The housing crunch with a taste of rental squeeze: Incomes down and home prices up. Los Angeles families took a hit to their household incomes yet home prices soared.

People rarely think about the cost of living and how it impacts their long-term economic future. The Bay Area may seem expensive but incomes in the area do justify some higher prices (maybe not to current levels but that is how the market responds). That is why, the LA/OC region is the most unaffordable in the nation because incomes simply do not justify current prices. It has caused the LA market to enter into rental Armageddon where people are packing in like sardines just to afford the rent. You also have millions of full grown adults living at home because they can’t afford the rent, let alone purchase a renovated crap shack of their own. In reality, what has happened since the housing bust hit is that more disposable income is going directly into housing. When we look at household incomes, we find that for most of those in the LA area they have moved back in time while home prices have moved up. Part of the move has come from big investor demand. And with housing, momentum is huge. However, with appreciation slowing and investors pulling back, where does the momentum go? There is good data on income and income matters especially in the LA market where most people rent.

The housing crunch

The National Association of Realtors put together some interesting data on household incomes across the country and what has happened over the last 10 years. What is telling is that home prices have soared while incomes have gone stagnant. In places like Los Angeles, when we adjust for inflation incomes are actually below where they were in 2005. That is a big deal especially when rents and home prices have soared.

People always ask about options. You have a few: you either rent, you buy, or you can move out of the area. With low inventory and momentum, you will have to pay to play and many can only afford a crap shack if they want to buy. In reality though, most don’t even have enough to buy a crap shack and are forced into renting.

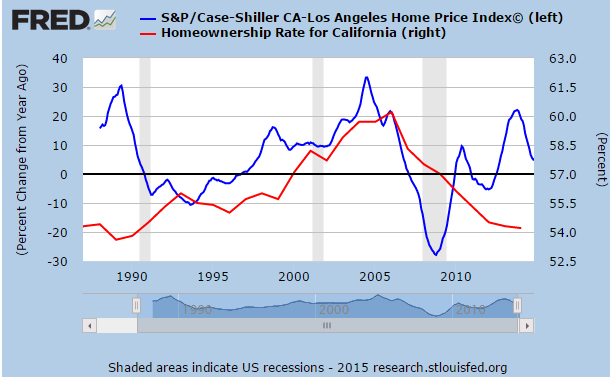

First let us look at home prices and homeownership rates in California and Los Angeles:

From 1990 to 2005 at the peak, home prices in LA went up hand and hand with the rise in homeownership for the state. Then from 2005 to 2012, LA home prices fell while the homeownership rate went down. So far all of this makes sense. But then in 2012 you have the continuing fall in the homeownership rate yet prices soaring. This was brought on by the flood of absentee landlords and investors buying up properties. You can also see from the chart above that price gains in the LA/OC market are heading lower now that investors have pulled back.

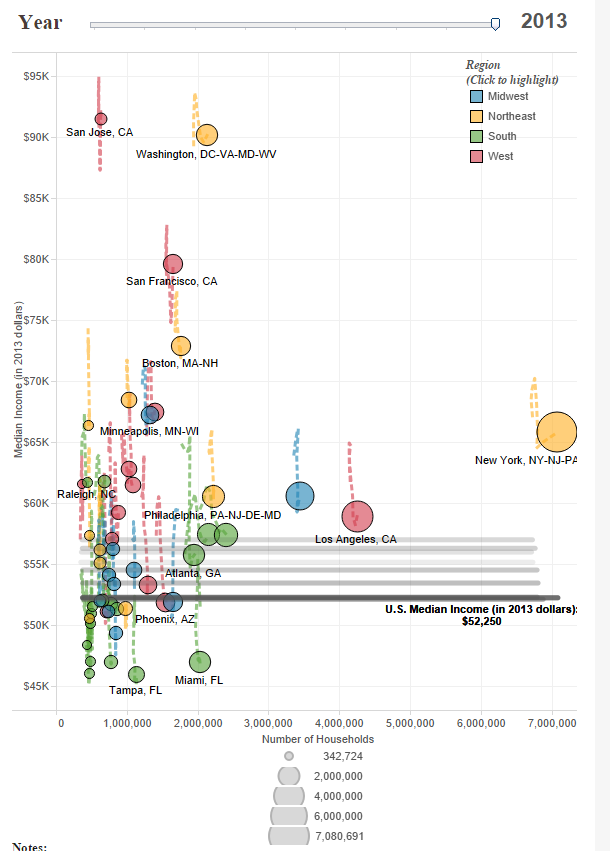

Why are regular households not out in mass buying homes? Because overall, families in the LA market don’t have massive incomes:

Source: Â Census, NAR

This is why many are now even having tougher times making rent and having to double up with roommates or live in high density areas.  People ask, how can traffic feel so much worse if very little new housing development has hit in the area? Well first, you have people doubling up with roommates, kids moving back home, and people crowding into homes.  More people, crammed housing. Plus you have areas like the Inland Empire where close to half of their residents drive into LA or OC for work. Ultimately all of this pressure hits the roads. This is the crunch that people are feeling.

But go back to that income chart above. You’ll notice that in places like San Jose, Washington DC, San Francisco, and Boston that higher household incomes are the norm, not the exception. Los Angeles on the other hand is not much higher than the national median income price for households. You’ll notice the pink dotted line down and this trail is from where incomes were in 2005, a decade ago. But home prices have risen strongly since then and so have rents. Again, more money is being sucked into the housing vortex but is that necessarily good?

For your entry level crap shack of $700,000 most working couples are going to have a tough time saving up 20 percent ($140,000). And your prize? You get to live in an area with subpar schools but at least you get to enjoy Taco Tuesdays at the hipster joint or maybe, a food van truck will stop by a block away and you can try a deep fried cookie. The last few days have been sweltering hot in California and the mega drought continues. Yet some are so delusional as to think we don’t need water. Hey, as long as the cable box is pumping in reality TV shows and you have enough to make the lease payment, everything is fine. I remember even in 2007 when things imploded people were in deep Freudian denial.

“But we still have the weather!â€

“We still have Hollywood!â€

“The beaches! Why is real estate going down!â€

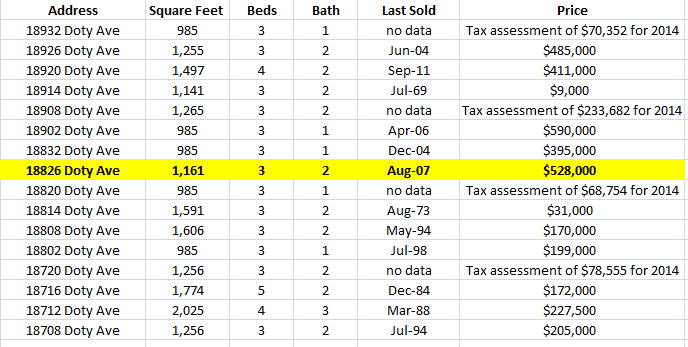

SoCal is the land of financial amnesia. Forget about the graveyard of 1,000,000+ completed California foreclosures. That is ancient history. Today if you want to buy, you have limited options and it still feels like a stalemate in the market. When we looked at deep details of a block in Torrance, we found that most were older buyers living in their granite countertop and stucco wall sarcophagus. I think it is worth looking at the data again:

And of course, you are likely to have some buyer diving in and sinking in a massive amount of disposable income for a house in the 1950s. The new buyer is going to pay 10 to 15 times more in taxes, for the same city and state services. The housing crunch is real. But for most, the only option is to rent and the figures back this up. That is why LA is becoming a heavily renter majority county. If the decision to buy were such a simple one the homeownership rate would be going up, not down and sales would be booming, not dropping.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

80 Responses to “The housing crunch with a taste of rental squeeze: Incomes down and home prices up. Los Angeles families took a hit to their household incomes yet home prices soared.”

about torrance, one major street divides torrance high from narbonne high (lausd), which is western. west of western, houses are in the $700,000 range. east of western, houses are in the 450,000 range. all because of the school district. if you care about your kids future, they are expensive

I’ve been thinking carefully about the California drought. Perth, Australia (for example) is even worse when it comes to water problems. They’ve developed a desalination plant but they also pay much more for water. I think California may end up the same way. There might not be a major exodus of people but it’s time to consider whether living in the (former) golden state is worth it.

I think over time property values will stay stagnant and there will be major gains in other regions. Silicon Valley = next Detroit?

Let’s face it. SoCal is third world. A few at the top live well. Those that come here to work receive little pay because they are happy because they live better than the place they came from, plus they get all the socialist benefits that the taxes of the San Francisco(aka The City) bay area high tech people pay. They have a lot of resentment. Never say that you come from SoCal to those people.

I am wondering what “socialist” benefits CA residents actually receive. Section 8 housing is pretty common in poor areas all over the US, but hard to come by in larger urban areas – there are decades-long wait lists for any of these units. Medi-Cal is a do-nothing system that makes middle-class and richer feel like they aren’t assholes for letting the poor die on the street, they get to die in hospitals instead. Every state has their own version of Medicaid. Welfare was cut so badly in the 90’s it’s not worth getting. Food stamps are federally funded so no difference there between CA and the rest of the country. Disability pays a whopping $800/month + Section 8 housing if you can get it. What benefits do we receive that other parts of the country don’t get? Serious replies only please.

With clever fraud schemes — claiming beneficiaries who don’t exist, medical conditions that don’t exist — it’s possible to squeeze out more from entitlements than one might get from working minimum wage.

According to KFI-AM’s John and Ken, one civilian police employee’s disability pay was 90% of her wages for an entire year. She claimed an injury and sat at home for a year, collecting 90% of her pay. Then shortly after she returned to work, she claimed another injury.

I wonder if she was entitled to federal disability benefits on top of her employee disability benefits?

Govt pension and health & disability benefits are quite generous throughout CA. Govt employees are the new middle/upper middle class.

Right. Because all those techies in SF making $150K/yr+ promoting social media in colossally overvalued companies are such a productive class

My advice to anyone is to rent, bank as much as you can and MOVE the heck out of the urban areas once you have enough scratch. Don’t be a slave to this system, because it will grind you up without a care.

“And your prize? You get to live in an area with subpar schools but at least you get to enjoy Taco Tuesdays at the hipster joint or maybe, a food van truck will stop by a block away and you can try a deep fried cookie.”

THIS. This is exactly what I mean. What good does it do you to live in a neighborhood near shops and dining when your mortgage is insane? Can you even afford Taco Tuesday anymore? This rationale makes no sense to me at all. Cooking at home is what most families should be doing. It’s healthier and more economical. And if you mortgage a house that’s $750k, how could a family of 4 afford to eat out more than once a week?!

Stretching it all the time got to be too much. Packed up and left. Glad I did it. Not making any more money than I was in LA but I now have savings. Cooking at home? Well I do it. Since people in LA like to eat out all the time, maybe they should build homes without kitchens. Then they could drop home prices…….

Always amazes me that people insist on huge kitchens, gourmet kitchen equipment, granite and stainless steel yet no one’s home to sit down to dinner and only the microwave gets any action. But friends and neighbors are soooo impressed.

imfromcolorado said “What good does it do you to live in a neighborhood near shops and dining when your mortgage is insane?”

That’s why we left NYC. Anything you might want, nothing you afford.

We’re in Las Vegas now. Prices here have risen 50%+ from bottom (at least for my crap shack rental); after a recent, brief downturn, its estimates are rising again. I’m disgusted. I have the down payment, but I refuse to participate in this BS. My sympathy to all in CA, where it’s even worse.

The same thing has been happening in Denver. One year ago we had plenty of money to put down on a modest home. We saved and saved. Now prices have risen so much in one year that I struggle to justify making such a big purchase when we can’t get something without major defects. I can live with outdated features…I’m talking major things need to be fixed like plumbing, structural, etc. I refuse to participate in this BS too. I know it doesn’t compare to CA but when you realize that incomes have remained stagnant and layoffs still happen, it makes you question “the pride of ownership.”

Home Prices are sky high, gas prices are back up, and it costs an arm to live in socal but I love this place! I just closed escrow on a crap shack in Lawndale. I am able to afford it because It needs a major remodel, otherwise it would be $500+k. I’m updating everything but the doorbell. The math adds up for me so I dove in, socal is not for everyone, there’s always Arizona, or Nebraska, or many other average states, but guess what, everyone there is dying to visit socal.

lawndale ……… terrible schools

Planes and hotels allow visits any time..

Congrats on your home purchase….

Now remember to do rain dance….

I’m buying home in northwest near water…

Hopefully, your house in the Northwest is in a town with a nice municipal water and sewer system and access to hydroelectric power. I own a house my Mother lived in which is out in the sticks in the Oregon rain forest, and I have to run my own water and sewer company for my tenants. Low rents and high expense make rural real estate a bad deal for landlords. And the cheap REA Co-op electric power and beautiful scenery out the windows only benefit my tenants! I’m going to try to sell it soon.

Thanks, northwest is where my next purchase will be.

Joe,

I’m looking at the northeastern Oregon-Southeast Washington..

not renting it…might airbnb and live in it during summer, fall. San Francisco can get cold in summer…water rights and acreage…

sparky.. You compare Arizona ( average state) to Neb.??? Look it up, Arizona is always in the top tier of most beautiful states or places in the world.

Drive the Scottsdale corridor south to north from downtown about 45 miles ( not blocks) homes from 1m to 30 million dollars nothing average at all about that.

Arizona is like Ca. lot of rich folks but like CA. the middle class is shut off for the most part. The difference is CA. can command higher wages in the Northern and Orange County part of the State, where to live in Arizona’s most desirable towns you need to have larger bank accounts because of lower pay. But then again property taxes are very low in Arizona, it comes down to one plays off another, certainly both states have high house prices overall.

You can get a nice house for 500k in Arizona but it is still 500k not 200k no paradise anywhere in America, either you have made it in life or are about to, if not you have a long road ahead, especially with higher rates around the corner. stay safe

I’m not sure where you get your information, but AZ has actually quite high property taxes. Historically they have been reassessing properties each year for full value. Recently they passed prop 117, which takes effect in 2015 and limits property value increases to 5% a year.

I owned a condo in Torrance, on the border of Lawndale near Alondra park. It got burglarized in broad daylight about a month after I moved in. They popped the sliding glass door off the tracks. The same thing happened to two of my neighbors not long after. And this was a fairly decent neighborhood, but apparently an attractive target for crooks. While you’re remodeling your house, be sure to get a security system and secure all your doors and windows as best as possible. The Lawndale/Hawthorne/North Torrance area has some nice neighborhoods and homes, but it’s very close to some sketchy areas. I’d also call your local police department and ask for a crime report for your specific street/neighborhood.

Trulia has neighborhood crime maps. I don’t know how reliable they are.

One of the few good things about condo living is that — in certain buildings — there’s a very low risk of burglary

My own Santa Monica condo is on an upper floor in a tall security building. Lots of security cameras and 24/7 doormen. As best I know, there’s not been a single burglary in this building in the 28 years I’ve lived here.

Only one major theft — in the 1990s, a car was stolen from the underground garage — by one of the doormen!

You don’t have to live in an unsafe neighborhood to be burglarized when you live on the ground floor, especially with sliding glass doors, or other easy-to-break-into entry points.

The burglary rate for the U.S. as a whole is 50%. Had a client who came home from vacation to his home in Naperville, an extremely nice outer suburb of Chicago, to find his entire house MOVED OUT on him, as happened to another neighbor of mine in another city 4 decades ago.

If you a. live in a SF house or ground-floor apt, or b. have entry doors with window panes that can be easily broken or c. a window over a landing or staircase, and d. live in a nabe where no one is home in the daytime and is c. loaded with corporate transferees and other transient types who never get to know you or each other, you are very vulnerable. If you live in a SF house that backs up to a highway or railroad tracks, that is even worse.

Look for an upper story apt with no windows over landings, catwalks, or staircases, preferably with a secured lobby, and heavy, solid-core entry doors with peepholes only, and heavy deadbolt locks. Granted, a determined housebreaker could even get past all that given the time and motive, but it would take all day and they mostly don’t have all day and don’t figure what they’re likely to bag would be worth it anyway. Most housebreakers are looking for easy opportunity. They want in and out of your place in a few moments. Anything that slows them down or baffles them will usually cause them to move on to an easier mark.

In talking to LAPD a while back about crime they said the best deterrent to burglaries is a big dog, not an alarm system…

Not everyone is dying to be in SoCal. That’s what the desperate are telling themselves and others in order to justify stretching into the least marginal commitment possible.

I lied in SoCal around 2000… could not wait to get out even at that time. I have in-laws still there… I wouldn’t trade their standard of living for mine ever.

Sparky: if everything is functional, nothing really needs “updating” unless it’s just something you want to do to the place. That would be a want not a “need”.

I see this a lot “It needs updating”. I think I’d save my money and upgrade mechanical aspects of the house: wiring, plumbing,roof before doing “would be nice” cosmetic stuff.

But that’s me. Not being snarky, just would like to hear your thinking on this and your take on it.

Thanks, in advance.

Nice Crap Shack!

https://www.redfin.com/CA/Lawndale/4528-W-170th-St-90260/home/6571415

The big question is whether the inflation paradigm makes sacrificing when you’re young worth it by the time you get old. In my case, a $131K basis is now worth $500K. But for the next few years, we may be in an era of debt deflation. Since I wisely paid off my place and have maintenance money and no HELOCs, I can ride out the tough times. But if we are in the beginning of a 20 year deflationary cycle, today’s 30 year olds will be digging a deep hole for themselves unless they come in with massive down payments like my Daughter did. From 2007 to 2027 would be the 20 years. Or it could be 30 years if surplus housing from boomers moving out or dying off hits the market in a big wave. This is not just an expensive market phenomenon. People living in other less expensive areas could just as easily be left with lower priced assets they’ve paid off.

Why would massive down payment be ok in your daughter’s case but different in the case of people in less expensive areas with paid off houses? With debt deflation your equity takes a hit no matter what. A lot of these house buyers are going to default. This time around even high-earners are living on a razor wire and we’re supposed to be entering a “good” economy. I see it like you do – debt deflation + boomer inventory hitting the market. Add in interest rate hikes over the next 10 years and housing is gonna be the asset class from hell.

Right. More up-front collateral vs more leverage on cheap money is still exposure to price deflation when you want to sell the underlying asset.

Since she isn’t going to move, having a lower house payment due to coming in with more money has allowed my Daughter to take time off from work for her kids. and it also has limited her exposure to debt, therefore less immediate deflationary risk. Existing debt gets more expensive in deflation and cheaper in inflation.

For the people with paid off houses (like me) it doesn’t really matter that much as long as you’re not trying to sell and live off the proceeds, or get a reverse mortgage, which is almost the same thing in a way. But lower asset prices will hit those who wish to sell and move to a retirement community, that’s all. And it hits people in all markets where the deflation is occurring regardless of how expensive the area is.

About 4 years ago I rented a apartment off Beverly within walking distance to Larchmont. It was a nice place, not exactly cheap. Shortly after I moved in some Mexicans moved into the 1-bedroom next door to me. There were literally 6 people and 2 dogs living in a 1-bedroom apartment. They would leave there door open and you could see them all sleeping on the floor. The manager told me she was duped. When they applied they said it was just 2 of them and no dogs. When the manager called them on it, they said that the other people and dogs were just visiting. Well it seemed like they were visiting a whole lot, to the point where they had taken up residency on the living room floor and brought all their pets with them. This is typical in most LA rentals from what I hear.

Condos and neighborhoods used to restrict how many people could live in X square footage via CC&Rs. For instance, my condo building’s CC&Rs state that no more than 2 people to a one-bedroom unit, and no more than 4 people to a two-bedroom unit.

However, housing discrimination laws have voided many of those restrictions. We have renters with large families (5 or more people) in two-bedroom units. Nothing you can do about it.

Face it. SoCal’s main game is the fantasy industry, millionaires and corrupt Chinese officials laundering their money.

If China collapses, then one leg of your stool will be cut off and you’ll be wobbling…

Keep your eye on the current tech bubble. SoCal has more exposure than ever before on that front.

People forget but there was a massive tech bubble in SoCal last time around as well. Yahoo, News Corp. and a bunch of other major companies expanded tech operations in LA. There were many small startups too. By 2003, almost nothing remained. The long-term infrastructure tech needs to survive and thrive does not exist in LA.

Los Angeles, does the graph just measure Los Angeles city? Or does it grab the whole county.. I’d be shocked if the median income of Pasadena is under $60k. Parsons tower must employ a gazillion engineers. Never mind JPL (if that is counted in Pasadena). Not saying housing is well priced, hell, my 6,000sq lot in Altadena has a tax value of 345,000, and I don’t live in the good area, just saying the chart is misleading.

The chart includes the Los Angeles metro/Orange County region.

If the chart were just Los Angeles city, then median household income plunges to about $48K per year. Including the affluent beach cities, San Gabriel Valley and Orange County pulls the median household income to about $58K per year.

I’m considering moving back to LA and Altadena was somewhere I liked when I lived in LA previously and am considering now. What are the pros and cons?

can you afford it or not. will you be living paycheck to paycheck or will you be able to save cash.

I look forward to cheaper socal housing or a large increase in my salary. But I’m not going to hold my breath.

Housing is sold to those who can afford it not the average charts. Charts don’t buy homes. But the people buying them seem to have found the money.

The most relevant point is that most Southern Californian’s live in denial! The ‘California Dream’ is an illusion for all except those who can afford to live close to a beach. That takes either a high income, a big bank account, being a beneficiary of Prop 13, or living 3-4 to a 1-bedroom apartment (surfers)! Otherwise, it is simply an 8-5 drudgery, bars on the windows, and a 45 – 90 minute commute each way to work! Just keep telling yourselves, I’m living the dream, I’m living the dream …

You have to say:

I am living the nightmare, I am living a nightmare….and if you repeat it often enough, you’ll get it.

Well, lets talked about Crime Houston Texas has violent crime of 450 and Anaheim only 202 in 2012 which means Houston has a lot of poor areas that are not nice like the burbs, so why does everyone here say to moved to Texas when Houston is much higher in crime than Salt Lake City or maybe Denver. Salt Lake is also cheaper than California and Salt Lake is high in high school and college graduates while Houston is closed to Anaheim and Houston population is even poor in the uS.

You are comparing the number of crimes between a city with a population of 2.3 million with one with population of 300 thousand? Go buy a house in Anaheim then since it obviously much safer.

Yes, Salt Lake is the promised land, but we like to keep it that way by not encouraging the Gentiles to move here and make it like Anaheim or Houston. Gentiles, don’t bring your corruption to Zion. We will close the 15 at the gap(below Cedar City and above St. George), if things get bad enough(refuges from earthquake in L.A., or EMP).

Spoken like a true Mormon. That kind of religious discrimination is exactly why SLC would be at the bottom of a list of places I’d consider living.

This is how mormons really think. Remember that next time they knock on your door in their white shirts and ties, in pairs of two. This is what they are really thinking.

My parents house in Anaheim Hills got burglarized last year, and then again 61 days later. I’ve been lucky thus far but burglaries are on the rise in the area north of Houston where I live. It’s not a paradise anywhere.

Let’s not argue children. Houston AND Anaheim are BOTH crime infested, horrible areas to live. Now that was easy wasn’t it?

I mean Houston population is more native born than Anaheim but almost as many high school drop outs and lacks college compared to Salt Lake or Denver.

The move to Texas meme is way overdone. Texas is a very strange place with significant variance between regions. If there is one thing that people on this blog should see by now it is DON’T FOLLOW THE HERD. Find the road less traveled. I try to limit telling people about the cool place I moved to because I’m afraid the herd will show up and ruin it here too.

Freely, the Texas meme is relevant. I am currently looking at San Angelo and Lubbock. San Antonio further south is high on the list as well. San Antonio has top notch medical facilities and friendly people.

West Texas is friendly, lower humidity and very inexpensive housing. The American dream is alive and attainable in Texas. That is why people are moving there.

Mike mor,

Are you considering a move to Lubbock to go to school, or are you older and looking to raise a family or retire?

http://www.dailykos.com/story/2015/03/15/1371066/-A-Tale-of-Three-States-California-Kansas-and-Florida?detail=email

It’s funny how some realtors are so bold in outright LYING. This Seattle house’s description says the house is “set on a tranquil and private oasis…”

Then you check Google streetview, and the house is right across the street from a football field: https://www.redfin.com/WA/Seattle/328-25th-Ave-98122/home/142512

I didn’t know football games were so “tranquil” or that hordes of rowdy football fans driving or walking past your house to the game made for a “private oasis.”

Recently I had some friends from Israel come to visit Los Angeles. They were shocked by how dirty and gross Los Angeles was. They expressed to me how disgusting it was and how they couldn’t wait to leave. This was coming from people who live under the constant fear of terrorism and missile attacks.

We don’t have suicide bombers and ISIS to worry about in LA… but there are ghetto people ready to rob you for $5 at gunpoint if you are at a wrong place or at a wrong time. And even cops that are ready to shoot you for any dumb reason.

As someone who came to LA by choice for a job and decided to stay, I have to say that the initial impression and indeed the impression of most of the city is very poor. It’s like an ugly sprawling, cheap and shitty shanty town for most of it, with some very nice areas. I’ve always either lived right on the beach or in the hills above the ocean so it’s been good, but you look around and even in so called nice areas, it’s ugly streets, strip malls – places like Lincoln Blvd, Santa Monica Blvd etc. Miles and miles of El Pollo Locos and Jiffy Lubes.

Still – you’d have to say that the setting of the place is lousy. The “urban center” of downtown compares negatively to the downtown of places like Providence, Kansas City, Portland etc. Most of downtown is desolate or looks like a central american city – meaning not historical, cheap shitty signage, crummy chain restaurants.

The beach areas like Malibu, Palisades, Manhattan Beach are very nice. Hills and open spaces are beautiful. Weather is great. But that’s just for a very small minority, and even for those people it’s mostly just trying to stay afloat.

I like the life I’ve had here. It’s been nice, but it certainly isn’t the only or bestest ever option.

That’s a very accurate assessment. The weather isn’t always great. We get plenty of outlier events such as the recent heat wave, whilst not as common or to the extremes as other areas, these occur with enough frequency to warrant mentioning in the same sentence. It’s the flip of how other areas often have many days of great weather as well, but people tend to recall only the extremes. Our air is quite often gross and that’s every bit a climate attribute as any other. I could care less how it was in the past as we’re breathing this stuff in the present. I’m amazed at the amount of cognitive dissonance which abounds in SoCal around the air quality issue.

Hunan….anyone who comes from a real city or historical city or place that wasn’t all built on the cheap in 1962 will think that LA is ugly, cheap and tatty look.

The drought is real in Cali. I have uncle who owns a small ranch in the central coast by Salinas valley. Very Agricultural area, he has 13 acres with two houses on the property, well over the weekend I found out that the well dried up, there is no water.

He’s getting water from the nabe and paying for it. So they’re gonna have to drill deeper for water and no guarantees to find plenty. It’s even more shocking when creeks runs along his property. Anyways is very expensive to do another well.

I was just up in Paso Robles wine region. It’s grim and there’s no simple solution – not just for agricultural land but more neighborhoods.

They better start by banning lawn watering both industrial, commercial and residential

Farming is going to have to figure out using less water and still get yield.

We are in 3 wave drought and the third is building not waning..

Today I had my radio on in the car. Heard on the news that replacing grass with cactus may earn you some subsidy in California after four years of drought. And I live in the Netherlands! The real estate market over there is sure going to be interesting to watch – who needs disaster movies.

Aaaaaaand we’re back into housing mania, full steam ahead!

Freddie Mac is offering a new low-down loan product.

$417K loan limit, and there’s an income limit of $92K.

Remember folks, buy now or be priced out forever. Jump on the wagon now before rates rise this fall!

An income limit but no income minimum? What a joke the govt. controlled housing market has become.

Not really. Last time around a lot of the speculative destruction was from prime and non-prime average Joe homeowners flipping non homeowner occupied properties on the side or doing cash outs. It wasn’t only about the low income sub prime crowd where strawberry pickers were “buying” half million dollar homes. This Freddie product eliminates current owners from the equation. That only leaves non-owner sub primers and even at that, there are (Albert marginal) credit and income requirements, so not quite NINJA and Alt-A stuff like we saw before.

And just waiting to be bundled and sold as asset backed securities rated AAA by Moody’s, S&P and Fitch. “Trust us, It’s different this time”.

This is how slums devolve.

No-one ever constructs slums ab initio.

In the early going, the final destination is still obscure.

BTW, this current trend entirely replicates that of HARLEM — which was constructed as upper middle class housing in Manhattan all those decades ago.

If you troll through the back videos of This Old House you’ll run into some rather spectacular examples of how a fine home was divided up into slum quality living.

During their remodeling, the old bones are exposed, and the horrific structural gutting falls into view.

As for racism: all of these tracts were transformed into White slums… in exactly the same sequence we are now witnessing across the Southland.

The Red Chinese economy has clearly hit the wall.

So they are entering the exact same crisis that unhinged the booming economies of

Japan

Taiwan

Thailand

Malasia

Korea

Each in their own way and time.

The kicker with Red China is that it’s too big to follow the ‘adjustment game’ of the others. The betting table is open.

A first approximation has Red China pulling back from massive commodities imports — with dire effects in Australia and Canada.

Even OPEC is feeling the bite: it needs frenetic consumption from Red China to make its cartel price stick.

This latest oil price war is really the transition to a post-OPEC world. Naturally, no-one sees it, no-one comments on it.

Iran, Iraq, … through to Putin are freaking out.

&&&&&&&

So we are at a monster global inflection point — that just happens to coincide with Los Angeles ‘compression.’

&&&&&&

Prices would revert to some normality if the Fedsury would only stop spewing out first mortgages.

One should keep a weather eye on the Beijing real estate insanity. It will lead the pack.

This leading indicator will prove to be such an accurate crystal ball as to astound. LA will track its trends — with a time lag of six to ten months.

It — the Beijing mortgage market — is the DOMINANT source of global liquidity/ mad money at this time. Admittedly, the Red Chinese have crafted a totally screwy version of Western debt markets — in mortgages. But the liquidity generation connection still holds.

And as the record shows, developers will build in deserts — empty cities — if the financing is made available!

This. It’s related to why so much fun is poked at the idea of SoCal RE being exempted from reality due to so-called wealthy foreign (Chinese) buyers. Recall the meme – incomes don’t matter because prime global world class everyone wants to live here weather capital tacos and ramen everywhere BS. What globalization giveth, it taketh, often with matching intensity and duration. The last thing anyone who values a stable neighborhood to put all their eggs in should want are neighbors with high exposure to overseas currents and lack of shared perspective. So yes, the China housing story is a bellwether along with tech bubble 2.0. All of which are intertwined.

Blert, how much of the Chinese money do you think is counterfeit? Whether it is in dollars or yuan? Form what I’ve read North Korea, who’s only friend is China has a very good printer. And.. much of the money leaving China is supposedly from underground connections. Do you think much of it is counterfeit? Or do you think China is printing more money than it tells anyone? Or perhaps both?

China does seem to be watering down the worth of every other country’s money… Many are putting restrictions on Chinese buying real estate in their country.

It is imperative that all other nations stop Red Chinese asset purchases of a strategic nature.

This is still a despotic, Communist, ethnocentric entity that embraces a supremacist world view.

This Chinese ‘tick’ goes back about 5,000 years at least. It’s not for nothing that the Vietnamese, the Koreans and the Japanese are paranoid about living in a Sino-centric world. They’ve all had the experience across all of the centuries.

[ Sino-centric? The graphic for China is a square with a line vertically straight down through it. The map represents the world — to the four corners. The line signifies China’s centrality within that map — the world entire.

This is why China is also termed “the middle kingdom.” The only comparable western powers with that self-image:

Alexander the Great

Rome

Imperial France/ Napoleon

Imperial Germany/ Hitler

Russia/ USSR

Cyrus the Great

Other than Cyrus the Great all of the above have all consuming despotic traditions.

&&&

Lastly, the Huns – – as in Attila — fled the Chinese. The Hun homelands were in western China.

Indeed, the Red Nordid race is considered to have originated in Mongolia — based upon DNA and burial discoveries. It was driven out by events now lost to time — merging with the White Nordid race (aka Cro-Magnon) prior to the dawn of the Neolithic era.

And then you have to take a gander at the race relations in all of Southeast Asia. It’s not a pretty picture. Historically, the expatriate Chinese use their economic connections back home to establish economic cartels for themselves in all nearby lands.

This ‘tick’ in Chinese culture has resulted in simply endless economic riots, race wars, and civil unrest over the centuries.

There is no reason to believe that this economic imperative has disappeared with the latest wave of expatriate Chinese land purchases. This is a story arc that normally lasts across MANY generations.

It’s far larger, more impactful, than any Coke commercial is prepared to deal with.

Along this line one might note the intense racial dis-harmony now erupting across Africa and South America whenever the Red Chinese drop in to help out… extracting mineral resources.

&&&&&

It’s not politically correct to say it: but forced blending of the world’s populations/ cultures triggers hatred, violence and unrest.

No government should actively encourage mass population transfers now or in the future. The planet is now officially full up.

This situation lies underneath MOST of the world’s unrest, national contention… and is setting the stage for a horrific global war that will eclipse all that have gone before.

The booming population of Europe circa 1840 through 1940 was the trigger for the epic slaughter of the 20th Century.

European peace — today — is hugely driven by stable to declining populations. No society wants to make war with first born sons — when they are their ONLY sons.

In the case of the Muslims, it’s worth noting that the combatants are coming from families that have massively excessive male populations — with nothing much productive for the guys to do. They come from no-growth societies.

And the West is encouraging this by shipping in w-a-a-a-a-y too much food at prices w-a-a-a-a-y too low. This causes farming to collapse and warfare to explode.

(cf Somalia — free food from the do-gooders has totally destroyed the previous farming culture. Now all of the boys want to fight and steal, the only way to make their way in that world.

Yemen is also locked onto the exact same path. Hence the headlines now evident.)

Does anyone want to see the 20th Century wars repeated with global numbers? With Iranian atomics?

On a global level I agree with a lot of what you say Blert. I think we’re dealing with different people in this migration wave than before. I lived in a Chinese neighborhood (not Chinatown) in SF and did some work for people years ago and found most of my neighbors and employers fair, honest and not terribly ethnocentric.

BUT. Today a lot of the informal (practical) policies are pretty yucky.

I am very interested if you have any idea how much Chinese money is counterfeit? Whether it is dollars or yuan, no difference- The money that is available to them?

Housing to Tank Hard @ 2016!!!

SBP,

That tells you just exacly how desperate they are to save housing prices. Dont be a falling knife catcher

la.curbed.com says 57% of LA residents can’t afford to live here.

http://la.curbed.com/archives/2015/03/57_percent_of_people_living_in_los_angeles_cant_afford_to_live_in_los_angeles.php

24 September 2013

BBC News: Why do so many Americans live in mobile homes?

http://www.bbc.co.uk/news/magazine-24135022

Paradise Cove in Malibu… it wasn’t there precisely (very high end), but nearby…a young (15-16 year old) online gaming pal parents had a trailer…. years ago (2003-04). Recall a picture.. there were about 12 trailers. I recall him saying his parents rented it, but had some sort of tenancy. He was youngest member of Call-of-Duty type multi-player game team, where we played other teams… all on voice coms with our headsets (wasn’t CoD – a faster older game called Return To Castle Wolfenstein). I recall the local Malibu high-school had some big mural of a shark on the wall, in some links he sent us all on Yahoo Messenger.

I’ve seen some okay trailer parks, that do extended stays (at very reasonable-looking monthly rates), but when doing deeper research… well many posts suggest you have to be careful as you’re often around people who are on edge of things financially. I’m just hating housing at the moment (the prices/unfairness/$Trillions in Global QE after having waited years for prime correction, only for it to get even more unfair).

http://rvparkhunter.com/state.asp?state=california

Where is that “housing to tank hard in ” guy? He seems relatively silent these days.

Leave a Reply