Investing for the Future: The American Housing Market. The United States has Enough Housing for Years. Will this Economy Change our Habits?

One reason homes are having a tough time selling is because of the credit crisis. Yet another less talked about reasons is that we binged at the housing trough for much too long. And now there is talk regarding a bailout for developers which goes to my SIIV argument; Super Ignorant Investment Vehicle which states each subsequent bailout is progressively dumber than the previous one. Builders went ahead and flooded the market with so much new housing that they in effect have put themselves out of business. Sure, this housing downturn is a complicated multi-faceted bubble popping yet what we have done is spent our future in the present. Whether we charged everything up on credit cards to pay tomorrow or bought cars with 7-year terms, instant gratification was the mantra of the past decade.

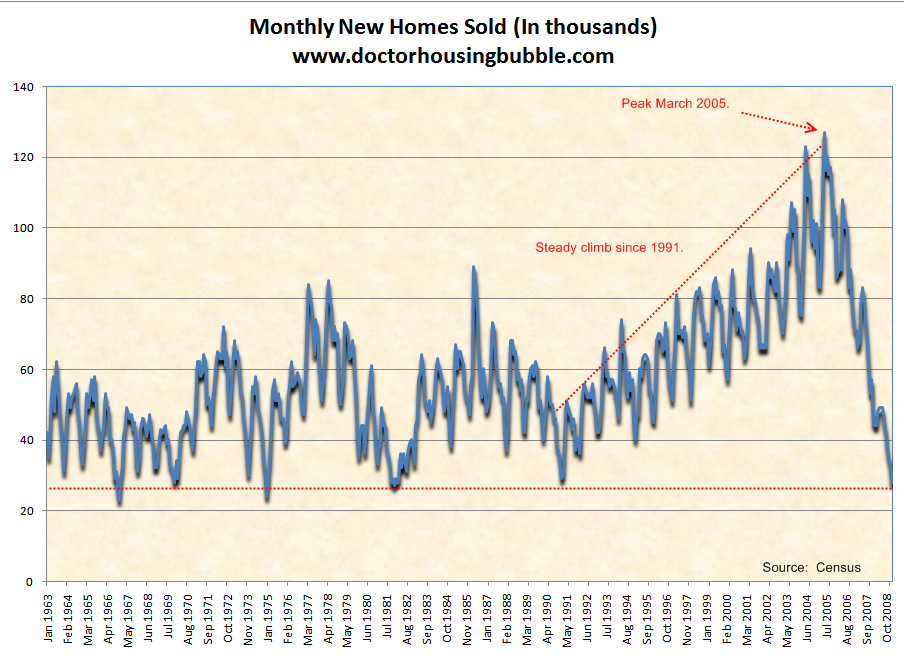

This already is shaping up to be the worst recession since World War II and possibly, the Great Depression. Just because we won’t see soup lines or dust bowls, doesn’t mean that the millions of families who are losing their homes or Americans losing their jobs is any less painful. And just because you don’t see it, doesn’t mean it isn’t there since a silent depression is already occurring. Today we’re going to look at new home sales from various perspectives to understand that interest rates and financing are simply one piece of the puzzle. In relation to new homes sold and housing starts, the trend has been upward since 1991 and reached a peak in 2005. Even the recessions of the early 1990s and 2001 did very little to change this trend. When we look at the charts, the pattern is rather apparent:

*Click for sharper image

This chart looks at the monthly new home sales in raw numbers. Keep in mind these are not seasonally adjusted and you have to account for population growth which only makes the recent steep decline more stunning. We’d have to go back to the early 1980s to find a month as bad as the one we’ve just had and that is not accounting for the population growth over nearly 3 decades. As I’ve mentioned before, the growth in new homes sales started strongly in 1991 and peaked in 2005. It would seem that nothing would stop the housing juggernaut. The fascinating thing to note is months of supply is still high:

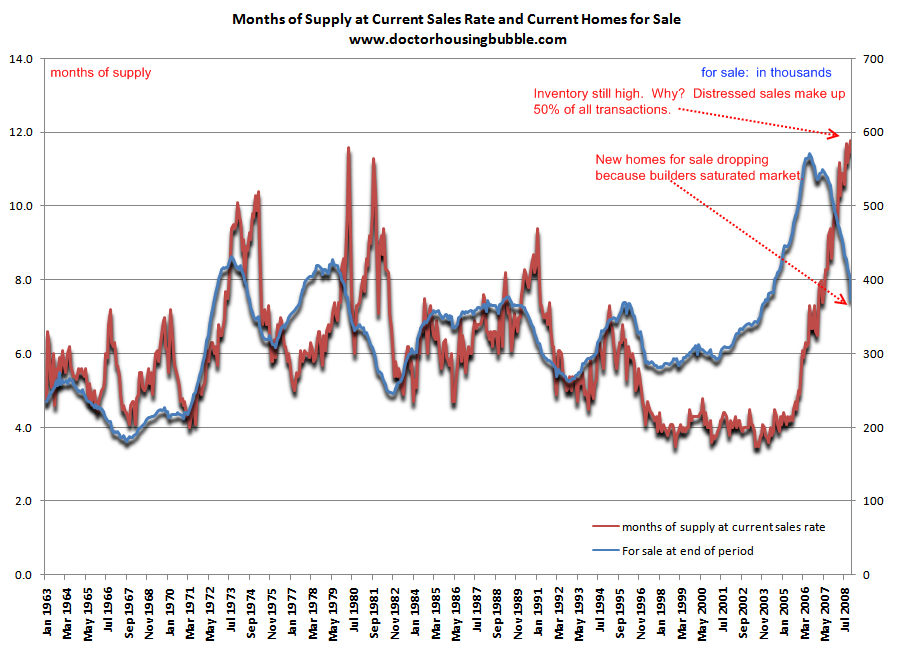

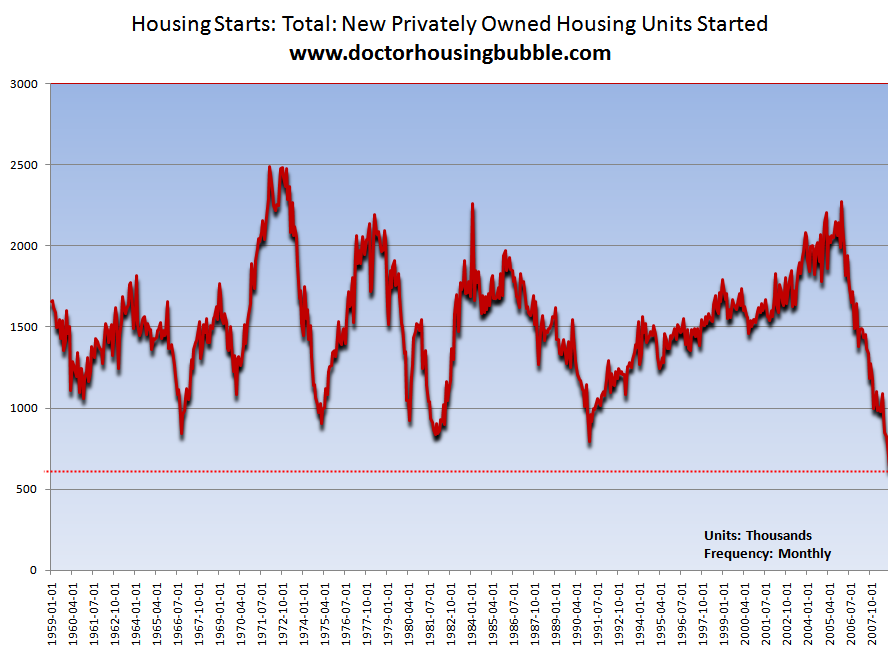

Now why is this occurring? First, last month approximately 50 percent of all homes sold were distressed sales. Rock bottom priced REO homes are competing with higher priced new homes. So logically, you would assume that less new homes hitting the market would cause monthly inventory to fall yet they are now competing with resale distressed properties. Price is moving the market. The above chart highlights this point very clearly. As you can see, the amount of new homes on the market started falling as of 2005 yet inventory is also rising because very few new homes are selling. The average amount of new homes for sale since 1963 is 329,000. Last month we came in at 374,000. At the peak in 2006 we had 572,000 homes for sale at a seasonally adjusted rate. That just doesn’t compute. Take a look at the overbuilding that occurred since 1991:

The drop in housing starts is rather drastic. This actually was a leading indicator of future market distress. After all, if you are an investor you need to make sure the numbers work before you set out and build a project. So the precipitous drop in 2005 told us something was coming our way. The drop has been non-stop. The trend should continue if you simply look at the other charts above. If nearly 50 percent of sales are happening with homes that are already built and are in distress, why would you want to jump in to compete? You also have to compete with borrowers trying to sell their homes which don’t show up as distress but very likely are marginal. That is, maybe someone lost a job and needs to sell a home yet has been current on their payments. Or you may have people that bought homes pre-bubble era who have more wiggle room in price and may need to sell for a variety of reasons. It is important to understand that many of the REO sales are one time deals. That is, in healthier times, someone selling their home was usually buying one as well. A large number of homes sold produced 2 transactions. With many REOs and distressed sales today, we just have one.

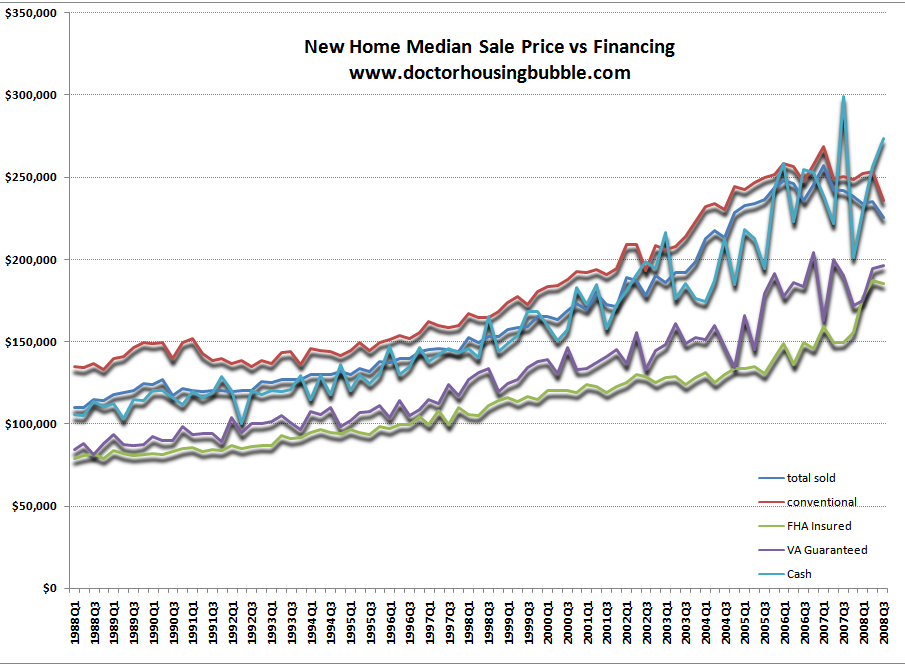

In addition, prices on new homes are more difficult to push lower. Take a look at the median sale price for new homes:

Yes, prices are falling yet nothing compared to the overall market. If anything, these prices are resilient. That is probably another reason so few new homes are now selling. Why would you want a minor discount when you can get an REO for 30, 40, or even 50 percent off?

The problem with this is that for nearly 2 decades, we have become a finance, insurance, and real estate economy (FIRE). I talked about this a very long time ago and had a hard time understanding how our economy could function by having 30 to 40 percent of our growth occurring by employment secured by real estate or real estate related fields.

What can we take away from the charts above? Basically we have cast our nation’s lot with housing and since housing is busting, we are crapping out as well. It is simply a logical outcome. When the FIRE economy was say 10 percent of our employment sector, then a housing bubble could only run so far. We took this housing market to the dangerous extreme that we are now facing.

The Daily Changes we will Face

To satisfy this unhealthy obsession new toxic mortgage products like option ARMs were created which will now be the next ticking time bomb. These mortgages provide no sustainable safety and stability to the long-term health of our economy. This monthly nut obsession, that is relying completely on what you pay a month, is one of the psychological problems with our society and Wall Street exploited it. What did they care if you were going to default? That is the problem with how the crony capitalist view the current system. They care not about the sustainability or longevity of our economy so long as they get their immediate fees. In fact, some of the absurd alphabet soup of products had no useful purpose aside to generate fees for the originator. One basic premise of capitalism is that the market will decide what is the most useful product and all others will either need to compete or perish. With foreign automakers, Americans have voted with their wallets and have pushed aside domestic producers. American autoworkers now have to adapt or perish.

Yet that is the problem with our current system. It was never capitalistic. Hasn’t been for a long time. The government has been operating as some quasi-kleptocracy. That is, sacrificing the good of the masses for a select few by nepotism or other forms of unhealthy economic growth. The case of Bernard Madoff and his $50 billion Ponzi scheme is a perfect example. He targeted for the most part, wealthy investors and played into this deep desire; that is, I have something special and since you are part of the special class you have a key to enter. We run along a spectrum of full on speculation and greed (i.e., the Roaring 20s, tech bubble, housing bubble) and government intervention to sooth the pain (i.e., social programs brought on during the Great Depression like Social Security and decades later, Medicare). Striking the balance is a difficult job yet that is why we have certain agreed upon regulations (meaning you have to enforce them) to stop us from our darker demons. You would think that after the tech bubble and our current housing bubble we would have learned something.

So what does this have to do with new homes sales? A lot. Many of the large contributors to both political parties were homebuilders. Did anyone even ask whether this was good for the country? Of course not. Politicians were bought, permits were signed, and then we now have our vast land of new sub-divisions in many cases sitting empty alongside commercial real estate projects that were also setup to cater to an audience that isn’t even arriving to the show. Maybe in a few years they will but certainly not now. Look at Florida, Nevada, Arizona, and parts of California and you’ll see why simply building for the sake of building was an unhealthy obsession.

In early 2007 I started uttering the words “Great Depression” simply as an observation. I took some heat for that at the time. Now, all I hear on the mainstream media is “how can we avoid the next Great Depression?” Each month when data is released we hear, “…worst data since the Great Depression.” How can so many economist have missed this when independent bloggers with no financial backing were able to see it miles away? Simple. It became less about economics and more about an unhealthy bubble. Bubbles are fueled by psychology. Those that understand consumer behavior can see the pattern emerging. Those that simply rely on data are bound to put on academic blinders and miss the big picture. Ben Bernanke is a perfect example. No doubt, he has expertise but even in 2007 he was certain the subprime market was going to be kept in a silo!

If there is any good news it is this, we are well into this unavoidable recession. Keep in mind that in the past, recessions were accepted just like the seasons. Spring would come after winter and so would the new cycle. Only in recent times have we had this psychological need to avoid facing reality. Want that car but don’t have the money? Forget saving for a few years and lease it. Can’t afford a starter home? So what, get an option ARM and buy a big McMansion. Your kid is tiring you out? Load him up with Ritalin so he can relax. Not happy with your weight? Take a pill instead of hitting the track. As usual, moderation is the key but looking at our patterns, do we excercise moderation? Wall Street was a sympton of this and took everything to the extreme. It is up to us to learn from this crisis. It will be painful and long. Yet we can educate ourselves and radically change our perspective or we can repeat the mistake later in the future. This means punsihing those on Wall Street even if it takes years. This means stricter enforcement. Homebuilders are learning the hard way. The above data tells us this. Was it really healthy for our economy to be so reliant on real estate? Clearly it was not.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

23 Responses to “Investing for the Future: The American Housing Market. The United States has Enough Housing for Years. Will this Economy Change our Habits?”

I am stunned by the depth and rapid speed that the recession is spreading by.

We always spend Christmas in Central Calif. , on the coast. The restaurant that we have Christmas dinner at for the last 5 years, is upscale, and always very crowded. This year, there were many vacant tables, and not even a line to get in.

The waiter confirmed that this is “very unusual”. Nearby Cambria is experiencing many commercial bankruptcies. Retiring store owners can not find a buyer, so they are simply selling the inventory, and closing down. The only Chevy dealer in Fremont is closing down, after 70 years in business.

Anyone who does not see the economic tsumani arriving is blind.

The economic devastation of the next 2 years will be beyond what most people can currently concieve.

Comrade Housing Bubble,

Not only does the supply of housing outstrip demand, the housing types built were wrong and in the wrong location. In a study I read recently, the demand for large homes on large lots (McMansions) in 2025 will exceed the 2003 supply. That means that we could cease building these types of homes and we would have more than enough, even with growing population. In addition, the study said that vehicle miles traveled increased at 3 times population (sprawl). Subdivisions seemed to sprout up in the unlikeliest of places. Not coincidentally, McMansions built in BFE are also where the highest rates of foreclosure are. These derelict suburbs are the legacy of the big national builders who built these places with reckless abandon.

~

The national builders’ business model is no more sustainable than that of the big 3 automakers. It astounds me that more of the builders haven’t gone BK. I totally agree that we should not be bailing them out (or any other business-as-usual, bubble blowing, crony enterprise). Taking the comparison one step further, the builders left us with a glut of SUVs and big trucks, the demand for which may never come back (let’s hope and pray!) The future doesn’t look pretty for these places.

My Good Doctor,

~

You are far more forgiving than I when you ponder why the corporate media’s “pundits” didn’t see this coming. You said, “Those that simply rely on data are bound to put on academic blinders and miss the big picture.”

~

I think all of these people had nefarious motives. They are (or work for) people who stood to benefit enormously from the status quo. Plus they have their advertisers, usually high-end retailers, to mollify. We’ve had a right-wing media wurlitzer for many years that literally got their daily topic faxed to them from Karl Rove’s office. I doubt this is any different.

~

Even today, I’ve read in the local newspaper how the housing bottom is “right around the corner.” “Early 2009” they breathlessly gush, exclaiming “this is the best time to buy!!!” The source? Why, the NAR of course! Any who is a significant purchaser of advertising in the newspaper? Realtors!

~

No, I don’t think for a minute that reporters were “blindsided” by this. It was a deliberate effort to maintain the illusion of a healthy economy. Call it our Potemkin economy.

Dr HB, great article as ever. I have always enjoyed your blog. You break down everything so that amateur’s like me can understand. I came to this blog because I had big questions and concerns. Time and time again you write about what I see and the mainstream media doesn’t. Thanks, all the best for 2009.

Unfortunately the FIRE economy continues… Especially in SoCal.

I just got approved for a $400k mortgage loan. I have a great FICO score and 30% down payment. However, I DO NOT have a job. I wouldn’t lend $ to me!

Ha, so much for a credit crunch… I knew it was a scam!

Testify, Doctor!

An excellent summary of where we are, and how we got here.

Don’t expect any kudos from the economist community – they will simply back-track, and claim your ideas as their own. The voices in the wilderness will find, in the not too distant future, that they were merely echoing the mainstream thought of the elite all along. They just didn’t know it at the time.

A truly excellent social commentary, at the present time, would be “Where do we go from here?”

A Plan for The Future is what we need ….. no matter how dark and dangerous those riptides look now, human ingenuity will (as always) get us through. We need to unleash those Plans (and they will be manifold), critique them, and provide a clear and cogent proposal to the Powers That Be.

Perhaps they may even listen ………

We are hitting the perfect storm for housing prices to continue it downward spiral.’ I have been predicting for years this would happen. My only reservation has been how much the government could stop the fall.

Well, I don’t have any reservations now. The whole world economy is now going down the tubes since September. When we start to see 600,000 to 700,000 jobs loss a month in the United States next year,the fall in housing will continue.

Then we will start to see in 2010 the option arm house hit the market. This will finish the upper middle class house that have only seen their value decrease by 10%.

There is an housing inflation adjusted graph going back a hunderd year by Robert Schiller on the web.

The graph display prices generally between 100 to 120 since 1950 except prices between 1998-2006. The prices were up to 200. That why economist are always saying 40% drop is expected. That would get it back to the top of the range. What economist don’t say is where the graph was during the depression. It was 70 to 80 on the charts. Bottom line, prices could fall 65% from it top.

Prices for real estate during the depression in San Diego fell 54%. (That right. Prices never fall in San Diego)

George Chamblin wrote today that its all good. California has a housing shortage so RE will rebound.

This is all very correct. Very very correct.

I find it hard to believe that the people in power didn’t know what was happening. Especially since so many bloggers predicted exactly what was going to happen.

Surely they knew that an economy based on FIRE is unsustainable and could only lead to an eventual disaster.

Kleptocracy is the nice term…thieving SOB’s is more accurate.

Dr., do you think that we are headed for a total collapse? Do you think that the dollar will collapse? Are we headed for hyperinflation as Peter Schiff says?

I’ve been reading these comments about the outsized FIRE economy for a while now. I understand how finance and real estate ballooned to oversize. But how has there been an insurance boom or bubble? I’m not talking about the phenomenon of some insurers investing in real estate or moving into finance. I just mean the business of insurance; what evidence of expansion is there?

Nice write up – forgot one detail. Homes are not selling because of the credit crisis is not correct. Homes are not selling because the prices are too high. Every home has a price a buyer is willing to pay, however the seller may not like that price.

The credit crunch may well have all been a myth:

http://organizationsandmarkets.com/?s=%22credit+crunch%22

but they still made off with 700 billion.

@David H: You are absolutely correct. If you have good credit and meet the 33 – 37% loan-to-income ratio (in other words, “qualify,”) you can easily get a mortgage today for a sanely (legitimately) appraised house. The only “credit crunch” I’ve seen is for marginally or unqualified borrowers who were able to get a “liar’s loan” (no-doc option ARM) in the past. And it was these loans that flooded the market with so much excess ill-begotten borrowed cash that caused housing prices to ascend into the stratosphere far beyond what anyone could legitimately afford.

~

The Good Doctor himself has shown quite clearly how homes have no trouble selling if they’re priced properly.

Hey Doc, thought you’d get a kick out of this article, (in a perverse sort of way)

It turns out that some of those fabulous granite countertops – are releasing cancer-causing radon gas. You can’t make this stuff up.

http://www.naturalnews.com/025186.html

Flaminia: the insurance bubble is best illustrated by the implosion of AIG… they turned the idea of “insurance” on it’s head and wrote billions (trillions?) of dollars of Credit Default Swaps, or insurance on various bond deals… not traditional insurance, of course, but someone’s idea of insurance. And that is what will blow them up, along with JP Morgan Chase and Goldman Sacks, their biggest counterparties. When (not if) those deals begin to smolder and blow off, grab your hardhat and hunker down in a bunker, cuz the shrapnel is going to be flying in all directions, taking down everything in its path…

“Will this Economy Change our Habits?”

Well here’s what’s already changed — we’re not going to see money stampede back into real estate or the stock market for quite some time. Not after getting burned like this.

Flaminia asks, “I just mean the business of insurance; what evidence of expansion is there?”

I don’t like snark, but can you spell A-I-G? More seriously, there is going to be a shakeout in many parts of the insurance industry, particularly medical insurance, where there are way too many middlemen hiving off way too much money that other people can’t afford anymore. That job contraction will of course contribute even more to asset deflation — the subject of this blog.

I’m not suggesting that legitimate insurance business has any responsibility for this crash. They’re going to suffer along with everyone else.

I actually find the fact that starts began their drop in 2005 reassuring. This means that the actual builders and funders AREN’T clueless idiots like Wall Street. OTOH, the mortgage industry seems to still have been drinking Kool Aid as late as the end of 2007.

Thanks, doc, great graphs!

If you have the time, could you answer a couple of questions?

1) I just saw a graph that shows the housing bubble vs. income, showing the diversion that occured in 1990. However, it was not current – do you have that data to do a graph with current statistics?

2) I read that we now have around 10 trillion dollars stuffed in our mattresses (not mine). Is this a bubble? What happens when a money bubble implodes? Inflation?

Just trying to divine the future : )

Thanks, Less than Zero – I’m suspecting that the insurance scam is why Obama is trying to prop this industry up. It’s unbelievable that the talking heads are still recommending insurance companies, nursing homes and big pharma. I’m thinking that that scam is about to collapse. Of course, the government has the power to tax us to the nibs, maybe that will keep it going for a little while, until they figure it out that unemployed people can’t pay alot of taxes, especially with the inflation that will result from the bailout illusion. Or does make-believe money cause inflation?

One of the actions that pushed the world over the cliff in the prior Great Depression was protectionism. Unfortunately, the bailouts perform just that. Most evident are the auto bailouts. If a business cannot compete successfully as it is structured, and the government supports them financially, that is protectionism. Not saying it’s the wrong thing to do here, but it is what it is. Support of other institutions that do international business will perform the same. Is there truly a solvent state, county or municipality in the CONUS outside of Texas? Most of us don’t know the actual paper that is involved in our ‘safe’ money market accounts. I feel that the next big bailout will be banking flagship BOA. How are they going to digest all poison they’ve eaten in the last few years (Countrywide, Merrill, LaSalle) without some powerful medicine ? How much pay-option cancer has been festering in that beast?

@robinthomas

They had to know, but wanted to smoke all the crack before the cops busted up the party, I think. It seems there are two powerful forces in contrary vectors (magnitude and direction). They appear to cancel one another out, but deflation wins this battle, because ultimately it’s like Gilligan’s Island. Howell had all that cash, but it was worthless on the island. The professor was the most valuable man on the island because he could produce. Since we’ve decided to produce services and pensions instead of products, even with lots of cash there won’t be products to consume eventually. If folks are afraid to buy there will be demand-side deflation and supply-side inflation. An explosive mix, I’d say.

Re: DHB 12/27. Flaminia, a 2006 piece by Michael Hudson over at iTulip on the “new rentier economy” may further flesh out the connection between FI and RE.

~

The new road to serfdom

http://www.itulip.com/forums/showthread.php?t=966

~

Your question raises a larger issue.

~

This economy may change some habits of some people…but my sense is that “the real problem” is much larger. The conversion of everything into real estate (territory that can be fenced off, legally or militaristically defended, marked up, traded, etc.) has been going on since Mesopotamia. Hudson also studies this–the origins of contemporary banking/finance in the ancient Near East. (The “cradle of civilization.”)

~

Even in the past century only REAL things (land, houses) could be REAL estate. But now even ideas and genes and images and contracts are being treated within the so-called “free market” model as concrete, tradeable entitites. One example is genomics. Corporations have changed patent law (renaming it “intellectual property”–i.e., real estate that exists only in documents) so that, for example, whoever sequences a genome can apply for and be granted ownership of it.

~

This system of thinking generates tulip economies out of obsession with the novel…rather than wealth defined by real goods, services, skills, etc. The goal of tulip wealth is to rocket past the modest wealth gained (and lost) in the slow, incremental, natural growth (and decline) of ecosystems. The goal is to concentrate wealth and palm off costs.

~

It’s one thing to take a degree in statistics–which isn’t hard–and to spend decades applying those numbers games in ways that generate pixel wealth for someone who will pay you a handsome salary. Entire industries in the ’80s, ’90s, and ’00s were built on this, with the newfound power of desktop computers absolutely exploding the potential for mathematical modeling. The “research departments” of many banking and finance companies were packed with numbers-crunching whiz kids who could make numbers do a certain profitability thing. Then it was up to the field staff to do whatever it took to ensure those profits. This is why later in the housing bubble mortgages were handed out without regard to the borrower’s ability to repay: assuring a fee-based profit stream in the present, to hell with the future.

~

The arithmetical increase of numbers is theoretical, abstract, and endless. We cannot expect concrete systems to behave that way. But we can manipulate economic and social systems so that they appear to follow the numbers for a time…and then change what we’re counting as soon as this becomes way too costly, or ceases to work. Politically, things must keep going up. There is no winter in politics, where it’s always bigger better faster more.

~

This is precisely what happened with the GNP/GDP. Doc, the reason that housing came to account for such a large part of leading economic indicators is that they were constantly changed to reflect whatever was going up.

~

I noted in mid-October how the “Dow Jones Industrial Average” has been changed over time and hardly has ANY actual industrial content anymore. Of those 30 stocks, there are only 9 “industrials.” The rest are consumer, drugs, entertainment, financial, and tech. A similar thing has happened with many other indicators.

~

And fields/industries. To go back to Flaminia’s question, what is so laughably called the “insurance” industry went from having some grounding in reality (a pooled set of resources to help bridge people through times of catastrophe, based on modest and prudent assessment of actual statistical risk) into the most massive mega-speculation on actuarial tables, converted into financial derivatives “products” by other numbers crunchers.

~

Like gambling addicts we know just enough about numbers to get ourselves in trouble. We may have some hope if we go back to counting what’s real, and aligning our expectations with that. Rather than worshipping numbers and going all helpless and angry where material reality and abstract concepts diverge. But it’s not going to be an easy transition, especially given that most people don’t know how to calculate a 10 tip in their heads, nor realize that a flat percentage increase over time yields an exponential curve of increase.

~

rose

In the book I co-authored—The Big Gamble: Are You Investing or Speculating—I wrote a chapter during the first quarter of 2008 entitled, The Mother of all Crisis: Haven’t We Learned? The following appears on page 86:

“Foreclosures in 2006 increased by 42 percent compared to 2005, according to Realty Trac. By 2007, the increase was 75 percent compared to 2006. Things got worse as we entered 2008. For the first quarter of the year, foreclosure filings, according to the Realty Trac index, were now 112 percent higher compared to the same period during 2007.

[…] By the first quarter of 2008, home vacancies and foreclosures in the United States had hit an all time record, as people kept losing their homes, or simply walking away from their mortgages. Robert Shiller […] warned that house prices could drop by over 30 percent. A worst drop than was registered during the 1930s depression.”

Since writing that, things have gone from bad to worse. Today there are nearly a million repossessed homes on the market. Statistics reveal that on average, foreclosed homes are priced almost 40 percent lower than normal real estate listings. Home prices in 20 major U.S. cities declined at the fastest rate on record because of increasing foreclosures and slumping sales.

None of this should come as any great surprise. For the past two years we’ve seen the same question being raised over and over again, “Is the housing bubble about to burst?†That question in and of itself implied that we all knew that the big party going on in the housing market was unsustainable.

The Fed are unquestionably implicated. Back in January 2001, former Fed Chairman Greenspan attempted to jump start the economy out of recession by slashing the federal funds target from 6.5 percent down to a ludicrous 1 percent by June 2003. Then they steadily ratcheted back up to 5.25 percent by June 2006. By then, the build up had generated more than $8 trillion in housing bubble wealth and it was inevitable that we’d end up in this mess.

Not only did Greenspan do nothing to halt the growth of the bubble, he actually encouraged it by recommending that we all take out adjustable rate mortgages. He even dismissed those who warned of the impending bubble, assuring us that everything was under control. Was it just coincidence that these interest rate moves ran parallel to the pumping up and popping of the housing bubble? Or was it a case where artificially low interest rates lead to poor investment decisions that would require a recession to correct?

It’s now obvious that Shiller was optimistic when he estimated a 30 percent drop in housing prices. If that figure is now at 35 percent, what’s going to happen when you factor in the record job losses, consumer paralysis, retail and other business bankruptcies. We are probably looking at an even worse scenario in the coming year.

This country is placing an inordinate amount of hope and trust in the incoming administration. But in our opinion, it’s going to take a team of super heroes to come up with a workable plan to get the housing market stabilized and back on track. And until we get our house in order here at home, the economies around the globe could continue to suffer and slide further into the abyss.

This comment was posted by Jose Roncal, co-author of “The Big Gamble: Are you investing or speculating?” – For more information, visit http://www.financialspeculation.com