Just Because you Crawl Today, Doesn’t Mean you Won’t Walk Away Tomorrow from a Home: The Next Chapter in the Foreclosure Crisis.

This weekend I’ve gotten many e-mails talking about the walking away “myth” and an onslaught of articles now addressing the issue. For those of you that read many of the economic and housing blogs, this is something you are already familiar with. In fact, there has been a sudden shift of trying to define what constitutes an actual “walkaway” from a home. The underlying assumption of a walkaway is when a homeowner who has sufficient income to pay for a mortgage chooses not to do so for various reasons. Typically, the primary reason is being underwater, that is owing more than the home is worth. There are a few articles that came out this weekend talking about walking away as being a myth:

In mortgage market, ‘walkaway’ homeowners may be urban myth

Mortgage Holders Find It Hard to Walk Away From Their Homes

Saying that walking away is a myth only provides a narrow perspective on the shifting psychology which is occurring in the current housing market. I think these stories were spurred by the high profile case of Jose Canseco walking away:

“Even so, the idea that some people are simply refusing to pay their mortgages has gripped the popular imagination. The notion picked up momentum in the last few weeks after “Inside Edition,” the celebrity-focused TV news program, reported that Jose Canseco, the former American League most valuable player who made millions during his baseball career, abandoned his $2.5 million mansion outside Los Angeles to move into a smaller property.”

“You look at the Jose Canseco issue and say that it’s a walkaway, but he is probably the only person on his block that did that,” said Robert Padgett, director of loss mitigation for Freddie Mac. “Those types of stories garner a lot of attention,” he added, but they are “isolated occurrences.”

The story was also picked up by the Wall Street Journal:

“Mr. Canseco, 43, who retired in 2001, told the celebrity TV show “Inside Edition” that it did not make financial sense to keep his 7,300 square-foot home in the Los Angeles suburb of Encino. “Inside Edition” said it had foreclosure documents showing Canseco owed a bank more than $2.5 million on the house, Reuters reports.

“I do have a judgment on my home and it to me is very strange because it didn’t make financial sense for me to keep paying a mortgage on a home that was basically owned by someone else,” he said.”

Clearly the situation here is unique but the mentality behind it is something we are going to have to get used to especially here in California. Anyone thinking that people are not going to walkaway in the next few years in California is going to be just as shocked as Ben Bernanke when he stated that the subprime issues were contained. Just because it hasn’t happened on a large scale doesn’t mean it won’t. Mr. Canseco also gives us the insight into his walking away:

“Canseco said the foreclosure was not a difficult issue emotionally. But he sympathized with the millions of other Americans who have already lost or face losing their homes because of soaring interest rates on sub-prime loans

“I decided to just let it go, but in most cases and most families, they have nowhere else to go,” he said. It was not clear from the “Inside Edition” report, Reuters reports, where Canseco was now living. Canseco said a good portion of the money he earned in his heyday went to pay for his divorces. “I had a couple of divorces that cost me $7 or $8 million,” he said.”

Given the cost of his liabilities, walking away may have been the wisest financial option. Interestingly enough, you can see the psychology of so-called affluent folks and how they view themselves as “prime” owners while those that lose their home due to financial strain or having subprime loans is somehow a different beast. If you are to read the articles, you will see that most people that do intentionally stop paying their mortgages are usually speculators. But again, how in the hell does the industry know who consciously decides to stop paying and who stops paying because of financial strain? It is the case that mortgage lenders have a hard time getting a hold of their own clientele! How much? How about 30 percent in some cases:

“Mortgage lenders hunting for delinquent homeowners who have dodged their phone calls and letters are employing aggressive new methods to track them down, potentially making every knock on the door or fancy envelope seem like part of the pursuit. Even wedding invitations are suspect.

…Wells Fargo estimated that it had no contact with about 30 percent of delinquent homeowners who went into foreclosure in 2006. Last year, it began testing envelopes in bold or unusual colors or resembling wedding invitations.

Last month, it began experimenting with offering $250 gift cards to delinquent borrowers who had been unreachable, said Joe Ohayon, a Wells Fargo vice president.”

Of course these people are not walkaways but simply subprimer’s who are “bad” while “good” affluent folk will keep making payments on their home. Anyone believing this is in for a world of shock these next few years. Keep in mind Southern California was still positive until the later part of 2007! In fact the Southern California region was up on a year over year basis up until August of 2007:

August Data:

Median Southern California Home Price: $500,000 (year over year change, +2.7%)

Now of course, I am being very specific here and going out on a limb saying that California will see a large increase of folks intentionally letting their mortgages go even if they can pay for it. There is a tipping point emerging where people are pushing themselves away from heavy liabilities including buying large SUVs because of the associate costs. It is the case that California has a ridiculous budget short-fall that is now at $20 billion which by the time we hit next month, will probably grow another billion or so. How is it the case that when these lenders cannot reach these people they have an idea behind the psychology of those defaulting? How do they know? It isn’t like you are going to pick up the phone, call your lender and say, “hey there lender. I overpaid for my home two years ago and guess what, I think I’m going to stop making payments. Is that okay with you?” You either are betting that lenders have better data than we do but clearly the way the market is imploding they had no freaking clue what they were doing and dishing out mortgages to anyone so I take their data with a grain of salt. And let me present to you the biggest leading indicator of why walkaways will be catching on:

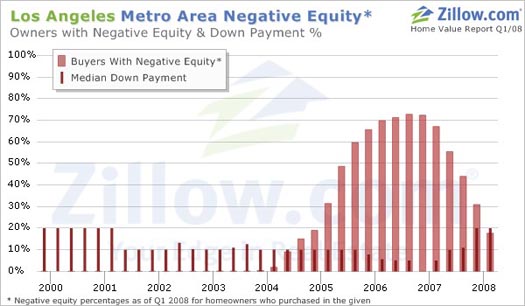

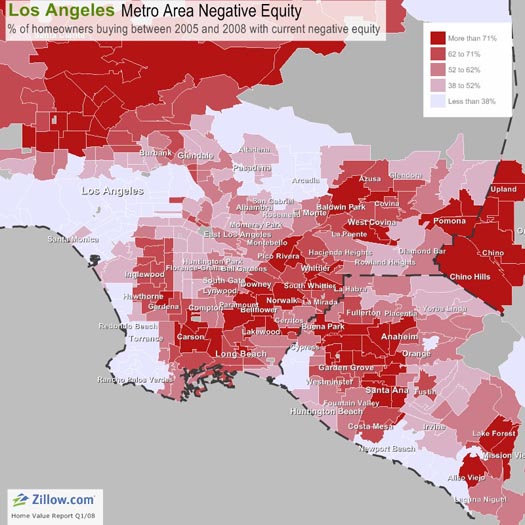

*source: Zillow

*source: Zillow

As you can see from this chart, we now have folks that bought from 2004 in negative equity positions. But wasn’t Southern California in the green in August of 2007? The rules have changed incredibly fast and that sticky market correction went out the window. Assuming that California has more to decline (it is already down according to the California Association of Realtors by 30% from a year ago in price from the peak) this chart is going to push further back. Each subsequent decline by definition is going to put folks in more negative equity positions. Yet according to some folks homeowners don’t have the mindset of investors:

“In fact, researchers say the rich are no more or less likely to walk away – “ruthlessly default” is the economic term for it – than those of more modest means. A person’s credit history is usually a better indication of how he will behave than his income. How much money a person put down on the house when he bought it also makes a difference.

Investors “are going to default right away because they have negative equity,” said Robert Van Order, an adjunct professor of finance at the University of Michigan. “But that’s different from people who moved into the house.

Owners who live in their homes do tend to default more when home prices fall. That is because being under water leaves borrowers fewer options if they run into financial trouble. When prices are rising, borrowers can usually sell their houses for more than they paid or refinance their mortgages.”

So what is the difference? That investors default quickly while homeowners default slowly? Is this like the soft landing argument? These folks are going to be in for a major shock. A large part of California and her economy was tied to real estate and the housing boom. Agents, brokers, construction workers, and others who were tied to this market had high incomes and good credit scores. What jobs are going to pay their $4,000 or $6,000 mortgages? And the credit score is dubious at best. Heck, even Warren Buffet isn’t 100% prime:

“Fortune Magazine reported that Warren Buffett has a FICO score of 718 (2008, March 31, The Oracle’s Credit Crisis). How can that be? Isn’t Warren Buffett one of the wealthiest men on the planet?”

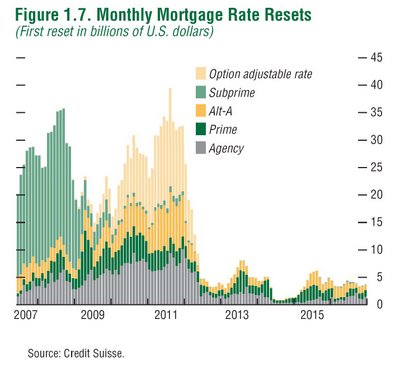

Bwahahaha! Warren Buffet looks like an Alt-A borrower. And we all know how poorly his financial budget sheet is. The point I’m making is walking away is a trend that is going to pick up steam. There is no myth to it. The issue is that there is no reliable data to track who and how many people are walking away. I would venture to say in the current environment that it is a handful. The major pain right now is being caused by those in tighter financial circumstances because they simply have no choice but to default because of lack of income. Yet those Alt-A and prime borrowers are going to be the next wave. Remember the Pay Option ARM problem facing us?:

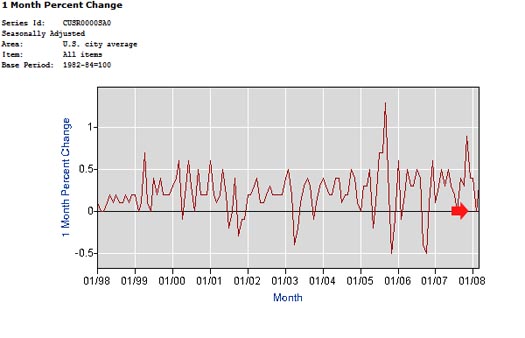

The government would also like you to believe there is no inflation:

Just because something isn’t happening on a large scale today doesn’t mean it isn’t going to explode tomorrow. Now in those articles I didn’t read anywhere that they are denying folks are walking away but they are simply stating it isn’t happening on a large scale. Remember the argument for stated income was for “lawyers, doctors, and high paid folks” who simply didn’t want to disclose their 7 figure incomes? We all know how that turned out. Now assuming folks won’t be walking away especially in places like California is the real myth.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

8 Responses to “Just Because you Crawl Today, Doesn’t Mean you Won’t Walk Away Tomorrow from a Home: The Next Chapter in the Foreclosure Crisis.”

Buffet is only at a 718 FICO? Wow…I have about $50B less than him and I have an 814…

BTW, Jose Canseco is now the spokesperson for some RE outfit called “You walk away” that handles everything. Unbelievable.

Interesting. Ironic.

What Zillow’s negative equity map seems to show is that refinancing is more likely inside LA’s city limits than in its suburbs.

Reverse Redlining, anyone?

(No wonder Congress is spouting Chicken Little Solutions.)

I prepare taxes in the Bay Area. 4 of my clients had home foreclosures in 2007. This was out of a client base of 350 individuals. All of these individuals could have kept their homes. They all are still employed with above average income. 2 of my foreclosure clients had purchased 2 homes during the bubble. In both cases the initial home was purchased at the peak. The second home was purchased as the market was on the way down.

The interesting thing is that none of these 4 clients paid tax on the additional income from the cancellation of debt on their 2007 tax return. They all received statements of cancellation of debt from their former lenders (1099A or 1099C). In all cases the debt was “recourse”(re-financed so personally responsible for the debt). But in all my clients the debt was so large and their savings was so small that they all could claim insolvency. Even with their above average incomes. There was no economic damage from the foreclosure. Their credit scores are a little lower but that’s a good thing for them. They won’t be tempted to buy another home in the next few years.

What do you think?

I think you’re right on the money. Just before reading this post, I was chatting with someone and said, “As bad as people think things are right now in real estate, it’s a growing problem that is only going to get worse.”

We need to be clear of about our definitions. Walking away is not necessarily leaving the house and mailing in the keys. A smart person will not walk away when they can stay for free. It is a matter of choosing between food, fuel, access to a credit card or paying for a declining asset. Why leave when you can live rent free? The bank does not want your property when it owns more than enough property already. Of course this extends foreclosures over the normal 1 year horizon. The government’s new program only encourages to stop paying. You must be 60 days delinquent to qualify for some programs. So now you will hear stories of how people are “sticking it out”. I personally know people who are living rent free. If you ask them they will tell you that they are “selling their house”. Of course this reveals a lot less than walking away and paying rent.

The fed will not go after you walk away from the original purchase loan for income on the debt that was not enforced.

But California did not change its rules. So you would have to declare the debt as income.

That will be a nice surprise for the walkaways.

there is a scenario that i think is very likely but not documented in those sites:

simply, change of mood in capitol hill etc…they change the rules of the games…

THEY WONT LET PEOPLE WALK AWAY.. people who walk away will still be financially responsible personnally. they will have to pay. of course, people with no income at all and deeply underwater wont be affected, because anyway they CANT pay, but for all the others, they will become debt slaves

What is wrong with this articles lately ( 2 links mentioned above). I read the first from LA times. And where the heck is that good old jurnalistic style one opinion on one side another one on the other side and the poor sheeple don’t know what to thing anymore. You know, like in ol’ days some say “they are walking away” some say “they are not wolking away”. No single “walkig away” expert. No surprise this newspapers are all going straight to the trash can.

Leave a Reply