Foreclosure Nation: Highest Foreclosure Quarter in History. On Pace for 3.5 to 4 million Foreclosure Filings for 2009. California Housing Market Bubble Update. More Speculation and more bubble economics. California true Unemployment Rate over 21 Percent.

In the first half of 2009, nationwide foreclosure filings topped the 1.9 million mark for the first time ever surpassing the 1.5 million for the first half of 2008. Also, Q2 of 2009 was the worst quarter in terms of foreclosure filings ever. Whatever the case may be with a handful of good earnings reports including some Wall Street firms that are making billions on a disaster they helped to orchestrate, the overall housing market is still deteriorating. The Alt-A and option ARM problems still loom in the near future with really no strategic way to address them. Many of these loans will be recasting in large numbers in states like California and Florida where housing is still in tatters. The U.S. Treasury and Federal Reserve seem intent on prolonging the slump as long as possible to give them time to craft another bubble. We’ve seen this with the loan modifications which amount to additional government sponsored option ARMs which virtually convert homeowners into long-term renters.

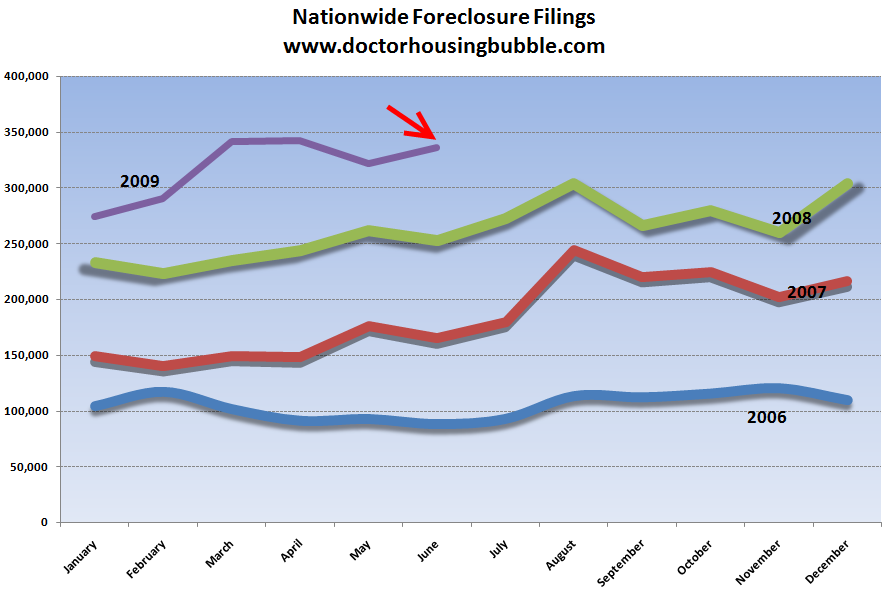

Before we drill down into California, let us first take stock of the nationwide foreclosure situation:

*Click for sharper image

We are on pace for approximately 3.5 to 4 million foreclosure filings in 2009. This is unheard of in modern history. What makes this number even more startling is that the government has handed over trillions of dollars to Wall Street and the banking system yet the problems still persist for most average Americans. Many Americans are wondering if the money they handed over (unwillingly most of the time) is even doing any good. The outrage from last September’s Paulson 3 page $700 billion memo seems to have subsided. From that time however, the bailouts have gotten bigger and are following the unfortunate same trend. That is why foreclosures are still rocketing up. We’ve committed some $13 trillion in bailouts, enough to pay off every single mortgage in the United States, yet here we are still with massive foreclosures slamming the housing market lower while more and more Americans lose their jobs.

Over the past few days there have been people voicing that the “recession is over” although much of this glow hides the darker reality and many fail to address where the jobs will be coming from. Even if the recession is over soon, we are not going to have housing bouncing back. Even if the recession is over, credit will never be as accessible as it was during the bubble. If anything, it will be a tepid recovery that will only register a green color on the GDP but for most people, unemployment will still be surging, wages will be stagnant or falling, and housing will continue to face massive foreclosures. So those claiming the recession is over are usually the Wall Street cheerleaders who have never looked out for the average American and are obsessed with turbo capitalism.

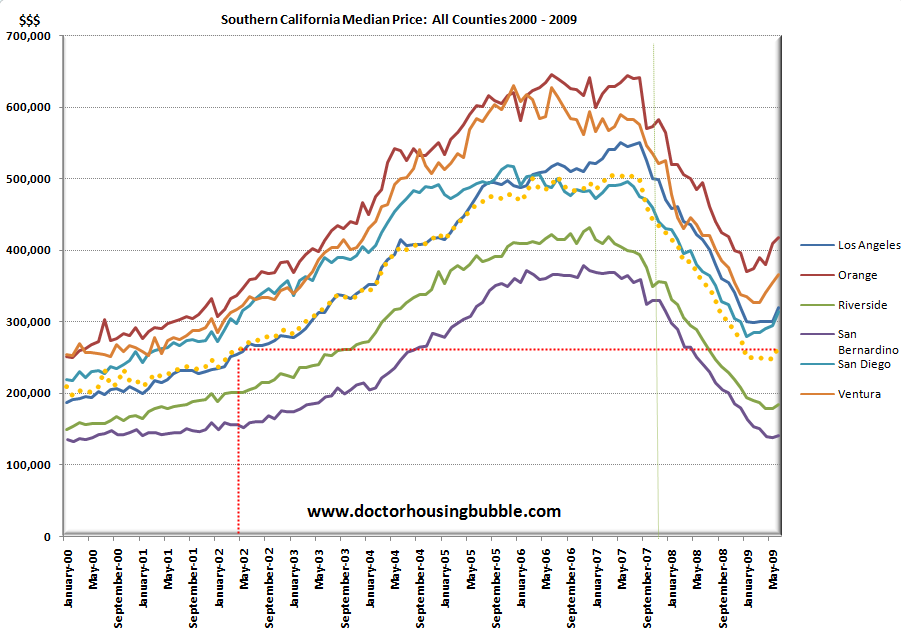

I received a few e-mails even after highlighting price issues in Culver City and Palms which are good areas and some of these people are jumping into the market. In some of the e-mails, these people are able to understand my argument regarding the Alt-A and option ARM tsunami that is on the horizon yet have decided to jump in. It is rather amazing. As of today, if you want the best rates you need good credit and a sizable down payment of 20 percent. You can get by with pristine credit and 10 percent down but this will not get you the best rates. So take for example a $500,000 home in Culver City. The argument I have presented is this range of the market will be hit in the next couple of years with a 10 to 15 percent decline and this home will drop to $450,000 or less. So there goes that 10 percent down payment. Yet the mentality of the current buyer has tinges of the same delusion of the buyer which bought into the bubble. “I know I may over pay a bit, but in 5 to 7 years prices will go up and we’ll have sizable equity.”  You sure about that? Japan has seen stagnant real estate for two decades. Sure they have very different demographics but real estate bubbles can linger for years. Many that bought in Southern California are back to prices that we’ve seen 7 years ago:

So there goes those 7 years. But wait. You notice how all counties have started creeping up recently? Welcome to phase two of the housing bubble bust. The eye of the hurricane mini rally. First, much of the distortion in the median price is based on the fact that mid to higher priced areas are lowering prices and moving inventory. Therefore, we now have a bigger sample of higher priced homes moving creating a momentum for a higher regional median price. But overall prices are still falling if we look at the Case-Shiller Index which looks at same home resales:

The trend is clearly still heading lower although at a much slower pace. Some try to spin this as a major shift from the cliff diving we were experiencing. Well of course it had to abate. At the rate we were going the stock market was going to zero and housing prices would be free in a few years. That was clearly not realistic. But now, we are trying to link actual value with economic fundamentals. That is the current battle. After a decade of a major real estate bubble, there is still much distortion in the system.

Yet the fact is, the median price did go up last month. If you understand why, you have a better grasp of the market and will avoid jumping into the pit right before the Alt-A and option ARM problems slam California. It looks like I’m not alone in this camp now:

“(Bloomberg) Payment-option adjustable rate mortgages will contribute to higher defaults, said Rick Sharga, executive vice president of RealtyTrac. Option ARMs allow borrowers to pay less than the interest they owe each month, tacking on the difference to their total debt and creating the potential for bigger bills in the future.

About three quarters of those loans will adjust to require higher payments next year and in 2011, with the peak coming in August 2011 when about 54,000 loans recast, according to data from First American CoreLogic of Santa Ana, California.”

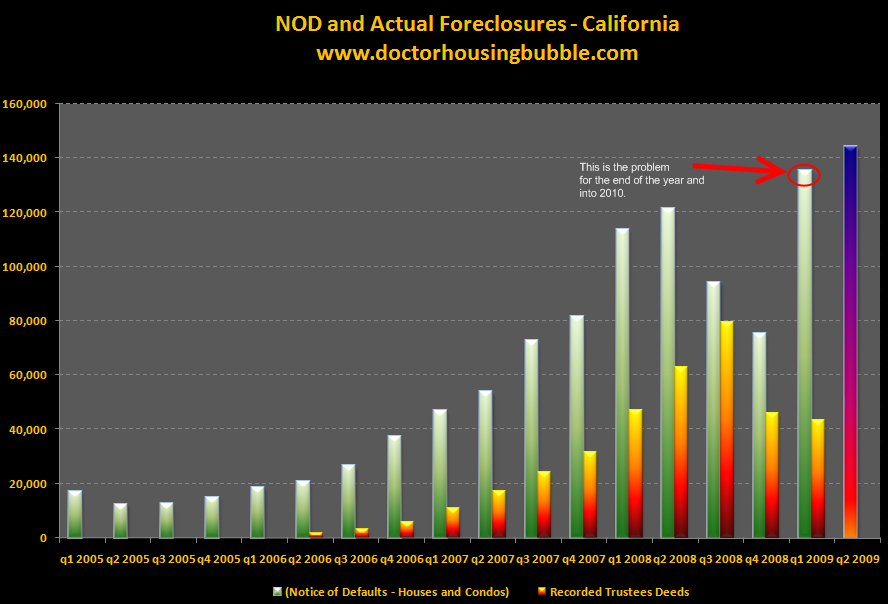

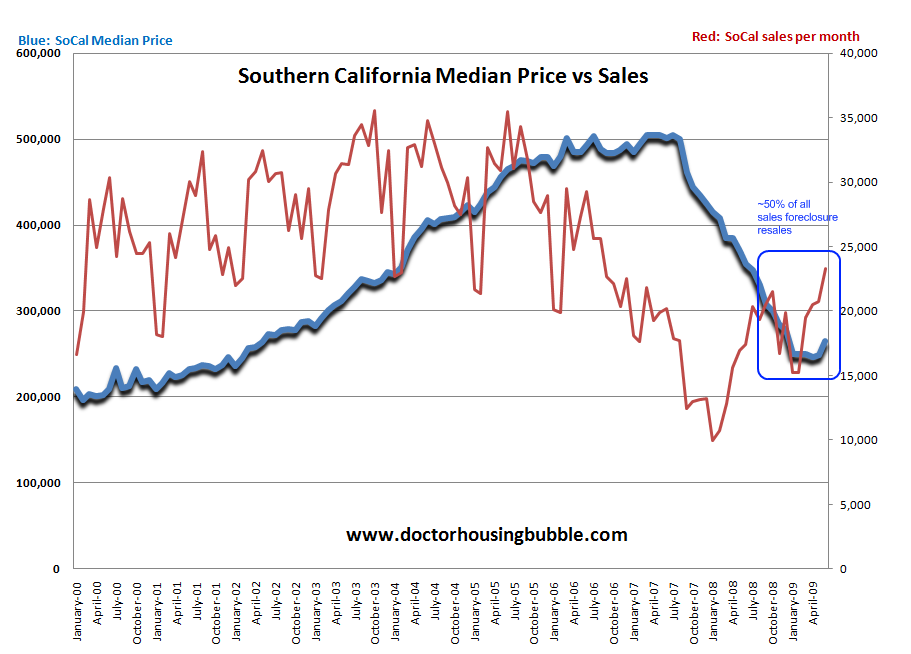

Last year I gave 10 reason why California would not see a housing bottom until 2011. Those factors are still in play. Last month, 45 percent of all homes sold in Southern California were foreclosure resales. This is off the 56 percent peak but still incredibly high. And it will remain high if you know where to look. We have a massive wave of pent up foreclosures that will hit late this year and into 2010:

The lull we are experiencing right now has to do with a few combined forces:

(a) The moratorium from last year has created a sense that things did get better. This filtered to the market and many on the fence are now buying.

(b)Â Prices have fallen 40 to 50 percent across the Southland and people are now jumping back in.

(c) A large part of the subprime problems have cleaned out giving the impression we are closer to the end. They fail to look at the second phase which includes the Alt-A and option ARM tsunami which is much larger than the subprime issues.

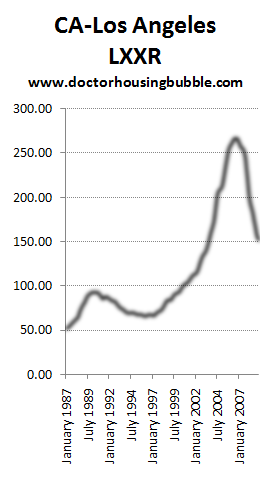

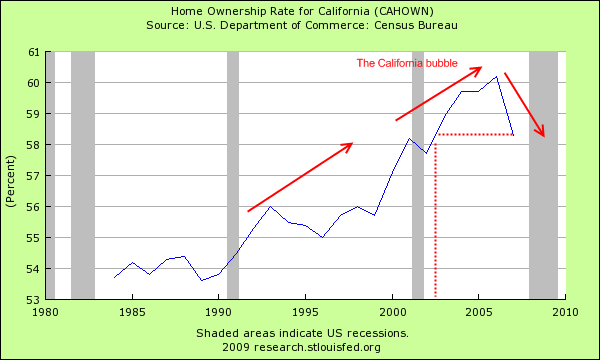

And I think this is probably one point that is being overlooked. During the bubble everyone and their mother, father, pets, and broke family members qualified to purchase a home. It was pure insanity. When people look back at this time in history they will say, “California entered a collective delusion and paid $500,000 for wooden shacks giving loans to everyone and anyone.” That part of the market is gone. And we can look at the California homeownership rate and you will see the bubble disappearing:

But I would argue that the bubble started earlier in the 1990s with the technology boom. So we went from one mega bubble to another. This is a key factor that is missed. Most assume we’ll go back to 2000 levels which eliminates the real estate bubble and that is that. Yet they forget that much of the holdover from the tech bubble was mixed in with this current real estate bubble. Either way, those that are buying in mid to higher priced areas are taking a gigantic risk and going against all data that I am seeing. I stand by my bottom call of 2011.

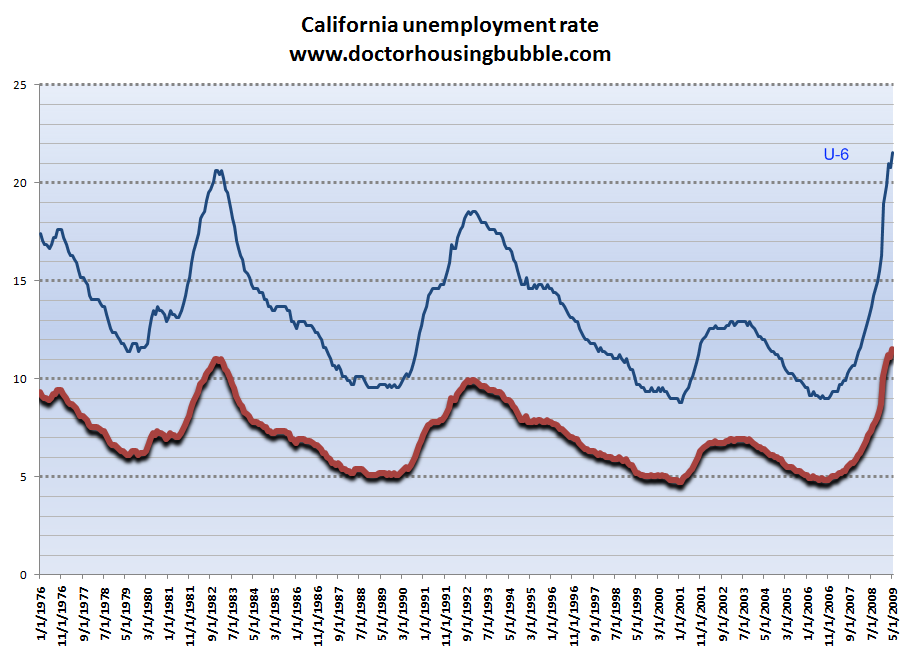

One of the reasons is also the horrific employment situation:

The BLS offered us a statewide look at the U-6 measure of unemployment for states recently. From the second quarter of 2008 to the first quarter of 2009 the California U-3 rate (headline) came in at 8.3 percent. The more broader measure which looks at unemployed and underemployed was at 15.6 percent. So with this ratio, which plays out nationally as well we were able to reconstruct the above graph. As of now, California has a U-6 rate of over 21 percent. And this is obvious. With 200,000+ state workers being furloughed and many others being laid off, the actual employment situation is worse than the headline states. Those getting hours cut are still considered fully employed but their buying power clearly is much weaker. You cannot have a healthy economy with this kind of weak employment numbers.

Now if we look at the recent runup in sales for SoCal, you will notice we are far from the bubble days and keep in mind for the past few months approximately half of all sales were foreclosure resales:

When you really look at the data, things will get much worse for housing. And with the Alt-A and option ARM problems just around the corner, those buying in California are once again speculating.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

34 Responses to “Foreclosure Nation: Highest Foreclosure Quarter in History. On Pace for 3.5 to 4 million Foreclosure Filings for 2009. California Housing Market Bubble Update. More Speculation and more bubble economics. California true Unemployment Rate over 21 Percent.”

UPDATE 2-MGIC to halt new business; posts steep loss

http://www.reuters.com/article/marketsNews/idINN1319502020090716?rpc=44

NEW YORK, July 16 (Reuters) – Mortgage insurer MGIC Investment Corp (MTG.N) reported a wider quarterly loss and said it will stop writing new business as losses mount in the battered housing sector, sending its shares down 14 percent in premarket trade.

The largest U.S. mortgage insurer said it will wind down its business and try to capitalize a fresh enterprise that would write new loans beginning next year.

It said it hopes to win a capital investment from the U.S. Treasury but “cannot predict whether we will be successful in obtaining capital from any external source.”

(more at link)

———————————————————————————————————–

This doesn’t sound too good for housing either. Especially mid to high end range. Or am I wrong?

It’s hard to get through to people hell bent on buying because prices are down, to help them understand that ‘down’ doesn’t mean ‘done falling’. It’s interesting when I talk to realtors that they are again caught up in the frenzy, drinking the kool-aid. They won’t look at the larger picture to see what’s coming. This is one picture where the parts you don’t see (the coming wave of Alt-A foreclosures, the inventory begin withheld from the market) are as important as the parts you do; perhaps more so.

This info is much appreciated…

DHB,

While I completely agree with you about the bottom not being reached until 2011 or 2012 it does seem that most of the air has been let out of the bubble. If you are a first time home buyer and the government wants to give you $18,000 to buy a home and interest rates are as low as they are going to get I tend to think buying in new is fairly safe for most people. $18,000 gives you a nice cushion in some areas though I would agree that you might want to wait it out a bit longer for some of the more expensive areas.

I’ve been saying for a while that buying is cheaper than renting in Riverside and SB county. As someone who bought in 2006 and is currently moon walking away I completely fail to understand why the government now wants to give people a free $18,000 to make their down payments when real estate is already so cheap. I find it pretty insulting that the government is using my tax money to subsidize someone getting the same house for less than half the price I paid. And yes I also find it insulting that the government is using your tax money to bail out the banks when I walk. I don’t see how anyone can expect someone who between 2004 and 2006 to stay put when their tax money is being used to subsidize people already getting a bargain on a home while we are being given nothing.

People are jumping into the market, because people are inherantly impatient.

Car dealers are trained to ask”Is tomorrow too soon for you to take delivery?”

Sales people are all trained to work on insecurities- “If you don’t buy this

(TV, house, appliance,etc.) TODAY you will loose out”. Very few people have the discipline to wait for a slow moving disaster to unfold over the next year or two.

You are correct that the next major wave of foreclosures will be from job losses. California schools and municipalities are talking about layoffs, but this has not really hit yet. In my city, small stores are hanging on by a thread.

When these people finally hit the unemployment line, you will have bargains galore in repossessed cars, further drops in home prices, and service providers suddenly “discovering” new discounts.

Hold tight, stay in cash, and be patient. We have a long way to fall.

DG wrote ” the government wants to give you $18,000 to buy a home and interest rates are as low as they are going to get I tend to think buying in new is fairly safe for most people. $18,000 gives you a nice cushion in some areas ”

>>>

(1) Uh huh….. Schiller is calling another 15-18% in price drops nationally and Roubini is saying another 25-30%. $18,000 is ONLY 10% of a $180,000 purchase price. If it drops 15%, they are underwater.

>>

(2) Near historic Low interest rates are NOT A GOOD THING. They are a BAD thing. Sooner or later interest rates will rise. If a buyer could afford a $1135 payment (principal and interest) with a 5.5% rate for a $200,000 mortgage, if interest rates go to (gasp) 7.5% (and over 30 years the average has been around 9%), that means for the payment to be $1135 for the next buyer, the mortgage can only be for $162,500.

>>>

Low interest rates = higher sticker price

>>>

High interest rates = lower sticker price

>>>

If interest rates go up, the price of the house must drop as households still won’t have anymore money for the payment than they did when interest rates were low. And the person who paid the ‘low interest’ sticker price will be stuck unless they (a) can find a buyer who has an income that is substantially higher than their own or (b) drop the price to keep the payments in the same range so they can sell to someone in their own income group.

GAEL

Normally you would be correct but these are crazy times.

Our Government comes out with the craziest responses to what is happening.

The craziest thing I can think of in regards to the story about MGIC is a bill introduced and passed by our elected Retards that the Federal Government will from now on insure all mortgages and people won’t have to worry about paying mortgage insurance any more to boot.

I would put money on this being the law of the land if other mortgage insures run into the same problems. It would be one more big blow towards reflating the housing bubble and just another of the many problems swept under the rug.

It’s bad all over…We are seeing more foreclosures every day here in Augusta GA.

I think that I almost fell out of my chair laughing when I looked at this article posted in USA Today.

http://www.usatoday.com/money/economy/housing/2009-07-15-home-mortgages-foreclosure_N.htm

“Given the evidence, the housing market is turning around,” says Bernard Baumohl at Economic Outlook Group. “In the third quarter, we might see evidence that the rise in foreclosures has finally stopped. We’ve hit bottom on foreclosures.”

And this is actually quoted right above the chart that clearly shows over 1.5 million foreclosures this year alone. Seriously, did the editor even take a moment to consider what they were putting together for this article.

I guess this Bernard guy should take a look at the small community that I live in called Ladera Ranch to get an idea of just how many people are bailing out of their Option ARMs and Alt A loans in the coming months.

I don’t think we have seen the worst in California. It will be interesting once the moratorium is over in September. But for now people are talking about a “June Surge in Sales” even though the foreclosures amounted for 46% of said sales. Another concern? property tax is due in November. This will most likely cause more NOD’s ,which means inventory will increase beyond the current 9-12 months supply.

Higher interest rates does not necessarily lead to lower home prices. Interest rates goes up due to inflation. If inflation rises, property values are bound to rise since its a hard asset – or vice versa. This will net out the effect of lower property prices due to increased mortgage payment.

Are No-Doc loans back?

http://www.redfin.com/CA/Los-Angeles/6360-La-Punta-Dr-90068/home/7127686

“BANK OWNED LANDMARK ESTATE IN HOLLYWOOD HILLS! Financing available w/NO INCOME VERIFICATION! Move right in & live like a king w/ 360 degree views of the entire city! Move-in condition & the pride of the previous owner. Privately gated, well cared for & approx. 8,000 sq ft w/ 5 bdrms, 2 master suites, office, library, media, office, maids, bonus rooms, 3 car garage, lg motor court. Bank says sell & will help you buy it! Move in quickly without the hassle of finding a bank to approve your loan! “

Are No-Doc Loans back?

http://www.redfin.com/CA/Los-Angeles/6360-La-Punta-Dr-90068/home/7127686

DB wrote: I’ve been saying for a while that buying is cheaper than renting in Riverside and SB county

Have you driven around Riverside and SB county lately and look at all the for rent signs popping up everywhere? Soon, landlords/investors will walk away from their properties because vacancy rates will be very high. Rents will continue to go down along with house prices as deflation continues to wipe out the false debt prosperity that began in mid 90’s.

Ajay wrote: Higher interest rates does not necessarily lead to lower home prices. Interest rates goes up due to inflation. If inflation rises, property values are bound to rise since its a hard asset – or vice versa. This will net out the effect of lower property prices due to increased mortgage payment.

You are thinking back in the late 70’s when housing prices were rising due to high inflation. However, peoples wages rose in equilibrium and there was not much debt in society like today. What we have now is worldwide deflation and cash will be king. In the next 2-3 years, government agencies due to permanent much lower tax revenues and the increasing unemployed will burn through their cash reserves, and eventually the bond market will collapse. People will continue to flee to gold to perserve their wealth and interest rates for cash will be very high. People will resort to selling art, collectibles, possessions to raise cash, further depressing assets worldwide. I predict that house prices will fall so low that most people will pay mostly cash for them by 2015.

Ajay,

Your theory only holds true if wages increase at the same rate of inflation.

There are a couple of things coming down the pike that will effect the entire world economy and housing as well. One, food prices will (are) move up worldwide and two, energy prices will also increase. This will take additional money out of an already deflationary and low wage cycle. I live in Mexico and avocados, one would thing a national basic, are now 52 pesos a kilo; translation, almost two dollars a pound. Avocados normally should cost around 15 to 20 pesos a kilo. By the way, the local minimum wage is just over 50 pesos a day, if one is lucky enough to have a job. A kilo of tortillas is around 12 pesos. So minimum wage workers are paying over 20% of their gross salary for one kilo of tortillas. Kind of like a US minimum wage worker paying $10 for a loaf of bread. See any incentive here to get to a higher wage country?

Could someone please explain the property history on Ellery’s link.

Comment by Ajay

July 16th, 2009 at 8:45 pm

Higher interest rates does not necessarily lead to lower home prices. Interest rates goes up due to inflation. If inflation rises, property values are bound to rise since its a hard asset – or vice versa. This will net out the effect of lower property prices due to increased mortgage payment.

___

>>

Ajay – looks like you aren’t old enough to have been buying a house when a 10% was absolutely wonderful and then 6 years later when 7% was a good rate. The prices changed when rates went up and when rates went down. (I’m talking the price of the house relative to income.) When Volker shoved interest rates up, house prices declined relative to the total monthly payment as more of the payments went to interest. When Volker eased off and lowered rates, prices increased as more of the payment could go to principal. And yes that happened over th space of 5-6 years and it DID have a huge impact on prices when interest rates went down. It had worked the opposite way when interest rates suddenly went up when Volker abruptly jacked the interest rate – house prices were lowered and lowered again both nominally and actually in order to sell them to buyers whose incomes had not gone up. “Nominally” neams not rising with the rate of inflation and “Actually” means cutting the price.

>>

You are wrong. The key to prices is how much the buyer can afford in payments. If the Buyer can afford $100 a month, that $100 can be $60 interest and $40 principal or $60 principal and $40 interest. (I’m using simplified numbers here to demonstrate that the total payment is principal and interest and if one is higher the other has to be lower.) Paying $40 in principal for 30 years means the purchse price could be $14,400. Paying $60 in principal for 30 years means the purchase price could be $21,600.

>>

Forget all the nonsense about ‘inflation’ driving up house prices no matter what. Been there, done that, have a lot of weird and scary loans out there defaulting because those loans were the only way people could afford houses which were going up, up, up (inflating in price) when their incomes had stayed flat or fallen relative to inflation.

>>

When setting a price for a good, the seller has to figure out how much the buyers can pay. If buyers, or not enough buyers, can pay the price, there are two outcomes: (1) The good isn’t worth producing or (2) the price has to come down. And it doesn’t matter how many people want ot need a good – it mattters how many people want it and can pay for it. You can’t sell the Hope Diamond for a price gain if your only market is 10000 Walmart employees and 1 buyer who can pay for it.

>>

Bottom line is US households for the past 15, in not the past 30 years, have not been able to afford increasing prices. The incomes of the bottom 90% have not kept even with inflation. First they sent a second worker into the workforce (2 income family) and then they resorted to using credit. Now the credit is gone and their incomes are actually falling (cuts to wages, hours, jobs…..) Since there is no reasonabley foreseeable source of jobs for 22,000,000 people who are unemployed or underemployed, wages/incomes will stay down.

>>>

That means they can NOT pay more for housing.

>>

And that means prices first have to fall and then will stay flat. And if interest rates go up prices will either have to drop more to accomodate the sudden rise in interest rates (say 5.5% to 7.75%) or will stay flat in the face of inflation (say 5.5% – 6.25%) The house prices will have to react to a change in interest rates because the ability of buyers to pay can not.

I am wondering how the recently reported bank profits could affect the foreclosure process. My take is that when banks report good profits and strengthen their balance sheets, they would want to speed up the foreclosure process. Sort of like taking a big bath and getting rid of those toxic assets. If I am the head of some major banks, I would want to clean up my balance sheet ASAP (under the condition that my bank doesn’t go bust) so that in the next couple of years I would see a big profit jumps and fat bonuses. I can always blame the current low profits on my predecessors.

DG, I wonder how many people like yourself still believe that they are going to get $18,000 in tax credits (one time only mind you). The State of California is broke and the California Tax Credits stopped taking new applications for it on July 6th. There was only enough money in the kittie for 10,000 applicants and by July 4th it was estimated that they would have 12,000 applicants by the 6th. How many people are currently buying in this summer heat wave, thinking that they are going to get a nice tax credit in April 2010? And, don’t forget that the Federal Refundable Tax Credit for 1st time buyers requires a close of escrow date of November 30, 2009. As D.H. has shown, much of the Alt-A Option Arms begin to heavily reset in November 2009.

Hey So CalMan. We’ve been waiting patiently to buy in Ladera Ranch. But it seems the Kool Aid of the recovery is being drunk without abandon. Many properties are going for over 95% to over %100 of asking. It’s frustrating, but we believe in DHB’s thesis. What are your thoughts on the future (next year or so) in Ladera?

And new housing starts are up for june… why? because we need more inventory? Don’t forget the shadow inventory and all the unfinished houses. Yeah… That’s the ticket. Build more houses.

Rpvrenter,

One observation I have made is that when folks are actually listing for 30% below the market, people are getting into bidding wars and the sale price ends up being at or even above the listing price. This is when you hear the stories of the “we had 20 bidders” on this property. I’m sure a good 15 of those were lowballs on it, so there were at most 5 (more likely only 1-2) serious bidders.

In any event, if you are unsure of the situation just go to Realtytrac or Foreclosureradar and sign up for a 7 day or whatever free trial and take a look at the market generally as to what is in the pipeline.

Some of those will cure, some will get bailed out, the banks will forget about some, but there are definitely homes that will get through the hurdles and will be listed this year and next. You may want to then check back and sign up for a subscription at one of those sites early next year when the “wave” starts. IMO the best bets are going for the short sales if you have the patience.

My even more dire prediction is that with all these homes in some stage of foreclosure–if you are the owner are you paying your property taxes? In all likelihood, not. So you take recent buyers who have way overpaid for those houses that probably bear a good chunk of the state property tax revenue. Come December 10 when those taxes are due, I think California is going to be much further off its predicted shortfall than they are thinking. Likewise, as employment continues to fall, those income tax revenues will come short and hey, by the way, so are those sales tax revenues because unless you need to buy something, you won’t.

2010 is going to be a very bad year.

Whattodo, thanks for the insight. I have been waiting to sign up for one of the foreclosure radar sights.I’m sure they give much more insight on the real state of the housing debacle than the mls. Being in L.A., it’s hard to gage the pulse of the market in OC communities.

I keep telling people about your point #2 and some morons just don’t get it. A home is the only purchase you make based on the payment alone. A $500,000 mortgage at 5% is about $2,500 per month after the tax savings. If rates go to 10%, that loan now costs about $4,500 per month. If the market can only support a $2,500 per month payment, the house must fall to $300,000 to get back into the $2,500 per month payment range. That’s a 40% drop in value for the same monthly paymant. This is the inverse law of why values went so high (a.k.a. the Bubble) when interest rates dropped to record lows. Rates down, prices up. Rates up, prices down.

For a first time home buyer, the absolute best time to buy is when interest rates skyrocket. When the cycle returns to lower rates, you can refinance (the same loan, not a bigger loan), get a lower payment and realize significant equity paper gains.

I’m not that smart, so I don’t understand why some people can’t see this logic.

It’s the “Illusion” of supply and demand. The banks hold onto inventory knowing there is a ton of pent up demand and they only release a few houses at a time and let people fight via bidding wars. Then when those go through escrow they release a few more and so on. This is going to take years. I hope I can qualify via my social security – if that’s even still around…

I would think that sooner or later the damn has to break though… right???

Whattodo said something I’ve tried not to think about in regards to property taxes. Does anyone have estimates on the shortfall?

The Reuters story about MGIC is completely wrong. MGIC isn’t stopping writing new insurance, it’s taking steps to increase it’s ability to write new insurance.

See http://phx.corporate-ir.net/phoenix.zhtml?c=117240&p=irol-newsArticle&ID=1308267&highlight= for the press release.

Someone should slap that reporter with a trout.

Jeff2 pretty much summed it up. I’ve been telling everyone that’s eager to buy right now to just wait until interest rates are at 8-9% again, and in the mean time save up for a bigger downpayment to get a 15 year mortgage instead of a 30 year one.

Of course, hardly anyone I talk to is willing to try to comprehend the reasoning behind it.

The country is still in denial.

Had to bring this here because its my favorite blog and I think it relates. I applied last year to have my property taxes reassessed because my property had fallen from $370,000 to I believe $270,000 by Jan 1st 2008. The county came back with $345,000 as the Jan 1st 08 value. I appealed their value, but they were so far behind processing appeals that it took until mid Jan. of 2009 to get a hearing. In the meantime they expected me to pay the $6100 tax bill and they would refund any extra if they decided I was correct. The bank had originally informed me the tax bill would be around $4000, but they admitted to not being 100% sure of the exact amount. What I find a little bit humorous about this is that it was my property tax bill that initially put me into default. By January of 2009 the value had already fallen another $100,000 or more so I didn’t even bother with the hearing since I already wasn’t able to pay the original taxes and had decided my only recourse was to default on my entire loan since I would eventually lose the whole thing anyway.

I got a notice in the mail today from the assessor’s office in Riverside County. Apparently this year they did an independent review of all homes purchased after January 1st 2001. They now have my property pretty close to what the real value is ($173,000) and it states that my prop 13 value is $387,000. Its pretty sad because if the assessor had done it this way last year I might not have had to default on my loan. Now with penalties and all the other late fees between last years taxes and mortgage there is no way I could bring it current. I find it interesting how much different the county is treating it this year than last. I also have no real incentive to try to work anything out given that my loan is $372,000 and my value is probably a little less than $173,000.

Absurdity…

“We’ve seen this with the loan modifications which amount to additional government sponsored option ARMs which virtually convert homeowners into long-term renters.”

—-

These two articles were posted to my local newspaper website at the same time…

—-

http://www.denverpost.com/theeconomy/ci_12861403

“Preparing for your loan modification” …. “Other things to watch out for, according to the Treasury Department: offers to buy the house and then rent it back to the homeowner, instructions to the homeowner not to contact the lender and false claims of government affiliation.”

—-

http://www.denverpost.com/theeconomy/ci_12860020

“Proposal would let foreclosed borrowers rent their homes” …. “A top Treasury Department official told a Senate panel Thursday that the government is considering a proposal to allow homeowners to stay in their home as renters after a foreclosure.”

Sorry DG. There’s got to be a better way to run a country. Too bad we all don’t work for Goldman instead of Walmart. I’ve seen the microcosm: Woman is used to exaggerated standard of living. Man goes to work and figures this will all somehow work out. Nobody has a clue about a real budget. Eventually they are so far underwater they couldn’t swim to the surface if they tried.

That the State and local governments profiteered in the Bubble and have left this state exposed to this tragedy is horrible. This is worse than the Enron scandal by far.

Rob,

You are right about the Ca. tax credit but you need to think about the crazziness in Washington when thinking of the Federal credit.

Not only are the going to extend it, there is a good chance the will expand it.

Rpvrenter – I’m renting in San Clemente and I think Ladera and Talega prices will continue to drop. And what’s gonna happen to those HOA fees? I would think that’s one of the last thing people under water are paying. Will those HOA fees go up?

Hang in there – I’m know how you feel. I’m holding out to buy in San Diego.

Even if we don’t time the bottom exactly, it’s not like prices are gonna skyrocket by 20% annually.

“The first half of 2009 nationwide foreclosure filings topped the 1.9 million mark” !

The guys on Wall Street still continue to get rich and payout big bonuses too, good job people, give yourselves a pat on the back and try not to think about the Global economic disaster that you created.

Leave a Reply