Who needs a mortgage? Mortgage applications running near multi-decade lows while mortgage rates fall.

How often can you go back to the low rate well? That seems to be the question at least when it comes to low interest rates. I heard an analyst say that the bulk of low hanging fruit already refinanced so small basis point moves are simply not going to make an impact on refinancing activity short of home values going higher. I would also add that sales volume is not going to jump significantly because of a few basis points given current levels. The higher price amount is constrained by a variety of factors including stagnant wage growth. Younger Americans that make up the bulk of first time buyers are largely absent from this market and many are living at home with parents. Headlines were raging that mortgage applications soared in the last reading. But when we look at the data, it looks like a blip on the radar screen. Who needs a mortgage? Anyone that isn’t the Wall Street investor buying crowd or foreigners that purchase properties with all cash offers. Given how low mortgage rates are, you would expect more people to be buying into this momentum but they are not. Why? Rates have been low for some time now and it is rather apparent that investor buying was a large push for higher prices, not regular families buying up homes.

Mortgage applications

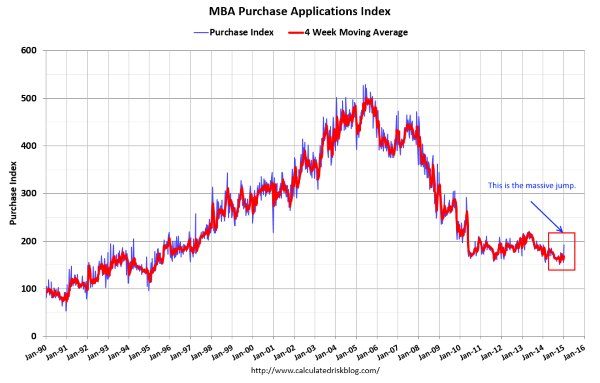

The Mortgage Bankers Association (MBA) saw that mortgage applications jumped by 49.1 percent in the last week. Seems fantastic right? Well you have to look at the broader picture as well and factor in seasonal variability. We are bouncing off multi-decade lows in terms of mortgage originations.

Take a look at the bigger picture here:

Source:Â MBA

You see that little blue line deviating from the 4-week moving average? That is your massive jump in mortgage originations. The current volume of mortgage originations is on par to what we were seeing back in 1994 – 20 years ago. Only difference is that we had 263 million people in the US versus 320 million today.

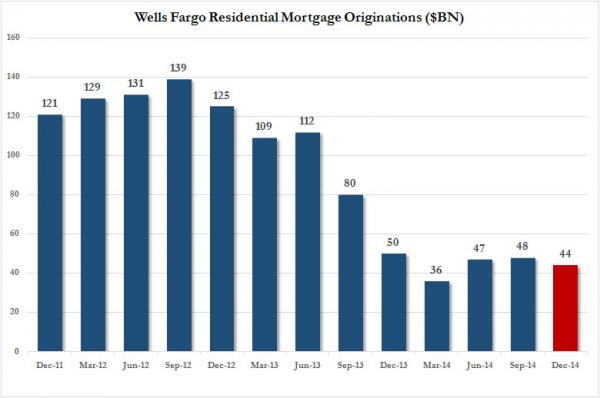

It might also be useful to look at mortgage origination data from actual banks releasing information to the public. Wells Fargo tends to be the big player here and mortgage originations don’t look so great:

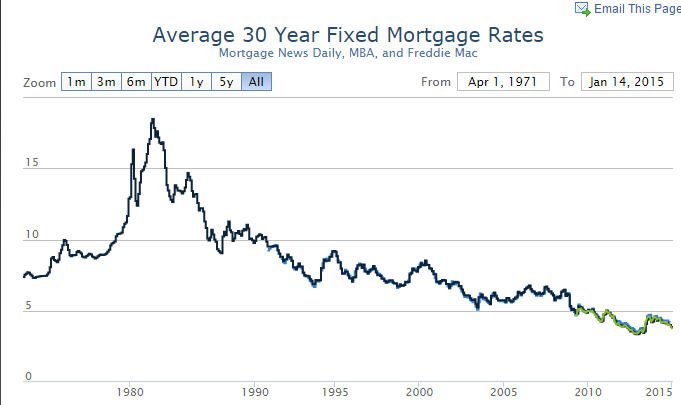

That is a massive drop in December originations year-over-year from one of the largest originators in the country. Mortgage origination data is not looking healthy relative to how low mortgage rates are. Take a look at current mortgage rates:

The current daily survey for the 30-year fixed rate mortgage is coming in at 3.62 percent. That is incredibly low. Within the 3 percent range, you are basically getting an interest free loan after factoring for inflation. So why don’t people dive in and buy every house on the market? There are two main reasons:

-1. Inventory remains very low

-2. Household incomes are still weak

So with investors pulling back from buying single family homes, the slack is now left to regular households. Of course, when you look at the crap shack filled landscape, those that have the means to buy are probably opting not to given their options. Those itching to buy are having to stretch their budgets to the maximum breaking point. You also have prime areas being heavily targeted by foreign money so mortgages are an afterthought.

Volume is low because the qualified pool of buyers is low. You have a small amount of inventory on the market and those itching to commit to a 30-year mortgage have to contend with the ugly options available. Wall Street was largely interested in turning homes into rentals. Given current prices and local area incomes, that play got weak in 2013 with massive movements out in 2014.  After all, rent can only be hiked to a point where local area incomes can support the payment. This is net income and not leverage based buying where interest rates can inflate the underlying cost of an item like housing.

In a place like California where housing and the state is largely driven by the stock market and wealth gains, we’ve been on a roar since 2009. Keep in mind the state collects taxes based on the assessed price of the home so higher home values is fantastic. Also, the state collects taxes on stock market gains and wealth created by the stock market. If we look at the S&P 500, it is now up a whopping 195 percent from the lows in 2009. Every market faces a correction and of course given current valuations, one is due.

The low interest rate game is unlikely to give the market a boost similar to the last jump simply because rates have been low for a very long time already. This is why we now hear about the FHFA talking about 3 percent down mortgages (as if 5 percent was already too high of a bar). At this point, the housing market has become a lucrative place for booms and busts. Anyone looking at the housing market today is speculating for better or worse thanks to the Fed and banking policy. So go forth and buy that crap shack! The banking industry needs those mortgage originations or you might have $700,000 lying around for a glorified stucco box.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

82 Responses to “Who needs a mortgage? Mortgage applications running near multi-decade lows while mortgage rates fall.”

I had a preapproved mortgage and plenty of cash for a down payment back in 2011/2012 when I was still looking and that turned out to be worthless when I tried to buy, got beat by a 100% cash buyer every time. The 60% runup the flippers and speculators fueled in the meantime means buying no longer makes sense for me, will continue to rent until Bubble 2.0 pops, after that may try again.

We are in a similar boat. Planning to rent until it makes sense to buy. We’ve been outbid on homes due to all cash offers that are 20k over asking. It’s insane. Maybe it will make sense in the future.

All cash buyers over bid?

From what I hear, if you’re bidding all cash, you can underbid and still win, because it’s more certain the sale will go through.

Were I bidding all cash, I’d bid at below list price, and see what happens. Some sellers might go for it.

I bought in early 2011 and paid asking for a fixer upper. It needed everything but I figured I could do it over time. One year later the house next door (same floor plan, slightly worse shape) sold for $100,000 more and they’ve taken it down to the studs. It’s a total rebuild. The couple is in their thirties. I could never afford my house now and it’s been less than four years. I don’t know where the top will be but I don’t think we’re there yet.

They could be using a structural FHA 203k, which would still mean highly leveraged and little skin the game.

“I don’t know where the top will be but I don’t think we’re there yet.”

Don’t let the Lotto ticket you scored go to your head man. The top was Early 2014. The median rise is all in the luxury segment. Sure mortgage rates are low now, but the only way this market picks up is with price drops. Once that downward momentum starts do you really think the appetite for MBS will stay constant? Not unless rates reflect the real risk premiums. Those higher rates = further price declines. And I wouldn’t put much hope in Aunt Janet intervening as this will be private equity taking the hit, not the Big 4 Banks. If anything lower housing costs and increased transaction volume for the RE industry will likely be lauded. If the s&P can stay levitated we could see that mid 90’s rerun I’ve been predicting.

We bought in mid-2011 too. It was scary as hell and I had panic attacks near closing. Everyone was saying I was crazy to be buying a fixer. The debt crisis in congress scared eveyone later that year and prices kept falling after we bought. Then rates fell and we refinanced a full percent lower in the fall. Saved us $300 a month… Lowered our PMI too which we recently has removed because our house appraised for $160k more than our purchase price with only $25k in work.

We now pay a significantly lower mortgage than anything rentable nearby. Rents would have to collapse for our mortgage to not make sense. Rental parity was what got me to buy in 2011. Everyone acts like rental parity is a dirty word on here and they were wrong.

It’s all about perspective, 2011 buyer, and it’s not surprising that someone with short term experience is only thinking as far as today’s rent parity ratio. That’s not to say that your situation is a bad one, it’s to say that rental parity is subject to being mitigated by unknown future factors. But hey, if you’ve got it all figured out, feel free to save yourself time by skipping skeptical blogs and nod along with NAR and NAHB sponsored main stream sources as there’s plenty of that out there.

Another point for 2011 buyer that I missed in my earlier post. Renters don’t have to put $25K of capital into fixes, upgrades, and repairs.

We had simulator situation. We had 20% down payment, good full time jobs (still have’em), were approved for a mortgage, but for anything that was reasonably priced and in decent shape were outbid by all cash or 50%+ down offers. The year was 2013, though… Since then we decided to satay put. Just signed a new lease, moved to a really nice condominium in DT Bellevue, WA. Best neighborhood in WA state (one mile from Bill Gates residency), great schools. Pay less that I would’ve otherwise if bought. We rent from a retired couple (in their 80s), the place is paid off, so we got a really nice deal! We will rent until it makes sense to buy. We do not feel anyhow more inferior to the “owner”, since most units in our condominium complex are owner occupied.

You are in a great spot and that’s awesome to hear. We also have rented a great condo in Denver in a very desirable neighborhood, but we began renting before it became “a thing,” and our landlord never raised our rent. They plan to sell the place because there is high demand for condos in Denver right now (pesky construction defects law) but the short of the long is that we’ll either plan to live with family for 6 months, store away a bunch of cash and try to buy in the spring/summer, or continue to rent until it makes more sense to buy. It sucks to get excited about a place in our price range only to be outbid time and time again. We’re currently DINKs and we both have great jobs as well…but just because we can’t buy right now doesn’t mean it will be that way forever. At least I keep telling myself that 😉

Markets have been pretty volatile last few weeks. I’m still happy to be in my rental right now. Hope everyone is doing well 🙂

Us too Jim! Don’t feel like we’re missing out on anything at the moment….just crazy sky high prices that some people are going to regret in a few years.

It really depends on where you live. In the SF Bay Area, rents are climbing high. While new homes are entering the market here and there, it’s not enough to lower demand. I am also sitting out on the sidelines but I’m also really wanting to get into the game. I’m not trying to get in to flip houses, I’m just trying to get in for a better quality of life for my family.

So am I, Jim. I would see that the housing potentially may tank in 2015, though, but I am still firm on my 2016 prediction. It all comes to the FED (QE4, interest rates, etc)

Real Yields on 30 year TIPS are currently around 0.65% and nominal yields on 30 year bonds are around 2.4%. So the market expects inflation of 1.75% over the next 30 years. If you pay 3.6% interest on a mortgage, you are paying 2% over the expected inflation rate. If you think inflation expectations are too low, you can load up on TIPS and wait for expectations to rise and then sell. However, the “bond king” Jeffrey Gundlach said in yesterday’s teleconference that TIPS are not a good buy in the near term and he is convinced there will be better entry points in the months to come.

Both the dot com crash and the housing crash were preceded by multiple increases in the interest rate by the central bank, causing money supply growth to slow substantially. If you think Japan’s stock and housing crash in 1989 was any different, watch this movie first: https://www.youtube.com/watch?v=p5Ac7ap_MAY.

One could argue that the central banks have always been in control and the timing of crashes have always been more or less predictable based on money supply growth rates. One of the best predictions for the current cycle that I have seen is at http://www.realforecasts.com/how-will-the-end-of-quantitative-easing-impact-the-true-money-supply-growth-rate/.

Based on that analysis, we may be good for a few more months, but the Fed needs to make up its mind as to whether they really want another crash or whether they’re going to announce QE4.

Sounds like MiSh, and his opinion that availability of credit is the true factor of inflation and deflation.

As for QE4, I believe it is coming. I don’t believe the Gov will let a crash happen until an external black swan breaks the entire system. And then home prices won’t matter. But I also believe this event is years or decades away. Don’t fight the Fed.

Mish was arguing back in 2009 that QE can’t possibly work and that the Fed can’t overcome the forces of deflation. He’s been consistently wrong and now that the Swiss bank has abandoned the peg to the Euro, he takes credit for predicting that currency interventions don’t work.

If the Fed tightens first and then decides to ease afterwards, it may be too late and the Fed won’t be able to stop the crash. At that point, you can be sure that Mish and Hussman will take credit for predicting that the Fed is powerless. Belief in the Fed was only an illusion.

Martin Armstrong says 2015.75 or the Crash is to begin sometime end of September 2015. armstrongeconomics.com Jim Willie goldenjackass.com also says late this year. Why not prepare somewhat and hope for the best. Will 401k’s, pension accounts, and other private assets be nationalized in an emergency? Will the financial value of dollar-denominated cash accounts be transferred to cover governmental costs and crashing derivative bets finally gone bad. These current series of international events are particularly concerning. Best of luck.

As the Swiss central bank demonstrated this week, central banks can pull the plug on QE whenever they want.

Last week the Swiss CB said they were perfectly fine with the Euro-Franc currency peg (QE). A few days later, BOOM! The Euro-Franc currency peg (QE) is eliminated with no warning. Wall Street, London and the markets got caught with their pants down on this.

I think the FED will do QE4 eventually… The FED cannot contain the tsunami forever, but they will try until it will no longer be possible, but then we can expect the dollar crash which is even worse…

QE3 was all about transferring garbage mortgage backed securities from banks to the Federal Reserve. All the garbage MBS’s are now at the Fed. There is no reason to do QE4 because the MBS’s left at the banks consist of mortgages for people with pristine and impeccable credit. The other mortgages issued since 2007 are all government backed so those are on the backs of taxpayers.

There will be no QE4.

I beg to differ. The system is reliant on it and there will be QE’X’ until the entire system collapses.

Fontana, Rancho, and Ontario have built a tremendous number of homes the last 2 years and they all sold. The malls in SoCal were packed for Christmas. Clearly the economy here is quite healthy, as it should be. This is a city of Kings.

The Realtorist

Haha, did you stand around at malls and count people?

http://www.chicagotribune.com/business/ct-nrf-holiday-results-0115-biz-20150114-story.html

I’m not talking about macro trends, I am well aware from other blogs that other cities may be hurting.

I am talking about SoCal, it’s dense and wealthy population. and tourism on top of that. The malls, restaurants, and freeways were jammed this holiday season.

“The malls, restaurants, and freeways were jammed this holiday season.”

-The Realist

Those malls, restaurants, and freeways are ALWAYS jammed in in SoCal. Please enlighten us with another useless uneducated thought.

Hey man, I just keep it 100

– The Realist

Mortgage?! Who needs a stinking mortgage when there are hundreds of millions of gold encrusted Red Chinese trolling over California real estate. Become a real estate agent to the Chinese nationals and you will sell one hundred houses a month. And soon, you too will become worth hundreds of millions of dollars, just like all of the uber rich Chinese nationals in San Marino, Rosemead and Irvine.

Oh yes, get a unicorn that farts gold pixie dust…

There are still lots of Chinese buying up the sweet bungalows on the larger lots in my town, Sierra Madre, and tearing them down and building monstrosities. Or remodeling them into oblivion. I’ve come to hate those people.

@pammy, the Chinese economy is slowing to a crawl so in a few years these Red Chinese putting up McMansions will go the way of the dinosaur.

What you are seeing in Sierra Madre is the last throes of red hot Red Chinese money that managed to get out of China a couple of years ago. Capital controls were put in place last year, anti-corruption was started a few years ago in China.

When Chinese energy consumption went negative year over year last summer, it was clear that the Chinese economy was screeching to a halt. The tanking of commodities, first copper, then steel and finally oil merely confirms what I’ve been telling people about China.

Hating Chinese + Living in the SGV = Ultimate Masochism

Or aren’t you special, I bet your parents are proud of you. I’d say you should “hate” the African welfare queens in California more, or the illegal Mexicans and all of their kids born here on the taxpayer’s dime.

These bottom feeders are responsible for the state being broke and for filling our prisons to the brim, you know, Cailfornia has the largest prison system in the world filled with “Africans” and Mexicans.

Why hate just the Chinese? At least the “Chinese” bring wealth into our impoverished state and their kids fill up our universities.

Wells Fargo is one of the big mortgaging banks suffering lowered revenues from residential loan originations. Soooo ….. they decided to go big into the energy financing boom last summer… !! Brilliant !!

Don’t be silly,mwaiting to buy is like waiting to die. You can’t enjoy a rental, no painting and gardening with true pride of ownership. If your in an area where homes are 200-400k buy now. Look at rates v price. Rent is literally throwing away money. If you can buy and qualify for a loan I’d do it now, why, because if you are fired or start your own biz self employees, it’s nearly impossible to get a loan. This only applies to homes that aren’t over priced at 700 k. Most inland empire is worth buying now,mits cheap or high desert or analogue valley , don’t wait. I had 14 rentals, most all cash when different areas fell, but now rates and price pan out. Aside from upscale areas in Los Angeles, there’s plenty of options. I’ve been in same home I bought in 2002 for 785, it went to 1.1 million and then down a little, but sits at 1.1 today, why because I enjoyed making upgrades, stairs, hard scale etc…. Renting is for the dead, it’s a trap.mgo buy if you can. Use realtor.com and go to listing agent direct because they’re greedy and will push your offer thru since they’re getting double commission. Always better to buy in this environment. And for me, I can’t get a loan today,nope, do I care that I wouldn’t qualify, nooooo, why, because I’m staying put in my 6 bed 4 bath house in a great town. Thousand Oaks. Weigh the details and I tell you I’d be depressed if I rented !!!! It’s a trap. Buy right and make sure it’s a good loan and affordable for you. Peace

Cheri, I agree.

Look at the vanpool lots in the South Bay, they are chock full of people with the desire and willpower to own a piece of SoCal. It keeps the train chugging along. Yes the coast and westside are for the key players, and people who want to rent close to the key players. The IE is a great place to live, good schools and weather that’s a little hotter but it’s cheaper. Lots to do out there too, ATV’s, Victoria Gardens, Ontario Mills, Morongo, Mission Inn, antiquing, mountain hikes and skiing, racing, you name it.

Yet people think it’s overpriced here. If you ask me, it’s the steal of the century. Compare to NYC, Tokyo, London, etc. Horrible cities that cost twice as much.

June 5, 2012 at 8:44 am

It’s not a “privledge†to own a home in SoCal, trust me this banana republic aint all you think it is. Ever seen the ghettos or 1/2 the Inland Empire???

September 19, 2012 at 9:16 am

Being house poor or even rent poor in SoCal is so not worth it…I’d rather shovel snow out east and at least be able to go out to eat a few times a month than be stuck in my CA home broke.

And people brag about CA? I don’t get it…

September 19, 2012 at 12:18 pm

Funny, living elsewhere, there is always money to take a vacation, but living in SoCal you can not have a home and take vacations as the COL in SoCal is too high.

January 28, 2013 at 8:22 am

Will this pay off in the long run? Will I stay employed? Time will tell…

Nyc, Tokyo, London or the ie? What to pick, thinking thinking…….

Winner isssss 1st place Tokyo,2nd place NYC, 3rd London,4th Hell,5th IE

I’ve heard good and bad things about Thousand Oaks.

One of those “best of” lists (U.S. News & World Report, I think) had Thousand Oaks as one of the safest small cities in America. It’s apparently a great place to raise a family.

But I’ve also read that T.O. has some heavy public employee pension obligations looming in the future, which it might not be able to meet. That means heavy tax increases.

Also heard that T.O. was hit especially hard with foreclosures after the bubble popped.

That said, I wouldn’t want to live in T.O. I checked it out while house-hunting. It’s one of those sterile suburbs full of planned communities, identical cookie-cutter houses, streets without sidewalks, and cul de sacs. Not very walkable.

And no downtown. The Oaks mall is pretty much it for night life, no?

Paying rent is not literally throwing money away. Is paying property taxes and interest on a loan throwing money away as well? or the cost of maintenance? How about when your property value becomes less than what you paid? Did you throw your money away then. The majority of people need some kind of shelter; and that costs money, just like everything else.

“Paying rent is not literally throwing money away. Is paying property taxes and interest on a loan throwing money away as well?”

Not exactly equal = you can’t deduct rent on your taxes. Property taxes and interest are tax deductible.

eden

I wrote off my rent as I had a llc at home, very easy to do, I have a friend that rents in different cities to see what life is like there and writes everything off with home business. He was in Kona for 2 years, now in Seattle. Renting for less than buying and enjoying the freedom of movement…

eden, you do realize that said deductions are not 1:1 recoupment? For many tax situations, especially at these lower rates with less interest being paid, the standard deduction is close to or higher than itemizing. You have to consider the difference between the standard deduction and total benefit from mortgage interest deduction in itemization to arrive to the actual benefit. This is also another reason why higher rates are better because the effective subsidy given by the interest deduction is greater.

If you’re writing the entire rent of where you live as ‘office space’ business expense, you’re committing tax fraud. You can write off the square footage that is exclusively used.

Of course write offs aren’t a 1:1 ratio — but that holds true with the ‘office space’ CD is talking about.

From looking at Docs chart on purchase loans, I remember the pain I felt in about 1996 and then again around 2000 when business absolutely sucked. Mind you there were likely half as many lenders in those years and without the internet lenders of today, our margins were not as compressed as they are now. No wonder I look at the P&L and think WTF???? Without the refinances, lenders would be seriously crushed. Once rates go up, if they ever do, this industry is going to get real ugly unless prices take a big adjustment to spur on sales and I doubt that. Time to GBTW.

We sold a house in Reno (not exactly a hot RE market) in July within 48 hours of listing for all cash 5% over list price. We bought a house in Carmichael in October that had multiple offers within 24 hours of listing and we paid about 4% over asking. The housing market is doing just fine, it’s just that people are earning the same as they did 20 years ago and unless something happens they will not only be squeezed out of the housing market but probably out of the rental market too. I’m starting to wonder where the 60k a year teachers and accountants will find a place to live in California..

The $60k crowd will adapt like everyone else. It’s better to teach in the land of sun and beaches than to go own a crapshack in the frozen tundra.

The only tundra in the United States is in Alaska.

Are you saying that it’s either buy a house in SoCal or move to a crapshack in Alaska?

Everywhere except California is garbage tundra.

Your comments are usually the most unrealistic ones on this board. Just how will they adapt exactly?

Markin, the same way everyone else does. Double up, find a cheaper place, commute, or just plain have less spending cash. Whatever it takes.

Hmm, notice anything about the number of sales in Reno since you sold your house?

http://www.trulia.com/real_estate/Reno-Nevada/market-trends/

I know… real estate never goes down, they’re not making any more land, it’s a balanced market, yawn.

“The current daily survey for the 30-year fixed rate mortgage is coming in at 3.62 percent. That is incredibly low. Within the 3 percent range, you are basically getting an interest free loan after factoring for inflation.”

Not really, if wages aren’t inflating. If prices are inflating out of order with wages, then the cost of servicing the debt is higher.

Low rates are a symptom of weakness in the economy. Some here “believe” this thing or that thing about what the Fed will do. Sure does appear as if they are setting things up for not only a discount window hike, but also no new MBS purchases. Time will tell. Beliefs can be dangerous. I’m sure a lot of folks that have and will be hammered by today’s SNB game changer believed things, too.

“The current daily survey for the 30-year fixed rate mortgage is coming in at 3.62 percent. That is incredibly low. Within the 3 percent range, you are basically getting an interest free loan after factoring for inflation.â€

Not really, if wages aren’t inflating. If prices are inflating out of order with wages, then the cost of servicing the debt is higher.

Low rates are a symptom of weakness in the economy. Some here “believe†this thing or that thing about what the Fed will do. Sure does appear as if they are setting things up for not only a discount window hike, but also no new MBS purchases. Time will tell. Beliefs can be dangerous. I’m sure a lot of folks that have and will be hammered by today’s SNB game changer believed things, too.

The interest rate for 30 year fixed is 3.62%, FHA’s down payment is 3%, and mortgage applications are at a 20 year low. That leaves cash buyers to support this market; and it doesn’t appear there are enough of them to do it. Something has got to give.

That’s right, something has to give as in, “Houses are too expensive!” The Jig is up and it’s crashing. Why? Because people can’t afford houses at these bubble prices.

Only a fraction of the residents in L.A. County can afford even a median priced home. So it doesn’t matter what the interest rates are, the prices are fundamentally too high.

This insanity has crushed economies around the world and it’s been driven by the same idiotic thinking. Everybody was going to get rich by “investing” in property, it’s the world’s OLDEST profession.

Yes, it’s even older than the whores–it’s called RE speculation! And the Real whores have been playing this game since Eden.

They can’t print money fast enough to keep this current bubble afloat. The crap shacks being talked about here on this blog prove that the whores are still at work trying to convince everyone that buying wildly inflated and fundamentally crappy houses is a good idea.

Yeah, it’s a great idea just like renewable energy is such a great idea. It’s only a great idea if you can take the money and flee before the music stops. Here’s a hint, if you can double your money in a couple of years, then it’s probably a scam.

So what will the REAL payback price be? I’d like to see World War III and riots in the streets of L.A. when the economy crashes for real and the Obama phones stop working and EBT cards run out of free money.

Yeah, that should do it. Then the M1 Garand will be the thing that has real value.

I have a very strong feeling that you don’t really want Mad Max, and if it were to happen

1) You would probably not have a job

2) You would be scared sh|tless

Sound and fury…

Massive deflation expected in Europe, bond yields are going negative:

http://money.cnn.com/2015/01/15/investing/interest-rates-negative-switzerland-ecb/index.html

Last line is the best: “It’s a bit jaw-dropping. It all makes you wonder: Do we really have a functioning global banking system when rates are essentially zero?”

Much as I want them to, I don’t see how the Fed is going to raise rates.

Janum,

I was saying the same thing here for years now. Some bloggers tried to contradict me insisting that the FED will raise rates. Regardless of what the FED is saying, they can’t.

If they do raise them for 0.25 or 0.5, they will bring them them down really fast before the economy crashes completely. It would be an accomplishment if they don’t go negative like in Switzerland.

My Wife and I were figuring out where our Daughter’s mortgage would be refinanced with $200/month less payment on a 30 year fixed. She is at 4.1% now. At 3.6% she saves $100/month. At 3.15% she saves $200/month. How looow can you goooo….

Hey Jim, is housing going to crash in 2015?

It might, but I don’t think it will. Here is my take on this. We know that Draghi is launching QE in EU this year, so, as I said earlier, the EU QE will be a stealth US QE for the FED via currency swaps and the EU buying US treasuries. So, with the EU QE the FED can expect the 10 year T-note to stay the same or even go lower, which means no mortgage rates increase. FED can also announce QE4 or postpone the interest rates hike, which will result in the same thing – moar demand from the investors for housing and stawks. We can have a third scenario, which i think is very unlikely… The FED can deliver on promise and raise the interest rates, then it will be the last nail in the US rekovereee and everything will tank. This will result in the FED tapering the “taper” (lowering interest rates back and announcing QE4) or pretty big downturn in the US economy otherwise. Pick you channel and get your pop corn, it is getting funnier from here on.

Nothing is selling in my area. Price drops then they get taken off the market.

Most of the local listings I’ve researched and they were bought top of the market 2006 for ridiculous prices. Owners obviously making last desperate attempt to ditch them before all hell breaks loose.

One house right across the street from me has been on the market for 3 months. Went pending for a few weeks then back on the active list. Obviously the r fled or couldn’t get financing.

The inventory is at record low in our area, Seattle metro, and homes sell like hot cakes if priced right. Some homes sit for months without offers and price reductions. If home is priced right, it will sell in any market. If home sits for month, guess What?… not priced right

You wouldn’t believe how many in the last several months in SoCal go pending only to come right back on the market a few weeks later. Usually flips. Appraisals probably aren’t coming in high enough for low down borrowers. Then there are the delusional organic sellers, especially in marginal nabes, asking at par with the shiny updated flips. The prices are too high.

The failed transactions are happening because you have potential buyers attempting to stretch their budgets to buy SoCal crapshacks.

Once all the expenses (not just housing) are factoring in, the deal falls through.

There is too much debt overhang in SoCal.

Hey mister ernst blofeld – Do you even read the news? “Capitol control in China” was relaxed this past year, not tightened. Where on earth did you get the idea that capital rules were tightened recently in China? Here is an actual article (not some fluff on Fox news or the Enquirer). From Bloomberg:

http://www.bloomberg.com/news/2014-10-09/china-outlines-plans-to-ease-capital-controls-boost-use-of-yuan.html

We’ve given up on buying a home. We are dinks, and with a successful side business in addition to our two good jobs, we will pull in over 300k this year, and we still will not buy. The simple reason is that where we can comfortably afford to buy, the quality of home (and neighbor) is middle class at best. Not even upper middle. And the homes are usually either the cheapest flimsy flips or just beat down 30-year old homes. We are renting the best home we found @$2600 per month (after looking at 40 homes) and at least it has a decent facade.

Instead we will continue to invest and build wealth by saving, dividend paying stocks, maxing out out 403bs and 457s, piling up cash, buying a few bond funds here and there, and continuing our direct lending (p2p and other direct loans—probably half our portfolio). The REIC won’t get a dime from us.

The only exception we have considered is to buy land and build exactly what we want. This is still an option in the IE. When land prices fall, we may jump. Anyone have experience with that?

Why would land fall? And where will you buy it, Banning or Temecula?

If it doesn’t, so be it. There are lots all over the IE, not just in those cities.

With your income you can easily qualify for a high 6-figure mortgage. With 20% down you are into a property in the low million $ range. You have some pretty good options in that price range.

You could have easily bought in my neighborhood in 2009-2011. Upper middle class. Sitting on the sidelines has cost you about $300K in equity/net worth. Not a good strategy.

Afraid of poorly timing the market? Good luck with market timing any market. You could have bought in my neighborhood at the crazy peak in ’06, and today you would still be above that value plus be 1/3 of the way into paying off the house. With 9 years of pmts under your belt you would be sitting on several hundred K in equity from paydown alone.

Stop thinking short term and get into real estate for the long term. I had my doubts in the 90’s but I listened to people smarter and more experienced than me. You have already left a ton of money on the table, but over the long run there will be more appreciation to come. My advice is get off the fence and get invested.

The combo of scared buyers because of subprime disaster, poor paying jobs or no raise in sight, college for the kids to high, administration that wants tax paying, good credit folks to look after the losers in life, lease car payments to high, all makes for the housing market to be left in the cold and dismal at best. In America house buying and selling was big business now it is smoke and mirrors loans, worse ever RE agents, house prices soaring with little takers, this is got to worry everybody going forward.

Home prices are too high. Prices drop, more people will buy, bottom line. Everything else isn’t addressing the core problem.

No. Demand = price increase

Negative. STEM pays well and people are buying. Don’t get a degree in basket weaving.

You people clearly underestimate the draw of SoCal, yet you articulate yourselves as being quite educated so I don’t get it. Oxymoron? I don’t know…

All I know is a helluva lot of people love this place, love living here, and many more want to be here. Every Rose Bowl and Winternational, they show the sunny San Gabriels and 1000 Uhauls are booked tomove here. Its not about economic fundamentals, its about raw emotion and passion. Like DHB says, California Love

Yeah, and in SoCal people’s farts don’t stink. And it never rains. And the real estate prices always go up.

And a uHaul rental leaving L.A. for anywhere EAST costs 2.5 times as much as a rental TO L.A There are so many BULLShi**ers on this forum that if you’re so stupid as to believe them, then you deserve to loose your shirts/pants/undies….

Just had dinner with a physician friend. A doctor colleague got a new Porsche for Christmas–guy sends a new photo everyday to friends. Of course, the guy’s wife is also an M.D. so they can afford a very nice house, cars and pay for kid’s education to any college.

But they’re making way north of 500K a year. How many here are making that kind of change?

RealHoar?

Yeah right, and these are poor M.D.’s.

The bottom line is that the entire State is overvalued for most people’s income. So unless you really don’t have to worry about money (and if you’re that well off, you wouldn’t be visiting this blog), then you’d have to be an idiot to buy anything right now.

So Cal is just another state in the USA. It’s not that special. But be stupid if you insist and listen to the hoars.

EXTRA! According to the news from NHK, China’s bureau of statistics announced that housing prices fell over 10% in Hangzhou, and between 3-4% in Shanghai and Beijing (YoY new houses).

The bubble is bursting in the Chinese housing market. Of course, this will have no effect on the market here. So Cal is different!

Hey, but if you’re bringing in $500,000/yr and you’re only on this blog to amuse yourself (like RealHoar), then BUY BUY BUY!!! Only suckers rent!

Who is RealHoar?

Realist = Realtor = Real Hoar, simple. Who else spouts non-stop nonsense on how great California is and it’s a great time to buy overpriced crap shacks?

Im a small inverter (non cash) and buying my 4th home in the most exclusive part of town here on Arizona’s West Coast. If your target VA foreclosures then they are not allowed to reject your offer simply becasue the competition has all cash, like bank foreclosures can. Also the VA cant drag there feet like a bank can for years on a short sale. However even as a non cash investor I still have to come up with the 20% down which is not a cake walk. Im not a flipper but renting until the under valued market here takes off again (Spring 2015) at which point I will sell out and walk away from real estate investing (no greed). One huge part of the rental parity ration people are forgetting is the cost of renters moving every 2 years where locally that cost is about $2500 and $7000 across states. I think renter like to rent becasue they get the change of venue without all the red tape in their minds anyway. Buyers buy becasue they see the larger more important picture of live in home ownership and sale being the most lucrative and easiest way to invest your money with such small risk, provided you bought wisely not dumbly.

Leave a Reply