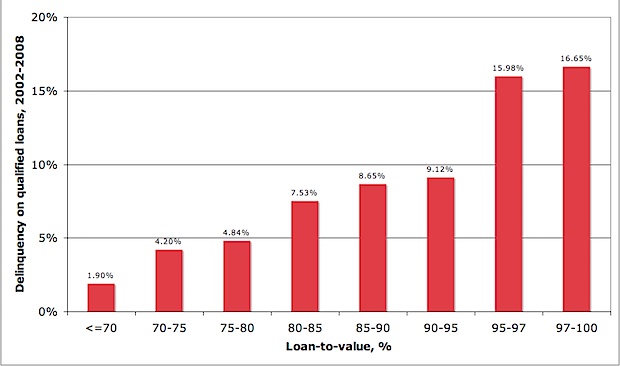

Why a sizeable downpayment is so important for the long-term health of the mortgage market – Market data clearly shows that a low downpayment is directly related to higher mortgage delinquency rates. When loan-to-value exceeds 90 percent delinquency rates rise above 10 percent.

I’m a bit perplexed why so many people think that a low downpayment has very little to do with mortgage delinquencies. Aside from the actual facts that show a low downpayment does correlate with significantly higher defaults rates, it also makes logical sense. I believe part of this mentality stems first from not knowing the facts, but also believing that this shifts blame from the financial industry or government backed system we currently have for purchasing mortgages. On this front I do agree that the financial industry is the prima causa of the financial crisis and there is plenty of blame to go around. Yet if we are to reform the system we need to understand what can be done to fix the mortgage market moving forward. A low downpayment is unhealthy for a variety of reasons as we will discuss below. I’ll give a few reasons for why having a larger downpayment is absolutely crucial in bringing back a semblance of sanity into the mortgage markets but also from stifling potential future price bubbles.

FHA share of market

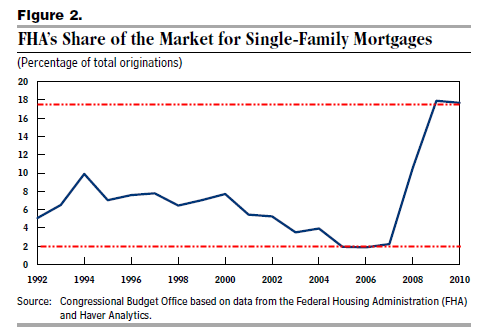

The first point I would like to make is that the share of FHA insured loans has reached an all-time high. It isn’t because these loans are better priced from other conventional loans but because Americans are unable to come up with even a 10 percent downpayment that these loans now dominate the market. You might ask why was it low in the 2000s then? 3.5 percent is all that is required for a loan that is insured through the FHA but during the 2000s you were able to get zero down mortgages or other exotic loans that were even easier to land (and more lucrative on the surface) than FHA loans. As the exotic financing market imploded interest has now shifted to FHA insured loans because they are the next loan in the line of easy to get mortgages.

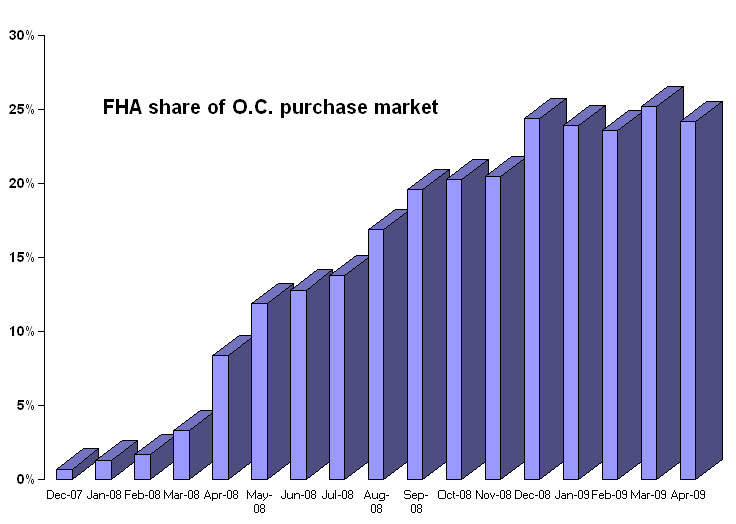

You need to remember that FHA insured loans were never meant to be a big part of the mortgage market and their core mission was to help with affordable housing. Nationwide in 2010 FHA insured loans made up close to 20 percent of all purchase activity (a big leap from 3.7 percent in 2006). What is fascinating is the reality that these loans now makeup a large portion of activity in bubble markets that by definition are not affordable to begin with. Take for example the most expensive county in Southern California, Orange County:

Source:Â Everything Housing

So FHA insured loans are now a large part of the financing for one of the most expensive counties in the United States. In Southern California overall it is worse. 33 percent of all home purchases last month were made with FHA insured loans. The median down payment? You guessed it, 3.5 percent. Given our weak economy and the reality that FHA loans carry PMI and higher interest rates, the underlying answer why people are choosing this loan product is because they are unable to save enough for a downpayment to purchase a bubble priced home. Ironically the FHA which is touted as helping those to find affordable housing is actually keeping prices inflated in many markets.

The data is rather clear but let us move onto the facts showing that low downpayments actually carry a much higher default rate.

Data on mortgage delinquencies by downpayment

Source:Â Felix Salmon

Felix Salmon did a fantastic post poking holes through the downpayment argument. The mortgage industry makes money by churning loans and sucking out commissions. The lower the downpaymet, the more buyers you have in your pool. This is not good although it may seem noble on the surface. I’ve been trying to find reliable data on the entire mortgage market delinquency rates but it has been a challenge and Felix ran into similar road blocks. We were able to look at option ARMs, subprime, and Alt-A loans for example but merely in silos and deduce that these loans were bad. Of course this left a loophole open for the mortgage industry to argue that it was the underwriting, not the downpayment that was an issue. Well now we have some aggregate market data here proving what should be obvious. A lower downpayment does have a higher delinquency rate. Just look at the chart above:

“When the mortgage industry starts complaining about the 14 million people who would be denied the chance to buy a qualified mortgage if they don’t have a 5% downpayment, it’s worth remembering that qualified mortgages for people who don’t have a 5% downpayment have a delinquency rate of 16% over the course of the whole housing cycle.â€

I’m horrified that there is even a battle to require a 5 percent downpayment.  Ultimately the industry isn’t concerned with long-term solvency but for quick commission churns and actually keeping home prices inflated.  Once again the industry fails to look at stagnant household incomes and instead focuses on getting people into homes without requiring them to save or the long-term sustainability of the system. After all, when things implode it will be the taxpayer that shoulders the cost for the banking industry and the defaulted homeowners. The above chart is rather clear. Once you move below the 10 percent downpayment mark you start seeing delinquency rates of 10 percent or higher. This is enormous.

“And you can see too why the 20% downpayment limit was put in place: it’s the point at which delinquencies fall to less than 5%. If you take one group of loans with a 20-25% downpayment, and a second group of loans with a 15-20% downpayment, then the second group, on these numbers will have a delinquency rate 56% higher than the first.â€

I’m not sure what more evidence is needed to show that a low downpayment mortgage does increase the chances of delinquency dramatically. It would make logical sense that the less you put into a place, the less vested you would be in it when times became rough or the fact that you simply did not have the economic means to save enough for a buffer.

Strategic defaults

There is also data showing that people that strategically default on a loan actually have higher credit scores. On the surface you might think this does not make sense but it actually does. First, those who strategically default actually have the money to pay their mortgage. That is, they are not like the majority of people losing their homes who flat out don’t have the cash flow to keep up with their mortgage payment. These are people who consciously choose to stop paying their mortgage.

There is a large number of people living in homes with no mortgage payment for over 2 years:

This is frankly a jaw dropping figure. Yet this makes sense with so many people in the last decade buying homes with virtually nothing down with exotic loans. People in effect used mortgages as large call options. If home prices soared, these people were able to use other people’s money (OPM) to leverage up to the stratosphere. Yet if prices collapsed as they did, the only thing they were out was the paltry down payment (which in many cases during the bubble was zero). Easier to strategically default when you put down zero or 3.5 percent instead of 20 percent.

Demonstrate you can save for a rainy day

The reason why a downpayment helps keep delinquency rates lower and the data shows this is that it actually demonstrates an ability for a household to save before buying. There is no reason why someone should be given a large mortgage simply because they want “homeownership.â€Â This is the nonsense we got from the last few leaders in D.C. and the only people that ended ahead in the last decades are the big financial banks on Wall Street who finance the D.C. leadership. Homeownership rates have erased all the gains of the last decade and household wealth has gone through a lost decade. Not everyone can own a home without going into financial peril. It is also the case that by allowing anyone with a pulse to buy you artificially inflate prices on the front-end but society ends up paying in the long-term because as we are now seeing, defaults will occur and the cost is reflected through bailouts.

Another argument I hear is “well if someone were to save for a California home, it would take over a decade to save 20 percent!â€Â Well isn’t that the point? How in the heck did people do it before the housing bubble? The reason it has become so hard to save 20 percent is because many areas are still in freaking bubbles! Nationwide the median home price is roughly $158,000. Let us be conservative and say that all mortgages backed by the government would require a 10 percent downpayment. So we are talking about $15,800. Ironically this is close to the 3.5 percent down needed for an FHA insured loan of $500,000 ($17,500) which is being used extensively on bubble priced California homes.

The case is rather clear that moving forward, a larger downpayment is one component of improving the mortgage markets for future generations. But then again, investment banks and D.C. are primarily concerned with churning out volume in the short-term even if it comes at the expense of future generations.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

90 Responses to “Why a sizeable downpayment is so important for the long-term health of the mortgage market – Market data clearly shows that a low downpayment is directly related to higher mortgage delinquency rates. When loan-to-value exceeds 90 percent delinquency rates rise above 10 percent.”

Right on the mark, as usual, for Dr. HB. The attitude toward taking out a mortgage and making payments would drastically change if people had significant (20%+) skin in the game.

h huh… see Va Loan data below. Downpayments are meaningless predictors of loan success or failure. Its the underwriting.

ANd in addition it would take the average household 14 -17 years to save a downpayment for a median priced house – assuming no college loans, no job losses, no illnesses, and probably no kids…..

Of current owners over 53% couldn’t have bought if they needed 20% down. That pushed people way out of the market.

ANd that means Welcome to the Fiefdom of the USA where the top 1% own the land and housing and rent it out to the about the other 85-90% who are the peasants.

And when the bottom 80% can never get a house ( student loans, job loss, illness, kids costs etc keep eating any savings), then the top 10% can lord it over them when they are old and can’t afford rent and say “you should have bought.” So either the self-righteous 20 perventers can (a) ante up more money to care for the elderly forced to rent or (b) live with getting robbed by the have-nots who have been kicked out of any chance of security.

AnnS, we have gone through this argument before. Say what you want, you are crazy if you think low or no down loans didn’t play a role in the housing meltdown. These low or no down lenders are akin to drug dealers. They know nothing good will come from their products in the future, it’s just easy money for the here and now.

If you can’t scrape two dimes together, you shouldn’t be able to purchase a home PERIOD. Not to mention that us responsible taxpayers had to pony up for many of these people who had zero business buying.

“ANd in addition it would take the average household 14 -17 years to save a downpayment for a median priced house – assuming no college loans, no job losses, no illnesses, and probably no kids”…..Is this nationwide or is this only in bubble areas like California? From the Dr.’s article, the nationwide median is 158K, you are telling me that it would take the average Joe 15 years to save 30K for a down. Are you out of your effing mind?

“Of current owners over 53% couldn’t have bought if they needed 20% down. That pushed people way out of the market.” Just imagine if those 53% of people were not allowed to buy, where do think home prices would have went. DOWN TO MORE REALISTIC LEVELS. See, this isn’t really that hard to figure out.

Prices will continue to decline and hopefully some sanity will return when it comes to lending!

Ann- Sorry to burst your bubble, but the average family CAN save a down payment,

IF they are willing to make the changes necessary to actually save.

1. No, I can’t cut out cable TV. What would I watch?

2. I HAVE to have my morning Starbucks to wake up.

3. I DESERVE a new car.

4. This year, we are only going to Hawaii on vacation, not Europe. See, we are willing to sacrafice.

Do you actually comprehend what you read? Your whole the sky is falling argument is weak and unpersuasive.

There are already underwriting standards, but they were ignored much like financial regulation on Wall St. – the rules are there, no one enforces them. A hard and fast rule, such as 20% would have stopped the BS underwriting cold.

You downing effect real-a-tards simply do not grasp the cold, unflinching reality of the immutable laws of the universe, such as gravity. The universe is not going to grant your wishes that everybody should have a house, no matter how hard you try.

Housing is still very much is a bubble. Just look at incomes vs. prices. The gap must be filled with debt, and with the huge gap that exists now, that debt is not realistically serviceable. Stop trying to defy Nature. It is that simple.

Owning a home is a privilege — not a right. It can be done. I bought my first house in 1979 when I was a single mom and interest rates were a whopping 12%. Yes, I had to save 10 years for a down payment, and my first house was an old one — built in 1925 and 700 square feet. I could barely make the mortgage payment, but I never defaulted; and after 5 years I was able to sell that house and move up to a better fixer-upper. The problem I saw that created the bubble is that no one wants to start with a fixer-upper any more — they all want to live in houses that only rich people can afford. Live within your means.

AnnS,

What you don’t seem to understand is that making the down payments so low perpetuates a bubble which actually keeps home prices inflated and less affordable for middle class families and the poor. It allows a slightly higher percentage of people into homes but makes the whole market much more expensive for everyone else. This in turn actually destroys our economy because such a large percentage of peoples income goes into their housing payment and not to other goods. You seem to think these low down payments help the middle class and poor when quite the opposite is true over the long term. As many others stated with low down payments you see much higher default rates which is also bad for housing. Clearly the market was much more stable when everyone was required to put down 20%. I do believe the government has some role to play in making sure housing remains affordable for everyone, but lowering down payment requirements is not that way.

Well, not every one should be buying a house then. Screw the so-called American Dream!

AnnS=Realtard.

Sam

July 12, 2011 at 6:03 amAnn- Sorry to burst your bubble,

ANd you are an arrogant …..(fill in the blank)

Tose are the facts. The average worker makes around $32,000. The median household income is $50,000.

Prices must and will fall to be in line with incomes.

A 20% down is totally unrealsitic when in the past 30 -40 years

(a) average price car went fromm beiing 27.3% of the median household income to being 60% of the median householdincome

(b) undergrad private college went from 35% of the median household income to 1oo% of the median household income

(c) health insuranc ewent from 5% of the median household income to being 24% of the median household income.

They D O N O T have the money left anymore to save. The cost of basic neccesities have gone up astronomically compared to incomes. ANd then there is job instability – not like it was 40 years ago when people could exepct to keep their job and not suddenly get cut and they have to get by on savings until they find something else.

It is NOT ‘Ozzie and Harriet or Leave it to Beaver out there people. THe financial demands on households are far higher as a proportion of their incomes. And if you think we can go back to the 50s or 60s with 20% down , well, there is the bridge for sale….. (And I expect most of you were NOT buying houses back then either – even in the late ’70s and early 80s, 5 and 10% downpayments were as common as 20% down. )

And can all the crap about big screen TVS and all the rest. These days – in case you haven’t noticed – employers expect you have internet at home and a cell phone (reachable whereever your are.)

The average household does not have all that – they are trying to get by and keep health insurance and hoping they keep their job and trying to gigure out how many more miles they can get out of that car before it dies completely. (The arrogance of the chattering classes is showing in these comments……come help with my volunteer financial counseling and you will quickly learn that the typical household does not have the shiney new SUV or the vacatin to Mexico – they can’t pay to fix the transmission and still pay the kid’s dentist that month.)

So what do you propose they do if they are in the bottom 65 -75%? Rent and then try to live on the average over-65 income?

Median household income for those over-65 is $32,000 for a couple – and minimum $10,000 a year of that goes to Medicare premiums, copays, deductibles….. and they still have to pay for dental and vision.. For a household of 1 person who is over-65, the median income is $18,000 and again about $5000 in premiums deductibls and copays.

Only the top 25% have over $50,000 a year in retirement – and a lot of that from still working after age 65.

WHere do you propose the median household live after they are 65 and only have $20,000 or $1666 a month to live on for 2 people? And what about the individual who has less than $1100 to live on after Medicare costs? Do they live in a tent? They sure as hell can’t pay for food, utilities, clothing, personal care and transportations on what they have.

Your 1950s retro fantasy is not gonna happen. Househould incomes do not allow for the kind of savings you think they should do – they can barely keep the necessities going. ANd when they are too old to work, you would leave them renting but unable to afford it and on the street.

Ann, if the average person is only making 30K per year (according to you), they sure as hell shouldn’t buy a house. Making 30K per year entitles you to all sorts of government assistance. What they should do is better themselves either through education or learning a marketable trade. NOT EVERYBODY IN LIFE DESERVES TO OWN A HOUSE. When you get that through your head you might understand that prices need to come down. Lower prices would actually benefit all these people you crowing about!

AnnS

Here is another factor you are choosing to ignore: Carry Costs *outside* of a mortgage irregardless of downpayment percent or its size. Carry Costs include property taxes, insurance, local homeowner fees and maintenance. For example, I follow the Irvine market closely and have calculated that such Carry Costs are 3-5% of the *purchase price*/year. Thus a $1mm home requires $30/$50K of new cash flow PER YEAR outside of any mortgage.

Very few individuals can carry such costs. Think of it this way: Suppose a rich uncle *gave* you a property with no mortgage – free and clear. Could you afford the Carry Costs? Probably not. However, as prices deflate (which they will) the amount of free cash available to each household increases. Thus, housing will become more afforable on two fronts 1) mortgage costs (if mortgage is obtained) and 2) Carry Costs.

Sigh. Said it before and I’ll say it again, you’re putting the cart before the horse. Bad underwriting is enabled by low down payments, and the best predictor of whether an owner will lose a house is the origination LTV.

If few people can afford a house at these prices it means prices are too high.

AnnS is clearly frothing mad here (you can tell from her typing even) and making bad arguments on top of bad arguments. Theyve already been refuted by previous posters, so I wont bother. We should be extending tons of credit to people BECAUSE they have no hope of ever possibly making their payments.

I recently moved from the midwest, where I grew up and went to school, and lived in one of the most economically vibrant places in the entire region on less than $700 a month for years. If youre retired, on a fixed income of $30K, wtf are you buying a $500K house for? In fact, wtf are you doing in Socal?

Look, this is the home of the most powerful economy in the world. Thats why its gilded, and thats why its a kick ass place to live, and thats why people all over the world will kill themselves to live there. No ones entitled to spend their nonproductive years in the most expensive place in the world.

Ann has been arguing this for years on this blog, leaving reams and reams of obscure arguments all of which the good Doctor has re-butted, and saying nasty things about anyone who disagrees with her…but there are all the statistics clearly put in the above article for anyone to read for themselves.

AnnS, that’s the problem not everyone should own a home. If you can’t save 20-30% they you should not be allowed a mortgage! I saw alot of cases where you have a couple whose total household income is $100,000 and they feel they should buy a million dollar house with ) 0 to 3.5% down. That is just BS! If you can’t save money then don’t buy a house. I am so sick of Barney Frank and FNMA and Freddie Mac with this everyone should own a house.

“Of current owners over 53% couldn’t have bought if they needed 20% down. That pushed people way out of the market.”

I won’t buy this a argument: If you remove 53% of the buyers, prices will go down, a lot. So low that you eventually have the same amount of buyers than now and they are not “out of the market”. Only prices will change and that’s exactly the thing banks don’t want.

my husband and I paid a low (5%) down payment on all three house purchases….sold two and paid off the third in eight years. Not one default, bankruptcy or bad credit rating on our records. go figure….. I also don’t carry any credit card balances have one zero percent car loan and now we rent instead of owning a house (sold the paid off house to get out of the taxes and insurance and to pay off the 50 acres we bought.)

That’s great for you Kathleen…but most people who buy with a low down payment end up defaulting as per the statistics listed in the above article and the tax-payers of the country are left holding the bag.

Kathleen, as they say “timing is everything in life.” I assume you didn’t buy any of these places with 5% down during the bubble years. If it were peak bubble years (05-07), good chance you would have walked from the house because that made the most financial sense.

When you have millions of people buying with little or no down, any sizeable decline in prices will have BAD results that we all pay dearly for. This is why considerable downs are a must.

octal77: excellent comments re: carrying costs. The cost to maintain a home are usually underestimated, esp. by first time home buyers. Let’s take a look at one more huge element to carrying costs for FHA loans: PMI (private mortgage insurance).

The upfront PMI cost for an FHA loan is 1.75% of the total loan value. The ongoing annual premium is 1.2%!!!!

For a 450k one bd condo in Santa Monica you pay $7600.00 in up front PMI. Then your monthly premium would be $434.00…. That’s just for the PMI cost!!!

Factor in taxes (1.25%), HOA dues (200-500/month), homeowners insurance, earthquake insurance, and repairs – and that condo suddenly looks a little bit more expensive than it did at first glance!

…and don’t forget Texas. They had/have a law limiting the LTV ratio of a loan (piggy-backs included) and their housing bubble was non-existent.

The industry will fight calls for a mandatory down payment, and paint it in colors that make it sound as though the big, irresponsible gov’t is trying to prevent hardworking you from affording a home. Quite the contrary, higher loan values work for everyone, but for the buyer.

No appreciation either…

Downside said:”No appreciation either…”

But that’s ok. It’s just a place to live, not a slot machine. When you buy a home, you are making a speculative land purchase with a deteriorating and depreciating pile of sticks on top of it. If you can keep up with the repairs, you can live in it.

…I love how everyone has been conditioned to expect appreciation and will come up with every gimmick in the book to keep it going no matter what the consequences.

I know someone who did the FHA 3.5% down on a $700K house…that’s only like $21K down, no? Crazy! This is also a one earner household, too.

FHA is lowering their loan limits from $729K to $625K in LA and OC Counties. Just a small decrease, but I bet it will still have a little impact. Rumor is to get the loan limit down to $417K at the end of 2012 and I still think that’s way too high. In fact, I think the whole program should just go away….

Well, I’d like to add a couple things…

One this was a great post by the doctor.

I think the program might go away due to defaults. The country is nearly broke and paying all the FHA insurance premiums will be on a similar hit as the FRE/FAN bailouts that are still ongoing.

So, rich bondholders get bailouts and elderly and poor folks are going to get creamed on SS. Oye.

Meanwhile the government is going to suck us middle class fooking dry.

Not arguing against needed entitlement reform here. Just mentioning the misplaced priority.

FHA just keeps the ponzi scheme alive. Reducing the conforming limit will knock down the mid level tier, as Dr. HB has discussed before. Soon we will have the Low End Tier and Mid Level Tiers of the real estate pyramid being eaten away,.leaving only the High End Tier starved for buyers. Parts of Malibu have dropped up to 45% from 2007 already.

http://www.westsideremeltdown.blogspot.com

I’m not sure I’m convinced the low down payment (for first time buyer principal residence only) is to blame for our problems. I think it’s a very good way for a lot of deserving people to get into homes instead of renting when there is parity. The problem still comes down to investment speculation, imo. Get rich quick is the core cause of the problem. Any and all investment properties should never ever be subject to this low down payment program and very strict adherence to that should be exercised.

I think a key problem here is entitlement. Nobody “deserves” to have a house. To the credit of advertising companies that have convinced everyone that life on this planet exists to purchase houses and fill them with stuff, everyone now believes that they should have a house because their friends have a house. Not true.

If you cannot save the money, it’s in our country’s best interest that you do not have a house. Budgeting is necessary for home ownership, and we should not have to backstop someone’s fiscal irresponsibility or failure to plan. Sure, stuff happens and jobs are lost, but get your life on solid footing before sticking other people with your bills.

This isn’t “Alice in Wonderland” where the Dodo said, “Everybody has won, and all must have prizes.”

And again with the ‘low downpayment bad and causes foreclosure†excessive simplicity based upon concurrence rather than causation …….sigh….LOL! And Felix Salmon also forgot to look at all the facts – like loan programs that have been around for over 6 decades and are Zero Downpayment. Not considering all data is kinda like being blindfolded and trying to describe an elephant by one touch – bound to get it wrong.

Now Doc you are S-T-I-L-L confusing concomitant occurrence with causation – and ignoring the other major important parts of making a loan like underwriting (and that was always what Tanta on Calculated Risk said caused the collapse of the housing loans – bad underwriting, not lack of downpayments.)

Just because two things are present in a situation does NOT mean one caused the other. Just because two factors are present does not mean one caused the other.

The amount (or paucity) of the downpayment d-o-e-s N-O-T cause a default. It is not a 1 + 1 =2 situation. You are pointing at the FHA with its 3 ½% downpayments (and also equating those with NINJA loans and other fly-by-night loans from such worthy lenders as Countrywide, Argent, Option One etc. Come on – be fair. FHA loans require income documentation ahd DTI caps on the back and front.)

Let’s look at a loan program that has done around 19,000,000 loans in 66 years. Yep, lets talk about a loan program that lets borrowers put done 0 as in Zero as in Nothing as in 100% financing of the price and rolling in all closing costs to boot.

Let’s talk about the VA loans.

90% of VA borrowers put down nothing – 0 – zero – not one dime. We are talking 100% plus mortgages here as they can roll in all the closing costs and fees and points if the place will appraise (and 99% of the time they do appraise.) http://democrats.veterans.house.gov/hearings/transcript.aspx?newsid=578 and next MBA link below

In 2010 (according to the MBA at http://www.mortgagebankers.org/files/Conferences/2010/97thAnnual/AC10GovtHousing.Buffton.pdf ) VA borrowers had a median household income of $64000 and a median FICO of 704 (yeah, 50% were lower!) and median assets (aka money in the bank thing) of $6,600.

Top 10 states for VA loans include such ‘non-bubble’ places (sarcasm off) as Virginia #2, California #3, North Carolina #4, Florida #5, Georgia #6 and Arizona #9.

As of the end of the 1st qtr of 2011, when comparing VA loans to prime loans, subprime loans, and FHA loans, VA loans have typically the L-O-W-E-S-T rate of foreclosures. According to the MBA here is who they compare at http://www.mbaa.org/NewsandMedia/PressCenter/76676.htm

(1) Delinquencies – 4.59 percent for prime fixed loans, 11.25 percent for prime ARM loans, 22.04 percent for subprime fixed loans, 26.31 percent for subprime ARM loans, 12.03 percent for FHA loans, and 6.93 percent for VA loans.

(2) The percentage of loans in foreclosure, also known as the foreclosure inventory rate . That rate for prime fixed was 2.59% and for prime ARM loans it was 9.53 percent; for subprime fixed loans 10.53 percent; subprime ARM loans 22.26 percent; FHA loans 3.35 percent; and the rate for VA loans was 2.39 percent.

And the VA foreclosure and serious delinquency (more than just a payment late kind of thing which is just delinquency) has ALWAYS been the lowest of all loan types through the entire bubble collapse and housing crash. VA loans – those Zero Down loans – have the lowest rate of foreclosure and VA loans that go delinquent have a much higher cure rate than other loan types except the FHA loans. VA delinquencies cure 66% of the time and do not go to foreclosure while 72% of FHA loans cure and avoid foreclosure.

So by your hypothesis, the VA loans should be defaulting like crazy and ending in foreclosure and defaulting even more than FHA loans which at least need 3 ½% down – after all , they have 0, Zero, Nada, Zip, Nothing as a downpayment and closing costs rolled in at least 90% of the time. Except there is one problem – the facts D-O N-O-T fit your theory. Basic rule in any scientific inquiry is when the results/facts contradict the theory/hypothesis, you need to get a new theory/hypothesis.

And the reason VA Zero Down Loans do not fit your theory is the underwriting – much much stricter on income and how much can be borrowed than pretty much any other type of loan or lender.

See page 7 -8 for the basics on underwriting. http://assets.opencrs.com/rpts/RS20533_20110112.pdf

The concept of ‘residual income’ goes beyond back-end DTI. As the CRS summary states “Residual income is determined by subtracting taxes, the proposed shelter cost, and other obligations from the veteran’s monthly income. The VA has prepared a table which shows the minimum residual income, by region, for families of various sizes.5 The applicant’s residual income should equal or exceed the stated minimum for the applicant’s family size.â€

WOW! They actually have a $$$ dollar amount that households need to have left after taxes, housing and other expenses. What a passé, old-fashioned idea! LOL! But it works as shown by the lack of defaults.

As to how well the tough underwriting works, see the initial testimony of Jim Danis from the Mortgage Bankers Assoc at http://democrats.veterans.house.gov/hearings/transcript.aspx?newsid=578 where he states “. “And VA loans have performed better than any other segment of the market. Despite most of these borrowers not having skin in the game, VA loans have outperformed their counterparts through the recent housing crisis. According to MBA data, the seriously delinquent rate for the first quarter of 2010 was 5.29 percent, well below even the 7 percent delinquency rate for prime loans. The VA portfolio has been able to weather today’s turbulent market largely due to its conservative underwriting standards. VA mortgages have always been fully documented and fully underwritten loans on owned or occupied properties.â€

The key in determining whether a loan is at risk of default is NOT Fico (VA borrowers are low and VA very flexible on that), is not assets at hand (VA borrowers have very little) nor – contrary to your oft-repeated assertion – the size of the downpayment.

The key in determining whether a loan is at risk of default is the U-N-D-E-R-W-R-I-T-I-N-G standards. Crappy careless loose underwriting = risky loans that default. Tough underwriting = extremely low default that is lower than pretty much all other types of loans (even if the borrower has NO kind of downpayment ‘cause that is not the controlling factor in defaults as shown by the VA loan program.)

I’d like to examine the default stats of Veterans who didn’t use the V.A. for their home loans. Probably would be low also… My point is, if the borrower is a Vet, there may be lower default rate, not just because of the “vetting” (underwriting).

The real problem is PRICING. Prices are inflated because of the low down payment scheme and the lack of thorough financial check into credit-worthiness. So I agree with the writer (higher down) and with AnnS (underwriting). Increase down payments and make the qualifying process stricter. This will bring down the prices of homes and make it more affordable for everyone. Imagine folks actually being able to afford their homes, what a concept.

Your theory is wrong. The data shows that it is the UNDERWRITING – much tougher and realistic.

ANd that is the consensus of those in the mortgage industry who have analyzed the VA loan performance.

Nowhere in the article did the author state “The amount (or paucity) of the down payment d-o-e-s N-O-T cause a default.” That is simply your faulty *inference*. The author gives statistics which demonstrate the inverse *association* of down payments and defaults. That is clear (to anyone not smoking an ass-load of crack.)

Really, your argument rests upon VA loans over the course of 66 years? And what is percentage of VA loans to loans were made in 2003-2007? I don’t have the data in hand, but I’ll bet a *very* small percentage (think atomic scale). So, the VA loan story you tell really is irrelevant.

Your lack of brain power is really apparent.

Oh, “…tough underwriting works…†until it doesn’t, just like circa 2003-2007.

ANd your Variance DOc are a rude clueless and ignornat and reading illiterate @#?!!

DOc has been arguing for years that if the downpayment is a large aka 20%, the loans then that will prevent defaults. Try readiing and thing.

My sentence of ““The amount (or paucity) of the down payment d-o-e-s N-O-T cause a default.— was not a quote. YOu are so illiterate you don’;t know the difference. Have a problem with reading and infering much or do you need to be spoon fed ala Fox News.

Obvioulsy you are so computer illierate that you can not click on the links and the pull up all the other MBA quarterly reports I did not spoon feed you or the COngressional Record.

The default rates I mentioned ARE NOW – or at least the past 5 years since that is the crash time since that is the relavant time period for analyzing the risk of default when the borrower has ZERO down and housing prices collaped

How manymade in 200s? LOOK IT UP – it is int he links.

WHy bother giving you links? You are such a fool that with the brains of a gnat that you couldn’t read what I gave you as it is. Really a waste of time engagin in a battle of wits with an unarmed person.

@ AnnS

“Try readiing and thing.”, “…waste of time engagin…”, etc.

Sorry, I don’t speak your language. Please reformulate and repost in English.

Who are the monkeys that think that a low downpayment has very little to do with mortgage delinquencies?

You are absolutely right. These lowballing bastards need to get some skin in the game, and lose 100s of thousands if they walk away.

Otherwise it’s a situation of “heads I win, tails you lose”.

I remember overhearing some realtor in Santa Monica in 2007… she said “If you can scrape together a 5% downpayment, even if you have to cash out the kids’ college fund, DO IT! [Bulging eyes] It’s all upside, baby.” Made me sick then, makes me frigging RAGE now! 😛

That is really disgusting..

yes, as in all things…caveat emptor.

I was a looking at a place once and had my own financing pre-approved, so when I show up to sign the paper-work, the realtor has his buddy the loan officer there telling me that I couldn’t use that loan I was approved for, but he had a nice 5/1 ARM (or whatever ridiculous lingo he used for his high-commission for him/high-risk for me loan.)

Needless to say, I got up from the table smiled in their faces and left. And I’m sure they thought I was crazy to walk away from such a smoking deal.

I very much agree with the good Doctor here. I’d also add that one can simply look at history in general here for confirmation that low down payments are always a disaster. This is a type of leverage, and historically high leverage (E.g. low down payments) have always lead to a disaster. Always. Without exception.

So much so, that Banks were required not to use excessive leverage by law, and keep a significant portion of deposits in the Bank, rather than loaning everything out. This has been continually whittled down over time, so now that most Countries ignore this, and the only semblance of order is kept by the BIS (the international clearing house for banks).

But now, people have forgotten history, again. Unfortunately that’s about to hit us square in the face as a reminder.

The bottom line is that the people arguing for low-downs have absolutely no valid argument to make. Not from the math, not from logic and not from the reality of past experience. Their only argument is by whining “but that will cause prices to fall!”. Yep. Exactly. And I’ve got further bad news. Prices are falling, and will continue to fall, regardless. That’s what happens when excessive leverage has been used, and there’s nothing which can prevent it. Eventually credit will dry up even more, and the 20% minimum will be back. And yes, that will keep prices down. That’s not just a good thing, but a great thing. Unless you’re a willing victim who has bought a mortgage.

“That’s not just a good thing, but a great thing. Unless you’re a willing victim who has bought a mortgage.”

Yes…or a realtor/mortgage broker or other financial services vampire who feels entitled to those fat commissions.

Thank you for the article. I’ve seen a lot of posts around the net, in forums and in new articles, that try to discredit the link between lower down payments and higher delinquency rates. Usually the posts vaguely reference something they heard in a study, but I’ve always been skeptical. I think a lot of the data being used to justify that down payments don’t matter in rates of default isn’t really applicable. The years that the data comes from matters, if it’s from years when housing generally only followed an upward trend, the initial amount may not have mattered as much as it does when housing is depreciating. This is similar to the problems with models that were being used during the bubble with historical data to predict the potential default rates. What was being done with credit during the bubble was unprecedented and the historical data on default rates was a poor indicator of future performance.

If anything I think too much emphasis is put on a credit score, a number based typically on shorter loan terms, in coming up with a prediction of a person’s ability to repay over 30 years.

Look at who is lobbying against increasing down payments, it’s an unholy union of lenders, the NAR, and community groups. We know what the lenders and the NAR want, to keep prices inflated for higher commissions, and then push the risk on to the government through government backed loans. The irony with the community groups is that they are actually hurting the very people they are trying to help by pushing for more loans and credit. Most articles I’ve read on raising down payment requirements always use a least one example of a buyer that wouldn’t be able to afford the home if down payment requirements were increased. This always includes a comparison of the down payment before and after, but for some reason the home price is always kept the same. They ignore that home prices would probably decrease in the calculations, even though elsewhere in the article they will usually mention how bad higher down payments would be for the housing market. Of course drops in housing prices are always a bad thing (in every real estate article), even if they make housing more affordable for the average borrower. For some reason, everybody wants affordable mortgages not affordable housing.

Michael D. “For some reason, everybody wants affordable mortgages not affordable housing.”

I thought this was a great incite into what’s going on. Everyone wants to try to cheapen the mortgage in order to maintain valuations – this is great for the RE industry but can be horrible for lenders or anyone insuring this mess, hence why the gvt. is so damn active in the market, because no one else wants a piece of it.

We didn’t need to mess with the financing until everyone went ‘gaga’ and inflated housing prices. Other than SoCal, this was basically just the last 10 years, other than that we’ve had reasonable housing prices relative to incomes. And SoCal facilitated all this as a lot of people in their homes 10-20 years could never afford to buy today and would choke on current property tax levels if they weren’t protected.

People need to stop trying to sell the idea of current values being a good thing for anyone other than a realtor, a current owner dependent on equity extraction to fund living/not go into default, or a lender on the hook with bad collateral. Even if someone gets free financing, they are on the hook for the whole overpriced ticket and if they have to sell due to job relocation and that idiot financing is not still in place…well, affordability went down and the house value gets crushed accordingly. Nothing is worth more than what the market is willing/able to pay when you need to sell. Better hope you don’t need to sell to me at some point.

People also need to consider the housing of today and how much bigger and more opulent it is vs. previous decades (when people were a lot more wealthy according to Ann). Big houses are going the way of the Dodo, which means they are going to get a lot cheaper on a relative basis as we have a lot of them out there and few incomes which can support them at current values.

This is just a nightmare. Stop this HGTV driven insanity. This is unsustainable and doesn’t end well whether it’s now or later – eventually houses come to market and property taxes rise to “current valuations” which crush most of the marginal types in the carrying costs (the rub of higher housing values) and drive values lower. There is plain no saving this, property values are too high relative to incomes.

Holy smokes! Check this out:

http://www.tfmetalsreport.com/forum/1480/show-me-note-litigation

It’s posted by someone who claims to be a lawyer and is following the MERS nonsense in California:

“so if this one little, tiny, insignificant borrower wins this case, then there will be a clear, simplified process to challenge EVERY SINGLE MORTGAGE IN CALIFORNIA. Holy mother of job security (for lawyers, that is)!!!!”

Sit back and pass the popcorn!

The root of the problem is fractional reserve banking (the banking system currently in operation). Under this system, money is LOANED into existence. That is the US population cannot get hold of an extra $X without someone running up an extra $X of debt (owed to private banks).

The alternative is “full reserve†banking. Under this system, extra money is fed into the economy by government, and is debt free.

What makes you think full reserve banking would be better? How could the government possibly know who would make the best use of cash and when? Yes, fractional reserve banking has its problems. These are easily addressed with regulations put in place after the last economic catastrophe (And removed before the current one).

This is right on the money!

I have strategically defaulted on my 400K home and have been squatting for 19 months.

I never would have considered defaulting if the house behind me did not sell for 50K in a foreclosure sale, and I was forced to put down 80K of my own money.

Never heard of that significant of a price decline. Where do you live (city/area)? Looks like it might be time to buy in your neighborhood. . . .

Way to go on the free 19 months of rent. I don’t know why we say there is no homeowner bailout. You are living proof that the bank bailout that is indirectly causing the shadow inventory is also a defaulted homedebtor bailout. I have a friend who has been living rent free in his house for over a year now and saving a massive bundle. . . .

AnnS posted the following delinquency rates:

“(1) Delinquencies – 4.59 percent for prime fixed loans, 11.25 percent for prime ARM loans, 22.04 percent for subprime fixed loans, 26.31 percent for subprime ARM loans, 12.03 percent for FHA loans, and 6.93 percent for VA loans.”

Not sure of her source, but what jumps out at me is that the entire process is mathematically unsustainable.

Bloomberg reports that the national average for a 30-year fixed rate mortgage is 4.51%, which is essentially equal to the mortgage rate offered under the best of circumstances Ann points out above. Think about that: Banks are writing loans for 4.5% interest knowing that 4.5% of the least risky type of loans are going to default. If mortgage lenders actually had to hold notes until maturity (not that I advocate that), I guarantee you that the loan rate would exceed the expected delinquency rate no matter how much skin purchasers had in the game.

So add to the list of problems the fact that the government has structured a system where taxpayers assume all risk of default. Moral Hazard anyone?

Did you click on the – ya know – links? Or maybe post them in the browser? Or maybe like READ the sentence before the data stating where it came from? DUh —- try the MBA quarterly reports

Hi Bob,

You’re giving Bobs a bad name! 🙂 I think there are a couple of unstated assumptions behind your thinking that are not true.

First, the APR is just that, an *annual* percentage rate. So, on a $100k loan at 5%, the bank makes $5K per year (assuming no pay-down of principle). The default rates, I believe, mean over the entire term of the loan. If the average loan duration is in the neighborhood of 6-7 year (due to selling the home or refinancing and paying of the original loan). Then the bank makes probably at least 5x the APR over that term (figuring in decreasing interest revenue due to paydown), they also get the principle back (assuming the price of the home stays constant).

Another flaw is that you seem to assume that default/delinquency == 100% loss. If that we true, then yes, it would be unsustainable if the default rate equaled or exceeded the APR. However default/delinquency does not = 100% loss. The banks recover value by defaults self curing, penalties/fees, mortgage insurance of various kinds, short sales and foreclosure.

Great article. You have been calling for a 20% down payment for along time now and the reasons are clear and undeniable. However, doesn’t it seem like the industry is going that direction anyway? You mention that there is a move for a mandatory 5% downpayment that is being met with adversity, but as the FHA loan limits end, especially in bubble areas, this will have a huge effect on the median downpayment size.

Also, maybe I am confused, but it appears in the article that you mention that the FHA interest rates are higher than conventional? I have read that this is not that case. I understand there is a 1% premium added to the loan, but generally the interest rate is cheaper.

There is an industry flak on Good Day LA this morning, convincing people that areas like Woodland Hills, Pasadena and Altadena are ‘stable’ right now. Well, at least the showcased homes didn’t have any garbage cans out front.

If one always had to put 20% down on a house, so many people would not have to go through so much hell now and for many years to come. AnnS selfishly wants to retain her BUBBLE COMMISSIONS!.

The Anti-Down Payment. Is anyone out there in Real Estate Land Doing deals where purchase is subject to the loan of record? Obviously this only works if equity is floating at near zero and the loan isn’t so toxic that it eats the buyer. Thus, the buyer and seller is trading nothing for nothing. This worked the last down turn. I know, that’s how I bought a house after losing another one in foreclosure.

To Ann:

Everything you state shows that the USA is still in a debt BUBBLE of massive proportions!!! It is not just a real-estate bubble but a MASSIVE DEBT BUBBLE. No matter what we try EVERYTHING must de-leverage. Housing/Education/Autos/ you name it. Why do you think the powers that be (the fed/banks) are doing everything they can to keep the DEBT BUBBLE going and doing everything they can to create inflation…… BUT….. it is failing….. it will fail…. there are no options….. The alternate choice is a wheel barrow full of worthless dollars for a loaf of bread.

I agree. It will just take some more time before it kicks into high gear in California. Probably another year or so. The smart money is still on the fence watching at this point. Parts of NorCal are going to be hit really, really hard.

Just stating the obvious (threads higher are cluttered):

1) If we had 20% downpayments, pricing could have never gotten out of line with incomes/ability to save in the first place. This has the effect of preventing a pricing bubble, thereby adding market stability, as well as keeping someone from defaulting because the house lost some value.

2) If you think the rich win and poor lose in a real estate decline, you have no idea how much wealth (leveraged wealth) is tied up in real estate values worldwide. Many many fortunes were build upon this and have not been remotely cashed out. The rich will still be richer than most but a lot of that excess wealth would go up in smoke.

3) If you think about wealth creation in the past 30 years it has come not from income increases but asset price inflation (land, equities, etc…). Those that owned assets in the late 1970s and early 1980s have done fabulously – also realize that those assets were levered (mortgages and company debt) and with interest rates going from 20% to 5% you really enhance equity value up to the point where no one can afford to pay more or your equity is “fully valued”. The debt tailwind is over for real estate, prices remain too high relative to incomes.

agreed.

While I agree that downpayments increase the owner’s worth in a home, I would like to see how this compares to the 1992-1994 time when an earthquake created structural defaults in LA. As well how do certain regions with established communities versus new communities without strong ties change the default picture. Further I am curious when these FHA loans grow older how their default rates compare. I can only assume that they will be as low as some other larger downpayments due to the strict income limits and documentation. I do disagree that FHA loans are easy, if anyone has tried to get one in the last few years, I am sure they can describe the painful financial process with documentation and requirements. Defaults occur for many reasons, and while downpayments maybe one factor, I am not convinced from this analysis if it is casual or coorelational.

Why can’t both essential comments be true – people should save to make a downpayment (and this may involve personal sacrifice). At the same time, housing prices have to come in line with wages (and truthfully, wages which have been in realy decline for 30 years) need to be increased (and given the level of corporate profits and executive pay, arguments that this can’t be done are purely hokum).

another great post, except for my one peeve: No homes were “lost” They are still “there” unless a CA wildfire burnt them down….and besides, they were never “theirs” in the first place!! Even if they are paid-off and the bank doesn’t really own them, your opressive government DOES!! You have to pay property tax for infinity!!! Dont beliveve me? Stop paying tax and guess who has first dibbs on your shack? I’m afraid this might just be a communist scheme to put “workers” into free homes, courtesy of the “government” I’m sure no welfare recipeints will reject the prospect of getting a house handed to them they didn’t have to “pay” for.

Shelter costs money. Either you buy or rent, you have to pay for a roof over your head. There is no other way around unless you want to stay in with your parents. Would you prefer to live in a wilderness? It is where we would be if there was not government.

I have some very bad news for people in the California real estate game. Not only are home prices still crashing but the quality of life that everyone seems to be so enamored with is also dropping like a rock each and every day. People have been willing to pay a tremendous premium to live in California. The problem is economics and demographics. The few new jobs being created in California are mostly low paid and far removed from supporting an average mortgage. I suggest a drive through some of the marginal neighborhoods, that would be more than half of LA county, and take a look at the number of cars parked in front of the houses. Each one of those cars represents a really shitty job that pays around $10-$12 an hour if they are lucky. To pay that mortgage takes four or five incomes. That is the trend in California. Eventually, you will have very few enclaves along the coast and the rest low income, just like Mexico City, Capetown, Rio, etc. I would suggest unless you are securely wealthy and don’t find living in a third world environment, you get out now.

Excellent analysis. SoCal is a great place to rent. With the current economic/political climate in California, buying seems to be a very risky proposition.

SoCal is full of 40+ boomers with little/no savings. I know many who lost high paying jobs, collecting UE until it runs out, few/no prospects for finding a job in SoCal remotely near their previous income. They live as they did before the job loss; Vegas trips, dining out, etc. Most I know say they’ll never leave SoCal; they like the weather, lifestyle. Where will they go when their credit cards are eventually declined, what little savings they have is spent…who will pay for their housing, food, healthcare, etc? I believe the future financial burden on CA taxpayers to provide for this demographic could be enormous. Not to mention the existing CA welfare class, growing by the day.

I own some rental properties. I require first, last, and a securtiy deposit. Early in my career, some people could not come up with the total amount. I let a few of them move in anyway.

Every single one of them ended up being a problem tenant, and usually had to be evicted.

If you can not even come up with 10% down on a house, you are living too close to the edge. A car breaking down, unexpected medical costs, etc. will send you over the edge.

Do not buy a house without a substantial back up emergency fund. You are courting disaster.

Is there data on defaults before 2002? I’m just wondering if there were confounding factors during the years you show in your graph.

On a more personal, anecdotal note, my husband and I recently tried to qualify for a 10% down payment on a condo that was $299K, and were were instead offered an FHA loan for up to $380K with the same amount down. The condo didn’t qualify for FHA financing, so we couldn’t get it. It was a foreclosure in the neighborhood where we live now–which has excellent schools. But the idea that we would qualify for much more than we could actually afford really, really confused me. It was like a carrot to keep us going, I guess. The reason we did not qualify for the 10% down was that we didn’t have six months of reserves beyond the down payment and closing costs–which seems reasonable to me. But then why pre-qualify us for a bigger loan and a higher monthly payment? Throw the risk on the federal government!

After doing some more research, we decided to keep renting and save more money.

This is so much more simple than you guyz/gals are making it out to be. % downpayment is merely the shifting of the risk to the buyer vs the lender. Anyone at anytime can put MORE down, ie 90% downpayment. All that means is the BUYER took on more of the EMBEDDED RISK than the lender. There is RISK to EVERY life decision: Ie Ann chooses to drive Prius, and I, in my drunken stuppor ramm into her in my suburban. She “saved the planet” & some gas money, but she’s dead. Commercial loans for instance….it is usually what, a 40-50% downpayment required. There is ALWAYS RISK…the biz might fail, so you cant pay the lease/payment on the building….you might get hit by bus and who pays your mortgage then?? The % SHOULD be based upon this risk/reward realtionship NOT artificially SET by the FED. % down is just part of the algebraic equation.

You have it exactly right. Lenders were too aggressive and enabled buyers to pay up heavily. This drove a real estate boom based on “affordability” gains not so much fundamental income gains and ultimately affordability (and ultimately collateral value) was overestimated by both lender and purchaser. Caught with both hands in the cookie jar.

The issue is that once you pull the easy credit, fraudulent underwriting, and unbridled enthusiasm at the purchaser level….pricing goes way down – at a minimum you need to be back in line with incomes and supply/demand. No one wants to accept that and the government wants to do everything it can to slow the decline and/or stabilize things. Of course, seeing this carnage and manipulation makes most people, certainly me, even more risk averse.

Many many years ago, after I graduated from UCLA, I went to work for Kenneth Leventhal and Company, a national CPA firm that specialized in representing real estate developers, mortgage bankers, real estate operators, etc.

The first thing that they asked me to do was to read the AICPA’s treatise on revenue recognition and real estate developers. When issuing financial statements, a developer could NOT recognize income from the sale of residential real estate UNTIL the buyer had a minimum of 20% equity in the purchase. The reason is really quite simple. The AICPA felt that without this level of equity, the buyer did not have enough “skin in the game” in order for the buyer to have enough incentive to continue to make good on the mortgage payments.

As the Doctor has said in this article, requiring a minimum down payment of 20% will go a long way to stabilizing the real estate market. However, those who currently own homes are not going to be very happy. I am sure the government is well aware of the issues out there. The challenge is in finding a way to gradually bring the real estate market back to the underwriting guidelines that existed in the early 1970’s while making it less harsh on those who currently own.

We have a long way to go.

I’m with AnnS on this one. People against her sound like bankers blaming poor people for THEIR mistakes. Bankers need to own up to the fact that they wanted their greedy commissions and had no problem lending to people who KNEW didn’t qualify.

There are lots of people who put down twenty percent and STILL got screwed. Why would I put down twenty percent if I might lose it with markget decline.

I’d rather put as little down as possible. I can stomach losing 3.5 percent, not 20 percent. BTW, I have great FICO, income, and COULD put down twenty percent. Something this whole bubble bursting taught me is that corporations are out for themselves. So, I should be out for myself. If I could do FHA, I’ll do it. And use the remaining 16.5 percent investing elsewhere.

No banker here, try a p/t teacher! FHA was originally set up to help the poor, but it has been exploited greatly and is helping keep home prices high. The current FHA limit is $729K, that is nuts.

It’s really simple: You cannot cheat an honest man.

Think about it. A con artist in most scams relies on the mark’s perception that they are getting a special deal they couldn’t otherwise obtain. Failing to question the motives and circumstances of this ‘deal’ is critical to the scam.

It was much the same during the dot.bomb era. If more o these companies had been forced to answer the question, “At what point does somebody, other than investors, give you money? At what point does this become a functioning business rather than a free service for its own sake?”

The recession at the end of the 90s could have been considerably reduced if more people had been honest with themselves and demanded it of others.

All working class that will not work for slave wages should be eliminated. Not EVERYONE is entitled to food, water, a safe shelter and medical insurance. F poor people, why do they think they are entitled to anything. Remember, if you aren’t producing to the god mammon, you don’t deserve to even live.

BTW, very good posts Ann, now you see the mentality behind the conservative Orange Curtain, and it’s not compassionate (even though huge mega-churches) and it’s not fulfilling. Do you honestly think these people who read and post here can relate to the struggling lower working class? Paaah, send me some cash to invest in Las Vegas.

Making <$30K here!

When the number of people “who will not work for slave wages” and are “entitled” to safe shelter and medical insurance just because they exist begin to far outnumber the people who will work, actually produce something of value and pay more taxes/fees to fund all these entitlements, what do you think the outcome will be?

AnnS and her supporters’ entire argument is premised on the seemingly unchangeable fact that “prices are high.” And because prices are high, we need to compassionately allow people to leverage more than they should. Complete and utter bollocks. As someone said, she sounds like a realtor, or some one of the other parasites in the RE industry.

Here are some irrefutable truths:

1. Home prices should probably fall to be in line with income

2. Incomes should probably rise to counteract the 30-year long trend of the top 5% grabbing a bigger and bigger share of productivity increases/income/profits made possible by the American worker

3. Even if both #1 and #2 happen, not everyone should own a home

It’s disingenuous to argue that there is no causal relationship between down-payment and default. As someone with rental properties points out, if you can’t save 20%, it means that there is some combination of irresponsibility, low income or high debt burden to blame. All of these things combine to increase the probability of default, esp if there is some unexpected event. It is true that people perhaps have more kinds of obligations than in the 60s and 70s — college, cell phones, cable, cars etc. But what does this mean? It means that cars should not cost so much, it means that college shouldn’t cost so much, and it means that houses shouldn’t cost so much. What it ABSOLUTELY does not mean is that you should encourage or con people into over-leveraging to maintain high sale prices and commissions.

It is so darn simple. Supply and demand.

Also, the people I know that used FHA make over $100K a year. They are too greedy to save up the money, spending it on fancy cars instead.

Greedy is not a right word. Some people are good with saving money, others are not. It depends on a person.

Um, I know these peeps, greedy is the right word here! Sure, not ALL people are good at saving, and maybe they shouldn’t be homeowners. You really have to have a good stash of cash set aside once you buy for surprises….slab leaks, roof repair, etc.

I am with AnnS. Great post! With our over 100K income we could not save 20% for down payment either. And we don’t even have a flat screen TV! Rent, child support, college tuition (I am still a student) was eating up all our income. If we, with our income, could not save, what about folks living on 50K with 2-3 kids? We bought a house recently, with 3.5% down FNA. Our mortgage is just 500$ more than rent. House we bought is much nicer than shitty, old place we rented where everything was broken. In our area (Central Valley), rent is as high as a mortgage! I don’t get it. What’s the point in renting? Yes, not everybody deserve a house. So, those who don’t deserve it, should rent and put their hard-earned cash in your pocket renting your condos, right guys? More renters= higher demand for your properties =higher prices? If people could not get mortgage with 3.5% down, they will be renting, thus, increasing gap between rich and poor, between those who can afford multiple homes and those, who can’t afford any, so they have to pay those who bought multiple properties and renting them out. Every situation is different. My point is, if not FNA loan with 3.5 % down, people like us still would be renting and throwing money away in somebody’s pocket.

You must be another realtor. Renting is not throwing money away. That is a myth propagated by the NAR. Nice try!

lol

I am not a realtor. Nice guess though. I am a teacher and an average person who wants to have a place to stay, decorate it, feel stability and fix it myself when something is broken. In our rented house, everything was falling apart and my husband was too polite to ask landlord to fix anything. Carpet was stained and there was nothing I could do about it. Windows were old and shitty, the house was cold when it was cold outside and hot when it was hot, summer day. In our own house, if carpet was stained, I would save money, replace it or hire the best cleaner. I hated that feeling of insecurity and inability to decide for myself. I don’t mention when, after 5 years of renting, just before Christmas, we were informed that our landlord was going to foreclose and we had two months to get out. Imagine our Christmas. Anyway, I am glad that we rented instead of buying during the housing bubble. Even if we approach a decade of stagnation in home values, I don’t care, because I love the house we bought. We bought a place to live and it is how it should be.

“3.5 percent down” and “recently”. So, how much are you underwater now?

Sure hope you don’t have to move soon. You’ll have to bring a bunch of money to the table just to get out.

You are mean and your reply full of sarcasm.

We bought a house in February and we are not underwater. Actually, homes in our neighborhood are selling for a higher price than we bought.

Anyway, prices are not my concern, because I love our house and I agree to risk, pay premium and work two jobs, but have a quality of life and my personal swimming pool. If we loose it, we loose it, but I enjoy every day I live in this house. This upscale neighborhood, there is different atmosphere here! I will do whatever I can to save it.

I hate renting (I am not a realtor!). I was born in a country where everybody owns a place (Russia). Even if there are 4-5 people in a 2-bedroom apartment, but it is theirs. I still have those values. As I already mentioned, prices for rent are so high here that renting does not make sense to me.

Ding! Reality check time!

You say you’re a student and tuition is swallowing a major portion of you’re income. Is this not a planet-sized hint that you shouldn’t be in the market for a home purchase? Priorities matter. Most student endure lesser quality housing in hopes of being able to afford far better as they gain standing in the profession of their study. (Assuming their field of study actually has any significant earning potential. It amazing me the number of people I’ve in massive debt because they got a degree in some variation of Underwater Basket Weaving and then found the UBW section on Monster.com had no listings.)

You rental sucked and your husband was too polite to say anything? How does your choice to be a victim make Ann’s ranting valid? From the sound of it, the foreclosure of your rental was a great gift as it forced you to take action. Merry Christmas, indeed! Hard lesson are not without value if something is learned.

The main issue being missed here by all posters is that mortgage default is caused by a variety of factors, of which the two primary concerns are poor underwriting (FHA UW is STILL poor-putting a 620 mid fico borrower into a home @ 45% D/R and 96.5% LTV is obviously sorry ass UW, but who gives a hoot if the gov’t-AKA you and I-will backstop the losses), and low down payments. It’s a combination of these things, people. No single factor is to blame. In addition, the majority of posters here are completely ignoring the fact that a home should be viewed as a place to live, not an investment or an entitlement. Not everyone can afford carrying costs (pointed out by a smarter than average bear earlier) and that is the reason renting works for many.

Affordability is, in fact, impacted by government programs which artificially increase housing prices. Government involvement in the housing market does exactly the opposite of what it purports to do; instead of increasing affordability, it actually keeps prices inflated to the point where buyers are forced to become debt slaves to own a home. Wake up and smell the propaganda bitchez (read: AnnS). If homes were priced @ 3-4 times median income per historical norms, a larger down payment would not be so difficult for the average family to come up with.

Some posters have mentioned this is not the retro 50’s and 60’s any more. Please consider the fact that that is part of the problem. America is not the same land of opportunity it once was, where the dream of home ownership is easily obtained. Jobs are scarce, manufacturing base is gone, debt (personal and government) are at all time highs in relation to GDP and median income, and we’re busy squandering resources overseas rather than focusing on domestic issues. It’s simple to see, as the good Dr. is always quick to relay, that incomes simply do not justify values in most markets.

Just look at government involvement and the results: war on drugs=more readily available, more affordable drugs everywhere, war on terror=increased wars and attacks of violence, war on poverty=record number of people on food stamps , government healthcare=skyrocketing healthcare costs.

It doesn’t take a genius to figure out that our government is a bloated, inefficient bureaucracy working to benefit the interests of the elite. The less involvement the government has in housing, the more affordable housing will become for the average working family, including the poor.

I don’t think anyone believes that low-or-no down payments are the sole agent at work in causing the problem. But what is understood is that allowing this contribution combined with the other issues to create a far worse result than any would have created alone.

It’s like the recent earthquake-tsunami combo in Japan. Large numbers of people who came through the earthquake alive were drowned because large building that might have provided a place to be above the waterline had collapsed or were damaged sufficiently to be brought down by the deluge.

One disaster is tough. Two in immediate succession is overwhelming.

And just to add a disclaimer, I’m a licensed CA RE broker in addition to other professional titles I hold, and happen to be member of the NAR (as well as local and state RE organizations) and NA of Mortgage Brokers.

Just because you are a member of these trade organizations does not mean you should be promoting home ownership for all. It’s funny that I happen to be directly involved in real property transactions from a variety of angles yet I am not in agreement with most “realtards” on this site. Not all agents/brokers follow the norm of trying to shove prospective clients into properties they cannot afford. Renting is an excellent option for many, especially in bubblelicious Cali.

Leave a Reply