Housing All-Stars: First Half 2008 in Review. Acceleration in Foreclosures, Historical Price Declines, Stimulation Checks, Expensive Texas Tea, and Job Losses.

Unless you follow the housing market closely, you may think that not much in the housing market has changed. Yes, in January we already knew that the housing market was having problems but these last 6 months have added fuel to the flame. In January, the year over year drop for Southern California was 13.3% and the median price was $425,000. That may seem horrific and was a record but measure that with data 6 months later that now has the year over year drop at 26.7% and a median price of $370,000. The velocity of the drop intensified exponentially during this time frame.

We can also measure this against national price changes with looking at the Case-Shiller data. In January when the data was released, the most recent data indicated the following:

20 City Composite

November 2006: 204.65

November 2007: 188.98

Drop of: 7.6%

Now fast forward to the most recent data:

April of 2007: 200.53

April of 2008: 169.85

Drop of: 15.2%

The Case-Shiller data trails the market by two months. That is, the data released in late June covers the market until April of 2008. The data released in late July will go up to May of 2008. This is something to remember because even data from other sources is 45 to 60 days behind because the nature of closing a sale on a home is not instantaneous. From signing a contract, getting financing, inspection, appraisal, and to closing escrow does take sometime. It’ll be interesting to see if we even get a tiny jump when the May and June data is reflected in the current data. If we are to look at preliminary data like mortgage applications and also contracts, the above trend is most likely to continue.

The first half also witnessed interesting sales gimmicks like buy one get one free marketing ploys to entice buyers to jump into the market. The government during this time also engineered the first bailout for a Wall Street investment firm of Bear Stearns. It turns out that things were worse than they wanted us to believe. During this time we also saw the fascinating dance phenomenon take fire not on Dancing with the Stars but on the streets of America. People were learning the ease and flexibility of moonwalking away from your mortgage and responsibilities. Sometimes in life, you do get second chances and people realized that those on Wall Street shouldn’t have complete domain over speculation. Mary and John Doe realized that they too had some power in the market.

The first half of 2008 was only the beginning of a year that is going to prove to be a major turning point in our nation’s history.

Foreclosures

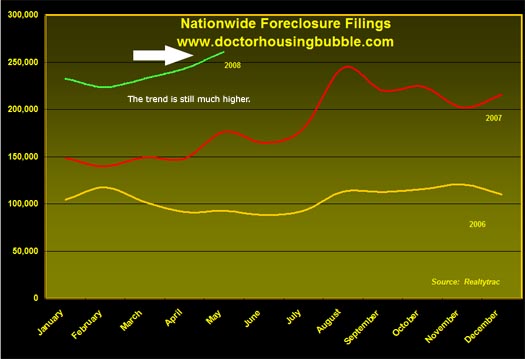

Once upon a time, foreclosures actually made headlines in the media. Now, it seems like there is this major fixation on oil and everything else is taking a backseat. Well guess what? During this time foreclosures as you can see from the above chart are still moving up. What is even more telling is that this is occurring while all these various measures are being launched at Wall Street to prop the market up. So what is happening? Wall Street is getting charity while the American people (see above chart) are not getting the trickle down from this supposed support.

The market is deteriorating and people are feeling the pinch while lenders and the government engineer lucrative bailouts. All you need to do is follow the data to realize that the façade being put up is to hide the corporate welfare being given to the purveyors of this once in a century bubble.

Foreclosures should be the headline story since much of the leverage of this decade was based on expanding housing. The fact that foreclosures are rising on such an alarming pace is only a leading indicator that more firms will be doing further write-downs in the months ahead. In fact the $391 billion in write-downs may be peanuts when we examine the potential $1 trillion target that we are predicting conservatively.

Major Price Declines

It must come as no surprise that prices are falling off a cliff both nationwide and in California. The reason California carries a lot of weight is that taken alone, California would be the world’s 8th largest economy. California is also the hub of the mortgage bubble. We earlier reported that prices in the golden state were off by 27 percent but have to update that since the C.A.R. recently came out saying the median price drop now stands at a stunning 35%! Given the $500 billion Option ARM implosion which will be one of the major stories in the second half, we can nearly predict the next few months.

Nationwide prices are down 15.2% which is the steepest drop ever. Even worse than the drop during the Great Depression because of the speed in which prices are correcting. What once seemed a mere impossibility, the forecasts for nationwide drops of 20 to 30 percent almost seem like foregone conclusions. We should be seeing 20 percent this year and if prices accelerate, who really knows. These forecasts were for bottoms in 2009 and 2010 at least if we are to look at futures markets but a 35% drop in California in one year is even shocking bears like myself. The ferocity of the correction is stunning.

And much of these price declines are because of the foreclosure onslaught. Last year, the struggle was that lenders simply did not want to lower prices. That stubbornness has led to massive amounts of inventory at a time when they should have aggressively pushed homes off their books. Now, REOs are flooding the market competing amongst each other at a time where the middle class American is being crushed by rising consumer costs and a gloomy job picture. Result? People are now more reluctant for big ticket purchases even if they qualified which many are not.

Stimulation Checks Out

In January, we reported that the Stimulation checks were going to be a waste of money and guess what? They were exactly that and put us into a bigger deficit:

“(January 2008) Don’t you just love how they are calling this fiscal boondoggle a stimulus package? Since we are all about “stimulating the consumer” they will also throw in a few syringes with heroine, methamphetamines, and two Red Bulls for good measure. This way, consumers can load themselves up and spend for 48 hours straight shopping without even pausing for water or sustenance (I guess the government assumes your lifetime goal is to be on the perpetual Wal-Mart hamster spending wheel). I can imagine everyone running to their mailboxes eagerly reaching in with their hands, on a bright sunny spring day and pulling out a nice $600 on a Statue of Liberty watermark check. Thanks Paulson! Just got screwed on the AMT and Social Security but hey, who can argue with a nice watermarked check?”

Well as it turns out, not paying attention to more important issues consumers were salivating to get their checks simply to offset the rise in consumer prices set off by the rise in energy. Not exactly the boost they were looking for. In fact, this put us further into debt putting more pressure on the dollar and also causing more inflationary pressure since more money went out competing for the same amount of goods. Unintended consequences folks! Now we are hearing more talk about a second round? Why not just send us all a $1 million and be done with it?

Black Gold Just Got More Expensive

What has now become the number one economic story, oil is another major change that occurred during the first half of the year. Prices have jumped from $92.95 to the stunning $145 price per barrel. That is over a 50% jump in 6 months and is simply putting everything into a tailspin. With this move, airlines are struggling for survival, the American automakers are gasping for air, and consumer prices are skyrocketing:

How bad are things for the U.S. automakers? Toyota Motor Corporation has a market cap of $144 billion while GM now has a market cap of $5.7 billion. Toyota has a market cap 25 times larger than GM! That should tell you something about what is going on in the current scheme of things. They used to say, “As GM Goes, So Goes the Country” and if that mantra still holds true, we are in for some deep pain. I disagree with this mantra given that our country went from having a strong manufacturing base to becoming a service economy where we traded houses to one another and pushed archaic derivatives based on these houses to other investors. Basically we bet everything on the house and the house is collapsing.

Job Losses

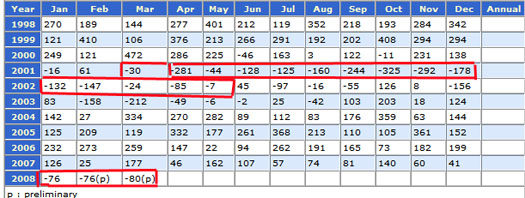

Amazingly on Thursday we had a horrible jobs report but the market did not react. For the first half of the year, nearly half a million jobs were lost and previous data from older months was revised upward. Take a look:

Data from April

Notice how the numbers were revised up? This happens routinely but when the numbers are revised to reflect a deteriorating economy plus you just reported that for the entire year, each month has had job losses you would think that this would make the market blink. Not so. Apparently job losses aren’t so bad according to the assistant Treasury secretary:

Notice how the numbers were revised up? This happens routinely but when the numbers are revised to reflect a deteriorating economy plus you just reported that for the entire year, each month has had job losses you would think that this would make the market blink. Not so. Apparently job losses aren’t so bad according to the assistant Treasury secretary:

“(Washington Post) The assistant Treasury secretary for economic policy, Swagel came out for his monthly economic briefing yesterday, 90 minutes after the Labor Department reported that the country had shed jobs in June for the sixth straight month.

Does this mean the economy is worse than the Bush administration expected?

“We shouldn’t, in a sense, be surprised when the data are, are, soft,” Swagel managed to say.

Does the economy need another stimulus package?

“I-it seems, you know, it seems like that’s, that’s enough, uh, enough.”

What might trigger another round of economic stimulus?

“I don’t, I guess I don’t have an answer, I mean, you know, beyond saying we look at all the data and, um — so, my usual line.”

Okay, so it wasn’t a strong performance. But let’s cut Swagel some slack. He’s a sharp economist (his PhD is from Harvard) and, in ordinary conversation, he suffers none of the speech difficulties that plagued him on the stage yesterday. His various roles in government, at the Council of Economic Advisers, the Federal Reserve and the International Monetary Fund, were too junior for him to deserve any blame for the current economic troubles.”

This is actually becoming a comedy skit. How long can we keep telling Americans the economy is fine without being chased out of Washington with a revolution? I think what occurred on Thursday is indicative of what is going on in the nation overall. Exhaustion. People get that we are going in the wrong direction. Most understand the economy is bad. Like a bad movie, they simply want this thing to be over. But I have news for you. This won’t get better without you taking action. It can be something as small as choosing not to buy a home and playing into this lame game (which the government is going to try to entice with the new bailout plan giving buyers a one time tax deduction). It can also be voting out many of these idiots come November. It can also be you saving your money and not playing the consumption game which got us into this mess. Either way, there are things you can do. Yet it appears many are simply sticking their heads in the sand or zoning out in front of the tube. That will only get you more frustrated.

As you can see, much has happened in the first six months of the year. The second half will prove to be just as tumultuous and volatile. We have the option ARM implosion, the Presidential Election, the summer Olympics, and many other unintended consequences from fiscal mismanagement. Hopefully the All-Stars of the second half make wiser choices.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

9 Responses to “Housing All-Stars: First Half 2008 in Review. Acceleration in Foreclosures, Historical Price Declines, Stimulation Checks, Expensive Texas Tea, and Job Losses.”

Great but terrifying blog today! So glad that I discovered you two years ago and had the sense and another viable career path which enabled me to get out of real estate sales. The greed and deceit on all sides that I observed from my time as a realtor was appalling. Hopefully your readers will heed your excellent financial advice to them. I have been reading an excellent book on the Jacksonian era and it is pretty scary that the characteristics observed by European visitors in American’s in the 1830s are still the characteristics we exhibit as a nation today. Those that don’t learn from the past are bound to repeat it, hey?

The new issue of Vanity Fair has a fascinating article on the demise of Bear Sterns. A terrifying foray into the hubris of the firm’s top management and a suggestion that they were done in by short sellers and instant financial news coverage. Interesting reading anyhow. Thanks.

I think the new revolution is around the corner, greed and corruption has grown epidemically too large, bad habits and damage are not repairable, no more politicians! they have got to me moved on for the sake of this Country they are a negative personification of magnetic energy, for the people by the people not for the elite by the elite, we have to take this Country back! there is going to be allot of changes, say goodbye to Corporate America and Wall Street and say hello to the common people making common sense on common income and reasonable housing. God bless!

Just remember, Bear sterns in short hand is BS. That is exactly what there deal with Bank of America is turning out to be, BS for the american public who have no idea what is going on around them.

Their might be a cure

! bring all military home , not just iraq afgan but all military, chop pentagon budget to a level for a viable national defense and paying existing va & mil injured vets

2 cut all aid payments to all nations especial military aid

3 raise import duties on products from companies that offshored manufacturing

4 put 90% of congress and the executive dept on trial for treason and war crimes

5 use the opportunity’s to do some real fixing of this countries problems Constitutional convention time

OR ignore it all until l a real revolution raises itself up and unleashes hell

There will be AT LEAST two more stimulus packages. The next one will arrive in time for Christmas and will be larger than the first.

RE: the Vanity Fair article – excellent read. However, it gives a free pass to Paulson and Bernanke other than to say that Hank essentially said, let BS feel pain. The systemic causes of why BS and its brethren were permitted to go off-balance-sheet a la Enron were left unexplored.

Any word on the California state budget? It’s past due…

With real inflation at >10%, saving that stimulus check is stupid IMHO. My stimulus check is gone. I stockpiled food, purchased a bicycle, non-perishable household items and car parts with it. You have to have a rainy day money stash, but when inflation outweighs interest, it doesn’t make sense to increase your savings when you can increase useful items (that will only increase more in price) instead.

See this, Doc?

http://www.ocregister.com/articles/loans-helocs-heloc-2085396-credit-lenders

You’re right – to comment on one of your minor points – drilling off shore will do nothing in the short term. This has been repeated to the public for 35 years that I know of and there’s only one thing I can put in my (needed) auto — oil.

We need better, cleaner solutions that stop sending our money to crazies but all I can use for the foreseeable future – even in a Prius – is oil.

When we refuse to drill and refine here we are merely exporting the pollution to far poorer stewards of the environment and practicing NIMBY at a horrific expense to our balance of payments. Who is being fooled here?

We need a countrywide high-energy project like getting to the moon in the 60’s but until then we need oil.

We are currently buying it from fanatics, haters and slobs. We don’t help the environment and we weaken the dollar.

I’m pretty unhappy when someone says something won’t help in the short term. I can think long term and strategically — why can’t our leaders? The short and long term tough decisions taken 20 years ago – if only – would not have us in this pickle — either for oil or mortgage lending.

Leave a Reply