What if housing doesn’t recover for another decade? When the young cannot afford to buy a home from their parents. The reemerging trend between the US and Japan housing bubbles.

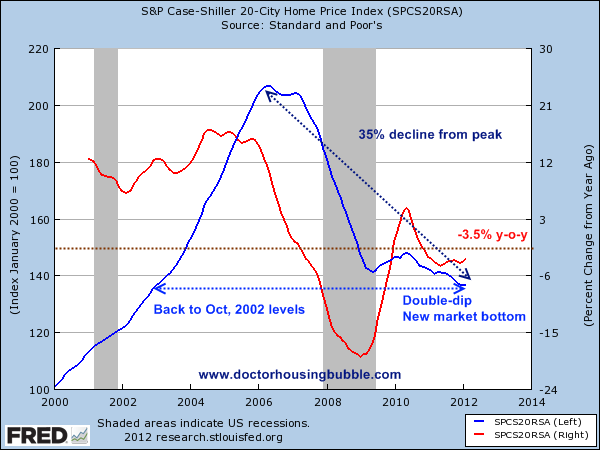

Robert Shiller of the famed Case-Shiller Index came out only a few days ago stating that housing may not recover for over a decade. As dire as this may sound, we have a similar example to look at in Japan. It wasn’t like he stated this just to cause a stir but talked about compressed household wages, record low mortgage rates, and a large pipeline of distressed inventory. Even though real estate values are now down 35 percent from their peak taking values back to 2002 (a lost decade) we would need to increase housing values nationwide by 50+ percent to get back to the peak. This is what he was discussing about home values not recovering to that price point. Japan has had well over two decades of a depressed real estate market and values today still do not approach the peak values reached in the early 1990s in spite of their central bank pushing rates even lower than the Federal Reserve. In fact, prices are holding closer to the trough. Examining the data we already find ourselves into one lost decade. Is another possible?

The nationwide housing market

For the little coverage it received, we did have a double-dip in the real estate market:

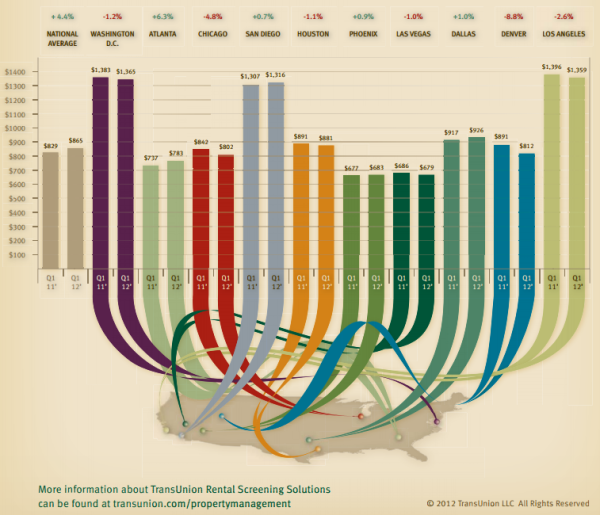

You can see that in 2009 prices hit a trough, went back up into 2010, and today have made new record low. Prices are now back to levels last seen in 2002. The year-over-year price change remains negative and markets like Atlanta and Las Vegas continue to see massive price declines. People may forget given the insanity of the housing market for well over a decade that housing is a utility that typically tracks inflation over the long-run. Rental parity makes sense if you have stable employment markets. A recent survey found that rental rates are not exactly soaring in mid-tier markets:

The above is an interesting perspective on the rental market. Denver has seen rental rates fall by 8.8 percent in the last year and Los Angeles has seen rates fall by 2.6 percent. The strongest market? Interestingly enough it is Atlanta that saw home values fall by 17 percent. Why would that be? It largely has to do with a flood of people losing their homes and becoming renters in the short-term. Yet this isn’t necessarily a positive sign. Las Vegas, a big investor haven has seen rental rates fall by 1 percent and this is probably because there is a glut of rentals as investors have bought massive amounts of properties for the last couple of years.

Employment matters

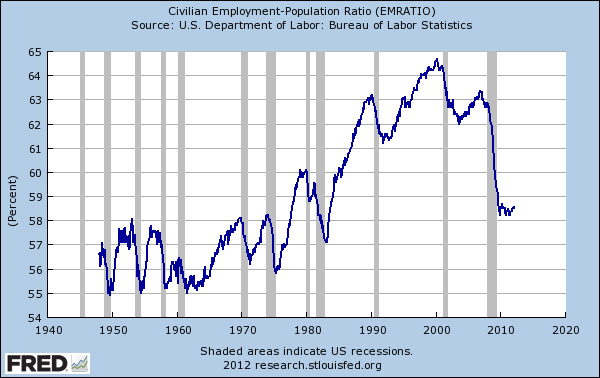

The news coming out on Friday reflects a weak economy:

We have an employment-population ratio that is similar to that from the 1980s. How is this good for household formation? More importantly, this reflects a troubling demographic reality for housing. You have 75 million baby boomers that as a group, are wealthier than their student loan indebted children but who will boomers sell their properties to? To other baby boomers? Over 10,000,000 properties today are in a negative equity position. Many younger Americans have no savings and because of the weak economy are 5 to 10 years behind their parents in terms of starting their careers. They also start out with a significant amount of student debt that was not really an issue for any previous generation (certainly not to the level we are seeing with student debt far surpassing credit card debt).

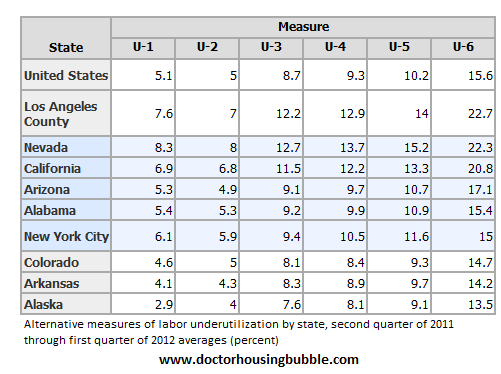

This weakness in employment markets is reflected in the underemployment rate:

This data might be surprising. Los Angeles with mid-tier market prices has one of the highest underemployment rates in the country. The underemployment rate in Los Angeles is 22.7 percent while economically hard-hit Nevada is at 22.3 percent. California overall has an underemployment rate of 20.8 percent. Employment absolutely matters. The last couple of years the housing market has been held together with FHA insured loans that bring back low-down payment mortgages and the Federal Reserve buying trillions of dollars in mortgages to keep rates artificially low. If you didn’t notice, rates made another record low this week. Yet rates are not truly reflecting the real risk in the market and you already see that rates do not have the power to suddenly increase home values because people still have to document income to take out a loan.

This does boil down to a household income issue and consequently an employment issue (it always did). From 1997 to 2007 the bubble in home values did not reflect solid wage increases but a flood of easy to get loans where a pulse was the only requirement to buy. With all of that removed, we have had 5 million completed foreclosures and trillions of dollars of faux equity evaporated into thin air. Prices are back to levels last seen a decade ago and 10,000,000 homes are underwater with another 5.8 million in foreclosure or with at least one missed payment. All of this in spite of historically low interest rates and low down payment products like FHA insured loans.

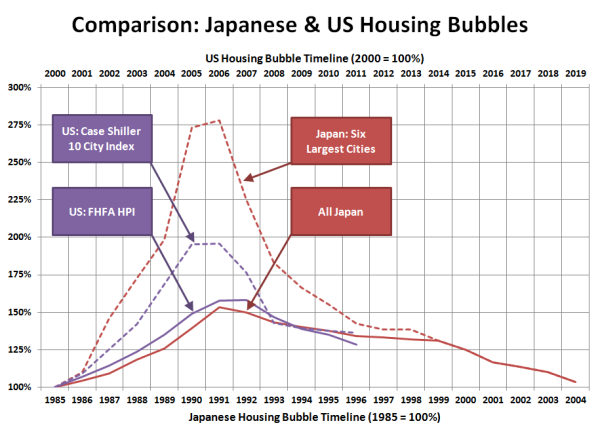

Take a look at Japan and compare it to the US:

Source:Â Seattle Bubble

Nothing plays out exactly the same but we do have many similarities with Japan:

-Massive number of zombie banks

-Central banks artificially keeping interest rates low

-Giant real estate bubble followed by a bust

-A younger generation that will likely be poorer than the current generation selling

Nothing in history repeats exactly. Yet for home values to recapture that peak, housing prices would need to rise by 50+ percent. When are we ever going to capture that price again unless wages rise? Interest rates are reaching levels that are below inflation and we risk more dramatic problems because of this just to support bank balance sheets. Ultimately home values will once again become a boring local commodity that provides shelter. In many markets that already seems to be the case. In many other markets tiny bubbles flourish and people keep saying “it is different here†until clearly it is not.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

69 Responses to “What if housing doesn’t recover for another decade? When the young cannot afford to buy a home from their parents. The reemerging trend between the US and Japan housing bubbles.”

Real employment has not changed since 2000. Same goes for wages and now real estate is close to this as well. The stock market is in about the same level.

So, it’s pretty clear that we are following the Japanese model of economic “growth”. US demographics indicate this too. People under 30 are unemployed and debt laden. And probably will be having much smaller family formations going forward. 46M people on food stamps.

The only thing the real estate market has going for it is very low interest rates and a system that allows the mortgage holders to not foreclose in delinquent loans.

There is plenty of cheap money out there, and it ain’t chasing housing. And it’s not in our hands either. The big guys control the trends and the peon sheeple (us) mearly follow and get the table scraps. But hey, the DOW is up, right? Well, that is until the credit cards are maxed out again, people stop buying AAPL, and the market crashes again.

Expect low interest rates to continue for at least a decade. There is no other option for servicing the national debt.

The only way I see out of this is the next big tech boom, like the cure for cancer or something. I mentioned this before and someone countered with the dark ages…I laugh. Really? That’s where we’re going? So humanity has peaked and we’re done for 500 years? Maybe if we go to war with Iran and China jumps in and nukes fly. But I digress…

I see high food and fuel and stagnant to falling housing for a while. CPI inflation is a wildcard as well…fuel prices and human rights are pressuring up Chinese wages and product pricing. Europe is a shambles, some rampant inflation and some countries hurting for anything i.e. downward wage pressure, similiar to the state to state situation in America. There is no equilibrium right now (thanks Obummer) and until there is, there will be no “recovery”. You are looking the current “recovery”.

Let me add –

“Booms” come in many forms. War, electricity, radio, TV, national freeway construction, internet, all created booms. Obama failed at green energy.

We do not know the next boom, it’s not invented, it’s not conceived. If it was, it would be happening. Anti gravity? Cure for cancer, cure for aids? Who knows…

“Obama failed at Green Energy?” I’m not particularly impressed with BO, but what sense does that make and how does it translate to housing?

There could have been a tech type boom in green energy is what he is saying and Obama messed it up pumping money into a company that failed miserably ruining it for investment in other companies. Personally I dont thing Green energy is ready but even if it was the government should stay out of the market place since they have a poor record of managing…well anything. Which is why they should get out of the health care field- because of their poor record of handling fraud waste and abuse- give it to the people who have the best record handle funds, fraud, waste and abuse- the credit card companies. Anyway look away from green energy but close by in “Clean Tech”

If you think that humankind moves in a linear mode then you have never read a page of history in your life.

Papa obviously has an agenda in that he has not thought things through all the way. It’s like he got the math up to fractions but when it comes to Algebra he can’t keep up. His comment “Thanks Obummer” gives this away. He doesn’t conceive that it is a complex scenario of the senate and house, Republicans and the private sector, in particular the powerful cartels of energy and banking. Additionally he has a very negative take on how it plays out. I make these comments based on reading many of his posts. He ignores Bush, He ignores the legislative buy in on the changes to credit, bank regulation and GW’s rush to war and bail outs. He exhibits a narrow focus on the Executive as though the world actually worked on the concept of divine right of kings. Papa it’s a lot more complex and involves the blinders worn by the electorate and the elected as to the reality of how things work. Sadly those blinders may bring your negative fears to fruition but it is not because this particular black man is president. His sins are mainly in getting suckered into the terror scam and selling out our constitutional freedoms.

your obviously an Obama supporter. It has nothing to do with Bush or the fact that Obama is black or the so called “terror scam” (scam really? tell that to Boston). Anyway his point was , if you missed it and it seems you did, Obama is the president and claims there is a “recovery” when there simply is not. We all blamed Bush- which was absolutely stupid since the crash had been coming after decades of build up and many contributors to the problem, including Clinton. So if you are or were one of those people blaming Bush then it stands to reason you must now blame Obama for at least not doing what is necessary to change things. But Obama seems to think he has changed things for the better. I believe things are better but only because the market is adjusting itself.

Bush made the mistake of trying to help people own homes who should have kept on renting. He tried to help redistribute wealth, which is one factor in maintaining long-term economic growth in developed nations. Most people who were buying property simple couldn’t afford it or did not have the skills to manage their finances correctly or both. He like all governments should have stayed out of it and let the poor be poor because most of them are worse off now.

In the end the market corrected itself.

Transunion’s chart is pretty and completely wrong about Denver.

All statistical and anecdotal data for Denver say that rents are rising at a 4-8% annual rate.

The apartment vacancy rate for each of the 6 counties in greater Denver are hitting record lows.

“All statistical and anecdotal data…” Ummm, what? You need to provide some actual evidence form objective sources, and saying something like anecdotal evidence to buttress your point is hilarious – “hey, I heard from some guy down da block that he’s got some rental units that are sold out for the next five years!”

I left Littleton CO about a year and a half ago. I was in an apartment complex of about 80 units. When I rented it they said they had 2 available, and I got one. The raised the rent about 25% on me after about one year. I spent a month looking for apartments and had a hard time finding a decent one. I saw no evidence of a surplus of apartments in Denver, it looked to me like there was a shortage of apartments. Also I was surprise that the rent in Littleton is not much cheaper than the rent in S CA.

The rents are higher exactly because people cannot afford buying a house. So they rent!!!

I think we’re in a new normal. We should expect things to remain this way for the next 5 years or so. The only real question is what happens when interest rates rise or banks really let go of foreclosures. Something’s gotta give.

Look at Japan. Something gotta give…..but that could take a lot longer than most people think. I could see this trend continuing until at least 2015.

drHB,

I like to keep it simple, so I prefer to go forward after standing on the truth. Here’s a suggestion for an audience: first show them this USA track record of ours:

http://homepage.mac.com/ttsmyf/RHandRD.html

Then ask them “Do you know folks who had kids to have someone to sell high to?

Here’s my question; is this chart a national chart because if you are showing housing as inflation wise reverted to late 90’s that may be accurate for Kentucky but it sure as heck ain’t for coastal, urban California? These areas are still in the mid 00s.

National chart. An update of

http://www.nytimes.com/imagepages/2006/08/26/weekinreview/27leon_graph2.html

wydeeyed,

A little more reply … Referring again to

http://homepage.mac.com/ttsmyf/RHandRD.html

the phrasing “the public be suckered” is fair for BOTH

(1) our track record of these real price histories, AND

(2) keeping these histories out-of-sight.

The word ‘investment’ is a power lie. Truth is ‘the coming and going of irrationality’.

hey wideeyed. I really enjoyed the first comment further up that you posted. I thought it was very insightful and from a broad perspective. love to get your thoughts on an article I wrote. the subtitle is called “a super cycle survivor.” I really just wrote it to help my friends see the big picture of what’s happening in our economy and stock market. the link is in my name. I haven’t asked anyone to look at it in quite a while but you really seem to get the true underlying problems.

.. at least check out the chart toward the end of the article where I compare japan to us. you may also enjoy my argument about the importance of velocity of money.

Interesting charts, and they drive home what I’ve been saying for a while now: that housing has fallen from the bubble highs to the top end of the past 50 years’ normal channel. Of course, with the current state of our economy and unemployment figures, they should be moving toward the low end of normal. To really get a fuller picture, it would be interesting to see unemployment and inflation adjusted wages next to those.

This was interesting an horrifying…

http://blogs.sfweekly.com/thesnitch/2012/05/foreclosure_auction_conspiracy.php

Why would any sane person what to go back to the bubble prices of 2006/7, as if that was the true value real estate?

Word. Mainstream media sure seems to think rapidly rising real estate prices would be the bees knees though. Kinda makes me wide eyed.

Because then we’d all “feel rich” again and be out spending our “wealth” and “growing the economy”. But only until the next crash, of course.

Jobs is the key. We can’t compete on price against someone making 10 bucks a day. They cna live comfortably in their country on 10 bucks a day-we can’t. So the only thing left is to dump free trade and go back to proctetionsim. Unlike smaller countries, we have the world’s biggest internal market and can really do well on our own. But both parties are not interested and instead are fighting on contraceptives, gays, evolution and climate change. Sigh.

I always get a kick out of those who say we can’t do this or that because “we could start a trade war, and that would be devastating”.

Would someone please explain to me how the U.S. could ever lose a trade war when we import 600 to 800 billion more than we export? The nation that is a net exporter is the nation that needs to worry about a trade war, a nation that is a net importer can only gain by taking a protectionist stance.

Of course, multinationals don’t have a “homeland” so they will pay off politicians to do their bidding and multinationals don’t want protectionism for the u.s., weather it would be beneficial to us or not.

The fact is if the u.s. adopted the same protectionism Japan, China and many other net exporters have, we would be accused of starting a trade war and most u.s. politicians would claim that adopting the same protectionism as other countries would be “starting a trade war” because they have been bought and paid for by the multinationals.

Yes, it is true, in the short run, adopting the same protectionism as China and Japan (and therefore starting a trade war) will probably be detrimental to the economy, in the long run, it can be beneficial.

In summary, my point is, free trade is a good thing but when you have other nations taking advantage of us and whenever we try to stand up for ourselves, we are accused of starting a “trade war” when it is in fact just standing up for FAIR TRADE, there is a problem. If standing up for FAIR TRADE means a trade war, then so be it, we can’t lose, because we are a net importer.

Martin,

The financial shenanigans of the past four years have nothing to do with average Americans (aka consumers) and their well being. Ben Bernanke and his pals are working furiously to “save” the large banks, and these sociopaths will do whatever is necessary to achieve that end. Your observation that net importers can’t lose a trade ware is correct, but any actions in that direction would not benefit multinational banks, so Bernanke will oppose tariffs and trade sanctions.

The end game for this housing “crisis” is a bailout for the big banks, funded by unborn taxpayers, and wrapped in a made in China American flag.

Riddle me this batman: Would I have fewer choices or more choices? Would my std of living go down or go up as an isolationist?

Robin, as an isolationist, it would go down, but standing up for fair trade would improve your standard of living.

I have a question for you. If you spend more than you take in, year after year after year, would your standard of living increase or decrease? In the years you spent more than you took in your standard of living would increase. How would you fair in the longer term?

Asking China and Japan to treat us as we treat them is not being isolationist, that is just another FOX talking point.

At least once a week I have to remind my kids, Life Aint Fair!! You, and no-one else can define what is “fair” trade. How about a 40% tarrif on all motorcycles over 700cc’s? Enter the honda nighthawk. Hooray, we saved harleydavidson!! At what cost? A GSXR 750 is SAME bike as the GSXR 600, but its price is $3000 more. WTF? Trade isnt between countries, it is between 2 individuals, and thank you “smart” guy, you F’kd me!!

Since the Japanese real estate bubble started, 1985, the Yen has revalued about 70% versus the dollar. In dollar terms the bust is not as bad as it seems. Not to say it is not a collapse. All of this was setup by Nixon (bye,bye, gold) and his tricky inflation to pay for the Vietnam fiasco. It was the first of a series of wars that were not and will not be paid for with the requisite economic sacrifice. Unfortunately, we have hit the wall and there is no demand because we are all debted out. Reseting the machine is going to be a real bitch. This is NOT some normal cyclical downturn, boys and girls. Ben has poured gasoline on the barn and it still will not burn. How is that Greenmountain brew smelling today?

Nixon and his buddy, Kissinger, were/are very nasty fellows. Made a lot of money for their friends but ruined our country. If you listen to the Nixon tapes, you will get a real feel for the diabolical. Ironically, he hated Jews and loved his Mormon accountants.

http://en.wikipedia.org/wiki/Japanese_Yen#Historical_exchange_rate

I’m not denying your position that it was about paying for Nam as I understand the costs of war, on the ground and in the lost opportunity but I read that he took us off the gold standard because the Saudi’s were concerned about getting paid for their oil and may have demanded a run on our gold crashing our solvency. I appreciate your comment about our ability to run our economy internally. I also have two concerns. I’m not sure the workers off shore actually live well on $10.00 a day any more than 1900s US coal miners lived well. If we went back to isolationism which was our modus prior to WWII how much more would the rest of the world hate us? As much as they hate our boots on the ground I believe they are really dependent on our business.

“I read that he took us off the gold standard because the Saudi’s were concerned about getting paid for their oil and may have demanded a run on our gold crashing our solvency”

You miss the point. Gold was the money! Green paper was the receipt for money, which was Gold. So, if as you say, the Saudis wanted not the receipt but the real thing, big deal, that is the way it had always been in the past.

The problem came from producing too many green papers that represented Gold, if you do that, soon, you have no Gold. It is much like, if you spend more than you have, soon you are broke.

We went off the Gold standard because we were broke! The world blinked and chose to accept the receipt for gold, the dollar, as the NEW GOLD”. That was the choice, accept u.s. dollars as GOLD or have the world economy collapse.

At the time the u.s. economy was mighty compared to any other economy in the world so the world accepted the situation and went on its merry way with King Dollar.

We are some 40 years into the FIAT currency experiment and I see problems brewing in every corner. How about you?

NIXON!

…as if the New Deal, “Great Society” and BHO’s Fundamental Transformation of this country have had no consequences!

…and Rev Wright, Saul Alinsky, and Bill Ayers are Saints.

Laughable.

@Doug

The events you mention are mainly recent and mostly inconsequential in the economic history of the US, like the Rev. Wright. Nixon’s little trick is spelled out for you below. I would bet even money you, like 99% of Americans, never heard, much less understand, what Nixon did in terms of the gold standard and Bretton Woods. Read, you wil be enlightened and realize that both parties are the same when it comes to doing the bidding of the powerful. And, by the way, you are likely to get a front row seat for the denouement of Nixon’s handywork. It is not going to be nice.

http://en.wikipedia.org/wiki/Nixon_Shock

I did not live through the great society but I can tell you that in the 80’s I witnessed an elderly white man living in a clapboard shack in southern California with barely two nickles to rub together. As the great society I know that it ushered in the end to lynchings in the south. So you can slam the Democratic actions out of your ideology but I must wonder what you see as the promise of Life, liberty and happiness for all. Nixon don’t forget resigned to avoid impeachment in the face of criminal behavior. We have done precious little in the way of American greatness in the executive branch since. Mostly we lived insanity of fear of Left wing enslavement, not the bull crap dumped on Democrats today but the dominoes of Communism suppressing our religious freedoms and making slaves of our workers morphed into the godless Muslims when the Commie myth imploded. Don’t be mistaken in what I say, godless Muslims is just the commie fear moniker re-branded.

blame game, easier than facing the truth that the answer in self reliance. That old fart could have bettered his situation if he wanted to. It is not my job to rescue the lazy from their self inflicted plight, nor should it be yours. Tell me what you did for that old guy? Did he move into your house and pick up his share of the chores?

I think this, or close to this is what we are going to see. There may be false “bumps” in the market as people see interest rates rise and clamor to get in before the train leaves the station…but as those rates rise, the affordability of homes will fall. Homeownership isn’t the magnificent thing it was once seen as being. I think once a nominal bottom is reached, homes will appreciate very, very slowly, making them rather blah as investments unless A: you can steal them, or B: they cashflow. Of course, any piece of real estate that cashflows is its own justification, provided you can rent it and replace a tenant with another. I see little reason to own a home these days on an economic basis, but I am a single man, and I don’t have the fmaily “nesting” instcint—which is strong and can be quite valid. Now if you find a cool place by the beach (or the mountains or some place you really like) and it isn’t too dear, that’s another story…the delta over a normal place to rent might make such a place worth the extra hassle and cost of ownership.

The headlines I read “Maybe no housing rebound for a generation: Shiller”. That is Twenty or more years. A decade is ten.

My belief is that the collapsing economy was the recoverey. Steady growth is the norm.

Differed interest payments’ super cheap interest’ and government programs to assist. Assist who? People who can’t get a down payment together? People who are broke? This has all been going on strong since the 70’s or longer that I can remember. FHA was created in 1934 to stabilize the mortgage market. Good job Congress. Let’s leave Congress in charge they have a track record of success. Not.

The way I see it. 5 years ago we completed the largest construction boom in the history of the world and the majority of buyers needed assistance. Assistance is not the sign of a strong economy. To think the economy was strong while these homes sold is crazy.

I hear one side of the political spectrum says ” We cannot go back to the failed policies of the past.” But oh please Mr. Pres., fix the economy. Make it as good as it was under those failed policies.

It isn’t going to happen again. Not in my life time.

And all the king’s men couldn’t put Humpty, back together again. It is different this time. The last 40 years + have bankrupted us and we are now on the path of Japan. We will continue to grind down for the next 5-10 at least. Not a time to make a house purchase for most people. The market ultimately trumps crooks and thieves as always, because it is not restricted to any timeframe. At 50% off 2007 prices, inventory wil begin to clear. Even then, prices will remain flat, as wages are and have been decimated. Most desirable Westside homes are still 35% overpriced. In the end the tide raises and lowers all boats the same.

http://Www.westsideremeltdown.blogspot.com

The comparison chart between the US and Japan show Japan getting back to where they started in 20 years. The US trend shows us getting back to our starting point in 15-16 years. The slope of our entry in to the second lost decade appears to be increasing in spite of efforts (low interest rates, slow dribble of the shadow inventory in to the market, etc)

Our bubble may not have been bigger, but it sure looks like the air is coming out faster.

What do you all think of this, please? (specifically, the MAIN ENABLER assertion)

The MAIN ENABLER of sizable asset price bubbles is keeping the real price histories little apparent. E.g.:

http://homepage.mac.com/ttsmyf/begun.gif

http://www.nytimes.com/imagepages/2006/08/26/weekinreview/27leon_graph2.html

http://homepage.mac.com/ttsmyf/RHandRD.html

Blame venal professions doing intellectual savagery: economics, finance, journalism, holders of elected office.

A decade is a long time, Dr. H., but that is a reasonable guess for the remainder of this housing slump, based on what we know now. At some point, the US dollar could collapse in a hyper inflationary episode, and peoples’ debt vaporized, but so far the fed has been able to maintain control.

A healthy housing market has two components, first time buyers and move up buyers. You have already gone into quite a bit of detail on the former, so suffice it to say that half of the equation will be weak for a decade, or more.

That leaves move up buyers. You have to have equity, and lots of it, to move up. Enough said.

This just in, Mark Kiesel from PIMCO who sold his home at the peak and became a renter is now in escrow.

http://www.pimco.com/EN/Insights/Pages/Global-Credit-Perspectives-May-2012.aspx#

He seemed like a genius at the time, but he probably gained littled my selling. Places in Newport only went down about 20%, he probably paid taxes on his windfall sale, had the pleasure of moving and becoming a renter, and lost his Prop 13 tax basis and tax write off.

I hate to say it, but I think we are very close to the bottom. It has become very clear to me that the government simply will not allow another large leg down in housing prices (10 or 20%), that would result in economic chaos. If you plan on staying put for around 10 years, buying today with sub 4% 30 year money or 3% 15 year money probably makes sense. While it sucks for responsible people who have been waiting…you will lose to the powers that be everytime.

Lord Blankfein do you think now is the time to buy or wait till the fall or even another a year or two?

Renter,

Let me clarify a few things. I think we are very close to the bottom in nominal pricing. But remember, we will be bouncing along the bottom for years to come. No, there is no hurry to rush out and buy today. If you truly want to buy a house in the near term, I would wait until the slow season (Oct-Jan) and hopefully there will be more options (inventory) out there. Additionally, I doubt nominal prices will change much for the rest of the decade. So if the numbers make sense to YOU and becoming a loan owner makes sense, then buy for all means.

I saw some posts below laughing at my comment “the government won’t allow prices to fall much further.” Maybe they need a refresher to see what the government/Fed/Wall St./lenders have done so far:

Record low rates that will probably go lower, who would ever have thought we would see this cheap money for so long. Savers be damned, they don’t care about you. They don’t care about inflation, all the numbers are fraud anyway. Rewriting certain accounting rules (mark to market), they’ll rewrite more if need be. Trickling out inventory one drop at a time, this seems to be working…why would they change this. Allowing squatters to squat indefinitely, we hear stories of YEARS now. If we had another 20% leg down, there would be millions of more loan owners throwing in the towel…do you really think the powers that be will let this happen.

Forget about what is right/rational/reasonable. Most people are homeowners in this country, politicians will always favor the majority. Most of the 1%ers and powers that be have massive real estate interests. Same goes for the financial overlords, they also have massive real estate interests. Then you have all the powerful real estate lobbyists adding fuel to the fire…how many lobbyists do the responsible renters/savers have? Savers/renters/future generations will utterly get screwed, but that is all irrelevant to the powers that be. Just follow the money trail and it makes sense.

Do you really want advice from someone taking the name of Lloyd Blankfein?

Rhiannon, I use my screen name to specificially get a rise out of people exactly like yourself.

If you don’t have anything constructive to add to the discussion, please stay out of it!

Well, incredibly, according to Zillow, my home and my neighbors’ homes in Westlake Village (an affluent town NW of L.A.) have fallen 10% – 17% since January 1, 2012. My house is down 15.7% in four months.

In real terms, not withstanding hyperinflation, I believe home prices have another 35% minimum to fall. I just didn’t expect half of that further decline to happen in the past 4 months here.

Another 35% decrease? Not to worry, if you believe a previous poster. The government will not let it happen because it will cause chaos.

You are experiencing reality, others who may have believed that home prices would continue to rise in the past are now putting forth the fantasy that they can’t go lower because the govenment won’t let it happen.

RTS, don’t even look at Zillow numbers. They are all over the map. I wouldn’t even consider them a data point. Comparable sales is what you need to look at.

Another 35% drop? I could maybe see a big drop in the houses priced in the stratoshere (double digit millions), I doubt you will come close to that anything under 1M today. Even the biggest real estate bears (which I have been one for years) couldn’t even fathom this. So today’s 600K house will be worth 390K after the 35% drop. That is laughable to say the least, if you have bidding wars today, what do you think will happen when we see 35% off pricing?

Planning to stay put for 10 years is the smaller part of the equation. Securing income to pay mortgage each month is the main issue people should think about. Real estate has become a financial trap. Easy to get in, painful to get out. There was an article talking about the younger generation in Japan. They don’t want to load up debt of a house because they grew up witnessing their parents fighting about losing their house and related stress. 3% down payment and artificially extremely low interest rate invites buyers who are very unlikely to keep up with the long duration of the loan amortization. That puts real estate market at extreme risk.

By the way, government wanted higher % of house ownership, did it work out the way they wanted? No. We shouldn’t be thinking that whatever the government wants is what the government gets. Economic experts have always disagreed on how to improve economy and so far it has gone no where. Nobody knows the formula! It is not like math where you get 4 when you add 2 and 2 together. There are many factors that the government do not have the controls!

…Gamblers always think that they are investors.

You people need to get out of SoCal and see the rest of the country.

It is different here in the hinterlands.

No thanks, I like my lectures at CalTech, UCLA, and USC, LACMA and MOCA, art galleries, restaurants up the wazoo, diversity, sunshine…

This post reminded me of the Diane Chambers character from “Cheers”…what a great show…thanks for the chuckle!

Went to an open house down the street…………MLS 120022924 They are asking 425 for a 600sq foot shack! http://www.ziprealty.com/property/4876-MANSFIELD-ST-SAN-DIEGO-CA-92116/80935011/detail

This used to be a 2 on 1 but they split the property and now they are selling both properties separately. This property therefore sits on a lot of about 2400sq feet.

It is true this house will never sell for 425K, but it will sell for over 300K.

On another note…….I just did a drive by on a house I lost out on in a bidding war to another cash offer. Some 3 weeks after closing, it sits empty, no activity. Clearly another house soaked up by an “investor”.

I remember Phoenix 2005 an investor bought the rental we were living in in Phoenix. She had apparently bought a total of 6. As I recall, this was less than 2 years before prices began their huge plunge in Phoenix.

Investors are the market in San Diego. You will find plenty of choices above 699K, prices declining, few sales. Investors have made the sub 500K market a frenzy. One has to wonder what will happen when this “echo” bubble fizzles.

Fizzle it will because I am just one example of the larger market. I am in the market for a 600 to 650K house and I have given up because I can literally rent the same house for 60% of the buying cost. Because of the investors in the sub 500K range, they have forced up so so type houses into the 500 to 650 range. I could stretch my finances and get up to the 750K range but for me to do that I would have to see a house that I would literally give anything to live in. Those types of houses, where I would give anything, are currently in the 900K range but coming towards 750K while ironically at the same time the 400K is moving towards the 500K. Which end of the spectrum is the true trend?

So like Burbank Martin, Investors are the market here. They are flipping us all the way down, and we are on a slow decline. Burbank is at the 2003 price levels, and I can remember thinking then that prices were insane. Well unbeknownst to me at the time we took insanity to a whole new level. Everybody talks about the massive price declines of 50%, but if you think about the fact that prices tripled here from 2000 levels, we are still massively inflated. We are lulled or should I say beaten into sense of normalcy, thinking that a half million dollar debt is OK. I can’t give up and buy a 600K house just becuase it is above the level where an investor feels they can turn a decent profit. Truly the banks are the most culpable only secondary to the crony politicians who continue to allow them to suspend mark to market and flood them with cheap cash so that they can hold back all the distressed property. The vulture investors then sccop it up, slap paint on it, and sell into a manufactured low inventory market.

Banks…..happy

Investors….happy

Politicians….happy

People…..screwed

I know the term “housing recovery” is always used but I’d like to know what that means exactly, and if we don’t need to modify our understanding of “recovery” given the catastrophic nature of these times?

The Fed sanctioned bankster strategy is pretty simple:

Drip, drip, drip out REO homes, keeping the price atificially high, and wash the unavoidable lossess through the buyers.

For real!!! it very well could be a decade or more of slow decline since we have lost all sense of fundementals. This is a 100% manipulation.

Look at the current fight over interest on student loans. Do you think for a second that college would be so expensive if it wasn’t for our government manipulating rates. The lower the interest the higher the price just like housing.

Water seeks its own level…prices seek what people think they can afford, and government manipulates affordability.

Interest rates will stay down a long time and inventory will trickle out…little by little. All the while “investors” will be buying homes that they can rent for positive cash flow as quickly as they can lay their hands on them. So the “sweet spot” for the average shmuck is going to be the $650K and up range because the investors can’t cash flow on them and the banks will have to move them out. But still…..how sweet is $650K ???

CAE, I agree 100% that the higher end (650K +) will be the sweet spot for those waiting…that is if you can afford it. The conforming loan limits are 625K or 729K (depending on where you shop), anything above this requires much more stringent underwriting that will rule the majority of people out.

As we are seeing right now, anything decent below 500k is gone instantly. With super low rates, government backed subprime loans available, little inventory and investors seeing positive cashflow from these purchases…buying in this range will be extremely competitive and frustrating. I don’t see this changing anytime soon.

Yup. I follow all the real estate investor groups in CA. They are going crazy trying to buy anything that cash flows as a rental. And this is typically the under $500K homes. So good luck trying to buy anything in that price zone. I hear them talking about Section 8 more and more. Reliable payments.

But just think what CA will look like as the only people left here will be those making $125K/year or more and those making $20K/year or less.

Gamblers evaluate house price only based on % of the crazy peak. They need to read this wiki page: http://en.wikipedia.org/wiki/Japanese_asset_price_bubble. If they are too busy with gambling their hard earning cash away, just read this:

“…Tokyo’s financial districts had slumped to less than 1 percent of its peak, and Tokyo’s residential homes were less than a tenth of their peak…”

Japan government wanted the real estate to go up as bad as ours does. They also have the “power” and lobbyists but what happened there?

It is true that governments can exert influence over prices but there is a limit. The key factors in real estate demand is…employment, employment, employment! Renters and buyers in Southern Cal need to have secured and high-paying jobs. Higher house prices -> higher cost living -> higher labor cost -> less competitive labor in the global market -> job losses -> cannot afford to keep mortgage or buy house or rent here -> house prices get pressured down.

For the people who don’t believe interest will go up in a few years, they should still wait. The “affordability” has been getting much better every few years due historically low rate. Why jump in now? The longer the more it’s affordable.

For the rest of us, with the going-lower trend of 30yr fix mortgage rate, we will hit 0% 30 year mortgage rate within 3 years! It’s not possible to have 0% mortgage rate because it means you can borrow a large junk of money without paying interest.

While gamblers are bidding on ugly houses in bad locations, investors are waiting until until at least next year to see better inventory and observe what happens when interest rate has no more room to go down.

CLEAR, one big difference between the current US situation and the slow motion trainwreck happening in Japan for the last 20+ years is that the US of A currently holds the world reserve currency. Will this change in the future? I don’t know. However, as long as this remains unchanged…defying economic gravity will continue.

Would I recommend anybody buying in today’s market, absolutely not. However if it makes sense for YOUR situation (kids, family, stability, etc)…it’s definitely not the worst time in the world. Like I said previously, anybody buying today should bank on no appreciation for at least a decade. A home should be viewed as a shelter, and as you can see our government gives special consideration to shelter “owners.”

Dr. Housing Bubble, you are too optimistic. (California)”Population growth declined sharply in the 1990s to 1.5 percent a year and fell to just 1 percent in the first decade of this century. A NEW REPORT from the state Department of Finance estimates that growth was only 0.7 percent in 2011 – just a third of the 1980s rate.

A massive new study by demographers at the University of Southern California concludes that California will see sub-1 percent growth rates for DECADES to come, due to sharply lower immigration and birthrates, with 6 million fewer residents by 2040 than previously thought.

The potential impacts – positive and negative – are immense.

It would lessen demand for public infrastructure and services, thus easing the backlog of unmet needs. But it would also LOWER DEMAND FOR HOUSING and dampen retail sales and employment, which would mean less economic activity and tax revenue.” http://www.sacbee.com/2012/05/06/4469161/dan-walters-population-slowdown.html#storylink=cpy

Hey I’m loving less immigration into CA personally! My commute has been great the past year… Probably because of all the unemployed and high gas prices.. But, hey if you got a job, you gotta love the promise of an easier time getting around Los Angeles!

So many pessimists who only look at the glass half full! 🙂

Thank my man Obama. He solved the immigration and crime problems with the GDP of 1.8% while Mexico has over 4% and he solved the crowded freeway problem with gasoline on the way to $5 a gallon with his war on big oil. next_to_freeway, remember to vote for the man that brought you your higher quality of life.

History basically tells us that when there is a bust in a major asset bubble like the one we saw with housing, it does take a generation to recover. But that is in the “macro” sense. There are still good housing markets out there where value is appreciating. It just takes a little bit more time and effort to find them.

Leave a Reply