Failure to launch generation: Why household formation for younger Americans continues to lag while home prices soar. 46 percent of younger Americans living with older family members.

Many are giddy about the rise in home prices. Yet gains in home prices with no subsequent gain in income are merely a repeat of the previous bubble with a different tune. In the last bubble, the memory has seemed to faded, the impetus for funky loan products came because incomes were not rising and products that offered additional leverage were taken up to mask the growing decline of wages. In the last couple of years, the tinder that lit this latest run came from the Fed’s artificially low rate eco-system. The difference this time is that the gains in home prices largely went to big investors that now dominate the market. In the midst of all this trading, the homeownership rate has fallen. Household formation for younger Americans is dismal. The economy officially exited the recession back in the summer of 2009 (half a decade ago this summer). So why is housing formation so weak when it comes to younger households if the economy is supposedly booming?

Household formation – Under-performance

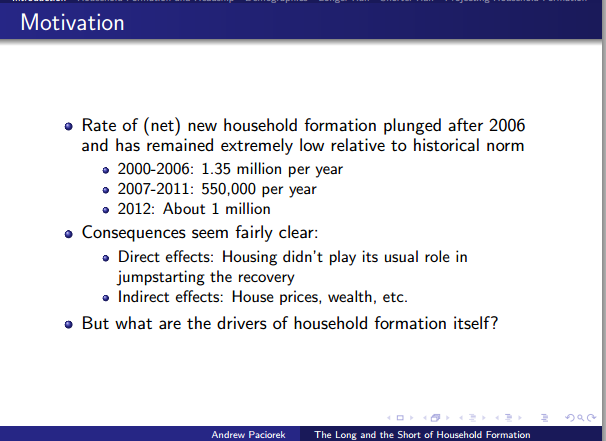

There was an interesting presentation made by Andrew Paciorek and was posted over at the Fed’s Atlanta website. The gist of the analysis attempts to examine the math behind the weak growth in housing formation.

One main reason that I have argued is that many younger households are simply saddled with large amounts of debt and weak incomes.

First, let us look at the math behind housing formation:

From 2000 to 2006, roughly 1.35 million households were forming per year. This baseline may be inflated given this was at the meat of the first housing mania. But let us use that as a baseline. Then, with the real estate crisis, housing formation hovered around the 550,000 range. That is a massive drop. What happened here was the yanking of maximum leverage loan products that really did not care about the borrower’s ability to repay the loan (i.e., their income). When that was put back into place, the market corrected fiercely since many were walking on eggshells hoping the bottom didn’t give out.

In 2012 household formation recovered to 1 million per year. This came because the vanilla 30-year rate collapsed and also, prices sinking made it more affordable for families to venture out and buy. The slide above mentions that housing didn’t jump start the recovery but I disagree. Investors plowed into the market. They jumped in with generous liquidity provided by the QE system. Investors went from something like 10 percent of all sales to well over 30 percent of all sales. A reader made an astute comment that items for the 1 percent are doing exceptionally well (i.e., luxury cars, food, and clothing) while items for the general population are taking a big hit (i.e., JC Penny, etc). Investors are buying homes with non-traditional financing largely unavailable to the general public. Indirectly, the rise in home prices has now created a wealth effect yet again:

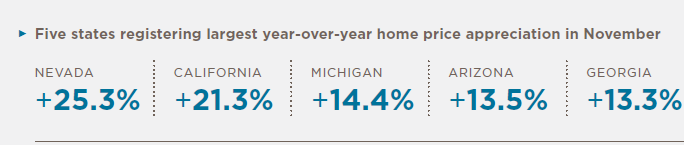

Source:Â CoreLogic

These are some incredibly large year-over-year gains especially when incomes remain stagnant. So what you really see for many is that more income is going to housing in the form of higher mortgages or higher rents. Of course who gets these higher payments? Big investors that are now a big portion of the single-family housing market. So yes, the real estate market is once again front and center for this recovery yet this recovery is largely leaving out the middle class.

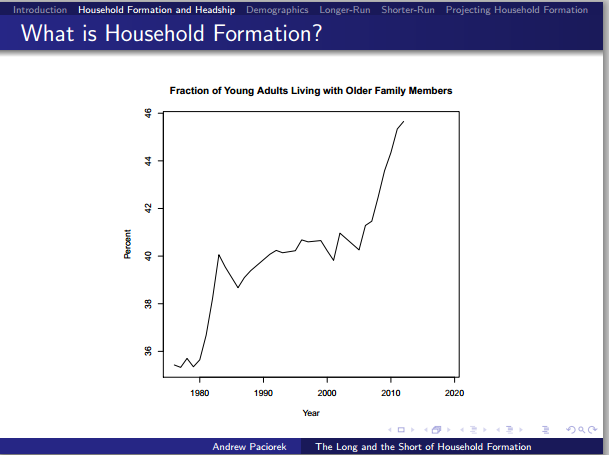

Household formation – Living with the parents

The other more obvious point is a larger portion of younger Americans now live at home with parents. In California, it isn’t uncommon to see multi-generations live in one household either out of saving money or necessity. This trend is undeniable across the nation:

In the early 1980s, about 36 percent of young adults lived with older family members while today it is up to 46 percent. Keep in mind this happened during the so-called recovery. Yet from 1990 to 2008 the pattern held around 40 percent. Why? Because young households bit the bullet and took on maximum leverage loans either the vanilla variety or of the more exotic kind like ARMs. The results were disastrous since 5.4 million homes have been repossessed since the real estate bust hit. Yet investors have been gobbling up these homes at distressed prices and leveraging the low rate eco-system developed by the Fed.

The reason for the lag

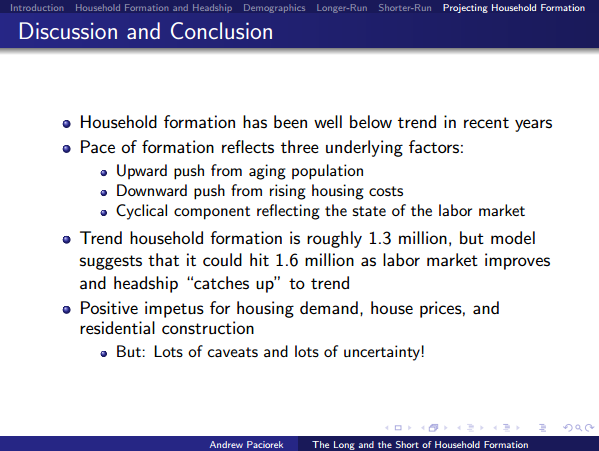

This answers a couple of points as to the lag in household formation from the young but the bigger point is jobs (or good jobs to be more precise) and income. Let us look at the conclusion of the presentation first:

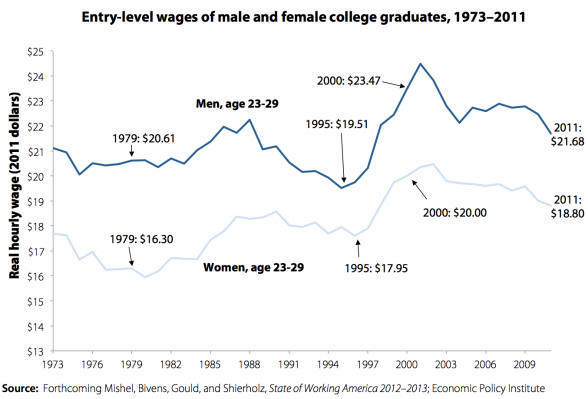

I agree with the three underlying factors of formation. The third point is given very little attention. The labor market for younger Americans, even college graduates is not as positive as to justify current home prices:

Wage growth for college graduates has fallen. A large reason for home price increases has been a simple supply and demand equation. You have very little supply being metered out by banks and you have investors dominating the market (up to 50+ percent in Arizona and Nevada and over 30+ percent across the nation). Recall those massive price gains in home prices? Well now you have only 1 out of 3 households that are able to afford a home in California. The question of household formation strikes at a new issue in that this next generation is likely to have a tougher go at the economy than the baby boomers. In California for example, you have baby boomers that went to state universities when competition was not as fierce and the price-tag was virtually free plus the added bonus of the Prop 13 lottery that hit in 1978. Then, exiting into a job market that is nothing like the one today (and pensions were abound even in the early 1980s with low healthcare costs). Throw in the record bull market in stocks and you have a healthy combination of luck, timing, and fortune meeting together. Today I have talked with 2 income households where both are college educated professionals making good incomes and they are struggling to purchase a modest home in a decent neighborhood without throwing most of their net income at the mortgage.

The household formation question is an interesting one but I seriously doubt that young Americans are going to be part of the new real estate renaissance for a few years. Many are actually getting conditioned to enjoying renting and the employment mobility that is more part of the economy today compared to the lifetime employment of a generation ago. The facts are clear and that is a larger portion of younger Americans are living at home for some reason and not venturing off to launch on their own.

Â

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

102 Responses to “Failure to launch generation: Why household formation for younger Americans continues to lag while home prices soar. 46 percent of younger Americans living with older family members.”

1) Jobs

a) none

b) Mickey D’s, or equivalent thereof

2) Student loan debt.

Combine the two, young adults can’t buy their starter home (and won’t be able to for many years yet), which means those in their starter homes can’t move into their family homes, and those folks can’t move into their post-family homes, and *they* can’t move into their retirement homes.

The pipeline is choked, and will be for a long, long, time …

I give it 10 years. What many are ignoring is that Boomers have the majority of their retirement wealth in home equity. They are banking on selling their homes for a massive profit. What happens when the largest generation alive tries to sell their homes all at the same time? Well it depends on how much risk Wallstreet is willing to burden. If there is a momentary flood of supply, it should cause all the home values to drop, and the longer that supply lasts (the mores desperate retirees become) the worse those investments become… My hope is that wallstreet goes broke on this and that the boomers get what they deserve, except with a bunch of poor boomers, we will now have a huge medicade burden. It could cause an epic meltdown on the economy… The good thing is that we’ll be able to buy a house. The bad is that we may have to house our parents.

” What happens when the largest generation alive tries to sell their homes all at the same time?”

Sorry, that’s not going to happen, young man. What’s going to happen, or, is starting to happen, is that these Boomer homes will trickle into the market, one by one, as the Boomers die, one by one. If they were going to suddenly “cash in” and sell all at once, Florida and Arizona would be flooded with even more old people, snapping up bargains, starting bidding wars, but, that isn’t happening, I’m afraid. No, half are stuck in their homes with zero savings, and the other half, on average, have about 60,000 in retirement savings, which is, of course, jack. They’ll be working until the end, and, if they lose their jobs, they’ll be fighting of the foreclosure for years. With the kids in the basement.

Gar,

i think you are right and the one thing Mike is overlooking is how many houses the boomers have, i have a friend who owns 5 (almost all the boomers i know have at least 2) and he’s getting ready to pull the trigger this summer, he’s seen the writing on the all and “it’s time to bail on housing in California”

Garrusoverload: >> What happens when the largest generation alive tries to sell their homes all at the same time? <<

I agree with Mike M. It ain't gonna happen. Instead, desirable California properties will mostly remain "in the family."

In my Santa Monica condo building, I had these elderly neighbors who'd bought their condo in the 1970s. (According to my Zillow/Trulia research of the various units in my building.) They lived there until their died about 10 years ago, in their 80s. They left their condo to their Xer grandkid, who now lives there with spouse and 3 kids — who still only pay 1970s level property taxes on it, since it's a family transfer.

Another condo on my floor, an old woman died in the 1990s and left it to her daughter who still lives there, now in her 60s. Again, no increase in property tax due to it being a family transfer.

Another woman on my floor, an Xer, tried to sell her condo in 2007 but couldn't find anyone to met her price. She's since married and moved out, but has held onto the condo and rents it out, on and off.

Lots of property owners are not selling here in desirable Santa Monica, even when they marry, move, or die. Instead, it's kept in the family.

So I don't see any great impending sell-off in desirable coastal areas. Instead, the golden handcuffs are transferred to younger heirs.

mumbo_jumbo seems to be under the mistaken impression that all boomers have 2 or more houses? My husband and I barely managed to keep our one house in Garden Grove during the great recession after my husband lost his job in 2009. He has since found another job (at much lower pay) and fortunately we were able to refinance our home to be able to keep it. My elderly mother moved in with us after my father passed away. She was living on social security and could no longer afford her rental apartment in Laguna Woods. Our son has been living with us after he graduated from Cal State Fullerton last year with a degree in psychology. He works about 20 hours a week as a barista at Starbucks and he has been unable to find a full time job yet. Our daughter also lives with us while she attends Cal State Long Beach. She works part-time at a store at The Block in Orange. We have very little in retirement savings which we had to spend it down during my husband’s job loss. My husband’s company cut out his healthcare benefits this year and gave him to $3,000 to find insurance on the Covered California health exchange. We found a lousy health insurance policy with high premiums, high co-pays, and high deductibles–hopefully none of us will get sick! We may never be able to retire! I know that there are many other middle class families in our situation. God help us all!

This is interesting:

http://www.foxandhoundsdaily.com/2014/01/market-closing-prop-13-commercial-property-tax-gap/

Basically, it says that only 13% of CA residences still enjoy a property tax level that was capped back in 1978 when Prop 13 became law.

To me that means two things:

A. This 13% population is mostly comprised of the “golden handcuff” population that DRHB alludes to, e.g. coastal middle classers who couldn’t re-purchase their home nowadays. (But note the Prop 13 % drop in the article…clearly a lot are indeed moving.)

B. California is not suffering from a tax revenue shortfall due to Prop 13. It is a myth. 87% of residences “enjoy” far worse tax treatment than the pre-1978 crowd. So, the hope that reforming Prop. 13 to balance pension issues and education and whatever else to make California more attractive to the middle class is misguided.

@mumbo_jumbo

mumbo, you’re living in a bubble. Five houses? Hey, two houses? Free and clear? Highly doubtful for most. The Boomers, in general, have no real assets, and plenty of debt. As I said, if they were going to cash in their “forced savings” from their real estate, you would see that happening on a grand scale, because they started turning 65 on 01/01/11 at the rate of 10,000 a day. Where is this grand sell off?

‘Its not your fault. Dammit, Blue was old. That’s what old people do. They die.’ Jim Taylor should know that movie quote. Anyway, not trying to be a jerk. Unfortunately we all die and that’s when many houses will be sold (KR had some great stats on the real nums behind prop 13 and not just anticdotal stories like ‘EVERYONE on a block besides these 5 new rich couple or foreigners is sitting pretty with 1970s property taxes’). Isn’t there like 70-80 million boomers? Not sure how many homes they own (even if its half a house each that’s a lot of houses), but there still only 365 days in a year. Some may sell bc they want to, some may need to sell for money, some may die and the kids sell. Regardless, it may not be tomorrow or 2015, but soon enough thems a lotta houses coming through the pipeline. Btw, in terms of boomers wealth, there is no need to be so anticdotal there too. There’s tons of stats online (of course read each stat with whatever grain of salt you choose):

http://www.immersionactive.com/resources/50-plus-facts-and-fiction/

The 13% number of people who still benefit from 1978 pre Prop 13 tax rates is a little misleading. What about the buyers from 1980s, 1990s and early 2000s? What percent do they make up? These are all people who are greatly benefitting (some more than others) from Prop 13. Then the argument goes deeper, people will hold onto houses much tighter in the desirable areas. Anybody who doesn’t think this somehow affects housing prices in certain areas of CA doesn’t get it.

@FTB

Not sure what you’re getting at with that marketeers list of facts, but maybe you missed one near the bottom:

“Only 1 in 3 adults in their 50’s have attempted to create a retirement plan (Lusardi & Mitchell).”

The rest is kinda sad, in a way, because the rest of the bullet points attempt to emphasize that the Boomers are the wealthiest of us all, but, really, what does that say for the younger people when you hold a generation (of which I’ a charter member) on a pedestal, and they have no basis for such praise. Here:

http://www.economicpolicyresearch.org/guaranteeing-retirement-income/528-retirement-account-balances-by-income-even-the-highest-earners-dont-have-enough.html

Half of all Boomers have no savings at all. No net worth, if they are underwater on their home. If they occupy a home.

“Individuals with incomes over $52,201 per year have more in their retirement accounts, but their balances are not high. Their average retirement account balance for this income group is $105,012. Because only a few people have very high balances, the median balance is much lower; 50 percent of people ages 50-64 in the top 25 percent of the income distribution have retirement account balances of only $52,000.”

That’s not going far. Unless they can sell the house, which is proving to be very difficult these days, and trade down to something much cheaper, or, find a cheap rental in the sticks (yeah, right), they can’t monetize their “forced savings” of home equity. That is, if they aren’t paying a HELOC from monetizing that equity, oh, back in ’04.

Mike M-I wasnt trying to make any specific point with those facts other than to toss them out as a starting point, rather than just the back n forth of individual tales/myopic viewpoints. I said take the stats with a grain of salt as its hard to even verify them nor did I do any further research. I’m not saying its all golden wheelchairs and silk adult diapers. Not even close. I agree with you that tons and tons of boomers are going to struggle mightily. Keep in mind thats with all the RELATIVE advantages of “timing”/size/war/job market/costs of energy, college, housing/social security/healthcare/etc, etc, etc….BUT, guess what, as I just said, its all relative. The generations after you have it worse. How do you think we’re going to do in retirement if you think you have it so bad? Take a hunch on which way the nums are trending. None good. You seem like a nice, normal guy, but I think you tend to be myopic, IMO.

“The 13% number of people who still benefit from 1978 pre Prop 13 tax rates is a little misleading. What about the buyers from 1980s, 1990s and early 2000s? What percent do they make up? These are all people who are greatly benefitting (some more than others) from Prop 13. Then the argument goes deeper, people will hold onto houses much tighter in the desirable areas. Anybody who doesn’t think this somehow affects housing prices in certain areas of CA doesn’t get it.”

—LordB-I was thinking about that too. I believe they are misleading as you stated. Hard to say what they really are. that being said, there is a lot of talk on here where one would be led to believe the numbers are much much higher than they are. It really is impossible to track as i know people who had their home reappraised down during bubble 1.0 and I doubt the home has been reappraised all the way back up since then. The point is how many people are truly golden handcuffed/meaning super low relative taxes to market (not just a 10-40% discount-remember they are still capped at the end of then day for even new buyers). I doubt anyone knows that for sure.

@FTB

Well, I’m going to do pretty well, mainly because I didn’t get all of my money sucked into the RE ponzi scheme of the past twenty years, out of dumb luck more than anything. Well, I am also lucky enough to have a small pension, too. You’re right, though, The Boomers are going to have it better than younger people, which, as I said, is really sad, because I don’t even want to think what the “retirement crisis” will be like in twenty to thirty years. You’re about to witness senior poverty on a massive level for years to come.

Those houses are already reverse-mortgaged to the banks…. Upon death the banks will promptly repossess them.

Gar is fairly right.

The boomers represent a big bump up in the population around a certain time period. Look at the Calculated Risk animation below carefully:

http://www.calculatedriskblog.com/2013/08/us-population-distribution-by-age-1900.html

I don’t have the citation, sorry, but around 7% of 65 year olds move per year and that number goes to greater than 50% per year at age 85 from their primary home. “Move” can be a euphemism for many different things!

Combining that data, there will be an unusually high bump up of selling off SFH’s as boomer “retire” and downsize.

>The bad is that we may have to house our parents.

I was very quick to start, but my parents nonetheless housed me for 18 years, and that was over 30 years ago. I owe them. I’ll always owe them.

FWIW, at least luxury cars are still within reach. I know too many households where young adults living with their parents, attending some sort of community college or cal state and working at McD’s or some other retail store driving brand new BMW and Mercedes. World’s smallest violin…

I love the story from the M-B dealer about the woman who came into the dealership with $300/month left in her budget, and she needed something–anything–wi a three-pointed star. Yes, such an exclusive brand nowadays…

That anecdote lends some credence to Doc’s point that younger folks are tending to value mobility more.

And that doesn’t bode well for the future outlook of housing market demand.

Nice article. I took my first “professional” job in ’94 and it was tough to find that first entry level position. Seems like it’s a heck of a lot worse now.

I sure hope some future politicians step up and do things to get the economy in better shape. From my perspective that means innovation, invention, manufacturing, and less offshoring…. Even though I’m in Silicon Valley I just don’t see enough of it happening.

Where are the good/decent paying jobs being created? The oil fields in North Dakota and financial/banker/investment jobs are about the only things that come to mind.

Very interesting. One of the best and brightest former SoCal kids I know who’ll be graduating with a finance degree from an Ivy League school soon recently told me he plans on starting his career in North Dakota or North Carolina. I was surprised; back in the day he probably would have headed LA or NY. Go figure.

That’s very anecdotal. These days in my profession it’s not unusual to see kids straight out of college and not uncommonly straight out of high school and land $60k to 100k jobs in large quantities. That could not have been done at anytime prior to 2000.

LOL and then you reply with something That’s very anecdotal….too funny

Sigma: What kinds of jobs are paying high school grads $60-100K? Is part of that pay for dangerous conditions?

Yes, my points were anecdotal as I was speaking from personal experience. But I really don’t see job creation happening other than in tech/financial hubs like SF, San Jose, or NYC. The only new high paying job that I had heard of recently that didn’t fit this description is a geologist that splits his time between being onsite in the oil fields and working from home. He had a few years of experience and makes 150k/yr.

It’s just completely baffling to me that our government doesn’t do more to spur/support innovation and keep manufacturing here.

” it’s not unusual to see kids straight out of college and not uncommonly straight out of high school and land $60k to 100k jobs”

Football season is over but I’m throwing the B.S. flag on this quote

“These days in my profession it’s not unusual to see kids straight out of college and not uncommonly straight out of high school and land $60k to 100k jobs in large quantities. That could not have been done at anytime prior to 2000.”

I can’t be the only one curious about a profession where it’s not uncommon that large quantities of kids right out of high school/college land 60K-100K jobs, and it couldn’t be done prior to 2000! What is it, Sigma?

i’m guessing Sigma is talking about jobs requiring programming skills (i.e., mobile apps, data jujitsu, etc.). with the right intellect and dedication, one can pick up these skills for very cheap. though, not everyone can be good at it. also, the jobs requiring these skills could care less about college degrees as long as you can show a high skill level, which isn’t hard to do via all the social media tools available to market oneself.

In IT I see tons of straight out of college making over $100k and straight out of high school making over $60k in abundance as well as shale oil N.Dakota and similar areas.

“In IT I see tons of straight out of college making over $100k and straight out of high school making over $60k in abundance”.

Hmmm. Tons? Really? Great! However, I’d bet for every IT “kid” hired at those salaries there’s an age 40+ “IT adult” laid off who now does contract work for 1/2 their previous salary, is “semi-retired”, or has taken a sub$15/hr job to make ends meet. Perhaps it all balances out? 🙂

@Sigma wrote: “…In IT I see tons of straight out of college making over $100k …”

You are describing the Bay Area. The Bay Area is its own micro bubble. $100K in the Bay Area is equivalent to $70K in the L.A. metro area, and about $80K in Orange County. That is why all the SF area technology giants have been opening offices in Los Angeles and Orange County because the salary structure in the Bay Area is completely whacked.

Doctor Housing Bubble,

I have already made my case that nothing has changed since the crash in 2008. Debt to GDP is still historically very high (higher than the peak in 1929). Worker participation is still at the same level as it was after the crash of 2008. GDP growth has been anemic at best. Nothing has improved economically.

I assume that you believe in asset bubbles given the name of your Blog. It is my understanding that the nature of asset bubbles requires that the bubble continues to grow in order to sustain. The useful value of the underlying asset is exceeded by definition in an asset bubble. I believe that it would take continued growth to continue the bubble because “investors†will only be willing to take on new “investments†if there is a perception of continued future growth (aka greater fools). Therefor I believe that a prediction that we will “level out†is the least viable prediction. But most are predicting that we will see very modest growth (2% – 6%) for 2014. I would argue that we would need to be in double digit growth to sustain the current bubble over any period of time. I am not convinced that there is any historic evidence of an asset bubble forming then sustaining at a fixed level for a full year. This is why I disagree with most predictions that do not take asset bubble dynamics under consideration.

I’m not sure what to call it. In my area many of the newer houses are bought for with cash from foreigners. The title closing lady said many are young kids (from China, Russia, Iran and Nigeria) who have multimillion dollar bank accounts from money transferred to them by their parents with instructions to buy houses. It’s hard to believe but that jives with many of the articles I’ve read a bout foreign money flooding into this country and also has been written about extensively on blogs like zero hedge. So I guess if that is true, and if you live in a desirable area for these foreigners house prices will stay high until something stops the flow of cash.

You know what is the best part of history repeating itself? You can predict the future!

well. I’m in this situation, I’m 32 years old. Not really young adult anymore, but I this whole housing situation just turns my stomach sick, and I am in a better position than those friends I went to college with: some divorced, unemployed, underemployed and the such. I’m in San Jose, I made 81K this year, usually 75 ish. I know this is peanuts here. I’d like to find a house away from SJ within 35-40 mile commute. I hate San Jose urrr.

I’d like to get marry at this point of my life, and start a family. My girlfriend is younger and in cooking school (that’s what she likes,) will have small student loan, but she won’t make much money.

I am depressed. Here I am with a 78K job and about 80K in savings living in a $1200 ghetto tiny apt. when I mean ghetto is for real, I open the window and smell drugs, look out the window and I see, prostitutes, gangbangers, transvestites…. *sigh* If I want something decent for a family 1bd is $1800

I have friends who have no savings, and student loans, way worse off than me. What about those young kids in college who will graduate with student loans, then they have to spend 50% of income in rent… how will they save to buy home or start family???

Jimmy, you really need to consider moving out of that area. Like you said, 80K salary in that part of CA really is peanuts. For some of these areas with very limited supply and high demand, it’s almost futile competing with old money, new money, foreign money, two six figure DINKs, people who will lever themselves to the hilt, etc. Sounds like your life would be an order of magnitude better in another city or state.

You speak like a troll “I open the window and smell drugs, look out the window and I see, prostitutes, gangbangers, transvestites…. *sigh*”

But I’ll give the benefit of the doubt. $80k is basically “minimum wage” if you think about it. I used to make that. It’s enough to pay rent, buy food, have a car note, and stash some $ in a 401k. Go shopping and out to eat a few times a month, and that’s about it. Now imagine youy get married, and your girl also makes $80k. That’s $160k a year, times 3 (for mortgage underwriting) and you have $480k. Now you know why so many average homes cost $480k, because there is no shortage of that income in coastal Cali. Anything less goes inland.

Although I do believe inland homes are 15% over valued.

You could not buy anything in San Jose or Bay area in general for $480k. Maybe Rancho Cucamonga or Fontana.

excuse me Mr… Don’t call me a troll. I read this blog often, I just don’t post all the time. you may not be familiar with San Jose, but try living downtown by the 280… and it is indeed pretty ghetto.

I’m OK with it, if I save money i can sacrifice for a while. in 6-8 months I should have close to 100K in savings. If I keep brown bagging to work and keep downloading movies instead of actually going to the movies and dinner. *gulp.

Well, leaving is HARD as family and long time friends are in santa cruz county. some are content working and renting apartments or living in trailers.. aka Manufacture homes… I am not… I’ll probably move to Dallas or Houston once married and +1 or +2…

x-3?

nothing is underwritten at x-3 anymore….thats 80’s talk….try 8X

I live in San Francisco, avg 1 bdrm apt. is $2400.00, I have tons of equity on my flat and I know it’s fake….hot money is the key here…hot money easily catches fire and when it does, you will cry to mommy it will hit so fast…get real

Calling the guy a troll based off his comments seems pretty is harsh for someone whom doesn’t know where he lives….well I do and I can tell you this bubble is funny money and nothing more….San Jose has turned into a shit hole….no different than East L. A. with possibly more murders…

Jimmy,

It’s time to just face the reality that anywhere within a 50 mile radius of the Peninsula is simply no longer liveable on a middle class income. It’s also an ever higher density traffic hellhole, so you should just rip the bandaid off and realize your future lies elsewhere.

The good news is that time is on your side. With a good current job you’re in a much better position to seek employment elsewhere than your underemployed peers. Furthermore your girlfriend’s field of cooking is one that can lead to employment almost anywhere. So begin the planning process now. Start looking seriously at other parts of the country where your skills can be used. Even if it takes a year or two it just means you’ll be saving up more to buy a place in the decent part of the country you move to. Don’t despair – just don’t waste your energy planning for a non-existent future in the Bay Area.

I agree; I was going to make a similar point. Do you really see yourself still in the Valley in ten years? Five years? Do it for now, get your reputation and skills and experience up, and then move somewhere else. I worked five years in the Valley and then got a sweet job with a tech. company down in San Diego because I had the track record and relationships to back things up. (I left San Diego since then because of the very same reasons you see in DRHB’s post above…now I live in Florida and own a great home that cost me 2x annual income.)

So don’t be depressed. Sounds like you have a great gal and a promising future. The 280/680/880 all get old and you’ll want to move along with your life at some point. You don’t want to live in Santa Cruz and commute the 17, either. So start traveling and see what you like outside of the Valley.

JIMMY How long of commuter are you willing to make because there is actually a fairly nice still relatively affordable place. I tell people it’s hot and horrible but truthfully the home of the Haybalers has cooler temps and is a pretty nice place to live. I do think the hour commute can be rough on families though. There isn’t really a beach but there are plenty of bikers! Lol

Ann, I could deal with a 35-40 mile commute to the south. I would never go to the east bay, that is nuts. I used to commute on the 17 back in the 2005-2008 pre- recession since my job is by the SJ airport. If you’re talking about a hot place with bikers I think I know what you’re talking about. I’m not sure I want to be there, it’d be the last resource 😉

Jimmy – I live in south Santa Cruz County and work next to SJC. The commute is not that bad if you have flexible enough work hours. I get in early and leave early and take the back way home when traffic on 17, the fishhook or 1 is bad. I only go into the office 3 days a week now a days but the commute is not that bad. I lost my carpool buddy so if you move you will have a carpool buddy! 🙂

Jimmy,

I don’t think I’m giving away any big secret that Ann’s talking about Hollister – a solid 50+ miles south of SJC (and last I looked the 101 south of San Jose looks like a parking lot during commute hours). If that works for you have at it, but I wouldn’t opt for that commute while I was still young enough to have a choice.

PS. My favorite Hollister image is Brando in The Wild One, when asked what he was rebelling against saying through his best sneer of bored disdain: “What’ya got?”

@ What? – At the top of the market in 2006-2007 and used to commute and it wasn’t bad. I worked 10 to 7, so it was great after rush hours. I’d would be OK living anywhere from 41st to Buena Vista and commute again. I’m assuming your around there. If could only convince my employer to do 4 day weeks it’d be a done deal. I’d rather live in a townhome down there than in a crap house in SJ…!

@ apolitical scientist, of course its not secret. I just don’t want to piss anybody off, some people here are a bit sensitive… Hollister is No, No. It’s a damn bottle neck there, like no other! narrow and awful. I know some guy whose wife said “we either move or divorce” she was working in Palo Alto and living there. They rent up there now.

good luck with an hour from hollister…might as well head to Los Banos…

so much hopium in here I think were close to a top….

everyone who thinks you make 100K is really making a 100K is plum is crazy…thxis is Calif. 9% tax, income tax, property tax, registration tax, local tax and the big kahuna..

get real

Go East, young man.

I’ve long sensed that the sort of desperation exhibited by Jimmy is motivating young and capable talent to leave California. That’s a looming threat to the status quo by which many landed Californians are relying on to maintain their preferred positions.

I’m a boomer, born in 1959, the year that Cadillac made that car with the giant fins 🙂

My friend has 3 children and perhaps their situation sums up many young Amerikans these days:

the 26 year old has floundered through many years of junior college and is now a Journalism major at Humbolt University, wants to graduate and live and teach in Japan. He has saved money from jobs and has no loans but little money to spend.

The 23 year old has college education, he is the head chef at a hip restaurant in Downtown LA. Shocking how little $ a head chef makes these days, perhaps due to all the Hispanics working their way up in the restaurant industry. He rents a house with his girlfriend and another couple – a 3 bedroom house in the barrio in Pasadena for $1500 per month.

The 22 year old, she graduates this year with full scholarship degree in nursing and expects to make $75K. she has no debt and expects to move back home with mommie (in LA) to save money.

When I graduated college with an engineering degree in 1987, I made $25K per year and it took me 6 weeks to find a good job (which was considered a long time in 1987).

Now I am part owner of a small engineering consulting firm here in LA. I am truly worried about todays young ones, and esp. my nephews who are 8 and 11 years old. What kind of world and what kind if LA will they grow up in?

Sounds like the 22 yr old nurse has her act together. Living at home for a few years after graduation sure isn’t glamourous but will pay off financially. If she can be disciplined and save money for a few ears, she’ll be better off than 99% of her cohorts. She’ll likely be owning her own place in her mid to late 20s…that’s pretty good for LA standards.

It’s very difficult for anyone except the most exceptional people under 35 to buy a home. Student loan debt is not the only issue. The “tech payments” absorb disposable income, but tell a youngster they don’t need the $100 data plan, and $100 home tv/net plan. These have become as common as the electric bill to most.

According to CBS news earlier this year, 48% of children are born out of wedlock. This makes it hard for the parents to save money for a home.

And we just plain live in a credit based, entertainment driven, “have fun” society. With the beach, Westside, and Pasadena all screaming at you with glittery lights to come spend money, who is saving? The proof is in the pudding…not many.

I’m not saying it’s not possible, and that conservative and responsible people are not doing it, but for the majority this is the new Amerika. That or like another guy I know, with his wife, 2 kids, and pets. He “loves his house” but sheesh, the kind of stress and complaints he always throws out makes one scratch their head…

Oh c’mon now, Papa, let’s not pretend the young and their irresponsible tv and cell data plans are the only irresponsible spenders. Need I remind you just last year you were self admittedly up to your ears in debt and your family had to bail you out. Just keep it real.

That is real. And as for me, I made a mistake, learned from it, and moved on. There is nothing wrong with family help, in fact it’s practically required to move up in this world. Everyone I know that has something, began with a “boost” from family. Be it a trust, inheritance, large down payment, or even living at home for free for a few years. Something to help out. And that was mine.

I am now a poster child for fiscal conservatism and this board. I paid over 50% of my debt off myself (the rest was the family), have an 800 FICO, a home @ 2.5X income, and do a budget every month. Life is good and not too hard, it could be a lot worse.

Cool, Papa. I’m glad to hear you’re doing well now.

OK, I call “Market Top” for housing:

http://blogs.marketwatch.com/capitolreport/2014/01/07/home-prices-seen-finishing-2013-with-fastest-growth-in-eight-years/

If household formation is so low, and the young people are living with parents, then Mom and Dad can’t realistically downsize until JR moves out.

Yet another reason why sellers aren’t selling, and inventory remains low.

The obvious short is real estate brokerages…

Turnover in real estate assets is destined to crater.

…

Plan B: Prop 13 lid is handed down to progeny — and the parents stay on with their kin taking care of them in their declining years.

Unlike North-easterners, Californians have no need to sell and get to a better climate.

In retirement, the brutal Californian tax code passes over the heads of most.

Municipal bonds and Social Security payments are not taxed. The pitiful dividends and interest received end up low on the graduated income tax return. Prop 13 puts a lid on damage. Their kid saves them a boodle in home nursing expenses, runs all of the errands, repairs the home and yard….

So the family sits pat.

This gambit is not favored in the Dakotas. The winters are just too severe, so it’s off to Phoenix, Arizona. (It would be a good thing if fracking made them rich.)

Blert, circling back on our previous debate…this article from zerohedge best describes what is happening now. They call it monetary tectonics, not hyperinflation.

http://www.zerohedge.com/news/2014-01-09/inflation-vs-deflation-%E2%80%93-ultimate-chartbook-monetary-tectonics

I agree many middle aged boomers are moving in with their aging parents, many with their own children in tow, to care for said parents as their care needs become greater. It can be good for all…parents get caregivers, adult kids (many with little/no savings, job loss, divorce etc.) can live in a nice neighborhood, continue on in California. And hopefully family love is the best benefit of all.

However, once the parent passes, I’m doubtful many of these middle aged “kids” will be able to keep the parents house, even with Prop. 13 tax advantages. Many have little cash, the property often has much deferred maintenance they can’t afford, and sometimes there is a sibling also inheriting that doesn’t want “sister” or “brother” living in Mom/Dad’s house (often with their grown kids) not paying rent, no exit plan. Then attorneys sometimes get hired…and so on…

Housing To Tank Hard in 2014!

How about bond fund market to tank 2014 and beyond?

CA is still a nice place to live. Boomers with enough equity get a reverse mortgage and have money and a decent place to live until the very end.

Will they have a nice place to live?

If the SoCal environment becomes more akin to a two class system, as it appears it might, what impact will that have on quality of life for everyone within its confines? Who will the State levy in order maintain the currently known quality of infrastructure and services, the majority poor?

Bottom line is this is a really messed up real estate market. From the causes behind it like QE, to the percent investors and/or cash buyers, to the foreign money, etc. All unnatural forces piled on top of an already bloated and unnatural and unsustainable real estate market that was never allowed to naturally correct. Its a heaping pile of horse sht topped with dog sht and now its sold as grade a fertilizer.

On the pro housing side, at least when we read statistics of underwater borrowers, I would think they aren’t including selling costs and could be missing a decent number of ‘underwater’ borrowers who need the houses to go even higher in value before they sell. If selling costs are included than ignore this paragraph.

On a sidenote, I think I jinxed myself here talking about Ocare. I just got a letter today from Aetna that my plan is not compliant with the ACA and is being cancelled. My hunch is my new options won’t be a new, better plan at the same or lower costs with the same or more doctors with the same or shorter lines. Oh well. Cest la vie.

My observation here …Scottsdale is full of $20k’year “millionaires” still living with their

parents. I see them at the grocery stores/

I work with a woman who lives at home with mommy and daddy. She is 35 yo. Her bum loser boyfriend moved in for a few years there too but he up and left a few years ago. I take it the whole situation was too weird, even for him.

So this woman earns about 40% more than I do, even though she has no further education or training, has just been promoted due to longevity in the company. She has worked there 16 years. She has never lived out of home. She pays no rent or board or utilities.

AND SHE IS DEAD BROKE. She doesn’t have a penny saved. She has no retirement savings. She is in DEBT and she states her credit sucks. On a six figure income.

She doesn’t give a damn about saving or planning because she is an only child and mommy and daddy have promised her she will get everything (modest house) if she never leaves home. By the sounds of it her parents are a bit whacko. She doesn’t have any friends. Only that one boyfriend and nobody since. She never goes out. Has no social life.

She spends every weekend shopping for clothes and useless junk. She has a basement full of brand new clothes with tags still on them.

In her case why scrimp and save and plan and work hard if its all going to be handed to you on a platter anyway?

Calgirl, I feel very deeply for the young woman you described here. This woman’s parents RUINED her- they have no doubt encouraged her bad money management and have waved a big carrot in front her- their house- to induce her to stay and be their little girls forever.

She knows what she is missing out on, trust me on that. But she has been so robbed of her self-confidence and courage by parents who spoil her by indulging her, while, no doubt, painting a very ugly picture of the world outside her door. I’d like to be a fly on the wall in the house- I’ll bet that every time she displays the least bit of independence or will, they remind her of her past mistakes and how bad her age-mates have it economically. Her lack of self-esteem is manifest in her compulsive shopping and hoarding- these are not the behaviors of a happy person.

Be glad you are not her.

blaming it on the parents is bs… Do you think her parents whip her because she didn’t buy some shit this weekend….

she is one with the material world…its common…

You’re looking at the face of mental illness.

And a very lonely, frustrated woman, who’s no longer even visible to men.

America has a sea of such women.

blert, judging by your writing style, it’s not much of a surprise that when looking at your face, it’s is one of mental illness.

What can be said? Corporations are greedy, the rich get richer, and the tax codes r ridiculous.

Too many chiefs, not enough Indians at companies today.

I got word that my store might be closing, along with 40+ other stores. Sooo

what do we do during this time? Why lets spend money on flying these managers out to New York to discuss the current situation.

$1800 round trip flights for 80+ managers & their assistants, plus 6 night hotel stay ($285 a night) plus food and travel and meeting accommodations.

These meetings are a slap in the face to us, because we’re all aware that these meetings r one big circle jerk to stroke the ego’s of the corporate brass. All it serves for us is a reminder that we’re just a drop in the bucket and a write off.

I don’t know what the solution is to the pan caking of the middle class but how long can this continue at the status quo?

If you’re employed by a public company… buy puts/ sell calls… go short.

You make it sound like you’re working for JC Penny or Sears.

In which case, my first advice is too late.

Tragically, it’s often the case that such confabs are conducted to find out which veteran can work with another — in a downsized scheme that’s going to be introduced PBQ. The hope of top management being that enough of the faithful will fall on their swords and retire — so that the blood-letting doesn’t have to be epic.

Not uncommonly, the s t r e t c h meeting is scheduled so that an outplacement firm can lock down positions for whomever — saving the corporation brutal severance payments. Don’t be too surprised to find out that THIS is the primary motivation of the excessively large confab. Don’t be too surprised to find out that those attending are either right at the retirement door — or are in a position to demand maximum exit payouts. It’s then all about terminal cash flow. The actual expense of the big meet is a pittance compared to what’s afoot.

As for yourself, by the time it’s at this stage, the end is neigh. Believe it. This is the ‘tell’ for an epic ‘downsizing’ of the labor force.

Top management is NOT requesting a brain-storming session — just go with me on that.

My guess is Macy’s.

In any case, I recommend to anyone under 50 without a trust fund in tow to consider an exit from Southern California. No matter how “affordable” housing is made, you still have several key economic hangovers that have dramatically changed the trajectory of the state since the 1960s/70s/80s:

* Environmental regs. California has always been eco-conscious (not bad) but now it is at too great an expense of manufacturing. The greens think the only kind of economic activity should be web- or film-based, apparently. To wit: remember Marineland? That great place that awoke our environmental sensibilities and led us to save the whales? Nowadays, it would be thrown under the bus a la Blackfish. What was liberal once is now unacceptably conservative.

* Pension Debt. The CalPERS, CalSTRS, et al, pension obligations are ticking time bombs with real ramifications. Any way you look at it, the taxpayer will be the loser, either in terms of services or tax rates.

* Redistribution. The State of California is here to ensure everyone enjoys “fairness,” and increasingly, that means equal outcomes for all. Look for this pattern to continue across education, healthcare, taxation, etc…

If you really love blue state culture, then go to Austin or some other blue city in a red state. But these fiscal pipe dreams are completely unsustainable when you have a population that has the ability to remove itself from those who govern it, i.e. move.

You are right, u can’t escape uncle Barry, but you can escape uncle Jerry.

There is little reason for the working affluent to stay here. If you are earning between $100,000K and $500,000K a year, you are taking it in the shorts. You are not rich enough to be able to afford the extra taxes, rent/housing and tuition for private school. Yet, you are not poor enough for all the handouts this state has to give.

This is going to lead to a brain drain in the state. I am afraid CA is going to become a second world nation. Once the economy picks up for real in a few years, there will be little to keep the young, relatively affluent and talented here. I suspect tech companies will continue to branch out of silicon valley as well.

My Wife’s family kept the mineral rights to the old family farms in North Dakota. They got 12 grand for allowing exploration (one guy held out for more so they passed him by). No oil or gas was found, so there isn’t going to be a big payday. Too far from Williston, I guess. My Brother moved to Fargo for a tech job with an agriculture twist. Makes pretty good $$, but on this blog, the 80K-120K jobs like his are disdained. That is the more typical job pay available to good skilled technical workers like me. We had to keep a tight budget, but over time, we paid our debts and can now live pretty well on that kind of money. I like my North OC neighborhood, but it isn’t a rich neighborhood like say, Villa Park. My Daughter owns a home nearby as I’ve mentioned. I don’t know if I’m one of the “braggarts” that get slammed here occasionally. I just have a nice life here, and my Daughter and her Husband have laid a foundation for a good life for their family with a house payment they can meet on one salary. She may go back to her Government job next fall when the youngest baby is 2. They took a risk getting out of the town house and into a larger, older single family house with no Mello Roos, but so far it has paid off very well. With a conventional loan and Prop 13 taxes, they know their cost of housing for the next few years. Take a look at the areas in North Orange Co. off the 57, the 22, the 55 and the 91 and you might find something you’d like. If you are committed to living somewhere long term, the market timing gets less important. Affordability based on payments is very important. If you get less house than you could absolutely afford, you may be better able to move up if you can save more cash and use the appreciation (if any) to get a better place after 5 to 10 years.

Leaving the United States and coming to China opened my eyes in a lot of ways. Not only did it show me another place with a horribly inflated, out of control housing market (rental in Beijing is beyond the means of most people) but it gave me an opportunity to see a little bit of what this ‘adult life’ I keep hearing about it. It’s only here that I managed to find a professional job that feels dignified and pays enough that I can even save a little bit of money.

The third point that people my age (26) don’t have enough money, have low salaries, and massive debt is often overlooked because the elderly people running the economy (violently into the ground over and over again) basically don’t give a crap about young people. To them we’re either cheap labor to be used, suckers to sponge student loans off of, or ungrateful and lazy. I’ve heard it over and over again from my elders, which was definitely one reason I decided I was done with America. The US has largely failed young people, turning us into a means by which wealthy baby boomers will grow wealthier and die comfortably. We will largely be consigned to low paying jobs and shackled with debt we were told to take on over and over again by our parents’ generation, who will proceed to tell us how worthless we are.

If you’re young and reading this do yourself a favor and leave the United States. It is not a land of social mobility or advancement, it is a place where you get royally screwed trying to take a shot at a basic life. It’s a place where you can get sent to debtor’s prison, even though this is illegal, where loan sharks will endlessly hound you for a portion of your measly $1,500 a month if you’re lucky enough to have a job. Friends? Family? Yeah, okay, stay with your friends, stay with your family, and be poor. Be brave, leave, start a new life, and have a chance at something better.

There are many parts of the United States where one can afford a decent home on a median salary. On this point, is your beef with the more inflated cyclical areas such as SoCal, or can you honestly generalize the entire country? Is the Beijing housing market very representative of the majority of China?

The bleeding of the young is primarily going to a fantastic slug of illegal immigrants. This effect is most pronounced in the ‘sand’ states: California, Florida, Arizona and Nevada.

The Boomer Generation has NOT yet tapped into the Social Security Trust Fund. That EPIC ramp is only now just beginning. It was never a factor until 2011, as few take SS until 65… and even the retirement age is now shifting up to 66.

No, the funding, the wealth, went to every manner of social goods:

Run-away college entitlements (not for Boomers – just Boomer professors)

Run-away illegals entitlements (breaking the California state budget, BTW: schools, prisons, Medi-Cal — entire prisons are filed to the brim with Mexican nationals — felons)

Run-away feminist entitlements (Title Nine rules for college sports — never mentioned, but epic none-the-less; displacement of men from college — said co-eds to then get advanced educations in hating their suitors, marriage rates cratering; single-motherhood/ bastardy — now through the roof even in all ethnics — how wonderful… sustained out of wealth that should be retained by young men establishing families.)

Yep, that’s where your generation’s money went.

Your plaint against the Boomers will come true very shortly. You’re just Y E A R S too early.

Most of the ‘sins’ of the Boomers are, in fact, sins of the ‘Silent Generation’ — those born from 1926 through 1943. It is THEY who’ve been running the store during the critical legislative years: 1982-2006. Significantly, the Silent Generation produced ZERO presidents. They did utterly dominate the Congress: Ted Kennedy being at the top of the heap. He had more influence than any other single Senator in the 20th Century. b2-22-32 d8-25-09. He was at the heart of all the economic matters laid out above.

This ‘hold-over’ effect from the Silents in the Congress is ENTIRELY due to the fact that it’s an institution that is driven by SENIORITY. This means that the legislative impact of an age cohort is the LAST thing imprinted upon history. The Lion of the Senate goes from the apex of power to the grave — like a Pope.

One can only hope that you keep studying.

And be most wary: the popular media is in the thrall of the delusions of crowds.

For, surely, that’s where you ever came up with the zany nostrum that Boomers caused your misery.

(Will give you full credit for Barry and Bush, though. Yet, both danced to Ted’s tune. Check out the No-Child-Left-Behind statute — it’s Ted’s baby, front to back — Bush loved it. Dittos for Medicare Part D. And Barry became the nominee BECAUSE of Ted.)

(Ted was raised in a weird world where money was no limit. FYI the entire Kennedy clan had a professional money manager/ cashier who gave ALL of the kids check books that drew on a COMMON account. You read that right! They never had to balance their own checks — and they never had a budget to hit. Should Robert F Kennedy need a quick $50,000 all he had to do was write a check. A phone call to the clerk to make sure that funds were in hand would only be a courtesy. (!) The master account usually held big money at all times. Such is the way of living a billionaire lifestyle. (Inflation adjusted, of course — old Joe had $100,000,000+ in the Great Depression!)

Ted took that kind of emotional logic to the Senate — and spent all of his life spending.

Keep him in mind when you look at the Federal budget. His emotional logic is being replicated by Pope Francis even now. Spending other peoples wealth is so emotionally fulfilling, it becomes a compulsion. (See: Shoes of the Fisherman)

Great post–I think you’re gonna get chewed up for telling it straight, but I had never thought about the impact of the Silent Generation. Great observation.

So…the Boomers didn’t rob the bank, they merely drove the getaway car. In my book, they are still guilty.

A prediction of mine back in 2010 for Housing in 2011

Consequences of an unstable market.

The longer term consequences of an unstable residential real estate market may be more serious than just the destruction of individual wealth. The ideal of middle class homeownership may be at stake. The census bureau reported a 7% decline in national rental vacancy rates in 2010, along with an overall decline 0.7% in homeownership rates compared to a year ago. There were fewer “organic†buyers, more renters and more investment buyers in the market in 2010 and I expect this trend to continue into 2011. Are we at the beginning of a sociological movement away from middle class homeownership and towards a cultural split between the investment property landlords and their renters both of whom may have less personal investment in neighborhood security, local schools and shared public facilities compared to primary homeowers?

Now for 2014 Housing Predictions

5. The shift towards renting instead of buying will continue in 2014. Millions of Americans will rent because they can’t qualify for a home mortgage and the days of staying in a delinquent home have pretty much come to an end. At the end of 2013 we had nearly 3 million loans in delinquency. Many these will go the way of foreclosure or a short sale and these would-be owners will become renters. The younger, would-be first time home buyers will face both housing price inflation and the massive amount of student loan debt on the books. While all other household debt can be deleveraged through foreclosures and bankruptcies, there is no escape from student loan debt – and this will eventually take its toll on the housing market by limiting the number of qualified buyers.

http://loganmohtashami.com/2013/12/30/2014-housing-predictions/

A 60 to 90 minute commute in a vanpool is not that bad, and you spend most of your time sleeping. You don’t have the stress of the driving. There are occasional days, like friday before a holiday weekend, you are crawling and it takes 2 hours or more, but those days are rare. PTO them. I don’t see where people get this idea “it’s so stressful on families” and “Oh I couldn’t do that”. Well I couldn’t do your coastal $2500 rent or $3000 mortgage which is slavery.

Papa, everybody has their price. Yours is the $3000/month mortgage. You would have to pay me quite a handsome fee to sit in a van for 3 hours a day…or I could just use that money and buy a place close to work. Many people will choose to do the latter. That’s another reason why housing prices are very high adjacent to the socal job centers.

Papa,

All of us who work in LA make one accommodation or another, and we all tend to justify our choices that would be abhorrent to many others. Some folks live close to work and have high housing costs. Some, like you, vanpool and probably spend 12+ hours away from home every day in work + commuting. Some (like me) work a really early schedule, miss much of the traffic for a faster commute and more time at home, but suffer a messed up sleep schedule.

Pick your poison.

In other words, it’s a shit sandwich no matter how you package it.

according to the republicans if you own a tv and a refrigerator you are well off.

First, we have two Calfornia’s. The Bay Area, and the rest of the state. The Bay Area with the high tec, things are booming. The rest of the state has been left behind and the people of the Bay Area complain about paying most of the taxes to support the slackers outside of “The City”.

Second, multi generational housing is common in Mexico and China. When they come to California, they continue the old ways, as if you have not noticed. There is nothing wrong with continuing our old country ways in California. But we do love all the California government benefits that immigrants receive, it helps to make the mortgage payments and etc. California is truly the “Golden State”.

My advice to all younger families: DO NOT BUY REAL ESTATE. I’m 32 yrs old with a wife and child on the way. I live in the Silicon Valley with a combined income of $160k/yr and I will NOT buy real estate.

Reasons:

1. Mobility. There is no job security anymore. No matter what industry you work for or what level in the company you are, you can be laid off. Seen it too many times in Semi-Conductor and Medical Device industries. You might find another job in a month or it may be five months or longer. Then your commute may go from 20 minutes to over an hour. Live close to where you work and rent, much better quality of life and piece of mind. At most jobs, your duration at the company will only be 2-5 years (at least in the Bay Area). Also, if better opportunities arise, you are mobile and can take advantage of them. Buying a home is a better strategy as you near retirement and don’t require any mobility.

2. Real Estate is a rigged and manipulated market, currently in another bubble. Dr. HB has pointed out how the inventory is artificially low, investors are again speculating, which are driving prices artificially higher. Why put your hard earned savings into the slim pickings now? Patience will pay off.

There are many other reasons, but the top two should be enough. Enjoy your life and don’t let debt slavery degrade your life.

“Patience will pay off.”

You sure about that? My uncle thought so when he decided to not buy at the end of the 88-92 bubble. That was over 20 years ago. 20 years a rent slave with no end in sight!!!

how is he a rent slave, he pays no property taxes, no insurance, no maintenance and he is renting for much less than owning….get real….

come by my flat in san francisco proper and look at the ocean, the city and the GG park

make sure you have a mini for easier parking…don’t get caught by the parking police, the noise-buy earplugs….brings lots of cash and be in good shape as you have 3 flights of stairs to navigate on every costco run….

I own a flat valued at astronomical prices that even I know is bs….get real

Patience alone is not enough. Patience rewards the prepared. The details we have on your uncle’s story are too vague to make anything of it.

“how is he a rent slave?”

Because if he does not buy – ever, he will someday be 85 years old paying god knows what in rent – and trying to do this on a fixed income is indeed slavery. My 60 year old uncle is realizing this now and it has him scared shitless.

Sure some of us will pay cash, but for most of us, its a choice – either 30 years of slavery to a bank or a lifetime of slavery to a landlord.

Narl, using your logic, we can also conclude that anyone who eats is a food slave and anyone who sleeps is a sleep slave.

Shelter is a basic human need that most are not able to receive for nothing else in exchange. Your argument is of the strawman variety.

Joe, I agree that job security is a huge problem. We probably live very close to each other and I too have had many companies (pharma, biotech, IT service providers) go out of business or get bought and shut down while I was employed there.

But those conditions alone don’t mean that it’s best not to buy. I lived in a nice rental home in SoSF for 1 1/2 years. That cost me $50k. If I were to have purchased that home then resold it at the same price, the net cash loss to me would have been about the same. (This is based on a simple financial model, so it’s easy to tear holes in my formula, but it’s mostly accurate.)

So when I moved to Santa Clara, I was pretty sure the job would last at least 2 years so I bought. That will hopefully prove to be a fortuitous decision, but since I haven’t listed and sold this home I can’t know until that happens.

But my spitball estimate was that 2 year’s rent was about the same as the costs to sell a home. So if I think I’ll be living in one spot for 2+ years, I’ll buy.

Plus, if you’re in enough demand and you change companies, your new company may pay your agent’s fees when selling a home. So there are many things to consider beyond the most important guess as to whether home prices will rise or fall in the future.

Don’t be too sure that patience will pay off. As long as the Fed keeps printing $80 billion out of thin air, it’s hard to see hard assets dropping in value. Those $ have to go into something. And yes, neither you nor I have them, but they’re still out there…

And yes, things can go in any number of directions from here, so I am not trying to lecture or state absolutes. Just passing along my opinion and approach.

you never own a house and must expect higher taxes to pay for the bubble and pension obligations that can’t be paid as of today

Amen Brother. Housing to Tank Hard in 2014!

Obama announced that Los Angeles (along with San Antonio, Philadelphia, southeastern Kentucky, and the Choctaw Nation of Oklahoma) would be part of what he called “promise zones.” (aka Wealth Redistribution Zones). “Promise Zones are a new way of doing business,†an administration official said. “They will be led by local community leadership (Black Panthers, La Raza, ACORN, etc) working toward a common goal … supported by the federal government. Participants will get priority for federal grants and help applying from an array of agencies.”

If you like your promise zone, you can keep your promise zone?!

Promise Zones are like districts in The Hunger Games?!

This millennial bought a condo last year and has a 1200/mo mortgage. Going to live in this place for a long time. I can’t really tap the equity anyways with rates that keep going up. But I won’t need to since my mortgage is so damn low. Glad I bought instead of sitting on the sidelines.

If you’re so glad about your decision, why come here to gloat? In other words, you’re full of crap. It’s always suspect when confidence in an unknown outcome is claimed out loud.

“Today I have talked with 2 income households where both are college educated professionals making good incomes and they are struggling to purchase a modest home in a decent neighborhood without throwing most of their net income at the mortgage.”

The issue isn’t just tying up your net income, it’s tying up your net assets – at least assuming you plan to put any significant % down.

I see a lot of people trading equity in one home for equity in another as a way in the door, but most first-time buyers don’t have 10% (much less 20%) in liquid assets to plunk down, at least not without breaking the bank.

If you’re buying with less down, then your talking about a 2nd mortgage/mortgage insurance, and the real monthly ding on your income will be higher than what the teaser figure was. Only $1500/mo!!!!*

*(if you have perfect credit and put 80,000 down, quoted price does not include property taxes or insurance)

Leave a Reply