The housing ATM is back in service! Black Knight Financial Services reports that 44 percent of Q4 refinances were cash-outs, highest equity drawn in eight years.

Have you heard the good news brothers and sisters? The housing ATM is now back in working order. Hallelujah! Black Knight Financial Services reported that in Q4 of 2016 44 percent of refinances were cash-outs. Meaning, people are now using their homes like ATMs which flies in the face of all the house humpers who continually act as if people are acting prudent in buying crap shacks. No, people are sucking on the teat of housing mania and now they are drinking from the nectar that is being produced. This percentage was the highest level of cash-outs in the last eight years. What was happening eight years ago? The housing market was imploding in epic fashion and nearly 8 million people lost their homes to foreclosure. Many lost their homes because they took out HELOCs and Home Equity loans to live beyond their means. I have to make this point since people always forget – the vast number of foreclosures happened on traditional vanilla 30-year fixed rate mortgages.

The Housing ATM is back in business

The stock market is at record levels, housing prices are at record levels, auto debt is above $1 trillion, student debt is over $1 trillion as well, and credit card debt is going crazy. I am getting more credit offers in the mail compared to 2006 and 2007. People are once again living beyond their means on debt. Housing is now being used as a piggybank to finance HGTV inspired renovations, vacations, cars, and other non-essential spending. Many are tapping the equity buffer out.

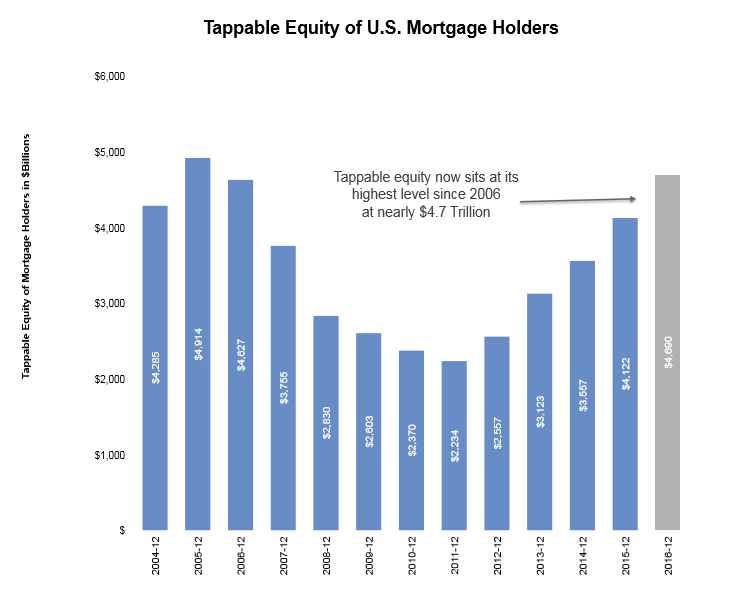

And of course, the first areas that will get smashed are the working class areas but then again, according to some, all of SoCal is now gentrified and Compton is now the next Newport Coast. The amount of “tappable†equity is now at levels last seen in 2006:

And of course, we all know that people were diligent and careful when it came to this. People used their home like an ATM and sucked out any equity like a vampire draining blood from an old man. You have to wonder how much of our economy is now running on this debt induced spending. You do have to pay this back at some point.

Of course people are going to try to justify crap shack prices in San Francisco and talk about mass gentrification in SoCal. But here you go with nearly half of all refis in Q4 having a cash-out component. What this means is that when a dip in the economy hits, these people are going to have less of a buffer of protection. And stop this pipedream nonsense that you are not going to lose your home. Nearly 8 million people lost their home in the last decade! Many of those homes were then bought at rock bottom prices by investors including Wall Street firms. Rinse and repeat.

This is a troubling indicator of mass euphoria which happens in bubbles. In many cases, these larger economic contractions happen because of solvency issues when it comes to paying debt. People are locking in future income to current purchases be it with houses, autos, or even going to college. That debt still needs to get repaid.

The entire model right now is built on permanent real estate appreciation. Even a slight decline is enough to burst this train. But right now, you have an entire menu of new excuses that replace the excuses made back in 2007 and 2008.

History doesn’t repeat but it rhymes. Roses are red, crap shacks are beige, my home is an ATM, now let me spend like a drunken sailor before the party ends and I have to pay this bill!

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

167 Responses to “The housing ATM is back in service! Black Knight Financial Services reports that 44 percent of Q4 refinances were cash-outs, highest equity drawn in eight years.”

Housing To Tank Hard Soon!!

I’m not surprised by this one bit. The system is so rigged to rinse wash and repeat.

Realtors all around my neighborhood of studio city are convincing condo sellers that their properties are worth less than they are and then everyone thinks they are heroes when it sells for multiples over asking price. This happened to my friend who was bragging about their agent. I showed him a comp that sold for 50k over what his idiot agent sold his for. If I ever was to sell with an agent I would first tell them what I think I could sell it for myself. Then have them sell me on why they can sell it for more than 3% over that number. Realtors are the new lawyers

TheBert – as I keep noticing, even on here, there are houses that you could buy and sell the *same house* and get rich on it. If that’s not proof of lather-rinse-repeat I don’t know what is.

@ASJ, my whole point is people can’t trust their realtors to give them an accurate price on the market. their motivation is the sell the property, not get their client top dollar. a 50k difference in price is only say $1000 out of their pocket after they pay their broker.

Cash out refinancing can be very smart, or very dumb. If the cash out money is invested in a high quality investment like a blue chip rental property, than it can be very smart in the long term. I did a lot of this and I am retired in my 40s.

But, if it is wasted on remodels, cars, or paying down consumer debt, then it is extremely stupid.

If the money is used to finance your kid’s college education, then it is a must have. You can never do enough to support your kids.

Do you still own all your beach houses? If you are still a landlord, I don’t see how you are “retired.” Being a landlord is time-consuming work. Lots of hassles with tenants. Lots of paperwork (e.g., taxes, insurance, regulatory agencies, utilities, employees, repairs, etc.)

Managing rentals is no big deal. I charge below market rents, and the tenants start complaining about anything above necessary repairs, I give them the boot. I make sure they understand this before they move in.

The paperwork is minor. You pay your insurance once per year. You cash the checks. No regulatory issues. Tenant pays utilities and is responsible for gardening.

My rental management experience is in my late father’s business in New York City, with rent stabilized (a form of rent control) apartment buildings. Very time-consuming, much paperwork, many regulations.

Rentals are so heavily regulated in NYC, they even having a separate court system — Housing Court — devoted solely to landlord/tenant disputes. My father had two or three cases in housing court every year, not an uncommon number for NYC landlords.

And you can’t just “boot out” a tenant in NYC. Evictions are difficult, resulting in lengthy court proceedings, with the tenant often asking and getting extensions. Tenants have a right to renew their lease (except in rare circumstances), a right that they can pass on to their children.

I am glad I am not a NYC landlord. I hear it’s also rough for landlords in Santa Monica and Berkeley.

As the percentage of renters increases, I expect ever more tenant-friendly laws to pass across the U.S. Tenants outvote landlords, so landlords should be wary of having their rights voted away in coming years.

Son of Landlord, come on man, you are smarter than that. JT is just a troll. full of fake stories and bs.

“and is responsible for gardening”

Now i KNOW you are a troll. LOL the LAST thing you want is the tenant in charge for that up keep AND, as any land lord knows, you have have the gardening done as a way to keep an eye on the property.

you aren’t thinking these trolls thru very well are you?

Nothing irritates me more than somebody who bought real estate back in the 1990s at decent prices and are protected from property taxes à la proposition 13 and now says anybody can do it!

And give me a break that 15% is a lot! In the last two months I have seen a jump in prices of 10% just because of the spring buying season! Prices may easily raise another 15 to 50% before a crash is forced by economics, And when it does happen you will be dreaming about a 15% decline

Oops that previous comment was meant for JT.

Wait, didn’t you buy your property back in the 90s???

Yes, bought most in the 90s not long after I graduated from college. Back then, First Federal in Santa Monica had no problem writing option ARMS on homes with minor down payments. Plus, their appraisers seemed to always hit a number that made refinancing possible. If I found a property you wanted to buy as a rental, they would refinance one of my current properties to free up the cash to buy the additional property. They were picky about what I was buying … they actually sent a rep to drive down from Santa Monica just to make sure they felt OK with the property you wanted to purchase … before the loan app was submitted. Unfortunately, they went out of business in the bust.

I added one property in early 13, and another last year. I may buy one more, or I may never buy again. Now that the South Bay and Newport/CdM are so high, I poking around Dana Point. In another 15 years, I think Dana Point will be big money.

One more comment … at this point in the real estate cycle, I am more worried about making sure I can hang on when the next recession hits. It can’t be all that far off. When a recession hits, I land up cutting my rents and I sometimes have unfilled rentals. So, I am working through the numbers. My guess is prices drop 15% in the next recession. We will see.

jt, if a recession turns into depression, if it gets bad enough, tenants will demand laws that make it ever harder to evict non-paying tenants. “Greedy landlords are throwing grandma out into the streets!” All sorts of delays and technicalities will be added. In NYC, eviction proceedings can take 6 months to well over a year, with the tenant paying nothing.

SOL, you forgot to mention that the more liberal/progressive/socialist/collectivist the US is becoming, the harder will be for the landlords to get any meaningful return or even to recoup the investment. Something for JT to consider.

Before this will be common place occurrence in the whole US, they will become prevalent in blue state like the one where JT invests. For that higher risk the market should provide a higher % return than a place like AZ – that based on common sense rules of finance – the higher the risk, the higher the rate of return should be to compensate for that risk.

As CA becomes a state of renters, the politicians will be under increased pressure to remove the Prop. 13, which would make the return OF the capital next to impossible; forget about return ON capital. That is another risk JT has to consider when he calculates his ROI. Add to that the louder and louder voices within the FED to liquidate over 3 Trillion of assets they bought since 2008. That is going to be lots of liquidity retired from the system – major credit crunch and super high interest???!!!! What about the significantly higher rates impact on the federal budget on double the debt (20 Trillions)???!!!….

JT: “My guess is prices drop 15% in the next recession. We will see.”

Angelo Mozilo, former Countrywide CEO: “I’ve never seen a soft-landing in 53 years”

15% is not a soft landing. When you see the average fall by 15%, you can find areas where the drop much higher … That is a big deal.

“15% is not a soft landing. When you see the average fall by 15%, you can find areas where the drop much higher … That is a big deal.”

Compared to the last downturn, it would a soft landing. Considering how much prices have risen since the last downturn, 15% would be a chink in the armor.

Jt, you display the mentality that has destroyed so many baby boomers financially and guaranteed that they are going to be their children’s dependents in their old age. A large percentage of this age cohort is saddled with college loans as they approach old age, and the bulk of those were taken out for their kids. The baby boom generation is the most debt-encumbered older generation in history.

Yes, it is good to help your kids with college if you are able. However, if one must choose between putting the kids through college, or funding your retirement, you must take care of yourself first, if only to make sure that you are not your child’s dependent and, hopefully, to leave your kids more than a pile of college debt.

More than that, the availability of loans for college has been the single largest factor in driving up the cost of tuition. One of the reasons Keynesian and liberal economic policies do not work and only make economic conditions worst, most of all for the non-rich, is that these economic theories discount the effect the availability of ever increasing amounts of money have on prices. In short, the more money you make available for a commodity, be it a house or a semester of college, the more the price rises.

You can help your kids through school by providing them with free housing while they attend a commuter school, like the local community college, for the first two years, and/or work their way through school part time, paying as they go. It would help if college borrowing were capped at, say, $15,000 for the lifetime of the borrower. Tuition would very quickly adjust to what people have available to pay, though not without pain for tens of thousands of overpaid administrators, and shareholders of worthless for-profit diploma mills that would fold almost overnight were the supply of E-Z loan money for any field of study, no matter how economically irrelevant, were cut off. Students contemplating borrowing $20K, or $50K, or $150K to pursue courses of study that do not lead to jobs would be saved from their foolishness, and tuition would drop steeply for serious students pursuing degrees in well-paid professional fields…. and both the students and their parents will be able to contemplate an old age spent doing something other than paying off 6-digit loans for an “investment” that doesn’t pay off for a large percentage of student borrowers, and depending on Meals on Wheels for their one meal a day.

I would do anything for my kids, even if it wrecked my retirement. But, that is a personal decision each person needs to make for themselves. There is nothing wrong with forcing your kid to finance their own college. I have decided to pay for my kids college, even though that will cramp my lifestyle.

“One of the reasons Keynesian and liberal economic policies do not work” This tired linking of JM Keynes to “liberal economic policies” is just so far off the mark. Keynes’ economic genius engrained in American economic policy created the most stable real estate market in this nation’s history for over 40 years. Prior to the great depression, real estate was a boom and bust affair in this country who’s cycles (defined in years, particularly the 18 year cycle) were predicated on the same elements – cheap credit, exponentially rising land values due to one economic activity or another & fueled by an increasingly insane speculative frenzy. We’re seeing this now but it’s the same pattern that you can trace back to the 1700s. What you’ll find from the late 30s through the mid 70s is a very stable housing market that moved with the rate of inflation. Do you really think that JM Keynes would not be aghast at the financial predicament this country finds itself in and the economic guidance that has created it? The model created in the 1930s that was largely from the brain of Keynes has been systematically destroyed piecemeal over that time. Be it the deregulation of the banks and the ever omnipotence of the Fed, the free trade deals that destroyed the manufacturing base, the redistribution of income by turning the tax tables into mechanisms that reward unearned income over labor in the extreme, the unmooring of the currency to anything tangible in order to maximize financial skimming, etc. etc. We’re not in this position because of JM Keynes. These “liberal policies” are only “liberal” in the sense that they free the ultra wealthy and speculators from restraint in going about what they do they best – taking the earnings of working people legally. It’s not any policy, it’s the ultra wealthy on the job doing the only thing they know how to do – find ways to put your money in their pocket.

Laura, I agree that college tuition is exorbitant now. Back in the mid-80’s UCSB was 1K per year tuition so I could work 5 weeks at $5 per hour in the summer to pay my tuition. Now, college tuition is 14K per year which means 35 weeks FT work at $10 per hour. What in the heck happened? I could have taken loans out in the mid-80’s but my tuition was still reasonable.

My suspicion is that the people on Wall Street got greedy.

And thank you MarkinSF for the explanation and proof that Keynesian policies saved the US after the Great Depression. You know, back in the Good Old Days when America was Great. We’ve dismantled too many of these stabilizing policies starting with Reagan.

Hi Laura, I like what you’ve said here. I’m 31 and I was a commuter college student. I lived at home, worked 25-30 hours per week all four years of college, and I have no student debt. I kept costs low and it paid off. I also have an advanced degree (got a scholarship) and was able to live cheap, also with no loans. I’m very fortunate to have parents who were willing to help me through. Without my frugal boomer parents, I would have nothing. I am grateful.

I’ve made some poor life choices, but doing college as cheaply as possible was the best (and arguably, possibly the only) good decision I’ve made! Not everyone thought it was a good idea, because the city college didn’t have the prestige of a 4 year, traditional university. I knew kids who had the “college experience” and they’re going to be paying it off for a long time.

Even with no debt, it is difficult to save for a home. Where I live (Denver) rents are very expensive, so much of my take-home is spent on a rental. I don’t make that much money as I’m still working my way up in my career. I make enough to support myself, but not nearly enough to afford rent, etc. while being able to save for even a condo here where things get snapped up in a day for thousands over asking or for all cash.

I hope to advance in my career enough to be able to move to a less expensive part of the country where I can purchase a home affordably. Probably a pipe dream at this point the way things are going. ……..

Given that mortgage interest rates are still low, I can think of a few reasons to borrow from your house rather than other sources.

1) Pay for college or your kids college. You can refinance at 4% today while a school loan is typically 6.8%. I know people who are financially doing much better now after paying off their college loans with a lower rate mortgage refinance.

2) If you need a car, it’s better not to finance a car with an auto loan.

3) If you had an emergency and are paying 28% credit card rates for medical bills or other emergencies.

4) We had a friend who refi’d and took cash out to add an extra bedroom and bath to their existing house. They claim they had 200% ROI with this investment when they sold the house 5 years later.

Note that I would take cash out with a mortgage refi for the reasons above as long as I kept spending under control. ie just because I had the cash, I’d still buy a reliable used car vs a new Corvette with any money borrowed.

I believe the only loan you should have is for a house. The rest are typically due to emergencies, bad planning, or college loans (6.8%). I’d rather pay the lowest rate possible which is typically a mortgage.

Some additional comments on using refi cash for home improvements.

1) In the case I mentioned above, they converted a 1960’s 3Bd/1ba house to a 3 bd/i office/2 bath house. In the 60’s when mom stayed home with the kids, 1 bath sort of worked. Today, with mom, dad, and 2 kids trying to get ready for work/school in the AM, 1 bath just doesn’t work. 2 baths are a minimum for most of today’s buyers and they will pay a premium for it.

2) Even the notorious kitchen remodel might be worth it. An old friend was trying to sell a house and kept getting lowball offers from flippers who eagerly wanted his avocado color sink, yellow tiles, linoleum, and mahagony paneling. He upgraded and was able to sell to a real buyer for 2X more than the improvement costs.

3) People at least want move-in ready. After spending $1M for your crapshack, they may not have any left to replace the dog stained carpets or update the cracked and stained counter tiles. They can roll your improvements plus your labor into their mortgage and at least live in it before saving enough to make it livable.

4) We debated whether to replace our 90’s gold doorknobs and handles to burnished bronze. Good thing we waited, gold is back! And we saved money by not keeping up with the Jones’s . Purely cosmetic renovations may not be worth borrowing on your house.

I admire some flippers. They are improving the houses and turning them to make a profit within a couple of months (not enough time for even insane appreciation to really have an affect.) They turn it from truly crappy to livable.

I have followed my parents footsteps (who were children in the Depression). – no loans except for mortgage. me and my siblings all went to Santa Monica College to save on tuition for the final 2 years at a university. But I learned the hard way, when I graduated engineering school in 1987, I got lots of credit cards and spent frivolously…. paid off the cards and cut them in half. When I purchased my first home in 2012, the loan officer asked me about other debts or loans – I told him ‘none’ and he didnt believe me…. he said “ok, what about car loan’ I said: I told you I have no debt. anyway, since I was paying off a credit card each month, I had a high credit score.

Speaking of landlords, tenants, new rules in the works for evictions in LA, LA, LAnd

http://la.curbed.com/2017/4/6/15215378/eviction-rules-los-angeles-rent-control-ellis-act-law

… As the number of Los Angeles residents evicted from rent-controlled units continues to climb, city officials are contemplating new ways to protect tenants and hold landlords accountable to laws governing units protected under the city’s Rent Stabilization Ordinance.

The City Council’s Housing Committee on Wednesday unanimously approved a preliminary ordinance tightening restrictions on how and when landlords can evict tenants under California’s Ellis Act……

Bob,

Agreed that one bathroom is just not acceptable for a family in this day and age. You will likely get every penny back and then some when making a 3/1 into a 3/2. Kitchen remodels can be done relatively cheap (speaking from experience). It helps to keep existing plumbing and electrical locations and do the cheap things that look nice. Most people simply don’t want to deal with the hassle or mess of doing these remodels while they are living in the house. A premium will be paid to have everything move in ready.

QE abyss,

what kind of loan officer can’t read a credit report? It states your credit lines in black and white….

were u using johnny on the spot loan broker service?

Here’s an unethical reason to own a house. If you take cash out during a refi to pay off your student loans you are not only paying off your loan at a lower rate, you have also moved that debt to a vehicle that is covered by bankruptcy.

Legally, you can never walk away from a student loan. Even in bankruptcy.

You can walk away from a house and suffer 7 years of credit history damage and then be back to normal as HisFrogness pointed out below.

Paying off your student loans with a refi makes sense in terms of lower payments and better legal protections.

Why not do it?

My financial philosophy is very similar to QEAbyss. Both of us were fortunate to have $1K per year college tuition bills in the mid-80’s so we could work our 200 hours per year (5 weeks FT summer job) at the minimum wage of $5 per hour to pay for college. The reason for loans today for college is that it now costs 14K per year for college so even at $10/hour it would take 1400 hours (35 weeks FT) to pay just the tuition. We need to lower tuition, raise minimum wage, or follow Mike Rowe’s advice and lower college demand by getting more people interested in the trades.

As QE Abyss points out, that’s the other thing that really annoys me. If you are paying off 20K on your credit card at 28% interest, you will have a higher FICO score than someone with no debt. Wall Street’s influence on loans. They don’t want those deadbeats who don’t have any debt to have an advantage over someone who is already paying loan shark rates for irresponsible borrowing. Strange world we live in.

One of the greatest thing i ever did in my real estate life was to refinance one of my rentals and buy another investment property. Doing that allowed me to retire early and live off the income of that investment property.

Let’s see…..

“No one ever went broke underestimating the intelligence of the American public” ~ Mencken

“Those who do not remember the past are condemned to repeat it” ~ Santyana

“Stupidity is it’s own reward” ~ My dad

“Stupidity is it’s own reward†~ My dad

Ironically, you misspelled his remark about stupidity.

The possessive form is its (no apostrophe).

The spelling with the apostrophe — it’s — is a contraction of it is.

Son of a landlord, you must love the Trump tweets?

“How low has President Obama gone to tapp my phones during the very sacred election process. This is Nixon/Watergate. Bad (or sick) guy!”

Have you seen the movie “Idiocracy”? I think we are not far away from it.

Be careful Millennial; this is a Trump love-fest here.

Someone on here mentions being glad they held off on changing some gold plated door handles to brushed brass because “gold is back” and indeed it is – gold doorknobs, gold toilets, gold welcome mat, tack is back!

I meant gold colored vs burnished bronze colored. Solid gold fixtures are always in style under this regime.

Professor Steve Keen has a Minsky model that looks at the levels of private debt to GDP and analyzes that considering that the economy is inherently unstable, the opposite of what we all learned in Econ 101. Since this article points out that levels of private debt are at a nadir similar to what we saw during the aughts, but does not draw specific attention to the difference this time being the dearth of supply, can we draw the conclusion that there will be a bust?

No bust will ever happen: …….For as long as there remains a good supply of sheep to be sheared and cattle to be slaughtered.

A bubble must draw in every last possible suc…er investor before it bursts.

But there is too little supply, and even at the high prices people are lining up to put in offers on homes in good neighborhoods. If there is a 15% reduction like “son of a landlord” and them are discussing, there is an entire coterie of middle class buyers waiting on the sideline waiting to purchase at those prices. One thing missing this time around is the huge boom in construction.

@eckspat

“But there is too little supply, ”

A myth perpetuated by the sell side. There is ample supply, but very few who can afford their bubble prices.

“and even at the high prices people are lining up to put in offers on homes in good neighborhoods.”

I’m sure that there were people lining up as well before sales and prices started falling in high-flyers such as San Francisco and Manhattan. What makes overpriced So Cal immune to this?

“If there is a 15% reduction like “son of a landlord†and them are discussing, there is an entire coterie of middle class buyers waiting on the sideline waiting to purchase at those prices. One thing missing this time around is the huge boom in construction.”

The sell side has been claiming the same thing for the past 8+ years — that fence-sitters would commit when prices were at least 20% lower than they are now. If things were as simple as you claimed, then there would never be a real estate bust. But we all know that the masses are greedy when prices rise and fearful when prices fall.

“I’ve never seen a soft-landing in 53 years” — Angelo Mozilo, former Countrywide CEO

@Prince of Heck,

I am not claiming it is simple.

I am, however, saying that there is no OVERSUPPLY like i saw last bubble when I would drive out to Phoenix and see the soon to be ghost towns unbeknownst to the builders, and see all the deals offering cash back from the builder, etc.

@eckspat

But it is simple. You moved the goal posts, from “ there is too little supply” to “no oversupply”. As a poster used to hammer over and over, the 6+ months of inventory only happens during a recession in full bloom. Before then, the seeds of destruction had already been planted. The common thread to bubbles in the RE market is a deluge of cheap and easy credit fueling price growth not sustainable by its traditional customer base.

I think the bust to come might be due to higher interest rates or a combination or foreign financial problems. Maybe the housing bubble in Canada may cause a ripple effect here in the US?

My bet is a combination of higher rates and credit tightening due to higher risks associated with sky high valuations. Too few stable buyers at current prices.

@Prince of Heck, the conflation is only interpreted that way if you ignore certain factors. I have no real pulse on the millions of millenials itching to get into a home, but the credit situation is not the same this time around either. The credit criteria are fairly stringent at this point in time. And you did not address the fact that builders last time around were offering kickbacks all over craigslist and that every Tom, Dick and Abdullah were jumping into the loan officer game with their friends who took a 6 week course at Countrywide. While I acknowledge your apt points about the 6 month supply, the numbers of new units are simply below demand for many young buyers.

eckspat,

You make a classic confusion between “desire” and “demand” or “pent up demand”. There are not the same and the difference between them is as astronomical as are the house prices in SoCal relative to wages.

“Desire” is just that – the desire to buy a house. Most everyone has one.

“Demand” means you are in a position to demand a house – that is you have a high income relative to prices and a strong job and downpayment – in other words you “CAN=ABLE TO” buy instead of just desiring to buy. It is a big difference.

At the last peak, in 2007, the “demand” was artificially created by the government and TBTF banks eliminating the “CAN” factor – any warm body was “ABLE” to buy.

These days, the millennials and young generation in particular are NOT able to buy. That leaves the demand only from overseas buyers and investors.

“@Prince of Heck, the conflation is only interpreted that way if you ignore certain factors. I have no real pulse on the millions of millenials itching to get into a home”

I have no doubt that many end buyers, including millenials, are itching to buy. But the laws of economics are prohibitive to them. Hence the stark facts: lowest home ownership rate in decades based on population growth because of the worst qualifiable affordability in perhaps history.

“but the credit situation is not the same this time around either. The credit criteria are fairly stringent at this point in time. And you did not address the fact that builders last time around were offering kickbacks all over craigslist and that every Tom, Dick and Abdullah were jumping into the loan officer game with their friends who took a 6 week course at Countrywide.”

You must be new here because I have addressed this point incessantly in previous posts. To re-interate my earlier post, the cheap and easy credit has been fueling this the current RE cycle (where do you think ZIRP money went to?). Investors, not end buyers, were the primary benefactors of this loose lending. Hedge funds and financial institutions borrowed to acquire huge lots at deep discounts during the initial stages of this “recovery”. As these investors scaled back, the government stepped in and re-initiated subprime lending for organic buyers through low or no money down FHA loans. Meanwhile, flipping activity is at its highest level since prior to the last downturn.

“While I acknowledge your apt points about the 6 month supply, the numbers of new units are simply below demand for many young buyers.”

Have you seen new properties being advertised below $300K in So Cal? There is not enough demand from young buyers at current prices. By the time that new units come online, they’ve already priced out many organic buyers. Developers overpaid for the land and therefore can’t price their properties to satisfy low end demand.

Corrections to my last paragraph:

Have you seen new properties being advertised below $300K in So Cal? There is not enough demand from young or move-up buyers at current prices. By the time that new units come online, they’ve already priced out many organic buyers. Developers overpaid for the land and therefore can’t price their properties without buyers resorting to unconventional financing.

Much as I dislike the Fake President, I do feel a bit sorry for him. The shitstorm is going to happen on his watch. Of course, he’ll blame everyone else under the sun no matter what.

I take that back. Donnie is an idiot. He now wants to dismantle Frank Dodd:

http://www.reuters.com/article/us-usa-trump-business-banks-idUSKBN1761YC

Only an idiot would fail to see that Dodd-Frank is worthless.

The truth is Dodd-Frank embraces policies that do not address the causes of the last crisis, it lays the groundwork for the next crisis, and it impedes economic growth in the interim.

A study published by the Harvard Kennedy School of Business concluded that the Dodd Frank law has accelerated the consolidation of too big to fail banks because of Dodd-Frank’s regulatory compliance costs. The extra burden is also dragging on consumer lending.

http://hotair.com/archives/2015/02/12/harvard-study-dodd-frank-actually-made-too-big-to-fail-even-bigger/

If only you DemocRATS had run an actual candidate instead of a criminal, rape-victim-shaming, corrupt Russian stooge (Hitlery Klanton) maybe you could’ve seen more of your terrible policies enacted… as usual, Republicans are left to clean up your entitlement spending messes.

You must be one of the thousands of Russian trolls that Senator Warner was talking about…or you’ve been duped by said trolls.

Agree with you Barnie!!!

I’d feel sorry for a moron who got himself into an awkward or hazardous situation accidentally, but Cheeto Benito’s not just a mere moron. He’s malignant, has been angling to become President for decades, is largely financed by a genuine evil genius (Mercer) and even after his Reich goes down in ashes, will still have his loyal followers.

Frankly I wish we’d just voted in George Lincoln Rockwell years ago; at least he had a wicked sense of humor!

Perhaps I am paranoid, but I am deeply concerned the world is slipping to a major war. The North Korea and the Syrian situation just plain scares me. I hope Trump can navigate this dangerous situation …

Perhaps, but removing a dictator in Syria would have little to no bearing on the US housing market. N. Korea will reach a detente when China deems it beneficial. So, don’t worry. If Dana Point will be hot in 15 years, would you see Oceanside and San Clemente benefiting from that?

Thank god Trump is listening to McMaster. I’ve been hearing raves about him, even from the left, for decades. McMaster and Mattis are adults and I believe Trump is smart enough to let them make the final decisions. This is no time for Trump to wing it.

jt – when you say “the world is slipping to a major war” – next time please say “the global oligarchs are using the US military to start another war”.

Don’t believe that? Syria is in the midst of a civil war, but the rebels are backed by foreign interests (so it’s not really a civil war). The big question is – who is backing those terrorists/fighters? One has to dig deep to get the answer.

From my perspective, I’d just wish we (USA) would stop meddling in other country’s business. Regardless of whether the Syrian gov’t or the rebels launched the chemical weapons, how does that affect the USA? I don’t think that it does. And I don’t think that the Syrian gov’t did it as there has been zero proof presented.

@Jed, perhaps he will listen to the general, but thus far it was been a feces show. Hoping Bannon can be sidelined with the insane delusions and things can turn into some type of normalcy.

@Jeff, I empathize with your skepticism and acknowledge that since the military industrial complex expansion after WWII became entrenched in the deep state, that all the world’s nails have received hits from US hammers. But on the other side, despite much of the intellegencia’s meddling in other nations’ affairs, the elected part of the US has a moral obligation to uphold and enforce a certain ethos that it advertises as an ideal. It does not do it well, however, when it sends military in without following up with schools and hospitals like Robert Fisk has oft written. But in the case of Syria, I have first hand knowledge, as do many other ME studies analysts like Prof. Juan Cole, that the regime commits genocides daily and is responsible for the bulk of the over 300k deaths. The only counter to that emanates from Putin’s think tanks and reverberates in alt-right echo chambers and Iranian press alike. Not everyone skipped social events in college to study Arabic, so not blaming the average person for imbibing the Alex Jones alternative narrative, but it’s simply not true. Let’s all hope cooler heads prevail in the next crucial step.

eckspat: the elected part of the US has a moral obligation to uphold and enforce a certain ethos that it advertises as an ideal.

That’s just an excuse to be ready to defend Israel when called.

There’s savagery all over the world, which the U.S. (rightfully) ignores. Instead, the U.S. cherry-picks fights, more often than not when it’s to Israel’s benefit.

Israel wanted this attack on Syria. Israel wants its Muslim neighbors fighting each other, rather than uniting under stable regimes (which can then focus on Israel).

This is why so many Israel supports freaked when Trump said “American First.” It implied a foreign policy that abandon Israel to fend for itself. (Nobody really cared about any other nation having to fend for itself.)

All this talk of “moral compasses” and “ethos of humanitarian intervention” is just cover for an Israel First foreign policy. We rattle a saber at North Korea, but don’t do much else. (Nor should we.)

jt, I worry about wars too. Trumps got in office, bombed Yemen and now bombing Syria. He didn’the even ask the congress. Whoever thinks we are bombing Syria because the guy is a dictator is a bit naive. It’s part of the plans. Look at Eastern Syria and where we have our posts…looks like we are getting ready to take over those oil-rich areas.

Please stop saying that about the chemical weapons. It was the rebels that used it:

http://articles.chicagotribune.com/2013-05-05/news/sns-rt-us-syria-crisis-unbre94409z-20130505_1_chemical-weapons-sarin-syria

eck – don’t get lost in the minutiae. The US has no business getting involved in internal conflicts in other countries. They aren’t threatening the US proper, and there aren’t a bunch of US interests in-country that might need protection/saving.

You really think that Assad is somehow worse than the force he’s fighting? Get real.

Presidents tend to conduct a circular firing squad. Obama rightly blamed Bush for the troubles under his watch. Meanwhile, much of his policies are helping to set up the next bust for his successor.

I’d be interested to see this graph based on inflation-adjusted numbers.

That poem is truly poetic to my ears.

Good news, Millenials will save USA. USA last hope!

According to millenials, the most self-important generation ever.

From their parent’s basements.

Wrong! Millenials are worse off than their parents, making 20% less.

https://www.usatoday.com/videos/money/2017/01/13/millennials-broke-and-we-should-probably-look-into-fixing-/96541836/

The “Millennial” designation is a farce, constructed by marketers to herd several generations off a cliff of debt. The schemers have labeled people born over a 25 year period as millennial, gen x gets a mere 15 years. No fking surprise it’s a lot of people. The advertising scum need a nuke dropped on them. Remember Generation Y? Yeah, it got disappeared, need more sales and especially LOANS.

“Good news, Millenials will save USA. USA last hope!”

Just fyi, this is how you spell: Millennials.

The last thing I want to do is save or support this rigged economy. I am waiting for an economic collapse.

millennials are USA last hope

No, it’s Obi-wan

So much for all the houses bought with cash which give confidence for no crash. The bulls forgot about all the refi and HELOCs.

And reverse mortgages…

The ludicrous amount of debt that is currently reflating the bubble should worry RE bulls who count on the “all cash” buyer to soften the next downturn.

Get the popcorn ready! Crash is coming! Yee-haw!

It worries this RE bull. Over my lifetime I was a RE bull. Now, seeing what is happening I am a complete bear. Or I should say, I am a realist who watches not ONLY for ROI but also return of the capital. Worry is more in regard to the overall bubble economy we live in rather than my own finances where I have control over. I am almost paid off. I have only 1:30 debt:equity. I hope to be completly debt free soon by the time everything crashes down and hopefully to have extra for more pennies on the dollar investments. Still I have lots of HELOC I can access, but the deal should be obvious to make it worthwhile – maybe 60% off in good locations. In the last crisis I bought for 70% off the previous sold price from few years prior with only a golf course separating the property from the ocean. It was an REO from the bank, repossessed.

@Flyover

I will be a RE bull when prices are justified by local incomes, and not by rampant over-speculation and cheap and easy credit splurging.

This is where the carnage really happens. The crash just exposes the carnage. A mouse trap works not because of the hammer but the cheese. I’ll bet a lot of these cash outs are Taco Tuesday Boomers who need margarita money.

I grew up in a very snobbish part of the UK. I recently visited there to see some friends. The place hasnt changed. People driving flash cars, with expensive houses and eating out. They literally look down on other people.

What annoys me after “waking up”. Is the cars will be leased, they wont be saving for a pension, they will have interest only MASSIVE mortgages and probably using their house as an atms. By being responsible I will end up supporting their lifestyles one way or the other. Either with low interest rates so they can afford their houses or supporting their state pension because they didnt save.

Sorry for the rant. I had a flashback of my last summer while reading the article.

Your points are valid!!! Although this is happening everywhere; its the “live for the moment” and “$30,000 Millionaire” mentality

Oxnard is the next Newport Beach, not Compton. I know that the homies have taken it over(the natives have gone to the Antelope Valley, moving uptown for them), but no way is that place destined to be Newport. Oxnard has a harbor where I keep my Viking 50, good news, I got my Coast Guard license back.

The area is economically depressed….but it’s on the beach, in California! why?

Sorry Carlos, but no one wants to live in Oxnard.

my homies are coming. Taco Tuesday everyday here. Some yuppies come here too because it is affordable.

I have seen a lot of big changes in the Oxnard area lately, especially the North end near the freeway, a lot of new stores, restaurants, and homes. Downtown is still a Barrio, and why the areas near the beach have not gentrified, puzzles me.

If you are earlier 30s or younger, you will witness Oxnard flipping from barrio to upper middle class. One or two of those single family homes could fund a retirement in 25 years.

Never borrow against your house, that’s silly. I work as much OT as I can, and put it toward principal. Will be paid off in 20 years instead of 30.

psst….the RE cheerleaders don’t like to hear that. Buying an overpriced house during the bubble and using it as an ATM is the way to prosperity and early retirement. Nothing can go wrong because housing only goes up from now on. Trump is a real estate guy!! Duh!

Good for you. I’ve done just the opposite and retired early. Different strokes for different folks.

Jeff: “I’ve done just the opposite and retired early.”

Who would have guessed.

I don’t make the rules, I just play by them. Are you telling me that you didn’t take advantage of low interest rates on low purchase prices a few years ago? How’d that work out for you?

Signed – a guy with 5 mortgages.

Nothing wrong with borrowing against your house if you can easily afford it. People don’t lose a house because they bought at the peak or took out a HELOC – they lose a house because they couldn’t comfortably afford it to begin with.

Understandable

They also walk away when the value of the house drops far below the face amount of the debt they’ve racked up on it, whether that debt is a 1st mortgage, or a series of home equity loans. In a state like CA where the lender has no recourse, that is relatively easy to do, while here in IL, where the lender DOES have recourse, bankruptcy is the only way out of the situation unless you can either get the lender to approve a short sale or principal write down. Many people here in Chicago saw the value of their places drop far enough to wipe out their 20% down payment- I know of two such people- and finally let the place go after struggling to make the payments. Watching a condo you paid $275K for drop to $150K is very demoralizing, especially when you realize that your payments are far above what you’d pay for a comparable rental, and your main motivation- your stake in your place- is wiped out.

Personality, I think housing will go down. Right now there is low inventory. Congress is getting rid of the Eb-5 program which price up housing in LA and OC. Dana Point is not going up it doesn’t attract an international buyers market except for Germany not China. Also, the end of eb-5 means houses ain’t going up much.

@Cynthia Curran

Don’t bet on Congress getting rid of EB-5. This program has been around for 30 years and they will continue to extend it and kick the can it. Instead of getting rid of it, they want to reform it and make it more lucrative for developers.

http://nreionline.com/investment/congress-moves-closer-eb-5-reform

For your consideration.

Actually, I thought the Taco Tuesday crowd are the smart ones (buying cheap tacos on Tuesday afternoon to save money). You should always buy a house when prices are low!

S. California is a place where people like to come up with funny names for the places they live! Examples are:

Costa Mesa – Costa Misery

Tustin – Rustin’ in Tustin

Newport Beach – New Porsche Beach

Anaheim – Anaslime

Garden Grove – Garbage Grove

Oxnard – Oxsnot

Sorry but it’s not the new Newport. Weren’t they calling the coast along there the “silver strand” or the “silver coast” something like that?

Costa Mexico and Stabba Anna, and Garbage Grove.

The east side of Costa Mesa is very nice. Great place to live.

Aaaaaaaaand there’s our proof JT’s a troll who’s pulling things out of his ass.

Here are some Costa Mesa listing on the eastside. Al are pending.

https://www.redfin.com/CA/Costa-Mesa/461-Costa-Mesa-St-92627/home/4605036

https://www.redfin.com/CA/Costa-Mesa/487-Broadway-92627/home/3558194

https://www.redfin.com/CA/Costa-Mesa/426-Lenwood-Dr-92627/home/4587094

Don’t forget, GuadaLaHabra!

I tried to withdraw money from my House-ATM and it said, “Insufficient funds.” WTF?!?!

“You do have to pay this back at some point.” —

ehhhh …no you don’t. Many of those 8 million people cashed out and then walked away from their mortgage as soon as they were underwater. Sure their FICO score went down to 500 but by the time the market’s done bleeding it will be back up to 635 and they can get another FHA loan.

And they can do this while all the while calling themselves victims of predatory lending. LOL.

For all the housing cheerleaders on here, Malibu is now a sanctuary city.

So when you lose your wife, house, job and toys due to the next recession; go out and buy a conversion van and park it on the PCH and sign up for food stamps. If you make $0 a month the GOV PAYS you $194 for food. I would say that is a pretty nice severance package deal. Best part is they can’t kick you out because it is a sanctuary… for people. They will even have little food machines where kids can feed the vagrants mike n ikes and chiclets.

Surfs up broh.

I think you are confused with the words “sanctuary city.” The rich folks up in Malibu want NOTHING to do with homeless people living in tent cities or vans in their beautiful community. I can assure you the local police will be on top of this. Any illegals or undocumented people who are arrested there just won’t be turned over to ICE, they will likely be given a one way ticket to DTLA and dumped off there. This is a pure politics that the left has been doing for years.

Sadly that appears to be the case. If you remove the unfortunate the city would likely look better again. Likely less crime from theft or other potential issues as the unfortunate are no where they could skim off the wealthy. If the world becomes zero tolerance you may likely start seeing walls going up in cities just to carve out the elite from the deprived.

Yep “Sanctuary city” is about illegals not homeless. In fact, the sanctuary city movement was started back in the 80s by some aberrant Christians who actually read their Bible and were willing to take a chance on getting in some minor trouble to save people who were coming up here because it was wetback it up here or be shot by death squads back home.

The regularly scheduled horrible treatment of homeless people will not change. So if you lose your place to live through accident or illness, house fire etc., don’t worry, your family and friends and hometown will still treat you like a rabid dog, as is tradition.

Da Lord is correct. Libs talk a good game but try that homeless stuff around where the rich libs live and you will get the jack boot where the sun dont shine real quick. Saw this on Maui many years ago (where many malibu residents have a second home or condo). You better have a legit place to crash or you’re toast – hippies get no love, but trustafarians are always welcome. Oh, you take credit? Namaste!

The cost of living in LA is so high, I don’t know how an Average Joe makes it here. Also, add the increased in taxes that one must pay: gasoline tax, Prop H tax, measure H tax. Soon, they are going to tax people for taking a dump.

“The cost of living in LA is so high, I don’t know how an Average Joe makes it here.”

That’s because LA is the center of the universe, filled with beautiful people, world class beaches, unparalleled culture, blah, blah, blah. The TV shows never show the horrendous traffic, huge homeless population, ever-growing numbers of illegals & welfare recipients, Africa-like summer heat, all the dirty decaying streets and broken infrastructure, and of course the ever-increasing costs of living which seem to increase daily based on the whims of the ultra-liberal politicians who control the state. I have a feeling that half the people who move to LA have no idea what the cost of living is here and the other half come for the hand-outs. LA is a playground for the extremely wealthy and a sh*t existence for everyone else who is fighting for table-scraps or waiting for their monthly slice of government cheese.

Bubble bursts while all of these high density complexes come online in LA. Surely the tbtf banks will find a way to socialize the loss.

Millennials and especially especially GenX have nothing but contempt for Baby Boomers. Nobody is going to rescue them from the soup line.

Kill Prop 13. Pop some corn.

The largest risk to prop 13 is that there are more renters than owners so at some point it may be overturned. I have personally wondered how all these bonds and taxes are passed each year. It’s likely the same effect.

Good news, now you can participate in a Ebay style bidding war for your next apartment. Renting just got so much easier and less stressful. Isn’t technology great?

http://www.businessinsider.com/rentberry-expands-nationwide-2017-4

I hope in the next depre…..Great Recession we have bulldozers ready to level old homes/towns including ones repossessed. Why hold these ghost properties. Time to empty the swamp.

Cities will need to start cleaning up their mess of allowing development in areas that should not be built and likely set some regulations back into place from creating conflicts with development standards. We need to avoid another Detroit.

https://www.redfin.com/CA/Torrance/3720-W-177th-St-90504/home/6579646

what do you guys think of this house? I’m about to make an offer, but tlhere’s one of those electrical power towers behind the house.

Let’s see – half a million for a dump with 2 major sources of cancer: Power tower and Freeway smog. If you would pay half a million for a dump in an excellent location I would understand – the value of land would justify it. Here, is the value of land with 2 VERY BIG negatives, minus cost of demolition worth half a million? That is the question a smart investor would ask (the investor making money in RE).

Don’t tell me that is your dream house you plan to retire in and you buy it for living and not investment.

It is probably only worth $425,000 even in a mania market. It is also very close to a freeway.

I would say half that price. However, put it up for auction with no reserve price and see what it is worth?

HomeRun, this is a mania market. If the listing price were dropped to $375,000, there would probably be a dozen offers within 2 weeks–and a bidding war. Why would anyone in his right mind bother to auction a home in a mania market? That is one thing which I haven’t been able to figure out.

Why to do banks continue to auction homes when they are so easy to sell?

Buy! Buy! Buy! Buy everything and anything.

You better buy that dump before I do. I’m on the phone with my agent right now.

OMG I am dying from laughter, call the ambalance

I’d offer 15k.

This is a “backdoor” increase in interest rate. If the FED sells the 4.5 TRILLION in assets, it has the same effect on mortgages as raising the interest rates a lot – they mop the liquidity from the system.

http://www.birchgold.com/news/backdoor-hike-official?msid=94970&utm_source=Birch+Gold+Group+Market+Update&utm_campaign=3865df9085-market_update_email_040817&utm_medium=email&utm_term=0_f225c8b1ba-3865df9085-74213181&goal=0_f225c8b1ba-3865df9085-74213181

The effect of a large increase in interest on RE prices????….

You do realize that website is in the precious metals business and is trying to scare people into buying gold?

Yes, I do understand and I am not a gold bug. The issue is that the FED is trying to liquidate at least some of that 4.5 Trillion paper asset. I heard that from multiple sources not just from a gold bug. So, what I said stays – it is going to mop lots of liquidity from the financial system and the effect will still be higher interest. That was the point.

Yes, the internet is full of sellers; that doesn’t mean the FED does not try to get rid of the paper assets they accumulated. First, they drop the news in different publications for the investors to get used to the idea. They don’t want to spook the markets doing something without warning. You can skip the part about buying gold. If the FED spooks the markets, yes, gold will go up but the FED doesn’t want to spook the markets and they don’t want gold to go up. That is why they drop these news here and there.

@Flyover

By selling off its balance sheet, isn’t the Fed essentially saying that they’re afraid of all the consequences of excess liquidity currently in the economy? Perhaps they terrified of Trump and the nationalism produced by policies that encouraged extreme wealth concentration in in the hands of the elite .00001%.

If this is plausible, then I’d be very skeptical about any major bailouts should the RE market falter again.

LA,

Here is another article supporting my thesis. It looks that they drop them everywhere everyday. They feel something and they try to get out of the paper bubble they created – they are looking for shelter from the financial weapons of mass destruction they created. They feel the tremor.

http://www.financialsense.com/gary-dorsch/fed-bombshell-minutes-indicate-balance-sheet-reductions

Count this on top of the interest rate increases they promised and feel the impact on RE values. If people can’t see the obvious, they must be blind to how the financial markets work. If they lose everything, …well….what can I say – ignorance is not bliss. Smart people hide when they see the black clouds coming.

Feels like the 70’s all over again.

Buying gold scares me more than buying a house. The year-to-year volatility of gold is +/- 25 to 30%.

Gold at $10000/oz is very scary to think about, but it could happen. Hopefully not in our lifetimes.

This article epitomizes the problem with LA:

http://la.curbed.com/2017/4/4/15145394/la-burger-landmark-development-6001-pico

To prevent the construction of 48 residential units (including five unites reserved for low-income) the local city council is trying to turn a glorified food truck into a historic landmark. Totally ridiculous.

An example of NIMBYism and the “preservationist” mentality run amok- a sad little structure that was an eyesore the day it was built and is truly an example of everything that went wrong with the U.S. in the 20th Century, is now a historic monument, while the property investor who paid for a property zoned for high-density construction and wants to build a good-looking building that will improve the neighborhood, is stuck with a lot rendered valueless. If the NIMBYS get their way, it will be a monument, alright, to NIMBY stupidity.

The NIMBYs have only one valid argument against increasing the high density housing stock in Los Angeles, and CA in general, and that is that the state is already grossly overcrowded- and lacks the water storage AND lacks the capacity to add more of it. That is a very good argument, really. There are very few suitable sites for dams that don’t already have one sitting on them left in the state. All the good sites were taken by 1955, and all the marginally good ones by 1975. What’s left would either add very little water storage capacity relative to its cost, such as the proposed Auburn Dam that would have barely increased storage capacity by 5%, or would mean taking water from Oregon & Washington, who will of course fight tooth and nail to protect their water supplies from being poached by other states.

Yeah. No. The high density buildings are eye sores, feature 3500-4000+ rates for a small living space, and most importantly replaced affordable units occupied by families who lived there for many years and cannot afford to move back into the same neighborhood. The kicker is they are largely vacant. And are killing the neighborhood. It’s a bit late in the game but about time.

I could go on and on. Most are funded by REIT’s. Lots of investors about to get took methinks

They’re doing the same in Santa Monica. Giving landmark status to crapbox rentals in order to prevent the landlord from Ellising out. Destroys the land value if you can’t tear down the crapbox currently sitting on the lot.

Flyover, interesting that gold is recommended, which is where I’ve been “investing” recently. Down a little at the moment, but I have not felt comfortable buying real estate or stocks for several years; and most currencies appear unstable.

Who exactly would buy them and why?

Real homes of Genius

Hello Doc. Ok, we all know the ekonomy is running on fumes, there have been no NINJA loans for more than a half decade, and millenials are making less than their mum and paw, AND banks are more careful in lending…. so who has the money for all these homes?

Especially $3/4million for homes in Jefferson Park !!!

https://www.trulia.com/homes/California/Los_Angeles/sold/3894799-2912-Edgehill-Dr-Los-Angeles-CA-90018

https://www.trulia.com/homes/California/Los_Angeles/sold/158843-3623-6th-Ave-Los-Angeles-CA-90018

https://www.trulia.com/homes/California/Los_Angeles/sold/3890961-3525-8th-Ave-Los-Angeles-CA-90018

Until there is a job-loss recession, I dont see this changing. And dont tell me another 9-11 event, or earthquake will change anything.

All of those homes are in pretty bad neighborhoods. I can’t help but wonder if the people who bought these homes realize just what they got themselves into. 750K for a crapshack in the hood. Welcome to the jungle baby!

“Hello Doc. Ok, we all know the ekonomy is running on fumes, there have been no NINJA loans for more than a half decade, and millenials are making less than their mum and paw, AND banks are more careful in lending…. so who has the money for all these homes?”

SMH…This is a global bubble enabled by global central bankers first and foremost for investors and financial institutions. Subprime is almost exclusively an American phenomenon. So guess where the cheap and easy credit went first and foremost to. Hint: not regular buyers who took out conventional mortgage loans.

Heck, Prince, great questiop. Who on this blog is a real estate agent or close to a house buyer and can reveal below how the last few people they are aware of bought their house in S. CA? I can start. A friend just sold their 900K house near Santa Monica to a Chinese buyer who paid cash for his daughter who was attending college in the area. On the other coast a nurse millennial friend and her engineering husband just bought a 3 bd 2 bath house for 200K in NC. The house sold new in 2006 for 230K and sold again in 2012 for 185K. They saved the 40K down payment and took out a conventional loan and are living like royalty in that area. Where are people getting the income and down to afford a 1M house with a conventional loan?

So who REALLY is buying homes in So. Cal?

Foreign? (I doubt its a huge number) T

Trustafarian rich kids? (Probably more likely…i’ve seen a couple of young couples with a baby on their hip move into 2 mil+ houses here in Santa Monica…one is a documentary filmmaker, the other a blogger…you do the math on that)

Downsizers?

High income couples?

Developers?

Not sure…RE agents are liars and fools….I wouldn’t trust one of them. They just tell you what you think you want to hear to get ANY listing.

@SIAbB

“A friend just sold their 900K house near Santa Monica to a Chinese buyer who paid cash for his daughter who was attending college in the area.”

It must be a Chinese American, and not a Chinese mainlander, right? Because the latter cannot legally transfer more than 50K annually out of the country. And the Chinese government is further tightening control on capital outflows. And Chinese mainlanders have been known to buy on margin, if not through mortgages. In other words, hard loans can pass for “all cash” transactions.

@GreenGroovyMom – Trustafarians make sense. I very personally know a family that put $20K into a child stock account in the early 90’s for their child in the hope that it would provide a good start for their child into adulthood. Today it is worth nearly $500K. Plenty of money for a down payment if they want to blow it all on an overpriced house. I personally believe the overbloated stock market is driving housing prices. If the market crashes, this money will be greatly reduced and pop the housing bubble.

Heck, It was a mainland Chinese buyer. They may have brought the money out earlier OR they may have friends in high places.

The only sane people IMHO are the millennial couple in North Carolina who can live within their means.

Christmas in April. Trump just said he will be getting rid of Dodd Frank. That means mortgage money will flow like it did in the past. Easier mortgage money means home prices should be heading much higher.

I think it is more or less springing the trap. The bull will not last too much longer. If Demo’s don’t want to see a turn around under Trump’s watch I’ll bet they want to see him fail horribly. Would likely see 70 crisis all over again and probably a lot worse in my opinion.

This is why many consider you a troll. Just bluster and no facts.

To replace Dodd-Frank, which has done little to stem the money flow into real estate in the first place, Trump promised to re-instate Glass-Steagall.

Trump also promised to scrap Obamacare…

I don’t think Trump can or will completely dismantle Dodd-Frank. To do so will require congressional approval. And I’m sure all Dems and some Republican senators are not on board for a complete scrap of Dodd Frank. What I believe will happen will be a cherry-picking of repeals on some of the more stringent and less popular regulations imposed by dodd-frank ex. bank liquidity & capital requirements, lending requirements, government oversight, etc. These changes should spur profitability for banks across the board and open up the door for more lending at higher risks than what we are seeing now, including mortgages.

I think you may be right. Since Glass Steagall was orverturned back in 1999 banks and financial institutions merged fast and probably made themselves TBTF so it would be probably impossible to separate them if GS were reinstated? Maybe that is why smaller banks and credit unions will be the next areas to provide the lending for the masses? Who Knows.

Gold has served me well in the past. Been trading in a 100 dollar band for a couple of years. And overpriced at the moment. When it drops down to a thousand buy. It’ll go past 2k in the next run.

You’re obviously smarter than I am. I bought some Gold back when it was under $1K and the S&P was about the same. When it hit 1800 I remember feeling vindicated and letting it ride… and then watching it fall and then stagnate while the S&P more than doubled in value. Good thing I had 60% of my assets in equities and 2% in Gold or I’d be really annoyed.

Anyway, my point is that Gold is good hedge against stock volatility (which is why I’m still holding my position), but unless you have a crystal ball or a great sense of timing it can be just as effective a means of losing money as any other investment.

Yikes! Inflation adjusted Gold was

$2000 per ounce in 1980

$360 per ounce in 2000

$2000 per ounce in late 2011

$1200 per ounce now.

If I’d bought gold in 1980 or 2011, I’d have lost 40% of my money today

If I bought gold in 2000, I’d be up 400%. today.

The only reason I think $1200 is high is that it may plunge back down to $360 per ounce in the next few years and I’d lose 80% of my money.

The volatility of gold makes housing look tame.

Gold /Silver are essentially insurance if you need money in times of Hyperinflation. also just to have money that is not backed by any government FIAT. Can only wonder what to do about the debt.

Whatever happened to “Buy low, sell high†as a sound investment strategy? Bubbles destroy such rational investment notions. What about “Buy and hold� Sadly that only works if you don’t need to sell any time in the decade or two. It sure isn’t the strategy employed by that massive army of house-flippers. There is no investment strategy that can protect you from the coming decline, except to refusing to participate. It’s the only sane choice at this juncture.

Check this out! 800K for this dump! “Contingent indeed”. Unreal! http://www.sdlookup.com/MLS-170011797-771_Santa_Florencia_Solana_Beach_CA_92075. Looks like a hoarder house to me with “stolen” post office box containers to boot! Lovely!

On the other hand, here’s someone who did well with timing, if you look at the sales history: http://www.sdlookup.com/MLS-170011090-3952_Lago_Di_Grata_San_Diego_CA_92130. These areas keep inflating — how high can they go!

I’ve driven by that 1st place on the way to Del Mar. It’s immediately overlooking the busy 5 freeway with a ocean view in the distance. Not worth it IMO. I would set a match to it.

Leave a Reply