Foreclosure Nation: More Like Foreclosure States. 4 States Made up 50 Percent of all Foreclosures and Distressed Property Action.

I was digging through the nationwide distressed property information put out for April of 2008. In this data, we have notice of defaults, notice of foreclosure sale, lis pendens, and REOs. This data gives us a snapshot of where we are but also allows us to see where we are heading. For example, we can look at notice of defaults as a leading indicator of how many defaults we will be seeing in a few months.

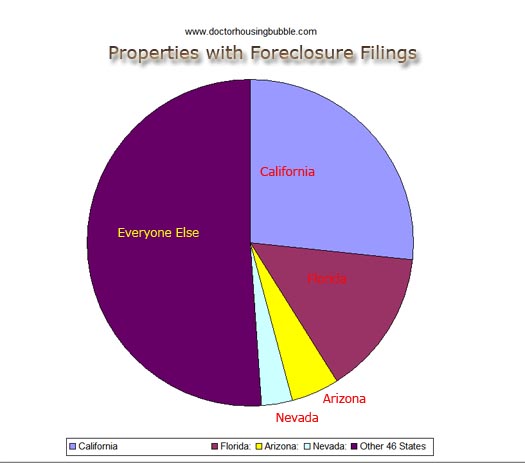

There are many sources putting out information regarding foreclosures but one cited quite often is data from Realtytrac based out in the heart of Orange County, Irvine. The numbers are stunning no matter how you look at the data. It turns out that only 4 states out of the entire 50 states of our country make up approximately 50 percent of all distressed action! Think about that. We’ve all heard that real estate is about location so we can assume that the same goes for foreclosures. Let us crunch the numbers:

California (Properties with Foreclosure Filings): 64,683

Florida: 35,264

Arizona: 11,620

Nevada: 7,276

Total 4 States Above: 118,843

Total Nationwide distressed filings: 243,353

*Source: Realtytrac

Maybe it would help to visualize the lopsidedness of this:

This is simply stunning when you think about it. Not only is this going to be problematic in the short run, but take a look at what we have to look forward to by examining the notice of defaults that are now turning into foreclosures at an alarming rate:

California (April 2008):

Notice of Defaults: 40,294

Notice of Trustee Sale: 8,822

Real Estate Owned: 15,567

That is a very ominous sign since that 40,294 is only an indicator of how difficult things will get in the future. Many of these homes are 90 days late or are still in the process of hitting the market. If you want an indication of how bad things have gotten in California over the past year, just take a look at the numbers for April of 2007:

California (April 2007):

Notice of Defaults: 24,305

Notice of Trustee Sale: 4,200

Real Estate Owned: 2,000

In one year, notices of defaults have doubled, trustee sales have doubled, and real estate owned has jumped from a low of 2,000 to a jaw dropping 15,567. This is why I simply do not buy into any of the bottom talk and especially not for California. I wanted to cross check the above data with the quarterly foreclosure information posted by DataQuick. For the first quarter of 2008 they list 113,676 notice of defaults.

Realtytrac first quarter data NODs:

January 2008: 38,148

February 2008: 35,731

March 2008: 40,761

Total First Quarter 2008 NODs: 114,640

Not bad at all. At least by using a few different sources we can at least trust to a certain extent the data. So with that said, the troubling implication is that fewer and fewer people are able to manage their way out of a notice of default and are unable (or unwilling) to catch up:

“(DQNews) Of the homeowners in default, an estimated 32 percent emerge from the foreclosure process by bringing their payments current, refinancing, or selling the home and paying off what they owe. A year ago it was about 52 percent. The increased portion of homes lost to foreclosure reflects the slow real estate market, as well as the number of homes bought during the height of the market with multiple-loan financing, which makes ‘work-outs’ difficult.”

That is simply shocking. What this tells us is 68 percent of these notice of defaults will go through the full foreclosure process. Now of course this number is simply getting worse because of the state of the California economy and the extent of bubble prices in many areas. Fuel prices are only the last nail in the coffin. Let us apply this number to the first quarter notice of defaults:

114,640 * 68 percent = 77,955 homes will be foreclosed in California from the homes that received NODs in the first quarter.

Now if last month, 8,822 homes went to a trustee sale and things are pretty bad, just look at the above estimate and take a wild guess how things are going to get for California. Is this really any sign of a bottom? That is why even folks like Ed McMahon are struggling to keep current on their mortgage. The problem with California more so than the other states is the massive size of the mortgages. For example, Ed McMahon on his $4.8 million loan to Countrywide is arrears by an incredible $644,000. Let us assume a $500,000 loan at 6 percent that falls into bad shape. Just look at how badly things can get and how quickly:

Principal and Interest Only:

1st payment due: $2,997

2nd payment due: $5,994

Late payment: $40

Total to cure account: $6,034

3rd payment due: $8,991

Late payment: $40 x 2

Total to cure account: $9,071

4th payment due: $11,988

Late payment: $40 x 3

Legal fees: $75

Total to cure account: $12,108

5th payment due: $14,985

Late payment: $40 x 4

Legal Fees: $75 x 2

Total to cure account: $15,295

6th payment due: $17,982

Late payment: $40 x 5

Legal Fees: $75 x 3

Total to cure account: $18,407

At this point, a bank would most likely issue a demand for full payment including full balance, back interest, plus late charges, and legal fees all at once. The legal notices begin. The lender at this point normally will only accept full payment which of course, if you didn’t have enough to make the $2,997 payment where in the world are you going to get $18,407 to cure the account? But that is why we are seeing that REO number skyrocket and holding steady. Many lenders are now trying to gauge their options assuming they don’t go under. Either they workout a modification with the owner (assuming they want to keep the home) or simply take their losses, take over the home, and try their luck given the current marketplace.

Do lenders really have the force to keep up with this? Some are arguing that they are not and the numbers are looking extremely suspicious. Why is that? First, inventory has been steadily dropping in the Southern California region yet sales haven’t picked up in any sizable fashion. A realtor over in San Diego offers a bit of insight into this:

“Speaking of holding back, the properties assigned to me were all foreclosed just a few days before – and I thought, “yippee, these guys are really on it!” That thought was a bit premature.

Since the end of April when I had 20 properties sent to me, only three have made it to market. Another one got rescinded (stand-by, this one will be a story in itself) and three others have extenuating circumstances why they have stalled. But literally the other 13 are sitting vacant, waiting for Countrywide’s asset managers to give me the green light to put them on the market.

I think they are overwhelmed – there have 60 asset managers at their servicing facility in Simi Valley, each with 100+ files on their desk. The majority of these mortgages are ones they sold to Deutsche Bank and HSBC, both foreign entities. Countrywide is just their servicing agent, meaning they collect the monthly payments, and handle the foreclosure proceedings. There isn’t much incentive for them to not be expediting the sales, unless the banks that actually own the properties are telling them to stall. But why would Deutsche Bank or HSBC want to stall – they can’t be waiting for a bailout, who is going to give them a hand? The U.S. Government? No way.”

Jim actually puts out some good information at his bubbleinfo blog and you should check it out when you get a chance. What Jim talks about was my gut reaction at first. These lenders are simply overwhelmed. By looking at the NODs we already know that we have an absolute tidal wave of bad mortgages coming our way. You can only infer that lenders with a heavy weighting of mortgages in California are going to be creamed. Washington Mutual who holds many California mortgages including one for our beloved California Democratic representative mogul would-be Donald Trump Laura Richardson isn’t exactly doing so hot recently. Take a look at the 1 year performance of WaMu:

Down 84% in one year! That isn’t exactly what I would envision as a bottom. I would be especially angry if I ended up buying stock at $44 a share last year. Either way, the problem is we have many investors not from this area that simply do not have any sense of the magnitude of Real Homes of Geniuses with banana republic mortgages that are floating out there.

Now riddle me this. If California, Florida, Nevada, and Arizona make up nearly 50 percent of all distress property filings in April and their early indicators are telling us that we have even more pain ahead, what is going to get these NODs cured? Here is a quick and dirty fact for you; all those HELOC and those piggyback loans once so popular in California just got annihilated. Many of these lenders are out 100 percent. Heck, the 30 percent median price drop last year pretty much wiped out 2 years worth of 2nd mortgages on homes. The only thing that remains is lasting memories of Maui, a gas guzzling Hummer, and a new granite countertop.

Do you really think the pain is done?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

10 Responses to “Foreclosure Nation: More Like Foreclosure States. 4 States Made up 50 Percent of all Foreclosures and Distressed Property Action.”

DHB,

First off, let me say that I LOVE the Great Depression Series you did. It’s amazing to sit here and watch what is essentially a re-run.

I would think the pain is going to get worse. But I suspect there will be a bailout coming soon. Especially if Obama wins and the Dems control Congress. I shake my head and wish I’d gotten in and done some HELOC abuse while the gettin’ was good, instead of being financially responsible and refusing to get in over my head.

Thanks for your insightful, educational and well researched writing.

mean wile what were the fastest growing states over the last 10 years, NV AZ TX & FL. Funny how that worked out.

DR HB

So what’s the GOOD news??

I guess only the strong survive in tough times. The great depression bred a generation of frugality, and conservatism. Rinse and repeat in 08.

Excellent post!

down 30 percent and still way way overpriced………….

Mr. Mortgage made a new video about the latest CA foreclosure info and it just keeps getting worse: http://www.youtube.com/watch?v=kJOJYUJi4n8

On those NOD numbers from the four states, Nevada’s ratio of population to NOD amount is staggering compared to the other three which is why I maintain when all is said and done Vegas prices will be the most devastated.

I live in a newer development in San Joaquin County. There are many homes that have shown up in the public notice section of the local paper in this development and the immediate surrounding area. These same homes sit vacant after the “owners” depart. You rarely see a realty sign out front. It seems the more moderately priced homes, or homes that had smaller outstanding balances, are the ones with the signs. The McMansions sit empty. Am I a nut for fearing that the banks will start to have these places burned in order to collect the insurance?

Has anyone thought about how many illegal aliens make up the population in these states? I think it bears research. The banks were all to happy to give them home loans without social security cards and thorough background checks. Wouldn’t be nice for American’s and LEGAL citizens to be able to jump ship and run back across the border and be scot free?

Great post, Doc. My only thought is on your comment about the decline in WAMU’s stock price from $44 to $6.68 and how the investor at $44 would be “especially angry”. Has anyone ever heard of a stop-loss order? It’s really very simple whether you use a broker or trade on-line. If you bought the stock at $44, there must be some price at which you should realize you might have made a mistake. If you want to give it some “room to fluctuate”, try 15% down. At the time of purchase, you would have entered a sell order that was to be in effect until you either cancel it or it is executed at a price of $37.40. Yes, you would have sold the stock on Aug 8, very soon after the “troubles” began to manifest themselves in the stock price. Sure would have saved a lot of pain, and you would have had some money left over to pay for that $4.20 gasoline.

Being from Ohio I was struck by the phrase” Cleveland is the foreclosure epic center”

As I read, looks like 1.5 million foreclosures with 2.5 million in the process.

This foreclosure/credit crisis has many sides that are all interconnected. What blew my doors off, is the fact that federally chartered savings bank( Countrywide CA; Washington Mutual WA; Am Trust OH) are not legally bound by federal consumer banking regulations, because there are none. These types of banks they operate with absolute impunity. They have no accountability to anyone. Their federal supervisor, the Office of Thrift Supervision has no authority to protect a borrower from unethical actions by a federally chartered savings bank. However by using the shield of secrecy (which is now labeled privacy); the OTS does protect the bank. The States have no authority over federal banks. This is verified by the fact that two States are now suing Countrywide, and if they win, new and bold case law would be established. I look for more States to join this lawsuit parade which will march on for years.

It does appear that nothing has changed since the last savings and loan crisis other than it is much worse. We see on the horizon where the Banks maybe violating TILA (truth in lending act) by freezing HELOCs. The list of unethical lending operations keeps growing like a ship without a rudder. Personally, I would agree with the many that say this foreclosure /credit crisis is only the very tip of the iceberg. If this current crisis was the Titanic, then the politicians would be on the lifeboats waving goodbye to the women and children who were left on the decks of the sinking USS Economy.

Michael LittleBig

Leave a Reply