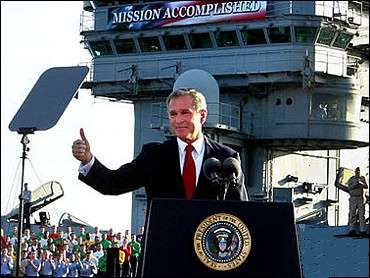

Mission Accomplished: 3 Housing Issues: Multiple Bottoms, Declining Dollar, and More Sub-prime and Alt-A Defaults.

Multiple Bottoms

Let us take a look at a few bottom calls from David Lereah, the chief economist for the National Association of Realtors:

May 25, 06: “This may be the bottom. It appears May is a little better.” (Real Estate Journal)

September 25, 06: “We’ve been anticipating a price correction and now it’s here. The price drop has stopped the bleeding for housing sales. We think the housing market has now hit bottom.” (Bloomberg)

Dec 29, 06: “It appears we’ve hit bottom, the price drops are necessary to stir sales. It is working.” (Globe and Mail )

Mr. Lereah also issued a bottom call in March but at this point why keep track? We also have Leslie Appleton-Young from the California Association of Realtors saying “Our economy is growing. We’re running about on par with what we see nationally.†Apparently she didn’t take a look at the massive hit in GDP during the first quarter that came out last week. And of course we have the talking heads over at the Fed saying that we’ve reached bottom in the housing market. Sometimes I feel like I’m taking crazy pills listening to these folks. How can we be at bottom if for the next two years we will be facing resets of approximately $100 billion per month according to the MBA. Take a look at this chart:

Those in the housing syndicate would like you to believe that we lived through this in 2006 and housing was still resilient. Well for one thing housing was still trading in Pollyanna and easy money was flowing on Main Street USA. That came to a screeching halt in late February and March of 2007 with the sub-prime spigot being turned off. In addition, many folks that found themselves in trouble in 2006 were able unload to a greater fool since appreciation was still present. Now that appreciation is MIA and the sub-prime market is gone we are seeing incredible drops such as the 800% increase in NODs in

Declining Dollar

As Wall Street is dancing with the stars on the boulevard with 13,000, the dollar is heading in the opposite direction. Last week the dollar reached a new low and the DOW hit a new high. What the public doesn’t seem to understand or even care about is that massive orgy credit hurts an economy’s currency. Even though a gallon of milk will cost you $5.00, twice the price from only a few short years ago, they are happy they have a 10% increase in pay over five years. Inflation is a stupid tax and apparently this is fleecing many in the public. Instead of decrying the government step in and protect the currency folks are happy that their 401k is up 4% for the year. In addition, this is another reason that housing prices are in the stratosphere. A declining dollar crushes purchasing power. So even though you are making more nominally overall you aren’t keeping up with the true inflation in assets. The CPI is a joke and I’ve discussed this many times, I doubt anyone believes inflation is 3% a year. Is healthcare 3% higher? Is housing 3% higher? The bulk of where Americans spend their incomes is massively up. Not sure if many care or even understand the implications of a declining currency. Maybe American Idol should have a PSA with Seacrest saying, “today please call your local congressman and tell them that you will not stand for your dollar being fleeced; and now, here’s American Idol.â€

Sub-prime and Alt-A Resets and Defaults

We’ve all heard about the debacle in sub-prime loans. The absolute debauchery going on in companies such as New Century Financial have made many people recoil. Or cases where a 102 year old man was able to obtain a 25 year mortgage loan, apparently with new modified underwriting standards. Or the immigrant worker with a $15,000 salary purchasing a $700,000 home. These stories are tips of the iceberg of what we will be expecting in the next few years. But again, the pundits in the real estate industry maintained that Alt-A loans, those given to prime borrowers but with lax underwriting standards, are now taking a hit. Apparently good credit can turn bad instantly if put in a precarious situation. We are starting to see cracks in this system as well. Maybe this could be part of the fact that 30% of all jobs contributed in the past 7 years have direct ties to real estate. So if real estate goes down, these folks lose their jobs, and no credit can stay good with unemployment.

But don’t listen to the facts. This mission is accomplished. Housing has hit bottom. Go out and buy a home, it is your patriotic duty.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

32 Responses to “Mission Accomplished: 3 Housing Issues: Multiple Bottoms, Declining Dollar, and More Sub-prime and Alt-A Defaults.”

Dr. HoBub…you are SO right on the money! What a breath of fresh air!

I have been getting really frustrated lately because everyone seems to be steeped in D-E-N-I-A-L!

It is infuriating!

All I want in this world is the ability to buy a home that is big enough for my growing family. Nothing fancy…even a fixer…just a 3 bed/2 bath entry-level home in a neighborhood where I don’t have to worry my kids will get shot. Small yard, functional kitchen, solid roof. That’s all.

But I’ll be damned if I’ll pay $700k for the privilege (not that I can afford that, at all, because I WON’T BUY A HOUSE THAT’S 10 TIMES MY INCOME WITH A LOAN THAT WILL BITE MY FAMILY IN THE @SS FIVE YEARS FROM NOW…go figure).

So we sit, waiting in our 2/2 townhome rental (paying only $1500/month for Eastside Costa Mesa) and just growing increasingly frustrated with all the rhetoric and spin.

“Bottom this” and “bottom that”…meanwhile, screwed sellers hold onto these nuggets of hope like a life-raft – keeping prices up – while those of us who WANT to buy their homes say, “No, I won’t take your house at the expense of my family and financial security.”

I don’t mean to “snob out” here, but my husband and I make a combined $130k income…and we can’t afford a 30-year fixed on an entry-level fixer. There is something SO WRONG in this world when that’s the case. Inflation is wildly out of control, and the sheeple just keep cheering it on. Up and Up and UP!!!

Gawd, at this point, maybe I SHOULD take out a 50-year loan. After all, the value of a dollar 10, 20, 50 years for now will be SO LOW…the longer the term, the better. Right?

The idiotic Zip realtor in our area keeps emailing me the listings of new homes on the market. She KNOWS our income and modest down payment amount…yet she keeps sending me homes in the $1 million range for consideration. WTF??!

Then, she sends me listings for $600k condos…like I would move out of my rental condo to buy another condo and pay 4xs as much for something I won’t be able to sell!?!

Then, she send me an article written by some “expert” that says “any time is a good time to buy a home.” With a little note that says, “Here’s the name and number of my loan broker…you should get pre-qualified today and lock in historically low rates!”

OMG!!! Either she’s crazy or I’m crazy…but one of us is NOT tethered to reality and I’m seriously starting to think it’s me. I swear, one of these day I’m just going to BLOW and my head will pop clean off my neck.

I am only 30 years old – and in my short time on this planet I’ve tried to get really self-educated in finance and real estate and the history of the markets – so it chaps my hide when people twice my age are STILL going through life with blinders on. So much for wisdom!

How stupid and naive can you be if you’ve lived on this planet for 50+ years? You’ve been there for booms, busts, oil crises, stock market crashes, political upheaval, droughts, earthquakes, floods. Haven’t you learned a thing or two? Don’t you at least have good insurance, equity in your home and an emergency fund of cash somewhere? Hello…anybody home!?!

Seriously, now I know why they put warnings on hair dryers that say, “do not dry hair while in water” or “do not cook food with this appliance” etc. People really are that dumb!

No wait, that’s giving them an “easy out” to say they’re dumb and it can’t be helped.

People really are that lazy, soft, complacent, unable to get off the couch and better their situation…

Whew!

Thank god for people like you and your readers, Dr. HoBub. I think I’d have to be committed if I couldn’t get my daily dose of sanity on blogs like yours.

Thanks for all you do…you are my rock in the midst of this shameful, idiotic chaos. If I’m crazy, then at least we can all get shipped off to the nut house together! Which is fine by me…I’m not sure I want to live in a society where rational thought, learning from our mistakes, and rewarding hard work just doesn’t fly.

Keep up the good info…we appreciate you! 🙂

MMAB

MMAB,

The thing to remember is that some people WERE making OBSCENE amounts of money off the bubble, but the ones we have left are trapped specuvestors who are like cornered animals caught in the headlights of an oncoming collapsing pyramid scheme. It’s hard to imagine, but many realtors actually believed the nonsense to the point of leveraging ALL their income and holding into the sacred cash cow, real estate.

Realize the trapped realtors and specuvestors DEPEND on that sale, so will be getting more and more desparate as things continue to go sour. Part of the problem is that people rapidly adjust their expectations of the windfall profits as the norm, and delude themselves into thinking the gravy train will run forever.

Hand in there: we’re already starting to see turn-arounds, with alot of good values starting to appear IF you’re willing to negotiate. But frankly, I think anyone would be FOOLISH to buy anything until next year (unless it’s 50% 2006 valuations), as the great unwinding is just getting started…

MMAB, well said. Sometimes I think people have leveraged their futures for “Hi-def, Plasma/LCD TV”, so to speak.

At 10:17 AM, April 30, 2007, Make Mine A Bubble said…

No, you’re not crazy, but I gotta ask – aside from your jobs, what keeps you here? If you are focused on raising a family, why not move to a family-friendly place other than CA?

At least you guys seem to be turning a corner. Here in Alberta (yes, Canada…please don’t hate me because I say “eh” alot), this nonsense is still in full gear…even though the outcome south of the border is clear as day. Last big crash..80 – 81 (we are an oil town), people were abandoning thier houses with everything in them and running back to the coast…and no one seems to remember. Stunning.

heh. another eastside costa mesa resident here. Paying $2125 for a 3br 2ba rental house. I ran by a “fixer upper” on E 18th st, asked the realtor who was putting up open house signs what the asking price was. “Oh, it’s $779k And as you can see, it’s pretty much a tear down”. Yup, denial is still in full effect.

I’d love to move out of state where I could put 20% down no problem, some areas even more. But with a newborn and a wife with family close by. Moving out of state doesn’t make sense, especially not when I can net a much higher salary here.

So I save and save, trying to grow it faster than inflation. Getting frustrated by everyone that treat houses as stocks and expecting to get a $100+k profit every two years. I just want a place to live where I can paint and fix things.

The real estate gravy train has definitely derailed, now gravy is spilling all over the place.

The reason prices are not coming down is probably due to the fact that most specuvestors are trapped in their investments. They can’t sell for less, but they also can’t find great fools to sell to. So they either get foreclosed on or they will try to rent the place out with rent maybe covering half of their monthly expenses. Since the market ran out of fools with borrowed money it will probably take 10+ years before prices get back to where they once were.

I rent until the cost of ownership is equivalent to the cost of rent, but we’re still a good 40-50% away from that here in Miami. Judging by the glut of empty rentals prices are more likely to adjust downward than rent is going to adjust upward.

It’s a seller’s market! It’s a buyer’s market! No fools, it’s a renters market. Sometimes it’s just better to watch from the sidelines.

I live in the 310 area code. Here’s why we don’t move to East Beowawe:

Hermosa Beach

Disneyland

Getty

Lakers

Dodgers

Pasadena Kidspace Museum

2 Aquariums

Hollywood (clubs & restaurants)

Art Movie Houses

Picnics in December

Redondo Beach

Grandma & Grandpa

California State & National Parks

(incl Yosemite, Sequoia, Kings Canyon, Redwoods, Mount Lassen, Joshua Tree, San Onofre, ad infinitum)

Catalina

Hollywood Bowl & Greek Theatre

El Porto Beach

Spanish Missions

Angeles Crest Highway

Poppy Preserve

20-minute Commute

My Old Preschool

Hula Classes

CA Science Center

Malibu

Torrance PD & Class 1 FD

Freeways (Love ’em)

No Rotating Seasonal Wardrobe

Rose Parade

Venice Beach

Santa Barbara Wine (see “Sideways”)

Vans Indoor Skate Park

Seaside Lagoon

Pomona Dragstrip (2 nat’ls ea yr)

Del Mar/Cardiff/Encinitas/Legoland

My fingers are getting tired…

The point is, it’s home. My wife and I are both natives of a place with a lot to offer for a family with two young kids. Except affordable housing…

So we rent. $1,275/mo for a 900 ft stucco box. The yard is huge, though, the weather is great, and the neighborhood has held up well in the 55 years since it was built.

We make a combined 100k/yr and cannot/will not purchase a similar place @ $600K.

So yes, other places have their charms, and the attraction of cheap housing, but it’s not home.

I’ve spent several years living in “rural” areas of other states. While I had great times there, local culture and cliques can be a tough nut to crack.

Also, don’t tell anyone you are from CA, or they’ll blame you for driving up THEIR cost of living, even if they just moved there themselves. (This is a favorite complaint of several friends who moved to the Pacific Northwest during the Dot-Com days.)

Finally, if you decide to move to a smaller town somewhere, don’t be:

Noticeably Ethnic,

Gay,

Liberal,

Too Skinny (women),

Long-Haired (men),

Pierced,

Vegetarian,

A Single Parent,

Catholic/Buddhist/Jewish/Krishna,

Highly Educated,

Well-Traveled,

or just too different.

MMAB, you are saying what every realtor, speculator and lender is thinking in the deep, dark places of their minds. Just remember, the more people sit on the fence like us, the worse it gets for these greedy jerks. So everyone stay home and keep saving for that 20% down!

One thing that still seems to be skyrocketing is the price of high-end homes. The LA Times did a story on this on Sunday. Here in Chino Hills the Vellano development is selling out of $1.5-2 million homes. Too many rich folks not interested in properties that subprime borrowers buy. I wonder if this could be a separate bubble?

I’ve been reading your posts, guys.

It seems like people with 130K income (we have similar here in New England) say “we cannot afford houses”. 🙂

But folks with 30-50K income don’t hesitate to “buy” houses now! 🙂

They are wealthy enough to do that! 🙂

No, guys, we are not crazy!

THEY ARE CRAZY!

Everybody are buying?

Oh, sure, as old proverb says: “Millions of lemmings cannot be wrong!”

Seriously: this is not funny!

Saving rate in America in 2006 was -1%! The average credit card balance is $9,000!

Tes, fools (lemmings) will pay a tough price for partying so hard using money they didn’t earn.

But the sad thing about it is we, smart and responsible people, will pay for this madness also. We will suffer from recession and job loss.

What’s more, the politicians that cheered “healthy housing market” now wants us to “bail out” so-called “victims of predatory lending”. 🙁

Stop worrying about “buying a piece of the American Dream”. You can raise a kid or even two in 900 sq ft. Diversify your investments instead of sinking it all into real estate.

MMAB,

I appreciate your thoughtful comment. Let me address one of your points:

“I don’t mean to “snob out” here, but my husband and I make a combined $130k income…and we can’t afford a 30-year fixed on an entry-level fixer. There is something SO WRONG in this world when that’s the case. Inflation is wildly out of control, and the sheeple just keep cheering it on. Up and Up and UP!!!”

It is not a question of whether you can afford a home, you can, but whether you are willing to mortgage yourself to a point where you are owned by your home. Even your realtor needs to eat and at this point many will be filtered out of the market because of the resistance many buyers are going to put up against sellers. Even if all us made $1 million a year we wouldn’t pay $50,000 for a Pinto simply because we could; deep down we know economically and fundamentally we are being ripped off.

The deep draw of housing is fascinating. There are a couple of blogs that went offline because of their insider scoop on the mortgage industry. I’m sure this was a few of many to come. There is a lot of money at stake here folks. Housing is where the bulk of American wealth is. Housing is the bulk of what kept the economy going for the last 7 years. Not surprisingly there is a lot of momentum to keep prices from falling.

MMAB, I know it can be frustrating to supposedly be making a good income only to see it disappear in a massive monthly nut for a 1,000 square foot box. That is why I invest out of state, get the benefit of homeownership, and rent in sunny California in an area where I don’t need to look out for gang members or graffiti Picasso’s.

And for what its worth MMAB, many people are now landing on this blog by searching on Google for things like:

“Is housing in a bubble?”

“Southern California bubble 2007”

“When will the housing market bottom”

This has dramatically increased in the past two months. We are in the first stage of a multi year housing decline. Rent your nice pad and enjoy it. Sock away your money in investments you are comfortable with. The game has turned and you need to have Cheetah like instincts to buy a home when everyone is saying “real estate is a horrible investment.”

Adam,

Valid points. Never in our history as a nation have we been so depended on real estate for our economy. Whether it is jobs or for consumer spending. We will witness a housing led recession.

All,

I think all us have our reasons for staying here in So Cal. Whether it is high incomes, being natives, or enjoying the diversity and weather. There are many great things about living here. But that doesn’t mean that we can’t point out that housing is in a ludicrous bubble with no economic merit. It is built on false assumption that are collapsing. I was reading the LA Times article and they were discussing how few people actually have earthquake insurance. Just imagine if a natural disaster would happen (they even claimed we are due for one soon). If anything, who would pay for the rebuilding? Even without this horrible prediction housing will go down because economically people are unable to deficit spend their way through life. The game is over and slowly this train wreck will derail. Maybe Arnold should stop focusing on the bullet train and shift his energies to the housing train.

Thanks for all the regulars on here. Last night at 12:01pm we hit our 100,000 visitor! Amazingly this person was from Phoenix Arizona where inventory is now over 60,000+. I’ve been blogging for 6 months and slowly the audience is growing. We were featured on the LA Times housing blog and I look forward to finding more Real Homes of Genius out there. Many of you have suggested some amazing places; prospective homes that will be featured on Lifestyles of the Rich and Famous if it were still on – maybe CRIBS is more appropriate. Thanks for the support and much fortune to you all.

Doctor Housing Bubble

MMAB

Conrats to you for having such a experienced level of understanding of market bubbles without ever have made the mistake of buying at or near a top. You carry a wealth of knowledge and I believe that you will be greatly rewarded if you wait out this craziness, and buy in 2-3 years down the road. I know its tough, but you will get a better house than you ever imagined and it will be very affordable. Hold on to that thought, you are not crazy.

Anonymous

P.S. Don’t give in and buy in a place that is affordable. You will still take a loss, only it will be a smaller loss.

Thanks everyone for your words of encouragement, etc.

The reason WE don’t move? All my family lives here in OC…and I really want to raise my kids knowing their grandparents, aunts, uncles. You know, family barbeques and movie night at grandma’s house. Angels games with the uncles and cousins. Family is important to us.

Unfortunately, the rest of my family has been “grandfathered” into home ownership (they bought back when prices were normal) so they’re not leaving.

Honestly, we have been considering renting a larger house, but in our area it’s recently become almost as expensive as owning! I looked into renting houses in Costa Mesa and they’re all in the high $2000 – high $3000 range.

Um, hello!?!

If I’m going to struggle to pay off a mortgage, it will be my own not someone else’s.

As for the realtors “just trying to make a buck”…well, I own my own small business and I must say that these realtors that try to “strong arm” me into a million-dollar home or shoehorn me into a $600k condo have a TERRIBLE business model. My business wouldn’t last five minutes if I treated my clients with such disregard and disrespect.

Instead of bashing me over the head with these properties I just won’t buy, they should be working WITH me to haggle down the prices of available homes and getting me into something within my budget.

After all, 0% of a $1 million home is NOTHING. At least 3% of a $350k home is SOMETHING.

I guess they just don’t realize their scare tactics (“if you don’t buy now, you’ll be priced out forever!”) and broken record tactics (continuing to send me listings that aren’t even CLOSE to my price range, or listings that are in my price range but aren’t even CLOSE to my specs), just won’t work, anymore.

Those tactics, fit Dr. HoBub’s definition of insanity more than anything else in this market. Doing the same thing over and over – and expecting different results.

I want to scream at the Zip realtor, “I didn’t want those homes last week, I don’t want them this week, and I won’t pay for them next week, either! Bring me something that will accommodate my family, in a safe neighborhood, within my price range…or BUG OFF!”

C-R-A-Z-Y.

MMAB

Regarding anon 8:01am.

Hey retard, I love your intelligent insight into Southern California and the rest of the nation. If you leave so. cal. you are bound to face uneducated bigots throught the US. You will be forced to dance with toothless rednecks while listening to their fiddles and banjos. Southern California is the only place in America where you can be around intelligent and sophisticated people. LOL!!!!!

Go to any coffee shop or mall in OC and listen to some people talk. People are idiots here. You will hear the word “like” about 100 times during the conversation. You know why people say like. Because they are too lazy to put out the effort to actually describe something intelligently. There are so many cities throughout the US that have better populaces than la or oc. I have travelled all around the US and Europe. So. cal. people are some of the most stupidest people I have ever met. Gotta love LA:

Illegal mexican capital of the US

Worst air quality in America

Worst traffic

Worst people

Most superficial and materialistic

More non english speaking people than anywhere else

So keep living in your So cal paradise stucco box and never own any real assets. It must suck being a landlord’s bitch. LOL!!!!

@MMAB and everyone else:

Yes, as Dr. HoBub stated, I think anyone with some financial sense will feel like they’re on crazy pills and that we’re all about to be court-ordered to confinement for Permabearism at the Ayn Rand Home for the Culturally Infirm. This morning I actually found myself reaching for the collar of some commentator on the radio, then realized I was trying to throttle empty space in my office.

Like MMAB I am young (25), earning a slightly-above median salaray, and confused as hell. Growing up my parents had no understanding of finance, lost (and have not recovered) 60% of their savings mostly in company shares (they worked in tech) on the stock market, and still use 18% credit (i’ve had screaming matches with my dad over that before) to provide for necessities because they spend too much on their cheif investment, their house. So when I earned my degree and got hit with $30k in debt (over half of which I’ve eliminated), I wised up real quick, but I still remember how it felt to get hit with the truck.

I will say one thing. A lot of young people are working themselves to death and are running into some hellish barriers to entry. I fear for the future when I think about the effect that essentially punishing all the ants will have so that some grasshoppers can fantasize about American Idol fame in their zero-down zero-payment Ditech homes.

People aren’t taught even basic personal finance. I suspect it’s a form of malevolant neglect by the powers-that-be that leads to that. Then people are inundated with “conventional wisdom” bullshit and social pressures to buy a home. Considering how conformist people tend to be it’s not hard to see how a little bit of “suasion” by the Fed, a lot of late-night Kiyosaki-Serin infomercials, and episodes of “Flip Dat”, people get bilked. A friend of mine bought a house in 2004 and I told him I would have waited for the next recession but “you don’t have equity if you rent and real estate never goes down!” Guess what? You don’t have equity if your payments just service the interest.

Compound all this with the aptly-termed “Specuvestment.” Anyone who isn’t in some specuvetment stock plan is a “chicken” at best, “unpatriotic” at worst, and a “rabid bear” if they’re intelligent and refuse to put your wealth into a 6% after-fees actively-managed mutual fund when inflation is somewhere between 1.8 to 15 percent. The 1929 Casino Grande attitude that “everybody ought to be rich” has seriously skewed perspectives such that good advice is buried like so many rubies in the mud of raging alcoholic bull “real estate always goes up!!!” hogwash. For christ’s sake, you’ve got to dig and dig to find discussion of targets, allocation, or dollar-cost averaging. It’s not anywhere in your Yahoo! Finance cheerleader investment fluff article.

baby boomers are reluctant in letting go of their rental properties even if they have a small loss per month. It’s like an old sewing machine that does not work; instead of getting rid of it, most baby boomers rather keep it around. Ever wonder why most grandmas keep useless/old stuff at home? Now imagine thousands of grandmas/grandpas holding to their rental properties. The bubble will not burst, but instead slowly lose value 10% per year for the next 15 years. It’s a matter of personal greed. my 2 cents.

Congrats Dr. H on your 100,000 visitor. I’m still working on my 2000th

I so FEEL you, Anon 9:47.

It’s weird how our generation seems split down the middle. Half of us are spoiled little losers who feel entitled to EVERYTHING RIGHT NOW and spend $$ we don’t have to get it.

The other half, is paying off loans and trying to afford car payments AND save for a down payment…and are getting emotionally beaten down by the sheer brunt of it all. Inflation may sting older, more accomplished generations and chip away at the value of stock dividends…but it’s absolutely KILLING the younger gerations just trying to move up in the world.

It’s why I started my own business. I literally couldn’t make enough at a fulltime job to keep up with inflation and expenses. Just to get a 3% raise after 2 years of service was like pulling teeth! Finally I said, “Screw it! I can do better on my own!”

I can’t help but wonder if today’s boomers failed to save sufficiently for pending retirement – and thought this recent housing boom was the sweet chariot swingin’ low to save them – so now they have a white-knuckle death grip on their real estate, hoping and praying it keeps it’s insane value just to save them from the po’ house.

I really do suffer inside for the people who liquidated everything and leveraged their childrens’ futures just to “claim” to own a home these past few years (“claim,” because we all know with 0% down, the bank really owns the home).

As frustrated as I am…at least my family has an emergency fund of 6-months income, no cc debt, great insurance, paid-off cars, paid-off school loans, and my future down payment earning 5.5% in CDs.

Yes, I don’t currently own a house…but right now, I wouldn’t swap places with any FB’ers out there.

Yes, I’m seriously frustrated and pissed off…but at least I sleep well at night (in my cramped little rental bedroom).

Yes, I’m terrified of a major recession and job losses…but at least I have the cash to cover expenses for a while.

(sigh)

MMAB

All,

I need to amend the article, things are changing daily:

“WASHINGTON (Reuters) — The economist who prodded investors into the U.S. housing boom and has been skewered by bloggers during the bust is leaving a top real estate trade association, the group said Monday.

David Lereah, the author of “Are You Missing the Real Estate Boom?” will leave the the National Association of Realtors by the middle of next month after serving as the head economist for seven years, a spokesman said.”

You can read the rest on CNN. If you had a chance to read his book, he is such a cheerleader. I’m not sure how he gets away calling himself an economist. He should bring out his pink pompoms with N.A.R. written all over them.

How convenient, we have a real estate bubble for 7 years and we have Lereah for 7 years. Coincidence?

Anon 9:40

Hmm. Since I pay less than half his mortgage, that makes him MY bitch. And I laugh all the way to my stockbroker.

MMAB,

Your comment …

“I want to scream at the Zip realtor, “I didn’t want those homes last week, I don’t want them this week, and I won’t pay for them next week, either! Bring me something that will accommodate my family, in a safe neighborhood, within my price range…or BUG OFF!””

Simply tell them to get lost (they are no friend of yours) – or, if you use a Mac “Bounce” their emails. Stick with your instincts about now not being the time to buy. Perhaps decide what would be a good time to buy, e.g., “when Y.O.Y. median prices increase for 12 consecutive months I will enter the market”. You are fortunate as one comment said to have not experienced a loss first hand and be your age with this insight. Your time will come. In the meantime enjoy life.

anon 8:01

Just keep watching your Dodgers and Lakers in your shitbox. You Rockefeller. You probably live in some poor Hispanic community.

Anon 11:53

Brokers make you broker.

Be they stock or real estate.

Instead of taking the state of affairs out on homeowners or real estate agents, I suggest looking at the demand side as well. According to the State of California, California has not been building enough housing units in just about any year since 1967 to meet demand.

http://www.hcd.ca.gov/hpd/hrc/plan/he/hsgneed_ucdclass050506.pdf

California adds population equivalent to a city the size of Long Beach every year on average.

I’m not an econ genius but rule of thumb things like “3X income” don’t trump scarcity. Throw in all the new products that allow one to use a home like a bank (wisely or not) — these make houses attractive to people.

Second, about realtors — would you like to deal with the general public the way they have to? I don’t have to, nor do I have to sell stuff to make a living. I feel sorry for those people.

Lastly, being a grownup means honestly asking oneself what one wants. If the answer is “I want an affordable home” and if there aren’t any around, one has to move. Those who refuse to do this while calling others “sheeple” is humorous. All because people won’t sell their homes for what you want to pay..the nerve!

Anon 2:30 said: Lastly, being a grownup means honestly asking oneself what one wants. If the answer is “I want an affordable home” and if there aren’t any around, one has to move.

Uh, yeah right, Anon.

This is your solution? As opposed to, what, people who asked themselves what they want, decide it’s an affordable home, and takes out a suicide interest-only teaser loan to “afford” it for 24 months?

Me? I ask myself what I want, decide it’s an affordable home, and am slowly SAVING A DOWN PAYMENT to get one.

I am just frustrated at how long it is taking because the sheeple – YES, SHEEPLE – bought homes they could not afford, in areas they could not afford, are now whining that they aren’t going up in price, and want my taxes to bail them out. Sound “grownup” to you, Anon?

MY definition of “grownup” is taking responsibility for your actions and not jumping into something like a lemming just ’cause your boss or secretary or hair-dresser did. These idiots will pay a big price for their stupidity…period. How’s that for nervy?

Sheesh! I wish you had the “nerve” to not post anonymously so we knew who you were. That way, we could watch you eat crow two years from now when the “fit hits the shan.”

Anyone who thinks a housing market that doesn’t allow for 6-figure-income, first-time homebuyers (not to mention a little piece of the condo pie for single teachers, nurses, garbagemen, grocers, etc.) is smoking some serious crack.

Keep polishing those granite countertops, Anon, and ignoring all the NODs stuffing your mailbox.

MMAB

anon 2:30,

“Instead of taking the state of affairs out on homeowners or real estate agents, I suggest looking at the demand side as well. According to the State of California, California has not been building enough housing units in just about any year since 1967 to meet demand.

http://www.hcd.ca.gov/hpd/hrc/plan/he/hsgneed_ucdclass050506.pdf

California adds population equivalent to a city the size of Long Beach every year on average.”

Actually we do have a shortage. A shortage in AFFORDABLE HOUSING. Guess why the population is increasing? Immigrants. We’ve actually lost many middle to high income earners because of high prices. There has been a net loss in this demographic.

I’m sure immigrant families are the first in line to purchase $500,000 home. Actually many were during the boom and fortunately little by little lending standards are tightening up. Guess which group is going to be hit the hardest in California? Minorities because of shady loans normally ushered by those in their own respective community. When you mention we have to look at the demand side these folks were conned.

We can assign blame all over the map. From the Fed, Wall Street, Mortgage Brokers, Agents, and buyers. But the brunt of this has been pushed by the real estate syndicate. It was a massive hard sell on the public. We are now seeing law suits because brokers lied to buyers. Fraud was committed in countless cases. A recent survey by the LA Times showed that 60 percent of all no-doc mortgages were overstated by 50% in income. That is outright fraud on both sides. One for not paying attention and the other for greed. Were is the fiduciary responsibility from these so called professionals?

Housing is high for many reasons; many that the public doesn’t think about. For one, the dollar is worth a lot less therefore pushing up hard asset prices. Another reason is high prices are subsidized in California because of Prop 13. And finally a credit crazy nation has punished savers and glorified debt. But this game is now over. Any economy with consistent deficits will face either major recessions or a depression.

California needs to build more affordable housing but what builders will take this on? All this mumbo jumbo of “not making land anymore” has been purchased by the public hook line and sinker. Have you been to the Inland Empire? What about Ventura? Or maybe you’ve driven by run down parking lots. All these areas have land and need to be converted to affordable high density housing but this isn’t profitable for many builders because of ridiculous legislation in the state. And who protects this legislation by lobbying fiercely? The real estate complex. And that is why the majority of the blame needs to be assigned to them. No need to mince words here. They have created their own undoing – they wanted to keep prices as high as they could for as long as it would hold. This isn’t free market economics but special interest groups controlling policy.

Hi There:

Yes, things are starting to get a bit testy. I live in Northern California and many around here think they are immune from this insane housing bubble. It ain’t so. This thing is just starting and will probably take 5 or so years to play out. Patience is the keyword for future home buyers. For those of you who are still renting and saving, you have every right to be outraged over any proposed bailout of sub prime borrowers and others. To think some politicians want to prop up the housing market at the expense of people who were prudent or for whatever reason, did not partake. And, by proxy, in the process we all get to bail out those who made these bad loans. Its a win-win for everyone except the taxpayer. Its total insanity. By the way, I was one of those who purchased in 1995 and made almost $1 million on our home. Ain’t it great. Problem is, my daughter, a college graduate can barely afford rent. Most of her friends are in the same position. I hope the bottom falls out of this ridiculous RE market even if it means I take a hit also. Such unmitigated BS!

There are still a lot of people who are making stupid decisions.Its not the sub prime or Alt A. its everyone. People who dont read blogs and read only NAR’s spin believe that the world is rosy and getting rosier every day. My friend who is a home owner just signed for 775K house in PA saying he is getting a discount of 25K as the builder is offering a great discount. He has not sold his first house which he bought for 340K two years back and he is hopeful that the first house would fetch 440K hence he would be able to afford the 100k down payment. His income of 115K is not sufficient for 775K home but the ARM that he got is great as per him. I warned him once during drinks that this might not be a good time to buy a big house and the answer was “What’s the point of not buying. The same house will cost 850-900 k in two years”.I shut up and wished him all the success. Time will tell the story.

Mike,

Your friend is F___d. Period. Of course, you know that already.

Friends, I have also been in same situation. I am a happy renter and a patient investor as I believe the market forces will balance the excesses at some time in future, we do not know when. My frustration is largely towards government that has encouraged this mess through tax incentives that are insane. They are creating an unequal playing field against us renters. In the name of fairness I think government should give all renter a tax break similar to interest payments on rents for primary residence. Also how about 250K capital gains tax free on all investments not just housing. I can live in a rented place forever as long as it makes finacial sense to me, but being treated unfairly by Uncle Sam enrages me a lot more.

Stop the rich from being on welfare…..

I admit I’m not exactly a happy renter.

I wanted to buy in 1999, when a beautiful one-bed, 4-room vintage condo in my Chicago nabe could be had for about $50K.

Now the very same unit sold for $160K in 2005, and sellers of comparables are just now breaking down to $140K.

As I am a middle-aged single woman who suffered a business catastrophe in the 90s and am now a salaried manager, I have been in no mood to be bold. I couldn’t buy in 1999 because of forementioned disaster, and by the time I had recovered my income and credit, the prices were moving way past me.

Call me a stodgy midwesterner, but I subscribe to the 30-year-fixed for no more than 3X your income gospel, and though the prices on these beautiful vintage condos may seem absurdly cheap in SoCal, they are still out of my range. 80% of the recent buyers of condos in my ‘hood, all teachers, managers, whatever making $45K to $75K a year, bought with “creative” mortgages, for they couldn’t afford these modest places any other way.

I passed. I made 4 extremely lowball offers, but I wouldn’t go higher because I wasn’t feeling suicidal. I’m glad.

If 4X your income is too much to be financed on a 30-year-fixed, how insane is 10X your income.

Now, I realize that half the folks in the USA are to the left of the I.Q. divide. However, you do not need even 5th grade arithmetic to figure that you can’t make a $5500/month nut on an income of $1500 a month. If Andrew Carnegie, a grade-school dropout, could build one of the most powerful and successful industrial combines in the world, do you really need 4 years of college to figure out that payments as big, or bigger, than your monthly income don’t work? Do you need a degree in economics to do 8th grade arithmetic?

I had and have no intentions of becoming a flipper. All I want is a condo that is exactly like my beautiful rental, for a price that is in line with the target market for such a place and with payments not more than incrementally larger than my monthly rent.

So I might rent a little while longer, especially since the places around here I could reasonably afford are such a steep comedown from my rental.

Leave a Reply