The housing crash sequel in California – Foreclosure sales made up 45 percent of sales in Q1 of 2011 with an average discount of 33 percent. 431,000 jobless Californians have exhausted unemployment insurance.

Subjects under hypnosis are susceptible to the powers of suggestion. If that is the case, a large part of our nation has been in full slumber when it comes to housing propaganda. If the nation is facing a double dip in regards to housing prices California will face a double housing crash. Let us be clear that many areas in California like Riverside, San Bernardino, and the Central Valley have seen home prices absolutely collapse. Take for example Riverside County. Riverside County is home to over 2,200,000 people and is part of the Inland Empire, an area devastated by the housing crash. In June of 2006 Riverside County hit a median home price peak of $422,000. Today the median price is $190,000 or what amounts to a 54 percent drop. That is a crash. Yet other areas have seen prices adjust lower on a more controlled basis for a couple of reasons including the shadow inventory being held back by banks and a touch of delusion brought on by financial self-hypnosis. Yet market sentiment is fickle and is turning. One of the many reasons the economics and financial field has failed miserably in predicting this crisis is that it was largely one of consumer behavior and manic psychology.   Incomes are certainly not supporting current prices and the Federal Reserve is dangerously overheating its own balance sheet trying to prop up inflated real estate values to keep the dream-state going. California is in for a very long haul moving forward and this is hitting just in time for the typically hot summer selling season.

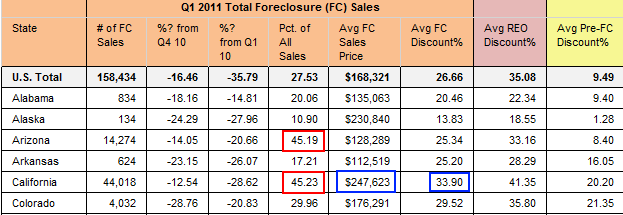

Q1 foreclosures make up 45 percent of all California sales

Source:Â RealtyTrac

I had to do a double take with the above chart. Foreclosure sales made up 45 percent of all home sales in California during the first quarter. This number even surpassed the apocalyptic housing market in Arizona. It is no secret that foreclosures sell for a steep discount like expired milk or older vegetables at your grocery store. In California the average “discount†is 33 percent. We’ve had enough foreclosure sales to anticipate the future for the massive shadow inventory in the state. If Q1 of 2011 is any indication we are moving 44,000 foreclosures per quarter. At the same time 68,000 notice of defaults were filed in Q1. At the moment 227,000 homes are either bank owned, are scheduled for auction, or have a notice of default filed. Just to get rid of the current viewable shadow inventory would take 5 quarters. This is 5 quarters of cheaper home sales dominating the market and naively thinking that those 68,000 recent NODs will not become actual REOs (most will). And don’t forget that we are still adding more foreclosures to the pipeline since our economy in the state is still shaky:

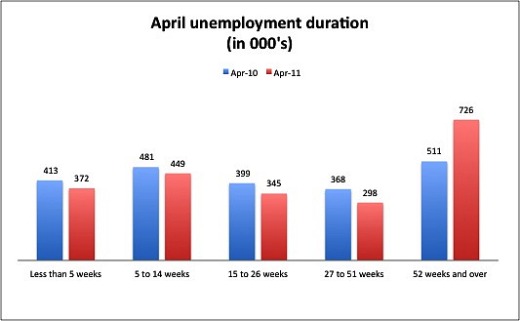

Source:Â OC Register

“(OC Register) Nearly three-quarters of a million people in California who were unemployed in April had been out of work a year or more, according to the state Employment Development Department. It is the only category of unemployment based on time out of work that increased year-over-year.

The EDD says another 431,000-plus people have exhausted their 99 weeks of unemployment benefits. It is not known how many of those have since found work.â€

It is insane that 431,000 people have exhausted their benefits and it is not known if they have found work. Many people are simply falling off the official statistics. Then you have the reality that 33 percent of those without jobs in the state have been unemployed for a year or longer. This signifies that our current recession isn’t merely a business cycle one but a structural change to how we run things in the state. The idea that California home prices will always be higher depended on a stronger state economy. Is that largely the case right now?

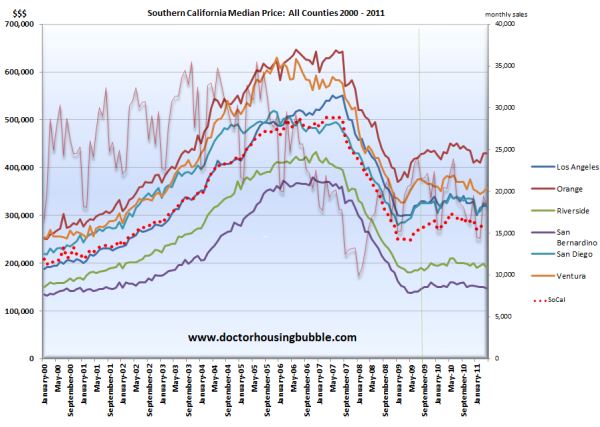

Southern California enters double dip

Southern California is officially in the double dip. The above chart shows the brief respite in home prices reached in 2010 but we are now clearly moving lower as people start to wake from their hypnotic state. As usual home sales are a leading indicator and they are much lower on a year over year basis. Home sales are down 9.2 percent from a year ago for the region. The median price is down 1.8 percent. Yet the bigger issue moving forward is the willingness for banks to leak out the shadow inventory. Going back to the first chart you will notice that foreclosures resales in say Alabama go for a 20 percent discount. On a $70,000 home this might not be a big deal. But what about the million dollar foreclosures in areas like Beverly Hills? Then the California 33 percent discount looms extremely large.

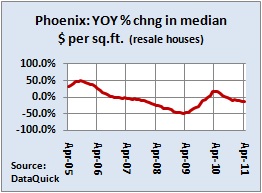

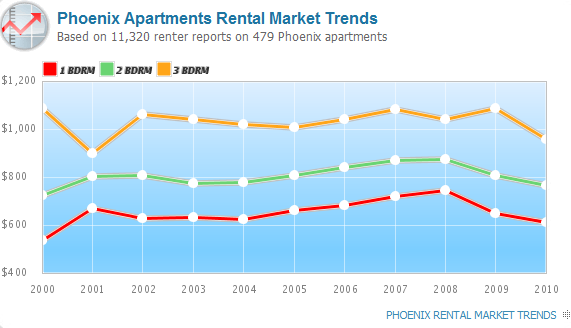

Even low home prices may not be enough to support a market. Just look at Phoenix where home prices have cratered:

Source:Â DataQuick

The double dip is hitting even in an area that is seeing home prices going back to the late 1990s. Why? Because of the economy and employment. Last year the run-up was largely due to investors rushing in and selling to other investors. Yet with this market being exhausted there are only so many local renters that can support current market rents. Contrary to propaganda rents are not skyrocketing in many areas:

Source:Â Apartment Ratings

Rents in many cases are lower than they were in 2000! Going back to California, the shadow inventory that still festers in the background is largely expensive and inflated. Banks were willing to move fast and quickly in lower priced areas yet this still will not bring prices back up. The same will happen in the second phase when higher priced areas start being dumped. It isn’t a question of when since it is already happening. The remaining issue is the depth of the next correction.

Take the more expensive Orange County market. The median price peaked at $642,500 in August of 2007. Today the median price is $430,000 in the most exclusive county in Southern California (this is a decline of 33 percent). It is interesting that more headlines are psychologically preparing sellers to accept the reality that the days of 2006 and 2007 are long gone:

“Home clearance sale coming from ‘desperate’ sellers

NEW YORK (CNNMoney) — Home prices are already a third off their highs, but this summer could bring the real discounts.

Buyers are still cautious, and anxious sellers will have to price aggressively to get them off the fence.â€

The reasons given are issues we’ve discussed many times:

-More price drops

-Bloated inventory

-Tight credit (I disagree with this one. If you have enough for a 3.5 percent FHA insured loan you are golden)

-Unemployment (23% are underemployed in the state of California)

And one more thing I will add is our manic budget process. We will need to raise revenues (aka taxes) or cut spending (aka jobs). In the end this will decline your buyer pool. The double dip is already here. Prices are going to move lower because incomes simply do not justify prices. This has been the story for four years now and for many more years going forward. Don’t let the hypnosis drag you into a false trap like those that jumped in head first in 2010 when the “housing is going back up†dream was moving with full steam ahead.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

72 Responses to “The housing crash sequel in California – Foreclosure sales made up 45 percent of sales in Q1 of 2011 with an average discount of 33 percent. 431,000 jobless Californians have exhausted unemployment insurance.”

“Subjects under hypnosis are susceptible to the powers of suggestion. If that is the case, a large part of our nation has been in full slumber when it comes to housing propaganda.”

GREAT thematic headline. While I’m reassured by a few more “peeps on the street” (in So-Fla) waking from this slumber, they/we are still a tiny minority. Most folks I chat with are still “under” the hopey-changey hypnosis… it’s surreal talking to humans, in grown-up form, who can ignore hard data, and vocally hope against hope… the most tragicomic are the skirt-wearing RE babes along Las Olas Blvd., who think I’m going to buy them a drink, after I drain them of anecdotal info… they slay me with their humor… ;’)

The missing macro-ingredient is to identify under which rubric Helicopter Ben is “backfilling” the TBTF balance sheets, since every foreclosure sale releases significant flatulence from their FASB-distorted balance sheets, and impacts their look-the-other-way capital requirements… is it Maiden Lane III? I simply can’t keep track of the TRILLIONS Duh Fed is allowed to hide under the official seashells.

That’s why we call buying a house “The American Dream”. As George Carlin noted, you have to be asleep in order to believe in it.

Just met a like-minded neighbor looking to buy in Laguna Beach. She said she could buy now, but she’s waiting for the market to fall further based on Suzy Orman’s insight. Most the new people I’ve been meeting lately have been listing agents, so it’s good to get in an agreeable conversation once in awhile. I pointed her this way.

Point her this way, too.

“The Problem with Suzy Orman”

http://www.spiritual-happiness.com/suzeorman.html

Thanks for that. I was getting that annoyed feeling that Orman was becoming an MSM talking head that was getting closer and closer to the same pile that I throw Dr. Phil in.

I’m guessing most of the readers here have been sick of the mainstream media for quite sometime. I ditched CNN years ago. Interviews with the Kardashian’s??? Seriously???

Orman,Suze… LOL… you can look up her Real Beachfront Condo of Genius here, bought well into Bubble, about 18 months before peak:

bcpa.net (search by Owner Name: Orman,Suze)

She’s about $200k underwater per county appraiser, which probably means $300k actual market… wonder if she’s current? ;’) I could comb her whole building against Broward Clerk of Court foreclosure filings, but it’s tedious, and I’m not that interested… odds are that bldg. fits the usual profile.

I love the way the genius architect sited the swimming pool, such that it’s in the shadow of the building most of the day, lol.

@tpofsp:

Ditto on the “thanks” for that Suze Orman link. It’s a must read for anyone who pays attention to her.

There were things which bothered me about that gal; some obvious, and some I couldn’t put a finger on. That article clears things up considerably and fills in the missing pieces.

My impression is that she knows what’s going on today; but only drops hints about it here and there. In the meantime, she’s trying to screw everyone over so she can make her wad of cash.

DHB’s lead reminded me of this:

http://www.theonion.com/articles/fed-to-make-interest-rates-undulate-relaxingly,1033/

You are getting sleepy…sleeeeeeeeeeeepy.

Doc is also exactly correct about the Pull Date Principle now being applied to houses. What I’m seeing that’s even uglier is RealTorz using this fear tactic to get people to sell when it’s not a good time for them. I.e., prices may be going down, but they’re in no position to up roots. I’ve advised three different acquaintances to run their numbers and sit tight, because they’re really not in bad shape, just being terrorized by people knocking on their door saying, “I can sell your house for you and if you don’t get out now, you never will!”

Meanwhile those same RealTorz are trying to get others to buy when it’s not a good time for them. Either way, they get X percent of the sale.

One of those three acquaintances is having a hard time letting go of fantasies of making lots of money just for drawing breath while time passes: the real corruption of The American Dream ideal. AKA, The Magic Of Compounding. It’s a little bit like believing that IQ should go up, just for sitting for 20 years in a stuffy room with a wall-sized Fox News feed.

Doc:

I think you left out one issue in the reasons for this that means the second dip will continue apace for at least the next year and that’s incomes. I just read an article on alternet that asks if we are in a depression.

Quote: “A little-discussed aspect of this downturn is that many Americans never fully recovered from the last one before the crash hit. In 2000, before the dot-com bust, a person right in the middle of the economic pack took home $27,833 inflation-adjusted dollars, and since then, that same person has only earned more in one year – 2006 (Excel). By 2008, the median income was a thousand bucks less than it had been in 2000, and then in 2009 and 2010 we saw the largest two-year drop in wages and benefits since 1962-’63. ”

The full article is here and echos many of the things you’ve been pointing out:

http://www.alternet.org/economy/151170/9_signs_that_we_may_be_living_through_another_depression/?page=2

Thanks for posting that. I read it this morning and was thinking about posting it here!

To be fair, The Doc trumpets (and incorporates into the big pic) income data (and trends) ALL THE TIME, just not in this particular post.

He was ahead of the curve on the student debt issue as well, which even the MSM can hide no longer.

Prices are dropping like a rock in inland orange county, but the beach towns and closer regions are hanging tough. Not many sales in the nicer areas, period. I wonder if this means that people aren’t buying in the cheaper areas (so prices fall) and that people in the richer areas aren’t selling (so they stay inflated)? It would be great to see a graph of percent turnover for houses in different price ranges. So,

#(million $ houses sold)/# (all million $ houses) > #(sub-million$ houses sold)/ #(all sub-million $ houses)?

The OCregister talks about the OC Real Housewives suing to stop foreclosures on their properties, so maybe it’s not banks holding back the good houses, but that wealthier people have the resources to stall and call in favors?

“… so maybe it’s not banks holding back the good houses, but that wealthier people have the resources to stall and call in favors?”

It’s both. The primo $1M+ props get headline attention in local news rags (and blogs), whereas the rows of tract-shacks liquidating for sub-$100k is lost in the noise. You’d think it’s all fungible–like money itself–but to some extent banks are sensitive to the perceptions and whinging of their RE broker buddies, and the RE-tards have a “snowball” theory about the “impact” (on the hypnotic spell they’ve cast on the sheeple) the Ed McMahon McMansions have on Duh (rigged) Market. It’s kind of a hopey-hopey thing… shyt rolls downhill, etc… i.e. if that kind of haircut can happen to Mr. $4.2M (nee $2.3M) in Bev Hills, what chance do I have with my $639k (nee $390k) shack in Pasadena?… or something like that.

But it’s also true (at least here in Ground Zero Two–SoFla) that a lawyer can drag things out for 39 months, while those who walk away and/or have no legal counsel will see their “dream” liquidated in as little as 4 months. All bow to the Am-Bar-ASSociation… all bow to the bankSters… all bow to the NAReal-Tors… 🙄

While I mention them all in the same breath, it’s only fair to point out that the American Bar Association, with all its faults, is your ONLY protection against the BankSters and the NAR, so in this case, their power is a good thing… still, when you get the legal fees bill, you’ll be bowing… over the commode. ;’)

My wife and I live in the Westside of Los Angeles in Brentwood. In 2009, I sold my townhome in the Pacific Palisades Highlands area. My wife threatened to leave me as she felt that housing prices were going lower still. I now feel fortunate to have sold that property for essentially the same amount that I paid for it in 2004. I always felt that housing prices must go down to 1998 levels before the housing market begins to heal. I may not be so far off. My wife and I have been renting since selling the property. We have been looking for a place to buy; however, it seems that sellers remain unrealistic as to prices. But, in Santa Monica, for instance, home prices seem to continue to be out of wack taking into account the economy. And I am wondering…why is this? Is it because the entertainment industry drives much of what happens on the Westside of Los Angeles? I cannot believe that people who work in the entertainment industry can continue to support prices in, say, Santa Monica. Just today, Disney announced that they are laying off 5% of their worldwide workforce because of fundamental changes in the distribution platform for entertainment content. When will Santa Monica feel the effects of housing prices coming down to mirror economic realities?

“My wife threatened to leave me as she felt that housing prices were going lower still.”

“I always felt that housing prices must go down to 1998 levels before the housing market begins to heal.”

If both you and your wife both thought housing had a long ways to fall, why did you almost get a divorce over selling?

Bob Cohen: the problem is you and every other guy (like me) is waiting patiently for Santa Monica real estate to come back down to earth. Is it so much to ask for a modest 2,000 sq house north of wilshire for under 1.5 million? Apparently so far, it is.

Everybody wants to be there but only those with 350K plus annual incomes can really afford it, at present. And their overalll numbers grow every day or at least hold steady.

The new middle class in LA is really just what was once considered the upper middle class (200K-350K per hear household), and you can’t really afford a stand alone house in Santa Monica on that much pre-tax income these days. You can swing it, but barely.

Bob Cohen:

Its not so much the entertainment industry, although they are part of the equation.

Whenever you get a large university with a medical school, teaching hospital, and law school combined, you’re going to get what’s going on in San Diego: high home prices due to a statistically significant number of university professors, teaching physicians, teaching attorneys, and highly compensated university staff.

In the case of the Westside, you have UCLA, Loyola-Marymount, & Pepperdine Malibu (which also has a school of law).

Then you have the wealthier legal practitioners on the Westside (Santa Monica Bar) and the Downtown lawyers along with private practice medical doctors. Think of the nearby hospitals: Cedars-Sinai is one example.

Then add all that up to include real estate agents making big commissions on sales to the above and you get an idea of why prices are slow to come down.

~Misstrial

Good points Misstrial. Along with all the high earning professionals you listed, you have many successful business owners/entrpeneurs/consultants/people in the FIRE industry/rich foreiners and most important of all is entrenched money. These are people who have owned for 30+ years. They have watched their personal real estate fortune sky rocket. The last thing they will do is sell, they will probably give the house to their kids if they pass away. Prices will come down in those areas…but not overnight, it will take years.

Fellow readers of the Doc… Is there any way to speed up a short sale and force lenders to set a closing date. Does the lender control all the terms? with all cash and quick 30 day escrow offered, the lender refused to talk closind dates. Seller’s had accepted our offer but thier lender won’t budge. Is this just the way it is? Thanks all!

Don’t know what state you’re in, but here in FL that’s kind of the way it is. OTOH, in FL anyway, only fools (i.e. those under the hypnotic spell of the Real-tards) get involved in a short sale without a savvy RE ATTORNEY on their shoulders–that goes for the seller/squatter, and DOUBLY so for the potential buyer. You know the lender has an ARMY of shysters, you need one too.

I feel your frustration, esp. since you’re an all-cash buyer… you’d THINK there’s leverage in that… but perhaps the only leverage is to betray zero emotional attachment to the prop in question, and SET A DATE CERTAIN DEADLINE, and make clear that on said date your pile of bank-building CASH is marching on to a better deal down the street. Don’t let bankSter scum tie up YOUR capital.

Eff the mofos… let them obstruct until short sale turns into FORECLOSURE… the latter almost always a MUCH better buy. ;’)

Not to mention TIME is also on your side… just look how everything DrHB has laid out for 4+ years has all unfolded… and STILL IS unfolding… F*CK the game-playing lender… they’re just milking the current owner for a few more “catch-up” payments. Line up the next (3) deal(s) now, walk out on the current deal on the date YOU set.

… of course, if it’s truly a one-of-a-kind, gem house on a gem site, my-trophy-wife-will-leave-me-if-I-don’t-submit/buy, then you’ll just have to go along for the ride… with your attorney. ;’)

Sadly, the scammers have been rigging the land-title game for over a century now… or arguably since the Magna Carta.

We did walk away… They moved on to another offer.

“We did walk away… They moved on to another offer.”

Please follow it anyway, and report back. We all learn that way, and you might be surprised at how that property plays out. You may have another bite at that particular apple, or at least discover someone else paid too much. Dumbass lender may even call you back, when their “solid deal” falls through.

Again, when backstopped with OUR money, the banks are free to do the most selfish and (apparently) non-sensical things with their inventory.

In response to the question about why prices are firm in the ritzy west side areas, the short answer is they don’t have to sell. But, they will eventually. If you look at the demographics I am sure you will these areas chock full of baby boomers with equity and no rush to sell. The first boomers are hitting the wall this year, and they will sell. They, for the most part, will have to downsize and move tax friendlier states.

As an aside, another demographic quirk that affects mostly California and South Florida, is the multi-generational home. These are easily spotted by large of vehicles parked out front. Each car is attached to a low paying job and a contribution to the house payments. However, when gas jumps to 5 or 6 dollars a gallon that contribution will be greatly diminished and all sorts of social chaos will ensue. This is mostly an Hispanic issue but it will spread.

These and other factors covered in this blog is why you’ll have to wait longer for the creamy props to drop. The savior foreign buyer is not such a myth when it comes to the choice beachfront/waterfront props. In general foreign buyers are moving their cash out a country/currency that’s even more screwed than ours, so they WILL PAY MORE than you’re willing to… statistically speaking.

Should we ban foreign buyers from beachfront and other choice props? Mexico does, and, well… look at the results… it’s Mexico.

“This is mostly an Hispanic issue but it will spread.”

Yeah, already the doubling/tripling up has spread into some very nice waterfront areas here in So-Fla. Add to that the bane of any town, an element found esp. in “ritzy” areas, you guessed it–INHERITED properties. Unless the heirs have mismanaged their “affairs” so badly that they can’t even pay the taxes and maint., that’s another whole group who also don’t have much pressure to sell.

As Thomas Paine famously said: “What we obtain cheap, we esteem lightly.” Thus explaining the presence of BEACHFRONT properties in So-Fla, that are in deplorable, nearly-condemned, “does anyone live there?” condition. I have no Solomonic solution to lazy, unappreciative heirs. Don’t insult us with any Marxist solutions, they’ve failed miserably.

IMO this trend will definitely spread. Last year I had a take basically an entry level job for a while to get some experience in a new field. Most of my colleagues were 18-22 or so and all lived at home with parents. None of these kids had enough cash to move out or get an education. About half also had to share a car with family, rode pub trans or biked. None of them minded living at home and not having their own car. They all had a lot of hobbies, used their paycheck to go out and have fun, and didn’t really care about money or buying a house someday. There seems to be a generational shift: you aren’t a loser anymore if you still live with your parents or don’t have a car. The younger generation seems content with a different style of living.

Well, do you blame them?

Wages have been stagnant for 10 years. The amount of debt they have incurred to go to school is astronomical. Housing is still bloated. Then there’s Social Security, which probably won’t be there when they retire, in any appreciable form. Same with medicare.

Then there’s inflation. About the only thing that hasn’t gone up in cost is an iPad. Any way you look at it, their situation is pretty grim, the mountain they have to climb to get to a “normal” point is pretty monumental, except if they want to buy an iPad (or other nonessential goods).

So if they want to buy an iPad, I say let ’em. Hell, throw in a jet ski. You only live once and you know what your future is going to look like, so there’s not much point in saving toward it. You might as well just enjoy what you have right now and hope for the best.

Personally, given what they have to face, it’s a kind of sad way to look at things, but I really don’t blame them one bit.

With luck they will be able to pick up the scraps after the Boomers don’t need them anymore. That is, one thing going for the youth of today is that they can afford to wait. In the mean time, they’ve gotten a healthy education in the value of frugality and good sense by watching their elders. I have a lot of faith in them.

The Y generation that downsizes and keeps costs and material goods minimized will be able to adapt to a new urban/suburban local-centric paradigm. I could care less if someone lives with their folks or owns their own four person carrier combustion engine. Kudos to any family that can get along (1) and pool resources for a higher standard of living (2). The only drawback to not having a safe personal mode of transportation is the lack of public transit infrastructure here in Southern California.

Only in a few of the wealthiest countries is it considered strange to have multigenerational housing situations or kids over 22 still at home.

If the adult kids are contibutors (not parasites) or have medical/mental issues and the parents are supportive of or need their children’s assistance than it doesn’t seem strange, but rather and honorable solution for both parties to share the same roof.

In Santa Ana, CA Escalades and Navigators with DUB rims drop children off for free breakfasts and lunches at schools, yet the vehicles drivers share rent with 1-3 other renters in 1200-1400 square foot homes. Seems like those cowboys ought to be driving Donkeys instead of Clydesdales. I guess the utility of the bling ride is greater then that of family privacy and living space?

I see a downhill spiral here with many of these REO’s being purchased by investors. They expect a discount for a quick cash sale, and then these sales are used as comps for appraisals, by those that need to borrow money to buy a house. This will force sellers to lower their prices to match the appraisal.

I live in what is supposed to be one of the few “unaffected” areas of the country but I’ll tell you this is a real issue and our upper middle to higher-end housing is suffering hugely (but did run up substantially 2002-2006 in good areas despite the non-bubble everyone here claims).

For example there was a nice house we saw go on/off the market for a few years starting at high $800s and finally sold for mid-$500s this year (they bought in 1996 in the low 400K so had time/money to play with). Probably 4K square feet 3 car garage, on cul-de-saq, nice land/lot too with privacy. The issue though is that for all intents and purposes this is a jumbo loan so someone is paying for closing costs and bringing $110K for a 20% downpayment.

Of course a comparable house just up the street, maybe as nice but not nicer just went on the market at the same time of sale for $899K. They bought much more recently (still decently below asking) but don’t have nearly that kind of room to play with. Given the comparable sale if someone was to pay their asking price it would be a maximum $440,000 mtg (20/80 on directly comparable sale at $550K) but now the buyer would need to bring closing costs and $459K in cash to the deal. I’ll tell you that people sitting on $500K in easily parted with cash tend to buy well up the food chain (even though these homes are VERY nice by most standards). Very simply, there is almost no chance this home can be sold without the owner taking a massive haircut and pricing closer to the new comp. On a long-shot he hits the 1 in 1,000,000 buyer flush with cash who wants to buy well below their pay grade – but there are far more houses than there are people in that position.

“Subjects under hypnosis are susceptible to the powers of suggestion. If that is the case, a large part of our nation has been in full slumber when it comes to housing propaganda.†This is true, and not only applies to housing, but to politics also. We got all the Hope and Change we can stand. The overall economic situation, especially housing, seems on a never ending downward spiral. The current policies do not seem to have anything but a negative effect. QE2 pumped billions into the system to no avail. So many people without jobs and so many more under employed. Highly trained college graduates without a hope of finding a job. We need to change course and try some different ideas. Small business in this country is the largest employer. Instead of dollars for junk cars, billions pumped into banks, and incentives to buy overpriced real estate the government needs to get the Small Business Administration into the act. I hear calls for more taxes. Incredible! This has never worked and never will. During hard times taxes should be reduced across the board. This has always stimulated the economy. There should be tax incentives for businesses that create jobs. Its like we haven’t learned any lessons from the Great Depression and other recessions we’ve endured.

There is a significant lag between when investment occurs and when you really start to realize the returns. So, if you are disappointed in QE2, it might be because very little of the effects have been felt yet.

My take on it is that we started to get some change in 2009-10 — not enough — but then the country voted in a larger and even more rabid crop of anarchists into Congress, and that put an end to it. What we have now is a hung Congress who can’t get much done due to fundamental religious disagreement about policy. Good government is the casualty. The Hope and Change candidate delivered fine on the hope but waffled too much on the change. Hope only works for a little while, but without concrete change it is easy to become disillusioned.

Or it could just be that Keynesianism is just a silly fraud that has come up short every time it has been applied. Or claimed to be applied. No government has ever followed enough of the ‘put aside a surplus during good times’ side of the the formula. Because they are incapable of doing so. It’s like the parts of Marxism that require inhuman behavior to function.

I have been thinking of buying a place in Ventura County, CA. The house sold for $770k in 2005, is now in foreclosure (bank owned) and they have lowered the price from $479k to $429k and now to $399k. While I agree that housing prices will likely continue to drop, I am ready to buy a home. I wonder when considering the rent I would pay anyway ($2k/month), the tax deductions when buying, etc. if buying the house now makes sense, even though it might fall another 10-20%.

Part of my rush is to have my own home to start a garden, solar power, etc. and be able to ride out any financial collapse.

Any thoughts?

I think you should post your question elsewhere

@Jason: Yes. If you think there’s going to be a financial collapse, you’re an utter fool to go into debt at this time. Your preparations will be of zero use if they are taken away from you.

For the record, I’m of the opinion that the basic math indicates that, yes, there will be a collapse. Wish I could tell you “when” though. IMO, it will be sooner rather than later.

Why do you call him a fool? Maybe he has cash that he wants to spend before the USD loses a lot of its buying power.

Will the potential rent cover the mortgage? What does the house next door rent-out for? You need to KNOW the answers to these questions before commiting a half million dollars (much more than that over time) to something you will have to maintain. Always run multiple worst-case scenarios: If you have to move temporarily, could you rent it out and cover all costs?

If you really believe there will be a financial collapse, and that you expect the home may drop another 10-20%, why would you buy? Don’t go against your instinct and buy for the simple reason of avoiding paying $2k a month in rent. If you put down 20%, and the value of the house drops 15%, you will have lost your down payment should you decide to sell after commissions and other costs. Don’t forget that interest rates are very low. If interest rates raise from 4.5% to 6.0%, the same payment would force the nominal house price to decrease by 15%, all other factors constant (ignoring tax benefits, etc).

The shadow inventory is real. The un(der)employment is real. Our state budget issues are real (think pension burden).

Even with the tax deductions, there is still an element of “rent” associated with your house purchase because of interest, RE taxes, HO insurance, and R&M. In your case, don’t fool yourself and say you’re saving $2k a month in rent by buying. Realistically, it’s probably only 25% of that amount when you consider maintenance, repairs, and improvements. Not to mention your time spent if you don’t pay someone else to do the work.

Have I convinced you to rent for 2-3 more years?

Put your confidence in housing as you would in the next generation’s (current high school/college grads) ability to land a good paying job and support the retirement of the elderly. *chuckle*

Nothing you own or buy will help you “ride out financial collapse.”

Survival in hard times is a matter of character, will, and intelligence.

By contrast, solar panels will get you electrons.

How many square? Nice Area? You got Cash? Offer $250K cash on the barrelhead. OK maybe $300k if you are getting it at $150 a square foot.

You buy now anywhere near asking, you can kiss a large chunk of your ducats goodbye and they won’t be coming back for a decade.

Seriously, unless you can insulate yourself by buying way below comps you are throwing your money away.

I agree Jay, if you want to live in a decent area of Los Angeles, you need to be rich, pulling in 350K. The rest of us have to fight it out for a box to call home. This fundemental truth will not change. Most of us will never be able to afford Santa Monica, no matter how far down the overall housing market goes. There will always be someone who will bid up prices in that area, and put it out of our reach. Let’s face it 100,000 to 150,000 and just getting by is not abnormal raising a family in LA. Then try buying. I got low relative rent in Burbank, and it eats a good chunk of my income. Buying would wipe me out… Forget new cars or vacations, and Christmas for that matter. I face the fact that I am working poor in LA at over 100K per year.

“I face the fact that I am working poor in LA at over 100K per year…”

WOW… help me understand the attraction… your ocean is COLD, your bikini babes are HOT, the hottest anywhere, but… our bikini babes in So-Fla are almost as hot, and without the delusions of Hollyweird and star-dumb… and you can swim in the ocean year round, no wetsuit!… it’s the babes, isn’t it? ;’)

What else can “eh-splain” it? Seismic event excitement? We’ve got hurricanes, but you can see them coming for days… kills the thrill, I admit, lol.

Seriously, from what I can gather, life in So-Cal peaked in the 1946-1961 Post-War era, and has been on a sad, sad slide ever since. But hang on, I’m sure the rest of the nation will be raped to make up your state.gov’s $28*B*illion deficit!

My acquaintance is in the middle of as short sale. The house is in a far suburb of Sacramento. 1.2M note. Short sale 430K to the investor who wants 530K from my acquaintance to keep the house. The investor wants 90days and out. Cool 100% annual return on his investment. Great work if you can get it, eh?

Two questions. 1. Why does the bank take the loss to 430K when the house (notionally) is valued at 530K? 2. How does the investor insinuate himself into this deal. Is there some back room stuff going on with the local bank manager?

Again, Thanks to DHB. Superb analysis.

What do you mean 530k back to the aquaintance? Sell it back for all cash? How would this person purchase back from the investor in 90 days?

“It is no secret that foreclosures sell for a steep discount like expired milk or older vegetables at your grocery store. ” Who writes this stuff – I laughed so loud reading your post this morning, I woke up my wife. Love the humor in the articles, thanks Doc.

I also like this from Compass Rose: “One of those three acquaintances is having a hard time letting go of fantasies of making lots of money just for drawing breath while time passes: the real corruption of The American Dream ideal. AKA, The Magic Of Compounding. It’s a little bit like believing that IQ should go up, just for sitting for 20 years in a stuffy room with a wall-sized Fox News feed.

Off today’s topic, but here are a couple of articles today about student loans:

They are now using SWAT teams to take you out if you default:

http://market-ticker.org/akcs-www?post=187745

You have to wonder when they’ll be pulling that for residential mortgages.

And here’s some advice from a lawyer who deals with this on the best that you can do if you have a student loan:

http://www.sfgate.com/cgi-bin/blogs/esandberg/detail?entry_id=90524

Thanks, Doc. Interesting read as usual.

That 431,000 figure for exhausted UI is rather frightening. Last I heard (maybe 4-6 months ago) was that only about half of all working age adults in California actually work, and that the ratio of working people in the population at large is around 35%. In most other states, these figures are closer to 65% and 50%, respectively.

Carrying that through, if we assume a population of 35 million for the state, that is maybe 12 million employed workers in all. That 431,000, then is around 3.5% the size of the employed workforce. And they will be falling off the counted ranks of the unemployed. And those 33% of unemployed workers who have been out of jobs for over a year are within a year of joining them. When that happens, we’ll be told the great news about how unemployment is falling, and we’ll be encouraged to go out and make large purchases somehow while as few as a quarter of us try to cover the ludicrously overstretched state tax coffer. How long can that possibly last before the state declares insolvency and/or chases all productive members of society to less broken locales?

Many moons ago I posted that we had put my fathers’ house on the market (Nov 2010). It was a rotten time of year to try to sell in the Dayton, OH area and I showed it to many tire kickers – people simply shopping above what they could afford. Those people thought they could get a fully remodeled house at 40% off market. *rolls eyes*

I suppose they could if they went with a foreclosure but we wouldn’t entertain that price point. The result of all this is discounting is that people expect to buy cheap when in reality the market doesn’t support it. Its feeding the frenzy downward IMHO.

It sold at a very good price because the area it resides in has only had an 8% drop in RE prices since the 2008 crash of the stock market. We did have to totallly remodel the house last year though – to the tune of 40K – in order to even get someone to look at it. Buyers are looking at FULLY finished homes only, and asking big concessions on closing costs. If you are selling be prepared to take either a price cut or have to pay out of your pocket to close the deal. My family was fortunate, the house is desireable for a number of reasons (extra garage, basement and 5 bedroom) in a good area so the pricing held up well. I dealt with a few uncommitted buyers who would bargain in not-so-good-faith for a sale price, and then refuse to sit down and write a sales offer on it. I got tired of that and finally listed it with a realtor, who shot the price up and sold it very high for us. So you never know what will occur in real estate…the house did sell at 11K over appraisal price due to the condition and location. We had it independantly (from the realtor) professionally appraised to make sure we were being represented honestly on the sale price of the home.

We still have a solid employer in this area – the AF base, so those that do sell are finding it to have to be in near-perfect condition due to the size of the inventory. Banks have still not let loose with the shadow inventory in this area, and we are glad we got this one done before that happened. Still, until that happens, not all markets are DOA. Good luck if you are selling or buying!

Good for you, glad it worked out for all involved… sounds like even the Real-Tor added some “value”, but… AF bases do get closed, so next seller might not be so lucky.

But indeed, in your NON-Bubble zone, probably 85+% of the market is “normal”, “arms-length”, i.e. non-distressed, but still, if even say, only 11% of for-sale inventory in your locale is “hinky” in some way, that greatly pressures the rest of the houses. Buyers know this, that’s why you had to deal with so many idlers and low-ballers. (Note: I AM in a Bubble-Zone–Miami-FtLaud–and proudly consider myself a low-baller, aka sane bidder… but never an idler, or non-serious bidder… admittedly, cranky HGTV-brainwashed sellers may disagree, lol. ;’)

No, buyers just seem to think they can get things for “free” and someone else is going to pay for them. Typical “American” way – everyone wants what they can’t afford for what they want to pay. Everyone wants brand-new for the price of used.

I’m sure the car industry see’s the same thing now – its a dangerous mindset for the consumer to have thinking they are going to get something for ‘free’ all the time.

The key in this was that we were not desparate to sell..we would’ve held onto the house for another year if we had to getting the best price.

As for my realtor, the lady I chose (I interviewed 3) was top notch and I could not speak more highly of her. She is very professional, extremely good communicator, knew her pricing, knew the market, and has been just the best to work with. She has 30 years in the business, and you don’t get that far with a successful sales record being dishonest. The moral in this story is to shop around for a good agent, and be clear about the sales pricing and the marketing of the property WITH THE AGENT. Still, many people are so covered up in debt that they can only dream – not produce the $ to buy. At least one of the ‘buyers’ who dorked us around could not qualify in reality. So be careful who you choose to work with – demanding up front proof of affordability (bank financing letter) was the key to making the final sale. No more tire kickers taking up our time and wasting our energy. The realtors comment to me was “we don’t even put them in the car to show them properties until we are sure they can afford the price range we are looking at”. That’s what its come to.

Wells Fargo’s New Fixed-Rate Student Loans Come With High Interest

(watch video)

http://www.huffingtonpost.com/2011/06/08/wells-fargo-unveils-fixed-rate-student-loan_n_873345.html

Doc,

I want not call the foreclosures as a discount price but rather the new price for the market.

I just bought a new iMac and Pro Tools 9 and I’m unemployed and I probably should have saved my money. Should I feel bad? I figured I’d rather play and record music all day rather than sit at Starbucks and watch the kids on their laptops, or watch American Chopper all day on tv. LOL!

Matt;

Foreclosures ARE a discounted price. Its not a “new price for the market” when all homes that are not in foreclosure are selling at a higher $ amount. The simple fact is that the banks are discounting these homes to move them – much like having an Aldi’s or a Dollar General around who discounts cheap goods to sell them. The unfortunate effect of all the discounting by the banks is to force down the price of homes that are not in foreclosure status, which is putting the squash on the rest of the housing market.

This is all smoke and mirrors coming from the banks, who only care about unloading their liabilities (that they created themselves). The American citizen is taking it in the shorts at least 2x now – we paid for QE1 and QE2 and Tarp, and again by the reduction of home prices in reasonable markets.

I’d like to know where the prosecution is of the people who caused this who debacle?

HOLY COW: Robert Shiller Could Easily See Another 25% Drop In Home Prices

http://www.businessinsider.com/robert-shiller-fall-in-home-prices-wouldnt-surprise-me-at-all-2011-6

Meredith Whitney: ‘More Validation’ Everyday Of Impending Muni Debt Crisis

(Watch video she talks housing going down 10-20%)

http://www.huffingtonpost.com/2011/06/08/meredith-whitney-more-validation_n_873341.html

They will go a lot lower in some markets if/when the “double dip” (i.e. Depression) becomes official.

ENZOMIMO you have got to get a life man you are like every other post, more than that though you need a course in typing because what you think is flash talking comes across as gibberish for those of us who haven’t had a doobie yet today.

I am also a little tired of your use of the word realtard. I am a Realtor, admittedly as a group we are not the sharpest knives in the drawer but you are insulting a lot of folks with learning differences that take particular exception to the word retard.

FYI: *I* did not coin the term “RealTard”, but I think I speak for many on this blog when I say that our derision of most Realtors (and the NAR, and MOST ESPECIALLY NAR “ECONOMISTS”) is NOT based on anyone’s native intelligence, but rather on their ETHICS… or lack thereof. What have you done to yourself? Ouch.

PS: Don’t think I haven’t thought about getting my RE Brokerage license, just to get the inside skinny on all the scams, err, I mean “sweetheart deals”.

I’ve had some bad realtor experiences, all of them are not like that. You basically get what you pay for, and what you research. If you don’t do your homework, you can expect to get burned with a shady/unscrupulous realtor. There are a lot of good hardworking realtors out there who DO earn their commission.

you have got to get a life man you are like every other post, more than that though you need a course in typing because what you think is flash talking comes across as gibberish

WTF? Blog posters don’t always make sense or wield rhetorical might, but this fragment quoted above is a bit of the old “pot and kettle” idiom. I would never mention it except for the poster’s call for a course in typing and the use of the word gibberish. Funny stuff.

Hello Doc & fellow members,

First of all I want to thank you for such an informational posts, analysis and discussions.

I was resident of So-cal for 4 years (2005 – 2008) and agree with doc and fellow members. Real Estate prices in that area is still pretty high and there is still lots of room for correction.

I have moved to east coast after that (NY/NJ/PA tri state area). I have not seen significant changes in property values in this area after the bubble burst. Merely it is 20% down from the pick prices. People here are saying this area is kind of “immune†to what is happening to elsewhere in US. I don’t agree with them but the house price on sale says it otherwise. I wish if Doc or some fellow members can run similar analysis on property in this area or at least point me to the good source for similar information.

I know lots of People will think why I am commenting on this column but just wanted to get the clear picture. Any information on this will be really appreciated.

I’ll try to fill in a little bit here. I spend some time in that region and lived/still have family in SE PA. First, NY and NJ have an average of around 900 days to foreclosure. It is ridiculous. Second the resuscitation of the financial system dramatically helped out and revived speculation. Third, I imagine the banks are being VERY selective in what they bring to market especially in jumbo loan land. This has all helped to support prices but the reality here is the same as most places. Incomes do not match up with prices regardless of interest rate applied and we are going into a period of higher costs, higher taxes, and demographic change where many owners of larger homes have grown kids and are looking to downsize.

The reality is that the supply manipulation and government incentives which put a brief floor under housing had an outsized impact on CA, the home of RE speculation and outright idiocy, and Tri-State/major financial centers because the government turned back on the juice for them. Eventually here, we still need to work through problems of higher taxes (likely at all levels) and higher general costs hurting discretionary income. Lower leverage and more regulation for the financial system is lower profits/earnings/salaries/economic benefits into these areas. The majority of middle class and above houses today are in the discretionary range – WAY more space and luxury than needed. Compare a middle class house today to one in the 1950s-60s. Ridiculous.

Anyway – eventually incomes need to match prices otherwise you get a game of landowners vs. have nots where no one new can enter and a fixed population of landowners trades pretend fixed equity between themselves. Of course people die, there are estate taxes, people build on proper economically priced houses on available land and all this too eventually erodes to prices=incomes. There is no stopping it.

Great article Doc! Here in Ventura co. Realty agents have played some new games. From “Refreshing” old listing over & over, dropping distressed sales from comps., dropping the terms “REO, Short Sales…” from listings, showing homes which turn REO as regular sales and at asking price in weekend paper, including attached garages in living area Square footage, And much more… Has anyone else been seeing this in your area? Look carefully before making an offer.

Somis Guy, I live about 5 miles from Somis… I am seeing exactly what you describe.

Trail Rider, if you find an honest Agent who works only for you in a sale and doesn’t play both sides to keep prices high – I’d love to know they’re name. We have caught several agents pushing so hard to make a sale that they are no longer working for us, but for themselves to save the Deal. Each in the same way, trying to pass off the manipulated data with out doing any fact finding to help us get a fair deal. We’ve saved ourselves many a heartache by doing our own fact finding, but this has become more difficult as the industry itself is the biggest hinderance. It’s easier to make a decission when you are not confused by the Facts… Thanks much and good luck Trail Rider!

What is truly sad is that for many this was their last chance. I know folks who are also in their 60’s and still need to work, but that’s just about over. they will probably be forced into retirement in poverty. The new American dream is to work your ass off for 40 years and hope to be a Walmart greeter to supplement your retirement. Unless you’re a gold-man and you try to take your millions to the grave…not a lot in between. Too many Potter’s and not enough George Bailey’s…

Love the blog and comments, keep them coming.

I’m Australian and we have ours coming (not sure how soon but can’t be far.)

I remember the top of Japanese market was when 50 year loans were made available and people thought they had better help their kids by buying a house while it was still affordable…….

Secondly in general in Japan since late 1980s/early 1990s they have had deflating house prices , so one would pay the loan interest at ? 2-3% + capital repayment; and then houses prices have been deflating on average 2-3 percent annually. So its costing you 2-3 % per year and losing value at compound 2-3% per year! Only a drongo would buy a property on these sums. You get the idea. It’s a property bubble in reverse.

Leave a Reply