Don’t Mistake a Silent Mortgage Volcano for Being Inactive: The New Face of Alt-A and Subprime Mortgages.

There seems to be a false sense of security that somehow, the credit (debt) crisis is now slowly floating away into space. The market rally is indicative of this false sense of security. All bad news is ignored while slim glimmers of good news are enough to spark a rally. We are starting to look like the first quarter of 2007 when the idea that sub-prime was going to be contained in a tightly sealed silo and the market rallied all the way through August, only to be slashed to its current level. I’m not sure what data the bulls are looking at but it really doesn’t point to a recovery for sometime. In fact, many states are now revising their budgets for the fiscal year and things are a lot worse than they once appeared. California is now looking at a $20 billion budget deficit revised from the earlier $14.5 billion deficit only a few months ago.

These are things that I hope most of you are already aware of. Yet the focus has been taken away from the actual data in these toxic mortgages. Have things reached their apex of crap? Unfortunately they have not and let us go through a few reasons for this.

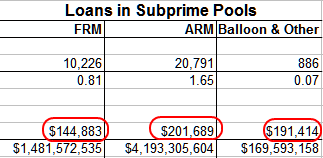

First, we’ll be looking at a sampling of 1% of first lien mortgages from the Fed that was put out in March of 2008:

The first thing I want to draw your attention to is the mean of these loans in various mortgage products. Overall, what we are seeing is distress on loan balances that seem below the median price of a home in the United States. The balances are not that high but remember that these are only for first lien mortgages and as we all know, many took out second mortgages and piggy-backed on these so they could go with little or no money down. It looks like the average size of a sub-prime loan ranges from $140,000 to $200,000. Out of the 1% sampling, we can get a quick glimpse and see that the bulk of these mortgages are ARMs; in this sample group over 70% of the sub-prime mortgage balance is in ARMs. So how are these mortgages performing?

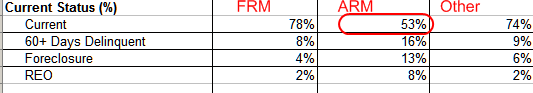

Out of this small pool, already 47% of the ARMs are not current! 13% are foreclosed and 8% are real estate owned. Guess where that 16% 60+ is heading? You may be running the math above and see that it only adds up to 90%. You can assume that we are looking at 90+ lates or other forms of distress for that remaining 10%. Either way, the performance here is absolutely abysmal and that 16% is likely heading to further future distress in the market. That is baked in. But the next shoe to drop is the Alt-A loans. You know, the cream filling between an ultra-prime and sub-prime taco? Let us quickly look at that profile:

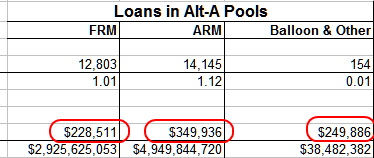

This is where things get even more disturbing. From this sample profile you’ll notice that the mean is much higher than the sub-prime pool. In fact, we have a range of $220,000 to $350,000 with the bulk of the loans being in the ARM profile and being close to $349,000. And by the way, many of these are in high priced areas like California. The first line above is observations which is the actual individual mortgages measured in this 1% sampling. Take a look at the first row and the second. Now you understand why the next shoe to drop is actually more distressing than the sub-prime profile. In fact, the size is comparable to the sub-prime portfolio. The nearly double in size is much more suspect and now that we know that ratings of AAA aren’t worth what they try to imply, we know many of these loans are going to go into some form of distress down the line. Look at the current status:

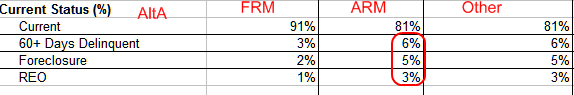

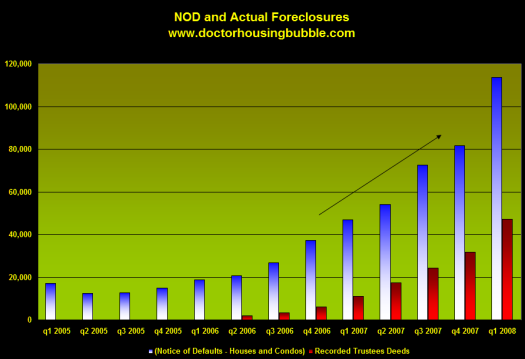

Already 19% of this portfolio is delinquent! And assuming many of these loans are in high priced areas like California, we have only entered the first stage of the debacle. In fact, the median year over year price was still positive as late as the 4th quarter of 2007! So you can certainly expect this number to balloon. Just take a look at the notice of default chart below:

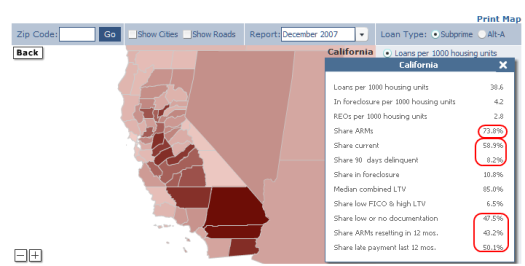

What you’ll notice is how quickly these notice of defaults are turning into foreclosures. If this is any guide to the future, these loans are going to get hammered into the ground. And of course, California is living in another dimension assuming that we are at a bottom. Now take a look at the California “non-prime” aka banana republic mortgage profile:

Okay, so the share of loans that are non-prime and ARMs is 73.8%. 58.9% are current. 43.2% of these are resetting in the next 12 months. And things are bottoming out because?

And by the way, anyone that bought in California in the last three years is most likely already underwater so any of these additional bailouts will not help since these folks are in negative equity positions. Severe negative equity. And you notice how the above is first liens? A high percentage have junior liens and they have no desire to let the property go since it will very likely wipe their loan out completely. That is why you are seeing such a delay in short sales getting done. The loss mitigation department with the first lien in most cases wants to work with you but the junior note holders have no rush to cancel out their debt. That is why cram downs are so important to improving the market. This way, judges can force and approve these deals without other parties delaying simply because they are delusional they’ll get some money back. They won’t. The industry is shooting itself in the foot here. Many of the bailout proposals on the table at a minimum require some equity which rules out the vast majority of California loans. And that is assuming most people are willing to stay in an asset that is depreciating with no potential of equity for a very long time. Most are deciding to practice the new modern dance of moonwalking away from their mortgages.

I am extremely disappointed with our leadership and this isn’t just me:

“WASHINGTON DC (CNN) — A new poll suggests that President Bush is the most unpopular president in modern American history.”

A fitting way to end the final year in office. Can’t get lower approval than that and just look at the state of our country today. Am I blaming this entire mess on one person? Of course not! The current Congress is just as bad on both sides. But when you are commander and chief (aka CEO of the U.S.) the buck stops with you. If this were a publicly traded company he’d been fired a long time ago. No one has a crystal ball but even a toddler can understand that giving people mortgages that they cannot pay is a recipe for disaster. The invention of perpetual housing appreciation was a myth. The “ownership society” was an Orwellian ploy to screw the vast majority of Americans. When they marketed ARMs with the blessing of Greenspan it was for prudent investing and to free up additional resources. Of course the absolute inverse happened. And why not? No one bothered to enforce any of the regulations on the books. This government was preoccupied with destroying the future of our country and putting us into an incredible amount of debt. Anyone that thinks are country is in good financial shape is out of their minds and probably still thinks these mortgage products were good ideas. Thankfully, 70 percent of the country disagrees with how things are being handled at the top. When you build your entire fortune and fortress on a volcano, don’t be angry when it explodes.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

31 Responses to “Don’t Mistake a Silent Mortgage Volcano for Being Inactive: The New Face of Alt-A and Subprime Mortgages.”

I couldn’t say it better. You rock doc!

http://www.highrises.com is a great real estate site if you just love bullshit, that everything is fine & dandy.

I work in San Diego in an engineering firm. You’d think people who dealt with numbers for a living would be a little more analytic, but at least three guys I work with are sure now’s the time to buy. One told me ‘my’ numbers (off this blog) might be right for some parts of California, but his realtor friend told him people are now bidding up houses in Mira Mesa, so, he says, obviously the bottom has come and prices are going to start heading back up any day.

Glad you delved into this subject.

I think this tool doesn’t give enough info and paints a rosy picture.

It appears that there are approximately 38 of these loans per 1000 housing units in the subprime category. About 28 of these loans are ARMs. It makes the average person say “hey…this is no big deal…only 2.8% of loans are potential trouble”

This is the info that I’d want from this mortgage map tool.

1. An explanation of what a housing unit is. Are rental apartments considered housing units?

2. I want to see the PRIME mortgage breakdown, not just Subprime and Alt-A. And I’d like it even further broken down into categories so that we know how many Prime option ARMs were written. I could care less what a persons credit rating is. It can be spotless, but if they bought more house than they could afford by using a plain vanilla ARM or an ultra-toxic Option-ARM it can only end in disaster…especially for the people that bought in the 1-1.5M range.

3. I’d like to see a HELOC map (Subprime, Alt-A and Prime)

4. I would assume that these 1000 housing units also include those that were bought up to 30 years ago. What % of the people who bought pre-2000 can say “Sure…I could afford to buy my house now” So…It would be interesting to see an income breakdown for the “households” by year of purchase. Oh…wait…can’t do that…too much “fudging”.

http://seekingalpha.com/article/74861-fha-who-says-the-subprime-party-s-over-housing-tracker

S&P Downgrades $41 Billion Mostly Alt-A Deals. “Reuters: Standard & Poor’s cut the ratings on about $41 billion of mostly higher-rated U.S. residential mortgage-backed securities backed by so-called Alt-A loans on Tuesday. The rating agency’s action affected 2,183 RMBS classes from 334 Alt-A deals originated during 2006.†(Calculated Risk, Apr. 29th)

No Assets? No Problem. “Many Americans can still buy homes with nothing down thanks in large part to the federal government and a legal loophole that lets builders and bankers ensure a steady stream of asset-challenged borrowers for taxpayer-insured loans… The Federal Housing Administration is already offering the next-best thing to nothing down on a house: a payment of just 3.0% will get practically any American with a pulse and a job a mortgage of up to $729,000, at least until the end of this year… A not-for-profit organization can give prospective buyers the teensy down payment… Of the 180,881 loans that the FHA insured in FH1’08, 36.7%, or 66,337, were seller-funded.†(Forbes, Apr. 29th)

Last year I told my in-laws that I think San Diego was going to fall even further, but they went ahead and bought a place for my sister in law anyway. It was a 680 sqft condo for $210000. Now it’s probably down 25%. or so. This is just the beginning of it all. I’m finding more and more San Mateo home sellers in trouble every week. The fall is speeding up, not slowing down.

The main difference that should scare everyone is the number of ALT-A that are not owner occupied. It is much higher than for Subprime and means that the owner is much more likely to walk away.

I have said along that Bush is the worst president in history, and the biggest ass of all time!

He is a complete idiot!!

I am,

George Vreeland Hill

Doc,

It’s tough to take you seriously when you end with the conspiracy theory of how “The “ownership society†was an Orwellian ploy to screw the vast majority of Americans” It makes you sound like sound like that nutbag Reverend Wright who says the US gov’t invented aids to kill blacks. Quit talking so stupid.

A more accurate depiction of this phenomenon is the”rights without responsibilities” attitude that prevails in the mind of today’s liberals. The Community Reinvestment Act, etc. They used the same exact argument to cry “redlining” that they now use to cry “greenlining.” And I’m not defending our government from their own stupidity, but, anyone intoxicated with the past returns on real estate only wanted to up the ante by buying more and taking bigger risks. There is plenty of culpability to go around – call it what it is.

Doc:

Great article. George Bush is the worst president of all time, not only because of the insane Iraq War, also paid for with credit but because of the massive debt he has allowed to happen. Whoever thinks the growth of DEBT is the same as the growth of wealth is economically insane. He mortgaged my kids future to China, Saudi Arabia and others. Great USA president!

As to San Diego condos a close relative (who works in real estate) bought one for investment purposes in 2003 for $89,000. She had an offer at $225,000 early in 2007 but her husband didn’t want to sell just yet, and they had borrowed on it to upgrade from a $225K personal house to a $750K house. The condo started collapsing in price and the bank refused short sales at $180K, 140K and $110. It sold for $80K last month.

Trying to catch a falling knife – housing prices – may be hard to do. After all who would have thought that the NASDAQ could drop from 5,100 to less than 900! Think of all the people who tried to catch that falling knife.

P.S. In Milwaukee the housing prices are still rising slightly. There are a lot more foreclosures and it takes much longer to sell. If you want, or need, to sell quickly you will take a big hit in prices.

Dr. You are the man. Your analysis is on point, but there is one issue I am taking with your latest article. Bush, he maybe the most unpopular President now, but I am a skeptic. I hold my strong opinions until they are either confirmed or denied. I believe that there was another purpose behind this housing inflation, then deflation of the dollar….Simply stated CHINA. We have been running MASSIVE deficits all the way back in the 90’s to this country, they wouldn’t inflate the Yen to it’s true value, so that we could incurr more and more deficits. This Massive contraction in dollar value (rips their 1.2 Trillion in securities almost in half) puts us in a conservative state as a society (also ripping into their GDP and deficits go away or subside to a much more manageable number). I know this sounds like conspiracy talk but right before the “credit crunch” in August last year, the U.S was taking China to the WTO for monetary manipulation, I think we just returned the favor to China and kicked the WTO (aka enemy of the state) on the way out the door. I honestly believe we are going to contract, experience pain, move on and our society will benefit from some “STRATEGIC” (I am calling them that because it is looking much further into the future than a foreclosure or housing recovery. What do you think? Shoot me an email if you have insight to share. And thanks for the continued high quality articles.

I don’t believe that the Bush administration set out to intentially rip off people who work for a living. Instead, what we are witnessing are experiments in economic freedom. The correct response is to observe the outcome of these policy experiments, examine the results, and improve the product. Live and learn.

Something that 71% of the country agrees with! WTF is wrong with that other 29%?

Totally agree with you, doc.

I would also like to thank sites like this, and Itulip.com for educating me on what is really going on.

My natural instinct told me during the run up that something wasn’t right, and thank god my credit wasn’t great (College Student, no job, sure we will give you a credit card). My buddy and I, couldn’t understand or figure out, how people were buying these houses, but through basic reasoning figured out that something was wrong, and that the bottom was going to fall out.

Now I am scared, really scared, and thanks to your website, I feel sort of disconnected from reality. I understand that we are just at the beginning of this disaster, and everyday I log in and see the stock market is up, when the headlines state, Jobloss was better then expected. Are you kidding me?

Stating that…. and I am looking to the “bulls” here, or people that still have faith that we will pull out of this…. I want to know, “how”… what are the scenarios or solutions that could actually pull our collective a$$ out of the fire.

Please remember, that this economic disaster is on a size and scale that has never been seen before, and we know that what has already been put in place isn’t going to work. So I am asking what else needs to be done…

Doc, has shown us the problem, no what is the solution, or possible solutions.

Thanks

JIm: blaming liberals doesn’t make you seem any more sensible. It’s exactly that our team vs. their team thing that needs to disappear from all conversation in our society. We don’t have time for that petty crap. This is an economic emergency which requires honest debate and working together, not liberals vs. conservative nonsense. the term Ownership Society is quite Orwellian. Just like No Child Left Behind, the Clear Skies Initiative and many other numerous terms concocted by our government over the past 8 years. Was it a secret plan to screw middle class Americans? Probably not, but the results of unregulated greed and outright fraud have done exactly that. That greed permeated every level of our society and economy, from Wall Street to mortgage lenders to home owners sold by TV shows like Flip This House that buying a home was an investment of a lifetime guaranteed to bring in a substantial return to all who participated. Our government isn’t stupid. They were greedy, reckless and dishonest. Add in championing torture. It’s an administration that will live in infamy. Rev Wright might be nutty, but he’s no where near as dangerously insane as Hagee.

But I digress. Sorry for the stupid un-housing rant.

I was at the Farmers Market last nite and there were two fellows in line with me at Loteria talking about how there homes have been on the market for over a year with no buyers. Nice neighborhood too. Couple that with a co-worker in a similar situation and it really seems like this whole thing is no where near the bottom. I wonder if, even if someone was interested in buying, would they be able to secure a loan now?

Jes,

I have the same experience except with scientists. It’s been my experience that technical and mathematical skill has absolutely nothing to do with monetary smarts 🙂

I’d like to know who is in the 30% group.

Maybe the croneys who get no-bid contracts and hotlines to the Fed? Could there be that many?

Can’t be the parents and families of those killed in the false war could it?

Are there that many who benefit from his tax cuts for the rich?

What a freaking mess.

Pitchforks and guillotines please.

In your analysis of loans in the subprime pool you make a statement comparing the mean of this pool to the median home price in California. To get all mathy, this isn’t really comparing apples to apples. These two numbers can be quite different depending on the distribution of home prices. How does the mean home price in California compare to the median home price in California? Do you have that number or the distribution? All I ever see is the median price quoted.

Great Blog, keep up the good work.

Jeff

Jim writes “A more accurate depiction of this phenomenon is theâ€rights without responsibilities†attitude that prevails in the mind of today’s liberals”

****And you think Doc sounds like a ‘nutbag’? That is the pot calling the kettle black.

****It wasn’t the affordable housing advocates who created 0 down, NINJA loans – it was the good ole’ Republican boys on Wall St who did that. In case you hadn’t noticed, it was the right wing neocons who told us all to be patriotic by going shopping. And least you forget, the current round worshipping of the idea that ‘greed is good and avarice is better and buy, buy, buy more more more’, got cooking again under Ronnie-the-senile-actor and came to full boil under Georgie II.

As a individual who speaks on real estate on a daily basis through my company, I want to say that as far as my research has shown that their is relief insight. Though the real estate market and economy in general seem horrible, it should be taken with stride. Real estate is cyclical, and as it the market has gone bad, in the same way the market will become better. From all of my research based on the factor affecting the market – it will take an additional 2 more years. This year will be by far the worst year. 2009 will be better then this year, and 2010 will be a good year.

So if you are not suffering right now by having a loan that you are unable to pay, you should not be stressing. You should instead be taking advantage of this situation and purchasing investment properties. If on the other hand you are having loan issues, their are a few options out there. I would strongly suggest getting help because their are options. You can contact me at psingh@rempower.com and I will share all the information I have for free.

You need to go back to school and learn how to communicate. I guess you only wish to communicate with those familar with the same jargon as you. I am a professional. However, I could not understand your crappy explanation.

. . .The first thing I want to draw your attention to is the mean of these

loans in various mortgage products. Overall, what we are seeing is

distress on loan balances that seem below the median price of a

home in the United States. The balances are not that high but

remember that these are only for first lien mortgages and as we

all know, many took out second mortgages and piggy-backed

on these so they could go with little or no money down. It looks

like the average size of a sub-prime loan ranges from $140,000 to

$200,000. Out of the 1% sampling, we can get a quick glimpse

and see that the bulk of these mortgages are ARMs; in this

sample group over 70% of the sub-prime mortgage balance is

in ARMs. So how are these mortgages performing? Out of this

small pool, already 47% of the ARMs are not current! 13% are

foreclosed and 8% are real estate owned. Guess where that 1

6% 60+ is heading? You may be running the math above and

see that it only adds up to 90%. You can assume that we are

looking at 90+ lates or other forms of distress for that remaining

10%. Either way, the performance here is absolutely abysmal

and that 16% is likely heading to further future distress in the

market. That is baked in. But the next shoe to drop is the

Alt-A loans.

WOW! How is anyone outside the realestate business suppose to understand all that. This was too important a topic for you to be so careless with your explanation. I doubt if 10% of those attempting to read this understood this pathetic explanation. I’m not saying you’re wrong, I’m saying quit being so caught up in your own head and walk us through it better than all that jargon. Too bad for your website. Who’s willing to come back and take another chance and read another article from Mr. I’m sooo smart that I lose touch with my reading audience?

THANKS FOR NOTHING!

BLAME WHO?

How do you explain what USA means? “Useless Stupid Americans†when supply exceeds demand a correction is in order many times this happens on its own, other times a gently push towards proper alignment.

This country is so (Fuked) sorry for the profanity it’s should be the least of your worries. I get sent offers on properties every day from various lenders and investors. A first position non-conforming is worth about 22-31 Cents, a second position 7 to 15 cents on the dollar. Now these properties may take up to three years to remove occupants in my state NY. That means Pay servicing, pay the taxes, heat, maintenance, court costs, and hope the evicted owners don’t wreck and tear up the home in many cases they do.

IF WE DONâ€T SELL HOMES WE will become EXTINCT. Watch the great depression of 2009, previews are already here live.USA. Ok let’s just wait for 45% of the population to get evicted , so we can use all the unsold condos as apartments? I’m in favor of keeping homeowners in their homes by any means necessary.

Ok now I’m told the FHA is the antidote for subprime borrowers? BIG JOKE. Well now it’s the predatory lenders fault? 2,203,295 foreclosure filings in 2007 hum only 75% more fillings than in 2006? USA. The peak of teasers, Arms, Interest only will mature in November of 2008, just in time for a new President to milk us a little more? USA. Today’s milk average price $4.31 per gallon. USA.

What a joke, we need to execute a few simple one page applications for subprime borrowers. With new loans accepted, almost all new home purchases with even the worst of credit should qualify. Make energy building standards mandatory, save energy save a family save the environment cut back on fossil fuel needs. USA

We sit and watch oil and gas prices rise and rise, with nobody really complaining or doing anything to stop the oil companies, USA rather pay than fight! January 2000 regular gas was $1.27 per gallon at the start of George Bush Term, Today is regular is $4.00 per gallon USA. Did anyone stop and think of the domino effect? Our operating costs of a home are as much as some mortgages? USA.

We allowed our government to print unlimited undocumented dollars to support the war, you voted an oil Baron as president, and after he places us in a winless war with poor results you vote him for another term. USA. USA. We allowed our greedy homeowners to ATM the last penny out of their homes in hopes of catching up with credit card debt and rising costs, USA

Help struggling families win the war here in America by keeping them in their homes. Or buy multifamily buildings I hear rentals are on the rise.

Mike Fish

@Jim

Please review the last 8 years of government spending. It was done under the auspices of a “conservative” president with 6 years of a “conservative” Congress. Then review the financing of the political campaigns of the US Senate and House, and the number of ex-elected officials who are now registered lobbyists. Given that the “conservative” side of the aisle has more ex-officials than the other side over the past decade, doesn’t it stand to reason that they have greater numbers in the lobbying brigade, to protect their special interests? Or will you now try to claim that there are more “liberals” in lobbying?

It appears that somehow you have a difficult time reasoning out that the same players who ran up the largest deficit in financial history are not innocent observers, and that you would believe that somehow they had NO inkling that this would entail the greatest transfer of wealth in history from the lower socio-economic strata to the upper. You also manage to gloss the fact that the financial instruments offered to Joe 6-pack to permit him to become “intoxicated with the past returns on real estate” – the ones that give the borrowers culpability – were created by the financial investment class which populates Wall and Fleet Streets. Since you do seek to minimize their responsibility in offering toxic mortgages, I imagine there really is little chance that you would accept the conclusion that this wealth transfer was intentional.

You prefer to blame the bogeyman “liberal”, rather than place culpability at the feet of the monied class. It’s your right to be willfully ignorant, of course. It also happens to be the primary reason that this nation is in the state that it IS in. Attempting to link Wright to any meaningful criticism of the power structure is a classically neocon tactic, of course, writ Rove and Goebells before him. What was it he said? Tell a big enough lie and people will believe it.

We agree on one point – there is plenty of culpability to go around. We have an educational system that doesn’t teach children about financial responsibility. We have an entertainment system that values anorexia and nymphomania over meaningful discourse. We have a war that sucks billions from taxpayers, and a President who won’t acknowledge his own responsibility in creating a terrorist haven. Wright may be incendiary and even loony – but some of what he said was spot-on. The US consumes many times its share of the energy wealth of the planet. We all are culpable on that point. And the players on Madison Avenue and Wall Street are fully cognizant that to keep their own Ferrari’s humming, they have to “sell” a lifestyle to an essentially trusting and perhaps even ignorant populace, to keep buying the “dream”.

But you don’t get that, do you? You don’t understand that the manipulation of advertising, marketing – of “dream-making” – is part and parcel the mechanism by which wealth is transfered from the working class to the monied class. You’d prefer to blame that damnable “liberal” attempt to have “rights without responsibilities”. How quaint. And how utterly pathetic. Where exactly is the responsibility of those who created what Buffett rightly termed “financial weapons of mass destruction”? Have they paid with their bonuses? With incarceration? With the dismantling of their companies? Bear Stearns is just one among many – is it the sole sacrificial lamb, meant to appease the critics, while so many others slink away in the shadows? Tell me again about responsibility, Jim. And quit talking stupid.

I pocketed a bit over $3500 yesterday from the sale of my SunTrust stocks. 2nd time this year I have benefitted from the fool’s rally in bank stocks. It’s almost like taking candy from a baby. I don’t short bank stocks because you never know what’s going to happen in a month or two. They’ll probably go down but if your option expires in the midst of one of these fools rallies you’ll get burned. The thing to do is to buy the shares after they’ve slid back from the last rally then

wait for the Fed to prop the banks up again. Bought 500 shares of SunTrust at 52 and sold them yesterday at 59.39. I owe my success to following Doctor Housing Bubble and realizing those banks with heavy mortgage exposure geese are cooked. SunTrust is big in Alt-A loans in Florida. As those falter I suspect I’ll see SunTrust fall back into the 40’s just as they fell from the 60’s into the 50’s. As this happens the FED will get worried and come to the rescue again. I think there will be one more rally in bank stocks after the next decline then the bottom will fall out when one of the GSE’s goes bust.

Jes,

your comment on engineering ignorance is absolutly right. I been a enginner myself have seen so much overeducated fools in this profesion, that makes this kind the predominant. This people are narrow minded and they lack the ability to see the big picture, no common sense, no life wisdom and no tribal knowledge to compensate becouse this guys have interests besides electrons and if…then… The position of have relativly good salary give them the right to not think much about life issues, becouse you are soooo smart. But why think you are smart becoming enginner in first place, if dentist with only 32 teeth to worry generaly have 50% bigger income? Wonder why I am like this? I am product of differnet time and different society, born on the other side of the planet, where without common sense you are doomed, lost. I had similar discusions with 2 coleges last years and see only total denial. One was bolstering 1 milion house in Woodland Hills another from Westminster. Now both cities are down 30% and still going down strong. Another guy, again summer 2007, was looking to buy house ( second house – investment property ) in Santa Ana and I told him straight that after 2 years I will buy it from him for $200K less and he started to masage his neck in the back. I thinks soon it will be all my fault.

Bwa-ha-ha!

I have a friend who bought an 2 bedroom house in San Diego for 650K and no money down 3 years ago. After one year Zillow had the house up to 750K so they were definitely loving life. Now I bet they would be lucky to get 550K for their house and they have no equity and there only option is to continue to pay the mortgage as they would be underwater if they tried to sell.

For the first time since the Depression, conservatives, the self-proclaimed adults, got almost everything they wanted and they blew it, again! They could have ridden Bush to control this country for generations but all they’ve done is reveal they are the parasites we always knew they were.

People who think that NO high level conspiracies can exist(organizing & planning & carrying out plans out of the public eye) are the idiots.

The ‘ownership society’ came with Homelend Security and the Endless War on Terrorism AFTER 911.

Whatever was done in the last ten years or so by the private Federal Reserve and the government Executive and Legislative branches and from deregulating banking regulations to destroying the Dollar…well it was done by ‘informed’ planning and agreed upon strategies. Wake up! All of this bubble/bust pain could easily been avoided…mortgage loans made without checking income is the kind of ‘financial activity’ that was allowed and ENCOURAGED. Get real!

Now when the Bust come and the wealth transfers upward when the Big Fire Sale comes.

We have to seriously ask ourselves if this was just ineptitude at higher levels or just fate or chance. And we have to be rigorously honest and awake when we intelligently answer this question based on all the tons of evidence that is available if you simply turn off the TV and look.

Doctor, it seems that Rent has ballooned in the last 3 years. How is this related to the housing bubble and can we predict avg. price drops in Rent in this recession? I would love to see some tie-in between owner and renter in a coming blog…

PS: This other website i stumbled upon gave me a good guffaw.

http://timothyellis.googlepages.com/nohousingbubble.html

There is definitely an effort amongst homeowners and other financially responsible adults in California (and beyond) demanding that these bailouts don’t happen.

Just looking on the AngryRenter.com petition, there are already almost 8,000 signers opposing these bailouts in CA alone, and over 40,000 nationwide.

( http://angryrenter.com/view_state.php?state=CA&go=265177 )

Hopefully this is an issue that candidates will start to address more, because by the time November rolls around, there are going to be a lot of angry people (not just renters) against these actions, who will demand candidates that oppose these actions.

In response to George from Vreeland Hill, yes.. I agree, Bush is the worse President in History, damn him from holding a gun to the borrower’s heads when they signed for the mortgage.. silly bush.. you are the idiot.

Caveat emptor, then? Shephard, you may not get the point of DHB’s post. Regardless, care to quantify your support of Bush 2 and the policies that his administration either put in place (war, tax reductions for the richest 1%), didn’t support (alternative fuel R&D besides nuclear and biofuels), blocked or otherwise didn’t enforce (SEC non-enforcement of regs, a blind eye at the Treasury, among others)?

Before you think I support bailouts of FB, I don’t. To say I empathize with why many bought is not the same as condoning the purchases, or the negative impact. Neither of which has much to do with why #43 is so stunningly bad as Commander in Chief.

Leave a Reply