Mortgage Fraud Report – Burn after Modifying: FBI Finds Rampant and Deep Fraud in Real Estate Industry. Guess What State Ranks #1? IOU All-Star California.

It is bad enough that we have legally sanctioned bank robbery being perpetrated by the U.S. Treasury and Federal Reserve punting the U.S. Dollar off the financial edge in Wile E. Coyote fashion. The U.S. Treasury, FDIC, and Federal Reserve are greasing their gears for the obnoxiously named private-public investment program that will start buying “legacy assets”, what we all know as nuclear waste mortgages. The FBI put out a report highlighting mortgage fraud for 2008 and as you may have guessed it, is rampant with cases of blatant fraud, shows deep corruption, and goes well beyond the “few bad apples” theory. The FBI found a boatload of scams, gimmicks, and brazen fraud that would make any sensible regulator faint (that is, if anyone was paying attention). We are also seeing a good number of first payment defaults on government backed loans which really should put a break on government backed loans instead of putting our foot on the mortgage gas.

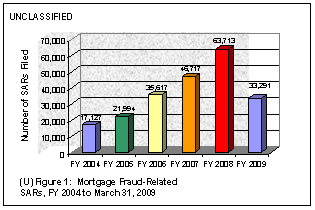

In the publication the FBI found that Suspicious Activity Reports (SAR) for 2008 shot up by 36 percent to 63,713 for the 2008 fiscal year. The report tells us that the actual figure of mortgage fraud is unknown but we all know it is pervasive given that it is latched onto the back of American banking and also has a crew of cronies on Wall Street operating it as if they were maneuvering a remote controlled financial drone. It is fascinating that the FBI also mentioned those pesky “legacy assets” of Alt-A and Option ARM loans:

“While the amount of mortgage fraud cannot be precisely determined, industry experts agree that there is a direct correlation between fraud and distressed real estate markets. As the housing market continued to decline in response to an increase in housing inventories, lack of sales, and new foreclosures surface, to include a wave of Alt-A and Option ARM loans due to reset beginning in April 2009, real estate values softened, and fraud reporting increased throughout 2008.”

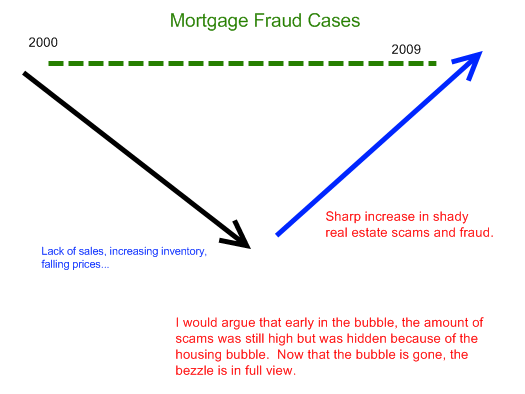

Let us map out this relationship:

The argument is that as the housing bubble imploded, many people got more and more desperate in their actions. This is true. However, I would argue that fraud was also rampant during the earlier stages of the housing bubble but much of this was masked by the ever inflating housing market. Much of it was never detected because most people were in a trance drinking from the cup of housing mania thus passing on their fraud to another would be player. Subprime, near prime, and prime loans were being pumped out of the market like pancakes.

The analysis is important because it has a significant impact on what we can expect for the next few years in the California housing market. California is in a fiscal disaster with a $26.3 billion budget deficit and our state government is even more dysfunctional than your high school associated student body. The reason this matters is the state with the highest level of mortgage fraud (we’re talking about FBI labeled fraud) is California. Let us highlight that all those bazooka happy Alt-A and option ARM products are labeled as “legacy assets” and don’t constitute fraud but I would definitely put much of these items in that category. Since I would suspect most of you are law abiding, here is a list of mortgage fraud listed in the report:

(1)Â Property flipping

(2)Â Builder Bailouts

(3)Â Short sales

(4)Â Foreclosure rescues

(5)Â Reverse mortgage fraud

(6)Â Credit enhancements (not to be confused with male-enhancement)

(7)Â Condo conversion

(8)Â Loan modifications

(9)Â Pump and pay

I’ll go into detail a little bit further in the article how these frauds were executed in the market. Let us first look at the SAR chart:

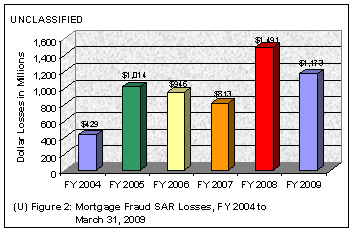

What you’ll see here is that already for fiscal year 2009, cases are going to eclipse the 2008 figures. Yet it is the case that many fraud areas like short sale fraud never really bloomed during the bubble because there was no need for short sale fraud. All you needed to do was find another sucker and unload the property with toxic mortgages which were liberally being dished out by banks fully sanctioned by the Wall Street crony machine. As you would expect with housing values plunging, the amount of losses associated with fraud is also exploding:

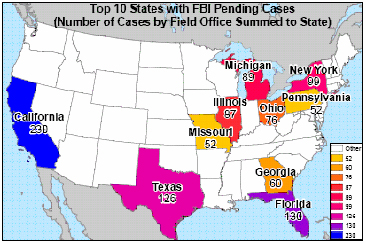

Of course, not only is California pumping out IOUs but is also the award winning recipient for most active SAR mortgage fraud cases:

This probably doesn’t come as a surprise to many of you. Much of this fraud is now being exposed by the imploding real estate bubble known as the California housing market. It baffles me how some people in the state are able to put aside the Alt-A and option ARM data, the fact that the state is fiscally insolvent, the record breaking 11.5 percent unemployment, and with a straight face say “we are at a bottom.” In addition, I have read on more than one occasion on what many would consider fiscally prudent financial blogs where people pinch pennies and dollar cost average into the stock market preaching the ways of the tortoise. Yet in some cases, these people for whatever reason (i.e., wife/husband wants home, new baby, we need a pool, my cat needs his own room, etc) bought near or close to the peak in California in the mid to upper priced areas! This one simple act negates years and years of financial prudence. It baffles the mind but people aren’t robots and sometimes psychology throws a lasso around their common sense and drags them down into wonderland.

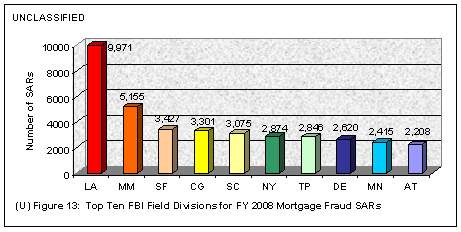

To dig deeper in the data, world renowned Los Angeles, my home city, is the top offender in mortgage fraud:

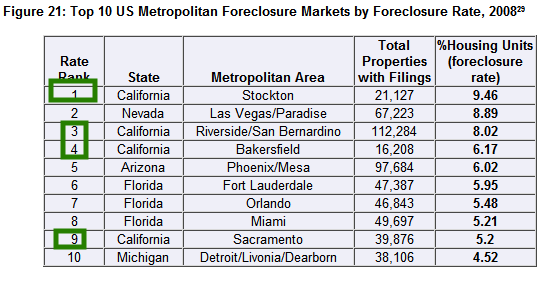

Well at least the Lakers brought a championship home this year. I have to add a caveat here as well and that is the L.A. county region is one of the largest MSAs in the country so the data does skew but make no mistake, fraud is off the charts. And as we all know, a declining market puts people in desperate situations and all you need to do is look at the top foreclosure areas in the U.S.:

California dominates the chart with 4 of the top 10 foreclosure rate areas. Keep in mind this is by a percent of housing units so this does reflect actual severity in a more proportionate perspective. Florida tries to wrestle the foreclosure king crown away from us with 3 top areas. Yet these figures are astounding. Nearly 10 percent of all housing units in Stockton California are in foreclosure! That is simply nuts. Makes you wonder how many Alt-A and option ARM products are out there. Anyone with an Alt-A loan in this region has the same probability of paying their mortgage on recast as California learning to live within its means.

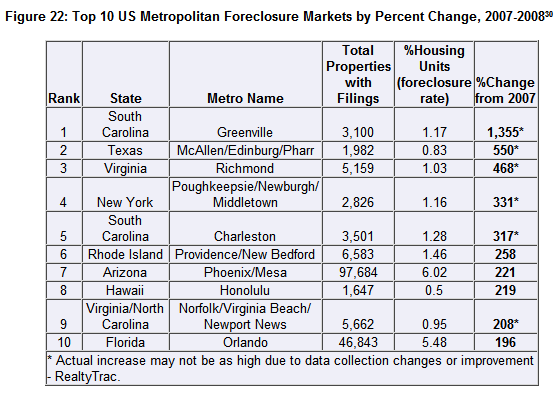

But let us stop focusing on the awesome foursome of California, Arizona, Nevada, and Florida for a minute. Many other states have decided that they are now going to jump on the bandwagon. Many of these states I would suspect are seeing foreclosures because of California equity giant types taking money out of state and trying to imitate Donald Trump in these other markets. Take a look at the diversity in the chart:

Keep in mind some of these areas like Texas and South Carolina had minor appreciation compared to other parts of the country. This jump is showing how this housing bubble disaster is now spreading to even parts of the country that had little to do with the housing bubble.

That is the back drop of the mortgage fraud environment. Let us now look at the kind of frauds out there.

Reverse Mortgage Fraud

This type of fraud is especially deplorable because it targets the elderly:

“Unscrupulous loan officers, mortgage companies, investors, loan counselors, appraisers, builders, developers, and real estate agents are exploiting Home Equity Conversion Mortgages (HECMs)-also known as reverse mortgages-to defraud senior citizens. They recruit seniors through local churches, investment seminars, television, radio, billboard, and mailer advertisements, to commit the fraud primarily through equity theft, foreclosure rescue, and investment schemes.”

In essence, the fraud goes like this:

-Identify a distressed property

-Purchase property with straw buyer by lying on loan application that home will be a primary residence

-Recruit seniors to buy home from straw buyer

-After senior is in home for 60 days, they obtain a HECM with fraudulent appraisals

-Encourage seniors to take lump sum

As the FBI notes, with a baby boomer population now entering retirement, this fraud has a lot of attraction with criminals.

Credit Enhancement Schemes

This is basically the “you don’t have any money but your rich uncle does!” scheme:

“Credit enhancement schemes may take various forms. In the most basic scheme, a loan officer and home builders are taking measures to encourage borrowers to have their names added to the bank accounts of friends or family members temporarily to circumvent the underwriting process to show that they have sufficient deposits on hand.”

Desperate and corrupt many in the housing industry are now trying to create their own methods of nothing down or ways of gaming the system. If you haven’t noticed, these cases of fraud hinge on getting loan approval. Loans that are now more and more backed by the government. That is why I simply do not understand why we are offering tax credits and trying to encourage home buying when the system is being gamed. Here in California we are doing another foreclosure moratorium which gives servicers $1,000 per modified loan. What a waste of money. Credit enhancement schemes are toxic and have a fancy name like legacy assets.

Builder-Bailout – Pump and Pay

Desperate builders in your favorite states are figuring out ways to game the system and inflating housing prices is one of them.

“Builders in Florida, North Carolina, California, Texas, and various other locations throughout the United States are working with co-conspirators to inflate the appraised value of their properties. This false equity is distributed to the perpetrators and disguised as set-asides for future maintenance, insurances, and tax payments on the property.”

Good times right? What do you expect from a corrupt industry being fueled by an even more corrupt Wall Street? They pump and dump stocks on you so why not pump and dump properties?

Foreclosure Rescue Schemes

This crap is extremely prevalent here in California especially in poorer areas. I have seen absurd flyers which reek of fraud. This kind of fraud is despicable because basically people are praying on those who are losing their home or are in financial trouble. As we know, 90 percent of the cases are as simple as, “unfortunately, you should stop paying and focus on finding a rental.” That is it. Yet these crooks tell homeowners about fantastic modifications and other hyperbole when in fact, they are only lining their pockets. In some cases, they tell the borrower to send money directly to them and , “they’ll send the payment to the bank for you.” Before they know it, the borrowers realize that nothing has been sent to the bank and they are even in worse financial shape.

The FBI has also seen a rise in another type of foreclosure rescue, arson. This is probably as blatant as you get. Many people committing arson need to watch CSI for a couple of episodes and realize that no, fire doesn’t hide all evidence.

Foreclosure Rescue – Loan Modification Program Schemes

As I have argued before, loan modifications are an absolute joke and are actually going to create more losses in comparison to doing nothing. In a case of Murphy’s Law, here we have the logical extension which is a scam:

“Loan modification schemes, typically in the form or an advance-fee/foreclosure rescue scheme, are emerging as recent vulnerabilities in HERA and EESA legislation (see second text box) becomes apparent. Lenders are mandated by recent legislation to work with homeowners to assist them in keeping their homes out of foreclosure; however, individuals are perpetrating advance-fee schemes to generate income from victim homeowners. Perpetrators solicit homeowners with mail flyers offering to help them stop the foreclosure process on their homes. Homeowners are falsely told that their mortgages would be renegotiated, their monthly payments would be reduced, and delinquent loan amounts would be renegotiated to the principle. Perpetrators require an up-front fee ranging from $1,500 to $5,000 from homeowners to participate in the loan-modification program. Perpetrators often request that the victim homeowners stop payments and communication with their lender. When victims receive delinquency and foreclosure notices, the perpetrators convince them that the loan was renegotiated, but that the lender needs a good faith payment to secure the new account.”

This is the problem when you have the government and Wall Street praising the virtue of loan modifications when in reality, all they are doing is converting qualifying loans into option ARMs. This is ultimately kicking the can down the road but as you can see, many in the public hear “loan modification” and think they are going to get a sweet deal. These scammers play on this and here we go with just another scam. That $1,500 or $5,000 could be used to secure a more stable rental but god forbid the government encourage people to rent who simply cannot afford to own a home.

Other scams include serial property flipping and short sale scams. The bottom line is fraud is rampant throughout the country. People not only have to be vigilant of the legal scams that are being put out there with loan modifications but now have to watch out for shysters trying to make a fast dime.

To put the icing on the cake, take a look at this story:

“(CNN)Â 25 charged in $100 million mortgage fraud

The D.A.’s office described a “particularly brazen sham transaction” where one of the suspects, Stephen Martini, allegedly wrote up a bogus appraisal of $500,000 for a two-family home, but “in reality, the location was a vacant lot.”

Just another day in the crony neighborhood.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

30 Responses to “Mortgage Fraud Report – Burn after Modifying: FBI Finds Rampant and Deep Fraud in Real Estate Industry. Guess What State Ranks #1? IOU All-Star California.”

So the FBI is finally catching on that there was mortgage fraud. Maybe they should have been reading some of the housing blogs. They wouldn’t even had to leave their offices. They could have just asked the bloggers about all the suspicious activities.

I just have to walk through my neighborhood and see the $1.2M homes bought in the last 5 years by young couples (pair of 30-year-olds) who have middle-class jobs to know that there is mortgage fraud going on.

So I sit on the sidelines since I can’t extend myself like that (I have a family after all), waiting for homeprices to drop back to reality, meanwhile liars buy & stay in their homes…. I am a sucker…

Off topic, sort of. I’m hearing of a bank holiday in September. Do you have any insight into this? And if this is a reality is there any way other than pulling all my money out of the bank to protect myself? I don’t want to sound paranoid but I heard of horror stories out of Argentina when this happened there. Of people not being able to pay their rent or buy their medicine. This is very irritating. Help Dr. HB.

Excellent piece, Doc. Quick question: who is behind most of these scams? Is everyone in the RE business, are they professional cons, organized crime, or something else?

To Dan,

I just wonder how you “know” that a couple in their early 30s cannot afford a million dollar house? If both earn 100k and they made or inherited 200k (flipping a starter house or condo or two), they you’re pretty much in the neighborhood for an interest only ARM, which is NOT the same as an option ARM or other liar loan. Granted they’re probably screwed now either way, but they may have started out honorably. You just don’t know.

The FBI did know this was going on, escalating, during the housing bubble and warned in about 2004 to 2006 that it could take out the economy. The FBI also reported within this time frame that 80% of mortgage fraud was being done by industry insiders.

Very few legitimate home buyers were committing fraud, nor could they have, since they lacked the knowledge, skills, and connections, to pull it off. Many were duped, or victims of outright fraud. Many so-called “buyers” were straw buyers in mortgage fraud schemes, or flippers/investors, they were not buyers looking for a place to live. While I certainly don’t condone buyers who did commit or comply w/fraud, I don’t believe most legitimate buyers engaged in fraud. The evidence shows it was and had to be the INDUSTRY that created the way to commit fraud and then did it.

But when the FBI asked for funding to fight it, the agency was denied. The amount they were asking for is nothing compared to what the bailouts have already cost, and most of the bailout money is going into the pockets of the very industries that caused the bubble in the first place.

This is possibly the biggest and most damaging fraud perpetrated on the USA in our lifetime. While the Madoff and Enron scams got a lot of press coverage, the lending and homebuilding industries are flying under the radar when it comes to mainstream media coverage and that in itself should be considered criminal. If the media were not so beholden to corporate advertisers and owners, the public could’ve been educated much sooner.

Even now, there are people who still wrongly think home buyers caused all of this. This is very convenient for the industry to perpetuate this myth, to take the heat off themselves.

Many in the building and lending industries should be going to jail. A few smaller co’s CEO’s are, but the big co’s get a bailout, a slap on the wrist, or settle w/the govt as Beazer did in it’s criminal mortgage fraud case this month.

Big business lobbying helped push the fraud, so our govt blessed this mess, now wants responsible tax payers to clean it up.

We need to sever the ties between corporate influence over government and media or we will continue to be ruled and scammed by businesses that consider fraud completely acceptable. They are destroying this country! And ignorance and apathy of Americans is making it entirely possible. It has nothing to do with democrat or republican policies and everything to do with corruption. We are rotting as a country because of it.

8% of all homes in Rivereside/SB are in foreclosure, but what is the true rate when you factor in the thousands of people not paying their mortgage for 6+ months that still have yet to receive an NOD.

I think the nation’s housing market is facing new downward pressure as holders of subprime-mortgage bonds inundate the market with foreclosed homes at prices that are much lower than where many banks are willing to sell.

“Experts say this is a bad omen for residential real-estate prices and homeowners trying to sell or refinance, because the fire sales, many to cover soured subprime loans, put downward pressure on the value of nearby homes. All of this undermines federal efforts to stabilize the housing market and revive the broader economy.

“While the banks are trying frantically to get loans off their books, they face the problem of large shadow inventories of housing being dumped on the market, which would depress prices further,” said Anthony Sanders, real-estate finance professor at George Mason University in Fairfax, Va.”

With high joblessness, it is only normal that subprime-mortgage holder would like to sell their properties since they are not sure of the employment status in the coming months.

Recently read an article on a similar premise.

http://www.housingnewslive.com/is-the-housing-market-recovering.php

Check outhttp://www.housingnewslive.com/blog.php

Apparently the whole news media has ignored the Bill Moyer & William Black interview on PBS. Greenspan with Paulson & goldman Sachs along with a bunch of corrupt politicians ran the exotic mortgage scam on the whole world.

http://www.pbs.org/moyers/journal/04032009/transcript1.html

So why don’t people from Riverside just stay in their homes?

First, if the bank is not foreclosing, then just stop paying and stay in the home.

Second, if they foreclose, just move your stuff out long enough to please the Sheriff, and then move it back in.

No-one is looking. No-one is buying. No one wants the houses kept up except the next-door neighbors, and I know they would be happy if the old neighbors stayed on.

So why aren’t folks squatting like crazy all over Southern California? They are living in tent camps, but they are not squatting in tens of thousands of vacant houses. Why?

They squat in Europe in the big cities, for heaven’s sake, filling up vacant apartment buildings, and the police don’t do a darned thing as long as they don’t actively damage the building.

What am I missing?

Looks like the news media completely ignored the Bill Moyer & William Black interview on PBS. They pointed the finger at Greenspan, Paulson, & goldman sachs with a bunch of our criminal politicians doing away with the regulations for them & the rating agencies giving their worthless investments a tripple A rating and cheating the whole world with their exotic mortgage scam.

There was definitely fraud early on … rising home prices resulted in no-loss liquidations in many of those cases … or people were able to refinance out of loans because of rising prices and the availability of credit. When the tides goes out, the bodies litter the shoreline … Of course, we’ve been reporting it all along at Mortgage Fraud Blog!

Keep up the good work!!

Rachel

@Consumer

Great piece–wish it weren’t so, but looks like you hit the nail on the head. As the pyramids and other ancient litho-marvels show, civilization has advanced and collapsed numerous times around the world. We may be in the midst of the next one. The insane are truly running the asylum.

You certainly are.

But don’t feel bad, you have a lot of company, myself included.

Check this out….Prices are such a bargain (yeah right)

http://www.sdlookup.com/MLS-090023134-4911_W_Mountain_View_Dr_San_Diego_CA_92116

@martin, r u kidding me. $460K for 744 sq ft? how did that even appraise?

Kelli, it is easy to see that a two-income couple cannot afford a mortgage for 4X their income. Let’s say the house is $1MM, and they brought a $200K downpayment to the table, they are left with a mortgage for $800K, 4X their income.

The only way they can afford this is with some kind of ARM, and an IO ARM is one of the worst. You are deferring ALL your interest with an IO loan and building Negative Amortization thereby. You have to be insane to do this unless you are extremely sure that the property is going to appreciate very quickly, in time to rescue you once your loan reaches 125% LTV (here in Illinois) or 145% (CA and a few other places), at which point it will have to reset to a much higher payment which is much higher than the payment for the 30 year fixed which you already couldn’t afford.

Worse, you are looking at other expenses that increase geometrically on larger, more expensive properties, such as taxes, maintenance, and utilities.

One seasoned real estate man here in Chicago, back in the saner days of the 80s, told me that at that time, a 50% downstroke was required on “upper bracket” properties because of the difficulty of unloading them because the market for them is so much smaller, and because high-income jobs, when lost, are more difficult to replace. So, if 2.5X loan-to-income is the safe ratio for moderate income buyers , then 2X should be the top end for upper bracket buyers. 3X your income is the absolute most anyone can pay without making themselves housepoor, and if the only way you can afford a place is with an IO ARM, you can’t afford it.

Indeed the FBI was busy, as was the Good Doctor:

August 17th, 2008

When Mortgage Fraud is Rewarded: Lessons from the Great Depression Part XVIII. Charity for Financial Deviants.

Home Sweet Home

The above photos are from condos that were involved in a mortgage fraud. The appraisal described “recently renovated condominiums†to include Brazilian hardwood, granite countertops, and a value of $275,000.

The FBI also offered this handy graphic.

I disagree, Laura. For most above average earners, a fully amortized loan at 4X income is absolutely reasonable, and leaves plenty of cash after housing. Low earners should be careful though. Housing is expensive and should be one’s greatest expense. Those who are expecting housing costs to reflect the 2.5-3X figure in some the of more desired locations are never going to see it. In the Bay Area for example, Santa Clara county has hovered around 4X for 20 years, San Mateo County over 5X. These things will likely never change.

Consumer,

I am with you 100%.

We should exterminate may of the people in power and start over.

Why We’ll Leave L.A.

The business climate is worse than the air quality.

If New Yorkers fantasize that doing business here in Los Angeles would be less of a headache, forget about it. This city is fast becoming a job-killing machine. It’s no accident the unemployment rate is a frightening 11.4% and climbing.

I never could have imagined that, after living here for more than three decades, I would be filing a lawsuit against my beloved Los Angeles and making plans for my company, Creators Syndicate, to move elsewhere.

But we have no choice. The city’s bureaucrats rival Stalin’s apparatchiks in issuing decrees, rescinding them, and then punishing citizens for having followed them in the first place.

—

Subprime Resurfaces as Housing-Market Woe

The U.S. housing market is facing new downward pressure as holders of subprime-mortgage bonds flood the market with foreclosed homes at prices that are much lower than where many banks are willing to sell.

While nationwide figures are scarce, a review of thousands of foreclosures in the Atlanta area shows that trusts managing pools of securitized mortgages sold six times as many properties as banks during the six months ended March 31. And homes dumped by subprime bondholders sold for thousands of dollars less on average than bank-owned properties, the data show

Is there any truth to the rumour that the worst is yet to come as far as other types of mortgages being called in. A and B mortgages, from what I have heard north of the border here, have yet to be brought up and currently it was only the toxic mortgages causing the problem.

Joek, I have a much longer memory stream than most people posting here, and can tell you that prior to 1980, which was the time the first ARMs appeared, most lending was risk based and 2.5X your income was the MOST you were lent, even with a high income, with 20% down. In fact, at that time and before it, a high-income person was considered weird if he couldn’t come up with at least a 50% down payment. My mother, who was not a high earner, but whose income was the male average, borrowed 1.7X her money with 40% down during the early seventies, when housing was truly cheap, and we felt “tight” for a while, even though she had no car loan and little house debt. Similarly, my grandparents bought their first house just after WW2, and put 40% even though he was a department store executive with a high income. The house was an 1800 sq ft 3 bed 1 bath. One bathroom, imagine that. Only one car, as well, for which he paid cash.

ARM loans appeared about the time the United States started to lose its manufacturing to foreign countries, and started having to import most of its oil. The economic landscape of 1980 was very different that that of 1970, the last year in which this country was still truly prosperous. In the late l70s, the geniuses at Solomon Bros. invented the CMO, and the ARM was born at this time in response to skyrocketing interest rates. We got our first housing bubble in the early 80s, very small and short lived, but concurrent with the introduction of the first ARM loans lending standards were loosened to 4X income, and down payment requirements were eased. A local grocery store clerk was flipping houses and owned 7 at the bubble peak. It was not any healthier for well-off friends of mine than it would have been for me, a single woman. They borrowed exactly 4X their income, with 10% down on the house, and were in foreclosure in less than a year even though their combined income was 4X the area average and they had no children to support and no college bills. Foreclosures started becoming more frequent at this time, too.

It has to be difficult for someone born since 1970 to think how different things were before the country went totally off the rails from the mid-70s forward, and economic “growth” was fueled by asset inflation, debt creation, and the generation of one financial scam right after another, instead of the commerce and heavy industry that made us, for a while, the most truly prosperous country in the world.

Well, that prosperity is gone and we will have to revert to the habits that made us rich and secure to begin with. Since the late 70s, it has become ordinary to carry high loads of unsecured (credit card) debt as well as multiple car loans per household. This will have to cease, for this was possible only in an economy that supplied most people with reliable jobs that paid decently. That’s over, probably for a long time. Jobs are unstable, insecure, and subject to obsolescence and downsizing, and until we get our economy back on an honest footing, they will remain so. No one can be sure that the job he went to school for 4, 6, or even 8 years to qualify for will still be there in 10 years. Friends of mine who are ten years younger than me and had no problem pulling $100K a year in high tech jobs 5 years ago are now laid off and will be glad to see $50K.

Life is going to be different from here forward, than it has been for the past 30 years, and its not going to be easy for people who’ve lived off leverage and debt for their entire adult lives But the good part is that the youngsters just now arriving at adulthood are becoming accustomed to frugality and prudence, traits will serve them well throughout their lives; vs the self-indulgence and extravagance of my generation of grasshoppers, which will ride into its old age destitute after lifetimes spent living over their heads and going into deep debt for overpriced houses and ridiculous toys.

Doc,

None of this stuff surprises me. Cal is horrible but it’s bad in a lot of other places too.For twenty years now, as someone outside Cal who worked in a job making well over $100k all those years, I looked at the enormous sums people spent on houses and asked, “How can they afford this?”

If I make considerably more than the average wage, and the cost of buying something in the 400-500K range makes ME blanch, how can people making a lot less do this?

Simple answer: they couldn’t, and a heck of a lot of people were living WAY beyond their means. Nothing like that can go on forever–on either a personal or a national level. We as a nation need to remember that. Unfortunately, it looks like we’re now governed by people with all the self-control and restraint of your average high-school kid given booze, a sports car and an unlimited credit card.

This isn’t going to end well.

There was a simple answer: they couldn’t

SIR MIKE………………….

I imagine it was an all cash buyer so maybe no appraisal was needed, I don’t know.

What I do know is this is proof that the current frenzy is putting upward pressure on prices for these wonderful bargains of crap.

If I make considerably more than the average wage, and the cost of buying something in the 400-500K range makes ME blanch, how can people making a lot less do this?

Well said, mac. Many years ago I realized the same thing, and it led me right here.

Cheers!

Prime mortgages are now foreclosing: per cover of Sacramento Bee.

http://www.sacbee.com/business/story/2017811.html

(If you would remove your reference to Love SoCal, I could get people in NorCal interested in this blog)

Thanks.

In the early to mid ’90s I worked for Freddie Mac where it mas my job to audit EPD’s (mortgages that became at least 90 days past due within 12 months of origination). Way back then, I recall that after auditing and re-verifying the authenticity of the EPD file’s documentation, at least 90% of them proved to contain material misrepresentation. I suspect that more than 95% of the present day defaults are fraudulent. That’s why all this modification crap is such a pipe-dream. 95% of the defaulted borrowers either do not have the means to repay even the principal much less the interest, or the defaulted borrowers were scammers who never had any intention what so ever to repay a penny of the defaulted mortgage.

Laura, your math is way off. Additionally, your understanding of interest only and negative am is hopelessly confused and incorrect. A pair of kids making $200,000 a year, or $16667 a month in total are only devoting 25% of their GMI (gross monthly income) to the P & I payment, using 6% on a 30 year fixed. When using 7% on a 30 year fixed the figure jumps to 31% of GMI..we don’t know the taxes or insurance, and we don’t know other recurring debts. At 7% fixed rate P & I, which should cover the majority of full doc, 30 year fixed mortgages written in the last 7 or 8 years, the couple still has $11,000 in residual income to cover other monthly expenses. More than enough for most borrowers.

3x income is pretty safe. Depending on other monthly debts, and property escrows a lender might start to get nervous at 4x or 5x income, yet many international banks will entertain 4x or 5x income mortgages all day long. Of course, here in the US we use debt to income ratios, not 3x income or 5x income, and other foreign affectations.

By the way, interest only mortgages never negatively amortize, by definition (look it up) and by the mechanics of such a product. Only negatively amortization mortgages (such as option arms) will negatively amortize.

@consumer–absolutely right on. It was robbery pure and simple but I guess too complicated for people to demand accountability. It burns me to see a few thousand people loot billions right under our noses. When the social contract gets broken, the “let them eat cake” moment arrives and the corporate media flee their studios like the helicopters from the Saigon embassy in 1975. This has happened before in history, just not here…at least in our lifetimes.

I was married 20 years and during this time, I come to find out recently, my “ex” had over 65 deeds, reconveyances, defaults, substitutions, release of obligations, etc. filed on the property I now have given him hundreds of thousands of dollars more than the house is worth just to have “shelter” as I am disabled and he is making $30,000 per month, or was, just the months and years before the Judge granted me a slight modification in spousal support, which now, neaerly two years has gone by and not one dollar has been given me. Going into foreclosure and no one cares about “who better to steal your identity than your “ex”?” I can’t get one person even interested in throwing out a woman in her late 50’s, disabled, having MRSA which kills more people htan AIDS in the United States since 2004, and is legally blind! Can anything or anybody else do more damage to my request to “exist”? This is a horrible situation perpetuated by a bitter “ex” who just won’t stop until I am in the streets like he promised he would do to me. But because you were once married to this scam artist, and has been since the day we got married, but it does not show how stupid I was, it shows how good he was! Any advice or organizations to go to…..I feel “raped” over and over again, losing every single dollar I worked for and gained through the marriage, but he had other things in mind and saw me as a “financial cash cow” as I raised and worked full time the entire marriage and took care of his small children from the day we got married (well, before that) until their majority, then I go blind, and I get out gracefully and what a person can do, even if you were once married, does not mean that it should be overlooked and not investigated by some agency, authority, government assistance to the disabled, or whatever else I can think of that would care in this cruel act on someone I did not know at all! Thank you.

I know this is an old article but I think this is still happening. In the last two years there’s been some suspicious fires in Hollywood, California. All pertaining to house’s that were being sold.

Leave a Reply