Financial and Economic Amnesia: A Society who has Long Forgotten the Great Depression. 3 Critical Tipping Points: Technical Trading, Retail Sales, and Biggest Market Volatility.

I had to step back from the market the last few days. Trying to follow it by the minute you sometimes lose the bigger perspective of what really is transpiring. On Thursday for example, the market was heading for another major loss continuing a multi-day trend and it looked like we were going to test the October 27 lows. This is normal in most volatile markets. Markets never go down in a straight line. The balance between buyers and sellers always manages to put floors at different price points. Well the market blew right through the low and flirted in the 7,000 territory. This was crucial. After testing those technical lows the market blasted through the stratosphere with a 911 intraday swing. Insanity.

At the end of the day the punditry had very little to say. These were some of the headlines:

“Bargain hunters are back.”

“People are focused on value.”

“I have no idea what just happened.”

The last headline made more sense. During the day on CNBC they were running around like chickens with their heads lopped off talking about complete nonsense and then at the end, it was all about value investing. Aside from the lack of knowledge, something came to my attention at that moment. We now have a majority of Americans, many in positions of power that have never lived through an economic calamity like the Great Depression. They have no idea what is going on. The economic events of their generation although big, are not epic like those in previous generations. This one will be legend yet people are still trying to fit it into some sort of known construct. You hear “stagflation of the 1970s” or “supply side” or all these other terms that simply reflect a known universe. We are traveling in a different galaxy with a GPS device built for Earth.

One of the things that popped into my mind is that most that lived through the Great Depression are now no longer with us. The few that did live through it are most likely retired and no longer in positions of power. Those in their peak power years are baby boomers who never faced World War II or the Great Depression. In addition, those that lived through the depression had shorter life expectancies:

Take a look at the chart above. Those that would remember the Great Depression with absolute clarity are those in their 20s, 30s, and 40s. Let us use the 20 age range. They would have been born in the 1900s. Many of those people had an expected life expectancy of slightly above 40 years for males and 50 for females. So their collective history if not passed on by their children was finished in the 1940s or 1950s. Those born in the 1910s lived slightly longer, males slightly above 50 years and females 55 years. So that pushes the range out to the 1950s and 1960s. The same range applies for those that were actually born during the Great Depression. You have to go to the 1941 – 1951 range to see a real jump in life expectancy. In this batch, we have many of the baby boomers. At this point, we now have males living to 65 years of age and females breaking the 70 years mark. Many from this group now hold positions of power and have only historical reference of the Great Depression. With approximately 76 million boomers in our country, this is a sizable part of our population.

I bring this up because when I hear mainstream commentators, many boomers themselves the majority have a lack of understanding of major economic calamity. Frankly, they may be saying, “this is as bad as the Great Depression” but really don’t have any conviction behind it. They still believe that those things aren’t possible. Why would they? They’ve never lived through an economic bubble of this size.

It is also important to notice that maybe one reason for the distance between historical memory of previous bubbles is the fact that we have nearly doubled the life expectancy from those that were born in the 1900s. Many people live longer to keep the narrative alive. In fact, we have the Long Depression that lasted a stunning 23 years from 1873 to 1896 which was twice as long as the Great Depression. But a sizeable number of people in their 20s, 30s, and 40s during the Long Depression were no longer alive during the 1920s.  There was a new generation that had forgotten the past. Now, it takes a little longer simply because of the shifts in demographics. Just an observation. The Glass Steagall Act came about in 1933 and was repealed in 1999, 66 years later. Nearly the life expectancy of a male born in 1942 right before the baby boom got going.

Enough of the past for a second, let us bring things back to the current day. Thursday’s stunning reversal was purely a technical resistance bounce. There was no good news coming out. Unemployment claims breached the 500,000 weekly mark and put us at a 7 year high. Retail sales are pathetic and are stunning us on the downside.  Companies are reporting horrible earnings and managing expectations for the future. There was zero good news yesterday aside from the fact that we went under 8,000 and technical traders simply jumped in whether they were bottom fishing or short covering. We will also talk about in this article that with retail sales getting hammered, the unemployment rate is set to sky rocket because a large number of employment is in the retail side. Also, these big up and down days are not indicative of a healthy market.

Technical Trading Bounce – Retesting October Lows

Â

The above chart should be rather clear. As the market progressively gets into a vicious feedback loop of bad news fueling bad earnings which then fuels bad sentiment, we need to understand why major rallies happen within bear markets. The reason at least from a technical and micro side is money is still to be made in these short term fluctuations. People jump in after a 10% drop and sell out in mass pushing prices up again. At this point, many things are disconnected from reality and are purely technical.

In fact, the last few months saw the largest number from retail investors pulling their money from mutual funds because they simply do not trust the markets. Why should they?

Take for example the absurdity which was the mortgage backed securities market. Here is how the crap played out:

(a)Â Originate subprime mortgage

(b)Â Batch said subprime mortgages into a security

(c)Â Cut the security into tranches of varying quality (i.e., AAA, AA, BBB, etc)

(d)Â Sell securities to investors

(e)Â Get greedier and create another side bet with CDOs

(f)Â Since many investment funds cannot buy securities that aren’t “A” rated, you can take that BBB fund, chop that down and create additional tranches of AAA, AA, and BBB.

(g)Â Rating agencies rate it as AAA and investment funds by this stuff up

But return to point a. All this is premised on mortgages that were 100% assured to blow up. In addition, the derivatives market create a market larger than the actual face value of the mortgages. How so? Think of it as a fantasy basketball league. Does the fact that millions play fantasy basketball actually impact the game or real players? No. But in the case of the derivatives market, synthetic securities were created above and beyond the real world mortgage values. That is why losses are now larger than the actual face value of many subprime loans. And let us be honest, Wall Street securitized anything that walked including consumer debt, student loan debt, and mortgage debt. I talked about this one year ago in the CDO Super Mortgage Birth Story and should give you an insight into how we got into this mess. What seemed controversial then is flat out common sense now.

The market as I write this is down 300 points which puts us so far with a 3 months losing streak:

DOW September 2008 performance:Â Â Â Â Â Â Â Â Â Â Â Â -5.7%

DOW October 2008 performance:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â -14%

DOW November 2008 performance so far:Â Â -8.4%

So that is how things stand. Let us now move on to the consumerist machine that is the United States which is coming to a screeching halt.

Retail Sales Drop Biggest on Record

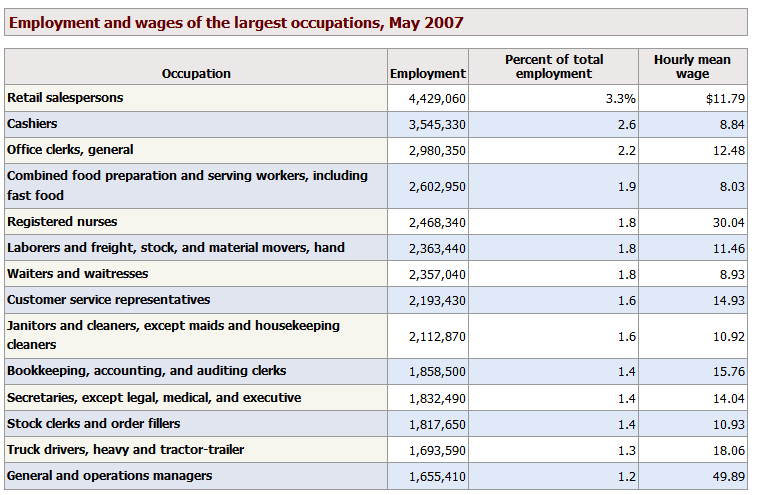

The market was already expecting a major drop in retail sales. They were expecting a 2.1% drop but got a record breaking 2.8% drop. Now that may not seem like a big deal but when approximately 70% of our economy depends on consumption, this is gigantic. This again reflects the silent depression that is already being experienced by countless Americans. The shopping gig is up. Look at recent bankruptcies of Circuit City and Mervyns and you’ll get an idea of where spending is going. Best Buy announced anemic results in the week thus fueling the flame. Even the unstoppable latte espresso machine Starbucks announced an incredible drop of 97% in profits for the 4th quarter. These are not good results folks. But what is more problematic is that this will slam on the retail employment side of things. Do you want to see which singular fields employ the most people?

Now this is a chart of largest occupations, not largest sectors but keep in mind the retail trade side of things employs 17.6% of the entire population. As you can see from the chart, these are also lower paying fields. The top two occupations of retail salesperson and cashiers are going to be hit hard by all these stores closing and the abysmal number in sales. Even though this number may jump up a bit for the holiday season, you can expect that 2009 is going to be horrific. Many of these are the folks that are considered employed but really want more solid work. Now, even these jobs will be cut back. Expect this to show up in the employment numbers in droves over the coming months.

Market Volatility not a Sign of a Healthy Market

It goes without saying that these major up and down swings in the market are not good. Stability is good. A market that performs well with both economic and technical fundamentals. The dollar cost averaging daily retail investors is done at least for a good amount of time. What if you dollar cost averaged for 20 years and saw your account go to say $400,000. It drops 50% over the past year. Say you have a few years before retirement. How much dollar cost averaging will you need to do to recover that $200,000? And this is someone who simply invested in say the S & P 500 or a broader range of products. We’re not even talking about riskier investments that could have wiped out an entire portfolio.

Even the most “conservative” funds went insane in this market. Take a look at one of the largest retirement systems in the world, the CalPERS system here in California:

“(LA Times) The California Public Employees’ Retirement System reported Wednesday that in the year ended June 30 its real estate portfolio declined to $6.08 billion from $9.36 billion, based on 461 independent appraisals of its investments in 288,000 housing units across the country.

The decline in real estate represents a portion of CalPERS losses since the fund hit a high of $247.7 billion on June 30, 2007. It fell to $239.2 billion a year later and since then has plunged a further 23%, to $184.2 billion as of Monday.

CalPERS provides pension benefits for 1.6 million current and former employees of the state and many local governments and school districts. Those employers, which are suffering from strained budgets, could be forced to increase their contributions to the pension fund if CalPERS’ investment performance does not turn around in the next couple of years.”

This doesn’t even factor in additional losses that will come down the pipeline. We have merely entered into the first stage of the actual major recessionary job losses that will show up in large droves in the BLS numbers. These are late to the game but we are in full feedback mode now. These funds gambled and lost big. $63 billion in losses in one year in a supposedly conservative retirement fund. The fact that they bought real estate at the peak is frankly out of this world and thought this was a good piece to add to a “diversified” portfolio. This is like saying since you have cat, dog, horse, and turtle crap it won’t smell so bad because it is diversified.

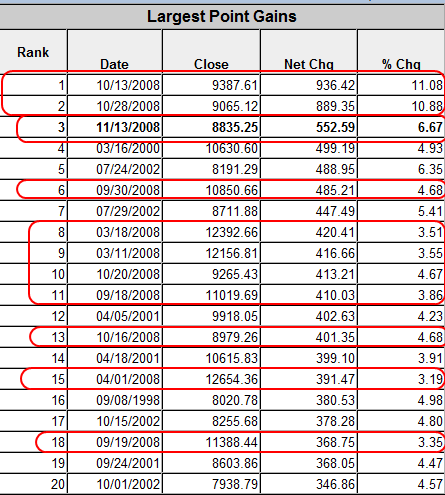

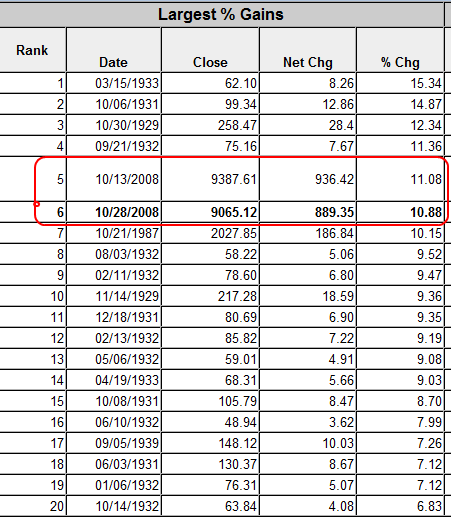

Remember that big jump on Thursday? Let us look at the biggest point gains for the DOW:

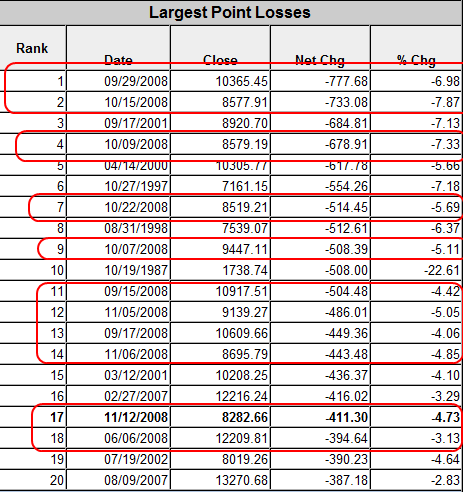

Most of the best days have come in 2008! The worst year on record for many decades. This again is simply a reflection of how absurd saying big jumps and drops is good. It reflects a poor performing economic system. Let us look at the biggest point declines:

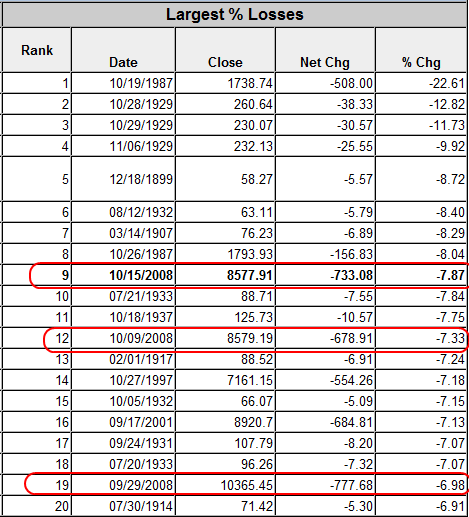

Once again you see that 2008 reemerges the winner. Of course, simply going by points doesn’t reflect the actual pain. We need to look at percentages to reflect changes from history:

Notice something eerie in that chat above? Most of the biggest percentage daily gains occurred during the Great Depression. In fact 17 out of 20 biggest one day gains occurred during that time. We also have the one day jump in 1987 but guess what else shows up on the list? Two days in 2008. Nearly 80 years of history and we now have 2 days of this year showing up here. Not a good sign. And this is for a supposedly biggest positive day! Let us look at the worst percentage drop days:

2008 once again shows up but three times here. 9 out of the top 20 down days occurred during the Great Depression. Then we have other mixed periods such as the panic of 1907, 2001, and various other eras. But make a note that 2008 is now tied for the worst yearly percent declines in terms of actual days with 1929. Both have 3 of the worst days on record.

Take that for what it is worth.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

24 Responses to “Financial and Economic Amnesia: A Society who has Long Forgotten the Great Depression. 3 Critical Tipping Points: Technical Trading, Retail Sales, and Biggest Market Volatility.”

I agree with you.

Its absurd that we cannot find quality information on those who lived during the great depression. NO books, video, nothing. I wanted so much to find books about wealth creation during the depression, but only found a book about deflation published in the 1930’s. It reads as if I was published in 2008. I looked for stories, very little of quality. Almost as if no one talked about it.

Those who became richer or weathered the storm well are long forgotten, keeping their wealth private. Their brats know basically nothing because they were poor children who could not comprehend.

Which means, anyone in their 20 can only guess at what is going on. Good info is so scarce!

I think , after this mess, someone should be encouraged to document all that happens and create a multi series work. We need to let people know what happened to us!!!

I would love to see stats on the largest daily trading spreads – yesterday’s 900-point spread has to be up there.

CNBC just reported that Soros upped his shares from 600,000 to 3.8 million shares in Walmart. Follow the money.

There are MANY oral history projects that documented the Great Depression. The Library of Congress Web site alone has hundreds of links. Go to http://www.loc.gov and search on:

great depression

~

The WPA employed literary types to go out and document people’s experiences. Search Google on:

Folklore Project Federal Writers’ Project

or

WPA Life Histories

or

FSA OWI (for photographs)

~

Back to Doc. Of the “largest occupations” categories in the table above, those earning over $30,000 per year for full-time work account for around 6% of total US employment. Not that I expect most of them *have* full-time work.

~

Derivatives = fantasy b’ball reflects an even bigger issue: how our economic system is grounded in virtual realities removed from physical ones. And is in overshoot on all fronts.

~

I’ve often heard economist colleagues say that economics is a time machine reapportioning assets and liabilities over time. The casino-based stock market is a factory of wealth concentration, as well as mover of profits/wealth through time.

~

Think about how young people are routinely advised to invest high in the stock market (allocate 100% minus your age to equities) and change the allocation as they age. This represents an intergenerational wealth transfer. You put more money in the market as a kid, the theory is that the shares will always go up, and as you have fewer thru reallocation, they’ll be worth more when you age.

~

This is obviously balderdash, since markets go up and down, sometimes hysterically, as we’re witnessing. People who’ve invested since youth may need the money now, as a new retiree, and it may have gone away, and promises that it will come back in 20 years or something won’t be much use. It’s pretty clear that when speculation and hedging (casino gambling) take the place of serious investing, what we get is a monster, not an economy.

~

The derivatives markets bet on future events (i.e., price collapses, systems failures), transferring money across time to concentrate it in fewer and fewer hands.

~

I’d take it a step further, Doc. We model our economic systems on how we interact with thermodynamic and ecological systems. We consume faster than resources can regenerate. We ignore our impacts on larger thermodynamic realities (such as hydrological systems). We live in a perpetual state of ecological overshoot.

~

DHB has made this point in the past–about debt being the mechanism by which we spend tomorrow’s income. The problem is when that income doesn’t materialize, and the debt continues to grow. As we are seeing.

~

So it comes as no surprise that our habits of overshoot appear everywhere, and are in similar crisis. Ecological, economic, personal, spiritual, moral, thermodynamic. It’s a hell of a clusterfuck, as Kunstler puts it. The only way out is through.

~

Regarding CalPERS, Barron’s current cover story is how Harvard got screwed with the Yale investment model.

~

The numbers games that mistake gains for performance were what inflated the bubble.

~

rose

Of the many economic blogs, newspapers, and business magazines that I read, yours is the best thought out and reasoned commentary. Not only do we not have people who remember the Depression, no one under the age of 45 even remembers the severe recession in the 70’s. For those of you who do not remember that time, mutual funds dropped by 50% , and took many years to recover. Unemployment reached levels higher than today, and people with great resume’s could not find jobs. Nearly all the “experts” on TV are under 40, and have no clue of what happened just a few decades ago.Their mantra is “stay the course”, or “do not panic and sell- you will miss the big upturn”. The US is entering a severe and deep recession, likely to last at least 2 years. There is no

“Upturn”.to look forward to.These talking heads are merely rearranging the deck chairs on the Titanic. DO NOT listen to them- head to the lifeboats.

CNBC just reported that Soros upped his shares from 600,000 to 3.8 million shares in Walmart. Follow the money.

There is other money going to commodities. I’d rather do that than support the abomination called Walmart. There could emerge a serious backlash against this company and their practices. And if the Chinese stop giving away their stuff, the cheap shit at Walmart might disappear. I wouldn’t be surprised to see a new chain of stores emerge that only sells USA (or North American) products, sometime in the future. Crazy? Maybe, but what is happening in the world right now is absolutely INSANE.

Many years ago I walked out of a Walmart, pledging to never return. This was before knowing much about them, but I knew something was wrong.

It is so true what you say about people not having any real historical context. In viewing this market, all the signs of depression are there and people still choose to ignore it with pure hope. Look at the facts and it is clear to see. We are in severe assett devaluation right now and job losses are just beginning. Just think where we will be at this time next year. My guess is, we will end up somewhere between the Long and Great Depression lasting another 5 years. Thinking about buying anything right now is especially foolhardy, as the price of everything is dropping.

It amazes me how thick the denial of real estate prices are here on the Westside of Los Angeles. As the days stretch on, people will finally realize whats happening.

http://www.westsideremeltdown.blogspot.com

Yes, this is the best damned blog in the world!!! I always read this blog with anticpation, excitement and awe and often wish there were more people paying attention to what has been going on. Thank you Dr.!!! I pump this blog all the time also – to anyone who will listen! I’m no economist and don’t even have a college degree, but I’ll tell you this; I have been able to educate myself about not only what got us into this mess, but where we are headed and how to prepare for what;s coming. I know many well educated folks who don’t have any clue about any of it and “think” we’re in a temporary lull that will pass after the holidays. What’s that saying…”You can lead a horse to water but…?”

With all of the depreciating assets out there, what is your opinion about buying gold, platinum, and silver? Do you think that their prices will depreciate further, or start to go up as a safe haven?

Thursday’s action in the stock market was fascinating to watch. At approximately 1:30 PM the DJIA was around 7900; a new low. During the next 2 1/2 hours the market recovered and closed up at approximately 8835. A nine hundred point swing in this very short period of time. So what happened? As the Dr. says the financial media has no answer. The most used comment was that “bargain hunters” were responsible. As a matter of fact the market gained over 550 points in the last 40 minutes of trading! That’s a lot of bargain hunters….

For a long time now it has been suspected that the FED has a “plunge team” in place to buy equities and futures to artificially keep the market from tanking during volatile downturns. I believe this is probably what happened here. If Paulson, Bernanke and company are willing to prop up every business that’s “Too Big To Fail”, then why not the stock market? By the way, there are other trading days, during this debacle, with similar swings where the action is highly suspicious. World markets take their cue from the US and the next day their markets were up too. Decoupling is a myth. One of the reason’s that Thursday’s action is so interesting is that there was absolutely NO positive financial news. I follow it fairly closely and could not find even one piece of positive news; even looking into the future. Who were these “bargain hunters”?

Who coulda knowed?

Phillip Katt, this past summer I phoned an old high school friend with birthday wishes. We discussed the economy (as we always have), and he said, “Aren’t you grateful that our parents were Depression kids, who had so much to teach us about savings and all?”

~

Both of us were ninth-inning babies, surprises late in our parents’ lives, so even though we qualify as trailing edge Boomers, we have this direct connection to all that memory, and had guidance growing up.

~

My friend and I used to talk about economic booms and busts as teenagers, and we navigated all our life choices out of that memory of our parents’ experiences. We each talked to the others’ parents as well. This always made us rather freakish, as we made choices for frugality throughout the cocaine, dot-com, and housing bubble eras. Though we don’t expect to be immune from what’s happening today, at least our lives make sense over the long haul and we don’t have the regrets so many others do.

~

It’s best of all to be connected to the living flow of history, as so many of the fiscal geniuses of the past 20 years have not been, just as Phillip notes. Friends, there is plenty of that memory still around. Look to the octogenarians in your own neighborhood. Ask them to be your elders. I promise you, they will be eager for someone to listen to them after all these decades of being ignored and ridiculed. We may have to listen to stuff we don’t want to hear…or we may be surprised by just how radical those folks were, albeit not in “The Sixties” or Obama-voter way!

~

rose

(who expects the DJIA to dip to 7600 this year)

My mother was in her teens in the 30s and remembers and describes The Great Depression quite vividly. I had her tell me some stories about that time just last week.

She predicted this crash and sold her home in northern California at the peak in mid-2005. Her intuition based on years of experience was far more accurate than the grand theories and mathematical models of most economists and Wall Street financial wizards.

My intuition on our current situation is that it will ultimately be described as a Depression. It will not, however, be like the 1930s. Before the crash in 1929, and in spite of stock market wealth, about 60% of the nation lived in poverty. Today, accumulated wealth is far more pervasive than then. We also do not have the human-caused “Dust Bowl” of that era. We also have the advantage that much was learned from the Great Depression and the same mistakes will not be repeated. (The joke is that Paulson and Bernanke want very much to make their own new mistakes.)

Additionally, the average life expectancy chart is mis-used in this situation as it includes young deaths (especially of children). Today, fortunately, our average life expectancy has gone up in large part due to avoidance of child deaths due to early births and disease that were formerly quite common. Thus, there are more Depression era witnesses than the chart implies.

Doc

>>>

You are way way over estimating the mortality rate of those born in the late 1880s and early 1900s. Those are the life expectancies at the time of their birth and it changes throughout one’s lifetime. Here is one family:

>

Great-grandfather – born 1882 died 1972. (And in his day, 13, 14, 15 and 16 year old teenagers went to work on the farm or for business and were fully aware of the economy unlike teens today.)

>

Grandfather – born 1901 died 1993. 28 years old and married with children in 1929

>

Grandmother – born 1903 died 1983. 26 years old and married with children in 1929

>

Grandfather – born 1904 died 1986. 25 years old and newly married. Only child was born in 1931 (after they had bought a house in 1930 & it is still in the family)

>

Grandmother – born 1906 died 1983. 23 years old and newly married. Only child born in 1931 (after they had bought a house in 1930)

>

Great- grandaughter and granddaugher born 1954. From listening to them talk about the Long Depression of the 19th century and the Great Depression, I specialized in the political, social and economic history of the Great Depression (and the time leading into it and right after if.) It is more real to me that what is on TV these days and I have no idea who is Jolo (or whatever these young actresses/singers call themselves) or what they have done. I can talk all day about Harry Hopkins, the Milk Riots, the purpose of Social Security which was to reduce the number of people looking for work, the Van Sweringen brothers and Ivar Kreuger, holding companies and leveraged pyramids, the foreclosure near-riots with armed men blocking the bidding, the Great Hurricane of 1938, boarding houses and hobo camps, the falure of private charity to meet the needs, starvation and deaths from the cold,………..

>

Historians ARE the repository of the memories of a culture. 3 years ago when I mentioned my specialty, people’s eyes glazed over and they made polite noises. Now, their mouths drop open and they say “Tell me about. You know what happened and can happen again. How did people survive?” And yes, I saw all of this comiing when I figured out that the incomes in the US could not support all the McMansions, Cadillac Escaldes (sp?) and trips to the Bahamas. No one believed me 5+ years ago.

>

And I learned from my elders. I can sew – even tailoring a man’s suit to the standards of Brooks Brothers; cook from scratch with raw ingredients; can food; garden (although I prefer my perennial flowers and have not yet had to switch to tomatoes); paint a room or a house; refinish wood floors; install a sink and do other useful things rather than paying someone to do them. Partly from my elders and partly from my studies, I have always regarded Wall St with trepidation and disdain as the Great Gambling Casino where the game is played with illusory money and no one could ever tell me what doorknob I owned at the corporate headquarters if I bought stock.

>

Those born after WWII who listened to their grandparents, remember.

Speaking about the lack of historical memory — an even greater concern is that most Americans have no points of reference in terms of chilling alternatives to free economy. Now that everybody is sufficiently spooked by the economic collapse, people are sincerely open to exploring “other” ideas. If we bravely turn left under the new dear leader who has already given us a hint by saying “since when selfishness is a virtue”, the consequences will play out over a couple of generations, not just a few years. Ironically, we have already tested the idea of being less selfish by handing out millions of loans to everyone who needed them. The results are glorious, and this is just a glimpse of the bright future.

Hi Asada,

here is a story from one family that lived through the GD.

Very sad but probably far better than the difficulties some faced.

Cheers,

David,

New Zealand.

The effects of the Great Depression in one middle-class family:

Father was not much invested in stocks. He was conservative, and was saving by buying bonds. He mortgaged the house in 1927 to raise cash to buy a small interest in the company that he managed.

The craziness of the market in 1929 made no real impression on us. Life went on just as before.

In 1930, father bought sister a new car when she graduated from school. I remember it vividly, it was a Ford sport coupe, in Washington Blue with Bronson Yellow wire wheels.

By the spring of 1931, things were not going so well at the plant. In March wages were cut by 20%. Brother was laid-off, as the new company policy was to save work for family men whose wives and children were not working.

Father let the furnace man and yard ,man go. I had to take care of the furnace each morning and evening, a job that I loathed.

Mother stopped paying the kitchen girl, who offered to stay on for just room and board. Mother agreed, but took on more of the workload herself, as she did not think it right to work a girl to death for nothing.

Father and his managers, clerks and foremen went on half-pay in May. Business deteriorated further, in summer wages were cut by another 15%, and in October hours were cut to 20 a week, in order to enable the firm to spread around the little available work amongst the men with families.

Women, who worked in the radio department doing delicate assembly were let go unless they were breadwinners. Single women and men were all let go.

In the fall of 1931, my oldest brother came home with his wife and children. He had been working as an accountant for a large bank that failed in 1930, and had not been able to find any other work.

Father tried to sell the cottage and could not. He moved my other older brother and his family into it. It was a nice place in summer but, as it was not weatherized, it must have been pretty uncomfortable in a Michigan winter..

Around Christmas time, the family of our kitchen girl lost their place. We let them set up housekeeping in the haymow of our carriage house. A little beaverboard, and some printed cotton curtinas, a stove and a bit of paint made a pretty cozy home.

In the spring of 1932, my brother William went West on the rails looking for work. He bummed it on freight trains. He found some kind of work in Colorado, and wired us that he would come home after the job. he finished work at the end of January, 1933. He was coming home when a railroad man in Wyoming found him frozen in a freight car. He still had the money that he made, about $120.00, pinned inside his shirt, so the police said was that a railroad policeman had clubbed him, closed the door on the freight car, and left him to freeze.

Around this time, the mortgage on our house was to be re-written. In those days, most mortgages were written for a period of 5 years. the mortgagor generally paid only interest, and then paid off the principal at the end of the term. Any shortage of principal would be rolled over. This time the bank called the mmortgage due. Were it not for the bank holiday, and the HOLC, which put us into a modern 20 year mortgage, and allowed us to pay interest only for several years. were it not for this intervention, we would have lost our house.

by February of 1933 father’s company closed. we had by now, no money, and and four families, with eighteen mouths to feed

He sold sister’s practically unused car for $40.00. When he purchased it three years earlier, it cost $550.00. He got $10.00 for the eight cylinder Paige, and kept the Dodge Victory Six, which he drove for the rest of his life.

Mother opened up the living room as a tea-room, my brother and I moved into the garage and my sister moved out to the cottage so that we could take in 5 paying boarders in our two rooms, at $7.00 a week each for room and food. Our tabs at the butcher’s and grocer’s were pretty long in those days. Mother made filling but cheap food, heavy on starch, most of the meat was reserved for the boarders.

Father never worked a managerial job again. The Depression pretty well defeated him. In the mid 1930’s my brother and I got on the CCC, and my married brothers got on the WPA.

We could not have survived without the HOLC, the CCC and the WPA.

Father was proud that he never went on relief, but things were pretty desparate for a while.

Father finally found work sweeping, wiping and polishing up in a local electric light plant. When the plant was closed as obsolete during the War, he retired. He passed on at the age of 84 in 1952.

@Ed:”the average life expectancy chart is mis-used”.

Yup.

Search google for “life expectancy by age” and get, e.g.

http://www.infoplease.com/ipa/A0005140.html

So a 20 year old white male in 1930 had on average 46 years to go: the same age person in 2004 56-57 years. In general life expectancy at economically productive years has been increasing on the order of a year every decade in the 20th century.

My mom was a child during the Great Depression and does remember a few things about life during those times. Her family’s department store went bust and her father moved the family around looking for work finally getting a job for Sear Roebuck (the Walmart of its day). She still remembers how destitute people were. Unemployment was at 25% and probably under-reported. Many people lost their houses and farms and moved in with family. In those days, multi-generational households were quite common.

~

Sticking with the retail theme for a minute, I heard Mark Vitner, Chief Economist at Wachovia speak the other day. He said that retail is a train wreck and the only thing preventing more closures is the hope that the holidays bring. He said that many retailers can’t even pay for the inventory that they have on hand which doesn’t bode well for manufacturers and suppliers. He opined that the reason Circuit City filed before the holidays is to try and get a better price for their inventory before everyone starts dumping. Jobs will be lost, shopping centers will become ghostowns and commercial real estate will follow residential down the rat hole. No matter what Washington does, the consumer economy is gone. Perhaps now we can focus our economy on things of intrinsic value.

~

Comrades, be brave. The news will get much worse before it gets better. But in the end, we will be a better society

Asada –

(1) Fredrick Lewis Allen

>>>(a) Only Yesterday: An Informal History of the 1920s (published 1931 as GD worsening)

>>>>(b) Since Yesterday: The 1930’s in America, September 3, 1929 to September 3, 1939

>>>>(c) The Lords of Creation

(2) Studs Terkel

>>>>(a) Hard Times: An Oral History of the Great Depression

>>>>(b) Coming of Age: The Story of Our Century by Those Who’ve Lived It

(3) David Kennedy “Freedom from Fear: The American People in Depression and War, 1929-1945 ”

(4) Fiction but accurate

>>>John Steinbeck “Grapes of Wrath” (and the movie with Henry Ford is super.)

>>>James Cozzens (anything he wrote)

(5) Warren Sloat “1929: America Before the Crash”

(6) T.H. Watkins “The Hungry Years: America in an Age of Crisis, 1929-1939”

(7) Robert McElvaine “The Great Depression: America, 1929-1941”

(8) Edmund Wilson “The American Earthquake: A Chronicle Of The Roaring Twenties, The Great Depression, And The Dawn Of The New Deal ” ((contemporaneous material – reporting, essays and articles by Wilson)

(9) David Kyvig “Daily Life in the United States, 1920-1940 : How Americans Lived Through the Roaring Twenties and the Great Depression”

(10) Nancy J. Martin-Perdue “Talk about Trouble: A New Deal Portrait of Virginians in the Great Depression” (oral histories)

(11) Michael Parrish “Anxious Decades : America in Prosperity and Depression 1920-1941”

(12) William E. Leuchtenburg “Franklin D Roosevelt And The New Deal”

(13) Robert S. McElvaine (Editor) “Down and Out in the Great Depression: Letters from the Forgotten Man”

(14) “One Third of a Nation: Lorena Hickok Reports on the Great Depression” Hickock was a top reporter – a pioneer of women in journalism – in the 1920s and 30s who travelled the US on behalf of the Roosevelt administration reporting on conditions.

(15) Errol Lincoln Uys (editor) “Riding the Rails: Teenagers on the Move During the Great Depression”

(16) James R. McGovern “And a Time for Hope: Americans in the Great Depression”

>>>>>And that is just a start. First read Kennedy so you have the dates and events in order. When you get through that list, I’ll give you more.

We’ll see DJIA 7161 (see above table) again very soon – a few weeks perhaps.

Hard Times by Studs Terkel

Did I not predict:

http://www.moneyandmarkets.com/the-g-20s-secret-debt-solution-27996

…actually I (about 2 months ago) predicted the Amero but this is SO MUCH MORE…

The recent low for the DJIA was around 7200. I recall when DJ exchange traded funds started, the average opened at 7500 or $75 ps. It went up for several years, then 9-11 happend & the average as I said earlier hit close to 7200 the technical low. Watch for resistance at that point. Now if the resistance breaks there is nothing I can think of other than total menipulation by Hanky Panky paulson & friends that prevent the markets from complete disaster.

ha ha

New realtard catchphrase for the new era

“Prices like this won’t last!!!”

Which is true but ironic in an interesting sort of way

Dave and Compass Rose – thank you both for your interesting posts. I enjoyed reading them.

Doctor – love your posts. I am a major fan of your common sense

and gift of explaining complicated ideas so even simpletons like

me can understand. Much appreciated. Thanks!

Leave a Reply