Feeding on the mid-tier perception of higher home prices – Survey finds bubble tendencies in purchasing homes. High-tier in Los Angeles and Orange Counties make post-bubble low.

Perception does have an impact on housing dynamics. There is little doubt that home buying psychology has shifted in 2012. Is this a simple head fake or something more pronounced? It is true that the market is slowly working through years of backlogged shadow inventory. Yet the change is also being mixed in with the typical seasonal nature of the spring and summer. The true test will come in fall and winter. Digging deep into the Case Shiller Index tiered data we find that the lower tier of the market moved lower, the mid-tier ticked up, and the high-tier actually made a new post bubble low. This is telling for the overall market and many of you are probably experiencing this if you are out to buy in mid-tier markets. What does this mean for home buyers and sellers?

Home Buyer Survey

Redfin had an interesting survey looking at 1,000+ home buyers and their current perceptions on the current market. The survey might not extrapolate widely since those on Redfin are likely a more tech savvy audience than a random mid-tier buyer. Understanding psychology is important so the survey does reflect a recent shift:

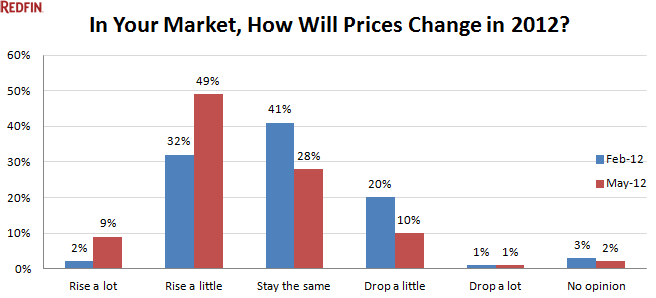

The results highlight what many of us know. Delusion runs deep. From February of 2012 to May of 2012 those who believed market prices would “rise a lot†went from 2 percent to 9 percent. Those thinking it would “rise a little†went from 32 to 49 percent. In other words most believe prices will rise in 2012. Yet as we know with the overall economic trends and especially the situation in California, the underlying economics really don’t justify higher prices unless household incomes also rise. The current turn is really being driven by psychology and also low interest rates:

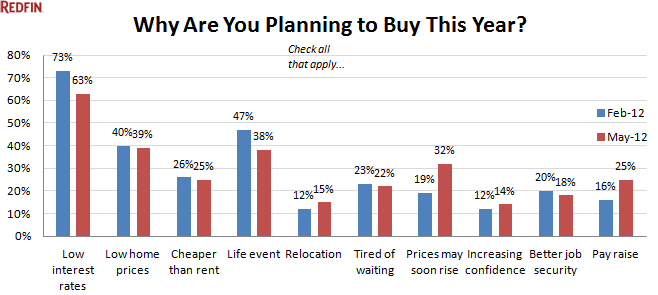

This is rather interesting. As we have stated in the fog of low interest rates article, much of recent buying action is because of abnormally low interest rates allowing buyers to purchase more expensive homes. Yet one of the biggest changing factors over the last few months is the perception that prices will rise soon and some believe prices will rise by a good amount. Does this sound familiar for California? It is true that many suffer from economic amnesia. Interestingly enough, the focus on the mid-tier is probably based on a combination of those who actually still have solid incomes to buy and this group chasing after a controlled set of low inventory (i.e., select markets):

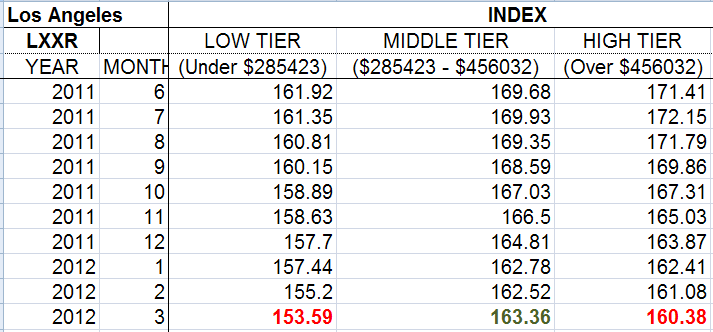

The chart above is data from the latest Case Shiller Index tiered market info for Los Angeles-Orange Counties. The low-tier is back to hitting the 2009 price level and the high-tier is making post-bubble lows. The mid-tier was the only segment that moved up in March but this slight movement is merely being pushed by what is being reflected in the Redfin survey. A subset of buyers are going out and buying on the perception that prices will be rising and that inventory is “running out.â€Â This group congregates and talks with peers so it becomes a self-fulfilling prophecy. Does this have staying power? That is really the major question here.

Only 10 percent of those in the survey actually think home prices will “drop a little†even though the trend for 2012 is showing drops for LA/OC! The high tier is at post bubble lows and the low range is moving even lower. Of course, income data and job data really doesn’t justify this trend but keep in mind this is a group that is actively looking to buy and is savvy enough to use Redfin to search for properties and purchase a home with a discount. The majority of the community believes prices will go higher so you get an interesting feedback loop and the site is there to assist in buying and selling. However, when we look at hard data in regards to employment and household wage growth there is little evidence to suggest that housing prices will rise a lot.

The spring selling season is essentially winding down and followed by the summer haul. It will be interesting to see how things play out in the fall especially given the big election year for the nation but also the state. In the short-term those extremely low interest rates are having an impact combined with generous low down payment mortgages. The endless summer is back in California where you can quit your job and make a living flipping homes merely by slapping on a coat of paint, installing some modern lights, and resurrecting those glorious granite countertops.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

72 Responses to “Feeding on the mid-tier perception of higher home prices – Survey finds bubble tendencies in purchasing homes. High-tier in Los Angeles and Orange Counties make post-bubble low.”

DHB, I wonder if you might retouch on the supply side of the equation again. This was a good post from a while ago:

http://www.doctorhousingbubble.com/option-arms-enter-the-eye-of-the-hurricane-the-189-billion-recast-problem-targeted-directly-at-the-california-housing-market-of-189-billion-in-securitized-option-arms-109-billion-in-california/

The plots indicate a precipitous end to option arm recasts about now. Did this prediction hold true. Can we expect the backlog of shadow inventory to start to drain now? If we manage to avoid severe state government contraction with passage of the tax hike in Nov., employment seems likely to pick up.

I think option ARMs for the most part have gone down one of the following roads:

-Many have already defaulted given the severity of negative equity

-Some banks, very few, actually re-worked these loans through mods

-Many are simply sitting in the shadow inventory thanks to the suspension of mark-to-market accounting

The problem of course is now bigger than option ARMs which were a small segment of all loans. At last count I believe one out of three home owners is now underwater. The state budget is in a very problematic situation. The best case scenario is that the economy booms with plentiful jobs and household incomes rise. No use if we only add Taco Bell jobs for half million dollar homes right? Yet it is funny that you mention that rising taxes is somehow the solution to avoiding a contraction. I tend to think we will need both cuts and tax hikes for years to come. Of course this is merely a humble opinion.

I speaking purely of contraction of state employment.

As far as economic contraction goes, this also seems unlikely to me to be severe. The economy is still growing. Its been long enough since the last downturn that it business cycle might hit its regularly scheduled nadir in the near to medium future. However there are so many nattering nay-bobs of negativity around for so long that I don’t think such a contraction will last long. That is, there just isn’t likely to have been as much new nonsense added that needs pruning since 2008. I suppose there is plenty of old nonsense left over from pre-crash (e.g Jamie Dimon) that does.

A republican landslide in November certainly could send us into prolonged recession as they cut, cut and cut some more. The problem really is government — as they will tell you — except it is job cuts in government especially state and local that is causing the prolonged unemployment now. Private hiring growth has been back to 2006 levels for a while now.

Government employment is a lagging economic indicator, except at the moment it is the tail wagging the dog.

Ollmann

I would take the other side of that bet. If there is a Republican win, the purse strings of the Government will fling open…..unless this time is different from Reagan, Bush 1 and 2.

Reagan was all over Carter about his deficit then tripled it and Bush 1 keep it going. Bush 2 took a surplus and went to a 1.8 trillion dollar deficit in his last year and handed Obama 1.6 trillion in his first year. Now we are at around 1.4 trillion a year, not growing and actually down from Bush 2s last year..

I can hear it now, as I heard it in 1980 from Regan “we can’t worry about deficits at a time like this. We need to get our economy growing and grow out of our deficits, we can’t cut our way out”.

Again…..Unless this time is different.

If I may, Ian and Martin can split the difference. The Tea Party is the new, and very real, variable this go round. So, the Republicans will cut, cut, cut, but only on discretionary and social welfare programs, and not amounting to much actual dollars on a relative scale. The pre-paid ATM card to the FIRE industries, tax favoritism to the wealthy, corporate welfare and Industrial Military Complex spending will continue or increase. In the end, the Republicans will do just what the Democrats to…whatever it takes to spin the electorate in order appease their campaign donors and therefore stay in power.

How many citizens are employed by the state vs self/privately employed? Your point makes sense if they are a high percentage of the total. I sure hope you are wrong, or liberty is in serious trouble.

Har! Despite everything the Fed and Treasury has thrown at the situation, (QE; the bailouts; ongoing corporate welfare; artificially cheap capital/low interest rates, etc), the economy is *barely* growing — and indeed, I would argue it only appears to be growing when using metrics that have been jiggered and re-jiggered to make them look better on paper. It’s like holding a nickel up to the mirror and believing you really have a dime.

Meanwhile, nothing has been fixed since 2008, and really, it cannot be fixed — and what’s more, there is no incentive to fix it. The 2008 ‘crisis’ itself was merely a symptom of a much more systemic epidemic — and that is the ongoing attack on labor/the middle class. Low rates/access to easy credit is a sort of classic stop gap deployed to sate the public in the meantime — kinda like financial morphine to help distract us from our slow but sure evisceration — in part, by those very same low rates that initially seem to help ease the pain.

I have a friend who is in exactly this situation but the Fed has forestalled that wave of foreclosures by keeping real interest rates negative (and therefore deliberately destroying the savings of the responsible & prudent in our society in exchange for rescuing the banks and speculators).

He had an interest only loan from a purchase near the peak (2005, trendy area of SF) and would have been in trouble but his payment has actually dropped rather than rising because of the crazily low rates.

I’ve been thinking about this a lot lately and it seems to me that the Fed and government have boxed themselves in at this point – Obama has added $5T to the debt in just a few years, and there is no plan to cut back at all. If they raise rates substantially now, our ability to keep borrowing to fund that spending and keep servicing that massive debt will become a seriously problematic item in our budget. Therefore, even with inflation spiking, they will keep rates low, and instead just change how they measure inflation to pretend it’s not happening (already going on, if measured as it was in past decades, inflation would be in double digits), and the value of saving for anyone who has any will be utterly destroyed in the process.

Haven’t you heard the latest spin from the talking-head economists? All our problems are due to “irresponsible” short-term “savers”, people who are “hoarding” money instead of spending it. If only these cheap-o bastards would open their wallets (or swipe their credit cards), we’d all be saved!

Mark my words, these are not random musings. A bullseye has been painted on the backs of individuals with significant cash accounts, and they are going to be punished for daring to defy the wishes of the politicians and their Keynesian lackeys. Of course the wealthy crony capitalists, union pension funds, and “suffering” public-sector workers will be somehow exempted.

I believe the reason people are rushing to buy RE is because of Fed printing press; seems every time the market hiccups Ben rushes in with more QE and “easing”; stock market soars, RE surges, people feel happy, spend. Europe’s problems surely will be papered over, why worry? Reflecting on the psychological sea change that has occurred in the past few years, what is the worst case scenario? Things go south, stop paying the mortgage, squat for months/years, default on credit cards, who cares?…some faceless entity will write it off, eat the loss, another “Fresh Start for You!” program will be implemented. And if RE goes up buyers may again consider themselves financial geniuses, bragging to neighbors/friends how much their house has increased value this year, maybe time to buy another house for “investment”! Sound familiar? Wheeeeeeee!

So go buy a house, charge a “Paradise Ain’t Cheap” yard sign (made in China) to hang on your new front porch, and enjoy the beautiful day!

I am looking (just shopping, no realistic expectation of buying unless a deal too good to be true happens –which, if it does, it probably is too good to be true) in the Bay Area, specifically the Oakland hills (Montclair, Berkeley Hills). There was some rumbling about multiple offers, “taking offers†days, etc. a month ago from agents. The agents were doing their best to wave the towel to churn interest. There are few real decent houses on the market, and a slew of “foreclosure†properties (REO, NOD, etc. – -do a search of 94611, Montclair, in Trulia). Probably 4-5 foreclosures for every “organic†listing (and some I imagine are short sales or at least negative equity or close to it). And these foreclosures are in the same neighborhoods as the MLS listings (contrary to what the agents say – -one told me, “at least they aren’t in the good neighborhoods.†L-i-a-r. ). I get updates for new listings and changes. I am seeing mostly price reductions and “back on the market†listings, along with a lot of crazy prices (e.g., over 800K for a 2BR, not even fixed up, small lot, etc.). Most of the listings are either “major fixer†types or flipped houses – -and almost all are not prime listings – -there is something majorly wrong (no yard, no garage, major pest abatement, etc. – something just not right). Almost all are totally staged (and that isn’t cheap to do). I sense a real desperation on the part of agents to get the frenzy started again, but it really isn’t working. I smell a serious crash and burn when the spring/summer “boom time†sales are tallied, and some newly-minted knife-catching bagholders who bailed out the agent/flipper big time by buying in this artificially limited market. There may be 20 serious buyers, but only 3-5 decent houses out there. That isn’t some kind ofm real “comeback.†Sorry agents, I’m not buying it. I’ll wait for a nice solid slide in the fall and winter, when prices get real!

Most established neighborhoods have limited inventory which reflects a low desire to move by the citizens who live in these areas. Most buyers today cannot image the Bay area when builders were constructing large tracts from Gilroy to American Canyon which provided endless opportunism for move up buyers to seek newer and more upscale homes. The move up buyer of the past created inventory within established areas but today the new housing industry is a ghost of its former self and most of the Bay Area is now a mature housing market. Most if not all mature neighborhoods tend to be pretty stable with little turnover unless, divorce,health,old age etc force a sale. This is the immediate future for the Bay Area as move up buyers have few options and will probably vote to stay put generating lower volume and putting the final stamp on the recent bubble metrics. Lower interest rates and higher FHA loan limits are directed at the first time buyers who will have less inventory within the employment sector as more and more folks come to realize that moving out to Morgan Hill and beyond for a bigger house is costly and has little upside.

I pull a couple trillion out of my ass to buy up all the overpriced houses. Then I and my friends hoard them so we don’t look bad when all the junk investments in MBS fail. You can’t afford my price? Too bad.

It is the middle class (the mid-tier markets), where the real estate riches mentality is engrained. It was their parents and grandparents who pounded the idea that their home was the greatest “investment†and the best decision they ever made.

Generational mindsets take time to unwind, but it will. Once people realize that cookie cutter homes have no reason to rise in value (beyond inflation), the mentality will change. That will be the tipping point, and mid-tier home buyers will come back to the reality of actually earning income to pay for and own their home, not just selling it for a higher price some time down the road.

With all due respect Joe, you make the assumption of a sound monetary system.

You are 100% correct assuming, if we had a sound monetary system. The kicker is, we DO NOT have a sound system. The monetary authorities can mint as many green turds they want.

I am not saying it is going to happen but are 1 million dollar mortgages financed at 30 years at 1% down the road? 3 years ago I laughed at sub 4% mortgages, I am not laughing anymore. If the FED needs to keep this all together by pumping housing and dropping rates further, it is within the realm of possibility.

Given this situation, if I could finance a house, with little skin in the game, I would do it. I would definitely risk my credit rating for 2 years so that I could get in on the bet that the FED is run by a bunch of NUTS. On the other hand, I am not willing to take that bet with MY money. And, I think that is what the current frenzy is all about, risking someone else’s money that the FED is indeed insane.

I understand your thought, but, a couple things…. 1) that which can’t go on forever, won’t, and 2) Most people won’t borrow money with the seedy mindset of “gaming” the system, and not paying it back if things don’t work out. A few will, but not most, as we’ve seen in the stats.

Virtually everyone who has had a foreclosure, short sale or a loan modification and even a refi while technically underwater, have gamed the system.

So, I disagree there are not very many.

My house purchase story

I sold my house last year August and moved to renting home in expansive place, 91011, La Canada.

My rent is $3800 per month for 2400 sq ft.

My down payment (40%) is sleeping in the bank and 0.6% interest will be taxed again one third of them.

I am looking for the house to buy.

Case 1. Short sale asking $1.55M (approved)

– 4200 sq ft with 18,000 sq ft lot

– initially approved $1.39M, then jack up due to market activity

– submit offer $1.42M

– Two loans with two banks

– Pool is very green and bluish now

– 1st and 2nd BPO are done

– Waited for one month (usual turnaround of previous record is about 3 to 4 months)

Case 2. REO asking $1.375M “AS-IS†sale

– 4200 sq ft with 18,000 sq ft lot

– Need about $50k to $100k for retrofit and working condition

– Submit offer $1.555M

– Waiting for acceptance

Since visiting open house every weekend is tired, I hope we can buy a house hopefully soon.

Should we wait until fall or winter?

Well, any advice is appreciated.

we are the buyer in the same area! I know exactly your 2 cases since we submitted the offers as well (lavender and shepherds). My feeling is that you are not going to get it either one since market is really different from last year. our offers for 2nd case is 1.6M but it was not even countered. inventory is just too low and just too many strong/crazy buyers. wait for the winter time.

What do you guys do to make so much money???

Steve,

Thank you for your advice of waiting until winter.

Proably I don’t have a choice.

Good luck for your house hunting!

When people start throwing out 1.6M numbers like it is confetti, I would like to know to where did you guys make your money if you wouldn’t mind sharing?

Is this bubble money from the past, money from abroad (probably Asia) or you have high paying jobs and worked and saved for a long time? Inquiring minds would like to know. Please do share because this gives more insight to others wanting to buy in this crazy area.

Two working professionals saved for a while.

last house bought 2003 and sold 2011 earned about $70k after paying realtor.

If I buy the house, I have no saving.

My two sons are in school age. If they go to college, I don’t need to be here.

If I don’t buy the house, I don’t know how to handle the money, which is sleeping in the bank for a while.

Brian, thank you for sharing. If you only came out with 70K from you last sale, your family must be very financially disciplined (good savers) to afford a place like you mentioned. My hats off to you, that is a rarity in LA. Good luck with your home purchase.

Well, I have nearly 100K in cash just sitting in the bank…that I saved over three years! No bubble equity or mommy and daddy, I am proud to say. I have zero debt, LOW overhead and have 150K coming in and 20K in total quarterly bonuses. I am a self-taught professional in a niche field — no college debt…and…wait for it…I rent a 900 sq ft hovel for 1350 a month!!! Huzzah! It really sucks!!!!

I am presently thinking of buying a nice place for 500K, (an obnoxious amount of of money which I never F’ing dreamt of spending for any abode), and shooting most of my wad on it to put 20% down. I will likely lose my ass, I think it’s a terrible idea to buy in a low rate environment, and as a saver who’s been royally screwed-over by ZIRP, I feel misgivings in abiding by it…but dammit already! Low rates are probably here to stay for at least another decade if not for the rest of my lifetime. (There is no turning this around, folks, as it’s not a simple downturn; it’s just the first major fissure in an ongoing fracture that won’t stop until we’re all so used to picking up all the tiny pieces left behind (read: crumbs) that we won’t even remember what it was like to not have to live that way.)

In this expensive area, any house selling below 1.5M will attract tons of people.

Yeah, because there’s tons of solvent/liquid people eligible for that kind of debt load. Yeah.

our case is very similar to Brian. Both my wife and I are working, and we do get some cash/gain from the previous home selling (we were lucky to be forced to sell our previous home in the middle of 2007 due to job relocation). When you do the rent/buy analysis, the rent (our case is $4200 for a 2800sqft house) is almost the same as the mortgage if we count in the tax benefit of owning a house. In this expensive area, any house selling below 1.5M will attract tons of people. I guess most of buyers in this price region would be like Brian and us.

Coastal Calif is basically a mature RE market without significant space for new tracts others then infill projects. Combine this with the limited number of move up buyers its not hard to imagine the current market trend today dominated by low interest loans with high FHA limits directed towards first time buyers. The problem is that Calif is not a go go builder paradise as miles of urban space has been covered with endless housing tracts and the desire for buyers to commute long distances to work are limited due to high fuel cost and crowded freeways.

The bottom line is that Calif RE is transitioning into a mature industry that will experience lower growth and less capital from government and individuals as time marches.

I am confused how renting is still not cheaper for you. when i calculate PITI for a 40% down loan @ 3.875% interent on 1.5 million, i get:

Mortgage Payment: $4,235

Homeowners Insurance: $750

Monthly Property Taxes: $1,563

Mortgage Insurance: $0

Total Monthly Payment: $6,547

Even after the MID, your affective payment is still ~5500 $ for a 35% bracket.

I’m not questioning your decision to make offers, just wondering if i’m calculating something wrong.

you have to compare apple to apple. A 1.5M house with over 4000 sqft will require a rent of at least $5000-$5500/month. Using your assumptions, btw, homeowner insurance is not expensive at all, typically in the range of $100/month. Yes, you pay the property tax, but it and the mortgage interest will be tax deducted, which typically saves you, say in the range of ~$1000/month just like what you figure out. So all in all, $5K rent vs $5K mortgage, which one do you choose?

Steve, just FYI, the insurance has changed. I think it went up quite a bit. For the house like that, the insurance premium can be between 4-500/month. Insurance Company has to do their own appraisal for houses more than 1 m. They calculate premium based on the appraisal value, not the market price. They almost always come up with higher value.

A few days ago I saw a shocking display of real estate amnesia by some people in a bidding war on a condo. It is a nice place and obviously a flip. Asking price $180,000. Before the day was over offers came in bidding the place up 20%. I just shook my head to my agent when she told me. No, I am not playing that game. I have time but also have a 50 lb dog who figures in the deal. Because of that I am being gouged by greedy landlords so buying is cheaper for me. This was in North County of San Diego. I do know the shadow inventory has not been cleared out. I also heard banks can only release a limited number of foreclosures at a time but eventually they will come on the market and probably a whole big load at the same time. I seriously think that I will wait until fall when the Spring buyers have settled down.

AS a former agent in two states I realized how much the market has changed but economics has not. And now buyers have to meet serious qualifications to buy. No matter how low the down payment a buyer still has to meet income requirements. I also think the Hedge fund investors have primed the pump. As the RE agents say, houses are flying off the market. And I am sure the bidding wars are pushed and cheered by the NAR and their local affiliates.

What do the rest of you think?

According to the first chart, I’m a one-percenter! It astounds me more people dont think like me, I guess im some sorta contrarian.

I’m in the 1 percent too. That’s why I’ve been waiting patiently.

Do sellers/agencies “buy” their own houses to make it seem like the house is saleable? I’m seeing some really odd activity on a few houses in my nieghborhood and was wondering if this was common.

I’ve wondered that myself.

What data are you looking at? Some “sales” are just transfers to trusts or other deed activity.

Does anyone have any input on the Huntington Beach/Fountain Valley area? I have been waiting patiently, but I’m not sure how much longer my husband and I can stand it in this apartment. Our lease is up the end of September. I really do want to buy and prices have come down since we moved back in 2009, but does anyone think that the HB/FV area will go much lower? We really don’t want to spend more than 430K. We had qualified for 500K in 2010, but my husband has been able to make more since then. Still, we want to be comfortable with our mortgage/impound payments. 450K would be max. I’ve been looking online and it’s not looking that great. I just don’t know what to do. We have 20% to put down and we have excellent credit. Still, what if the mid-tier market drops another 50K? Has anyone had any recent experiences buying in the HB/FV area?

Patiently Waiting, I’m also looking in HB and have been keeping tabs on price movements there the past few years. As you know, right now is probably not the best time to be house shopping. Sure rates are super low, but there is NO inventory. Anything decent below 500K goes very quick. I would recommend waiting until later in the year for more inventory to materilize (hopefully).

One other thing I did notice is that people are really drawn to houses that completely turn key and you will definitely pay for this. Houses that need TLC (good bones but in need of renovations) tend to sit longer and can be had for much less. This is what I will be looking for. I personally like doing a lot of my own work and customtizing to my own likes on my own schedule. I’ve seen a few places in HB in the low to mid 400K range that might work.

Your comment of mid tier correcting another 50%, not gonna happen. With these super low rates, many of these places are already at or below rental parity. A 400K 30 year loan at 4% is about $1900/month. Many houses in the 500k range in HB or FV will rent for around ~2200/month. When you factor in taxes, insurance, maintenance and tax writeoff…it’s probably a wash.

Good luck with your purchase. It is very clear the “powers that be” are doing everything possible to keep prices from dropping. The high end will still go down considerably, but sub 500K in decent areas probably don’t have that much more to fall.

Thank you Lord Blankfein. Good luck to you too.

Moved back…from Austin?

I think if you wait 18 more months, that 20% will magically become 30%…keep your eyes peeled, look once a month, you’ll know when the price is right for you. make sure you can RENT the place out for more than your combined total payment. That is your cushion & indicator if you are paying too much or reasonably priced.

PW – I’ve been monitoring the HB market myself and decided that I can’t afford it (near the beach) and will have to buy in San Clemente instead.

Regardless of the difference in absolute prices, prices in HB are often at 2004/2005 levels whereas in San Clemente you often see 2002/2003 prices.

I am convinced that prices will drop more, but I have no idea how slowly this will happen. Regardless, NOW seems to be the worst time to buy since 2007. If you can’t wait years, at least skip the spring insanity and wait until the fall. And once you bought, do yourself a favor and stop looking at prices 😉

You also may want to consider a 15 or 20 year loan which will give you a lower rate and faster equity gains. At least that’s what I’m doing…

Good luck!

I know it’s farther out, but I would choose SC over HB in a heartbeat.

San Clemente is nice and still has that small town vibe to it, unlike HB which has gotten big time commercialized in the last 15 or so years. The only bad thing is that San Clemente is so far from everything (which can be good and bad). The nice thing about HB’s location is that you are equidistant to many job centers, which can not be said for San Clemente…and that is probably what is keeping the prices elevated.

Right now is definitely not a buyer’s market. I wonder what will happen six months from now. Is the inventory going to be much less? If that is the case, we’ll start seeing the headlines of record low sales.

I hear that banks are holding some inventory off the market because they think that prices may go higher. People have been waiting a long time to buy to get a family started and they can not wait any more(biological clock keeps ticking away)

, especially with their parents pushing them. Life goes on. Everything is not about a good investment or getting a good deal. In 8 years, the prices should not be lower than now. They may go down and up in the meantime, but who cares. Life must go on.

There’s more to life than buying houses. Honestly, most families would be better off renting for their entire lives.

The banks don’t think the prices are going up – the banks are the ones manipulating the market so that prices don’t plummet. However they cannot keep the prices from continuing to go down.

Life goes on? Since when do you have to own a home to have a family? Life going on doesn’t mean jump into a falling real estate market so you will owe more than your house is worth within months.

No……… I’d rather buy facebook shares!

guys, do you need to be reminded? houses were “flying off the market” in 2006 as well

Broken market. I guess banks don’t realize that one of the results of rigging a market for so long is that you turn off a solid portion of people. This is easy to see and I think real damage has been done to multiple generations. Our next “first home” generation is saddled by student loans but their attitude toward debt and real estate from my conversations is very conservative (think max 2x gross). They have enough idiocy on them already. There are long term ramifications to this. I can’t imagine it ends with well as there are long-term changes in demographics, earnings, and no more 30 years of declining rates to constantly push up equity and allow inorganic upward movement.

Here you have it:

http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2012/06/08/BU8D1OU0NR.DTL

I’ve heard Way Point has been all over SoCal as well.

I wonder if they’ll buy them on the open market, or get bargain-basement prices from banks or the government – more crony capitalism at work.

If they really do end up as affordable housing for low-income people, I guess this could be a good thing. But I have my doubts.

And 100 houses in 2 years is a drop in the bucket.

A search at Realtytrac.com just now show that Oakland has:

1568 bank-owned houses

711 scheduled for auction

963 pre-foreclosure (received NOD) – and, presumably there are about twice this number of defaults that haven’t received NODs yet (many in mid and upper-tier areas)

Correction: The numbers I posted above were all kinds of properties, 2+ bedrooms.

The numbers for only SFRs in Oakland are:

914 bank-owned

479 scheduled for auction

612 defaults

I would keep in mind that Way Point will probably not be alone in this methodology.

Dr. Would you know of any research on what the amount of money might be that is available to consumers who have defaulted on their mortgages and the effects that spending might have. I assume these enormous amounts of funds are being spent on consumer goods and services and affecting employment in such a large state like California? Is this what is driving the increase in lower paying jobs in the state? Thank you.

Hey Brian,

Look up Keith Jurrow, article on current situation in RE and the near future. Jurrow is just publishing facts and numbers just like DHB. People are scared. You can see why with seasonal house buying, low inventory and cash investors. Focus on the facts. Enjoy the summer!

We have been looking at Woodland Hills where nice homes list at about 500K & up. I was very disappointed to see that nearly everything we were interested for sold for AT LEAST $20K more than list. Lots of bidding wars are still happening there.

Frankly, that should scare anyone who possesses even half of any of their five senses.

IOW if you can’t see the nonsense for what it is, then you should be able to at least smell the BS.

FYI,

The lastest house I made an offer on went for 625K CASH. Actually, on this one the seller took the first offer which was at ask since the seller listed it on a Weds and recieved the all cash offer on Friday and then accepted it. I didn’t get to see the house until Saturday so I put in a back up offer at 630K but I just heard it is closing on this coming Weds so the back up offer was pointless.

So out of the last 4 houses I have made offers on ALL have turned out to be cash. 452K cash

702Kcash

722ish Cash

and now 625K cash.

“Investors” can be some of the stupidest money out their.

People think it’s been a long enough time – the bubble must be over and we must have hit bottom because inventory is low in some areas. It’s just the eye of the storm, artificially created. Hold on tight and wait.

I hope and pray that all of the bankers get cancer and die miserable agonizing deaths. Ask me how I really feel.

Thank you for this does of sanity. High unemployment, devastated savings, broken banks, and European financial hurricanes brewing don’t bode well for those who buy the “flippers” hype. Europe’s financial implosion is leading to a flight to safety into our Treasuries. This is why the dollar is strong and the 10-year is at such an absurdly low. What happens to future housing values WHEN long-term rates rise again?

Be careful out there, people….

http://www.huffingtonpost.com/2012/06/09/home-mortgage-raised-foreclosure-banks_n_1582047.html?ref=business&ir=Business

Thanks for the link to this timely article, Rhiannon.

It reinforces my resolve to do whatever the hell it takes to buy a place for cash. We have no protection whatsoever against the bloodsucker leaches running our financial cartel. The only way to protect yourself is to have a few dealings with them as you can possibly get by with.

In my dreams, Americans by the tens of millions decide together that they will get out of debt and stay out, and not contribute any more profits to these lice. Oh, yeah, you will have a lot more negotiating leverage if you pay cash, too. And if doing that means that I have to settle for something a third , or a fifth as good as what I could have borrowed the money, that is just what that means. I’d rather live in a garage than give these scum the opportunity to victimize me as the woman interviewed in that article has been.

You’re welcome, thanks for replying. I agree, cash only. What a freakin’ nightmare.

Miami Bubble Property

dear DHB, any input on housing market trend in Seattle area?

Cash only is a suckers bet. Opportunity costs anyone? Why would you destroy such a chunk of your liquid wealth? Unless the total costs equal only, say, 1/3 of your cash, and the house needs absolutely nothing AND you plan on staying in it for the rest of your years…then I would avoid this plan.

The guy up above who suggested that he was trying to pay CASH for a 625K house is a perfect example of how the windfalls made during the housing bubble have or will be destroyed by ending up being sunk right back into the very asset class that created their new-found wealth. The sure destruction of this wealth is a forgone conclusion — it will either be destroyed buying up rental properties or overpriced primary residences, or in the rope-a-dope going on the equities market.

By paying cash you not only have more bargaining power on the price, but even at these low mortgage rates, you save interest that is equal to the price of the house and about 4X the money you save with the tax deduction for mortgage interest, figuring on a 30 year loan. In the case of a 20 or 15 year loan, the savings are not as striking, but they are still substantial and are considerably more than the mortgage interest deductions would be over the same length of time.

Borrowing only makes sense if you foresee great appreciation in house prices over the coming decades, which i don’t. There is also the matter of my age- I’m at a point in life where I have to worry a lot about rents escalating faster than my income, but where it is never a good idea to take on massive debt

I can understand where you’re coming from, Laura — especially if you plan on being in the house for the rest of your life. However, I still wince at the idea of tying up all your capital into a single, poorly performing asset. Even putting down, say, half the total cost of the home and then salting the other half away into CDs or some other safe haven would be better. Then, if you still want to, pay the whole she-bang off in five to seven years. Think of the interest paid in that brief time frame as an insurance premium for not having all your dough tied up in one place.

Just a thought.

Leave a Reply