Economic and Financial Alchemy: 3 Trends to Follow in the Next 90 Days: Pseudo Drop in Nationwide Foreclosures, The End of One Plasma in Every Room, and Loving Your Car a Little Longer.

In the midst of this epic and monumental election campaign, which I do sincerely hope you go out and vote, the number one issue which is the economy is now fluttering into the abyss at a much quicker pace. On Monday, automotive sale numbers came out and the numbers were downright shocking. U.S. auto sales dropped to levels unseen in 25 years. General Motors U.S. sales are down 45 percent from a year ago while Toyota is down 29 percent. For those holding out on decoupling coming back that dream may be shattered once again with sales dropping 40 percent in Spain and 19 percent in Italy. Every major auto manufacturer was impacted with Ford dropping 30 percent and Nissan following 33 percent. These are across the board collapses. Later in the article, I will go into the detail of what these numbers mean for the overall U.S. economy.

If that wasn’t enough to highlight the sad state of the economy, big ticket flat screen seller Circuit City announced that it will be closing 155 of its 700 stores meaning more job cuts are in the pipeline. Circuit City has about 43,000 employees and recent estimates are looking at an additional 7,000 job losses. This is simply another testimony that consumers are tapped out and the silent depression is making its full fledge attack on the consumer economy. What this also means is people need to get ready to see more folks driving their cars a little bit longer.

What we will also be seeing in the weeks to come is a “surprise” drop in foreclosures. It really won’t be a surprise for those that are following the news with Bank of America, JP Morgan, and IndyMac Bank and their great experiment in mass mortgage modifications. JP Morgan recently announced a moratorium of 90 days on foreclosures on loans targeted for modifications. Why is this big? Well because they now own uber toxic mortgage dealer Washington Mutual that went buck wild here in California with the wonderful Pay Option ARMs.

These are 3 trends to follow in the next 90 days. Let us dig deeper into the numbers and see what this will mean for the economy.

Beware the Phony Drop in Foreclosures

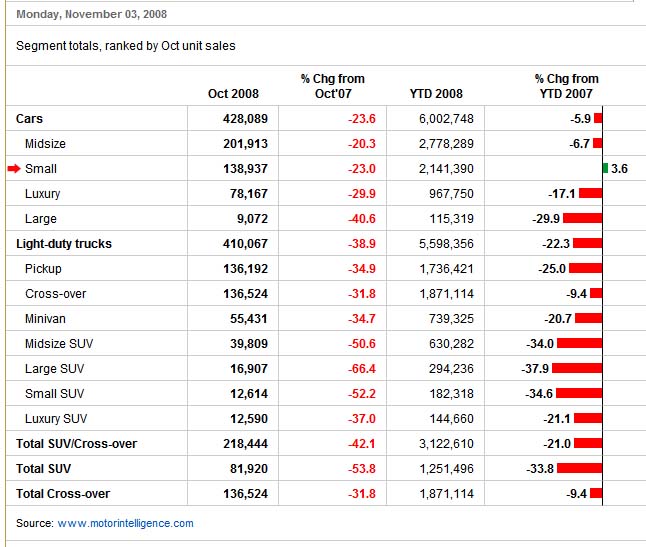

Nationwide foreclosure filings are still running at a record pace. We are in the path of a tempest and will see 3,000,000 foreclosure filings this year:

[click for larger chart]

As you can see from the chart above, we are clearly running higher than 2007 and still much higher from 2006. So why will we see a slight drop in foreclosures? Well two of the largest banks JP Morgan and Bank of American will be on a campaign of massive loan modifications. JP Morgan now the proud of owner of Washington Mutual, Wells Fargo with new baby girl Wachovia, and Bank of America who now owns poster boy of mortgage greed Countrywide Financial.

So what does this effort look like?

JP Morgan:

$70 billion in loans targeted

Potential mortgage pool:Â Â Â Â Â Â Â Â 400,000 mortgages

Freezing foreclosures for 90 days to setup process

Bank of America:

Two-tier modification

1st Potential mortgage pool:Â Â Â 265,000 mortgages targeted (all kinds)

Second-tier modification

2nd Potential mortgage pool:  400,000 subprime and option-ARM customers serviced by Countrywide. Deal hashed out with 14 state attorney generals.

Wells Fargo:

Potential mortgage pool: Â Â Â Â Â Â Â Large number of roughly $120 billion option ARM pool in portfolio from Golden West purchase by Wachovia in 2006.

So we’re talking a large number of loans. In addition, California recently through SB 1137 recently announced a few more measures lenders will need to go through in order to help borrowers with their loans. But if recent shenanigans at government run IndyMac Bank are any indication, borrower responses may be low. You need to remember that a large number of this pool is right here in California. Washington Mutual has a disproportionately large number of loans here in California especially of the option ARM flavor. The Golden West lunch special bag of mortgages is largely California based. Countrywide? Oh yeah. Get the picture? This get out the modification effort is largely targeted at the tsunami we’ve been talking about for over a year which is the $300 billion in option ARMs here in California. Will this work? No. But it’ll sure make the numbers look a bit better for a few months.

It is an American Right to Have a Plasma in Every Home

Circuit City, the technology store went from having a market cap of $5 billion to currently having the market cap of $60 million. If you want to see the collapse of the big ticket consumer economy just take a look at this:

That is a shocking decline. Year to date the company is down 91% which of course isn’t saying much now that it is trading under $1. Yet think about the massive implication here. Circuit City employs 43,000 people. What do you think is going to happen? More importantly, who is going to go out there and load up on $5,000 plasma televisions? Not many. If you think this is strictly a problem facing Circuit City look at big kid on the block Best Buy:

Best Buy is down 47 percent year to date and that is with the recent jump up. However, you’ll notice that most of the decline came in September and October. Why? Well first, I think the last bastion of steroid consumer dogma was just shattered during the epic market decline we have recently lived through. People realize that without easy credit and people having near heart attacks opening up those October 401k statements, people are not going to be in the mood to load up on expensive technology gadgets. In economics there is a thing called elasticity. That is, these stores sell items with elastic goods. For example, a person can easily forego a $4,000 surround sound system and go with the generic Wal-Mart brand for $200. They’ll still get sound but not at the quality of the more expensive unit. They’ll survive. Inelastic goods are items such as insulin where someone has no reasonable substitutes in the market. The consumer will pay whatever price is demanded.

These industries are getting hammered. But take a look at Wal-Mart and Family Dollar Stores for the year:

Wal-Mart and Family Dollar Stores are up 17 and 40 percent respectively for the year. Why? Well they sell items at lower prices including household goods like food, clothes, and medicine which people will need no matter what. I have yet to see a study but I am willing to bet that maybe for a brief time, while folks decided to stay away from Best Buy and Circuit City electronics, Wal-Mart goods in this area did well. Only for a short timeframe as the market adjusted but now, everyone is hurting including higher priced goods at Wal-Mart.

What do you Mean I Can’t Trade in my Car?

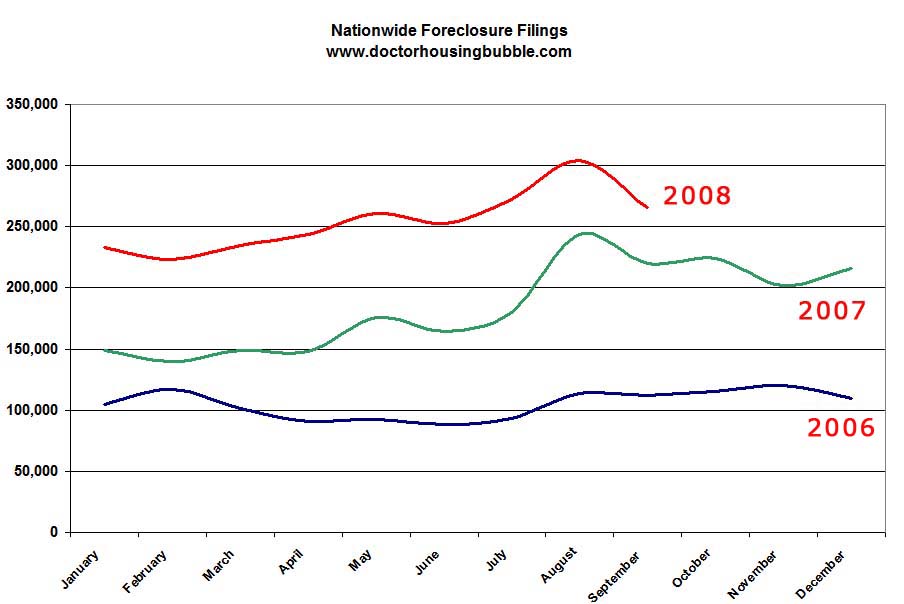

There is only one word to describe auto sales. Pathetic. The data on this is so stunning that it would have sent the markets down if it weren’t for the world on hold for a historic election. Let us take a look at the raw and startling data:

Every single area got hammered into the ground aside from one tiny group that barely edged up, small car sales and that is if we look at year to date performance only. If we go back to October of 2007 sales are down 23%. SUV sales are down 53.8 percent across all sizes since October of 2007. Large car sales are down 40.6% from the same timeframe.

Aside from insane oil prices for much of the year, what else contributed to this decline? Can it be that Americans are broke? That is one factor. But another factor is the sudden desire for standards in the industry when it comes to loaning money out. GMAC, the financing arm of General Motors is now requiring a 700 FICO score for MSRP prices:

“GMAC Leaders and NAO Team:

In light of the disruption in the credit markets, GMAC NAO is announcing a temporary, more conservative purchase policy for retail auto contracts in the United States. In the short term, we will limit auto contracts to those consumers who have a minimum 700 credit bureau score, with an advance rate equal to or less than dealer invoice. This means that consumers will be required to make a down payment. In addition, we will restrict approval of contract terms beyond 60 months, except for those customers qualifying for GM-supported 72-month incentives currently advertised.

These are extraordinary times, and we must take these prudent steps to focus our resources on high quality retail contracts and critical areas such as dealer wholesale financing, until the credit markets are stabilized. To assist dealers, GM has enhanced its retail incentive programs in October to utilize more cash incentives. GM and GMAC will continue to work collaboratively through these challenging financial market conditions.

Barbara Stokel

Executive Vice President, North American Operations”

[source:Â Financiapocalypse]

What do you mean I now need good credit and a down payment to buy a new Corvette? Suddenly people are looking for good credit and are coming to realize very few Americans fall in this area. And those that do have good credit for the most part have it that way since they are financially prudent and not out there buying gas guzzlers! It is a paradox. I have to tell you a quick anecdotal story that captures this sentiment. This weekend I went down to my local Ralphs supermarket for some angus steak. It felt like a good weekend for a steak and a good Laker game versus the Denver Nuggets. As I was coming out of the store, there is a local recycling center in the parking lot. In Southern California, these are all over. What I couldn’t help noticing though was a younger guy pulling up to the center in a brand new Jaguar. The car was loaded with cans, plastic bottles, and empty beer glasses. Out come these items from the passenger seat, the back seat, and finally the trunk which was completely full.

Now I’m all for recycling but this wasn’t someone recycling for keeping the planet green. This was someone looking for the cash it would bring. And the line was twice as long from normal weekends. The car was a newer model leased within the past year since the plates had a “leased at…” type frame. And you wonder why homes across the country are defaulting in record numbers.

Only in Southern California folks can you make your monthly Jaguar payment by recycling cans.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

19 Responses to “Economic and Financial Alchemy: 3 Trends to Follow in the Next 90 Days: Pseudo Drop in Nationwide Foreclosures, The End of One Plasma in Every Room, and Loving Your Car a Little Longer.”

Steroid Consumer Dogma. What a great name for a garage band.

~

The cans story was priceless, so to speak. I thought we had it bad here, where the county is shutting down recycling centers because people are abusing them by doing things like dumping their dead pets. (Word on the street is that people are starting to off their poor animals, rather than face the brief emotional labor of handing them over to a shelter for readoption. If I were superstitious outside of the baseball season, or religious in the least, I’d say this is begging for divine retribution. Or is this related to the human need to sacrifice innocents in a time of difficulty?)

~

The question I have is how the sudden pandemic of fiscal prudence is being defined as a recession, and bad, merely because numerical methods designed to count and affirm shopaholism as a robust economy are down. The worst news I’ve seen recently–apart from Sarah Palin, of course–is gas at $2.39 a gallon. I mean, mess with people’s rides, and they actually start to think!

~

It’s about time we developed methods that counted healthy, sane things as valuable. And taxed things we want to discourage (like pollution, waste, scamming, health-destroying products/habits/lifestyle choices), rather than discouraging things we want to tax (like work, savings, prudence).

~

Doc, you need to calculate a new affordability ratio: the soda-can-to-median-house one. While you’re at it, tot up pints of blood per RHG. Sigh.

~

rose

great article as usual. The goobermint will try all sorts of schemes to delay the inevitable – after all, the people who run the goobermint run it on borrowing, so they think that borrowing is good!

We are rapidly approaching a revelation – we can print treasury bonds till we are knee deep in them – but at some point, the world is gonna realize… they are only paper, backed by…nothing.

My hope is that this new administration, whichever party, will bring in a sense of confidence in the administration. By doing so, it will have a positive effect on the economy!

I read a great article about WAMU over the weekend in the NY Times. It was priceless and revealed how bad WAMU was operating. An underwriter was pleading with her superiors that certain loans were fraudulent and borrowers even with Liar Loans could not make the monthly payments. Appraisers in California were just part of the scheme. Addresses were different in certain docs.

The long and short of it was the underwriter was written up and eventually fired for not approving loans. Mortgage brokers were being paid big bucks and were telling WAMU if they didnt approve a bad loan that they would pull their business.

WAMU deserves to fail. WAMU should be sued by every pension that invested in the company. However, instead of prosecuting the white collar crooks, we reward them with Government money. I want a list of the supervisors at WAMU and Countrywide and see if they were around during this period of outright theft.

Oh, I know if WAMU fails and Countrywide fails then we will drift into the financial abyss but we may be heading their faster even without a bailout.

You can read the article by googling Ms. Cooper and WAMU. Made be sick.

This comes from http://www.lablescar.com the retail history blog.

The complete article with comments could be found by clicking the link at the top.

We called it: Circuit City is closing 155 stores, not even waiting to see if holiday sales have a chance of propping up the 700-store chain. This is a very bad sign; I’d look to see if Circuit City is one of the titans to fall in January. Consumerist has the complete list of stores to close. The cuts are heavy in Georgia, Arizona, California, Illinois, and Ohio, and they’re scooting out of some markets entirely. Surprisingly, the Northeast is largely spared with only one store in New England to shut and relatively few in the New York City metropolitan area.

Bloomberg:

The company has posted six straight quarters of falling sales. Circuit City hired FTI Consulting Inc. and replaced its chief executive officer in September after losing customers to Best Buy Co. and Wal-Mart Stores Inc. Circuit City is closing stores in 55 metro areas and will exit 12 of those markets altogether, including Atlanta, Phoenix and Kansas City, Kansas.

“Since late September, unprecedented events have occurred in the financial and consumer markets causing macroeconomic trends to worsen sharply,’’ CEO James Marcum said in the statement. “The weakened environment has resulted in a slowdown of consumer spending, further impacting our business as well as the business of our vendors.’’

All I really want to know is when and where to get the going-bust deals from Circuit City. I’ve been wanting to replace my POS Olevia with an Aquos for months. (and I’m going to put it on plastic, too. Just because I can. =D )

No matter who wins this election, simple confidence cannot float the Titanic. We still have trillions of dollars in debt, and an entitlement mentality that will crush America as we know it today. To think that Patriots died for the country we’ve become. We are a nation of Nintendo zombified, credit card junkies without any idea what is coming based on our consumptive excesses.

If societal collapse is coming it’s not going to be like the 1929 crash. We had the gold standard, an educated population, and a moral backbone, albeit with the worst racist tendencies in us that were allowed to flourish. Today we have a nation of McJob diploma mill graduates, and zero sense of right and wrong – only the back wash from the “Me” generation who lived by the “if it feels good, do it” mantra. Look where that mentality has gotten us – a population who can’t name the original 13 colonies but knows whose being voted off “Dancing with the Stars”.

Fear for our future. If you don’t – as a recent college graduate to name the Supreme Court members, or what are in the original Bill of Rights and see what their response is. It will convert your perspective in ways you do not expect.

I am rebuilding the engine in my 1970 Mercedes, it gets 25 mph ,seats five and it has a manual tranny. It is easy to repair so I should get another twenty five years from it.

I know it’s hard to get out of a bad/reactive mood, particularly when it has lasted for eight years or more. And I must confess to being a huge cynic (and independent voter) about elections because of how they’ve been taken over by plutocratic budgeted media. But think about this: we can see that people are choosing a culture or rhetoric of unity over that of divisiveness in this election, regardless of whatever that means in praxis.

~

Perhaps this will lead only to 4-8 years of Pollyanna in Rainbow Land, or perhaps some genuine multipartisan efforts will emerge to repair all that has been destroyed and shredded by Reaganomics, and the toxic Bling Uber Alles culture established in that era and worshipped since then. Whatever happens, this nation’s repute on the world stage needs desperately to be strengthened.

~

I agree with JWMTG to a certain degree. J, remember that the only real backing for this nation’s fiat currency is in fact the confidence that people will repay their debts. The debts which create money in our system. So confidence IS important…though I, the progressive economics geek, still hope to see a more reality-based system. Where, for instance, the GDP measures healthy people and ecosystems and communities, rather than counting cancer and plane crashes and divorces and Katrina as net gains because of the money that has to be spent on them.

~

Stay calm, stay strong, and stay intelligent. It just may be the case that being smart will once again be fashionable.

~

DHB, I mention all this because of something I read in the last hour, that the big difference in the shift in electorate intelligence in the past four years has been the blogosphere. You have been one of my and our great daily comforts these past three years–the clarity and intelligence, the unrepentant and feisty focus on numbers rather than blaat, and the constant rooting in really good and enduring values like work, savings, and prudence. I wish we could all chip in to send you a fruit basket or something. 😀

~

rose

Hi Doctor, another good post, thank you.

>

This thing was run by greed and the belief that we deserve better. That we are better. That we can borrow endlessly putting the debt on our children and on foreigners.

>

Quotes like “Deficits don’t matter” from our leaders like Dick Cheney and business commentators like Larry Kudlow.

>

We now say we see it for what it was. Fact is, we always did; we were just unwilling to stop.

I hope them banksters don’t foil my plan to walk away with this 90 day moratorium…

If I only could write this well

THE SHALLOWEST GENERATION

http://www.financialsense.com/editorials/2008/1103.html

Judging from how Californians keep voting for more debt (zabillion dollar high speed rail?!? and we can’t even pay state employees for a few months without federal help?), the days of buy now pay later are very very far from over at least as far as government is concerned.

But Obama as president? Well let’s just say the status quo needed it’s repudiation, can’t complain.

Dear Comrade DHB,

Thank you for bringing the auto industry into the picture. The cratering of the auto industry has relevance to the other megabubbles of our time in ways that are not often discussed. The financial, energy, housing, global warming, auto, airline and likely food crises are linked by the fact that we have created a modern world dependent on cheap fossil fuels. McMansions in remote places, land yacths clogging over-burdened roads, strip malls selling cheap, shiny things from China, industrialized food production, petro wars and the physical and financial infrastructure supporting them will not survive as we know it in the 21st Century. We are witnessing the initial bursting of these megabubbles.

~

Here’s a simplistic example of the connections. Residential and commercial properties in sprawl locations will wither because they are unsustainable in the post-fossil fuel economy, thus, the demand for cars will be dramatically reduced as we live closer to jobs and amenities. The financing that funded this cheap fossil fuel arrangement will fail. The inability to continue consuming on cheap credit will cause a contraction in production and accelerate job losses causing an even further decline in discretionary consumption. We may even face a national solvency dilemma.

~

My point here is that all these things are interconnected and if we don’t start investing in the post-fossil fuel world, we will not survive it. The new leadership in Washington needs to embrace the stark realities of the 21st Century by focusing on energy policy, infrastructure and domestic production capacity seriously and by shifting away from our focus on a consumption-based economy. This will be no easy task but the fate of future generations depend on our actions.

Hay Bluetown,

Were you taking a page from James Kunstler’s playbook?

http://www.kunstler.com

I was going to start car shopping and was hoping to make a decision by the end of the year but the way things are going I’m waiting until Febrary/March. Cars just keep getting cheaper and credit is getting tighter. Got my cash ready to go when the time is right.

Doctor,

Another tangent…do you think that our currency is in trouble? What do you think of Peter Schiff and his prediction of the dollar’s collapse/hyperinflation?

Sean,

I am an urban planner, developer and environmentalist (yes, such a combination does exist in one person) so I have a unique perspective on the world. I share many of the same philosophies as Kunstler and he is one of my favorite authors although he is profoundly more pessimistic than I.

Excellent post Doc. But no one has been checking the international news. The bad news isn’t in your post. The bad news is that the EU, China, OPEC, Russia, India and other G-20 nations have been meeting to create a new world reserve currency to replace the dollar. The new interbank currency, the International Monetary Unit, is based on the old European Currency Unit. China has been asked by the EU to use its $2 trillion US T-bill saving account to recapitalize Western economies, and the IMF. China has agreed that “reform is necessary”, but the talks were closed.

The Bretton Woods II financial summit is scheduled for Nov. 15th in Washington where these proposals will be laid out. (Bretton Woods conference was in 1944 and at that meeting it was greed the dollar would be the world reserve currency; the IMF, World Bank, and Bank For International Settlements set up.)

It appears that the G-20 is preparing to throw the US to the economic wolves. That is unless the US voluntarily adopts some draconian austerity economic program. Otherwise, within a few years the dollar would melt down in value. And the $45 trillion dollars held by foreigners could trigger what could be called a run on the Fed itself.

This is BIG bad news. Dr. Housing Bubble recent post is only a little bad news.

I

Leave a Reply