The mortgage market trembles: the test of higher rates and the sustainability of the current run in housing values. A record move in the mortgage markets.

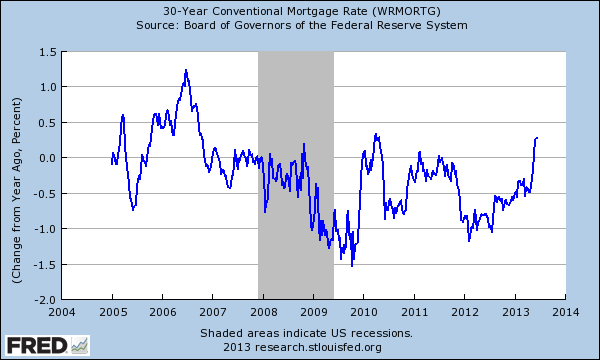

If you weren’t paying attention, you might have missed one of the most dramatic moves in the history of the mortgage market. There was a sense that the Fed had all the power in the world to push mortgage rates to whatever level they desired. This seemed to be the case when rates touched a low around 3.25 to 3.29 percent. Slowly, rates have crept back up even before Ben Bernanke mentioned a tapering off of the Fed’s MBS purchasing binge. How dramatic was the move? The 30 year fixed rate mortgage is now up by 40 percent in the last 52 weeks. We now get to test the resiliency of the housing market without the full unbridled support of the Fed. The bond market movement is stunning. I love the mentality out in the current market. “Well the Fed is devaluing money so might as well borrow, buy something tangible, and ride this puppy until the wheels come flying off in a blaze of glory.â€Â Sounds like a good foundation for a strong economy right? The Fed realizes that the market is overheating for all the wrong reasons. The financially connected have leveraged incredibly low rates to play this game to a point where hedge funds are buying rentals to lease out all in the name of higher yields. So how dramatic was this move?

30 year rate dramatic move    Â

I have a few colleagues in the industry that have e-mailed me on how sudden this move was. Let us examine this on a chart:

This chart may not seem so dramatic but the above change is a 40 percent movement in the last 52 weeks. What is more important is that it bucks a half decade trend. Some interesting observations on the move:

“(Mortgagenewsdaily) Last Wednesday, Fed chairman Bernanke said during a post-FOMC press conference that rising home prices compensate for higher rates. Then on Friday, Bank or America Merrill Lynch’s MBS team was out with a note reacting to this stance by Bernanke, saying: “we would guess the Fed assumption is that a 5% mortgage rate would be acceptable.” If this is the case, hoping for a near-term dip in rates could prove futile. ” –Julian Hebron, Branch Manager, RPM Mortgageâ€

This is an interesting observation. What is the true mortgage rate without the massive Fed basically buying up $85 billion a month in MBS? The Fed balance sheet is already up to $3.3 trillion and all we have gotten is inflated home values without real substantive growth in household wages. Wages don’t matter? They apparently matter given the Fed simply mentioned a mere tapering of QE and the market suddenly lost confidence. The above quote mentions that a 5 percent 30 year fixed rate mortgage is acceptable to the Fed. Good luck trying to decipher “Fed speak†but this sounds about right for 2013. Historically, I would say a 6 to 7 percent rate is closer to the lower bound. We are likely to find out since the Fed was rather clear on the tapering of QE when it comes to MBS purchases (even though this wouldn’t likely begin until 2014!). Hot money has been bailing and this has accelerated recently.

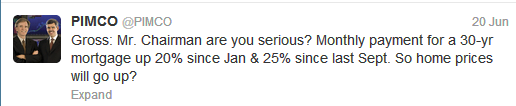

It was interesting to see how the bond market gurus would react to this:

I love this. It pretty much confirms what we have been saying. This entire housing recovery is like breaking a $20 bill into two $10 bills and pretending you were all the wealthier for it. Just because a person can now afford a $200,000 home instead of a $150,000 on the same income is not exactly a positive for the underlying economy especially when the Fed is creating massive market distortions. What of the $3.3 trillion balance sheet? Do we go Jane Eyre on that and simply forget about it?

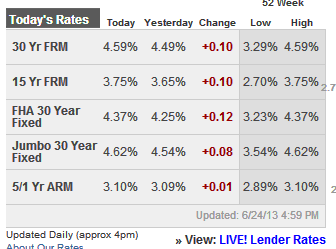

The increase in rates has occurred across the board:

This big movement in rates comes at a time when expensive area buyers are going all in with jumbo loans stretching every penny they have. Incomes don’t matter? Of course they do! Especially when big funds have bought leveraging low rates for already squeezed out yields. What do you think this 40 percent move is going to do to already tight yields?

The trend is rather obvious and keep in mind the below chart doesn’t include the dramatic change of the last few weeks (the below is based on a 4 percent rate when today it is closer to 4.59 percent):

This is a big movement. The problem with creating these incentives is that the financial sector instead of seeking out the next medical technology or industry that will create an entirely new sector for our economy has been obsessed with buying up homes. Why provide such a massive incentive for housing? In the end, it really didn’t benefit the regular home owner which has been the bread and butter of a stable housing market since World War II. That is, until we let lose Wall Street and easy money into the markets in the 2000s and now many have to compete with a hedge fund to find a place to live. Big money investors have been the big winners after the crash.

Make no mistake in that this was a big move in the mortgage markets. Over the last few years, every panic in the market actually pushed rates lower. What is different this time is the falling in stocks is happening because rates are going higher. Bill Gross is right in that mortgage payments just got 20 to 25 percent more expensive in the last few months. The biggest budget expense of Americans just got that more expensive and you already know the trend for household income. In California, this can be anywhere from $500 to $750 a month on a jumbo mortgage (which is now back in fashion and people are stretching just to buy homes). FHA insured loans are already very expensive given the mortgage insurance changes in June.

Another interesting observation on the market:

“The volatility in mortgage rates has been unprecedented. Daily swings cause changes intraday and unfortunately that creates distortion for consumers. The recent volatility will not subside until the free market determines where the real bid/ask is minus the FED. Until that point expect the swings to continue. 30-45 days should be locking. Longer term may be able to float, however we do not recommend it with the current environment. We went from low 3’s to high 4’s in a couple of weeks, and this morning we were possibly talking 5’s. the day is not over and the week just begun. ” –Constantine Floropoulos, Quontic Bankâ€

Exactly. What is the real bid/ask minus the Fed? We’re quickly finding out that without the Fed, there is little appetite for MBS at these absurdly low rates.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

56 Responses to “The mortgage market trembles: the test of higher rates and the sustainability of the current run in housing values. A record move in the mortgage markets.”

“The problem with creating these incentives is that the financial sector instead of seeking out the next medical technology or industry that will create an entirely new sector for our economy has been obsessed with buying up homes.”

Amen, brother.

Back in 1995, I bought a one bedroom apartment from someone who took my first offer of 20% less than asking right off the bat with almost a smile. That’s how fed up he was holding this worthless asset that was costing him so much for so long. Maybe, just maybe, now that this rate shock has finally come, capitulation is right around the corner for millions, and prices will soon be reasonable for us mortals with savings. I hope.

Not according to Keith @ Housingpanic. He came back from the missing to post the new bubble. http://housingpanic.blogspot.com/2013/06/welcome-to-housing-bubble-20.html

I’ve argued against him before and lost on every call so I’ll have to lend credibility to him.

Mr. Housing Panic needs to lay out some details before I can take him seriously. Sounds like all the gold bugs and inflationista types who have been yammering about this for five years and counting. Where’s the inflation? How will inflation take hold? He seems to think that a devalued dollar will spark that inflation. How is that possible? What’s going to be more expensive? Chinese made TVs and BMWs? So what? Wages have to march up with those supposed prices out of control. Do you think that’s going to happen, with our unemployment situation? “Hey, Boss, that there, uh, inflation is a bitch, ain’t it? How about a raise? I need a new Lexus. What? Yeah, yeah, I know you gave me a raise last week, but, damn, it’s like Weimar out there! Ok, well, if that’s the way you want it, I’ll just quit and get a job………..uh…….next……..door.”

Japan has been “printing money” for twenty years now, and there is still predominantly deflation in that country. Just tried another in a long line of stimuli, and, that’s fizzling out after a few months. That may very well be our future, unless we invent some new industries that will make us all rich. And, I’m not talking about Facebook. Problem is, the Chinese will just hack it and copy them.

That link (which you posted last week as well) made me connect some dots, so thank you.

There are exactly *zero* profitable SFH investment funds today (even those with 10k+ homes) but the buying and billion-dollar lending has largely continued unabated.. in fact if interest rates rise I think we’ll see another wave occur, pushing the individual (sub 500k) homebuyer further out of the picture.

Someone is betting on that inflation, and has been for almost two years. It’s the only way this experiment pencils out in a five-seven year period (which most, if not all, have signalled their target exit).

Hehe love it Mike. A lot of older homeowners keep telling me that I have to hang on for wage inflation, to make house prices more affordable for younger (late 30s) people like me.

Like I’ve not already saved for 15 years towards buying, as house prices inflated more than I could save. Remember the times people were celebrating that their homes earned more in a year than they earned themselves? Well it’s been happening again during the reinflation phases.

And as though wage inflation is a serious possibility, and even if it were, it’s unlikely to bring house prices down with people competing for housing with higher incomes x morgages. They want anything rather than spill a drop of the hyperinflated precious value of their homes.

Great ending to the article. It will be interesting to see what rate the market demands for different tranches of mbs (although pathetic on many levels that home ownership is tied to outside investors risk appetite). Maybe someone should be the house (no pun intended) and take bets on what date, we hit what rate.

5% on _____, 2013?

5.5% on _____, 201_?

6% on _____, 20__?

Going back 100 years, the historical average for a 30 year mortgage is somewhere between 8% and 9%.

May 1st, the 30 year rate was 3.25%. Today, June 25th, the 30 year rate is 4.5%. That is almost a 40% jump in two months. In a few months we should see all the talk about housing recovery changing to housing recession. All due to interest rates going up.

Home selling prices where wages are stagnant means that changes in interest rates will drive the direction that home selling prices move to.

Yup. Unless we see a lot more cash buyers or lenders get a lot looser, house prices will start stagnate. Not unlike the economy as a whole.

http://www.cnbc.com/id/100839986

Take what you want from this article in terms of a lot of the bs fluff, but i find a paragraph halfway through the most important where it talks about how lending standards matter and not solely rates and there likely is a whole group of idiots (or geniuses if the govt (aka taxpayers) ready to use exotic mortgages to finance their purchase if allowed to. If you have buyers/borrowers thinking the govt will backstop them via squating, reduced monthly payments, etc as well as banks/lenders (where people get bonuses on short term profits) thinking they are backstopped by the govt or via bail-ins by depositors, ‘machine’ may not stop yet. could go into hyperdrive first before crashing even further. As always, enjoy prediciting a bottom to this hot mess.

Take away the punch bowl and the party starts to dwindle. If rates cannot be kept down then the lending industry has to become much looser in order to keep the party going. So, what are the odds they will start making NINA, NegAm, etc loans again? And if they did, would the public take them? I’m thinking the public still feels pretty burned by the last implosion.

That is the thing we’ve found to be most disconcerting — that people don’t learn. At ALL.

The depths of the stupidity and self-destructiveness of the masses is truly beyond belief.

Well, mortgage applications have gone to the cellar since the rates started climbing. And that’s the average person, because most of us do not have the cash to buy a $600K house. So it mortgage apps are way down, but purchases are holding steady, it aint your average person doing the buying.

Got too much time on my hands as im waiting for the cable guy, so forgive all the responses today. I see what youre saying on some levels, but maybe people did learn from the last bubble. They learned they can squat for free for years, get principal reduced or most likely get away with a strategic default. They learned the banks have the power to change foreclosure laws/how long they can hold a home before selling and that mark to market will be suspended if need be. They learned that we have very little things left in america besides finance and housing so our govt will try to support it if they can.

True enough, FTB.

But in terms of buying into another maniacal bubble — joining the hysteria and spending way too much for housing just because they think everyone else is doing it too — not learning much there.

And to be clear — I don’t mean the squatters (plenty of opportunists out there, to be sure) — I mean the people siphoning money out of 401ks and savings to plop down 50-100% of purchase price.

I predict many will go for exotic loans. How many who have recently bought a house rationalize “if I lose my job/market craters/economy implodes, etc. I’ll just stop making payments, strategically default/squat for months/years, I dare the bank to try to kick me out!…and when/if I do get kicked out I’ll take money I saved not making payments as a juicy little down payment to buy another house in a few years with some dynamic program designed to give “housing victims” a “Fresh Start!” It’s the New American Dream.

Well, we can always go back to the adjustable mortgages to stretch the dollar, right?

Listen, cheap housing helps ALL of us…and the economy too…Main Street, that is…if our housing costs were maybe 15 percent of our income (like they were back in the 60s and before), the rest of our income could be plowed into other areas of the economy. Because we have to spend so much of our income on housing, the “rest” of our income is pretty small (at least for us average Main Streeters). The only people really hurt by plunging house prices? The 1 percent and those who took on too much risk/debt and later can’t pay for it. For those who would be underwater if house prices crater, all I can say is that you agreed to pay that price…I certainly would not have. And there’s always foreclosure and/or bankruptcy as options for getting out of debt.

Still more homeowners than renters in the US and homeowners tend to be wealthier than renters (more lobbying power, etc) so the majority of folks like when they can sell an asset for more than they paid for it (especially if one believes qe has to lead to inflation at some point so locking in a fixed payment can be beneficial, but regardless one is still locked in at a set monthly if it goes down in value). Sure property taxes will be lower on the home if it goes down, but thats about it…and then theyll raise prop tax percent in states that allow it or raise other taxes or lower services (the govt just wont power their pension costs). The rest is fixed so why would folks who own houses want them to crumble in value rather than hope to beat inflation at a minimum and sell for appreciation later (which may be an unpredicatble point in the future so better always up then down). Better for renters (the minority), but not existing homeowners in most cases, imo.

By all of us, you are probably excluding the government that relies on high property values and associated properties taxes, right?

As a real estate broker, I was selling homes in the early 80’s at 18-21% interest rates. My advice to my clients is to use common sense when purchasing…Don’t focus too much on the interest rate. But, what you can afford in a monthly payment. I always encourage fixed rate loans for 30years if under double digit rates. Plan on staying in the home for 5-7 years or longer. More importantly, stay within your budget.

What? your comments contradict one another. Tell my clients to use common sense and interest rates don’t matter – seriously? They used common sense in 2005-2008 when they stated their incomes? And interest rates don’t matter – interest rates are a main component behind price. LOL. You were a real estate broker – please. Why do you need a 30 year fixed when average time in a home is 5-7 years like you stated? Media makes you believe you need a 30 year mortgage so you can pay more interest and little in principal. I agree with one comment you made, stay within your budget. Prices would not be where they are though without LOW INTEREST RATES!

Of course you tell your clients to focus on the monthly payment because there is an implicit conflict of interest in that your commission is based off of the purchase price, not monthly payment.

The purchase price is forever fixed and if the purchaser has to sell in a down market, you’ll be long gone while they are wishing that they would have paid more attention to the price.

Bay Area Renter:

You’re ignoring the fact that when someone purchases a home or rents, that money is going into the sellers or landlords pocket. High home prices should not, in principle, result in less economic activity…instead they transfer wealth from one group to another group. Of course, today it largely ends up being a transfer of wealth from younger generations to the boomers. That is what this is really about….

Tyler, simple answer to that is, you gotta live somewhere. You assume that Boomers are cashing in on the “younger generation”, but, how so? So they sell the house. Where do they go? N.Y. to Arkansas? L.A. to Boise? First, it isn’t happening in any kind of large numbers for various reasons, most of all because older people tend to stay put – moving is even more of a hassle at age 70. But, let’s say that the move happens. the best hope, unless one is trading down from a very nice MacMansion to a trailer park in methville is maybe cashing in, or liquifying $250,000 after costs. That’s not a whole lot of money to survive on, and that’s assuming the home is entirely mortgage free, which is quite rare these days, even for older “owners”. But, as I said, it isn’t happening. I suspect it will, but, very slowly, as the Boomers die in place, and the children, who don’t move into the home, sell it off in an estate sale.

I can’t speak to where LA folks retire, but tons and tons of northeasterners absolutely leave NY/NJ/CT as they get older and move to Florida (especially jewish folks) often in assisted living homes or in older person communities. A few go to Miami, but most go to other places like bosa raton, Naples, ft lauderdale, etc. none I know moved into meth labs and all sell their properties for handsome returns (albeit less people the past few years). They also cash out for significantly more than 250k after paying off their mortgages. Not sure if the trend continues with older people working longer, but most northeasterners start doing Florida half a year (they are called snow birds) in their early 60s as the winters suck in ny and eventually move down full time closer to their 70s.

FTB

Maybe your parents generation, but, not now. The Boomers (well, 90% of them) are not moving to Florida. The RE market down there is still horrible, with the only bright spots in Miami and maybe Naples, fueled by international money, most from South America. Kind of amazing, considering how cheap it is to live down there with super low housing costs and no state tax.

I could have sworn that Florida would take off by now, considering that the Boomers are turning 65 at the rate of 10,000 a day, but, isn’t happening. May be a sign how poor and underwater on their mortgages these people are up north. Working to the last breath to pay off the HELOC.

Florida’s housing market is terrible? Really?

http://www.trulia.com/blog/ed_18/2013/06/florida_housing_market_is_hot_1

As far as personal acquaintances/friends selling homes/leaving CA, my experience is I hear of one about once a month. May, a retired prof I know moved to Kentucky. June, a friend is relocating to Hawaii; bought a vacation house a few years ago and has decided to make this his permanent residence. Yes, people sell CA houses, move elsewhere. Been to Dallas, Austin, Scottsdale lately? Seems every fourth person I come in contact with in said towns is a refugee from CA who left because of economic/job opportunity, tax issues, lifestyle concerns, cost of living, etc.

My parents and friends parents (i still remain close to 12 friends from junior high/high school via fantasy football) are actually in the 63-70 year old range in NJ. They mostly bought there homes in the mid to late 70s and have paid off their mortgages. None are loaded in terms of lifetime incomes. but all have 400k-800k in equity in their homes and all have saved money. If you bought a home in NJ near a train station to nyc (and secondarily near a bus line), your house went up in value. nyc has(d?!) this thing called well paying jobs for a while (it is the bus cap of the world ya know) so if you lived in nj, long island or ct, your home did well as all are easily commutable (basically within an hour or less). They also dont have home equity loans and their kids got good public educations. They can afford florida as many (not mine or course :)) already go there part of the year. A lot dont leave bc the next generation (there kids) married later in life and had kids later in life so if they go to florida now they wont see their grandkids (plus my friends do like the free babysitting ;). A lot also think northeast is hot n muggy enough and florida is worse so until its more of a sedimenatary lifetsyle, why rush? Nj, etc has great golf courses, albeit part of the year. Like all stats, try and look behind them. I keep trying to say real estate, heck life itself, is very local, but yall keep saying no. Yes all can go down at once, but not nearly to the same degree. Most folks in nj saw 10-20% down. I mean do you panic on that? No. You complain like everyone else and just live your life.

I do agree the boomers sucked the resources, future income, etc of america and still vote that way. However, it may not be bc all nj/ny/ct boomers are poor all of a sudden that they arent retiring to florida. Most are retired in fact…besides my family bc my dad split and we broke as a joke besides my moms home equity 🙂

Newsflash that everyone knows-your standard of living will most likely be lower than your parents. Your standard of living will likely go further down even from where it is today based on odds due to globalization (public corporations compete in a global world for investor money or they die and US salaries/benefits/potential costs of employee litigation over harrassment, overtime, 401k match. etc just crush balance sheets). I saw my income as a small business owner get hacked so i adjusted and left calis beautiful weather/high expenses (food (everything is 20-25% cheaper in texas whole foods), as well as gas, movie tickets, car registration, etc). Wah. Tough sh+t on me but i wanted to buy based on if my salary went down another 25%, not stretching off what i make today. My advice is to just be su

@We Don’t Make Those Drinks No More

You lose 20 points for even thinking of posting something from a Trulia blog in this blog. I’m guessing the good doctor is thinking of banning you for that, but, my vote, pass, just this time. Still, “ED” wrote this, which gave me a chuckle:

“The statewide median for townhouse-condo properties was $128,000, up 13 percent over the previous year. NAR reported that the national median existing condo price in April 2013 was $189,500.”

I love that phrase. “Existing” condo price. Basically what someone is telling me there, in a strange way, is they reality = 128,000, but, fantasy = 189000. Funny.

Florida is so bad, and has been so bad since ’07 (it started early there), that any kind of selling activity is measured in the double figures instantly. You know, nowhere to go but up. And, I’ll bet, since condo activity volume is pretty much nothing, considering the zillions of condos in Florida, that the median is skewed by the very expensive trophy condos in Miami and maybe Naples. The Boomers aren’t moving in. Just Brazil and maybe Russia and China.

Hey, it’s a huge surprise to me. I lived there when I was about 28 in West Palm, and, loved a lot about it. The winter weather is awesome, and the water never drops below 75. I thought I would be back, now, when I was 60, but I picked up a few activities, like bicycling, that are awful in S. Florida. But, if you’re a senior who wants cheap, affordable, and no tax living in a place with good weather (never mind the hurricanes) and excellent geriatric health care, Florida is for you. And, if you want cool, Miami is real cool, if you know where to go. But, nobody is moving there. Strange.

@We Don’t Make Those Drinks No More II

“Been to Dallas?”

You see, that’s the problem. Have you ever been to Dallas? I wouldn’t live there if you gave me a free house. Seriously. There’s a reason L.A., N.Y.C, S.F are expensive, and Dallas is cheap.

I wouldn’t live in Texas if you paid me.

Thanks, Mike. Happy to hear you took up bicycling in your 60’s, understand you wouldn’t take a free house in Texas. Re: the FL housing market “The Boomers aren’t moving in. Just Brazil and maybe Russia and China”. Great info, good to know.

“High home prices should not, in principle, result in less economic activity…instead they transfer wealth from one group to another group.”

Excellent point, Tyler.

“Of course, today it largely ends up being a transfer of wealth from younger generations to the boomers. ”

Hmmm. Don’t really know that this is true. Most of the investors I’ve seen lately are younger Asians. But that is anecdotal. Not sure exactly the profile of the folks in these large investment firms, but I am guessing that it is less a generational thing than a class issue. I don’t know that the one-percenters are necessarily just ‘baby boomers’.

Don’t worry folks. Benny boy only tries to test the water, he dares not to allow interest rate goes up above 5%, because of the following:

1. Higher rate means USA pays more interest on our debt. Why would the goverment wants to pay more on its debt?

2. What good to the economy for crashing the housing market? Who dare to fail the ‘too big to fail’, which holds a lot of MDs.

3. Higher rate means Stronger dollar, which will weaken our global competitiveness? why doing that?

Therefore, I triple dog dare Benny boy on rate hike!

Your assumption is that Ben is in control. In that case what you say it’s true.

While Ben has significant power to influence the market, he is not God. The global bond market is so big that makes Ben a dwarf in a toy helicopter. He is riding the wave to create the impression that he is bigger than the ocean.

I believe that soon the market will reduce him to size; therefore he is talking tough to create the impression that he is that powerful.

Just my 2c

Ben or whoever in FED power next will remain as ‘GOD’, as long as American dollar considered the primary trade and reserve currency of the world. I don’t believe there will be any big FED policy change until euro debt crisis ran its course, which will takes years.

My prediction is that rates will be headed back to zero pretty soon (within months). It is delusional to think that tapering off will actually ever happen. Of course we won’t admit it but keep saying end of 2013, midi 2014, early 2015, … (same pattern in the past). When QE got started there never was a plan to stop, let alone unwinding it. Does anybody really believe a drug addict when he says he will quite tomorrow, next week or next year? If he eventually quits, that’s because he’s dead, but not before that.

Bernanke may bark once in a while about taking away the punch bowl. But he will soon be replaced by someone who will continue QE infinity if not doubling it. That’s almost as sure as the sun rising from the east.

I follow this blog but rarely comment. My observation is that the discussions in the past few years are more like looking at the housing market circus as a bystander. Those who were actually looking for some buying/selling advice might have had some degree of disappointment. The sentiment on housing market has been predominantly negative. However, looking back if you did buy a house couple years ago, you could sell for a profit now. Sure, hind site is always 2020. My point is that it maybe more constructive if we also look into the possibilities to deal with the ups and downs of the housing market.

W

You are so right. I bought what everyone was saying on this blog and patrick.net and missed out.

The thing about ‘bear’ blogs is they sound very logical and people make some great thought provoking comments….but if housing experts don’t have a clue, neither do us commenters. We all read articles, look at the world around us and make guesses. However, if all the logic we studied was true, the United States should have crumbled many years ago. It still will crumble like all great empires, but who wants to live a life trying to time that?

As I’ve stated here, I would touch many parts of CA (or Miami, Phoenix, Vegas, etc) with a ten foot pole bc I don’t need to raise my family there and why jump in when it feels super frothy, but for those stuck in CA and want to own, here’s the big question: when will you have the balls to pull the buy trigger in a down market and what homes will be available for you in that down market? Do you buy when things go 5% down, 10% down, 20% down, 25%+ down? Once things do start going down, most buyers think “hey, things will go down further, so I shouldn’t buy yet (see the last housing crash) and then try to time the absolute bottom. When housing starts going down, this website will be FILLED with statements of ‘I told you so’ and ‘I knew things would crash,’ with predictions of the apocalypse and predictions of further downs which will scare folks into waiting for a bigger crash before they buy. Then those folks could never own, if that’s what their goal is. Basic psychology, proven time and time again, although illogical, forces most to buy when things are going up, not down. Just a thought for those on the sidelines. Try and have an actual gameplan if you want to buy my dream house and not just ‘ill buy at the next dip.’ Or just rent and be happy wit it. I’ve tried timing stock and housing markets as well as the app market where I made a game on the App Store. Sometimes I get lucky, but at least I admit its luck, not skill. Its real hard!!!

I personally LOVE owning my depreciating asset in Texas that perhaps I overpaid for, despite the fact that its hot as balls here as my legs are now covered wit mosquito and chigger bites.

Don’t feel bad joe, it is a rigged game. No one can really give sound advice because the thugs (that give Ben his speech notes) that rule the $ supply, are fully invested in housing. Your not buying a house but a bond any more. Hang on and live as cheap as you can and even though there is no interest earn to be earned presently, keep a stash of cash always. Everyone will advise against it, but you will be richer and sleep soundly. Your generation will eventually be able to control the demand. You have more power than you know. The thugs need millions of you to skim their money.

One anecdote, I have some second cousin who is 32, who is leveraged into so much real estate value it is unbelievable to me. He make a high income but keeps buying at the peaks. He has a house he rents that he has owned for 7 years now with $0 equity, he is just purchasing a prop that went up 400k in 1 1/2 years to 1.2 mill, a bit of a fixer. He has no equity and qualifying on a high income. the guy who bought it 2 years ago must be very happy, but this cousin thinks he is diamond jim. it makes no sense, but his ego is to the moon. I believe the thugs are just rubbing their hands and thanking this young exec for keeping the banks rigged game going.

Am I way off here? today’s finance world is beyond belief to me

Joe, I followed many of the bear blogs myself for years. My favorite blog was the original Irvine Housing Blog which now became ochousingnews dot com. The author Larry had excellent posts which made complete financial sense. He even had the Orange County Association of Realtors after him for posting not so nice things about realtors…which were all true. He admitted that the one thing that really put a wrench in his many predictions were all the unprecedented actions taken to save housing (mark to market accounting, 3% interest rates, letting deadbeats squat for years, banks withholding inventory, investors having first dibs on any deals, etc). He analysis showed that the start of 2012 was the time when OC housing was the most affordable since the late 90s (relative to rental parity)…this was a giant buy signal.

It’s a shame Wall St. and all the other greasy organizations have screwed up housing. Find a place you can afford, plan on staying for a long time and enjoy living there. Who gives a rat’s ass if prices rise or fall because you are locked in for the long haul. As I have been saying here, shelter is something everybody needs…you either write a rent check or sign up for a mortgage. If the prices between buying and renting is close, buying is a no brainer. I noticed some of the posters here getting really giddy about the recent rate rises, I would say be careful what you wish for. The monthly payment difference between a 3.5 and 5.0 percent mortgage is 20%. The chances of housing prices going down 20% to reflect this is slim and none (the house that sold for 750K a few months ago isn’t going for 600K today). Borrowers will likely get saddled with a 20% higher monthly payment. I would think rates would have to rise over 5% for the interest in housing to disappear.

Good luck with whatever you do.

“looking back if you did buy a house couple years ago, you could sell for a profit now.”

Sir, with that statement, you show to us that you miss the point entirely. Housing is not supposed to be a commodity or equity that one speculates with in the short term. Houses are for people to live in. I suggest some other web site, like, oh, is there a house flipping.com, or something like that?

You know, I keep on saying, you gotta live somewhere. So, great, your house is more valuable to someone else than it was to you when you bought it. What now? So, you sell it. Where are you going to live? In a trailer next to a meth lab? No, you’re still stuck in the same inflated market, right? But, hey, then again, you can do a HELOC and dive deeper into debt, I guess.

Unfortunately mike, unlike those in their 50s and above, us younger guys have to try and make gains wherever we can as our incomes are turning to sht and its a long way to retirement. Sucks, but the new world requires trying to take little pieces here and there for profit, basically attempting to diversify your revenue streams (especially as we likely don’t have any pension and social security will be less and delayed). Not saying I personally would flip a house for money and its a separate convo if its beneficial to housing markets (would depend on if you own or rent and when you wanna sell basically), but some people are just trying to feed their families, which I understand/respect on some levels bc no one else will. I mean are you mad at the grocer for selling food for a profit?

Also, you say its trading one inflated asset for another, which may or may not be true (on a basic level) as it would depend on if you’re moving to a cheaper state and/or downsizing to a smaller house as well other tax considerations. Life is about raw numbers, not percentages of inflation.

Its really sad how the only people that were really able to take advantage of the housing crash were large financial institutions. I understand private equity is not technically a big financial institution but what’s really the difference bunch of 1%’ers @ end of the day. I think once Michael Moore starts doing documentaries on how hedge funds & private equity own all the homes and average people can’t get their offers accepted, ambulance chasing lawyers start figuring out how to identify the homes these guys own and low-income strategic default minded, section 8-live off the gov’t forever mindset renters realize that they have a landlord that is “too big to fail” these institutions aren’t going to have a long run in the property mgmt business, I’ll be glad when they have to liquidate quickly into a higher interest rate environment to brwrs that have to qualify with real income. I hope they lose money when they do, they deserve it for taking advantage of a situation. I definitely don’t feel there was enough pain in the financial services industry after 2007 crash…

Don’t worry, their time will come, although I wouldn’t say that they are “taking advantage” of this situation. They are gambling, as they always do, and some careers are riding on this gamble. They aren’t dumb people. They know the risks. If the renters don’t show up quickly and in large numbers (which is already a problem in some markets, I have read), then heads will roll at some hedge funds and PE firms, as thy always do when they can’t meet their numbers they proposed in the powerpoint presentations when they were pitching this to higher ups and other money. It’s a brutal world, and losers don’t last long in it.

Be careful not to buy any of the funds and REITs that these guys are pitching to the retail investor to cover their butts, though. I can see a lot of yield chasing naive retirees falling for the 8% returns some are promising. I doubt that they will able to make so much money. Maintenance costs will be much more than they expect, and, they will not be able to meet projected rent increases with wages stagnant. Some PE firms have projected out 5% a year rent increases, which is absurd, considering the quality of tenants they will get, and the general income stagnation most are experiencing.

With so few sellers today, will someone please explain to me how there will be more sellers when interest rates rise?

One of the reasons there are so few homes for sale is because people are waiting for prices to increase. If interest rates rise and home prices drop, will there suddenly be more homeowners eager to sell?

a) You are not worried about sellers – you are worried about inventory. Inventory is like a bath tub. It is filled by a faucet (the sellers) and drained by a drain (the buyers). The high interest rates effectively clog up the drain as it takes buyers out of the equation. The result is more water in the tub.

b) While people are waiting to sell their asset, it bleeds. Think gardner, running utilities, HOA, maintenance and property taxes. You got to fill it up with an occupant or you are losing three percent a year plus work and effort plus whatever your mortgage interest is. Sitting on it is a money losing proposition.

c) BABY BOOMOERS!!!! Can not be overstated. Fairly well studied. 65 year old has a 6 to 7 percent chance of moving out per annum. Someone in their 80’s has a >50% chance of moving out per annum. Oldest baby boomers are 67 now. They will start affecting the market around 2015. It should be noted that the trend in elderly downsizing will likely even be faster than previously studied given low savings rates. It should also be be noted these people bought their house in the 80’s and 90’s and are not even close to underwater, HELOC’s or not.

c) Panic. People only hold on to assets they feel to be appreciating, not depreciating. It only takes an inflection point to have people head for the exits.

d) Investors. Much of the syphoned off inventory went to investors who bought at the lows in 2009, 2010 and 2011. Rising interest rates will scare them into, again, thinking that they might have a depreciating asset. They are going to head for the exit in the next 12 months while still being able to make money.

c) Assuming that everyone can assume the same position and not sell. Imagine if every janitor in the world got together and demanded a $100 an hour for their wages. This would work exactly for two weeks before teenagers out of high school were hired to take their jobs at $8 an hour. Not all sellers can hold the line and if they try, new construction or a shift to renting will limit them severely.

Yes all of the forces you speak of, are pretty much pointing to reduced prices in the future. Well interest is the trigger of the inflection, even though partly psychological the market will quickly turn trying to ‘anticipate’ the inflection. Once people think the high price has come and gone, investors will start pulling and the ‘organic’ market if it can even be called that anymore, with higher interest can afford less so without all these things holding the price up it will have to come back to reality.

This could also be a ruse, because re-fi an commissions are drying up and creating some movement in either direction allows some wealth to be redistributed. They don’t care buy or sell as long as you TRANSACT someone is making money (from you), and they can dump their trash to the government.

This is why our financial system is a game, rigged, and pointless. Borrow, default, squat, steal does it matter anymore ? I no longer blame people trying to get a piece of the pie because soon all that will be left is the crust. Expect them to have morals when no one else in power does ?

Generating artificial market inefficiencies, bubbles, and crashes = 21st century sophisticated robbery. I have to admit the folks engineering all this are geniuses, so easy to distract attention from with other news while they bail out.

Creation of real value (production) and not financial games is the answer but I think we are too far in to get out now.

Pretty well thought out AK, but to counter:

A). It takes out a lot of traditional buyers using normal financing for sure. It does not take out cash buyers or those that will use interest only or other loans if lending standards are lowered, which has to be at least 50/50 they will be (they already are at the non-big banks). Still a very valid point though.

B). Only applies to investors, not the average family in their SFH. They would be occupying the home so paying this in normal course.

C) most likely will increase supply for sure, studies i read predict the baby boomers will effect housing closer to 2019. Is that’s true, many folks aren’t going to wait for that down period. Also, who knows what will be happening in 2019 with other macro and micro factors. Maybe home formation is different. Maybe instead of one family in this being homes, its multiple fams. Maybe more people get sick of big, dirty cities, like me and can’t afford private school for kids bc schools suck in most big cities so things trend back to suburbs. Hard to predict tomorrow, let alone years from now.

C part 2) applies mostly to cash buyers and those not underwater and needing or wanting to sell. If another crash happens, people will be underwater very quickly and won’t be able to sell. All my friends held their depreciating homes in the last crash with one selling a small one for a loss, but getting a bigger one at rock bottom price in 2010.

D). Could be. Depends on the investor. Herd mentality is definitely a Wall Street thing, especially as they use others money. Other smaller investors may not sell or be able to sell. This could definitely be a big factor in places where big money is. However, big money isn’t in every city, but lots in CA for sure.

Logic aside.

I am pretty sure we hit the top. Good luck.

Another California co heading to Texas; adios, Daegis…

http://technews.tmcnet.com/news/2013/06/26/7232489.htm

Preach it drinks. anytime your in austin, stop by and say hello. Picked up my legally delicious fireworks today for the 4th. 😉

Shocker that in a super competitive global world US companies are tax shopping states and Texas be the winner. I could cite 10 articles here showing the massive trend, its been called the great Cali Texodus. my neighborhood of 40 houses by the lake had 4 cali folks move in the past 15 months….and they brought 4 wheelers and tricked out golf carts to ride on their properties (my neighbor has 3 acres).. 😉 yes, it’s horrible here. No fun at all.

To be non-biased, LA does have some money coming its way if some investment bankers can convince some idiots that snapchat is worth a few billion. I heard they have a chance at least and that’s where they are HQ-Ed.

FTB – I just moved to Austin! From Clearwater, FL.

I’m trying to figure out this Austin, TX real estate market. I’m just renting for the next year, but the house I’m in is upscale in a really nice area. It borders the Green Belt (SW Austin) and supposedly these houses don’t come up for sale very often. The owner eluded to me that he may be interested in selling it – so by next June I’m hoping interest rates go up with hopes that home values go down. Then I’ll see what my finances look like – it would be perfect timing if I decided to pull the trigger. Never too early to start planning. Property Taxes are something like 8800 a year – which may be the deal breaker. Even with a free and clear house you’re still paying $700+ a month indefinitely.

TX, FL, WY and a few others have 0% state income tax rate.

I’m single, early 30’s with no dependents and own an online business that pays me more than I need. I am free in every way my neighbors are not. That’s another thing keeping me from buying – freedom. I can pretty much live wherever I want as long as I have internet access. I was thinking about trying out Colorado after this…maybe Montana near Glacier Park.

Bill Gross is a Hypocrite… First he wanted Bernenke to Taper QE, and now when it’s actually happening, he’s whining like a little baby… That rapid increase in yields probably caught Mr. Gross off guard. Good Luck with that PnL…

http://igg.me/at/economic-collapse/x/3758033

We can debate both sides, but what is real is we have rates moving up, and on the MLS I am seeing more short sales, and REO’s. I hadn’t seen any for 6 months. Prices are easing already. Time to let this farce of a housing recovery fizzle out. Soon we will see home price tank!

Leave a Reply