Housing Unit Permits Reach Pre-Housing Crash Levels: Rising Interest Rates, Forbearance Moratoriums, and Interest Rates.

Expensive does not mean good in many cases. People tend to think that things only go up and somehow, things do not correct (ask Meta how that logic goes). Things do correct and they usually do not happen in the way you think. People are cramming into homes stretching their finances to the brink. There are some significant headwinds coming down the pipeline and these involve rising interest rates, more housing units, and the economy coming out of Covid-19 restrictions. Builders tend to join the party late in the housing market and given how hot things have gotten in housing, there are some signals starting to go off that we should be paying attention to.

Housing Units Authorized Near Pre-Housing Crash Levels

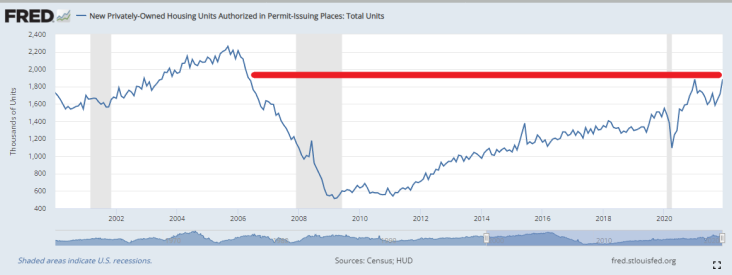

There is a rush to build homes across the US and we see that with permits being issued:

This is the highest level of permits being issued going back to 2006. You’ll see on the chart the Covid-19 led dip but we have gone nearly straight up since then. What this means is that more housing units will be coming to a neighborhood near you.

You also have millions of homes that were on forbearance plans coming “online” and some will decide to sell in the upcoming year. The idea that housing can simply outpace wage gains without consequence is simply unsustainable. The market has been artificially propped up and with inflation raging, the Fed is going to need to act. That action will be with higher interest rates.

Interest Rates

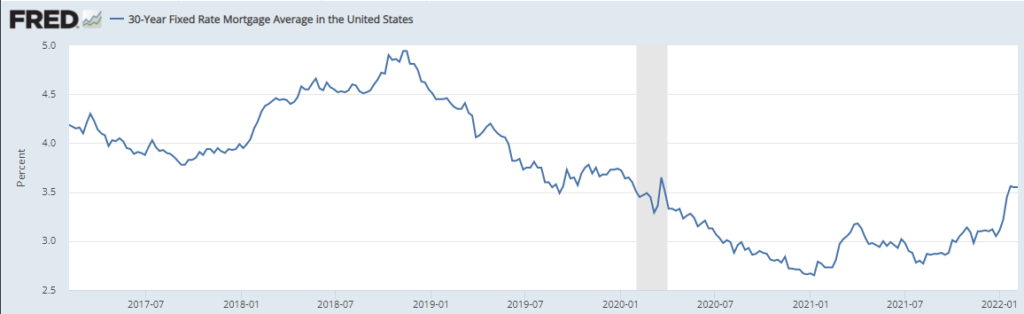

Interest rates are starting to pick up and the market is already pricing in a few increases this year. But look at the 30-year mortgage rate over the past five years:

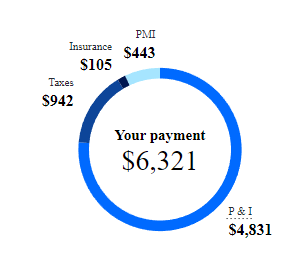

We are already off the record lows. Even so, 3.5% is ridiculously cheap and with inflation at 7% (at least based on headlines) this is “free” money. But of course, this isn’t free but subsidized by the Fed and inflation is a direct consequence of this action. But do the math here. Let us say we are looking to buy a $1M crap shack. We were able to get 2.5% at the lows but what if rates go up to say 4% or 5%? The below is for a $1M home with a 10% down payment:

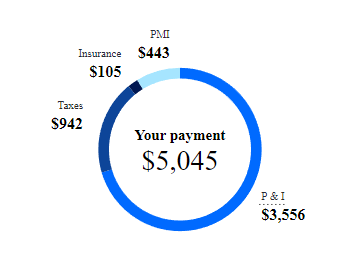

At 2.5%

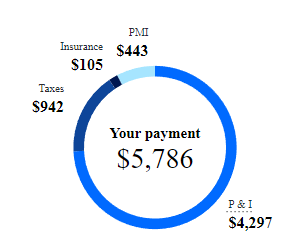

At 4%

At 5%

This is why artificially low rates are problematic. People are now addicted to this. At 2.5% your monthly payment is $5,045 but at 5% it is $6,321. The DTI levels for people trying to squeeze in is wild right now so a move like this will cause major market issues. We’ve already seen a 1 percent move in the last year, so another 1 percent move is highly likely, especially this year.

The idea right now is that housing only goes up and you should buy at any price. Very similar logic was running rampant pre-Great Recession. Sure, no NINJA loans this time around but when you can’t afford your payment, having a NINJA loan or a regular loan does not matter if you can’t pay it. Inflation is a big problem right now and the Fed will need to act.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

111 Responses to “Housing Unit Permits Reach Pre-Housing Crash Levels: Rising Interest Rates, Forbearance Moratoriums, and Interest Rates.”

I would have to guess by 90% of home buyers are taking out mortgage. (even so called cash buyers often have financing lined up so they do not require a contingency).

Significant amount of home buyers are taking 30year loans.

In other words, vast majority of home buyers are buying based on monthly budget (not overall price). Which is directly tied to interest rates.

Rates go up – more buyers will get squeezed. At very low rates, the squeeze rate is going to be very high (going from 2.5% to 3% is not the same as from 6% to 6.5%).

In this situation, rising rates are going to disproportionately affect buyers ability to qualify for loans. Putting pressure on prices.

Here are two very good comments from the good Doctor HB in this latest article:

1) “This is the highest level of permits being issued going back to 2006. You’ll see on the chart the Covid-19 led dip but we have gone nearly straight up since then. What this means is that more housing units will be coming to a neighborhood near you.”

In a post I made on the last article, I quoted an article that stated there is a lot of reluctance for big developers to build new apartments in SoCal because of the regulations and slim profits. Huge numbers of new permits means huge numbers of ADUs “coming to a neighborhood near you”.

2) “We are already off the record lows. Even so, 3.5% is ridiculously cheap and with inflation at 7% (at least based on headlines) this is “free” money. But of course, this isn’t free but subsidized by the Fed and inflation is a direct consequence of this action.”

Exactly what I have been saying. Inflation isn’t greedy businesses raising prices; it is big government agencies flooding the money supply with dollars with low interest payments (or no interest payments at all!).

Thanks for continuing to bring these issues to the public, Doctor!

What about all cash buyers?

I know someone who offered $200K over asking all cash and got beat today by someone offering a half million over all cash.

That person also showed me another listing that just went $1.5 million over asking..

WTF is going on? In Newport Beach. Very nice but certainly not amazing homes.

Can someone explain to me what’s going on? I guess I forgot to order a printing press on Amazon like every one else.

HI. Its not rocket science what is happening.

The 1% have gotten massively richer than the average cup of Joe over past 2 years.

Those 1%’s are buying up homes in all the beach cities in SoCal, esp. Newport Beach !

overpaying a few hundred thousand here or there is nothing for them.

Bitcoin and the NASDAQ index both dropped significantly since late last year.

Were people cashing out to buy houses with cash? Like M?

Where did the profit-taking money go?

If I had been brave like M and put $200K down payment money into Bitcoin in December 2019, I would have had $1.6M in November 2021. Plenty of cash to buy the entire house.

Nope. You will have roughly 800k left (after taxes). Not quite enough to buy what you want in So.CAl

“Bitcoin and the NASDAQ index both dropped significantly since late last year.”

Bob, as always is good for a laugh. Down just under 10% from its all time high in 2021. If you think that is “significant” you have no idea who investing works. You’re the kind of amateur that freaks out about a 10% drop, forgetting that even after the “CRASH” (lol) of January ’22, we’re still up 100% since Feb 2019. Up 100%, then down 10. Yeah I’ll take that all day every day.

Also Bob, it’s not “The Nasdaq index”. Nasdaq is a market. It’s an acronym for National Association of Securities Dealers Automated Quotations. There is no such thing as the nasdaq index. What you meant to say is the NASDAQ Composite, which one of several indexes of stocks traded on the Nasdaq. The other common one is the NASDAQ 100, which while closely tracking the NASDAQ Composite, is different. And that is your lesson for today.

Mr Landlord,

Respectfully, you need to take a basic math class. Why do I have to fact check you?

Bitcoin:

November 9, 2021 – 4 months ago – 68,000

Today – 45,000

I’ll let you do the math.

Sorry, I meant to say Nasdag Composite Index.

QQQ

2021 high: 403

Today: 364

Billions were pulled out of the market in the last few months. Possibly to pay cash for a house.

Surge,

You are correct, taxes will take a bite out of it unless you have tax shelters like Trump.

I don’t know a lot about rich people taxes, but LT Capital gains are capped at 20% for Federal taxes. Plus another 3.8% investment tax. CA cap gains are capped at 13%.

The total is 37%.

For my example above. The gain is 1.4M. 1.4M * 0.37 = 518K

1.6M-518K ~= $1M

$1M should buy a nicer house with cash.

If you moved to TX, like Elon, there is not any State income tax so your tax will be 23.8% . You would have about $1.3M to pay cash for a house. If you live in TX and are cashing out in large BTC gains, you would pay 13% less in taxes.

Also, we are talking about bitcoin gains.

If you sell your bitcoin on a foreign exchange for $1.6M, nobody is sending you or the IRS a 1099B to report it.

I’d always report it on MY taxes but if a tree falls in the woods and nobody sees it, did it happen?

LOL Bob. You think QQQ is the composite index? Dude, there’s that saying about a hole and stop digging. QQQ is an ETF that tracks the Nasdaq 100. Which I said above is not the same thing as the composite.

I always love when amateurs like you dispense investment advice. It is hilarious.

Elon has “moved” to texas since he can afford it.

Moving somewhere else (especially out of coastal california) to save 10% on your taxes (but more in some other ares) is stupid, if you ask me.

@Surge: can you elaborate why it’s not worth changing states to save 10%? For high income people like myself, i’d save $2k a month by doing such. For elon musk, I can’t even imagine how much he saves by doing it.

Relative to overall income, you are probably saving ~2%. To me personally not worth it, but to each their own.

I find this to be very interesting re cash purchases, and do believe that this phenomena where so many are participating that one is easily outbid does have to do with the 1% and inordinate growth of their worth in the past two years. Others participating may also be corporations, and people from other countries like China.However, might the small apartments in Los angeles t be in a different category, and actually go down in price? I look at the offering and think Ive noticed a drop. (I’m wanting to purchase a small apartment with cash so I can visit a son)

Thanks, Doc.

I appreciate every effort you make to help us. Thanks in every way. Best of luck to you and your family. If the others dont say so, they too love to have you telling us how it is. Smile.

The FED does not lead, it follows.

Keep your eyes on the three month treasury bills rate. On Dec. 30th the rate was 0.05%, Feb. 4th it was 0.23%.

The FED must raise somewhat equally or SHTF.

https://ycharts.com/indicators/3_month_t_bill

Why would I put my house on the market to pay a higher interest rate on the new house and therefore a higher mortgage?

I wouldn’t. People who hope for lower prices…..buckle up. This might be a year of record high appreciation as we have not seen such low inventory in metros like phoenix.

https://fortune.com/2022/02/07/zillow-our-2022-housing-forecast-is-way-off-home-prices-now-set-to-spike/?source=patrick.net

You believe demand is constant? The entire articles showing how small changes in interest rates will eliminate demand. Now banks could switch to interest only, in fact they’ll have to in order to find more suckers willing to hold the appreciation line.. but once a segment starts falling behind on payments, banks aren’t going to be willing to loan out 1 million for a crap shack to 2 people making 50k a year.

People who buy nowadays can afford the payments. I went through two purchases. Q1 2020 and just now. Every penny you want to use as downpayment gets sourced and you got to have the income and credit to qualify. This time is very different from the NINJA loans in 2005-2008.

The biggest lesson I learned from this blog:

When almost everyone on this blog cheered that I bought the top in Q1 2020 and the market will crash, I gained +300k in equity. 90% here were wrong. A few congratulated me.

Lesson learned: don’t follow what the majority of people think will happen. Follow your gut and buy a house when you can comfortably afford it. Nobody knows for sure what will happen a year from now.

Millie, I’m glad you got it figured out. If you can comfortably afford a home and plan on owning for the long term, there is no reason not to buy. Trying to time markets is for fools.

The day I quit listening to other people’s doomsday nonsense was the day I started making some serious money.

Speaking of nonsense, I just checked my local markets building permit stats. New SFH builds down 11%, multifamily builds up 300%. Of course, both categories are lumped into one and then reported on these “insightful” articles and YouTube videos about how the end is near and viola the sky is apparently falling. It took all but two minutes to pull that information up but people would rather trust so called “experts” than take a few minutes to educate themselves.

Speaking of educated people, anyone know what happened to Realist? I miss that guy ????

Umm…Anyone that held any real assets over the last decade made serious money. But yeah, you are the man. You’re probably too young to have experienced a recession economy.

Law #1

Interest rate goes up, price comes down until the mortgage on the higher interest rate is at an equilibrium with the mortgage at the previously lower interest rate. The faster the increase/decrease, the more volatile prices get. A 1% increase within a 3 month period is NOT the same as a 1% increase over a period of 1 year.

Law #2

As long as the mortgage is at or below the cost of rent, you will still have buyers in the market.

Law #3

The housing market, like all commodities, are governed by supply and demand. Permits for ADU’s, which are all the rage these days, are incorporated into the “new build supply” permit artificially inflating actual supply. Analyze and understand the quality of data presented to you. This leads to the next law.

Law #4

Be wary when comparing factors from two completely different time periods. Analyze the factors that led to the previous crashes and ask yourself if these factors are present today. These include average household income, inflation, interest rates, demographics, loan practices, societal changes and much more. All of these factors listed have changed since the previous crash. It would be very foolish to analyze the present market using the factors from the previous market. Remove all biases, wishful thinking doesn’t change the reality of the situation, it only changes YOUR reality.

Law #5

Be wary when analyzing the market as a whole and apply your analysis to your local market. Local market conditions always govern. Not all regions of the US appreciate/crash the same. Using macro averages for micro market analysis will more that likely invalidate your analysis and will often lead to a false perception of the market’s trajectory.

Law #6

Do not listen to what anyone says about the RE market (including myself). Analyze the quality of the data/points presented and do your own research. Again, remove all biases from your analysis. Account for factors that are unique to you. Ex: your current housing situation, your current housing expense, your occupation, your future endeavors etc. Watching YouTube videos from insanely wealthy people telling you not to buy and accepting their bias data presentation without doing your own due diligence is detrimental to your financial success. Remember: they made the bulk of their money by scaring you into staying on the sidelines while you watch them capitalizing on the RE market boom. You’re paying a much higher price than just the few hours of your wasted time watching these “doomsday” videos.

Best of luck to everyone, may we all prosper.

NewAge, you should write a book. The laws of RE.

I am serious, you should!

A book?!?! He might prefer a YT channel so he can enjoy all the wonderful comments.

New Age,

I agree with your common sense approach. However, the interest vs. price analysis while it is correct in terms of how they influence each other, all other things being equal, in REAL life the situation is far more complex than that – all other things are never equal but play a role in various degrees. There are lots of variables in this puzzle; so many that even the FED is puzzled by the final outcome of their decisions.

New Age,

I agree with your common sense approach. However, the interest vs. price analysis while it is correct in terms of how they influence each other, all other things being equal, in REAL life the situation is far more complex than that – all other things are never equal but play a role in various degrees. There are lots of variables in this puzzle; so many that even the FED is puzzled by the final outcome of their decisions.

@M

If you compile all of the comments I’ve posted thru the years, you might accidentally start a religion because some of the comments posted as far back as 2017 “prophesized” the events of today. I specifically remember mentioning how inflation will deflate whatever bubble people thought we will be and how technological advancement will impact the RE market in the form of “work from home” although I will admit, I did not think it would happen this soon nor the circumstances that brought it about. It was enough info for readers (scratch that, doers) to make a boatload of money off of!

@Flyover

These self-proclaimed laws of RE are akin to the laws of physics. Base theory neglects all nuances the same way friction was ignored back in my college engineering class but the theory is generally sound and can, at the very least, point in the general direction of the market’s trajectory. Nobody knows when the ball will stop because nobody can calculate the resisting factors that are analogous to “friction” or “drag” when you roll a ball down surface but you can definitely determine which side of the field the ball will end up nonetheless. Back in 2019, interest rates shot up to 5% and the market oversold to far more than the 10% decrease that it would take to bring prices back in line with a 4% mortgage. Another example is how the market shot up far more than the 10% during a 1% mortgage drop during the pandemic housing boom. That is definitely a factor worth considering: when people are spooked, they oversell and when people are optimistic, they overbuy. Will that happen this time? My crystal ball says yes but not to the extent of 2019. Depends on the “factors.”

Factor 1: Extent of Interest Rate Increases

What we know so far is that interest rates are up 1% from ATL and the market is barely reacting. I’m not seeing bidding wars but I’m not seeing price cuts either. Properties are sitting on the market a bit longer and sell for asking or slightly less. I’ve only seen condos sell for barely 10% below ATH but condos are known for being boom/bust RE assets with their price volatility. December 2018 has already set that precedent with 5% interest so that is something I can confidently stack my chips on. What is relatively unclear is whether or not rates will hit 6% which is unprecedented in the modern RE market (post Great Recession Era).

Factor 2: RATE of Rate Increase

With the recently reported 2021 inflation report, I would say 6% it’s not out of the realm of possibilities. This is sure to have a negative impact on RE prices not simply because of “equilibrium” but because there will be a psychological impact on todays buyers. Seeing how Millennial and Gen Z make up now dominate the housing buyer market, this is “uncharted” territory for them. Couple that with how rapid and sensationalist the flow of their information is, you can bet that media outlets will capitalize on the highly profitable fear-mongering that is sure to ensue. Of course, the slower the increase the less profound the effect. Interest rates are like water, it can either pass under the bridge or completely wash it out depending at the rate at with it flows. This is not clear at how fast/slow the increase will be at the moment but there is mounting pressure to contain this inflation.

Factor 3: Rent Prices

Rent prices are not coming down. However, it could actually level off. After reading Doc’s latest article, I did some digging and saw that this “building boom” is actually a rental unit boom, at least in my area (Inland Empire, SoCal). SFH home building are slowing down which makes a ton of sense to me. You have rising costs of building material and that material has to be allocated to either MFH or SFH. Both markets are in huge demand but the MFH has the most ROI, by far. This is the essence of capitalism. What this also means is that the there is not an abundance of SFH inventory that will flood the market. Google your area and see for yourself.

With that all said, this is what I’m personally doing. I’m investing in high density zoning land. I’m closing on a decent plot next week and getting straight to designing the buildout. I will not build at least until the subdivision of SFH that I’m currently building is completed in June. Once those sell, I’ll decide if I want to roll that over to a MFH development or sit on the cash until the hysteria takes hold. Once I hear the word “housing crash” more than I hear the word “pandemic” on the news, that is my queue to make like a pig and gobble up discounted properties. Once people discover their calculators and see that the numbers make sense to continue buying, I will be ready to sell just enough to finance the MFH development which with the price rally, will be in more demand than ever before. Do you know how I am certain of this just as I have been certain of everything single major RE event that I was able to predict and capitalize on?

Because it’s a New Age people.

Uhh.. There is almost no inventory and almost all owners have a huge amount of equity. Why would they ever sell? Prices will not go down until inventory goes up. It’s also very unlikely that rates will go over 4% based on the bond market. I just don’t see how you think an opportunity to buy cheaper is coming anytime soon.

Never sell real estate. Your next property tax bill in states like California will be much, much higher (if you sell and buy). Rent it out instead. My goal is to accumulate RE. In Europe mortgage rates are 1-2%. We have a ways to go down from

Here. Btw., we just hit 30trillion of US debt, to think we can afford higher rates is a pipe dream.

Housing has hit the iceberg, taking on water and the homedebtor’s are rearranging the deck chairs listening to the band play Olde Glory lol

Enjoy the slow decline into those icy waters, I’ll be on the beach drinking rum willing to pay .60 cents on the dollar for your crap shack.

Ive been reading this site with interest for years and I realize that california RE is unique. I was interested in a comment noting how 1% has gotten that much richer in past two years, enabling the them to pay that much more. I wonder if that applies to Los angeles neighborhoods that are blighted now by homeless and crime. Prices seem to have gone down and am wondering if it might be a good time to buy an apartment there now. Any comments? thnx. Lief

You cant buy an apt bldb in a nice neighborhood anywhere from Malibu to Long Beach that will give you a Cap Rate of more than 4.5% unless it has major issues.

Typical apt bldgs in Venice and Santa Monica are selling with a 3% Cap Rate. They are sill selling because they are hot neighborhoods but even SM has rent control (max rent increase 3% per year).

Cap Rates are not increasing (selling price is not decreasing) even though homeless has increased in some parts of SM and Venice.

Anywhere else in the country you can find much higher cap rates. but of course, who will manage the bldg for you? you plan to live near where you buy?

Institutional investors buy with cash. A yuuuuuge portion of home sales are now to outfits like BlackRock. You bears are fighting the last war. Today’s housing market is way different. And yes I know that is the “this time it’s different” cliche. But this time is IS different.

Thanks to Brandon’s policies, everything is inflating at a rapid pace. People are making money while driving new cars for crying out loud. Why would real estate be any different. Of course it will also inflate. America voted for this because they didn’t like mean tweets. OK cool. Enjoy renting for the next 50 years. At least tweets will be nice, so you have that going for you.

“ Enjoy renting for the next 50 years. At least tweets will be nice, so you have that going for you.”

Made me laugh hard but the sad thing is this is so true. I know a few hard core liberals that would vote for the most leftist agenda. They truly believe that voting for the far left will improve their life. And trump was the devil. And everything bad happening now is of course Trump’s fault. Don’t need to tell you they rent and don’t have high paying career jobs.

But hey, as a landlord I like people who rent forever, I’d even give you slightly below market rate at all times 🙂

An annual inflation rate of 7.5% was just announced. The astute observers know it much higher since the .gov only cherry picks what goes into the inflation equation. Locking yourself into a 2.X or 3.X mortgage rate was the inflation protection I was preaching about for years. What have guys like myself and Mr. Landlord been saying about owning assets?

And no crash in sight as of yet. Follow Logan Mohtashami for reasons why.

– chronic underbuilding since last crash

– huge swath of 25-35 year olds moving through our demographics who have saved to buy

And other reasons.

I say 2022 will be another banner year for housing prices. Maybe 5% increase.

Stay tooned

Yes, Institutional investors are rapidly driving up house prices and paying cash.

What happens if the housing prices drop 10-20%?

A bigger and faster crash is likely to happen as the BlackRocks try to dump their loser investments.

We have seen this all before but not at this scale. Housing is now an investment and like any investment, the big guys will dump it quickly to avoid losses.

It wouldn’t be a true Mr. Landlord post without a perjorarive reference to “Brandon.”

And yes, it’s all worth it – to not be exposed to a daily barrage of paranoid and maniacal tweets.

It’s interesting you say were seeing all cash buyers. I suppose it depends on the price point. My realtor just was telling me that the majority of buyers they are seeing are coming in with 10% down. They are still seeing 3.5% and 20% too, but 10% is most common. This is to stay under the limit for jumbo loans at the pricepoint we are talking ~$1m

BlackRock and other institutional investors doesn’t use your relator. If your realtor doesn’t understand this, he/she kinda sucks at their job.

It is hilarious that my Kia is worth $5K more now used than it was when I bought it new in 2019.

It’s not really hilarious, it’s sad that Brandon has destroyed the dollar. But Richard is enjoying this. That’s hilarious.

This is Jerome’s fault at least as much as Joe!

Who’s Richard?

Where I live in Burbank, $1mil + people pay cash. There is a lot of cash out there amongst certain people(who will remain nameless) and they want to invest it to escape inflation and etc.

Some people pay cash. There is a lot of cash out there.

Zillow just predicted that housing prices would rise 11% in 2022. As usual, take it with a giant grain of salt. The overwhelming factor was supply and demand, and that gets exacerbated in socal. The looks bad for the fence sitting crowd.

The price tag for the plan I purchased in Phoenix already appreciated by a few thousand. They released the new phase at a much higher price due to lumber price increases and labor increases. Beautiful to have inflation on my side. Hoping for hefty rent increases as well!

Millie, that’s how you play the game. Start thinking like a 1%er and you’ll do real well. You’ll get the wiped out holding on to a middle class mentality.

Millie,

I have a lease coming up. True market value dictates I should increase rent by $300/mo. But I will be kind and only increase it $275/mo. This was Bob won’t accuse me of price gouging, See I’m a nice guy, haha.

But in all seriousness, welcome to the club my friend. May leftist life long renters who continually vote for their own demise, make you rich beyond your wildest dreams.

I think you can be a nice guy.

You do make good points.

Long term renting is financial suicide. I reuse that point often.

I like my current tenant. I will likely raise the rent slightly up this year to keep them. Mortgage is fixed, property taxes went up 2%, insurance is up about 7%. Expenses are up about 3% in total. As you said, landlords can’t run a charity and it is likely that my tenants are seeing higher than a 3% raise this year since they are professionals.

OC Register columnist Lazerson has an article on new finance packages for investment property. There is no place on the application for a listing of your employment. However you do need a lot of cash to put down and you need to front load four years of principal and interest into a bank account. For a $2 million loan you need $600K down. You pay about $7K a month at 4.5% interest. Your payment reserve for this loan comes to about $340K. Therefore you are paying about 47% down, but you have no payment for 4 years. And there is no requirement to prove where you got the dough. Lazerson comments “Can you say straw buyer?” One more cost; you need to pay pay points upfront.

If you have a group of friends who want to go in together to get a rental property, this just might work out in my opinion as long as inflation continues for the next couple of years.

Lazerson also commented on Freddie Mac rates. He said that the latest rates would have a monthly payment on a ~$650K 30 year loan that is $340 a month more than one year ago (now about $3000 per month). The loan he quoted is for the maximum dollar amount in LA and Orange counties for a FHA conforming loan (less in the Inland Empire).

Rents are up 30%

Music to my ears as a homeowner and landlord

https://www.cnbc.com/2022/02/11/what-to-do-if-youre-worried-about-a-big-rent-hike-.html?utm_content=Main&utm_medium=Social&utm_source=Facebook&fbclid=IwAR2OkHnT9-vIn_BwsAO-3EBn9JKOrFo4p_UEg3sjd4XW5glkJlD3yCBoIzw#Echobox=1644596317

The key is the Federal Reserve. The rapid rise in mortgage rates in the last 45 days shows that it wants to dampen the housing market to curb inflation. It has unlimited power to raise mortgage rates considering the amount of MBS it holds.

The FED has been controlling interest rates and the economy since 2008. We haven’t been a true capitalist country in over a decade.

Instead of a Central Government controlling the economy as in communist countries, the US is controlled by the banks and central government (The Fed). Most define that as fascism without an authoritarian dictator (yet).

The Central Bank in Canada already got their own puppet dictator – Castreau. Canada became the new Tiananmen Square with Martial Law and everything. I think the FED already got their own puppet – Biden – they just need to create a red flag to have their own Martial Law. Dictators hate the Constitution and the Bill of Rights; they beg for a Martial Law in US to find a scapegoat for the actions of the FED. For 2 years they blamed it on Covid. Since that became old, they found a new villain in Putin. If that fails, they need a new red flag here. Anything to push global funds to US so they don’t have to raise the rates.

“Things do correct and they usually do not happen in the way you think.”

Well said Dr.

We won’t see the extent of the damage until the water recedes. I do not think it’s going to be a pretty picture.

LMAO, CA Titanic is sinking, .40 on the $ come 2024- The Orange County Register. “Southern California homebuying got off to a slow start in January with both prices and sales dipping. At current rates, a buyer with 20% down would have paid $2,379 monthly on January’s $687,000 median vs. a year earlier’s $1,938 house payment on the $595,000 median. That’s a 23% jump in the mid-range house’s theoretical loan payments.”

From Crosstown on California. “Another reason for the drop in foreclosures may be that as housing prices skyrocket, people refinance their property or take out a home equity loan. Loan amounts are based on the difference between a property’s market price and the mortgage due, which means homeowners may be able to borrow more. The lenders are paying attention. ‘It’s very uncommon for banks to foreclose on properties when the values of their properties are appreciating or going up,’ added Gary Painter, a professor at the USC Sol Price School of Public Policy.”

From Socket Site in California. “Having been expanded, renovated and converted, the now 3,172-square-foot St. Francis Wood house at 250 Santa Paula Avenue was foreclosed upon by Deutsche Bank last year. Listed as a bank-owned property for $4,197,600 this past September, the asking price for 250 Santa Paula Avenue was reduced to $3,987,800 in October, to $3,788,500 in November and then to $3,599,100 in December. And the sale of 250 Santa Paula Avenue has now closed escrow with a contract price of $3,239,200 or roughly $377,000 less than the $3,616,117 Deutche Bank had been owed at the time it foreclosed.”

I get that housing starts are up, but construction in Orange County is still crazy slow. So long as people can afford the monthly payments (wages are rising along with inflation), why would they market correct severely?

I am loving that the people who supported Brandon the most – millenials and Zoomers – are the ones being crushed the hardest by his near-hyper inflation. Meanwhile evil rich white guys like me are making a killing.

The universe produces some awesome cosmic justice some days.

Biden is doing what needs to be done to return to a free market.

Unlike Trump, he is not acting like a fascist dictator and forcing the Fed to continue to lower rates causing massive inflation. The Fed should have continued to raise rates in 2019 but due to political pressure, they did not which caused a huge housing and stock market bubble.

Thanks to Biden, the housing market will level off or slightly fall this year. Millions of home buyers will thank him and vote for him again.

Biden should not have implemented the last round of Pandemic handouts. He is now stopping the handouts that Trump started. Trump deficit spending was 3X higher than any budget by Obama. I am a fiscal conservative. Trump was not. Biden is getting us back to a free market.

Guess what? Biden and Trump and all the other Presidents of the last X years and nearly every member of Congress today is the same when it comes to fiscal issues.

They’re doing whatever it takes to make the economy appear good, get re-elected and rake in extra dough for themselves and their well-heeled kinda-sorta puppetmasters. And that means low interest rates, spending like a drunken sailor and “free” stuff for half the country or more. Debt, debt, debt and kicking the can as far as humanly possible.

The only reason rates are going up right now (and they’re still irresponsibly low, by the way) is because inflation is raging out of control and so there’s no other option but to raise them. Uncle Sam caught himself between a rock and a hard place. Not that I blame Biden as much as Jerome Powell. And no Trump would be no solution. The Fed is the real enemy here. Ron Paul was right.

It truly is a swamp. Even Trump became a part of it. When he was running the first time, he said interest rates need to go up. It was music to my ears! AS president, not surprisingly, he started talking about negative interest rates like they’d be great. And that’s when I began to realize all of the above is true. Still, I’ll keep voting Republican because they really are the lesser of two evils. Just hope it’s not Trump winning that primary again.

“Unlike Trump, he is not acting like a fascist dictator and forcing the Fed to continue to lower rates causing massive inflation”

Bob, you are the least informed person here. Bar none. I mean seriously dude, do you know anything about anything? You just spew left wing talking points with no basis in reality. Get off Twitter, stop watching MSNBC. Learn something, I beg you.

Here is the average federal fund rate yield by year. It was hovering around 0 for all of Obama’s years. Then the second Trump got in, rates started rising and did so for 3 years straight. And now, under BIden the rates are EVEN LOWER than Obama!! LOL. Rates have never been this low. Everything you think you know is wrong. Every single thing.

Obama is elected

2009: 0.16%

2010: 0.18%

2011: 0.11%

2012: 0.14%

2013: 0.11%

2014: 0.09%

2015: 0.13%

2016: 0.39%

Trump is elected

2017: 1.00%

2018: 1.79%

2019: 2.16%

2020: 0.36%

Biden is “elected”

2021: 0.08%

2022: 0.08%

Bob, after so many years on this blog and with all the information at your finger tip, there is no reason to remain ignorant; contrary to popular opinion, ignorance is not bliss. The first thing to start learning something is to turn off CNN or MSN.

Millennial came here totally ignorant, but in about a decade he learned a thing or two and I am sure he is much happier today than a decade ago.

Three decades ago I was as ignorant as Millennial was, but I had an excuse – I grew up under total censorship – something like the MSM and big tech is trying to do now in US. However, here in US, you still have alternative sources of information; you don’t have to stay willfully ignorant. Ask millennial if he was happy in that state of ignorance.

As Texan said, Trump initially allowed the Fed to raise rates. However, in 2019, Trump browbeat the Fed to lower them again. Trump even bragged that he would lower rates to negative values. Biden is fixing this.

Please don’t be ignorant and spend some time looking at Trump’s deficit spending. It is easy. Just Google deficit spending. You will see that Trump’s yearly deficit was 3X more than Obama’s.

Flyover and Mr Landlord, you cannot defend this. These are facts. Why would any conservative vote for this?

Bob,

I refuse to believe you can be so obtuse. I’m starting to think you’re just trolling. I kinda hope you are because that would make me feel better than knowing someone like you actually exists. in real life.

Mr Landlord, I only post facts.

When you resort to name-calling, you have lost.

You’re the last one to talk. As soon as things go south, you’ll be gone, just like you disappeared last time. You’re a hypocrite of the highest order. Lol. Your criticisms of Biden are hilarious. The last failed president would be helping Putin do whatever he wants so long as he got his Trump Tower Moscow.

Investing in Russia in general and Moscow real estate in particular is a game rigged by the house. I’m surprised that Trump kept looking at this as long as he did. It was a good thing for his bottom line that his “partners” weren’t connected enough to get things started. It would’ve been a money pit. I understand that he was impressed with the City of Moscow and wanted to have a “first”. A lot of people misjudged Putin, including Boris Yeltsin.

Oh, and I forgot to mention Bill and Hillary… the reset button and the $500K speech. But I’m not sure they were fooled, just greedy.

https://www.nationalreview.com/2017/04/clinton-russia-ties-bill-hillary-sold-out-us-interests-putin-regime/

And before you say “right wing National Review propaganda”, consider the Never Trumpers at that rag:

https://www.nationalreview.com/2020/11/i-was-never-trump-in-2016-im-still-a-conservative-heres-how-im-voting/

In 2014, Putin invaded Ukraine when Biden was VP

In 2022, Putin invaded Ukraine when Biden was “president”.

But Trump is a Putin stooge.

LOL. I love the left, best source of comedy on the planet.

What does Mr Landlord always say? Renting long term is financial suicide. I need to change that to renting even short to medium term is financial suicide.

“In the 50 largest U.S. metro areas, median rent rose an astounding 19.3% from December 2020 to December 2021, according to a Realtor.com analysis of properties with two or fewer bedrooms. Other cities across Florida — Tampa, Orlando and Jacksonville — and the Sun Belt destinations of San Diego, Las Vegas, Austin, Texas, and Memphis, Tennessee, all saw spikes of more than 25% during that time period.”

When even s**thole cities like Memphis and Las Vegas are seeing rents increase 25%. you know it’s time to buy.

https://apnews.com/article/business-lifestyle-us-news-miami-florida-a4717c05df3cb0530b73a4fe998ec5d1

The longterm renting mentality is definitely financial suicide, especially in places like socal. I have two acquaintances that had the means to buy in the last decade, but didn’t for whatever reasons. They are between a rock and hard place now. They now have a few choices, either leave socal for cheaper places or stay here and work for another decade or two longer than those who bought places. When the millenials and zoomers “grow up”, they’ll be no different than the groups who came before them. That means having kids and buying homes in leafy, safe suburbs. Count on it!

If you take posts from 30 years ago, you will not know the difference. Same concerns, whining, blame assignment. Tells me nothing has really changed.

(there was no internet 30 years ago, I am aware).

This really old millennial is here to tell you that, indeed, there was Internet 30 years ago. It sounded like this:

*beeeep! screech! boop! bop! deeeeee! crshshsh!*

“Welcome, you’ve got mail!

Yeah, I had AOL in the 90s. But I don’t remember the sound effects.

They used to mail every household a CD every week, it seemed. Some guy collected massive quantities for years then dumped them at the door of AOL Headquarters. It was awesome, but apparently that was too long ago for even YouTube to have a single video showing the event. I must’ve read it int he paper.

They produced more than one billion CD’s!

That was sound modems made when they connected. Whether to AOL or anything else.

I wonder when the Fed will raise interest rates *for real* because my house is “making” $10,000/month again and that ain’t right for such a little thing in Texas. My 2019 Kia might go for $10,000 more than I paid. And that’s bizarre, to say the least.

Clearly the Fed is still favoring high earners with assets over the average Joe. The former gets to watch their real estate and investments inflate while the latter has to figure out how the heck to keep buying the same amount of food for their family.

Jerome Powell’s heart doesn’t seem to be in the right place (probably keeps it in his wallet). Inflation will continue until rates go up *significantly*, not just a little.

LMAO Orange, CA Housing Prices Crater 27% YOY As The Triple Cripple Of Falling Prices, Plunging Demand And Soaring Mortgage Defaults Blanket Southern California

Keep rearranging those deck chairs, it’s gonna be a cold awakening bbbbbbbbbrrrrrrrrr

House prices have gone insane where I live (SoCal). I have gained a bit over 400k in equity within 2 years. And no end in sight. There is just not enough inventory.

Buy RE and protect yourself against this Biden inflation. You can’t win against ever rising rents, gas prices and house price inflation. Lock in a 30y rate and enjoy living in your own house. Never worry about crazy rent hikes!

What are you talking about. OC home prices just set another record.

https://www.ocregister.com/2022/03/05/orange-county-home-prices-hit-record-950000-up-201500-in-pandemic-era/

While i do agree that things are getting frothy. All the factors that caused this are still here: no supply, massive demand, super low interest rates and inflation ramping up where owning assets is vital. I had my eye on a rental property back in 2019, in hindsight I should have bought it no questioned asked.

Bob, let me explain it to you. Energy is everything for an economy like US. Biden, the very same day he was inaugurated, he gave executive orders to decimate our oil industry. That is a fact. Once the price of oil goes up, then all prices go up; then people ask for more money, then prices go up even more in a vicious circle. Again, this is a fact.

Price of oil was very low during Trump for two reasons: internal policies favoring oil companies and oil production and foreign policy. Biden failed on both. When you’ll pay $10/gal of gas don’t blame Trump – it was totally a Biden creation on all fronts. When Trump left I was paying under $2/gal for gas.

This is Biden agenda for lowering inflation: increase minimum wage, strenghten the unions and their size, carbon tax, more money spent on SOCIAL infrastructure and you believe that is going to lower the inflation?!!!…

Fact: Over 100 oil industry companies went bankrupt under Trump in 2020.

Fact: 56 Oil companies went bankrupt under Biden in 2021. The lowest in 4 years.

Please just look it up.

“If you like your gas prices, you can keep your gas prices!”…:-)

Nobody cares how many oil companies went bankrupt under Trump or Biden. People care very much when the price of filling your gas tank up or going to grocery store skyrockets. Biden owns this no questions asked. The US was energy independent two short years ago before Biden and the Dems went full in with the ridiculous green agenda. There won’t be any places to hide come November.

Bob, look at the history of John D Rockefeller and the early oil industry. His competitors were driven into bankruptcy because Rockefeller could keep oil prices low by efficiency and large volume shipping discounts. So more bankruptcies under Trump is consistent with lower oil prices. That isn’t bad for consumers, just bad for less efficient producers.

You all have good points.

My argument is that under Trump, the oil industry was a disaster. Exuberant investors and a “Drill Baby Drill” government caused an enormous glut. Under Trump, Oil prices were negative for awhile. That isn’t efficiency, that is insanity. That is government favoring oil drilling. Flyover might call that communism. Yes, it is true that with enough incentives, government can drive gas prices down to nothing. This is not capitalism.

I believe that the current situation will be cleared up by next month. The Ukrainian war will be over one way or another and the oil companies are currently ramping up for more drilling an pumping in the Permian Basin to meet demand. Oil companies have committed to this supply and demand issue. Biden is not stopping them.

Government should stay out of this unless it is on public lands.

Biden should not support cheap oil leases in National Parks and public lands. Trump was for this. This is a government give-away to corporations. I am against this.

The Keystone pipeline was also stopped. The pipeline was to used for bringing Canadian oil through the US for shipment to refineries in and out of the US. This would have created many jobs in Canada but very few in the US. As usual, the US taxpayers would be on the hook for any disaster cleanup. If this pipeline involved government subsidies, I was against it. Biden was against it.

My point is oil prices were not real under Trump. They were government subsidized. I am against this since it is communism.

Bob will blame Trump because Bob is incapable of thinking on his own. CNN and Twitter says blame Trump so he blames Trump. It’s not much more complex than that.

I can respect a leftist that has his own ideas. I’ll disagree but I can understand where he’s coming from. With Bob you can’t even do that. He just parrots left wing talking points.

SAD!

Mr Landlord,

I only post facts.

When your entire post is name calling, you look so desperate. This is a Trump tactic and he lost. All of my fiscally conservative friends did not vote for him for this reason.

Please post facts and someone might believe you.

“When Trump left I was paying under $2/gal for gas.”

I was paying $2.80/gal….oh, but I live in California! As I recall, you’re in Spokane.

We have the Biden agenda and the Newsom agenda. Oh, and didn’t Newsom make it in politics because he was connected to an OIL BILLIONAIRE?

The twofold impact on housing:

1) People will have less money to pay for housing, especially for getting a downpayment.

2) The cost of commuting long distance from cheaper housing to your job will destroy your budget. Two solutions:

a) telecommuting (only for some occupations).

b) move jobs closer to where housing is affordable.

Option b) is happening big time with companies relocating manufacturing out of CA and to inland areas for warehousing and distribution.

Yes, Housing prices will fall and wages will increase. Eventually oil companies will invest in oil again after the huuge wave of Trump energy bankruptcies clear out.

They will if Biden removes the Fed’s control and restores capitalism.

Biden will restore capitalism.

If Biden caves and promises negative rates like the last President, then we are doomed.

Bob, you are out of touch with reality. Closing down oil production on Federal land and stopping pipeline construction here while OKing Russia’s pipeline are the reason why we’re now importing oil instead of exporting it. Importing oil costs more than producing it. I didn’t say housing prices would fall. That is based on supply and demand and the housing for sale supply is low. At 7% inflation, interest rates need to be 8%. But the Fed chair (same guy as for Trump) isn’t going there. Mr Landlord already documented the rates under Trump. Not a minus sign in sight. The Fed hasn’t changed its practices for a long time. The last decent Fed chair was Volker (appointed by Carter, kept in place by Reagan). Rates that reflect inflation are Capitalism. Rates below inflation (assuming we are in an inflation and not deflation) are financial repression.

“They will if Biden removes the Fed’s control and restores capitalism.”

OK; that means NEVER.

“They will if Biden removes the Fed’s control and restores capitalism.”

OK; that means NEVER.

“Promising” something and “doing” something, for politicians is meaningless.

Joe R,

Do not believe Mr Landlord.

On March 15th 2020, The Fed dropped their rates to 0%. At the same time, Trump was bragging that he could force negative rates.

It is easy to look this up. I don’t want to sink to his level and call names, but again, do not believe anything Mr Landlord posts without checking it.

Bob:

Here is the table Mr Landlord posted:

Obama is elected

2009: 0.16%

2010: 0.18%

2011: 0.11%

2012: 0.14%

2013: 0.11%

2014: 0.09%

2015: 0.13%

2016: 0.39%

Trump is elected

2017: 1.00%

2018: 1.79%

2019: 2.16%

2020: 0.36%

Biden is “elected”

2021: 0.08%

2022: 0.08%

It is obvious that these rates are annual averages. In order to get a 0.36% average, there were obviously higher and lower rates at some time. You are talking about a rate that did not exist for the entire year while Mr Landlord is talking about the average of all the rates during a year. So you are the one who is being misleading, not Mr Landlord.

Besides, the rate under Biden is even lower that Trump’s average rate for the year of the pandemic, with much higher inflation than under Trump. So financial repression under Biden is much worse than under Trump in ALL cases.

OC Register Columnist Lazerson has a “silver lining” of last week’s war. Freddie Mac mortgage rates dropped 16 basis points in the last 2 weeks (3.76% 30 yr fixed).this is the biggest 2 week drop since July 2021. In troubled times, the flight to safety to US Treasury bills and Federal mortgage-backed securities drives down interest.

Another flight to safety occurred briefly during the same period:

https://finance.yahoo.com/quote/BTC-USD/chart/#eyJpbnRlcnZhbCI6ImRheSIsInBlcmlvZGljaXR5IjoxLCJjYW5kbGVXaWR0aCI6NDIuNjUzODQ2MTUzODQ2MTUsImZsaXBwZWQiOmZhbHNlLCJ2b2x1bWVVbmRlcmxheSI6dHJ1ZSwiYWRqIjp0cnVlLCJjcm9zc2hhaXIiOnRydWUsImNoYXJ0VHlwZSI6ImxpbmUiLCJleHRlbmRlZCI6ZmFsc2UsIm1hcmtldFNlc3Npb25zIjp7fSwiYWdncmVnYXRpb25UeXBlIjoib2hsYyIsImNoYXJ0U2NhbGUiOiJsaW5lYXIiLCJwYW5lbHMiOnsiY2hhcnQiOnsicGVyY2VudCI6MSwiZGlzcGxheSI6IkJUQy1VU0QiLCJjaGFydE5hbWUiOiJjaGFydCIsImluZGV4IjowLCJ5QXhpcyI6eyJuYW1lIjoiY2hhcnQiLCJwb3NpdGlvbiI6bnVsbH0sInlheGlzTEhTIjpbXSwieWF4aXNSSFMiOlsiY2hhcnQiLCLigIx2b2wgdW5kcuKAjCJdfX0sInNldFNwYW4iOnsibXVsdGlwbGllciI6MSwiYmFzZSI6Im1vbnRoIiwicGVyaW9kaWNpdHkiOnsicGVyaW9kIjoxLCJpbnRlcnZhbCI6ImRheSJ9fSwibGluZVdpZHRoIjoyLCJzdHJpcGVkQmFja2dyb3VuZCI6dHJ1ZSwiZXZlbnRzIjp0cnVlLCJjb2xvciI6IiMwMDgxZjIiLCJzdHJpcGVkQmFja2dyb3VkIjp0cnVlLCJldmVudE1hcCI6eyJjb3Jwb3JhdGUiOnsiZGl2cyI6dHJ1ZSwic3BsaXRzIjp0cnVlfSwic2lnRGV2Ijp7fX0sInN5bWJvbHMiOlt7InN5bWJvbCI6IkJUQy1VU0QiLCJzeW1ib2xPYmplY3QiOnsic3ltYm9sIjoiQlRDLVVTRCIsInF1b3RlVHlwZSI6IkNSWVBUT0NVUlJFTkNZIiwiZXhjaGFuZ2VUaW1lWm9uZSI6IlVUQyJ9LCJwZXJpb2RpY2l0eSI6MSwiaW50ZXJ2YWwiOiJkYXkiLCJ0aW1lVW5pdCI6bnVsbCwic2V0U3BhbiI6eyJtdWx0aXBsaWVyIjoxLCJiYXNlIjoibW9udGgiLCJwZXJpb2RpY2l0eSI6eyJwZXJpb2QiOjEsImludGVydmFsIjoiZGF5In19fV0sImN1c3RvbVJhbmdlIjpudWxsLCJzdHVkaWVzIjp7IuKAjHZvbCB1bmRy4oCMIjp7InR5cGUiOiJ2b2wgdW5kciIsImlucHV0cyI6eyJpZCI6IuKAjHZvbCB1bmRy4oCMIiwiZGlzcGxheSI6IuKAjHZvbCB1bmRy4oCMIn0sIm91dHB1dHMiOnsiVXAgVm9sdW1lIjoiIzAwYjA2MSIsIkRvd24gVm9sdW1lIjoiI2ZmMzMzYSJ9LCJwYW5lbCI6ImNoYXJ0IiwicGFyYW1ldGVycyI6eyJ3aWR0aEZhY3RvciI6MC40NSwiY2hhcnROYW1lIjoiY2hhcnQiLCJwYW5lbE5hbWUiOiJjaGFydCJ9fX0sInRpbWVVbml0IjpudWxsfQ–

Bitcoin rocketed up to $44K and then dropped back to ~$38.5K. Russians with money exchanging Rubles for Bitcoin. Then Bitcoin markets stopped taking orders from Russia. Whether it was to punish Russia, or to avoid a sinking currency, demand dropped quickly for Bitcoin. I am not against the idea of Russians ditching the Ruble for Bitcoin, but I wouldn’t want their Rubles in this situation. It’s turning into the Rasbucknik.

Why do people always talk about the rent and gas prices…

As a couple we live in the South Bay area where rents go for 6-13k a month…been living here for 20+ years renting for UNDER 3k and the landlord does not want us to leave…we save over 100k a year and invest…

And gas prices don’t matter as long as you work for a company that provides cars with gas

I rather have lower inflation in energy so my renter can pay me more rent. Do you want to pay $10 for a gallon or pay me a few hundred bucks more in rent?

Now that I own my house and became a landlord I want skyrocketing rents!!

M – you have jumped the shark with this comment

what a scumbag

Hi SV, not everyone receives the truth well. The truth is that As a homeowner and landlord I am happy about asset inflation and rent inflation. Being a landlord is not a charity, it’s a business. And just like any other successful businessman I like making money 🙂

If I had oil to sell I would probably be happy about $10 per gallon but since I rent out my investment property and don’t have oil, I rather have higher rents than higher gas prices.

Renters should just see it this way:

You are supporting a small business owner and not the saudis! Small businesses are the backbone of this beautiful country!

You got an outlier deal. 99% of people pay market rent and not provided cars from work.

This is diguised attempt to brag about your very good arrangment, however it is not representative of the real world

It matters because most companies don’t provide cars with gas. Most of the people pay for the gas out of their pocket. It matters because the whole economy depends on oil and gas – transportation, agriculture, fertilizer for food, and on and on….

To stop drilling and suspend drilling licenses is criminal. If you are not a career politician you are screwed directly or indirectly – everything is interconnected.

Even with gas prices in stratosphere, Biden refuses to reverse the bans he put on drilling through executive orders (some people believe that he is pro free market!). He wants the US economy dependent on dictator Putin, or dictator Maduro or dictators from Middle East. All because the “green” agenda and the bogus “global warming”. Who cares; the billionaires supporting this puppet have enough money for the private jets and private yachts (ask Kerry). The agenda is just for plebes to make them even poorer and dependent on the state.

By the way, oil started to increase supper fast way before Ukraine was invaded.

Fibi,

You have a good point. Gas and rent inflation does not affect everyone.

Many are still working from home and have spent very little in gas.

Good thing you don’t have Mr Landlord as your landlord.

However, your current landlord may decide to sell or may sadly pass on into the great CA sunset at any time. You are not secure with renting. Mr Landlord is correct that long-term renting is financial suicide.

If you own a home and are working from home, you are not likely affected much from the rent increases or the gas increases. Your house payments are likely fixed for 30 years and then they drop to nothing (except taxes (CA is capped at 2%/year increases from Prop 13) and insurance).

“My point is oil prices were not real under Trump. They were government subsidized. I am against this since it is communism.”

That is a lie and you know it; you don’t agree with oil subsidies, but you agree with all other forms of subsidies and there are thousands of them – from the new “green agenda” to all the trillions sent as subsidies to millions of people and businesses chosen by the Democrats. You don’t like subsidies to the oil companies because for the most part they support republicans. In US, everything is subsidized – the mortgage you pay is also subsidized, the Prop. 13 is also a form of subsidy, etc.

The inflation you see now in double digits is not going away anytime soon. You still believe in “transitory inflation”?! Even Powell gave up on that. With high oil prices, there is no way the inflation will go down.

Here is a better chart of the days when Bitcoin jumped due to Russian demand and then fell when Russia was closed off from trading:

https://finance.yahoo.com/quote/BTC-USD/chart/#eyJpbnRlcnZhbCI6NSwicGVyaW9kaWNpdHkiOjEsInRpbWVVbml0IjoibWludXRlIiwiY2FuZGxlV2lkdGgiOjEsImZsaXBwZWQiOmZhbHNlLCJ2b2x1bWVVbmRlcmxheSI6dHJ1ZSwiYWRqIjp0cnVlLCJjcm9zc2hhaXIiOnRydWUsImNoYXJ0VHlwZSI6ImxpbmUiLCJleHRlbmRlZCI6ZmFsc2UsIm1hcmtldFNlc3Npb25zIjp7fSwiYWdncmVnYXRpb25UeXBlIjoib2hsYyIsImNoYXJ0U2NhbGUiOiJsaW5lYXIiLCJwYW5lbHMiOnsiY2hhcnQiOnsicGVyY2VudCI6MSwiZGlzcGxheSI6IkJUQy1VU0QiLCJjaGFydE5hbWUiOiJjaGFydCIsImluZGV4IjowLCJ5QXhpcyI6eyJuYW1lIjoiY2hhcnQiLCJwb3NpdGlvbiI6bnVsbH0sInlheGlzTEhTIjpbXSwieWF4aXNSSFMiOlsiY2hhcnQiLCLigIx2b2wgdW5kcuKAjCJdfX0sImxpbmVXaWR0aCI6Miwic3RyaXBlZEJhY2tncm91bmQiOnRydWUsImV2ZW50cyI6dHJ1ZSwiY29sb3IiOiIjMDA4MWYyIiwic3RyaXBlZEJhY2tncm91ZCI6dHJ1ZSwiZXZlbnRNYXAiOnsiY29ycG9yYXRlIjp7ImRpdnMiOnRydWUsInNwbGl0cyI6dHJ1ZX0sInNpZ0RldiI6e319LCJzeW1ib2xzIjpbeyJzeW1ib2wiOiJCVEMtVVNEIiwic3ltYm9sT2JqZWN0Ijp7InN5bWJvbCI6IkJUQy1VU0QiLCJxdW90ZVR5cGUiOiJDUllQVE9DVVJSRU5DWSIsImV4Y2hhbmdlVGltZVpvbmUiOiJVVEMifSwicGVyaW9kaWNpdHkiOjEsImludGVydmFsIjo1LCJ0aW1lVW5pdCI6Im1pbnV0ZSJ9XSwiY3VzdG9tUmFuZ2UiOnsic3RhcnQiOjE2NDY2NDAwMDAwMDAsImVuZCI6MTY0Njk3NTEwMDAwMH0sInN0dWRpZXMiOnsi4oCMdm9sIHVuZHLigIwiOnsidHlwZSI6InZvbCB1bmRyIiwiaW5wdXRzIjp7ImlkIjoi4oCMdm9sIHVuZHLigIwiLCJkaXNwbGF5Ijoi4oCMdm9sIHVuZHLigIwifSwib3V0cHV0cyI6eyJVcCBWb2x1bWUiOiIjMDBiMDYxIiwiRG93biBWb2x1bWUiOiIjZmYzMzNhIn0sInBhbmVsIjoiY2hhcnQiLCJwYXJhbWV0ZXJzIjp7IndpZHRoRmFjdG9yIjowLjQ1LCJjaGFydE5hbWUiOiJjaGFydCIsInBhbmVsTmFtZSI6ImNoYXJ0In19fSwicmFuZ2UiOnsiZHRMZWZ0IjoiMjAyMi0wMy0wN1QwODowMDowMC4wMDBaIiwiZHRSaWdodCI6IjIwMjItMDMtMTFUMDc6NTk6MDAuMTM0WiIsInBlcmlvZGljaXR5Ijp7ImludGVydmFsIjo1LCJwZXJpb2QiOjEsInRpbWVVbml0IjoibWludXRlIn0sInBhZGRpbmciOjB9fQ–

Bob is virtue signaling with electrical cars like our president Biden. People can not afford $5-6/gal gas but they can afford over $60,000 EV!…

EV produce the most pollution in the world. They are more dirty than combustion engines if you factor in the REAL cost in human life and pollution caused by the mining companies to get Lithium, Cobalt and other metals required for the batteries.

More detail can be found here: https://www.realclearenergy.org/articles/2022/03/09/joe_bidens_electric_car_plans_support_the_worlds_worst_humanitarian_abuses_820821.html

On top of that, the more EVs you have in CA, the more rolling blackouts we’ll see.

Stand by for a housing market shit show coming your way soon. The California housing market is in for a correction, possibly like we have never experienced. Hopefully, this will somehow be mitigated, but at this time I don’t see where relieve will be coming from. For those who have patiently waited, and have some cash, opportunity awaits. For many this will be a replay of 2008.

The Federal Reserve is caught between a rock and a hard place through their own actions and malfeasance. Sadly, many very nice people will pay the price. I truly hope I’m wrong…

Leave a Reply