more cash. I think what will result is a much more stable and healthy housing market with the right people in the right sized homes.

An exception would be “flips,” in which case flippers need to show cost documentation on all improvements and are limited to X% markup profit on those costs.

I realize this is somewhat half-baked, so i encourage those that like the idea to add/improve upon it.

What bugs me is most of the reporters and politicians have their own underwater properties they bought during the bubble, so of course they cheer lead for reversion back to bubble pricing.

Journalists are always disclosing conflicts of interest, yet they never mention any when writing about housing.

It would be interesting to see a study on legislative members housing status, heck the executive branch as well.

@Tim Smith

Exactly. One has to always filter the opinions of pundits and financial analysts when they talk about the housing market, because, chances are very likely that they are probably in hock for a pretty expensive home that they bought in the bubble years of ’98-’05. If they’re like most Americans, that home is their largest asset, and you know damn well they just want one more bubble to get above the water line and breath again.

An exception would be members of the NY media who live in Manhattan and rent. Yes, America, there are upper middle class to wealthy people who rent in NYC. Probably the only place in America where their social peers don’t look down on renting. Some of them may have even won the jackpot, and are living in rent controlled or rent stabilized apartments. Lucky b***ards.

Ask and you shall receive

http://www.charlotteobserver.com/2012/08/15/3457710/house-members-vip-loans-excluded.html

I’m always thinking about that when I read things & hear what people say… and I mean everyone from politicians, journalists… or even people I know personally. I just get this nagging question that occurs to me… What’s their stake in this? And are they wishful thinking? Because I happen to think a lot of the investment market, and housing market, has a lot of people who no matter what the hell happens, they’re still always under that Ralph Kramden-esque get-rich-quick spell. And I totally believe that they will do anything, say anything that can preserve that somehow.

I often feel like I’m on the outside, and I feel like I’m looking at these people who are somehow under this powerful spell of confused fantasy, because they have a stake in the fantasy.

I can almost liken it to looking around at a bunch of zombies who won’t oppose the will of Landru. lol

Then I get even more cynical and think that many of these people who say things are in fact aware of reality but have personal gain reasons to try to tell outright bald face lies.

I don’t think that would work well. The CPI is cooked to minimize the expression of the actual effects of inflation upon consumers. Basically, if you’ve had a job for 30 years and your wages have risen in lockstep with the CPI, your purchasing power is somewhere around half of what it was when you started. As such, this proposal is essentially a price ceiling and would interfere with the market’s ability to set prices according to supply and demand. Over the long term, it would be destructive.

And i don’t see any need to limit flipper profit caps. Flipping is risky. The level of profit in an endeavor is usually inversely proportional to the risk assumed. Sure, in the run-up of the bubble any fool with an ikea account could polish a turd of a house and make money. It’s just the same as when, during the stock market bubble, 60 Minutes literally had a monkey pick stocks by throwing darts at a newspaper and those “investments” outperformed the professional brokers and money managers they’d given the same amount of money to at the beginning. A similar experiment in a more temperate market, I’m sure, would not yield the same results. I see no good reason to limit the profits made from flipping. Clearly, the market has a place for such activity.

It doesn’t have to be the CPI. Any somewhat defensible number.

The point is that allowable BANK FINANCING would be pegged to this. If you want to buy a house at a greater annual appreciation than that, then you have to come up with cash. This puts more risk on the buyer. We’ve seen the alternative. Minimal/zero down payment leads to taxpayer bailout. I suppose you’re fine with that status quo?

The point about the flips was only to introduce a component to the proposal that accounted for flipped properties and allowed for greater appreciation than the benchmark. I guess one could still allow even more than flipper cost+markup, but then maybe require cash again to makeup the difference, no financing.

Btw, as someone who’s probably going to buy within the next 12 months, I’m perfectly fine with this arrangement. I don’t view buying a home as gambling for a potential windfall should a bubble occurr again during the time I own my home. I’d personally prefer market stability rather than boom and bust dynamics causing my neighborhood to vacillate between cashout millionaires and deadbeat borrowers.

One last word. As someone who’s actually worked with RMBS and CDO data, including corelogic loan level data and Intex RMBS/CDO tranche data, I’m always amazed by the level of correlation seen in defaults of, ex-ante, seemingly solid credit profiles. This tells me that the current financing situation simply turns normal joe schmoe home buyers into real estate investment trusts. Not something healthy for the long term financial strength of this country IMHO.

Yup, the Politicians want things back to the good ole bubble because it causes huge false real estate taxe payments into the coffers and other transaction taxes. That’s so they can go back on a spending bender. The Pols are weak, mostly dishonest, greedy and want to give yours and my cash-n-capital away for votes. Let’s all help them find a 12 step program or…..jail, where they belong.

^^^ this

I’m a little confused by the wording of that paragraph. Can you clarify it?

August 15

http://confoundedinterest.wordpress.com/2012/08/15/mortgage-applications-fall-4-5-purchase-applications-still-in-a-rut/

“Mortgage purchase applications fell -2.01%…

The MBA Purchase Application index remains in a red zone since May 2010. It is hard to imagine a vibrant housing market recovery with mortgage purchase applications stuck in a rut.”

Is the spring/summer dead cat bounce over?

What are some other timely indicators to judge the real time state of the market, rather than indicators that are delayed by weeks or months?

Another bubble, another ‘X’ number of years waiting, paying rent, this is BS!

Geez the Gov tries to get housing affordable for years, it’s finally getting there, and now they want to raise it again. What a crock of baloney. Stupid Gov, the solution is clear…

“That to secure these rights, Governments are instituted among Men, deriving their just powers from the consent of the governed, That whenever any Form of Government becomes destructive of these ends, it is the Right of the People to alter or to abolish it, and to institute new Government, laying its foundation on such principles and organizing its powers in such form, as to them shall seem most likely to effect their Safety and Happiness. But when a long train of abuses and usurpations, pursuing invariably the same Object evinces a design to reduce them under absolute Despotism, it is their right, it is their duty, to throw off such Government, and to provide new Guards for their future security.”

Hey great quote there Papa. Two things came to mind as I read it. The line about reducing them to being under absolute despotism recalled the current hubub about the Repubs and Dems making campaign noise with phrases about shackles and chains. The other is a twist of irony in how it flies in the face of the current propaganda spouting America’s exceptionalism when in fact this piece defining Americas new government (back then) is sine que non the heart of her exceptionalism.

Thank You Papa To Be -The Declaration Of Independence rocks. Too bad our country “people “don’t understand its purpose and don’t have the chutzpah to use it. I’ve always said it was a wasted document and right of the people. In laymen terms “throw the bums out”. Every single one of them. Kudos PTB for posting the DOI’s meat!

Hear Hear!! I nominate Papa to Be for POTUS!! Wish more people understood this!!

My thoughts exactly.

I thought about this when I read something about people wanting to do away with minimum wage. Then I thought about the median income around the country becoming spectacularly low… and would the price of the average house remain the same? Would rents remain the same? Could they?

It seems like a lot of politicians, and citizens, have ideas that superficially might make sense, or even sound really good… but that they don’t seem to think it through to the long-term end result in most cases.

I guess it’s the short-term mentality the culture has gotten stuck inside.

I don’t know what the answer is… but it just seems whenever I hear someone propose an answer, it often overlooks some horrendous probable outcome down the line.

DHB – I have a couple of observations on your analysis and think there are number of misses on this one.

First, a technical issue with the following statement:

“With demand being increased via:

-Lower interest rates

-Banks controlling distressed inventory

-Low down payment mortgage productsâ€

I think the general public is very weak on economic principals and I think we need to be clear. Lower interest rates and low down payment mortgage products shifts the demand curve out (to the right) which in isolation will increase price and volume. Banks controlling distressed inventory shifts the supply curve back (to the left) which in isolation will increase price and lower volume. The most likely outcome of these two shifts is an increase in price. Volume can go either way based on the shifts of both curves.

Second, I think you missed a macro economic problem with the following conclusion:

“The premise is interesting and I think this is likely a path for housing for the next few years. A sort of bouncing along on the bottom as distressed inventory is funneled out but also, many underwater home owners come online to sell and thus pushes inventory up putting a cap on how high home prices can go up.â€

This could be the case if the housing market was isolated from other markets. The real problem is that the Fed’s propping up of the housing market has ramifications on other markets. The artificially low interest rates are increasing the supply of dollars which lowers the price/value of dollars. This impacts the cost of items we bid for on the world market like food and fuel. Wages are at best going to be flat in real terms given the slack in the US labor market and the pressures of globalization. This will cause a crowding out of housing spending as flat wages compete for food, fuel and housing.

So, I think the real question would be your definition of short term. Can the Fed continue this until the election? Most likely yes! Can the Fed continue this for the next several years? Most likely no. There is no easy way out of this problem. We have shifted the SL crisis to the dot com crisis to the financial crisis to a sovereign debt crisis. My colleague suggested shifting the sovereign debt crisis to Jupiter or Saturn… I think we are all out of deck chairs to move on the Titanic…

What is rarely addressed in discussions of supply/demand – especially the undying myth of ‘pent-up demand’ – is the *quality* of the supply and the *eligibility* of the demand. Prices won’t increase if there is not substantial qualified demand, and I certainly don’t see anything in the BLS numbers to suggest any imminent wage/salary inflation to support such a scenario. As for supply – no matter how much banks attenuate their foreclosures – if the homes which comprise the shadow inventory are in significant distress from deferred maintenance, then you have a serious issue of quality supply, too.

Prices will continue to bounce around and eventually over-correct. A cursory understanding of all asset bubbles throughout history reveals not a single instance of that asset not overshooting to the bottom at least as wildly as it shot to the top. The only thing that FED policy has managed to do is to slow the rate of that correction.

“Prices won’t increase if there is not substantial qualified demand, and I certainly don’t see anything in the BLS numbers to suggest any imminent wage/salary inflation to support such a scenario”

I’ve thought the same thing… isn’t there some big picture here where there just can’t be a price increase cascade without some kind of “free money”? At some point in order to justify price increase, it will have to mean a great many people homeless or living 15 to a 2-bedroom apt or house… and then that alone will push prices back down because there will be empty houses & apartments. ????

“Prices will continue to bounce around and eventually over-correct. A cursory understanding of all asset bubbles throughout history reveals not a single instance of that asset not overshooting to the bottom at least as wildly as it shot to the top.”

Perhaps you can answer this question. Perhaps it sounds silly. But was there an over correction in Tulip Mania? Did tulip prices overshoot the bottom?

Curiosity’s comment about purchase applications being in the red zone since 2010 and the docs comments about the fed, especially the quote “…. growth in jobs and incomes should help keep the financial obligations of most households manageable.â€brought to mind this article from last week: http://www.pe.com/business/real-estate-headlines/20120809-real-estate-california-still-no.-1-in-foreclosures.ece.

From the article: California retained its No. 1 rank in foreclosures for the second consecutive month, with 19,210 notices of default recorded on houses and condos during July, despite an 11 percent decrease in foreclosure activity from June and a 25 percent decrease from one year ago.

and

The Riverside and San Bernardino metropolitan area continues to hold some of the highest rates among metropolitan areas in the nation, he said.

For the Inland Empire, there were 3,569 notices of default filed in July. “That’s up 16 percent from a year ago,†Blomquist said, and it marks the third straight month of year-over-year increases in notice of default filings, the first step in the foreclosure process.

Yes it is Inland and the Central valley that lead this. Practically 98% of the listing I receive in my search are foreclosures. That’s in Temecula one of the better communities and a commuter base for SD and Orange county. But given Bernanke’s observation that it is jobs and incomes that will make the market stable I’d expect the pain to spread to the coastal regions going forward. Don’t ask me how long I’m a civilian. I do believe that inventory will increase in the fall and winter partly because sales will decline and mainly because the foreclosures will increase.

Phoenix rental prices have been dropping .As these big buyers that flooded the market the last few years put more and more rentals on the market they can expect lower returns and a longer timeframe to rent.Plus MLS properties for sale has been steadily rising again .You have to wonder if all these fools that bought the spike are not going to make much with their investments in rentals.

Yep, I rented in Phoneix from 2008 to 2009. I rented a 2200 sq foot house in a nice hood for 1550 back then. I was checking out craigslist and it looks like I can rent the same type of house in the same area for about 1000 to 1200 today.

As the above quote on the drop in Phoenix rents indicates, the investor rental market is cooling off considerably. With regard to rising prices, what would have happen if investors had been taken out of the picture? In some areas, such as Las Vegas and Phoenix, they have been as high as half the buyers. The overall Fed strategy to force everyone they can into risk based assets to try and reflate housing and the stock market has had some initial success. With interest rates manipulated to near zero for investors, rental property can look enticing until it collapses, like the numbers out of Phoenix. It is all a Ponzi the central planners are trying to control but the market is much stronger and will prevail. Lack of investor demand will be brutal in many parts of the country.

@ Jeff

This is why we call it the LAW/RULE of supply and demand, not the THEORY of supply and demand. It has been very interesting to watch how the laws/rules of economics keep manifesting themselves in the current controlled market. It is like watching a young child on the beach trying to stop the water from getting into their sand castle. The child fixes one breach and the relentless water finds the next path of least resistance. Eventually the laws of physic will win as will the laws/rules of economics…

There are exceptions to every law. The cost of healthcare is one prime example of how the LAW of supply and demand does not always work out according to how the text books say it should.

@hamsun

Please explain how the law of supply and demand does not pertain to healthcare. I think it is always important to understand who the real customer is when we talk about demand. If you ain’t paying you ain’t the customer…

Aug 15 2012, 3:14PM

http://www.mortgagenewsdaily.com/consumer_rates/271026.aspx

Mortgage Rates Reach Two-Month Highs

“Mortgage Rates made an abrupt move higher today, leaving most lenders at their worst levels since early June. Recent momentum has carried rates in a weaker direction despite a relative lack of impetus from underlying market events. At first, this could be chalked up to low volume volatility, but volume surged today (yesterday too, to a smaller extent), and securities in rates markets hit levels not seen in months. All told, it was enough to move the Best-Execution rate decisively up to 3.625%.

This means that depending on your starting point in observing mortgage rates, you’re definitely up at least an eighth of a point from any time in the last few weeks and in some cases, a quarter of a point.

…Clearly, the trend toward higher rates continued today and has stampeded through each instance of “potential resilience” in the past two weeks.”

To accept this as a viable theory, several conditions must be met.

Equity will increase to 6% to cover sales commissions.

Cost of moving will be covered by the increase in equity.

It is cheaper to rent than to continue to own, even with mortgage deduction is considered.

Homeowner believes that the upward move will not last, so better to get out then.

Homeowner has no intention of repurchasing unless he has savings for a new purchase down payment.

I could only see a very few persons meeting all of these conditions. However, if they do meet the conditions, it is a very good move.

Patrick

LFI Analytics

I live in Chicago and thankfully (because of websites like this one) did not buy a home. I am still going to sit out of the housing market because the banks still have reo’s on their books. Is there a way to look up how many homes are waiting on the sidelines?

How many homes are sitting on the banks balance sheets but are not listed? Does anyone know? Thanks.

REO’s are an island all to themselves. The bulk sales to deep pockets for rental housing has done a great deal to take a majority of the the REO’s off the retail market. If you want to follow foreclosures in the till, or homes currently headed for foreclosure (but most likely get a postponement or cancellation), Foreclosure Radr dot com is $50-/mo and is great.

There is REOMAC (association) and of course Foreclosure Truth, Sean O’Toole’s bLOG (CEO-Prez/Foreclosure Radar) is a great data point.

We’re in So Ca actively going through deals like M&M’s. Not many REOs anymore. Short Sales and Regular Sales (w/a $10K premium). What a buyer’s nightmare.

When removing distressed property at a loss from the bank’s balance sheet a lower adjustment will be noted, prior to the sale, the bank statement had shown the current value of the asset. If banks were more aggressive in foreclosures, the losses reported would run off shareholders. TARP played in part in this deferred foreclosure process.

Mark To Market just pisses me off, Don. TBTFs are treated with kit-goves, while the rest of us are not.

Our house money is earning almost nothing. I hate, and mean hate, these engineered low interest rates.People are throwing offers out there with no sense of value and we’re sensible. There is a law of diminishing returns on playing the bidding game. We might win, and actually lose. Why can’t these idiots get it? Frustrating is an understatement.

And you’re right, Don. The banks pad their FS with MTM, and bonuses are pumped up. Wish I was a bankster!

This has nothing to do with the “banks” balance sheet. The loan was sold long ago to the GSE’s or MBS’s. The MBS is most likely insured by AIG (aka government). So the real losses will show up on AIG’s balance sheet or the GSE’s balance sheet. The banks have been selling their loans and MBS’s to the GSE’s and Fed over the past five years. I would guess that the only things on the big bank’s balance sheets at this time would be treasuries.

Dear Doc Bubbles, please turn on the Bubble machine and tell where all that inventory is hiding????? My impression is banks are now the big rental dudes, them and insurance and the greedy 1% or less. So this really looks more like the good ole days of the 1930’s depression to me..How about a nice morning coffee thread on that subject during these tense political daze.

Thank you 1hutch. I agree, this is the Greatest Depression.

The govt & media to the sheeples:

Wash.Rinse.Repeat.

(The stats and “news” are nothing but mental masturb*tion)

I’ve been watching homes in my neighborhood and this is the most recent flip…

http://www.redfin.com/homes-for-sale#!lat=34.16840225253393&long=-118.39709052143411&market=socal®ion_id=37911®ion_type=2&sf=1,2,3,4&sold_within_days=90&uipt=1&v=8&zoomLevel=16

I went in and the realtor said it sold for $425,00. On redfin it’s listed at $472k when it sold previously If sites obscure their numbers and the real cost of properties on purpose this is a huge problem. It’s a $47k mistake that influences the general perception of what homes are selling for. The renovations on the flip were “adequate,” but not in upwards of $154K by any means. Does this misrepresentation happen often?

valley village, great area! Rents are high there though…

check out:

http://www.pacapartments.com/properties/search/?city=Valley%20Village&zip=&bedrooms=&bath=&petfriendly=0

Your gonna pay a minimum $1400 for a 2 bed/2bath apartment… (and they charge you a monthly water and trash fee too, not included in rent).

I pay $2280 PITI .. for a 4 bed/2bath house with a pool and large yard. I’d say that’s pretty close to rental parity… considering how much MORE you get for the extra $680 a month.

What! Those are the same rates in Rialto, and Rancho Cucamonga is even more expensive.

This market makes me want to EXPLODE

Paul

Here’s a tip. I use Trulia or Redfin to get the sold price. Wait until escrow closes and it records. You can also use realtor dot com after a while to get the price. It’s a special section called property records.

Also, I can’t agree more on flips. But I will say a few flippers have integrity and will go ahead and replace the “bones” of the house. (HVAC, roof, plumbing, electrical wiring) but most just do lipstick on a pig. Maybe twice we’ve seen the pool resurfaced.Overall, the parasites just throw in granite and the idiots will overpay. Flips aren’t such a deal at the auction anymore in my county.

With the condition of short sales and regular sales, flips are looking more interesting to us, if they are priced at market. If they are too greedy, they can kiss my hinny.

I grew up in that area. North Hollywood High, and Valley Jr, and then on to “reform school”. LOL My mother lives at Magnolia and Bellaire.I LOVE parts of that area. Very cool tree tunnel streets and cute post WWII homes, some not so small. I use to hang in Laurel Canyon as a teen, and went to sitcom tapings at CBS on Radford. I didn’t realize how lucky I was until the rearview mirror. I had a great childhood and teenhood.

Yeah, my childhood and youth were great. Jobs were plenty, housing was cheap, family still meant something. I feel sorry for kids today- no jobs, have to compete with India or China wages, while having to live in first world expenses.

We have a government that cares more about free trade and the profit of a few corporations than the fact that this has led to massive job loss. Back then Nixon, a republican, slapped import taxes on all imports because our balace of trade was out of whack. Now even the dems wont declare China a currency manipulator-despite the fact that they hold it down to the last cent.

I wonder if this is a massive bump or we reached a massive peak and just tumbling down.

Leave a Reply