Mapping out the Los Angeles Gentrification: 10 years of home price changes in Los Angeles County.

There was a story that I read recently about a man living in Venice that rented out his apartment and then lived at his office for 500 days. Why? Because the rent is too damn high! The LA/OC mega-metro area is now ranked as having the highest rents relative to what the locals make. So it was no surprise to find out that someone took the next logical step of renting out their Venice apartment and simply camping out at work to save up some cash. This is of course is an extreme measure but there are countless others having to double and triple up with roommates just to get by. The idea that somehow sky high housing costs are good for the economy is a misnomer. All that happens is more money is sucked into the real estate sector. Housing is shelter at a basic level whether you own or rent. Even for those that own, you have to sell to unleash that hidden equity. And as many Taco Tuesday baby boomers are finding out, many won’t sell because their adult kids are moving back in with big student debt and are having a tough time affording local market rents, let alone venturing out to buy a $700,000 crap shack. There has been a massive disparity in home price increases over the last 10 years in Los Angeles and mapping this out is really fascinating.

The uneven housing recovery

The idea that someone with a middle class income was going to buy a Beverly Hills mansion even in the midst of the housing crash was unrealistic. However, in many areas that were thought of as untouchable, prices did crater and took a big hit. Even in prime areas but let us be real. A $3 million home going for $2 million is not going to help most of the regular cubicle hamsters.

Since we are now in investor driven housing version 2.0, many people are scrambling to look at what they can do to get a piece of the action. Sales volume still remains low but so does the available inventory. In some areas, foreign money is buying a good number of homes. In other areas, flippers are still at it trying to squeeze out those last drops of profit.

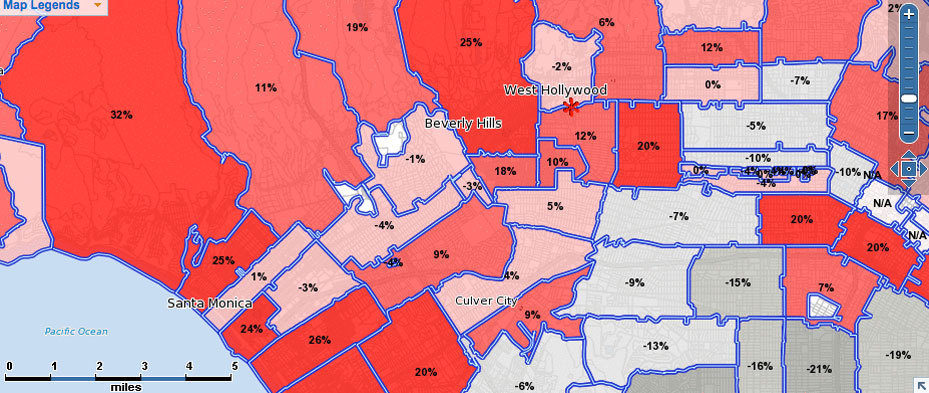

Let us look at Los Angeles home price changes over 10 years. First, it might be useful to look at the Westside of L.A.:

Source:Â Property Shark

Red is good in this case. The closer you are to the beach, the better real estate values did over the last 10 years by a wide margin. But you’ll also notice just even a tiny move in, price gains aren’t all that spectacular. Just take a look at Downtown and adjacent areas:

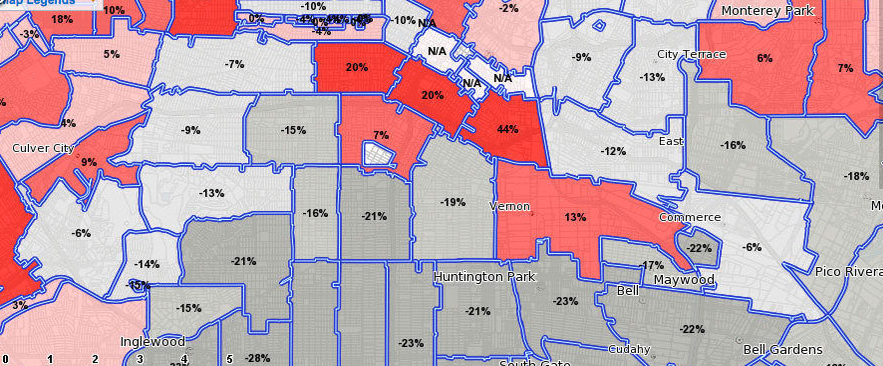

You notice that most areas around Downtown haven’t fully recovered over the last 10 years while the further west you go, not only have prices recovered but are making new peaks. It doesn’t mean that your beard sporting hipster is now going to afford a Santa Monica pad. Take a look at places like Huntington Park and Bell.

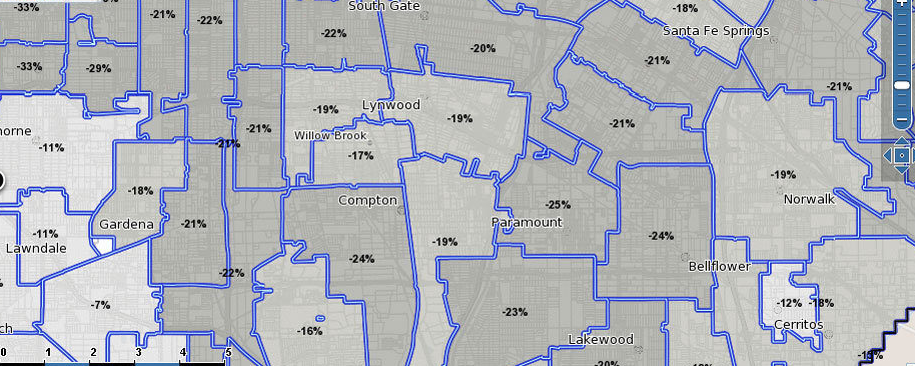

If you look at South L.A., the trend is even worse:

All these areas are still a far cry from their peak prices. We’ve highlighted Compton deals for you in the past. Gentrification or not, the recovery is definitely not even. At least from looking at things in a map format, the key driving force is the ocean when it comes to boosting home values. But there is only so much beach property and you have 10,000,000 people living in Los Angeles County alone. Most do not live near the beach.

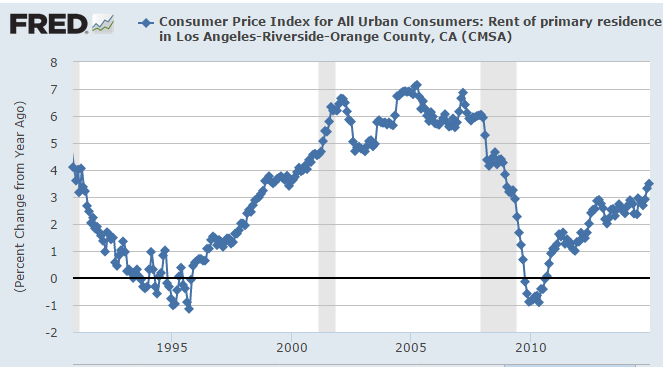

And rents are up across the entire region:

The CPI examines the owners’ equivalent of rent and it is moving up in a strong way. Can this trend continue?  Hard to tell but the end outcome is showing strains on living behavior: roommates deep into your 30s and 40s, multiple incomes/families under one roof, adult kids moving back home, working professionals going into mega mortgages just to buy, and giant chunks of change for rent. The above maps should clearly show that the gentrification trend does have limits.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

49 Responses to “Mapping out the Los Angeles Gentrification: 10 years of home price changes in Los Angeles County.”

The homeless population in LA county has risen 12% in the past 2 years.

Stagnant wages and high rent

The NEW HOMELESS are the “OLD Middle-Class”.

==================================

Channel-2-News(ABC) reported two nights ago that more than 250,000 HELOC Loans (2nd mortgages) will be RESET in the next 24 months and this will TRIGGER A Wave of Foreclosure Action.

(May 12, 2015)

=======================================================

“According to RealtyTrac, 3.3 million homeowners nationwide have a HELOC that’s scheduled to reset in the next four years, and 250,000 of those are in Los Anglees and Orange counties. That’s the largest number of HELOCS of any metro area in the country.

=======================================================

STORY REPORTED HERE:

“SoCal Homeowners Should Brace For Possible Boost In Home Equity Payments”

=========================================================

http://losangeles.cbslocal.com/2015/05/12/socal-homeowners-should-brace-for-possible-boost-in-home-equity-payments/

Oops – Correction:

Channel -2 News is CBS for Los Angeles

Wait until the new train to West L.A./Santa Monica comes online.

Then the maids from Central L.A. will be able to take the train to work. This will raise the value of property in the Washington Boulevard/Marina Del Rey area to new heights.

Fundamental issue:

99.9% of the instant gratification public doesn’t read blogs like this one, thus research and education pertaining to current market conditions are left to Suzanne the Realtor and/or hysterical main stream media articles who can only repeat the party line, “real estate only goes up”.

http://la.curbed.com/archives/2014/04/new_maps_show_exactly_how_polluted_every_la_hood_is.php

High correlation between less polluted areas and property value growth.

Now, that’s interesting!

High correlation between negative property values and “diversity.”

Just a thought

VicB3

There’s a strong correlation between pollution and diversity because in the first half of the 20th century, LA was a very racially segregated place, where “whites only” areas were developed, leaving the rest of the market, which was mostly older houses, to people of color.

A look a the HELOC maps of the 1930s will show that the current ghettos were, basically, the old ghettos. Some notable exceptions are places like Venice and the South Bay.

Not only were minorities poor and suffering racism in housing and work, they also lacked political power. So, consequently, a lot of the dirtiest industries ended up near these communities. Freeways ran through poor communities because they lacked political clout. There are still houses that abut freeways – people got screwed. The reverse is also true – lacking money, people settle for what they can get, and that’s often a house near a toxic waste environment.

This isn’t a random thing. It’s racist oppression. You’re just looking at it with a colorful map.

Everything you’re describing happened — in the 1970s — in Hawaii — especially Honolulu…

Other than in Honolulu, prices didn’t really pull back.

Delayed family formation, kids in with their parents… all the rest… you bet.

It was a running joke forty-years ago about Japanese boys still living with mom — into their late thirties. (The Japanese were the only ethnicity that had parents — in numbers — who owned homes and had island resident adult children. Caucasians left the politically-economically hostile state en masse; the other ethnics were simply never written up in the local newspapers.)

[With 25% of the population, Japanese Americans held 100% of the Civil Service secretarial positions in the state government; their husbands won all of the construction contracts — a linkage that even the local newspaper brought up.]

Generations have passed. The result: housing turn-over has collapsed. The epic contraction in Tokyo (1989-90, peak) put Honolulu into a generational real estate depression/ contraction.

The Red Chinese simply skipped that Japanese cultural bastion — and now “San Francisco is Honolulu/ Vancouver, BC”

Over the next generation, one should reasonably expect the real estate brokerage craft to contract 70% to 80% in fits and stops.

There was a time when every fifth soul in the Islands had a real estate license. Then, there was a period when every soul with a real estate license needed a fifth.

Everything that has a beginning has an end.

“There was a time when every fifth soul in the Islands had a real estate license. Then, there was a period when every soul with a real estate license needed a fifth.”

Wow. Blert made a joke. And a good one. This must portend some kind of black swan event in the near future.

What are the economics of living on a boat in So Cal.? Marina slips around San Rafael in the Bay Area were $10-12 per foot when I had my boat up there ( didn’t live on it, it was too small). Still a decent boat ( used) 35-40 feet can be had for under $200k and a really nice one (45 to 50 feet) for way under $500,000. Don’t need furniture, built in cabinetry, 2 bedrooms/baths and including cockpit 1000 or so square feet of living space plus its a boat. You can go cruising. Trawler hulls and sailboats don’t go fast but don’t use much fuel either. Financing is different and there is no appreciation but compared to rent you do have some resale value.

My recollection is that City of LA (Marina Del Rey Harbor) has realized there is more money to be made by accomodating the super yacht society – towards this end – replacement of small slips with large slips and plans to kick out all the people living in their small boats. Kind of like a McMansion, harbor-style.

http://www.mdrcondos.com/living-aboard-a-boat-marina-del-rey-ca-patch/

I’ve been looking into this recently. It’s cheap to the point where I’m thinking about getting a slip and NOT living on the boat. A really nice used 30′ cruiser can be had for less than $100k, with a slip going for ~$450/month in San Diego. That’s a lot less than a mountain cabin. Taking a private boat to the channel islands for a weekend is WAY more fun than a snowball fight or yet another pool party.

I know, “best and worst day in your life”, etc.

Make that “two best days…” Whatever, I want a boat.

Around 2003 a friend of mine bought a 30-something foot sailboat for around $3000 and had a slip at some horrible yet extremely cheap slip in Oxnard. If I remember correctly, he was paying well under $300 a month. I remember carefully having to walk over broken boards on the dock and stepping over the bird crap. It was a cool setup for a single guy in his early 20s.

I know, BOAT = Break Out Another Thousand, but how bad could a sail boat be? Especially one that I don’t plan on actually sailing?

A boat is also a lot more headache than a cabin. And it depreciates. A cabin will at least (hopefully) appreciate over time. Why not just rent a boat (or a cabin) when you want to use one? It’s probably much cheaper over the long term. That way, your money can be more wisely invested.

Boat maintenance is a nightmare. It’s a bit like trying to stay on top of substandard housing in a dubious neighborhood. I’ve had 3 fairly large boats over the years. My rules to live by are to never try and live aboard a sailboat – too narrow to be spacious enough, never buy anything with a fair amount of wood. Staying on top of the destruction is near impossible. A Grand Banks Trawler is pretty close to perfect. You don’t live in a cave with them. After ’76 or so they are nearly all fiberglass – a real plus. Buy as much over 40 feet as you can afford.

Housing will crash hard

And TANK HARD TOO! 🙂

A house in Upland just sold for 65K less than comps. I’m seeing 10% plus drops in suburbs and IE closing prices on Redfin. Not everywhere mind you, but the momentum is their. And remember we’re looking at a 50% increase in the FED rate by the end of the year if we get the 2 expected .25 basis point increases. A SGV broker friend said sales volume is down 40% YOY and 2014 was significantly down from the mania of 2013. We’ve had a busted Spring Selling Season 2 years in a row.

You we’re right last year Jim, just not in the way you thought you’d be. Volume tanked first. The price tank will likely be protracted, but sitting tight for 2-3 years sounds like a much better option than overpaying by 25%.I thought last year was analogous to 2007 and I don’t think I was necessarily wrong, it’s just that the volume crash is taking more than a year this time. The specuvestors are out, but you still have a trickle of retail and knife catching flippers. Once that shallow pool is drained price action will really pick up.

Patience Jim. The next window is coming 🙂 Read this Mark Hanson article to cheer yourself up! http://mhanson.com/archives/1788

The uneven distribution of housing appreciation/recovery doesn’t seem unusual in L.A. There simply are vast wastelands in Southern California’s L.A. Basin, and I’m sure if you asked the people that live in those wastelands, they would gladly take the beach community or a hill location if they had the means. L.A. has become the U.S. version of Rio de Janeiro, where the glitz, glitter, are interrupted by the slums/shanty towns on the hillsides surrounding the city, only in this case, the slums occupy the flatlands of L.A.

“L.A. has become the U.S. version of Rio de Janeiro, ”

…. a shocking statement made more shocking because of the truth it contains.

Very interesting observation re: your comparison to Rio. This is very much a symptom of the growing neo-feudalism of the new age. LA provides a raw glimpse of that growing and glaring inequity. But leave it to the gods at the Fed who believe through quantitative easing they can “stimulate” (thinking of a sexual innuendo) the economy.

No, it is not like Rio, the butts in Rio are much bigger than the ones here. Come on over to Oxnard, and I will get you a reasonable house.

Carlos,

Oxnard schools are some of the worst in the state, but I shouldn’t need to tell you this. There’s a good reason it’s so cheap. And, I’d prefer my kids don’t have to work for “cash” on Taco Trucks. Here’s a lovely graph for the families considering Oxnard: http://www.greatschools.org/california/oxnard/oxnard-school-district/

“we are going to be rich”, you don’t understand Mexicans(soCal will soon be one big Mexico, and Corona beer, of course, get use to it). In regards to schools, Mark Twain middle school, in the 90066 zip is a 3 rating and it is surrounded by million dollar plus homes. If you don’t have kids, “what’s it matter”.

@JN, you are correct. 75% of the Los Angeles population had a median household income of less than $75K per year.

Median income for a male in Los Angeles: $28K/year

Median income for a female in Los Angeles: $24K/year

Median household income in Los Angeles: $49K/year

http://www.usa.com/los-angeles-ca-income-and-careers.htm

The L.A. metro area is Third World caliber and gentrification is mythology pushed by people smoking hopium.

Thank you ernst, for a dose of reality. Global elite, majority high wage earners, etc, nope. SoCal filled w/people who bought decades ago, couldn’t buy their RE now; inherited money; working class living many bodies per dwelling, welfare, those making decent $ but live paycheck to paycheck, and “kids” of all ages living w/Relatives, many will never move out. I doubt few will leave CA…family here, ego tied to California, can’t tolerate four seasons, would miss beach, Disneyland, nowhere else to go, etc.

A relative lives in a “highly desirable” CA beach town; many neighbors appear to be people who bought RE decades ago, inherited money, renters who blow a paycheck to live there…seems to be very few “high wage earners” she is aware of.

City of Los Angeles is raising the minimum wage to $15 an hour(30K a year). This includes employers with one employee. The Taco trucks employ relatives that are paid in cash, so it doesn’t apply to them.

And it would appear obvious that the people living in the areas that have not recovered, have not had their incomes recover or even keep pace with the people buying in the 20%+ appreciation areas.

Last time around (2003-2007) thise areas could appreciate not due to income growth, but because Liar Loans were available at 100% ltv to anyone that could fog a mirror.

Now you must be able to document the income to qualify. For those families that change made a big difference in how the communities appreciated.

The moral of this story? Own RE where people really make money.

Good school districts?

@jim, it wasn’t just liar loans. There were 2/28, 3/27, and 4/26 loans which were the biggest culprits. i.e. the first 2, 3 or 4 years at 1% or 2% interest until the introductory period expires then the loan would reset to the prevailing market interest rate. So a household with a $50K/year income could easily squeeze into $500K crap shack for 2, 3 or 4 years until the introductory interest rate expires.

There was a moral to that story, EB.

Housing markets 2015 is like staging cancer. Stage 1 locations,good chance of recovery, stage 2, still a possibly of recovery, stage 3, think of how big a loss can you absorb, stage 4, see CA-New York city?

Appreciation in “elite” zip codes is a red flag. This is not a rising tide lifting all boats. It is a sign of polarization (unequitable wealth distribution); and continues to increase. Will it ever end?

I look at the Property Shark maps and read the comments wondering where (if any place) there might be hidden gems. OK, it’s near the water but remember when Venice was a ‘hood to avoid without armed guards? Some of the North Santa Monica areas and thereabouts seems to have avoided any appreciation. Also, Culver City and areas around it seem appreciation immune. Might these be an area to go “hunting” in for value plays? I guess Oxnard if you like Carlos’ siren calls.

Tujunga – Great air quality, a lot of houses of all sizes – small single family homes to large ‘architectural’ mansions. Prices that aren’t entirely insane (by LA standards), lots of empty business fronts waiting to become the cool little coffee shop. 15 minutes to downtown, 15 minutes to Burbank, 15 to Pasadena, 10 to Glendale.

It’s Eagle Rock but with much better views – and for the moment, still off people’s radar. They have either never heard of it or imagine it to be ‘biker/meth town’ (which it was fifteen years ago)

Tujunga? Air quality can be poor–especially during fire season since it’s at the base of the San Gabriel mountains. Median household income: $58,001. Median home price $510K. Here’s a 2 bedroom 2 bath tract house built in 1953 being offered at $545K:

http://www.zillow.com/homes/for_sale/Tujunga-Los-Angeles-CA/20100596_zpid/27484_rid/1_pnd/days_sort/34.468637,-118.165855,34.085649,-118.838768_rect/10_zm/2_p/

Wonder what the water bills are going to be with all the kids moving back in with those long showers?

I found the classic Golden sarcophagus: https://www.redfin.com/CA/Santa-Monica/1243-Princeton-St-90404/home/6763092

You can even see the Old Woman owner in one of the photos. She’s sitting there, looking sad and lonely. Her house is worth nearly $1.5 million, yet it’s in need of TLC.

Interesting find, especially with the woman sitting in the pic.

Just curious…do you think a flipper will buy that and gut it/remodel with 75K of work …put it back out there for 2.2 mil?

I dunno. Two houses on that same street, less than half a block away, were sold in 2013 for 1.24 million and 1.18 million. And they were already fully restored. See: http://www.realtor.com/realestateandhomes-detail/1250-Princeton-St_Santa-Monica_CA_90404_M27411-71685?row=3

So asking 1.425 for a tear-down is a stretch. But note how the listing emphasizes that the area is zoned for multi-unit housing — condos and townhouses.

That is a lovely, small stucco Spanish Colonial, though I can’t begin to see $1.4M for it. I bet the older lady in the picture will be very glad to get her hands on the money-or, at least, her kids will be very glad to see her get her money out of the house.

The first thing I’d do to restore this house is remove the tacky enclosed front porch, which really detracts from the appearance of the house. I’d do that even before I tackled the outdated kitchen- that is a 50s vintage stove sitting there that SOME folks would pay a lot of money for. Other than those two things, the house looks great, and has all the nice vintage details intact. With luck, there is at least one bath with beautiful vintage tile.

And check out the property tax – less than $100/month! Prop 13 Rulez…

http://losangeles.cbslocal.com/2015/05/12/socal-homeowners-should-brace-for-possible-boost-in-home-equity-payments/#comments

“According to RealtyTrac, 3.3 million homeowners nationwide have a HELOC that’s scheduled to reset in the next four years, and 250,000 of those are in Los Anglees and Orange counties. That’s the largest number of HELOCS of any metro area in the country.”

“SoCal was the hotbed for home equity lines because so many people gained so much equity in their homes so quickly that it was very tempting to take that money out 10 years ago,†RealtyTrac Vice President Daren Blomquist said.

But hey, since 2012 everyone wants to live here, it’s international global world class coastal prime and this time REALLY is different so no worries bro.

http://www.latimes.com/business/la-fi-santa-monica-airbnb-rental-law-20150513-story.html

“Santa Monica’s City Council passed one of the most restrictive laws in the nation on short-term rentals Tuesday night. Or, more accurately, the council promised to enforce laws that are already on the books, but are largely ignored.”

“What does that mean? It means an estimated 1,400 of the 1,700 short-term rental units listed on three big websites – Airbnb, VRBO and Homeaway – in Santa Monica will now be prohibited. But it also means people who rent space in their homes can do so legally.”

I’m sure none of those units were purchased for the express purpose of short-term renting. Nah.

http://www.latimes.com/business/realestate/la-fi-santa-monica-council-oks-tough-rental-regs-20150512-story.html

“Santa Monica comes down hard on Airbnb; will crackdown spread?”

“At the event, several Santa Monica residents said short-term rental sites have helped them afford to continue living in the pricey beach city by renting out their house when they travel.”

“Los Angeles officials are considering new regulations as well, and short-term rental advocates fear that Santa Monica’s action may lead to a broader crackdown.

“That is one of our tremendous fears,†said Robert St. Genis, spokesman for the Los Angeles Short-Term Rental Alliance, a network of vacation-rental property managers. “We don’t want to see this end up in Pasadena, Manhattan Beach, you name it.â€

Leave a Reply