Gear up for the 2022 and 2023 Housing Correction: 5 Charts Highlighting the Pain Ahead for the Housing Market.

Housing is always the last sector of the economy to turn when the market enters into a recession. It should also be noted that the past is not prologue to the future but at the end of the day, people pay their housing or rent payments via income that comes from somewhere. Case-and-point is that the Great Financial Crisis of 2007 to 2009 did not lead to a housing bottom until 2012. It is worth noting that out of over 7,000,000+ foreclosures during that period, only 1,000,000+ were of the subprime flavor. The rest of those foreclosures came from vanilla 30-year fixed rate mortgages that went into negative equity situations and high unemployment made it where people could not pay their monthly mortgage. We are already seeing the layoffs starting and this time around, inflation is out of control and the Fed is running out of ammunition to curtail the price increases. I want to be very clear here, Democrats and Republicans are both responsible for this since they both enjoy spending and tax cuts when they are in power. From my vantage point, we have a day of reckoning that is going to take a few years to unwind here. Here is why I think the housing pain is only starting.

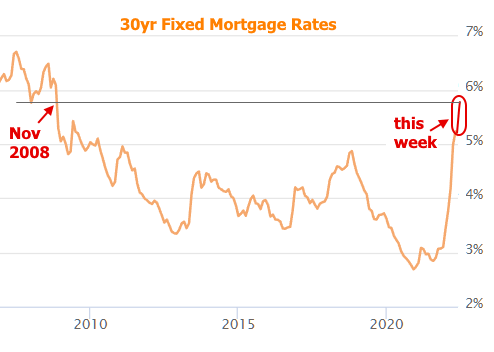

Reason #1 – Interest Rates Have no Choice but to Correct

The recent CPI “surprise” caused the markets to drop because it signaled to others that the Fed will absolutely need to increase rates to curb runaway inflation. See that chart above? Rates are now back to 2008 levels and we saw one of the most dramatic moves in rates in one week here. Just do some simple math here. Here in SoCal, a typical beat up home is $1,000,000. Say you go in with a 20 percent down payment. Let us run some numbers here:

Home price: $1M

Interest Rate: 3%

Down Payment: $200,000

Principal and Interest: $3,373

Taxes: $867

Insurance: $105

Total monthly payment: $4,344

Run these numbers again but with interest rates at 6%.

Home price: $1M

Interest Rate: 6%

Down Payment: $200,000

Principal and Interest: $4,796 (42% increase)

Taxes: $867

Insurance: $105

Total monthly payment: $5,768

This is significant here since households are already cash strapped and trying to squeak in with any extra income they have. The FOMO has already been strong for a couple of years. Low inventory, low rates, and a desperation to get a home have led to unhealthy buying habits. We are already seeing this with credit card debt soaring.

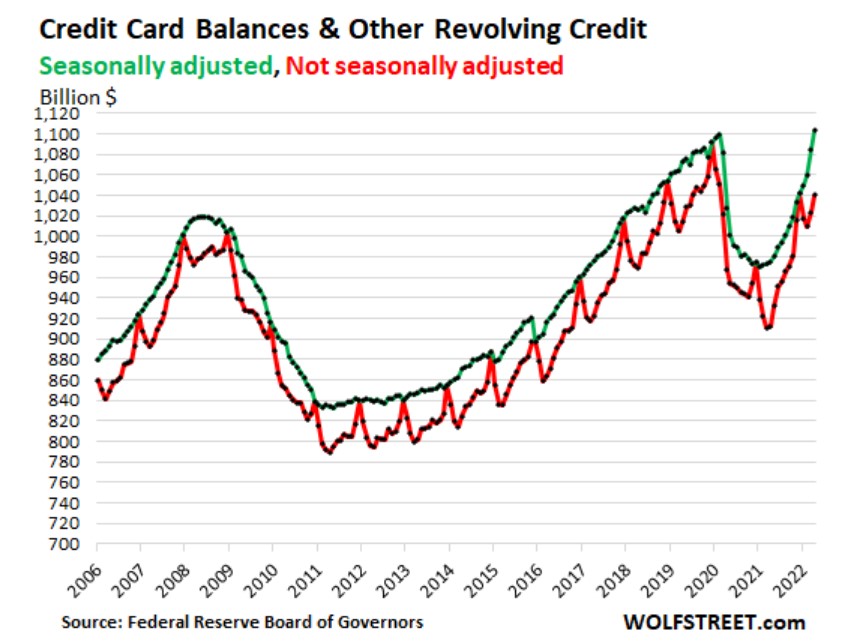

Reason #2 – Households are Maxing out Credit Cards

Given the rise in the cost of virtually everything, Americans are leaning on credit card debt and revolving debt to keep up their lifestyles:

This is very problematic since this is really covering up what is really happening – real wages are being eaten away by inflation as raging prices are slamming consumers from food, energy, and household expenses. This happened in the last financial crisis as well as you can see in the chart in that Americans were tapped out and were using HELOCs, credit cards, and other revolving debt to keep up with their lifestyles but the unfortunate outcome was that people had maxed out.

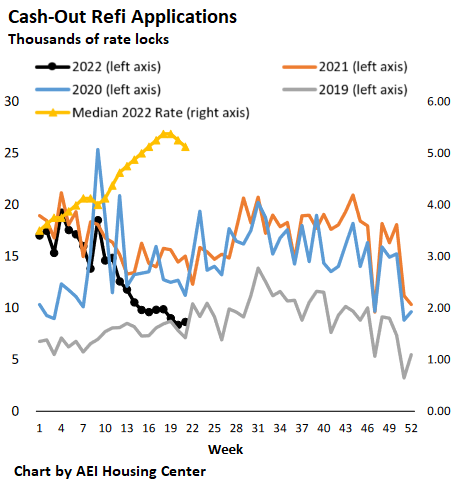

Reason #3 – Cash Out Refinances Imploding

Thanks to artificially low rates, Americans have been tapping out equity from their homes or refinancing. As you can see from the chart above (the black line) the home equity machine game is fizzling out in 2022. This has supported the economy in the pandemic but again, this was all smoke and mirrors covering up what was happening below the surface. Artificial rates, low inventory, and massive money printing have now come home to roost. There is no place to hide aside from a correction – in a way, the Fed wants this because if inflation gets really out of control, you have bigger issues to look at and we are not talking about your home value going up.

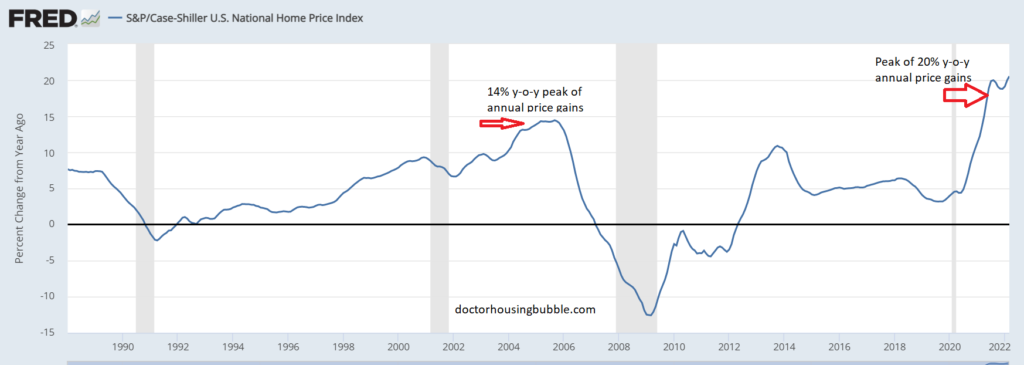

Reason #4 – Housing Values Increased Faster During the Pandemic than the Great Recession

Just take a look at this chart carefully. Remember how insane the last housing bubble turned out to be? At the peak, we were seeing nationwide 14% year-over-year annual gains. This time around we are at 20% year-over-year annual gains! And this is in the midst of a global pandemic with epic money printing. Also, the Fed has really no choice but to pop the housing bubble because inflation is a much more sinister problem but of course they cannot say that. First, take a look at the Fed funds rate here:

When the last housing bubble hit, the Fed Funds Rate (FFR) was at 5%. So it had room to navigate lower and inflation at the time was not out of control. Today the FFR is at 0.83% which is ridiculously low even with the recent tightening. What this means is that the cost to borrow to buy a home is only going to get more expensive (and since housing is a big part of the CPI, there may be some intent to smash parts of the housing growth since it is running away thanks to FOMO and easy money).

Reason #5 – Jobs and Recession

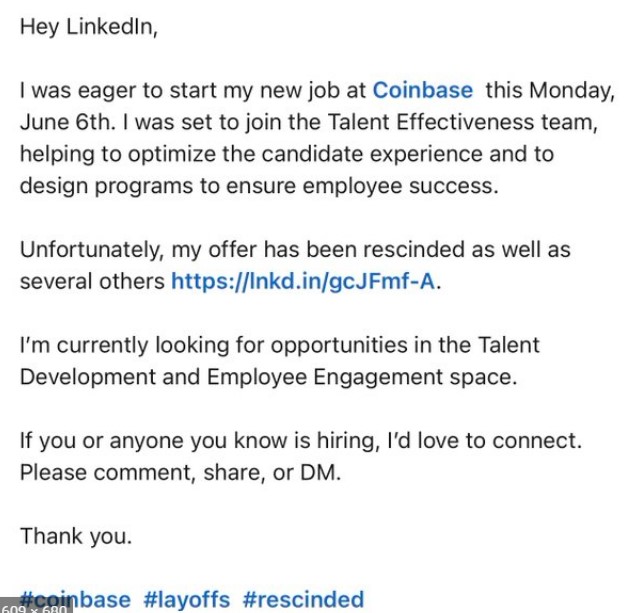

It is hard to pay your mortgage when you do not have a job. Many VCs and new companies, especially in places like crypto and tech are falling hard. Just take a look at a big player like Coinbase:

Coinbase is down a stunning 84% from its 52-week high. I’ve also seen recently, many cases like this:

These are high paying jobs in high paying areas like California. And there are more and more stories like this hitting the news every day. These were companies built on ridiculous VC valuations where sometimes people were looking at 10x, 20x, and sometimes 100x valuations! So how are those high home prices going to be supported when high income jobs contract, rates are high, and stock values get slammed because costs are so high?

Given that housing values are the last to show up in a correction since they move so slow, you will see a shift later this year and into 2023. While history does not repeat, it does rhyme.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

342 Responses to “Gear up for the 2022 and 2023 Housing Correction: 5 Charts Highlighting the Pain Ahead for the Housing Market.”

What does this mean for prospective new home buyers? Are we pretty much screwed even even if we see a 20% correction with rates moving up to 7-8%?

20% wouldn’t make much of a dent, IMO. It’d hardly roll back prices one year and not even that in some places. Where are you?

I’d be doing everything I can to scrape together as big of a downpayment as possible right now. It seems rates will continue to rise because inflation is still raging. The more cash you put in, the less the rate matters.

If prices do happen to come down in a significant way then you’ll be ready. It will be people with cash can capitalize on the “deals”. But prices could very well just sit where they are for a number of years. Who knows?

If you live in a HCOL area and ever get tired of the game, then leave! There are greener pastures where people don’t have to fret about whether or not they can ever live in a house they actually like without stressing themselves half to death.

All the best to you!

For perspective home buyers:

if you are mortgaging – your monthly payment Debt Service will NOT go down. Home prices might go down a bit to reflect reduced pool of buyers due to higher rates, but do not expect owning home to be cheaper.

If you are buying cash – you might benefit from potential lower prices. But at expense of the opportunity cost of not investing somewhere else.

It is as simple as that.

What this means is that mortgage payments are likely hover around comparable rents. Rents are going up and they are not coming down. This provides sellers with a floor on prices which will largely be controlled by rates. Two buyers buying the same house at different rates are likely to pay the same mortgage with one buyer paying more up front with a lower rate and the second buyer paying less up from at a higher rate. If you gave me the option between which buyer I would rather be, I would choose to be the second buyer that pays less upfront at a higher interest rate despite the same monthly payment. That buyer has the option to refinance down to lower rates in the future whereas the first buyer that locked in and already low rate will not have that luxury. In general, the rule of thumb is that when refi rates are one percentage point or more below your current borrow rate, then it would be worth it for the buyer to refinance. A lot of buyers, myself included, locked in a 2.6% interest rate so refinance rates would have to be 1.6 or less for me to justify refinancing. Luckily, I bought way early on during the pandemic so I was able to snag 2019 prices at 2020 rates. Price increases coupled with higher rates means that buyers that want to purchase my house today will be paying twice what I pay in monthly payments. For buyers that bought at those same low rates in late 2021, they will not be able to decrease their monthly payments since they bought at higher prices and lower interest rates. Despite all of this, those buyers are still safe because interest rates have risen two or more percentage points since then and in some markets, prices rose or at the absolute worst flattened out meaning current buyers are paying over 40% or more in mortgage payments than buyers just a few short months ago.

I have yet to see REAL price drops. A lot of people on this blog claim that they are seeing price drops which may be the case in some markets but in my market of SoCal, specifically Inland Empire, I am not seeing real price drops. What I am seeing is sellers listing their properties at projected prices based on the unprecedented price growth of 2020 – 2021 and assuming that the increasing price trend is valid today. Those sellers realize that they grossly overpriced with todays higher rates and “decreased” the price on their listing back down to a more reasonable level. The mortgage payments on these properties are still significantly more than Q4 which means the rising mortgage payments trend still continues to this day. A real price drop would be when prices drop to a level that well bring mortgage payments down to a point that is at or below the most recent all-time high that we are currently seeing. A house at $500K that was dropped from $550K is not a price drop in this market when that same house would’ve sold for $500K in December at lower rates. The payment is still significantly higher. Once that house drops to 400K at 6%+ interest and the mortgage payments drop with it, then THAT would be a true decrease.

My advice to you is to identify the area and attributes that you prefer in a house. How many square feet is your absolute minimum? What’s the oldest house that you are willing to tolerate? How big of a lot do you want? How many bedrooms and bathrooms do you need? Ask yourself as many questions as you can about what your needs are in a house. Then track what houses that meet your criteria are renting for. This establishes a reference point as to what is a reasonable amount to pay in a mortgage. Look at listings and see what similar houses are going for and what their payments will come out to at the most recent interest rates. If you find a house that is below or at the absolute most in line with comparable rent, just buy it and don’t listen to the noise. The comments section of this blog has been a cesspool of hyper pessimistic wishful thinking wannabe analysts. Just to give you an idea, a lot of these guys have been saying that the market is due to crash sense at least 2015. And each and everyone of them now would kill to be able to purchase at the same prices they claimed were overvalued. Doing your own research is the most important tool at your disposal. Keep in mind that there are more than enough buyers that are currently sitting on the sidelines and salivating at the opportunity to buy at prices that are not much lower than today’s prices. Those are the buyers that well keep the market steady-ish so do not be foolish and expect a 2008 style crash like a lot of the dimwits on this blog. The bus will come and go and you’ll still be at the bus station. Also keep in mind that wages are due to increase significantly after inflation tapers off. Wages, specifically employee wages, are usually the last thing to increase during an inflationary period and that is on the horizon. This will add more buyer competition and keep prices steady. You will not see much volatility like you did in 2008. Contrary to popular belief, most of these mortgages are serviceable and it’s only when a vast amount of mortgages become unserviceable do you see the kind of volatility did in 2008. What people fail to understand until this very day is that mortgages in 2006 had a much higher payment to income ratio because of the loose lending. Most of the buyers towards the tail end of that last boom we’re grossly unqualified to take on their mortgages which is why we saw what we saw in 2008. With today’s lending practices, this is far from the case despite higher prices today then in 2008 which is why you WILL NOT see a remotely similar result in the market moving forward.

Well said

Clearly, you have no brain.

“The comments section of this blog has been a cesspool of hyper pessimistic wishful thinking wannabe analysts.”

I’ll just remind you this blog is titled ” Dr. Housing Bubble”.

Your comments are long winded, poorly written and speculative.

Very well put. House prices follow the money supply, and the rhythm our central banks developed to transfer wealth from the poor to the rich is “more money, more money, more money, less money, repeat”. After a “more money” the chances are still high that another “more money” is next. That was the case in 2015. People underestimate the sheer printing capability of those in power.

But as of 2022, it really looks like we’re going to have a “less money” coming up, followed by lower house prices. Finally.

Well said!

I agree with what you are saying is the likely outcome with a soft landing. It is ideal.

If you are the type with freeze dried food in the basement, a pile of gold buried in the backyard, and a high paid job in the RE or mortgage industry, here is a worst case scenario:

For the pessimist:

1) The Fed screws up and we are plunged into crash landing. A recession with high unemployment with people who can no longer make mortgage payments. This happened in 2008 with massive job losses which caused home losses. It was started with loosely approved loans but as home prices fell, it affected homeowners with qualified conventional loans who had lost their jobs and mailed back the keys to their recently purchased overpaid houses. The spiral in home prices and job losses continued until 2012. 4 years.

For the optimist who is the anti-prepper and has no food in the fridge:

1) The Fed chickens out and lowers rates to 0 again. They did this in early 2019 so there is a recent precedent. If this is the case, then houses and stocks will recover and proceed to increase to the moon. If that starts failing, then there is always negative rates. Who cares about 10% inflation when you can get a -10% loan. ie you borrow money and they give you 10%. That seems like crazy talk, but Europe still has negative bank rates.

Trust the Fed! But not like you trusted them in 2008.

Excellent analysis.

good summary. When I purchased a home in LA in 2012 for $470K I was told I was ‘catching a falling knife” such moronic comments. My home is now worth $1.3M

My PIMI is now about same as a 1 bedroom apartment in downtown Santa Monica.

Now, people are talking crash, well so what the market does crash every 10-15 years, no?

@QE

Thats the power of shutting off the noise and turning on your brain. It’ll make you a lot of money. Im glad you had the confidence in yourself at that time to make that move.

As for the market crashing, people say that the market crashes once every X years but the fact is that the market is not on some timer. Markets crash when the supply vastly outweighs the demand. The bigger the gap, the steeper the prices drop. As long as demand outweighs the supply then prices will stay at or above current levels.

A couple of weeks ago, the OC Register’s columnist Lansner gave a 5 bubble rating to the current market. A local banker sent in a question about how bubbles end. He noted that bubbles can fizzle as well as burst. He felt that inflation will cause a fizzle rather than a burst. So Lansner went back into history to see when bubbles fizzled. The 1980s bubble ended in what could be called a fizzle. There was a recession, and then the OC financial crisis. That led to an 8 year dip in CA house prices while elsewhere there were modest gains.

He noted that his spreadsheet showed that the year that ended in March 2022, all states plus DC had double digit gains in percent increase of home prices for the first time in 47 years. The last time it came close to this was 1979 when 43 states showed such gains. Lansner calls this housing “sizzle”. Nationally, sizzle happened 16% of the time. California sizzle since 1975 has been a whopping 37% of the time! (That’s #1 of course.) He reckons that bursts also happen 16% of the time nationally. California has a 25% burst rate which ranks 4th. Lansner’s fizzle calculation based on slowing markets is 33% of the time nationally but only 12% of the time in California. So California is twice as likely to have a bubble burst as a fizzle.

It seems to me that fizzle is more likely in an inflationary environment such as the 70s or what we have now. But you must remember, that the numbers aren’t inflation adjusted, and if inflation is high enough, fizzle may actually be a bubble burst in constant value currency. But that does make getting out of cash and into tangible assets more attractive, and real estate fits the bill. Look for more cash offers from investors as prices drop due to increasing interest rates and market fizzle.

Agree this could be much worse than previous crashes given the extreme insanity of current prices with many middle class houses in the $2 million plus range. Unless you are making $800k per year you can’t buy these houses at 6% rates. Where is all that money going to come from?

For the first time in my 70 years, the historical relationship between interest rates and RE values may cease to be an indicator/vector to purchase or sell. I sense the die off has started, will gain pace and provide a glut of dwellings not needing buyers. Just occupants that… walk right in.

Forget about loans and rates, focus now on self preservation and the devices needed for same.

Housing will be simple.

Saving your life will be the hard part.

Prepare as best you can, especially defense.

God be with you.

I think you are correct There will be a massive die off that is accelerating. The vaxstermanation will take about 70 percent of the population

I’m unvaxxed. Don’t trust it.

But I don’t think it will kill 70% of the population. More likely, it will harm people’s immune systems, so they’ll be more likely to die of cancers and other diseases 10 or so years from now.

You people are nuts and will be the first in line to use the mRNA vaccines when they are available to treat cancer. Either that or you are going to drown from all the kool-aid that you have drank. Haha

The fact is that the mRNA delivery which trains the immune system to fight a “target” has been being worked for decades, and specifically for cancer treatment, but researchers pivoted to use it for covid once the pandemic hit.

BobC – remember you are in housing bubble blog. You know, it tends to attract a certain type of individuals.

Your sensor is too un-sophisticated for the modern world if that’s what it senses.

The End Is Nigh! Repent!

There, I said it without having to put on a ragged smock and stand on a busy street corner.

The Interwebs is awesome!

Glad you are back.

Glad we are retired.

Love the out of touch example. How many people are buying million dollar houses.?

Joel,

Enough people are currently buying million dollar homes in CA to keep the bubble rising to 1.5M dollar homes.

The real question is: Where are people buying million dollar homes getting the DP and income to support this? I suspect high down payments from stocks and bitcoin gains are still driving up prices. Gains are still up 300% from 3 years ago. Higher down payments are driving up prices and not wage growth. If the crypto and stock market deflate, then we will see a change. It has deflated somewhat, but it is still up 300%.

A few years ago, this blog predicted Millennial demand to drive up housing prices. It is happening and they have tons of cash from stock and crypto gains to purchase with high down payments.

No crash in sight while this is happening. When it ends, a crash might happen. Maybe….

I am a real estate broker specializing in foreclosure prevention in California. The current market is unsustainable and inflation is the highest it’s been since 1981. The correction is coming, and not even California will be insulated. If you own a home and have been on the fence about selling it, I’d highly advise doing it now. Your homes value will not be what it is today, a year or two from now. If you have no equity, short sale the property; it is a liability and not an asset.

Or you could just keep your home and live in it??? What the heckin

Howard, how will Clifford make a commission if you just stay in your home and live in it? You monster!

HODL your primary home.

Build up some cash/gold reserves to ensure that you don’t lose it. The banks will happily kick you out into a van down by the river and wait for the next bubble.

As people found out in 2008, renting for 7 years after foreclosing, was financial suicide.

Seriously, if you are underwater after 30% price increases over the last year, you are to blame.

Great Article!! @ JMart no, not everyone, just CYA best you can. All of us should keep in mind that a BIG reason so many went Belly Up from Great Recession was as soon as people needed to tap their capital (Mom & Pop RE Folks + Small Businesses) Banks went into CYA mode. They yanked Capital and many of us needed it, even with solid enuf renters and good paying jobs. But Many over-leveraged (admit I was). So you can do fine, just create a financial plan. It’s why I (stupidly) keep too much cash liquid but always zero debt, luxury cars & big ticket items still = Cash or can pay off in 6 months or don’t buy! Traumatized by 2011 (I held on until then) so after 5 yrs recovery, spent 5 yrs building F U fund, i.e. not beholden to anyone and a year + reserves if things do go south. I didnt get my $1.5 M McMansion we can easily afford, but retiring at 52 and will live between 2 TH (current rentals) 1 small primary + 1 vaca pad vs 1 big Bad House Dream Home (and vaca pad)…lol! Better then a sharp stick in the eye.

@ Joe R–great breakdown and I agree with much of what you said! Thankfully many of my friends have listened to my CYA and are currently getting their Finance houses in order. So all should Be as bullet proof as possible.

I’m glad I was raised Insure everything and that has always included Disabilty & General Unemployment. In last 20 years having Policies has Saved My Arse (Breast Cancer and out of work a total of 1.5 yrs over 5 yrs) Funerals for both our Parents to cover and being the higher earner between Hubs and I, I was SO Lucky to have paid (post taxes) for un-taxed policies that pay decent $$ to help cover us!

Headline: Crypto crash: Bitcoin falls to 18-month low, ether, other cryptocurrency prices today also plunge

https://www.livemint.com/market/cryptocurrency/cryptocurrency-prices-today-bitcoin-falls-to-one-month-low-ether-dogecoin-other-cryptos-also-plunge-11655088181957.html

Bitcoin price continued its selloff as part of broader declines in cryptocurrencies after a sharp rise in US inflation triggered risk-off sentiment. The world’s largest digital token tumbled as much as 7% to $25,366, at 18-month low. The most popular crypto is down more than 43% so far this year (YTD), and is trading far below its record high of $69,000 it had hit in November last year.

On the other hand, Ether, the coin linked to the ethereum blockchain and the second largest cryptocurrency, fell nearly 8% at its 15-month low to $1,340. Meanwhile, dogecoin price today was also trading almost flat at $0.07 whereas Shiba Inu also up 0.2% to $0.000011. The global cryptocurrency market cap today is $1.08 trillion, down more than 8% in the last 24 hours.

Other crypto prices’ today performance also tumbled as Stellar, Uniswap, XRP, Tron, Tether, Solana, Polkadot, Avalanche, Polygon, Chainlink, Terra Luna Classic, Cardano, Litecoin prices were trading with cuts of as much as 15% over the last 24 hours. …

============

M is right about one thing. I did miss the crypto boat. But I can’t say I’m unhappy about it.

Holy cow, it’s down to 23K now.

Everything is eroding, and somewhat quickly, except real estate.

Hang on!

I feel sorry for all the people who were talked into buying at 60K. Even converting some of their retirement savings to crypto! Just imagine their stress levels right now.

Why feel sry about BTC investors?! As long as they hold and not sell at a loss they will make money. People said “I feel sorry for bitcoinets who

Bought at 1k”. Remember those days? Yeah, years later the peak was 20k. The last peak was 60k. In a few years people say: you were just lucky that you could buy bitcoin at 60k!! Would anyone really be surprised if bitcoin hits 120k during the next bull cycle? Of course not!

M is a true believer.

My Millennial son was also when he bought at bitcoin at 1K and sold at 30K. I told him to get out at 8K and not be greedy, but since he ignored me, he now has enough for a down payment on a house.

Millennials are the luckiest generation ever!

I still don’t understand why bitcoin had risen so far and fast.

Its volatility makes it the worst currency ever.

Maybe I’m just old but I was never lured into a cult back in the day.

You can’t argue with results. I did hear that same phrase from pets.com stockholders back in 2000. They didn’t get out in time.

“Investing” in a currency. Backed by literally nothing. Absolute gambling.

““Investing” in a currency. Backed by literally nothing. Absolute gambling”

That is too simplistic, turtle. With that mentality your wealth grows as fast as a turtle can walk.

Gambling is when you go to Vegas and put your money on red or black. Investing in bitcoin and holding long term is genius. Imagine how I am smiling having bought bitcoin many years ago. I want it to go down more to buy more.

How high is your confidence level that we will see bitcoin at 100k in the next few years? I think the probability is at 98%. With that in mind, anything below 20k is cheap.

I don’t say this lightly….I should say….it’s all over!!! Going to zero!!!! Sell now!!! Because without massive capitulation I can’t get more bitcoin at a incredible discount.

>>> That is too simplistic, turtle. With that mentality your wealth grows as fast as a turtle can walk.

And yet this millennial became a millionaire around the same time as you without speculating in cryptocurrency or buying a bubbled up house with money from family. My name is Turtle because staying the course long-term is the way to go. We agree on that much, just not on what/when. But still, you’re more like a rabbit, running around here and there, doing things that risk finishing first at the line. I think that rabbit was feeling pretty good about himself at one point?

>>> Gambling is when you go to Vegas and put your money on red or black. Investing in bitcoin and holding long term is genius.

Long-term is the way to go for traditional income-generating investments where there is an overall history of ups exceeding downs through decades and that are backed by something tangible. It’s boring but works. Crypto is none of that. If any crypto wins out (as in actually becomes functional for purchases mainstream), it’ll be a government-backed digital dollar pinned to fiat currency. Hence, no opportunity for speculation. Do you really think Uncle Sam will let an unregulated currency overshadow its own?

>>> I want it to go down more to buy more.

You’re a walking contradiction. Every situation is always great? That’s not reality. You’re either comforting yourself or you’re actually delusional. You’re on record making polarized statements like, “housing crash imminent” and “no crash ever”, “low interest rates rock” and “high interest rates are great”, “crypto to the moon” and “yay, low crypto”, “cash is for losers” and “cash is king”. Sometimes your dichotomies complete themselves within days.

>>> How high is your confidence level that we will see bitcoin at 100k in the next few years? I think the probability is at 98%.

The thing is, you’ve been saying “end of the year” things like this for a couple years now and here it is barely out of the teens, down from $65K when crypto FOMO apparently reached critical mass around January. I’m not sure there are many people left to fool into this tulip scheme so good luck with the hype going forward.

—

I had never thought you were a troll. But now I see that you are a troll, just not intentionally. And a very good one too because here I am wasting more time.

I think I figured out Turtle’s problem. It’s the same problem many perma bears have.

They don’t understand how a savvy investor can be cheering for their favorite asset to GO DOWN in price. For them it’s a contradiction.

Not for Warren B. Warren is happy for his fav stocks to go down. He loads up on them.

I am happy for stocks and crypto to go down (short/midterm). Even though i am bullish on stocks and crypto long term. You don’t get rich by buying the top. These super bearish/crash times are exciting for me because I understand:

Bull markets make you money. Bear markets make you rich.

If someone here doesn’t get that, than that person is likely a renter or non-successful investor.

I have lots of buy orders set for BTC at much lowers prices! Go crash Bitcoin! I want that capitulation candle!

Don’t forget to do the dip! Oops, I mean buy the dip!

You got it wrong pops, again. Told you many times, during a bear market you wait for a confirmed bottom and load up during accumulation phase. Wait for my signal. Buying dips during bear markets is like catching a falling knife. When will you listen and learn? 🙂

M’s Daddy is obviously a Boomer.

They missed out on this spectacular 1000% rise in stocks and bitcoin which paid for Millennial down payments on overpriced houses.

Just like Boomers benefited in the run up of equities in 2006 to purchase their overpriced homes.

We’ve seen this all before Historically, it hasn’t ended well for many buying at the peak.

Except for primary home HODLers.

People who HODL’d their primary home with enough cash to pay the payments have done well. Boomers are now retiring with their HODL’d homes with ultra-low payments. Renting is financial suicide. I hope the Millennials HODL just as well as the Boomers.

And Bob is spot on, again!

You missed the boat when it was $5000 a coin in March of 2020. That boat is still sitting pretty even at todays “crash”. That’s the flaw with looking at historical prices of things as the ultimate proving point. You only have to go back in time just far enough to make your point. Go back farther and you’re point completely “crashes.” If we’re gonna look at history to make a point then we should be able to pull any sliver in time to further validate/invalidate points being made.

This kinda ties into why I believe Real estate prices are not going to crash and are more likely to go off. If we look at prices through a narrow lens and only consider the last couple of years and it’s easy to believe that real estate is inflated. But if we took that lens and widened it up to as far back as the Middle Ages, then RE is a complete bargain right now. It’s not out of the realm of possibilities for history to repeat itself where a very small percentage of the population owns the property and the rest rent it out never to have the ability to own property themselves with unimaginable asking prices. To a medieval serf, saving up to afford a property and pigs flying are one in the same.

It’s a New Age people.

I agree with your point.

Real Estate for a primary home should be a place to live and not an investment. You should plan on living in any primary home for 10-15 years and have enough cash in savings to ensure you do not lose it back to the bank in foreclosure.

Real Estate as an investment is is also long term. It can be short term during certain periods but not reliably. Every person I know who has a rental and could stick through hard times and negative returns, eventually came out ahead. It takes effort. Manual, financial, and mental effort but they all eventually had a good return through both good and bad times. It is much easier to put your money in a long term CD and forget about it. The Fed destroyed the CD option by suppressing savings rates, so people went where the money is. Unfortunately, due to the current 14 year ramp up in RE prices, many do not realize it is long term.

I am seeing some signs of desperation in AirBnB landlords. Not enough bookings to make the mortgage and expenses. High cleaning, maintenance, fees, taxes, mortgage expenses exceeding their income. Given enough time, maybe 10 years, this will fix itself with inflation. Hang in there and lose money, but long term, it will be a good ROI. Just have enough money to hang on.

AirBnB holders might be the weak link in holding the market. If recession hits, their costs will remain the same, but their operational in-flows to support their costs might decrease significantly. Effectively, this is same as cost increase which is where liquidity issue might start.

Surge: “AirBnB holders might be the weak link in holding the market.”

AirBnB owners in Santa Monica will soon have to absorb an increase in the hotel occupancy tax.

Headline: Santa Monica City Council Approves Ballot Measure That Would Increase Hotel Bed Tax

In a vote on June 28, the Santa Monica City Council approved placing a measure on the November ballot to raise the city’s hotel bed tax to fund measures to address homelessness.

Currently, the city’s bed tax or transient occupancy tax, a tax levied on motel, hotel, and home share rentals is 14% of the total amount paid for each rental. …

…the measure “would increase the City’s Transient Occupancy Tax (TOT) rate by 1 percentage point for hotels and by 3 percentage points for home-shares …

Sorry, forgot to post the link to the above story: https://smmirror.com/2022/07/santa-monica-city-council-approves-ballot-measure-that-would-increase-hotel-bed-tax/

Tax increases are still minor and will be passed to customers.

The trouble come if number of customers will reduce/evaporate during recession (depending on how hard it is).

Well, apparently no crash in RE according to this RE agent…it takes a certain level of stupidity in SoCal to sustain this level of craziness. I believe him that people are still paying top dollar for houses out here as if all of a sudden as collective we decided there will be no more houses ever build in LA/OC and you better get in now…Herd stupidity at its finest

https://www.youtube.com/watch?v=veNftzQk1Kc

“Herd stupidity at its finest”

Not really a herd is it? Barely anything for sale and only people with excellent finances get to buy. The majority of people rents and dreams of an epic RE crash.

I think the herd is watching live what “survival of the fittest” means.

Herd mentality….. reminds me of 2005 “buy now or be priced out forever” and everyone who could fog a mirror got a loan for a house. Todays market is the opposite. I bought two houses in the last 2 years. I know. Only qualified buyers get a house.

Turns out despite all his bragging and bloviating, M did buy at the peak and will soon be house poor and probably lose his rental property

Lol. Couldn’t happen to a nicer guy.

M is just a troll. Don’t believe anything that he says here. I usually skip his comments in here.

I am not a troll. I have been pretty transparent in sharing my success story. Dont confuse success with trolling

M, honestly, you are not a success story. Success story would be owning 10 properties by your age not 2. You got to the game too late to be a success story and the only reason you got to the game is because of inheritance (external stimuli).

I couldn’t disagree more surge. Yea, time is a big factor but you can’t make blanket statements like “in your 30’s you should already have ten properties”. I am super happy and proud that I turned from perma bear to a longterm bull! It’s exiting to have my first rental already. And so far my renters are paying timely. Let’s see if they treat my property well.

Let’s give it some time and see how things go and and then buy my second rental. Life doesn’t happen in a straight line. You have to find contentment and learn from your mistakes. You also have to admit to yourself when you were wrong. It’s not easy to get out of your perma bear shell and see the light. This blog helped me a lot to make that transition. I knew many were right when they repeatedly said: “buy a house when you comfortably afford it. Don’t try to time the market. Renting long term is financial suicide.” BUT I chose to stick to my perma bear strategy for a looong time. Hopefully my story helps other to buy RE sooner and prevents them from trying to time the market.

Remember when I bought my first house during Covid (Q1 2020 and everyone told me I will lose my shirt). “Millennial bought, the peak is in”. Lol

Two years later I bought my second property and again, people telling me the crash is here/coming.

I would be kicking myself if I hadn’t bought in 2020!!!! I can’t imagine renting an apartment ever again! My life improved so much….gotta be thankful! And enjoy every moment of your life!

Remember when I bought my first house during Covid (Q1 2020 and everyone told me I will lose my shirt). “Millennial bought, the peak is in”.

Not everyone. From the start, I doubted that you bought a house.

And I continue to doubt much of your life story.

M,

When you bought your home in Qx in 2020, nobody called a peak because of you. It was pure irony. The range of opinions on this blog is wide.

Right SOL, most called the peak when I bought in Q1 2020. And I don’t blame you for doubting stuff you read on the internet.

You also don’t trust vaccines and you still use your landline., right? Nothing says boomer than a guy who still uses landlines in 2022. So I would expect you are not big into new stuff/tech like Bitcoin and other cryptos either? Deep down you wish you would own a Bitcoin but prob don’t know how to buy/transact and store it?

“When you bought your home in Qx in 2020, nobody called a peak ”

99% called the top during Covid in Q1 2020 on this blog. It shows how the masses are usually wrong.

Countless times in the last ten years Bitcoin has been deemed “dead”.

Do the opposite of what people say and invest responsible. Don’t invest more in speculative assets than you can afford to lose.

Stick to this simple strategy and you will do better than most investors who trade based on emotions.

M “Deep down you wish you would own a Bitcoin but prob don’t know how to buy/transact and store it?”

Buying Bitcoin is easy. Since before the crash, PayPal has been spamming me, telling me that I can now easily buy Bitcoin through PayPal.

If you can use PayPal (and I do) you can buy and store Bitcoin. But I choose not to.

=========

Landlines are a great backup for cell phones. Safer to have both than only one.

=========

I’ve been vaxxed, just not against Covid. I don’t trust any of the Covid vaccines. Even so, I feel fine.

A friend of mine was forced to get vaxxed — two shots of Moderna — to keep his city job. He got real sick after the second dose. He’s okay now, but who knows what the longterm damage will be?

“A friend of mine”

Ya sure. Anecdotal. I take what landline-users and anti-vaxxers say with a grain of salt.

Its 2023 in a few month. Nothing says outdated boomer like “I still have my landline”.

Kids nowadays don’t even know how a landline looks like or works since it’s obsolete. Let me guess, you still pay for cable too? And you still don’t own a single bitcoin?

you own a smart phone?

Ya sure. Anecdotal.

This, coming from the king of anecdotes. All your many claims, your whole life story, are but a collection of wild, unsubstantiated anecdotes.

Let me guess, you still pay for cable too?

Wrong.

My HOA pays for cable and internet, which is rolled into my monthly HOA fees. I have no say in the matter. I can’t cancel my cable, though I want to.

I never watch cable TV. I prefer my DVD collection and (free) MP4 movie downloads from YouTube. I have over 2,400 feature films on my hard drives, downloaded over the years. Not including short films and TV shows.

And you still don’t own a single bitcoin?

True.

But I can easily learn how, should I want to. I built my first website in 2000, and a dozen or so since then. People have been using computers since before you were born.

Yes, I know you claim to have made a million or so with crypto. But I doubt your anecdotal claims.

you own a smart phone?

I own an iPhone 13 Pro.

So what? What does that prove? Do I get a medal?

“Let me guess, you still pay for cable too?

Wrong. My HOA pays for cable and internet, which is rolled into my monthly HOA fees”

I knew you would still pay for cable!

Sry, I simply don’t trust people’s judgement if they tell me they aren’t able to progress by holding on to their landline and cable …..in 2022.

I also think you still have a flip phone. And not owning a Bitcoin is probably a big mistake. You want to be invested in profitable asset classes. Bitcoin was just a few hundred bucks a few years ago.

Buy and hold stocks, crypto and RE. Instead of buy and hold landlines, cables and flip phones.

Thank me later!

M: I also think you still have a flip phone.

And I think you lost your shirt on Bitcoin, and never bought a house.

Of course. All boomers that are jealous say that. And I own two houses, not just one 🙂

M too busy licking his Bitcoin losses. What a fool

As I recall, the one consistent thing about the guy now known as M and formerly known as Millennial is that he’s been all in for Bitcoin. Which means most of his coin was probably bought before it started fetching 5 figures.

Yep, my goal is more bitcoins and hold long term. This is my third bubble in crypto/crash. Every crash allows me to add more bitcoin and every bull market allows me to add more bitcoin because I trade my ALTs back to BTC. I am an extreme bitcoin bull LONGTERM. It doesn’t matter to me if I traded ADA for BTC and BTC loses value (for 1-2 years). I am 98% confident BTC will trade over 100k. I was wrong in predicting BTC to be at 100k this years. It’s gonna take a few more years. But if my strategy works out that just means I will have more bitcoin by the time it hits 100k versus if 100k would have happened in 2022.

Like warren B, I love when my favorite asset loses value so I can add even more. And the truth is, even the hardest crash in BTC still means I am in profit since I have been buying BTC since many, many years now. Never sold BTC. During accumulation phases I buy heavy into ALTs. And when they skyrocket I trade the Alt to BTC pair to scale out of ALTs and int BTC.

I bought in Q1 2020 and people told me I bought the peak. Now I have like close to half a million of equity gains off the purchase price. You think my house will lose that much in value anytime soon? And even if…..so what…..my mortgage is much less than what the rent would be for this house. And if Preises truly fall, great, I’ll buy a second rental.

It’s easy to be a genius when you’re using other peoples money. Obviously your inheritance was large enough to let you weather the coming storm, but that says nothing about your investing prowess. You just got extremely lucky by inheriting money. That doesn’t make you smart. It just shows you’re lucky as hell. I’d like to hear what you’d be saying without that pile of free money you were given.

“to let you weather the coming storm”

So in 2020 I was told the peak is in and we will see a huge crash. Opposite happened.

Now there is an upcoming storm? This year? Next year? Or is there always something brewing? Until the rest of our days?

My one relative really likes me and doesn’t have kids. She’s very old. Oh boy, do I inherit more money in a few years? Sounds like my RE buying spree won’t anytime soon?!

Or should I stop buying until the storm is over? Naaaah, that’s for perma bears. I buy when I can comfortably afford it…..it worked out so far!!

Lol. Couldn’t happen to a nicer guy.

Blast from the past …

M (April 14, 2022): Sheila pls don’t sound so entitled. Owning a house is not a right. … In the US you can easily buy a house if you are willing to relocate. It’s already to busy here in California (close to the coast). If you can’t afford to buy a house here move away.

Source: https://www.doctorhousingbubble.com/real-homes-of-genius-paramount-with-a-median-household-income-of-55000-but-selling-a-home-for-800000/

Sol,

“ If you can’t afford to buy a house here move away.”

That’s true but keep in mind landlords like me don’t mind life long renters! Renters exist to make landlords rich. It’s called survival of the fittest!

Debunking each of the 5 points:

1. Higher Rates: Rates are currently sitting at 5% which is still relatively low compared to historical standards. Rates peaked at almost 7% prior to the crash of 2008. Of course rates are heading higher which means you might see slight price decreases depending on how sharp and how how high rates rise But this most recent 2% or so rate increase has just simply made the market less competitive and flatline and prices. We went from bidding wars and price increases to bidding skirmishes and list price sales. Whoopti doo. It will take another 2% increase before you see any noteworthy downward price movement.

2. Households Maxing Out Credit Cards: This is a misleading point because it takes A very broad and general trend and tries to make a connection to a much narrower demographic aka potential homebuyers. If my credit card balance is $1000 in my neighbors credit card balance is $49000 does that mean that we are both out of luck because our average balance is $25,000? No it just means he is hyper screwed and I’m still financially healthy enough to purchase a home. This is the same reason why despite all time high joblessness during the onset of the pandemic did not have even the slightest effect on home sales in the months that followed. Despite an unprecedented amount of unemployment, there were still more than enough individuals that remained employed to fuel the demand. Despite an unprecedented amount of credit card debt, there are still more than enough potential buyers that are have the min necessary debt/income ratio to qualify.

3. Cash Out Refi imploding: Yes Doc, when interest rates go up borrowing goes down. Excellent observation. If anything less cash out refi‘s means less people are exposing themselves to the risk of owing more than what their properties are worth and therefore much less likely to default. If refis are imploding then so does future foreclosures numbers. And if foreclosures aren’t exploding then prices are not imploding.

4. Housing values increased faster than ever: Yes because interest rates decreased faster than ever. When you go from 5% to 2.5% then a $500K house becomes $650K with no change in mortgage. If rates went to 0% overnight I’m certain you’ll see an even sharper price growth than this recent one. It’s simple math yet you try to present it as if there’s an unexplainable arbitrary driving force.

5. Jobs and Recession: Supply is so low that the amount of potential buyers That are left employed will still dwarf the current inventory. Coin base employees aren’t the barometer for how qualified buyers are. Even tech employees as a whole. You’re doing the exact opposite of what you did in point number two. You’re taking something extremely narrow and trying to apply it to a very broad concept. You’re taking oranges and trying to make Apple juice.

Supply is very low and demand is very high. Supply is unlikely to dramatically increase enough to a point that has downward pressure on prices and demand is even more unlikely to drop to a point that sellers are forced to reduce their asking prices. And rates are not likely to increase high enough, fast enough to reduce buyer demand below the supply threshold. And rental rates are very likely to continue increasing which makes buying more attractive and therefore increasing demand. The factors that contribute to an increasing supply or not likely and the factors that contribute to decreasing buyer demand are not sufficient and the factors that contribute to increasing buying demand are very likely. Sounds like no crash in sight to me.

One thing we might not realize as fortunate Americans with a stable currency is that home prices can absolutely exponentially reach unfathomable heights if the dollar hyperinflates. My wife is from a country that experienced not only hyperinflation, but a severely imploded economy and a full scale Civil War. Her family‘s house is valued at 5 million of their local currency prior to all this and is now valued at 200 million their local currency. No change in real value dollar wise but it was their most valuable hedge because I know for damn sure wages did not increase 40x in that same time period. A true value indicator is pricing real estate in ounces of gold. It takes 291 ounces of gold to buy a house at todays prices. In 2009 it took 290 ounces, at the bottom of the crash in 2011 it took 140 ounces, in mid-2018 it took 305 ounces of gold, in mid 2020 it took 200 ounces of gold. In 2005 it took 750 ounces of gold which is unbelievable. Going back 130+ years, the average home prices is 500 ounces of gold. Do with this fact what you will.

Monday, June 13th, 30 year fixed is 6.13%, S&P500 down close to 4%.

And the 30 year treasury is 3.42% (on 13th… 3.45% today) with May inflation at 8.6%.

So a 30yr mortgage is almost twice a thirty year treasury note, and both are well below inflation. US inflation is similar to Germany, but more than 3 times higher than Switzerland, Japan or China which have had limited stimulus from the central banks. So it seem that central bank activity is more important than oil price hikes for inflation. (Not what our head of state says, but who trusts him to tell the truth?)

It’s pretty crazy to see mortgage rates double in just half a year. Inflation is nowhere near under control so apparently the Fed is just getting started.

Many who missed the crypto boat told me “you were so lucky buying at these low prices”

I call BS on “luck”. Here is why: people who say this won’t buy when it goes down. Ever! It’s the same with stock/re perma bears. They never end up buying and always hope for a bigger crash. Lol

I have heavy buy orders in to accumulate more Bitcoin. You scale in when everyone believes bitcoin is dead and will go to zero. We are not there yet. Maybe month away. We need all non-bitcoiners cheer and the majority of retail to capitulate. That’s the buying opportunity of a lifetime.

Just like good ol’ warren b, I cheer for lower prices on my favorite assets. Greed works at the top of the bubble and at the bottom the same way if you know what I mean.

My motto has been: bull markets make you money, bear markets is when the real money is made. That’s how I generated life changing wealth in crypto. Let the anti-crypto crash boys have their year of cheering. It’s all over! Going to zeeero! Bitcoin is dead! Fools! It’s snake oil! Buying digits – what could wrong?

All these comments are music to my ear. Time to get the popcorn out and wait for capitulation and then load up the new jeep with bitcoins!

M,

BTC has gotta experience more downside due to Celsius and Terra Luna. But I would think anything under 20k is a great buy long term. How about GME and AMC? They have actually been trading very strong into a tough head wind of the overall market. It just feels like a squeeze coming any day.

The FED knows housing can stand on its head and stay relatively stable even with 5-8% rates. It will certainly be slower deal flow, a real estate agent nightmare is this current market, deal volume is very low, less listings to compete for in already brutal profession for the average agent trying to get deals. Up or down 10% next 12 months depending on the property and area. No big shock to prices in 2022 or 2023, just a steady enough market that is certainly slowing but has gas left in the tank.

This is about the worst time in the world to be a long time renter. Even if rates are 5%-8%. If you can afford a down payment and come anywhere close to your rental payment matching your mortgage payment then immediately become a homeowner.

“But I would think anything under 20k is a great buy long term”

Yes, thinking we could even go back down to 10k during these bearish times. Those great opportunities don’t come often in life. I got buy orders in between 10k-20k. the next 6 month will prob be down/sideways until the next bull run starts. Lots of time to accumulate.

Can someone explain to me how RE prices will crash if no one is selling or building? And what if, despite a recession, there will still remain enough qualified and willing buyers to fuel demand? I thought that record high unemployment would mean that the buyer pool would dry up, that seems to make sense right? Well if that’s the case, what happened to the RE market after we experienced unprecedented unemployment at the start of the pandemic? The biggest RE bull run in recorded history??? That doesn’t make any sense though! What if instead of buying a home, I build it myself? Oh darn it, construction costs are too high, something to do with a 40 year high inflation and it ain’t looking like it’s coming down anytime soon. Shucks.

So if there is too little of something that too many people want and the people that have it wont lose it and the people that don’t have it can’t produce it, how on earth will prices crash again? Oh that’s right interest rates going up makes monthly payments go up which dries up demand, that actually makes sense! But wait one second, if the price to use it but not own it is also going up wouldn’t that offset demand loss due to interest rate increases? Also don’t wages usually rise at a much sharper pace following high inflation? Doesn’t that further offset mortgage rate increases since buyers will have more money? I’m sooo confused! I just don’t get it! I really hope the market crashes! Come on guys, let’s hold hands and make a circle and put a hex on the market! I’m certain this will work because nothing else seems to be working!

I’m not so skilled at math so please let me know how many BTC can be bought when the price is zero. I also want to know if you’ve already chosen a design to cover up your BTC tattoo. TIA

Exactly the comments I am looking for me. We need that sentiment. The Bottom is near!

M got a crypto tat?

No tat’s but digital wallets. (Trezor, ledger nano s)

“I have heavy buy orders in to accumulate more Bitcoin. You scale in when everyone believes bitcoin is dead and will go to zero. ”

You remind me of a younger me.

I invested in Lucent in 2001 when it had dropped from nearly $100/share down to $12/share.

Lucent! This is the great Bell Labs that invent the transistor among many other things!

Why are they so cheap with all of those government R&D contracts?

I was a believer!

It dropped to $3/share and I learned my lesson.

Since obviously I don’t understand BTC for use as a highly volatile currency, my opinion is biased by both ignorance and being burned in my faith.

Ha! Memories. My then coworker’s wife was sitting on 3k Lucent shares she acquired via employee performance bonuses. He, the coworker, wanted her to liquidate all so they could afford a larger house. He was upset for the longest time. I, too, suffered some financial pain in the tech wreck but not that much.

A challenge with real estate is the binary nature of the exposure. You either own or rent, own or sell, rent or buy (ignoring owners of multiple properties).

My blog from ~3 years ago offers a third solution – hedge a portion of your exposure. That can be in CME Case Shiller futures, HPHF OTC agreements, shared appreciation strategies, etc.

Further, (on the first two) one can “dollar cost average” with exposure to home prices in a similar way that you can stocks in your 401k.

https://www.homepricefutures.com/posts/reduce-the-stress-of-100-rent-vs-100-buy-decision-with-bite-sized-pieces

Wash, rinse, repeat— same as ‘01 and ‘08. Housing will correct 10-15% in desirable areas, and up to 50% in less-desirable ones. The floor though will be higher this time because of lack of supply.

This is only the beginning. On the political side, all the media is predicting that the GOP will take back both houses of congress. This won’t be bad for the Democrats. They will have someone to blame, other than themselves, for this current disaster. Let the gaslighting begin. Both parties are responsible.

MMT, Modern Monetary Theory basically states that individual countries, that control their own fiat currency, have no risk of default. This current crisis is just an extension of 2008 when QE by the Fed bailed out the banks by buying all the horrible debt they held. This occurred in other western countries and Japan. Essentially, this just kicked the can down the road. Printing trillions more is NOT going to fix the problem this time!

Raising rates is only going to cause a huge slow down in the economy, making things exponentially worse. The FED will then be forced to lower rates. The effect of this is speculative. Stand by for much pain.

The observation that Americans are carrying large amounts of debt and playing the credit card pyramid scheme is unfortunately very accurate. Anecdotally speaking, how is it that I see thousands of new expensive cars and large trucks on the road and in the parking lots when gasoline costs are exploding? The vast majority of these vehicles are financed! This is only the beginning. Someone, mostly millennials, are in for a very rude wake up call.

I can’t believe we have people looking to put huge down payments into real estate to purchase a house that’s price is grossly inflated… AT THIS TIME!

Let the games begin!

That’s right. Most people forget that run away inflation is 10X worst than a stock market crash or housing crash. With stocks/housing the FED can print and QE… Inflation is motherf**rrr. Even-though the US$ is the world’s reserve currency, if Inflation is run-away the currency is destroyed.

The US dollar is failing to the upside. This is super dangerous. Foreign countries holding US dollar denominated debt have to repay that in local devalued currency. Today we are seeing smaller countries defaulting on their debt and facing actual total economic collapse. As I write, Sri Lanka, a country of 23 million, has completely collapsed and fallen into total chaos. There are other countries, including some in South America, that are on an economic precipice and will follow. It’s just a matter of time. Southern California real estate pricing is an ancillary issue when a general collapse occurs. In 2008 the incredible trillions in bad RE loans were never resolved, but bought up and put on the Fed’s balance sheet. This done with newly printed money. (QE) In this way the M2 money supply was not greatly effected, keeping things stable for awhile.

Today, car loans are in default to the tune of 2.8 million loans in the first six month of 2022. This is ‘huge’ and a leading indicator to anyone who has half a brain. Credit card debt is a true Ponzi scheme to the tune of 1.4 trillion dollars. Inflation is screaming. So what does the FED do? Raise rates 75 basis points, and threaten more tightening. This appears to me to be a policy error with grave consequences. We’ll see.

Recently the millennial oligarch, Zuckerberg, announced that his company is going to lay off employees! Others Silicon Valley behemoths are sending out similar signals. It’s just a matter of time. Wall Street earnings season declarations are right around the corner. Prepare yourself for some big numbers to the downside. Since January the stock market has dropped about 25%. Even Bezos of Amazon lost billions of his personal fortune.

Yes, these insane BS inflated real estate prices are going to take a hit. RE is usually the last to drop, but it will happen. Don’t get caught holding he bag. There’s a ‘huge’ economic storm heading our way. it will be followed by a renaissance. This will take time.

Meantime, let’s hope the Federal Reserve and politicians don’t screw up things even worse than they already have. Every bit of this is man made and self induced.

My Dad took a train from Paris to Warsaw in the early 1920s, and in German rail stations there were people begging for food coupons issued by the railroad. German Marks were basically worthless. You think Germany is a backward country like Zimbabwe? And it can’t happen here?

BTW, the two best things to own in 1920s Germany were gold and real estate.

In Venezuela, where their currency is toilet paper, people are paying for food, products and services with flakes of gold. Some stores are listing their products ad services labels in gold increments.

I remember all the debunks in the early 90s and again in the mid-2000s. This thing is going to crash hard. I’m thinking 30% or more in LA/OC. and 40% in the IE.

But that would only take prices back to last Tuesday. 😛

Stats and fundamentals are cited by everyone from seasoned economists to basement millennial trolls. But everyone forgets the one aspect that has the greatest affect. How people react to fundamentals and stats. Human emotion cannot be predicted or measured. FOMO is quickly transitioning to FOLE, fear of losing everything.

So a $1M IE homes is gonna cost $2900/month and refinancable down to $2100 a month according to your seemingly arbitrary and unsubstantiated 40% drop guessing game. Do you have to smoke drugs for that to make sense to you or are you naturally gifted?

Well well well, looky here – The Los Angeles Times. “‘The market is not the same as it was a month ago even,’ said Lindsay Katz, a Los Angeles agent at Redfin. On Covello Street in Van Nuys, the owner of a four-bedroom house recently cut the price by $50,000 to $949,900 after the 1950s tract home sat on the market for three weeks. Other homes in the area are listing even bigger price reductions: a $78,000 cut for a two-bedroom home, and a house with an accessory dwelling unit first listed at $1 million now for sale at $860,000 — a $140,000 price cut.”

“The share of homes listed for sale that took recent price cuts has more than doubled since last year. During the four weeks that ended June 5, 16.2% of listings in L.A. County had at least one price cut, up from 7.5% during the same period last year, Redfin data show. In Orange, Riverside and San Bernardino counties the share of price drops rose to more than 20% of listings, up from about 7% a year earlier. Nationwide, there haven’t been this many price cuts since 2019.”

“Carl Izbicki, a real estate agent at RE/MAX Estate Properties in Los Angeles, said homes that used to get about 15 to 25 offers now get three to five. When the market was on fire, one of Izbicki’s clients, a couple, lost out on about eight homes despite bidding well above the asking price. Last week, Izbicki sent them a list of properties that have been on the market for more than 30 days. ‘If they like one of these homes, we are going to offer less,’ he said.”

Well, you’ll always have ur magic coins 🙂

Got popcorn 🙂

Realist, I like that you predict the end of times and back it up with data.

Let’s look at the data:

https://www.zillow.com/homes/17141-Covello-St-Van-Nuys,-CA-91406_rb/19953469_zpid/

5/3/2019 – Sold 615K

3/1/2022 – Sold 865K +40% over 3 years.

6/15/2022 – Pending 950K +10% over 3 months. True, they had to drop the price from 1M

Yawn! Wake me up when the crazy price increases are over.

Also, wake M and I up when bitcoin drops below the 7K it was 2.5 years ago. +300% increase today.

There is still too much demand and cash sloshing around currently to cause a crash. We’ll see what happens after a year of inflation eats up all of that extra money.

“ Also, wake M and I up when bitcoin drops below the 7K it was 2.5 years ago. +300% increase today.”

That’s right. The strongest support line is around 10k but many will front run it. In other words we might see a bottom somewhere between 10-20k. As of now too many people are cheering for lower prices to buy bitcoin at a discount. That doesn’t sound like despair/capitulation too me. We still need this bear market to last a while and change sentiment. Once people talk about “bitcoin is dead”, “bitcoin will go to zero”, etc. that’s when I get more bullish. For the next 3-6Month we are in crash times. Stack cash, wait and enjoy this summer. We are getting ready for our Tahoe vacation!

Looking at Bitcoins previous boom and bust, it topped of at $20K and bottomed at the tail end of 2018 at around $3K. Applying the same principle to this boom and bust would put BTCs floor to $11K. Whats funny is people say “it’ll go to zero” but wont say how they think it’ll go zero. When the internet stops existing? I think we’ll have bigger problems if that ever happens.

That’s weird. I just clicked on the Zillow link above for the Covello home.

The house was sold for $1M after the sale was pending at $950K.

This is a 16% increase from the last time it sold 3 months ago.

During normal times, I’ve seen the sold price drop after the inspection.

What would cause the price to increase after the sale was pending? I thought after the sale was pending that there couldn’t be any other bidders. Maybe it fell out and another bidder came in at full price?

RE seems to be still very hot.

I also wanted to thank Realist for finally pointing out real examples instead of predicting doom with no evidence.

Housing prices per Realist real data are UP 16% in 3 months in the LA area!!!

Keep it up Realist and we will let you know when your predictions of Doom are achieved.

Keep the faith! It may happen! However…., not yet.

I’m hoping for a soft landing with RE prices up slightly for several years with prices being eaten away by massive inflation that the Fed is half-heartedly saying they are tying to deal with. At least they haven’t caved and dropped rates to zero like they did in early 2019. Inflation is a serious problem.

However, millions of people giving their homes back to Freddie and Fannie if housing crashes again like 2008 would be an even worse problem.

As I have said above, this is a better drama than anything aired on Netflix today.

Drama can mean short-term pain to some. I have no control over it. The Fed has also handed out millions to some during the pandemic in 2019. I also had no control over that but these are the consequences.

Is it insane to think the simplist solution to the CA housing shortage is simply to limit the number of homes a person can own?

Does a person really need to own more than 3 homes? 5? Where is an appropriate cut off?

If a person owns more than 1 home, he is most likely renting them out. So it does not add or substract from the housing stock. This is more housing ownership concentration.

lots of large companies own thousand of units providing viable housing options to millions of people.

And a person who owns a 20 unit apartment house should be forced to turn it into a condominium complex? Or the government just takes it and converts it to public housing?

No thanks. Sovietizing housing leads Soviet conditions. Like in Soviet Armenia, where an earthquake killed more people a remote area than the stronger Mexico City quake did in one of the world’s largest metropolises. I own 2 houses (and half of a third with my Brother), two of which we rent out and one I live in. We built the rental houses ourselves. It’s called sweat equity. Like squirrels saving nuts for the winter. If someone were to make me a good offer, I’d sell either of the two rentals, but for now I’m not listing them. And the only offers I’ve ever gotten were from people who wanted me to carry paper on the house. I’m not a bank, but I know that there’s a reason for banks; to weed out bad credit risks.

“…Simplest solution to the CA housing shortage…”

What almost nobody truly understands that there is no shortage of California homes, only a shortage of homes for *sale*. The housing shortage mythology has been manufactured by the REIConplex and by speculators, who believe / want to believe the price of California Real Estate only goes up.

Of course, someone will always chime in and say “But what about all those new families moving into California” Well, what about them?

Here is a reality check from Google:

In 2020 alone, nearly 650,000 people left California for other states — about 210,000 more than moved to California from elsewhere in the U.S. This phenomenon of departures exceeding arrivals isn’t new. Every year since the 1990s, more people have exited California than have moved in from other parts of the country.

Net net more homes are available than ever before.

The amount of housing square footage per individual may rise, (the trend to larger homes that has been going on for the last 70 years), but that is a different discussion.

Take out the speculation (which will/is happening due to rising interest rates) and problem will solve it self.

Economics always wins, always.

Yeah, it’s funny. There’s a shortage… until there’s not! It’s called PEOPLE STOP BUYING because PROBLEMS. High interest rates, paycheck-eating inflation, recession / job losses, etc.

Rather than government control, ie limiting the number of houses owned, rent control, higher taxes, I think the solution is less control by government.

!) The Fed must stop suppressing rates. If anyone has a choice to make 6% in a CD or 6% in a rental property, most will choose the CD. Housing prices will fall. Both corporations and private landlords will not invest. Higher mortgage rates that are not suppressed will lower prices eventually.

2) Stop stimulating the rental market with tax incentives. Our last President put in some nice loopholes for landlords (Funny that he is one) but took away loopholes for primary homeowners (SALT). SALT does not not apply for a rental property so landlords get the full deduction. It is great that renters now have a doubled std deduction for taxes. You’d think that they would be doing better, but landlords smell extra money so rents have gone up (Among other reasons).

3) This crazed FOMO mentality of I’ll overbid 50% on a house somehow has to stop. Like with any fad, (ie Beanie Babies)It will stop eventually but it still exists now. It will take a small price drop to stop it.

4) The 300-1000% gains in the stock market will have to diminish. Too much money in system is driving up the cost of everything. Too much demand with money and not enough supply is inflating everything.

I have been on the receiving end of individuals such as DOZZ complaining about myself and others owning more than one house. Tes, I own multiple SFH all rented out to individuals driving ( or leasing ) high dollar vehicles, just keeping up the appearance of doing well financially. These follks need to get a job in the circus with their ability to keep their financial obligation debt balls in the air. They appear to be doing well until an unexpected bill comes due, and since we are in the same financial ocean, we never know who is swimming naked until the tide goes out.

I can’t believe people are still under the impression this correction is going to be minimal. Today, Jerome Powell mentioned the vast amount of homes which will be going on the market at the same time the QT is going on. He tried to walk it back, but people in the industry know its the truth. Its going to be 2008 on steroids folks.

“It’s going to be 2008 on steroids.”

Let’s go down history lane. In 2005 house prices peaked. And inventory was sooooo much higher than today.

NINJA loans were given to anyone who could fog a mirror.

I am giving you already two facts that show the 2005 market was completely different than 2022.

I suggest you read up on the 2008 housing crash and what led to it before making those remarks. I don’t want you to be set up for disappointment.

So what you’re telling is that your source that an incoming massive oversupply enough to offset demand is “some guy in a suit that has a track record of lying said so.” I cant believe that words coming out of the mouth of someone thousands of miles away from you is enough to convince you that what your seeing right in front of you is not reality. Did you even stop and think how this will come to fruition? Are homeowners on the verge of losing their homes? No their rates are too low and their payments are serviceable enough to get them thru potential job loss. Is their overbuilding going on that im not aware of. No, permit data suggests otherwise. What about buyer demand? Is that going to come to grinding halt? No, that not the case seeing how buyer activity is still strong despite increasing rates. So then what is it?

Blast from the past …

M (Sept 17, 2021): “The amounts I have staked with Cardano are astronomical. On paper I am already a crypto millionaire…”

Source: https://www.doctorhousingbubble.com/more-housing-inventory-is-coming-850000-borrowers-will-exit-forbearance-between-august-and-october/

Cardano is one of my favorite crypto assets besides bitcoin and Ethereum and to an extent Polkadot (dot).

My targets for ETH are 300-600

My targets for Cardano are much, much lower from todays prices

Same for dot.

I think this crypto crash will see a capitulation within this year and after that a re-accumulation phase. That will be the opportunity of a lifetime. I am hyped.

I bought bitcoin a long time ago and sold a long time ago. Made some money, not big bucks.

Ended up taking the profits and investing in real crypto technologies that actually provide a service that is useful (AMD and BR).

I have done really well although sold AMD a while back.

As far as I could tell, Bitcoin was basically a tulip investment. If someone could explain to me how BTC and ETH are not tulip investments, I am all ears.

Does BTC license its crypto technologies that are developed? That would be great service that justifies investment. Other than that, I don’t get it.

“If someone could explain to me how BTC and ETH are not tulip investments, I am all ears.”

*crickets*

“ If someone could explain to me how BTC and ETH are not tulip investments,”

My favorite subject. It’s self explanatory for the savvy investor but I always like to help out the guy in the back:

First, I gotta explain what the tulip bubble did not have:

Longevity. It was a very short bubble.

Bitcoin has been around since a decade despite the fact that it was called dead for uncountable times. The other major difference here is the fact that Bitcoin prints higher highs and higher lows since inception. It started with basically zero.

I remember when I first looked into it and people told me it’s not worth a few hundred bucks. Than it crossed a thousand usd and people said my BTC will go down to a few hundred. When it crashed people told me it will never be over 1k again.

Bitcoin investments. Beanie babies. AMC. Stocks and RE speculation.

All have one thing in common that will never change:

As long as people exist, some will always look for a shortcut in life (get rich quick). They don’t care what the thing is they speculate with as long as it keeps their dream alive to be rich quick.

Banks, Wall Street, institutions, savvy investors (like me) know this and also understand how valuable those get-rich-quick people are since they are the exit-liquidity.

Someone will pay 100k for a bitcoin when I sell. Mark my words.

And it’s likely that this someone is the same person who told me years and years ago that bitcoin is overpriced at 1k. It’s likely that this is also the same person who believed in buy now or be priced out forever.

““The amounts I have staked with Cardano are astronomical. ”

Cardano:

Sept 17 2021 – $2.50/share

June 17 2021 – $0.49/share

80% astronomical loss.

At least M will have a huge loss to counter those BTC gains.

80% astronomical loss.

Well, as late as Jan 2020, M was still predicting an EPIC CRASH in real estate. So he was half right. An EPIC CRASH did occur. Just not in real estate.

That’s correct. And ALT’s can easily drop another 80-90% from here on. They go down much more than people can imagine. The re-accumulation phase of a life time awaits for savvy investors!

A housing crash won’t occur anytime soon. Maybe a correction me thinks. But we will see. It would be nice if a RE crash happens…..would like to buy more rentals. One can only dream 🙂 but since we have crashes in crypto that allow us to load up on super discounted coins, money won’t be an issue in the future (if history rhymes again and ALTs make a 50-100x in the next bull phase).