Financing the Cassandra Effect – People Choose to Ignore Economic Facts Contrary to Their Benefit. MLS in Southern California Going Up? Distress Inventory 3 Times the MLS Data. Big Salaries of Mortgage Brokers Gone.

In recent months we have seen many articles talking about the lack of predictability in big bubbles like the current credit crisis. Some of these authors argue that bubbles are impossible to predict and therefore preparation is futile. This observation is false simply because history is littered by people that have predicted events including the Great Depression. And it is nonsense on the surface because if you see your friend having 20 shots of tequila it is very likely that it will not end pretty even though it is fun in the moment. What makes bubbles seem impossible to predict during the mania is this collective groupthink where the herd dominates most of the conversation drowning out opposing views. We’ve highlighted many homes during the years here in California and the obvious explanation was a bubble was here and it would burst at a certain point. Yet there is little reward for being the messenger of bad news and this was the tragedy of any modern day Cassandra.

I’ve noticed a few people in other articles and blogs talk about how great of a deal they got on a California home. 30, 40, or even 50 percent off the peak price. Yet this discount in itself is meaningless unless we put it into context of the local economy, incomes, and inflation-adjusted home prices for that area. Yet even today, we see the same psychological trappings of those that bought in 2006 and 2007. “Well it has to go up because it went up in 2002, 2003, etc†and this was the basis of prices heading higher. Today, it is more like “I got a home for 30, 40, or even 50 percent off therefore it is a good deal.â€Â But price alone does not tell you everything. If a low price was the measure of value, then Detroit would be the ultimate value play but there is a reason homes that once sold for $100,000 which seemed cheap a decade ago are now going for $1,000 or even $500.

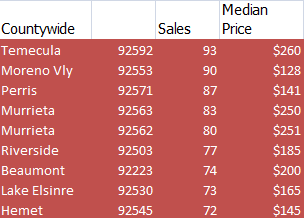

Now why bring this up? We are seeing unique trends in the housing market. For example, there has been a large amount of sale activity in the Inland Empire:

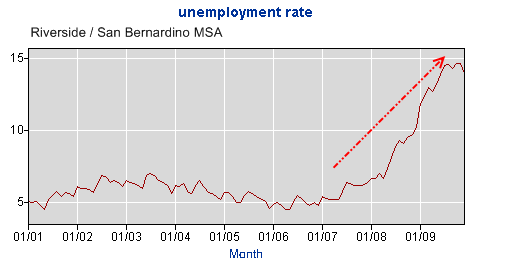

The amount of sales in distressed markets is astounding. From data showing financing on these purchases, we see that many investors are rushing out to buy homes. But are prices making sense even in these areas where prices are down 50 or even 60 percent? It is hard to tell because these local economics are feeling the brunt of the recession. For example the above chart shows some areas in Riverside County part of the Inland Empire. The sales volume above is intense. For example, in the Temecula zip code above 38 home sold in December of 2007. Today that volume is three times that. The Hemet zip code above is running at double the pace. So the volume is there. But take a look at the unemployment rate in the Inland Empire:

Source: BLS

There is a reason for the extraordinarily cheap housing prices when headline unemployment is 14 percent (meaning the underemployment rate is upwards of 25 percent). As an investor it is hard not to be tempted by low prices. But going out there to view the market, you see in some cases, home after home either boarded up or completely uncared for. Many of these communities are dealing with a large surge of Section 8 renters. Just look at how many rentals are available in these areas and you can see that many investors are getting in over their heads. They are only focusing on one side of the equation in price. They are failing to examine the local economy or trends in the area.

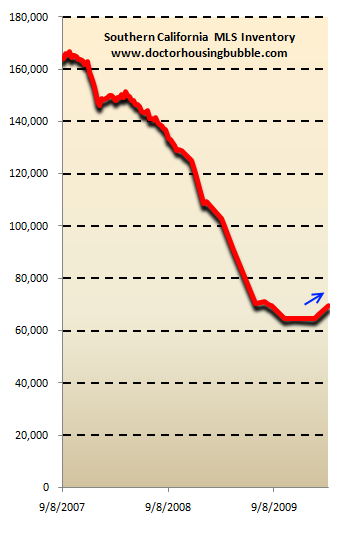

MLS

For the first time in three years of tracking the MLS data have I seen a significant jump in inventory for Southern California. The six counties in Southern California currently have 69,000 homes listed on the MLS. This is up from the low reached in October of 2009 with 64,000 properties listed. Part of this has to do with a large number of short sale properties hitting the list but also, the expiration of HAMP offers for many who simply do not qualify. The housing market has gone from a manic casino to a slow payout slot machine. But only looking at the MLS data is misleading as we already know. We recently found out the massive gimmick Lehman Brothers was using to hide toxic assets. Well the MLS does not tell the entire story.

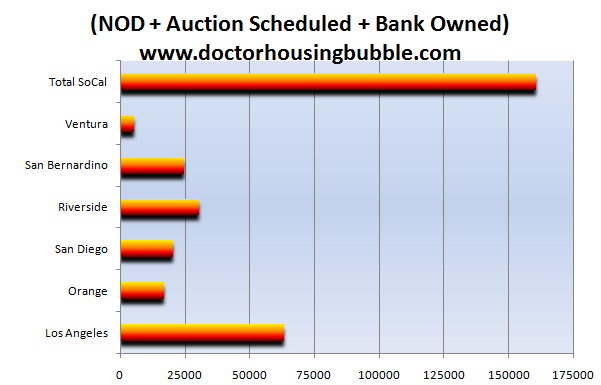

If we look at distress inventory, we find out that it is true that many Southern California communities have a large amount of distress properties:

Source:Â Foreclosure Radar

This is being reflected in the median sale price. The median sale price in Southern California has gone up since it hit a low in January of 2009 of $250,000 for almost a year. However, last month it dipped by $17,500. Part of it has to do with the fact that California has a 12.5 percent unemployment rate. A lot of the housing volume has come from investors. Last month 28.9 percent of all Southern California home purchases were all cash. So either people are looking to flip again or purchase to create rentals. But the rental market is already saturated:

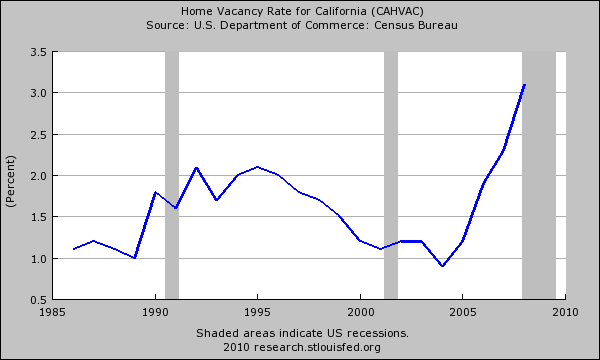

The California vacancy rate is the highest on record. So if these investors plan on turning these units into rentals, by supply and demand prices will be pushed lower so hopefully they are factoring this in. Some are taking solace that there will be no tsunami but in that belief, they assume that there will be no further price corrections. This is one large fallacy going around today. Tsunami, trickle, or any other weather comparison prices will correct in many areas simply because they do not reflect the current market. Did we also mention the massive California budget deficit?

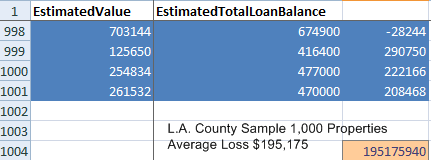

Estimated Balance on Distress Properties

One way to get a sense of how much correcting we have, I dug deeper into the distress data. Take for example the top 1,000 properties in Los Angeles County that are scheduled for auction or bank owned:

These homes haven’t hit the market. A handful are on the MLS but not many. If these homes sell today for the estimated value (unlikely since it is a bit high) we would see an average loss of $195,175. Now this is only a sample of the 63,000 distress properties in Los Angeles County. Banks clearly have this data so they rather take on people that have stopped paying their mortgage then realize that $195,175 loss. But this has a timeframe attached to it. Just look at a couple of the mortgage balances. $470,000 would carry a $3,000 to $4,000 total housing payment depending on the interest rate. The loss on that property is roughly $210,000. So they can hold off for 4 years ($4,000 x 48 months) but this won’t happen. The most I’ve seen has been 18 months from when the NOD was filed. Yet the loss at a certain point will be realized. And make no mistake, the reason banks are not lending is because of this. Their internal cash flow is bleeding. They are simply hoping for a bubble resurgence which obviously is not going to happen. Why?

California Big Salaries Down

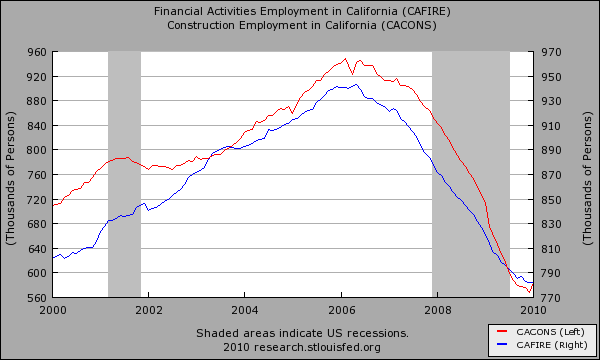

What people don’t want to talk about deals with the reality that many of the high paying jobs were basically cogs of the bubble machine. Many mortgage brokers, agents, and bankers were getting lucrative income for being sellers of this financial mess, the biggest since the Great Depression:

“(May 2007) Brokers can earn higher commissions – up to 3 percent instead of the typical 1 percent – by having customers buy loans with interest rates that are higher than market rates, with prepayment penalties charged if the loan is paid off before a certain date, and with little or no verification of the borrower’s income, known as “stated income” loans. That’s the difference between a $12,000 and a $4,000 commission on a $400,000 loan.

Leonard said he believes such practices are common, partially because there is no state law requiring the broker to disclose that the borrower is eligible for a lower rate.

Many loans offering the highest commissions have been subprime loans, higher interest rate loans that often are sold to those who have low credit ratings or present other risk factors, such as undocumented earnings. Mortgage industry experts say the majority of defaults in the last two years are tied to these loans.â€

With option ARMs outlawed and other toxic junk finding no market in Wall Street, the only game in town is government backed loans that certainly do not carry a $12,000 commission. So what we have is this:

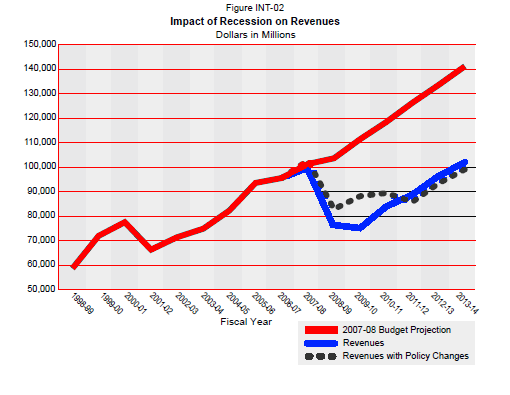

And many of these people were buying in prime areas like the Westside with inflated bubble salaries that are now gone. So the pool of qualified buyers is down for mid to upper tier markets. Going back to the Cassandra effect, the state was satisfied as well because they were collecting large amounts of taxes from these people. They were getting good money from payroll taxes but also, solid revenues from properties that were now assessed at absurd prices. There was no incentive for the state to stop the party. California was an economy that was built by the housing bubble both in employment and housing values. It is now suffering on both ends of the spectrum. That is why our unemployment rate is still at the peak while nationwide the unemployment rate seems to have leveled off. It is also the case why our state government is in an absolute mess. They counted on the bubble revenues:

So what this means is get ready for higher taxes or more cuts. Unless we decide to recreate the housing infrastructure to start another bubble but Wall Street is already done with the housing market and is on to better bubbles to chase with taxpayer money. In other words, California is going to have a stagnant housing market for years to come.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

42 Responses to “Financing the Cassandra Effect – People Choose to Ignore Economic Facts Contrary to Their Benefit. MLS in Southern California Going Up? Distress Inventory 3 Times the MLS Data. Big Salaries of Mortgage Brokers Gone.”

Great post doctor. I agree that many people who are rushing in to buy these homes at “discount” prices are not looking at the big picture. California is in a financial death spiral…how will real estate thrive under these conditions? The recession in CA will be much more brutal and last much longer than most other states. Let’s face it, the party got completely out of hand here and the hangover will be lingering with us for years to come. Add in factors such as a completely looney state government that will not cut spending and wants to raise taxes to the moon, unfriendly business laws, a huge welfare state, millions of illegals and you have a toxic brew for which there is no cure.

I recently spoke to my parents who live on the central coast. They were shocked to see the unemployment rate in their city to be 18%. They mentioned there are no new jobs on the horizon and business are leaving or folding. This is just a little microcosm of CA…the worst is still to come. And there is no way that inflated real estate prices will weather the storm. Buckle your seatbelts.

The downsizing of consumerism is taking place in California, but I think the next leg of this will be multiple families living under the same roof, Reluctant owners will have to make the sacrifice and advertise rooms for rent, to pay for their food and utilitites, And the destitute may like it as well, not having to live in cars and refrigerator crates if they can fork out a couple hundred bucks each month. Most people in California will make sacrifices they never dreamed they’d have to make.

The worst part here is that there are investors with cash that are buying properties thinking that it has hit bottom. Little do they realize that the values of their investment houses will continue to go down, rents will go down, and they will be in a trap. This will exacerbate the downturn as these “smart investors” will also lose their cash and not have money to spend on goods. The government trying to prop up the housing market, the banks holding off putting inventory on the MLS, is only causing bigger damage to the economy at the end by fooling those thinking the bottom is in now. If the government did not intervene and banks put foreclosures on the MLS quickly, the housing market will hit bottom sooner than later and the economy can begin its recovery.

How much further do you all think prices have to drop in middle tier and upper tier areas of Southern California?

The comparison with Detroit is apt. The median price of a home in Detroit is under 10,000 dollars. Once upon a time, that was a symbol of the industrial might of America. I don’t know where we are heading. In a global economy, we can’t compete on price. Looks like free trade is here to stay. The future looks increasingly dicey. Agriculture states might escape the pain, but CA I really don’t know. I mean look at Japan, they haven’t recovered from their bust .

great post, great blog!!!!!!!

I have noticed a larger inventory on the MLS in my area of Los Angeles. The prices had gone up around 10% this last summer, but now it has gone down . Many listing now have reduced prices and all properties are on the market longer. I know because I watch it every day.

I think we are starting to see the market get stuck. I mean the tax credit is expiring, Things are starting to stall. This housing bubble saga keeps going and going and going. The state and local government just “kicks the can down the road”, and is unable and unwilling to make any painfull decisions or address any of the obvious problems, like the pay and benifits to California government employees and the problems that are caused by massive illegal immigration.

California is becoming a mini hell, based on bubble economics and crazy population growth from illegal immigration. Unfortunatly we are seeing and living through the downside of all of this.

<

Has anyone seen the unemployment data at EDD for LA county for January 2010?

It's gone up to 13.1%. It is obvious to me that their is no way real estate prices can be maintained in this kind of environment, and I don't see anything generating jobs and income on the horizon.

Love your blogs, I really look forward to reading them. Could you possibly touch on the OneWest bank and FDIC or other banks in general where the FDIC purchased the first mortgages at %70 of the value and Heloc’s at %58 of the value. I also understand that FDIC will cover %85-%90 of the losses should the home forelcose or go to short sale? The reason I ask I feel it ties into your articles on where the market is heading in a sense that, yes jobs are the most important factor, but by what I read it seems the banks make money either way in the “bubbles” or the “hard times” and I quite frankly don’t understand how this is not illegal.

Is there any data concerning rental properties? While the article states that the rental market is saturated, here in south coastal Orange County it’s difficult to find a decent, reasonably priced SFR rental. I’m just wondering where all of these folks displaced by foreclosure if they are not renting and thereby creating a tighter rental market.

I disagree, living here in Temecula, the housing is fair in my opinion. The bubble blew up the prices to the 400 & 500 grand range, now its in the mid $200,000 range. The avergae houshold in my area make $75,000 give or take a few grand. That’s the NORM. Now the Northern San Diego County area (Carlsbad, encinitas, La Jolla etc is WAYYY out of whack. LA County of still way out of whack as well. Riverside county HAS corrected to traditional values, it really has. You can buy little houses for $60,000 in Perris & Lake Elsinore. That is not overpriced as you say. I paid $238,000 for a great 3 bedroom, 3 bath home in a beautiful area of Temecula, and I pay a mortgage of $1,200 a month. I said, $1,200 a month! You say I’m foolish for that, you’re wrong. I can rent my house out and make money, What say you?

My parents house in Santa ana, lower/mid income zip code, was looking like crap during the bubble years. Now its looking the best it has in a long time. Prices corrected, people bought for half bubble prices. Neighbor house sold to illegals for 600,000 dollars during the madness. Dirt lawn, 20 people living there. A mess. Sold 9 months ago for 300,000, Vietnamese family of 4. House is looking good. Housing, just correct already.

Hello Dr.Housing Bubble….Your info is mind blowing…..I love how you put it and make it so easy to understand ……Thank you always and keep up the great work 🙂

I live in one of the markets you spoke of and I agree about the sales. 4 homes nearby sold within the past 2 months, but there are still many for sale signs up. I also know for certain myself and my neighbor both haven’t paid our mortgages for well over a year now and we are both still living in the homes(not trying to delay foreclosure I might add). When interest rates go up and all these shadow inventory homes hit the market these people who bought now will get slammed. At least they won’t lose $250,000 like me and my neighbor because the homes aren’t even worth that much.

Mid term elections are only 7 months away now. The Dems have a vested interest in proping up the market, any way possible, to avoid a collapse before then. The GOP has a vested interest in letting things play out, to capture seats in Nov.

The REAL economy will emerge in Dec. and later, as all stimulus plans expire, and after the elections.

@HomerSimpson: I don’t think your argument disproves Dr. HB much at all since the doctor has mentioned on several occasions that that many parts of the IE have returned to 2.5-3x annual household income, as with your example in Temecula, for those fortunate enough to keep their job in those areas. As you alluded to, the problem is that the majority of areas in SoCal, such as your example with N. San Diego county, remain at 4-7x annual income and still have a ways to fall.

I just can’t get over the general shittiness-to-price ratio. I’ve been looking at homes in the 300-380K range for the last six months. They’re terrible, AND either in a bad neighborhood or so far out from where I work that it’s not worth it (the terribleness is uniform). Look, if a house is a fixer-upper, price it under 200K. If you haven’t kept the house nice (or if it’s a foreclosure), it isn’t worth the upper limits of what the neighborhood can afford based on average income. I don’t believe that a house in a poor, gang-infested neighborhood is worth 350K. It just isn’t. Don’t care what you’ve done to it. If the neighbors all make 50K

Susie Q- I couldn’t agree more. My husband and I have been looking in the same price range. We have seen some crazy things. Foreclosures that nobody bothered to even clean out- we’re talking food still in cabinets, just generally messy. Then there was the property with the cinder block wall collapsing out back and the inside stunk like pet urine. This was an open house, and the hosting agent says “there are already multiple offers on the place”. When we asked about the collapsing wall, she said “nobody cares, they just all want to live here so badly”… They can have it.

we havnt even made it to the eye of the shit storm yet.

Do you guys remember back in early 2007 (when the real estate bubble went bust a year earlier, inventories started piling up and prices went down) there were ads by the National Association of Realtors and the main stream media was saying “now is the best time to buy a home”??? Anyone who bought from 2006 when the bubble busted to now had their behind handed to them.

Whenever someone tells me they want to buy a house because “now is the best time to buy a house”. I will give them the basic facts (baby boomers who need to sell, shadow inventory, the government is the last creditor financing houses and that won’t last forever, etc….) but it seems a lot of people have their mind made up no matter what facts are presented.

It is such a shame that people can be so emotional when it comes to purchasing the biggest asset in their entire life. Plus unless they are paying cash for it, it is debt burden they will place themselves under for a long time.

I was beginning to loose hope this summer , because prices were rising.

Now with just a little more inventory on the market prices came down quickly.

I think economic stability is becoming a greater importance for people in Los Angeles. As this recession drags on stretching your finances for housing seems less and less appealing.

<

I am also beginning to see how this recession will also be called the "lost decade" just like it was in Japan.

Our Next Economic Plague: Japan Disease

http://english.caing.com/2010-03-15/100126807.html

Japan’s nominal GDP fell 6 percent to 475 trillion yen last year, while its real GDP declined 5 percent. Meanwhile, nominal GDP in the United States decreased 1.3 percent to US$ 14.2 trillion and real GDP fell 2.4 percent.

If you travel across Japan and the United States, you get the impression that America is in much worse shape: Americans cannot stop screaming about their woes, while the Japanese face economic sufferings quietly. Maybe this is due to cultural differences. Regardless, Japan is in dire shape. Its nominal GDP is now lower than it was in 1992 when the nation’s property prices first began to decline.

“I’ve noticed a few people in other articles and blogs talk about how great of a deal they got on a California home. 30, 40, or even 50 percent off the peak price. Yet this discount in itself is meaningless unless we put it into context of the local economy, incomes, and inflation-adjusted home prices for that area. ”

Nice research But

You continue to neglect interest rates. Why is that? If the fed creates a vehicle to bypass the banks and get home loans to buyers for say 2%, will you be using 3xincome? If we end up with 18% interest rates, will you be using 3x income?

Nimesh makes a good point about the selective memory that many people fall in to.There is simply nothing to support the type of comeback in housing that people are desperately hoping for. Unemployment highs, 20% increase in NODs last month, expiring gov’t programs, Option Arms and Alt-A resets… As it is now a large number of sales are cash investors who think they’re getting the timing right to make a fast buck. When prices start to fall further all that investor cash is going to dry up; and then what?

Been following the blog on and off for about 3 years now…

I’m in Ventura county, and decent 4+3 homes in my area are listing for about $500K. This is about 5-6x my annual income. I’ll need to decide in the next 30 days whether to buy, or sign on to rent for another year (landlord has said that shorter terms are not possible).

Given that there are fewer distressed mortgages in Ventura county, don’t you think it’s an acceptable position to buy rather than wait another year? We are planning on staying put for at least 10 years.

Advice appreciated…

Tim, I would submit that if you have to pay 5-6X your income, you can’t afford the area. Either buy in a cheaper area, or wait. This is no time to stretch yourself financially- you need to be packing a lot of cash away against job loss and other emergencies, especially if you have kids.

What’s the use of a “bargain” if it destroys you financially?

Why not buy a 3-2 in a less pricey area? Either go much smaller, or into a cheaper ‘hood, or keep renting, but borrowing more that 2.5x your income in this economic climate is insanity. Consider that your housing expense is by no means “fixed” or controllable since your local tax authority can hike your taxes drastically at any time. I have a friend here in the Chicago area whose taxes were very low 6 years ago and had bought a house well within his means on a 30-year-fixed. Well, the taxes have doubled TWICE since 2004, for a new tax bill of $8500, more than 4X what he paid 6 years ago. And that happens concurrent with his wife losing her job, halving their income. This could happen to you, too, especially in financially failing states like IL and CA.

Face it, we are all going to have to scale back our lifestyles and expectations,if we want to regain our financial health. If you still have yours, don’t put it at risk.

To Nimesh, I remember the ads “now is the best time to buy a home†very well. What a bunch of liars.

To Tim, I would wait another year. The economic storm is not over. It is not a good idea to buy a place 5 – 6 times your income unless you can put down 50%. It is too much risk. What if you lose your job, you will default and lose your down payment and the interest you paid. If it is better to pay rent with the money that would go in for interest and save the down payment in case something happens. Wait another year or 2 and see how the market plays out. Be patient. This is what I keep telling myself too. I am looking to buy as well. But there will be some correction for the area you are looking at. Just look at http://www.RealtyTrac.com and see how many houses the area you’re seeking are in pre-foreclosure, auction and bank owned. These 3 categories are about 4-5 times of the MLS listings (for sales category) in nice areas. During the boom time, they are the opposite. There are a lot of downward pressure. The real estate usually takes a long time to bottom out. Look at 1989-1990 bubble. The price did not reach bottom until 1996-97.

Same here. I bought at 60% off peak, renting it out and earning double my monthly PITI and do not plan on selling. Even if rental prices go down, which they already have about 7% I will still be positive. Believe it or not there are some gems to be had unless you’re too busy calculating the bottom. And if prices go down further as this blog predicts I (and others) will buy some more.

Laura…I so agree!

I’m not sure how or why it makes financial sense to “buy” a home, period. If you look at a home purchase as a strictly financial arrangement, the numbers just don’t add up. Housing tracks inflation, which means that you’re locking up all that equity in an investment that returns 2% a year. And, you’re locked into a location for, ideally, 30 years, but where are these jobs that people feel secure for 30 years? If you’re trying to be upwardly mobile, to increase your net worth, chances are you will have to move at some point in that 30 years. Average person is at a job now for 1.5- 2 years, right? Say 3 years on the outside, which means hopping 10 jobs in 30 years. If you’re limited by your immediate location, you’re paying a penalty for your house in potential lost income.

As others have said, you’re either renting a house, or you’re renting money for your house. At least in one instance, you have the option to invest the 100k and gain a return to beat inflation.

Owning used to be the privilege of a relative few, from what I’ve seen, until we changed that after WWII, and now I think it makes sense to change it back to a renter/mobile society. We don’t carry our lunches to factory in pails anymore, and we can’t count on growing old in the same town either.

Another thing about such a DTI ratio as Tim is considering taking on: it was when lenders starting allowing borrowers to borrow 4, 5 and 6 (or even more) times their incomes, that prices ratcheted out of any relationship to rents and incomes, AND it was such large loans that went into default first. Any loan that is such a high multiple of your income is categorically speaking “subprime” and will bury you. All it takes is a minor emergency, like your pet needing vet care or an auto breakdown, to put you behind. Then the penalties start stacking up.

A DTI ratio of 3:1 should be the max.

I’ve always said that FHA could have gone on making no down payment loans as long as the borrowers’ incomes were verified and they stuck to mortgages no more that 2.5 times income. It worked fine for 40 years, with very little trouble. It wasn’t until lenders made mortgages for 4X income that we started getting a lot of defaults.

For a long time I wanted to buy a house. Prices zoomed way up and I was priced out. I decided to stay out of the real estate market as prices even zoomed higher and friends, relatives, and coworkers laughed at me. But the rational, logical part of my brain told me “stay out of the real estate market, prices are at bubble highs”.

Now the tables have turned and (and no, I have not laughed at someone else’s misfortune) it sure does feel good to know that I was right.

Now the question “is should I buy now because we have hit the bottom?” Well here is my line of thinking.

There really is no need to time the exact bottom. Even Warren Buffet can not time the exact bottom. So why try to time the bottom of any market? Even if prices hit at a bottom then prices are not going to go up by 15% to 25% like they did during the bubble years! There aren’t going to be multiple bids and people camping out of a housing development to buy a house.

I really recommend reading Maniacs, Panics and Crashes and Popular Delusions and Madness of Crowds. Two excellent books on bubbles. You will learn that bubbles whether it’s the tulip mania, the dot com technology stocks or real estate, it all follows the same pattern when rational thinking humans think they can make easy money via speculation.

I believe prices will drop even further. Now, I may be wrong and prices may zoom back up again. If prices do go back up again, then fine, other people can be happy paying five, six and even more times the multiple of their income. They will have a nice home, but end up paying 50% to 70% or even more of their take home pay. Way to go Einstein.

I will wait until prices come back down to two to three times the area income. Until then, I am not buying. If prices go back up, then I still win because my rent is cheap and compared to buying vs. renting, I will save a botaload of money.

@EricH

Total agreement. Young people don’t understand the paradigm shift going on. This is not your dad’s America. We are in the final stages of a failed experiment to see if we can renege on the Breton Woods Agreement and maintain accelerating prosperity on the world’s faith in the Federal Reserve note. The fact we’ve been able to keep up the ruse for almost 40 years is amazing. Trade deficits, budget deficits, Ponzi commitments…everyone in the world with an IQ over 70 knows the math doesn’t work.

Response to hlowe’s question

“You continue to neglect interest rates. Why is that? If the fed creates a vehicle to bypass the banks and get home loans to buyers for say 2%, will you be using 3xincome? If we end up with 18% interest rates, will you be using 3x income?”

Short answer- YES!

Long answer- back in the late 1970’s early 1980’s interest rates were double digit rates, the double digit interest rates were put in place to try to tame inflation. Inflation eventually was forced down, but higher borrowing costs form high interest rates meant less borrowing and fewer borrowers. Higher rates also meant sellers had to lower their prices or be forced to give up selling the house.

If interest rates go down to 2% smart buyers would still use 3X income for Safety’s Sake.

What is Safety’s Sake? If the buyer of a house is demoted, has to pay for unexpected expenses, gets fired from their current job and has to take on a new job that pays less, sees their taxes or living expenses go up, etc then the 3X rule makes prudent financial sense. A buyer who used 3X will struggle under unexpected financial problems to keep paying the mortgage, a 4X or higher buyer will watch helplessly as their savings erode away and seethehouse eventually go into foreclosur. Those who tried to buy a house using 5X or 10X are watching the house go back to the bank, those who used 2.5x or 3X are still able to make payments on their STILL AFFORDABLE mortgage.

3x income was the old maximum amount that a house buyer would use to calculate his or her ability to buy a house Without Going to the poorhouse, something the “financially savvy†buyers of a few years ago ignored or laughed at as old school thinking. Now we have seen and learned that old school was right all along when it comes to buying a house, 3X max or the house eventually goes back to the bank.

3X income is like gravity, it is a universal law that you can’t defy for long without getting hurt in the process.

Hello Richland, Ya, OC always been expensive place to live comparing to Los Angeles or San Bernardino County…..therefore OC’s rental is always high and not sure 100% how OC economy doing but , compare to LA county and San Bernardino, OC is doing much much better. Its funny, all counties are next to one another but, OC is always been healthier……

Will The Federal Reserve Stop Buying Mortgages-Backed Securities?

by J.D. Rosendahl

It’s common knowledge that the Federal Reserve has pledged to stop buying mortgage-backed securities at the end of March 2010.

I believe the Federal Reserve will attempt this plan for some timed period (3-12 months), and learn very quickly its detrimental affects. Personally, I wish they would get out the market completely, but such a notion is unlikely and naive based on past actions of the government.

Below is a chart of mortgage-backed securities held by the Federal Reserve, which reflects nothing short of an explosion or “bubble” in the ownership of these securities…

This is already happening.

Comment by Susie Q “I don’t believe that a house in a poor, gang-infested neighborhood is worth 350K”. Susie, you could not be more wrong!!! Most gang infested areas demand a high price because of neighborhood desireness, most gang members want to live to close to each other, thus the higher price. How much would you pay to live next door to Tony Montana from “Scar Face”? Imagine the parties and people that get invided to such events.

Maybe I read this article in time. I ‘m a NY real estate investor “small”

I have done well because I purchased under valued rental properties prior to 2007 and improved properties and rentals. I am experiencing a marginal increase in vacancies which worries me. But I have room to be competitive which means paying brokers fees and God forbid lower rents on hard to lease unit. This isn’t what I am concern with. I am going to Florida to look at investor properties there. Based upon what I am reading here I could be making a mistake. Prices in the NYC area aren’t down significantly. The Florida market Broward county show advantageous returns. The prices and rents in this area are similar to return I achieved in the city without the renovation investment. So I am asking whether in opinion of is it to early or whether the economy in southern Florida makes any real estate investment there foolish.

Spencer,

I hope what you posted is just some sort of a joke, because unlike those still drinking the NAR Kool-aide, now is NOT a good time to buy.

Florida? You want to buy in Florida, the ground zero of the east coast of deflating housing bubble real estate?

Do you know anything about the neighborhoods in Florida? Do you know which houses in Florida have mold, Chinese drywall, alligators living in the backyard (unlike New York sewers, alligators DO in fact live in back yards in a few neighborhoods of Florida. It gives a whole new meaning to the phrase “feeding the alligator.â€)

Dou you know about Florida real estate taxes, Florida taxes in general, the traffic, the crime, the hurricanes?

Jumping into a market you know nothing about is much like jumping into an empty swimming pool that is ten feet deep, you are going to get hurt and you have no one to blame but yourself.

I am agreed with Doug N because its the common case of study that is demonstrated there i would add the Islamic banking concept there because if you are interested in it. Islamic banking provides that you are not supposed to pay a interest just pay the free and Bank would pay on your behalf if you are paying the installment regularly then you would become the owner of that house with out interest.

z-z-z-z-z-z-z-z-z-z-z . . . . sorry folks, this is getting very tired and lame. Nobody cares what is happening in California anymore . . . the money left and took the knife catchers’ cash with them. Wake up Tools! California has been a banana republic since the 80’s..

Hey Tools . . . my good buddy Tangelo is laughing all the way to the bank! I am sure some of the B of A bailout scratch got sent to him for all of his hard work at cuntrywide salami mortgage.

TOOLS!!!

DOLTS!!!!

DOPES!!!!

Bundee I understand your point I just return from a trip there 3 days ago. As much as you can learn in 3 days I tried. I understand the tax situation about 2 % of purchase price. There are no alligators where I am looking. Now the real issue when are we at the bottom. This is what caught my eye about this blog or discussion. Yes I went there to investigate a property. I came back with a feeling I am in looking in the right area. What I don’t have a feel for is the economy. Normally people have pride in their area they may be going through tough times but they still have hope. I almost to the person didn’t find this in South Florida where I was looking. Well the Real Estate brokers were the exception. Duh ! But every other person I met were so negative. Normally when everyone is negative its time to stake out a positive position. Could this be the time not only for Southern Fla but also Cali as well?? I have read here the reason why not, but where else can we go. People on this site think it can get worst? For Real ! People need shelter, food and clothing. Basics as long as our population is still growing these needs will not falter. I know Fla is perhaps overbuilt at the luxury end but the middle class and working class normally always needs a reasonable price housing in good areas ” near shopping and the beach” in Fla. I know I could be premature in timing. Someone help me out with

signals to look for when the time is right for such a move. What is the bottom what is a buy sign ??

Leave a Reply