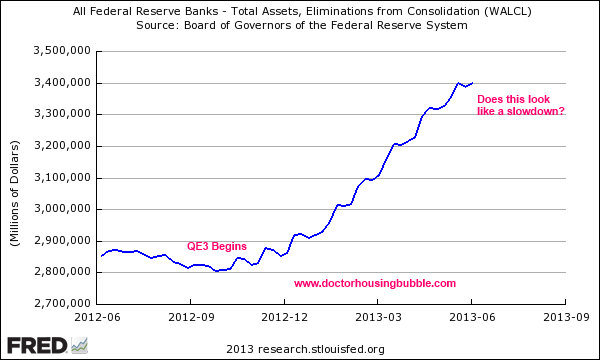

The confidence game in housing: Fed could slow Quantitative Easing later this year. Maybe. Federal Reserve expands balance sheet by $500 billion since QE3 began in September.

The recent rise in interest rates is a big deal for the housing market. As the economy appears to be heating up, hot money will flow to any sector with a perception of higher yields. The recent increase is occurring because of this perception. The Fed has put itself in a corner. The stance is that QE3 and all easy monetary policy will continue so long as the economy is sluggish. Well with a record rally in the stock market, jobs being added, and housing values overheating the Fed looks to be bluffing on this call. Of course much of this rise has occurred because of hot money (the same fuel causing the rally). The Fed has expanded its balance sheet by $500 billion since September of 2012 when QE3 began. Does that seem like a slow pace of growth? There is a big confidence game in housing at the moment.

Fed trying to talk down interest rates

The Federal Reserve has exhausted most normal monetary policy tools when it comes to stimulating the economy. In more normal markets, the Fed would tinker with the Fed funds rate. In a hot economy you would raise rates and in a slow economy you would lower rates. The Goldilocks approach to economics. Yet it is hard to go lower than 0 and we’ve been there for years.  Quantitative Easing and other asset purchase programs have provided alternative methods for the Fed to lower rates. The Fed mentioned that it will continue to buy assets so long as it views the economy as growing slowly. If that is the case, the Fed is seeing something we are not:

The Fed has expanded its balance sheet by $500 billion in a few short months only since QE3 started. The Fed is hinting at slowing down QE3 but this is more of a bluff:

“(WSJ) Federal Reserve officials are likely to signal at their June policy meeting that they’re on track to begin pulling back their $85-billion-a-month bond-buying program later this year, as long as the economy doesn’t disappoint.â€

Vague statements like that give the Fed power to enlarge a balance sheet to $3.4 trillion. Before this crisis hit it was well below $1 trillion of mostly healthy and safe securities holdings. That is no longer the case. The housing market has been ravaged like locusts by the hungry appetites of yield seeking big money from Wall Street. A reader is currently working on putting together some data on big money investors bailing on the real estate market (or trying) and we’ll make sure to put together an article on this because this is a very telling trend similar to the massive short bets that were being placed in 2007 on subprime brokers.

Rates took a big turn recently:

The 30-year fixed rate mortgage went above 4 percent reaching levels seen in 2011. What is hilarious but fully understandable is that the rise comes because of the Fed hinting it will stop buying mortgage backed securities:

“(Bloomberg) Mortgage rates have been following government bond yields higher as a strengthening economy stokes speculation that the Federal Reserve will reduce efforts to push down borrowing costs. The increase may spur homebuyers to accelerate deals to lock in low rates, said Keith Gumbinger, vice president of HSH.com, a mortgage-information website.â€

Of course higher rates will stop the massive banking profits that are being generated by constant refinancing. Readers are using their visual senses and are seeing the same thing that I am seeing on the morning television. The amount of hyper-steroid like ads promoting refinancing are now plaguing the morning “news†like a 7:00am circus. In between the weather jokes and Groundhog Day reports on traffic, many of the ads are either refinancing related, about furniture to fill your home, or plumbing for your home. In other words SoCal’s economy is once again tethered to real estate in a major way.

The Fed is mainly concerned about their key banking constituents. With the stock market being this red hot and rental yields being crushed, big money will exit extremely fast given the opportunity. Reading behind the cryptic words of the Fed is the reality that they will continue to buy large amounts of MBS (as noted by the Fed’s giant balance sheet) and the Fed funds rate isn’t going anywhere. At this point the Fed is using words as a method of talking down rates. This can only work as long as confidence holds up. Like in any good con, you have to get someone fully invested in believing that you can do anything like a financial Houdini. While the public may believe this, the fact that big money is pulling out of the market in many areas is probably a signal that something is starting to shift.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

18 Responses to “The confidence game in housing: Fed could slow Quantitative Easing later this year. Maybe. Federal Reserve expands balance sheet by $500 billion since QE3 began in September.”

Wow! Once again you are ahead of the curve Dr. HB. Hot money is like hot air, always seeking the highest level. And pump and dump is their motto. Wall Street and the banks are surely puting lipstick on this pig and getting ready to sell. Get ready for popping bubbles next. First RE, and later the stock market. The reverse of what happened in the 2000s.

Sheeple beware.

http://Www.westsideremeltdown.blogspot.com

http://Www.santamonicameltdownthe90402.blogspot.com

I totally agree. I sold my San Diego house to an investor who paid $900+k cash. With a fair market rental price of $4000, that is around a 4% annual return before taxes, maintenance and expenses. Following the Dr.’s thumbnail of assuming close to half of that going to keeping the pool clean and paying the parcel taxes for the local schools, that leaves a return closer to 2%. Wait until rates actually rise, how trapped they’ll be between falling home values and negative real returns.

WHO CAN AFFORD $4k A MONTH FOR A PLACE TO LIVE!!!!!!

The dump should be hitting about now. OR very soon. Even though it is still early summer, I’m starting to see a slow down in transactions. Perhaps tracking REIT IPO’s is the way to tell? Not sure, but they need to foist this stuff onto the public pretty quickly now.

My feeling is that those who have gone public will float for a bit; we’ll probably see the smaller funds (under 2k homes) start to bail out when the larger funds start raising red flags, or see a significant drop in their stock. Then the race is on..

“…the reality that they will continue to buy large amounts of MBS…”

The question is from whom??? Even if rates lower further the lack of inventory and the maxed out consumer leave precious little MBS to be created. While Wall Street will be able to dump some of their inventory on Joe Six-Pack the FED is basically pushing on a string. All cash investors have destroyed mortgage demand and the likely exit strategy of selling to Mom and Pop investors and retail buyers is going to fail. The rush for the exits is starting and I’d say Housing Bubble 2.0 has already popped.

NZ, I like the way you think and agree that the MBS supply is likely getting thin, especially now that the refi market has effectively dried-up.

As much as I’d like to see this bubble pop, my gut is signaling to me that the gummet might try to bring back the subprime market. Subprime bubble 2.0 perhaps? If my instinct proves correct, I bet they come up with some different term or set of names for it in an attempt to obfuscate what’s happening. I also wouldn’t be surprised to see it coincide with immigration policy changes.

If this happens, there would presumably be a lot more MBS that the banks can trade for Fed book entries. Unfortunately, I think they still have some audacious tricks left in the bag.

All the talk about the Fed “Tapering” is just talk. They can’t stop. We will have Buzz Lightyear monetary policy – QE to Infinity and Beyond! With 22 million homeowners trapped in their underwater homes, up to 50% of all-cash offers from hedge funds, huge shadow inventory, etc. no wonder there is low inventory causing multiple offers, rising prices with a resultant BUBBLE.

1st Q GDP showed real discretionary incomes plunging at over 9% annualized rate, worse than the largest plunge during the 2008/9 crisis and household savings rate fell to an abysmal 2.3%. Mortgage apps are plunging.

As economist Peter Schiff wisely wrote “A successful economy can’t be built on housing. Rather, a robust real estate market must RESULT FROM a healthy economy. You can’t put the cart before the horse. As a nation, we do not need more houses, We built enough over the last decade to keep us well sheltered for years.â€

The only Ponzi scheme bigger than the stock market is the housing market. They are both cyclical, malinvestments, manipulated, based on debt, and fabulous for the financial sector which runs this country. Having a 2,400 sq. ft. house instead of 2,000 sq. ft. house does not increase your standard of living twenty percent. However, investing that money in productivity does increase your standard of living. Playing the stock market does not increase your standard of living, those who get the commission and trade on insider information are the ones who make out. California is the epitome of the Ponzi. Have you ever really listened to Diane Feinstein speak? She is not just stupid but batty as well. Yet, her husband is worth hundreds of millions from the real estate game. Can you call either one productive? Read the details of how he was bailed out by Fed money. And, I am not just picking on the lovely couple, there are millions like them in our economy. By the way, the Fed is owned by the banks and works for them, not you.

Well stated…

Mr. Feinstein just happened to get contract to broker closed Post Offices via commercial sector, Imagine that!

The system is utterly corrupt and 1984 was way before it’s time..see recent events..

If everything was great FASB 157-8 would be in place…its a fairytale world and so many are enthralled with dancing with stars, 25K dinner parties etc…

Peak America will also cause issues for bubble housing, they will tax the homeowner more in years to come….it’s inevitable

Water seems like a good investment…

I totally agree. You have to live somewhere, so I just keep it modest as a place of residence, not some gateway to funding my retirement or capital appreciation. In terms of investments, I just keep it highly liquid so that everything can be pulled out in a single day. Avoid bonds.

Are you speaking of U.S. Sen. Diane Feinstein and her husband Richard Blum?

Speaking of Richard Blum, Perini-Zachary-Parsons, a construction group partially owned by Blum’s investment firm, Blum Capital and their investors, won an almost billion dollar contract for the first-phase construction for California’s high-speed rail.

This didn’t seem to be too widely reported on, or perhaps most Californians were busy watching the Kerdasians or collecting govt bennies to care.

Here is the problem I see: even if these manipulations falter and prices start to dip, it was prices reaching a certain threshold that allows some organic sellers to bail on their houses (no longer underwater) and banks to want to start putting their inventory out there (break even on loans or closer to target price), increasing total inventory.

If the price drops, the market will remain paralyzed with short sales + foreclosures, all of which the bank controls and manipulates when it comes to market. So what I am looking for is really an inventory recovery and it is not happening either way it seems, however with a MAJOR price drop (second crash) investors and possibly banks could do the ‘dump’ part of pump and dump to get ahead of potential larger losses and shift money to a better returning asset classes (most of the investors paid cash so they CAN get out, those who got jumbo mortgages are looking at foreclosures round 2).

The real problem is inventory IMO. If prices crash people will just once again go invest when it “looks like a temporary bottom” and we’ll just keep bouncing off a certain price level with still no real inventory. I suppose in the “background” the banks are offloading to hedge funds or management companies who are in turn selling paper to a greater fool.

Unfortunately in none of these cases do I see a buyers market emerging any time soon, even if prices drop. You will find SOME good opportunity eventually if you have cash, but you won’t have your pick of the litter on housing for a while yet. We are in a housing liquidity trap because so many properties are stuck in the queue. I wonder if banks really have a 10 year limit enforced, and if this will start making things move through the system; somehow I doubt it.

Maximus

Thank you for taking the time to show exactly what a joke the California housing market is. There are way fewer variables involved in the purchase of a gold mining claim. It reminds of the old joke of what is a gold mine, a hole in the ground with a liar standing next to it. In stead of purchasing house, I suggest you look into the opportunities below from http://www.paddypower.com/bet?action=go_betlive_financials_home

12. Virtual Market (Random Walk)

Definition/Betting Hours

Bets on the Virtual Market are based on a Random Walk algorithm, populated by a Random Number Generator approved for use by the Isle of Man Gambling Supervision Commission. The market is open for betting from 00.02 to 23.58 Dublin time Monday to Sunday. Markets are quoted on a 2-Minute basis throughout the day.

Settlement

2-Minute bets are settled against the first price created by the RNG after the market time has passed. For example the 4pm market will be settled using the first price time-stamped after 4pm.

I wouldn’t trust sites like that. Instead, there are what are called Binary Options that are sold for popular stocks and the US market indexes. It’s still essentially gambling at the end of the day but at least they attempt to regulate it.

Maximus

I certainly would trust John Corzine, Obama’s buddy, a lot more than Paddy Power.

http://www.intrepidreport.com/archives/4151

What will be most interesting to see is if the subprime market is brought in for the second boost phase.

FACT: TLT July 2012 $132 – June 2013 $112 – basically, this is the part of the yield curve QE targets with some additionally spiciness of EXTREMELY high risk mortgages from FHA. FED bought trillions of this garbage.

If the FED had to operate with BASEL capital requirements, VAR and Mark-to-Market rules, it would be declared bankrupt and closed up. Tens if not hundreds of billions, in book losses from going long 20-30 year mortgage risk at less than 3% yield

The problem with cornering a market – which is all QE has done while making the trading desks at TBTF banks/brokers rich by front running guaranteed, massive buys – is everyone knows the sucker at the table and you can’t unwind profitably once the game blows up Oh well, the taxpayer can eat the losses.

Leave a Reply