Is the Los Angeles housing market in another bubble? Prices at new peak and up 181% since 2000. The market is shifting but does this mean a bust?

We are creatures of habit and suffer from historical financial amnesia. As you would expect, the market is now turning and the question now shifts to how big of a correction we are expecting. Los Angeles has been in a decade long renting trend where the vast majority of new household formation has come in the form of renters. I understand that many people on this blog either own or want to own but the reality is, many people are voting with their wallets and rent because prices are simply too high. So it comes as no surprise now that sales are slumping and inventory is slowly picking up. The housing market in Los Angeles is up 181 percent since 2000 while the CPI is up 50 percent in this similar period. When you look at history, there is really no pattern as to how the market will respond and the reality is people do lose money in real estate which for many decades was something you were unable to utter.

Los Angeles housing turning?

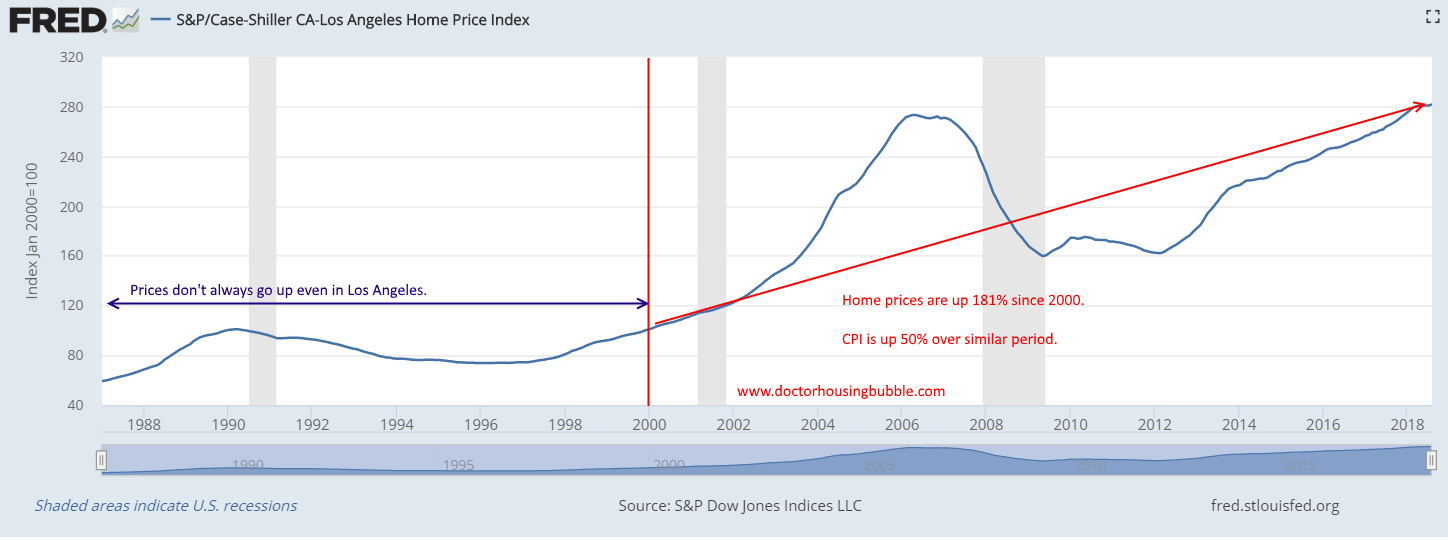

It might be helpful to take a long view of the housing market in the greater Los Angeles MSA area. “Long†for L.A. is 30 years. Take a look at the below chart:

First, from 1990 to 2000 prices simply moved sideways in Los Angeles. This isn’t ancient history, but people like to pretend that housing values only go up in the area.

You then see the massive bubble from 2000 to 2007 followed by the crash.

Prices hit a bottom in 2009 and moved sideways until 2012.

From 2012 to today we now have another massive bull run. In fact, prices are at a new peak.

Prices have gone up 181 percent since 2000 for the region. But the overall inflation rate is up 50 percent during this same period. That is a big difference. Now one argument we hear about 2000 versus today is the mortgage rate difference. In 2000 a 30-year fixed rate mortgage was close to 7 percent. Today it is at 4.83 percent. Therefore, the argument goes, you can buy more house because of the rate. Yet this argument has some flaws because in 2012 at the bottom of the market, a 30-year fixed rate mortgage could be had for 3.3 percent and homes in L.A. were 43 percent cheaper. If rates had everything to do with it, prices would have dropped as rates rise (the opposite has happened). In other words, there are many other variables at play.

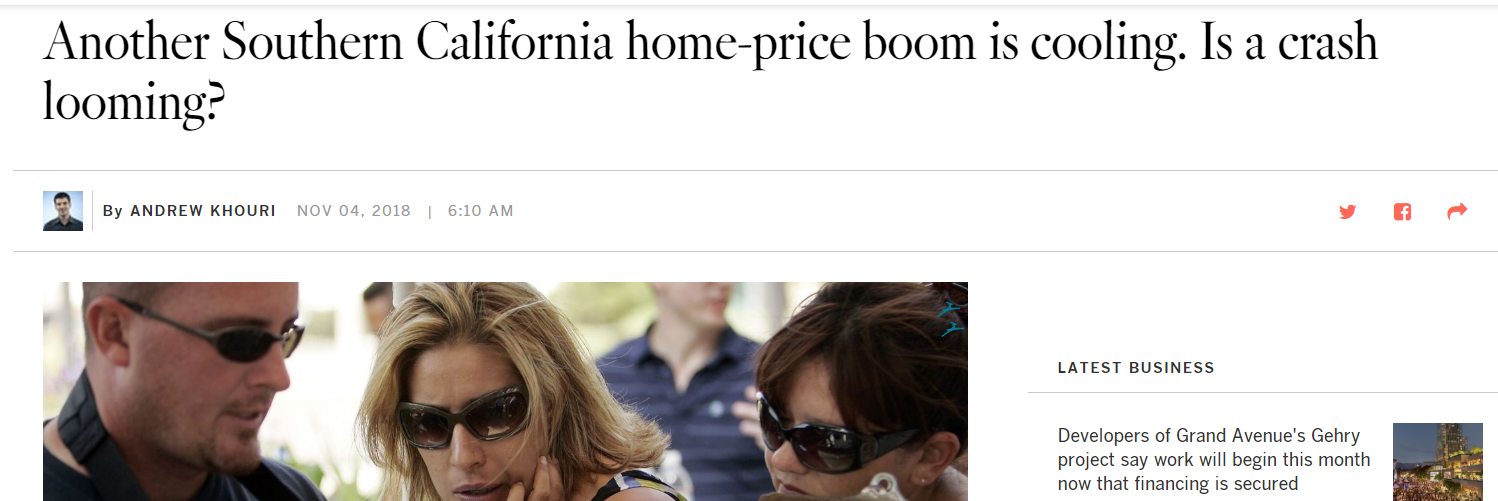

Sentiment is also changing at least in some headlines:

There are more articles talking about the softening market. Crash or no crash? Is the housing market stalling? The market has already stalled for many middle class Californians. In some areas a large portion of the buying has come from foreign money. Ultimately real estate has become like a global stock; a place to speculate and invest.

Sales are definitely slowing down and the stock market has barely had any correction. Home values are absurd in many areas of Los Angeles and the logic you get is shallow in perspective – history is defined as post-2000 and let us forget about the last housing bubble because of course that can never happen again. The market collapsed because of NINJA loans only. When in truth, the majority of foreclosures came at the hands of those with 30-year fixed rate mortgages. Of course it can never happen again in the exact same way but even a minor recession will put many foreclosures back on the market. Households are strapped to the max with debt in California.

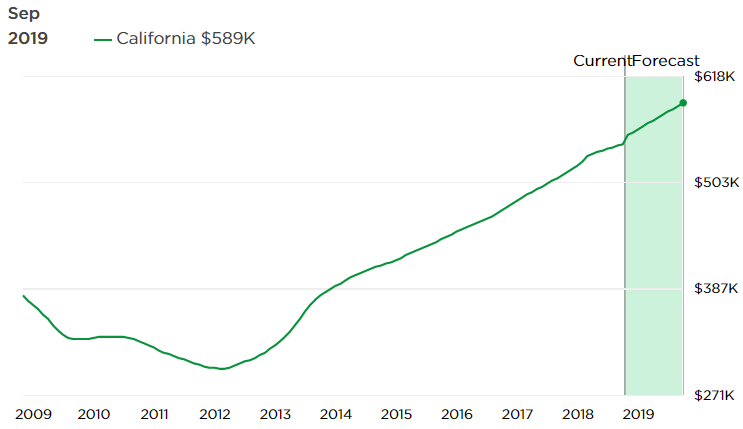

Inventory is up 29.9 percent year-over-year in Los Angeles. That is a big jump. And the jump in prices in Los Angeles is not only a L.A. thing but a California trend:

This market was predicated on a blistering hot stock market and once again, the assumption that real estate only goes up. This slowdown is also happening during the traditionally slower selling seasons of fall and winter. There are many people that only know a bull run in real estate now and were operating under FOM0 mechanics. The L.A. market is definitely seeing a shift. Will this be a bust or a minor correction will depend on the stock market and jobs (and at times those are connected).

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

228 Responses to “Is the Los Angeles housing market in another bubble? Prices at new peak and up 181% since 2000. The market is shifting but does this mean a bust?”

ZIRP + lying/fraud = implosion. These loanowners will burn the city to the ground if they don’t get HAMP 3.0.

Biggest midterm voter turnout ever, Obama got off his ass to rally support, everyone and their mother were called racist, and Oprah even came out! All that effort and the best they could muster was a blue blip. The market has responded with green across the board. jt may be right about next year. Millennitroll may say the data didn’t come from credible sources.

When it comes to politics I don’t have a dog in the fight. Believe it or not I am not a democrat or republican.

No one asked for your political position.

well, you are very interested in my investing advice and so it makes sense to ask me about political views as well.

Market,

If you are not interested in our political opinion, why are you giving us your political opinion?

Is anyone here doing well with short-term rentals in the SoCal market? There are lots of municipalities outlawing Airbnb and its competitors, from Anaheim to Irvine. This election has a bearing on the outcomes in some areas.

But with a 10% correction I would enter the market as an investor if there was a good opportunity to cashflow with short-term in a city friendly to investors. I don’t see a crash from my POV. I need the right property manager and the right realtor, however. Thus far I haven’t met the person with the right formula.

As a real estate agent, I find that most investors want a real estate agent to “find them a deal.” They want the real estate agent to do the math to determine if the property cash flows; then all the investor must do is bring the money to the closing table. If I did all that, I’d buy the property myself.

So what do you do to earn that commission?

You sound like a reliable realtor, but why is everyone here beating you up?

Those who can DO; those who can’t peddle property.

As a real estate agent, I find that most investors want the real estate agent to “find them a good deal.” They want the agent to determine if the property cash flows, and do all the other due diligence required to make a profitable decision. Heck, if I did all that, I’d buy the property myself.

Most realtors were not able to get a real job. And if they don’t make it as a used car sales man they end up in real estate. Virtually anybody can print out real estate papers and pretend to be an agent. One out of 20 realtors is useful. Now, that the market is crashing a significant amount of realtors will disappear.

@Libel

God forbid you earn that fat commission and offer any real value to your clients.

LibelFreeZone is “Exhibit A” of why many R/E agents are as useless as t*ts on a bull.

LibelFreeZone: Please explain why when I find a flyer on my front door exclaiming “I am your local R/E expert”, exactly what “expertise” are you guys pontificating about?

Note: I am perfectly capable of driving around to open houses, taking notes and then going to some swanky lunch spot.

What is it that you do for your 6% that I can’t do myself??

What you’re looking for are fully managed rentals. They’ll hold your hand and sell you your dream. Just don’t come crying when you get screwed.

I have a few friends who converted their garages into studio apartments and rent them out on AirBnB – making tons of cash after paying off the cost of converting their garage. And they are doing it illegally but if they are on good terms with their neighbors, no one cares.

a PAC financed by VRBO/AirBnB and other moneyed interests just used a misleading signature campaign to get a referendum on the new San Diego rules governing short-term rentals and the city council ended up reversing it’s decision to avoid an actual voter referendum in 2020.

Corporations always win and the wealthy property owners using their homes as hotels will continue to make obscene amounts of money here for many years to come.

“I don’t see a crash from my POV”

Then don’t do it. I say that because you don’t seem to have a clue.

California RE does 2 things, it booms and busts every time. I sold a house in 2005 for $459K by 2011 it was down to $195K it just sold again (I looked it up on zillow) for $440K and it will drop again to probably $200K during the coming crash.

and crash it will…….IT ALWAYS DOES.

I hope you’re right..at this point I have lost all hopes of owning a house in SoCal and pay a reasonable/affordable price without falling into FOMO like rest of the people..I am not sure if I will ever see that happen in my life time

Recessions and corrections in southern California housing happen at the same time.

I expect this to be more like a head fake, similar to 2004 and 2014. It’s soft right now, but inventory is still low even though inventory is up from historic lows. Price reductions are mostly off wishing prices and prices are still up. It will take until at least May/June time frame to know, but I expect with a strong 2019 in the economy house prices will be up next year. The recession is at least 2 years away.

What you really need to ask yourself is what would happen today if interest rates were 3.5% again. That’s the central bank playbook. You have countries like Japan, the Netherlands, etc…with 1% or lower mortgage rates.

House prices will go down in Southern California during the next recession as they always do. The playbook will be the same, lower interest rates to historic lows. For those waiting on the side lines don’t make the same mistakes many made from 2009-2016. Buy as soon as you can buy for less than the cost of rent.

Probably true. I read about many overpriced markets besides La-OC having to dropped prices. It will probably go down a little before a recession and more so if their is a recession. OC I think would not have gone up as much if the Chinese didn’t buy into Irvine that much. It depends if the foreign market will be involved after another recession.

Leftists are trying to suppress the housing market with a media blitz claiming the housing market is crashing. However, that is false. The economy is strong and interest rates are low. No recession = no housing crash.

We are in a seasonal slowdown. This housing suppression story has caused some to delay a house purchase. Inventory is still very low. This will be another strong spring like the last one.

JT told us almost exactly one year ago that the 2018 spring selling season will be epic. We hit a wall in May 2018 in almost all of California. Sales volume has plummeted. Buyer demand is in the toilet. Now his forecast is this next spring selling season will be “strong†(not epic). That should translate into a 10% decline! Keep in mind this is all without a recession. The recession will hit at some point in the next couple of years. You will see a full on collapse at that point. Buy now and regret it forever.

Btw, 7mio job openings…. what does that mean? The next rate hike is settled!

Spring 2018 was an epic market. Record high prices and most everything that was available sold. What more do you want?

I want nothing more. I got everything I hoped for. Housing market hit a wall and is going down since May.

Line looks to be right on trend not way over nor under. Unsure if you’re right about the market but leftist media will try to bring it down. Millenitroll said inventory numbers were fake now he acts like they’re real. Wise owl guy says we should be nice to people who do dishonest things like that.

Correct. The inventory is low lie turned out to be a marketing strategy to sucker in the last buyers at highly inflated prices. If you communicate these type of sales pitches (lies) you can sell easier. By providing the data from credible sources I am able to counter these false statements. The data clearly shows inventory is increasing rapidly. Two Sellers have to compete with one buyer now and subsequently prices fall left and right. It’s entertaining to watch. Next year should be even more interesting with heavily increasing interest rates and the new tax laws (salt and 24k std deduction).

The same “credible” sources are being used now as were being used back then. You’re digging a deeper hole of dishonesty.

I would call it wisdom and expertise (not dishonesty). I said multiple times the inventory is low lie is just that….a lie. Nobody spreads the lie anymore so they? Certain people have an agenda and need to make up false data. By looking at the facts/data you can dismantle those lies. Exactly what I did. I understand you don’t like that the market is going down and that my data isn’t supporting your narrative. You are in the same boat as most RE cheerleaders. It’s a tough adjustment for some. Better get used to it as the pain won’t go away on the next months or years.

Nope, it’s dishonesty. No amount of ad hominem trolling you try to make about any “agenda” changes the fact that the inventory data was always real and still is. In fact that inventory data is from the exact same sources you’re now using to try to convince us a 50-70% price crash is coming next.

very true. there will be a 50-70% crash.

Leftists and Contrails and Obama. Leftist and Contrails and Obama.

“They are trying to supress the housing market.” THose pesky leftists.

I’m buying and selling in this mess (both in Inland Empire) – will close both within next 10 days. We’re selling for a far lower price than expected to ensure we get the house we (SHE) really want.

We’re definitely now into a balanced or Buyer’s market. The euphoria is long gone. I’ve watched the volume of transactions into Escrow and closed come down significantly. Obvious to me that the rising interest rates are pressuring prices back down.

I don’t see a CRASH coming like 2006-2008 because there is no Neg-Am, IO, or Option ARM mortgages anymore. So I’d not expect mortgage defaults and foreclosures to go through the roof again. But homes will sit and sit if they are using Early 2018 pricing and comps to expect what their house will sell at.

Unfortunately, most of real estate pricing is dependent on monthly payment, and monthly payment heavily dependent on mortgage interest rates. I’d expect prices to fall modestly in line with rise in rates.

However on the flip side, I see the interest rate top coming soon, as a 2019 or 2020 recession will cause rates to come right back down…

^^^Jason is spot on. I concur with everything said and I’m seeing the exact same thing (as a mortgage lender).

Dan! Long time no “seeâ€.

You agree with everything Jason said? Really.

“I expect prices to fall modestly (…)?â€

Your opinion changed rather quickly, no?

So I take it there won’t be pot boom (which would somehow translate in RE surging prices) anymore. as you predicted many month ago?

You also bought last year because you couldn’t wait any longer and you didn’t see prices going down anytime soon. Due to boomers not downsizing and low inventory.

I actually hand it to you for a) still being here and b) shifting gear into reverse.

There must have been a point where the light bulb came on. I noticed you slowed down with your posts since about May. That’s in line with the OC market hitting a wall: increasing inventory, rising mortgage rates, decreasing demand. That sound about right?

LOL at millennial’s post (just because it’s funny).

I think the supposition that there will be a nice soft decrease in house prices and everything will otherwise just go on as more or less normal, is a little naïve. The most recent two times there has been a stock market bubble (2000 and 2007), there has been a significant crash. The last time there was a housing bubble, there was a significant crash. There is now a concurrent stock market bubble AND a housing bubble, both of which way more inflated than the last bubbles, and both of which appear to be weakening. I’m just a layperson with regard to economics, but I’m a layperson with a brain. Based on past evidence, I think there is a very strong possibility we are in for a wild ride ahead. I have my popcorn (large down payment) ready, and will be waiting to see what happens in the coming years.

hehe, unfortunately, Dan doesnt respond like he used to…..must be too painful facing realtity….. and God forbid he admits he was dead wrong on his market predictions.

“The housing market in Los Angeles is up 181 percent since 2000 while the CPI is up 50 percent in this similar period.”

Actually, if you use the altogether much more accurate Burrito Index – street-level economics in action, a metric that considers all inputs – the CPI is closer to 160%. In turn that means that in constant dollar terms the L.A. market is only up ~20% or so.

But that’s not the same thing as affordable or a moderate increase. In addition to household debt load, wages are either flat or have regressed. Again in real world terms, a working man used to be able to buy a Ford f-150 with only 600 hours of his labour. Now that same truck will cost him 1200 hours of his time.

Now consider the various nickle and diming regulatory aspects of L.A./California living – think plastic bags here as a poster child – that increase the price – both monetary and opportunity cost – of doing every last little thing. Then factor in things like the AirB&B rentals to try an make ends meet, i.e. “taking in boarders,” something that was common in the Great Depression….

A lot of people have left for greener pastures. And everybody is holding on with their fingertips.

Something has to give. Tainter’s Collapse comes to mind. One good earthquake and/or Redondo Canyon slide (with the consequent tidal waves) that cuts off the water, power, and consequently fuel – can’t pump gas without electricity – and watch what happens.

Mortgage defaults will be the least of everyone’s problems as all the tribes turn on each other and the various Governments reveal their feather bedding and crony incompetence. It will be the L.A. Riots all over again, only this time writ very, very large. and holding hands and singing Kubaya won’t be enough to fix it.

And then property prices will come way down. Sorta’ like in Detroit or Philadelphia.

Just a (cheery) thought.

VicB3

And then property prices will come way down. Sorta’ like in Detroit or Philadelphia.

New York City and Los Angeles are not Detroit or Philadelphia. NYC and L.A. are playgrounds for the international uber-rich.

Bel Air, Beverly Hills, Santa Monica, Malibu, etc. are not coming down in price.

Look at NYC. Many neighborhoods are ghetto, and many more are Third World dumps. No white middle class. Yet the elite buildings have penthouses selling for over $100 million.

Prime areas in SoCal will remain increasingly expensive.

I looked up the Burrito index, and I agree that it is a useful metric of the rise in low-cost discretionary items with little price elasticity between vendors in a given area (or even nation to some extent). The consumer price index does not reflect the reality of the day to day lives of urban and suburban middle class workers in our modern society. That is a problem with government indices, that they are always a generation behind in their thinking.

we’re on track to have mortgage rates up 1% in one calendar year – when is the last time that happened?

One of my college buddies just sold his inherited 2br home in East Venice/Mar Vista for nearly 2.5 million. His father had purchased this property for less than 400k in the 90s. Wacky. Bubble or not, prices aren’t (and won’t) come down far enough any time soon to make Los Angeles real estate feasible for anyone besides millionaires. I’m not complaining as I no longer live in LA and I have a killer deal on rent here in SD, but prices are just beyond goofy and I can’t see a proper correction happening any time soon.

I think it’s the funniest thing in the world when people try to guess a recession as if the economy owes us one every X amount of years. I’m not saying there’s NEVER going to be one but based on the current economic outlook, there’s not even a hint of one in the near future.

I think it’s even funnier that people really think this housing slump is “the tide beginning to turn.” It’s a slight correction because of interest rates and wages. It’s hit a relative peak in terms of getting qualified borrowers a home but that doesn’t mean that the show is over. Banks are barely beginning to play with the idea of sub-prime mortgages so you know the show is only about to begin. Prices will stagnate for a year maybe two to re-charge the borrowers pool, meanwhile, wages are catching up because of record unemployment and you have yourself a recipe for another onward climb.

In conclusion, people who truly believe there’s a bubble among us are very foolish and it wouldn’t hurt to really think about the factors involved in this housing market vs the factors involved in the previous housing boom. There is no chain reaction of people defaulting because of variable interest rates and easy credit. We are also in a COMPLETELY different world than we were in 2000. Do you not notice your Chinese neighbors? I’m not saying “this time it’s different” I’m just saying that you can’t apply old rules to a new world. Now go out there and get yourself a house because you ain’t seen nuthin yet.

Happy to go out and buy. All I need to do is wait another two years and pick a nice house up at a 50-70% discount during the next recession.

What’s funny is that if Millie invested in RE since he started crying wolf he would’ve been up at least 35% in equity plus rental income. I wonder what’s prompting him to believe that a recession is imminent. What economic factors today indicate that? And in the event of a recession, how will that significantly impact the housing market? You may have forgotten but the 2008 housing crisis caused the recession not the other way around. As you know the factors involved in the 2008 housing crisis are not present in this current real estate market. The cost of Labor and materials has gone up so don’t expect massive Housing Development projects anytime soon, thus, no oversupply. Easy credit is history and foreign investors and large property management firms are eating up the market. Rent has gone up which only justifies the price even more and unemployment is at record lows. I hate to sound like a broken record but it really all comes down to supply and demand. I will admit that there’s market manipulation at play with the lack of inventory but unlike 2008 it’s actually sustainable.

“NewAge says:

What’s funny is that if Millie invested in RE since he started crying wolf he would’ve been up at least 35% in equity plus rental income. I wonder what’s prompting him to believe that a recession is imminent. What economic factors today indicate that?”

NewAge,

The best part is that when Southern California prime areas finally do drop 20-25% in the next recession, 2+ years from now…. Millennial won’t buy.

Then he will be complaining for years about how the Fed dropped interest rates to record lows and the market is artificially inflated.

You seem to be new to the REAL ESTATE game. Let me help you out.

You need to look at rental parity. If your cost of renting is far below buying you are better off investing your money other than RE. When RE corrects (which it always does) than you buy because you can always fall back on renting it out and break even or make money.

If you put 20% down and you are still far away from rental parity its a no brainer to NOT buy. People like you should buy high (dont waste your time here, go out and buy high), simply because people like you dont mention/think of rental parity or opportunity costs. Amateurs. 🙂 You also think you have equity because the bubble inflated housing values. That equity is gone in a blink of an eye during the next recession….try selling your house right now….unless you price way below market you cant even get one offer letter in….

people should do a basic IQ test before allowed to post here. Well, i take that back…its more entertaining with these newbies and dummies.

What’s also funny is that Millennitroll says it will be a 50-70% price crash in the next recession but also says this time isn’t different. 50-70% price crashes don’t happen in recessions.

New Age he can’t even keep his trolling straight. Recessions don’t have “epic” price crashes of 50-70% off across the board unless this time is different but he says he’s not saying this time is different. He’s also too scared to provide any more detail such as exactly WHERE said “epic” price crash would occur. He does this so that when some shithole place has a half off sale on shit shacks he can say see I told ya there was gonna be an “epic” price crash. This guy is worse than the trolling realtors he complains so bitterly about.

Its all about boom and bust. Soft landing dont happen in California. If you would actually go and research it, read some books or listen to some experts you would know this. I guess its easier to spread false information on blogs instead of actually informing yourself.

Expect a lecture from Millie – and prepare to be labeled a RE cheerleader.

Agreed 100%. People who promote buying now to others (especially at the worst time) are typically RE cheerleaders. They don’t want to buy RE themselves but want others to buy sky high. Often RE cheerleaders try to disguise themselves by not directly using the cheap sales pitches like “this time is different†, “it’s always a good time to buyâ€, “interest rates are still lowâ€. They essentially say the same thing though, just talking around it and trying to not use the standard phrases. Bottom line, they mean the same thing and their BS can be placed in the same drawer.

Funny, unless you are trying to sell or refinance.

New Age,

Those are all good points. You can go back in the blog archives and you will have read the same words “the tide is turning” since 2012. How did that work out? The market may go down, sideways or up. Nobody knows. And this market is totally different than a decade ago. The most qualified buyers ever swimming in equity, the wealthy have gotten filthy rich and hold much more RE, rich foreigners, investors, etc. And the desirable parts of CA of truly separated themselves from the lesser areas. To think you’ll buy an SFR in one of these desirable areas for a bargain price is ludicrous. And meanwhile, rent goes up and up and up.

My rent hasn’t gone up. Ever. Meanwhile incentives from homeowner have been taking away (blue states) and std deduction has been increased to 24k for married couples. Most people won’t itemize anymore.

“The market may go down, sideways or up. Nobody knowsâ€

People with expertise know exactly that there is only one way….it’s going down. Maybe more rapidly than you think. (Hope for)

Just wait and see.

That’s why Millennitroll won’t tell us where he would buy. He’s dishonest like that so when trailers in California City are half off he can say told ya so.

Market,

Huh!? When have I ever been dishonest? Also, if you want to know where I plan on buying during the downturn why don’t you just ask nicely? Have I ever not answered a question? How precise do you want it? Area name, or just the city? Coordinates or some street names? Just the zip code?

@ New Age it is kind of peculiar how people on this blog see some background noise to home prices (ie: slight increases in inventory or slightly more price reductions) and start cheering on a crash.

Its silly and shows no sophistication in understanding the housing market.

What do some of our local RE experts say: Robert Schiller, Bruce Norris and Logan Mohtashami ……no crash in the near term.

Lol

Schiller said many times this looks like 2006 and we are overdue for a recession.

Logan is one of the biggest bulls out there (no wonder he is a lender). Even Logan said multiple times that some of his recession indicators are checked off now.

Sure, if you take their statements from 2014 and not the current ones you might have a point here. But aren’t you fooling yourself? Or you might not be able to allow your head to think a recession will hit at some point in the near future? Too scared? You remind me a little bit of the Chinese that go out and protest because condo prices are falling. Some people got used to the impressive bull run we had. Falling prices can not be allowed.

This next crash will be epic and end in tears for a lot of people.

Millennitroll no one is saying there won’t be a recession nor price correction coming next. The difference is that you’re saying there’s going to be an “epic crash” coming next … well that’s not a run of the mill recession. You’re trolling needs work because you can’t even keep your smoke and mirrors together.

That is correct. there will be an epic crash. exciting times ahead and very profitable!

Yes I am correct that your trolling game is off when you say a recession correlates to a 50-70% price crash. That’s not a recession. It would be a depression. You’re saying it’s different this time.

This couldn’t be further from the truth. Wages are not catching up and the record unemployment is not causing people to run out and buy a house in SoCal. The suckers have all bought and now the market is dependent on the smart buyers who aren’t being duped by scare tactics. Prices will continue to go down for the next few years.

Every time is different. Creation of the Fed was different. 1929 was different. Nixon shock was different. Fall of USSR was different. 2008 was different. Trump was different. It’s easier for simple minded people to think that things are never different. Twain probably said it best that history doesn’t repeat but it sure does rhyme. It takes a brain to figure out a rhyme but it only takes an idiot to say this time is like the last time.

+1

It sure does rhyme! Every bubble pops eventually!

The issue with those who claim this time is different isn’t that they say the cause is different. They simply try to pretend this bubble won’t pop. They use “this time is different†to tell the avg joe now is a good buy time to buy RE. It looks like buyers don’t buy it 🙂 get it?

Millennitroll says this time is different. He says it will be a 50-70% price crash which is different than most times.

100% correct. This time isnt different and there will be a 50-70% crash. Similar to last time.

Exactly I’m 100% correct Millennitroll that you’re saying it’s different this time. Last time was different than anytime before it so you’re saying this time will be different than just about any other time.

Maybe there’s no point in repeating what a dozen other people have said, but Socal has NEVER had a 50%-70% crash in living memory (maybe the 1890’s, certainly not since). Even the great bubble only brought a 40% crash. We are in something of a bubble now, but not nearly as bad as the 2000-08 one, and there will probably be a crash, which likewise won’t be as bad as that, probably more like 20%. That’s a heck of a crash, because late buyers with 20% will be completely wiped out. But if you’re waiting to buy until the prices drop 50%-70% here, the only thing you’ll ever buy here is a cemetery plot.

There are countless examples where houses were bought for half off from the previous peak during the last crash. Never looked at a Zillow or Redfin price history huh? The often referenced soft landing (only a 20% crash) is the wet dream of many RE bulls. That’s fair, you are entitled to hope for the best (and hopefully prepare for the worst). In my opinion a 50-70% crash is a given at this point. Wait, see and be ready.

I believe you are all correct.

This time is slightly different.

In the late 80’s and 90’s there were 10% declines in the housing market but also recoveries so the market was mostly flat accounting for the extremely high inflation.

The Tech stock bubble grew in the late 90’s and then catastrophically crashed in 2001. I worked with some people who were ready to retire in their early 60’s at Lucent and when the bubble burst, Lucent and other tech stocks crashed from $120 down to $3 per share. No retirement for them with an 80% decline in their retirement funds. Except for Silicon Valley, there wasn’t a housing bubble so mainstream America never noticed much of anything.

In 2007, there was a housing bubble and a stock equities bubble. Fair Economist is correct, most of S. CA “only” crashed 40% but the Inland Empire crashed 50+%. Today, the housing bubble is even bigger than 2007 by most metrics (salaries, prices compared to inflation). The potential to crash 50-70% is much more likely for all of S.CA. In 2007. a pseudo Black Swan was uncovered that lenders were offering no down (no skin in the game) loans . When the economy turned south by 40%, all of these loans defaulted causing a crash in housing prices and a loss of jobs. Like a domino effect, homeowners with 20% down also defaulted. Longer term homeowners even with up to 40% equity, panicked and walked away.

Those who stayed and didn’t panic, eventually did well. The key is “Don’t panic” but you can’t stop human nature.

Dan is correct. He knows loans are NOT hanging out there by a thread today like they were in 2007.

What could cause a Black Swan similar crash condition today?

1) War with bombs. Trump could declare war on Iran, N. Korea, and even China and Canada on a provocation. Trump seems to be provoking everyone.

2) A major natural disaster. CA fires have wiped out thousands of homes but a major earthquake could wipe out millions of homes.

3) A pissy Trade War driving up inflation drastically. The Grand Trumps ego won’t back down. So said the El Presidente of Venezuela. Bad news for Venezuela. Bad news for US housing if that happens here.

4) Fed raising rates. Yes, but so far, they have leveled off the stock equities market and the housing market. If their grand experiment actually works, we will have a soft landing and level prices for years. “If” is the key word but they can lower interest rates on a dime if a crash occurs. Apparently, they can lower rates below zero if need be. I still can’t wrap my head around that. I studied Controls Engineering in college and this is fascinating. Maybe real controls theory has permeated into economics. It is a hard problem with too many jerk inputs from panicking people. Does the Fed have enough control points to keep the system stable?

Can you see any more potential pseudo Black Swans to repeat the 2008 40+% crash?

How can you say this housing bubble is worse? Housing prices in Socal are about where they were in 2006 but wages, prices, and most significantly, rents are all much higher. There is far *less* of a bubble this time.

Yes, some places do worse in a crash (and others do better – my area didn’t even go down 40%). If you say there’s going to be a 50-70% crash, the implication is that most places go down in that range, with maybe a few higher or lower. That’s just not in the cards, barring some kind of black swan like some you mention. But while a monstrous black swan producing that kind of thing is possible, it’s far from likely, and it’s bad policy to plan investments on *expecting* unlikely events.

Socal had an excellent buying opportunity in 2012-14, and Millennial missed it. I did too, actually – we were thinking about doing some RE investments and never did because I thought prices would drop lower. It was an understandable mistake, but still a mistake. But that was probably the best buying opportunity any of us will ever see. There will be more in the future, but because the 2000-2008 bubble was epically huge the future bubbles will almost certainly be less, and so will the subsequent buying opportunities.

According to the Case Shiller home price index, home prices today are 3% higher than the peak of the last bubble in Los Angeles and Orange Counties. This is only slightly different.

As you pointed out, people earn higher wages now so they can afford more.

I found the historical Orange County Housing Affordability Index. It shows how many people in % can afford a median home in an area. The link is here:

https://www.car.org/marketdata/data/haitraditional/

According to the data, currently the housing affordability % value in Q3 2018 for Orange County was 20%. Meaning 20% of the Orange County residents can afford a median priced home.

The index was at 10-11% during the peak of the bubble for over 2 years from Q1 2005 until Q3 2007.

At the low point of the crash in Q2 2012, the value was 39%.

(An inflection point during a crash may indicate a good time to buy.)

The last time the value was 20% was while the bubble was deflating in Q2 2008.

The prior time it was 20% was in Q1 2004. 3 years before the bubble burst.

It is likely the 10-11% value from 2005-2007 did not cause the crash. The crash was caused by a loose lending practice Black Swan.

The entire system was marginally stable and the Black Swan disturbance caused the entire system to become unstable causing the crash. IMHO, the FED did not start lowering rates and QE soon enough or fast enough to prevent the 40% drop in home prices, but likely prevented a further fall in prices.

The fact that the current affordability index is at 20% (and not 11%) could mean the system is more stable than the peak of the last bubble. It should be more robust to handle another Black Swan. Depending how big it is. The FED will likely be much more aggressive in lowering rates and resuming QE if it appears to be crashing again.

A slowing of housing prices is NOT a crash.

A YOY flattening of housing and stock prices is NOT a crash.

Based on the data above, I also do not think another crash is imminent or will be as severe as it was in 2008. Barring any major unlikely Black Swan.

Our Millennial is saying that all he needs is one house that crashes 50-70%.

Since that was very common in the 2008 crash (almost half the houses crashed over 50%), I think Our Millennial will get his wish IF another Black Swan flies in.

I bet you get a kick out of gravity too every time you fall down. Its like it OWES your mass something, ha ha!

“Yet this argument has some flaws because in 2012 at the bottom of the market, a 30-year fixed rate mortgage could be had for 3.3 percent and homes in L.A. were 43 percent cheaper.”

So 2012 was the time to buy. That was only 6 years ago, so all the geniuses here should have made a killing. I enjoy going back in the archives here and reading how many people actually claimed it was time to buy at this time. They were all called ‘realtor liars’ or idiots. Unfortunately everyone was obsessed with ‘shadow inventory’, unemployment and low wages.

Never seen so many “bubble deniers” trolling a housing bubble blog lol

They are in panic mode because the last flip did not sell yet. By the time they sell they might lose money.

2019 economic expansion continues, yet real estate priced for perfection and pull back of foreign buyers, increasing interest rates, etc., should cap gains in real estate for next few years.

Rates and other major factors could wipe out a lot of profit,like stock holders most hang on too long.

Well, here goes, real estate listings in the O.C.have gone from 3 months out last summer to 36 month out as of now. I would never buy here in L.A, though I make over 6 figures, why because, I can’t afford to live here. Elsewhere I can live like a king, with none of the L.A. problems..People are really leaving and going elsewhere, for the same reasons, and in the not too distant future, there will be no middle class here..I took my job with me to Texas and worked there for a year and saved 10 grand..That is going to be the end of LA, people telecommuting from other sites and internationally..Take a look around at all the empty office space, someday that will be LA housing. And remember the middle classes pay most of the taxes.. The crazy thing is that everyone knows this you can’t work your way out of a depression, but people keep going because they think those homes they own that are million dollar crap shacks means their rich…It doesn’t mean anything if you can’t sell it. I come back because of a sick adult child, insured pays her insurance bill every month but can’t use her insurance because the deductible is too high…

Oh man this thing is cracking big time. Anyone who thinks there are not major underlying real problems with the housing market in the US are just kidding themselves. Do some research.

The question is, not if, but when the next real estate crash will begin. Personally, I think it will start late next spring–April, May or June. The only question is how far will prices drop.

Prices will have to drop 15-25% for the decline to be invest-able. The last decline was 30-50% in Southern California, but that type of decline may have been a once in a lifetime occurrence. The future of home prices should be much

The question is, not if, but when the next real estate crash will begin. Personally, I think it will start late next spring–April, May or June. The only question is how far will prices drop.

Prices will have to drop 15-25% for the decline to be invest-able. The last decline was 30-50% in Southern California, but that type of decline may have been a once in a lifetime occurrence. The future should be much clearer in 6 months.

Glad it didn’t pass? #metoo

What a joke this prop5 is…..it’s backed by CAR (California assoc. of realtards). That should tell you all you need to know. It would cost school and local governments over 1 billion dollar annually. Just so that 55+ Folks enjoy more freebies. Remember they already pay next to nothing in property taxes since decades(thanks to prop13). Plus prop90 allows them to transfer their ridiculous low property taxes to the next home once in their lifetime if the next home is equal of size (or less). These greedy folks want that scam to be expanded through prop5: “transfer their tax assessments from their old home to their new home, no matter the value of the new home, its location, or how many times the buyer has moved.â€

Unbelievable, what an entitled, selfish generation that is. Instead of expanding this scam, prop13 and prop90 need to be repealed. This is not a socialist country, we can expect everyone to pay their fair share and not live off of younger generations. Why should I pay extra so older farts can enjoy freebies?

Couldn’t agree more. The assault on younger generations continues from old people.

Agreed. 100%. No need to give handouts to people who hoard real estate and have made millions on the gains.

prop90 allows them to transfer their ridiculous low property taxes to the next home once in their lifetime if the next home is equal of size (or less).

WRONG. Prop 90 allows seniors to transfer low property taxes to another home equal in VALUE (i.e., selling price) not SIZE. Big difference.

Seniors cannot currently upgrade to a more expensive home. You sell for $2 million, the new home must cost no more than $2 million to keep your tax breaks.

Prop 5 would have changed that.

Why should I pay extra so older farts can enjoy freebies?

What feebies? Seniors don’t attend public schools. Nor do their grown children.

Besides, it’s ungrateful brats who benefit from free schooling, not seniors.

freebies:

they did not exit college with student debt. Back in the day colleges were free.

They also did not have to buy during these insane bubbles. Real Estate used to be overpriced but not to the extend that its 10 times more the annual household income. They locked in low property taxes and pay far less in property taxes than new buyers. So Prop13 is your next freebies for seniors. If they cant afford to live here they need to move. Stop wasting taxpayer money on these seniors.

I picture you as one of the 2 grumpy old muppets in the balcony of the theater, but not as funny. Wheres the funny, maaaaan? I would think all those good socal vibes and $ growing on trees and sprouting out of your orifices would make people funny, but whenever I’m around socal people or in socal its like everyone is on lithium.. . maybe because its in the water or contrails, lol.

Property taxes support more than just schools lol. How about firefighters, parks and recreation, water services, etc. etc.

Mortgage Applications Plummet To 18-Year Lows As Rates Hit 2010 Highs

https://www.zerohedge.com/news/2018-11-07/mortgage-applications-plummet-18-year-lows-rates-hit-2010-highs

Fantastic news. I hope the stock market goes back up so that we get three more little rate hikes next year besides the one in December. Rate hikes and low mortgage applications are the best thing since sliced bread.

Interesting that Prop 5 was defeated. And by a wide margin — over 58% voted NO: https://vote.sos.ca.gov/returns/ballot-measures

Wealth seniors are among those most likely to vote. Yet they failed to pass Prop 5’s expansion of Prop 13.

Maybe an early sign that Prop 13 will be eroded, bit by bit, over the next 20 years.

You call 58 to 42 a wide margin? Lol

I do agree with you that this is a sign that prop13 is next. The scam has to end at some point 🙂

California is a hopeless case. Newsom wins and gas tax stays.

The sale on that $1,728,000 Santa Monica condo (discussed in the previous thread) fell though: https://www.redfin.com/CA/Santa-Monica/1043-11th-St-90403/unit-5/home/6772944

It’s been relisted.

Home of genius in Santa Monica: https://www.redfin.com/CA/Santa-Monica/1012-Euclid-St-90403/home/6772765

$1,240,000 gets you a house that’s …

* 440 sq ft

* 1 bed, 1 bath.

* 1,321 sq ft lot.

* Built in 1928.

This was likely a working class shack, back in 1928. Now it’s a “condo alternative.”

And I thought Chicago was bad in its trendy downtown neighborhoods with their 19th century A-frame 1500 sq ft workers cottages for $800K.

You’d live better in a condo. You’d get a much nice place with nice design and community amenities, with fewer maintenance chores, and lower taxes because you have less land- property taxes are principally land use taxes, and it beats me that single or childless people will happily pay huge taxes just to have a back yard they almost never use, or bother to landscape.

There is a simple question, you may ask your self about is this bubble or not. Could people who live there, afford to buy there own property now? And if most of them cannot, this means – we are in the bubble now.

+1

What’s the percentage of those who can’t buy their own home? Affordability has never been that low. I would guesstimate north of 75% wouldn’t be able to buy their own home anymore.

It is not about bubble vs no bubble. It is about recession vs. strong economy. If we hit a recession, prices will fall. In a recession, prices will fall anywhere from 5% to 25% depending how much deflation occurs during the recession. If the economy stays strong, then housing will do just fine. You should not be on a bubble watch. Stop focusing on all the bubble arguments. Instead, focus on a recession watch. That is what matters.

Even more important is if you buy a home you must make sure you do you homework. You must check your finances to make sure you will not lose your home in a recession. Sometimes, everything looks good so you buy a home, then a recession shows up that no one saw coming. Not even the experts see it. Stuff happens to the smartest people. So, if you are unlucky, make sure you don’t lose it all.

Its even easier than that…..just wait and buy RE (low). Dont buy (high) and wait.

It’s not that simple. People buy the best they can afford at whatever time in the cycle that may happen. Sure in some top tier neighborhoods there may be people who bought in 2012 that cannot afford today’s price but that doesn’t mean there’s a bubble. What that tells you is that in California you buy as soon as it makes sense from a personal financial perspective. As the cycle moves on those that waited to buy may be priced out of top tier neighborhoods and will need to substitute down neighborhoods to be able to afford a home.

It is a very stupid way to analyze a bubble. Of course, people who currently live “there” can afford to buy another home “there” -> They simply sell their house and buy another one at the same price. Of course they will pay a penalty in terms of selling fee and higher tax base; but it is not ground-breaking.

October numbers are coming in. San Diego Inventory (active) is up YoY by….wait for it…42%!!!!!

There is no question housing bubble 2.0 has burst. The question is how farther will prices go down before the median house price is affordable to the median household income. That’s the big question. As with the last bubble burst, inventory will explode while sales crash. This has already starting to happen and much quicker than the last bubble. House prices will go negative YOY in a few months and this is when the fun starts. All the REIC shills will shout “This time is different” or “Please don’t panic” but it’s already too late. Flippers and foreign buyers will start to bail out first, even selling at a loss. At the same time, the economy will slow and jobs will be cut as a result. Then come the real panic, as the Chinese economy imploded from the trade war and their own housing bubble, and that’s when the fun really start. Grab a chair and some popcorn. Lets hope all you realtors saved your commission checks as you probably need it to eat in the next 3-5 years.

I have seen the first flip in my area that sold at a loss!! Investors, flippers and builders are starting to panic. Wonderful!

FYI, In 2004-5 Inventory went from 5K to about 15K in San Diego County. Vegas went up something like 8-9 fold about a year later – I think it was 5K to 45K IIRC.

It’s fire season again in “perfect weather” SoCal: https://www.nbclosangeles.com/news/local/Woosley-Fire-Voluntary-Evacuations-Underway-500096741.html

As of now, 30,000 homes threatened.

California’s burning. I live near bell canyon. Smoke covering the sky. No resources to fight the fire. Go long on Home Depot. A lot of rebuilding to be done.

How are those fires in Malibu going to affect the RE prices in the prime area of Malibu!?….I’m sure those house insurances will go through the roof.

Fire insurers sometimes even drop coverage in certain areas. I would expect your premium will increase in certain risk areas and/or it will get harder to obtain coverage at all.

https://sacramento.cbslocal.com/2018/09/07/california-homeowners-fire-insurance/

http://www.latimes.com/business/lazarus/la-fi-lazarus-fire-insurance-20171011-story.html%3foutputType=amp

No worry about home insurance for rich Malibu folks.. they get California Fair Plan insurance, courtesy the taxpayers. All states have Fair Plan insurance, subsidized insurance for properties too risky for private insurers to touch, much like the National Flood Insurance Program for those who live in areas with extremely high flood risk. The Fair Plans were designed to help slum owners who could never get underwritten otherwise, and when they were instituted some 50 years ago, triggered a wave of arson fires in deteriorating urban neighborhoods nationwide. They also provided an “out” for cities that didn’t want to upgrade their fire departments to meet insurer’s standards. All these insurance subsidies of course enable and encourage bad behavior, such as expensive development in high-risk areas that really should be off-limits to development, and would be effectively off-limits to anyone who wanted insurance.

The Malibu coast, along with other fire-prone areas in the semi-desert west, has burned broadly every few years ever since we white people settled the area, and evidence is that it was burning a long time before that. After a major fire that burned through the Malibu Coast in 1930, the famous park designer, Frederick Law Olmsted, who was there to witness it, recommended that the area be made off-limits to development. Instead, it became progressively trendier and more expensive after each fire. I guess some folks just have a lot more tolerance for pain and disruption than others- imagine an hours notice to gather up essentials and fleeing down clogged roads with hundreds of other panicked residents with the flames a half mile behind you.

If there is a bright side to all of these terrible fires, it is probably safe from fire and to rebuild and live in the area for the next 50-100 years until everything grows back.

Paradise may be relatively safe for a while, but the Southern California fires are in chaparral and that grows back fairly quickly. It will be fully grown in 10-20 years.

All those homes could burn to the ground. Would the owners move to Texas or Florida. Nope, they’d all be rebuilt. Putting up with natural disasters is all part of living in paradise.

No fire on this earth can prevent the bubble from bursting 🙂

“Market” seems like an angry realtor to me– Aattacking Millenial because his/her/zer commissions are down and forced back to the Nordstrom’s shoe department where he/she/ze/it started.

If you can’t see that this RE market is not only a big fat bubble, but one that has popped, then you are a lemming with rocks for brains.

The data is very clear that prices have detached from fundamentals and the Fed has pricked the asset bubble. You bullish house jockeys will be taken behind the woodshed and rogered by Uncle Market Forces very soon. I will buy your dumps at a discount with cash while Uncle Market Forces pulls his overalls back up.

Not a real estate agent but you both might want to get some therapy for that. Millennitroll gets “attacked†only for his dishonest trolling techniques and mistruths. Seems fair.

Yeah, that market guy seems very upset. The housing slowdown is hitting a nerve

Millennitroll says we’re going to have a 50-70% crash in this cycle. He won’t say where. He won’t even say if that’s prices or sales volume or anything more specific. He dishonestly avoids being specific. His tactic is to purposefully obfuscate any details. When he’s cornered he dishonestly repeats only a portion of the disputed response in order to double down on a non specific claim. When he’s really cornered he and his friends default to old tired real estate agent labeling.

So what this guy is saying is that in less than two years every currently valued $500K house for sale anywhere in the nation or who knows where is going to sell for $150K. All $300K homes will sell for $90K to everyone. No time or quantity limits. The discounts will be permanent and everyone who wants one will get one. And he says this time isn’t different as if discounts that steep are a common feature of a standard recession. And he says he has wisdom even though he hasn’t bought a house before. I guess that means he wins a trolling badge or something.

Market,

Our Millennial is just stating that housing prices could fall 50%-70%.

Since we had all seen housing price drop 50% in certain parts of S.CA only 10 years ago in 2008, denying it could happen again makes you more of a troll than Millennial.

The bubble is even bigger now so 70% could be a possibility.

It would take a major recession to make a 70% drop happen.

It is more likely the drop will be less.

The hard part is calling the bottom when the noise is 5%.

You really want to know where I am planning to buy…If you ask nicely, I’ll give you an answer!

It looks like buyers are not too excited to buy homes:

http://www.investmentwatchblog.com/us-home-buying-sentiment-craters-to-second-lowest-level-ever-recorded/

https://www.reuters.com/article/us-dr-horton-results/d-r-horton-forecasts-weak-home-sales-shares-fall-10-percent-idUSKCN1ND1MW

Sol, Did you visit any?

It’s Sunday here and I am happy to go out and visit some nice properties. I love when I walk in and ask so how is traffic, how is it going? They usually say, it’s slow. Meaning I am the first one lol. I usually stay and chat about the market for a while. Just to test the realtards knowledge. And sometimes I learn something new. At one open house, they were doing Hot Dogs outside and had chips.

fyi, on the sign in sheet, the first three are bogus names, made up by realtards so it looks like someone else has been there. You don’t need to read it in one of many articles: buyer demand is in the toilet. All you have to do is visit some open houses and see how nobody wants to buy anymore. Rising inventory, dropping prices and bad flips will be the story line for the month to come.

I went to two open houses today (Sunday) in Newport Beach where I’m hoping to buy eventually, and each one was surprisingly busy. Each were condos (it’s all I can hope to afford here). One (priced at $1.5M) was much higher than our budget, the other (priced at $700K) was well within our budget but more than what we would ideally like to pay. Keep in mind, the $700K one was 1,150 sq ft just to give you an idea of how high prices are here.

My gut instinct is that housing is way overpriced here in Newport Beach relative to what people actually earn (probably by at least 30 to 40 percent), and I don’t see how sellers are going to avoid a very rude awakening eventually. This is further evidenced by the extreme increase in inventory I’ve seen over the past 6 months or so in Newport Beach within my price range.

That being said, my experience today (busy open houses) was somewhat discouraging. Looks like I’m taking the wait-and-see approach like other rational people here.

It’s Saturday morning. On Redfin, I’m still seeing lots of Open Houses in Thousand Oaks, Malibu, and other fire affected areas. How many of those houses even still exist?

It’s weirdly surreal. You know there’s a fire there, parts of some freeways and roads are blocked by fire personnel. Yet the MLS still lists those Open Houses.

What are you, a child?

YEs some homes on mls got burnt.

You are fascinated they are still on mlsv

As I said, it feels surreal to me. “Fascinated” is your word.

You must be very bored. I make a casual observation, and you want to pick a fight.

The wind that accelerates a financial fire is debt deflation. I don’t see a lot of that right now. People and institutions haven’t accumulated enough high interest debt to give a really good debt-deflationary crash. If salaries and/or investment cash continue to rise, home prices will rise regardless of rising interest rates (which are not a leading indicator). But a debt cycle implosion could be in the offing if investments are made that require an asset price rise to make a profit. From hedged to speculative to Ponzi, the stages leading to a crash of asset values are well known.

From BBC News Article:

“Three stages of debt:

Minsky had a theory, the “financial instability hypothesis”, arguing that lending goes through three distinct stages. He dubbed these the Hedge, the Speculative and the Ponzi stages, after financial fraudster Charles Ponzi.

In the first stage, soon after a crisis, banks and borrowers are cautious. Loans are made in modest amounts and the borrower can afford to repay both the initial principal and the interest.

As confidence rises banks begin to make loans in which the borrower can only afford to pay the interest. Usually this loan is against an asset which is rising in value. Finally, when the previous crisis is a distant memory, we reach the final stage – Ponzi finance. At this point banks make loans to firms and households that can afford to pay neither the interest nor the principal. Again this is underpinned by a belief that asset prices will rise.”

Lets assume the the housing market IS in a bubble and that the bottom of the market is in 2021. Now, assume prices are now 30% less than today. OK…. who on this blog will buy then (aside from investors, flippers) ????

none of the permabears will buy because they are the same ones who arrogantly sat back claiming a dead cat bounce was just around the corner (circa 2010-2013).

We just might do so. In the last decline we helped our daughter get into a big house from her townhouse with a loan. They bought at the start of the rise in 2013 and waited a few months for the townhouse to sell and wound up with about $50-70K more than if they’d done it the other way around. We got our $$ back but by then we felt the market had risen too much to buy rental property. Next time we could be buying as we won’t do this again for her. When the income from buying a rental beats other investments, we’ll go for it.

It depends if there is another downturn if the foreign market comes back. Irvine was priced up a lot by a foreign market. I heard the mayor was a republican again. I’m not of the left but the left in Irvine was against housing growth which might have stopped this.

House-humpers on this blog keep mentioning that this time is different because there are No NINJA loans! This assumes it’s not something else, like China imploding and foreign investment dropping through the floor, just like Japan in the early 90s.

https://www.zerohedge.com/news/2018-11-10/nightmare-scenario-beijing-50-million-chinese-apartments-are-empty

You are right, it could be a chinese market implosion or some other global event (other than NINJA loans). This ASSUMES there will be a job-loss recession, right?

Unless or until there is a job-loss recession there is no housing crash?

If there are scenarios where there have been housing crashes WITHOUT job loss recessions, please shed light on this.

Proposition 5 did poorly in both Democratic and Republican Counties, but solidly Democratic counties really clobbered it.. Only Orange County gave it more than 50%. The counties that gave it more than 45% fall into 2 groups: Southern California counties with a lot of people who might want to move to rural Northern California (Orange, San Diego, Riverside, San Bernardino, Kern, Ventura), and Northern California counties that might have attractive rural properties (Tuolomne, Eldorado, Sutter, Placer, Nevada, Lassen and Del Norte) that might bring higher prices if the people buying got a tax break. Most of those are in the Sierras or the Sierra foothills. Modoc County, that once offered the property tax transfer option but rescinded it, voted against Prop 5 57% to 43%.

I am glad prop 5 did not pass. It would have increased the supply of properties for sale in SoCal beach cities since the property tax basis could be moved. Glad to see prop 5 go down to defeat. Last thing I want to see is changes to the property tax laws which increase supply.

JT,

Why? Higher supply is good for decreasing prices. Whats not to like?

Prop5 would have allowed older people (55+) to transfers their ridiculous low property taxes to a more expensive house. Its a good thing that didnt pass. If we reduce property taxes for millennials or repeal prop13, i will vote for that. That would be the right thing to do.

In terms of higher inventory….its already going up YoY tremendously. I shared earlier the numbers from San Diego….42% increase YoY. Its similar for SF, Seattle, OC and other areas.

“Market” you still sound really upset. Are you a spec developer or did you just lever into some rental houses at the peak of the bubble? You are so mad at Millenial for being a bear it makes me think you are in serious financial trouble. Since I’m sitting on a lot of cash for the downturn that is happening right now, I will lend you some dough, but I charge usurious interest rates and would need obnoxious amounts of collateral to float you some coin, especially given your propensity for outrage. Just to be safe. Lemme know bro!!

I think Market is really Mr Landlord who has just realized Our Millennial may be correct.

Mr Landlord won’t come around since he lost his ass with his Amazon stock.

Yep, “Mr†is history. lost his shirt with stocks and had to sell his laptop.

Wow, I think that is actually a distinct possibility. Mr. Landlord has been AWOL since the equity and RE markets began collapsing. A reincarnation as “Angry Market” is a distinct possibility.

Here is what I am seeing … I own beach close fixers that are well located. For years, I always watched what was available in these areas below two million. For the first time ever, not a single home is available for under two million in multiple areas. For the first time ever, to get in under two million, you need to buy on a street with traffic, or under an airport flight path, or with a defective lot. However, in prime location, nothing is available in any condition under two million. I just don’t know how you can call that a crash.

But, you can still get into very west Torrance in the low 1Ms. That is not going to last.

Price is a LAGGING INDICATOR, not a LEADING INDICATOR. Maybe the caps below will help hammer this distinction home.

The market has shifted, we have entered a cyclical bear market in RE. It is settled fact for anyone who can read basic charts.

Nobody has said prices are back at 2010 levels, where they will likely settle ultimately. We are just acknowledging that the market shift has occurred, which is not even debatable at this point. Prices will follow, hence, its LAGGING INDICATOR status.

Fine maybe your little beach enclave is temporarily insulated in some way, fine, what’s your point? All of the major markets are cratering in terms of their LEADING INDICATORS. These are signs that tell us price will be changing later since it LAGS.

Give it up, these permabulls will never get it. Just take advantage of the opportunities when they come!

I know people willing to buy if a half way decent property shows up. Nothing to pick from. A large percentage of what is for sale is the leftovers … in other words, the garbage. Not a lot of good property available. You are dreaming.

JT seems to be a more crumpy lately. Guessing the last flip is not going well. Can’t be fun being a RE cheerleader while the market is going down.

Do some sellers engage in BOGUS SALES to increase their property’s appraisal and Zillow value?

Consider this Santa Monica house: https://www.zillow.com/homedetails/1039-25th-St-Santa-Monica-CA-90403/20475431_zpid/

2004 – Sold for $1.5 million.

February 2018 – Offered for $3.1 million.

Price was reduced several times, then …

August 2018 – Sold for $2,820,000.

Now, three months later, it’s being offered again for $2,995,000.

Really? Bought and offered again in 3 months?

* I toured this place when it was initially offered, and again this weekend. I take photos when I tour. The drum set in the studio appears identical. Same furniture, same owner?

I didn’t take photos of the other rooms the first time, so I can’t compare those, but the house looked very lived in, messy kids rooms, etc. Not like a new family had just moved in a couple of months ago. No recent cleanup.

* I checked this property on BeenVerified.com. No reported activity (no new mortgages or loans on the house, no title changes) throughout 2018.

Is it possible to arrange a bogus sale (one family member or entity to another — but keeping it in the family) to up the appraisal?

BTW, I had a conversation with the realtor. Here’s how it roughly went:

Me: I noticed this house was just bought three months ago. Why is it being offered again?

Her: Oh yes, did you see it back then?

Me: Yes. So why are they selling it after only three months?

Her: Yes, it had been on the market previously. So what did you think?

She was talking past me. Smiling her empty smile, and avoiding my question.

Youre onto something. Wear a camera and try and negotiate with the seller directly – offer 2.6M or thereabouts and bail before things get too involved. Are they foreigners? Tons of them do shady stuff w.r.t. to financial transactions – our laws mean nothing to them. The sales record on my old house in socal was 150K LOWER than what it sold for – I believe the agents conspired to hide the fact that the market turned so it would show more appreciation than had actually occurred when the buyer was looking to flip it. Armenian – man do they smell! All dumber than dirt and drive mercedes too.

How do you know the actual sales prices vs. recorded price?

I know the price I sold it for and I saw the records – albeit it several years later – to find out what the buyer sold it for (after putting in probably 100K in upgrades) and noticed they knocked off about 150K from the price I sold it for. No matter, I got my $$$.

What you are implying here is that it is impossible to sell at a loss. You sold a home and someone else sold it for 150k less shortly. How about you just sold it too high and they could not properly flip it?

Lol, I have to spell this out better –

Sold my house – 605K. Flipper puts in about 100K (give or take) into it. Sells about 2-3 years later. I check property records, flipper sold for 635K, BUT – and this is the point – the property records claim I sold it to the flipper for 450K. Nope – property records were WRONG! How did this happen? I claim it was likely done intentionally because this was when the market was just starting to turn but it wasnt until 6-9 months later that the media/RE complex started to admit things were slowing down. Tons of fraud at that time, cash back to buyers who skated right after the close (never made a payment), flippers who wanted loans from the seller because they couldnt qualify, etc.

Well, you knew you were trolling her so you got the indifferent treatment back. Why do you think you deserve an earnest response when you know you are there just to troll?

Troll? I asked this realtor an honest, reasonable question.

The house was put up for sale only 3 months after its previous sale. Isn’t it reasonable for any buyer to ask, Hey, why is this “new” owner selling after only 3 months?

The only reason for this realtor to ignore my question is if there was no good answer (i.e., I’d caught her owner in a lie; the previous sale was bogus). My question gave her the benefit of the doubt. Do I not deserve credit for giving her a chance to offer a good explanation?

You had not intent of buying. RE agents deal with so many people, they can sense BS right away. This is why you got BS back. Sorry, man

They can smell BS….I strongly disagree. They are desperate and chase very lead. There are also way to many of them. The next crash will flush a few out.

California

Pros

Sunny

Physical beautiful

Cons

EQ

Fires

Wind

Landslides

taxes

40 million people

freeways/traffic

crime

pollution

state gov’t

Hollywood

home prices/rent

RE agents

zoning laws

about 80 more in other words I guess 2 out of a 100 isn’t bad???

Looks like Americans are getting smarter. Less and less are willing to buy at the most expensive time.

https://www.marketwatch.com/story/this-chart-shows-fizzling-momentum-in-the-housing-market-2018-11-12?link=sfmw_fb

“13% of americans are planning to buy in the next 12 monthâ€. Lol

At this point you can wish the real estate agents, lenders and RE cheerleaders just one thing… good luck!

Do you think 13% of American plan to buy a home in next 1 year is low? 🙂

What would be the “normal” value

Yep, very low. In Q4 2017 it was 24%. Going down quickly.

https://wolfstreet.com/2018/11/14/mortgage-rates-reach-6-percent-sooner-fed-sheds-mortgage-backed-securities-whatll-that-do-to-housing-bubble-2/

6% mortgage rates are coming our way! Woohoo!! Beautiful!

Reminds me of that realtor that gave me a house tour a few days ago. When we talked about rates she looked up to the sky, put her hands together and said “we are all praying there won’t be more hikes next yearâ€.

So that’s how it ends, RE agents hoping a miracle can prevent rates from further going up. At least they got faith and hope!

Give yourself a pat on the back. Five years ago, you could get a fixer in east Manhattan Beach in a good location for 800K. Those are now approaching 2M. South Redondo had then for a little less than 700K. Those are about 1.2M.

But, not all is lost. You can still get into a gang infested area for 700K just a short drive to those South Bay homes you missed because you thought it was smarter to rent.

Now, I am sure you are going to pretend you were in college 5 years ago, but no one believes you.

Correct, it was way smarter to rent instead of buying high. Yeah 2009-2013 was a nice buying opportunity. Yes, I finished college during the last bust. Now ten years later the market is crashing again already. Buy low and win big. Wait and buy, don’t buy(high) and wait. Worked out nicely. Sitting on a large cash balance. I am ready to invest in a nice house when prices go down 50-70%. Experts (including me) expect that to happen within the next 1-2 years! I’ll keep you posted!

Who gives a crap what they are approaching? Only an idiot with more money than sense would pay double for the same house that was selling for 700k a few years ago. I would wait, if someone can buy a 2mill home, they sure can rent in luxury for a while longer. Maybe it goes back to 1 mill and then snatch it up.

goodtimes….JT likes to make up stories. He has never posted that much ever before here…..he must be pretty worried. Most houses havent even reached their 2005 levels and are already going down again. Goodtimes ahead…indeed!

Funny and very telling to watch Logan Motashami’s speeches. He is no longer mentioning the plummeting mortgage applications. He did admit the economy is slowing. “Housing sales and car sales look still fineâ€. Rofl! since he can’t just disappear like our RE bulls here it will be interesting to see his switch when the economy falls into a recession. I have never experienced a market downturn that close and never really followed market commentators. Exciting times ahead. Can’t wait for it.

Talk about disappearing acts, the most vocal bears on this blog have all came and went. Some have returned posting under other names. They were not only wrong, but 100% flat dead wrong. Sitting in your rental and investing in gold proved to be a bad, bad financial move.

Millie, I hope we get those 6% rates soon too. Why not stop there, 8% would be even better. That beach close rental will be paid in all cash. Be careful what you wish for.

Jt is right. South Bay RE is forever changed. Yes, this time is definitely different. The middle class is never coming back here. Even the upper middle class will struggle to buy homes here.

Blankmind! There he is! I was legitimately concerned we are running out on RE cheerleaders!

Sure, this time is different. Prices will never go down ever again. We heard it and dont believe a word. Because, all we have to do is look at some data…..demand is in the toilet, mortgage apps are way down, inventory is up, price reductions left and right, expiring listings, home builders reducing prices, etc. etc.

8% interest rates would be a dream come true! i am already going to be happy with 6-7%!

Millie’s posts are becoming increasingly more belligerent. I suspect there is some serious pressure to buy and Millie knows that the buying opportunity is likely years away. Renting in a not so nice part of town only can last so long. Now it turns into a waiting game and we’ll see who has what it takes.

Blankmind, Just stick around for the next 5 years here. Wait, save and see! Patience is key. Renting for a cheap rental rate can last for decades. Why walk away from a gift?

Millie is happy to live there forever. It’s his wife who hates everything about it.

Jed,

What!? That’s sounds miserable…imagine you want to save money and take advantage of the market downturn but you have your partner on your back trying to push you to buy now!

No way! It’s very important that you and your partner are on the same page and understand the real estate game. Take your time in finding the right partner! Don’t rush into marriage.

Jed, guaranteed Millie’s wife isn’t happy about renting in a bad part of town for the foreseeable future. She’ll be even more pissed when she finds out the house down payment money was squandered investing in crypto currency. Just another reminder that NOBODY can predict the future. Buy RE only when it makes sense for YOU.

Oh boy! Imagine someone would use the downpayment to invest in crypto. Way too risky.

Here are some guidance to play the real estate game right:

1)Don’t partner or marry someone who isn’t on the same financial wave. In order words, a spender doesn’t match well with someone who lives frugal, saves and invest in smart ways. Smart ways would be to save in good times and invest when markets are down

2) don’t waste your money on overpriced real estate. That applies to renting and buying. I wouldn’t want to rent for market value or pay for a nice condo or SFH. There are smarter ways to do it. My rental rate is dirt cheap (realtors don’t believe me, I scanned my lease agreement and blacked out some personal stuff on it) that helps to prove it.